CA Inter Costing Question Paper Nov 2022 – CA Inter Costing Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter Nov 2022 Costing Question Paper Solution

Question 1.

Answer the following :

(a) A Ltd. is a pharmaceutical company which produces vaccines for diseases like Monkey Pox, Covid-19 and Chickenpox. A distributor has given an order for 1,600 Monkey Pox Vaccines. The company can produce 80 vaccines at a time. To process a batch of 80 Monkey Pox Vaccines, the following costs would be incurred:

| ₹ | |

| Direct Materials | 4,250 |

| Direct wages | 500 |

| Lab set up cost | 1,400 |

The Production Overheads are absorbed at a rate of 20% of direct wages and 20% of total production cost is charged in each batch for selling, distribution and administration Overheads. The company is willing to earn profit of 25% on sales value.

You are required to determine:

(i) Total Sales value for 1,600 Monkey Pox Vaccines

(ii) Selling price per unit of the Vaccine.

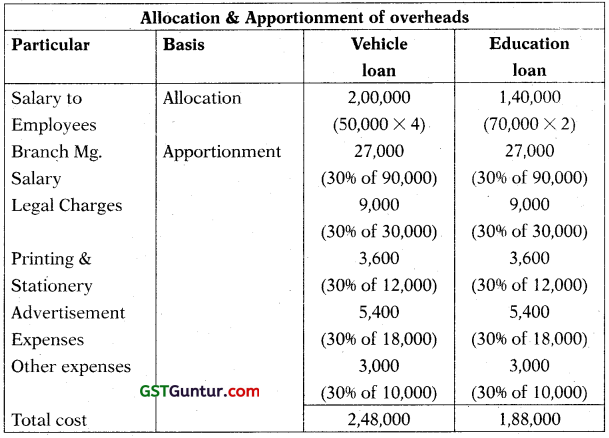

(b) ABC Bank is having a branch which is engaged in processing of ‘Vehicle Loan’ and ‘Education Loan’ applications in addition to other services to customers. 30% of the overhead costs of the branch are estimated to be applicable to the processing of ‘Vehicle Loan’ applications and ‘Education Loan’ applications each.

Branch is having four employees at a monthly salary of ₹ 50,000 each, exclusively for processing of Vehicle Loan applications and two employees at a monthly salary of ₹ 70,000 each, exclusively for processing of Education Loan applications.

In addition to above, following expenses are incurred by the Branch:

- Branch Manager who supervises all the activities of branch, is paid at ₹ 90,000 per month,

- Legal charges, Printing & stationery and Advertising Expenses are incurred at ₹ 30,000, ₹ 12,000 and ₹ 18,000 respectively for a month.

- Other Expenses are ₹ 10,000 per month.

You are required to:

(i) Compute the cost of processing a Vehicle Loan Application on the assumption that 496 Vehicle Loan applications are processed each month.

(ii) Find out the number of Education Loan Applications processed, if the total processing cost per Education Loan Application is same as in the Vehicle Loan Application as computed in (i) above.

(c) MM Ltd. uses 7500 valves per month which is purchased at a price of ₹ 1.50 per unit. The carrying cost is estimated to be 20% of average inventory investment on an annual basis. The cost to place an order and getting the delivery is ₹ 15. It takes a period of 1.5 months to receive a delivery from the date of placing an order and a safety stock of 3200 values is desired.

You are required to determine:

(i) The Economic Order Quantity (EOQ) and the frequency of orders,

(ii) The reorder point.

(iii) The Economic Order Quantity (EOQ) if the valve costs ₹ 4.50 each instead of ₹ 1.50 each.

(Assume a year consists of 360 days)

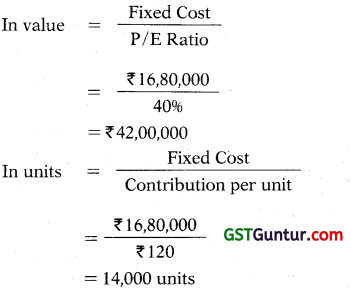

(d) ABC Ltd. sells its Product ‘Y’ at a price of ₹ 300 per unit and its variable cost is ₹ 180 per unit. The fixed costs are ₹ 16,80,000 per year uniformly incurred throughout the year. The Profit for the year is ₹ 7,20,000.

You are required to calculate:

(i) BEP in value (₹) and units,

(ii) Margin of Safety,

(iii) Profits made when sales are 24,000 units,

(iv) Sales in value (₹) lo be made to earn a net profit of ₹ 10,00,000 for the year. (Marks 4 × 5 = 20)

Answer:

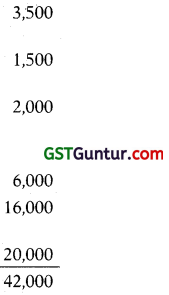

(a) Statement of cost per batch and per order

No. of batch = 1600 units ÷ 80 units = 20 batches.

| Particulars | Cost per Batch | Total cost |

| Direct Material cost | 4,250 | 85,000 |

| Direct wages | 500 | 10,000 |

| Lab set up cost | 1,400 | 28,000 |

| Production overheads (20% of direct wages) |

100 | 2,000 |

| Particulars | Cost per Batch | Total cost |

| Total Production cost

Add: S&D and Administrative overheads |

6,250 1,250 |

1,25,000

25,000 |

| Total cost

Add: Profit |

7,500

2,500 |

1,50,000

50,000 |

| Selling price | 10,000 | 2,00,000 |

(i) Total sales value = 2,00,000

(ii) Selling price p.u. = \(\frac{2,00,000}{1,600}\) = ₹ 125/unit

![]()

(b)

(i) Cost of processing a vehicle loan = \(\frac{2,48,000}{496 \text { loans }}\) = ₹ 500

(ii) Given that cost of processing an education loan is same as cost of pro¬cessing a vehicle loan

∴ No of education loan processed = \(\frac{1,88,000}{500 / \text { loan }}\) = 376 loans

(c) Annual Requirement = 7500 × 12 months = 90,000 units

Ordering cost = ₹ 15

Carrying cost = ₹ 0.3 (1.5/unit × 2096)

(Per unit)

(i) Calculation of Economic Order Quantity

EOQ = \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{C}}}\)

= \(\sqrt{\frac{2 \times 90,000 \times 15}{0.3}}\)

= 3000 units

Frequency of orders = \(\frac{90,000}{3,000}

(ii) EOQ when purchase cost is ₹ 4.5 each instead of ₹ 1.5 each

EOQ = [latex]\frac{\sqrt{2 \mathrm{AO}}}{\mathrm{C}}\)

= \(\frac{\sqrt{2 \times 90,000 \times 15}}{0.9}\) = 1732 units

Calculation of carrying cost ⇒ 20% of ₹ 4.5/unit = ₹ 0.9

(iii) Calculation of Re-Order Point

= Safety stock + Average lead Lime consumption

= 3,200 + [\(\frac{90,000}{360 \text { days }}\) × 45 days]

= 14,450 units.

(d)

(i) Calculation of Break Even Point:

(ii) Margin of Safety = \(\frac{\text { Current sales }- \text { Break even sales }}{\text { Current sales }}\)

= \(\frac{20,000-14,000}{20,000}\)

= 30%

![]()

(iii) Calculation of profit when sales are 24,000 units

(iv) Calculation of sales to earn net profit of ₹ 10,00,000

Total contribution = Fixed cost + Expected profit

= 16,80,000 + 10,00,000

= ₹ 26,80,000

No. of units = \(\frac{\text { Total contribution }}{\text { Contribution per unit }}\)

= \(\frac{₹ 26,80,000}{₹ 120}\)

= 22,333 units

Total Sales = 22,333.333 × ₹ 300 = ₹ 67,00,000

Question 2.

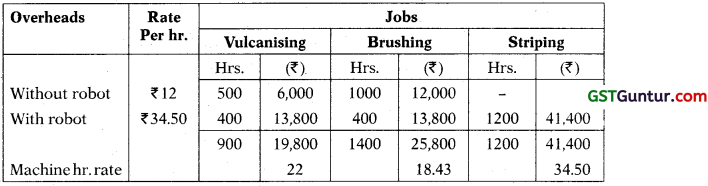

(a) USP Ltd. is the manufacturer of ‘double grip motorcycle tyres’. In the manufacturing process, it undertakes three different jobs namely, Vulcanising, Brushing and Striping. All of these jobs require the use of a special machine and also the aid of a robot when necessary. The robot is hired from outside and the hire charges paid for every six months is ₹ 2,70,000. An estimate of overhead expenses relating to the special machine is given below :

- Rent for a quarter is ₹ 18,000.

- The cost of the special machine is ₹ 19,20,000 and depreciation is charged @ 10% per annum on straight line basis.

- Other indirect expenses are recovered at 20% of direct wages.

The factory manager has informed that in the coming year, the total direct wages will be ₹ 12,00,000 which will be incurred evenly throughout the year.

During the first month of operation, the following details are available from the job book:

Number of hours the special machine was used

Jobs-Without the aid of the robot-With the aid of the robot

| Vulcanising | 500 | 400 |

| Brushing | 1000 | 400 |

| Striping | – | 1200 |

You are required to :

(i) Compute the Machine Hour Rate for the company as a whole for a month (A) when the robot is used and (B) when the robot is not used.

(ii) Compute the Machine Hour Rate for the individual jobs i.e. Vulcanising, Brushing and Striping. (10 Marks)

(b) A skilled worker, in PK Ltd. is paid a guaranteed wage rate of ₹ 15.00 per hour in a 48-hour week. The standard time to produce a unit is 18 minutes. During a week, a skilled worker – Mr. ‘A’ has produced 200 units of the product. The Company has taken a drive for cost reduction and wants to reduce its labour cost.

You are required to:

(i) Calculate wages of Mr. ‘A’ under each of the following methods :

A. Time rate,

B. Piece-rate with a guaranteed weekly wage,

C. Halsey Premium Plan,

D. Rowan Premium Plan.

(ii) Suggest which bonus plan i.e. Halsey Premium Plan or Rowan Premium Plan, the company should follow. (6 Marks)

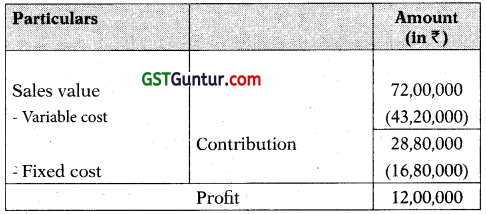

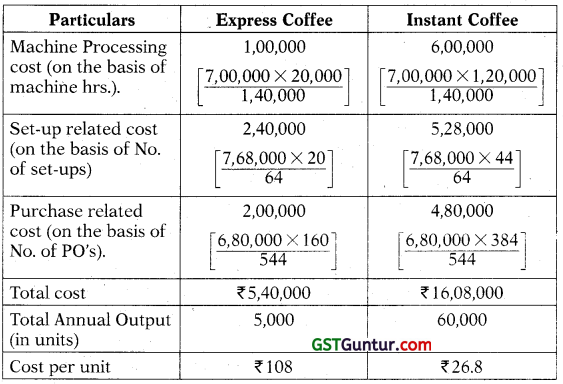

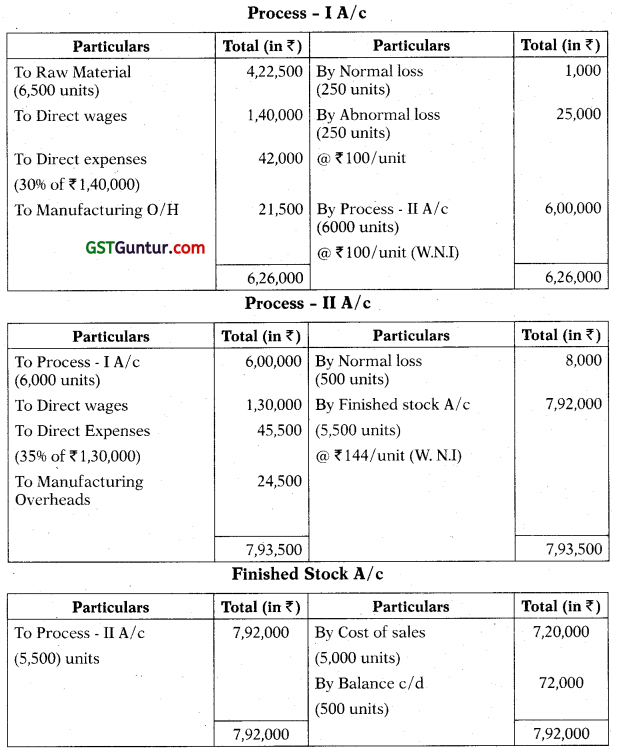

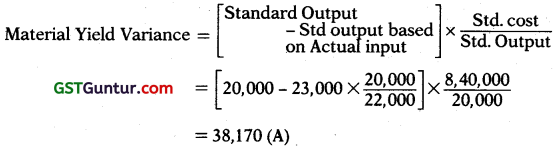

(c) XYZ Ltd. is engaged in manufacturing two products – Express Coffee and Instant Coffee. It furnishes the following data for an year:

The annual overheads are as under:

| Particulars | ₹ |

| Machine Processing costs | 7,00,000 |

| Set up related costs | 7,68,000 |

| Purchase related costs | 6,80,000 |

You are required to :

(i) Compute the costs allocated to each product – Express Coffee and Instant Coffee from each activity on the basis of Activity-Based Costing (ABC) method.

(ii) Find out the Overhead cost per unit of each product – Express Coffee and Instant Coffee based on (i) above. (4 Marks)

Answer:

(a)

Working Notes

(i) Total special machine hours used

(500 + 1000 + 400 + 400 + 1200) = 3,500

(ii) Total special machine hrs. without aid of robot

(500 + 1000) = 1,500

(iii) Total special machine hrs. with aid of robot

(400 + 400 + 1200) = 2,000

(iv) Total overheads of special machine per month

Rent (₹ 18,000 ÷ 3 months) = 6,000

Depreciation (19,20,000 × 10% × 1/12) 16,000

Other indirect expenses

(20% of 12,00,000 × 1/12) = 20,000

Total = 42,000

(v) Robot hire changes

= (2,70,000 ÷ 6 months) – 45,000

(vi) Overheads for using special machines without robot

= \(\frac{₹ 42,000}{3,500 \text { hrs. }}\) × 1500 hrs. = 18,000

(vi) Overheads for using special machines with robot.

= \(\frac{42,000}{3,500 \mathrm{hrs}}\) × 2000 hrs. + 45,000 = ₹ 69,000

(d) Computation of machine hr. rate for the firm as a whole for the month

When the robot is used = \(\frac{₹ 69,000}{2,000}\) = ₹ 34.50

When the robot is not used = \(\frac{₹ 18,000}{1500}\) = ₹ 12

![]()

(b) Computation of machine hour rate for individual job.

(i) Calculation of wages of Mr.A

A. Time rate

48 hrs. × ₹ 15/hr = ₹ 720

B. piece – rate with a guaranteed weekly wage.

Std. units/hr. = \(=\frac{60 \text { minutes } / \mathrm{hr} .}{18 \text { minute } / \text { unit }}\) = 3.33 units/hr.

∴ Piece rate = \(\frac{₹ 15 / \mathrm{hr} .}{3.33 \text { units/hr. }}\) = ₹ 4.5/unit

Wages = 200 units × ₹ 4.5/units = ₹ 900

Therefore, Mr. A will be paid ₹ 900 as it exceeds the minimum guaranteed weekly wage of ₹ 720.

(c) Halsey premium plan

Standard time for actual output

= \(\frac{200 \text { units } \times 18 \text { minutes } / \text { unit }}{60 \text { minutes } / \mathrm{Hr} .}\)

= 60 Hrs.

∴ Time saved = Time allowed – Time taken

= 60 Hrs. – 48 Hrs.

= 12 Hrs.

Wages under Halsey premium plan

= TT × TR + 50% of TS × TR

= 48 × ₹ 15/hr. + (50% of 12 hr.) × ₹ 15/hr.

= ₹ 810

(d) Rowan premium plan

Wages under Rowan premium plan

= TT × TR + \(\frac{\mathrm{TT}}{\mathrm{TA}}\) × TS × TR

= 48 × ₹ 15/hr. + \(\frac{48}{60}\) × 12 × ₹ 15/hr.

= ₹ 864

(ii) Rowan scheme of premium bonus is a suitable incentive scheme for the company. If this scheme is adopted, the entire gains due to time saved by a worker will not pass to them.

Another feature is that a worker cannot increase his earnings or bonus by merely increasing its work speed. The reason for this is that the bonus under Rowan scheme is maximum when time taken by a worker on a job is half of the time allowed.

Lastly, Rowan scheme provides a safeguard in case of any loose function of the standards by rate-setting department.

(c)

(i) Allocation of each product on the basis of ABC

![]()

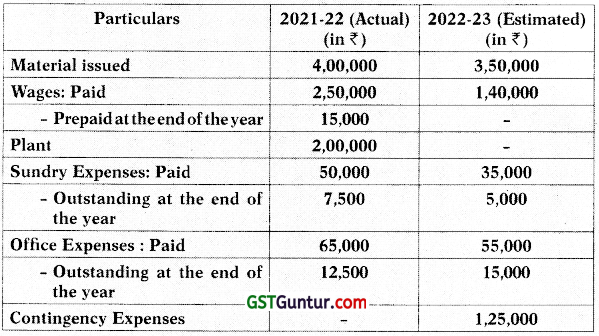

Question 3.

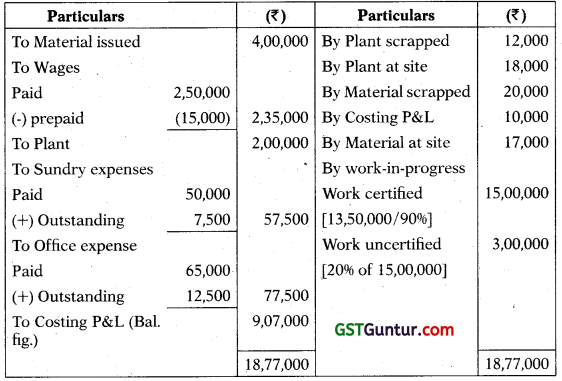

(a) XYZ Construction Ltd. has obtained a contract of ₹ 25,00,000 in the Financial Year 2021 -22. The work on the contract commenced immediately and it is expected that the contract will be completed by 31st March, 2023. Chief accountant of the company has provided following information related to the Contract:

Following additional information is also available:

- A part of plant costing ₹ 12,000 was scrapped and written-off in the F.Y. 2021-22.

- The value of Plant-at-Site on 31st March, 2022 was ₹ 18,000.

- Company would have to spend an additional sum of ₹ 80,000 on the plant in F.Y. 2022-23 and the residual value of the plant on the completion of contract would be ₹ 10,000.

- A part of material costing ₹ 30,000 was scrapped and sold for ₹ 20,000 in F.Y. 2021-22.

- The value of Material-at-Site on 31st March, 2022 was ₹ 17,000.

- Cash received on account till 31st March, 2022 was ₹ 13,50,000 representing 90% of the work certified.

- The cost of work uncertified on 31st March, 2022 was valued at 20% of work certified.

You are required to:

(i) Prepare a Contract Account for the year ended on 31st March, 2022.

(ii) Calculate Estimated Total Profit on this Contract. (10 Marks)

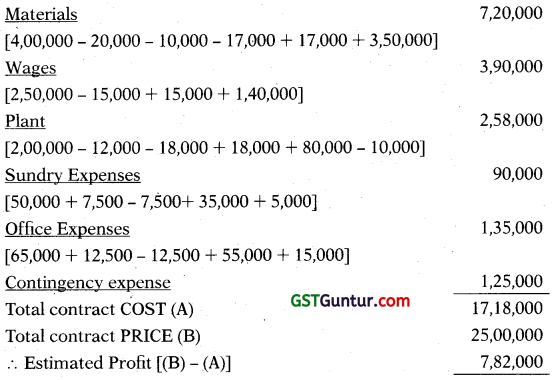

(b) N Ltd. produces a product which passes through two processes – Process-I. and Process-II, The company has provided following information related to the Financial Year 2021-22:

| Process I | Process II: | |

| Raw Material @ ₹ | 65 per units | |

| Direct Wages | ₹ 1,40,000 | ₹1,30,000 |

| Direct Expenses | 30% of Direct Wages | 35% of Direct Wages |

| Manufacturing Overheads | ₹ 21,500 | ₹ 24,500 |

| Realisable value of scrap per unit | ₹ 4.00 | ₹ 16.00 |

| Normal Loss | 250 units | 500 units |

| Units transferred to Process II/finished stock | 6,000 units | 5,500 units |

| Sales | – | 5,000 units |

There was no opening or closing stock of work-in-progress.

You are required to prepare:

(i) Process-I Account

(ii) Process-II Account

(iii) Finished Stock Account (10 Marks)

Answer:

(a)

(i) Contract A/c for year ended on 31st March, 2022

(ii) Calculation of estimated total profit on the contract.

![]()

(b)

Working Notes:

1. Calculation of cost per unit of completed units and abnormal loss :

= \(\frac{6,26,000-1,000}{6,500-250}\) = ₹ 100 Process – I

Question 4.

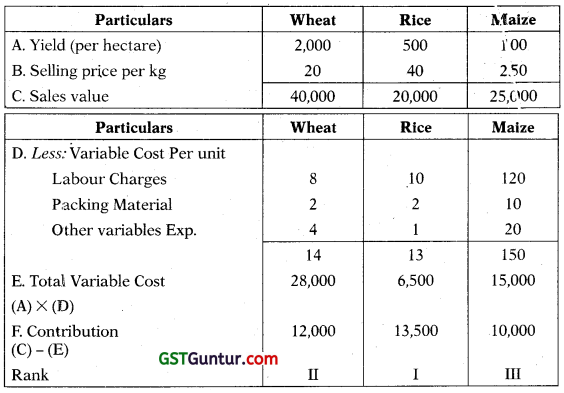

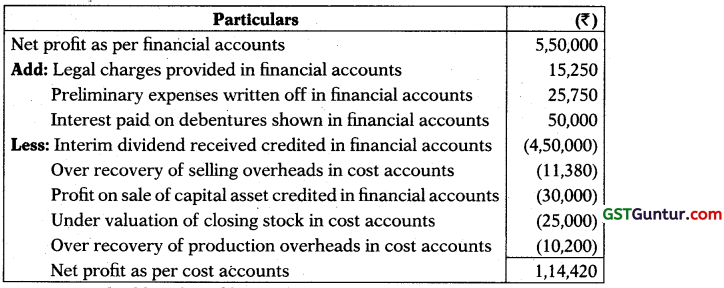

(a) An agriculture based company having 210 hectares of land is engaged in growing three different cereals namely, wheat, rice and maize annually. The yield of the different crops and their selling prices are given below:

| Wheat | Rice | Maize | |

| Yield (in kgs per hectare) | 2,000 | 500 | 100 |

| Selling price (₹ per kg) | 20 | 40 | 250 |

The variable cost data of different crops are given below:

(All figures in ₹per kg)

| Crop | Labour Charges | Packing Materials | Other variable expenses |

| Wheat | 8 | 2 | 4 |

| Rice | 10 | 2 | 1 |

| Maize | 120 | 10 | 20 |

The company has a policy to produce and sell all the three kinds of crops. The maximum and minimum area to be cultivated for each crop is as follows:

| Crop | Maximum area (in hectares) | Minimum Area (in hectares) |

| Wheat | 160 | 100 |

| Rice | 50 | 40 |

| Maize | 60 | 10 |

You are required to:

(i) Rank the crops on the basis of contribution per hectare.

(ii) Determine the optimum product mix considering that all the three cereals are to be produced.

(iii) Calculate the maximum profit which can he achieved if the total fixed cost per annum is ₹ 21,45,000.

(Assume that there are no other constraints applicable to this company) (10 Marks)

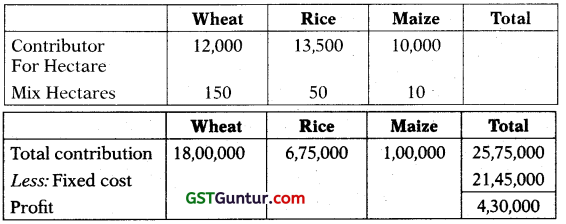

(b) PNME Ltd. manufactures two types of masks- ‘Disposable Masks’ and ‘Cloth Masks’. The cost data for the year ended on 31 st March, 2022 is as follows:

| ₹ | |

| Direct Materials | 12,50,000 |

| Direct Wages | 7.00,000 |

| Production Overhead | 4.00,000 |

| Total | 23,50,000 |

It is further ascertained that:

- Direct material cost per unit of Cloth Mask was twice as m uch of Direct material cost per unit of Disposable Mask.

- Direct wages per unit for Disposable Mask were 60% of those for Cloth Mask.

- Production overhead per unit was at same rate for both the types of the masks.

- Administration overhead was 50% of Production overhead for each type of mask.

- Selling cost was ₹ 2 per Cloth Mask.

- Selling Price was ₹ 35 per unit of Cloth Mask.

- No. of units of Cloth Masks sold- 45,000

- No. of units of Production of:

Cloth Masks: 50,000

Disposable Masks: 1,50,000

You are required to prepare a cost sheet for Cloth Masks showing :

(i) Cost per unit and Total Cost,

(ii) rofit per unit and Total Profit. (10 Marks)

Answer:

(a)

(i) Calculation of contribution per hectare.

![]()

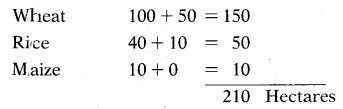

(ii) Determination of optimum product mix

First of all, minimum area required for each crop will be utilised i.e.

100 for Wheat

40 for Rice

10 for maize

150 Hectares

Now, we are left with 60 Hectare of land (210-150), which will be utilised on the basis of ranking.

Firstly , it will be utilised for cultivation of rice, as it gives highest contribution.

Therefore 10 acres of land will be cultivated for rice.

Afterwards, remaining 50 Acres of land will be allocated for cultivation of wheat, as it gives 2nd highest contribution.

Therefore mix will be as follows:

Wheat 100 + 50 = 150

Rice 40 + 10 = 50

Maize 10 + 0 = 10

= 210 Hectares

(iii) Project will be maximum if optimum mix is followed.

(b)

Working Notes:

Direct material cost per unit of Disposable mask is x

Direct material cost per unit of cloth mask is 2x

To, Direct material cost

= (2x × 50,000) + (x ×, 1,50,000) = ₹ 12,50,000

= 1,00,000 x + 1,50,000 x = ₹ 12,50,000

x = ₹5

Therefore, Direct material cost per unit of cloth mask = 2x = ₹ 10

2. Direct wages per unit of cloth mask = y

Direct wages per unit of disposable mask = 0.6y

= (y × 50,000) + (0.6y × 1,50,000) = ₹ 7,00,000

= 1,40,000y = ₹ 7,00,000

y = ₹5

3. Production overhead per unit = ₹ 4,00,000

50,000 + 1,50,000

= ₹ 2

![]()

Question 5

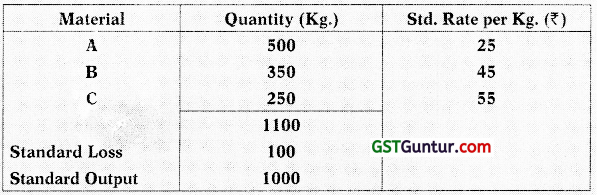

(a) Y Ltd. manufactures “Product M” which requires three types of raw materials “A”, “B” & “C”. Following information related to 1st quarter of the F.Y. 2022-23 has been collected from its books of account. The standard material input required for 1,000 kg of finished product ‘M’ are as under:

During the period, the company produced 20,000 kg of product ‘M’ for which the actual quantity of materials consumed and purchase prices are as under:

| Material | Quantity (Kg.) | Purchase price per Kg. (₹) |

| A | 11,000 | 23 |

| B | 7,500 | 48 |

| C | 4,500 | 60 |

You are required to calculate:

(i) Material Cost Variance

(ii) Material Price Variance for each raw material and Product ‘M’

(iii) Material Usage Variance for each raw material and Product ‘M’

(iv) Material Yield Variance

Note: Indicate the nature of variance i.e. Favourable or Adverse. (10 Marks)

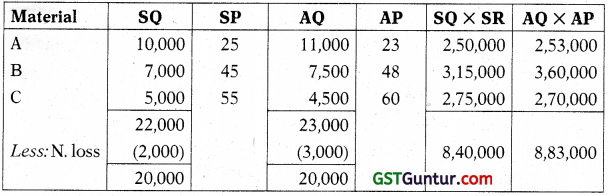

(b) ‘X’ Ltd. follows Non-Integrated Accounting System. Financial Accounts of the company show a Net Profit of ₹ 5,50,000 for the year ended 31st March, 2022. The chief accountant of the company has provided following information from the Financial Accounts and Cost Accounts:

| Particulars | (₹) |

| (i) Legal Charges provided in financial accounts | 15,250 |

| (ii) Interim Dividend received credited in financial accounts | 4,50,000 |

| (iii) Preliminary Expenses written off in financial accounts | 25,750 |

| (iv) Over recovery of selling overheads in cost accounts | 11,380 |

| (v) Profit on sale of capital asset credited in financial accounts | 30,000 |

| (vi) Under valuation of closing stock in cost accounts | 25,000 |

| (vii) Over recovery of production overheads in cost accounts | 10,200 |

| (viii) Interest paid on Debentures shown in financial accounts | 50,000 |

Required:

Find out the Profit (Loss) as per Cost Accounts by preparing a Reconciliation Statement. (5 Marks)

(c) ASR Ltd. mainly produces Product ‘L’ and gets a by-Product *M’ out of a joint process. The net realizable value of the by-product is used to reduce the joint production costs before the joint costs are allocated to the main product. During the month of October 2022, company incurred joint production costs of ₹ 4,00,000. The main Product ‘L’ is not marketable at the split off point. Thus, it has to be processed further. Details of company’s operation are as under:

| Particulars | Product L | By Product M |

| Production (units) | 10,000 | 200 |

| Selling pricing per kg | ₹ 45 | ₹ 5 |

| Further processing cost | ₹ 1,01,000 | – |

You are required to find out:

(i) Profit earned from Product ‘L’.

(ii) Selling price per kg of product ‘L’ if the company wishes to earn a profit of ₹ 1,00,000 from the above production. (5 Marks)

Answer:

(a)

(i) Material cost variance = SQ × SR – AQ × AR.

= 8,40,000 – 8,83,000

= 43,000(A)

(ii) Material Price variance

Material A = AQ(SP – AP)

= 11,000 (25 – 23)

= 22,000 (F)

Material B = 7,500 (45 – 48)

= 22,500 (A)

Material C = 4500 (55 – 60)

= 22,500 (A)

Product M = 22,000 (F) + 22,500 (A) + 22,500 (A)

= 23,000 (A)

![]()

(iii) Material Usage variance

Material A = SP (SQ – AQ)

= 25(10,000 – 11,000)

= 25,000 (A)

Material B = 45(7,000 – 7,500)

= 22,500 (A)

Material C = 55(5,000 – 4,500)

= 27,500 (F)

Product M = 25,00(A) + 22,500 (A) + 27,500 (F)

= 20,000 (A)

(iv) Material yield variance

Std. Mix for Actual Qty. (RSQ)

A = 23,000 × \(\frac{10,000}{22,000}\) = 10,455

B = 23,000 × \(\frac{17000}{22,000}\) = 7,318

C = 23,000 × \(\frac{5000}{22,000}\) = 5,227

Material Yield Variance = (SQ – RSQ) × SP

Material A = (10,000 – 10,455) × 25 = 11,375 (A)

Material B = (7,000 – 7318) × 45 = 14.310(A)

Material C = (5,000 – 5227) × 55 = 12.485(A)

Total = 37.170(A)

OR

(b)

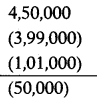

(c) (i) Net realisable value of by product M

= 200 units × ₹ 5/ unit

= ₹ 1,000

Joint cost allocable to product L

= ₹ 4,00,000 – ₹ 1,000

= ₹ 3,99,000.

Profit earned from product L

Sales (10,000 × ₹ 45) = 4,50,000

Less: Allocable joint cost = (3,99,000)

Further processing cost = (1,01,000)

(50,000)

Therefore there is loss of ₹ 50,000

(ii) If company wishes to earn a profit of ₹ 1,00,000, then selling price should be:

\(\frac{3,99,000+1,01,000+1,00,000}{10,000 \text { units }}\) = ₹ 60/ unit

Question 6.

Answer any four of the following :

(a) Which system of inventory management is known as ‘Demand pull’ or ‘Pull through’ system of production ? Explain. Also, specify the two principles on which this system is based.

(b) Indicate, for following items, whether to be show n in the Cost Accounts or Financial Accounts:

(i) Preliminary expenses written off during the year

(ii) Interest received on bank deposits

(iii) Dividend, interest received on investments

(iv) Salary for the proprietor at notional figure though not incurred

(v) Charges in lieu of rent where premises are owned

(vi) Rent receivables

(vii) Loss on sale of Fixed Assets

(viii) Interest on capital at notional figure though not incurred

(ix) Goodwill written off

(x) Notional Depreciation on the assets fully depreciated for which book value is Nil.

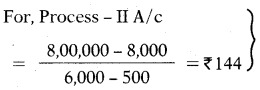

(c) PP Limited is in the process of implementation of Activity Based Costing System in the organisation. For this purpose, it has identified the following Business Functions in its organisation :

(i) Research and Development

(ii) Design of Products, Services and Procedures

(iii) Customer Service

(iv) Marketing

(v) Distribution

You are required to specify two cost drivers for each Business Function Identified above.

(d) Define Budget Manual. What are the salient features of Budget Manual?

(e) Mention the cost units (physical measurements) for the following industry/product:

(i) Automobile

(iii) Brickworks

(iv) Power

(v) Steel

(vi) Transport (by road)

(vii) Chemical

(viii) oil

(ix) Brewing

(x) Cement (Marks 4 × 5 = 20)

Answer:

(a) ‘Just in Time’ is a system of inventory management with an approach to have a zero inventories in stores. According to this approach material should only be purchased when it is actually required for production.

- This system is also known as “Demand pull” or “Pull Through” system of production.

Note: JIT is based on two principles,

(i) Produce goods only when it is required.

(ii) The product should be delivered to customers at the time only when they want.

(b) Items to be shown in cost accounts.

- Salary for the proprietor at notional figure though not incurred.

- Charges in lieu of rent where premises are owned.

- Interest on capital at notional figure though not incurred.

- Notional depreciation on the assets fully depreciated for which book value is NIL.

Note: Items to be shown in financial accounts.

- Primary expenses written off during the year.

- Interest received on bank deposits.

- Dividend, interest received on investments.

- Rent receivables.

- Loss on sale of fixed assets.

- Goodwill written off.

(c)

| Business Functions | Cost Driver |

| Research and Development |

|

| Design of products, services and procedures |

|

| Customer service |

|

| Marketing |

|

| Distribution |

|

![]()

(d) Budget Manual:

The Budget manual is a document or booklet which contain guidelines for the preparation of budget in an organization.

CIMA, London, defines budget manual as, “A document which sets out the responsibilities of the persons engaged in, the routine of, and the forms and records required for, budgetary control.”

Note: Salient features of budget manual:

(e)

| Industry | Cost unit (Physical Measurements) |

| Automobile | Number of vehicles |

| Gas | Cubic Meter |

| Bricks works | Thousand |

| Power | Kilo-watt hour |

| Steel | Tonne |

| Transport | Tonne – kilometer, passenger kilometer |

| Chemical | Litre, Kilogram, Tonne |

| Oil | Barrels |

| Brewing Cement | Tonnes, kilogram |