Students should practice Dividend Policy – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Dividend Policy – Financial and Strategic Management MCQ

Dividend Policy Determines MCQ Question 1.

Dividend policy determines___

(A) What portion of earnings will be paid out to stockholders

(B) What portion will be retained in the business to finance long-term growth.

(C) Only (A) not (B)

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

MCQ On Dividend Policy Question 2.

Dividend constitutes the cash flow that accrues to –

(A) Holders

(B) Equity holders

(C) Bondholders

(D) All of the above

Answer:

(B) Equity holders

Financial Management MCQ

- Nature & Scope of Financial Management MCQ

- Working Capital Management MCQ

- Receivable Management MCQ

- Inventory Management MCQ

- Management of Cash & Marketable Securities MCQ

- Leverages MCQ

- Capital Structure Decisions MCQ

- Cost of Capital MCQ

- Capital Budgeting MCQ

- Dividend Policy MCQ

- Security Analysis & Portfolio Management MCQ

- Chapter 12 Project Finance & Types of Financing MCQ

Dividend Policy MCQs With Answers Question 3.

Which of the following factor will affect the dividend policy of the firm?

1. Insufficiency of cash

2. Firms contractual obligation

3. Ratio of debt to equity.

4. Business cycle considerations

Select the correct answer from the options given below.

(A) 1 and 3 only

(B) 2 and 4 only

(C) 2, 3 and 4

(D) 1,2, 3 and 4

Answer:

(D) 1,2, 3 and 4

Dividend Policy MCQ Question 4.

Retained earnings are –

(A) An indication of a company’s liquidity.

(B) The same as cash in the bank.

(C) Not important when determining dividends.

(D) The cumulative earnings of the company after dividends.

Answer:

(D) The cumulative earnings of the company after dividends.

Dividend Decision MCQ Question 5.

In retention growth model, percent of net income firms usually payout as shareholders dividends, is classified as –

(A) Payout ratio

(B) Payback ratio

(C) Growth retention ratio

(D) Present value of the ratio

Answer:

(A) Payout ratio

MCQ On Dividend Decision Question 6.

Which of the following is an argument for the relevance of dividends?

(A) Informational content.

(B) Reduction of uncertainty.

(C) Some investor’s preferences for current income.

(D) All of the above.

Answer:

(D) All of the above.

MCQs On Dividend Policy Question 7.

As per Modigliani-Miller hypothesis of dividend irrelevance price of share at year zero is –

(A) D0 + P0/1+Ke

(B) (D1 + P1) × (1 + Ke)

(C) D1 + P1/1 + Ke

(D) 1 – (D0 + P0) ÷ Ke

Answer:

(C) D1 + P1/1 + Ke

Question 8.

All of the following are true of stock splits except:

(A) Market price per share is reduced after the split.

(B) The number of outstanding shares is increased.

(C) Retained earnings are changed.

(D) Proportional ownership is unchanged.

Answer:

(C) Retained earnings are changed.

Question 9.

Which of the following techniques does not reward shareholders for investing in a company?

(A) Repurchasing company shares

(B) Offering non-pecuniary benefits

(C) Making a rights issue

(D) Offering a scrip dividend

Answer:

(C) Making a rights issue

Question 10.

Forecast by analysts, retention growth model and historical growth rates are methods used for an –

(A) Estimate future growth

(B) Estimate option future value

(C) Estimate growth ratio

(D) Estimate option present value

Answer:

(A) Estimate future growth

Question 11.

The repurchase of stock is considered a decision rather than a decision.

(A) An investment; a financing

(B) Financing; an investment

(C) An investment; a dividend

(D) A dividend; a financing

Answer:

(B) Financing; an investment

Question 12.

If OML Corporation buyback 10% of its outstanding common stock from the secondary market, the result would be –

(A) A decline in EPS.

(B) An increase in cash.

(C) A decrease in total assets.

(D) An increase in the number of stockholders.

Answer:

(C) A decrease in total assets.

Question 13.

Historical growth rates, analysis forecasts, and retention growth model are approaches to estimate:

(A) the Net present value of gain

(B) Growth rate

(C) Growth gain

(D) Discounted gain

Answer:

(B) Growth rate

Question 14.

The primary goal of a publicly-owned firm interested in serving its stockholders should be to

(A) Maximize expected total corporate profit

(B) Maximize expected EPS

(C) Maximize the stock price per share

(D) Maximize expected net income.

Answer:

(C) Maximize the stock price per share

Question 15.

A decrease in a firm’s willingness to pay dividends is likely to result from an increase in its –

(A) Earnings stability

(B) Access to capital markets

(C) Profitable investment opportunities

(D) Collection of accounts receivable.

Answer:

(C) Profitable investment opportunities

Question 16.

The payout ratio is subtracted from one to calculate –

(A) Growth ratio

(B) Present value ratio

(C) Retention ratio

(D) Future value ratio

Answer:

(C) Retention ratio

Question 17.

Which of the following would not have an influence on the optimal dividend policy?

(A) The possibility of accelerating or delaying investment projects.

(B) A strong shareholders’ preference for current income versus capital gains.

(C) The costs associated with selling new common stock.

(D) All of the statements above can have an effect on dividend policy.

Answer:

(D) All of the statements above can have an effect on dividend policy.

Question 18.

A stock split will cause a change in the total amounts shown in which of the following balance sheet accounts?

(A) Cash

(B) Common stock

(C) Paid-in capital

(D) None of the above

Answer:

(D) None of the above

Question 19.

You currently own 100 shares of stock in Baba Ltd. Does the stock currently trade at ₹ 120 a share? The company is contemplating a 2:1 stock split. Which of the following best describes your position after the proposed stock split takes place?

(A) You will have 200 shares of stock, and the stock will trade at or near ₹ 120 a share.

(B) You will have 200 shares of stock, and the stock will trade at or near ₹ 60 a share.

(C) You will have 100 shares of stock, and the stock will trade at or near ₹ 60 a share.

(D) You will have 50 shares of stock, and the stock will trade at or near ₹ 60 a share.

Answer:

(B) You will have 200 shares of stock, and the stock will trade at or near ₹ 60 a share.

Question 20.

Consider the following two statements:

(1) Buyback can be used by companies to defend against hostile takeovers since they increase the proportion of debt in a firm’s capital structure.

(2) After a 3-for-l stock split, a company’s price per share will fall and its number of shares outstanding will rise total value remaining the same.

Which of the above statement is correct?

(A) (2) only

(B) Neither (1) nor (2)

(C) (1) only

(D) Both (1) and (2)

Answer:

(D) Both (1) and (2)

Question 21.

The dividend growth model can be used to compute the cost of equity for a firm in which of the following situations?

I. Firms that have a 100% retention ratio.

II. Firms that pay a constant dividend.

III Firms that pay an increasing dividend

IV. Firms that pay a decreasing dividend.

Select the correct answers from the options given below.

(A) I & II only

(B) II & III only

(C) II, III & IV only

(D) I, II & III only

Answer:

(C) II, III & IV only

Question 22.

If markets are in equilibrium, which of the following will occur:

(A) Each investment’s expected return should equal its realized return.

(B) Each investment’s expected return should equal its required return.

(C) Each investment should have the same realized return.

(D) All of the statements above are correct.

Answer:

(B) Each investment’s expected return should equal its required return.

Question 23.

Regular Dividend Policy means___

(A) Investors get dividends at the usual rate.

(B) Reserve fund is created to pay a fixed amount of dividend.

(C) Payment of low dividend per share constantly plus extra dividend in the year when the company earns a high profit.

(D) All of the above

Answer:

(A) Investors get dividends at the usual rate.

Question 24.

Which of the following examples best represents a passive dividend policy?

(A) The firm sets a policy such that the proportion of dividends paid from net income remains constant.

(B) The firm pays dividends with what remains of net income after taking acceptable investment projects.

(C) The firm sets a policy such that the quantity (dollar amount per share) of dividends paid from net income remains constant.

(D) All of the above are examples of various types of passive dividend policies

Answer:

(B) The firm pays dividends with what remains of net income after taking acceptable investment projects.

Question 25.

Modigliani and Miller argue that the dividend decision

(A) Is irrelevant as the value of the firm is based on the earning power of its assets.

(B) Is relevant as the value of the firm is not based just on the earning power of its assets.

(C) Is irrelevant as dividends represent cash leaving the firm to shareholders, who own the firm anyway.

(D) Is relevant as cash outflow always influences other firm decisions

Answer:

(A) Is irrelevant as the value of the firm is based on the earning power of its assets.

Question 26.

Consider the following two statements:

(I) A company with a large portion of inside ownership, all of whom are high-income individuals.

(II) A growth company with an abundance of good investment opportunities.

For each of the companies described above, would you expect it to have a high or low dividend payout ratio?

(A) Low dividend payout ratio for both companies

(B) High dividend payout ratio for both companies

(C) Low dividend payout ratio for the company mentioned in Statement (I) and high dividend payout ratio for the company mentioned in Statement (II)

(D) High dividend payout ratio for the company mentioned in Statement (I) and low dividend payout ratio for the company mentioned in Statement (II)

Answer:

(A) Low dividend payout ratio for both companies

Question 27.

Consider the following two statements:

(I) A company is experiencing ordinary growth and has high liquidity and much-unused borrowing capacity.

(It) A company with volatile and high business risk.

For each of the companies described above, would you expect it to have a high or low dividend payout ratio?

(A) Low dividend payout ratio for both companies

(B) High dividend payout ratio for both companies

(C) Low dividend payout ratio for the company mentioned in Statement (I) and high dividend payout

the ratio for the company mentioned in Statement (II)

(D) High dividend payout ratio for the company mentioned in Statement (I) and low dividend payout ratio for the company mentioned in Statement (II)

Answer:

(D) High dividend payout ratio for the company mentioned in Statement (I) and low dividend payout ratio for the company mentioned in Statement (II)

Question 28.

If you are calculating market price by using Gordon’s Model, increasing payout ratio other things renaming the same will –

(A) Increase the price per share

(B) Decrease the price per share

(C) Will not have any effect on the price of the share

(D) Price will remain constant.

Answer:

(A) Increase the price per share

Question 29.

As per Gordon’s Model, whether the company adopts 50%, 80%, or any other payout ratio, the market price will remain the same when

(A) Ke > r

(B) Ke < r

(C) Ke = r

(D) Ke > Rf

Answer:

(C) Ke = r

Question 30.

If you are calculating the market price

by using the dividend growth method ie. D1 ÷ (Ke – g) increase in growth rate leads to

(A) Fall in the market price of the stock

(B) Increase in the market price of the stock

(C) No change in the market price of the stock

(D) None of the above

Answer:

(B) Increase in the market price of the stock

Question 31.

Company A and Company B both calculate their market price by using Walter’s formula. Both companies will have the same market price if –

(A) Ra > Rc and retention ratio of Company A is more than retention ratio of Company B.

(B) Ra < Rc and retention ratio of Company B is more than retention ratio of Company A.

(C) Ra = Rc whether retention ratio is same or different for both the companies.

(D) All of the above

Answer:

(C) Ra = Rc whether retention ratio is same or different for both the companies.

Question 32.

As per Walter’s Model when Ra < Rc increase in dividend payout ratio will lead to –

(A) Increase in market price

(B) Decrease in market price

(C) No change in market price

(D) None of the above

Answer:

(A) Increase in market price

Question 33.

As per Walter’s Model when Ra < Rc decrease in retention ratio will lead to –

(A) Increase in market price

(B) Decrease in market price

(C) No change in market price

(D) None of the above

Answer:

(A) Increase in market price

Question 34.

As per Walter’s Model when R = R market price will remain the same when –

(A) Retention ratio increases

(B) Retention ratio decreases

(C) Retention ratio increase or decreases

(D) None of the above

Answer:

(C) Retention ratio increase or decreases

Question 35.

As per Walter’s Model when Ra > Rc increase in dividend payout ratio will lead to –

(A) Increase in market price

(B) Decrease in market price

(C) No change in market price

(D) No change in market price

Answer:

(B) Decrease in market price

Question 36.

As per Walter’s Model when Ra > Rc decrease in retention ratio will lead to –

(A) Increase in market price

(B) Decrease in market price

(C) No change in market price

(D) No change in market price

Answer:

(B) Decrease in market price

Question 37.

Which of the following is the correct formula to calculate market price as per MM Model?

(A) Po = (1 + Ke) ÷ (D1 + P1)

(B) Po = (D1 + P1) × (1 + Ke)

(C) Po = (D1 + P1) ÷ (1 + Ke)

(D) Po = (D1 + P1) ÷ (1 – Ke)

Answer:

(C) Po = (D1 + P1) ÷ (1 + Ke)

Question 38.

As per the MM Model total value of the firm remains the same whether it declares dividends or not. You are required to state if the dividend is declared the market price per share as per MM Model –

(A) Increase

(B) Decreases

(C) Remain constant

(D) None of the above

Answer:

(A) Increase

Question 39.

Which one of the following is a non-cash payment made by a firm to its shareholders that dilute the value of each share of stock outstanding?

(A) Reverse stock split

(B) Cash distribution

(C) Stock dividend

(D) Regular dividend

Answer:

(C) Stock dividend

Question 40.

Market price =?

(A) D1 ÷ (Ke – g)

(B) EPS × P/E Ratio

(C) (D1 + P1) ÷ (1 + Ke)

(D) All of the above

Answer:

(D) All of the above

Question 41.

The date by which a shareholder must be recorded as the shareowner in order to receive a declared dividend is called the:

(A) Ex-rights date

(B) Ex-dividend date

(C) Date of record

(D) Date of payment

Answer:

(C) Date of record

Question 42.

The target payout ratio is:

(A) A firm’s preferred rate of dividend growth.

(B) The inverse of a firm’s equity multiplier.

(C) The preferred number of dividend payments per year divided by 12.

(D) A firm’s long-term desired dividend-to-earnings ratio.

Answer:

(D) A firm’s long-term desired dividend-to-earnings ratio.

Question 43.

The difference between the highest and lowest prices at which a stock has sold is called the stocks:

(A) Average price

(B) Bid-ask spread

(C) Trading range

(D) Opening price

Answer:

(C) Trading range

Question 44.

Which one of the following statements concerning cash dividends is correct?

(A) The chief financial officer of a corporation determines whether or not a dividend will be paid.

(B) A dividend is not a liability of a firm until it has been declared.

(C) If a firm has paid regular quarterly dividends in the past it is legally obligated to continue doing so.

(D) Cash dividends always reduce the paid-in capital account balance

Answer:

(B) A dividend is not a liability of a firm until it has been declared.

Question 45.

The fact that flotation costs can be significant is justification for:

(A) A firm to issue larger dividends than their closest competitors.

(B) Maintaining a constant dividend policy even when profits decline significantly.

(C) Maintaining a high dividend policy.

(D) Maintaining a low dividend policy and rarely issuing extra dividends.

Answer:

(D) Maintaining a low dividend policy and rarely issuing extra dividends.

Question 46.

When a firm is short of cash yet it wishes to distribute something to shareholders, it should consider –

(A) Cash dividend.

(B) Liquidating dividend

(C) Stock dividend

(D) None of the above

Answer:

(C) Stock dividend

Question 47.

A company wants to buy back stock. How will this impact the company and its stock?

(A) The company makes more money because management owns more stock.

(B) Other investors make less mon¬ey because management can pay more dividends to interned shareholders before external shareholders.

(C) Because there are fewer shares in the open market, the price of the shares goes up.

(D) The net income of the company will go up because of the increase in stocks

Answer:

(C) Because there are fewer shares in the open market, the price of the shares goes up.

Question 48.

Which of the following would ultimately give the greatest benefit to stockholders?

(A) A stock buyback

(B) The issuance of a bond

(C) A stock split

(D) The issuance of new stock

Answer:

(A) A stock buyback

Question 49.

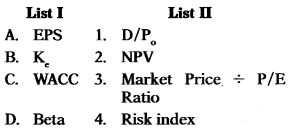

Match the following:

Select the correct answer from the options given below.

Answer:

(B)

Question 50.

Required return × Retention Ratio =?

(A) Ke (Cost of equity)

(B) WACC

(C) B(Beta)

(D) g (Growth Rate)

Answer:

(D) g (Growth Rate)

Question 51.

A share of common stock has just paid a dividend of ₹ 2.00. If the expected long-run growth rate for this stock is 15 percent, and if investors require a 19 percent rate of return, what is the price of the stock?

(A) ₹ 57.50

(B) ₹ 62.25

(C) ₹ 71.86

(D) ₹ 64.00

Hint:

D1 = 2 × 1.15 = 2.3

2.3/(0.19 – 0.15) = 57.5

Answer:

(A) ₹ 57.50

Question 52.

CPC Company’s stock is currently selling for ₹ 40 a share. The stock is expected to pay a ₹ 2 dividend at the end of the year. The stock’s dividend is expected to grow at a constant rate of 7% a year forever. The risk-free rate (RF) is 6% and the market risk premium (RM – RF) is also 6%. What is the stock’s beta?

(A) 1.06

(B) 1.00

(C) 2.00

(D) 0.83

Hint:

Ke = 2/40 + 0.07 = 0.12 i.e. 12%

K = Rf + β(Rm – Rf)

12 = 6 + 6x

6 = 6x

x = β = 1

Answer:

(B) 1.00

Question 53.

Retention ratio is 0.60 and return on equity is 15.5% then growth retention model would be –

(A) 14.9%

(B) 25.84%

(C) 16.1%

(D) 9.3%

Hint:

15.5% × 0.60 = 9.3%

Answer:

(D) 9.3%

Question 54.

Ali Motors recently completed a 3 for 1 stock split. Prior to the split, the company had 10 million shares outstanding and its stock price was ₹ 150 per share. After the split, the total market value of the company’s stock equaled ₹ 1.5 Billion. What was the price of the company’s stock following the stock split?

(A) ₹ 15

(B) ₹ 45

(C) ₹ 50

(D) ₹ 150

Hint:

150 × 1/3 = 50

Answer:

(C) ₹ 50

Question 55.

If payout ratio is 0.45 then retention ratio will be:

(A) 55%

(B) 1.45

(C) 0.055

(D) 100%

Answer:

(A) 55%

Question 56.

Retention ratio is 0.55 and return on equity is 12.5% then growth retention model would be –

(A) 0.1195

(B) 0.06875

(C) 0.1305

(D) 0.2272

Answer:

(B) 0.06875

Question 57.

Company Q is all-equity financed. For each ₹ 1 of earnings, it consistently pays 30 paise in dividends and retains 70 paise for reinvestment. It expects to earn a rate of return of 14% on capital employed. According to the Gordon Growth Model, what would the rate of earnings growth be in the future? Ignore tax.

(A) 4-2%

(B) 7%

(C) 9-8%

(D) 14%

Hint:

br = g = 0.70 × 14 = 9.8%

Answer:

(C) 9-8%

Question 58.

DHC Ltd. is looking to purchase WIC Ltd., which has the following information: Revenue ₹ 40,00,000; EBITD ₹ 9,00,000; Basic EPS ₹ 1.40; Net assets ₹ 50,00,000 Dividends paid ₹ 0.50. Research has shown that the price-earnings ratio for companies like WIC Ltd. is 9.5. Based on that ratio, what is the value of WIC Ltd.?

(A) ₹ 23,75,000

(B) ₹ 85,50,000

(C) ₹ 50,00,000

(D) ₹ 66,50,000

Hint:

Market Price = P/E Ratio × EPS

9.5 × 1.4= 13.3;

50,00,000 × 13.3/10 = 66,50,000

Answer:

(D) ₹ 66,50,000

Question 59.

The market price of Jhakas Ltd. is ₹ 200 per share as per Gordon Model. EPS is ₹ 20 per share. The cost of capital is 11%. The rate of return on investment is 12%. What is the retention ratio?

(A) 80%

(B) 75%

(C) 100%

(D) 50%

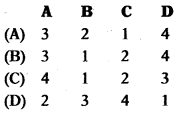

Hint:

P0 = \(\frac{E(1-b)}{K_{e}-b r}\)

200 = \(\frac{20(1-b)}{0.11-(b \times 0.12)}\)

200 = \(\frac{20-20 b}{0.11-0.12 b}\)

22 – 24b = 20 – 20b

2 = 4 b

b = 2/4

b = 0.5 i.e. 50%

Answer:

(D) 50%

Question 60.

The market price of Sara Ltd. is ₹ 1,000 per share. EPS is ₹ 20 per share. The cost of capital is 11%. The rate of return on investment is 12%. What is the dividend per share?

(A) ₹ 2

(B) ₹ 3

(C) ₹ 4

(D) ₹ 5

Hint:

110 – 120b = 20 – 20b

90 = 100b

b = 90/100

b = 0.9 i.e. 90%

The retention ratio is 90% which means the payout ratio is 10%.

DPS = 20 × 10%=2

Answer:

(A) ₹ 2

Question 61.

The following information is available in respect of Sober Ltd.:

No. of shares outstanding: 1 lakh

Earnings per share: ₹4

Equity capitalization rate: 12%

Rate of return on investment: 15%

You are required to calculate the Dividend payout ratio to keep the share price at ₹40.

(A) 50%

(B) 40%

(C) 60%

(D) 20%

Hint:

0.576 = 0.12x+ 0.6- 0.15x

0.576 = 0.6- 0.03x

0.024 = 0.03x

x = D = Dividend = 0.8

Payout ratio = \(\frac{0.8}{4}\) × 100= 20%

Answer:

(D) 20%

Question 62.

A Chemical company belongs to a risk class for which P/E Ratio is 10. It currently has 50,000 equity shares selling at ₹ 200 each. The firm is contemplating the declaration of dividend of ₹ 16 per share in the current fiscal year which has just started. Given the assumption of Modigliani-Miller, what will be the price of the share at the end of the year if the dividend is declared?

(A) ₹ 205

(B) ₹ 208

(C) ₹ 204

(D) ₹ 225

Hint:

Ke = \(\frac{1}{\mathrm{P} / \mathrm{E} \text { Ratio }}=\frac{1}{10}\) = 0.1 i.e. 10%

16 + P = \(\frac{16+P_{1}}{1+0.1}\)

220 = 16 + P1

P = 204

Answer:

(C) ₹ 204

Question 63.

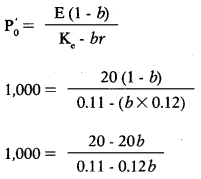

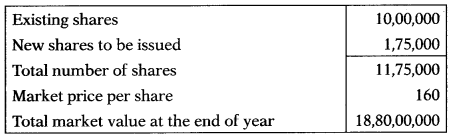

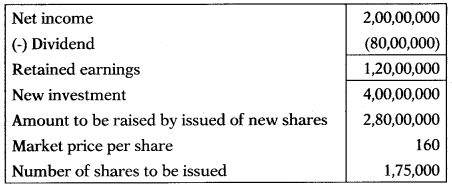

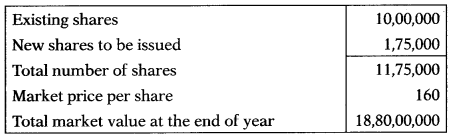

Damodhar Ltd. has ₹ 10 lakh equity shares outstanding. The current market price of the shares is ₹ 150 each. The board of directors of the company has recommended a dividend of ₹ 8 per share. The rate of capitalization is 12%. How many shares are to be issued as per MM Model at the end of the accounting year on the assumption that the net income is ₹ 2 Crore and the investment budget is ₹ 4 Crore and the dividend is declared as recommended by the directors.

(A) 1,19,047 shares

(B) 1,75,000 shares

(C) 1,57,000 shares

(D) 1,68,419 shares

Hint:

150 = \(\frac{8+\mathrm{P}_{1}}{1+0.12}\)

168 = 8 + P1

P1 = 160

Answer:

(B) 1,75,000 shares

Question 64.

Take the data above question and calculate the market value of the company after giving effect to the proposal as stated above.

(A) ₹ 8,80,00,000

(B) ₹ 15,50,00,000

(C) ₹ 18,50,00,000

(D) 19,90,00,000

Hint:

150 = \(\frac{8+\mathrm{P}_{1}}{1+0.12}\)

168 = 8 + P1

P1 = 160

Answer:

(A) ₹ 8,80,00,000

Question 65.

An equity share of ₹ 100 is expected to earn an annual dividend of ₹ 10 and this share can be sold at a price of ₹ 180 at the end of the year. If the required rate of return is 12%, calculate the value of the equity share.

(A) ₹ 196.46

(B) ₹ 169.64

(C) ₹ 149.66

(D) ₹ 170.05

Hint:

P0 = \(\frac{\mathrm{D}_{1}+\mathrm{P}_{1}}{1+\mathrm{K}_{\mathrm{e}}}\)

= \(\frac{10+180}{1+0.12}\)

= \(\frac{190}{1.12}\)

P0 = 169.64

Answer:

(B) ₹ 169.64

Question 66.

The net profit before tax of Acumen Ltd. is ₹ 17,50,000. The company has 1,00,000 equity shares of face value ₹ 10 each, fully paid-up. The current market price of the shares is ₹ 85 per share. Income-tax @30% applies to the company. Compute the P/E ratio for the company.

(A) 5.92

(B) 8.63

(C) 6.94

(D) 9.46

Hint:

| Profit before tax | 17,50,000 |

| (-) Tax @ 30% | (5,25,000) |

| Profit available to equity shareholders | 12,25,000 |

EPS = \(\frac{12,25,000}{1,00,000}\) = 1225 per share; PIE Ratio = \(\frac{85}{12.25}\) = 6.94

Answer:

(C) 6.94

Question 67.

The following details are available to you for Beauty Ltd.

Internal rate of return 15%

Capitalization rate 15%

Earnings per share ₹ 12

Cash dividend per share ₹ 5 Calculates the value of an equity share.

(A) ₹ 70

(B) ₹ 80

(C) ₹ 90

(D) ₹ 95

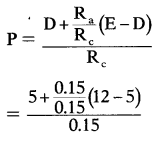

Hint:

= \(\frac{12}{0.15}\)

= 80

Answer:

(B) ₹ 80

Question 68.

Rama Ltd. had 1,00,000 equity shares of ₹ 10 each outstanding. Shares are currently being quoted at par in the market. In the wake of the removal of the dividend restraint, the company now intends to pay a dividend of ₹ 2 per share for the current financial year. It belongs to a risk class whose appropriate capitalization rate is 15%. Using MM Model and assuming no taxes, ascertain the price of the company’s shares as it is likely to prevail at the end of the year – (i) when a dividend is declared; and (ii) when no dividend is declared.

Hint:

(a) If dividend is not declared:

10 = \(\frac{0+\mathrm{P}_{1}}{1+0.15}\)

P1 = 11.5

(b) If dividend Is declared 2:

10 = \(\frac{2+P_{1}}{1+0.15}\)

11.5 = 2 + P1

P = 9.5

Answer:

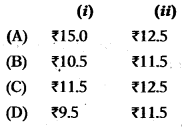

(D)

Question 69.

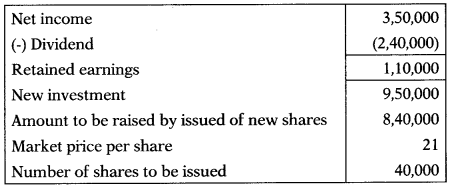

Rosa Ltd. has outstanding 1,20,000 shares selling at ₹ 20 per share. The company hopes to make a net income of ₹ 3,50,000 during the year. The company is thinking of paying a dividend of ₹ 2 per share at the end of the current year. The capitalization rate has been estimated to be 15%. On the basis of the MM model how many new shares the company must issue if the dividend is paid and the company needs ₹ 9,50,000 for an approved investment expenditure?

(A) 40,000 equity shares

(B) 50,000 equity shares

(C) 60,000 equity shares

(D) 70,000 equity shares

Hint:

(a) If dividend is not declared:

10 = \(\frac{0+\mathrm{P}_{1}}{1+0.15}\)

P1 = 11.5

(b) If dividend Is declared 2:

10 = \(\frac{2+P_{1}}{1+0.15}\)

11.5 = 2 + P1

P = 9.5

20 = \(\frac{2+\mathbf{P}_{1}}{1+0.15}\)

23 = 2 + P1

P1 = 21

Answer:

(A) 40,000 equity shares

Question 70.

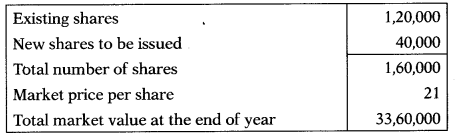

Take the data of the above question and calculate the total market value of the company.

(A) 05,40,000

(B) 02,90,000

(C) 03,60,000

(D) 04,30,000

Hint:

(a) If dividend is not declared:

10 = \(\frac{0+\mathrm{P}_{1}}{1+0.15}\)

P1 = 11.5

(b) If dividend Is declared 2:

10 = \(\frac{2+P_{1}}{1+0.15}\)

11.5 = 2 + P1

P = 9.5

20 = \(\frac{2+\mathbf{P}_{1}}{1+0.15}\)

23 = 2 + P1

P1 = 21

Answer:

(C) 03,60,000

Question 71.

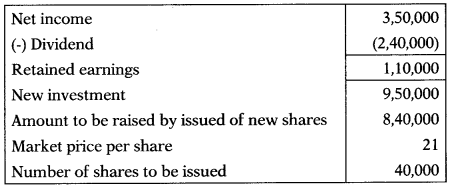

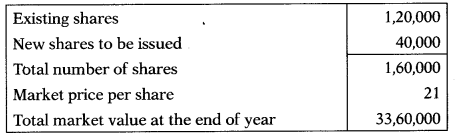

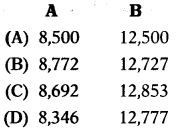

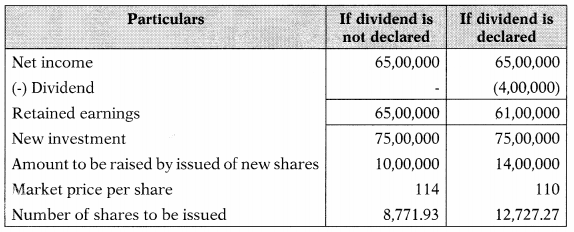

Abhishek Steel Ltd. has one lakh equity shares outstanding which are selling at ₹ 100 each. Its capitalization rate is 14%. The company is expecting ₹ 65 lakh income for the current year and is planning to pay dividends amounting to ₹ 4 lakh. The company wants to invest in a new project which will cost ₹ 75 lakh. It is assumed that the MM, Model on dividend policy is applicable. Compute the number of shares to be issued for financing when: A Dividend is not paid. B. Dividend amounting to ₹ 4 lakh is paid.

Hint:

(a) if dividend is not declareth

100 = \(\frac{0+P_{1}}{1+0.14}\)

P1 = 114

(b) If dividend is declareth

100 = \(\frac{4+\mathrm{P}_{1}}{1+0.14}\)

114 = 4 + P1

P1 = 110

Calculation of a number of shares to be issued if the dividend is not declared:

Answer:

(B)

Question 72.

Small Events Incorporation has recently paid dividends of ₹ 3.50 per share. The dividends are growing at 10% p.a. and the equity capitalization rate applicable to the company is 12%. Find out the implicit P/E Ratio if the EPS of the company is ₹ 7.

(A) 27.50

(B) 28.50

(C) 30.00

(D) 32.50

Hint:

D1 = D0(1 + g)

= 3.5(1 + 0.1)

= 3.85

P0 = \(\frac{\mathrm{D}_{1}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}=\frac{3.85}{0.12-0.10}=\frac{3.85}{0.02}\) = 192.5

P/E Ratio = 27.5

Answer:

(A) 27.50

Question 73.

The current price of the share of X Ltd. is ₹ 60 and the just paid dividend per share is ₹ 4. If the capitalization rate is 12%, what is the dividend growth rate?

(A) 3%

(B) 5%

(C) 4%

(D) 6%

Hint:

Let the growth rate be ‘x’.

D1 = D0(1 + x)

D1 = 4 + 4x

P0 = \(\frac{\mathrm{D}_{1}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}\)

60 = \(\frac{4+4 x}{0.12-x}\)

7.2- 60x = 4 + 4x

3.2 = 64x

x = 3.2/64 = 0.05 i.e. 5%

Answer:

(B) 5%

Question 74.

The following information is available in respect of Hajela Ltd.:

No. of shares outstanding: 3 lakh

Net profit: 18 lakh

Equity capitalization rate: 16%

Rate of return on investment: 20%

You are required to calculate the Dividend payout ratio to keep the share price at ₹ 42.

(A) 42%

(B) 46%

(C) 58%

(D) 52%

Hint:

EPS = 18/3 = 6

1.0752 = 0.16x+ 1.2-O.2x

– 0.1248 = – 0.04x

x = D = Dividend = 3.12

Payout ratio = \(\frac{3.12}{6}\) × 100 = 52%

Answer:

(D) 52%

Question 75.

The market price is ₹ 30 per share. Dividends are growing at 2%. The cost of equity is 10.5%. How much dividend must have been paid by the company at the beginning of the year or last year?

(A) 2.55

(B) 2.00

(C) 2.50

(D) 2.60

Hint:

Dividends are growing by 2% hence D0 must be 2.5 (2.55 × 100/102).

Answer:

(C) 2.50