Capital Gains – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Capital Gains – CA Final DT Question Bank

Question 1.

On 25.11.2020, A gave power of attorney and possession to B in respect of a vacant land acquired 10 years ago. The sale deed was executed in April, 2021. In which assessment year, the capital gain is chargeable to tax? [CA Final May 2010] [4 Marks]

Answer:

As per section 45(1), the charging section for the head ‘Capital gains’, any profits and gains arisirtg from transfer of a capital asset shall be chargeable to income-tax under the head capital gains in the previous year in which transfer took place.

Further the definition of ‘Transfer’ as contained in section 2(47) includes, inter alia:

- any transaction involving the allowing of the possession of any immovable property to be taken or retained in part performance of a contract of the nature referred to in section 53A of the Transfer of f Property Act, 1882;

Also in section 50C, Explanation 2 to section 50C provides as under:

For the purpose of this section, the expression “assessable” means the price which the stamp valuation authority would have, notwithstanding contained in any other law for a time being in force, adopted or assessed, if it were I referred to such authority for the purposes of the payment of stamp duty.

The term assessable also covers transfers executed through power of attorney within the scope of section 50C. Thus, when the assessee executes power of attorney and possession is given, the transfer is chargeable to capital gain in such year.

Thus, on combine reading of above provisions, capital gain shall be chargeable to tax in the year when the power of attorney and possession was given to Mr. B in respect of the vacant land.

![]()

Question 2.

Can reference be made to the Valuation Officer u/s 55A where the A.O. is of the view that in the context of computation of capital gains, the value of asset as on 1.4.2001 adopted by the assessee is more than the FMV? [CA Final May 2010] [4 Marks]

Answer:

Section 55A dealing with ‘Reference to Valuation Officer’ provides that the A.O. may refer the valuation of a capital asset to the valuation officer with a view to ascertain the FMV of the capital asset for the purpose of computation of capital gain, in a case where the value of asset as claimed by the assessee is in accordance with the estimate made by a registered valuer, and the A.O. is of the opinion that the value so claimed is at variance with the FMV of the asset.

Therefore, the A.O. can make a reference to the Valuation Officer for valuation of the capital asset in a case where the FMV of the asset as on 1.04.2001 is taken as the cost of the asset and he is of the view that there is a variance between the value as on 1.04.2001 claimed by the assessee in accordance with the estimate made by a registered valuer and the fair market value of the asset on that date.

![]()

Question 3.

A sold a house to his friend B on 01.11.2020, for a consideration of ₹ 25,00,000. The Sub-Registrar refused to register the document for the said value, as according to him, Stamp Duty had to be paid of ₹ 45,00,000 which was the Government Guideline Value. Mr. A preferred an appeal to the Revenue Divisional Officer, who fixed the value of the house as ₹ 32,00,000 (₹ 22,00,000 for Land, balance for Building portion). The differential Stamp Duty was paid, accepting the said value determined. Assuming that the FMV is ₹ 32,00,000, what are the tax implications in the hands of Mr. A and Mr. B for the A.Y. 2021-22? Mr. A had purchased the Land on 01.06.2016 for ₹ 5,19,000 & completed the construction of house on 01.12.2018 for ₹ 14,00,000.

CII: FY 2015-16: 254, FY 2016-17: 264, FY 2017-18: 272, FY 2019-20: 289, FY 2020-21; 301 [CA Final May 2010] [4 Marks]

Answer:

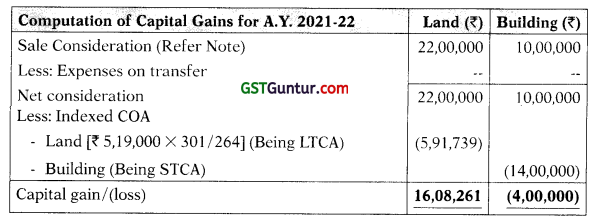

Note: Value fixed in appeal i.e. ₹ 32,00,000 (₹ 22,00,000 for Land and ₹ 10,00,000 for Building) shall be taken as Sale Consideration.

Tax Implication:

Mr. A: STCL can be Set-off against LTCG u/s 70. Therefore, LTCG of ₹ 12,08,261 (₹ 16,08,261 – ₹ 4,00,000) is taxable at 20%.

Mr. B: Receipt of immovable property for inadequate consideration, i.e. stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of consideration, will be chargeable u/s 56(2)(v) as ‘Income from Other Sources’. Taxable amount = Stamp duty – Consideration = ₹ 32,00,000 – ₹ 25,00,000 = ₹ 7,00,000.

![]()

Question 4.

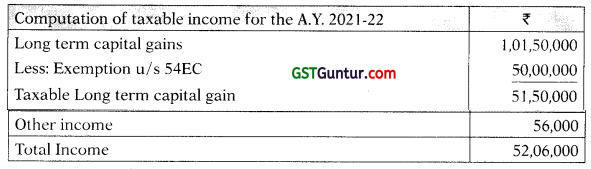

A resident woman (individual) sold a house property on 16.01.2021. On the said transaction, she earned a long-term capital gain of ₹ 1,01,50,000, She invested a sum of ₹ 50,00,000 in capital gains bonds specified in section 54EC on 05.03.2021. She further invested a sum of ₹ 50,00,000 in the x same bonds on 05.05.2021. Her other income for the financial year 2020-21 was ₹ 56,000. Compute the tax payable by her for the A.Y. 2021-22. Assume the assessee has not opted for Sec. 115BAC. [CA Final Nov. 2010] [6 Marks]

Answer:

To claim exemption u/s 54EC, the assessee has to invest in specified bonds of RECL or NHAI within 6 months from the date of transfer of the long term capital asset.

However, the amount of investments in the bonds by the assessee during the financial year in which such transfer has taken place and in subsequent financial year shall not exceed ₹ 50 lakhs in aggregate. Therefore, exemption in respect of amount invested in the bonds on 05.05.2021 shall not be available.

Computation of Income-Tax Payable:

As per section 112, in case of a resident individual, the unexhausted basic exemption limit can be exhausted against long-term capital gains, and tax would be leviable on the balance long-term capital gains @ 20%.

Therefore, the basic exemption limit of ₹ 2,50,000 should be first adjusted against other income of ₹ 56,000 and the unexhausted basic exemption limit of ₹ 1,94,000 should be adjusted against the long-term capital gains of ₹ 51,50,000.

The balance long-term capital gains of ₹ 49,56,000 would be taxable @ 20% = ₹ 9,91,200 plus Surcharge @10% plus Cess @ 4%. Therefore, the tax payable by the assessee would be ₹ 11,33,933.

![]()

Question 5.

ari has acquired a residential house property in Delhi on 1st April, 2008 for ₹ 10,00,000 and decided to sell the same on 3rd May, 2010 to Ms. Pari and an advance of ₹ 25,000 was taken from her. The balance money was not paid by Ms. Pari and Hari has forfeited the entire advance sum. On 3rd June, 2020, he sold this house to Mr. Suri for ₹ 35,00,000. In the meantime, on 4th April, 2020, he had purchased a residential house in Delhi for ₹ 8,00,000, where he was staying with his family on rent for the last 5 years and paid the full amount as per the purchase agreement. However, Hari does not possess any legal title till 31st March, 2021, as such transfer was not registered with the registration authority.

Hari has purchased another old house in Surat on 14th October, 2020 from Mr. X, an Indian resident, by paying ₹ 5,00,000 and the purchase was registered with the appropriate authority.

Determine the taxable capital gain arising from above transactions in the hands of Hari for A.Y. 2021-22. [CA Final Nov. 2010] [5 Marks]

Answer:

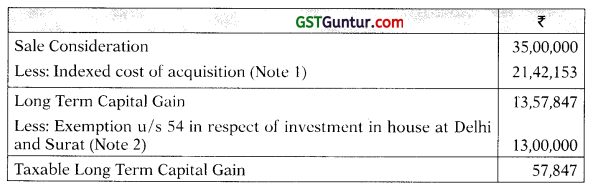

Computation of taxable capital gain of Mr. Hari for the A.Y. 2021-22.

Notes:

1. Computation of indexed cost of acquisition

2. In order to avail exemption u/s 54, the residential house property should be purchased within 1 year before or within 2 years after the date of transfer or it should be constructed within a period of 3 years after the date of transfer of the original LT residential HP.

As per the amendment made by the Finance Act, 2019, an individual can claim exemption u/s 54 in respect of purchase of two residential : house properties in India provided the capital gains does not exceed ₹ 2 crore. Here, in this case, since the capital gains does not exceed (₹ 2 crores, Hari can claim exemption in respect of both the house properties u/s 54. Where the assessee exercised the option to claim exemption in respect of two residential house properties, he cannot subsequently entitled to exercise the option for the same or any other assessment year.

In this case, Hari has purchased the residentialhouse in Delhi within one year before the date of transfer and paid the full amount of ₹ 8,00,000 as per the purchase agreement, though he does not possess, any legal title till 31.3.2021 since the transfer was not registered with the registration authority. However, for the purpose of claiming exemption under section 54, holding of legal title is not necessary. If the taxpayer pays the full consideration in terms of the purchase agreement within the stipulated period, the exemption under section 54 would be available.

Hari has also purchased old house in Surat on 14.10.2020 by paying ₹ 5,00,000 and therefore, he shall be eligible to claim exemption u/s 54 in respect of both the house property purchased i.e. ₹ 13,00,000 (₹ 8,00,000 + ₹ 5,00,000)

![]()

Question 6.

“Any transfer of a capital asset or intangible asset by a private company or unlisted public company to a LLP or any transfer of share or shares held in a company by a shareholder on conversion of a company into a LLP in accordance with section 56 and section 57 of the Limited Liability Partnership Act, 2008, shall not be regarded as a transfer for the purposes of levy of capital gains tax under section 45 subject to fulfilment of certain conditions”. Explain in the context of the provisions contained in the Act. [CA Final May 2011] [6 Marks]

Answer:

Any transfer of a capital asset or intangible asset by a private company or unlisted public company to an LLP or any transfer of a share(s) held in a company by a shareholder on conversion of a company into an LLP shall not be regarded as a transfer for the purpose of levy of capital gains on fulfilment of the following conditions:

(a) All the assets and liabilities of the company immediately before the conversion become the assets and liabilities of the LLP;

(b) All the shareholders of the company immediately before the conversion become the partners of the LLP and their capital contribution and profit sharing ratio in the LLP are in the same proportion as their shareholding in the company on the date of conversion;

(c) The shareholders of the company do not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of share in profit and capital contribution in the LLP;

(d) The aggregate of the profit sharing ratio of the shareholders of the company in the LLP shall not be less than 50% at any time during the period of 5 years from the date of conversion;

(e) The total sales, turnover or gross receipts in business of the company in any of the 3 P.Y. preceding the P.Y. in which the conversion takes place does not exceed ₹ 60 lakhs;

(ea) The total value of the assets as appearing in the books of account of ‘ the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed ₹ 5 crores; and

(f) No amount is paid, either directly or indirectly, to any partner out of balance of accumulated profit standing in the accounts of the company on the date of conversion for a period of 3 years from the date of conversion.

![]()

Question 7.

Mr. X transferred his residential house to Y for ₹ 11 lakh on 1st April, 2020. The value of the said house as per Stamp Valuation Authority was ₹ 16 lakh. Mr. Y is a childhood friend of Mr. X.

Mr. X gifted a plot of land (purchased by him on 1st August, 2017) to Mr. Y on 1st July, 2020. The value as per Stamp Valuation Authority is ₹ 8 lakh. Mr. Y sold the land on 1st March, 2021 at ₹ 14 lakh.

Compute the income of Mr. Y chargeable under the heads “Capital Gains” and “Income from other sources” for Assessment Year 2021-22. [CA Final Nov 2011] [5 Marks]

Answer:

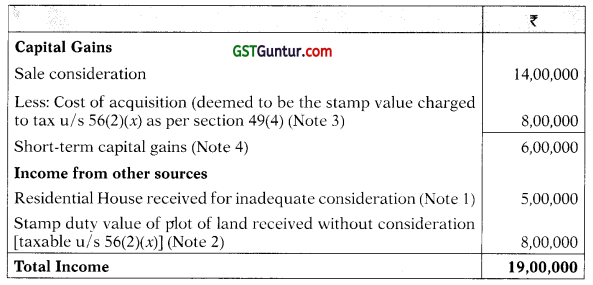

Computation of income of Mr. Y for A.Y. 2021-22

Notes:

(1) As per Sec. 56(2)(x), where any immovable property is acquired for inadequate consideration and if the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the consideration, the difference between stamp duty value of the property and the consideration shall be taxable as income from other sources. The higher in ₹ 50,000 and 10% of the consideration [i.e. ₹ 1,10,000 (₹ 11,00,000 × 10%)] is ₹ 1,10,000 and since the difference between the stamp duty value and consideration exceeds ₹ 1,10,000, the difference of ₹ 5,00,000 (i.e. ₹ 16,00,000 – ₹ 11,00,000) is chargeable to tax in the hands of Mr. Y.

(2) Sec. 56(2)(x) is also attracted where the immovable property is transferred without consideration, if the stamp duty value of such property exceeds ₹ 50,000. In this case, since Mr. Y has received a plot of land from Mr. X, a non-relative, without consideration and the stamp duty value of ₹ 8 lakh exceeds ₹ 50,000, the entire stamp duty value of ₹ 8 lakh is chargeable to tax u/s 56(2)(x).

(3) Section 49(4) provides that where the capital gain arises from the transfer of such property which has been subject to tax u/s 56(2) (x), the cost of acquisition shall be deemed to be the value taken into account for the purpose of section 56(2)(v). Therefore, ₹ 8 lakh would be the cost of acquisition in this case.

(4) Where cost is computed as per Sec. 49(4), the period of holding of previous owner is not to be included and therefore, the resultant capital gains will be short-term capital gains.

![]()

Question 8.

What are the consequences if the amount deposited in Capital Gains Account Scheme to avail exemption from capital gains is not utilised within the stipulated time? Is there any difference in the tax treatment in the event of death of the assessee before the stipulated time? [CA Final May 2012] [3 Marks]

Answer:

Where the amount deposited in Capital Gains Accounts Scheme to avail exemption is not utilized for the specified purpose mentioned under the respective section (i.e., sections 54, 54B, 54G, etc.) within the specified period of two years or three years, as the case may be, then the unutilized amount shall be chargeable as capital gain in the previous year in which the specified period of two years or three years, as the case may be, expires. The nature of the capital gain shall be same as the nature of the capital gain which was claimed as exemption under the section earlier.

The tax treatment in the event of death of the assessee before the stipulated time which results in receiving of the amount by his legal heirs will be different. The CBDT has, in Circular No.743 dated 6.5.1996, clarified that in the event of death of an individual before the stipulated period, the unutilized amount would not be chargeable to tax in the hands of the legal heirs of the deceased individual, since such unutilized amount is not income but is a part of the estate devolving upon them.

![]()

Question 9.

State the cases where the benefit of indexation of cost is not available for determination of capital gains. [CA Final May 2012] [7 Marks]

Answer:

Cases where benefit of indexation of cost is not available for determination of capital gains are as follows:

- Transfer of capital assets held for not more than 36 months (12 months in case of listed shares, units, etc. and 24 months in case of unlisted shares and immovable property), since capital gains arising therefrom would be a short term capital gains.

- Transfer of depreciable assets where computation is governed by section 50, since capital gains arising therefrom would always be short term capital gains, even if they are held for more than 36 months.

- Transfer of undertaking or division in a slump sale u/s 50B.

- Transfer of bonds debentures other than capital indexed bonds issued by the Government (Third proviso to section 48).

- Transfer of shares in or debentures of an Indian company, acquired by a non-resident in foreign currency (First proviso to section 48).

- Transfer of a foreign exchange asset by a non-resident Indian, who opts to be governed by the provisions of Chapter XII-A (Section 115D).

- Transfer of bonds and GDRs by non-resident referred to in Sec. 115AC.

- Transfer of units of Unit Trust of India or a Mutual Fund specified u/s 10(23D) purchased in foreign currency by an overseas financial organisation referred to as Offshore Fund (Section 115AB).

- Transfer of securities by Foreign Institutional Investors (Section 115 AD).

- Transfer of unlisted securities by a non-resident as per provisions of Sec. 112.

- Long term capital gains referred to in Sec. 112A.

![]()

Question 10.

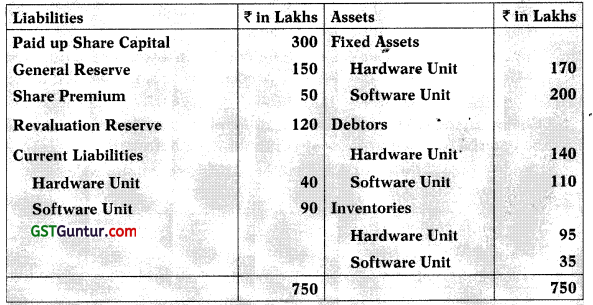

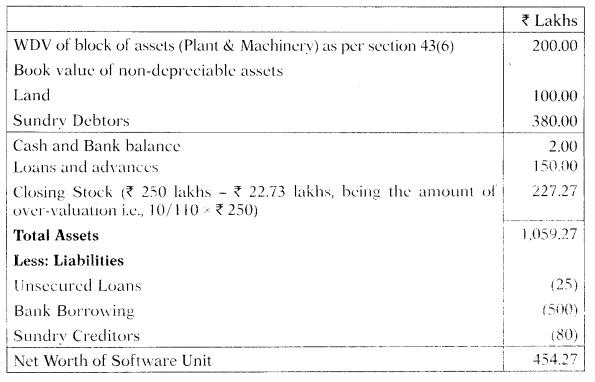

PQR Ltd. has two units-one engaged in manufacture of Computer Hardware and the other involved in developing Software. As a restructuring drive, the Company has decided to sell its Software Unit as a going concern by way of slump sale for ₹ 385 Lakhs to a new Company called S Ltd., in which it holds 74% Equity Shares. The Balance Sheet of PQR Ltd. as on 31st March 2021, being the date on which software unit has been transferred, is as under:

Following additional information are furnished by the Management:

- The Software Unit is in existence since May, 2017.

- Fixed Assets of Software Unit includes land which was purchased at ₹ 40 Lakhs in the year 2014 and revalued at ₹ 60 Lakhs as on March 31,2021.

- Fixed Assets of Software Unit mirrored at ₹ 140 Lakhs (₹ 200 Lakhs minus land value ₹ 60 Lakhs) is Written Down Value of Depreciable Assets as per books of account. However, the Written Down Value of these Assets u/s 43(6) of the Income Tax Act is ₹ 90 Lakhs.

Required:

(a) Ascertain the tax liability, which would arise from slump sale to PQR Ltd.

(b) What would be your advice as a Tax Consultant to make the restructuring plan to the Company more tax savvy, without changing the amount of sale consideration? [CA Final Nov. 2012, May 2011] [10 Marks]

Answer:

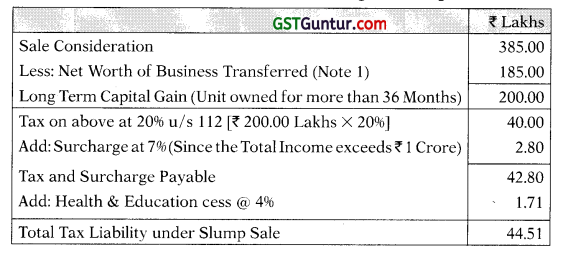

(a) As per section 50B, any profits or gains arising from the slump sale shall be taxable as- long term capital gains, if the undertaking is held for more than 36 months or more. Indexation benefit is not available.

Capital gains = “Slump sale consideration” minus “Net worth of the Undertaking or division”

“Net worth” = Aggregate value of total assets of the undertaking/division minus Value of total liabilities of such undertaking or division as appearing in the books of account.

For computing the ‘Net Worth’, non-depreciable assets are to be taken at their book values. In case of depreciable assets, the written down value of such assets shall be computed as per section 43(6).

Change in the value of assets on account of revaluation of assets shall be ignored for the purposes of computing the net worth.

Computation of Tax Liability arising on Slump Sale

NOTE:

1. Net Worth of Software Unit:

2. Benefit of indexation is not available as the transfer is on slump sale basis.

(b) Modification in the Restructuring Plan

Option 1: S Ltd – 100% Subsidiary

PQR Ltd may hold 100% Equity Shares of S Ltd (i.e. 100% Holding Company) and then the Software Unit to be transferred after 100% Shares are acquired by PQR Ltd.

Conditions: But the above transfer requires fulfilment of following conditions.

(a) Holding Co. should not cease to hold 100% Shares for 8 Years from date of transfer of such business, or

(b) Subsidiary Co. shall not convert the Capital Assets into Stock in Trade within 8 years.

Result: Assets transferred by the Holding Company to its 100% Indian ) Subsidiary Company is not a transfer u/s 47(iv), and the transaction would not attract Capital Gains.

Option 2: S Ltd – Demerger

PQR Limited may go in for Demerger and transfer the Software Unit to S Ltd.

Result: Transfer of Capital Assets by a Demerged Company (PQR Ltd.) to a Resulting Company is not a transfer u/s 47(vib) if the Resulting Company is an Indian Company.

![]()

Question 11.

Mr. Shakti purchased a residential house in March, 2009 for ₹ 22 lakhs. He sold the house on 1st December, 2020 for ₹ 100 lakhs. He paid brokerage at 2% on sale price. He invested ₹ 80 lakhs in April, 2021 in equity shares of Shakti Private Limited, an eligible start-up. Mr. Shakti holds 80% of share capital of the company.

The company utilised the sum of ₹ 80 lakhs in the following manner:

- Purchase of new machinery during April, 2021 ₹ 70 lakhs (including ₹ 10 lakhs for purchase of computers).

- Deposit in specified bank on 25th September, 2021 ₹ 6 lakhs.

- Remaining ₹ 4 lakhs was held as Cash balance.

The due date for filing return of income for Mr. Shakti for Assessment Year 2021-22 is 31sl October, 2021. Assume that he files the return on 28th October, 2021.

Compute the taxable capital gain arising from the above transaction for Assessment Year 2021-22. [CA Final May 2013] [6 Marks]

Answer:

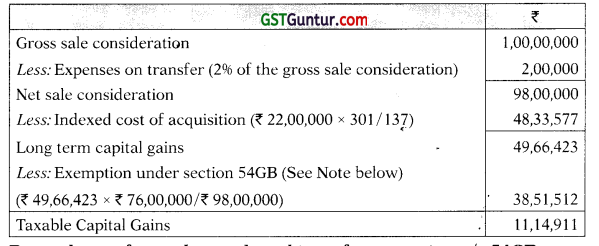

Computation of taxable capital gains of Mr. Shakti for AY. 2021-22

Deemed cost of new plant and machinery for exemption u/s 54GB:

| ₹ | |

| Purchase cost of new plant and machinery acquired in April, 2021 (including computers)

Amount deposited in the specified bank before the due date of filing of return |

70,00,000

6,00,000 |

| Deemed cost of new plant and machinery for exemption u/s 54GB | 76,00,000 |

NOTES: Exemption under section 54GB can be availed on long-term capital gains on transfer of a residential house, since all the conditions given below are fulfilled by Mr. Shakti:

(i) The sale proceeds are used for subscription in the equity shares of an eligible start-up.

Notes:

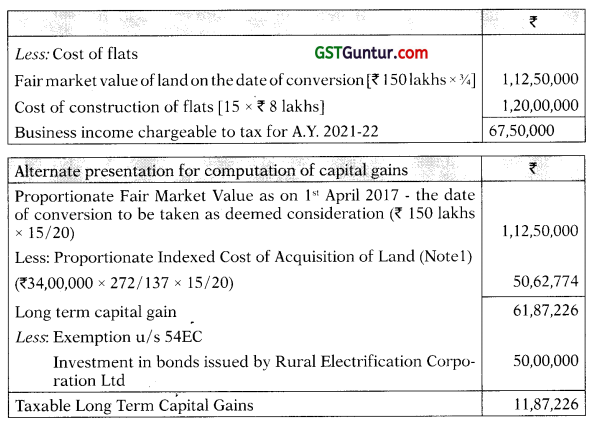

(1) The conversion of a capital asset into stock-in-trade is treated as a transfer under section 2(47) in the year in which the capital asset is converted into stock-in-trade.

(2) However, as per section 45(2), the capital gains arising from the transfer by way of conversion of capital assets into stock-in-trade will be chargeable to tax only in the year in which the stock-in-trade is sold.

(3) The indexation benefit for computing indexed cost of acquisition would, however, be available only up to the year of conversion of capital asset to stock-in-trade and not up to the year of sale of stock-in-trade.

(4) For the purpose of computing capital gains in such cases, the FMV of the capital asset on the date on which it was converted into stock-intrade shall be deemed to be the full value of consideration received or accruing as a result of the transfer of the capital asset.

In this case, since only 75% of the stock-in-trade (15 flats out of 20 flats) is sold in the P.Y. 2020-21, only proportionate capital gains (i.e., 75%) would be chargeable to tax in the A.Y. 2021-22.

(5) On sale of such stock-in-trade, business income would arise. The business income chargeable to tax would be the difference between the price at which the stock-in-trade is sold and the fair market value on the date of conversion of the capital asset into stock-in-trade.

(6) In case of conversion of capital asset into stock-in-trade and subsequent sale of stock-in-trade, the period of 6 months is to be reckoned from the date of sale of stock-in-trade for the purpose of exemption u/s 54EC. In this case, since the investment in bonds of RECL has been made within 6 months of sale of flats, the same qualifies for exemption under section 54EC.

![]()

Question 13.

The proprietary firm of ‘Mr. Amolak’ a practicing Chartered Accountant, was converted into partnership on 01.09.2020 when his son joined him in the firm for 50% share. All the assets and liabilities of the erstwhile proprietary firm were transferred into the newly constituted partnership firm.

“Mr. Amolak” was credited and paid an amount of ₹ 5 lakhs in his account from the firm. Explain as to chargeability of this amount of ₹ 5 lakhs in the hands of “Mr. Amolak” when it stands paid for:

- transfer of business into partnership;

- goodwill by the incoming partner. [CA Final Nov. 2013] [4 Marks]

Answer:

(i) If the amount was paid for transfer of business/profession to partnership:

On conversion of a proprietary business into a partnership, there is a transfer of interest in the assets of the proprietor’s business as the exclusive interest of the proprietor is reduced and the business assets become assets of the firm. Also, section 47 which lists the transactions not regarded as “transfer” does not include within its scope, transfer of capital assets consequent to succession of a sole proprietary concern by a partnership firm. Therefore, the transfer of capital assets by a sole proprietary concern consequent to its conversion into partnership firm is a transfer.

In the given question, as per section 45(3), the amount of ₹ 5 lakhs, recorded in the books of account of the firm, would be the full value of consideration received as a result of transfer and the capital gains resulting from this transfer would be chargeable to tax in the hands of Mr. Amolak.

(ii) If the amount is paid by the incoming partner for Goodwill:

The Supreme Court, in CIT v. B. C. Srinivasa Setty (1981), observed that where “the cost of acquisition of the capital asset” is not possible to ascertain, then, transfer of such asset is not chargeable to tax. Section 55(2)(a) provides that the cost of acquisition of certain self-generated assets, including goodwill of a business, is Nil. Therefore, for such assets, the decision of the Supreme Court in B.C. Srinivasa Setty’s case would not apply.

However, in respect of other self-generated assets, including goodwill of profession, the decision of the Supreme Court in B. C. Srinivasa Setty’s case, would continue to be applicable.

In effect, in case of self-generated assets not covered u/s 55(2)(a), since the cost is not ascertainable, there would be no capital gains tax liability. Therefore, in this case, since the consideration of ₹ 5 lakhs is paid towards goodwill of a profession, whose cost is NOT to be taken as ‘Nil’ since it is not covered u/s 55(2)(a), there will be no capital gains.

![]()

Question 14.

Mr. X had a leasehold property since 5th May, 2013. The leasehold rights were converted into freehold on 20th May, 2020. The said property was sold on 10th January, 2021. The assessee claimed the capital gain as long-term capital gain. The A.O. contended the same as short-term as the property was acquired by converting the leasehold right into freehold [ right only on 20th May, 2020. Is Mr. X justified in his claim? [CA Final May 2015] [4 Marks]

Answer:

The issue under consideration in this case is where a leasehold property is purchased and converted into freehold property at a later point of x time and then sold, should the period of holding be reckoned from the date r of purchase or from the date of conversion for determining whether the resultant capital gains is short-term or long-term.

The facts of the case are similar to the facts in CIT v. Smt. Rama Rani Kalia (2013) (All). in that case, it was observed that the ‘conversion of leasehold property into freehold property was nothing but improvement of the title over the property, as the assessee was the owner prior to conversion. Further, the difference between “short-term capital asset” and “long-term capital asset” is the period for which the property has been held by the assessee and not the nature of title over the property.

The lessee of the property has rights as the owner of the property subject to the covenants of the lease deed. Accordingly, the lessee may, subject to covenants of the lease deed, transfer the leasehold rights of the property with the consent of the lessor.

The Allahabad High Court, thus, held that conversion of rights of the lessee from leasehold to freehold is only by way of improvement of his rights i over the property, which he enjoyed. It would not have any effect on the taxability of gain from such property, which is related to the period for which the property is held, both as leasehold and as freehold.

Therefore, in this case, the period of holding of the property by Mr. X would be reckoned from 5lh May 2013 to 10th January 2021, which is more than 36 months. Consequently, the resultant capital gains would be long-term.

Thus, the claim of Mr. X to treat the capital gain as long term capital gain, is justified.

![]()

Question 15.

Mr. Ramesh purchased a plot of land in Chennai in June 2011 for ₹ 50 lakhs. He decided to sell the property to Mr. Mahesh for ₹ 80 lakhs and received an advance of ₹ 2 lakhs in May, 2013. Mr. Mahesh was unable to complete the agreement and hence, the entire advance was forfeited by Mr. Ramesh.

Again Mr. Ramesh entered into an agreement to sell the property to Mr. Rakesh for ₹ 95 lakhs and received advance money of ₹ 2.50 lakhs in August, 2020. But again the transfer did not materialise due to which the advance money was again forfeited.

On 4th January, 2021, the property was finally sold to Mr. Mukesh for ₹ 105 lakhs and the stamp duty value on that date was ₹ 125 lakhs. During financial year 2020-21, Mr. Ramesh earned business income of ₹ 25 lakhs.

He acquired a new residential property for ₹ 130 lakhs by investing entire g sale consideration and his business income. Determine the total income of Mr. Ramesh for the assessment year 2021-22 [CA Final May 2015] [7Marks]

Answer:

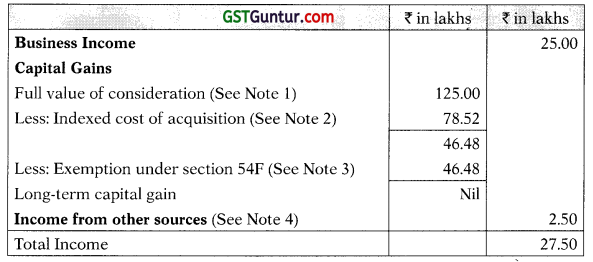

Computation of total income of Mr. Ramesh for the A.Y. 2021-22

Notes:

(1) As per Sec. 50C, where the stamp duty value does not exceed 110% of the actual consideration, the actual consideration so received or accruing as a result of transfer shall be deemed to be the full value of consideration. Here, the stamp duty value exceeds 110% of the actual consideration and therefore, stamp duty value shall be deemed to be the full value of consideration.

(2) Computation of indexed cost of acquisition:

(3) As per Sec. 54F, the exemption available to the assessee shall be the amount of capital gains which bears the same proportion, which the amount invested in the new house bears to the net consideration price of the asset transferred i.e. capital gains x amount invested/net sale consideration. In this case as the entire sale consideration has been reinvested in the new house within the prescribed period by the Ramesh, therefore he is eligible for exemption of entire capital gains, irrespective of the source of funds for such reinvestment [Gouli Mahadevappa v. ITO (2013) (Kar.)].

(4) ₹ 2.50 lakhs forfeited by Mr. Ramesh in August, 2020 shall not to be reduced from the cost of the asset while computing indexed cost of acquisition as it was received on or after 1.4.2014 and hence it is taxable as per section 56(2)(ix) under the head “Income from other sources”.

![]()

Question 16.

SS(P) Ltd., a domestic listed Indian company having two undertakings engaged in manufacture of cement and steel, decided to hive off cement division to RV(P) Ltd., a domestic Indian company, by way of demerger. The net book value of assets of SS(P) Ltd. before demerger was ₹ 40 crores. The net book value of assets transferred to RV(P) Ltd. was ₹ 10 crores. The demerger was made in January 2021. In the scheme of demerger, it was fixed that for each equity share of ₹ 10 each (fully paid up) of SS(P) Ltd., two equity shares of ₹ 10 each (fully paid up) were to be issued.

One Mr. N.K. held 25,000 equity shares in SS(P) Ltd. which were acquired in the F.Y. 2007-08 for ₹ 6,00,000. Mr. N.K. received 50,000 equity shares from RV(P) Ltd. consequent to demerger in January 2021. He sold all the shares of RV(P) Ltd. for ₹ 8,00,000 in March, 2021. In this background answer the following:

- Does the transaction of demerger attract any income tax liability in the hands of SS (P) Ltd. and RV(P) Ltd.?

- State the conditions in brief, which are to be satisfied under the Act for a demerger.

- Compute the capital gain that could arise in the hands of Mr. N.K. on receipt of shares of RV(P) Ltd.

- Compute the capital gain that could arise in the hands of Mr. N.K. on sale of shares of RV(P) Ltd.

- Will the sale of shares by Mr. N.K. affect the tax benefits availed by SS(P) Ltd. and/or RV(P) Ltd.?

- Is Mr. N.K. eligible to avail any tax exemption under any of the provisions of the Income-tax Act, 1961 on the sale of shares of RV(P) Ltd.? If so, state in brief. [CA Final Nov. 2015] [10 Marks]

Answer:

(i) As per sec. 4H(vib), capital gains arising on any transfer of a capital asset, in a demerger, by the demerged company to the Indian resulting company shall not be regarded as transfer for the demerged company. Hence, in this case, no capital gains shall arise on transf er of cement division by SS (P) Ltd. to RV(P) Ltd. and therefore, no income tax liability would be attracted in the hands of SS (P) Ltd. and RV(P) Ltd.

(ii) As per sec. 2(19AA) of the Income-tax Act, demerger should be in such a manner that:

(a) All the property of the undertaking, being transferred by the demerged company, immediately before the demerger, becomes the property of the resulting company by virtue for the demerger;

(b) All the liabilities related to the undertaking, being transferred by the demerged company, immediately before the demerger, become the liability of the resulting company by virtue of the demerger;

![]()

(c) The property and the liabilities of the undertaking, being transferred by the demerged company, are transferred at values appearing in its books of account immediately before demerger:

Provided that this sub-clause shall not be applicable where the resulting company records the value of the property and liabilities at a value different from the value appearing in the books of account of the demerged company, immediately before the demerger, in compliance to the Ind AS specified in Annexure to the Companies (Ind AS) Rules, 2015.

(d) The resulting company issues, in consideration of the demerger, its shares to the shareholder of the demerger company on a proportionate basis except where the resulting company itself is a shareholder of the demerged company;

(e) The shareholders holding not less than 75% in value of the shares in the demerged company (other than shares already held therein immediately before the demerger; or by a nominee for, the resulting company or, its subsidiary) become shareholders of the resulting company or company by virtue of the demerger; otherwise than as a result of the acquisition of the property or assets of the demerged company or any undertaking thereto by the resulting company;

(f) The transfer of the undertaking is on a going concern basis;

(g) The demerger is in accordance with the conditions, if any, notified u/s 72A(5) by the Central Government in this behalf.

(iii) As per sec. 47(vid), any transfer or issue of shares by the resulting company, in a scheme of demerger to the shareholders of the demerged company is not regarded as transfer, if the transfer or issue is made in consideration of demerger of the undertaking. Therefore, no capital gain shall be calculated for Mr. N.K. on receipt of shares of RV(P) Ltd. (ie. resulting company) in consideration of shares of SS (P) Ltd. (i.e. demerged company).

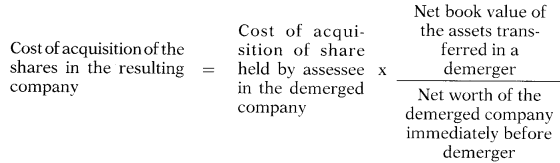

(iv) As per sec. 49(2C), where the shares are issued in the scheme of demerger, the cost of acquisition of such shares in the hands of shareholders shall be computed as follows:

On subsequent transfer of above shares, the period of holding, as per Explanation 1 to Sec. 2(42A), shall also include the period for which such shares were held in the demerged company by the shareholders.

Therefore, the cost of acquisition of shares received by Mr. N.K. in the resulting company shall be:

= ₹ 6,00,000 × ₹ 10,00,00,000/ ₹ 40,00,00,000 = ₹ 1,50,000

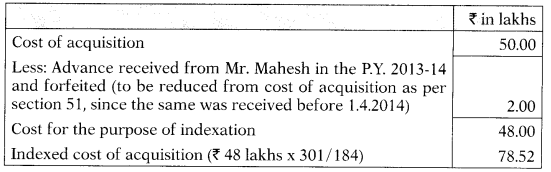

| Computation of Capital Gains | ₹ |

| Sale consideration (assuming sold at FMV)

Less: Cost of acquisition [₹ 1,50,000 × 301/129] |

8,00,000

3,50,000 |

| Long Term Capital Gains | 4,50,000 |

(v) No, the sale of shares by Mr. N.K does not affect the tax benefits availed by SS (P) Ltd. and/or RV(P) Ltd.

(vi) Exemption u/s 10(38) shall not be available in respect of long term capital gains arises from transfer of equity share or unit of an equity oriented fund or unit of business trust made on or after 01.04.2018.

However, Mr. N.K. can claim exemption u/s 54EE and 54F by making the specified investments and by fulfilling the conditions specified under these sections.

![]()

Question 17.

K and Co. (firm) had sold all its assets and liabilities as a slump sale on 31.03.2021 to SVPC & Co. (firm) for a lump sum consideration of ₹ 600 lakhs.

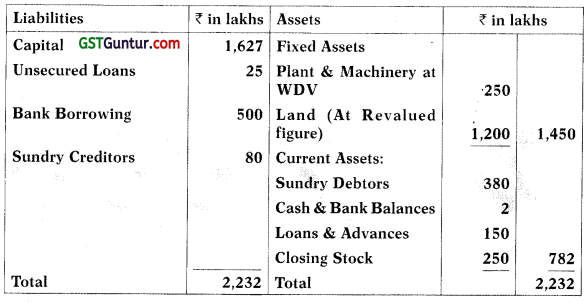

The statement of affairs of K & Co. as on 31.03.2021 is as below:

Additional Information:

- Cost of land in March 2010 was ₹ 100 lakhs.

- WDV of Plant & Machinery u/s 43(6) was ₹ 200 lakhs.

- Cost Inflation Index for the financial year 2009-10 was 148 and for 2020-21 is 301.

- Stock is overvalued by 10%

Compute capital gain arising from slump sale and tax on such gain. [CA Final May 2016] [10 Marks]

Answer:

As per section 50B, any profits and gains arising from the slump sale shall be taxable as long term capital gains, if the undertaking is held for more than 36 months or more. Indexation benefit is not available.

Capital gains = “Slump sale consideration” minus “Net worth of the Undertaking or division”

“Net worth” = Aggregate value of total assets of the undertaking/division minus Value of total liabilities of such undertaking or division as appearing in the books of account.

For computing the “Net Worth”, non-depreciable assets are to be taken at their book values. In case of depreciable assets, the written down value of such assets shall be computed as per section 43(6).

Change in the value of assets on account of revaluation of assets shall be fe ignored for the purposes of computing the net worth.

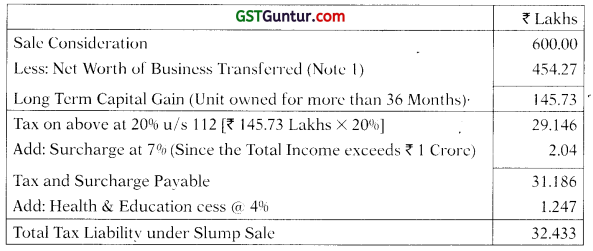

Computation of Tax Liability arising on Slump Sale

NOTE:

1. Net Worth of the undertaking:

2. Benefit of indexation is not available as the iransfer is on slump sale basis.

![]()

Question 18.

Mr. Raghu purchased 10,000 equity shares of AB Avenues Pvt. Ltd. on 25.05.2009 for 1,20,000. The company went into liquidation on 3 1.07.2020. The following is the summarized financial position of the company as on 31.07.2020.

| Liabilities ‘ | ₹ | Assets | ₹ |

| 60,000 equity shares of ₹ 10 each | 6,00,000 | Agricultural lands in urban area | 22,00,000 |

| General reserve | 40,00,000 | Cash at bank | 32,22,200 |

| Liability for income tax | 8,22,200 | ||

| 54,14,305 | 54,14,305 |

The assets remaining after discharging liability for income tax were distributed to the shareholders in the proportion of their shareholding. The market value of agricultural land as on 3 1.07.2020 is ₹ 60,00,000.

The agricultural land received as above was sold by Mr. Raghu on 28.02.2021 for ₹ 15,00,000.

Discuss the tax implications in the hand of the company and Mr. Raghu.

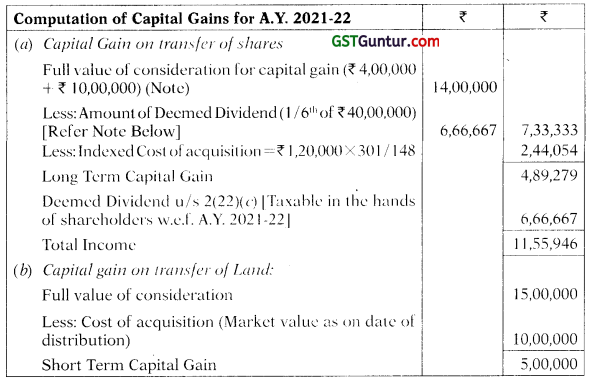

The cost inflation indices are F.Y. 2009-10: 148 and F.Y. 2020-21: 301 [CA Final Nov 2016] [10 Marks]

Answer:

Note:

As per section 46(2), where the shareholder receives money or other assets from the company in lieu of the shares held by him, on the liquidation of the company, he shall be chargeable under the head ‘Capital gains’.

The value of monies received and the FMV of the assets received on the % date of distribution, is reduced by the amount deemed as dividend u/s 2(22)(c) shall be deemed to be the full value of consideration in the hands of the shareholders for the shares transferred on liquidation.

Now, as per section 2(22)(c), any distribution by a company to its shareholders at the time of its liquidation shall be treated as deemed dividend in the hands of the shareholders to the extent of accumulated profits of the company, whether capitalized or not.

Mr. Raghu has 10,000 shares out of total 60,000 shares, so he will be receiving 1 /6th of total distribution. .

Therefore, money value (₹ 32,22,200 reduced by tax liability paid ₹ 8,22,200) = 24,00,000 × 1/6 = ₹ 4,00,000 + FMV of the agricultural land ₹ 60,00,000 × 1/6 = ₹ 10,00,000 shall be deemed to be full value of consideration in hands of Mr. Raghu for the shares transferred on liquidation.

After the amendment made by the Finance Act, 2020, the companies are not required to pay DDT on dividends distributed to the shareholders and such dividends shall be taxable in the hands of the shareholders. Thus, in this case, the deemed dividends u/s 2(22)(e) shall be taxable in the hands of Mr. Raghu under the head ‘Income from Other Sources’.

![]()

Question 19.

Mr. Ankit sold a plot during the EY. 2020-21 and invested the sale proceeds in purchase of a new house in the name of his wife by the end of the financial year i.e. 31st March, 2021. He claimed deduction u/s 54F in respect of the new house purchased by him in the name of his wife. The A.O. while making assessment for the A.Y. 2021 -22 denied such deduction on the ground that in order to avail benefit u/s 54F, it is necessary to invest the sale proceeds in the name of the assessee.

Comment on the validity of action taken by the Assessing Officer. [CA Final Nov 2016] [4 Marks]

Answer:

The facts of this case are similar to the facts of the case CIT v. Kamal Wahal (2013), where the Delhi High Court observed that for the purpose of section 54F, a new residential house need not necessarily be purchased by the assessee in his own name.

The Delhi High Court observed that the assessee had not purchased the new house in the name of a stranger or somebody who is unconnected with him, but had purchased it in the name of his wife and the entire investment for purchase of new residential house had come out of the sale proceeds of the capital asset (of the assessee) and there was no contribution from his wife.

Hence, the Delhi High Court, having regard to the rule of purposive con-struction and the object of enactment of section 54F, held that the asses-see is entitled to claim exemption u/s 54F in respect of utilization of sale proceeds of capital asset for investment in residential house property in the name of his wife.

Applying the rationale of the above judicial decision in this case, Mr. Ankit is eligible for exemption u/s 54F even though the sale proceeds has been invested in purchase of new house in the name of his wife. Therefore, the contention of the A.O. that in order to avail deduction u/s 54F, it is necessary to invest the sale proceeds in the name of the assessee is incorrect.

![]()

Question 20.

A manufacturing company was transporting two of its machines from unit ‘X’ to unit ‘Y’ on 1st September, 2020 by a truck. On account of a civil disturbance, both the machines were damaged. The insurance company paid ₹ 5 lakhs for the damaged machines. On these facts, for submitting the return of income for the previous year ending 31st March, 2021, your advice is sought as to:

- Whether the damage of machines results in any transfer, vis-a-vis eligibility to capital gains.

- How the amounts received from the insurance company are to be treated for taxability.

- Whether there will be any impact on the written down value of the block of plant and machinery as at 31.03.2021? [CA Final May 2017] [3 Marks]

Answer:

As per section 45( I A), where any person receives any money or other assets from an insurer on account of damage to, or destruction of any capital asset as a result ol, inter alia, civil disturbance, then receipt of insurance compensation in the form of money or any asset is to be treated as consideration and capital gain is accordingly to be charged to tax.

In the present case, compensation was received from insurance company for ; damaged machines on account of civil disturbance and thus, it will treated i as consideration to be taxable as ‘Capital Gains’ u/s 45(1 A). By applying 1 the provisions of section 45(1A), our advice to the company regarding the issues raised is as follows:

(i) Where there is damage or destruction to a capital asset as a result of civil disturbance, there is no actual transfer; but it will be treated as deemed transfer and profit and gains from receipt of insurance compensation will be chargeable to tax as capital gain.

(ii) The receipt of insurance compensation of ₹ 5 lakhs has to be treated as the lull value ol consideration received as a result of transfer of such capital asset.

(iii) The receipt of compensation of ₹ 5 lakhs shall be reduced from the WDV of the block of assets as per Sec. 43(6)(c). If the written down value is more than ₹ 5 lakhs, then, ₹ 5 lakhs should be deducted from written down value and if it is less than ₹ 5 lakhs, the dillerence would be treated as short term capital gain.

![]()

Question 21.

Alpha Ltd. has two industrial undertakings. Unit 1 is engaged in the production of television sets and Unit 2 is engaged in the production of refrigerators. The company has, as part of its restructuring program, decided to sell Unit 2 as a going concern, by way of slump sale for ₹ 300 lakhs to a new company called Beta Ltd., in which it holds 85% equity shares. The following are extracted from the balance sheet of Alpha Ltd as on 31st March 2021:

| ₹ (in lakhs) | ||

| Unit-1 | Unit-2 | |

| Fixed assets | 112 | 158 |

| Debtors | 88 | 68 |

| Inventories | 85 | 22 |

| Liabilities | 33 | 65 |

| ₹ (in lakhs) | |

| Paid-up share capital | 231 |

| General Reserve | 160 |

| Share premium | 39 |

| Revaluation reserve | 105 |

The company had set up Unit 2 on 1 st April, 2016. The written down value of the block of fixed assets for tax purpose as on 31st March, 2021 is ₹ 130 lakhs out of which ₹ 75 lakhs are attributable to Unit 2.

Determine what would be the tax liability of Alpha Ltd, on account of this slump sale.

How can the restructuring plan of Alpha Ltd. be modified, without changing the amount of consideration, in order to make it more tax efficient? [CA Final May 2017, May 2012] [10 Marks]

Answer:

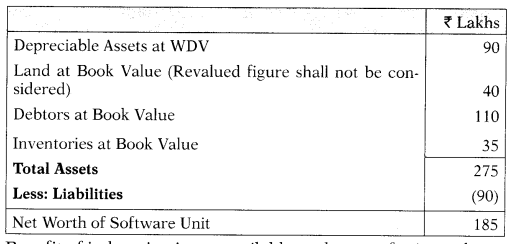

(a) As per section 50B, any profits or gains arising from the slump sale shall I be taxable as capital gains in the previous year in which the transfer took place. If the undertaking transferred under slump sale is held for more than 36 months before slump sale, the capital gain shall be deemed to be long-term capital gain.

Indexation benefit is not available in case of slump sale.

Capital gains= “Slump sale consideration” minus “Net worth of the ‘ Undertaking or division”

“Net worth” = Aggregate value of total assets of the undertaking/ division minus

Value of total liabilities of such undertaking or division as appearing in its books of account.

Change in the value of assets on account of revaluation of assets shall be ignored for the purposes of computing the net worth.

For computing the “net worth”, non-depreciable assets are to be taken at their book values and in case of depreciable assets, the written down value of such assets shall be computed as per section 43(6).

![]()

Computation of Net Worth of Unit II

| Net worth of Unit II | ₹ |

| WDV of depreciable assets under section 43(6) | 75,00,000 |

| Book value of non-depreciable assets: | |

| (i) Debtors | 68,00,000 |

| (ii) Inventories | 22,00,000 |

| Net worth of Unit II | ₹ |

| Aggregate value of total assets

Less : liabilities |

1,65,00,000

65,00,000 |

| Net worth of Unit II | 1,00,00,000 |

| Calculation of Capital gains | ₹ |

| Slump sale consideration

Less: Cost of acquisition (net worth) |

3,00,00,000

1,00,00,000 |

| Long-term Capital Gain | 2,00,00,000 |

| Calculation of tax liability | ₹ |

| Income tax @ 20% on ₹ 2,00,00,000 | 40,00,000 |

| Surcharge @ 7% | 2,80,000 |

| 42,80,000 | |

| Health & Education Cess @ 4% | 1,71,200 |

| Tax liability | 44,51,200 |

(b) Tax Advice:

(i) Transfer of capital asset by a holding company to its 100% Indian subsidiary company is exempted from tax u/s 47(iv). Therefore, if it is possible for Alpha Ltd., it should try to acquire the entire shareholding of Gamma Ltd. and thereafter make a slump sale, so that the resultant capital gain shall not attract tax liability. However, in such case also, Alpha Ltd. should not transfer any shares in Gamma Ltd. for 8 years from the date of slump sale.

(ii) Alternatively, if acquisition of 15% share is not feasible, Alpha Ltd. may think about demerger plan of Unit II to get benefit of section 47(vib).

![]()

Question 22.

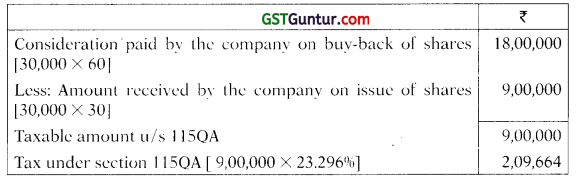

Avimanyu, a resident individual held 25% equity shares in FMC Ltd., an Indian company. The company’s paid up share capital as on 31st March, 2020 was ₹ 10 each issued at a premium of ₹ 20 each. The shares were allotted to the shareholders on 1st October, 2015. The company had gone for buyback of 30% of its shares on 30th July, 2020 as per the provisions of the Companies Act, 2013.

The company paid ? 60 per share on buy back.

Explain and compute the tax effect in the hands of FMC Ltd. and Avimanyu if the shares of FMC Ltd. are not listed on recognised stock exchange.

Whether the answer would be different if the shares of FMC Ltd. are listed on recognised stock exchange.

Cost Inflation Index: 254 for F.Y. 2015-16; 301 for F.Y. 2020-21 [CA Final Nov 2017] [10 Marks]

Answer:

(i) If shares of FMC Ltd. are not listed on recognized stock exchange:

Tax effect in the hands of shareholders (i.e. Avimanyu): On buy-back of shares, there shall be no capital gains in the hands of shareholder as it is exempt u/s 10(34A).

Tax effect in the hands of the company (i.e. FMC Ltd):

As per section 115QA on buy-back of shares, company shall be chargeable to additional tax @ 20% plus surcharge @ 12% and cess @ 4% = 23.296% on the distributed income (i.e. the consideration paid by the company on buy-back as reduced by the amount received by the company on issue of such shares).

(ii) If shares of FMC Ltd. are listed on recognized stock exchange:

The answer would remain the same even if the shares of FMC Ltd. are listed on recognised stock exchange. As per the amendment made by the Finance (No. 2) Act, 2019, even the buyback of listed shares shall be chargeable to additional tax u/s 115QA in the hands of the company with effect from 05.07.2019. Therefore, after this amendment, buyback of both i.e. listed and unlisted shares, shall be chargeable to additional tax u/s 115QA in the hands of the company and the capital gains in the hands of the shareholders shall be exempt u/s 10(34A).

![]()

Question 23.

Shri Chandok is running a factory in Nagpur for the past 10 years. He sold the factory building for ₹ 80 lakhs and the consideration was appropriated as ₹ 20 lakhs for the building and ₹ 50 lakhs for the land underneath the building. The factory building is the only asset of the block on which depreciation was claimed and whose WDV was ₹ 1,80,000. The indexed cost of acquisition of land is ₹ 22 lakhs. He deposited ₹ 48 lakhs in capital gain bonds of NHAI within 2 months after the sale of the factory building. The A.O. disallowed the claim of exemption on the reasoning that capital gain on transfer of depreciable asset being short-term is not eligible for exemption u/s 54EC. Is the action of the A.O. valid in law? [CA Final May 2018 (Old Syllabus), May, 2014] [4 Marks]

Answer:

Issue Involved: The issue under consideration is whether the benefit of exemption u/s 54EC can be available where the capital gains arises on sale of depreciable asset being land or building or both, held for more than 36 months, is reinvested in long term specified assets within the specified time considering Sec. 50 which provides that capital gains in respect of depreciable asset shall always be short term.

Provisions applicable: As per Sec. 54EC, where the capital gains arising from a transfer of long term capital asset being land or building or both, is invested within a period of 6 months after the date of such transfer, in long term specified assets which, inter alia, includes the bonds of NHAI redeemable after 5 years, then the assessee shall be eligible to claim exemption u/s 54EC for the amount deposited in such bonds or ₹ 50,00,000, whichever is less.

Analysis: The facts of the case are similar to the case of CIT v. V.S. Dempo (2016), where the Supreme Court observed that Sec. 50 is a special provision for computation of capital gains in case of depreciable asset and has a limited application in the context of computation of capital gains. It does not deal with exemption which is provided in a totally different provision i.e. Sec. 54EC. Also, Sec. 54EC does not make any distinction between depreciable and non-depreciable asset for the purpose of re-investment of capital gains in long term specified assets for availing the exemption thereunder and therefore, the exemption u/s 54EC cannot be denied to the assessee on account of the fiction created in Sec. 50. The Apex Court, therefore, held that since the depreciable asset being land or building or both is held for more than 36 months and the capital gains are re-invested in long-term specified assets within the specified period, exemption u/s 54EC cannot be denied to the assessee.

Conclusion: By applying the above rationale, the action of the A.O. to disallow the claim of exemption on the reasoning that the transfer of de-preciation asset, being short-term, is not eligible for exemption u/s 54EC, is not valid in law.

![]()

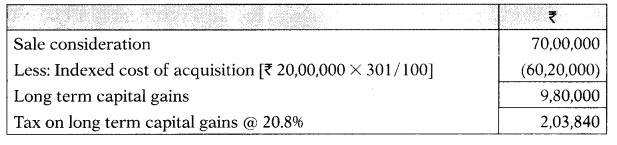

Question 24.

X Ltd., a company in which the whole of its share capital was held by Y Ltd. Both X Ltd. and Y Ltd. are Indian companies. X Ltd. had made investment in shares of ABC Ltd., in 1980 for t 3,00,000 which it sold to Y Ltd. on April 1, 2012 for a consideration of ₹ 30,00,000.

The fair market value of these shares of ABC Ltd., as on April 1, 2001 is ₹ 20,00,000. Y Ltd. disinvested 5% of the shares held by it in X Ltd., in January 2021 by sale to public. It sold the shares in ABC Ltd. in March 2021 acquired by it from X Ltd. for a sum of ₹ 70,00,000.

Discuss the issue with relevant provisions and tax effects of these transactions in the hands of X Ltd. and Y Ltd. in the relevant assessment years.

The cost inflation Index Value for the Financial Year 2020-21 is 301. [CA Final May 2018 (New Syllabus)] [7Marks]

Answer:

A.Y. 2013-14:

As per Sec. 47(v), any transfer of a capital asset by a wholly owned subsidiary to its holding company, being an Indian company shall not be regarded as transfer and therefore, shall not taxable as capital gains. Therefore, the transfer of shares in ABC Ltd. by X Ltd. to Y Ltd. shall not be taxable in the hands of X Ltd. Also, there will be no tax effects in the hands of Y Ltd.

A.Y. 2021-22:

For X Ltd.

As per Sec. 47A(1), yvhere at any time before the expiry of 8 years from the date of the transfer of a capital asset referred to in Sec. 47(v), the holding company ceases to hold the whole of the share capital of the subsidiary company, then the amount of capital gains arising from the transfer of such capital asset not charged to tax earlier by virtue of Sec. 47(v), shall be charged to tax as the income of the transferor company in the previous year in which such transfer took place. However, in this case, Sec. 47A(1) shall not apply since the 8 year period from the date of transfer expires on 31.03.2020 and the disinvestment of 5% shares held in X Ltd. was made in January, 2021.

For Y Ltd.

Transfer oi shares of ABC Ltd. by Y Ltd. in March, 2021 would attract capital gains in the hands of Y Ltd. for the A.Y. 2021 -22. The cost of acquisition for the Y Ltd. shall be the cost of acquisition of such shares for X Ltd. i.e. ₹ 3,00,000 or the FMV as on 01.04.2001 i.e. ₹ 20,00,000, whichever is higher. Therefore, the cost of acquisition for Y Ltd. shall be ₹ 30,00,000.

![]()

Computation of capital gains

Note: It is assumed that the shares are not listed on recognised stock ex-change and therefore, Sec. 112A shall not be applicable.

Question 25.

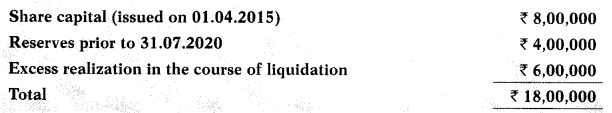

Eden Fabs Private Ltd. went into liquidation on 31.07.2020. The company was seized and possessed of the following funds prior to the distribution of assets to the shareholders:

There are 8 shareholders, each of whom received 12,25,000 from the liquidator in full settlement. You are required to examine the various issues and advice the shareholders about their liability to Income tax. [CA Final Nov 2018 (New Syllabus)] [6 Marks]

Answer:

As per Sec. 46(1), where the assets of a company are distributed to its shareholders on its liquidation, such distribution shall not be regarded as transfer in the hands of the company for the purpose of section 45. However, sec. 46(2) provides that where the shareholder, on liquidation of a company, receives any money or other assets from the company, he shall be chargeable under the head “capital gains”, in respect of the money so received or the market value of the other assets on the date of distribution as reduced by the amount of dividend deemed u/s 2(22)(c) and the sum so arrived at shall be deemed to be the full value of the consideration for the purposes of section 48.

As per section 2(22)(c), dividend includes any distribution made to the shareholders of a company on its liquidation, to the extent to which the distribution is attributable to the accumulated profits of the company immediately before its liquidation, whether capitalized or not.

In this case, the accumulated profits immediately before liquidation is ₹ 4,00,000 and the share of each shareholder is ₹ 50,000 (being 1 /8th of ₹ 4,00,000). Such amount of ₹ 50,000 shall be treated as deemed dividend u/s 2(22)(c) and the same shall be taxable in the hands of shareholder.

![]()

Therefore, ₹ 1,75,000 [i.e. ₹ 2,25,000 minus ₹ 50,000, being the deemed dividend u/s 2(22)(c)] is the full value of consideration in the hands of each shareholder as per section 46(2). Against this, the investment of ₹ 1,00,000 by each shareholder is to be deducted to arrive at the capital gains of ₹ 75,000 of each shareholder. The benefit of indexation is available to the shareholders (since the shares are unlisted and held for more than 24 months and hence long-term capital asset), but could not be computed in the absence of required information.

Since, the equity shares are not listed, it would not be liable for securities transaction tax and hence, such long term capital gains shall be taxable u/s 112. The benefit of concessional rate of tax @ 10% without indexation would also not be available. Hence, such long term capital gain would be taxable @ 20% with indexation benefit.

Exemption under section 54EC is available only where there is an actual transfer of capital assets and not in the case of deemed capital gain as per , the decision rendered in the case of CIT v. Ruby Trading Co. (P.) Ltd. (2003) 259ITR 54 (Raj). Therefore, exemption under section 54EC will not be available in this case since it is deemed transfer and not actual transfer. Also, exemption u/s 54EC is available only on transfer of long term capital asset, being land or building or both.