Students should practice Management of Cash & Marketable Securities – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Management of Cash & Marketable Securities – Financial and Strategic Management MCQ

Question 1.

Which of the following will NOT appear in a Cash Budget?

(A) Machinery bought on hire purchase

(B) Depreciation of machinery

(C) Sales revenue

(D) Wages

Answer:

(B) Depreciation of machinery

Question 2.

Which of the following is not true about a cash budget?

(A) A cash budget sets out all cash receipts and payments that a business expects to make over a period of time.

(B) Cash budgets are usually prepared on a month-to-month basis.

(C) Cash budgets show the expected bank balance at the end of the month.

(D) Cash budgets include personal cash receipts and expenses.

Answer:

(D) Cash budgets include personal cash receipts and expenses.

Question 3.

Of the four costs shown below, which would not be included in the cash budget of an insurance firm?

(A) Depreciation of a fixed asset

(B) Commission paid to agents

(C) Office salaries

(D) Capital cost of a new computer

Answer:

(A) Depreciation of a fixed asset

Question 4.

A cash budget for the six months ended 30th September 2020 shows an anticipated overdraft of approximately t 9,05,500. Which of the following would reduce the expected overdraft?

(A) Allowing customers two months credit, instead of one month credit, in which to pay.

(B) Suppliers’purchases being made for cash, instead of one month’s credit.

(C) Assets being leased, rather than purchased for cash, in 2020.

(D) Charging depreciation on fixed assets at 25% on the straight-line basis, rather than 20%.

Answer:

(C) Assets being leased, rather than purchased for cash, in 2020.

Question 5.

NSZ Ltd. cash budget forewarns of a short-term surplus. Which of the following would be the appropriate action to be taken in such a situation?

(A) Increase debtors and stock to boost sales

(B) Purchase new fixed assets

(C) Repay long term loans

(D) All of the above

Answer:

(A) Increase debtors and stock to boost sales

Question 6.

Which of the following is least likely to be considered short-term marketable security?

(A) An original issue 30 years corporate bond with 1 year remaining until final maturity.

(B) An original issue 30 years government bond with 1 year remaining until final maturity.

(C) 90 days Treasury bill.

(D) Short-term corporate debt instruments with 9 months original maturity.

Answer:

(A) An original issue 30 years corporate bond with 1 year remaining until final maturity.

Question 7.

Which of the following would NOT lead to an increase in net cash flow?

(A) Larger sales volume

(B) Reduced materials costs

(C) Lower depreciation charge

(D) Higher selling price

Answer:

(C) Lower depreciation charge

Question 8.

The optimal balance of marketable securities held to take care of probable deficiencies in the firm’s cash account is referred to as the segment in the firm’s portfolio of short-term marketable securities.

(A) Ready cash

(B) Controllable cash

(C) Free cash

(D) Cash and cash equivalent

Answer:

(A) Ready cash

Question 9.

Advantages of maintaining cash budgets would not include one of the following:

(A) Surplus cash can be put to more profitable uses if expected to occur

(B) Debtors can be paid more quickly

(C) Time is available to investigate the possible future sources of finance

(D) Overdrafts can be negotiated in advance of when they are needed

Answer:

(B) Debtors can be paid more quickly

Question 10.

Which of the following statements most accurately describes the modern approach to cash management?

(A) Cash Management involves the efficient disbursement of cash.

(B) Cash management involves the efficient collection and disbursement of cash.

(C) Cash management involves the efficient processing, collection, and depositing of cash.

(D) None of the above

Answer:

(C) Cash management involves the efficient processing, collection, and depositing of cash.

Question 11.

Which of the following would be found in a cash budget?

(A) Capital expenditure

(B) Provision for doubtful debts

(C) Depreciation

(D) Accrued expenditure

Answer:

(C) Depreciation

Question 12.

Collection float is the

(A) Toted time between the mailing of the cheque by the customer and the availability of cash to the receiving firm.

(B) Time consumed in clearing the cheque through the banking system.

(C) Time the cheque is in the mail.

(D) Time during which the cheque received by the firm remains uncollected.

Answer:

(A) Toted time between the mailing of the cheque by the customer and the availability of cash to the receiving firm.

Question 13.

Which of the following will not affect the preparation of the cash budget?

(A) Loan is taken by the firm

(B) Proceeds from asset disposal

(C) Reduction in provision for doubtful debts

(D) Cash sales

Answer:

(C) Reduction in provision for doubtful debts

Question 14.

Deposit float is the

(A) Total time between the mailing of the cheque by the customer and the availability of cash to the receiving firm.

(B) Time consumed in clearing the cheque through the banking system.

(C) Time the cheque is in the mail.

(D) Time during which the cheque received by the firm remains uncollected.

Answer:

(D) Time during which the cheque received by the firm remains uncollected.

Question 15.

Which of the following items would have to be included for a company preparing a schedule of cash receipts and disbursements for the calendar year 2019?

(A) The annual depreciation for the year 2019.

(B) Purchase order issued in December 2014 for items to be delivered in February 2019.

(C) Dividends declared in November 2019, to be paid in January 2020 to shareholders of record as of December 2019

(D) Funds borrowed from a bank on a note payable taken out in June 2018 with an agreement to pay the principal and all of the interest owed in December 2019.

Answer:

(D) Funds borrowed from a bank on a note payable taken out in June 2018 with an agreement to pay the principal and all of the interest owed in December 2019.

Question 16.

Availability float is the

(A) Total time between the mailing of the cheque by the customer and the availability of cash to the receiving firm.

(B) Time consumed in clearing the cheque through the banking system.

(C) Time the cheque is in the mail.

(D) Time during which the cheque received by the firm remains uncollected.

Answer:

(B) Time consumed in clearing the cheque through the banking system.

Question 17.

A cash budget is like an income statement.

(A) I agree

(B) I disagree

(C) I cannot say

(D) The statement is ambiguous

Answer:

(B) I disagree

Question 18.

Cash management is a broad term used for collecting and managing cash. The speculative motive of holding cash refers to –

(A) Holding the cash to utilize it in internal projects.

(B) Holding the cash for any future loss the company is expecting.

(C) Holding the cash to avail of any future investment opportunity.

(D) Holding the cash to utilize it for an international project.

Answer:

(C) Holding the cash to avail of any future investment opportunity.

Question 19.

Non-cash transactions

(A) Form part of cash budget

(B) Do not form part of cash budget

(C) May or may not form part of cash budget

(D) I cannot say whether they are part of the cash budget

Answer:

(B) Do not form part of cash budget

Question 20.

Companies hold the cash from time to time. Transaction motive of holding cash means

(A) Keeping a cash reserve for purchasing goods and services to balance out the cash inflows and outflow.

(B) Keeping the cash for all the transactions made during a periodic term.

(C) Keeping the cash for transactions mandatory for day to day activities

(D) Keeping the transactions for foreign trading.

Answer:

(A) Keeping a cash reserve for purchasing goods and services to balance out the cash inflows and outflow.

Question 21.

The cash Budget statement shows the position of the business as one of the business period.

(A) Opening date

(B) Closing date

(C) Between the opening and closing date

(D) None of the above

Answer:

(C) Between the opening and closing date

Question 22.

The statement of cash flows tells us__

(A) The financial position of the business at a point in time.

(B) The forecast cash movements over a period of time.

(C) How much cash has been received and paid during an accounting period.

(D) How much profit the business has made during an accounting period.

Answer:

(C) How much cash has been received and paid during an accounting period.

Question 23.

Net profit + Non-cash expenditure

(A) Cash profit

(B) Cash flow

(C) Out of cash

(D) Cash gross profit

Answer:

(A) Cash profit

Question 24.

Cash flow is –

(A) Linked only to the balance sheet.

(B) Linked only to the income statement.

(C) Not linked to the balance sheet or income statement.

(D) Linked to the balance sheet and income statement.

Answer:

(D) Linked to the balance sheet and income statement.

Question 25.

The term cash includes

(A) Cash and Bank Balances

(B) All the Current Assets

(C) All the Current Liabilities

(D) None of the above

Answer:

(A) Cash and Bank Balances

Question 26.

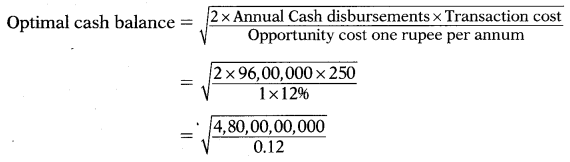

Z Ltd. has an estimated cash payment of ₹ 8,00,000 for a one-month period and the payments are expected to steady over the period. The fixed cost per transaction is ₹ 250 and the interest rate on marketable securities is 12% p.a. Optimal cash balance = ? and No. of transaction =?

(A) 20,000; 4.8

(B) 2,00,000; 48

(C) 20,00,000;480

(D) 2,00,00,000;4,800

Hint:

Optimal cash balance = ₹ 2,00,000

No. of transaction = \(\frac{\text { Annual Cash disbursements }}{\text { Optimal cash balance }}=\frac{96,00,000}{2,00,000}\) = 48 in a year

Answer:

(B) 2,00,000; 48

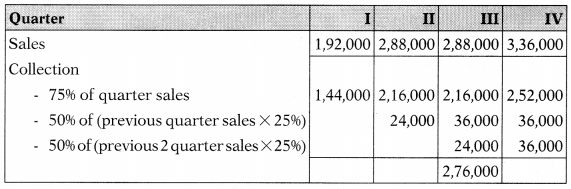

Question 27.

The budgeted sales for the next four quarters are ₹ 1,92,000, ₹ 2,88,000, ₹ 2,88,000 & ₹ 3,36,000, respectively. It is estimated that sales will be paid as follows:

75% of the total will be paid in the quarter that the sales were made. Of the balance, 50% will be paid in the quarter after the sale was made. The remaining 50% will be paid in the quarter after this.

The amount of cash received in quarter 3 will be

(A) ₹ 2,76,000

(B) ₹ 1,44,000

(C) ₹ 3,24,000

(D) ₹ 2,40,000

Hint:

Answer:

(A) ₹ 2,76,000

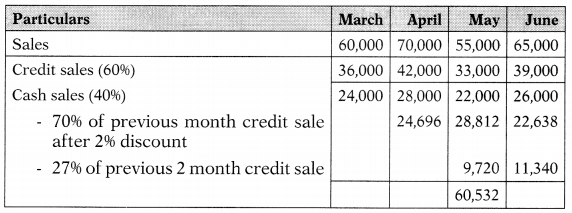

Question 28.

BDL Ltd. is currently preparing its cash budget for the year to 31 March 2019. An extract from its sales budget for the same year shows the following sales values.

| ₹ | |

| March | 60,000 |

| April | 70,000 |

| May | 55,000 |

| June | 65,000 |

40% of its sales are expected to be for cash. Of its credit sales, 70% are expected to pay in the month after sale and take a 2% discount. 27% are expected to pay in the second month after the sale, and the remaining 3% are expected to be bad debts. The value of the sales budget to be shown in the cash budget for May 2019 is

(A) ₹ 60,532

(B) ₹ 61,120

(C) ₹ 66,532

(D) ₹ 86,620

Hint:

Answer:

(A) ₹ 60,532

Question 29.

If the beginning balance of cash is ₹ 5,000 and the desired closing cash balance is ₹ 10,000, with the only other cash-related items being sales/revenue ₹ 15,00,000, direct materials purchases ₹ 10,45,000, and cost of direct labor ₹ 4,68,000, what would be the surplus or deficit of cash at the end of the period?

(A) Deficit of ₹ 8,000

(B) Surplus of ₹ 18,000

(C) Deficit of ₹ 18,000

Hint:

5,000 + 15,00,000 (sales) -10,45,000 (material purchase) – 4,68,000 (labour) – 10,000 (desired cash balance) = – 18,000

Answer:

(C) Deficit of ₹ 18,000

Question 30.

JPL has two dates when it receives its cash inflows, ie. Feb. 15 and Aug. 15. On each of these dates, it expects to receive ₹ 15 Crores. Cash expenditure is expected to be steady throughout the subsequent 6 month period. Presently, the ROI in marketable securities is 8% p.a., and the cost of transfer from securities to cash is ₹ 125 each time a transfer occurs. What is the optimal transfer size using the EOQ model? What is the average cash balance?

(A) ₹ 9,06,186; ₹ 4,53,093

(B) ₹ 96,825; ₹ 48,413

(C) ₹ 3,06,186; ₹ 1,53,093

(D) ₹ 9,68,246; ₹ 4,84,123

Answer:

(D) ₹ 9,68,246; ₹ 4,84,123

Question 31.

The annual cash requirement of A Ltd. is ₹ 10,00,000. The company has marketable securities in lot size of ₹ 1,00,000. The cost of conversion of marketable securities per lot is ₹ 1,000. The company can earn a 5% annual yield on its securities. Calculate the total cost.

(A) ₹ 10,500

(B) ₹ 10,450

(C) ₹ 12,500

(D) ₹ 14,500

Answer:

(C) ₹ 12,500

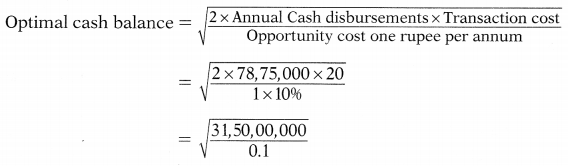

Question 32.

Z Ltd. has a separate account for cash disbursement. Estimated cash payments of ₹ 6,56,250 for a one-month period and the payments are expected to steady over the period. The fixed cost per transaction is ₹ 20 and the interest rate on marketable securities yields 10% p.a.

(A) ₹ 57,283

(B) ₹ 56,125

(C) ₹ 57,125

(D) ₹ 56,283

Hint:

Optimal cash balance = ₹ 56,125

Answer:

(B) ₹ 56,125

Question 33.

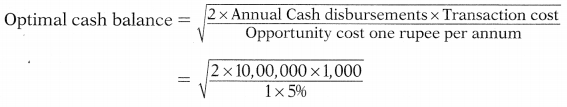

The annual cash requirement of A Ltd. is ₹ 10,00,000. The cost of conversion of marketable securities per lot is ₹ 1,000. The company can earn a 5% annual yield on its securities. Optimal cash balance = ? and No. of transactions =?

(A) 1,00,000; 5

(B) 4,00,000; 10

(C) 2,00,000; 5

(D) 2,00,000; 10

Hint:

Optimal cash balance = ₹ 2,00,000

No. of transaction = \(\frac{\text { Annual Cash disbursements }}{\text { Optimal cash balance }}=\frac{10,00,000}{2,00,000}\) = 5

Answer:

(C) 2,00,000; 5

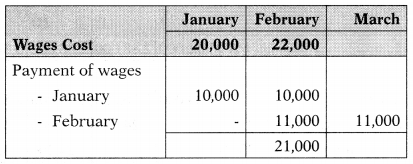

Question 34.

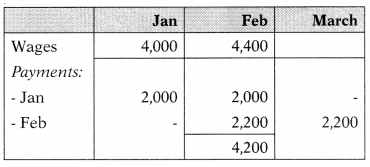

Dec 2014: The following information is available:

Wages for January: ₹ 20,000

Wages for February: ₹ 22,000

Delay in payment of wages: 1/2 month

The amount of wages paid during the month of February is

(A) ₹ 11,000

(B) ₹ 22,000

(C) ₹ 20,000

(D) ₹ 21,000

Hint:

Answer:

(D) ₹ 21,000

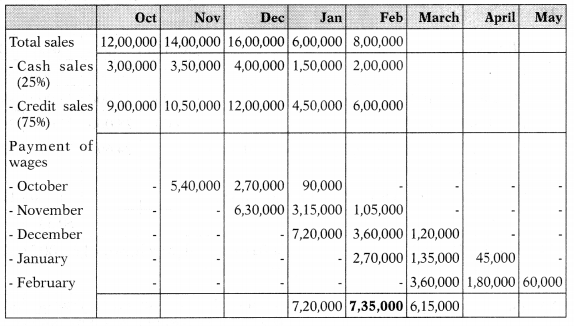

Question 35.

Dec 2014: In an organization, cash sales are 25% and credit sales are 75%. Sales for October, 2013 is ₹ 12,00,000, November, 2013 ₹ 14,00,000, December, 2013 ₹ 16,00,000, January, 2014 ₹ 6,00,000 and February, 2014 ₹ 8,00,000. 60% of credit sales are collected in the next month after-sales, 30% in the second month, and 10% in the third month. No bad debts are anticipated. The cash collected in the month of February 2014 from debtors is___

(A) ₹ 5,00,000

(B) ₹ 9,80,000

(C) ₹ 7,35,000

(D) ₹ 80,000

Hint:

Answer:

(C) ₹ 7,35,000

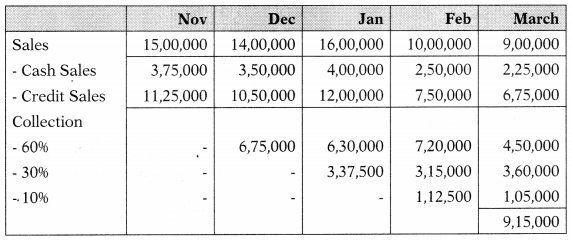

Question 36.

June 2015: In Rise Ltd., cash sales is 25% and credit sales 75%. Sales for November, 2014 is ₹ 15,00,000, December, 2014 ₹ 14,00,000, January, 2015 ₹ 16,00,000, February, 2015 ₹ 10,00,000 & March, 2015 ₹ 9,00,000. 60% of the credit sales are collected in the next month after sales, 30% in the second month and 10% in the third month. No bad debts are anticipated. The cash collected in the month of March, 2015 from debtors is

(A) ₹ 14,60,000

(B) ₹ 14,20,000

(C) ₹ 12,20,000

(D) ₹ 9,15,000

Hint:

Answer:

(D) ₹ 9,15,000

Question 37.

June 2015: Estimated wages for January is ₹ 4,000 and for February ₹ 4,400. If the delay in payment of wages is 1 /2 month, the number of wages to be considered in the cash budget for the month of February will be__

(A) ₹ 4,000

(B) ₹ 4,400

(C) ₹ 4,600

(D) ₹ 4,200

Hint:

Answer:

(D) ₹ 4,200

Question 38.

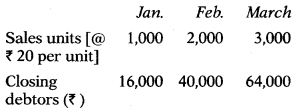

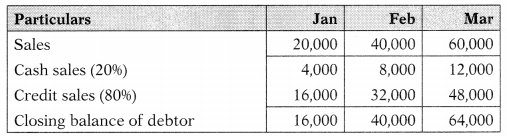

June 2016: Kriti Ltd. has provided the following information for the quarter of January to March:

2096 of the sales are on a cash basis and balance on a credit basis. The amount to be collected from debtors in the month of February and March will be

(A) Zero and ₹ 8,000 respectively

(B) ₹ 8,000 & ₹ 16,000 respectively

(C) ₹ 8,000 & ₹ 24,000 respectively

(D) ₹ 16,000 & ₹ 36,000 respectively

Hint:

Amount collected from debtors Opening Balance + Credit Sales – Closing Balance

Feb = 16,000 + 32,000 – 40,000 = 8,000

Mar = 40,000 + 48,000 – 64,000 = 24,000

Answer:

(C) ₹ 8,000 & ₹ 24,000 respectively

Question 39.

Dec. 2016: While preparing the cash budget, which of the following items would not be included

(A) Interest paid to debenture holders

(B) Salaries and wages

(C) Bonus shares issued

(D) Income-tax paid

Answer:

(C) Bonus shares issued

Question 40.

Dec. 2016: Consider the following statements:

(1) Depreciation reduces tax liability, hence it is a source of funds.

(2) Decrease in current liabilities during the year results in an increase in working capital.

(3) The term cash equivalents include short-term marketable investments.

(4) Conversion of debentures into equity shares appears in the fund’s flow statement.

(5) Only non-cash expenses are added to net profit to find out funds from operation. ’

Select the incorrect statements from the options given below:

(A) (1), (3), (4), and (5)

(B) (1), (2), (4), and (5)

(C) (1), (4), and (5)

(D) (2), (3), and (4)

Answer:

(C) (1), (4) and (5)

Question 41.

Dec 2018: Which of the following involves a movement of cash?

(A) A bonus issue

(B) A right issue

(C) Depreciation of fixed assets

(D) Provision for taxes

Answer:

(B) A right issue

Question 42.

Dec. 2018: Working capital will not change if there is:

(A) Increase in current assets

(B) Payment to the creditors

(C) Decrease in current liabilities

(D) Decrease in current assets

Answer:

(B) Payment to the creditors

Question 43.

Dec. 2018: Which one of the following is false?

(A) If cash outflows exceed cash inflows on an ongoing basis, the business will eventually run out of cash.

(B) Rapidly expanding companies can sometimes face a cash shortage.

(C) Cash is the lifeblood of a business and without it, the business will die.

(D) A profitable company will never run out of cash.

Answer:

(D) A profitable company will never run out of cash.

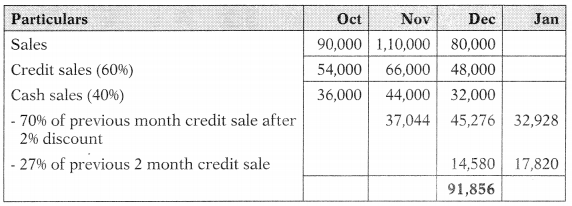

Question 44.

June 2019: The following information extracted from the records of P Ltd.

Sales for October, November and December, 2018 are ₹ 90,000,11,10,000 and t 80,000 respectively. 40% of its sales are expected to be for cash. Of its credit sales, 70% are expected to pay in the month after-sales and take a 2% discount on it. Balance is expected to pay in second-month after-sales and 3% of it is expected to bad debts.

What are the sales receipts to be shown in the cash budget for the month of December?

(A) ₹ 92,990

(B) ₹ 1,23,174

(C) ₹ 95,609

(D) ₹ 1,25,793

Note: MCQ is wrongly drafted; for further clarification please see the hints.

Hint:

None of the options contains a figure of 91,856 and hence MCQ Is wrong.

Answer:

Question 45.

June 2019: The following information is given:

Depreciation provided during the year: Furniture ₹ 15,000, Building ₹ 14,000. The statement of P&L for the year:

Opening balance ₹ 38,500 Add Profit for the year ₹ 40,300, Less: Goodwill wrote off ₹ 15,000, Closing balance ₹ 63,800.

What will be the amount of cash from operations?

(A) ₹ 69,300

(B) ₹ 54,300

(C) ₹ 78,800

(D) ₹ 25,300

Hint:

63,800 + 15,000 + 15,000 + 14,000 – 38,500 = 69,300.

Answer:

(A) ₹ 69,300