Go through this Partnership Accounts-Retirement and Death of a Partner – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

1. Retirement of a partner means when a partner leaves the firm.

2. A partner may retire in any of the following ways:

- with consent of all the partners.

- in accordance with an express agreement by the partners.

- where the partnership is at will, by giving notice in writing to all other partners of his intention to retire.

Note: Partnership at will is a type of partnership which does not have any fixed duration and can come to an end according to the will of the partners.

3. Due to retirement, only the old partnership comes to an end but the firm continues (in case of more than two partners).

A partner after retirement, is entitled to his share in the following:

- Share in goodwill

- Share in reserves

- Share in revaluation of assets/liabilities

- Share in accumulated profits

- Share in joint life policy (if any).

Accounting treatment on retirement of a partner involves the following:

- Calculation of new profit sharing ratio.

- Treatment of reserves and undistributed profits.

- Revaluation of assets and liabilities.

- Treatment of goodwill.

- Adjustment of capital by remaining partners.

- Payments to the retiring partner including his interest in the firm.

1. Calculation of New Ratio:

- When a partner retires, his share of profit is distributed among the remaining partners.

- As a result, the remaining partner’s share of profit increases.

Note- Gaining Ratio:

The ratio at which the remaining partners’gain the share of retiring partner, it is known as the gaining ratio.

It is calculated as follows:

Gaining Ratio = New Ratio – Old Ratio

Example:

A, B and C are partners sharing profits and losses in the ratio of 4:3:2. B retires and A and C decide to share profit/losses in future in the ratio of 5:4. Calculate gaining ratio.

Solution:

Gaining Ratio = New Ratio – Old Ratio

A’s gaining share = \(\frac { 5 }{ 9 }\) – \(\frac { 4 }{ 9 }\)

= \(\frac { 1 }{ 9 }\)

C’s gaining share = \(\frac { 4 }{ 9 }\) – \(\frac { 2 }{ 9 }\)

= \(\frac { 2 }{ 9 }\)

So gaining ratio between A and C is 1 : 2

This implies that A and C will gain the share of B in the ratio of 1 : 2.

Calculation of new profit sharing ratio:

If the remaining partners purchase the share of retiring partner in some specified proportions, then the fraction of share purchased by them is added to their old share to get the new share.

Example:

A, B and C were partners sharing profits in the ratio of 5:4:3. C retired and his share was taken up by A and B in the ratio of 3:2. Find out the new ratio.

Solution:

C’s share will be divided between A and B in the ratio of 3:2.

A will gain = \(\frac { 3 }{ 5 }\) of \(\frac { 3 }{ 12 }\)

= \(\frac { 9 }{ 60 }\)

Hence, A’s new share = \(\frac { 5 }{ 12 }\) + \(\frac { 9 }{ 60 }\)

= \(\frac { 34 }{ 60 }\)

B will gain = \(\frac { 2 }{ 5 }\) of \(\frac { 3 }{ 12 }\)

= \(\frac { 6 }{ 60 }\)

Hence, B’s new share = \(\frac { 4 }{ 12 }\) of \(\frac { 6 }{ 60 }\)

= \(\frac { 26 }{ 60 }\)

New Ratio = A \(\frac { 34 }{ 60 }\) : B \(\frac { 26 }{ 60 }\) or 17 : 13

Note : If the new profit sharing ratio of remaining partners are not given, it will be assumed that the remaining partners continue to share profits and losses in old ratio.

2. Treatment of undistributed profits and reserves:

- The retiring partner is entitled to the accumulated profits and reserves appearing in the firm.

- At the time of retirement these reserves should be transferred to all the old partners in the old profit sharing ratio.

- Journal Entries:

(i) For distributing reserves and accumulated profits:

General Reserve A/c Dr.

Reserve Fund A/c Dr.

Profit/Loss (Cr. balance) A/c Dr.

To All Partners Capital A/c (in old ratio)

(ii) For distributing accumulated losses:

All Partners Capital A/c Dr.

To P/L A/c (Dr. balance) (old ratio)

(iii) For transferring specific funds:

Workmen Compensation Fund A/c Dr.

Instrument Fluctuation Fund A/c Dr.

To All Partners Capital A/c

Alternatively, instead of transferring full amount to all the partners, only the share of profit of retiring partner shall be transferred to his capital A/c.

Reserves and Profit A/c Dr.

To Retiring Partners Capital A/c.

(share of retiring partner).

3. Revaluation of Assets and Liabilities:

- Retirement of a partner is a form of reconstitution of the firm and hence, revaluation of assets and liabilities is required.

- The purpose of revaluation is that the retiring partner should get the benefits from the change in the value of assets and liabilities.

- Revaluation of assets and liabilities will be carried out in the same way as in case of admission.

- If value of assets and liabilities have to be changed – Revaluation A/c will be prepared.

- If assets and liabilities are to be shown at original figures then Memorandum Revaluation Account is prepared.

- Profit from revaluation will be transferred to old partners in old ratio.

- Revaluation A/c Dr. – To All-Partners Capital A/c (old ratio)

- Loss from revaluation shall be debited to Partners Capital Account.

- All Partners Capital A/c Dr. To Revaluation A/c (old ratio)

4. Treatment of Goodwill:

- Goodwill earned by the firm is the result of the efforts of all partners and the goodwill shall be distributed among all the partners at the time of retirement.

- As already studied in the previous unit, Goodwill A/c cannot be raised in the books of account until it is purchased.

- Hence in case of retirement, adjustment for goodwill will be made through Partner’s Capital A/c.

Continuing Partners Capital A/c Dr.

To Retiring Partners Capital A/c

(in gaining ratio with the share of goodwill of retiring partner) - Goodwill A/c is not opened only Capital A/c of the partners may be debited and credited with the necessary accounts.

5. Capital in Profit Sharing Ratio:

After retirement of a partner, the remaining partners may decide that their capitals be in their new profit sharing ratio. The adjustments in the capital accounts for this purpose may be made either by bringing in or payment of cash or through current accounts.

6. Purchase of retiring partner’s share by remaining partners:

The retiring partner’s share may be purchased by the remaining partners in an agreed ratio. In such case, retiring partner’s capital account is closed by transfer to the remaining partner’s capital accounts in the ratio in which they agree to purchase his share.

7. Computation of retiring partner’s interest in the firm:

(i) Retiring partner’s interest represents the amount due to retiring the partner in the firm.

(ii) It comprises of the following:

- Balance of the Capital Account of the retiring partner appearing on the date of retirement.

- Share of undistributable profits and reserves.

- Share in firm’s goodwill.

- Share in profit and loss on revaluation of assets and liabilities.

- Share of profit and loss till date of retirement.

- Salary and interest on capital or drawing till the date of retirement.

Payment of Retiring Partner’s interest:

The mode of payment of the amount due to the retiring partner is based on the agreement between the partners. However, if agreement is silent on these terms, the payment shall be made based on mutual agreement between the partners.

Methods of Payments:

(a) Lump Sum Payment Method –

- This method is applied when the firm has adequate funds.

- The whole amount due shall be paid to the partner at first instance.

- Retired partner capital A/c will be debited & Bank A/c will be credited.

(b) Installment Payment Method –

- This method is applied when the firm is not in a position to pay all the amount due to the partner at once.

- Here, the amount is paid to the partner in installments and till the whole amount is paid, the Capital

- Account appears as a Loan A/c in the books of the firm.

Installments may be paid in the following ways –

(i) Decreasing payment method:

Here the total amount due is divided in equal installments and amount of installment plus interest on the outstanding balance is paid out.

It is so called because as and when the payment is made the outstanding balance goes on decreasing. Due to this, interest also reduces.

(ii) Equal Payment Method:

Here the total amount to be paid is divided in number of equal installments such that every payment (installment + interest) is equal.

Hence, it is known as equal payment method.

Death of a Partner:

1. When a partner dies, the firm will be reconstituted and hence, it will require various adjustments as done in case of retirement.

2. On the death of a partner, the amount due to him will be paid to his legal representatives.

3. The deceased partner’s capital a/c will be credited with his share of profits.

4. The deceased partner’s legal representative will be entitled to the following:

- Amount standing to the credit of Capital A/c

- Share in goodwill

- Interest on capital (if any)

- Share in revaluation profit

- Share in undistributed profits and reserves

- Share in Joint Life Policy

- Share in profit upto the date of death.

5. All adjustments will be done in the same manner as in case of retirement.

Joint Life Policy:

- Partners may take joint life policy for setting the claims of the deceased partner at the time of death of a partner.

- Premium is paid by the firm and on the death the amount is received from the insurance company.

Treatment of Joint Life Policy:

(a) When premium paid is treated as an expense:

(i) For payment of premium:

Joint Life Insurance Premium A/c Dr.

To Bank A/c

Profit/Loss A/c Dr.

To Joint Life Insurance Premium A/c

(ii) For receipt of policy money:

Bank A/c Dr.

To All Partners Capital A/c

(b) When premium paid is treated as an asset and surrender value is taken into account:

(i) For payment of premium:

Joint Life Policy A/c Dr.

To Bank A/c

(ii) At the year end, the amount in excess of surrendered value is treated as a loss and transferred to P/L A/c:

Profit and Loss A/c Dr.

To Joint Life Policy A/c

The balance in JLP A/c is shown as asset in the Balance Sheet.

(iii) When amount is received from the insurance company:

Bank A/c Dr.

To Joint Life Policy A/c

(iv) Amount received on maturity in excess of surrender value will be distributed among all the partners in their profit sharing ratio.

Joint Life Policy A/c Dr.

To All Partner’s Capital A/c

(c) When premium is treated as an asset and Life Policy Reserve

Account is maintained.

(i) For payment of premium of Joint Life Policy

Joint Life Policy A/c Dr.

To Bank A/c

(ii) At the year end an amount equal to the premium paid is appropriated and transferred to Policy Reserve Account:

Profit/Loss A/c Dr.

To Joint Life Policy Reserve A/c

(iii) The balance of Joint Life Policy Account and Joint Life Policy Reserve Account shall be made equal to the surrender value, for this purpose Joint Life Policy Account is credited and Joint Life Policy Reserve Account is debited with an amount equal to the difference between balance of Joint Life Policy Account and surrender value.

Joint Life Policy Reserve A/c Dr.

To Joint Life Policy A/c

(iv) When amount is received on maturity Bank A/c Dr.

To Joint Life Policy A/c.

(v) Closing Joint Life Policy Reserve Account by transferring its balance to Joint Life Policy Account.

Joint Life Policy Reserve A/c Dr.

To Joint Life Policy A/c

(vi) Balance remaining in Joint Life Policy A/c is distributed among partners.

Joint Life Policy A/c Dr.

To All Partners Capital A/c

Individual policies on life of each partner:

- Sometimes, instead of taking a joint life policy, policy is taken on life of individual partners.

- When the partner dies, the amount of his policy will be received in cash and other policies will be shown at their respective surrender values.

Repayment of amount due to the deceased partner:

The amount due to the deceased partner shall be paid as follows –

- Whole amount in lumpsum

- Repayment in installments over a period of time and interest paid on outstanding balance.

- Amount due will be treated as a loan to the firm.

- Payment of annuity to the heirs of deceased partner.

Note:

As per Sec. 37 of the Partnership Act, the representatives of the deceased partner would be entitled, at their discretion to interest @ 6% p.a. on amount due from the date of death to the date of payment or to that portion of profit which is earned by the firm with the amount due to the deceased partner.

Partnership Accounts-Retirement and Death of a Partner MCQ Questions

1. Outgoing partner is compensated for parting with firm’s future profits in favour of remaining partners. In what ratio do the remaining partners contribute to such compensation amount?

(a) Gaining Ratio

(b) Capital Ratio

(c) Sacrificing Ratio

(d) Profit Sharing Ratio.

Answer:

(a) Gaining Ratio

2. Claim of the retiring partner is payable in the following form:

(a) Fully in cash.

(b) Fully transferred to loan account to be paid later on with some interest on it.

(c) Partly in cash and partly as loan repayable later with agreed interest.

(d) Any of the above forms.

Answer:

(d) Any of the above forms.

3. The balance in the retiring or deceased partner’s capital account is transferred to the _________ capital account in the profit sharing ratio.

(a) Solvent Partners

(b) Insolvent Partners

(c) Remaining Partners

(d) New Partners.

Answer:

(c) Remaining Partners

4. At the time of retirement of a partner, firms gets _________ from the insurance company against the Joint Life Policy taken severally for each partner.

(a) Policy Amount

(b) Surrender Value

(c) Policy Value for the retiring partner and surrender value for the rest

(d) Surrender Value for all the partners.

Answer:

(d) Surrender Value for all the partners.

5. As per Section 37 of the Indian Partnership Act, 1932, the executors would be entitled at their choice to the interest calculated from the date of death till the date of payment on the final amount due to the dead partner at _________ percentage per annum.

(a) 7

(b) 4

(c) 6

(d) 12.

Answer:

(c) 6

6. When premium paid on JLP taken up severally for each partner, the amount received on death of a partner would be firm’s profit. It is also, necessary to credit Partner’s Capital Account with _________ of the policy on the lives of the remaining partners.

(a) Policy Value

(b) Lump-Sum Value

(c) Surrender Value

(d) Actual Value.

Answer:

(c) Surrender Value

7. To provide funds to pay to the retiring partner or to the representatives of a deceased partner generally partner creates:

(a) Sinking Fund

(b) Joint Life Policy

(c) Reserve Fund

(d) Separate Bank Account.

Answer:

(b) Joint Life Policy

8. At the time of death of a partner, firm gets _________ from the insurance company against the Joint Life Policy taken jointly for all partners and policies taken severally for each of the partner.

(a) Policy Amount

(b) Surrender Value

(c) Policy Value for the dead partner and surrender value for the rest

(d) Surrender Value for all the partners.

Answer:

(c) Policy Value for the dead partner and surrender value for the rest

9. A, B and C takes a Joint Life Policy. After five years, B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement, A and C decide to share profits equally. They had taken a Joint Life Policy of ₹ 2,00,000 with the Surrender Value ₹ 30,000. What will be the treatment in the Partner’s Capital Account on receiving the JLP amount if Joint Life Policy A/c is maintained at Surrender Value along with the reserve for JLP?

(a) ₹ 30,000 Credited to all the partners in old ratio.

(b) ₹ 2,00,000 Credited to all the partners in old ratio.

(c) ₹ 1,70,000 Credited to all the partners in old ratio.

(d) Distribute JLP Reserve Account in old profit sharing ratio.

Answer:

(d) Distribute JLP Reserve Account in old profit sharing ratio.

10. Balance of M/s A, B and C, sharing profits and losses in proportionate to their capitals, stood as follows: Capital Account: ₹ 3,00,000; ₹ 2,00,000 and ₹ 1,00,000 respectively. A desired to retire from the firm and the remaining partners decided to carry on. Joint Life Policy of the partners is surrendered and cash obtained ₹ 50,000. What will be the treatment for JLP?

(a) ₹ 50,000 Credited to Revaluation Account

(b) ₹ 50,000 Credited to Joint Life Policy Account

(c) ₹ 25,000 Debited to A’s Capital Account

(d) Either (a) or (b).

Answer:

(b) ₹ 50,000 Credited to Joint Life Policy Account

11. A, B and C are the partners sharing profits and losses in the ratio 2:1:1, firm has a Joint Life Policy of ₹ 1,40,000 and in the balance sheet it is appearing at the surrender value i.e. ₹ 40,000. On the death of A, how this JLP will be shared among the partners?

(a) ₹ 50,000 : 25,000 : 25,000

(b) ₹ 60,000 : 30,000 : 30,000

(c) ₹ 40,000 : 35,000 : 25,000

(d) Whole of ₹ 1,20,000 will be paid to A

Answer:

(a) ₹ 50,000 : 25,000 : 25,000

12. A, B and C were partners sharing profits and losses in the ratio of 3:2:1. A retired and goodwill of the firm is to be valued at ₹ 50,000 and Goodwill Account is to be raised which is not appearing in the balance sheet. What will be the treatment for goodwill?

(a) Credited to Revaluation Account at ₹ 50,000

(b) Credited to Partners Capital Account ₹ 50,000 in Profit Sharing Ratio.

(c) Only A’s Capital Account Credited with ₹ 25,000

(d) Only A’s Capital Account Credited with ₹ 50,000.

Answer:

(b) Credited to Partners Capital Account ₹ 50,000 in Profit Sharing Ratio.

13. A, B and C are partners with profit sharing ratio 4:3:2. B retires and Goodwill ₹ 30,000 was shown in books of account. If A & C share profits of B in 5:3, then find the new profit sharing ratio.

(a) 47:25

(b) 17:11

(c) 31:11

(d) 14:21.

Answer:

(a) 47:25

14. A, B and C are partners with profit sharing ratio 4:3:2. B retires and goodwill was valued ₹ 10,800. If A & C share profits in 5:3, find out the goodwill shared by A and C in favour of B.

(a) ₹ 1,850 and ₹ 1,950

(b) ₹ 1,650 and ₹ 1,750

(c) ₹ 2,000 and₹ 1,600

(d) ₹ 1,950 and ₹ 1,650.

Answer:

(d) ₹ 1,950 and ₹ 1,650.

15. The capitals of A, B and C are ₹ 1,00,000; ₹ 75,000 and ₹ 50,000, profits are shared in the ratio of 3:2:1. B retires on the basis of firm purchased by A and C. The new ratio between A and C is 3:1, find the capital of A and C.

(a) ₹ 1,25,000 and ₹ 1,00,000

(b) ₹ 1,46,250 and ₹ 42,000

(c) ₹ 1,56,250 and ₹ 68,750

(d) ₹ 86,250 and ₹ 46,250.

Answer:

(c) ₹ 1,56,250 and ₹ 68,750

16. A, B and C take a Joint Life Policy. After five years, B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement A and C decide to share profits equally. They had taken a Joint Life Policy of ₹ 2,00,000 with the Surrender Value ₹ 30,000. What will be the treatment in the partner’s capital account on receiving the JLP amount if, Joint Life premium is fully charged to revenue as and when paid?

(a) ₹ 30,000 credited to all the partners in old ratio

(b) ₹ 2,00,000 credited to all the partners in old ratio

(c) ₹ 1,70,000 credited to all the partners in old ratio

(d) No treatment is required.

Answer:

(a) ₹ 30,000 credited to all the partners in old ratio

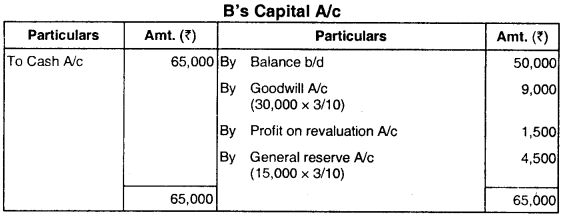

17. A, B and C were partners in a firm sharing profits and losses in the ratio of 2:2:1. The capital balance are ₹ 50,000 for A, ₹ 70,000 for B, 135,000 for C. B declared to retire from the firm and balance in reserve on the date was t 25,000. If goodwill of the firm was valued as ₹ 30,000 and profit on revaluation was ₹ 7,500 then, what amount will be payable to B?

(a) ₹ 70,820

(b) ₹ 76,000

(c) ₹ 75,000

(d) ₹ 95,000.

Answer:

(d) ₹ 95,000.

18. At the event of retirement, the remaining partners will pay the amount of Goodwill to the retiring partner in:

(a) New Profit Sharing Ratio

(b) Old Profit Sharing Ratio

(c) Gaining Ratio

(d) Sacrificing Ratio.

Answer:

(c) Gaining Ratio

19. Amar, Akbar, Anthony and Suleman are partners sharing profits and losses in the ratio of 1/3, 1/6, 1/3 and 1/6 respectively. Anthony retires and Amar, Akbar and Suleman decide to share the profits and losses equally in future. Which of the statements hold true.

(a) Amar gains nothing; Akbar and Suleman gains equally

(b) Akbar gains nothing; Amar and Suleman gains equally

(c) Suleman gains nothing; Amar and Akbar gains equally

(d) Akbar, Suleman and Amar gains equally.

Answer:

(a) Amar gains nothing; Akbar and Suleman gains equally

20. As per which Accounting Standard, goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it.

(a) AS-11

(b) AS-12

(c) AS 10

(d) AS 9

Answer:

(c) AS 10

21. When Memorandum Revaluation Account is opened:

(a) When value of Assets and Liabilities will not be altered in the books of accounts

(b) When value of Assets and Liabilities will be altered in the books of accounts

(c) On Revaluation of Assets and Liabilities

(d) None of these.

Answer:

(a) When value of Assets and Liabilities will not be altered in the books of accounts

22. Aman, Ashish & Manish are partners in a business and divide profits and losses in the ratio of 15:9:8 respectively. Manish retires. Aman and Ashish decide to share profits in equal proportions. Calculate the gaining ratio.

(a) 1:7

(b) 1:1

(c) 7:1

(d) 1:2

Answer:

(a) 1:7

23. At the time of retirement of a partner, if the goodwill appears in the Balance Sheet, it must be written off. The Capital Accounts of all partners are debited in:

(a) The old profit sharing ratio

(b) The new profit sharing ratio

(c) The capital ratio

(d) Equal ratio.

Answer:

(a) The old profit sharing ratio

24. A, B and C are partners with profits sharing ratio 4:3:2. B retires and goodwill of ₹ 10,800 is shown in books of account. If A & C shares profits of B in 5:3, then find the new profit sharing ratio.

(a) 13:11

(b) 17:11

(c) 31:11

(d) 14:21.

Answer:

(a) 13:11

25. The Capitals of A, B and C are ₹ 1,00,000; ₹ 75,000 and ₹ 50,000, profits are shared in to the ratio of 3:2:1. B retires on the basis that his shares is purchased by other partners keeping the total capital intact. The new ratio between A and C is 3:1. Find the capital of A and C after purchasing B’s share.

(a) ₹ 1,50,000 and ₹ 1,00,000

(b) ₹ 1,46,250 and ₹ 42,000

(c) ₹ 1,56,250 and ₹ 68,750

(d) ₹ 86,250 and ₹ 46,250.

Answer:

(c) ₹ 1,56,250 and ₹ 68,750

26. Joint Life Policy is taken by the firm on the life(s) of _________.

(a) All the partners jointly

(b) All the partners severally

(c) On the life of all the partners and employees of the firm

(d) Both ‘a’ and ‘b’.

Answer:

(d) Both ‘a’ and ‘b’.

27. A, B and C are partners sharing profits in the ratio 2:2:1, on retirement of B, goodwill was valued as ₹ 30,000. Find the contribution of A and C to compensate B.

(a) ₹ 20,000 and ₹ 10,000

(b) ₹ 8,000 and ₹ 4,000

(c) They will not contribute anything

(d) Information is insufficient for any comment.

Answer:

(b) ₹ 8,000 and ₹ 4,000

28. A, B, and C were partners in a firm sharing profits and losses in the ratio of 2:2:1 respectively with the capital balance of ₹ 50,000 for A and B for C ₹ 25,000. B declared to retire from the firm and balance in reserve on the date was ₹ 15,000. If goodwill of the firm was valued as ₹ 30,000 and profit on revaluation was ₹ 7,050 then, what amount will be transferred to the loan account of B:

(a) ₹ 70,820

(b) ₹ 50,820

(c) ₹ 25,820

(d) ₹ 58,820.

Answer:

(a) ₹ 70,820

29. A, B and C were partners sharing profits and losses in the ratio of 3:2:1. A retired and goodwill of the firm is to be valued at ₹ 24,000 and goodwill Account is to be raise which is not appearing in the Balance Sheet. What will be treatment for goodwill?

(a) Credited to Revaluation Account at ₹ 24,000

(b) Credited to Partners Capital Account ₹ 24,000 in profits sharing ratio

(c) Only A’s Capital Account Credited with 12,000

(d) Only A’s Capital Account Credited with ₹ 24,000.

Answer:

(b) Credited to Partners Capital Account ₹ 24,000 in profits sharing ratio

30. Balances of M/s Ram, Rahul and Rohit sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: Ram ₹ 3,00,000 Rahul ₹ 2,00,000 and Rohit ₹ 1,00,000. Ram desired to retire from the firm and the remaining partners decided to carry on. Joint Life Policy of the partners surrendered and cash obtained ₹ 60,000. What will be the treatment for JLP?

(a) ₹ 60,000 credited to Revaluation Account

(b) ₹ 60,000 credited to Joint Life Policy Account

(c) ₹ 30,000 debited to Ram’s Capital Account

(d) Either ‘a’ or ‘b’

Answer:

(b) ₹ 60,000 credited to Joint Life Policy Account

31. Balances of A, B and C sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: A ₹ 2,00,000; B ₹ 3,00,000 and C ₹ 2,00,000 JLP Reserve ₹ 80,000 and JLP ₹ 80,000. A desired to retire from the firm and the remaining partners decided to carry on in equal ratio, Joint Life Policy of the partners surrendered and cash obtained ₹ 80,000. What will be the treatment for JLP?

(a) Cash Received credited to Revaluation Account

(b) JLP Reserve balance credited to Partner’s Capital Account in new profit sharing ratio

(c) JLP Reserve balance credited to Partner’s Capital Account in new profit sharing ratio

(d) Cash Received credited to Partner’s Capital Account in old profit sharing ratio.

Answer:

(b) JLP Reserve balance credited to Partner’s Capital Account in new profit sharing ratio

32. Balances of A, B, and C sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: A ₹ 2,00,000. B ₹ 3,00,000 and C ₹ 2,00,000. A desired to retire from the firm, B and C share the future profits equally. Goodwill of the entire firm be valued at ₹ 1,40,000 and no Goodwill account being raised.

(a) Credit Partner’s Capital Account with old profit sharing ratio for ₹ 1,40,000.

(b) Credit Partner’s Capital Account with new profit sharing ratio for ₹ 1,40,ooo.

(c) Credit A’s Account with ₹ 40,000 and debit B’s Capital Account with ₹ 10,000 and C’s Capital Account with ₹ 30,000.

(d) Credit Partner’s Capital Account with gaining ratio for ₹ 1,40,000.

Answer:

(c) Credit A’s Account with ₹ 40,000 and debit B’s Capital Account with ₹ 10,000 and C’s Capital Account with ₹ 30,000.

33. Balance of A, B and C sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: A ₹ 2,00,000. B ₹ 3,00,000 and C ₹ 2,00,000. JLP Reserve and JLP at ₹ 80,000. A desired to retire from the firm. B and C share the future profits equally. Joint Life Policy of the partners surrendered and cash obtained ₹ 80,000. Goodwill of the entire firm be valued at ₹ 1,40,000 and no Goodwill account being raised. Revaluation Loss was ₹ 10,000. Amount due to A is to be settled on the following basis: 50% on retirement and the balance 50% within one year. The total capital of the firm is to be the same as before retirement. Individual capitals to be in their profit sharing ratio. Find the balances of partner’s capital Account:

(a) ₹ 3,50,000 each

(b) ₹ 3,20,000 each

(c) ₹ 1,90,000 each

(d) ₹ 1,30,000 each.

Answer:

(a) ₹ 3,50,000 each

34. Balance of Ram, Hari & Mohan sharing profits and losses in the ratio 2:3:2 stood as follows: Capital Accounts: Ram ₹ 10,00,000; Hari ₹ 15,00,000 Mohan ₹ 10,00,000 Joint Life Policy ₹ 3,50,000. Hari desired to retire from the firm and the remaining partners decided to carry on with the future profit sharing ratio of 3:2. Joint Life Policy of the partners surrendered and cash obtained ₹ 3,50,000. What would be the treatment for JLP?

(a) ₹ 3,50,000 credited to Partner’s Capital Account in new ratio.

(b) ₹ 3,50,000 credited to Partner’s Capital Account in old ratio.

(c) ₹ 3,50,000 credited to Partner’s Capital Account in capital ratio.

(d) ₹ 3,50,000 credited to JLP account.

Answer:

(d) ₹ 3,50,000 credited to JLP account.

35. A, B and C are three partners sharing profit and loss in the ratio of 1:2:3 and their capital are 50,000, 1,00,000 and 1,50,000 respectively. The balance in reserve stood at ₹ 20,000 and goodwill is valued at ₹ 10,000. Calculate the amount to be paid to B by the firm _________.

(a) ₹ 1,10,000

(b) ₹ 90,000

(c) ₹ 1,00,000

(d) ₹ 30,000

Answer:

(a) ₹ 1,10,000

36. Ram, Krishna and Ganesh were sharing profits and losses in the ratio of 5:3:2. Ram retires and Krishna and Ganesh share the future profits & losses equally. Goodwill of the firm is valued at 1,00,000. Calculate the amount of goodwill to be debited to Krishna’s and Ganesha’s capital A/c.

(a) ₹ 60,000 & ₹ 40,000

(b) ₹ 40,000 & ₹ 60,000

(c) ₹ 50,000 each

(d) ₹ 30,000 & ₹ 70,000

Answer:

(b) ₹ 40,000 & ₹ 60,000

37. P, Q and R are sharing profits and losses equally. R retires and the goodwill is appearing in the books at ₹ 10,000. Goodwill of the firm is valued at ₹ 40,000. Calculate the net amount to be credited to A’s capital A/c.

(a) ₹ 20,000

(b) ₹ 5,000

(c) ₹ 10,000

(d) ₹ 30,000

Answer:

(c) ₹ 10,000

38. A, B and C are sharing profits equally. C retires from the firm. The new profit sharing ratio will be 1:2. Calculate the gaining ratio of A and B respectively

(a) 0:1/2

(b) 1:1

(c) 1:1/3

(d) 0:1/3

Answer:

(d) 0:1/3

39. X, Y and Z are sharing profits in the ratio of 3:5:1. Y retires and his entire shares of profits is taken over by Z. Calculate the new profit sharing ratio _________.

(a) 1:2

(b) 1:3

(c) 3:1

(d) 1:1

Answer:

(a) 1:2

40. A, B and C are sharing profit and losses equally. A dies on 30th September, 2005 and the profits for the year ending 31st March, 2006 are ₹ 3,00,000. Calculate A’s share in profits

(a) ₹ 25,000

(b) ₹ 66,667

(c) ₹ 50,000

(d) None of the above

Answer:

(c) ₹ 50,000

41. X, Y and Z are partners sharing profits in the ratio of 7:5:8. Z died on 30th November, 2005 and the profits for the year are 4,80,000. Calculate Z’s share in profits

(a) ₹ 1,28,000

(b) ₹ 1,26,000

(c) ₹ 1,24,000

(d) None of the above

Answer:

(a) ₹ 1,28,000

42. The amount due to the deceased partner is paid to _________.

(a) Father

(b) Executor

(c) Wife

(d) Relatives

Answer:

(b) Executor

43. The interest rate which is paid to the executors from the date of death to the date of payment is _________.

(a) 7%

(b) 6%

(c) 9%

(d) 12%

Answer:

(b) 6%

44. The amount which the firm gets from the insurance company on the death of a partner is called _________.

(a) Premium value

(b) Surrender value

(c) Policy value

(d) None of these

Answer:

(c) Policy value

45. The premium paid on JLP is debited to _________.

(a) P&L A/c

(b) Insurance company A/c

(c) Partners capital A/c

(d) None of these

Answer:

(a) P&L A/c

46. The balance of Joint Life Policy appearing in the balance sheet represents _________.

(a) Surrender value

(b) Total premium paid

(c) Annual premium paid

(d) Policy amount

Answer:

(a) Surrender value

47. The JLP amount received by a firm is distributed in _________.

(a) Old profit sharing ratio

(b) Capital ratio

(c) Gaining ratio

(d) New ratio

Answer:

(a) Old profit sharing ratio

48. Claim of the retiring partner is payable in the following form _________.

(a) Cash

(b) Loan A/c

(c) Both (a) and (b)

(d) None of the above

Answer:

(c) Both (a) and (b)

49. If the firm dissolves due to the retirement of one of the partner, then what amount of JLP will be credited in the partners capital A/c _________.

(a) Surrender value

(b) Maturity value

(c) Premium paid

(d) None of these

Answer:

(a) Surrender value

50. JLP is taken by the firm on the life of _________.

(a) All the partners jointly

(b) All the partners severally

(c) On the life of employees

(d) None of the above

Answer:

(a) All the partners jointly

51. Retiring partner is compensated for parting with the firm’s future profits in favour of remaining partners. The remaining partner’s contribute to such compensation amount in:

(a) Gaining Ratio

(b) Capital Ratio

(c) Sacrificing Ratio

(d) Profit sharing Ratio

Answer:

(a) Gaining Ratio

On retirement of a partner, remaining partner contributes amount to retiring partner as compensation for his share in the firm. This compensation is borne by remaining as continuing partners in gaining ratio.

Gaining ratio can be determined as – Gaining ratio = New profit sharing ratio – old profit sharing ratio

52. A, B and C share profits and losses of the firm equally. B retires from business and his share is purchased by A and C in the ratio of 2 : 3. New profit sharing ratio between A and C respectively would be:

(a) 01 : 01

(b) 02 : 02

(c) 07 : 08

(d) 03 : 05

Answer:

(c) 07 : 08

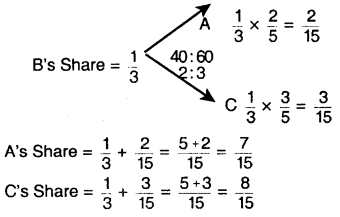

A’s old ratio = \(\frac { 1 }{ 3 }\)

B’s old ratio = \(\frac { 1 }{ 3 }\)

C’s old ratio = \(\frac { 1 }{ 3 }\)

Gaining ratio of A and C = 2 : 3

Gaining share of A = \(\frac { 1 }{ 3 }\) x \(\frac { 2 }{ 5 }\) = \(\frac { 2 }{ 15 }\)

Gaining share of C = \(\frac { 1 }{ 3 }\) x \(\frac { 3 }{ 5 }\) = \(\frac { 3 }{ 15 }\)

A’s new ratio = Old ratio + Gaining ratio

= \(\frac { 1 }{ 3 }\) + \(\frac { 2 }{ 15 }\) = \(\frac { 7 }{ 15 }\)

New Ratio between A and C = \(\frac { 7 }{ 15 }\) : \(\frac { 8 }{ 15 }\) = 7 : 8

53. If a partner goes insolvent and is not able to bring his share of deficiency in cash, then his deficiency should be borne by the remaining solvent partners:

(a) Equally

(b) On the basis of their profit sharing ratio

(c) On the basis of their adjusted capital ratio

(d) On the basis of their original investments.

Answer:

(c) On the basis of their adjusted capital ratio

In India, if it is mentioned in the Partnership Deed that on the insolvency of a partner deficiency of his capital A/c will be borne in particular ratio, it will be borne accordingly in the case of insolvency of the partner, but if no mention about any ratio is made in this connection in the partnership deed, the deficiency of the insolvent partner’s capital A/c will be shared by the solvent partners in their capital ratio.

54. A, B and C share profits and losses of a firm on 1 : 1 : 1 basis. B retired from business and his share is purchased by A and C in 40 : 60 ratio. New profit and loss sharing ratio between A and C would be _________.

(a) 1 : 1

(b) 2 : 3

(c) 7 : 8

(d) 3 : 5.

Answer:

(c) 7 : 8

Calculation of New Profit or Loss Sharing Ratio

Old Ratio of A, B and C partners is 1 : 1 : 1

After retirement of B, his share is distributed between A and C in 40 : 60.

Therefore, New Ratio of A’s = \(\frac { 1 }{ 3 }\) + (\(\frac { 1 }{ 3 }\)x\(\frac { 4 }{ 10 }\))

= \(\frac { 1 }{ 3 }\) + \(\frac { 4 }{ 30 }\) = \(\frac { 14 }{ 30 }\) = \(\frac { 7 }{ 15 }\)

C’s = \(\frac { 1 }{ 3 }\) + (\(\frac { 1 }{ 3 }\) x \(\frac { 6 }{ 10 }\))

= \(\frac { 1 }{ 3 }\) + \(\frac {6}{ 30 }\) = \(\frac {16}{ 30 }\) = \(\frac {8}{ 15 }\)

New share between A and C is 7:8

Thus option (c) is Right.

55. At the time of retirement of a partner from a partnership firm, the adjustment of goodwill is done in _________.

(a) Old profit sharing ratio

(b) Gaining ratio

(c) Sacrificing ratio

(d) New profit sharing ratio.

Answer:

(b) Gaining ratio

At the time of Retirement of a partner from a Partnership Firm, the continuing partners will gain in terms of profit sharing ratio. Therefore, the adjustment of goodwill is to be done in the gaining ratio to the retiring partners.

This Option (b) is Right.

56. X, Y, Z capitals are ₹ 80,000, 75,000 and 50,000 respectively. Z retired and is paid ₹ 60,000 and no goodwill is valued. What is the new capital of Y after retirement of Z.

(a) ₹ 71,000

(b) ₹ 74,000

(c) ₹ 75,000

(d) ₹ 86,000

Answer:

(c) ₹ 75,000

Amount of Z’s Capital – ₹ 50,000

Amount Paid to him = ₹ 60,000

Amount Paid to Z in excess of his capital = ₹ (60,000 – 50,000)

= ₹ 10,000

→ ₹ 10,000 to be borne by X & Y in equal ratio.

→ Y’s initial capital = ₹ 75,000

Less : Amount of capital borne

by him (10,000 x \(\frac { 1 }{ 2 }\)) 5,000

y’s capital after Z’s retirement 70,000/-

57. If at the time of retirement, JLP is received, it will be distributed among which partners _________.

(a) Retiring Partner

(b) Remaining Partner

(c) All Partners

(d) None of these

Answer:

(c) All Partners

At the time of retirement of a partner, the amount of JLP is distributed among existing partners along with the retiring partner. Hence, it can be said the amount of JLP received is distributed among all partners at the time of retirement

58. X, Y, Z are Partners in a firm, sharing profit and losses in the ratio 3 : 2 : 1. Z retires from the firm what will be the new profit sharing ratio.

(a) 3 : 1

(b) 3 : 2

(c) 2 : 3

(d) 1 : 2

Answer:

(b) 3 : 2

If the new profit sharing ratio of remaining partners are not given, it will be assumed that the remaining partners continue to share profits and losses in old ratio. Thus, after retirement of Z, new profit sharing ratio will be 3 : 2

59. Which amongst the following is transferred to Partner’s Executor’s A/c at the time of death of the partner?

(a) Interest on Capital

(b) Share in Goodwill

(c) Share in Profit

(d) All of the above.

Answer:

(d) All of the above

Following particulars are transferred to the Partners’s executor account at the time of death of a partner:

(a) Partner’s Capital A/c

(b) Interest on Partner’s Capital A/c

(c) Share in Goodwill

(d) Share of Profit & Loss

Hence, option all of the above is correct.

60. Calculate Gaining Ratio from following information :

Current Profit Sharing Ratio of A, B & C = 5 : 4 : 3

C retires and his share was taken equally by A and B.

(a) 1 : 1

(b) 1 : 3

(c) 13 : 11

(d) None of these.

Answer:

(a) 1 : 1

Gaining Ratio = New Share – Old Share.

→ Old Profit Sharing ratio of A, B, C= 5 : 4 : 3.

→ C’s Share = \(\frac { 3 }{ 12 }\) = \(\frac { 1 }{ 4 }\)

→ A’s Gain = \(\frac { 1 }{ 4 }\) x \(\frac { 1 }{ 2 }\) = \(\frac { 1 }{ 8 }\)

→ B’s Gain = \(\frac { 1 }{ 4 }\) x \(\frac { 1 }{ 2 }\) = \(\frac { 1 }{ 8 }\)

→ Gaining ratio = \(\frac { 1 }{ 8 }\) : \(\frac { 1 }{ 8 }\) = 1 : 1

→ Hence, option (a) is correct.

61. In a partnership firm A, B and C are partners sharing profit and loss in ratio of 3:2:1. They have taken a joint life policy of ₹ 1,00,000 and the Joint Life Insurance premium is treated as an expense. On death of B, the claim amount was received. The amount received on Joint Life Policy will be:

(a) Credited to all partners capital account

(b) Credited to B’s capital account

(c) Debited to B’s capital account

(d) Credited to remaining partners capital account.

Answer:

(a) Credited to all partners capital account

Partner’s often take out a Joint Life Policy to provide funds for settling the claim of the deceased partner. Annual premium is paid by the firm and on the death of a partner, the amount of the policy is received by the firm from the insurance company. On death of a partner, the amount due to his legal representatives will have to be paid.

So, on the death of B, the amount received of JLP will be credited to all partner’s capital account.

62. On the retirement of a partner any reserve lying in the books of account:

(a) Should be transferred to retiring partner only

(b) Should be transferred to all partner in the old profit sharing ratio

(c) Should not be transferred

(d) Should be transferred to remaining partners in the new profit sharing ratio.

Answer:

(b) Should be transferred to all partner in the old profit sharing ratio

On the retirement of a partner, any reserve lying in the books of account should be transferred to all partner’s capital account in profit sharing ratio.

63. In a Partnership firm, the Joint Life Insurance premium is treated as an expense. Which of the following account is credited for amount received from Joint Life Insurance Policy on the death of a partner?

(a) Bank Account

(b) All Partners Capital Account

(c) Deceased Partners Capital Account

(d) Remaining Partners Capital Account.

Answer:

(b) All Partners Capital Account

Joint Life Policy A/c Dr.

To All Partners Capital A/c

64. In a partnership firm, Ram’s Capital is (b) All Partners Capital Account

(b) All Partners Capital Account

(b) All Partners Capital Account

80,000, Sita’s Capital is ₹ 75,000 and Mohan’s Capital is ₹ 50,000. They share income in 3:2:1 ratio respectively. Mohan is retiring from the partnership. Mohan is paid ₹ 60,000 and no goodwill is recorded. What will be the Ram’s Capital balance after the retirement of Mohan?

(a) ₹ 74,000

(b) ₹ 70,000

(c) ₹ 75,000

(d) ₹ 86,000.

Answer:

(a) ₹ 74,000

Retiring partner Mohan’s capital account is ₹ 50,000 but he is paid ₹ 60,000 in order to settle his account.

Thus, ₹ 10,000 is being paid to him towards the goodwill of the business. This share is 1/6, therefore he will get this goodwill from remaining partner’s in their gaining ratio which will be 3 : 2.

Entry will be:

(3 : 2) Ram’s Capital A/c Dr. 6,000

Sita’s Capital A/c Dr. 4,000

To Mohan’s Capital A/c 10,000

Hence, after this Ram’s Capital Account will be ₹ 80,000 – 6,000 = ₹ 74,000/-

65. A, B and C were in partnership sharing profits in the ratio of 4:2:1 respectively. A guaranteed that is no case C’s share in profit should be less than ₹ 7,500. Profits of the firm for the year 2013 amounted to ₹ 31,500. A’s share in profit will be:

(a) ₹ 15,000

(b) ₹ 18,000

(c) ₹ 16,000

(d) ₹ 3,000

Answer:

(a) ₹ 15,000

A’s share → 31,500 x \(\frac { 4 }{ 7 }\) = 18,000

B’s share → 31,500 x \(\frac { 2 }{ 7 }\) = 9,000

C’s share → 31,500 x \(\frac { 1 }{ 7 }\) = 4,500

was guaranteed by A that his share will not be less than 7,500. Therefore, A will compensate from his share i.e. 18,000 – 3,000 = 15,000 = A’s share 4,500 + 3,000 = 7,500 ← C’s share.

66. A, B and C are partners in a firm, sharing profits and losses in the ratio of 5:3:2 respectively. The balance of capital is ₹ 50,000 for A & B each and ₹ 40,000 for ‘C’, ‘B’ decides to retire from firm. The goodwill of firm is valued at ₹ 30,000 and profit on revaluation of assets at ₹ 5,000. The firm also have a balance in the Reserve A/c for ₹ 15,000 on that date. What amount will be payable to ‘B’?

(a) ₹ 55,000

(b) ₹ 65,000

(c) ₹ 75,000

(d) ₹ 45,000

Answer:

(b) ₹ 65,000

B’s share in the profit & loss ratio = \(\frac { 3 }{ 10 }\)

B’s Capital A/c

67. On the death of a partner. Joint life policy amount if company treat JLP as expenses. Then amount is distributed among:

(a) All partner

(b) Gaining partner

(c) Deceived partner

(d) None of these

Answer:

(a) All partner

If Joint life policy is treated as an expense, then on the death of a partner the amount of policy received by the firm is credited to all partners capital accounts in profit sharing ratio.

68. A, B, C are partners. B retires A & C. Gaining ratio, if profit sharing ratio of A, B, C is 2 : 3 : 1?

(a) 3 : 1

(b) 2 : 4

(c) 2 : 1

(d) 3 : 2

Answer:

(c) 2 : 1

If nothing is given, it will be assumed that remaining partners will gain in their old profit sharing ratio. Thus, after retirement of B, A & C will gain in their old ratio i.e. 2 : 1.

69. In a partnership firm, Ram’s Capital is ₹ 80,000, Sita’s Capital is ₹ 75,000 and Mohan’s Capital is ₹ 50,000. They share income in 3 : 2 : 1 ratio respectively. Mohan is retiring from the partnership and his share is purchased by the remaining partners equally. Mohan is paid ₹ 60,000 and no goodwill is recorded. The Capital of Ram would be:

(a) ₹ 74,000

(b) ₹ 75,000

(c) ₹ 86,000

(d) ₹ 71,000

Answer:

(b) ₹ 75,000

Mohan’s share is 1/6 which is taken up equally by Ram and Sita i.e.

1 /12 each therefore Ram’s new ratio will be 3/6 + 1/12 = \(\frac { 6+1 }{ 12 }\) = 7/12

Sita’s new ratio = \(\frac { 2 }{ 6 }\) + \(\frac { 1 }{ 12 }\) = \(\frac { 4+1 }{ 12 }\) = 5/12

and there gaining ratio is 1 : 1

Mohan is paid ₹ 10,000 over and above his capital which will be borne equally by Ram and Sita i.e. ₹ 5,000 each therefore capital of Ram will be 80,000 – 5,000 = 75,000

70. According to Garner Vs. Murray rule in case of fixed capital, loss arising due to insolvency of a partner is :

(a) Divided among all partner in capital ratio

(b) Divided among all partner in profit and loss ratio

(c) Divided among all solvent partner in capital ratio

(d) Divided among all solvent partner in profit sharing ratio.

Answer:

(c) Divided among all solvent partner in capital ratio

According to the decisions in Garner Vs. Murray, in case of insolvency of a partner, the loss should be divided among the other partners in the ratio of capitals then standing. The effect of this decision practically is that the deficiency in the capital account of the insolvent partner has to be borne by the solvent partners in the ratio of capitals standing just prior to dissolution.

71. X, Y and Z are partner and sharing profit and losses equally. Y died, X and Z decided to continue with the partnership and Y’s share is purchased by X and Z in 2 : 3 ratio. Goodwill of the firm was valued for ₹ 18,000. The firm also booked revaluation loss of ₹ 9,000. If at the time of death of Y, his capital was ₹ 20,000 the amount payable to Y’s executors would be :

(a) ₹ 23,000

(b) ₹ 20,000

(c) ₹ 38,000

(d) ₹ 29,000

Answer:

(a) ₹ 23,000

Goodwill = 18,000

Revaluation Loss = \(\frac { (9,000) }{ 9,000 }\)

Share of Y in above = 9,000 x \(\frac { 1 }{ 3 }\) = 3,000

Total amount to be paid to Y’s executors = 20,000 + 3,000 = ₹ 23,000

72. P, Q and R are partners and having profit and loses equally. The capital balance stood at ₹ 25,000, ₹ 20,000 and ₹ 18,000 respectively. Their last three year’s profit were ₹ 18,000, ₹ 12,000 and ₹ 15,000 Q died. P and R decided to continue with the partnership and Q’s share is purchased by P and R in 2 : 3. As per agreement, the value of goodwill is calculated at 3 year’s purchase price of average profit of last three years. It is decided that no goodwill account is opened in the books of account and it is to be adjusted through Capital Account after adjustment, the Capital of P would be :

(a) ₹ 19,000

(b) ₹ 25,000

(c) ₹ 20,000

(d) ₹ 18,000

Answer:

(d) ₹ 18,000

Goodwill of the firm

Average Profit = \(\frac { Sum of Profit of years }{ No.of years }\)

= \(\frac{18,000+12,000+15,000}{3}\)

= 15,000

Goodwill = No. of purchase year x Average Profit

= 3 x 15,000 = 45,000

Q’s share of Goodwill = \(\frac{45,000}{3}\) = 15,000

Goodwill will be contributed by P and R in gaining ratio 7 : 8

P’s share = 15,000 x \(\frac { 7 }{ 15 }\) = 7,000

Goodwill

Q’s share of Goodwill

R’s share = 15,000 x \(\frac { 8 }{ 15 }\) = 8,000

P’s Capital A/c Dr. 7,000

R’s Capital A/c Dr. 8,000

To Q’s Executor’s A/c 15,000.

After Adjustment P’s capital would be 25,000 – 7,000 = ₹ 18,000

73. In a partnership firm, Ram’s capital is ₹ 80,000, Sita’s Capital is.₹ 75,000 and Mohan’s Capital is ₹ 50,000. They share income in 3 : 2 : 1 ratio, respectively. Mohan is retiring from the partnership, Mohan is paid ₹ 60,000, and no goodwill is recorded. What will be the Ram’s Capital balance after the retirement of Mohan?

(a) ₹ 74,000

(b) ₹ 71,000

(c) ₹ 75,000

(d) ₹ 86,000

Answer:

(a) ₹ 74,000

Amount of Goodwill paid = ₹ 10,000

Goodwill contribution ratio = 3 : 2

Ram = 10,000 x \(\frac { 3 }{ 5 }\) = 6,000

Sita = 10,000 x \(\frac { 2 }{ 5 }\) = 4,000

Capital After Retirement = 80,000 – 6,000 = ₹ 74,000

74. A, B and C share profits and losses of a firm on 1 : 1 : 1 basis. B retired from business and his share is purchased by A and C is 70 : 90. New profit sharing ratio below A and C would be

(a) 1 : 1

(b) 11 : 13

(c) 1 : 2

(d) 5 : 3

Answer:

(c) 1 : 2

If on retirement of partner, that remaining partners purchase the share of retiring partner and the new profit sharing ratio will be;

A’s old share : \(\frac { 1 }{ 3 }\)

A’s new share (after purchase of retiring partner) : \(\frac { 70 }{ 160 }\) – \(\frac { 1 }{ 3 }\) = \(\frac { 50 }{ 480 }\)

B’s old share : \(\frac { 1 }{ 3 }\)

B’s new shares (after purchase of retiring partner) : \(\frac { 90 }{ 160 }\) – \(\frac { 1 }{ 3 }\) = \(\frac { 110 }{ 480 }\)

B’s gain : \(\frac { 110 }{ 480 }\) = \(\frac { 50 }{ 480 }\) = \(\frac { 50 }{ 110 }\) = \(\frac { 1 }{ 2 }\)

Hence, ratio of gain between A & B is 1 : 2; option (c) is correct.

75. A, B and C Share Profits and losses of a firm on 1 : 1 : 1 basis. B retired from business and his share is purchased by A and C in 40 : 60 ratio. New profit and loss sharing ratio between A and C would be :

(a) 1 : 1

(b) 2 : 3

(c) 7 : 8

(d) 3 : 5

Answer:

(c) 7 : 8

New Ratio between A & C = 7 : 8.

76. At the time of retirement of a partner from a partnership firm, the adjustment of goodwill is done in :

(a) Old profit Sharing ratio

(b) Gaining ratio

(c) Sacrificing ratio

(d) New profit sharing ratio.

Answer:

(b) Gaining ratio

Due to retirement of one of the partner the other partners will gain in share and hence goodwill adjustment will be done in Gaining Ratio.

77. A, B and C were partner ‘B’ died and his share was taken over by A & C equally and later ‘P’ was enter for ‘1/4’ share. Find the new profit sharing ratio.

(a) 3 : 3 : 2

(b) 1 : 1 : 2

(c) 4 : 3 : 2

(d) None of the above

Answer:

(a) 3 : 3 : 2

A : B : C

\(\frac { 1 }{ 3 }\) : \(\frac { 1 }{ 3 }\) : \(\frac { 1 }{ 3 }\)

B died and his share taken by A & B equally hence

B = \(\frac { 1 }{ 3 }\) x \(\frac { 1 }{ 2 }\) → \(\frac { 1 }{ 6 }\)

A’s share = Old Ratio + Gaining Ratio

= \(\frac { 1 }{ 3 }\) + \(\frac { 1 }{ 6 }\) → \(\frac { 2+1 }{ 6 }\) → \(\frac { 3 }{ 6 }\) = \(\frac { 1 }{ 2 }\)

C’s Share = Old + Gaining

= \(\frac { 1 }{ 3 }\) + \(\frac { 1 }{ 6 }\) → \(\frac { 1 }{ 2 }\)

P is admitted for \(\frac { 1 }{ 4 }\)th share.

1 – \(\frac { 1 }{ 4 }\) → \(\frac { 3 }{ 4 }\)

A’s share = \(\frac { 3 }{ 4 }\) x \(\frac { 1 }{ 2 }\) → \(\frac { 3 }{ 8 }\)

C’s share = \(\frac { 3 }{ 4 }\) x \(\frac { 1 }{ 2 }\) → \(\frac { 3 }{ 8 }\)

P’s Share = \(\frac { 1 }{ 4 }\)

Hence, new Ratio of A : C : P = \(\frac { 3 }{ 8 }\) x \(\frac { 3 }{ 8 }\) → \(\frac { 1 }{ 4 }\)

i.e. 3 : 3 : 2

78. Profit of deceased partner is transfer in his _________.

(a) Loan A/c

(b) P/LA/c

(c) Executors A/c

(d) Both ‘a’ and ‘c’

Answer:

(d) Both ‘a’ and ‘c’

Profit of deceased partners is transferred in his either loan. All with the interest of @ 6% p.a. or partner’s Executors A/c.