Introduction to Cost and Management Accounting – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Introduction to Cost and Management Accounting – CA Inter Costing Question Bank

Question 1.

What are the main objectives of cost accounting? (May 2001, May 2008, 2, 2 marks)

OR

Enumerate the main objective of introduction of a cost accounting system in a manufacturing organisation. (Nov 2002, 3 marks)

OR

What is cost accounting? Enumerate its important objectives. (May 2010, May 2016, 2, 4 marks)

Answer:

Cost Accounting is defined as “the process of accounting for cost which begins with the recording of income and expenditure or the bases on which they are calculated and ends with the preparation of periodical statements and reports for ascertaining and controlling costs.”

- Cost accounting primarily deals with collection and analysis of relevant cost data for interpretation and presentation for various problems of management.

- Cost accounting is the application of accounting and costing principles, methods and techniques in the ascertainment of costs and analysis of saving and /or excess as compared with previous experience or with standards.

![]()

The Objectives of Cost Accounting are as follows:

| 1. | To ascertain and analyse costs | The primary objective of cost accounting is to ascertain and analyse costs incurred on the production of various products, jobs and services etc. |

| 2. | To control costs | There are a number of techniques in cost accounting like standard costing and budgetary control for controlling cost. |

| 3. | To reduce costs | By now, the objective of cost accounting has been extended to reduce costs. For cost reduction plan, products, processes, procedures, organisation, and methods are continuously reviewed or scrutinized in order to improve efficiency and to reduce cost. |

| 4. | To fix the selling price | Under cost accounting, reliable data is provided to act as a base for fixing selling prices. |

| 5. | To prepare periodic statements | In cost accounting system, periodic cost statements (viz. monthly, quarterly) for review of operating results are prepared. |

| 6. | To provide information | Cost accounting provides useful information for planning and control and for taking various decisions regarding increase in production, installation or replacement of a machine, making or buying of a component, continuing or closing down of a business etc. |

| 7. | To ascertain the profit of each activity | The profit of any activity can be ascertained by matching cost with the revenue of that activity. The purpose under this step is to determine costing profit or loss of any activity on an objective basis. |

| 8. | To assist the management in decision making | Decision making is defined as a process of selecting a course of action out of two or more alternative courses. For making a choice between different courses of action, it is necessary to make a comparison of the outcomes, which may be arrived under different alternatives. |

![]()

Question 2.

Distinguish Between Cost Control and Cost Reduction (Nov 2011, May 2014, May 2016, May 2019 RTP, 4, 4, 4, 5 marks)

Answer:

Difference Between Cost Control and Cost Reduction

| S. No. | Basis of Difference | ‘ Cost Control | Cost Reduction |

| 1 | Meaning | Cost control is the guidance and regulation by executive action of the cost of operating an undertaking. | Cost reduction is the achievement of real and permanent reduction in the unit cost of goods and services without impairing their suitability. |

| 2 | Emphasis | It emphasises on past performance and variance analysis. | It emphasises on present and future performance without considering the past performance. |

| 3 | Approach | It is a conservative approach which stresses on the conformity to the set norms. | It is a dynamic approach where in every function is analysed in view of its contribution. |

| 4 | Focus | It is a short term review with focus on reducing cost in a particular period. | It seeks to reduce unit cost on a permanent basis based on a systematic approach. |

| 5 | Nature of Function | It is a preventive function. | It is a corrective function. |

![]()

Question 3.

State the difference between Cost Accounting and Management Accounting. (May 2017, Nov 2020, 4, 5 marks)

Answer:

Difference Between Cost Accounting and Management Accounting

| S. No. | Basis | Cost Accounting | Management Accounting |

| 1. | Nature | It records the quantitative aspect only. | It records both qualitative and quantitative aspect. |

| 2. | Objective | It records the cost of producing a product and providing a service. | It. provides information to management for planning and co-ordination. |

| 3. | Area | It only deals with cost Ascertainment. | It is wider in scope as it includes F.A., budgeting, Tax, planning. |

| 4. | Recording of Data | It uses both past and present figures. | It is focused with the projection of figures for future. |

| 5. | Develop

ment |

It’s development is related to industrial revolution. | It develops in accordance to the need of modem business world. |

| 6. | Rules and Regulation | It follows certain principles and procedures for recording costs of different products. | It does not follow any specific rules and regulations. |

![]()

Question 4.

Answer the following:

Why are cost and management accounting information are required by the staff at operational level? Describe. (May 2018, 5 marks)

Answer:

The operational level staff like supervisors, foreman, team leaders are require cost and management accounting information:

- To know the objectives and performance goals for them.

- To know product and service specification like volume, quality and process etc.

- To know the performance parameters against which their performance

is measured and evaluated. - To know divisional (responsibility centre) profitability etc.

Question 5.

Discuss the essentials of a good Cost Accounting System. (May 2004, Nov 2005, 2, 4 marks)

OR

Briefly explain the essential features of a good cost accounting system. (Nov 2012, 4 marks)

Answer:

To be successful, a good cost accounting system should possess the following essential features:

| 1. | Simple and easy to operate | The system to be simple practical, flexible and capable of meeting the requirements of a concern. |

| 2. | Accuracy | The data to be used by the cost accounting system should be exact & accurate otherwise the output of the system will not be correct. |

| 3. | Cost-effective | The cost of installing and operating the system should justify the results. The benefit from the system should exceed the amount to be spent on it. |

| 4. | Management’s Role | The top management should have full faith in the costing system and should provide help towards its development and success. |

| 5. | Relevance of Data | The system should handle and report relevant data for use of managers for decision making. It should not sacrifice its utility by introducing meticulous and unnecessary details. |

| 6. | Participation by executives | Necessary co-operation and participation of executives from various deptts. of the concern is essential for developing a good system of cost accounting. |

![]()

Question 6.

Write short note on the essential factors for installing a Cost Accounting System. (Nov 2010, 4 marks)

OR

What are the essential factors for installing a cost accounting system? Explain. (May 2017, 4 marks)

Answer:

Essential Factors for installing a Cost Accounting System:

| 1. | Objective | The objective of cost system should be considered before installation. Whether to fix selling prices or control costs or both. |

| 2. | Nature of Business | The costing system, which is suitable to the business organisation, should be introduced. |

| 3. | Organisational Hierarchy | Costing system should fulfill the requirement of different level of management. Organisation structure should be studied to determine the manner in which costing system should be introduced. |

| 4. | Knowing the Product | Nature of Product determines the type of costing system to be implemented. The product which has by-products requires costing system which account for by-products as well. |

| 5. | Knowing the Production Process | A good costing system can never be established without the complete knowledge of production process. |

| 6. | Method of Maintenance oi Cost Records | The manner in which Cost and Financial accounts could be inter-locked into a single integral accounting system and in which results of separate sets of accounts, cost and financial, could be reconciled by means of control accounts. |

![]()

Question 7.

A factory manufactures only one product in one quality and size. The owner of the factory states that he has a sound system of financial accounting which can provide him with unit cost information and as such he does not need a cost accounting system. State your arguments to convince him the need to introduce a cost accounting system. (Nov 1996, 4 marks)

Answer:

Reasons for installing a cost accounting system in a single product manufacturing factory:

1. Management of a manufacturing unit needs information to draw plans for the future, to control the working of the unit and for making day-to-day decisions. All these information are not available from financial accounts which provides two documents viz profit and loss a/c and balance sheet at the end of the financial year. These two documents take about 13-14 months to reach the executives but the executives even then cannot set right anything that has gone wrong in the past. Therefore, in order to facilitate executives to perform well the functions of planning, control and decision making the use of cost accounting system is a must.

2. In financial accounting system no attempt is generally made to record data by jobs, processes, products, departments etc. It only provides information in terms of income, expenses, assets and liabilities for the company as a whole thus the available information is not quite useful for the ascertainment of price, control of costs, ascertainment of products profitability etc. Cost accounting records data in the manner that helps the ascertainment of price and profitability and also the control of costs by using variances.

![]()

3. Government in its efforts to protect consumers, often resorts to statutory price control, cost accounting can help by providing enough cost information which could be utilized to press upon the govt, to convince for price and to arrive at a suitable price before their arbitrary fixation.

4. A sound system of cost accounting will highlight the capacity utilization and efficiency which will be beneficial in taking suitable decisions for the improvement of operational results.

5. It also helps the management for the periodic assessment of the performance of its executives. This can be done by establishing standards and presenting reports to appropriate authority.

Question 8.

Define cost object and give three examples. (May 2000, 2 marks)

![]()

Question 9.

Give three examples of Cost Drivers of following business functions in the value chain:

(i) Research and Development

(ii) Design of products, services and processes

(iii) Marketing

(iv) Distribution

(v) Customer service. (May 2000, 5 marks)

Answer:

(i) Research and Development

Cost Drivers

- No. of Research Projects

- Personal hours on a project

- Technical complexities of the project

(ii) Design of products Services and Processes

Cost Drivers

- No. of Products in design

- No. of parts per products

- No. of engineering hours

![]()

(iii) Marketing

Cost Drivers

- No. of advertisement run

- No. of sales personnel

- Sales Revenue

(iv) Distribution

Cost Drivers

- No. of items distributed

- No. of customers

- Weight of items distributed

(v) Customer service

Cost Drivers

- No. of services caIs

- No. of products serviced

- Hours spent in servicing of products

![]()

Question 10.

Cost of a product or service is required to be expressed in suitable cost unit. State the cost units for the following industries:

(i) Steel

(ii) Automobile

(iii) Transport

(iv) Power (May 2013, 4 marks)

Answer:

| Industry | Cost Unit | |

| (i) | Steel | Tonne |

| (ii) | Automobile | Numbers |

| (iii) | Transport | Passenger Kilo-meter//Tonne Kilo-meter |

| (iv) | Power | Kilo-watt hour (Kwh) |

![]()

Question 11.

State the unit of cost for the followings

1. Transport

2. Power

3. Hotel

4. Hospital (May 2014, 2 marks)

Answer:

Unit of Cost

1. Transport – Passenger km.. Tonne km.

2. Power – Per kilowatt – hours

3. Hotel – Per room; per day

4. Hospital – Patient per day, room per day or per bed, per operation, etc.

![]()

Question 12.

Answer the following:

Mention the Cost Unit of the following Industries:

(i) Electricity

(ii) Automobile

(iii) Cement

(iv) Steel

(v) Gas

(vi) Brick Making

(vii) Coal Mining

(viii) Engineering

(ix) Professional Services

(x) Hospital. (Nov 2019, 5 marks)

Answer:

| Industry | Cost Unit Basis | |

| (i) | Electricity | Kilowatt-hour (kWh) |

| (ii) | Automobile | Number |

| (iii) | Cement | Ton/per bag etc. |

| (iv) | Steel | Ton |

| (v) | Gas | Cubic feet |

| (vi) | Brick Making | 1000 bricks |

| (vii) | Coal Mining , | Tonne/Ton |

| (viii) | Engineering | Contract, job |

| (ix) | Professional Services | Chargeable hour, job contract |

| (x) | Hospital | Patient day |

![]()

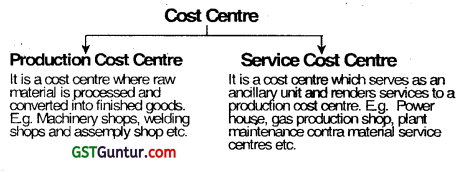

Question 13.

What is meant by ‘Cost Centre’? What are the different types of cost centres. (Nov 2002, Nov 2016, 4, 4, marks)

OR

Define ‘Cost Centre’ and state its types. (May 2015, Nov 2016, 4, 4 marks)

Answer:

Cost Centre

Meaning :

It is defined as a location, person, or an item of equipment (or group of these) for which cost may be ascertained and used for the purpose of cost control. It is a part of an organization that does not produce direct profits and adds to the cost of running a company.

Eg. R&D, marketing departments, help desk and customer services.

Cost Centre are of two types:

- Personal

- Impersonal

A personal cost centre consists of a person and an impersonal Cost Centre of a location or item of equipment.

1. Production Cost Centre :

It is cost centre where raw material is handled for conversion into finished product. Here both direct and indirect expenses are incurred. Machine shops, welding shops and assembly shops are examples of production Cost Centre.

![]()

2. Service Cost Centre :

It is Cost Centre which serves as an ancillary unit to a production cost centre. Power house, gas production shop, material service centres, and plant maintenance centres are examples of service Cost Centre.

3. Profit Centre :

Centres, which have the responsibility of generating and maximizing profits are called profit centres. The profit centre’s revenues and expenses are kept separate from the main company’s profit in order to maintain the profit centre’s profitability.

4. Investment Centres :

Investment centres are similar to profit centres but they have additional decision rights in terms of capital expenditure and investment. The manager is assumed to have better knowledge of input and output markets but also investment opportunities.

![]()

Question 14.

What is meant by ‘Profit Centre’? (May 2016, 2 marks)

Answer:

A profit centre is the centre whose performance is measured in terms of income earned and cost incurred. Its main responsibility is to generate and maximise profit.

Profit Centres is a branch or division of a company that is accounted for an a standalone basis for the purpose of profit calculation. A profit center is responsible for generating its own result and earnings, and as such, its managers generally name decision making authority related to product pricing and operating expenses. Profit centres are crucial in determining which units are the most and least profitable within as organisation.

Question 15.

Distinguish between the following:

(i) Profit Centres and Investment Centres

(ii) Product Cost and Period Cost (May 2006, May 2009, RTP 2, 2 marks)

Answer:

(i) Difference between Profit Centres and Investment Centres :

Profit centre is an organisational sub-units for which both cost and profit can be traced which are engaged mainly on maximization of profit where as investment centre is an organisation sub-unit for which both profit and investment are considered for performance appraisal which are mainly engage to earn return on investment.

![]()

(ii) Difference between Product Cost and Period Cost:

Product costs are associated with the purchase and sale of goods. In the production scenario, such costs are associated with the acquisition and conversion of materials and all other manufacturing inputs into finished product for sale’. Hence under absorption cost, total manufacturing costs constitute inventoriable or product cost.

Periods costs are the costs, which are not assigned to the products but are charged as expense against revenue of the period in which they are incurred. General Administration, marketing, sales and distributor overheads are recognized as period costs.

![]()

Question 16.

Distinguish between cost units and cost centres. (May 2011, 4 marks)

Answer:

Difference between Cost Unit and Cost Centre:

Cost Unit: It is a unit of production, service, time or a combination of these, in relation to which costs may be ascertained or expressed. It should be one with which expenditure can be most readily associated or ascertained. Cost Unit differs from one business to another. They are usually units of physical measurement like weight, area, volume, number, time, length and value.

Some illustrations of cost unit are as follows:

industry/Product/Input – Cost Unit

Cement – Tonne

Power – Kilo watt hour

Transport – Tonne , Km. or Passenger Km.

Sugar – Quintal/Tonne

Nuts and Bolts – Gross or Kilogram

Construction or Interior Decoration – Each contract

Automobiles – Number

![]()

Cost Centre:

It is defined as:

(a) A location e.g. Noida plant, Hyderabad factory etc.

(b) A person e.g. Area sales officer, Manager etc.

(c) An item or equipment e.g. Machine 1, 2, or Process A, B, etc.

Or a group of these, for which cost can be ascertained and used for the purpose of cost control. Cost centres are of two types viz. Personal and Impersonal.

A Personal cost centre consists of a person or a group of persons while Impersonal cost centre consists of a location or an item of equipment or group of all these. In a Manufacturing concern there are 2 types of cost centres:

![]()

Question 17.

Explain ‘Cost Unit’ and ‘Cost Centre’. (May 2017, 4 marks)

Answer:

Cost Unit:

It is a unit of product, service or time (or combination of these) in relation to which costs is ascertained or expressed. It is unit of measurement. For example the cost of carrying a passenger in terms of km, cost of hotel room expressed as cost per day etc.

Cost Centre:

It is a location, person or an item of equipment (or group of these) for which cost is ascertained and used for the purpose of cost control. The main purpose of ascertaining cost centre is to control the cost and to fix responsibility of the person in charge of a cost centre.

Cost Centres are of two types:

- Personal Cost Centre.

- Impersonal Cost Centre.

Cost Centres in a manufacturing concern:

- Production Cost Centre

- Service Cost Centre.

![]()

Question 18.

Answer the following:

Mention and explain types of responsibility centres. (Nov 2018, 5 marks)

Answer:

Four types of responsibility centres are

- Cost Centres

- Revenue Centres

- Profit Centres

- Investment Centres

1. Cost Centres:

The responsibility centre which is held accountable for insurance of costs which are under its control. The Performance of this responsibility centre is measured against pre-determined standards or budgets. The cost centres are of two types:

(a) Standard cost centre and

(b) Discretionary cost centre

(a) Standard cost centre:

Cost centre where output is measurable and input required for the output can be specified. Based on a well-established study, an estimate of standard units of inputs to produce a unit of output is set. The actual cost for inputs is compared with the standard cost.

Any deviation (Variance) in cost is measured and analysed into controllable and uncontrollable cost. The manager of the cost centre is supposed to comply with the standard and held responsible for adverse cost variances. The input- output ratio for a standard cost centre is clearly-identifiable.

![]()

(b) Discretionary cost centre:

The cost centre whose output cannot be measured in financial terms, thus input output ratio cannot be defined. The cost of input is compared with allocated budget for the activity. Example of discretionary cost centres are Research & Development department, Advertisement department where output of these department cannot be measured with certainty and co-related with cost incurred on inputs.

2. Revenue Centres:

The responsibility centres which are accountable for generation of revenue for the entity. Sales Department for example, is responsible for achievement of sales target and revenue generation. Though, revenue does not have control on expenditures it incurs but some time expenditures related with selling activity like commission to sales person etc. are incurred by revenue centres.

3. Profit Centres:

These are the responsibility centres which have both responsibility of generation of revenue and incurrence of expenditures. Since, managers of profit centres are accountable for both costs as well as revenue, profitability is the basis for measurement of performance of these responsibility centres are decentralised branches of an organisation.

4. Investment Centres:

These are the responsibility centres which are not only responsible for profitability but also has the authority to make capital investment decisions. The performance of these responsibility centres are measured on the basis of Return on Investment (ROf) besides profit. Examples of investment centres are Maharatna, Navratna and Maniratna companies of public sector undertakings of central government.

![]()

Question 19.

Discuss cost classification based on variability. (Nov 2004, 2 marks)

Answer:

Classification on the basis of Variability:

On the basis of variability, cost are classified into three types:

- Fixed cost

- Variability cost

- Semi-variable cost.

1. Fixed Cost :

CIMA defines fixed cost as “A cost which accrues in relation to the passage of time and which whin certain output or turnover limits, tends to unaffected by fluctuation in volume of output or turnover.

Characteristics of Fixed Cost:

- Amount of fixed cost remain constant for every level of output.

- Average fixed cost (i.e. fixed cost per unit) will decreases with increased output.

- Fixed cost in generally managed and controlled by the higher management.

Example of F.C.: Insurance, salary, rent etc.

![]()

2. Variability cost :

CIMA defines variable cost as “A cost which in aggregate tends to vary indirect proportion to change in the volume of output or turnover.”

Characteristic of Variable Cost:

- Variable cost varies directly with output/Sales.

- Variable cost is easily chargeable output or department.

- Variable cost is generally managed and controlled by the department heads.

Examples of V. C.: Direct materials cost Direct Labour Cost.

3. Semi Variable Cost :

CIMA defines semi l cost as “A cost containing both fixed and variable elements, which is, therefore, pantly affected by fluctuations in the output or turnover.

Characteristics of Semi-Variable Cost:

- Amount of semi-variable is neither fixed not varies directly along with the output.

- Semi-variable expenses is generally managed by various level of management jointly.

Example of semi variable cost: Telephone bill, electricity bill etc.

![]()

Question 20.

Distinguish Between Controllable Cost and Non-controllable Cost. (May 1997, Nov 2001, May 2003, RTP, 2 marks each)

OR

Discuss cost classification on the basis of Controllability (Nov 2004, May 2001, May 2008, 2 marks each)

Answer:

Classification on the basis of Controllability:

On the basis of controllability cost is classified into two types:

- Controllable cost

- Non-controllable cost

1. Controllable Cost: CIMA defines controllable cost as “Cost chargeable to a cost centre, which can be influenced by the action of the person in whom control of the centre is vested.”

In practice all variable cost are controllable cost.

Example: Direct cost i.e. direct material cost, direct laour cost.

2. Non-Controllable Cost: CIMA defines non-controllable cost as a “Cost chargeable to a cost centre which cannot be influenced by the action of the person in whom control of the centre is vested.”

In practice all fixed costs are non-controllable cost. Therefore such cost cannot be controlled by the responsibility manager.

Example: Expenditure on any service department is controlled by the manager of that service department but if such expenditure is apportioned to production on dept. then manager of that production dept. cannot control the expenditure of the service department.

![]()

Question 21.

Define Explicit costs. How is it different from Implicit costs? (May 2011, 2 marks)

OR

Distinguish between: Explicit and Implicit cost (May 2005, 3 marks)

OR

Explain the following: Explicit costs (May 2014, 2 marks)

Answer:

Explicit Cost: Explicit costs refers the cost, involving immediate payment of cash, such as – Salary, wages, commissions etc. Such costs are easily measurable it is also known as out of pocket cost.

Implicit Costs: It do not involved any immediate cash payment. It is also known an economic costs.

The main difference between Explicit cost and Implicit costs are:

- Explicit costs involves immediate outflow of cash where as implicit costs do not involve immediate cash payment.

- Explicit costs are entered in the books of accounts. Where as implicit costs are not recorded in the book of account.

![]()

Question 22.

Write short notes on

(i) Conversion Cost

(ii) Sunk Cost

(iii) Opportunity Cost (May 2003, Nov 2016, 2 marks each)

OR

Explain : Opportunity Cost. (May 2018, 2.5 marks)

Answer:

(i) Conversion Cost: It is the cost incurred to convert raw materials into finished goods. It is the sum of direct wages, direct expenses and manufacturing overheads.

Formula:

Conversion Cost = Direct Labour Cost + Direct Expenses + Manufacturing Overhead

Or

Conversion Cost = Factory Cost – Direct Materials Cost.

(ii) Sunk Costs: Sunk costs are the historical costs which are incurred in the past. They play no role in decision making in the current period.

(iii) Opportunity Costs: Opportunity costs refers to the value of sacrifice made or benefit of opportunity foregone in accepting alternative course of action. For e.g. a company accepts an expansion plan and for financing, withdraws money from its bank deposits. Then, the loss of interest on the bank deposits is the opportunity cost for carrying out the expansion plan. This cost plays an important role in managerial decision making process although these costs are not recorded in books of accounts.

![]()

Question 23.

Define the following :

(a) Imputed cost

(b) Capitalised cost. (Nov 2009, 2 marks)

Answer:

(a) Imputed Cost: Imputed costs are notional costs which do not involve any cash outlay. Examples of imputed cost are Interest on capital, the payment for which is not actually made, these costs are similar to opportunity costs.

b) Capitalised Cost: Capitalised costs are costs which are initially recorded as assets and subsequently treated as expenses.

Question 24.

State the types of cost in the following cases:

(i) Interest paid on own capital not involving any cash outflow.

(ii) Withdrawing money from hank deposit for the purpose of purchasing new machine for expansion purpose.

(iii) Rent paid for th factory building which is temporarily closed.

(iv) Cost associated with the acquisition and conversion of material into finished product. (May 2012, 4 marks)

Answer

Answer:

Type of Costs

(i) Imputed Cost

(ii) Opportunity Cost

(iii) Shut Down Cost

(iv) Product Cost

![]()

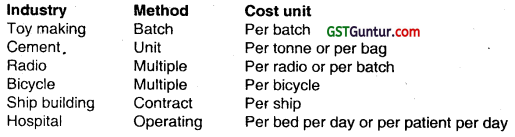

Question 25.

Specify the methods of costing and cost units applicable to the following industries:

(i) Toy making

(ii) Cement

(iii) Radio

(iv) Bicycle

(v) Ship building

(vi) Hospital. (Nov 1998, 3 marks)

Answer:

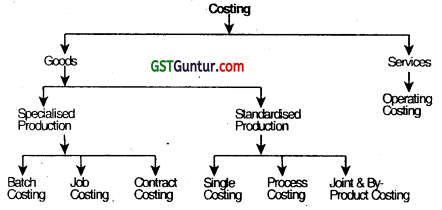

Question 26.

Discuss the four different methods of costing along with their applicability to concerned industry. (Nov 1999, 4 marks)

Answer:

The various method of costing can be summarised as under:

1. Batch Costing:

This costing is based on the concept of contract costing. This method is used to determine the cost of a group of identical or similar products’. The batch costing of similar products is the unit and not single item within the batch. This method can be applied for the production of nuts and bolts, medicines and other items which are manufactured in distinct batches.

![]()

2. Job Costing:

This method is used in those concerns where production is carried out as per specific orders and specifications. Each job is separate and distinct from other jobs and products. This method is popular in enterprises engaged in house building, ship-building, machinery production and repairs etc.

3. Contract Costing:

This method of counting, based on the principle of job counting, is used by house builders and civil contractors. The contract becomes the cost unit for which relevant cost are accumulated.

4. Single or Unit Costing:

This method is used where a single item is produced and the final production is composed of homogenous units. The per unit cost is obtained by dividing the total cost by the total number of unit of units manufactured.

5. Process Costing:

Under this method of costing, the cost of completing each stage of work is ascertained, like cost of making pulp and cost of making paper from pulp. This method is used in those industries where manufacturing is done continuously like chemicals, oil, gas paper etc.

6. Multiple Costing:

This method is used in those industries where the nature of product is complex such as motor cars, aeroplanes etc. In such cases costs are accumulated for different component making the final product and then totaled to ascertain total cost of product.

7. Operating Costing:

Ascertainment of cost of rendering or operating a service is called “service or operating costing”. It is used in case of concerns rendering services like transport, cinema, hotels etc. where there is no identifiable tangible cost limit.

![]()

Question 27.

Answer the following:

State the method of costing that would be most suitable for:

(a) Oil refinery

(b) Bicycle manufacturing

(c) Interior decoration

(d) Airlines company (Nov 2008, 2 marks)

Answer:

The suitable method of costing for the following is:

| (a) | Oil Refinery | Process costing |

| (b) | Bicycle manufacturing | Multiple costing |

| (c) | Interior decoration | Job costing but if on a larger basis then Contract costing |

| (d) | Airlines company | Operating costing |

![]()

Question 28.

Identify the methods of costing for the following:

(i) Where all costs are directly charged to a specific job.

(ii) Where all costs are directly charged to a group of products.

(iii) Where cost is ascertained for a single product.

(iv) Where the nature of the product is complex and method can not be ascertained. (Nov 2014, 4 marks)

Answer:

Methods of costing are as follows:

(i) Job costing

(ii) Batch costing

(iii) Single / Output costing

(iv) Multiple costing.

![]()

Question 29.

State the method of costing and also the unit of cost for the following industries:

(i) Hotel

(ii) Toy-making

(iii) Steel

(iv) Ship Building (Nov 2015, 4 marks)

Answer:

| Method | Unit | ||

| (i) | Hotel | Method of costing used in hotel is Operating Costing. | The rate for unit of cost used is per room, per day or per half day or per bed for costing. |

| (ii) | Toy Making | Method of costing used in toy making industry is Unit Costing/Batch Costing. | The unit of cost used in toy making industry is per unit of output of toy or per batch. |

| (iii) | Steel | The method of costing used in steel company is Process Costing. | The unit of cost used in costing is the percentage of output on the basis of the some factory or administrative overhead etc. |

| (iv) | Ship Building | The method of costing used in ship buildings is Contract Costing. | The unit cost or per unit used for shi|5 building is Project or Unit. |

![]()

Question 30.

Give the method of costing and the unit of cost against the under noted industries:

(i) Road transport

(ii) Steel

(iii) Bicycles

(iv) Bridge construction (Nov 2016, 4 marks)

Answer:

| Industry | Method of Costing | Suggestive Unit of Cost | |

| (i) | Road transport | Operating Costing | Passenger km. or tonne km. |

| (ii) | Steel | Process Costing/Single or Unit Costing | Tonne/ Metric Tonne (MT)/ Per kg/ per bar |

| (iii) | Bicycles | Multiple Costing | Number/per piece |

| (iv) | Bridge construction | Contract Costing | Project /Unit |

![]()

Question 31.

Identity the methods of costing where:

(i) all costs are directly charged to a specific job.

(ii) all costs are directly charged to a group of products

(iii) the nature of the product is complex and method cannot be ascertained.

(iv) cost is ascertained for a single product. (Nov 2017, 4 marks)

Answer:

(i) Job Costing

(ii) Batch Costing

(iii) Multiple Costing

(iv) Unit Costing/Single Costing/Output Costing.

Question 32.

Answer the following:

State the Method of Costing to be used in the following industries:

(i) Real Estate

(ii) Motor repairing workshop

(iii) Chemical Industry

(iv) Transport service

(v) Assembly of bicycles

(vi) Biscuits manufacturing Industry

(vii) Power supply Companies

(viii) Car manufacturing Industry

(ix) Cement Industry

(x) Printing Press (Nov 2020, 5 marks)

![]()

Question 33.

Answer the following:

State the method of costing that would be most suitable for:

(I) Oil Refinery

(ii) Interior Decoration

(iii) Airlines Company

(iv) Advertising

(v) Car Assembly (Jan 2021, 5 marks)

Question 34.

Answer the following:

Give any five examples of the impact of use of Information Technology in Cost Accounting. (Jan 2021, 5 marks)