Students should practice Activity Based Costing (ABC) – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Activity Based Costing (ABC) – Corporate and Management Accounting MCQ

Question 1.

Dec 2014: Cost attribution to cost units on the basis of benefit received from indirect activities, such as ordering, setting-up, assuring quality is known as:

(A) Allocation

(B) Activity-based costing

(C) Always better control

(D) Absorption

Answer:

(B) Activity-based costing

Question 2.

Dec 2014: Which of the following is not included in batch level activities___

(A) Material ordering cost

(B) Machine set-up cost

(C) Inspection cost

(D) Designing the product

Answer:

(D) Designing the product

Question 3.

Dec 2014: In activity-based costing, the allocation basis used for applying costs to services or products is called—

(A) Cost driver

(B) Cost object

(C) Allocation

(D) Applicator

Answer:

(A) Cost driver

Question 4.

June 2015: In activity-based costing, an item for which cost measurement is required is called —

(A) Cost driver

(B) Cost object

(C) Allocation

(D) Cost pool

Answer:

(B) Cost object

Question 5.

June 2015: Under activity-based costing, ‘material ordering’ is considered as —

(A) Unit-level activity

(B) Batch level activity

(C) Product level activity

(D) Facility level activity

Answer:

(B) Batch level activity

Question 6.

June 2015: According to the Chartered Institute of Management Accountants (CIMA), cost attribution to cost units on the basis of benefits received from indirect activities e.g. ordering, setting¬up, assuring quality is known as___

(A) Absorption costing

(B) Marginal costing

(C) Activity-based costing

(D) Job costing

Answer:

(C) Activity-based costing

Question 7.

Dec 2015: The basis of apportionment of overheads which takes into account the profitability of various departments is called___

(A) FIFO basis

(B) LIFO basis

(C) Ability to pay basis

(D) Activity basis

Answer:

(D) Activity basis

Question 8.

Dec 2015: The key area(s) of activity-based costing is/are___

(A) Product cost differentiation

(B) Identification of non-value-added cost

(C) Distribution between fixed and variable cost

(D) Both (A) and (B) above

Answer:

(D) Both (A) and (B) above

Question 9.

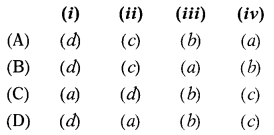

June 2016: Match the following events with the type of activity:

| Event | Type of activity |

| (i) Material ordering | (a) Product level activity |

| (ii) Designing the product | (b) Facility level activity |

| (iii) Production manager salary | (c) Unit-level – activity |

| (iv) Use of consumables | (d) Batch level activity |

Select the correct answer using the codes given below

Answer:

(D)

Question 10.

June 2016: What is the proper sequence of events in an ‘activity based costing’ system —

(i) Calculation of overheads application rates.

(ii) Identification of cost drivers

(iii) Identification of cost pools

(iv) Assignment of overheads cost to products.

Select the correct answer from the options given below:

(A) (i), (iii), (iv), (ii)

(B) (ii), (iii), (i), (iv)

(C) (iii), (ii), (i), (iv)

(D) (ii), (iii), (iv), (i)

Answer:

(C) (iii), (ii), (i), (iv)

Question 11.

Dec 2016: Which of the following is the main cost driver of customer order processing activity —

(A) Flow of the product from the assembly line

(B) Order value

(C) Number of problem suppliers

(D) Number of machine charges

Answer:

(B) Order value

Question 12.

Dec 2016:

Assertion (A)

Activity-based costing is not normally used for external reporting purposes.

Reason (R)

Activity-based costing does not conform to generally accepted principles.

Select the correct answer from the options given below:

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 13.

Dec 2016: A homogeneous cost pool is one that ___

(A) Does not change over time

(B) Needs many activity drivers to be allocated to a cost object

(C) Can be explained with a single activity driver

(D) Has only one type of material assigned to it

Answer:

(C) Can be explained with a single activity driver

Question 14.

Dec2017:In Traditional absorption costing system cost are first traced to:

(A) Activities

(B) Organizational unit

(C) Products

(D) Cost centers

Answer:

(B) Organizational unit

Question 15.

Dec 2017: The main reason for the usage of Activity Based Costing, by replacing the traditional costing system is that:

(A) The overhead recovery rates used in traditional costing systems are inappropriate for decision-mak¬ing.

(B) The companies deal with more number of product at present

(C) No scope for cause and effect relationship in traditional costing

(D) The new manufacturing technology needs information for feedback of performance even the product is in progress.

Answer:

(B) The companies deal with more number of product at present

Question 16.

Dec 2017: An Activity-Based Costing, an inspection of the product is a level activity.

(A) Unit

(B) Batch

(C) Product

(D) Facility

Answer:

(B) Batch

Question 17.

Dec 2017:

Assertion (A):

Implementation of the ABC System requires substantial resources which are costly to maintain.

Reason (R):

Activity-Based Costing is a two-stage product costing.

Select the correct answer from the options given below:

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(B) Both A and R are true but R is not the correct explanation of A

Question 18.

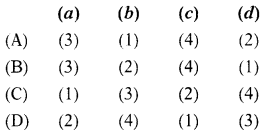

Dec 2017: Match the following:

| List I | List II |

| (a) Unit-level activity | (1) Material ordering |

| (b) Batch level activity | (2) Plant security |

| (c) Product level activity | (3) Use of indirect material |

| (d) Facility level activity | (4) Parts management |

Codes:

Answer:

(A)

Question 19.

Dec 2017: Fast Ltd., manufactures three types of products A, B, and C following ABC System. During a period the company incurred ₹ 73,000 as inspection cost and it was worked for 10, 20 and 9 production runs respectively for producing products A, B, and C. The inspection costs for product B under the ABC system was:

(A) ₹ 15,000

(B) ₹ 40,000

(C) ₹ 18,000

(D) ₹ 24,000

Answer:

(B) ₹ 40,000

Question 20.

June 2018: Which of the following statement is not true in respect of Activity-based costing?

(A) Activity-based costing improves control over overhead costs.

(B) Setting up equipment is a batch-level activity.

(C) In Activity-based costing each cost pool has its own predetermined overhead rate.

(D) Activity-based costing is less expensive to implement than traditional costing.

Answer:

(D) Activity-based costing is less expensive to implement than traditional costing.

Question 21.

June 2018: Performing periodic maintenance on buildings and general use equipment is an example of:

(A) Facility level activity

(B) Unit-level activity

(C) Batch level activity

(D) Product level activity

Answer:

(B) Unit-level activity

Question 22.

June 2018: The division of activities into the unit level, batch level, product level, and facility-level categories is commonly known as a:

(A) Cost object

(B) Cost application

(C) Cost hierarchy

(D) Cost estimation

Answer:

(B) Cost application

Question 23.

Dec 2018: Costs that are caused by a group of things being made or processed at a single time are referred to as:

(A) Product-level costs

(B) Cost pool

(C) Organizational-level costs

(D) Batch level costs

Answer:

(D) Batch level costs

Question 24.

Dec 2018: Level Activities are identified in traditional Absorption Costing.

(A) Unit

(B) Batch

(C) Product

(D) Business

Answer:

(A) Unit

Question 25.

Dec 2018: encourages managers to identify which activities are value-added activities.

(A) Standard Costing

(B) Activity-based Costing

(C) Uniform Costing

(D) Direct Costing

Answer:

(B) Activity-based Costing

Question 26.

Dec 2018: ABC emphasizes on:

(A) More precise profit analysis

(B) More accurate costing

(C) Improved cost control

(D) All of the above three

Answer:

(D) All of the above three

Question 27.

June 2019: In ABC System, the allocation basis that is used for applying costs to services or procedures are called:

(A) Cost Pool

(B) Cost Absorption

(C) Cost Object

(D) Cost Driver

Answer:

(D) Cost Driver