Income from Salaries – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income from Salaries – CA Inter Tax Question Bank

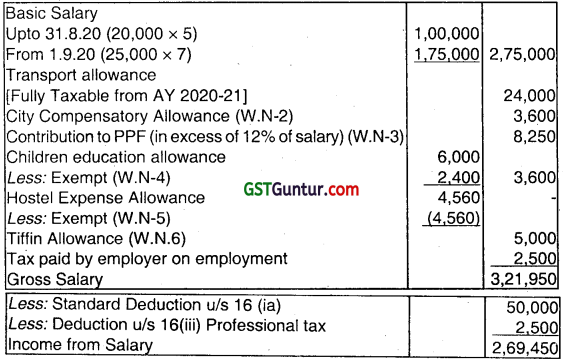

Question 1.

Mr. M is an area manager of M/s N. Steels Co. Ltd. During tt>e financial year 2020-21, he gets following emoluments from his employer: Basic Salary

Up to 31.8.2020 : ₹ 20,000 p.m.

From 1.9.2020 : ₹ 25,000 p.m.

Transport allowance : ₹ 2,000 p.m.

Contribution to recognised provident fund : 15% of basic salary and D.A

Children education allowance : ₹ 500 p.m. for two children

City compensatory allowance : ₹ 300 p.m.

Hostel expenses allowance : ₹ 300 p.m. for two children

Tiffin allowance (actual expenses ₹ 3,700) : ₹ 5,000 p.a.

Tax paid on employment : ₹ 2,500

Compute taxable salary of Mr. M for the Assessment year 2021-22. (Nov 2008, 6 marks)

Answer:

Working notes:

(1) Travelling Allowance

T.A is fully taxable from AY 2021-22 exempt in case of handicapped employee exemption is allowed.

(2) City Compensatory Allowance is fully taxable

(3) Contribution to recognized PPF is taxable in excess of 12% of salary.

Taxable contribution = Actual – 12% of salary

= (15% × 2,75,000) – (12% × 2,75,000)

= ₹ 41,250 – ₹ 33,000

= ₹ 8,250

(4) Children Education Allowance is exempt upto ₹ 100 per month per child.

Taxable Allowance = (500 – 200) × 12

= 3,600

(5) Hostel expense allowance is exempt upto ₹ 300 per month per child

(6) Tiffin Allowance is fully taxable

(7) No information for D.A is given, hence it is taken as NIL.

(8) Tax on employment is paid by Mr. M’s employer. Hence it is taxable in j his hand i.e. Mr. X & allowance u/s 16(iii) is available to him.

![]()

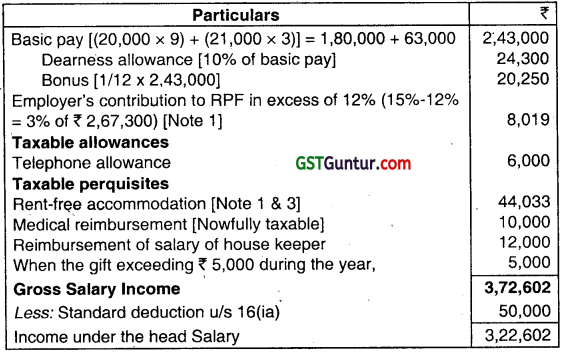

Question 2.

From the following details find out the salary chargeable to tax for the assessment year 2021 -22.

Mr. X is a regular employee of Rama & Co. in Gurgaon. He was appointed on 01.01.20 in the scale of 20000-1000-30000. He is paid D.A. 0% of Basic Pay and Bonus equivalent to one month pay. He contributes 15% of his pay and D.A. towards his recognized provident fund and the company contributes the same amount.

He is provided free housing facility which has been taken on rent by the company at ₹ 25,000 per month. He is also provided with following facilities:

(i) Facility of laptop costing ₹ 50,000.

(ii) Company reimbursed the medical treatment bill of his brother of ₹ 10,000, who is dependent on him.

(iii) The monthly salary of ₹ 1,000 of a house keeper is reimbursed by the company.

(iv) A gift voucher of ₹ 10,000 on the occasion of his marriage anniversary.

(v) Conveyance allowance of ₹ 1,000 per month is given by the company towards actual reimbursement.

(vi) He is provided personal accident policy for which premium of ₹ 5,000 is paid by the company.

(vii) He is getting telephone allowance @ ₹ 500 per month.

(viii) Company pays medical insurance premium of his family of ₹ 10,000. (Nov 2010, 8 marks)

Answer:

Computation of taxable salary of Mr. X for A.Y. 2021-22

Notes:

1. It has been assumed that DA forms part of salary for retirement benefits and accordingly, the perquisite value of rent-free accommodation and employer’s contribution to RPF have been worked out.

2. Facility of laptop is not a taxable perquisite.

3. When the accommodation is taken on lease or rent by the employer, the value of rent-free accommodation provided to employee would be actual amount of lease rental paid or payable by the employer or 15% of salary, whichever is lower.

Valuation of rent free house, for the purpose of salary includes:

(i) Basic salary i.e., ₹ 2,43,000

(ii) Dearness allowance (assuming that it is included for calculating retirement benefits) i.e. ₹ 24,300

(iii) Bonus i.e., ₹ 20,250

(iv) Telephone allowance i.e., ₹ 6,000

Thus salary is : 2,93,550

2,43,000 + 24,300 + 20,250 + 6,000 – 2,93,550.

15% of salary = 2,93,550 × 15/100 = 44,033

Value of rent-free house = Lower of rent paid by the employer (i.e. ₹ 3,00,000) or 15% of salary (i.e., ₹ 44,033).

∴ The perquisite value is ₹ 44,033.

4. Premium of ₹ 5,000 paid by the employer for personal accident policy is not liable to tax.

5. Conveyance allowance is exempt because it is based on actual reimbursement for official purposes.

![]()

Question 3.

Answer the question.

Mr. Shah, an Accounts Manager, has retired from JK Ltd. on 15.1.2021 after rendering services for 30 years 7 months. His salary is ₹ 25,000/- p.m. upto 30.9.2020 and ₹ 27,000/- thereafter. He also gets ₹ 2,000/- p.m. as dearness allowance (55% of it is a part of salary for computing retirement benefits). He is not covered by the Payments of Gratuity Act, 1972. He has received ₹ 8 Lacs as gratuity from the employer company. (Nov 2010, 4 marks)

Answer:

Calculation of Gratuity taxable in the hand, of Mr. Shah :

As Mr. Shah is not covered by the payments of Gratuity Act, 1972. The least of the following is exempt:

(a) Amount Specified ₹ 20,00,000

(b) Gratuity Actually received

(c) \(\frac{1}{2}\) × Last 10 months Average Salary × Completed years of service rendered by employee

Where :

Last 10 months Avg. Salary = \(\frac{(25,000 \times 7)+(27,000 \times 3)+(2000 \times 55 \% \times 10)}{10}\)

= ₹ 26,700 /-

Completed years of service = 30 year 7 months i.e. = 30 years

Hence exemption:

(a) ₹ 20,00,000

(b) ₹ 8,00,000 (Actual gratuity received)

(c) \(\frac{1}{2}\) × 26,700 × 30 = 4,00,500

Hence exemption in respect of gratuity = ₹ 4,00,500 (Being least of above)

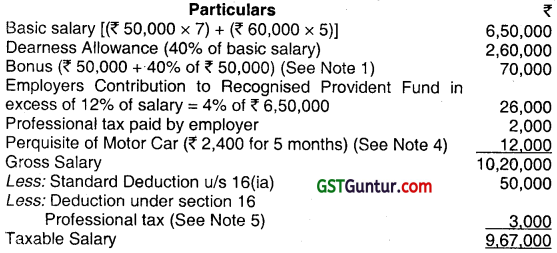

Question 4.

Mr. Balaji, employed as Production Manager in Beta Ltd., furnishes you the following information for the year ended 31 -03-2021:

(i) Basic salary upto 31-10-2020. ₹ 50,000 p.m.

Basic salary from 01-11-2020. ₹ 60,000 p.m.

Note : Salary is due and paid on .the last day of every month.

(ii) Dearness allowance @ 40% of basic salary.

(iii) Bonus equal to one month salary. Paid in October 2020 on basic salary plus dearness allowance applicable for that month.

(iv) Contribution of employer to recognized provident fund account of the employee @ 16% of basic salary.

(v) Profession tax paid ₹ 3,000 of which ₹ 2,000 was paid by the employer.

(vi) Facility of laptop and computer was provided to Balaji for both official and personal use. Cost of laptop ₹ 45,000 and computer ₹ 35,000 were acquired by the company on 01 -12-2017.

(vii) Motor car owned by the employer (cubic capacity of engine exceeds 1.60 litres) provided to the employee from 01 -11 -2020 meant for both official and personal use. Repair and running expenses of ₹ 45,000 from 01-11-2020 to 31-03-2021, were fully met by the employer. The motor car was self-driven by the employee.

(viii) Leave travel concession given to employee, his wife and three children (one daughter aged 7 and twin sons – aged 3). Cost of air tickets (economy class) reimbursed by the employer ₹ 30,000 for adults and ₹ 45,000 for three children. Balaji is eligible for availing exemption this year to the extent it is permissible in law. Compute the salary income chargeable to tax in the hands of Mr. Balaji for the assessment year 2021-22. (Nov 2011, 8 marks)

Answer:

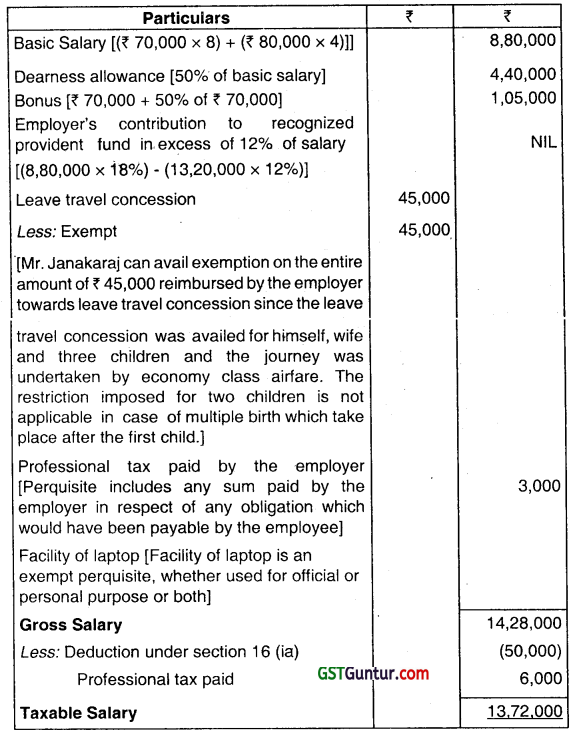

Computation of Taxable Salary of Mr. Balaji for A.Y. 2021-22

Working Notes:

- Since bonus was paid in the month of October, the basic salary of ₹ 50,000 for the month of October is considered for its calculation. As bonus was paid in the month of October.

- As per Rule 3(7)(vii), facility of use of laptop and computer is an exempt perquisite, whether it is used for official or personal purpose or both.

- Mr. Balaji can avail exemption u/s 10(5) on the entire amount of ? 75,000 reimbursed by the employer towards Leave Travel Concession since the same was availed for himself, his wife and three children and the journey was undertaken by economy class airfare. The restriction imposed for two children is not applicable in case of multiple births which take place after the first child.

- As per the provisions of Rule 3(2), in case a motor car (engine cubic capacity exceeding 1.60 liters) owned by the employer is provided to the employee without chauffeur for personal as well as office use the value of perquisite shall be ₹ 2,400 per month. The car was provided to the employee from 01.11.2020 therefore, the perquisite value has been calculated for 5 months.

- As per section 17(2)(iv), a “perquisite” includes any sum paid by the employer in respect of any obligation which, but for such payment, would have been payable by the assessee. Therefore, professional tax of ₹ 2,000 paid by the employer is taxable as a perquisite in the hands of Mr. Balaji. As per section 16(iii), a deduction from the salary is provided on account of tax on employment i.e. professional tax paid during the year.

Therefore, in the present case, the professional tax paid by the employer on behalf of the employee ₹ 2,000 is first included in the salary and deduction of the entire professional tax of ₹ 3,000 is provided from salary.

Assumptions :

- It is assumed that the leave Travel Concession was availed for journey within India.

- It is assumed that dearness allowance does not form part of salary for computing retirement benefits.

![]()

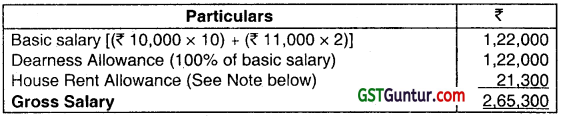

Question 5.

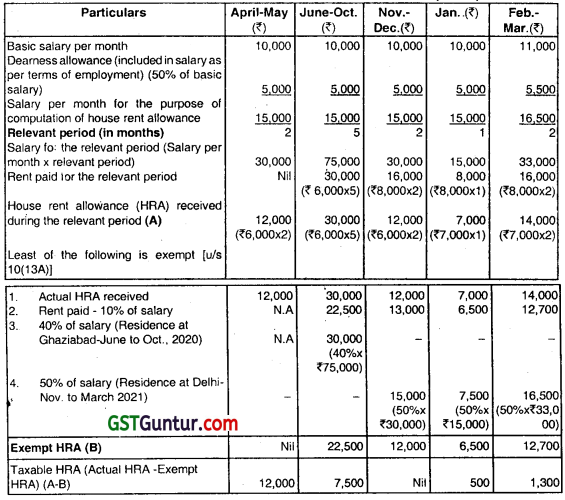

Mr. Mohit is employed with XY Ltd. on a basic salary of ₹ 10,000 p.m. He is also entitled to Deafness allowance @ 100% of basic salary, 50% of which is included in salary as per terms of employment. The company gives him house rent allowance of ₹ 6,000 p.m. which was

increased to ₹ 7,000 p.m with effect from 1-1-2021. He also got an increment of ₹ 1,000 p.m. in his basic salary with effect from 1-02-2021. Rent paid by him during the previous year 2020-21 is as under:

April and May, 2020 – Nil, as he stayed with his parents

June to October, 2020 – ₹ 6,000 p.m for an accommodation in Ghaziabad.

November, 2020 to March, 2021 – ₹ 8,000 p.m for an accommodation in Delhi.

Compute his gross salary for assessment year 2021-22. (May 2012, 8 marks)

Answer:

Computation of gross salary of Mr.Mohit for A.Y. 2021-22

Note: Computation of Taxable House Rent Allowance (HRA)

Taxable HRA (total) = ₹ 12,000 + ₹ 7,500 + ₹ 500 + ₹ 1,300 = ₹ 21,300

Question 6.

(i) Rajesh went to Shrinagar on a holiday on 15-11-2020 with his wife and two children (one Son – age 6 years; twin daughters – age 3 years). They went by aeroplane (economy class) and the total cost of tickets by his employer was ₹ 58,000 (₹ 43,000 for adults and ₹ 15,000 for the three minor children). Compute the amount of Leave Travel Concession exempt.

Will the answer be any different if among his three children the twins are 6 years old and son 3 years old? Discuss. (May 2013, 4 marks)

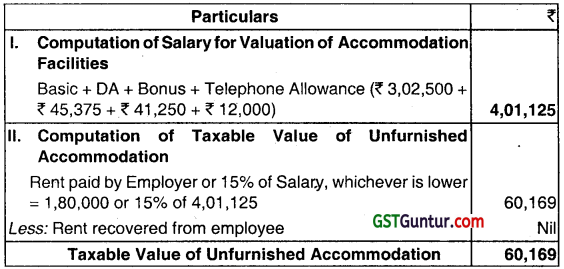

(ii) Mr. Gobind received retrenchment compensation of ₹ 10,00,000 after 30 years 4 months of service. At the time of retrenchment, he was receiving basic salary of ₹ 20,000 p.m; dearness allowance of ₹ 5,000 p.m. Compute his taxable retrenchment compensation. (May 2013, 4 marks)

Answer:

(i) Section 10(5) of the Income Tax Act, 1961 exempts the leave travel concession received by an employee from his employer for himself and his family which includes, inter alia, his spouse and children, in connection with proceeding on leave to any place in India. The exemption is not available to more than two surviving children of an individual. But, this restriction shall not apply in case of multiple births (i.e., after the first child). In the present case, Mr. Rajesh can avail exemption for all his three children since the son’s age is more than 1 the age of his twin daughters. The holiday being in India and the journey being performed by air (economy class), the entire reimbursement of ₹ 58,000 towards leave travel concession met by the employer is fully exempt under Section 10(5).

But, if the twins’ age is more than the age of the son, Mr. Rajesh cannot avail exemption for all his three children. The exemption in respect of leave travel concession under Section 10(5) can be availed in respect of only two children. The taxable leave travel concession, in this case, will be ₹ 5,000, being one-third of ₹ 15,000.

The leave travel concession exempt under Section 10(5), in such a case, would be ₹ 53,000 (₹ 58,000 – ₹ 5,000)

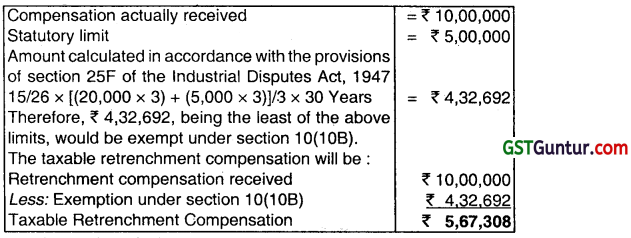

(ii) As per Section 10(10B), exemption available to Mr. Gobind in respect of retrenchment compensation, in this case, will be the least of the following limits:

![]()

Question 7.

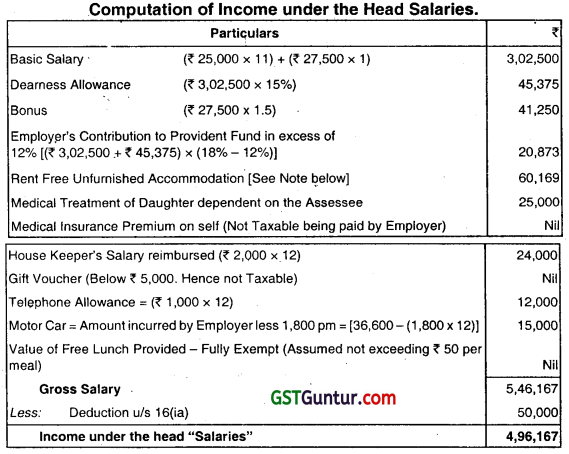

From the following details, find out the salary chargeable to tax of Mr. Anand for the assessment year 2021 -22:

Mr. Anand is a regular employee of Malpani Ltd. in Mumbai. He was appointed on 01-03-2020 in the scale of 25,000-2,500-35,000. He is paid dearness allowance (which forms part of salary for retirement benefits) @ 15% of basic pay and bonus equivalent to one and a half month’s basic pay as at the end of the year. He contributes 18% of his salary (basic pay plus dearness allowance) towards recognized provident fund and the Company contributes the same amount.

He is provided free housing facility which has been taken on rent by the Company at ₹ 15,000 per month. He is also provided with following facilities:

(i) The Company reimbursed the medical treatment bill of ₹ 25,000 of his daughter, who is dependent on him.

(ii) The monthly salary of ₹ 2,000 of a house keeper is reimbursed by the Company.

(iii) He is getting telephone allowance @ ₹ 1,000 per month.

(iv) A gift voucher of ₹ 4,700 was given on the occasion of his marriage anniversary.

(v) The Company pays medical insurance premium to effect an insurance on the health of Mr. Anand ₹ 12,000.

(vi) Motor car running and maintenance charges fully paid by employer of ₹ 36,600. (The motor car is owned and driven by Mr. Anand. The engine cubic capacity is below 1.60 litres. The motor car is used for both official and personal purpose by the employee.)

(vii) Value of free lunch provided during office hours is ₹ 2,200. (Nov 2013, 8 marks)

Answer:

Note:

Valuation of Rent free Unfurnished Accommodation

Question 8.

Ms. Rakhi is an employee in a private company. She receives the following medical benefits from the company during the previous year 2020-21:

1. Reimbursement of following Medical Expenses incurred by Ms. Rakhi.

(A) On treatment of her self employed daughter in a , private clinic ₹ 4,000

(B) On treatment of herself by Family doctor ₹ 8,000

(C) On treatment of her Mother-in-law dependent on her, in a Nursing Home ₹ 5,000

2. Payment of premium on Mediclaim Policy taken on her health. ₹ 7,500

3. Medical Allowance ₹ 2,000 Per month

4. Medical Expenses Reimbursed on her Son’s treatment in a Government Hospital. ₹ 5,000

5. Expenses incurred by company on the treatment of her minor son abroad. ₹ 1,05,000

6. Expenses in relation to Foreign Travel and stay of Rakhi and her son abroad for Medical Treatment.

(Limit prescribed by RBI for this is ₹ 2,00,000) ₹ 1,20,000

Discuss about the taxability of above benefits and allowances in the hands of Rakhi. (8 marks)

Answer:

Tax treatment of medical benefits, allowances and mediclaim premium in the hands of Ms. Rakhi:

1. Reimbursement of medical expenses incurred by Ms. Rakhi fully taxable from A.Y. 2021-22. Hence (4,000 + 8,000 + 5,000) i.e. 17,000 taxable.

2. Medical insurance premium of ₹ 7,500 paid by the employer for insuring health of Ms. Rakhi is an exempt perquisite as per Clause (iii) of the first proviso to Section-17(2).

3. Medical allowance of ₹ 2,000 per month i.e., ₹ 24,000 p.a. is a fully taxable allowance.

4. As per Clause (ii)(a) of the first proviso to Section 17(2), reimbursement of medical expenses of ₹ 5,000 on her son’s treatment in a hospital maintained by the Government is an exempt perquisite.

5. As per Clause (vi) of the first proviso to Section 17(2), the following expenditure incurred by the employer would be excluded from perquisite subject to certain conditions:

- Expenditure on medical treatment of the employee or any member of the family of such employee, outside India [₹ 1,05,000, in this case];

- Expenditure on travel and stay abroad of the employee or any member of the family of such employee for medical treatment and one attendant who accompanies the patient in connection with such treatment [₹ 1,20,000, in this case].

6. The conditions subject to which the above expenditure would be exempt are as follows:

- The expenditure on medical treatment and stay abroad would be excluded from perquisite to the extent permitted by Reserve Bank of India;

- The expenditure on travel would be excluded from perquisite only in the case of an employee whose gross total income, as computed before including the said expenditure, does not exceed ₹ 2 lakh.

Assuming that the limit of ₹ 2 lakh prescribed by RBI pertains to both expenditure on medical treatment of minor son as well as expenditure on stay abroad of Ms. Rakhi and her minor son, such expenditure would be excluded from perquisite subject to a maximum of ₹ 2 lakh. If such expenditure is less than ₹ 2 lakh, it would be fully excluded. The foreign travel expenditure of Ms. Rakhi and her minor son borne by the employer would be excluded from perquisite only if the gross total income of Ms. Rakhi, as computed before including the said expenditure, does not exceed ₹ 2 lakh.

![]()

Question 9.

Mr. Anand an employee of XYZ Co. Ltd. at Mumbai and not covered by Payment of Gratuity Act, retires at the age of 64 years on 31 – 12-2020 after completing 33 years and 7 months of service. At the time of retirement, his employer pays ₹ 20,51,640 as Gratuity and ₹ 6,00,000 as accumulated balance of Recognised Provident fund. He is also entitled for monthly pension of ₹ 8,000. He gets 75% of pension Commuted for ₹ 4,50,000 on 1st February, 2021.

Determine the salary chargeable to tax for Mr. Anand for the Assessment Year 2021 -22 with the help of following information:

| ₹ | |

| Basic Salary (₹ 80,000 × 9) | 7,20,000 |

| Bonus | 36,000 |

| House Rent Allowance (₹ 15,000 × 9) | 1,35,000 |

| Rent paid by Mr. Anand (₹ 10,000 × 12) | 1,20,000 |

| Employer contribution towards Recognized Provident Fund | 1,10,000 |

| Professional Tax paid by Mr. Anand | 2,000 |

Note: Salary and Pension falls due on the last day of each month. (Nov 2014, 8 marks)

Answer:

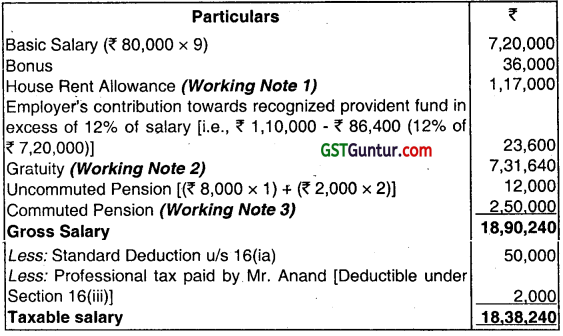

Computation of taxable salary of Mr. Anand for the Assessment Year 2021-22

Working Notes:

![]()

Question 10.

Compute the amount of LTC Exemption in the following cases with reference to the provision under Income Tax Act, 1961:

(a) Mr. Suresh went on a holiday on 09/09/2020 to Mysore with his wife and 3 children – one daughter born on 02/02/2013 and twin sons born on 05/05/2015. The total cost of travel was ₹ 80,000. The ticket cost for Mr. Suresh and his wife was ₹ 50,000 and for all three children was ₹ 30,000. The employer reimbursed total ticket cost ₹ 80,000.

(b) In the above case (a), if among his 3 children the twin sons born on 02/02/2013 and the daughter was born on 05/05/2015, what shall be the exemption? (Nov 2016, 4 marks)

Answer:

Computation of LTC Exemption: The value of leave travel concession received by an employee from his employer for himself and his family, in connection with his proceeding on leave’ to any place in India would be exempt under Section 10(5). However, the amount of exemption cannot exceed the amount of expenses actually incurred for the purpose of such travel.

The exemption referred to shall not be available to more than two surviving children of an individual. However, this restriction is not applicable in case of multiple births at the second instance after the first child.

(a) The total cost of travel of ₹ 80,000, being ₹ 50,000 towards ticket cost of Mr. Suresh and his wife and ₹ 30,000 for all the three children, reimbursed by the employer would be exempt. It is assumed that journey is performed by air (economy class).

The restriction of two children is not applicable to multiple births at the second instance after the first child. In this case, since the twin sons were born after first child i.e., one daughter, the restriction of two children is not applicable.

(b) If the twin sons were born first i.e., on 02/02/2013, then, the exemption in respect of amount of ₹ 30,000 received towards leave travel concession for the children would be restricted to the travel cost of two children i.e. ₹ 20,000. Therefore, ₹ 10,000 being the cost of travel of one child would be taxable and the remaining amount of ₹ 70,000 [₹ 80,000 – ₹ 10,000] would be exempt.

Question 11.

Mr. Nambi, a salaried employee, furnishes the following details for the financial year 2020-21:

| Particulars | ₹ |

| Basic salary | 6,00,000 |

| Dearness allowance | 3,20,000 |

| Commission | 50,000 |

| Entertainment allowance | 7,500 |

| Medical expenses reimbursed by the employer | 21,000 |

| Profession Tax (of this, 50% paid by employer) | 7,000 |

| Health insurance premium paid by employer | 9,000 |

| Gift voucher given by employer on his birthday | 12,000 |

| Life insurance premium of Nambi paid by employer | 34,000 |

| Laptop provided for use at home. Actual cost of Laptop to employer | 30,000 |

| [Children of the assessee are also using the Laptop at home] Employer-Company owns a Tata Nano Car, which was provided to the assessee, both for official and personal use. No driver was provided. (Engine cubic capacity less than 1.6 litres)

Annual credit card fees paid by employer [Credit card is not exclusively used for official purposes; details of usage are not available] |

2000 |

You are required to compute the income chargeable under the head “Salaries” for the assessment year 2021-22. (May 2017, 8 marks)

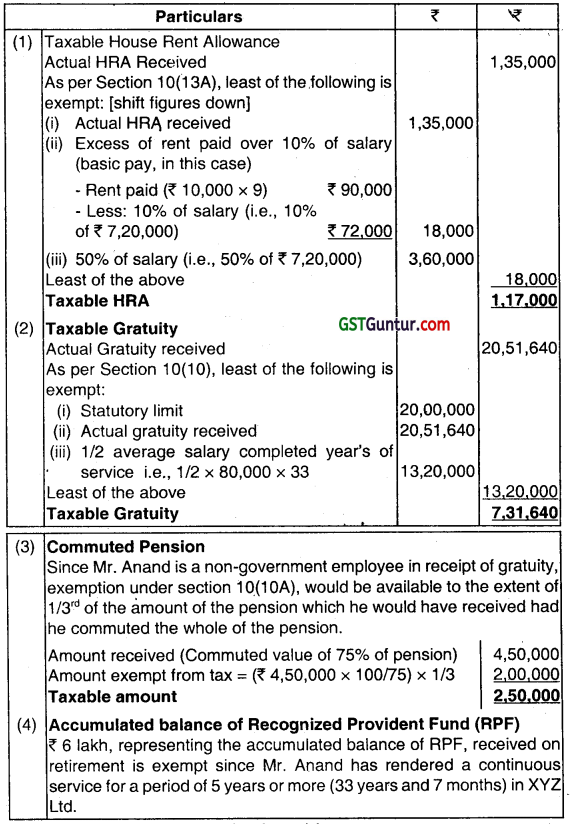

Answer:

computation of income under head salary

![]()

Question 12.

Ms. Jaya is the marketing manager in XYZ Limited. She gives you the following particulars :

Basic Salary ₹ 65,000 p.m

Dearness Allowance ₹ 22,000 p.m. (30% is for retirement benefits)

Bonus ₹ 17,000 p.m.

Her employer has provided her with an accommodation on 1st April, 2020 at a concessional rent. The house was taken on lease by XYZ Ltd. for ₹ 12,000 p.m. Ms. Jaya occupied the house from 1st November, 2020. ₹ 4,800 p.m. is recovered from the salary of Ms. Jaya.

The employer gave her a gift voucher of ₹ 8,000 on her birthday. She contributes 18% of her salary (Basic Pay + DA) towards recognised provident fund and the company contributes the same amount.

The company pays medical insurance premium to effect insurance on the health of Ms. Jaya ₹ 18,000.

Motor car owned by the employer (cubic capacity of engine exceeds 1.6 litres) provided to Ms. Jaya from 1st November, 2020 which is used for both official and personal purposes. Repair and running expenses of ₹ 50,000 were fully met by the company. The motor car was self-driven by the employee.

Compute the income chargeable to tax under the head “Salaries” in the hands of Ms. Jaya for the Assessment Year 2021-22. (Nov 2017, 10 marks)

Answer:

Computation of income chargeable to tax under the head “Salaries” in the hands of

| Particulars | ₹ |

| Basic Salary [₹ 65,000 × 12] | 7,80,000 |

| Dearness allowance [₹ 22,000 × 12] | 2,64,000 |

| Bonus [₹ 17,000 × 12] | 2,04,000 |

| Perquisite value in respect of concessional rent3 [See Note (1) below] | 36,000 |

| Gift voucher given by employer on Ms. Jaya’s birthday (entire amount is taxable since the perquisite value exceeds ₹ 5,000) [See Note 2 below] | 8,000 |

| Employer’s contribution to recognized provident fund in excess of 12% of salary is taxable as per Section 17(1 )(vi) | |

| 18% × [(₹ 65,000 + ₹ 22,000) × 12] – 12% × {[₹ 65,000 + ₹ 6,600 (being 30% of ₹ 22,000)] × 12} = 1,87,920 – 1,03,104 | |

| [Salary = Basic Salary + Dearness allowance, to the extent it forms part of pay for retirement benefits] | 84,816 |

| Medical insurance premium of ?18,000 paid by the employer to effect an insurance on the health of an employee is an exempt perquisite as per sub- clause (iii) of proviso to Section 17(2) | |

| Provision of motor car (engine cubic capacity more than 1.6 litres) owned by employer to an employee without chauffeur for both official and personal purpose, where the expenses are fully met by the employer – the perquisite value would be ₹ 2,400 p.m. [₹ 2,400 × 5 months] as per Rule 3(2) of the Income-tax Rules, 1962 | 12,000 |

| Gross Salary | 13,88,816

50,000 |

| Less: Standard Deduction u/s 16(ia) | |

| Salary Income chargeable to tax | 13,38,816 |

Notes:

1. Where the accommodation is taken on lease or rent by the employer, the actual amount of lease rent paid or payable by the employer or 15% of salary, whichever is lower, in respect of the period during which the house is occupied by the employee, as reduced by the rent recoverable from the employee, is the value of the perquisite.

Actual rent paid by employer from 1.11.2020 to 31.3.2021 = ₹ 60,000

[₹ 12,000 × 5 months] 15% of salary = ₹ 66,450 [15% × (₹ 65,000 + ₹ 6,600 + ₹ 17,000) × 5 months]

Lower of the above is ₹ 60,000 which is to be reduced by the rent recovered from the employee.

Hence, the perquisite value of concessional rent = ₹ 60,000 – ₹ 24,000 [₹ 4,800 × 5 months] = 36,000

Salary for valuation of perquisite = Basic Salary + Dearness Allowance, to the extent it forms part of pay for retirement benefits + Bonus

As per Explanation 1 to Section 17(2)(ii) read with Rule 3(1) of Income-tax Rules, 1962

2. As per Rule 3(7)(iv), the value of any gift or voucher received by the employee or by member of his household on ceremonial occasions or otherwise from the employer shall be determined as the sum equal to the amount of such gift. However, the value of any gift or voucher received by the employee or by member of his household below ₹ 5,000 in aggregate during the previous year would be exempt as per the proviso to Rule 3(7)(iv). In this case, the gift voucher of ₹ 8,000 was received by Ms. Jaya from her employer on the occasion of her birthday. Since the value of the gift voucher exceeds the limit of ₹ 5,000, the entire amount of ₹ 8,000 is liable to tax as perquisite. The above solution has been worked out accordingly.

Alternative view: An alternate view possible is that only the sum in excess of ₹ 5,000 is taxable in view of the language of Circular No. 15/2001 dated 12.12.2001, which states that such gifts upto ₹ 5,000 in the aggregate per annum would be exempt, beyond which it would be taxed as a perquisite. As per this view, the value of perquisite would be ₹ 3,000. The salary chargeable to tax, in this case, would be ₹ 13,83,816.

![]()

Question 13.

Mr. Honey is working with a domestic company having a production unit in the U.S. A. for last 15 years. He has been regularly visiting India for export promotion of company’s product. He has been staying in India for atleast 184 days every year.

He submits the following information:

Salary received outside India (For 6 months) ₹ 50,000 P. M.

Salary received in India (For 6 months) ₹ 50,000 P. M.

He has been given rent free accommodation in U.S.A. for which company pays ₹ 15,000 per month as rent, but when he comes to India, he stays in the guest house of the company. During this period he is given free lunch facility. During the previous year company incurred an expenditure of ₹ 48,000 on this facility.

He has been provided a car of 2000 cc capacity in U.S.A. which is used by him for both office- and private purposes. The actual cost of the car is ₹ 8,00,000. But when he is in India, the car is used by him.and the members of his family only for personal purpose. The monthly expenditure of car is – ₹ 5,000. His elder son is studying in India for which his employer spends 12,000 per year where as his younger son is studying in USA. and stays in a, hostel for which Mr. Honey gets ₹ 3,000 per month as combined allowance.

The company has taken an accident insurance policy and a life insurance policy. During the previous year the company paid premium of ₹ 5,000 and ₹ 10,000 respectively.

Compute Mr. Honey’s taxable income from salary for the Assessment Year 2021-22. (May 2018, 10 marks)

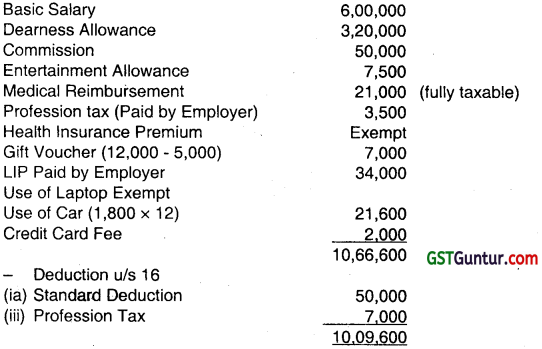

Answer:

Computation of income from Salary

Note:

1. Taxable RFA during stay in USA = 15% of Salary or Actual rent paid by employer, whichever is lower= 15% of [{6,00,000 + 36,000 (Amount received from employer (₹ 3,000 × 12))*6/12), No exemption is available in respect of allowance received for any education or hostel facility of children outside India] or (15,000*6) whichever is lower = 47,700 or 90,000 whichever is lower which is 47,700.

2. RFA during stay in India = Not taxable, since it is provided for stay when he visits India wholly for official purposes.

Question 14.

Mr. Janakaraj, employed as General Manager in Rajus Refractories Pvt. Ltd., furnishes you the under-mentioned information for the year ended 31 -03-2021:

(i) Basic salary upto 30-11 -2020 ₹ 70,000 p.m.

Basic salary from 01 -12-2020 ₹ 80,000 p.m.

Note: Salary is due and paid on the last day of every month.

(ii) Dearness allowance @ 50% of basic salary (not forming part of salary for retirement benefits).

(iii) Bonus equal to one month salary. This was paid in November, 2020 on basic salary plus dearness allowance applicable for that month.

(iv) Contribution of employer to recognized provident fund account of the employee @ 18% of basic salary, employee also contributing an equivalent amount.

(v) Profession tax paid ₹ 6,000 of which ₹ 3,000 was paid by the employer.

(vi) Facility of laptop was provided to Janakaraj for both official and personal use. Cost of laptop ₹ 65,000 and was purchased by the company on 11-10-2020.

(vii) Leave travel concession given to Janakaraj, his wife and three children (one daughter aged 6 and twin sons aged 4). Cost of air tickets (economy class) reimbursed by the employer ₹ 20,000 for adults and lumpsum of ₹ 25,000 for three children. Janakaraj is eligible for availing exemption this year to the extent it is permissible under the Income-tax Act, 1961.

Compute the taxable salary of Mr. Janakaraj. (Nov 2018, 6 marks)

Answer:

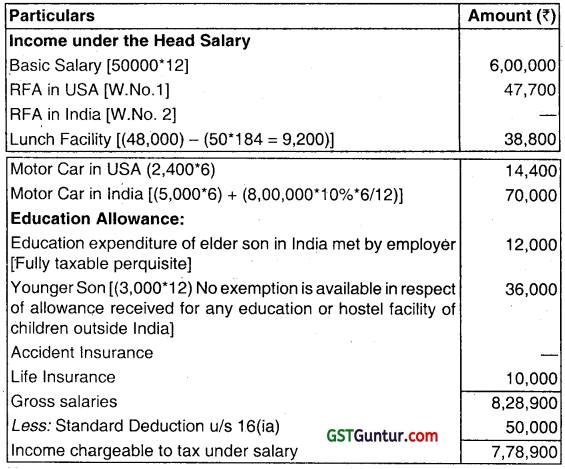

Computation of taxable salary of Mr. Janakaraj for the A.Y. 2021-22

![]()

Question 15.

Examine with brief reasons, whether the following are chargeable to income-tax and the amount liable to tax with reference to the provisions of the Income Tax Act, 1961:

Allowance received by an employee Mr. Ram working in a transport system at ₹ 12,000 p.m. which has been granted to meet his personal expenditure while on duty. He is not in receipt of any daily allowance from his employer. (Nov 2018, 2 marks)

Answer:

| Chargeability | Amount liable to tax (₹) | Reason |

| Partly taxable | 43,200 | Any allowance granted to an employee working in a transport system to meet his personal expenditure during his duty is exempt provided he is not in receipt of any daily allowance. The exemption is 70% of such allowance (i.e., ₹ 8,400 per month being, 70% of ₹ 12,000) or ₹ 10,000 per month, whichever is less. Hence, 1,00,800 (i.e., ₹ 8,400 × 12) is exempt. Balance ₹ 43,200 (₹ 1,44,000 – ₹ 1,00,800) is taxable in the hands of Mr. Ram. |

Question 16.

Mr. Raj Kumar has the following receipts from his employer:

(1) Basic pay ₹ 3,000 p.m.

(2) Dearness allowance (D.A.) ₹ 600 p.m.

(3) Commission ₹ 6,000 p.a.

(4) Motor car for personal use

(expenditure met by the employer) ₹ 500 p.m.

(5) House rent allowance ₹ 900 p.m.

Find out the amount of HRA eligible for exemption to Mr. Raj Kumar assuming that he paid a rent of ₹ 1,000 p.m. for his accommodation at Kanpur. DA forms part of salary for retirement benefits.

Answer:

HRA received ₹ 10,800

Less: Exempt under section 10(13A) [Note] ₹ 7,680

Taxable HRA ₹ 3,120

Note: Exemption shall be least of the following three limits:

(a) the actual amount received (₹ 900 × 12) = ₹ 10,800

(b) excess of the actual rent paid by the assessee over 10% of his salary

= Rent Paid -10% of salary for the relevant period

= (₹ 1,000 × 12) – 10% of [(₹ 3,000 + ₹ 600 ) × 12]

= ₹ 12,000 – ₹ 4,320 = ₹ 7,680

(c) 40% salary as his accommodation is situated at kanpur = 40% of [(₹ 3,000 + ₹ 600) × 12] = ₹ 17,280

Note: For the purpose of exemption under Section 10(13A), salary includes dearness allowance only when the terms of employment so provide, but excludes all other allowances and perquisites.

Question 17.

Mr. Srikant has two sons. He is in receipt of children education allowance of ₹ 150 p.m. for his elder son and ₹ 70 p.m. for his younger son. Both his sons are going to school. He also receives the following allowances:

Transport allowance: ₹ 1,800 p.m.

Tribal area allowance: ₹ 500 p.m.

Compute his taxable allowances.

Answer:

Taxable allowance in the hands of Mr. Srikant is computed as under – Children Education Allowance:

Elder son [(₹ 150 – ₹ 100) p.m. × 12 months] = ? 600

Younger son [(₹ 70 – ₹ 70) p.m. × 12 months] = Nil ₹ 600

Transport allowance [(₹ 1,800 × 12 months] = ₹ 21,600

Tribal area allowance [(₹ 500 – ₹ 200) p.m. × 12 months] = ₹ 3,600

Taxable allowances = ₹ 25,800

![]()

Question 18.

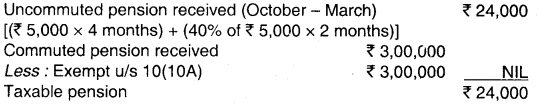

Mr. Sagar retired on 1.10.2020 receiving ₹ 5,000 p.m. as pension. On 1.2.2021, he commuted 60% of his pension and received 7 3,00,000 as commuted pension. You are required to compute his taxable pension assuming:

(a) He is a government employee.

(b) He is a non-government employee, receiving gratuity of ₹ 5,00,000 at the time of retirement.

(c) He is a non-government employee and is not in receipt of gratuity at the time of retirement.

Question 19.

Mr. Ravi retired on 15.6.2020 after completion of 26 years 8 months of service and received gratuity of ₹ 6,00,000. At the time of retirement, his salary was:

Basic Salary : ₹ 5,000 p.m.

Dearness Allowance : ₹ 3,000 p.m. (60% of which is for retirement benefits)

Commission : 1 % of turnover (turnover in the last 12 months was ₹ 12,00,000)

Bonus : ₹ 12,000 p.a.

Compute his taxable gratuity assuming:

(a) He is non-government employee and covered by the Payment of Gratuity Act 1972.

(b) He is non-government employee and not covered by Payment of Gratuity Act 1972.

(c) He is a Government employee.

Answer:

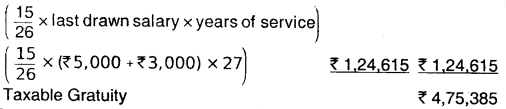

(a) He is covered by the Payment of Gratuity Act 1972.

Gratuity received at the time of retirement ₹ 6,00,000

Less: Exemption under section 10(10) Least of the following:

(i) Gratuity received ₹ 6,00,000

(ii) Statutory limit ₹ 20,00,000

(iii) 15 days salary based on last drawn salary for each completed year of service or part thereof in excess of 6 months

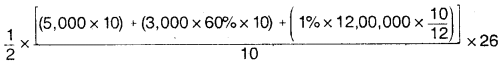

(b) He is not covered by the Payment of Gratuity Act 1972.

Gratuity received at the time of retirement ₹ 6,00,000

Less: Exemption under Section 10(10) (Note) ₹ 1,01,400

Taxable Gratuity ₹ 4,98,600

Note: Exemption under Section 10(10) is least of the following:

(i) Gratuity received ₹ 6,00,000

(ii) Statutory limit ₹ 20,00,000

(iii) Half month’s salary based on average salary of last 10 months preceding the month of retirement for each completed year of service.

\(\frac{1}{2}\) × Average salary × years of service

= ₹ 1,01,400

(c) He is a government employee

Gratuity received at the time of retirement ₹ 6,00,000

Less : Exemption under section 10(10) ₹ 6.00.000

Taxable gratuity Nil

![]()

Question 20.

Mr. A retires from service on December 31, 2020, after 25 years of service. Following are the particulars of his income/investments for the previous year 2020-21.

| Particulars | |

| Basic pay @ ₹ 16,000 per month for 9 months | 1,44,000 |

| Dearness pay (50% forms part of the retirement benefits) ₹ 8,000 per month for 9 months | 72,000 |

| Lumpsum payment received from the Unrecognized | |

| Provident Fund | 6,00,000 |

| Deposits in the PPF account | 40,000 |

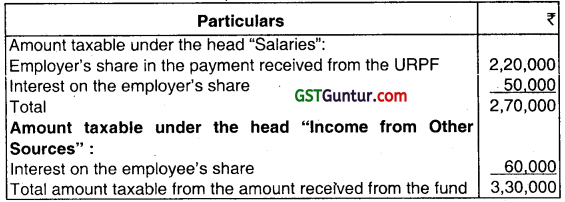

Out of the amount received from the unrecognized provident fund, the employer’s contribution was ₹ 2,20,000 and the interest thereon ₹ 50,000. The employee’s contribution was ₹ 2,70,000 and the interest thereon ₹ 60,000. What is the taxable portion of the amount received from the unrecognized provident fund in the hands of Mr. A for the assessment year 2021-22?

Answer:

Taxable portion of the amount received from the URPF in the hands of Mr. A for the A.Y. 2021-22 is computed hereunder:

Note: Since the employee is not eligible for deduction under section 80C for contribution to URPF at the time of such contribution, the employee’s share received from the URPF is not taxable at the time of withdrawal as this amount has already been taxed as his salary income.

Question 21.

Mr. C is a Finance Manager in ABC Ltd. The company has provided him with rent-free unfurnished accommodation in Mumbai. He gives you the following particulars:

Basic salary ₹ 6,000 p.m.

Dearness Allowance ₹ 2,000 p.m. (30% is for retirement benefits)

Bonus ₹ 1,500 p.m.

Even though the company allotted the house to him on 1.4.2020, he occupied the same only from 1.11.2020. Calculate the taxable value of the perquisite for A.Y.2021 -22.

Answer:

Value of the rent free unfurnished accommodation = 15% of salary for the relevant period

= 15% of [(₹ 6000 × 5) + (₹ 2,000 × 30% × 5) + (₹ 1,500 × 5)] [See Note below]

= 15% of ₹ 40,500 = ₹ 6,075.

Note:

Since, Mr. Coccupiesthe house only from 1.11.2020, we have to include the salary due to him only in respect of months during which he has occupied the accommodation. Hence salary for 5 months (i.e. from 1.11.2020 to 31.03.2021) will be considered.

![]()

Question 22.

Mr. X and Mr. Y are working for M/s. Gama Ltd. As per salary fixation norms, the following perquisites were offered:

(i) For Mr. X, who engaged a domestic servant for ₹ 500 per month, his employer reimbursed the entire salary paid to the domestic servant

i.e. ₹ 500 per month.

(ii) For Mr. Y, he was provided with a domestic servant @ ₹ 500 per month as part of remuneration package.

You are required to comment on the taxability of the above in the hands of Mr. X and Mr. Y, who are not specified employees.

Answer:

In the case of Mr. X, it .becomes an obligation which the employee would have discharged even if the employer did not reimburse the same. Hence, the perquisite will be covered under Section 17(2)(iv) and will be taxable in the hands of Mr. X. This is taxable in the case of all employees.

In the case of Mr. Y, it cannot be considered as an obligation which the employee would meet. The employee might choose not to have a domestic servant. This is taxable only in the case of specified employees covered by Section 17(2)(iii). Hence, there is no perquisite element in the hands of Mr. Y.

Question 23.

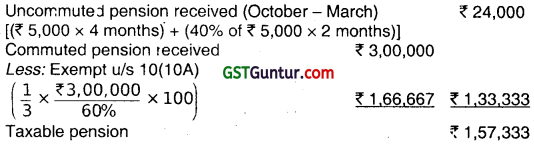

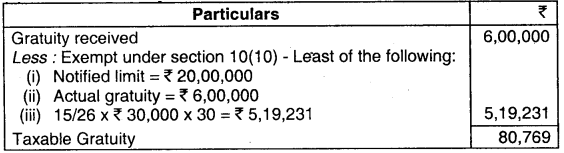

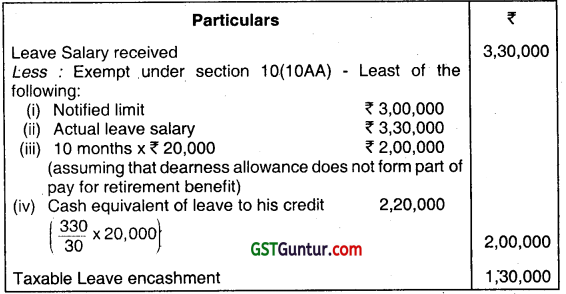

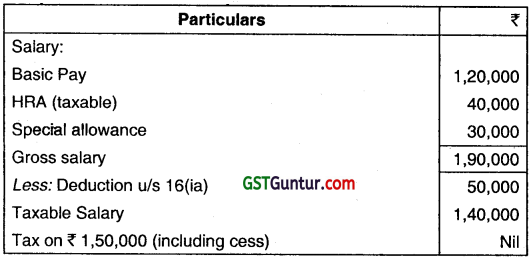

Mr. X retired from the services of M/s Y Ltd. on 31.01.2021, after completing service of 30 years and one month. He had joined the company on 1.1.1990 at the age of 30 years and received the following on his retirement:

(i) Gratuity ₹ 6,00,000. He was covered under the Payment of Gratuity Act, 1972.

(ii) Leave encashment of ₹ 3,30,000 for 330 days leave balance in his account. He was credited 30 days leave for each completed year of service.

(iii) As per the scheme of the company, he was offered a car which was purchased on 01.02.2018 by the company for ₹ 5,00,000. Company has recovered ₹ 2,00,000 from him for the car. Company depreciates the vehicles at the rate of 15% on Straight Line Method.

(iv) An amount of ₹ 3,00,000 as commutation of pension for 2/3 of his pension commutation.

(v) Company presented him a gift voucher worth ₹ 6,000 on his retirement.

(vi) His colleagues also gifted him a Television (LCD) worth ₹ 50,000 from their own contribution.

Following are the other particulars:

(i) He has drawn a basic salary of ₹ 20,000 and 50% dearness allowance per month for the period from 01.04.2020 to 31.01.2021.

(ii) Received pension of ₹ 5,000 per month for the period 01.02.2020 to 31.03.2021 after commutation of pension.

Compute his gross total income from the above for Assessment Year 2021-22.

Answer:

Computation of Gross Total Income of Mr. X for A.Y. 2021-22

| Particulars | ₹ |

| Basic Salary = ₹ 20,000 × 10 | 2,00,000 |

| Dearness Allowance = 50% of basic salary | 1,00,000 |

| Gift Voucher (See Note -1) | 6,000 |

| Transfer of car (See Note – 2) | 56,000 |

| Gratuity (See Note – 3) | 80,769 |

| Leave encashment (See Note – 4) | 1,30,000 |

| Uncommuted pension (₹ 5000 × 2) | 10,000 |

| Commuted pension (See Note – 5) | 1.50.000 |

| Gross Salary | 7,32,769 |

| Less: Standard Deduction u/s 16(ia) | 50.000 |

| Taxable Salary/Gross Total Income | 6,82,769 |

Notes:

(1) As per Rule 3(7)(iv), the value of any gift or voucher or token in lieu of gift received by the employee or by member of his household not exceeding ₹ 5,000 in aggregate during the previous year is exempt. In this case, the amount was received on his retirement and the sum exceeds the limit of ₹ 5,000.

Therefore, the entire amount of ₹ 6,000 is liable to tax as perquisite. Note: An alternate view possible is that only ‘the sum in excess of ₹ 5,000 is taxable in view of the language of Circular No.15/2002 dated 12.12.2002 that such gifts upto ₹ 5,000 in the aggregate per annum would be exempt, beyond which it would be taxed as a perquisite. As per this view, the value of perquisite would be ₹ 1,000 and gross taxable income would be ₹ 7,27,769.

Perquisite value of transfer of car: As per Rule 3(7)(viii), the value of benefit to the employee, arising from the transfer of an asset, being a motor car, by the employer is the actual cost of the motor car to the employer as reduced by 20% of such cost for each completed year during which such motor car was put to use by the employer on a written down value basis. Therefore, the value of perquisite on transfer of motor car, in this case, would be:

| Particulars | ₹ |

| Purchase price (1.2.2018) | 5,00,000 |

| Less: Depreciation @ 20% | 1,00,000 |

| WDV on 31.1.2019 | 4,00,000 |

| Less: Depreciation @ 20% | 80,000 |

| WDV on 31.1.2020 | 3,20,000 |

| Less: Depreciation @ 20% | 64,000 |

| WDV on 31.1.2021 | 2,56,000 |

| Less: Amount recovered | 2,00,000 |

| Value of perquisite | 56,000 |

The rate of 15% as well as the straight line method adopted by the company for depreciation of vehicle is not relevant for calculation of perquisite value of car in the hands of Mr. X.

(2) Taxable gratuity

(3) Taxable leave encashment

Note: It has been assumed that dearness allowance does not form part of salary for retirement benefits. In case it is assumed that dearness allowance forms part of pay for retirement benefits, then, the third limit for exemption under section 10(10AA) in respect of leave encashment would be ₹ 3,00,000 (i.e. 10 × ₹ 30,000) and the fourth limit ₹ 3,30,000, in which case, the taxable leave encashment would be ₹ 30,000 (₹ 3,30,000 – ₹ 3,00,000). In such a case, the gross total income would be ₹ 6,32,769.

(4) Commuted Pension

Since Mr. X is a non-government employee in receipt of gratuity, exemption under Section 10(10A) would be available to the extent of 1/3rd of the amount of the pension which he would have received had he commuted the whole of the pension.

| Particulars | ₹ |

| Amount received | 3,00,000 |

| Exemption under Section 10(10A) | 1,50,000 |

| Taxable amount | 1,50,000 |

(5) The taxability provisions under Section 56(2)(x) are not attracted in respect of television received from colleagues, since television is not included in the definition of property therein.

![]()

Question 24.

AB Co. Ltd. allotted 1000 sweat equity shares to Sri Chand in June 2020.The shares were allotted at ₹ 200 per share as against the fair market value of ₹ 300 per share on the date of exercise of option by the allottee viz. Sri Chand. The fair market value was computed in accordance with the method prescribed under the Act.

(i) What is the perquisite value of sweat equity shares allotted to Sri Chand?

(ii) In the case of subsequent sale of those shares by Sri Chand, what would be the cost of acquisition of those sweat equity shares?

Answer:

As per Section 17(2)(vi), the value of sweat equity shares chargeable to tax as perquisite shall be the fair market value of such shares on the date on which the option is exercised by the assessee as reduced by the amount actually paid by, or recovered from, the assessee in respect of such shares.

| Particulars | ₹ |

| Fair market value of 1000 sweat equity shares @ ₹ 300 each | 3,00,000 |

| Less: Amount recovered from Sri Chand 1000 shares @ ₹ 200 each | 2,00,000 |

| Value of perquisite of sweat equity shares allotted to Sri Chand | 1,00,000 |

(i) As per Section 49(2AA),where capital gain arises from transfer of sweat equity shares, the cost of acquisition of such shares shall be the fair market value which has been taken into account for perquisite valuation under Section 17(2)(vi). (The provisions of Section 49 are discussed in Unit 4: Capital Gains of this chapter)

Therefore, in case of subsequent sale of sweat equity shares by Sri Chand, the cost of acquisition would be ₹ 3,00,000.

Question 25.

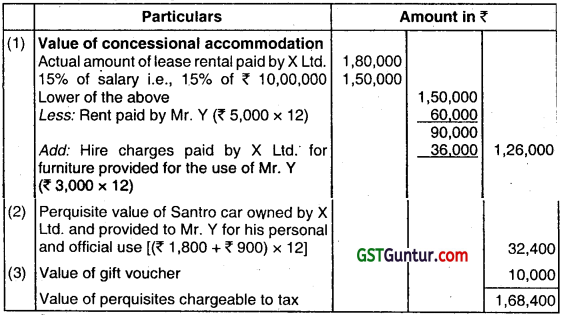

X Ltd. provided the following perquisites to its employee Mr. Y for the P.Y. 2020-21:

(1) Accommodation taken on lease by X Ltd. for ₹ 15,000 p.m. ₹ 5,000 p.m. is recovered from the salary of Mr. Y.

(2) Furniture, for which the hire charges paid by X Ltd. is ₹ 3,000 p.m.

No amount is recovered from the employee in respect of the same.

(3) A Santro Car which is owned by X Ltd. and given to Mr. Y to be used both for official and personal purposes. All running and maintenance expenses are fully met by the employer. He is also provided with a chauffeur.

(4) A gift voucher of ₹ 10,000 on his birthday.

Compute the value of perquisites chargeable to tax for the A.Y. 2021-22, assuming his salary for perquisite valuation to be ₹ 10 lakh.

Answer:

Computation of the value of perquisites chargeable to tax in the hands of Mr. Y for the A.Y.2021-22

![]()

Question 26.

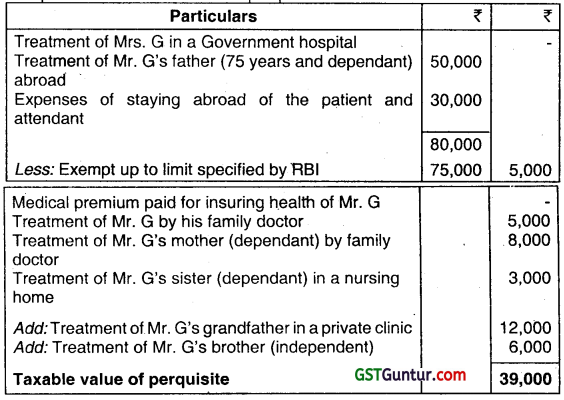

Compute the taxable value of the perquisite in respect of medical facilities received by Mr. G from his employer during the P.Y. 2020-21:

Medical premium paid for insuring health of Mr. G ₹ 7,000

Treatment of Mr. G by his family doctor ₹ 5,000

Treatment of Mrs. G in a Government hospital ₹ 25,000

Treatment of Mr. G’s grandfather in a private clinic ₹ 12,000

Treatment of Mr. G’s mother (68 years and dependant) by family doctor ₹ 8,000

Treatment of Mr. G’s sister (dependant) in a nursing home ₹ 3,000

Treatment of Mr. G’s brother (independent) ₹ 6,000

Treatment of Mr. G’s father (75 years and dependant) abroad ₹ 50,000

Expenses of staying abroad of the patient and attendant ₹ 30,000

Limit specified by RBI ₹ 75,000

Answer:

Computation of taxable value of perquisite in the hands of Mr.G

Note: Grandfather and independent brother are not included within the meaning of family of Mr. G.

Question 27.

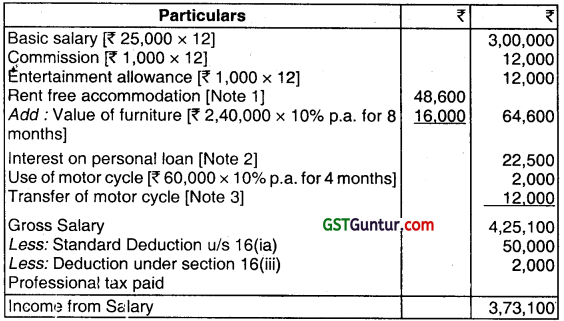

Mr. X is employed with AB Ltd. on a monthly salary of ₹ 25,000 per month and an entertainment allowance and commission of ₹ 1,000 p.m. each. The company provides him with the following benefits:

1. A company owned accommodation is provided to him in Delhi. Furniture costing ₹ 2,40,000 was provided on 1.8.2019.

2. A personal loan of ₹ 5,00,000 on 1.7.2020 on which it charges interest @ 6.75% p.a. The entire loan is still outstanding. (Assume SBI rate of interest to be 12.75% p.a.)

3. His son is allowed to use a motor cycle belonging to the company. The company had purchased this motor cycle for ₹ 60,000 on 1.5.2017. The motor cycle was finally sold to him on 1.8.2020 for ₹ 30,000.

4. Professional tax paid by Mr. X is ₹ 2,000.

Compute the income from salary of Mr. X for the A.Y. 2021-22

Answer:

Computation of Income from Salary of Mr. X for the A.Y.2021-22

Note 1: Value of rent free unfurnished accommodation

= 15% of salary for the relevant period

= 15% of (₹ 3,00,000 + ₹ 12,000 + ₹ 12,000) = ₹ 48,600

Note 2: Value of perquisite for interest on personal loan

= [₹ 5,00,000 × (12.75% – 6.75%) for 9 months] = ₹ 22,500

Note 3: Depreciated value of the motor cycle

= Original cost – Depreciation @ 10% p.a. for 3 completed years.

= ₹ 60,000 – (₹ 60,000 × 10% p.a. × 3 years) = ₹ 42,000.

Perquisite = ₹ 42,000 – ₹ 30,000 = ₹ 12,000.

![]()

Question 28.

Mr. Khanna, an employee of IOL, New Delhi, a private sector company, received the following for the financial year 2020-21:

| Particulars | ₹ |

| Basic pay | 1,20,000 |

| House rent allowance | 1,00,000 |

| Special allowance | 30,000 |

Mr. Khanna was residing at New Delhi and was paying a rent of ₹ 10,000 a month.

Compute the eligible exemption under section 10(13A) of the Income-tax Act, 1961, in respect of house rent allowance received.

(i) If Mr. Khanna opts for rent free accommodation whereby IOL would be paying a rent of ₹ 10,000 per month to the landlord and recovers a sum of ₹ 2,500 per month from Mr. Khanna which was in excess of his entitlement, what will be the perquisite value in respect of such rent free accommodation?

(ii) Which of the above would be beneficial to Mr. Khanna i.e., house rent allowance or rent free accommodation?

Answer:

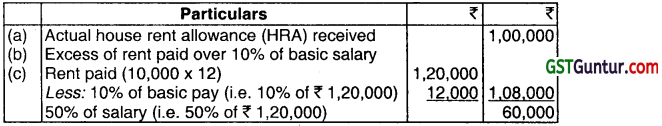

(i) The eligible exemption under Section 10(13A) in respect of house rent allowance received would be least of the following:

Least of the above is ₹ 60,000.

The house rent allowance received by Mr. Khanna would be exempt to the extent of ₹ 60,000 under Section 10(13A). The balance of ₹ 40,000 is includible in his total income.

(ii) Perquisite value in respect of concessional accommodation

As per rule 3(1), where the accommodation is taken on lease or rent by the employer, the actual amount of lease rental paid or payable by the employer or 15% of salary, whichever is lower, as reduced by the rent, if any, actually paid by the employee is the value of the perquisite.

(a) Actual rent paid by the employer = ₹ 10,000 × 12 = ₹ 1,20,000

(b) 15% of salary = 15% of basic pay plus special allowance = 15% of ₹ 1,50,000 = ₹ 22,500

Lower of the above is ₹ 22,500, which should be reduced by the rent of ₹ 30,000 paid by the employee (i.e.,2,500 × 12 = ₹ 30,000). The perquisite value is, therefore, nil.

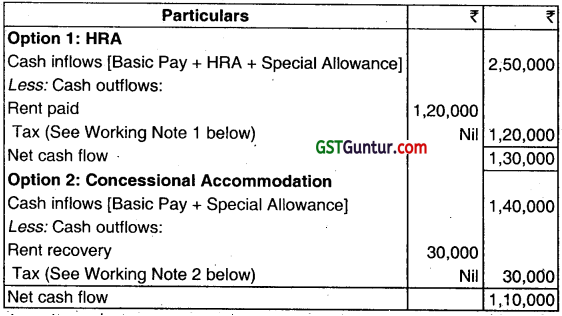

(iii) We have to see the cash flow from both the options to find out which is more beneficial.

Since the net cash flow is higher in Option 1, Mr. Khanna should opt for HRA, which would be more beneficial to him.

Working Notes:

1. Computation of tax under Option 1 (HRA):

2. Computation of tax under Option 2 (Concessional accommodation)

![]()

Multiple Choice Question

Question 1.

Mr. B, a Chartered Accountant is employed with A Ltd., as an internal auditor and requests the employer to call the remuneration as internal audit fee shall be chargeable to tax for such fee under the head.

(a) Income from Salaries

(b) Profit and gains from Business and Profession

(c) Income from other Sources.

(d) None of the above

Answer:

(a) Income from Salaries

Question 2.

R was employed from 1.8.2017 in the grade of ₹ 15,000-400-17,000-500-22,000 and his salary was fixed at X 16,200 from the date of joining. His gross salary for the assessment year 2021-22 shall be.

(a) ₹ 1,99,200

(b) ₹ 2,04,000

(c) ₹ 2,08,000

(d) ₹ 2,10,000

Answer:

(c) ₹ 2,08,000

Question 3.

Maximum exemption limit in case of employees covered under Gratuity Payment Act is:

(a) ₹ 2 Lakh

(b) ₹ 3 Lakh

(c) ₹ 5 Lakh

(d) ₹ 20 Lakh

Answer:

(d) ₹ 20 Lakh

Question 4.

The exemption of Voluntary Retirement compensation is available to an employee who has completed _______________ years of service or completed _______________ years of age except in case of employees of public sector company.

(a) 10,40

(b) 10,50

(c) 8,40

(d) 10,58

Answer:

(a) 10,40

Question 5.

Sneha is an employee in a private company. In the previous year she received salary ₹ 1,80,000 and entertainment allowance ₹ 12,000. She spent ₹ 6,000 on entertainment. Under Section 16(ii), she is entitled to deduction of:

(a) ₹ 12,000

(b) ₹ 6,000

(c) ₹ 5,000

(d) Nil.

Answer:

(d) Nil.

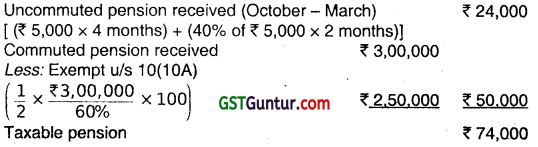

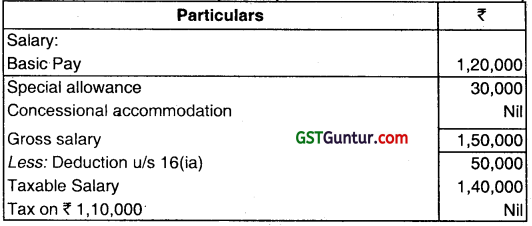

Question 6.

Reshma receives ₹ 50,000 p.m. as basic salary from ABC Ltd. She is also provided dearness allowance of ₹ 25,000 p.m. forming part of retirement benefit. She has been provided motor car (engine capacity exceeds 1.6 Its.) owned by employer for her personal use. The original cost of car is ₹ 6,00,000 (WDV ₹ 5,10,000). Expenditure incurred by the employer on running and maintenance of the motor car during the relevant previous year amounted ₹ 75,000. The salary of driver paid by the employer – ₹ 96,000. The taxable value of car facility for AY 2021 -22 will be:

(a) ₹ 2,31,000

(b) ₹ 39,600

(c) ₹ 2,22,000

(d) ₹ 1,71,000

Answer:

(a) ₹ 2,31,000

![]()

Question 7.

The value of free food and non-alcoholic beverages provided by the employer to an employee during working hours provided in a remote area shall be:

(a) Exempt upto ₹ 50 per meal

(b) Fully taxable

(c) Fully exempt

(d) Exempt upto ₹ 20,000

Answer:

(c) Fully exempt

Question 8.

Anand is entitled to get a pension of ₹ 600 per month, from a private company. He gets three-fifth of the pension commuted and received ₹ 36,000. He did not receive gratuity. The taxable portion of commuted value of pension is:

(a) ₹ 16,000

(b) ₹ 6,000

(c) ₹ 18,000

(d) ₹ 12,000

Answer:

(b) ₹ 6,000

Question 9.

For an employee in receipt of hostel expenditure allowance for his three children, the maximum annual allowance exempt under Section 10(14) is:

(a) ₹ 10,800

(b) ₹ 7,200

(c) ₹ 9,600

(d) ₹ 3,600

Answer:

(b) ₹ 7,200

Question 10.

Chhaya receives ₹ 25,000 p.m. as basic salary from ABC Ltd. She is also provided dearness allowance of ₹ 15,000 p.m. forming part of retirement benefit and has been provided, accommodation owned by employer in Delhi (population exceeds 25 lakhs). The employer has charged rent of ₹ 4,000 p.m. from Chhaya. The taxable value of concessional accommodation will be:

(a) ₹ 24,000

(b) ₹ 48,000

(c) ₹ 72,000

(d) Nil

Answer:

(a) ₹ 24,000

Income from Salaries Notes

Amendment of section 17.

In section 17 of the Income-tax Act, in clause (2), for sub-clause (vii), the * following sub-clauses shall be substituted with effect from the 1st day of April, 2021, namely :-

(vii) the amount or the aggregate of amounts of any contribution made to the account of the assessee by the employer:

(a) in a recognised provident fund;

(b) in the scheme referred to in sub-section (1) of section 80CCD; and

(c) in an approved superannuation fund, to the extent it exceeds seven lakh and fifty thousand rupees in a previous year;

(viia) the annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the fund or scheme referred to in sub-clause (vii) to the extent i( relates to the contribution referred to in the said sub-clause which is included in total income under the said sub-clause in any previous year computed in such manner as may be prescribed; and”.

Amount or the aggregate of amounts of any contribution made to the account of the assessee by employer

|

The amount or aggregate of amounts of any contribution made

|

| Annual accretion to the balance at the credit of the recognised provident f u n d/N P S/a pp roved superannuation fund which relates to the employer’s contribution and included in total income (on account of the same having exceeded ₹ 7,50,000) | Any annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the recognized provident fund or NPS or approved superannuation fund to the extent it relates to the employer’s contribution which is included in tot4l income in any previous year under section 1 7(2)(vii) computed in prescribed manner [Section 1 7(2)(viia)].

In other words, interest, dividend or any other amount of similar nature on the amount which is included in total income under section 17(2)(vii). |

![]()

Valuation of specified security, not being an equity share in a company for the purpose of section 17(2)(vi) [Sub-rule (9)]

The fair market value of any specified security, not being an equity share in a company, on the date on which the option is exercised by the employee, shall be such value as determined by a merchant banker on the specified date.

For this purpose, “specified date” means,

- the date of exercising of the option; or

- any date earlier than the date of the exercising of the option, not being a date which is more than 180 days earlier than the date of the exercising.

Tax on perquisite of specified securities and sweat equity shares is required to be paid in the year of exercising of option. However, where such shares or securities are allotted by the current employer, being an eligible start-up, the perquisite is taxable in the year

- after the expiry of 48 months from the end of the relevant assessment year

- in which sale of such security or share are made by the assessee

in which the assessee ceases to be the employee of the employer, whichever is earlier.