Students should practice Valuation of Goodwill & Shares – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Valuation of Goodwill & Shares – Corporate and Management Accounting MCQ

Question 1.

If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion?

(A) The stock has a low level of risk.

(B) The stock offers a high dividend payout ratio.

(C) The market is undervaluing the stock.

(D) The market is overvaluing the stock.

Answer:

(D) The market is overvaluing the stock.

Question 2.

Market-based methods of valuation should not be adopted when –

(A) When business is too small

(B) When assets are less than liabilities of the business

(C) In case of significant and unusual fluctuations in market price

(D) It is difficult to estimate the realizable value in case of going concerned.

Answer:

(C) In case of significant and unusual fluctuations in market price

Question 3.

Market value method is generally the most preferred method in case of –

(A) Frequently traded shares of companies listed on stock exchanges having nationwide trading

(B) Valuation of a division of a company

(C) Where the share are not listed or are thinly traded

(D) Where there is an intention to liquidate it and to realize the assets and distribute the net proceeds.

Answer:

(A) Frequently traded shares of companies listed on stock exchanges having nationwide trading

Question 4.

Which of the following is required to be taken into consideration while valuing equity shares of the company?

(A) Size of the block of shares

(B) Restricted transferability aspect

(C) Dividends

(D) All of the above

Answer:

(D) All of the above

Question 5.

Which of the following shall not be taken into consideration while calculating Capital Employed?

(A) Discount on issue of debentures

(B) Preliminary expenses

(C) Fictitious assets

(D) All of the above

Answer:

(D) All of the above

Question 6.

Goodwill is –

(A) Intangible asset

(B) Valuable asset

(C) Non-current asset

(D) All of the above

Answer:

(D) All of the above

Question 7.

Net asset value per share is also known as –

(A) Internal value per share

(B) Intrinsic value per share

(C) Economic value per share

(D) Recoverable value per share

Answer:

(B) Intrinsic value per share

Question 8.

Which of the following is deducted while calculating net assets available to equity shareholders?

(A) Proposed preference dividend

(B) Share suspense account

(C) Know-how

(D) Non-trading investment

Answer:

(A) Proposed preference dividend

Question 9.

Statement I:

Net Asset Method can be fairly used to value shares when the firm is liquidated.

Statement II:

This method does not give any weight to earning capacity of the company.

Select the correct answer from the options given below:

(A) Statement I is correct but State-ment II is incorrect

(B) Statement I is incorrect but Statement II is correct

(C) Both Statement I and Statement II are incorrect

(D) Both Statement I and Statement II are correct

Answer:

(D) Both Statement I and Statement II are correct

Question 10.

In which of the following cases valuation is essential?

(A) Conversion of debt instruments into shares.

(B) On directions of Tribunal or Authority or Arbitration Tribunals.

(C) When issuing shares to the public either through an Initial Public Offer or by the offer for sale.

(D) All of the above

Answer:

(D) All of the above

Question 11.

While deciding net asset value, fictitious assets –

(A) Should be considered

(B) Should not be considered

(C) Added to total assets

(D) Valued separately

Answer:

(B) Should not be considered

Question 12.

For which one or more of the following reasons is the recognition as an asset of an internally generated intangible prohibited? ,

(a) Because there may not be an active market for that asset.

(b) Because its cost is usually relatively insignificant.

(c) Because it is difficult to reliably identify the related costs

(d) Because it is difficult to establish the probability of flow of economic benefits

Select the correct answer from the options given below.

(A) (a) & (b)

(B) (c) & (d)

(C) (b) & (c)

(D) (b) & {d)

Answer:

(B) (c) & (d)

Question 13.

When controlling shares are to be sold then which of the following will be the appropriate base for valuation of shares:

(A) Rate of dividend

(B) Rate of earning

(C) Rate of gross profit

(D) Rate of risk-free return

Answer:

(B) Rate of earning

Question 14.

Fair value is the average of the –

(A) Intrinsic value and yield value

(B) Internal value and external value

(C) Capitalized value and earning value

(D) Notional value and book value

Answer:

(A) Intrinsic value and yield value

Question 15.

As per the valuation of equity shares based on the price-earnings ratio, the shares are valued on the basis of __ multiplied by the price-earnings ratio.

(A) Dividend per share

(B) Earnings per share

(C) Bonus per share

(D) Interest per share

Answer:

(B) Earnings per share

Question 16.

The market value of share =

(A) DPS × EPS

(B) P/E Ratio × DPS

(C) P/E Ratio × EPS

(D) (P/E Ratio ÷ EPS) × 100

Answer:

(C) P/E Ratio × EPS

Question 17.

Which of the following Accounting Standard deals with Intangible Assets?

(A) AS-22

(B) AS-24

(C) AS-26

(D) AS-28

Answer:

(C) AS-26

Question 18.

As per AS-26, there is a rebuttable presumption that the useful life of an intangible asset will not exceed___from the date when the asset is available for use.

(A) Ten years

(B) Five years

(C) Eight years

(D) Six years

Answer:

(A) Ten years

Question 19.

If control over the future economic benefits from an intangible asset is achieved through legal rights that have been granted for a finite period, the useful life of the intangible asset should not exceed the period of the legal rights unless:

(A) The legal rights are renewable and

(B) Renewal is virtually certain.

(C) Both (A) and (B)

(D) Neither (A) nor (B)

Answer:

(C) Both (A) and (B)

Question 20.

As per AS-26, the intangible asset can be recognized at –

(A) Research phase

(B) Development Phase

(C) Both (A) and (B)

(D) Either (A) or (B)

Answer:

(B) Development Phase

Question 21.

As per AS-26, expenditure on research or on the research phase of an internal project should be recognized when it is incurred.

(A) An Asset

(B) An expense

(C) Profit

(D) Liability

Answer:

(B) An expense

Question 22.

Which of the following is NOT the method of valuation of Goodwill?

(A) Average profit Method

(B) Super profit Method

(C) Capitalization Method

(D) Straight-line Method

Answer:

(D) Straight-line Method

Question 23.

Super profit means –

(A) Future maintainable profit minus the normal return

(B) Weighted Average Profit

(C) Future maintainable profit minus net profit earned by the business

(D) Normal return plus PAT

Answer:

(A) Future maintainable profit minus the normal return

Question 24.

In the balance sheet shares appears at___

(A) Face value

(B) Adjusted market value

(C) Market price

(D) Paid-up value

Answer:

(D) Paid-up value

Question 25.

Which of the following is not required while calculating yield value per share?

(A) Expected return rate

(B) Normal return rate

(C) Superprofit

(D) Paid-up value per share

Answer:

(C) Superprofit

Question 26.

The profits of last 5 years are ₹ 60,000; ₹ 67,500; ₹ 52,500; ₹ 75,000 & ₹ 60,000. Find the value of goodwill, if it is calculated on average profits of last 5 years on the basis of 3 years of purchase.

(A) ₹ 63,750

(B) ₹ 1,91,250

(C) ₹ 1,89,000

(D) ₹ 2,13,750

Hint:

Average Profit = \(\frac{60,000+67,500+52,500+75,000+60,000}{5}\) = 63,000

Goodwill = Average Profit × No. of years purchases

= 63,000 × 3

= 1,89,000

Answer:

(C) ₹ 1,89,000

Question 27.

It is agreed that goodwill of the company is to be valued at 3 years purchase of average profits for the last 5 years.

| Year ended | Profit/(loss) ₹ in ‘000 |

| 31st March 2015 | 16,110 |

| 31st March 2016 | 11,850 |

| 31st March 2017 | 8,145 |

| 31st March 2018 | (600) |

| 31st March 2019 | 12,750 |

Value of goodwill will be –

(A) ₹ 28,953 thousand

(B) ₹ 29,673 thousand

(C) ₹ 28,673 thousand

(D) ₹ 29,953 thousand

Answer:

(A) ₹ 28,953 thousand

Question 28.

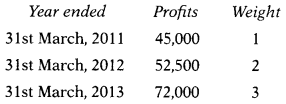

It is agreed that goodwill of the firm is valued at 2 years purchase of weighted average profits for the last 3 years.

Value of goodwill will be –

(A) ₹ 1,22,000

(B) ₹ 2,22,000

(C) ₹ 1,22,222

(D) ₹ 1,20,000

Hint:

Average Profit = \(\frac{16,110+11,850+8,145 \cdot 600+12,750}{5}\)= 9,651 thousand

Goodwill = Average Profit × No. of years purchases

= 9,651 × 3

= 28,953 thousand

Answer:

(A) ₹ 1,22,000

Question 29.

Find the goodwill of the company from the following information:

Total Capital Employed = ₹ 8,00,000

Reasonable Rate of Return = 15%

Profits for the year = ₹ 12,00,000

Use capitalization method.

(A) ₹ 82,00,000

(B) ₹ 12,00,000

(C) ₹ 72,00,000

(D) ₹ 42,00,000

Hint:

Goodwill = [\(\frac{\text { Future maintainable profit }}{\text { Normal rate return }}\) × 100] – Capital Employed

= [\(\frac{12,00,000}{15}\) × 100] – 8,00,000

= 72,00,000

Answer:

(C) ₹ 72,00,000

Question 30.

Find the goodwill from the following information:

Capital employed – ₹ 11,00,000

Rate of normal return – 10%

Future Maintainable profit – ₹ 2,00,000 No. of year purchases – 3 years

(A) ₹ 6,00,000

(B) ₹ 2,70,000

(C) ₹ 9,00,000

(D) ₹ 3,70,000

Hint:

| Future maintainable profit | 2,00,000 |

| Less: Normal return (11,00,000 × 10%) | (1,10,000) |

| Super profit | 90,000 |

Goodwill = Super profit × No. of years purchases

= 90,000 × 3

= 2,70,000

Answer:

(B) ₹ 2,70,000

Question 31.

Find the goodwill of the firm using the capitalization method from the following information:

Capital employed = ₹ 4,80,000.

Rate of normal return = 15%.

Profits for the year = ₹ 90,000

(A) ₹ 4,20,000

(B) ₹ 3,11,000

(C) ₹ 1,20,000

(D) ₹ 2,20,000

Hint:

Goodwill = [\(\frac{\text { Future maintainable profit }}{\text { Normal rate return }}\) × 100] – Capital employed

= [\(\frac{90,000}{15}\) × 100] – 4,80,000

= 1,20,000

Answer:

(C) ₹ 1,20,000

Question 32.

The average profit of a firm is ₹ 1,20,000. The rate of capitalization is 12%. Assets and liabilities of the company are ₹ 10,00,000 & ₹ 4,25,000 respectively.

(A) ₹ 3,25,000

(B) ₹ 2,25,000

(C) ₹ 5,25,000

(D) ₹ 4,25,000

Hint:

Assets – Liabilities = Capital employed

10,00,000 – 4,25,000 = 5,75,000

Goodwill = [\(\frac{\text { Future maintainable profit }}{\text { Normal rate return }}\) × 100] – Capital employed

= [\(\frac{1,20,000}{12}\) × 100] – 5,75,000

= 4,25,000

Answer:

(D) ₹ 4,25,000

Question 33.

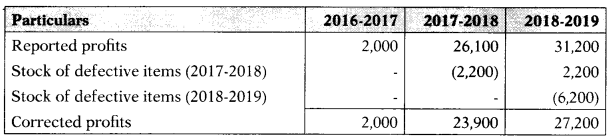

The profits for 2016-2017 is ₹ 2,000; for 2017-2018 is ₹ 26,100 and for 20182019 is ₹ 31,200. Closing stock for 2017-2018 and 2018-2019 includes the defective items of ₹ 2,200 and ₹ 6,200 respectively which were considered as having market value nil. Calculate goodwill on the average profit method.

(A) ₹ 23,700

(B) ₹ 17,700

(C) ₹ 13,700

(D) ₹ 17,300

Hint:

Note: Closing stock of one year is opening stock of next year. In next year it will be added

Averagc profit = \(\frac{2,000+23,900+27,200}{3}\)= 17,700

Goodwill = Average profit (As no. of year purchase is not given)

Answer:

(B) ₹ 17,700

Question 34.

A company has a total capital investment of ₹ 3,60,000. The company earned net profit during the last four years as ₹ 56,000, ₹ 64,000, ₹ 96,000 & ₹ 80,000. The fair return on the net capital employed is 15%. Value of goodwill if it is based on 3 years purchase of the average super-profits of past 4 years.

(A) ₹ 37,500

(B) ₹ 50,000

(C) ₹ 60,000

(D) ₹ 40,000

Answer:

(C) ₹ 60,000

Question 35.

Find the goodwill from the following information:

Capital employed – ₹ 8,25,000

Rate of normal return – 10%

Future Maintainable profit – ₹ 1,50,000

Annuity factor – 3.17

(A) ₹ 4,75,500

(B) ₹ 2,61,525

(C) ₹ 3,13,975

(D) ₹ 2,13,975

Hint:

| Future maintainable profit | 1,50,000 |

| Less. Normal return (8,25,000 × 10%) | (82,500) |

| Super profit | 67,500 |

Goodwill = Super profit × Annuity Factor

= 67,500 × 3.17

= 2,13,975

Answer:

(D) ₹ 2,13,975

Question 36.

The net profits after tax of Z Ltd. for the past 5 years are as follows:

| Year | Profit |

| 2007-2008 | 2,56,000 |

| 2008-2009 | 2,64,000 |

| 2009-2010 | 3,76,000 |

| 2010-2011 | 4,86,000 |

| 2011-2012 | 5,30,500 |

The capital employed is ₹ 16,00,000. The rate of normal return is 15%. Calculate the value of the goodwill on the basis of the annuity method on a super-profits basis, taking the present value of an annuity of ₹ 1 for the 4 years at 15% as ₹ 2.855.

(A) ₹ 7,65,000

(B) ₹ 8,67,800

(C) ₹ 5,70,000

(D) ₹ 4,06,838

Hint:

| Future maintainable profit | 3,82,500 |

| Normal return (16,00,000 × 15%) | (2,40,000) |

| Super profit | 1,42,500 |

Goodwill = 1,42,500 × 2.855 = 4,06,838

Answer:

(D) ₹ 4,06,838

Question 37.

The following particulars are available in respect of the business carried on by X Ltd.:

You are required to compute the value of goodwill on the basis of 5 years purchase of average profit.

(A) ₹ 1,25,000

(B) ₹ 1,50,000

(C) ₹ 10,000

(D) ₹ 1,20,000

Hint:

Goodwill = 30,000 × 5 = 1,50,000

Answer:

(B) ₹ 1,50,000

Question 38.

The net profits after tax of NZ & Co. for the past 3 years are as follows:

| Year | Profit (₹) |

| 2010-2011 | 20,000 |

| 2011-2012 | 2,61,000 |

| 2012-2013 | 3,12,000 |

Closing stock for 2011-2012 and 20122013 includes the defective items of ₹ 22,000 and ₹ 62,000 respectively which were considered as having no market value. Calculate goodwill on the average profit method.

(A) ₹ 2,37,000

(B) ₹ 1,77,000

(C) ₹ 1,37,000

(D) ₹ 1,73,000

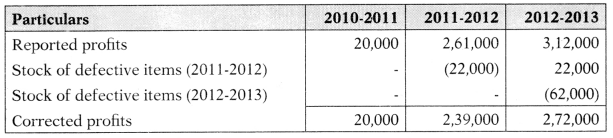

Hint:

Note: Closing stock of one year is opening stock of next year. In next year it will be added.

Average profit = \(\frac{20,000+2,39,000+2,72,000}{3}\) = 1,77,000

Goodwill = Average profit (As no. of year purchase is not given)

Answer:

(B) ₹ 1,77,000

Question 39.

Profits & losses for the last years are:

2011- 2012 Losses ₹ 10,000

2012- 2013 Losses ₹ 2,500

2013- 2014 Profits ₹ 98,000

2014- 2015 Profits ₹ 76,000

The average capital employed in the business is ₹ 2,00,000. The rate of interest expected from capital invested is 12%. The remuneration of partners is estimated to be ₹ 1,000 per month. Calculate the value of goodwill on the basis of four years purchase of super-profits based on the annuity of the four years. Take discounting rate as 10%.

(A) ₹ 13,500

(B) ₹ 13,568

(C) ₹ 13,668

(D) ₹ 13,868

Hint:

| Future maintainable profit | 40,375 |

| Remuneration of partners | (12,000) |

| Normal return (2,00,000 × 12%) | (24,000) |

| Super profit | 4,375 |

Goodwill = 4,375 × 3.1698 = 13,868

Answer:

(D) ₹ 13,868

Question 40.

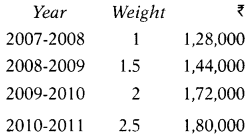

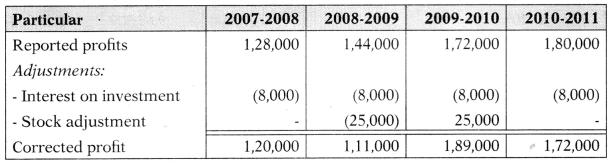

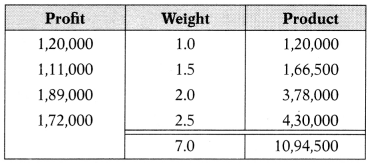

The following information is available for N Ltd.:

Capital employed is ₹ 5,40,000. A standard rate of return on capital employed in this type of business is 12%. The above net profit included a fixed income on non-trading investment of ₹ 8,000 per year. At the end of the year, 2008-2009 closing stock was overvalued by ₹ 25,000. Calculate goodwill on a weighted average super profit basis at 3 years of purchase. Ignore taxation.

(A) ₹ 2,74,671

(B) ₹ 2,47,671

(C) ₹ 2,74,167

(D) ₹ 2,47,716

Hint:

Normal return = 5,40,000 × 12% = 64,800

Weighted average profit = \(\frac{10,94,500}{7}\) = 1,56,357

| Future maintainable profit | 1,56,357 |

| (-) Normal return | (64,800) |

| Super profit | 91,557 |

Goodwill = Super profit × No. of years purchases

= 91,557 × 3

= 2,74,671

Answer:

(A) ₹ 2,74,671

Question 41.

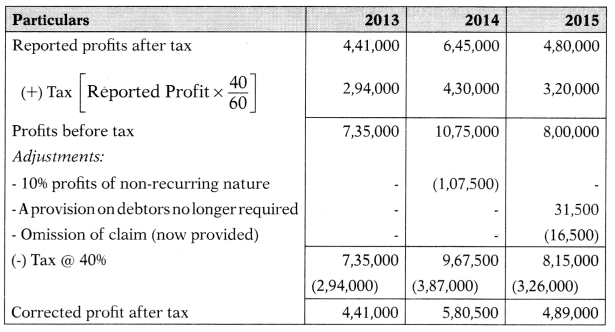

Profit after tax of Z Ltd. for the 3 financial years are as follows:

| 2013 | ₹ 4,41,000 |

| 2014 | ₹ 6,45,000 |

| 2015 | ₹ 4,80,000 |

Capital employed is ₹ 29,25,000. The normal rate of return is 10%. The tax rate is 40%. 10% of profits for the year 2014 arose from a transaction of non-recurring nature. A provision of ₹ 31,500 on sundry debtors was made in the financial year 2005 which is no longer required. A claim of ₹ 16,500 is to be provided against profit for the year 2015. Goodwill may be calculated at 3 times adjusted average profits of 3 years.

(A) ₹ 6,33,000

(B) ₹ 15,10,500

(C) ₹ 7,22,667

(D) ₹ 15,50,100

Hint:

Normal return = 29,25,000 × 10% = 2,92,500

Average profit = \(\frac{4,41,000+5,80,500+4,89,000}{3}\) = 5,03,500

Goodwill = Adjusted average profits × No. of years purchases

= 5,03,500 × 3 = 15,10,500

Answer:

(B) ₹ 15,10,500

Question 42.

The average net profit before adjustments is ₹ 5,14,000. Profit includes interest at 8% on non-trading investments. The cost of these investments is ₹ 1,98,200 while the face value is ₹ 2,00,000. Expenses amounting to ₹ 7,000 per annum are likely to be discontinued in the future. The provision for income tax to be made at 30%. The normal rate of return may be taken at 10%. The average capital employed in the business (including investments) is ₹ 18,98,200. Assuming 4 years purchase of super-profits, what is the value of goodwill?

(A) ₹ 7,43,000

(B) ₹ 8,34,000

(C) ₹ 7,34,000

(D) ₹ 8,43,000

Answer:

(C) ₹ 7,34,000

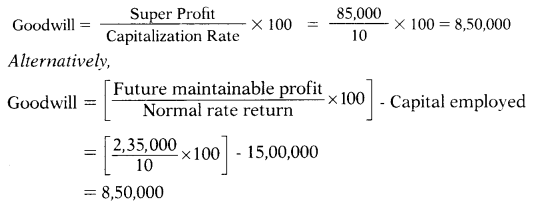

Question 43.

The average net profit of a business as adjusted for valuation of goodwill amounted to ₹ 2,35,000. Net tangible assets employed were of the value of ₹ 4,50,000. But upon valuation, they amounted to ₹ 15,00,000. Assuming that 10% represented a fair commercial return, the value of goodwill by capitalizing super-profits will be___

(A) ₹ 8,75,000

(B) ₹ 8,25,000

(C) ₹ 8,90,000

(D) ₹ 8,50,000

Hint:

| Future Maintainable Profit | 2,35,000 |

| (-) Normal return (15,00,000 × 10%) | (1,50,000) |

| Super profit | 85,000 |

Answer:

(D) ₹ 8,50,000

Question 44.

From the following particulars, calculate goodwill on the basis of 3 years purchase of super-profits:

Capital employed: ₹ 50,000

Trading profit (after tax):

2011: ₹ 12,200

2012: ₹ 15,000

2013: ₹ 2,000 (loss)

2014: ₹ 21,000

The normal rate of interest on investment 10% p.a. Remuneration from alternative employment: ₹ 3,600 p.a. (included in above profit).

(A) ₹ 10,250

(B) ₹ 8,850

(C) ₹ 7,450

(D) ₹ 12,350

Hint:

Average Profit = \(\frac{12,200+15,000-2,000+21,000}{4}\) = 11,550

| Future Maintainable Profit (i.e. Average Profit) | 11,550 |

| (-) Remuneration from alternative employment | (3,600) |

| (-) Normal Return (50,000 × 10%) | (5,000) |

| Super Profit | 2,950 |

Goodwill = Average Profit × No. of years purchases

= 2,950 × 3

= 8,850

Answer:

(B) ₹ 8,850

Question 45.

Compute the amount of goodwill based on 3 years purchase of super profit from the following:

Future maintainable profit after tax: ₹ 15,00,000;

Normal pre-tax rate of return: 20%;

Capital employed: ₹ 60,00,000; Tax rate: 30%

(A) ₹ 12,30,000

(B) ₹ 21,40,000

(C) ₹ 19,80,000

(D) ₹ 14,70,000

Answer:

(C) ₹ 19,80,000

Question 46.

Total assets of X Ltd. are ₹ 10,00,000 and total liabilities are ₹ 4,00,000. Expert valued goodwill of the company at ₹ 2,00,000. The company has two types of equity shares:

50,000 shares of ₹ 10 each fully paid-up

50,000 shares of ₹ 10 each, ₹ 7 paid up.

Intrinsic value per share of ₹ 7 paid- up is:

(A) ₹ 3.5

(B) ₹ 4.5

(C) ₹ 6.5

(D) ₹ 7.5

Hint:

| Capital employed (10,00,000 – 6,00,000) | 4,00,000 |

| (+) Goodwill | 2,00,000 |

| (+) Notional call (50,000 × 3) | 1,50,000 |

| Net assets available to equity shareholder | 7,50,000 |

Note: In the case of ₹ 10 but ₹ 7 paid-up shares 100% has been taken as notional call ₹ 3 has been considered while calculating “’ Net Assets” hence shares are fully paid-up.

Intrinsic value per share = \(\frac{\text { Net assets }}{\text { No. of shares }}\)

₹ 10 fullv paid-up = \(\frac{7,50,000}{1,00,000}\) = 7.5

₹ 10 share, ₹ 7 paid-up = 7.5 – 3 = 4.5

Answer:

(B) ₹ 4.5

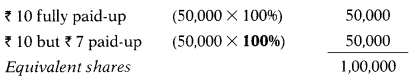

Question 47.

The profit available for equity share-holder of JK Ltd. is ₹ 1,27,500. The company has two types of equity shares:

50,000 shares of ₹ 10 each fully paid-up

50,000 shares of 10 each, ₹ 7 paid up.

Other companies in the same industries pay dividends @ 20%.

Yield value per share of ₹ 7 paid-up share is –

(A) 4.50 per share

(B) 6.25 per share

(C) 5.25 per share

(D) 3.50 per share

Hint:

Paid-up equity share capital = (50,000 × 10) + (50,000 × 7) = 8,50,000

Answer:

(C) 5.25 per share

Question 48.

Total assets of X Ltd. are ₹ 23,00,000 and total liabilities are ₹ 12,00,000. Expert valued goodwill of the company at ₹ 6,50,000. The company has two types of equity shares:

25.000 shares of ₹ 10 each fully paid-up

25.000 shares of ₹ 5 each, ₹ 3 paid-up.

Intrinsic value per share of ₹ 3 paid- up is:

(A) ₹ 22 per share

(B) ₹ 8 per share

(C) ₹ 6 per share

(D) ₹ 4 per share

Hint:

| Capital employed (23,00,000 – 12,00,000) | 11,00,000 |

| (+) Goodwill | 6,50,000 |

| (+) Notional call (25,000 × 2) | 50,000 |

| Net assets available to equity shareholder | 18,00,000 |

Note: In case of ₹ 5 but ₹ 2 paid-up shares notional call ₹ 2 has been considered while calculating “Net Assets” hence shares are fully paid-up i.e. ₹ 5. However, the face of these shares is half of the face values of other shares; hence 50% shares in terms of ₹ 10 paid-up shares will have to be taken.

Net assets

Intrinsic value per share =

₹ 10 fullv paid-up = = 48

₹ 5 fully paid-up = 48 × 5/10 = 24

₹ 5 but ₹ 3 paid-up = 24 – 2 = 22

Answer:

(A) ₹ 22 per share

Question 49.

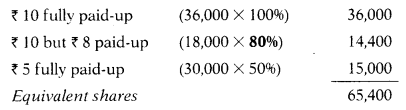

Total assets of X Ltd. are ₹ 5,00,000 and total liabilities are ₹ 2,00,000. The company has three types of equity shares:

36,000 shares of ₹ 10 each fully paid-up

18,000 shares of ₹ 10 each, ₹ 8 paid up.

30,000 shares of ₹ 5 each, ₹ 5 paid up.

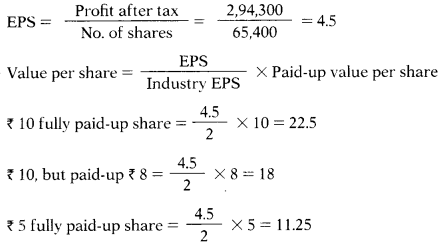

The company has earned ₹ 2,94,300 as profit after tax, which can be considered to be normal for the company. Average

EPS for a fully paid share of ₹ 10 of a Company in the same industry in ₹ 2.

Value per share on EPS basis of 30,000 shares of 10 each, ₹ 5 paid-up is –

(A) ₹ 22.5 per share

(B) ₹ 11.25 per share

(C) ₹ 18 per share

(D) ₹ 17.5 per share

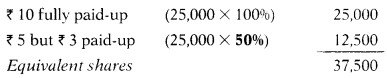

Hint:

As there are different types of shares ₹ 10, ₹ 8 & ₹ 5, we have to convert it into ₹ 10 shares as follows:

Note: In the case of ₹ 10 but ₹ 8 paid-up shares, 80% has been taken as notional call ₹ 2 has not been considered hence shares are partly paid-up.

Answer:

(B) ₹ 11.25 per share

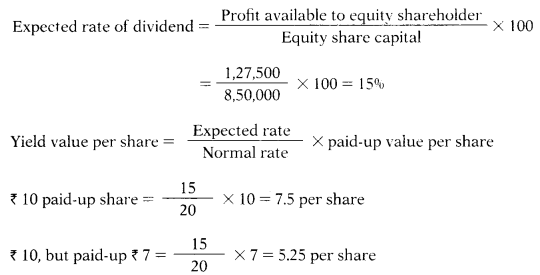

Question 50.

The capital Structure of SZ Ltd. is as follows:

| Types of capital | ₹ |

| 2,500 Equity shares (₹ 10) fully paid-up | 25,000 |

| 2,500 Equity shares of (₹ 10) paid-up | ₹ 8 20,000 |

| 2,500 Equity shares of (₹ 10) paid-up | ₹ 6 15,000 |

| 12% Debentures paid-up | 5,000 |

| 100, 9% Preference shares (₹ 100) | 10,000 |

| Expected profit per year before interest & tax: | ₹ 30,600 |

Rate of tax: 40%

Transfer to reserve: 10% of profit

The normal rate of dividend: 15%

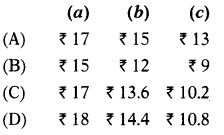

What is value per share as per yield method for

(a) ₹ 10 fully paid-up shares

(b) ₹ 8 paid-up shares

(c) ₹ 6 paid-up shares?

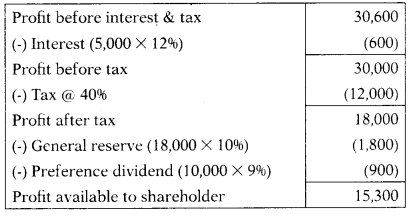

Hint:

Expected rate of dividend = \(\frac{\text { Profit available to equity shareholder }}{\text { Equity share capital }}\) × 100

= \(\frac{15,300}{60,000}\) × 100 = 25.5%

Yield value per share = \(\frac{\text { Expected rate }}{\text { Normal rate }}\) × Paid-up value per share

₹ 10 paid-up share = \(\frac{25.5}{15}\) × 10 = 17

₹ 8 paid-up share = \(\frac{25.5}{15}\) × 8 = 13.6

₹ 6 paid-up share = \(\frac{25.5}{15}\) × 6 = 10.2

Answer:

(C)