Students should practice Leverages – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Leverages – Financial and Strategic Management MCQ

Question 1.

The term Leverage in general refers to a

(A) Relationship between fixed cost and profit.

(B) Relationship between sales and fixed cost.

(C) Relationship between two inter-related variables.

(D) Relationship between two unrelated variables.

Answer:

(C) Relationship between two inter-related variables.

Question 2.

In financial analysis, Leverage represents the influence of one__over some other related

(A) Non-financial variable; financial variable

(B) Financial variable; financial variable

(C) Financial variable; non-financial variable

(D) Variable relating to revenue; financial variable

Answer:

(B) Financial variable; financial variable

Question 3.

Which of the following are not commonly used measures of leverage in financial analysis?

(A) Operating Leverage

(B) Financial Leverage

(C) Combined Leverage

(D) Matrix Leverage

Answer:

(D) Matrix Leverage

Question 4.

___ is the ratio of net operating income before fixed charges to net operating income after fixed charges.

(A) Financial Leverage

(B) Operating Leverage

(C) Operation Leverage

(D) Fiscal Leverage

Answer:

(B) Operating Leverage

Question 5.

Operating leverage indicates the tendency of operating profits (EBIT) > to vary disproportionately with zj

(A) Probst

(B) Fixed cost

(C) Sales

(D) EPS

Answer:

(C) Sales

Question 6.

Degree of is the ratio of the percentage increase in earnings per share (EPS) to the percentage increase in earnings before interest and taxes (EBIT).

(A) Operating Leverage

(B) Combined Leverage

(C) Working Capital Leverage

(D) Financial Leverage

Answer:

(D) Financial Leverage

Question 7.

There is no operating leverage if there is no

(A) Profit

(B) Sales

(C) Fixed cost

(D) EPS

Answer:

(C) Fixed cost

Question 8.

EBIT is usually the same thing as:

(A) Funds provided by operations

(B) Earnings before taxes

(C) Net income

(D) Operating profit

Answer:

(D) Operating profit

Question 9.

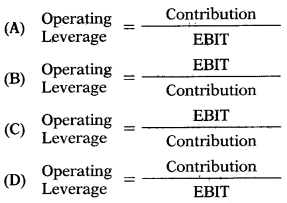

Which of the following, is the correct formula to calculate Operating Leverage?

Answer:

(A)

Question 10.

In the context of operating leverage break-even analysis, if the selling price per unit rises and all other variables remain constant, the operating break-even point in units will:

(A) Fall

(B) Rise

(C) Stay the same

(D) Still be indeterminate until inter-est and preferred dividends paid are known

Answer:

(A) Fall

Question 11.

Which of the following is the correct formula to calculate Operating Leverage?

Answer:

(C)

Question 12.

A firm’s degree of total leverage (DTL) is equal to its degree of operating leverage its degree of financial leverage (DFL).

(A) Plus

(B) Minus

(C) Divided by

(D) Multiplied by

Answer:

(D) Multiplied by

Question 13.

If operating leverage is 4, this means that

(A) 4% change in sales will cause a 1% change in EBIT.

(B) 1% change in sales will cause a 4% change in EBIT.

(C) 1% change in sales will cause a 4% change in EPS.

(D) 4% change in sales will cause a 1% change in EPS.

Answer:

(B) 1% change in sales will cause a 4% change in EBIT.

Question 14.

The degree of total leverage can be applied in measuring the change in

(A) EBIT to a percentage change in sales

(B) EPS to a percentage change in ‘ EBIT

(C) EPS to a percentage change in sales

(D) Sales to a percentage change in EBIT

Answer:

(C) EPS to a percentage change in sales

Question 15.

If the fixed costs are high, the operating leverage will also be

(A) Low

(B) High

(C) Zero

(D) Negative

Answer:

(B) High

Question 16.

The measure of business risk is

(A) Operating leverage

(B) Financial leverage

(C) Combines leverage

(D) Working capital leverage

Answer:

(A) Operating leverage

Question 17.

The presence of fixed costs in the total cost structure of firm results into

(A) Financial Leverage

(B) Operating Leverage

(C) Super Leverage

(D) Progressive leverage

Answer:

(B) Operating Leverage

Question 18.

High operating leverage indicates

(A) Highly favorable situation as it consists of low fixed costs.

(B) The Highly risky situation as it consists of large interest costs.

(C) Highly favorable situation as it consists of higher EPS.

(D) The Highly risky situation as it consists of large fixed costs.

Answer:

(D) The Highly risky situation as it consists of large fixed costs.

Question 19.

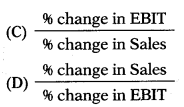

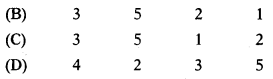

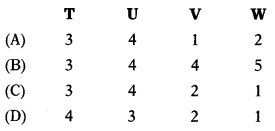

Match List-I with List-II and select the correct answer using the codes given below the lists;

| List-I | List-II |

| P. Factoring | 1. Sales |

| Q. Operating leverage | 2. Fixed interest cost |

| R. Debtors turnover ratio | 3. Working capital |

| S. Financial leverage | 4. Break-even point |

| 5. Fixed cost |

Select the correct answer from the options given below:

Answer:

(C)

Question 20.

Operating leverage depends on

I. Contribution

II. Interest cost

III. Fixed cost

IV. Volume of sales

V. EPS

VI. Profit after tax (PAT)

Select the correct answer from the options given below:

(A) I, IV, III

(B) II, V, VI

(C) I, III, V

(D) VI, I, III

Answer:

(A) I, IV, III

Question 21.

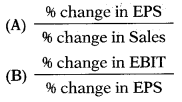

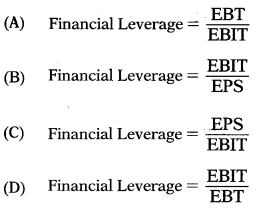

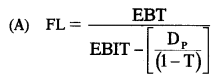

Which of the following is the correct formula to calculate Financial Leverage?

Answer:

(D)

Question 22.

A firm has a DOL of 4.5 at Q units.

What does this tell us about the firm?

(A) If sales rise by 4.5%, then EBIT will rise by 1%.

(B) If EBIT rises by 4.5%, then EPS will rise by 1%.

(C) If EBIT rises by 1 %, then EPS will rise by 4.5%.

(D) If sales rise by 1 %, then EBIT will rise by 4.5%

Answer:

(D) If sales rise by 1 %, then EBIT will rise by 4.5%

Question 23.

High operating leverage shows

(A) Higher burden of fixed cost and high EBIT.

(B) Low burden of fixed cost and high EBIT.

(C) Higher burden of fixed cost and low EBIT.

(D) Low burden of fixed cost and low EBIT.

Answer:

(C) Higher burden of fixed cost and low EBIT.

Question 24.

Operating leverage is directly__ to business risk.

(A) Proportional

(B) Not proportional

(C) Unrelated

(D) Not related

Answer:

(A) Proportional

Question 25.

A firm has a DFL of 5.5. What does this tell us about the firm?

(A) If sales rise by 5.5%, then EBIT will rise by 1%.

(B) If EBIT rises by 5.5%, then EPS will rise by 1%.

(C) If EBIT rises by 1 %, then EPS will rise by 5.5%.

(D) If sales rise by 1%, then EBIT will rise by 5,5%.

Answer:

(C) If EBIT rises by 1 %, then EPS will rise by 5.5%.

Question 26.

More operating leverage leads to

(A) Less financial risk

(B) More financial risk

(C) More business risk

(D) Less business risk

Answer:

(C) More business risk

Question 27.

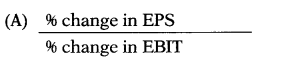

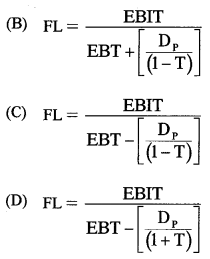

Which of the following is the correct formula to calculate Financial Leverage?

Answer:

(A)

Question 28.

Higher operating leverage is related to the use of additional

(A) Fixed costs

(B) Variable costs

(C) Debt financing

(D) Common equity financing

Answer:

(A) Fixed costs

Question 29.

Financial leverage indicates

(A) The tendency of profit before tax (PBT) to vary disproportionately with sales.

(B) The tendency of sales to vary disproportionately with the fixed cost.

(C) The tendency of profit after tax (PAT) to vary disproportionately with the fixed cost.

(D) The tendency of profit before tax (PBT) to vary disproportionately with operating profit (EBIT).

Answer:

(D) The tendency of profit before tax (PBT) to vary disproportionately with operating profit (EBIT).

Question 30.

Lower financial leverage is related to the use of additional

(A) Fixed costs

(B) Variable costs

(C) Debt financing

(D) Common equity financing

Answer:

(D) Common equity financing

Question 31.

The operating leverage indicates the impact of changes in sales on

(A) Operating income

(B) Operating cost

(C) Operating profit after tax

(D) Operating sales

Answer:

(A) Operating income

Question 32.

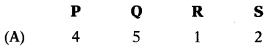

Match List-I with List-il and select the correct answer using the codes given below the lists:

| List-I | List-II |

| T. Matching approach | 1. Dividend policy |

| U. Combined leverage | 2. Inventory management |

| V. Ordering quantity | 3. Working capital |

| W. Bonus shares | 4. Should low as compared other industries infirm |

| 5. Authorized capital |

Select the correct answer from the options given below:

Answer:

(C)

Question 33.

If financial leverage is 2.5, this means that

(A) 2.5% change in EBIT will cause a 1% change in EBIT

(B) 1% change in sales will cause a 2.5% change in EBIT

(C) 2.5% change in sales will cause a 1% change in EBIT

(D) 1% change in EBIT will cause a 2.5% change in EBIT

Answer:

(D) 1% change in EBIT will cause a 2.5% change in EBIT

Question 34.

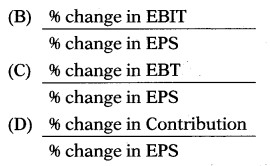

Which of the following is the correct formula to calculate financial Leverage (FL) when capital structure consists of preference shares and equity shares?

Answer:

(C)

Question 35.

Which of the following formulas represents a correct calculation of the degree of operating leverage?

(A) (Q – QBE)/Q

(B) (EBIT)/(EBIT FC)

(C) [Q(P V) + FC]/[Q(P V)]

(D) [Q(P V)]/[Q(P V) FC]

Answer:

(D) [Q(P V)]/[Q(P V) FC]

Question 36.

Where a company has a large number of fixed interest charges, the financial leverage will be

(A) High

(B) Low

(C) Negative

(D) Unreliable

Answer:

(A) High

Question 37.

Which of the following formulas represents the correct calculation of the degree of financial leverage?

(A) [NI + T + I]/[NI1 PD/(1 T)]

(B) EBIT/[EBIT1 PD/(1 T)]

(C) EBIT/[NI1 PD/(1 T)]

(D) All of the above are correct methods to calculate the degree of financial leverage (DFL).

Answer:

(B) EBIT/[EBIT1 PD/(1 T)]

Question 38.

The maximum amount of debt (and other fixed-charge financings) that a firm can adequately service is referred to as the____

(A) Debt capacity

(B) debt-service burden

(C) Adequacy capacity

(D) Fixed-charge burden

Answer:

(A) Debt capacity

Question 39.

High financial leverage is not good as it indicates the large content of

(A) Fixed cost

(B) Fixed interest charges

(C) Variable cost charges

(D) Contribution

Answer:

(B) Fixed interest charges

Question 40.

The cash required during a specific period to meet interest expenses and principal payments is referred to as the:

(A) Debt capacity

(B) debt-service burden

(C) Adequacy capacity

(D) Fixed-charge burden

Answer:

(B) debt-service burden

Question 41.

Earnings to equity shareholders (EPS) will fluctuate violently if

(A) Financial leverage is very high

(B) Operating leverage is very high

(C) Working capital leverage is very high

(D) Operating leverage is very low

Answer:

(A) Financial leverage is very high

Question 42.

If the Return on Investment (ROI) exceeds the rate of interest on debt, it is financial leverage. .

(A) Unfavourable

(B) Adverse

(C) A favorable

(D) Negative

Answer:

(C) A favorable

Question 43.

Which one of the following is correct?

(i) Liquidity ratios measure’s long-term solvency of a concern.

(ii) Inventory is a part of liquidity assets.

(iii) Financial leverage is related to business risk.

(iv) The number of gross assets is equal to net capital employed.

Select the correct answer from the options given below:

(A) (i), (ii) and (iv)

(B) (ii), (iii) and (iv)

(C) (i), (ii), (iii) and (iv)

(D) None of the above

Answer:

(D) None of the above

Question 44.

High operating leverage combined with high financial leverage will constitute

(A) Favourable situation

(B) Positive situation

(C) Less risky situation

(D) Risky situation

Answer:

(D) Risky situation

Question 45.

Read the following statement.

(i) With the increase in fixed cost operating leverage diminishes.

(ii) Networking Capital is the excess of current assets over current liabilities.

(iii) Greater the size of the business unit larger will be the requirement of working capital.

(iv) Working Capital is also known as circulating capital.

Which of the above statement is correct?

(A) (i), (ii) and (iii)

(B) (ii), (iii) and (iv)

(C) (iii), (iv) and (i)

(D) (i), (ii) and (iv)

Answer:

(B) (ii), (iii) and (iv)

Question 46.

Which of the following can be treated as ‘Ideal Situation?

(A) High operating cost and low financial leverage.

(B) Low operating leverage and high financial leverage.

(C) Operating & financial leverage both should below.

(D) Operating & financial leverage both should be high.

Answer:

(C) Operating & financial leverage both should below.

Question 47.

Assertion (A):

High operating leverage shows a higher burden of fixed cost.

Reason (R):

As fixed cost goes on increasing EBIT reduces.

Select the correct answer from the options given below:

(A) (A) is correct but (R) is incorrect.

(B) (A) is incorrect but (R) is correct

(C) Both (A) and (R) are not correct

(D) (A) is correct and (R) is the correct explanation of (A)

Answer:

(D) (A) is correct and (R) is the correct explanation of (A)

Question 48.

Which of the following statement is correct?

(A) If a business firm has a lot of variable costs as compared to fixed costs, then the firm is said to have high operating leverage.

(B) Combined Leverage = % change in EPS multiplied by % change in Sales

(C) If a business firm has a lot of fixed costs as compared to variable costs, then the firm is said to have high operating leverage.

(D) If contribution is less than fixed cost, operating leverage will be favorable and vice versa.

Answer:

(C) If a business firm has a lot of fixed costs as compared to variable costs, then the firm is said to have high operating leverage.

Question 49.

Operating leverage may be defined as:

(A) The degree to which debt is used in financing the firm

(B) The difference between price and variable costs

(C) The extent to which capital assets and fixed costs are utilized

(D) The difference between fixed costs and the contribution margin

Answer:

(C) The extent to which capital assets and fixed costs are utilized

Question 50.

Degree of___is the ratio of percentage change in gaming per share to the percentage change in sales.

(A) Financial leverage

(B) Operating leverage

(C) Combined leverage

(D) Working leverage

Answer:

(C) Combined leverage

Question 51.

Output (units) = 3,00,000

Fixed cost = ₹ 3,50,000

Unit variable cost = ₹ LOO

Interest expenses = ₹ 25,000

Unit selling price = ₹ 3.00

Applicable tax rate is 35%

Calculate Operating Leverage.

(A) 1.11

(B) 2.40

(C) 2.67

(D) 1.07

Answer:

(B) 2.40

Question 52.

Output (units) = 3,00,000

Fixed cost = ₹ 3,50,000

Unit variable cost ₹ 1.00

Interest expenses = ₹ 25,000

Unit selling price = ₹ 3.00

Applicable tax rate is 35%

Calculate Financial Leverage.

(A) 1.11

(B) 2.40

(C) 2.67

(D) 1.07

Answer:

(A) 1.11

Question 53.

Output (units) = 3,00,000

Fixed cost = ₹ 3,50,000

Unit variable cost = ₹ 1.00

Interest expenses = ₹ 25,000

Unit selling price = ₹ 3.00

Applicable tax rate is 35%

Calculate Combined Leverage.

(A) 2,67

(B) 2.30

(C) 2.00

(D) 2.15

Answer:

(A) 2,67

Question 54.

If operating leverage is, 2.1429 and financial leverage is 1.0699 then combined leverage will be

(A) 2.2927

(B) 2.0029

(C) 0.4993

(D) Data given is not sufficient

Hint:

Combined Leverage = 2.1429 × 1.0699 = 2.2927

Answer:

(A) 2.2927

Question 55.

If combined leverage is 2 and financial leverage is 1.25 then operating leverage will be

(A) 0.625

(B) 2.50

(C) 1.60

(D) Data given is not sufficient

Hint:

Combined Leverage = Operating Leverage × Financial Leverage

2 = x × 1.25

x = Operating Leverage = 2/1.25 = 1.6

Answer:

(C) 1.60

Question 56.

If combined leverage is 2.2926 and operating leverage is 2.1429 then financial leverage will be

(A) 1.0699

(B) 0.9347

(C) 4.9128

(D) Data given is not sufficient

Hint:

Use a hint of 55 and solve accordingly.

Answer:

(A) 1.0699

Question 57.

A company has sales of ₹ 1 lakh. The variable costs are 40% of the sales while the fixed operating costs amount to ₹ 30,000. The amount of interest on long-term debts is ₹ 10,000. You are required to calculate the combined leverage.

(A) 4

(B) 2

(C) 3

(D) 5

Hint:

| Sales | 1,00,000 |

| (-) Variable cost | (40,000) |

| Contribution | 60,000 |

| (-) Fixed cost | (30,000) |

| Earnings before interest & tax (EBIT) | 30,000 |

| (-) Interest | (10,000) |

| Earnings before tax (EBT) | 20,000 |

Combined Leverage = \(\frac{\text { Contribution }}{\mathrm{EBT}}=\frac{60,000}{20,000}\) = 3

Answer:

(C) 3

Question 58.

Operating leverage is 4. This means a 10% change in sales will cause

(A) 4% change in variable cost

(B) 40% change in EPS

(C) 4% change in EBIT

(D) 40% change in EBIT

Answer:

(D) 40% change in EBIT

Question 59.

Financial leverage is 2.5. This means a 10% change in EBIT will cause

(A) 2.5% change in EBIT

(B) 2.5% change in EPS

(C) 25% change in sales

(D) 25% change in EBT and EPS

Answer:

(D) 25% change in EBT and EPS

Question 60.

The combined leverage is 3.125. This means a 10% change in Sales will cause

(A) 31.25% change in PAT

(B) 31.25% change in EPS

(C) 31.25% change in capital employed

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 61.

If there is a 10% increase in sales, EBIT increases by 35% and if sales increase by 6%, taxable income will increase by 24%. Operating leverage must be

(A) 1.15

(B) 3.50

(C) 4.00

(D) 2.67

Answer:

(B) 3.50

Question 62.

If EBIT increases by 696, taxable income increases by 6.9%. If sales increase by 6%, taxable income will increase by 24%.

Financial leverage must be

(A) 1.19

(B) 1.13

(C) 1.12

(D) 1.15

Answer:

(D) 1.15

Question 63.

If stiles increase by 6% taxable income Le. PAT and EPS will increase by 24%.

Combined leverage must be

(A) 3

(B) 4

(C) 5

(D) 6

Answer:

(B) 4

Question 64.

The capital structure of a company consists of the following securities.

| ₹ | |

| 10% Preference Share Capital | 1,00,000 |

| Equity Share Capital (₹ 10 Shares) | 1,00,000 |

| 12% Debenture | 75,000 |

The amount of operating profit is ₹ 69,000. The company is in the 35% tax bracket. You are required to calculate the financial leverage of the company.

(A) 1.1500

(B) 1.5466

(C) 1.1566

(D) 1.1554

Answer:

(B) 1.5466

Question 65.

Operating leverage is 7 and financial leverage is 2.2858. How much change in sales will be required to bring 7096 change in EBIT?

(A) 10%

(B) 70%

(C) 11.429%

(D) 30%

Answer:

(A) 10%

Question 66.

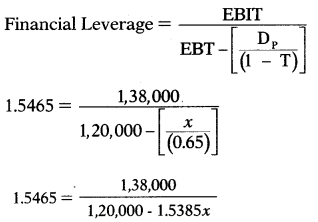

Financial leverage = 1.5465

EBIT = ₹ 1,38,000

Interest = ₹ 18,000

Tax rate = 35%.

The capital structure of the company consists of equity shares and preference shares.

Amount of Preference Dividend =?

(A) ₹ 19,950

(B) ₹ 19,898

(C) ₹ 20,000

(D) ₹ 19,899

Hint:

1,85,580 – 2.3792x = 1,38,000

2.3792x = 47,580

x = DP = 19,998 say 20,000

Answer:

(C) ₹ 20,000

Question 67.

Total assets of Alpha Company sire ₹ 3,00,000. The company’s total assets turnover ratio is 3, its fixed operating cost is ₹ 1,50,000 and its variable operating cost ratio is 50%. The income-tax rate is 50%. It also has long-term debts of ₹ 1,20,000 on which interest @ 10% is payable. Operating, Financial & Combined Leverages of the company is

(A) 1.5; 1.042; 1.563 respectively

(B) 1.05; 1.42; 1.05625 respectively

(C) 1.50; 1.42; 2.13 respectively

(D) 1.55; 1.042; 1.6151 respectively

Answer:

(A) 1.5; 1.042; 1.563 respectively

Question 68.

Contribution = ₹ 4,00,000

EBIT = ₹ 3,00,000

10% Debenture = ₹ 6,00,000

Combined leverage = ?

(A) 1.63

(B) 1.66

(C) 1.68

(D) 1.62

Hint:

Operating leverage = 4,00,000/3,00,000 = 1.33

Financial leverage = 3,00,000/2,40,000 = 1.25

Combined leverage = 1.33 × 1.25 = 1.66

Answer:

(B) 1.66

Question 69.

Operating leverage = 2

Combined leverage = 3.5

EBIT = ₹ 2,80,000

Interest = ₹ 40,000

Tax rate = 50%.

The capital structure of the company consists of equity shares and preference shares.

Amount of Preference Dividend =?

(A) ₹ 39,967

(B) ₹ 39,970

(C) ₹ 39,000

(D) ₹ 40,000

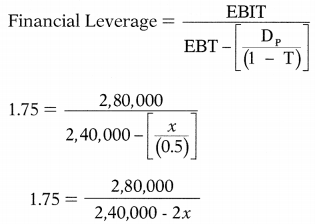

Hint:

Financial Leverage = 3.5/2 = 1.75

4,20,000 – 3.5x = 2,80,000

3.5x = 1,40,000

x = Dp = 40,000

Answer:

(D) ₹ 40,000

Question 70.

EBIT = ₹ 4,00,000

Fixed cost = ₹ 6,00,000

Interest = ₹ 80,000

Combined leverage = ?

(A) Sufficient data is not given

(B) 3.12

(C) 3.215

(D) 3.125

Answer:

(D) 3.125

Question 71.

EBIT = ₹ 40,000

Variable cost = ₹ 2,40,000

Sales = ₹ 4,00,000

Operating leverage = ?

(A) 3.5

(B) 4.125

(C) 4.6

(D) 3.125

Hint:

| Sales | 4,00,000 |

| (-) variable cost | (2,40,000) |

| Contribution | 1,60,000 |

Operating Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}}=\frac{1,60,000}{40,000}\) = 4

Answer:

(C) 4.6

Question 72.

Contribution = ₹ 7,00,000

Fixed cost = ₹ 2,00,000

Interest = ₹ 3,00,000

Financial leverage = ?

(A) 2.0

(B) 1.5

(C) 2.5

(D) 1.0

Answer:

(C) 2.5

Question 73.

The contribution of a firm is ₹ 4,000.

Fixed Cost:

Situation A ₹ 1,000

Situation B ₹ 2,000

Situation C ₹ 3,000

Compute the operating leverage for the three situations.

(A) 1.33; 1.18; 1.82

(B) 1.33; 2.36; 2.86

(C) 2.86; 2.00; 3.64

(D) 1.33; 2.00; 4.00

Answer:

(D) 1.33; 2.00; 4.00

Question 74.

EBIT of a firm is ₹ 3,000.

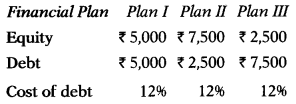

Compute the financial leverage for the three plans respectively.

(A) 1.33; 1.11; 1.43

(B) 1.25; 1.18; 1.43

(C) 1.66; 1.48; 1.90

(D) 1.25; 1.11; 1.43

Answer:

(D) 1.25; 1.11; 1.43

Question 75.

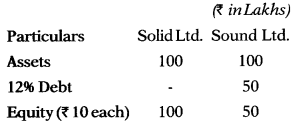

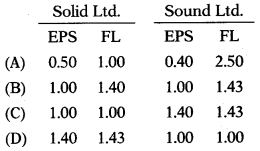

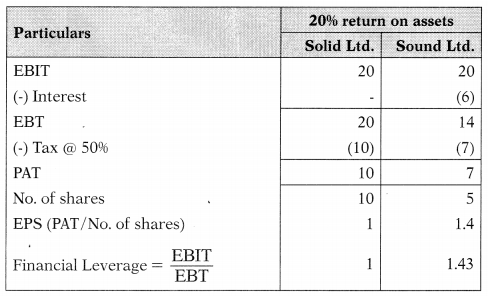

Calculate Financial Leverage & EPS assuming 20% before tax rate of return on assets. Other data:

Applicable tax rate firm is 50%.

Select the correct answer from the options given below:

Hint:

Answer:

(C)

Question 76.

From the following data of Abhishek Ltd., compute the operating leverage, financial leverage, combined leverage.

| ₹ | |

| EBIT | 10 Lakh |

| Profit before tax (PBT) | 4 lakh |

| Fixed cost | 6 lakh |

(A) 1.6;2.5,4.0

(B) 2.5; 1.6; 4.0

(C) 4.0; 2.5; 1.6

(D) 4.0; 1.5; 2.5

Hint:

Operating Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}}=\frac{16,00,000}{10,00,000}\) = 16

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBT }}=\frac{10,00,000}{4,00,000}\) = 2.5

Combined Leverage = \(\frac{\text { Contribution }}{\mathrm{EBT}}=\frac{16,00,000}{4,00,000}\) = 4.0

Answer:

(A) 1.6;2.5,4.0

Question 77.

From the following data of Tanishka Ltd., compute the percentage change in earnings per share (EPS), if sales are expected to increase by 5%:

| ₹ | |

| EBIT | 16.00 lakh |

| Profit before tax (PBT) | 6.40 lakh |

| Fixed cost | 9.60 lakh |

(A) 5%

(B) 10%

(C) 4%

(D) 20%

Hint:

Combined leverage is 4, this means that a 1% change in sales will cause 496 change in PAT/EPS. Thus, 5% changes in sales will cause a 20% change in PAT/EPS.

Answer:

(D) 20%

Question 78.

The following data is available for Alpha Ltd.

| Financial leverage | 2:1 |

| Operating leverage | 3:1 |

| Interest charges | ₹ 20 lakh |

| Corporate tax rate | 40% |

| Variable (% of sales) | 60% |

Sales =?

(A) ₹ 1,00,00,000

(B) ₹ 1,20,00,000

(C) ₹ 2,00,00,000

(D) ₹ 3,00,00,000

Answer:

(D) ₹ 3,00,00,000

Question 79.

The following data is available for X Ltd.

| Variable cost (% of sales) | 70% |

| Interest expense | ₹ 20,000 |

| DOL | 5:1 |

| DFL | 3:1 |

| Corporate tax rate | 30% |

EBIT =?

(A) ₹ 30,000

(B) ₹ 20,000

(C) ₹ 60,000

(D) ₹ 15,000

Hint:

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBIT – Interest }}\)

Let the EBIT be ‘x’

3 = \(\frac{x}{x-20,000}\)

3x – 60,000 = x

2x = 60,000

EB1T = x = 30,000

Answer:

(A) ₹ 30,000

Question 80.

The following data is available for Y Ltd.

| Variable cost (% of sales) | 75% |

| Interest expense | ₹ 30,000 |

| DOL | 6:1 |

| DFL | 4:1 |

| Corporate tax rate | 30% |

Contribution = ?

(A) ₹ 9,60,000

(B) ₹ 2,40,000

(C) ₹ 3,00,000

(D) ₹ 7,80,000

Hint:

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBIT – Interest }}\)

Let the EBIT be ‘x’

4 = \(\frac{x}{x-30,000}\)

x = 30,000

4x – 1,20,000 = x

3x = 1,20,000

EBIT x = 40,000

EBT = 40,000 – 30,000 = 10,000

Let the Contribution be ‘x’

Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}\)

6 = \(\frac{x}{40,000}\)

Contribution = x = 2,40,000

Answer:

(B) ₹ 2,40,000

Question 81.

The following data is available for Z Ltd.

| Variable cost (% of sales) | 50% |

| Interest expense | ₹ 1,00,000 |

| DOL | 2:1 |

| DFL | 2:1 |

| Corporate tax rate | 30% |

Sales =?

(A) ₹ 4,00,000

(B) ₹ 6,00,000

(C) ₹ 8,00,000

(D) ₹ 9,00,000

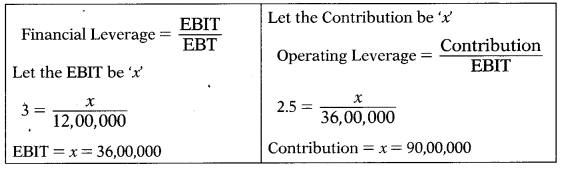

From the following information answer the next 3 questions:

Hint:

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBIT – Interest }}\)

Let the EBIT be ‘x’

2 = \(\frac{x}{x-1,00,000}\)

2x – 2,00,000 = x

EBIT = x = 2,00,000

EBT = 2,00,000 1,00,000 = 1,00,000

Let the Contribution be ‘x’

Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}\)

2 = \(\frac{x}{2,00,000}\)

Contribution = x = 4,00,000

Variable cost as % of sales is 50%. That means a contribution to sales is 50%. Thus,

Sales = \(\frac{4,00,000}{50 \%}\) = 8,00,000

Answer:

(C) ₹ 8,00,000

Question 82.

What percentage will EBIT increase, if there is a 10% increase in sales?

(A) 32.0%

(B) 31.14%

(C) 33.71%

(D) 32.5%

Answer:

(D) 32.5%

Question 83.

What percentage will taxable income increase, if EBIT increases by 6%?

(A) 6.86%

(B) 6.67%

(C) 6.33%

(D) 6.22%

Answer:

(A) 6.86%

Question 84.

What percentage will taxable income increase, if the sales increase by 6%

(A) 22.29%

(B) 22.92%

(C) 22.78%

(D) 22.87%

From the following information answer the next 3 questions:

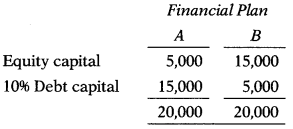

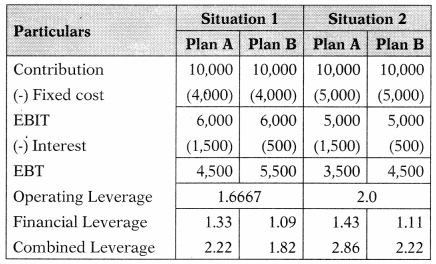

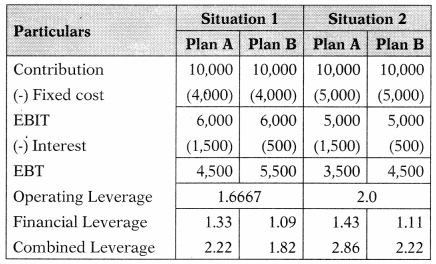

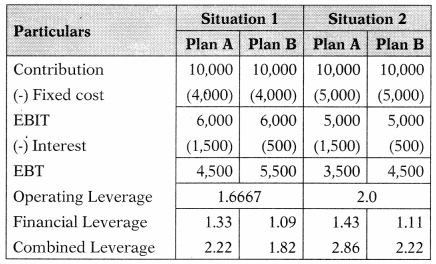

Following information relating to the operations and capital structure of Swadeshi Ltd. is available:

Installed capacity: 2,000 units

Production & sales: 50% of installed capacity

Selling price per unit: ₹ 20

Variable cost per unit: ₹ 10.

Fixed costs:

Situation-1: ₹ 4,000

Situation-2: ₹ 5,000

Capital structure:

Answer:

(A) 22.29%

Question 85.

What is the Operating Leverage?

Hint:

Actual production and sales = 2,000 × 50% = 1,000 units

Sales Variable Cost = Contribution; 20 – 10 = 10

Answer:

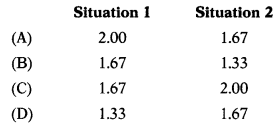

(C)

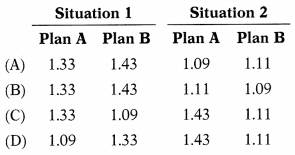

Question 86.

What is the Financial Leverage?

Hint:

Actual production and sales = 2,000 × 50% = 1,000 units

Sales Variable Cost = Contribution; 20 – 10 = 10

Answer:

(C)

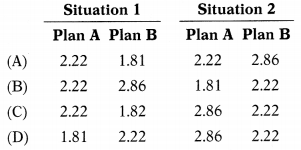

Question 87.

What is the Combined Leverage?

Hint:

Actual production and sales = 2,000 × 50% = 1,000 units

Sales Variable Cost = Contribution; 20 – 10 = 10

Answer:

(C)

Question 88.

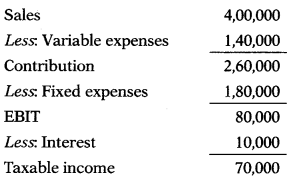

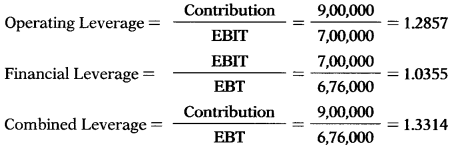

The total assets of Honey Well Ltd. are ₹ 6,00,000. The total assets turnover ratio is 2.5 times. The fixed operating costs are ₹ 2,00,000 and the variable operating cost ratio is 40%. The income tax rate is 30%. Calculate operating, financial, and combined leverage?

(A) 1.2857; 1.0355; 1.3314

(B) 1.0355; 1.2857; 1.3314

(C) 1.3314; 1.0355; 1.2857

(D) 1.2857; 1.3314; 1.2857

Hint:

Assets Turnover Ratio = \(\frac{\text { Sales }}{\text { Total Assets }}\)

2.5 = \(\frac{\text { Sales }}{6,00,000}\)

Sales = 15,00,000

| Sales | 15,00,000 |

| Variable cost | (6,00,000) |

| Contribution | 9,00,000 |

| (-) Fixed cost | (2,00,000) |

| Earnings before interest & tax (EBIT) | 7,00,000 |

| (-) Interest | (24,000) |

| Earnings before tax (EBT) | 6,76,000 |

| (-) Tax @ 30% | (2,02,800) |

| Profit after tax (PAT) | 4,73,200 |

Answer:

(A) 1.2857; 1.0355; 1.3314

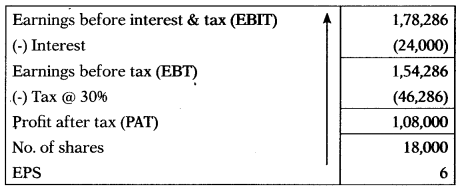

Question 89.

Total assets of Q Ltd. are ₹ 6,00,000. The total assets turnover ratio is 2.5 times. The fixed operating costs are ₹ 2,00,000 and the variable operating cost ratio is 40%. The income tax rate is 30%. No. of equity shares are 18,000. Determine the likely level of EBIT if EPS is ₹ 6.

(A) ₹ 1,54,286

(B) ₹ 1,78,286

(C) ₹ 1,54,682

(D) ₹ 1,78,862

Hint:

Perform reverse working.

Answer:

(B) ₹ 1,78,286

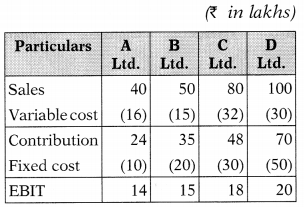

Question 90.

Which of the following company has greater business risk?

(A) A Ltd.

(B) B Ltd.

(C) C Ltd.

(D) D Ltd.

Hint:

D Ltd. has high operating leverage and hence its business risk is higher as compared to other companies.

Answer:

(D) D Ltd.

Question 91.

ABC Ltd. has an average selling price of ₹ 10 per unit. Its variable unit costs are ₹ 7 and fixed costs amount to ₹ 1,70,000. It finances all its assets with equity funds. It pays 30% tax on its income. QPR Ltd. is identical to ABC Ltd. except in respect of the pattern of financing. The latter finances its assets 50% by equity and 50% by debt, the interest on which amounts to ₹ 20,000.

Which of the following statement is correct?

(A) Both companies have similar business risks.

(B) QPR Ltd. has high financial risk as compared to ABC Ltd.

(C) QPR Ltd. has high business risk & financial risk as compared to ABC Ltd.

(D) All of the above

Hint:

- High operating leverage shows a higher burden of fixed cost consequently higher business risk. As both companies have similar operating leverage hence both have the same business risk.

- High financial leverage shows a higher burden of interest cost consequently higher financial risk. As QPR Ltd. has higher financial leverage hence it has high financial risk as compared to ABC Ltd.

- High combined leverage shows the combined effect of a higher burden of fixed and interest cost consequently higher business & financial risk. As QPR Ltd. has higher combined leverage hence it has high business risk & financial risk as compared to ABC Ltd.

Answer:

(D) All of the above

Question 92.

Bling Ltd. supplies the following data:

Operating leverage 2.5; financial leverage 3; EPS ₹ 30; the market price per share ₹ 225; and capital 20,000 shares. It is proposed to raise a loan of ₹ 50,00,000 @18% for expansion. After expansion, sales will increase by 25% and fixed cost by ₹ 3,00,000.

Work out the market price per share after expansion, assuming tax rate @ 50%.

(A) 25.56

(B) 52.56

(C) 56.25

(D) 65.52

Hint:

| Contribution (see calculations given below) | 90,00,000 |

| (-) Fixed cost | (54,00,000) |

| Earnings before interest & tax (EBIT) | 36,00,000 |

| (-) Interest | (24,00,000) |

| Earnings before tax (EBT) | 12,00,000 |

| (-) Tax @ 50% | (6,00,000) |

| Profit after tax (PAT) | 6,00,000 |

EPS = \(\frac{\text { Profit available for equity shareholder }}{\text { No. of shares }}\)

30 = \(\frac{x}{20,000}\)

x = Profit available for equity shareholder = 6,00,000

Tax rate is 5096 hence profit before tax will be Rs. 12,00,000.

Market price per share (MPS) after expansion:

| Contribution | 1,12,50,000 |

| (-) Fixed cost | (57,00,000) |

| Earnings before interest & tax (EBIT) | 55,50,000 |

| (-) Interest | (33,00,000) |

| Earnings before tax (EBT) | 22,50,000 |

| (-) Tax @ 50% | (11,25,000) |

| Profit after tax (PAT) | 11,25,000 |

EPS = \(\frac{\text { Profit available for equity shareholder }}{\text { No. of shares }}=\frac{11,25,000}{20,000}\) = 56.25

Answer:

(C) 56.25

Question 93.

He has a DOL of 3.5 at Q units. What does this tell us about the firm?

(A) If sales rise by 3.5% at the firm, then EBIT will rise by 1%.

(B) If EBIT rises by 3.5% at the firm, then EPS will rise by 1%.

(C) If EBIT rises by 1% at the firm, then EPS will rise by 3.5%.

(D) If sales rise by 1 % at the firm, then EBIT will rise by 3.5%

Answer:

(D) If sales rise by 1 % at the firm, then EBIT will rise by 3.5%

Question 94.

A firm has a DFL of 3.5. What does this tell us about the firm?

(A) If sales rise by 3.5%, then EBIT will rise by 1%.

(B) If EBIT rises by 3.5%, then EPS will rise by 1%.

(C) If EBIT rises by 1 %, then EPS will rise by 3.5%.

(D) If sales rise by 1 % at the firm, then EBIT will rise by 3.5%.

Answer:

(C) If EBIT rises by 1 %, then EPS will rise by 3.5%.

Question 95.

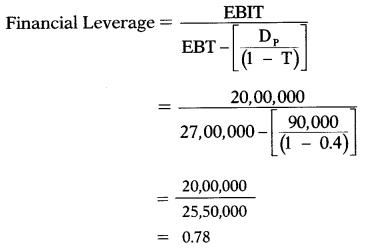

Calculate the degree of financial leverage (DFL) for a firm when its EBIT is ₹ 20,00,000. The firm has ₹ 30,00,000 in debt that costs 10% annually. The firm also has a 9%, ₹ 10,00,000preferred stock issue outstanding. The firm pays 40% in taxes.

(A) 0.78

(B) 0.80

(C) 1.24

(D) 1.29

Hint:

Answer:

(A) 0.78