Profits and Gains of Business or Profession – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Profits and Gains of Business or Profession – CA Final DT Question Bank

Question 1.

Explain in brief, the treatment as to the taxability and/or allowability, under the provisions of Income-tax Act, 1961:

‘C’ Ltd., which did not have any active business carried on by it incurred capital expenditure on scientific research amounting to ₹ 5,00,000 that related to its subsidiary companies. [CA Final May 2010] [3 Marks]

Answer:

As per section 35(1)(iv), deduction in respect of capital expenditure on scientific research shall be allowed only if the scientific research relates to the business carried on by the assessee.

However, in the given case, ‘C’ Ltd., did not have any active business carried on by it to which the said scientific research related to. The capital expenditure incurred by ‘C’ Ltd. related to its subsidiary companies and therefore, ‘C’ Ltd. is not eligible for deduction.

![]()

Question 2.

Indian Gas Limited commenced its operation of the business of laying and operating a cross country natural gas pipeline network for distribution on 1st July, 2019. The company incurred capital expenditure of ₹ 300 lakhs (including cost of land ₹ 45 lakhs and cost of financial instrument ₹ 5 lakhs) during the period from 1st April, 2018 to 30th June, 2019. The company did not claim deduction for such expenditure in the earlier assessment years. The entire expenditure was capitalised on 1st July, 2019. Further, during the previous year 2020-21, the company incurred capital expenditure of ? 200 lakhs exclusively for the said business.

(i) Compute the amount of deduction allowable under section 35AD assuming that the company has fulfilled all the conditions specified in section 35AD.

(ii) If the company has loss from such business in the assessment year 2021-22, how the same is to be set off and carried forward? [CA Final May 2010] [6 Marks]

Answer:

(i) As per Sec. 35AD, where the assessee commences the business of laying and operating a cross-country natural gas or crude or petroleum pipeline network for distribution, including storage facilities, he shall be eligible for, if it has opted, 100% of the capital expenditure incurred during the previous year, wholly and exclusively for the above business as deduction from the business income. However, expenditure incurred on acquisition of any land, goodwill or financial instrument would not be eligible for deduction.

If the capital expenditure is incurred before commencement of such specified business, then deduction shall be

allowed in the year of commencement provided such expenditure is capitalized in books of account on the date of commencement.

Therefore, the deduction admissible under section 3 5AD for A.Y. 2021 – 22 would be:

| ₹ in lakhs | |

| Capital expenditure incurred during the previous year 2020-21

Capital expenditure incurred prior to commencement of business and capitalized in the books of account on 01.07.2019 (₹ 300 lakhs – ₹ 50 lakhs i.e. cost of land and financial instrument) |

200

250 |

| Total deduction under section 35AD for A.Y. 2021.-22 | 450 |

(ii) As per Sec. 73A, loss in respect of the specified business shall be set off only against profits and gains of any specified business and the unabsorbed loss can be carried forward indefinitely and restriction ‘ of carry forward of loss for 8 assessment years is not applicable.

![]()

Question 3.

Aditya, Avirup and Avigyan carried on business of running hotels in partnership from 1st April, 2011 to 31st March, 2018. In order to increase its scale of operation and meet its fund requirement, the firm decided to carry on its business through corporate route. For that purpose, a company under the name and style “Triple A Hospitality Private Limited” was formed on 1st April, 2019 and the business of the partnership firm as a whole was succeeded to by the company with effect from 1st June, 2019.

The company’s profit and loss account for the year ended 31 st March, 2021 shows a net profit of ₹ 450 lakhs after debit/credit of the following items:

(i) Interest of t 3 lakhs paid to Allahabad Bank on a term loan taken for the purpose of acquiring a land at Bhubaneswar for a new hotel to be set up.

(ii) Depreciation charged ₹ 40 lakhs.

(iii) ₹ 2 lakhs credited on account of waiver of dues obtained from a supplier of the erstwhile firm against supply of certain materials.

(iv) ₹ 1.18 lakhs being the aggregate of amounts paid in cash to Rajaram, a transport contractor as follows:

Date of Payment – ₹ in lakhs

5th June, 2020 – 15,000

20th July, 2020 – 21,000

20th September, 2020 – 22,000

3rd November, 2020 – 26,000

5th November, 2020 – 36,000

Tax was not deducted at source as Rajaram submitted a certificate u/s 197(1) which he had obtained from the TDS circle of the Income-tax Department. .

(v) ₹ 0.50 lakh, being proportionate part of the cost of animals (purchased and kept for entertainment of the guests of hotel) amortised as per the accounting policy of the company.

(vi) ₹ 0.10 lakhs credited on account of sale proceeds of carcass of animal which died during the year.

(vii) Provision for bad and doubtful debts ₹ 12 lakhs.

(viii) Payment of ₹ 25 lakhs to some employees as compensation for voluntary retirement, as per scheme

![]()

Other Information:

(i) Depreciation as per the Income-tax Act, 1961 ₹ 65 lakhs.

(ii) Cost of animal died as referred to in (f) above was ₹ 2 lakhs.

(iii) Debt of ₹ 4 lakhs due from one corporate customer for three months I has been written off during the year after giving few reminders by debiting provision for bad and doubtful debts account.

(iv) The erstwhile firm was allowed exemption of ₹ 50 lakhs u/s 47(xiii) in respect of long-term capital assets transferred to the company.

(v) The company’s voting rights till 31st March, 2020 were held as follows:

Aditya – 40%

Avirup – 30%

Avigyan – 15%

Others – 15%

During the year, shares constituting 36% voting rights were sold by Aditya to his son-in-law, Avishek.

(vi) Unabsorbed business loss and unabsorbed depreciation of ? 10 lakhs each have been carried forward from Assessment Year 2019-20.

(vii) The company has a subsidiary company, Tours & Travels Private Limited (a closely held company). During the year, the company obtained a temporary loan of ₹ 12 lakhs from its subsidiary company. Accumulated profit of the subsidiary company was ₹ 30 lakhs at the time of payment of the loan. The loan was repaid by the company before the end of the year.

Compute total income of Triple A Hospitality Private Limited for the A.Y. 2021-22 indicating reason for treatment of each of the items. Ignore the provisions relating to minimum alternate tax. [CA Final May 2010] [20 Marks]

Answer:

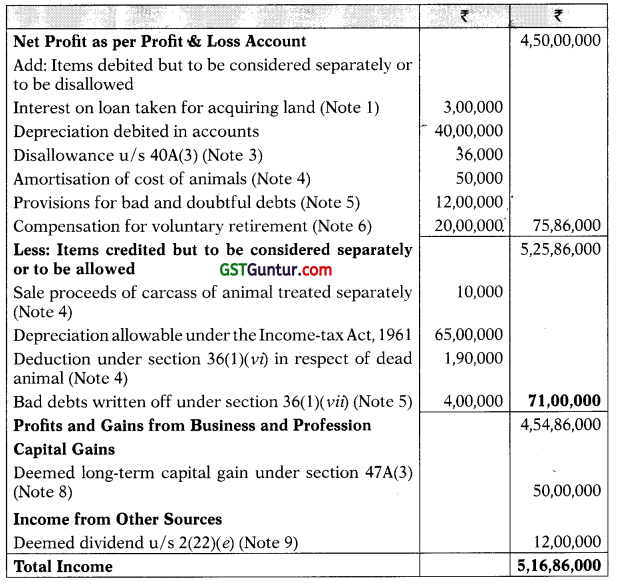

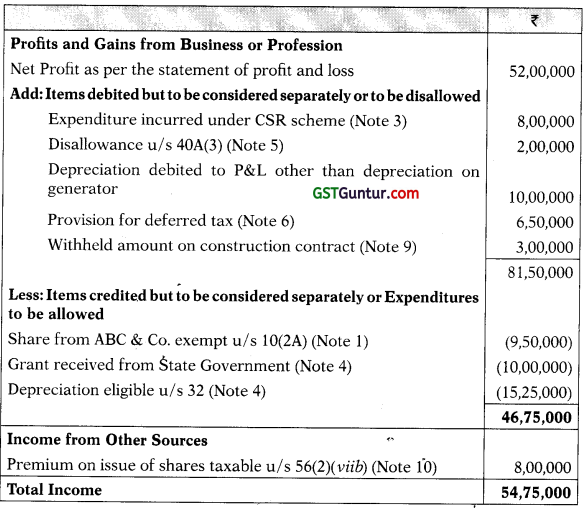

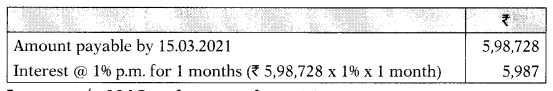

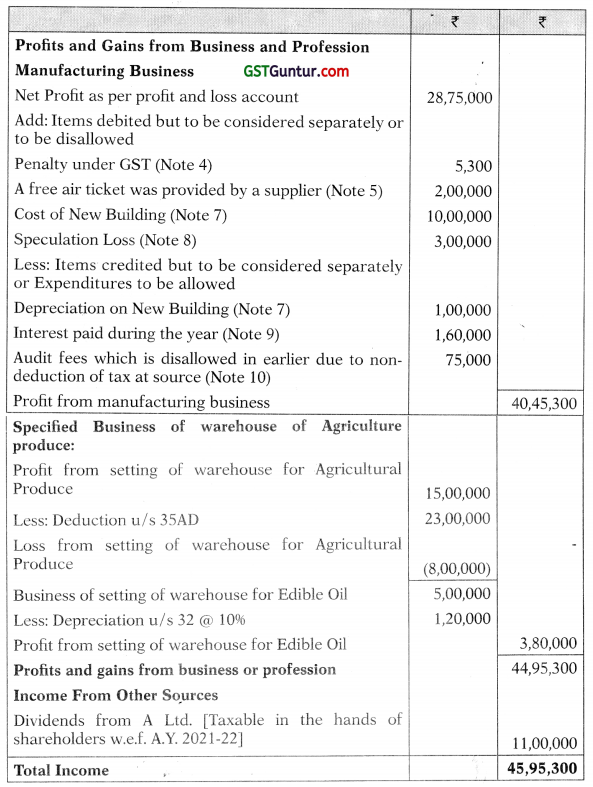

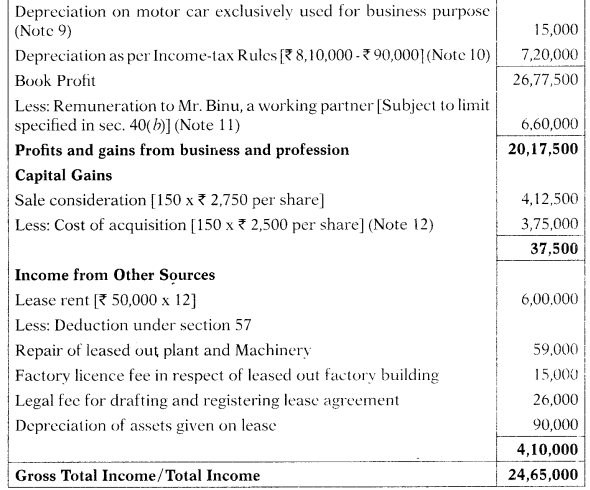

Computation of Total Income of Triple A Hospitality (P) Ltd. for the A.Y. 2021-22

Notes:

(1) As per proviso to section 36(1)(iii), interest paid in respect of capital borrowed for acquisition of an asset (whether capitalized in the books of account or not) for the period till the date on which such asset is first put to use shall not be allowed as deduction. Since, the land is yet to be put to use, deduction for interest is not allowable.

![]()

(2) As per Sec. 41(1), where any trading liability was allowed as deduction to the predecessor-firm and the successor has obtained some benefit by way of remission or cessation of such trading liability, such benefit obtained by the successor shall be deemed to be profits and gains of business or profession and would be chargeable to tax in the year in which the benefit accrued. In this case, waiver of ? 2,00,000 obtained from the supplier of the predecessor firm shall be deemed as business income of the assessee company. Since the amount is already credited to profit and loss account, no adjustment is necessary.

(3) As per Section 40A(3), where the assessee incurs any expenditure for which a payment or aggregate of payments made to a person in a single day, otherwise than by account payee cheque or account payee bank draft or use of ECS through a bank account or through such other electronic mode as may be prescribed, exceeds ₹ 10,000, no deduction shall be allowed in respect of such expenditure.

However, if the payment is made for plying, hiring or leasing goods carriages, then limit is ₹ 35,000 instead of ₹ 10,000. In this case, only the amount paid to Rajaram, a transporter on 5th Nov, 2020 exceeds ₹ 35,000 and therefore, ₹ 36,000 shall be disallowed and shall be added’ back.

Since, Rajaram has submitted a certificate u/s 197(1), no taxis required to be deducted and sec. 40(a)(id) shall not be attracted.

(4) As per Sec. 3 6( 1)(vi), in respect of animals which have been used in the business or profession, otherwise than as stock-in-trade, the difference between the actual cost of the animals and the amount, if any, realized in respect of the animals or carcasses shall be allowed as deduction in the year when they die or become permanently useless.

Therefore, ₹ 50,000 debited to profit and loss account has to be added back and ₹ 10,000 credited to profit and loss account has to be deducted. The difference between the cost of animal died (₹ 2 lakh) and the sale proceeds of carcasses (₹ 0.10 lakh) is allowable as deduction u/s 36(l)(vi). Therefore, ₹ 1,90,000, is allowable as deduction u/s 36(1)(vi).

(5) Provision for bad and doubtful debts is allowable as deduction u/s 36(1)(viia) only in the case of specified banks and financial institutions. Therefore, a company engaged in hotel business is not eligible for deduction in respect of provision for bad and doubtful debts and accordingly, ₹ 12 lakh, debited to profit and loss account has to be added back.

A bad debt written off is allowed as deduction u/s 36(1 )(vii) if such debt is written off as irrecoverable in the books of account. Therefore, the amount of ₹ 4 lakhs written off during the year by debiting provision for bad and doubtful debts is allowable as deduction u/s 36(1)(vii).

(6) As per section 35DDA, where in any previous year, any expenditure is incurred in connection with voluntary retirement of any employee, 1 /5th of the amount so paid shall be deducted in computing profits and gains of business for that previous year, and the balance shall be deducted in four equal instalments in the immediately succeeding four previous years. Therefore, out of ₹ 25,00,000, ₹ 5,00,000 is deductible in assessment year 2021-22 and the balance of ₹ 20 lakhs shall be added back.

![]()

(7) As per Sec. 47A(3), where any of the conditions laid down in proviso to Sec. 47(xiii) are not complied with, the capital gains which was not charged to tax u/s 45 earlier shall be chargeable to tax in the hands of the successor company for the previous year in which the requirements of the proviso to Sec. 47(xiii) are not complied with.

In this case, before the expiry of 5 years fronTthe date of succession, Aditya sold shares carrying 36% voting rights to his son-in-law which reduces the aggregate of shareholding of the partners in the company to below 50% of the total voting power in the company. Therefore, the long-term capital gain which was not charged to tax in the hands of the firm in the year of succession shall be deemed to be long term capital gain of the assessee company in the A.Y. 2021-22.

(8) As per Sec. 2(22)(e), where any company, in which public are not sub-stantially interested, makes any payment by way of loan or advance, to the extent of accumulated profits of the company, to any shareholder holding beneficial ownership of shares carrying not less than 10% of the voting power, then such loans or advances shall be treated as deemed dividends. As per the amendment made by the Finance Act, 2020, dividends including deemed dividends are taxable in the hands of shareholders. Therefore, ₹ 12,00,000 shall be the deemed dividend taxable in the hands of Triple A Hospitality Pvt. Ltd. under the head ‘Income from Other Sources’.

(9) As per Sec. 72A(6), accumulated loss and depreciation of the predecessor firm would become the loss and depreciation of the successor company of the previous year in which the conversion takes place provided the conditions laid down in section 47(xiii) are fulfilled. In this case, the conditions are fulfilled in the P.Y. 2019-20 and it appears that the assessee-company did not have sufficient profits during the P.Y. 2019-20, against which the brought forward loss and unabsorbed depreciation can be set-off and for this reason, the same has been carried forward to the P.Y. 2020-21.

However, in the P.Y. 2020-21, one of the conditions as per the proviso to Sec. 47(xiii) is not satisfied i.e. aggregate shareholding of erstwhile partners falls below 50%, and therefore, the business loss and unabsorbed depreciation cannot be set-off.

![]()

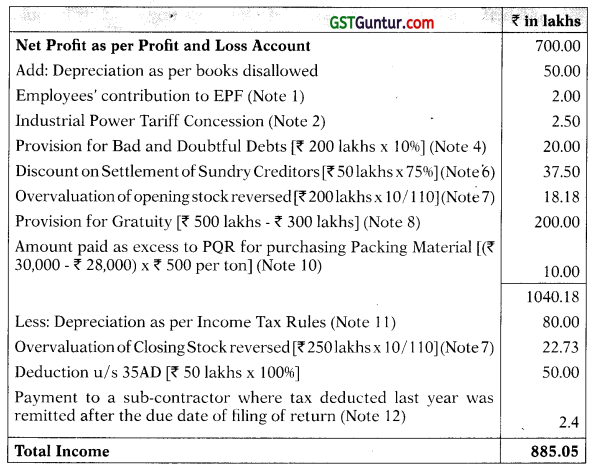

Question 4.

Della Limited is engaged in manufacturing pipes and tubes. The profit and loss account of the company for the year ended 31st March, 2021 shows a net profit of ₹ 405 lakhs. The following information and particulars are furnished to you. Compute the total income of the company for Assessment Year 2021-22 indicating reasons for treatment of each item.

(i) A group free air ticket was provided by a supplier for reaching a certain volume of purchase during the financial year 2020-21. The same is encashed by thfe company for ₹ 10 lakhs in April 2021.

(ii) A regular supplier of raw materials agreed for settlement of ₹ 8 lakhs instead of ₹ 10 lakhs for poor quality of material supplied during the previous year which was not given effect in the running account of the supplier.

(ii) Andhra Bank sanctioned and disbursed a term loan in the financial year 2017-18 for a sum of ₹ 50 lakhs. Interest of ₹ 8 lakhs were in arrears. The bank has converted the arrear interest into a new loan repayable in ten equal instalments. During the year, th6 company has paid two instalments and the amount so paid has been reduced from Funded Interest in the Balance Sheet.

(iv) The company remitted ₹ 5 lakhs as interest to a company incorporated in USA on a loan taken two years ago. Tax deducted under section 195 from such interest has been deposited by the company on 15th July, 2021. The said interest was debited to profit and loss account.

(v) Liquidated damage of ₹ 3 lakhs received from KS Limited for delay in supply of plant and machinery has been shown under the head “Other income” in Profit & Loss Account.

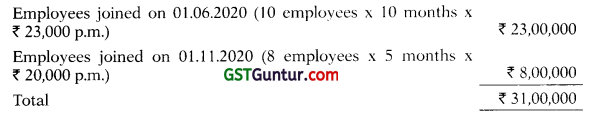

(vi) Sandeep, a sales executive stationed at HO at Delhi, was on official tour in Bangalore from 31st May, 2020 to 18th June, 2020 and 28th September, 2020 to 15th October, 2020 for the business development. The company has paid Sandeep’s salary in cash, from its local office at Bangalore for the month of May, 2020 (payable on 1st June) and September 2020 (payable on 1st October), amounting to ₹ 25,000 and ₹ 27,000 respectively (net of TDS and other deduction), as Sandeep has no bank account at Bangalore. These were included in the amount of “salary” debited to Profit and Loss Account.

(vii) The company has taken up initiative to restructure its debt and paid ₹ 20,000 to a finance company, M/s ABC Ltd., towards pre-payment premium. As per the scheme, ₹ 50,000 loans was waived against its loan and Della Limited directly credited it to its reserve account, considering loan waiver amount as capital receipt.

![]()

(viii) The company has contributed ₹ 50,000 by cheque to an electoral trust and the same stands included under the head “General Expenses”. [C4 Final Nov. 2010] [10 Marks]

Answer:

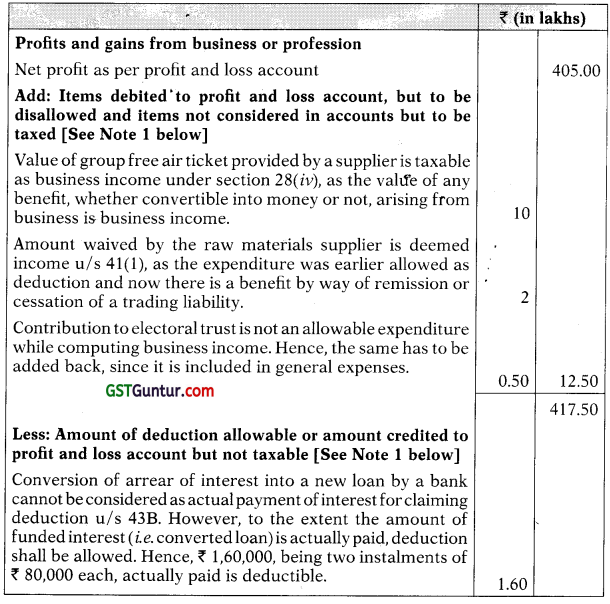

Computation of total income of Della Ltd. for the A.Y. 2021-22

Notes:

Since the question is silent as to whether the net profit of ₹ 405 lakhs is after taking into account the adjustments in (i) to (viii), the problem has been worked out on the assumption that except for items (iv), (v) (vi) and (viii) in respect of which there is a specific mention about inclusion, all other adjustments i.e. (i), (ii), (iii) and (viz) have not been given effect to in the profit and loss account.

![]()

1. Tax deducted by the assessee on interest payable outside India to a foreign company is deposited within the time limit under section 139(1) is not disallowed [Section 40(a)(i)].

2. Salary paid to sales executive in cash is not disallowable as he was temporarily posted for a continuous period of more than 15 days in Bangalore, not being the place of his normal duty, tax was deducted from such salary u/s 192 and he does not maintain any bank account in Bangalore. Therefore, no disallowance u/s 40A(3) is attracted in respect of such salary as per Rule 6DD.

3. Remission of principal amount of loan does not amount to income u/s 41(1) or u/s 28(iv), where there is a waiver of loan taken from a bank or financial institution, unless the loan is taken for a trading activity. It is assumed that such loan is not taken for a trading activity and therefore, waiver of loan cannot be treated as income.

Question 5.

ITP Limited is engaged in growing and manufacturing tea in India. It commenced its operation from 1st April, 2020. It acquired plant and machinery, factory building and furniture at cost of ₹ 40 lakhs, ₹ 25 lakhs and ₹ 10 lakhs, respectively, in the P.Y. 2020-21. All the assets were put to use for more than 180 days during 2020-21. Compute the written down value of each block of assets as on 1st April, 2021, [CA Final Nov 2010] [3 Marks]

Answer:

As per Rule 8 of the Income-tax Rules, 1962, only 40% of income from business of growing and manufacturing of tea in India is deemed to be income liable to tax. The balance 60% would be agricultural income, which is not chargeable to tax.

As per Explanation 7 to section 43(6), in cases of composite income, for the purpose of computing WDV of assets acquired before the previous year, the total amount of depreciation shall be computed as if the entire composite income of the assessee is chargeable to tax under the head “Profits and § gains of business or profession”. The depreciation so computed shall be § deemed to have been “actually allowed” to the assessee.

Therefore, even if only 40% of ITP Ltd.’s income from sale of tea grown and manufactured in India is taxable, full depreciation (and not 40%) should be taken as “actually allowed” for the purpose of computing’WD V. Accordingly, the WDV of each block as on 1st April 2021 will be as follows:

Plant & Machinery = ₹ 40 lakhs – ₹ 6 lakhs (15% of 40 lakhs) = ₹ 34 lakhs; Building (Factory) = ₹ 25 lakhs – ₹ 2.50 lakhs (10% of 25 lakhs) = ₹ 22.50 lakhs; Furniture = ₹ 10 lakhs – ₹ 1 lakh (10% of 10 lakhs) = ₹ 9 lakhs.

![]()

Question 6.

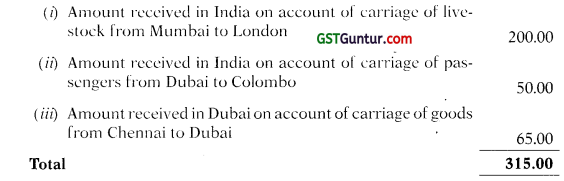

Can brought forward losses and unabsorbed depreciation be set off against the profit determined u/s 44B? [CA Final May 2011] 4 Marks]

Answer:

Sec. 44B provides that notwithstanding anything contained in Secs. 28 to 43A, in case of a non-resident engaged in the business of operation of ships, a sum equal to 7.5% of

(a) The amounts paid or payable whether in or out of India to the assessee, on account of carriage of passengers, livestock, mail or goods shipped at any port in India, and

(b) Any amount received or deemed to be received in India by or on behalf of the assessee, on account of carriage of passengers, livestock, mail or goods shipped at any port outside India, shall be deemed to be the profit of such business.

Sec. 44B overrides Secs. 28 to 43A and therefore it overrides sec. 32 which deals with the unabsorbed depreciation. So, the unabsorbed depreciation cannot be set-off against the income deemed u/s 44B.

However, it does not override Chapter VI which relates to carry forward and set off of brought forward losses and therefore, the brought forward business losses can be set off against the income determined u/s 44B.

![]()

Question 7.

X Co. Ltd. was amalgamated with Y Co. Ltd. on 30.04.2020. X Co. Ltd. was engaged in real estate whereas Y Co. Ltd. was engaged in manufacture of textile articles. Y Co. Ltd. on amalgamation altered its objects clause of Memorandum of Association, to carry on real estate business.

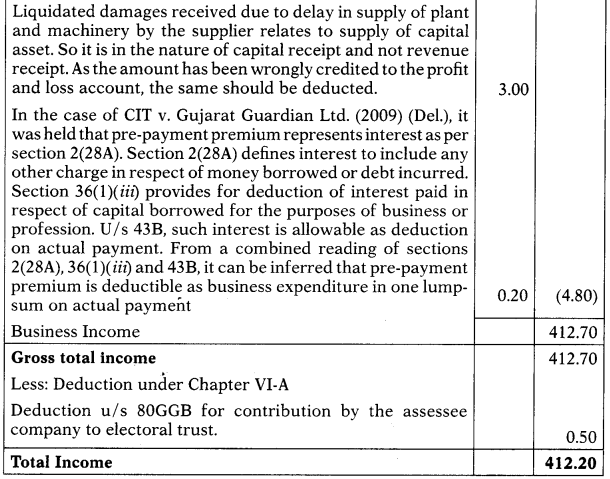

The stock in trade of X Co. Ltd. (being vacant lands) was taken over at ₹ 140 lakhs by Y Co. Ltd. as against their original cost of ₹ 125 lakhs to X Co. Ltd. for the purpose of amalgamation. Y Co. Ltd incurred ₹ 25 lakhs towards development of those lands obtained on amalgamation. It sold the entire land for ₹ 160 lakhs during the year ended 31.03.2021. Determine the tax implication of the transaction in hands of Y Co. Ltd. for the assessment year 2021-22. [CA Final May 2011] [4 Marks]

Answer:

In this case, since the stock-in-trade of X Co. Ltd. is taken over by Y Co. Ltd. on amalgamation, the provisions of section 43C are attracted and the cost of acquisition of vacant lands to Y Co. Ltd. (the amalgamated company) will be ₹ 125 lakhs, being the original cost of such lands to X Co. Ltd., the amalgamating company.

Since the amalgamated company i.e. Y Ltd. has altered its object clause so as to include real estate business, it is clear that the vacant land which were hitherto stock-in-trade for the amalgamating company continues to be in the nature of stock-in-trade for Y Ltd. Thereby, the provisions of section 45(2) i.e. conversion of capital asset into stock-in-trade is not attracted in this case.

Business income of Y Co. Ltd. on sale of such lands would be calculated as under:

Question 8.

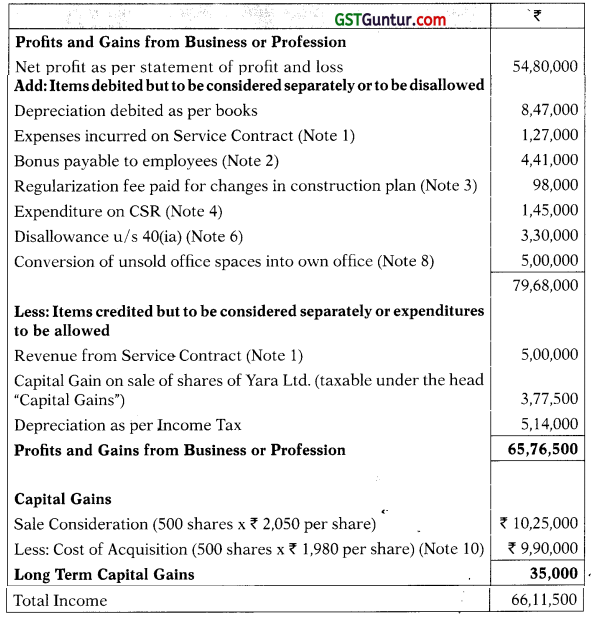

XYZ Private Limited is engaged in manufacturing and selling ceramic tiles. The net profit of the company as per its profit and loss account for the year ended 31st March, 2021 is ₹ 150 lakh after debiting or crediting the following items:

(i) One-time license fee of ₹ 20 lakh paid to a foreign company for obtaining franchise on 1st June, 2020.

(ii) ₹ 29,000 paid to A & Co., a goods transport operator, in cash on 31st January, 2021 for distribution of the company’s products to its warehouse.

(iii) Rent of ₹ 6 lakh received from letting out a part of its office premises. Municipal tax in respect of the said part of the building amounting to ₹ 15,000 remains unpaid.

(iv) ₹ 2 lakh, being contribution to a University approved and notified u/s 35(1)(ii).

(v) ₹ 3 lakh, being loss due to destruction of a machinery caused by a fire due to short circuit. The Insurance Company did not admit the claim of the company.

(vi) ₹ 4 lakh and ₹ 1 lakh, being amounts waived by a bank out of principal and arrear interest, respectively, in an one-time settlement. The loan was obtained for meeting working capital requirement four years back.

(vii) ₹ 1 lakh, being amount payable to a contractor (who does not have Permanent Account Number) for repair work at the company’s factory. Tax of ₹ 2,000 was deducted and paid in time.

(viii) Depreciation on tangible fixed assets ₹ 1 lakh.

![]()

Additional Information:

(i) Depreciation on tangible fixed assets as per Income-tax Rules ₹ 1.75 lakh.

(ii) The company has obtained a loan of ₹ 2 lakh from ABC Private Limited in which it holds 16% voting rights. The accumulated profits of ABC Private Limited on the date of receipt of loan was ₹ 0.50 lakh.

Compute total income of XYZ Private Limited for the Assessment Year 2021-22 indicating reasons for treatment of each item. Ignore the provisions relating to minimum alternate tax. [CA Final Nov. 2011] [16 Marks]

Answer:

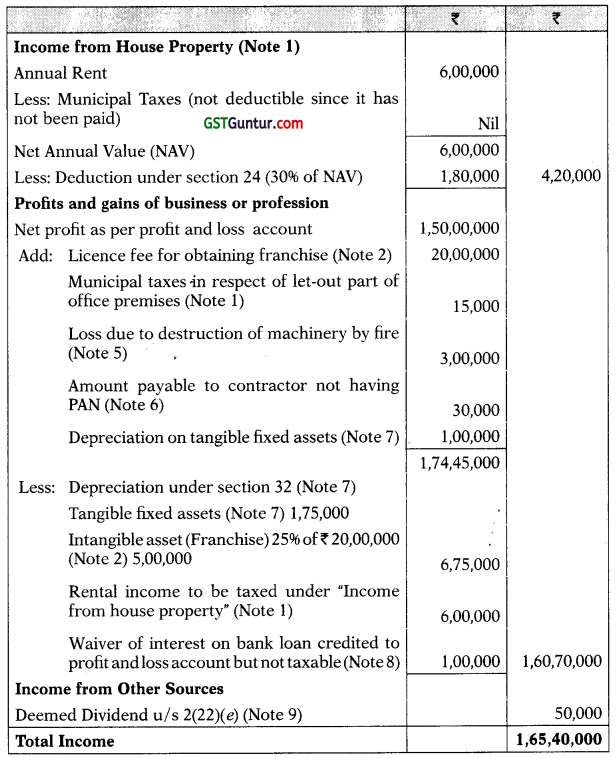

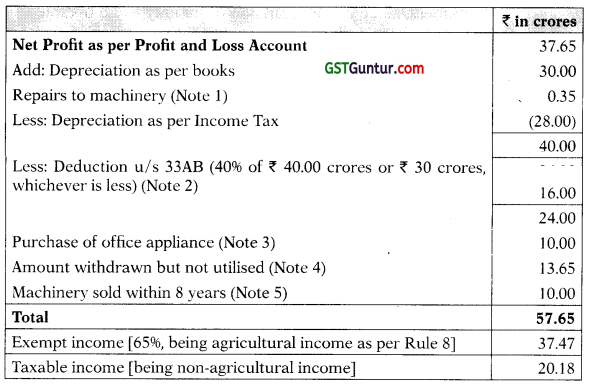

Computation of total income of XYZ Private Ltd. for the A.Y. 2021-22

Notes:

(1) Rental income from letting out a part of the office premises is taxable under income from house property”. Therefore, it has to be deducted while calculating business income, since the income has been credited to profit and loss account. Likewise, municipal taxes due in respect of such property, debited to profit and loss account has to be added back to compute business income.

![]()

(2) Franchise is an intangible asset eligible for depreciation @ 25%. Since one-time licence fees of ₹ 20 lakh paid to a foreign company for obtaining franchise has been debited to probt and loss account, the same has to be added back. Depreciation @ 25% has to be provided in respect of the intangible asset since it has been used for more than 180 days during the year.

(3) ₹ 29,000 paid to A & Co., a goods transport operator in cash is deductible while computing business income, since the limit above which disallowance u/s 40A(3) would be attracted in case of payment to a transport contractor engaged in the business of plying, leasing goods carriages is ₹ 35,000.

(4) Contribution to a university approved and notified u/s 35(1)(n) is eligible for deduction of 100% from P.Y. 2020-21. Therefore, since the contribution of ₹ 2,00,000 already been debited to profit and loss account, no adjustment is required. Loss of ₹ 3 lakh due to destruction of machinery caused by fire is not deductible since, it is capital in nature.

(6) Non-furnishing of PAN to deductor results in attracting provisions of section 206AA, which require tax to be deducted at a higher rate of 20%. Since, the company has deducted tax @ 2% and not @ 20% as per the requirement u/s 206AA, disallowance u/s 40(a)(ia) would be attracted @ 30% in respect of payment of ₹ 1 lakh made to contractor i.e. ₹ 30,000.

Note: There is a possibility of alternate views regarding the tax treatment of disallowance u/s 40(a)( ia) for short-deduction of tax. It is possible to take a view that only proportional disallowance u/s 40(a) (ia) would be attracted in such a case. Another view is that disallowance u/s 40(a)(za) is only for non-deduction of tax at source and not short-deduction of tax and therefore, no disallowance should be made in case of short-deduction of tax. The computation of total income would, accordingly, change.

(7) Depreciation as per Income-tax Rules, 1962, is deductible while calculating business income. Therefore, depreciation of ₹ 1.75 lakh on tangible fixed assets and ₹ 5 lakh on intangible assets shall be deducted and ₹ 1 lakh shall be added back.

(8) Since, the loan is for meeting working capital requirement, it shall be the trading activity and the waiver of principal amount of loan taken for trading activity is a benefit in respect of a trading-liability by way of remission or cessation thereof and is, hence, taxable u/s41(1). Since, the loan waiver has already been credited to profit and loss account, no adjustment is required.

However, the treatment is different in respect of interest on loan. Since, interest on such loan would have not been allowed as deduction in the earlier years as per section 43B due to non-payment of such interest, waiver of interest will not be taxable. Since ₹ 1,00,000 representing interest waiver has already been credited to profit and loss account, the same has to be deducted for computing business income.

(9) As per Sec. 2(22)(e), any advance or loan given by a closely held company, to the extent of accumulated profits of the company, to a share-holder, being the beneficial owner of shares, carrying not less than 10% of voting power, shall be treated as deemed dividends in the hands of shareholder. In this case, XYZ Pvt. Ltd holds 16% voting rights in ABC Pvt. Ltd and therefore, out of the advance of ₹ 2,00,000 obtained from ABC Pvt. Ltd, ₹ 50,000 being the amount upto the accumulated profits of ABC Pvt. Ltd., shall be treated as deemed dividend u/s 2(22)(e) in the hands of XYZ Pvt. Ltd. and shall be taxable under the head ‘Income from ‘Other Sources’.

![]()

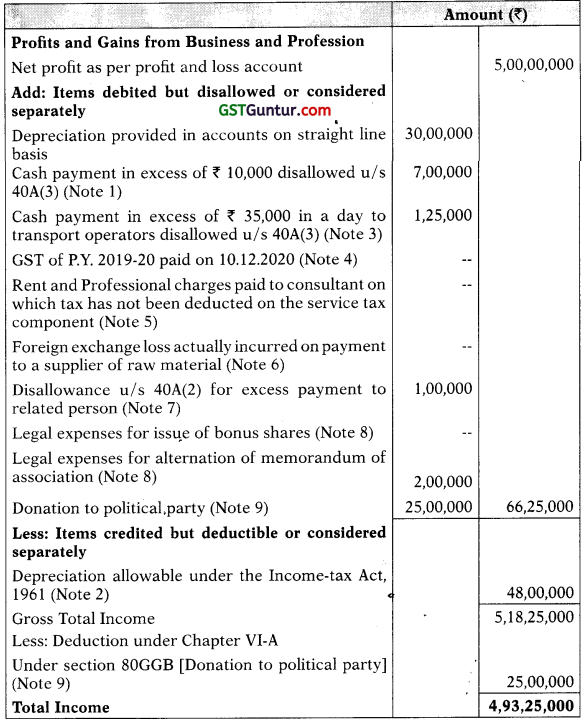

Question 9.

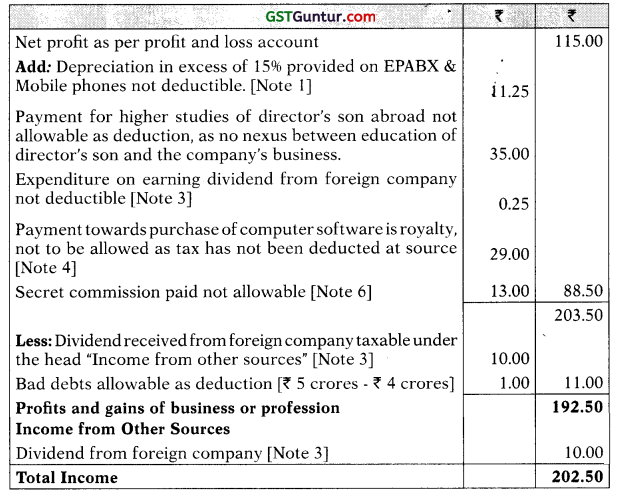

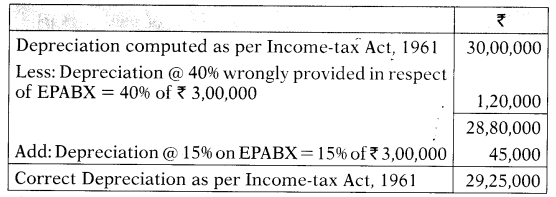

S Ltd. engaged in the business of manufacturing, having turnover of ₹ 244 crores for the previous year 2018-19 and net profit of ₹ 115 crores for the financial year ended 31.3.2021, after debiting Crediting following items:

(i) On EPABX and mobile phones (exclusively used for the business purpose) purchased during the year, depreciation amounting to ₹ 18 crores was claimed at higher rate of 40% treating them at par with computer.

(ii) ₹ 50 crores paid to N Ltd, towards feasibility study conducted for examining proposals for technological advancement relating to the existing business. The project was abandoned without creating a new asset.

(iii) ₹ 35 crores paid for the higher studies of the director’s son abroad, with a stipulation that he would be appointed as a trainee in the company under ‘apprentice training scheme where there is no evidence of existence of such scheme.

(iv) Payment of ₹ 29 crores towards purchase of software from a non-resident, meant for subsequent resale in the Indian market (no tax deducted at source), was ultimately sold at a profit during’ the year 2020-21.

(v) Dividend of ₹ 10 crores received from a foreign company in which this company holds 28% in nominal value of the equity share capital of the company, ₹ 0.25 crore expended on earning this income.

(vi) A machine in use since past 7 financial years having WDV amounting to ₹ 1.50 crores on 01.04.2019 was discarded on 3.9.2020. The depreciation on the block at 15% has been provided and charged to profit and loss account for the previous year ended 31.3.2021. The entire block is used for the purpose of business.

(vii) ₹ 45 crores were paid on 3.6.2020 to a National Laboratory with a stipulation that the said contribution shall be used for the purpose of an approved scientific research programme only.

(viii) Secret commission of ₹ 13 crores was paid and debited under commission account.

![]()

Additional Information:

A debt of ₹ 10 crores was claimed as bad debt in the previous year 2019-20. Assessing Officer allowed only a sum of ₹ 5 crores as bad debts. In 2020-21, a sum of ₹ 4 crores is recovered ultimately in respect of the debt.

Compute total income of S Ltd. for the Assessment Year 2021-22 and work out tax payable on such income, indicating reasons for treatment of each item. [CA Final May 2012] [16 Marks]

Answer:

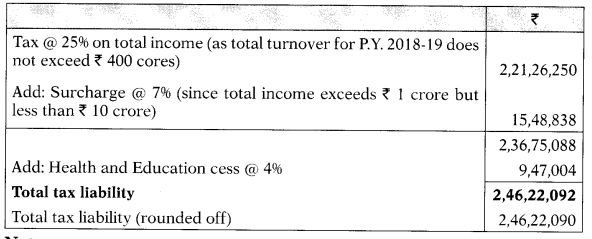

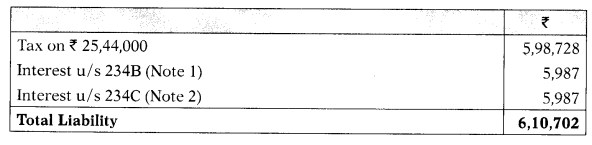

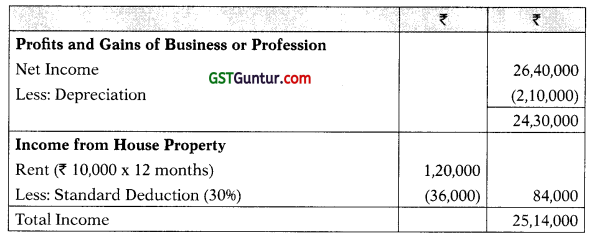

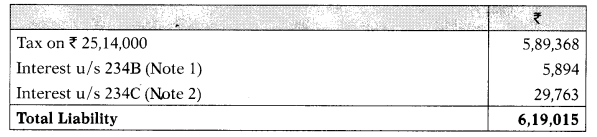

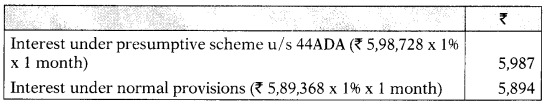

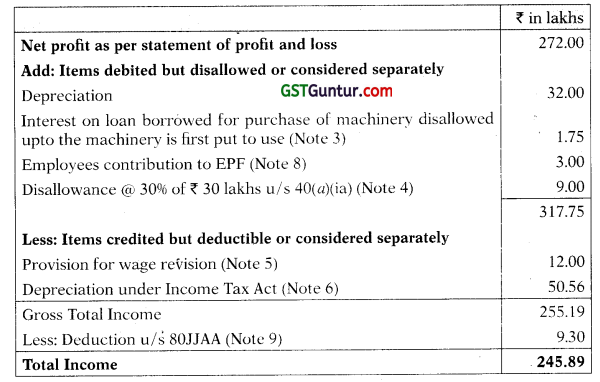

Computation of total income of S Ltd. for the 4-Y. 2021-22 (₹ in crores)

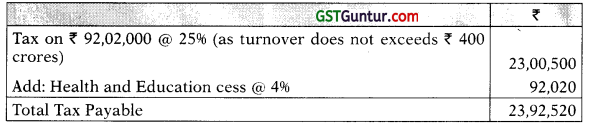

Tax liability of S Ltd. for the A.Y. 2021-22

Notes:

1. EPABX and mobile phones are not computers and therefore, are not entitled to higher depreciation @ 40% as for computers [Federal Bank Ltd. v. ACIT (Ker)]. Hence, normal depreciation @15% shall be allowed.

![]()

2. As per Delhi High Court in case of Priya Village Roadshows Ltd. it was held that if there is no creation of a new asset, then the expenditure incurred on feasibility study for the technological advancement of the project which was abandoned without creating a new asset, would be of revenue nature.

As the expenditure is already debited to profit and loss account, no further treatment is required.

3. As per sec. 115BBD, dividends received by Indian companies from Specified foreign company i.e. foreign company in which the Indian company holds 26% or more of the nominal value of equity share cap-ital, shall be taxable @ 15%. Also, no expenditure in respect of earning such income shall be available.

Further, as per section 56(2) dividend income is taxable only under the head ‘Income from other sources’.

In this case, as S Ltd. holds 28% of equity in foreign company, section 115BBD shall be attracted and therefore, expenditure debited on earning such dividend shall be added back.

Note: If the S Ltd. had distributed dividends during the previous year, then it may claim deduction u/s 80M in respect of such dividends received from specified foreign company upto the amount of dividend distributed by it.

4. Section 9(1)(vi) provides that the consideration for use or right to use of computer software is royalty and consequently tax has to be deducted at source in respect of such payments. Since no TDS was deducted, ₹ 29 crores is to disallowed under section 40(a)(i).

5. Contribution to a National Laboratory shall be eligible for 100% de-duction. Since, it has already been debited to profit and loss account, no further adjustment is required.

6. With regard to the discarded machine, no amount has been adjusted in block of asset as no money is receivable in respect of discarded machine. Thus, depreciation would be allowed assuming that there are other assets in the block.

7. As per Explanation to section 37(1) any expenditure incurred for a purpose which is an offence or which is prohibited by law, shall not be deemed to have been incurred for the purposes of business or profession and no deduction or allowance shall be made in respect of such expenditure. Therefore, secret commission being in the nature of bribe is not allowable as expenditure.

![]()

Question 10.

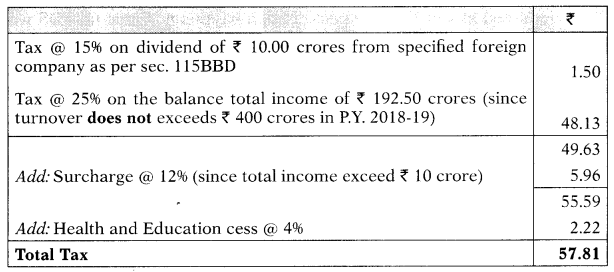

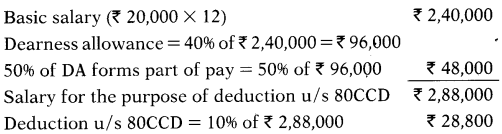

KLM limited has gone for pension scheme referred to in section 80CCD. It contributes 20% of basic salary to the account of each employee under the scheme. Dearness allowance paid is 40% of basic salary. 50% of dearness allowance forms part of pay for retirement benefits. Total basic salary of employees during the year ended 31st March, 2021 amounted to ₹ 100 lakhs. You are a finance executive of the company and get a basic salary of ₹ 20,000 per month and contribute 20% of basic salary to the pension scheme. On these facts:

(i) Compute the amount admissible as deduction u/s 36(1)(iva) and the amount inadmissible u/s 40A(9) in computation of business income of KLM Limited.

(ii) Explain the tax treatment. [CA Final Nov. 2012] [5 Marks]

Answer:

(i) Computation of deduction allowable u/s 36(1)(iva) and disallowance u/s 40A(9) while computing business income of KLM ltd. ‘

(ii) Tax treatment in the hands of the finance executive in respect of employer’s and own contribution to pension scheme referred to in section 8OCCD.

(a) Own contribution to pension scheme is allowed as deduction u/s 8OCCD maximum upto 10% of salary. For this purpose, basic salary means basic salary plus dearness allowance, if it forms part of salary for retirement benefits. Therefore, salary for the purpose of deduction u/s 8OCCD, in this case, would be:

(as against actual contribution of ₹ 48,000, being 20% of basic salary of ₹ 2,40,000)

₹ 28,800 is deductible u/s 80CCD(1), subject to the overall limit of ₹ 1,50,000 u/s 80CCE. The balance of ₹ 19,200 (₹ 48,000 – ₹ 28,800) can be claimed as deduction u/s 80CCD(1B) as this deduction is available over and above the deduction claimed u/s 80CCD(1) and is also outside the limit of ₹ 1,50,000 as provided in section 80CCE.

(b) Employer’s contribution to pension scheme would be treated as salary as per the definition of “salary” u/s 17. Therefore, ₹ 48,000, being 20% of basic salary of ₹ 2,40,000, will be included in salary.

Deduction allowable in respect of employer’s contribution u/s 80CCD(2) shall be restricted to 10% of salary (i.e. ₹ 28,800).

However, this deduction of employer’s contribution of ₹ 28,800 to pension scheme would be outside the overall limit of ₹ 1.50 lakh u/s 80CCE i.e., this deduction would be over and above the other deductions which are subject to the limit of ₹ 1.50 lakh.

![]()

Question 11.

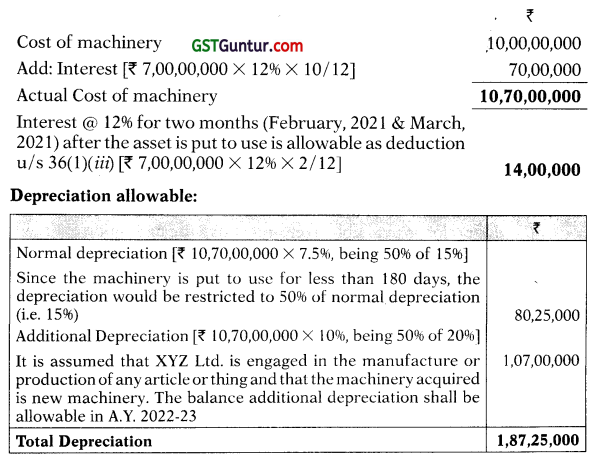

XYZ Limited purchased a machine on 1st April, 2020 for ₹ 10 crores by availing 70% loan facility from bank. The machine was required for extension of the business of the company and was put to use into effective production on 1st February, 2021. Interest on loan is charged at 12% per annum.

Advise XYZ Limited on the treatment of interest payment made on this loan and depreciation allowable for the Assessment Year 2021 -22. Assume that this machine is the only machine in the related block of assets. [CA Final Nov. 2012] [4 Marks]

Answer:

Treatment of Interest on loan for purchase of machinery:

As per section 36(1)(iii), interest paid in respect of capital borrowed for acquisition of an asset for the period beginning from the date of borrowing of loan for acquiring the asset till the date on which such asset is first put to use is not allowable as deduction. Interest for such period has to be capitalized, by adding the same to the cost of the as,set. Therefore, interest @12% p.a. for the period of 10 months from 1 st April, 2020 to 31 st January, 2021 on ₹ 7 crores, being the amount of loan, has to be capitalized.

![]()

Question 12.

P. Ltd. has two divisions, engineering division and tea division. It has transferred engineering division to Q. Ltd. pursuant to a scheme of demerger which satisfies the conditions of section 2(19AA). P. Ltd had a debt of ₹ 5 lakhs in engineering division which stood transferred to Q. Ltd. The said debt has been written off as bad in the accounts of 0 Ltd. Can Q. Ltd. claim deduction on account of the bad debt? [CA Final Nov. 2012] [4 Marks]

Answer:

In the case of CIT v. T Veerbhadra Rao (1985), the Supreme Court held that a successor to a business will be entitled to claim an allowance for bad debt even though the debt did not relate to the business of the assessee but to the business it has succeeded. The court held that even if the relevant debt had been taken into account in computing the income of the predecessor only and had been written off as irrecoverable in the accounts of the successor assessee, the assessee will be entitled to the deduction of bad debt.

Therefore, in this case, deduction u/s 36(1)(vi) on account of bad debts of ₹ 5 lakh shall be allowed to Q. Ltd. in relation to a debt incurred by P. Ltd. for the engineering division transferred to Q. Ltd., even though the same is not taken into account in computing the income of Q. Ltd. of the current previous year or any of the earlier previous years, provided the identity of the business in the hands of Q Ltd remains the same.

![]()

Question 13.

ACFS Ltd. is a Non-Banking Financial Company (NBFC). The company has not credited interest of ₹ 25 lakhs due on certain Loan Accounts which had become Non-Performing Assets in its Profit & Loss Account. As per NBFC Prudential Norms (RBI) Direction, 1998, which is binding on the Company, Interest or Discount or any other charges on NPA shall be recognized as Income only when it is actually realized. Can the A.O. make addition of such interest on the ground that the assessee follows Mercantile System of Accounting? [CA Final Nov. 2012] [4 Marks]

Answer:

As per section 43 D, Interest on those advances which have been categorized as Bad & Doubtful Debts as per RBI Guidelines are taxable in the year in which such interest is –

(a) Credited to Profit & Loss Account or

(b) Received by the assessee,

whichever is earlier, and not on accrual basis.

Interest on NPA is to be recognized on cash basis (as permitted by RBI) even though the assessee follows mercantile system of accounting.

Such Interest Income accrues only on actual realization. [DIT v. Brahmputra Capital Financial Services Ltd (Del.)] Hence, the contention of the Assessing Officer is not valid.

![]()

Question 14.

Mr. S, a lawyer by profession, incurred expenditure on his heart surgery. He claimed such expenditure arguing that the repair of vital organ i.e. the heart has directly impacted his professional competence as his gross income from profession increased manifold after the surgery, the heart should be treated as a plant and hence such expenses should be allowed u/s 31 as current repairs to plant and machinery or section 37(1) as an expenditure incurred wholly and exclusively for the purpose of his profession. Is the claim of Mr. S tenable in law? [CA Final Nov. 2012] [4 Marks]

Answer:

The issues under consideration are whether the expenses incurred on heart surgery can be regarded as:

(a) Current repairs to plant, allowable u/s 31 or

(b) A revenue expenditure, incurred wholly and exclusively for the purposes of the assessee’s profession and hence, allowable u/s 37(1).

The facts of the case are similar to the facts in Shanti Bhushan v. CIT (2011), where the Delhi High Court observed that to allow the heart surgery expenditure as repair expenses to plant, the heart should have been first included in the assessee’s balance sheet as an asset in the previous year and in the earlier years. Also, a value needs to be assigned for the same.

The assessee would face difficulty in arriving at the cost of acquisition of such an asset for showing the same in his books of account. Though the definition of plant u/s 43(3) is inclusive in nature but the plant must have been used as a tool for profession, which is not true in case of heart. Therefore, the heart cannot be said to be plant for the business or profession of the assessee. Therefore, the expenditure on heart surgery is not allowable as repairs to plant u/s 31.

According to the provisions of section 37(1), inter alia, the said expenditure must be incurred wholly and exclusively for the purposes of the assessee’s profession. However, a healthy heart will increase the efficiency of human being in every field including its professional work. Therefore, there is no direct nexus between the expenses incurred by the assessee on the heart surgery and his efficiency in the professional held. Therefore, the claim for allowing the said expenditure u/s 37(1) is also not tenable.

Therefore, applying the rationale of the above court ruling to the case on hand, the claim of S is not tenable in law.

![]()

Question 15.

Rolla Ltd. was engaged in the business of manufacturing and trading activities. The company was declared a sick industrial company and as a part of a restructuring programme, a part of the term loan for purchase of machinery and cash credit and interest was waived. The A.O. was of the view that the waiver of loans and interest amounted to remission or cessation of liability and was taxable u/s 41(1). Give your views on the correctness of the action of the A.O. [CA Final May 2013] [4 Marks]

Answer:

The term loan taken for purchase of machinery is not a trading liability. Therefore, the provisions of deemed profits u/s 41(1) cannot be applied in this case; since the waiver is in respect of a term loan taken for a capital asset and hence, cannot be treated as remission or cessation of a trading liability. Thus, the waiver of such term loans cannot be treated as income of Rolla Ltd.

However, such waiver of loan amounts to meeting of cost of asset directly or indirectly by any person other than the assessee and therefore will go to reduce the actual cost of plant and machinery as per section 43(1).

Further, where the loan is written off in the cash credit account, the benefit is in the nature of remission of a trading liability as the money had been borrowed for regular business operations. Thus, being in the nature of a revenue income, such amounts shall be treated as deemed income in the hands of R Ltd. by virtue of section 41(1). This conclusion has been drawn from the Delhi High Court decision in Rollatainers Ltd. v. CIT.

It is to be noted that interest due but not paid would not have been allowed as deduction in the earlier years or current year, on account of the provisions of section 43B. Thereby, waiver of interest on term loan is not taxable u/s 41(1).

![]()

Question 16.

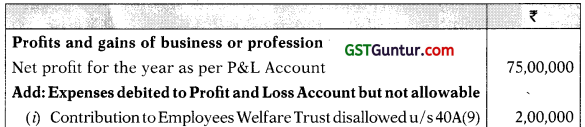

The Profit & Loss Account of ST Private Limited for the year ended 31st March, 2021 shows a profit of ₹ 75 lakhs after debiting the following items. Total Turnover of ST Pvt. Ltd. for P.Y. 2018-19 is ₹ 52 crores.

(i) ₹ 2 lakhs contributed to Employees’ Welfare Trust.

(ii)₹ 12 lakhs paid towards course fee and hostel expenses for MBA course of a close relative of a director. The relative is not in employment with the company.

(iii) ₹ 3.50 lakhs, being expenses incurred on installation of a traffic signal, so as to facilitate its employees coming to office to overcome traffic jam and save office time.

(iv) ₹ 3 lakhs spent on gift items distributed to various dealers under the company’s sales incentive scheme.

(v) ₹ 6 lakhs, being expenses incurred on the travelling of the wife of MD, who accompanied him on tour to Singapore on invitation of Trade and Commerce Chamber, Singapore.

(vi) ₹ 3 lakhs, being amount paid in March 2021 consequent upon change in currency rate due to exchange fluctuation in excess of the amount due to the supplier of machinery.

(vii) ₹ 18,000 and₹ 9,000 paid in cash on 25th October, 2020 by two separate vouchers to a contractor who carried out certain repair work in the office premises.

(viii) Interest of ₹ 2 lakhs was paid in March, 2021 to a company on a loan taken from a company. Tax deducted at source from such interest was deposited in July, 2021.

![]()

Additional Information:

(a) Provision for audit fee of ₹ 6 lakhs was made in the books for the year ended 31st March, 2020 without deducting tax at source. Such fee was paid to the auditors in September, 2020 after deducting tax under section 194J and the tax so deducted was. deposited on 7th November, 2020.

(b) During the year, the company purchased 10,000 shares of.VK Private Limited at ₹ 40 per share. The fair market value of such shares on the date of transaction was f 60 per share.

Compute total income of ST Private Limited for Assessment Year 2021 – 22 and tax payable on such income indicating reasons for treatment of each item. Ignore the provisions relating to minimum alternate tax. [CA Final May 2013] [16 Marks]

Answer:

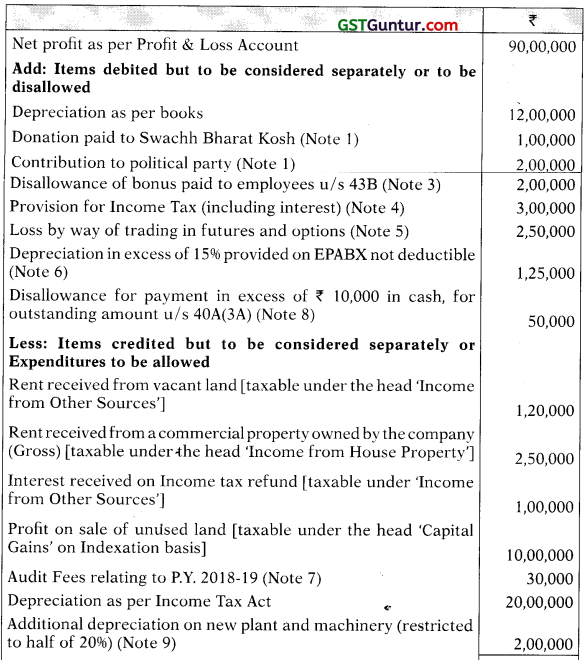

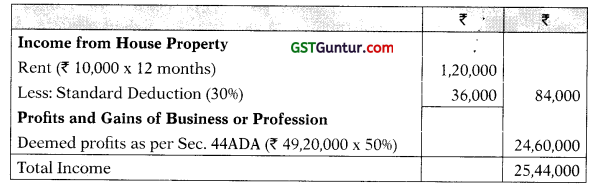

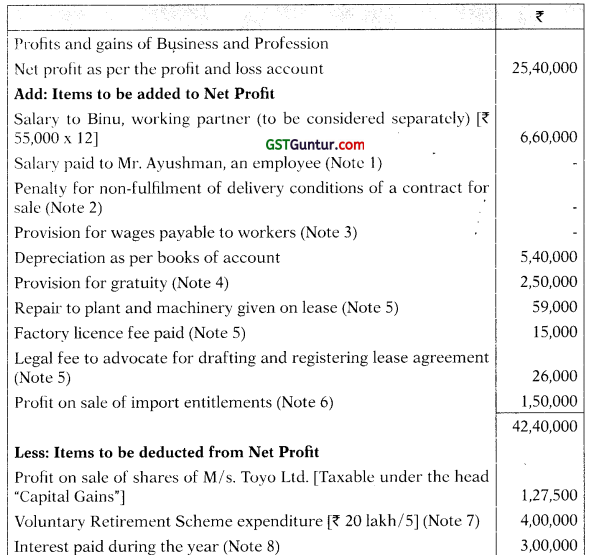

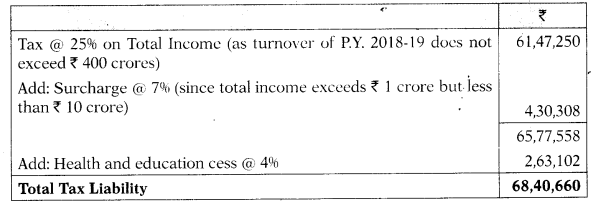

Computation of total income of Dhyan Ltd. for the A.Y. 2021-22

Computation of tax liability for A.Y. 2021-22

Notes:

1. Increase in liability due to change in currency rate and paid to the suppliers of machine shall be added to the cost of the block of asset as per section 43A and is eligible for depreciation. Hence, it should be added back to compute business income.

![]()

2. As per Gujarat State Road Transport Corporation case (2014)(Guj.), deduction for employees contribution made by the employer after the due date under the relevant Act shall be disallowed even if remitted before the due date of filing Return of Income. So, accordingly employees’ contribution to PF not remitted before the due date under the PF Act shall be disallowed.

But if the Contrary Judgments of AIMIL Ltd. and Kichha Sugar Ltd. is followed which provides that even the employees’ contribution to PF remitted after the due date under the relevant Act but before the due date of filing return of Income shall be allowed as deduction, then deduction of further ₹ 2,00,000 shall be allowed.

3. If the aggregate of payments made to a person in a single day otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system or through such other electronic mode as may be prescribed exceeds ₹ 10,000, then such whole payment shall g be disallowed as per section 40A(3). Where the payment is made for an expenditure to one person in one day, then the different vouchers are irrelevant. So, the aggregate shall be disallowed. Further, as it has not been debited to P&L A/c, it shall have no treatment.

4. As per section 56(2)(x), where the difference between the aggregate FMV of shares and the consideration paid for purchase pf such shares exceeds ₹ 50,000, then such difference shall be deemed as in the hands of person purchasing it. In this case, the company purchased 10,000 shares of VK Pvt. Ltd. at ₹ 40 per share whereas the FMV of the shares is ₹ 60 per share. Therefore the difference of ₹ 2,00,000 [(₹ 60 – ₹ 40) × 10,000 shares] shall be taxable in the hands of the company as Income from Other Sources.

![]()

Question 17.

MNO Limited is engaged in manufacturing activities. It received liquidated damages of ₹ 10 lakh from supplier of machinery due to delay in supply of machinery. State, with reasons, whether or not the income by way of liquidated damages is assessable as income from business. [CA Final Nov 2013, Nov 2011] [4 Marks]

Answer:

The issue under consideration in this case is whether the liquidated damages received by a company from the supplier of machinery for delay in supply of machinery is revenue in nature i.e., whether the same can be assessed as business income.

The Apex Court, in the case of CIT v. Saurashtra Cement Ltd. (2010), held that such liquidated damages were directly attributable to and intimately linked with the procurement of a capital asset. Therefore, it is a capital receipt in the hands of the assessee and hence not taxable under any head of income.

Applying the rationale of the above Apex Court ruling in this case, the income by way of liquidated damages of ₹ 10 lakh received by MNO Ltd. from the supplier of machinery is a capital receipt and hence, not assessable as income from business.

![]()

Question 18.

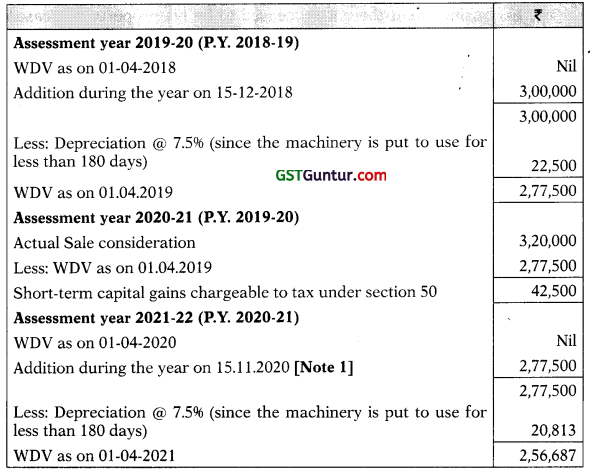

“Rameshwarm” after purchase put to use on 15.12.2018 a machine worth ₹ 3,00,000 which is eligible for depreciation (a 15%. He sold this machine to “Ganesham” on 1.1.2020 for ₹ 3,20,000 (FMV on that date was ₹ 2,50,000), who after having used the machine for his business purposes again sold it back to “Rameshwarm” on 15.11.2020 for ₹ 3,10,000.

Compute the amount of allowable depreciation and of chargeable capital gain, if any, for assessment years 2019-20 to 2021-22 assuming that this was the only machine in the block of asset held by both “Rameshwarm” and “Ganesham”. [CA Final Nov 2013] [7 Marks]

Answer:

Computation of allowable depreciation /chargeable capital gains

![]()

Notes:

1. As per Explanation 4 to section 43(1), where an asset which had once belonged to the assessee and had been used By him for the purpose of his business and thereafter, ceased to be his property by reason of transfer or otherwise, is reacquired by him, the actual cost to the assessee shall be lower of the following:

(a) Actual cost when he first acquired the asset minus the depreciation actually allowable to him till the date of transfer (i.e., ₹ 2,77,500, in this case); or

(b) Actual price for which it is reacquired (i.e., ₹ 3,10,000).

Therefore, in this case, the actual cost of machinery reacquired by Rameshwarm would be ₹ 2,77,500, being the lower of the two amounts given above.

2. As per Explanation 3 to section 43(1), where the assets were at any time, before the date of acquisition by the assessee, used by any other person for the purposes of business or profession and the A.O. is satisfied that the main purpose of the transfer of such assets was the reduction of his liability (by claiming excess depreciation with reference to enhanced cost), the actual cost to the assessee shall be such an amount as determined by the Assessing Officer, with the previous approval of the Joint Commissioner.

Consequently, the cost of machinery in the hands of Ganesham would be ₹ 2,50,000, assuming that the fair market value given in the question is the amount determined by the Assessing Officer, with the previous approval of the Joint Commissioner.

![]()

Question 19.

Examine the taxability or allowability or otherwise in the following cases while computing income under the head “Profits and gains from business or profession” to be declared in the return of income for the financial year ended on 31.3.2021.

(i) Amount received by A Ltd. towards power subsidy with a stipulation that the same is to be adjusted in the electricity bills.

(ii) Profit derived by an assessee engaged in carrying the business as dealers in shares on exchange of the shares held as stock-in-trade of one Company with the shares of other Company. [CA Final May 2014, May 2011][4 Marks]

Answer:

(i) Power subsidy received by A Ltd. is revenue in nature as it reduces the amount of the electricity bills. Thus, it is in the nature of compensation for the expense incurred by A Ltd. and therefore taxable as per ICDS-VII Government Grants, as ICDS is applicable to the company-assessee. Hence, the subsidy is taxable under the head PGBP.

(ii) As per ICDS VIII “Securities”, dealing with securities held as stock-in trade provides that where a security is acquired in exchange for other securities, the Fair value of the security acquired would be its actual cost for initial recognition. Subsequently, at the end of the year, the securities would be valued at lower of actual cost or NRV prevailing at the end of that year.

On exchange of shares held as stock-in-trade of a company with the shares of another company, the profit derived by the dealer in shares

i.e.

- difference between the cost of shares of the first company and the market value of shares of the new company on the date of exchange

shall be treated as business income for the dealer in the shares as derived in the normal course of his business. This was also earlier held by Supreme Court in the case of Orient Trading Co. Ltd. v. CIT.

![]()

Question 20.

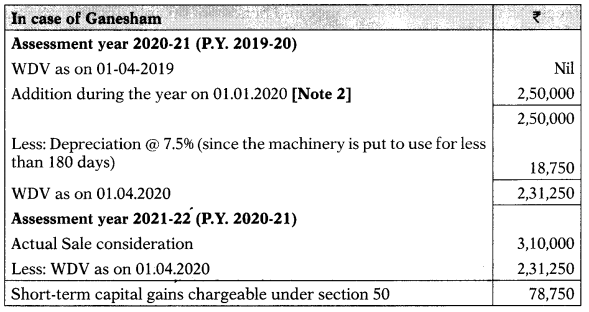

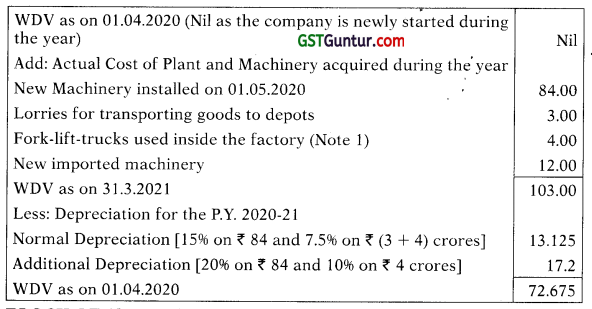

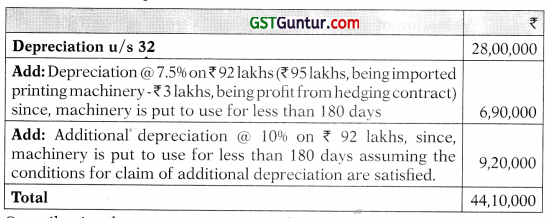

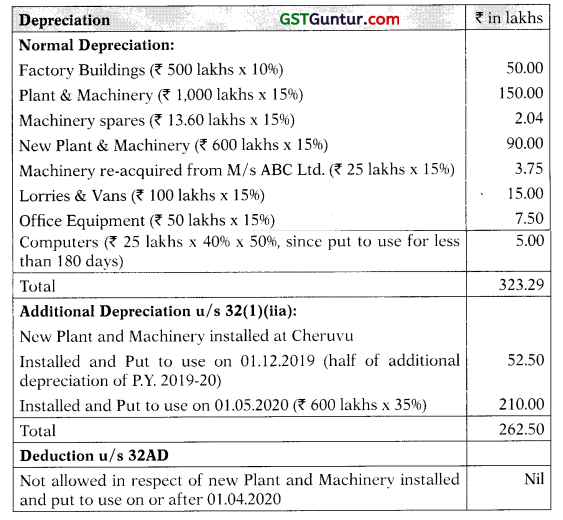

Compute the quantum of depreciation available u/s 32 of the Income-tax Act, 1961 and any other benefit available in respect of the following items of Plant and Machinery purchased by PQR Textile Ltd., which is engaged in the manufacture of textile fabrics, during the year ended 31.03.2021:

The new imported machinery arrived at Chennai port on 30.03.2021 and was installed on 03.04.2021. All other items were installed during the year ended 31.03.2019. The company was newly started during the year. Also, compute the WDV of various blocks of assets.

Will your answer be different if the above assessee were a partnership firm? [CA Final May, 2014] [8 Marks]

Answer:

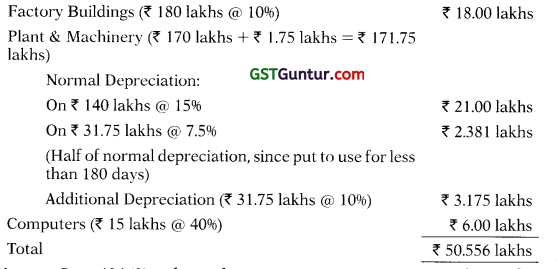

BLOCK of Plant and Machinery (subject to 15% depreciation)

Computation of Depreciation and the WDV as on 01.04.2020

BLOCK OF Plant and Machinery (subject to 40% depreciation).

Computation of Depreciation and the WDV as on 01.04.2020

Notes:

(1) As per Motor Vehicles Act, 1988, the definition of vehicle excludes, inter alia, a vehicle of special type adapted for use only in a factory or in any enclosed premises. Therefore, fork-lift trucks used only inside the factory shall not be considered as a vehicle but as just a regular plant and machinery. Hence, it is eligible for additional depreciation under section 32(1)(iia) and deduction under section 32AC.

(2) As per the third proviso to section 32(1)(ii), the balance of additional depreciation of ₹ 0.40 crores being 50% of ₹ 0.80 crore (20% of ₹ 4.00 crore) and ₹ 0.20 crores being 50% of ₹ 0.40 crore (20% of ₹ 2.00 crore) would be allowed as deduction in the A.Y. 2022-23.

![]()

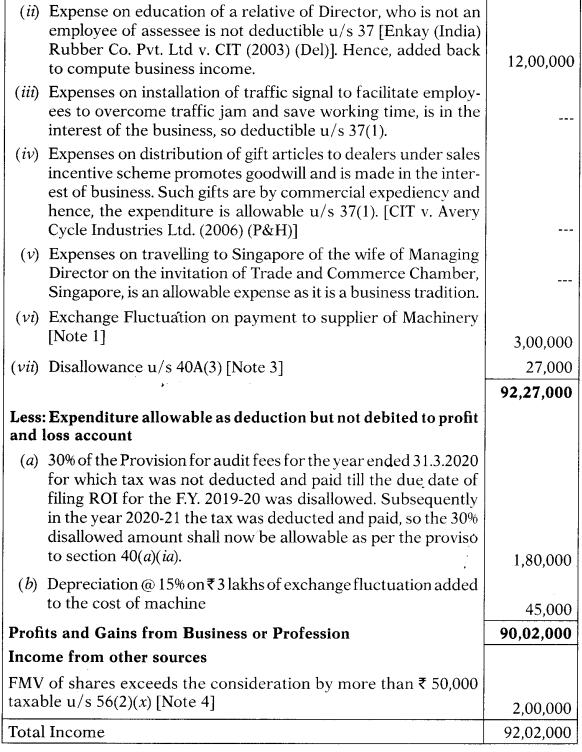

Question 21.

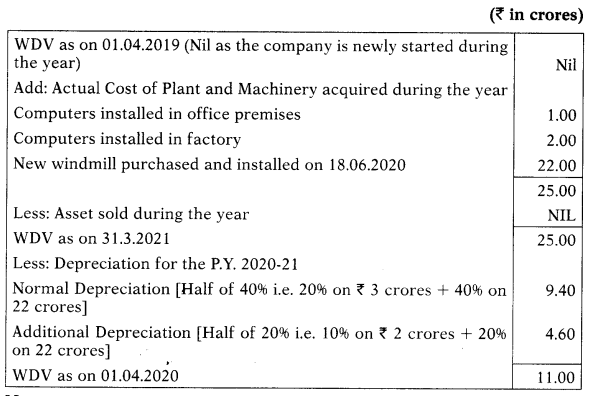

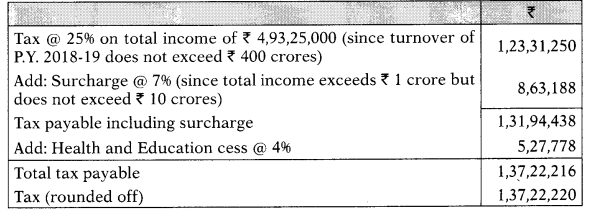

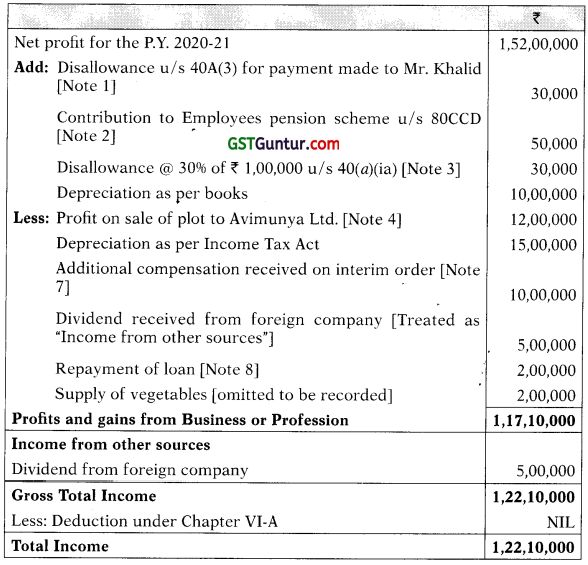

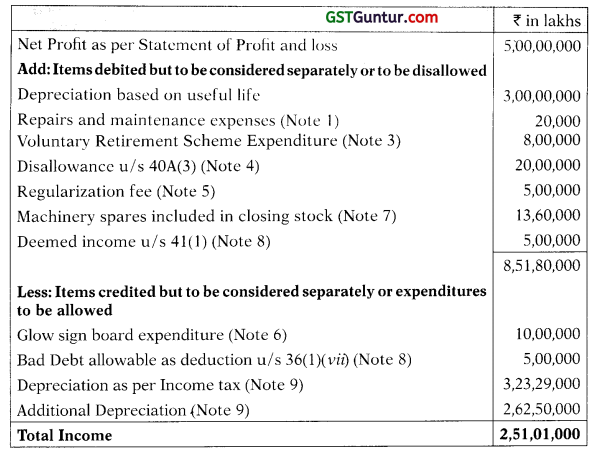

XYZ Ltd. is engaged in the business of manufacturing garments having turnover of ₹ 765 lakhs for the previous year 2018-19. Its P & L account shows a net profit of ₹ 500 lakhs for the year ended 31.03.2021 after debiting and crediting the following items:

Depreciation provided in accounts as per straight line basis is ₹ 30 lakhs.

Normal depreciation allowable is ₹ 28 lakhs. The company has made addition to machinery during the year to the extent of ₹ 100 lakhs, in June, 2020.

The company has made cash payments for purchases and expenditure as below:

On 04-06-2020 ₹ 5 lakhs (Due to strike by bank staff)

On 05-06-2020 ₹ 7 lakhs (Due to cash demanded by the supplier)

On 30-09-2020 ₹ 10 lakhs (Half yearly closing for bank; a bank holiday)

Payment made to transport operator for hiring of lorry as follows:

07-05-2020 ₹ 50,000; 08-01-2021 ₹ 75,000; 02-03-2021 ₹ 32,000.

♦ GST of ₹ 1.45 lakhs, pertaining to the year ended 31-03-2020, was paid on 10-12-2020.

♦ Rent paid and professional charges to a consultant including GST was ₹ 5,61,800 and ₹ 2,24,720 respectively. Tax was not deducted on the service tax portion for both the payments.

♦ The company has imported 1,000 kgs raw materials from a supplier in US at the rate $ 75/kg on 29-03-2020. The exchange rate was ₹ 59/$ when the imports were made. The payment to the supplier was made on 20-01-2021 when the exchange rate was ₹ 62/$. The company had not entered into a forward contract to hedge the risk.

♦ The company has also purchased goods of ₹ 55 lakhs from M/s. ABC Ltd. in which Directors have substantial interest. The market value of the goods is ₹ 54 lakhs.

♦ The company has incurred legal expenses for the following:

Issue of Bonus shares ₹ 10 lakhs. ,

Alteration of Memorandum of Association ₹ 2 lakhs (in connection with increase of authorized capital).

Donation paid to a political party is ₹ 25 lakhs.

Compute the total income and tax payable by the company for the A.Y. 2021-22. Ignore MAT provisions. [C!4 Final May 2014] [16 Marks]

Answer:

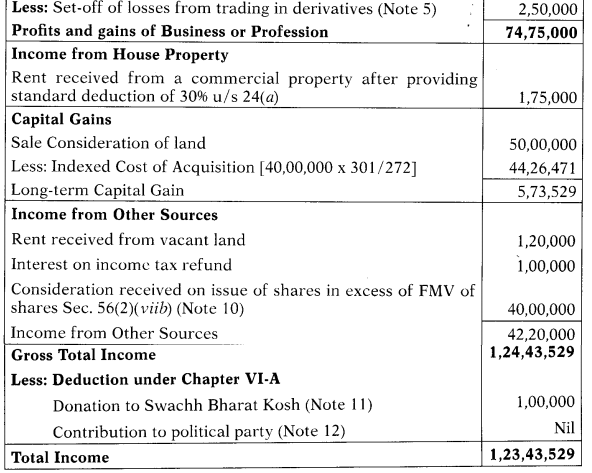

Computation of Total Income of XYZ Ltd. for the A.Y. 2021-22

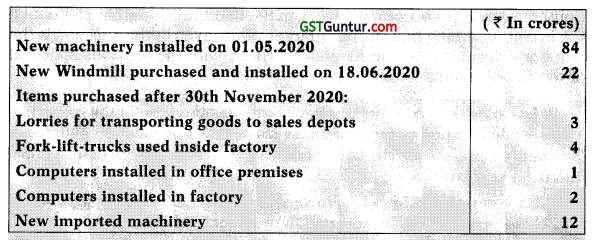

Computation of Tax liability of XYZ Ltd. for A.Y. 2021-22

![]()

Notes:

(1) As per sec. 40A(3), cash payments exceeding ₹ 10,000 in a day is wholly disallowed. However, Rule 6DD provides for certain exceptions, which includes, payments which are required to be made on a day on which the banks were closed either due to holiday or strike. Hence, cash payments of ₹ 5 lakhs made on the day of strike by bank staff and cash payment of ₹ 10 lakhs made on a bank holiday would not be disallowed u/s 40A(3), assuming such payments were required to be made on those specific dates. However, cash payment of ₹ 7 lakhs made on 5.6.2020 due to demand of supplier would attract disallowance u/s 40A(3).

(2) Depreciation provided in the accounts on straight line basis (i.e., ₹ 30 lakhs) shall be added back and depreciation as per Income-tax of ₹ 28 lakhs is allowable as deduction u/s 32.

Further, as per sec. 32(1)(iia), additional depreciation @ 20% shall be allowed on the actual cost of ₹ 100 lakhs of new plant and machinery purchased in June 2020. Hence, the total depreciation is ₹ 48 lakhs [i.e., ₹ 28 lakhs + ₹ 20 lakhs].

(3) Where the payment of an expenditure is made in cash to a transport operator, the disallowance u/s 40A(3) is attracted only if the payment exceeds ₹ 35,000 so the cash payment of ₹ 32,000 would not be disallowed. However, cash payments of ₹ 50,000 and ₹ 75,000 on 7.5.2020 and 8.1.2020, respectively, would be disallowed under section 40A(3) as they exceed ₹ 35,000 in a day.

(4) As per section 43B, where any tax is not paid till the due date of filing the return of income, the same shall be disallowed. But it will be allowed as deduction where it is paid in any subsequent year. Hence, the GST liability of ₹ 1.45 lakhs pertaining to previous year 2019-20 is deductible in the year of payment (i.e., P.Y. 2020-21). Since it is already debited to profit and loss account, no further adjustment is required.

(5) Where the service tax component comprised in the amount payable to a resident is indicated separately, tax shall be deducted at source on the amount paid/payable without including such service tax component.

Assuming that, the service tax component is indicated separately in the agreement between the company and the consultant, tax shall be deducted without including such service tax component. Therefore, no disallowance is attracted for non-deduction of tax at source on the service tax component.

(6) As per Sec. 43AA, subject to provisions of sec. 43A, any gain or loss arising on account of any change in foreign exchange rates shall be treated as income or loss and such gain or loss shall be computed as per the ICDS’s notified u/s 145(2). Sec. 43AA also provides that gain or loss on account of the effects of change in foreign exchange rates shall be in respect of all foreign currency transactions including those relating to monetary items and therefore, here sec. 43AA will be applicable.

![]()

As per ICDS-VI – The Effects of Changes in Foreign Exchange Rates,

the loss which arises on settlement of monetary items will be allowed as expense in the previous year when the said loss arises.

In this case, the foreign exchange loss of ₹ 2,25,000 (1,000 kgs × $75 × ₹ 3) has accrued and actually been incurred during the P.Y. 2020-21. Hence, the same is allowable as deduction in the A.Y. 2021-22. Since the same has already been debited to profit and loss account, no further adjustment is required.

Note: ICDS is applicable to all the company-assessees. In this case, it is assumed that XYZ Ltd. follows mercantile system of accounting and therefore, ICDS would be applicable. Further, it is also assumed that the rate of exchange on 31.3.2020 was the same as on 29.3.2020 and hence, no exchange loss is required to be provided for in P.Y. 2019-20.

(7) ABC Ltd. is a related person under section 40A(2), since the directors of the XYZ Ltd. have substantial interest in ABC Ltd. Therefore, excess payment of ₹ 1 lakh to ABC Ltd. for purchase of goods would attract disallowance under section 40A(2).

(8) As per Supreme Court in CIT v. General Insurance Corpn. (2006) on issue of bonus share, there is no fresh inflow of funds or increase in capital employed. There is only reallocation of the company’s fund. Consequently, legal expenses of ₹ 10 lakhs in connection with issue of bonus shares is revenue expenditure and is hence, allowable as deduction.

However, legal expense in relation to alteration of memorandum and in connection with increase in Authorised Capital is directly related to expansion of the capital base of the company and is, hence, a capital expenditure. Therefore, the same is not allowable as deduction. It has been so held in Punjab State Industrial Development Corporation Ltd v. CIT (1997) (SC).

(9) Donation paid to a political party is disallowed as per sec. 37 as not incurred wholly and exclusively for business. However, the same shall be allowed as deduction u/s 80GGB if the payment is made not by way of cash.

![]()

Question 22.

X & Co. Diagnostic Centre P. Ltd. has claimed referral fee paid to doctors as revenue expenditure for the assessment year 2021-22. Tax has been deducted u/s 194H for the said payments. The A.O. proposes to disallow such expenditure. Examine the correctness of the action of the A.O. [CA Final May 2014] [4 Marks]

Answer:

As per Explanation to section 37(1), any expenditure incurred by an assessee for any purpose which is an offence or which is prohibited by law shall not be deemed to have been incurred for the purpose of business and profession and no deduction or allowance shall be made in respect of such expenditure. As per the Indian Medical Council (Professional Conduct, Etiquette and Ethics) Regulations, 2002, no physician shall give, solicit, receive or offer to give, solicit or receive any gift, gratuity, commission or bonus in consideration of a return for referring any patient for medical treatment.

The demand as well as payment of such referral fee is bad in law. It is not a fair practice and is opposed to public policy. Applying the rationale and considering the purpose of Explanation to section 37(1), the assessee would not be entitled to deduction of such payments made in contravention of law or opposed to public policy or have pernicious consequences to the society as a whole. This view has been upheld by the Punjab & Haryana High Court in CIT v. Kap Scan and Diagnostic Centre P. Ltd. (2012).

Thus, the action of the Assessing Officer in disallowing the referral fee paid by X & Co. Diagnostic Centre P. Ltd. to doctors is correct. The fact that tax has been deducted u/s 194H is of no consequence.

![]()

Question 23.

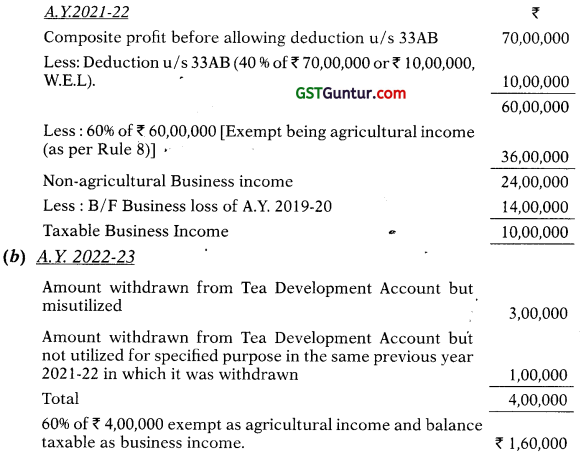

(i) Rahul Ltd. is engaged in the business of growing and manufacturing tea in India. For the previous year ending on 31.03.2021, its composite business profit before allowing deduction u/s 33AB is ₹ 70,00,000. On 01.09.2021 it deposited a sum of ₹ 10,00,000 in the Tea Development Account. During the previous year 2018-19, Rahul Ltd. had incurred a business loss of ₹ 14,00,000 which has been carried forward. On 25.01.2022, it withdraws ₹ 10,00,000 which is utilized as under:

₹ 6,00,000 for purchase of non-depreciable asset as per the scheme specified.

₹ 3,00,000 for purpose other than specified in the scheme.

₹ 1,00,000 was spent for the purpose of scheme on 05.04.2022.

(a) Compute the business income of Rahul Ltd. for A.Y.2021-22.

(b) What are the tax consequences of money misutilized/not utilized?

(c) What will be the consequence if the asset purchased for ₹ 6,00,000 is sold for ₹ 8,00,000 in April, 2022?

(ii) Assume that the asset which was purchased for ₹ 6,00,000 was a depreciable asset and it is the only asset in the block and it was sold for ₹ 8,00,000 in April, 2022. [CA Final Nov. 2014] [9 Marks]

Answer: (i)

(a) As per rule 8, before disintegrating the business profits into agricultural income and non-agricultural income, the income is to be computed under the head “Profit and Gains from Business and Profession”, which means besides other deductions, the deduction u/s 33AB shall also be allowed.

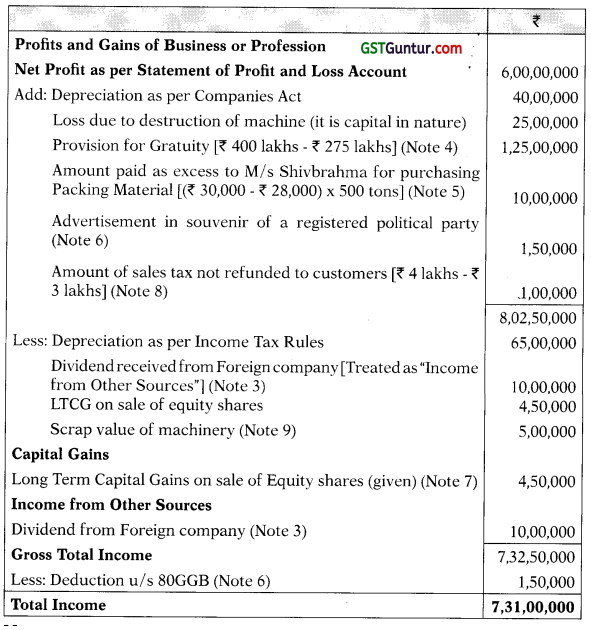

Computation of Total Income of Rahul Ltd.

Since, the asset is sold within 8 years, the cost of the asset i.e. ₹ 6,00,000 shall be treated as business income as the entire cost had been allowed as deduction in the earlier year but out of this ₹ 6,00,000, 60% shall be agricultural income and balance 40% i.e. ₹ 2,40,000 will be the income taxable under the head PGBP.

(ii)

A.Y. 2022-23: Depreciation on machinery acquired and put to use for less than 180 days = 50% of 15% of ₹ 6,00,000 = ₹ 45,000.

A.Y. 2023-24:

Short term capital gain ₹ 8,00,000 – ₹ 5,55,000 = ₹ 2,45,000

Business income shall be ₹ 6,00,000; but out of this 60% shall be exempt as agriculture income and balance 40% i.e. ₹ 2,40,000 will be the income taxable under the head PGBP.

![]()

Question 24.

PQR Ltd., a non-banking finance company was engaged in the business of leasing and hire purchase. It purchased motor cars from Ramaha motors and leased out these vehicles to its customers. The lease agreement with the customer stated that PQR Ltd. was empowered to repossess the vehicle, in case the lessee committed a default. Registration of the vehicle in the name of lessee, during the period of lease is mandatory as per the Motor Vehicles Act, 1988. PQR Ltd. claimed ₹ 5,00,000 as depreciation on the vehicles leased out for the year ending 31.3.2021.

H The claim was rejected by the A.O. on the ground that the assessee had merely financed the purchase of motor cars and was neither the owner nor the user of these assets. Is the action of the A.O. valid? Discuss. [CA Final Nov. 20J4] [4 Marks].

Answer:

The issue under consideration in this case is whether depreciation on leased vehicles can be denied to the lessor (PQR Ltd.) on the grounds that the vehicles are registered in the name of the lessee and that the lessor is not the actual user of vehicles.

The facts of the case are similar to the facts in I.C.D.S Ltd. v. CIT (2013), where the Supreme Court observed that section 32 imposes a twin requirement of “ownership” and “usage for business” as conditions for claim of depreciation thereunder. As far as usage of the asset is concerned, the section requires that the asset must be used in the course of business. It does not mandate actual usage by the assessee itself.

The Supreme Court further observed that the Motor Vehicle Act, 1988 contains a deeming provision which creates a legal fiction of ownership in favour of the lessee only for that Act and not for the purpose of law in general. No inference could be drawn from the registration certificate as to ownership of the vehicles, since registration in the name of the lessee during the period of lease is mandatory as per the Motor Vehicles Act, 1988.

Therefore, as long as the lessor has a right to retain the legal title against the rest of the world, it would be the owner of the asset in the eyes of law.

By applying the above rationale, the action of the A.O. in denying the depreciation claim of PQR Ltd. is not valid since PQR Ltd. has used the vehicles in the course of its leasing business even though it was not the actual user of the vehicles. Also, PQR Ltd. is the exclusive owner of the vehicle at all points of time as he is empowered to repossess the vehicle, in case the lessee committed a default. The proof of ownership lies in the lease agreement itself, which clearly points in favour of PQR Ltd.

![]()

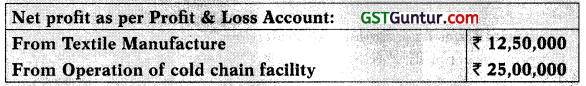

Question 25.

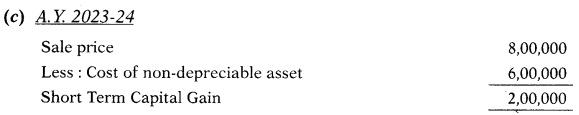

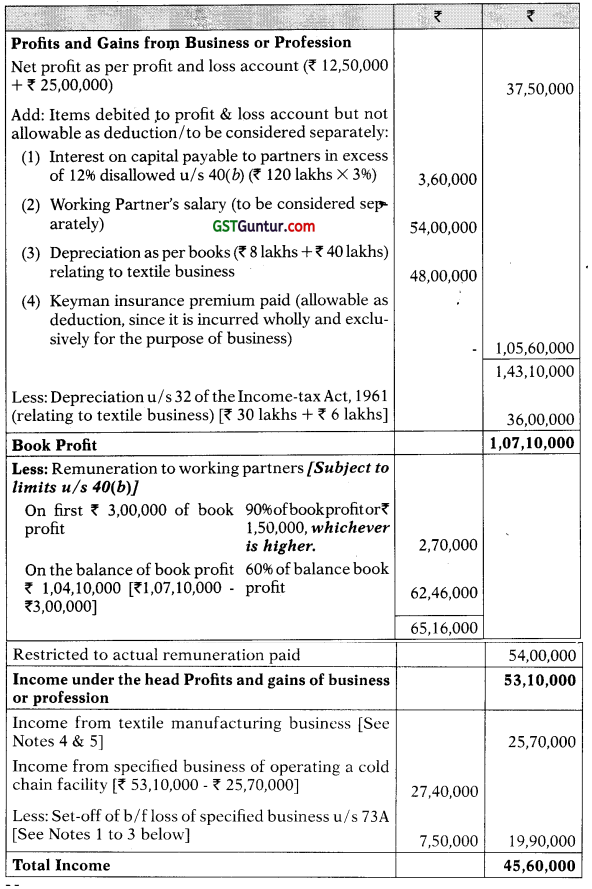

Riddhi Corporation LLP, is carrying on two businesses viz. Textile manufacture and Operation of cold chain facility. It gives you the following information for the year ended 31st March, 2021:

The following items are debited to Profit & Loss Account:

(i) Interest on capital payable to partners @ 15% on total capital of ₹ 120 lakhs.

(ii) Working partner salary ₹ 54 lakhs (i.e., ₹ 1.5 lakhs each per month for 3 partners).

(iii) Depreciation on textile factory building ₹ 8 lakhs.

(iv) Depreciation on Plant & Machineries of textile business ₹ 40 lakhs.

(v) Keyman insurance policy premium paid ₹ 1,60,000.

Other Information:

Eligible depreciation u/s 32 for the previous year 2020-21 are-

(i) On Plant & Machineries of textile business ₹ 30 lakhs.

(ii) On factory building relating to textile business ₹ 6 lakhs.

The assessee set up and operating a cold chain facility since 1st April, 2019. It incurred capital expenditure towards construction of cold chain facility during the period from 1st June, 2017 to 31st March, 2019 as under:

Cost of land (acquired on 1st June, 2017) ₹ 40 lakhs.

Cost of construction of building and machineries installed till 31st March, 2019 ₹ 90 lakhs.

The income of the firm for the previous year 2019-20 (A.Y 2020-21) is given below:

Income from Textile manufacture ₹ 15 lakhs.

Income from cold chain facility ₹ 80 lakhs (before deduction u/s 35AD)

The firm originally had 4 equal partners and one partner retired on 31-32020. The partnership agreement authorizes payment of salary and interest on capital which are debited to Profit & Loss Account.

You are requested to compute the total income of the firm for the A.Y. 2021-22.

Ignore Alternate Minimum Tax (AMT) u / s 115JC. [CA Final May 2015] [10 Marks]

Answer:

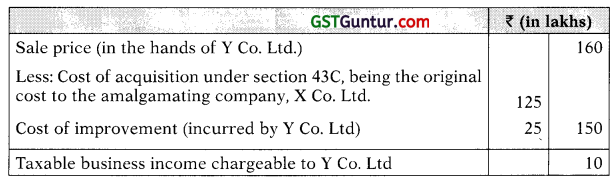

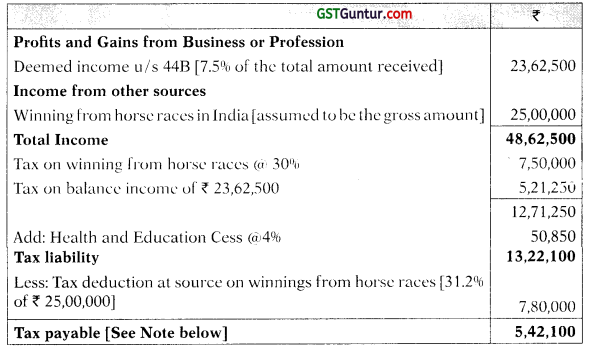

Computation of Total Income of Riddhi Corporation LLP for the A.Y. 2021-22

![]()

Notes:

(1) Computation of loss of specified business of setting up and operating a cold chain facility for P.Y. 20 19-20 relevant to A.Y. 2020-21:

(2) Expenditure incurred on acquisition of land is not available as deduction u/s 35AD(8). Therefore, only cost of ₹ 90 lakhs on construction of building and machinery installed would qualify for deduction u/s 35AD, [assuming such expenditure has been capitalized in the books as on 1.42019 (date of commencement of operations)1, as it was incurred prior to commencement of operations [Proviso to section 35AD(1)].

(3) Section 78(1) does not permit carry forward of losses pertaining to the share of a retired or deceased partner. Therefore, in this case, since one of the four partners have retired on 31.3.2020, his share of loss (₹ 2,50,000, being 1/4th of ₹ 10 lakh) for the P.Y. 2019-20 (A.Y. 2020-21) cannot be carried forward to the P.Y. 2020-21 (A.Y. 2021-22).

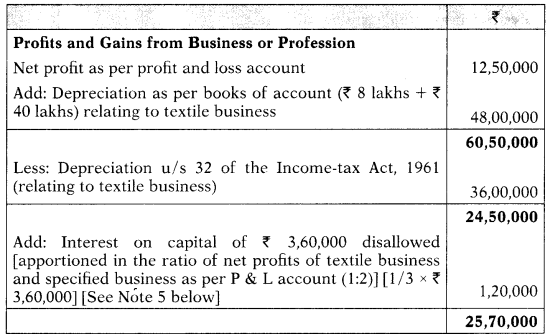

(4) Computation of profit from textile manufacturing business

(5) Loss of specified business can be carried forward indefinitely for set-off only against profits of any specified business. Therefore, it becomes necessary to segregate the income of ₹ 53.10 lakhs computed under the head “Profits and gains of business or profession”, so that brought forward loss from specified business relating to P.Y. 2019-20 can be set-off against profits of specified business of the P.Y. 2020-21.

For this purpose, while computing profits of textile manufacturing business included in the business income of ₹ 53.10 lakhs, the depreciation as per books of account has to be added back and the depreciation as per the Income-tax Act, 1961 has to be reduced from the net profit of ₹ 12.50 lakhs pertaining to textile business, since the depreciation adjustments clearly relate to textile business.

The entire remuneration is allowable as deduction because it is with- in the limits as per section 40(6)(v). It is only the interest on capital amounting to ₹ 3.6 lakhs (which has been added back while computing business income) which has to be apportioned between textile manufacturing business and specified business.

The interest on capital is to be apportioned in the ratio of 1 : 2 (ratio of the net profit of these two businesses as per P&L A/c) between textile manufacturing and specified business. The solution can also be worked out by apportioning interest on capital on any other logical basis.

![]()

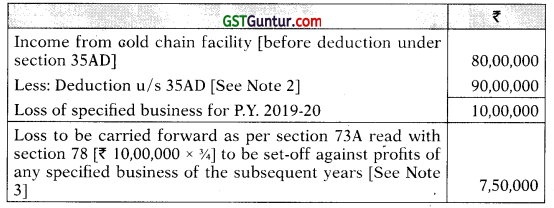

Question 26.

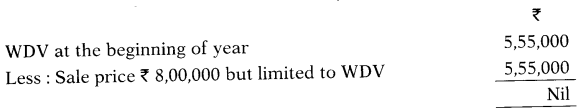

Star India Ltd., a listed company, engaged in manufacturing activity furnishes the following details:

Net profit as per Profit and Loss Account ₹ 60,00,000.

(i) The company took a loan of ₹ 15,00,000 in the P.Y. 2016-17 for the purpose of relocation of its office premises. The lender waived ₹ 10,00, 000 in the P.Y. 2020-21 and it is credited in the P & L A/c.

(ii) Depreciation charged to Profit and Loss Account is ₹ 18,00,000. Depreciation as per Income-tax Act, 1961 amounts to ₹ 30,00,000 which includes the following:

Depreciation rate meant for computers has been adopted for (i) accessories like printers and scanners; and (ii) EPABX. The written down value of these as on 1-4-2020 is given below:

(a) Printers and Scanners – ₹ 60,000

(b) EPABX – ₹ 3,00,000

Assume that there were no additions during the year.

(iii) It incurred ₹ 3,00,000 as expenditure for public issue of shares. The public issue could not materialize on account of non-clearance by SEBI. This amount is charged to Profit & Loss Account.

(iv) It incurred expenditure of ₹ 2,50,000 towards issue of debentures. This amount has been capitalized in the books.

(v) The company paid ₹ 1,50,000 as compounding fee for violations in the pollution control regulations. This has been charged as revenue expenditure.

(vi) The company lost cash of ₹ 28,00,000 due to theft when it was with-drawn from bank and taken to administrative office. It is not insured and hence, fully charged as revenue expenditure.

(vii) ₹ 6,00,000 was spent during the year towards permitted CSR activities as per 135 of the Companies Act, 2013 This is charged to Profit and Loss Account.

![]()

(viii) It paid ₹ 2,50,000 to share broker for transacting shares listed in stock exchange and ₹ 2,00,000 to commodity broker for commodity transactions at MCX. Both the amounts are debited to Profit and Loss Account and no tax was deducted at source on these payments.

(ix) The company has 200 employees as on 31.03.2020. During the be-ginning of the year, the company removed some of the employees and employed 115 new employees which makes the total number of employees as 295 as on the last day of the P.Y. 2020-21. It paid ₹ 3,000 p.m. to all the employees.

(x) It paid ₹ 60,000 to an electoral trust by cash and ₹ 1,20,000 by cheque to a registered political party. Both these are debited to Profit and Loss Account.

Compute the total income of the company for the assessment year 2021-22. Give reasons in brief for treatment of each of the above items. Ignore MAT provisions. [CA Final May 2015] [16 Marks]

Answer:

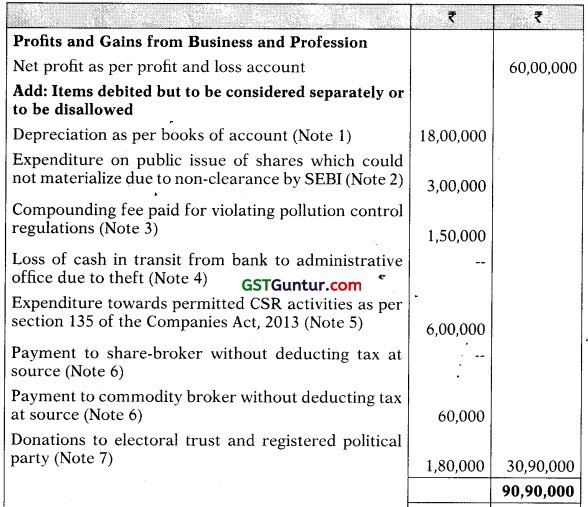

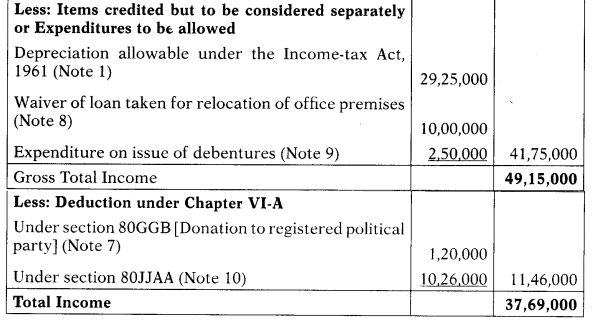

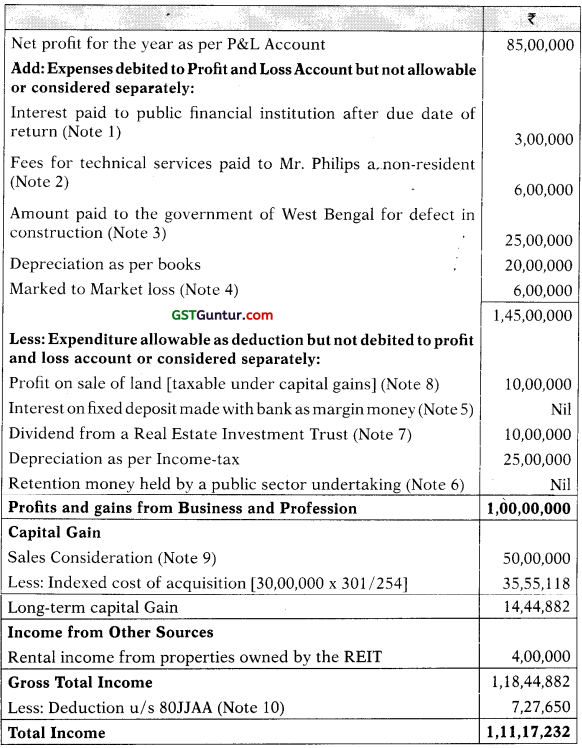

Computation of Total Income of Star India Ltd. for the A.Y. 2021-22

![]()

Notes:

(1) Depreciation as per books of account charged to P&L A/c (i.e., ₹ 18 lakhs) has to be added back and depreciation calculated as per Income-tax Rules, 1962 (i.e. ₹ 29.25 lakhs) is allowable as deduction u/s 32. Computer accessories and peripherals like printer and scanner form an integral part of the computer system and they cannot be used without the computer; hence, they are eligible for depreciation @ 40% [CIT v. BSES Yamuna Powers Ltd. (2013) (Del.)].

However, EPABX is not a computer and is, hence, not entitled to higher depreciation @ 40% [Federal Bank Ltd. v. ACIT (2011) (Kerala)].

Therefore, depreciation as per Income-tax Act, 1961 would be ₹ 28.65 lakhs, which is computed as follows –

(2) Share issue expenses constitute a capital expenditure, even though the company could not go in for the public issue on account of non-clear ance by SEBL Though the efforts were aborted, the fact remains that the expenditure incurred was only for the purpose of expansion of the capital base. The capital nature of the expenditure would not be lost on account of the abortive efforts [Mascon Technical Services Ltd. y. CIT (2013) (Mad.)]. Since the expenditure has been charged to profit and loss, the same has to be added back.

(3) The amount paid for compounding an offence is inevitably a penalty and the mere fact that it has been described as compounding fee cannot, in any way, alter the character of the payment which is in the nature of penalty and hence, is not allowable as revenue expenditure [Millennia Developers P. Ltd. v. Deputy CIT (2010) (Kar.)]. Since the compounding fee has been charged to P & L A/c, the same has to be added back.

(4) The loss incurred by theft, dacoity, embezzlement etc., if incidental to the carrying on of the business whether committed by the employees of the assessee or by strangers is deductible. [G.G. Dandekar Machine Works Ltd. v. CIT (1993) (Bom.)]. In this case, the loss due to theft took place when cash was withdrawn from bank and taken to administrative office is incidental to business and thus, allowable as revenue expenditure.

![]()

(5) Any expenditure incurred by an assessee on the activities relating to CSR referred to in section 13 5 of the Companies Act, 2013 is disallowed as per Explanation 2 to section 37. Since the expenditure has been charged to profit and loss account, the same has to be added back for computing business income.

It is assumed that the CSR expenditure is not of the nature described in sections 30 to 36 of the Income-tax Act, 1961, and hence, does not qualify for deductions under those sections.

(6) The payments to share broker and commodity broker are in the nature of commission. However, payment for transaction in securities has been particularly excluded from the scope of section 194H. Hence, payment of ₹ 2.5 lakhs to a share broker for transacting shares listed in stock exchange (which falls within the meaning’of securities) would not be disallowed for non-deduction of tax at source.