Chapter 6 Adjudication, Prosecutions, Offences and Penalties – Resolution of Corporate Disputes Non Compliances & Remedies Notes is designed strictly as per the latest syllabus and exam pattern.

Adjudication, Prosecutions, Offences and Penalties – Resolution of Corporate Disputes Non Compliances & Remedies Study Material

Question 1.

The current regulatory scenario demands the Company Secretary to be more vigilant and diligent specifically about the applicability of multiple laws and timely compliances. Briefly comment on the statement. (June 2019, 5 marks)

Answer:

The Company Secretary has a vital role to play in the event of invocation of any action under the Act. The current regulatory scenario demands the Company Secretary to be more vigilant and diligent specifically about the applicability of multiple laws and timely compliances thereunder as he being a Key Managerial Person is jointly liable for any non-compliances under the applicable legislation. The role Which a Company Secretary can play includes:

- To ensure timely compliances of the provisions of the Act to avoid any action for default or failure

- To represent the Company before the ROC, RD or NCLT, in the event of any action for default or failure

- To develop a robust internal compliance system which generates the details of compliances undertaken and any compliance lapses in a timely manner

- To initiate the compounding procedure in the event of any non-compliance(s) coming to light and to avoid recurrence of such non-compliances in future

- To ensure timely and appropriate disclosure pertaining to penalties or compounding offences or action by any authorities.

Further, since the Practicing Company Secretaries are also covered under section 447 of the Companies Act, 2013, they should ensure that they are not certifying any returns or issuing any report which contains any false certification or information or omits any material information or facts, as such a failure to ensure proper verification of compliances may lead to the Practicing Company Secretary being liable to penalties under the above referred provisions as well as disciplinary proceedings under the guidelines Space to write important points for revision

![]()

Question 2.

Super Source Limited has filed Form AOG-4 with Registrar of Companies after 85 days of its Annual General Meeting along with additional fee. State whether the Company can be penalized again under section 403 of the Companies Act, 2013. (June 2019, 4 marks)

Answer:

Yes. the additional fee does not absolve the Company from the liability of penalty or any other action under the Act for such default or failure.

One of the significant changes brought in by the Companies (Amendment) Act, 2017 is the amendment in section 403 of the Companies Act, 2013. Pursuant to the said amendment, the non -offence period of 270 days has been omitted from the Companies Act, 2013 and the filing of forms, returns or documents within the time prescribed under the relevant provision has been made mandatory. Accordingly, the non-filing of forms, returns or documents within the time prescribed under relevant provision (for e.g., Form AOC-4 within 30 days of date of AGM) is now considered as a default or failure and the payment of additional fees does not absolve the company from the liability of penalty or any other action under the Act for such default or failure.

Question 3.

Can Registrar of Companies order adjudication proceedings under Section 454 of Companies Act, 2013? In what cases can the Central Government appoint him as the Adjudicating Officer? (June 2019, 4 marks)

Answer:

The Registrar of Companies may note the non-compliance of the provisions of Companies Act as arrived at under section 206(4) of the Companies Act, 2013 either:

- by himself on a scrutiny of documents filed with him and on his satisfaction or

- based on any report on inspection or investigation, if any, under the relevant provisions of the Companies Act, 2013, or

- on the qualifications of the statutory auditors in the Annual Report or by the secretarial auditors in their Secretarial Audit Report whereby he can ascertain and identify the nature of non-compliance or default.

In all these cases, he himself cannot initiate any adjudicating proceedings if he is the adjudicating officer even as he may be clothed with a power of adjudication. Therefore, if adjudicating powers are under his jurisdiction, any other officer who is independent of his office has to identify the existence of violation as otherwise the adjudicating officer, being the head of his office may be biased. This is a grey area to be addressed by the Central Government as otherwise the adjudicating officer will be sitting on a judgement of the findings of his own office.

It is pertinent to note that it would, therefore, be only logical, prudent and wise for the concerned Regional Director not to appoint as the adjudicating officer pursuant section 454(2) of the Companies Act, 2013, the same jurisdictional Registrar of Companies whose office has identified the violation.

Question 4.

“A legal compliance program is generally defined as a formal program Specifying an organization’s policies, procedures, and actions with an intent to prevent^ and detect’violations of laws and regulations”. Comment briefly. (Dec 2019, 5 marks)

Answer:

A legal compliance program is a set of internal policies and procedures of a company to comply with laws, rules, and regulations or to uphold business reputation. A compliance team examines the rules set forth by government bodies, creates a compliance program, implements it throughout the company, and enforces adherence to the program.

Legal Compliance programs need to be tailored to the specific company’s needs, there are principles to consider in reviewing a program like:

- There should be a strong “tone at the top” from the board and senior management emphasizing the company’s commitment to full compliance with legal and regulatory requirements, as well as internal policies.

- There should be clear reporting systems in place both at the employee level and at the management level so that employees understand when and to whom they should report Suspected violations and so that management understands the board’s or committee’s informational needs for its oversight purposes.

![]()

Question 5.

During the previous year, Alfa Limited could not conduct its Annual General Meeting (AGM) within the timelines as per the Companies Act, 2013 due to some internal and operational issues. In the current year also, the Company could not conduct its AGM within stipulated time, thereby committing the same default in the current year as well.

What would be the penal provisions for such default ? (Dec 2019, 4 marks)

Answer:

As per the provisions of Section 99 of the Act, if the Company has defaulted in holding a meeting in accordance with Section 96 or Section 97, then the Company and every officer would be liable to fine upto Rupees 1 Lakh and further fine upto Rupees 5000 for each day of continuing default.

As per Section 451 of the Companies Act, 2013, if a company or an officer of a company commits an offence punishable either with fine or with imprisonment and where the same offence is.commjtted for the second or subsequent occasions within a period of three years, then, that company and every officer thereof who is in default shall be punishable with twice the amount of fine for such offence in addition to any imprisonment provided for that offence.

Hence. Alfa Limited would be liable to twice the fine as mentioned above, as it has committed the same default within a period of 3 years.

Question 6.

‘There is a difference in legislative intent for incorporating Section 441 and Section 454 under the Companies Act, 2013’- Discuss. (Dec 2020, 4 marks)

Answer:

Both these sections are independent of each other. The question of one section overriding the other does not arise. They operate concurrently but not parallel. It means simultaneously.

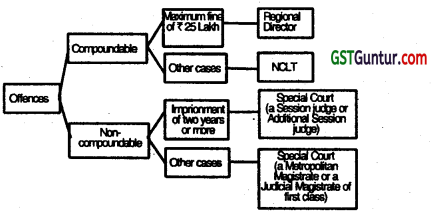

As per section 441 of the Companies Act, 2013, notwithstanding anything contained in the Code of Criminal Procedure, 1973, any offence punishable under Companies Act, 2013 [not being an offence punishable

with imprisonment only, or punishable with imprisonment and also with.fine], may, either before or after the institution of any prosecution, be compounded by:

(a) the Tribunal; or

(b) where the maximum amount of fine which may be imposed for such offence does not exceed ? 25 Lakh, by the Regional Director or any officer authorised by the Central Government.

454. (1) The Central Government may, by an order published in the Official Gazette, appoint as many officers of the Central Government, not below the rank of Registrar, as adjudicating officers for adjudging penalty under the provisions of this Act in the manner provided by the Companies (Adjudication of Penalties) Rules, 2014.

(2) The Central Government shall while appointing adjudicating officers, specify their jurisdiction in the order under sub-section (1).

(3) The adjudicating officer may, by an order-

(a) impose the penalty on the company, the officer who is in default, or any other person, as the case may be, stating therein any non-compliance or default under the relevant provisions of this Act; and

(b) direct such company, or officer who is in default, or any other person, as the case may be, to rectify the default, wherever he considers f|t.

Provided that in case the default relates to non-compliance of sub-section (4) of section 92 or sub-section (1) or sub-section (2) of section 137 and such default has been rectified either prior to, or within thirty days of, the issue ofthe notice by the adjudicating officer, no penalty shall be imposed in this regard and all proceedings under this section in respect of such default shall be deemed to be concluded.

Question 7.

One of a relative of an Authorised Officer under Prevention of Money Laundering Act (PMLA), annoyed by his neighbour, passes a false information to the authorised officer that his neighbour is keeping smuggled gold bars. Based on the information of his relative, authorised officer conducts search in the place and found nothing. Affected person claims that the search conducted by authorised officer is vexatious. Whether claim of the affected person is tenable. Briefly discuss the provisions under PMLA with punishment for vexatious search. (Dec 2020, 4 marks)

Answer:

According to Section 17 of Prevention of Money Laundering Act, 2002 (PMLA), where the Director or any other officer not below the rank of Deputy Director authorised by him for the purposes of this section, on the basis of information in his possession, has reason to believe that any person is in possession of any proceeds of crime involved in money-laundering then, subject to the rules made in this behalf, he may authorise any officer subordinate to him to enter and search any building, place etc.

Where he has reason to suspect that such proceeds of crime are kept, in the present case, the Authorized officer, appears to have exercised his power without going to merits and also acted beyond his scope hence, and he will be liable for punishment under Section 62 of PMLA, if he is proved guilty.

Punishment for vexatious search Section 62 of PMLA:

Any authority or officer exercising powers under this Act or any rules made thereunder, who, without reasons recorded in writing,

(a) searches or causes to be searched any building or place; or

(b) detains or searches or arrests any person, shall for every such offence be liable on conviction for imprisonment for a term which may extend to two years or fine which may extend to fifty thousand rupees or both.

![]()

Question 8.

Under the Prevention of Money Laundering Act, 2002, the Adjudicating Authority assumes the powers of a civil court under the Code of Civil Procedure, 1908 while trying a suit relating to certain matters. Under what circumstances, the adjudicating authority can do so? (Aug 2021, 4 marks)

Answer:

As per Section 11 of the Prevention of Money Laundering Act, 2002 states that-

1. The Adjudicating Authority shall, for the purposes of this Act, have the same powers as are vested in a civil court under the Code of Civil Procedure, 1908 while trying a suit in respect of the following matters, namely:

(a) discovery and inspection

(b) enforcing the attendance of any person, including any officer of a banking company or a financial institution or a company, and examining him on oath

(c) compelling the production of records

(d) receiving evidence on affidavits

(e) issuing commissions for examination of witnesses and documents; and

(f) any other matter which may be prescribed.

2. All the persons so summoned shall be bound to attend in person or through authorized agents, as the Adjudicating Authority may direct, and shall be bound to state the truth upon any subject respecting which they are examined or make statements, and produce such documents as may be required.

3. Every proceeding under section 11 shall be deemed to be a judicial proceeding within the meaning of section 193 and section 228 of the Indian Penal Code.

The adjudicating authority may assume the power of a civil court in under the Code of Civil Procedure, 1908 in accordance with above provisions.

Question 9.

2021 – Aug [3] (d) Explain what offences are cognizable and non-bailable under the Prevention of Money Laundering Act, 2002. (Aug 2021, 4 marks)

Answer:

Explanation to Section 45 of the Prevention of Money Laundering Act, 2002 (PMLA) provides that for the removal of doubts, it is clarified that the expression ‘Offences to be cognizable and non-bailable1’ shall mean and shall be deemed to have always meant that all offences under Prevention and Money Laundering Act, shall be cognizable offences and non-bailable offences notwithstanding anything to the contrary contained in the Code of Criminal Procedure, 1973, and accordingly the officers authorised under PMLA are empowered to arrest an accused without warrant, subject to the fulfillment of conditions under section 19 of PMLA and subject to the conditions enshrined under this section.

Question 10.

What do you mean by ‘Adjudicating’ under the Companies Act, 2013? What factors Adjudicating Officer shall consider while adjudging quantum of penalty? (Aug 2021, 4 marks)

Answer:

The word “Adjudicating” has not been defined in the Companies Act, 2013. “Adjudication” the legal process by which an arbiter or judge reviews evidence and argumentation, including legal reasohing set forth by opposing parties or litigants to come to a decision which determines rights and obligations between the parties involved.

Adjudication of Penalty under Companies Act, 2013 means the official imposing of penalty as prescribed under the respective sections of Companies Act, 2013 on the Company and its officers by the designated officer of Ministry of Corporate Affairs.

Under Section 454 of the Companies Act, 2013, the Central Government has appointed the Registrar of Companies / Regional Directors as the adjudicating officers for adjudging penalty under the provisions of this Act. Factors determining the adjudging quantum of penalty are as under: As per Rule 3(12) of the Companies (Adjudication of Penalties) Rules, 2014, While adjudging quantum of penalty, the adjudicating officer shall have due regard to the following factors, namely:

(a) size of the company

(b) nature of business carried on by the company

(c) injury to public interest

(d) nature of the default

(e) repetition of the default

(f) the amount of disproportionate gain or unfair advantage,, wherever quantifiable, made as a result of the default; and

(g) the amount of loss caused to an investor or group of investors or creditors as a result of the default.

It has been states that, in no case, the penalty imposed shall be less than the minimum penalty prescribed, if any, under the relevant section of the Companies Act, 2013.

As per Rule 3(13) of the Companies (Adjudication of Penalties) Rules, 2014, in case a fixed sum of penalty is provided for default of a provision, the adjudicating officer shall impose that fixed sum, in case of any default therein.

Hence, there is a boundary within which the adjudicating officer has to operate which is confined to only adjudging the quantum of penalty. He cannot wander into the area of ascertaining the merits and demerits of the offence or whether there is a contravention of the provisions of the Companies Act, 2013 at all in the capacity of an adjudicating officer.

![]()

Question 11.

Explain the circumstances under which persons may be detained for period longer than three months without obtaining the opinion of Advisory Board as prescribed jn the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974. (Aug 2021, 8 marks)

Answer:

Section 9 of the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 deals with such matter. This section provides that-

(1) Despite anything contained in this Act, any person (including a foreigner) in respect of whom an order of detention is made under this Act at any time before the 31st day of July, 1999, may be detained without obtaining, in accordance with the provisions of sub-clause (a) of clause (4) of article 22 of the Constitution, the opinion of an Advisory Board for a period longer than three months but not exceeding six months from the date of his detention, where the order of detention has been made against such person with a view to preventing him from smuggling goods or abetting the smuggling of goods or engaging in transporting or concealing or keeping smuggled goods and the Central Government or any officer of the Central Government, not below the rank of an Additional Secretary to that Government, specially empowered for the purposes of this section by that Government, is satisfied that such person –

(a) smuggles or is likely to smuggle goods into, out of or through any area highly vulnerable to smuggling; or

(b) abets or is likely to abet the smuggling of goods into, out of or through any area highly vulnerable to smuggling; or

(c) engages or is likely to engage in transporting or concealing or keeping smuggled goods in any area highly vulnerable to smuggling, and makes a declaration to that effect within five weeks of the detention of such person

Question 12.

A Director appointed under Prevention of Money Laundering Act, 2002 authorises his subordinate to carry out the search of certain records. The subordinate caught a Vehicle and since the Vehicle was locked, he calls the mechanic to break the locking system to open it. However, he found nothing inside the car.

Discuss whether a Director can authorise his subordinate to do such acts, if yes, whether the acts of subordinate are tenable. (Dec 2021, 4 marks)

Answer:

Search and Seizure (Section 17): As per Section 17 of Prevention of Money Laundering Act, 2002, where the Director or any other officer not below the rank of Deputy Director authorized by him for the purposes of this section, on the basis of information in his possession, has reason to believe that any person:

- has committed any act which constitutes money-laundering, or

- is in possession of any proceeds of crime involved ‘ in money-laundering, or

- is in possession of any records relating to money-laundering, or

- is in possession of any property related to crime, then, subject to the rules made in this behalf, he may authorize any officer subordinate to him to –

(a) enter and search any building, place, vessel, vehicle or aircraft where he has reason to suspect that such records or proceeds of crime are kept;

(b) break open the lock of any door, box, locker, safe, almirah or other receptacle for exercising the powers conferred by clause (a) where the keys thereof are not available;

(c) seize any record or property found as a result of such search;

(d) place marks of identification on such record or properly, if required or make or cause to be made extracts or copies therefrom;

(e) make a note or an inventory of such record or property;

In the given situation: it can be concluded that the act of the subordinate officer is justified and tenable.

![]()

Question 13.

Adjudication Officer under the Companies Act, 2013 has sent notice to the Alaya Ltd alleging that the Company had committed certain offences under the Companies Act. The provisions referring the offences as alleged by Adjudication Officer do not contain any penal provisions. The Management of Alaya Ltd contends that, as no punishment is prescribed under the Act, there is no violation by the Company. Is the contention of the Company valid? (Dec 2021, 4 marks)

Answer:

No Specific Penalty or Punishment:

As per section 450 of the Companies Act, 2013, provides for the punishment for non-compliances of those provisions of the Act where no specific Penalty or Punishment is stated.

According to said section, if a company or any officer of a company or any other person contravenes any of the provisions of the Companies Act, 2013 or the rules made thereunder, or any condition, limitation or restriction subject to which any approval, sanction, consent, confirmation, recognition, direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in the Companies Act, 2013.

Penalty: the company and every officer of the company who is in default or such other person shall be liable to a penalty of ₹ 10,000 and in case of continuing contravention, with a further penalty of ₹ 1,000 for each day after the first during which the contravention continues, subject to a maximum of ₹ 2,00,000 in case of a company and ₹ 50,000 in case of an officer who is in default or any other person.

Conclusion: Therefore, the contention of the company is not valid.

Question 14.

Registrar of Companies (ROC) has sent a Notice to a Company alleging default under Section 92(4) and Section 137(2) of the Companies Act, 2013. On receiving the notice, the Company immediately arranges to file the respective Forms/Retums and communicates within 30 days of the notice that the it has made good the default. However, the ROC proceeded to prosecute the Company for non-compliance under the aforesaid Section.

Is the action of the Registrar justified? If so, what may be the penalty for such non-compliances? (Dec 2021, 4 marks)

Answer:

Adjudication of Penalties: Section 454(3) of the Companies Act, 2013, provides that the adjudicating officer may, by an order-

(a) impose the penalty on the company, the officer who is in default, or any other person, as the case may be, stating therein any non-compliance or default under the relevant provisions of the Act; and

(b) direct such company, or officer who is in default, or any other person, as the case may be, to rectify the default, wherever he considers fit. Although, a proviso has been to section 454(3) Of the Act inserted vide the Companies (Amendment) Act, 2020 w.e.f. 22.01.2021, which provides as under:

In case the default relates to non-compliance of section 92(4) or section 137(1) or 137(2) and such default has been rectified either prior to, or within thirty days of, the issue of the notice by the adjudicating officer, no penalty shall be imposed in this regard and all proceedings under this section in respect of such default shall be deemed to be concluded.

In the given situation, the Registrar of Companies, who is the designated Adjudicating Officer for levying penalties under the above mentioned provisions is not empowered to proceed to levy penalty if the requisite Forms prescribed under the said provisions have been filed within 30 days of issue of the Notice.

Question 15.

An offence under the Companies Act, 2013 was compounded by the Company and Compounding order was issued by the Compounding Authority specially for offences by the Company and the Directors of the Company as officer in default. The Company has paid the Compounding Fee. However, one of the Director, who is also a party, to the Compounding as officer in default feels that compounding fee is high and he would like to go for an Appeal.

Evaluate whether the Director will be allowed to make an appeal. Also indicate the penal provision for non-compliance of compounding orders. (Dec 2021, 4 marks)

Answer:

It is necessary to refer to the below cases to understand the applicable law in the given circumstances.

No appeal against order of composition: A person having agreed to the composition of offence is not entitled to challenge the said proceeding by filing an appeal. [S V Bagi v. State of Karnataka (1992) 87 STC 138].

No penalty of prosecution after compounding: In P P Varkey v. STO (1999) 114 STC 224 (Bom HC DB), it was held that once an offence is compounded, penalty or prosecution proceeding cannot be taken for same offence.

No challenge to the compounding order: In S Viswanathan v. State of Kerala (1993) 113 STC 182 (Ker HC DB), it was held that once the matter is compounded, neither department nor assessee can challenge the compounding order. Department cannot reopen the matter on the reason . that actual suppression was much higher.

In the given situation, it can be said that the director will not be allowed to make an appeal.

According to section 441 (5) of the Companies Act, 2013.

If any officer or other employee of the company who fails to comply with any order made by the Tribunal or the Regional Director or any officer authorised by the Central Government under section 441(4) of the Companies Act, 2013, the maximum amount of fine for the offence proposed to be compounded under this section shall be twice the amount provided in the corresponding section in which punishment for such offence is provided.

![]()

Question 16.

Surasandhya, is a Practising Company Secretary specialising in Corporate and allied laws. One of her clients approached her, seeking inputs on value of penalty/fine payable for certain offences committed by his Company. He wants to understand the factors which are considered in deciding the quantum of penalty.

Outline the factors considered while deciding the quantum of penalty. (Dec 2021, 4 marks)

Answer:

Adjudication of Penalties: According to Sec 454(3)(a) of the Companies Act, 2013 read with Rule 3(12) of the Companies (Adjudication of Penalties) Rules, 2014, while adjudging quantum of penalty, the adjudicating officer shall have due regard to the following factors, namely:

(a) size of the company;

(b) nature Of business carried on by the company;

(c) injury to public interest;

(d) nature of the default;

(e) repetition of the default;

(f) the amount of disproportionate gain or unfair advantage, wherever quantifiable, made as a result of the default; and

(g) the amount of loss caused to an investor or group of investors or creditors as a result of the default: .

Provided that, in no case, the penalty imposed shall be less than the minimum penalty prescribed, if: any, under the relevant section of the Companies Act, 2013, to which the offence is related to.

Question 17.

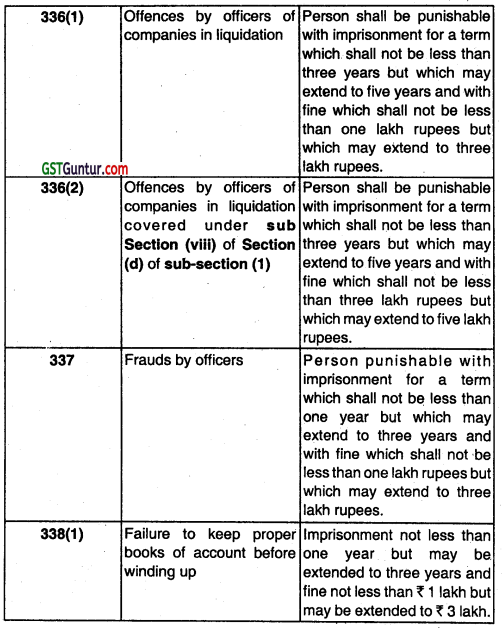

Explain whether the following offences are compoundable, if yes, by whom ?

(i) Failure to disclose director’s interest and participation by interested director.

(ii) Intentionally giving false evidence under Section 449 of the Companies Act, 2013.

(iii) Failure to maintain proper books of accounts before winding up.

(iv) Not publishing the order of confirmation of reduction in share capital by the Tribunal. (June 2022, 4 marks)

Question 18.

Explain ‘Execution of detention orders’ and ‘Revocation of detention orders’ under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA.1974). (June 2022, 4 marks)

Question 19.

X, a director of PQR Private Limited, is authorised by Board of Directors to prepare and file returns, reports or other documents to Registrar of Companies (ROC) on behalf of the Company. He files all the required documents with ROC, despite being aware of material discrepancies in them. Subsequently, it was found that the documents filed with ROC contained materially false details. Explain the penal provisions under the Companies Act, 2013 for this offence. (June 2019, 4 marks)

Answer:

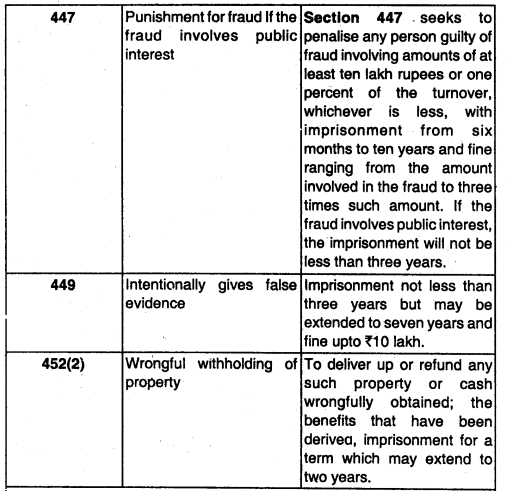

According to section 448 of the Companies Act, 2013, if any person makes a statement which is false in any material particulars, knowing it to be false or omits any material facts, knowing it to be material, such person shall be liable under section 447 of the Companies Act, 2013.

As per Section 447 seeks to penalise any person guilty of fraud involving amounts of at least ten lakh rupees or one percent of the turnover, whichever is less, with imprisonment from six months to ten years and fine ranging from the amount involved in the fraud to three times such amount. If the fraud involves public interest, the imprisonment will not be less than three years.

If the amount involved is less than ten lakh rupees or one percent of the turnover and the fraud does not involve public interest, the punishment shall be imprisonment up to five years or fine up to fifty lakh rupees or both. It must be noted that the liability will be personal here i.e. the personal assets will be used to pay up the penalty.

It’s not just the above penalty that is relevant. If a director is found to be guilty of fraud and sentenced to imprisonment for six months or more, he would need to wait five years to be over after the expiry of the sentence to become a director of any other company. If the fraud involved public interest, this would take in the minimum eight crucial years out from the career of anyone seeking to become a director of a company again.

Hence, X, director of PQR Private Limited shall be punishable with imprisonment and fine as mentioned above.

Question 20.

G is the General Manager (HR) of XYZ Limited. He wrongfully withholds the flat of the Company and also lets it out on rent to someone. XYZ Limited has filed a complaint against G. What are the penalties for such a conduct under the Companies Act, 2013. (June 2019, 4 marks)

Answer:

The Company is entitled to take following actions against “G“ in accordance with section 452 of the Companies Act, 2013, it provides that:

1. If any officer or employee of a company:

(a) Wrongfully obtains possession of any property, including cash of the company or

(b) having any such property including cash in his possession, wrongfully withholds it or knowingly applies it for the purposes other than those expressed or directed in the articles and authorised by this Act, he shall, on the complaint of the company or of any member or creditor or contributory thereof be punishable with fine which shall not be less than one lakh rupees but which may extend to five lakh rupees.

2. The Court trying an offence under sub-section (1) of Section 452 of the Companies Act, 2013 may also order such officer or employee to deliver up or refund, within a time to be fixed by it, any such property or cash wrongfully obtained or wrongfully withheld or knowingly misapplied, the benefits that have been derived from such property or cash or in default, to undergo imprisonment for a term which may extend to two years.

As per Companies (Amendment) Act, 2020

In Section 452(2) of the Companies Act, 2013, the following proviso has been inserted, namely:

“Provided that the imprisonment of such officer or employee, as the case may be, shall not be ordered for wrongful possession or withholding of a dwelling unit, if the court is satisfied that the company has not paid to that officer or employee, as the case may be, any amount relating to

(a) provident fund, pension fund, gratuity fund or any other fund for the welfare of its officers or employees, maintained by the company;

(b) compensation or liability for compensation under the Workmen’s Compensation Act, 1923 in respect of death or disablement.”

![]()

Question 21.

The Board of Directors of BIJI Private Limited made an application to the Registrar of Companies under section 248(2) of the Companies Act, 2013 for removal of name of the Company. The Board submitted an affidavit that Company has .no pending liabilities. However, it was later found that few amounts were still payable to creditors.

What penalties can be levied under the Companies Act, 2013 for such an application? (Dec 2019, 4 marks)

Answer:

As per section 251(1) of the Companies Act, 2013 where it is found that an application by a company under section 248(2) has been made with the object of evading the liabilities of the company or with the intention to

deceive the creditors or to defraud any other persons, the persons in charge of the management of the company shall, notwithstanding that the company has been notified as dissolved-

(a) be jointly and severally liable to any person or persons who had incurred loss or damage as a result of the company being notified as dissolved; and

(b) be punishable for fraud in the manner as provided in section 447 of the Companies Act, 2013.

Further, Section 251(2)* of the Companies Act, 2013 states that, the Registrar may also recommend prosecution of the persons responsible for the filing of an application under Section 248(2) of the Companies Act, 2013. Based on above provisions, the Board of Directors of BIJI Private Limited will be liable to penal provisions as per Section 251 of the Companies Act, 2013.

Question 22.

Infomatika Limited, a Public Limited Company was incorporated under the Companies Act, 1956 in the year 2010. During the financial year ended March 31,2019, the Company made a contribution of ₹ 50 Lakhs to a local political party, which, amounts to 9% of its average net profits during three immediately preceding financial years. Is the Company compliant with the provisions of the Companies Act, 2013, if not, what would be the penal provisions for such an act ? (Dec 2019, 4 marks)

Answer:

As per Section 182 of the Companies Act, 2013, a company, other than a Government company and a company which has been in existence for less than three financial years, may contribute any amount directly or indirectly to any political party.

Further, such contribution shall be approved by a resolution authorising the making of such contribution is passed at a meeting of the Board of Directors. Every company shall disclose in its profit and loss account the total amount contributed by it as cbntribution to political parties during the financial year to which the account relates.

Such contribution shall not be made except by an account payee cheque drawn on a bank or an account payee bank draft or use of electronic clearing system through a bank account. However, a company may make contribution through any instrument, issued pursuant to any scheme notified under any law for the time being in force, for contribution to the political parties.

Section 182(4) states that company shall be punishable with fine which may extend to five times the amount so contributed and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months and with fine which may extend to five times the amount so contributed.

Informatica Limited has made a political contribution of Rupees 50 Lakhs to a local political party. To become a compliant company, Infomatika Limited shall be in compliance with the provisions of section 182 of the Companies Act, 2013.

Question 23.

A Listed Company was awarded three contracts of drilling rigs. The value of contracts are substantial to the revenue of the Company. As per the normal procedure for bidding there was a time gap between the dates of declaration of the announcement as top bidder and the announcement of the award. This information is considered as ‘Price Sensitive’ until the stock exchanges were informed, but the company thought that it will inform only after declaration of official award of the contract. However, the officials of the Company were “RESTRICTED” from dealing in the shares of the company immediately after the announcement as top bidder.

In the meantime, the Managing Director of the company before submission of this information to the stock exchanges put this information on Facebook timeline and his friends on facebook made likes and some even bought shares.

As a Company Secretary elaborate based on a decided case, whether the posting of this on the Facebook timeline.

(i) Made the other friends a ‘connected person’.

(ii) Whether this meant an access to ‘Unpublished Price Sensitive Information’. (Dec 2020, 5 marks)

Answer:

- The Securities Exchange Board of India (SEBI) by its order in the matter of Deep Industries Limited (DIL) has held that Sujay is an insider by way of his association with any officer of the company (in the given case the Managing Director) by way of frequent communication with him in their social capacity as evident in this case by frequent interactions including likes on the social media.

- Further in the said case it was also held that by virtue of this association and frequent communication, Sujay was reasonably expected to have access to the UPSI of DIL at the relevant period.

- Hence, as per Regulation 2(1)(d)(i) of the Prohibition of Insider Trading Regulations, 2015, Sujay is a connected person and consequently is an Insider with respect to DIL.

- Yes, in view of the case law discussed above and Regulation 2(1)(d)(i) of the Prohibition of Insider Trading Regulations, 2015, the posting of the information on Facebook by the Managing Director, does made other Facebook friends a ‘connected person’ on the basis of Social Association.

- Yes, in view of the above discussion, this meant the connected person are reasonably expected to have, directly or indirectly, an access to ‘Unpublished Price Sensitive Information’ by virtue of their association and frequent communication as evident in this case by likes on the social media, unpublished price sensitive information.

![]()

Question 24.

An unlisted public company has Authorised Share Capital of 10,00,000 Equity voting shares of ? 10 each of same class. The subscribed and fully paid up Share Capital of the Company is 8,00,000 shares of? 10 each. To comply with statutory provisions on dematerialisation of shares, the company applied for allotment ISIN with a depository for the entire authorised share capital instead of application for paid up share capital.

(i) Examine the validity of the process adopted by the Company quoting relevant provisions.

(ii) What is the penalty, if any, prescribed for violation of process in such cases under Securities Contracts (Regulation) Act, 1956. (Dec 2020, 5 marks)

Answer:

(i) As a general rule inter alia the Depository Rules, Securities Exchange Board of India (Listing Obligation and Disclosure Requirements) Regulations, 2015 and under Sec 23F of the Securities Contract Regulation Act, 1956, the dematerialisation of more than the issued securities of a company or delivers in the stock Exchange the securities which is not listed in stock Exchanges are not permitted at all.

Further, according to Section 19E of Depository Act, 1996, if the company/issuer, fails to reconcile the records of dematerialised securities with all the securities issued, it shall be liable to a penalty which shall not be less than one lakh rupees but which may extend to one lakh rupees for per day during which such failure continues subject to a maximum of one crore rupees.

As per Section 28 of Depositories Act, 1996 provides that provisions of this Act shall be in addition to, and not in derogation of, any other law relating to the holding and transfer of securities.

Hence, the process adopted by the company is invalid.

(ii) Section 23F of the Securities Contracts (Regulation) Act, 1956 provides that If any issuer dematerialises securities more than the issued securities of a company, he shall be liable to a penalty which shall not be less than 5 lakh rupees but which may extend to 25 crore rupees.

Question 25.

PQR Ltd. failed to file return of allotment against the 16 lakh shares allotted by the Board of directors at its meeting held on 20th April, 2016 and got order for compounding of offence on 10th June, 2018. f The company again failed to file return of allotment against the 11 lakh shares allotted by the Board of directors at its meeting held on 4th March, 2019. What options are available to the company in respect of this default (Aug 2021, 4 marks)

Answer:

Interval between two similar offences for compounding under section 441 of the Companies Act, 2013

According to Sec. 441 (2) of the Companies Act, 2013 expressly provides that if any offence which was committed by company or the officers was compounded under section 441 of the Act, and an offence similar to what was compounded earlier is committed again by a company or its officers within a period of three years from the date on which the earlier offence was compounded, then the provisions of section 441 will not be applicable and the company and the officers concerned will not be eligible for compounding again.

In other words, similar offence can be compounded only once in three years Hence, in the given case, the company cannot go for compounding for non-filing of return of allotment. Although, there is no such restriction imposed under section 454 on adjudicating a penalty by the adjudicating officer. The adjudicating officer may, by an order-

(a) impose the penalty on the company, the officer who is in default, or any other person, as the case may be, stating therein any non-compliance or default under the relevant provisions of this Act; and

(b) direct such company, or officer who is in default, or any other person, as the case may be, to rectify the default, wherever he considers fit.

As perfection 460(b) of Companies Act, 2013, where any document required to be filed with the Registrar of Companies (ROC) under any provision of the Companies Act, 2013 is not filed within the time specified therein, the Central Government may, for reasons to be recorded in writing, condone the delay.

Therefore, the option of adjudication and condonation of delay is available to the company.

Question 26.

Singleton OP & Co., a One Person Company; passed certain resolutions on September 15,2021 which were supposed to be filed with ROC in Form MGT-14, within the stipulated time. However, Singleton OP & Co., filed it with ROC on October 30,2021. Comment if there has been any violation, if so, what are the penalties? (June 2022, 4 marks)

![]()

Question 27.

sessions, where SOS was explaining the overview of penal provisions under the Companies Act, 2013 one of the Directors asked if the penal liability can be escaped in case no specific penalty or punishment is provided for such contravention of the provisions of Act or rules made thereunder. Can a director or officer in default escape from liability if no specific penalty or punishment is provided for contravention of provisions of the Act ? Comment. (June 2022, 4 marks)

Question 28.

Write short note on compounding.

Answer:

Compounding

The Companies Act, 2013 does not define or for that matter the Companies Act, 1956, did not define the word “compounding” or the terms “compounding or composition of offences”. The dictionary meaning of the word “compounding” means “on prosecution, a prosecutor of an offence accepting anything of value, say a monetary fine, under an agreement not to prosecute the victim or to hamper the prosecution of an offence”. To compound would simply mean “to come to a settlement or agreemenf.

Question 29.

Write short note on Directorate Enforcement.

Answer:

Directorate of Enforcement (Section 36)

- The Central Government shall establish a Directorate of Enforcement with a Director and such other officers or class of officers as it thinks fit, who shall be called officers of Enforcement, for the purposes of this Act.

- Without prejudice to the provisions of sub-section (1), the Central Government may authorise the Director of Enforcement or an Additional Director of Enforcement or a Special Director of Enforcement or a Deputy Director of Enforcement to appoint officers of Enforcement below the rank of an Assistant Director of Enforcement.

- Subject to such conditions and limitations as the Central Government may impose, an officer of Enforcement may exercise the powers and discharge the duties conferred or imposed on him under this Act.

Question 30.

Write short note on Special Court.

Answer:

Special Courts (Section 43)

1. The Central Government, in consultation with the Chief Justice of the High Court, shall, for trial of offence punishable under Section 4, by notification, designate one or more Courts of Session as Special Court or Special Courts or such area or areas or for such case or class or group of cases as may be specified in the notification:

Explanation: In this sub-section, “High Court” means the High Court of the State in which a Sessions Court designated as Special Court was functioning immediately before such designation.

2. While trying an offence under this Act, a Special Court shall also try an offence, other than an offence referred to in sub-section (1), with which the accused may, under the Code of Criminal Procedure, 1973 (2 of 1974), be charged at the same trial.

Question 31.

Write short note on Revocation of detention order.

Answer:

Revocation of detention orders (Section 11)

1. Without prejudice to the provisions of Section 21 of the General Clauses Act, 1897 (10 of 1897), a detention order may, at any time, be revoked or modified

(a) notwithstanding that the order has been made by an officer of a State Government, by that State Government or by the Central Government;

(b) notwithstanding that the order has been made by an officer of the Central Government or by a State Government, by the Central Government

2. The revocation of a detention order shall not bar the making of another detention order under Section 3 against the same person.

![]()

Question 32.

Describe the offences triable by Special Courts.

Answer:

Offences triable by Special Courts (Section 44)

1. Notwithstanding anything contained in the Code of Criminal Procedure, 1973 (2 of 1974):

(a) an offence punishable under Section 4 and any scheduled offence connected to the offence under that section shall be triable by the Special Court constituted for the area in which the offence has been committed:

Provided that the Special Court, trying a scheduled offence before the commencement of this Act, shall continue to try such scheduled offence; or];

(b) a Special Court may, upon a complaint made by an authority authorised in this behalf under this Act take cognizance of offence under Section 3, without the accused being committed to it for trial;

(c) if the court which has taken cognizance of the scheduled offence is other than the Special Court which has taken cognizance of the

complaint of the offence of money-laundering under sub-ciause (b), it shall, on an application by the authority authorised to file a i complaint under this Act,’ commit the case relating to the scheduled offence to the Special Court and the Special Court shall, on receipt of such case proceed to deal with it from the stage at which it is committed.

(d) a Special Court while trying the scheduled offence or the offence of money-laundering shall hold trial in accordance with the provisions of the Code of Criminal Procedure, 1973 (2 of 1974) as it applies to a trial before a Court of Session.

2. Nothing contained in this section shall be deemed to affect the special powers of the High Court regarding bail under Section 439 of the Code of Criminal Procedure, 1973 (2 of 1974) and the High Court may exercise such powers including the power under clause (b) of sub-section (1) of that section as if the reference to “Magistrate” in that section includes also a reference to a “Special Court” designated under Section 43.

Question 33.

Discuss the Procedure and Powers of Appellate Tribunal.

Answer:

Procedure and powers of Appellate Tribunal (Section 35)

1. The Appellate Tribunal shall not be bound by the procedure laid down by the Code of Civil Procedure, 1908 (5 of 1908), but shall be guided by the principles of natural justice and, subject to the other Provisions of this Act, the Appellate Tribunal shall have powers to regulate its own procedure.

2. The Appellate Tribunal shall have, for the purposes of discharging its functions under this Act, the same powers as are vested in a civil court under the Code of Civil Procedure, 1908 while trying a suit, in respect of the following matters, namely:-

(a) summoning and enforcing the attendance of any person and examining him on oath;

(b) requiring the discovery and production of documents;

(c) receiving evidence on affidavits;

(d) subject to the provisions of sections 123 and 124 of the Indian Evidence Act, 1872 (1 of 1872), requisitioning any public record or document or copy of such record or document from any office;

(e) issuing commissions for the examination of witnesses or documents;

(f) reviewing its decisions;

(g) dismissing a representation for default or deciding it ex parte;

(h) setting aside any order of dismissal of any representation for default or any order passed by it ex parte; and

(i) any other matter, which may be, prescribed by the Central Government.

3. An order made by the Appellate Tribunal under this Act shall be executable by the Appellate Tribunal as a decree of civil court and, for this purpose, the Appellate Tribunal shall have all the powers of a civil court.

4. Notwithstanding anything contained in sub-section (3), the Appellate Tribunal may transmit any order made by it to a civil court having local jurisdiction and such civil court shall execute the order as if it were a decree made by that court.

5. All proceedings before the Appellate Tribunal shall be deemed to be judicial proceedings within the meaning of sections 193 and 228 of the Indian Penal Code (45 of 1860) and the Appellate Tribunal shall be deemed to be a civil court for the purposes of sections 345 and 346 of the Code of Criminal Procedure, 1973.

![]()

Question 34.

Explain the Procedure of Summon, Searches and Seizure under PMLA.

Answer:

Power of survey (Section 16 (1))

1. Notwithstanding anything contained in any other provisions of this Act, where an authority, on the basis of material in his possession, has

reason to believe (the reasons for such belief to be recorded in writing) that an offence under Section 3 has been committed, he may enter any place:

(i) within the limits of the area assigned to him; or

(ii) in respect of which he is authorised for the purposes of this section by such other authority, who is assigned the area within which such place is situated, at which any act constituting the commission of such offence is carried on, and may require any proprietor, employee or any other person who may at that time and place be attending in any manner to, or helping in, such act so as to:

- afford him the necessary facility to inspect such records as he may require and which may be available at such place;

- afford him the necessary facility to check or verify the proceeds of crime or any transaction related to proceeds of crime which may be found therein; and

- furnish such information as he may require as to any matter which may be useful for, or relevant to, any proceedings under this Act.

Question 35.

Discuss the Procedure and powers of Appellate Tribunal and special director.

Answer:

Procedure and powers of Appellate Tribunal and Special Director (Appeals) (Section 28)

1. The Appellate Tribunal and the Special Director (Appeals) shall not be bound by the procedure laid down by the Code of Civil Procedure, 1908, but shall be guided by the principles of natural justice and, subject to the other provisions of this Act, the Appellate Tribunal and the Special Director (Appeals) shall have powers to regulate its own procedure.

2. The Appellate Tribunal and the Special Director (Appeals) shall have, for the purposes of discharging its functions under this Act, the same powers as are vested in a civil court under the Code of Civil Procedure, 1908, while trying a suit, in respect of the following matters, namely:

(a) summoning and enforcing the attendance of any person and examining him on oath;

(b) requiring the discovery and production of documents;

(c) receiving evidence on affidavits;

(d) subject to the provisions of Sections 123 and 124 of the Indian Evidence Act, 1872 (1 of 1872), requisitioning any public record or document or copy of such record or document from any office;

(e) issuing commissions for the examination of witnesses or documents;

(f) reviewing its decisions;

(g) dismissing a representation of default or deciding it ex parte;

(h) setting aside any order of dismissal of any representation for default or any order passed by it ex parte; and

(i) any other matter which may be prescribed by the Central Government.

3. An order made by the Appellate Tribunal or the Special Director (Appeals) under this Act shall be executable by the Appellate Tribunal or the Special Director (Appeals) as a decree of civil court and, for this purpose, the Appellate Tribunal and the Special Director (Appeals) shall have ail the powers of a civil court.

4. Notwithstanding anything contained in sub-section (3), the Appellate Tribunal or the Special Director (Appeals) may transmit any order made by it to a civil court having local jurisdiction and such civil court shall execute the order as if it were a decree made by that court.

5. All proceedings before the Appellate Tribunal and the Special Director (Appeals) shall be deemed to be judicial proceedings within the meaning of Sections 193 and 228 of the Indian Penal Code and the Appellate Tribunal shall be deemed to be a civil court for the purposes of Sections 345 and 346 of the Code of Criminal Procedure, 1973.

![]()

Question 36.

Discuss the procedure of appointment of adjudication authority.

Answer:

Appointment of Adjudicating Authority (Section 16)

1. For the purpose of adjudication under Section 13, the Central Government may, by an order published in the Official Gazette, appoint

as many officers of the Central Government as it may think fit, as the Adjudicating Authorities for holding an inquiry in the manner prescribed after giving the person alleged to have committed contravention under Section 13, against whom a complaint has been made under sub-section (3) (hereinafter in this section referred to as the said person) a reasonable opportunity of ‘being heard for the purpose of Imposing any penalty:

Provided that where the Adjudicating Authority is of opinion that the said person is likely to abscond or is likely to evade in any manner, the payment of penalty, if levied, it may direct the said person to furnish a bond or guarantee for such amount and subject to such conditions as it may deem fit.

2. The Central Government shail, while appointing the Adjudicating Authorities under sub-section (1), also specify in the order published in the Official Gazette, their respective jurisdictions.

3. No Adjudicating Authority shall hold an enquiry under sub-section (1) except upon a complaint in writing made by any officer authorised by a general or special order by the Central Government.

4. The said person may appear either in person or take the assistance of a legal practitioner or a chartered accountant of his choice for presenting his case before the Adjudicating Authority.

5. Every Adjudicating Authority shall have the same powers of a civil court which are conferred on the Appellate Tribunal under sub-section (2) of Section 28 and

(a) all proceedings before it shall be deemed to be judicial proceedings within the meaning of Sections 193 and 228 of the Indian Penal Code;

(b) shall be deemed to be a civil court for the purposes of Sections 345 and 346 of the Code of Criminal Procedure, 1973.

6. Every Adjudicating Authority shall deal with the complaint under sub-section (2) as expeditiously as possible and endeavour shall be made to dispose of the complaint finally within one year from the date of receipt of the complaint.

Question 37.

Explain the Procedure of enforcement of the orders of adjudicating authority.

Answer:

Enforcement of the orders of Adjudicating Authority (Section 14)

1. Subject to the provisions of sub-section (2) of Section 19, if any person fails to make full payment of the penalty imposed on him under Section 13 within a period of ninety days from the date on which the notice for payment of such penalty is served on him, he shall be liable to civil imprisonment under this section.

2. No order for the arrest and detention in civil prison of a defaulter shall be made unless the Adjudicating Authority has issued and served a notice upon the defaulter calling upon him to appear before him on the date specified in the notice and to show cause why he should not be committed to the civil prison, and unless the Adjudicating Authority, for reasons in writing, is satisfied:

(a) that the defaulter, with the object or effect of obstructing the recovery of penalty, has after the issue of notice by the Adjudicating Authority, dishonestly transferred, concealed, or removed any part of his property, or

(b) that the defaulter has, or has had since the issuing of notice by the Adjudicating Authority, the means to pay the arrears or some substantial part thereof and refuses or neglects or has refused or neglected to pay the same.

3. Notwithstanding anything contained in sub-section (1), a warrant for the arrest of the defaulter may be issued by the Adjudicating Authority if the Adjudicating Authority is satisfied, by affidavit or otherwise, that with the object or effect of delaying the execution of the certificate the defaulter is likely to abscond or leave the local limits of the jurisdiction of the Adjudicating Authority.

4. Where appearance is not made pursuant to a notice issued and served under sub-section (1), the Adjudicating Authority may issue a warrant for the arrest of the defaulter.

(1A) If any person is found to have acquired any foreign exchange, foreign security or immovable property, situated outside India, of the aggregate value exceeding the threshold prescribed under the proviso to sub-section-(1) of Section 37A, he shall be liable to a penalty up to three times the sum involved in such contravention and confiscation of the value equivalent, situated in India, the Foreign exchange, foreign security or immovable property.

![]()

Question 38.

What are the various ground of detention severable?

Answer:

Grounds of detention severable (Section 5A)

Where a person has been detained in pursuance of an order of detention under sub-section (1) of section 3 which has been made on two or more grounds, such order of detention shall be deemed to have been made separately on each of such grounds and accordingly:

(a) such order shall not be deemed to be invalid or inoperative merely because one or some of the grounds is or are

(i) vague,

(ii) non-existent,

(iii) not relevant,

(iv) not connected or not proximately connected with such person, or

(v) invalid for any other reason whatsoever, and it is not, therefore, possible to hold that the Government or officer making such order would have been satisfied as provided in sub-section (1) of Section 3 with reference to the remaining ground or grounds and made the order of detention;

(b) the Government or officer making the order of detention shall be deemed to have made the order of detention under the said sub-section (1) after being satisfied as provided in that sub-section with reference to the remaining ground or grounds.

Question 39.

What are the maximum period of detention?

Answer:

Maximum period of detention (Section 10)

The maximum period for which any person may be detained in pursuance of any detention order to which the provisions of Section 9 do not apply and which has been confirmed under clause (f) of Section 8 shall be a period of one year from the date of detention or the specified period, whichever period expires later and the maximum period for which any person may be detained in pursuance of any detention order to Which the provisions of Section 9 apply and which has been confirmed under clause (f) of Section 8 read with sub-section (2) of Section 9 shall be a period of two years from the date of detention or the specified period, whichever period expires later:

Provided that nothing contained in this section shall affect the power of the appropriate Government in either case to revoke or modify the detention order at any earlier time.

Question 40.

What are the special provisions for dealing with emergency?

Answer:

Special provisions for dealing with emergency (Section 12A)

1. Notwithstanding anything contained in this Act or any rules of natural justice, the provisions of this section shall have effect during the period of operation of the Proclamation of Emergency issued under clause (1) of article 352 of the Constitution on the 3rd day of December, 1971, or the Proclamation of Emergency issued under that clause on the 25th day of June, 1975, or a period of twenty-four months] from the 25th day of June, 1975, whichever period is the shortest.

2. When making an order of detention under this Act against any person after the commencement of the Conservation of Foreign Exchange and Prevention of Smuggling Activities (Amendment) Act, 1975 (35 of 1975), the Central Government or the State Government or, as the case may be, the officer making the order of detention shall consider whether the detention of such person under this Act is necessary for dealing effectively with the emergency in respect of which the Proclamations referred to in sub-section (1) have been issued (hereafter in this section referred to as the emergency) and if, on such consideration, the Central Government or the State Government or, as the case may be, the officer is satisfied that it is necessary to detain such person for effectively dealing with the emergency, that Government or officer may make a declaration to that effect and communicate a copy of the declaration to the person concerned;

Provided that where such declaration is made by an officer, it shall be reviewed by the appropriate Government within fifteen days from the date of making of the declaration and such declaration shall cease to have effect unless it is confirmed by that Government, after such review, within the said period of fifteen days.

1. The question whether the detention of any person in respect of whom a declaration has been made under sub-section (2) continues to be necessary for effectively dealing with the emergency shall be reconsidered by the appropriate Government within four months from the date of such declaration and thereafter at intervals not exceeding four months, and if, on such reconsideration, it appears to the appropriate Government that the detention of the person is no longer necessary for effectively dealing with the emergency, the Government may revoke the declaration.

2. In making any consideration, review or reconsideration under sub-section (2) or (3), the appropriate Government or officer may, if such Government or officer considers it to be against the public interest to do otherwise, act on the basis of the information and materials in its or his possession without disclosing the facts or giving an opportunity of making a representation to the person concerned.

3. It shall not be necessary to disclose to any person detained under a detention order to which the provisions of sub-section (2) apply, the grounds on which the order has been made during the period the declaration made in respect of such person under that sub section is in force, and, accordingly, such period shall not be taken into account for the purposes of sub-section (3) of Section 3.

4. In the case of every person detained under a detention order to which the provisions of sub-section (2) apply, being a person in respect of whom a declaration has been made thereunder, the period during which such declaration is in force shall not be taken into account for the purpose of computing (i) The periods specified in clauses (b) and (c) of Section 8;

![]()

Question 41.

Discuss the Procedure of Appeal to Appellate Tribunal.

Answer:

Appeal to Appellate Tribunal (Section 19)

1. Save as provided in sub-section (2), the Central Government or any person aggrieved by an order made by an Adjudicating Authority, other than those referred to in sub-section (1) of Section 17, or the Special Director (Appeals), may prefer an appeal to the Appellate Tribunal: Provided that any person appealing against the order of the Adjudicating Authority or the Special Director (Appeals) levying any penalty, shall while filing the appeal, deposit the amount of such penalty with such authority as may be notified by the Central Government:

Provided further that where in any particular case, the Appellate Tribunal is of the opinion that the deposit of such penalty would cause undue hardship to such person, the Appellate Tribunal may dispense with such deposit subject to such conditions as it may deem fit to impose so as to safeguard the realisation of penalty.

2. Every appeal under sub-section (1) shall be filed within a period of forty-five days from the date on which a copy of the order made by the Adjudicating Authority or the Special Director (Appeals) is received by the aggrieved person or by the Central Government and it shall be in such form, verified in such manner and be accompanied by such fee as may be prescribed:

Provided that the Appellate Tribunal may entertain an appeal after the expiry of the said period of forty-five days if it is satisfied that there was sufficient cause for not filing it within that period.

3. On receipt of an appeal under sub-section (1), the Appellate Tribunal may, after giving the parties to the appeal an opportunity of being heard, pass such orders thereon as it thinks fit, confirming, modifying or setting aside the order appealed against.

4. The Appellate Tribunal shall send a copy of every order made by it to the parties to the appeal and to the concerned Adjudicating Authority or the Special Director (Appeals), as the case may be.

5. The appeal filed before the Appellate Tribunal under sub-section (1) shall be dealt with by.it as expeditiously as possible and endeavour shall be made by it to dispose of the appeal finally within one hundred and eighty days from the date of receipt of the appeal:

Provided that where any appeal could not be disposed of within the said period of one hundred and eighty days, the Appellate Tribunal shall record its reasons in writing for not disposing off the appeal within the / said period.

6. The Appellate Tribunal may, for the purpose of examining the legality, propriety or correctness of any order made by the Adjudicating Authority under Section 16 in relation to any proceeding, on its own motion or otherwise, call for the records of such proceedings and make such order in the case as it thinks fit.

Procedure and powers of Appellate Tribunal and Special Director \ (Appeals) (Section 28)

1. The Appellate Tribunal and the Special Director (Appeals) shall not be bound by the procedure laid down by the Code of Civil Procedure, 1908, but shall be guided by the principles of natural justice and, subject to the other provisions of this Act, the Appellate Tribunal and the Special Director (Appeals) shall have powers to regulate its own procedure.

2. The Appellate Tribunal and the Special Director (Appeals) shall have, for the purposes of discharging its functions under this Act, the same powers as are vested in a civil court under the Code of Civil Procedure, f 1908, while trying a suit, in respect of the following matters, namely:

(a) summoning and enforcing the attendance of any person and examining him on oath

(b) requiring the discovery and production of documents

(c) receiving evidence on affidavits

(d) subject to the provisions of Sections 123 and 124 of the Indian Evidence Act, 1872 (1 of 1872), requisitioning any public record or document or copy of such record or document from any office

(e) issuing commissions for the examination of witnesses or documents;

(f) reviewing its decisions

(g) dismissing a representation of default or deciding it ex parte

(h) setting aside any order of dismissal of any representation for default or any order passed by it ex parte; and

(i) any other matter which may be prescribed by the Central Government.

3. An order made by the Appellate Tribunal or the Special Director (Appeals) under this Act shall be executable by the Appellate Tribunal or the Special Director (Appeals) as a decree of civil court and, for this purpose, the Appellate Tribunal and the Special Director (Appeals) shall have all the powers of a civil court.

4. Notwithstanding anything contained in sub-section (3), .the Appellate Tribunal or the Special Director (Appeals) may transmit any order made by it to a civil court having local jurisdiction and such civil court shall execute the order as if it were a decree made by that court.

5. All proceedings before the Appellate Tribunal and the Special Director (Appeals) shall be deemed to be judicial proceedings within the meaning of Sections 193 and 228 of the Indian Penal Code and the Appellate Tribunal shall be deemed to be a civil court for the purposes of Sections 345 and 346 of the Code of Criminal Procedure, 1973.

![]()

Question 42.

Discuss the Procedure of appeal to Special Director.

Answer:

Appeal to Special Director (Appeals) (Section 17)

1. The Central Government shall, by notification, appoint one or more Special Directors (Appeals) to hear appeals against the orders of the Adjudicating Authorities under this section and shall also specify in the said notification the matter and places in relation to which the Special Director (Appeals) may exercise jurisdiction.

2. Any person aggrieved by an order made by the Adjudicating Authority, being an Assistant Director of Enforcement or a Deputy Director of Enforcement, may prefer an appeal to the Special Director (Appeals).

3. Every appeal under sub-section (1) shall be filed within forty-five days from the date on which the copy of the order made by the Adjudicating Authority is received by the aggrieved person and it shall be in such form, verified in such manner and be accompanied by such fee as may be prescribed:

Provided that the Special Director (Appeals) may entertain an appeal after the expiry of the said period of forty- five days, if he is satisfied that there was sufficient cause for not filing it within that period.

4. On receipt of an appeal under sub-section (1), the Special Director (Appeals) may after giving the parties to the appeal an opportunity of being heard, pass such order thereon as he thinks fit, confirming, modifying or setting aside the order appealed against.

5. The Special Director (Appeals) shall send a copy of every order made by him to the parties to appeal and to the concerned Adjudicating Authority.

6. The Special Director (Appeals) shall have the same powers of a civil court which are conferred on the Appellate Tribunal under sub-section (2) of Section 28 and;

(a) all proceedings before him shall be deemed to be judicial proceedings within the meaning of Sections 193 and 228 of the Indian Penal Code;

(b) shall be deemed to be a civil court for the purposes of Sections 345 and 346 of the Code of Criminal Procedure, 197.

Question 43.

Explain the Procedure of attachment of Property involved in money laundering.

Answer:

Attachment of property involved in money-laundering (Section 5)

1. Where the Director or any other officer not below the rank of Deputy Director authorised by the Director for the purposes of this section, has reason to believe (the reason for such belief to be recorded in writing), on the basis of material in his possession, that:

(a) any person is in possession of any proceeds of crime; and

(b) such proceeds of crime are likely to be concealed, transferred or dealt with in any manner which may result in frustrating any proceedings relating to confiscation of such proceeds of crime under this Chapter, he may, by order in writing, provisionally attach such property for a period not exceeding one hundred and eighty days from the date of the order, in such manner as may be prescribed:

Provided that no such order of attachment shall be made unless, in relation to the scheduled offence, a report has been forwarded to a Magistrate under Section 173 of the Code of Criminal Procedure, 1973 (2 of 1974), or a complaint has been filed by a person authorised to investigate the offence mentioned in that Schedule, before a Magistrate or court for taking cognizance of the scheduled offence, as the case may be, or a similar report or complaint has been made or filed under the corresponding law of any other country:

Provided further that, notwithstanding anything contained in first proviso, any property of any person may be attached under this section if the Director or any other officer not below the rank of Deputy Director authorised by him for the purposes of this section has reason to believe (the reasons for such belief to be recorded in writing), on the basis of material in his possession, that if such property involved in money-laundering is not attached immediately under this Chapter, the non-attachment of the property is likely to frustrate any proceeding under this Act.

Provided also that for the purposes of computing the period of one hundred and eighty days, the period during which the proceedings under this section is stayed by the High Court, shall be excluded and a further period not exceeding thirty days from the date of order of vacation of such stay order shall be counted.;

2. The Director, or any other officer not below the rank of Deputy Director, shall, immediately after attachment under sub-section (1), forward a copy of the order, along with the material in his possession, referred to in that sub-section, to the Adjudicating Authority, in a sealed envelope, in the manner as may be prescribed and such Adjudicating Authority shall keep such order and material for such period as may be prescribed.

3. Every order of attachment made under sub-section (1) shall cease to have effect after the expiry of the period specified in that sub-section or on the date of an order made under [sub-section (3)] of Section 8, whichever is earlier.

4. Nothing in this section shall prevent the person interested in the enjoyment of the immovable property attached under sub-section (1) from such enjoyment.

Explanation:

For the purposes of this sub-section, “person interested”, in relation to any immovable property, includes all persons claiming or entitled to claim any interest in the property.

5. The Director or any other officer who provisionally attaches any property under sub-section (1) shall, within a period of thirty days from such attachment, file a complaint stating the facts of such attachment before the Adjudicating Authority.

![]()

Adjudication, Prosecutions, Offences and Penalties Notes

Adjudication of penalties Section 454:

1. The Central Government may, by an order published in the Official Gazette, appoint as many officers of the Central Government, not below the rank of Registrar, as adjudicating officers for adjudging penalty under the provisions of this Act in the manner provided by the Companies (Adjudication of Penalties) Rules, 2014.

2. The Central Government shall while appointing adjudicating officers, specify their jurisdiction in the order under sub-section (1).

3. The adjudicating officer may, by an order-

(a) impose the penalty on the company, the officer who is in default, or any other person, as the case may be, stating therein any non-compliance or default under the relevant provisions of this Act; and

(b) direct such company, or officer who is in default, or any other person, as the case may be, to rectify the default, wherever he considers fit.

Provided that in case the default relates to non-compliance of sub-section

4. of section 92 or sub-section (1) or sub-section (2) of section 137 and such default has been rectified either prior to, or within thirty days of, the issue ofthe notice by the adjudicating officer, no penalty shall be imposed in this regard and all proceedings under this section in respect of such default shall be deemed to be concluded.

Offences under the Act:

- Except for 35 instances of defaults listed herein, all other acts or omissions under the Act have been classified as offences punishable with a) fine only, or b) fine or imprisonment, or c) fine or imprisonment or both, or d) imprisonment only or e) fine and imprisonment as may be prescribed under the relevant sections.