Students should practice Assessment of Individual & HUF – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Assessment of Individual & HUF – CS Executive Tax Laws MCQ Questions

Question 1.

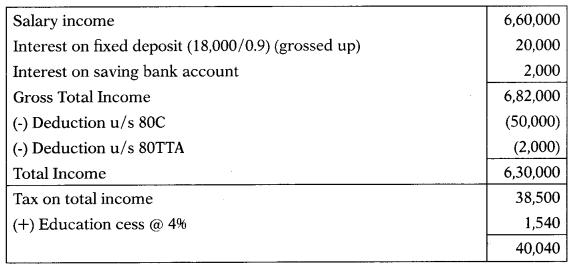

Arjun has a salary income of ₹ 6,60,000. He also received interest of ₹ 18,000 on his fixed deposit (after deducting TDS @ 10%) and ₹ 2,000 on his savings account with SBI. He deposited ₹ 50,000 in the PPF account.

The net income-tax liability of Arjun is

(A) ₹ 33,390

(B) ₹ 35,330

(C) ₹ 46,270

(D) ₹ 40,040 [June 2015]

Hint:

While solving this MCQ, it is presumed that the assessee paid tax as per normal provisions ie. not opted for tax u/s 115BAC.

Answer:

(D) ₹ 40,040

Question 2.

Under the Income-tax Act, 1961, dividend derived from the shares held as stock-in-trade are taxable under the head

(A) Income from other sources

(B) Income from profits and gains of business or profession

(C) Capital gains

(D) Either capital gains or income from profits and gains of business or profession [June 2015]

Hint:

W.e.f. 1.4.2020, DDT u/s 115-0 is not payable by the company. The dividend is fully taxable in hands of shareholders.

Answer:

(B) Income from profits and gains of business or profession

Question 3.

During the year 2020-21, Basu won ₹ 4,00,000 from a motor car rally out of which he deposited ₹ 1,50,000 in his PPF account. He does not have any other income.

Net tax payable by Basu for A.Y. 2021 – 22 will be

(A) ₹ 1,24,800

(B) ₹ 15,450

(C) ₹ 1,23,600

(D) None of the above [June 2015]

Hint:

4,00,000 × 31.2% = 1,24,800. PPF deduction is not available from winning of motor car.

Answer:

(A) ₹ 1,24,800

Question 4.

The voluntary contributions received by an electoral trust during the year is not included in its income

(A) When 85% of the contribution is distributed in the year

(B) When 95% of the contribution is distributed in the year

(C) To the extent of ₹ 10 lakhs

(D) To the extent of 50% of contribution or ₹ 100 lakhs whichever is less. [Dec. 2015]

Answer:

(B) When 95% of the contribution is distributed in the year

Question 5.

Balu paid ₹ 1,00,000 to Raj for the purchase of a standing crop (paddy). He harvested the produce, Le. paddy by incurring an expenditure of ₹ 25,000. He sold the said paddy for ₹ 1,80,000 to a trader. His other income for the year ended 31 st March 2021 was ₹ 4,60,000.

The total income of Balu is

(A) ₹ 6,40,000

(B) ₹ 5,15,000

(C) ₹ 4,85,000

(D) ₹ 5,60,000 [June 2016]

Hint:

Income from harvesting paddy is not agricultural income.

Total income = 1,80,000 – 1,00,000 – 25,000 + 4,60,000 = 5,15,000.

Answer:

(B) ₹ 5,15,000

Question 6.

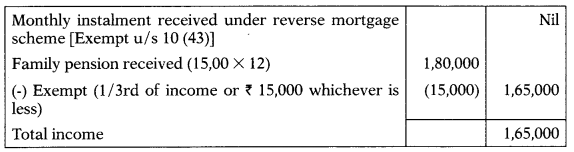

Mrs. Laxmi, 70 years old, received ₹ 30,000 every month from SBI under a reverse mortgage scheme by mortgaging her residential house property. She also received a monthly family pension of ₹ 15,000.

Her total income for the assessment year 2021-22 is –

(A) ₹ 5,40,000

(B) ₹ 1,80,000

(C) ₹ 1,65,000

(D) ₹ 3,60,000 [June 2016]

Hint:

Answer:

(C) ₹ 1,65,000

Question 7.

A registered trade union earned ₹ 1,00,000 by way of interest on bank deposit and ₹ 1,50,000 by way of rent from letting out premises.

Total income of the Trade union chargeable to tax would be

(A) ₹ 2,24,000

(B) ₹ 2,80,000

(C) ₹ 2,50,000

(D) Nil [Dec. 2016]

Answer:

(D) Nil

Question 8.

Ms. Pinky (age 61) pledged her residential building with the State Bank of India and received ₹ 10,000 every month under the reverse mortgage scheme during the financial year 2020-21.

The amount liable to income-tax in respect of such receipt would be:

(A) ₹ 1, 20,000 (fully taxable)

(B) ₹ 84,000 (after deducting 30%)

(C) ₹ 60,000 (after deducting 50%)

(D) Nil (as it is exempted from tax) [Dec. 2017]

Answer:

(D) Nil (as it is exempted from tax)

Question 9.

When Mr. X retired from X & Co. a partnership firm on 1.1.2021, he was paid ₹ 15 lakhs for not doing a competing business for the next 5 years.

The amount so received chargeable to tax in the hands of Mr. X is:

(A) Nil

(B) ₹ 5,00,000

(C) ₹ 1,00,000

(D) ₹ 2,50,000 [Dec. 2017]

Answer:

(B) ₹ 5,00,000

Question 10.

Mr. Chandan (age 70) received ₹ 30,000 every month during the financial year 2020-21 on a reverse mortgage of his property with State Bank of India.

The amount of receipt liable to tax in the hands of Mr. Chandan is:

(A) ₹ 3,60,000

(B) ₹ 2,52,000

(C) ₹ 40,000

(D) Nil [Dec. 2017]

Answer:

(D) Nil

Question 11.

The provisions of AMT under Chapter XITBA shall not apply to an individual, a HUF, etc. if the adjusted total income of such person does not exceed:

(A) ₹ 10,00,000

(B) ₹ 25,00,000

(C) ₹ 5,00,000

(D) ₹ 20,00,000 [June 2018]

Answer:

(D) ₹ 20,00,000

Question 12.

RS HUF consists of R Karta, Y and S coparceners, D, the daughter of a coparcener, and W, the wife of Karta as members.

The following can demand the partition of RS HUF:

(A) D

(B) R, Y, and S

(C) W

(D) (A) and (B) above [June 2018]

Answer:

(D) (A) and (B) above

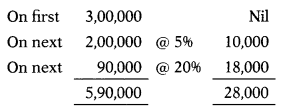

Question 13.

Mr. Soloman, a resident in India, aged 70 and has the following income for the previous year 2020-21. (All the incomes given below are the computed income):

(i) Net taxable pension from employer ₹ 3,30,000

(it) Rental income under house pro-perty ₹ 2,00,000

(iii) Agricultural income ₹ 60,000

His total tax liability for A.Y. 2021-22 is:

(A) ₹ 26,000

(B) ₹ 13,240 after rebate u/s 87A

(C) ₹ 18,240

(D) Nil, because total income is less than ? 5,00,000 [June 2018]

Hint:

| Net taxable pension from the employer | 3,30,000 |

| Income from house property | 2,00,000 |

| Total income | 5,30,000 |

Step 1:

Calculate tax on: Agricultural income + Non-agricultural income

60,000 + 5,30,000 = 5,90,000

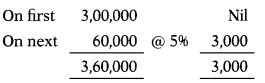

Step 2:

Calculate tax on: Agricultural income + Basic exemption limit

60,000 + 3,00,000 = 3,60,000

Step 3:

| Tax as per Step 1 | 28,000 |

| (-) Tax as per Step 2 | (3,000) |

| (+) Education cess @ 4% | 25,000

1,000 |

| 26,000 |

Answer:

(A) ₹ 26,000

Question 14.

Ram & Co., a proprietorship firm has paid tax for the assessment year 2021-22 as per Section 115JC of the Income Tax Act, 1961.

The credit of such paid tax can be carried forward by the proprietor for a period of the following a number of assessment years immediately succeeding the assessment year 2021-22:

(A) 8 years

(B) 5 years

(C) 10 years

(D) 15 years [Dec. 2018]

Answer:

(D) 15 years