Chapter 5 Indian Equity-Non Fund Based – Corporate Funding and Listing in Stock Exchange ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Indian Equity-Non Fund Based – Corporate Funding & Listing in Stock Exchange Study Material

Question 1.

Write notes on the following:

Employee stock purchase scheme (ESPS). (Dec 2012, 4 marks)

Answer:

(I) Definition: Employee stock purchase scheme is defined under Regulation 2(1)(k) of SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021. Accordingly “employee stock purchase scheme or ESPS” means a scheme under which a company offers shares to employees, as part of public issue or otherwise, or through a trust where the trust may undertake secondary acquisition for the purposes of the scheme.

(II) Pricing and lock-in [Regulation 22]

(1) A company may determine the price of shares to be issued under an ESPS, subject to conforming to the accounting policies specified under regulation 15 of these regulations.

(2) Shares issued under an ESPS shall be locked-in for a minimum period of one year from the date of allotment: Provided that in case where shares are allotted by a company under an ESPS in lieu of shares acquired by the employee under an ESPS in another company which has merged or amalgamated with the first mentioned company, the lock-in period already undergone in respect of shares of the transferor company shall be adjusted against the lock-in period required under this sub-regulation.

Provided further that in the event of death or permanent incapacity of an employee, the requirement of lock-in shall not be applicable from the date of death or permanent incapacity.

(3) If ESPS is part of a public issue and the shares are issued to employees at the same price as in the public issue, the shares issued to employees pursuant to ESPS shall not be subject to any lock-in.

Question 2.

Write notes on the following.

Employee stock option (June 2013, 3 marks)

Answer:

(I) Definition: Employee stock Option Scheme is defined under Regulation 2(1 )(j) of SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021. Accordingly “j. “employee stock option scheme or ESOS” means a scheme under which a company grants employee stock options to employees directly or through a trust.

(II) Other important points about ESOS:

1. Administration and implementation [Reg. 16]

- Subject to the provisions of these regulations, an ESOS shall contain the details of the manner in which the scheme will be implemented and operated.

- No ESOS shall be offered unless the disclosures, as specified in Part G of Schedule – I of these regulations, are made by the company to the prospective option grantees.

2. Pricing [Reg.17]

The company granting options to its employees pursuant to an ESOS shall be free to determine the exercise price subject to conforming to the accounting policies specified in regulation 15 of these regulations.

3. Vesting period [Reg. 18]

- There shall be a minimum vesting period of one year in case of ESOS.

- The company may specify the lock-in period for the shares issued pursuant to exercise of an option.

4. Rights of the option holder [Reg.19]

An employee shall not have the right to receive any dividend or to vote or in any manner enjoy the benefits available to a shareholder in respect of an option granted to him/her, till shares are issued to him/her upon exercise of the option.

5. Consequence of failure to exercise an option [Reg.20]

The amount paid by the employee, if any, at the time of grant, vesting or exercise of option—

(a) may be forfeited by the company if the option is not exercised by the employee within the exercise period; or ‘

(b) may be refunded to the employee if the options are not vested due to non-fulfilment of conditions relating to vesting of option as per the ESOS.

![]()

Question 3.

Write notes on the following :

Sweat equity shares (June 2014, 5 marks)

Answer:

(I) Definition of Sweat Equity Shares [Sec. 2 (88) of the Companies Act, 2013]: “Sweat equity shares” means such equity shares as are issued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called.

(II) Conditions: According to Sec. 54 of the Companies Act, 2013 a company may issue sweat equity shares of a class of shares already issued, if the following conditions are fulfilled:

(a) The issue is authorized by a special resolution passed by the company in the general meeting.

(b) The resolution specifies the number of shares, current market price, consideration if any and the class or classes of directors or employees to whom such equity shares are to be issued.

(c) The sweat equity shares of a company whose equity shares are listed on a recognised stock exchange are issued in accordance with the regulations made by SEBI in this regard and if they are not listed the sweat equity shares are to be issued in accordance with the Rule 8 of Companies (Share Capital and Debenture) Rules, 2014.

Question 4.

Write a note on the following:

Employee Stock Option Scheme (ESOS) (Dec 2015, 4 marks)

Question 5.

Write a note on the following:

Employee stock options (June 2016, 4 marks)

Question 6.

Comment on the following statements:

The option to participate in ESOP/ESPS scheme is not open for all employees of the company. (Dec 2013, 4 marks)

Answer:

The statement that ‘The option to participate in ESOP/ESPS scheme is not open for all employees of the company” is correct. The reason is obvious if we check the definition of “Employee” as given in SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021. As per this Regulation, “Employee” means:

“Employee”, except in relation to issue of sweat equity shares, means, —

- an employee as designated by the company, who is exclusively working in India or outside India; or

- a director of the company, whether a whole time director or not, including a non executive director who is not a promoter or member of the promoter group, but excluding an independent director; or

- an employee as defined in sub-clauses (i) or (ii), of a group company including subsidiary or its associate company, in India or outside India, or of a holding company of the company, but does not include—

(a) an employee who is a promoter or a person belonging to the promoter group; or

(b) a director who, either himself or through his relative or through any body corporate, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company.

Question 7.

What is a ‘bonus share’ ? What are the conditions to be satisfied before issuing bonus shares? (June 2014, 6 marks)

Answer:

(I) Meaning: Bonus shares mean the shares allotted by a company to its members free of cost by capitalizing its accumulated distributable profits. Simply, through bonus shares the members get an advantage without paying anything for it i.e. free of cost.

(II) The Requirements to be complied with while making a Bonus Issue are given here under:

1. Rights of FCD/PCD holders: The proposed bonus issue should not dilute the value or rights of the fully or partly convertible debentures.

2. Out of Free Reserves: The bonus issue is to be made out of free reserves built out of the genuine profits or securities premium collected in cash only.

3. Revaluation Reserves : The reserves created by revaluation of fixed assets should not be capitalised.

4. Bonus Issue not to be in lieu of Dividend : Bonus issue should not be made in lieu of dividend.

5. Fully Paid Shares : If there are any partly paid-up shares, these shares should be made fully paid, up before the bonus issue is made.

6. No Default in respect of Fixed Deposits/Debentures : The company should not have defaulted in the payment of any interest or principal in respect of its fixed deposits and interest on debentures or oh redemption of debentures.

7. Statutory Dues of the Employees : The company should not have defaulted in the payment of its statutory dues to the employees such as contribution to provident fund, gratuity, bonus, minimum wages, workmen’s compensation, retrenchment compensation, payments to contract labour, etc.

8. Implementation of Proposal within 15 days : The bonus issue should be implemented within 15 days, after the approval of BOD. However when the company is required to seek shareholders’ approval for capitalisation of profits or reserve for making bonus issue as per AOA, the bonus issue should be implemented within 2 months from the date of meeting of the BOD, Where in the decision to announce bonus was taken subject to shareholders’ approvals.

9. Provision in Articles of Association: The Articles of Association of the Company should provide for capitalisation of reserves and if not a General Body Meeting of the company is to be held and a special resolution making provisions in the Articles of Association for capitalisation should be passed.

10. Authorised Capital : If consequent upon the issue of bonus shares, the subscribed and paid-up – capital of the company exceed the authorised share capital, a General Meeting of the company should be held to pass necessary resolution for increasing the authorised capital.

11. Fugitive Economic offender: Any of its promoters or directors in not a fugitive economic.

![]()

Question 8.

Comment on the following:

For the purpose of issue of bonus shares, the reserves created by revaluation of fixed assets shall not be capitalised. (Dec 2016, 2 marks)

Answer:

| Nature of Statement | Correct |

| Reason/ Explanations |

|

Question 9.

Explain the following:

Sweat Equity Shares (Dec 2017, 3 marks)

Question 10.

Explain the provisions of the Companies Act, 2013 for Issue of Sweat Equity Shares. To what extent the Sweat Equity Shares can be issued to an Independent Director ? (June 2019, 5 marks)

Answer:

According to Section 54 of the Companies Act, 2013 a company may issue sweat equity shares of a class of shares already issued, if the following conditions are fulfilled:

(a) The issue is authorized by a special resolution passed by the company in the general meeting.

(b) The resolution specifies the number of shares, current market price, consideration if any.

(c) Not listed shares, the sweat equity shares are to be issued in accordance with Rule 8 of Companies (Share Capital and Debenture) Rules, 2014.

Independent directors are not entitled for sweat equity shares.

Question 11.

“In a growing company, ESOPs are being used to retain talent.” Discuss. (Dec 2020, 3 marks)

Answer:

- ESOP is a sweetner given to an employee at the time of joining or may be later on. The company need not make any payment to the employee.

- The stocks are issued to an employee by the company based on the entitlement.

- Listed Companies can offer attractive Employee Stock Option (ESOP) or Employee Share Purchase Schemes (ESPS) to attract required talent pool and also to retain them,

- Being listed, the ESOP/ESPS may command good price gain and attraction to the employees.

- ESOP & ESPS are used to attract talent as well as to retain the key employees and managerial personnel which is an important human capital for business.

- In case the company is growing, the stock price keep on moving upward.

- The employee drives huge benefits from ESOP which may run beyond his emoluments otherwise.

- Such benefits helps the company to retain the talented employees for a longer period.

Question 12.

Discuss the rules relating to pricing and lock-in under Employees Stock Purchase Scheme (ESPS) including exception if any, thereof. (Aug 2021, 3 marks)

Answer:

The company may determine the price of shares to be issued under an Employee Stock Purchase Scheme (ESPS), provided they conform to the” provisions of accounting policies as prescribed under the SEBI (Share Based Employee Benefit and Sweat Equity) Regulations, 2021. Shares issued under an Employee Stock Purchase Scheme shall be locked-in for a minimum period of one year from the date of allotment.

Although, in case where shares are allotted by a company under an Employee Stock Option Scheme in lieu of shares Acquired by the same person under an ESPS in another company which has merged or amalgamated with the first mentioned company, the lock-in period already undergone in respect of shares of the transferor company shall be adjusted against the lock-in period required under this sub-regulation.

If Employee Stock Purchase Scheme is part of a public issue and the shares are issued to employees at the same price as in the public issue, the shares issued to employees pursuant to ESPS shall not be subject to lock in share is ₹ 10. Current market price is ₹ 621. In addition, it announced split of shares by reducing the face value from ₹ 10 to ₹ 2. Calculate the share price if all other things remain constant. What would have been the situation if split would have been done before the issue of bonus shares? (Dec 2015, 5 marks)

Answer:

Case-I: Stock split post bonus issue:

| Particulars | Amount (₹) |

| Market value of 3 shares required to be held by shareholder (3 × ₹ 621) | ₹ 1,863 |

| Add: Issue price of bonus shares (1 × ₹ 0) | ₹ 0 |

| Total price of 4 shares | ₹ 1,863 |

| Number of shares post stock split from ₹ 10 per shares to ₹ 2 per shares (4 × 5) | ₹ 20 shares |

| Average price (1863 /20 shares) | ₹ 93.15 |

Case-II : Stock split before bonus issue:

| Particulars | Amount (₹) |

| Market value of 3 shares required to be held by shareholder (3 × ₹ 621) | ₹ 1,863 |

| Number of shares post stock split (3 × 5) | 15 shares |

| Number of bonus shares to be received (15/3) | 5 shares |

| Total price of 20 shares | ₹ 1,863 |

| Average price (1863 /20 shares) | ₹ 93.15 |

It is evident from the above calculations that there would be no change in the situation if the stock split taken place before issue of bonus shares.

Question 13.

Answer the following:

Success Ltd., a listed company with an authorized, issued and subscribed capital of ₹ 35 crore comprising of 3.5 crore equity shares of ₹ 10 each and a paid up capital of ₹ 34 crore decided to issue bonus shares in the ratio of 2:5. As a Company Secretary enumerate the steps involved in such an issue. (June 2017, 8 marks)

Answer:

Steps in Issue of Bonus Shares:

A company issuing bonus shares should ensure that the issue is in conformity with the Regulations for bonus issue laid down by SEBI (ICDR) Regulations, 2018.

The procedure for issue of bonus shares by a listed company is enumerated below:

1. Ensure that bonus issue has been made out of free reserves built out of the genuine profits or securities premium collected in cash only.

2. Ensure that reserves created by revaluation of fixed assets are not capitalised.

3. Ensure that the company has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it or in respect of the payment of statutory dues of the employees*such as contribution to provident fund, gratuity, bonus etc.

4. Ensure that the bonus issue is not made in lieu of dividend.

5. There should be a provision in the articles of association of the company permitting issue of bonus shares; if not, steps should be taken to alter the articles suitably.

6. The share capital as increased by the proposed bonus issue should be well within the authorised capital of the company; if not, necessary steps have to be taken to increase the authorised capital.

7. Finalise the proposal and fix the date for the Board Meeting for considering the proposal and for authorising the taking up of incidental and attendant matters.

8. If there are any partly paid-up shares, ensure that these are made fully paid-up before the bonus issue is recommended by the Board of directors.

9. The date of the Board Meeting at which the proposal for bonus issue is proposed to be considered should be notified to the Stock Exchange(s) where the company’s shares are listed.

10. Hold the Board Meeting and get the proposal approved by the Board of directors.

11. The resolution to be passed at the General Meeting should also be approved by the Board of Directors in its meeting. The intention of the Board of directors regarding the rate of dividend to be declared in the year after the bonus issue should be indicated in the resolution for bonus issue to be passed by members in general meeting.

12. Immediately after the Board meeting intimate the Stock Exchange(s) regarding the outcome of the Meeting.

13. Ensure that the company has announced bonus issue after the approval of Board of Directors and did not require shareholders’ approval for capitalization of profits or reserves for making bonus issue as per the Article of Association, had implemented bonus issue within fifteen days from the date of approval of the issue by the board of directors of the company and must not have the option of changing the decision.

However, where the company was required to seek shareholders’ approval for capitalization of profits or reserves for making bonus issue as per the Article of Association, the bonus issue has implemented within two months from the date of the meeting of the Board of Directors where in the decision to announce bonus was taken subject to shareholders’ approval.

14. Arrangements for convening the general meeting should then be made keeping in view the requirements of the Companies Act, with regard to length of notice, explanatory statement etc. Also three copies of the notice should be sent to the Stock Exchange(s) concerned.

15. Hold the general meeting and get the resolution for issue of bonus shares passed by the members. A copy of the proceedings of the meeting is to be forwarded to the concerned Stock Exchange(s).

16. In consultation with the Regional Stock Exchange fix the date for closure of register of members or record date and get the same approved by the Board of directors. Issue a general notice under Section 91 of Companies Act, 2013 in respect of the fixation of the record date in two newspapers one in English language and other in the language of the region in which the Registered Office of the company is situated.

17. Give 7 days notice to the Stock Exchange(s) concerned before the date of book closure/record date.

18. After the record date process the transfers received and prepare a list of members entitled to bonus shares on the basis of the register of members as updated. This list of allottees is to be approved by the Board or any Committee thereof. The list usually serves as allotment list and on this basis the allotment is to be made to the eligible members.

19. File return of allotment with the Registrar of Companies within 30 days of allotment (Section 39 of the Companies Act, 2013). Also intimate Stock Exchange(s) concerned regarding the allotments made.

20. Ensure that the allotment is made within fifteen days of the date on which the Board of directors approved the bonus issue.

21. Submit an application to the Stock Exchange(s) concerned for listing the bonus shares allotted.

![]()

Question 14.

An established company maintaining power projects in India, raised ₹ 11,000 crores from Indian Stock market with an issue price of ₹ 450 (FV of ₹ 10 per share) on 15th January, 2008. Anticipating a huge returns on the share price, the issue was subscribed 27.5 times and a huge response received to the company’s IPO. The company at the time of listing only owned a land for its six power projects which were to be developed for generation of electricity, and there was no revenue income at the time of listing.

On 15th February, 2008 the company listed its shares but due to the stock market meltdown, the stock fell to ₹ 320 per share, i.e. a discount of ₹ 130 from its issue price of ₹ 450. Facing huge criticism from its investors, the company decided to issue bonus shares in the ratio of 3 shares for 5 shares held. A Public Interest Litigation was filed challenging the issuance of bonus shares without any revenue income. The case was rejected and dismissed. Discuss the merits of the case and also the conditions for issue of bonus shares. (Dec 2019, 5 marks)

Answer:

Conditions for issue of Bonus Shares:

- In terms of section 63(2) of the Companies Act, 2013, no company shall capitalize its profits or reserves for the purpose of issuing fully paid-up bonus shares, unless — it is authorised by its articles.

- It has been authorized by the shareholders in a general meeting of the company, on the recommendation of the Board of Directors.

- It has not defaulted in the payment of interest or principal in respect of fixed deposits or debt securities, if any issued by it.

- It has not defaulted in respect of the payment of statutory dues of the employees, such as contribution to provident fund, gratuity and bonus.

- The partly paid up shares, if any outstanding on the date of allotment have been made fully paid up.

No Bonus shares in lieu of dividend:

The bonus shares shall not be issued in lieu of dividend. [Section 63(3) of the Companies Act, 2013].

According to Rule 14 of Companies (Share Capital and Debentures) Rules, 2014 states that the company which has once announced the decision of its Board recommending a bonus issue shall not subsequently withdraw the same.

Since the company has complied with all the conditions required to be satisfied, the court was correct in awarding the judgment in favour of the company.

Indian Equity-Non Fund Based Notes

1. Bonus Issue

A company may, if its Articles provide, capitalize its profits by issuing fully-paid bonus shares. The issue of bonus shares by a company is a common feature. When a company is prosperous and accumulates large distributable profits, it converts these accumulated profits into capital and divides the capital among the existing members in proportion to their entitlements. Members do not have to pay any amount for such shares. They are given free. The vesting of the rights in the bonus shares takes place when the shares are actually allotted and not from any earlier date.

2. Advantages of Issuing Bonus Shares

- Fund flow is not affected adversely.

- Market value of the Company’s shares comes down to their nominal value by issue of bonus shares.

- Market value of the members’ shareholdings increases with the increase in number of shares in the company.

- Bonus shares is not an income. Hence, it is not a taxable income.

- Paid-up share capital increases with the issue of bonus shares.

3. Conditions for issue of Bonus Shares

- In terms of Section 63(2) of the Companies Act, 2013, no company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares, unless – it is authorised by its articles;

- It has been authorized by the shareholders in a general meeting of the company, on the recommendation of the Board of Directors;

- It has not defaulted in the payment of interest or principal in respect of fixed deposits or debt securities, if any issued by it;

- It has not defaulted in respect of the payment of statutory dues of the employees, such as contribution to provident fund, gratuity and bonus;

- The partly paid up shares, if any outstanding on the date of allotment have been made fully paid up.

4. SEBI (ICDR) Regulations, 2018

SEBI has issued regulations for Bonus Issue which are contained in Chapter XI of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 with regard to bonus issues by listed companies.

(i) Eligibility

Subject to the provisions of the Companies Act, 2013 or any other applicable law, a listed issuer shall be eligible to issue bonus shares to its members if:

It is authorised by its articles of association for issue of bonus shares, capitalisation of reserves, etc. However, if there is no such provision in the articles of association, the issuer shall pass a resolution at its general body meeting making provisions in the articles of associations for capitalisation of reserve.

It has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it. It has not defaulted in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity and bonus. Any outstanding partly paid shares on the date of the allotment of the bonus shares, are made fully paid-up. Any of its promoters or directors is not a fugitive economic offender.

(ii) Rights of FCD/PCD holders

An issuer shall make a bonus issue of equity shares only if it has made reservation of equity shares of the same class in favour of the holders of outstanding compulsorily convertible debt instruments if any, in proportion to the convertible part thereof.

(iii) Bonus out of Free Reserves

Bonus issue shall be made only out of free reserves, securities premium account or capital redemption reserve account and built out of the genuine profits or securities premium collected in cash and reserves created by revaluation of fixed assets shall not be capitalised for this purpose.

(iv) Bonus Issue not to be in lieu of Dividend

The bonus share shall not be issued in lieu of dividend.

(v) Implementation of Proposal within fifteen days An issuer, announcing a bonus issue after approval by its board of directors and not requiring shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, shall implement the bonus issue within fifteen days from the date of approval of the issue by its board of directors.

5. Procedure for Issue of Bonus Shares

1. To check, if there is a provision in the Articles of Associations (AoA) permitting issue of bonus shares by capitalisation of reserves, etc. If there is no such provision, alter the AoA to permit the issuance of bonus shares. Passing a resolution at the company’s general body meeting making provisions in the AoA for capitalisation of reserve.

2. To check and ensure that the expanded capital after the issue is within the authorised share capital of the company. Otherwise, complete the proceedings by increasing the Authorised Capital suitably.

3. To check that there is no default in payment of interest or principal in respect of:

- fixed deposits or

- debt securities issued by your company.

4. To check and ensure that there is no default in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity, bonus etc.

5. In case the share capital of the company consists of any partly paid-up shares, to make it fully paid-up before issue of bonus shares.

6. To ensure that none of the directors or promoters of the company is a fugitive economic offender.

7. To ensure that the Bonus issue is made out of free reserve built out of the genuine profits or share premium collected in cash only; that Reserves created by revaluation of fixed assets are not capitalised and that bonus shares are not issued in lieu of dividend.

8. To ensure that in case the company makes a bonus issue of equity shares if it has outstanding fully or partly convertible debt instruments at the time of making the bonus issue, the company has made reservation of equity shares of the same class in favour of the holders of such outstanding convertible debt instruments in proportion to the convertible part thereof.

9. Issue the equity shares reserved for the holders of fully or partly convertible debt instruments at the time of conversion of such convertible debt instruments on the same terms or same proportion on which the bonus shares were issued.

10. Inform the Stock Exchange atleast 2 working days prior to the date of Board Meeting of the proposal to consider the Bonus Issue.

11. To Convene a Board Meeting to consider the issue of bonus shares and for taking necessary steps in that regard, including fixing the date of closure of books, in consultation with Regional Stock Exchange and to fix up the date, time, place and agenda for holding a General Meeting to pass an Ordinary Resolution, or a Special Resolution, if the Articles so require, to issue bonus shares

12. If the company announcing a bonus issue after the approval of your Board of Directors and does not require shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, the Company must implement the bonus issue within 15 days from the date of approval of the issue by Board of Directors.

13. If the company is required to seek shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, the bonus issue must be implemented within 2 months from the date of the meeting of your Board of Directors wherein the decision to announce the bonus issue was taken subject to shareholders’ approval.

14. Once the decision to make a bonus issue is announced, the issue cannot be withdrawn.

15. Permission of RBI if any required under Section 6(3)(b) of FEMA, 1999 should be obtained to allot bonus shares to Non-Resident Indians if such issue do not fall under the automatic route.

16. To pass necessary resolution at the General Meeting and to file the same.

17. To fix the record date to determine the shareholders who are eligible to receive bonus shares.

18. To hold a Board Meeting and complete proceeding regarding allotment of the bonus shares in the proportion and in the manner as mentioned in the resolution, and as approved by the Stock Exchange.

19. To obtain necessary listing and trading permission from the stock exchange and file the return of allotment with the ROC in PAS – 3 after paying the requisite fee within 30 days of the allotment of shares.

20. Ensure that the allotment is made within fifteen days of the date on which the Board of directors approved the bonus issue.

21. Submit an application to the Stock Exchange(s) concerned for listing the bonus shares allotted.

6. Sweat Equity

Section 2 (88) of the Companies Act, 2013 defines “sweat equity shares” means such equity shares as are issued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called.

The Company issue shares at a discount or for consideration other than cash to selected employees and directors as per norms approved by the Board of Directors of the Company. This is based on the know how provided or intellectual property rights created and given for value additions made by such directors and employees to the company.

Provisions of the Companies Act, 2013

According to Section 54 of the Companies Act, 2013 a company may issue sweat equity shares of a class of shares already issued, if the following conditions are fulfilled:

(a) The issue is authorized by a special resolution passed by the company in the general meeting.

(b) The resolution specifies the number of shares, current market price, consideration if any and the class or classes of directors or employees to whom such equity shares are to be issued.

(c) The sweat equity shares of a company whose equity shares are listed on a recognised stock exchange are issued in accordance with the Regulations made by SEBI in this regard and if they are not listed the sweat equity shares are to be issued in accordance with Rule 8 of Companies (Share Capital and Debenture) Rules, 2014.

![]()

7. Employee Stock Option

As per Section 62(1) (b) of Companies Act, 2013, the Company can offer shares through employee stock option to their employees through special resolution subject to the conditions specified under Rule 12 of Companies (Share Capital and Debentures) Rules 2014.

For the purposes of clause (b) of sub-section (1) of Section 62 and this rule “Employee” means –

| Employee means | But does not include |

| (a) Permanent employee (India or outside India)

(b) Director whether WTD or not (Excluding independent director) (c) an employee as defined in clauses (a) or (b) of a subsidiary, in India or Outside India or of a holding company |

(i) An employee who is a promoter or a person belonging to the promoter group; or

(ii) A director who either himself or through his relative or through anybody corporate, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company. |

8. SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021

SEBI” (Issue of Sweat Equity) Regulations, 2002 (“Sweat Equity Regulations”) and SEBI (Share Based Employee Benefits) Regulations, 2014 (“SBEB Regulations”) were notified on September 24, 2002 and October 28, 2014 respectively. The Sweat Equity regulations provided framework for issuance of Sweat Equity shares by listed companies and the SBEB Regulations provided framework to regulate Employee Stock Option Scheme, Employee Stock Purchase Scheme and other share based employee benefits.

Further, to improve ease of doing business from a regulatory perspective, it was observed that, both the SBEB Regulations and the Sweat Equity Regulations regulate employee benefits arising out of and relating with the equity shares of listed companies, thus the possibility of merging both such regulations may be explored.

The changes in the two regulations and their merger into a single regulation were approved by SEBI in the Board Meeting held on August 06, 2021. Thereafter, the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations. 2021 (herein referred as “New Regulations”) have been notified and become effective on August 13, 2021.

Pursuant to this, the SEBI (Share Based Employee Benefits) Regulations, 2014 and SEBI (Issue of Sweat Equity) Regulations. 2002 (herein referred as “Erstwhile Regulations”) stand\repealed.

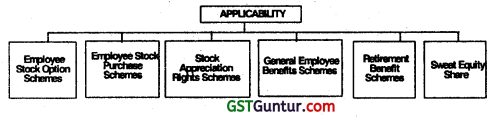

Applicability

The provisions of these regulations shall apply to following:-

Non-Applicability

The provisions pertaining to preferential issue as specified in the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 shall not be applicable in case of a company issuing new shares in pursuance and compliance of these regulations except wherever specifically provided for in these regulations.