Students should practice Ratio Analysis – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Ratio Analysis – Corporate and Management Accounting MCQ

Question 1.

Dec 2014: Find the current liability from the following:

Current ratio – 2:5

Liquid ratio – 1:5

Prepaid expenses – Nil

Stock – 7 4,000

(A) ₹ 20,000

(B) ₹ 40,000

(C) ₹ 80,000

(D) ₹ 4,000

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

\(\frac{x}{y}=\frac{2}{5}\)

x = 0.4y

\(\frac{1}{5}=\frac{0.4 y-4,000}{y}\)

y = 2y – 20,000

y = Current Liabilities = 20,000

Answer:

(A) ₹ 20,000

Question 2.

Dec 2014: In an organization, profit after interest, tax, and dividend on preference shares is ₹ 4,00,000. The number of equity shares is 40,000 and the dividend payout ratio is 40%. The dividend per share is

(A) ₹ 4

(B) ₹ 25

(C) ₹ 10

(D) ₹ 6

Hint:

EPS = \(\frac{4,00,000}{40,000}\) = 10

Dividend payout = 10 × 40% = 4.

Answer:

(A) ₹ 4

Question 3.

Dec 2014: From the following information find the value of closing stock

Stock velocity: 6 months Gross profit ratio: 25%

Gross profit for the year ended 31st March 2014: ₹ 1,00,000

Closing stock for the period – ₹ 20,000 more than it was at the beginning of the year.

(A) ₹ 1,50,000

(B) ₹ 1,40,000

(C) ₹ 1,60,000

(D) ₹ 70,000

Hint:

Gross Profit Ratio = \(\frac{\text { Gross Profit }}{\text { Sales }}\) × 100

25%= \(\frac{1,00,000}{\text { Sales }}\) × 100

Sales = 4,00,000

Cost of goods sold = 4,00,000 – 1,00,000 = 3,00,000

Stock Velocity = \(\frac{\text { Average Stock }}{\text { Cost of goods sold }}\) × 12

6 = \(\frac{\text { Average Stock }}{3,00,000}\) × 12

Average Stock = 1,50,000

Let Opening stock be = x

Closing stock = x + 20,000

Average Stock = \(\frac{\text { Opening Stock }+\text { Closing Stock }}{2}\)

1,50,000 = \(\frac{x+(x+20,000)}{2}\)

3,0, 000 = 2x + 20,000

2,80,000 = 2x

x = Opening stock = 1,40,000

Closing stock = 1,40,000 + 20,000 = 1,60,000

Answer:

(C) ₹ 1,60,000

Question 4.

June 2015: The net profit of a company is ₹ 2,00,000, preference dividend ₹ 25,000, and taxes paid ₹ 15,000. The number of equity shares is 1,00,000. The earnings per share (EPS) is –

(A) ₹ 1.5

(B) ₹ 1.6

(C) ₹ 2

(D) ₹ 1.75

Hint:

| Net Profit | 2,00,000 |

| (-) Tax | (15,000) |

| (-) Preference dividend | (25,000) |

| Profit available for equity shareholder | 1,60,000 |

Earnings per share (EPS) = \(\frac{1,60,000}{1,00,000}\) = 1.6 per share

Answer:

(B) ₹ 1.6

Question 5.

June 2015: The current ratio of Brave Ltd. is 2:1, while the quick ratio is 1.8:1. If the current liabilities are ₹ 40,000, the value of the stock will be___

(A) ₹ 12,000

(B) ₹ 6,500

(C) ₹ 8,000

(D) ₹ 10,000

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

2 = \(\frac{x}{40,000}\)

x = 80,000

Quick Ratio = \(\frac{\text { Current Assets – Stock }}{\text { Current Liabilities }}\)

1.8 = \(\frac{80,000-\text { Stock }}{40,000}\)

72,000 = 80,000 – Stock

Stock = 8,000

Answer:

(C) ₹ 8,000

Question 6.

June 2015: In an organization, working capital is ₹ 1,00,000 and current ratio 3:1. The value of current assets is –

(A) ₹ 1,50,000

(B) ₹ 1,00,000

(C) ₹ 50,000

(D) ₹ 15,000

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

3 = \(\frac{x}{y}\)

3y = x

CA – CL = WC

x – y = 1,00,000

3y – y = 1,00,000

2y= 1,00,000

2y = 50,000

x= 50,000 × 3 = 1,50,000

Answer:

(A) ₹ 1,50,000

Question 7.

June 2015: Working capital ratio is also known as:

(A) Quick ratio

(B) Debt-Equity ratio

(C) Current ratio

(D) Liquid ratio

Answer:

(C) Current ratio

Question 8.

June 2015: Credit sales of Jump Ltd. for the year is ₹ 12,00,000 and debtors at the end of year ₹ 2,40,000. Assuming 360 days in a year, the average collection period will be –

(A) 60 Days

(B) 72 Days

(C) 180 Days

(D) 80 Days

Hint:

Average Collection Period = \(\frac{\text { Debtors }}{\text { Credit Sales }}\) × 360

= \(\frac{2,40,000}{12,00,000}\) × 360

= 72 days

Answer:

(B) 72 Days

Question 9.

June 2015: For the financial year ended 31st March 2015, the figures extracted from the balance sheet of Excel Ltd. are as under:

Opening stock ₹ 29,000 Closing stock ₹ 31,000 Purchases ₹ 2,42,000 The stock turnover ratio will be –

(A) 12 Times

(B) 15 Times

(C) 9 Times

(D) 8 Times

Hint:

Opening Stock + Purchase – Closing Stock = Cost of goods sold

29,0 + 2,42,000 – 31,000 = 2,40,000

Stock Turnover Ratio = \(\frac{\text { Cost of goods sold }}{\text { Average Stock }}\)

= \(\frac{2,40,000}{30,000}\)

= 8 times

Answer:

(D) 8 Times

Question 10.

June 2015: Which of the following is a method used in analyzing financial statements –

(A) Variance analysis

(B) Trend analysis

(C) Break-even analysis

(D) Budget analysis

Answer:

(B) Trend analysis

Question 11.

June 2015: In an organization, the current ratio is 2.5, the liquid ratio 1.5, prepaid expenses nil, and stock ₹ 4,000. The amount of current liabilities is –

(A) ₹ 20,000

(B) ₹ 40,000

(C) ₹ 80,000

(D) ₹ 4,000

Answer:

(D) ₹ 4,000

Question 12.

Dec 2015: are necessary for the study of trends and direction of movements in the financial position and operating results of a concern.

(A) Trend ratios

(B) Cash flow statements

(C) Common size statements

(D) Comparative statements

Answer:

(A) Trend ratios

Question 13.

Dec 2015: Current ratio is 2.5 and the liquid ratio is 1.5. Working capital is ₹ 75,000. The value of the stock held will be

(A) ₹ 60,000

(B) ₹ 1,00,000

(C) ₹ 50,000

(D) None of the above

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

2.5 = \(\frac{x}{y}\)

x = 2.5y

Current Assets – Current Liabilities = Working Capital

2.5y – y = 75,000 1.5y = 75,000

y = Current Liabilities = 50,000

x = Current Assets = 1,25,000

Let the stock be ‘x’.

Liquid Ratio = \(\frac{\text { Current Assets – Stock }}{\text { Current Liabilities }}\)

1.5 = \(\frac{1,25,000-\text { Stock }}{50,000}\)

75,000= 1,25,000 – Stock

Stock = 50,000

Answer:

(C) ₹ 50,000

Question 14.

Dec 2015: Determine a firm’s total assets turnover, if its net profits margin is 8%, total assets are ₹ 8,00,000 and the return on investment is 14%

(A) 2.05

(B) 4.00

(C) 1.75

(D) 2.00

Hint:

14%/8% = 1.75

Answer:

(C) 1.75

Question 15.

Dec2015:Net income of a company after payment of preference dividend was ₹ 63 lakh. The number of equity shares was 1,40,000. The P/E ratio of the company was 8.50 times. Earnings per share and market value per share would be

(A) ₹ 45 & ₹ 382.50 respectively

(B) ₹ 45 & ₹ 308.20 respectively

(C) ₹ 33.16 & ₹ 281.86 respectively

(D) ₹ 45 & ₹ 5.29 respectively

Hint:

EPS = \(\frac{63,00,000}{1,40,000}\) = 45

Market Price = P/E Ratio × EPS

= 8.5 × 45

= 382.5

Answer:

(A) ₹ 45 & ₹ 382.50 respectively

Question 16.

Dec 2015: In ratio analysis, ‘proforma analysis’ implies

(A) Making a list of all the present ratios of the firm

(B) Comparison of liquidity ratios with another kind of ratios of the firm

(C) Comparison of the ratios of the firm relating to the performance of the firm

(D) Comparison of the firm’s past and current ratios with future ratios to ascertain the relative strengths and weaknesses in the past and future

Answer:

(D) Comparison of the firm’s past and current ratios with future ratios to ascertain the relative strengths and weaknesses in the past and future

Question 17.

Dec 2015: Match the following:

| List-I | List-II |

| P. Prepaid expenses | 1. Solvency ratio |

| Q. Sales ratio | 2. Net profit margin × Investment ratio |

| R. Return on investment | 3. Turnover ratio |

| S. 100 minus Proprietary | 4. Current asset ratio |

Select the correct answer from the options given below

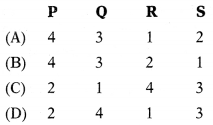

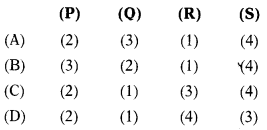

Answer:

(B)

Question 18.

Dec 2015: Which of the following pairs is correctly matched

(A) Administrative expenses + Selling and distribution expenses = Operating expenses

(B) (Gross profit × Net sales) × 100 = Net profit ratio

(C) Both (A) and (B) above

(D) None of the above

Answer:

(D) None of the above

Question 19.

Dec 2015:

Statement-I:

If any fixed asset remains idle due to abnormal or unusual events, it should be included in capital employed.

Statement-II:

Idle machines and tools required for the normal operation of the plant would not be included in capital employed.

Select the correct answer from the following

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is correct, but Statement-II is incorrect

(D) Statement-I is incorrect, but Statement-II is correct

Answer:

(B) Both statements are incorrect

Question 20.

Dec 2015:

Assertion (A):

Accounting ratios reveal the financial position of a concern.

Reason (R):

Accounting ratios are not useful in assessing operational efficiency. Select the correct answer from the following

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(C) A is true, but R is false

Question 21.

Dec 2015: Return on investment depends on two ratios

(A) Net profit ratio and capital turnover ratio

(B) Gross profit ratio and net profit ratio

(C) Capital employed ratio and assets turnover ratio

(D) Earnings per share and net profit ratio

Answer:

(A) Net profit ratio and capital turnover ratio

Question 22.

Which of the following pairs is not correctly matched

(A) Dividend per equity share / Earnings per share = Payout ratio

(B) [Operating profit/Capital em-ployed] × 100 = Return on capital employed

(C) [(Cost of goods sold + operating expenses)/net sales] × 100 = Operating profit ratio

(D) None of the above

Answer:

(D) None of the above

Question 23.

Dec 2015: Match the following:

| List-I | List-II |

| A. Operating profit | 1. Capital employed = _______ + Preference share capital |

| B. Liquid liabilities | 2. ____ = Gross profit – Operating expenses |

| C. Capital employed | 3. Quick assets = Quick ratio × ____ |

| D. Equity share capital | 4. Fixed assets ratio = fixed assets ÷ ___ |

Select the correct answer from the options given below

![]()

Answer:

(A)

Question 24.

Dec 2015: Which of the following pairs is correctly matched

(A) Profitability ratios – Expenses ratios

(B) Activity ratios – Total assets turnover ratio

(C) Both (A) and (B) above

(D) None of the above

Answer:

(B) Activity ratios – Total assets turnover ratio

Question 25.

Return on investment is also known as

(A) Dupont chart

(B) Activity ratio

(C) P/V ratio

(D) Market test ratio

Answer:

(A) Dupont chart

Question 26.

Dec 2015:

Assertion (A):

Either the gross profit ratio, the better it is.

Reason (R):

A low gross profit ratio indicates an unfavorable trend in the form of a reduction in selling prices.

Select the correct answer from the following

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 27.

Dec 2015: Equity share capital: ₹ 30 lakh (30,000 shares of ₹ 100 each); 9% preference shares: ₹ 10 lakh; profit before tax: ₹ 24.46 lakh and tax rate 30%. Earnings per share will be

(A) ₹ 54.07

(B) ₹ 81.53

(C) ₹ 78.53

(D) ₹ 57.07

Hint:

| Particulars | ₹ |

| Profit before tax | 24,46,000 |

| (-) Tax @30% | (7,33,800) |

| Profit after tax | 17,12,200 |

| (-) Preference dividend | (90,000) |

| Profit available for equity shareholders | 16,22,200 |

EPS = \(\frac{\text { Profit available for equity shareholders }}{\text { No. of shares }}=\frac{16,22,200}{30,000}\) = 54.07

Answer:

(A) ₹ 54.07

Question 28.

Dec 2015: Financial statement of X Ltd. shows the following data

Opening stock

Total purchases (including cash purchases of ? 1,75,000)

Closing stock

The stock turnover ratio is

(A) 6.70 times

(B) 8 times

(C) 7.2 times

(D) 9 times

Hint:

| Opening stock of raw material | 1,50,000 |

| (+) Purchases | 10,50,000 |

| (-) Closing stock of raw material | (1,20,000) |

| Raw material consumed | 10,80,000 |

Stock Turnover Ratio = \(\frac{\text { Raw material consumed }}{\text { Average Stock }}=\frac{10,80,000}{1,35,000}\) = 8

Answer:

(B) 8 times

Question 29.

June 2016: In financial analysis, ‘time-series analysis’ refers to

(A) Making a time series of various ratios to assess a firm’s profitability

(B) A graphical comparison of a firm’s sources of finance

(C) The comparison of financial ratios over a period of time to assess the direction of change and the financial performance of a firm

(D) A comparison of time values for various ratios of a firm

Answer:

(C) The comparison of financial ratios over a period of time to assess the direction of change and the financial performance of a firm

Question 30.

June 2016: If average collection period is 15 days and average account receivables is ₹ 45,000, the total amount of credit sales will be (assume 360 days in a year)

(A) ₹ 10,80,000

(B) ₹ 16,20,000

(C) ₹ 6,75,000

(D) ₹ 1,87,500

Answer:

(A) ₹ 10,80,000

Question 31.

June 2016:

Cost of goods sold 4,00,000

Administration & office expenses 35,000

Selling & distribution expenses 45,000

Net credit sales 4,75,000

Cash sales 1,25,000

Operating profit ratio will be____

(A) 30%

(B) 35%

(C) 20%

(D) 25%

Hint:

| Cash sales | 1,25,000 |

| Credit sales | 4,75,000 |

| Total sales | 6,00,000 |

| (-) Cost of goods sold | (4,00,000) |

| (-) Administration expenses | (35,000) |

| (-) Selling expenses | (45,000) |

| Operating profit | 1,20,000 |

Operating Profit Ratio = \(\frac{\text { Operating Profit }}{\text { Sales }}\) × 100

= \(\frac{1,20,000}{6,00,000}\) × 100

= 20%

Answer:

(C) 20%

Question 32.

June 2016: Current liabilities of a firm are ₹ 1,50,000. Its current ratio is 3:1 and liquid ratio is 1:1. The value of stock will be ____

(A) ₹ 3,00,000

(B) ₹ 4,50,000

(C) ₹ 2,50,000

(D) ₹ 1,50,000

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

3 = \(\frac{x}{1,50,000}\)

4,50,000 = x

Liquid Ratio = \(\frac{\text { Current Assets – Stock }}{\text { Current Liabilities }}\)

1 = \(\frac{4,50,000-x}{1,50,000}\)

1,50,000 = 4,50,000 – x

x = Stock = 3,00,000

Answer:

(A) ₹ 3,00,000

Question 33.

June 2016:

Assertion (A):

A current ratio of 2:1 is considered satisfactory as a rule of thumb but it should not be followed blindly.

Reason (R):

The greatest weakness of the current ratio is the possibility of window dressing and manipulation.

Select the correct answer from the options given below

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 34.

June 2016:

Stock turnover: 6 times Total sales: ₹ 3,00,000 Gross profit ratio: 20%

Closing stock: ₹ 4,000 more than opening stock

The opening stock is

(A) ₹ 36,000

(B) ₹ 38,000

(C) ₹ 40,000

(D) ₹ 42,000

Hint:

| Sales | 3,00,000 |

| (-) Gross profit 20% | (60,000) |

| Cost of goods sold | 2,40,000 |

Stock turnover ratio = \(\frac{\text { Cost of goods sold }}{\text { Average Stock }}\)

6 = \(\frac{2,40,000}{x}\)

x = Average Stock = 40,000

Let Opening stock be = x

Closing stock = x + 4,000

Average Stock = \(\frac{\text { Opening Stock }+\text { Closing stock }}{2}\)

40,000 = \(\frac{x+(x+4,000)}{2}\)

80,000 = 2x + 4,000

76.000 = 2x

x = Opening stock = 38,000

Answer:

(B) ₹ 38,000

Question 35.

June 2016: Which one of the following statements is correct

(A) Lower debt-equity ratio means lower financial risk

(B) Increase in net profit ratio means an increase in sales

(C) A higher receivable turnover is not desirable

(D) Interest coverage ratio depends upon the tax rate

Answer:

(A) Lower debt-equity ratio means lower financial risk

Question 36.

June 2016: Which of the following statement(s) is/are true:

(i) Common size balance sheet is a vertical financial analysis

(ii) Financial analysis performed on behalf of shareholders is called internal analysis

(iii) Trend percentage may be used for both balance sheet and profit and loss account.

Select the correct answer from the options given below

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (i) and (iii)

(D) (ii) only

Answer:

(C) (i) and (iii)

Question 37.

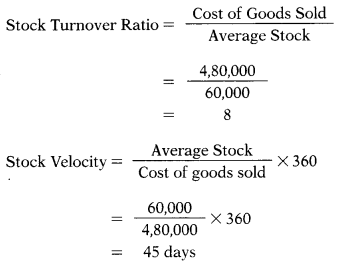

June 2016: From the following financial data, compute stock turnover ratio and stock velocity (assume 360 days in a year)

Opening stock: ₹ 58,000

Purchases: ₹ 5,02,000

Return outwards: ₹ 18,000

Sales : ₹ 6,53,000

Return inwards: ₹ 13,000

Gross profit: 25% on sales

Choose the correct option___

(A) 8 times; 45.62 days

(B) 8 times; 45 days

(C) 10.67 times; 33.75 days

(D) 7.74 times; 46.51 days

Hint:

Net Purchases = 5,02,000 – 18,000 = 4,84,000

Net Sales = 6,53,000 – 13,000 = 6,40,000

Cost of goods sold = 6,40,000 – 1,60,000 (25% profit on sales) = 4,80,000 Opening Stock + Purchases – Closing Stock = Cost of goods sold

58.0 + 4,84,000 – x = 4,80,000

x = Closing Stock = 62,000

Answer:

(B) 8 times; 45 days

Question 38.

June 2016:

% Preference share capital : ₹ 3,00,000

Equity share capital (₹ 10: ₹ 8,00,000 per share)

Profit after 30% tax : ₹ 2,80,000

The market price of equity share: ₹ 40

The earnings per share and the price-earnings ratio will be

(A) ₹ 3.50 and 11.43

(B) ₹ 5 and 8

(C) ₹ 4.70 and 8.51

(D) ₹ 3.20 and 12.50

Hint:

| Profit after tax | 2,80,000 |

| (-) Preference dividend | (24,000) |

| Profit available for equity shareholders | 2,56,000 |

EPS = \(\frac{2,56,000}{80,000}\) = 3.2

P/E Ratio = \(\frac{40}{3.2}\) = 12.5

Answer:

(D) ₹ 3.20 and 12.50

Question 39.

Dec 2016: Return on investment (ROI) is calculated to measure

(A) Long-term solvency of a business

(B) Earning power of net assets of the business

(C) Short-term liquidity position of business

(D) Goods sold and inventory level of business

Answer:

(B) Earning power of net assets of the business

Question 40.

Dec 2016: Interest coverage ratio is obtained by dividing EBIT by

(A) Interest

(B) Tax

(C) Income

(D) Sales

Answer:

(A) Interest

Question 41.

Dec 2016: If the price-earnings ratio is 0.05 and earnings per share is ₹ 8, the market price of a share will be

(A) ₹ 120

(B) ₹ 100

(C) ₹ 160

(D) ₹ 0.40

Hint:

Market price = EPS × P/E Ratio = 8 × 0.05 = 0.4

Answer:

(D) ₹ 0.40

Question 42.

Dec 2016: Sun Ltd. has furnished the following relevant data of financial statements as of 31st March 2016:

Equity share capital (1,00,000 equity shares of 110 each) 10,00,000

General reserve 2,00,000

15% Debentures 2,80,000

Current liabilities 8,00,000

Fixed assets 30,00,000

Current assets 18,00,000

Annual fixed cost excluding 2,80,000 interest

Variable cost ratio 60%

Total assets turnover ratio 2.5 times Tax rate 30%

Earnings per share (EPS) will be

(A) ₹ 31.35

(B) ₹ 15.80

(C) ₹ 20.00

(D) None of the above

Hint:

Total Assets = Fixed Assets + Current Assets = 30,00,000 + 18,00,000 = 48,00,000

Total Asset Turnover Ratio = \(\frac{\text { Sales }}{\text { Total Assets }}\)

2.5 = \(\frac{\text { Sales }}{48,00,000}\)

Sales = 1,20,00,000

| Sales | 1,20,00,000 |

| (-) Variable cost | (72,00,000) |

| (-) Fixed cost | (2,80,000) |

| (-) Interest (2,80,000 × 15%) | (42,000) |

| Profit before tax | 44,78,000 |

| (-) Tax @ 30% | (13,43,400) |

| Profit after tax | 31,34,600 |

EPS = \(\frac{\text { Liquid assets }}{\text { Current liabilities }}=\frac{8,80,000}{10,00,000}\) = 31.35

Answer:

(A) ₹ 31.35

Question 43.

Dec 2016: The relevant data from financial statements of Ross Ltd. as on 31st March, 2016 is given below:

Cash 1,50,000

Trade receivables 4,00,000

Investment (short-term) 3,30,000

Stock 25,00,000

Prepaid expenses 50,000

Current liabilities 10,00,000

The quick ratio will be —

(A) 0.88: 1

(B) 0.93: 1

(C) 3.43:

(D) 3.1 : 1

Hint:

Quick ratio = \(\frac{\text { Liquid assets }}{\text { Current liabilities }}=\frac{8,80,000}{10,00,000}\) = 0.88

Answer:

(A) 0.88: 1

Question 44.

Dec 2016: From the books of Raja & Co., the following details as of 31st March 2016 are collected:

| ₹ | |

| Equity share capital | 20,00,000 |

| Retained earnings | 10,00,000 |

| 10% Debentures | 20,00,000 |

| Current liabilities | 10,00,000 |

| Profit before interest & tax | 12,00,000 |

| Interest | 1,60,000 |

| Tax | 3,12,000 |

The rate of return on capital employed will be

(A) 30%

(B) 24%

(C) 14.56%

(D) 17.76%

Hint:

Capital employed = 20,00,000 + 10,00,000 + 20,00,000 = 50,00,000

Return on capital employed = \(\frac{\text { Operating profit }}{\text { Capital employed }}\) × 100

\(\frac{12,00,000}{50,00,000}\) × 100 = 24%

Answer:

(B) 24%

Question 45.

Dec 2016: The net profit margin of Rose Ltd. is 8%, its total assets are ₹ 6,00,000 and the return on investment is 18%. Total assets turnover will be

(A) 2.05

(B) 3.15

(C) 2.25

(D) None of the above

Hint:

Total assets turnover = \(\frac{18}{8}\) = 2.25

Answer:

(C) 2.25

Question 46.

Dec 2016: Which of the following is not a limitation of financial statements

(A) Financial statements are essentially interim reports and therefore, cannot be final because the final gain or loss can be computed only at the termination of the business

(B) The values ascribed to the assets presented in the statements depend upon the standards of the person dealing with them

(C) Financial statements fail to bring out the significance of non-financial factors

(D) Financial statements serve as a useful guide for the stakeholders of the company.

Answer:

(D) Financial statements serve as a useful guide for the stakeholders of the company.

Question 47.

Dec 2016: A company has annual sales of ₹ 150 lakh entirely on credit. It keeps an average inventory sufficient to meet sales demand for half a month and gives its customers one month credit. Its average current liabilities are ₹ 10 lakh. The company must maintain cash and bank balance to have a current ratio of 2.

The amount of cash balance will be

(A) ₹ 1,25,000

(B) ₹ 3,00,000

(C) ₹ 13,75,000

(D) ₹ 7,50,000

Hint:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\) = 2

= \(\frac{\text { Current Assets }}{10,00,000}\) = 2

Inventory = 1,50,00,000 × 0.5/12 = 6,25,000 (valued at sale price in absence of information about cost)

Debtors = 1,50,00,000 × 1/12 = 12,50,000

Cash balance = 20,00,000 – 6,25,000 – 12,50,000 = 1,25,000

Answer:

(A) ₹ 1,25,000

Question 48.

Dec 2016:

Assertion (A)

Accountants do not take into consideration the price level changes while valuing various assets in different periods.

Reason (R)

It is difficult to determine the value of assets, as the value of assets changes with change in time.

Select the correct answer from the options given below

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 49.

Dec 2016: Gross profit ratio for a firm was 20% in the year 2015 and 2016 but the net profit ratio was 15% in the year 2015 and 12% in the year 2016. The reason for such behavior could be

(A) Increase in manufacturing expenses

(B) Increase in indirect expenses

(C) Increase in cost of goods sold

(D) Decrease in sales

Answer:

(B) Increase in indirect expenses

Question 50.

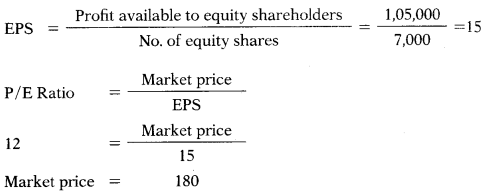

Dec 2016: The capital of Juhi Ltd. is as follows:

10% Preference shares of ₹ 5,00,000 ₹ 10 each

Equity shares of ₹ 100 each ₹ 7,00,000

Profit (after tax @ 50%) ₹ 1,55,000

Depreciation ₹ 60,000

P/E ratio 12 times

The market price of equity share will be

(A) ₹ 265.71

(B) ₹ 162.86

(C) ₹ 180

(D) ₹ 156

Hint:

| Profit after tax | 1,55,000 |

| (-) Preference dividend | (50,000) |

| Profit available to equity shareholders | 1,05,000 |

Answer:

(C) ₹ 180

Question 51.

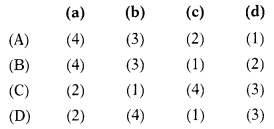

Dec 2016: Match the following:

| List – I | List – II |

| (P) The standard ratio of 2:1 is considered satisfactory | (1) Return on assets |

| (Q) It measures the profitability of the firm in terms of assets employed | (2) Current ratio |

| (R) The ratio which measures the long-term solvency of a firm | (3) Gearing ratio |

| (S) The ratio which indicates how much of the business is funded by borrowings | (4) Debt-equity ratio |

Select the correct answer from the options given below

Answer:

(C)

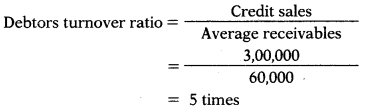

Question 52.

Dec 2016: Total sales: ₹ 24,00,000;

(A) ₹ 3,70,000 & ₹ 19,80,000

(B) ₹ 3,45,000 & ₹ 18,60,000

(C) ₹ 3,75,000 & ₹ 19,20,000

(D) None of the above

Hint:

Cost of goods sold = 24,00,000 – 4,80,000 = 19,20,000

8,00,000 = 2x + 60,000

7,40,000 = 2x

x = 3,70,000

Opening stock + Purchases – Closing stock Cost of goods sold

3,70,000 + Purchases – 4,30,000 19,20,000

Purchases = 19,80,000

Answer:

(A) ₹ 3,70,000 & ₹ 19,80,000

Question 53.

Dec 2016:

Statement -1

Working capital is short-term capital that is financed from long-term sources.

Statement – II

Working capital turnover measures the relationship of working capital with sales.

Select the correct answer from the options given below

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is incorrect, but Statement-II is correct

(D) Statement-I is correct, but Statement-II is incorrect

Answer:

(C) Statement-I is incorrect, but Statement-II is correct

Question 54.

Dec 2016:

Owners equity : ₹ 1,00,000 Current debt to total debt: 0.40 Total debt to owners’ equity : 0.60 Fixed assets to owners’ equity : 0.60 Total assets turnover : 2 times Inventory turnover : 8 times Fixed assets will be

(A) ₹ 70,000

(B) ₹ 60,000

(C) ₹ 65,000

(D) ₹ 72,000

Hint:

Fixed assets to owners equity = \(\frac{\text { Fixed Assets }}{\text { Owners Equity }}\)

0.6 = \(\frac{\text { Fixed Assets }}{1,00,000}\)

Fixed Assets = 60,000

Answer:

(B) ₹ 60,000

Question 55.

June 2017: Fill in the blank space. Dividend per share

\(\frac{\text { Dividend per share }}{\text { Market price per share }}\)× 100 = ………

Market price per share

(A) Payout ratio

(B) Earning yield ratio

(C) Dividend yield ratio

(A) Dividend ratio

Answer:

(C) Dividend yield ratio

Question 56.

June 2017: Proprietor’s net capital employed is known as:

(A) Net worth

(B) Equity shares

(C) Long-term loans

(D) Fixed assets

Answer:

(A) Net worth

Question 57.

June 2017: EBIT/Total assets ratio is:

(A) Liquidity ratio

(B) The Profitability ratio

(C) Solvency ratio

(D) Turnover ratio

Answer:

(B) The Profitability ratio

Question 58.

June 2017: Fill in the blank space.

\(\frac{\text { Cost of Sales }+\text { Operating Expenses }}{\text { Sales }}\) × 100 = …………

(A) Sales ratio

(B) Sales operating ratio

(C) Operating ratio

(D) Cost sales ratio

Answer:

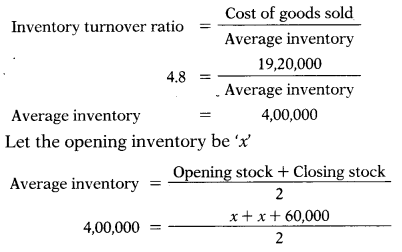

(C) Operating ratio

Question 59.

June 2017: Credit sales ₹ 3,00,000, Opening balance of accounts receivable ₹ 50,000, and Closing balance of accounts receivable ₹ 70,000 (assuming 360 days in a year). Debtors turnover ratio will be:

(A) 5

(B) 6

(C) 4

(D) 7

Hint:

Answer:

(A) 5

Question 60.

June 2017: Short-term solvency is indicated by:

(A) Debtors turnover ratio

(B) Liquid ratio

(C) Price earning ratio

(D) Stock turnover ratio

Answer:

(B) Liquid ratio

Question 61.

June 2017: Match the following:

| List I | List II |

| (A) Prepaid expenses | (1) Solvency ratio |

| (B) Sales ratio | (2) Net profit margin × investment ratio |

| (C) Return on | (3) Turnover ratio investment |

| (D) 100-Proprietary ratio | (4) Current assets |

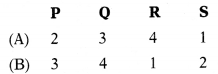

Codes:

Answer:

(A)

Question 62.

June 2018: The ratio that explains how efficiently companies use their assets to generate sales is:

(A) Revenue asset ratio

(B) Receivable turnover ratio

(C) Income ratio

(D) Fixed Asset turnover ratio

Answer:

(D) Fixed Asset turnover ratio

Question 63.

June 2018: Profit before interest and tax of AB Ltd. was ₹ 3,40,000. Their net fixed assets were 12,10,00,000 and working capital was ₹ 27,70,000. Return on investments =?

(A) 1.34%

(B) 0.57%

(C) 1.43%

(D) 1.57%

Hint:

Capital Employed = 2,10,00,000 + 27,70,000 = 2,37,70,000

Return on Investments (ROI) = \(\frac{\text { Operating Profit (EBIT) }}{\text { Capital Employed }}\) × 100

\(\frac{3,40,000}{2,37,70,000}\) × 100 = 1.43%

Answer:

(C) 1.43%

Question 64.

June 2018: Debtor velocity = 3 months; Sales ₹ 25,00,000; Bills receivable & bills payable were ₹ 60,000 and ₹ 36,667 respectively. Sundry debtors = ?

(A) ₹ 6,25,000

(B) ₹ 5,25,000

(C) ₹ 5,65,000

(D) ₹ 6,65,000

Hint:

3 = \(\frac{x}{25,00,000}\) × 12

x = Account receivable = 6,25,000

Debtors + Bills receivable = Account receivable

x + 60,000 = 6,25,000

x = Debtors = 5,65,000

Answer:

(C) ₹ 5,65,000

Question 65.

June 2018: Working capital ratio is also known as:

(A) Quick ratio

(B) Current ratio

(C) Debt equity ratio

(D) Liquidity ratio

Answer:

(B) Current ratio

Question 66.

June 2018: For the financial year ended 31st March 2017, the figures extracted from the balance sheet of EXE Ltd. are as follow:

Opening stock ₹ 29,000 Closing stock ₹ 31,000 Cost of goods sold ₹ 2,40,000 The stock turnover ratio will be:

(A) 12 times

(B) 10 times

(C) 8 times

(D) 9 times

Hint:

Stock turnover ratio = \(\frac{\text { Cost of goods sold }}{\text { Average stock }}\) × 12

\(\frac{2,40,000}{30,000}\) = 8 times

Answer:

(C) 8 times

Question 67.

June 2018: Debt service coverage ratio is obtained by dividing net profit before interest and taxes by:

(A) Taxes

(B) Income

(C) Equity

(D) Interest charges

Answer:

(D) Interest charges

Question 68.

June 2018: Working capital will not change if there is:

(A) Increase in current assets

(B) Payment to the creditors

(C) Decrease in current liabilities

(D) Decrease in current asset

Answer:

(B) Payment to the creditors

Question 69.

June 2018: Long term solvency is indicated by:

(A) Debt equity ratio

(B) Proprietary ratio

(C) Fixed assets ratio

(D) All of the above

Answer:

(D) All of the above

Question 70.

Dec 2018: Which of the following is not an objective of Management Accounting?

(A) To formulate planning and policy

(B) To provide a report

(C) To determine the selling price

(D) To assist in the decision-making process

Answer:

(C) To determine the selling price

Question 71.

Dec 2018: If Working Capital is ₹ 24 Lakh, Total Debt is ₹ 52 Lakh and Long-term Debt is ₹ 40 Lakh, then-current ratio will be:

(A) 2:1

(B) 3:1

(C) 0.6:1

(D) 1.9:1

Hint:

Current liability = 52 – 40 = 12 lakh; Current assets = 24 + 12 = 36 lakh

Current ratio = \(\frac{36}{12}\) = 3 12

Answer:

(B) 3:1

Question 72.

Dec 2018: If Stock, Current Assets, and Working Capital are ₹ 25 lakh, ₹ 80 lakh, and ₹ 30 lakh respectively, then the liquid ratio will be:

(A) 2.67:1

(B) 1.45:1

(C) 1.83:1

(D) 1.1:1

Hint:

Working capital = Current Assets – Current liabilities

30 lakh = 80 lakh – Current liabilities

Current liabilities = 50 lakh

Liquid assets = 80 lakh – 25 lakh = 55 lakh

Current ratio = \(\frac{55}{50}\) = 1.1

Answer:

(D) 1.1:1

Question 73.

Dec 2018: If the current ratio is 2.5: 1 and Working Capital is ₹ 120 Lakh, then-current liabilities are:

(A) ₹ 48 Lakh

(B) ₹ 200 Lakh

(C) ₹ 80 Lakh

(D) ₹ 180 Lakh

Hint:

Current ratio = \(\frac{\text { Current Assets }}{\text { Current liabilities }}\)

2.5= \(\frac{x}{y}\)

2.5 y = x

Working capital = Current Assets – Current liabilities

120 lakh = 2.5y – y

120 lakh = 1.5y

y = Current liabilities = 80 lakh

Answer:

(C) ₹ 80 Lakh

Question 74.

Dec 2018: If the Average Inventory is ₹ 125 Lakh, Inventory Turnover Ratio is 8 times and Profit is 20% on sales, then the number of sales will be:

(A) ₹ 1,000 Lakh

(B) ₹ 1,200 Lakh

(C) ₹ 800 Lakh

(D) ₹ 1,250 Lakh

Hint:

Inventory turnover ratio = \(\frac{\text { Cost of goods sold }}{\text { Average inventory }}\)

8 = \(\frac{\text { Cost of goods sold }}{125}\)

Cost of goods sold = 1,000 lakh

Sales = 1,000 lakh × 12596 = 1,250 lakh

Answer:

(D) ₹ 1,250 Lakh

Question 75.

Dec 2018: Current Ratio is 2.5:1 and Liquid Ratio is 1.5:1. If an inventory is ₹ 9,60,000, then the number of current assets will be:

(A) ₹ 9.6 Lakh

(B) ₹ 14.40 Lakh

(C) ₹ 24 Lakh

(D) ₹ 38.40 Lakh

Hint:

Current ratio = \(\frac{\text { Current Assets }}{\text { Current liabilities }}\)

2.5 = \(\frac{x}{y}\)

2.5y = x

Liquid ratio = \(\frac{\text { Current assets – Stock }}{\text { Current liabilities }}\)

1.5 = \(\frac{2.5 y-9,60,000}{y}\)

1.5y = 2.5y – 9,60,000

y = 9,60,000

x = 9,60,000 × 2.5 = 24,00,000

Answer:

(C) ₹ 24 Lakh

Question 76.

Dec 2018: Cost of Goods Sold is ₹ 90 Lakh, Purchases are ₹ 96 Lakh and Closing Stock is ₹ 18 Lakh, then Stock Turnover Ratio will be:

(A) 5 times

(B) 6 times

(C) 6.4 times

(D) 4.29 times

Answer:

(A) 5 times

Question 77.

Dec 2018: If Market Price per share, Earning per share and Dividend per share is ₹ 150, ₹ 16.50 and₹ 15 respectively, then Price Earnings Ratio will be:

(A) 10 times

(B) 9.09 times

(C) 1.1 times

(D) 0.91 times

Hint:

P/E Ratio = \(\frac{\text { Market Price }}{\mathrm{EPS}}=\frac{150}{16.5}\) = 9.09

Answer:

(B) 9.09 times

Question 78.

Dec 2018: Capital Gearing Ratio is categorized as:

(A) Profitability Ratio

(B) Activity Ratio

(C) Long-term Solvency Ratio

(D) Market Test Ratio

Answer:

(C) Long-term Solvency Ratio

Question 79.

June 2019: Dividing net credit sales by average debtors would yield

(A) Current ratio

(B) Return on the sales ratio

(C) Debtors turnover ratio

(D) Average receivables

Answer:

(C) Debtors turnover ratio

Question 80.

June 2019: ABC Ltd. has earned 12% returns on total assets of ₹ 8,00,000 and has a net profit ratio of 8%. Sales of the firm shall be:

(A) ₹ 96,000

(B) ₹ 6,40,000

(C) ₹ 12,00,000

(D) ₹ 7,36,000

Answer:

(C) ₹ 12,00,000

Question 81.

June 2019:9% preference shares of ₹ 10 each ₹ 4,00,000, Equity shares of ₹ 10 each ₹ 12,00,000, Profit after tax ₹ 4,20,000, Equity dividend paid 20%, Market price of equity shares ₹ 25 each. What will be the earnings per share?

(A) 3.50

(B) 3.20

(C) 5.40

(D) 9.60

Hint:

| Profit after tax | 4,20,000 |

| (-) Preference dividend (4,00,000 × 9%) | (36,000) |

| Profit available for equity shareholders | 3,84,000 |

EPS = 3,84,000/1,20,000 = 3.2

Answer:

(B) 3.20

Question 82.

June 2019: The average number of creditors is ₹ 74,000, creditors turnover ratio is 4.80. amount of credit purchase will be:

(A) ₹ 15,417

(B) ₹ 3,52,500

(C) ₹ 3,55,200

(D) None of the above

Hint:

74,000 × 4.8 = 3,55,200

Answer:

(C) ₹ 3,55,200

Question 83.

June 2019: What will be the amount of stock if the current ratio is 2:1 and quick ratio is 1.5:1 and current liabilities are ₹ 90,000?

(A) ₹ 55,000

(B) ₹ 1,80,000

(C) ₹ 1,35,000

(D) ₹ 45,000

Hint:

Current Ratio = \(\frac{\text { Current assets }}{\text { Current liabilities }}\)

2 = \(=\frac{x}{90,000}\)

x = 1,80,000

Liquid Ratio = \(\frac{\text { Current Assets – Stock }}{\text { Current Liabilities }}\)

1.5 = \(\frac{1,80,000-\text { Stock }}{90,000}\)

1,35,0 = 1,80,000 – Stock

Stock = 45,000

Answer:

(D) ₹ 45,000

Question 84.

June 2019: Conducted to ensure borrowings capacity of a concern to meet contingencies in near future is:

(A) Long term analysis

(B) Vertical analysis

(C) Short term analysis

(D) Internal analysis

Answer:

(C) Short term analysis

Question 85.

June 2019: A company has an inventory of ₹ 58,400, Debtors of ₹ 48,000, and inventory turnover 6 times. The gross profit margin is 20% on sales and its credit sales are 40% of the total sales. What will be the credit sales?

(A) ₹ 3,50,400

(B) ₹ 3,53,440

(C) ₹ 4,38,000

(D) ₹ 1,75,200

Hint:

Cost of goods sold = 58,400 × 6 = 3,50,400

GP ratio is 20% on sales that means it is 25% on cost.

Sales = 3,50,000 + 87,600 = 4,38,000

Credit sales = 4,38,000 × 40% = 1,75,200

Answer:

(D) ₹ 1,75,200

Question 86.

June 2019: The following information is given for X Ltd.:

Stock velocity 3.75 months, Gross profit ₹ 80,000 being 20% of sales. The closing stock of the year is ₹ 25,000 more than the opening stock. What will be the amount of opening stock and closing stock?

(A) ₹ 1,00,000 and ₹ 1,25,000

(B) ₹ 80,000 and ₹ 1,05,000

(C) ₹ 87,500 and ₹ 1,12,500

(D) ₹ 85,000 and ₹ 1,10,000

Hint:

Sales = 80,000/20% = 4,00,000

Cost of goods sold = 4,00,000 – 80,000 = 3,20,000

Opening Stock = x

Closing Stock = x + 25,000

Average Stock = (x + x + 25,000)/2

Average Stock = (2x + 25,000)/2

Average Stock = x + 12,500

Stock Velocity = \(\frac{\text { Average Stock }}{\text { Cost of goods sold }}\) × 12

3.75 = \(\frac{x+12,500}{3,20,000}\) × 12

12,00,000 = 12x + 1,50,000

x = Opening Stock = 87,500

Closing Stock = 87,500 + 25,000 = 1,12,500

Answer:

(C) ₹ 87,500 and ₹ 1,12,500

Question 87.

June 2019: A company has the following Current Assets:

Cash ₹ 40,000

Marketable securities ₹ 25,000

Debtors ₹ 20,000

Inventory ₹ 18,000

Total current liabilities were ₹ 65,400 (including the future tax liability of ₹ 4,800 which will be made after one year). What will be the quick ratio of the company?

(A) 1.40:1

(B) 1.81:1

(C) 1.57:1

(D) 1.30:1

Hint:

Quick Ratio = 40,000 + 25,000 + 20,000/65,400 – 4,800

85,000/60,600 = 1.40

Answer:

(A) 1.40:1

Question 88.

June 2019: Closing debtors are ₹ 8,00,000 which are 125 percent of opening debtors. Cash sales are 25 percent of total sales. If the debtor’s turnover ratio is 4 times then the number of total sales will be

(A) ₹ 36,00,000

(B) ₹ 28,80,000

(C) ₹ 38,40,000

(D) ₹ 48,00,000

Hint:

Opening debtors = 8,00,000/1.25 = 6,40,000

Average Accounts Receivable = (6,40,000 + 8,00,000)/2 = 7,20,000

Debtors Turnover Ratio = \(\)

4 = \(\frac{\text { Credit Sales }}{7,20,000}\)

Credit Sales = 28,80,000

| Cash sales | 25 | 9,60,000 |

| Credit sales | 75 | 28,80,000 |

| Total sales | 100 | 38,40,000 |

Answer:

(C) ₹ 38,40,000