Chapter 12 Loans and Advances – CS Professional Banking Law and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Loans and Advances – CS Professional Banking Law and Practice Study Material

Question 1.

Attempt the following: (Dec 2007)

(i) Briefly explain Tier-I capital and Tier -II capital . (5 marks)

(ii) Enumerate the principles of a sound lending policy. (5 marks)

Answer:

(i) Tier I Capital :

Tier I Capital also called Core Capital includes the following items:

(i) Paid-up share capital collected from regular members of a bank having voting powers.

(ii) Free Reserves as per the audited accounts. Reserves, if any, created out of revaluation of fixed assets or those created to meet outside liabilities should not be included in the Tier I Capital. Free reserves shall exclude all reserves/ provisions which are created to meet anticipated loan losses, losses on account of fraud etc., depreciation in investments and other assets and other outside liabilities. While the amounts held under the head ‘Building Fund’ will be eligible to be treated as part of free reserves, ‘Bad and Doubtful Reserves’ shall be excluded.

(iii) Capital Reserve representing surplus arising out of sale proceeds of assets.

(iv) Any surplus (net) in Profit and Loss Account i.e. balance after appropriation towards dividend payable, education fund, other funds whose utilisation is defined, asset loss, if any, etc.

![]()

Tier II Capital

Tier II Capital consists of:

(i) Undisclosed reserves and cumulative perpetual preference shares:

Undisclosed reserves should represent accumulation of post tax profits not encumbered by any known liability and should not be routinely used for absorbing normal loan or operating losses.

Cumulative perpetual preference shares should be fully paid-up and should not contain clauses, which, permit redemption by the holder.

(ii) Revaluation reserves: Revaluation reserves arise from revaluation of assets, which are undervalued in the banks’ books, e.g., bank premises. The revaluation reserves should be considered at a discount of 55% for being treated as part of Tier II capital. Such reserves will have to be reflected in the Balance Sheet as revaluation reserves.

(iii) General provisions and loss reserves: If these are not attributable to the actual diminution in value or identifiable potential loss in any specific asset and are available to meet unexpected losses, they can be included in Tier II Capital.

(iv) Hybrid debt capital instruments: Capital instruments which combine certain characteristics of equity and certain characteristics of debt come in this category. Where these instruments have close similarities to equity, they will be eligible to be included in Tier II capital.

(v) Subordinated debt: Banks, including foreign bank operating in India, are given autonomy to raise rupee subordinate debt as Tier II capital. For issue of subordinated debt instruments in foreign currency as well as for borrowing from Head Office by foreign banks for inclusion in Tier II capital, prior approval of Reserve Bank Indian should be obtained.

![]()

(ii) Principles of a sound lending policy :

Lending is the most important function of banking. It constitutes major sources of earning for banks. Income of banks arises from a variety of sources like Commission, Exchange, and Rent on lockers, earnings from miscellaneous services and interest on advances. Of all these sources of earning, interest on advances constitutes the largest source. Management of lending portfolio of a bank on sound healthy and profitable lines is the very essence of good banking.

Total lending portfolio of a commercial bank represents thousands of decisions taken at various levels like Head Office, Zonal and Regional Offices and Branches.

Today, a Bank’s branches run into thousands, spread over long distances including some branches in overseas centres also.

Number of borrowers and volume of business have grown tremendously. With emphasis placed now-a-days on lending to agriculture and weaker and neglected sections of the society and with the policy of achieving balanced banking development of all regions through encouragement of lending at various places throughout the country, a branch of a bank is no longer looked upon as a mere deposit collection center but each branch today is also looked upon as an outlet for funds.

Discretionary powers given to Branch Managers have also increased considerably. Many decisions relating to loans and advances are required to be taken independently at the level of the Branch itself. Even where a good advance proposal has to be forwarded to Regional, Zonal or Head Office for sanction, it is the Branch which has to originate the proposal and recommend the same for sanction.

it will be seen from the above that in today’s context, every branch of a bank is involved in the process of decision making as far as lending function is concerned. It is therefore, necessary for the Branch Manager to acquire thorough grasp of the principles of good and sound lending.

Management of lending portfolio of a bank can be described as management of 3 ‘R’s, viz. Resources, Risk and Remuneration.

![]()

Question 2.

What are the restrictions under the Banking Regulation Act, 1949 which a banker must adhere to while sanctioning advances against the security of shares? (June 2008, 5 marks)

Answer:

While sanctioning advances against the security of shares, the banker must adhere to provisions of Banking Regulation Act, 1949 and RBI guidelines issued from time to time.

In terms of Section 19(2) of the Banking Regulation Act, 1949, no banking company shall hold shares in any company, whether as pledgee, mortgagee or absolute owner, of an amount exceeding 30 percent of the paid-up share capital of that company or 30 percent of its own paid-up share capital and reserves, whichever is less, except as provided in sub-section (1) of Section 19 of the Act.

This is an aggregate holding limit for each company. While granting any advance against shares, underwriting any issue of shares, or acquiring any shares on investment account or even in lieu of debt of any company, these statutory provisions should be strictly observed.

![]()

Question 3.

What has been done to boost the credit delivery system of the banks? (Dec 2008, 5 marks)

Answer:

Several measures have been initiated by the Reserve Bank of India to boost the credit delivery system of banks. The norms for bank lending for working capital have been revised under which banks are free to decide the level of inventory holding and receivables. In order to usher in market driven banking the cut off limit of consortium lending has been done away with. Banks can organize syndication of credit in respect of prime borrowers.

Very recently, we have seen credit innovations in credit delivery in the form of micro credit and kisan credit cards.

Question 4.

What is the role of the Credit Information Bureau of India Ltd. (CIBIL) in dissemination of credit information on borrowers? (Dec 2008, 5 marks)

Answer:

Credit Information Bureau of India Limited (CIBIL) has been set up to compile and disseminate credit information on borrowers in a systematic manner for sound credit decisions, thereby helping to facilitate avoidance of adverse selection and thus, curbing growth of NPAs.

At present, CIBIL is entrusted with the task of development of a system of proper credit record and sharing credit information among financial intermediaries. This would help in enhancing the quality of credit decisions; improving the asset quality of banks and facilitating faster credit delivery. Information pertaining to suit filed accounts of willful defaulters as well as non-suit filed accounts is now required to be filed by banks with CIBIL.

![]()

Question 5.

Attempt the following;

“The bank is not required to give prior notice to the borrower before exercising its right of lien.” Examine the statement. (June 2009, 5 marks)

Answer:

Right of lien: The banker is not required to give prior notice to the borrower before exercising the right of lien, Section 171 of the Indian Contract Act does not contemplate any notice before exercising general lien and set off. Section 171 of the Indian Contract Act provides as follows:

“Banker, factors, wharfingers, attorneys of a High Court and policy brokers, may, in the absence of a contract to the contrary retain, as security for a general balance of account any goods bailed to them, but no other persons have a right to retain, as a security for such balance, goods bailed to them, unless there is an express contract to that effect”.

![]()

Question 6.

Attempt the following:

“Effective and efficient management of advances portfolio is the key to successful banking.” Comment. (Dec 2009, 5 marks)

Answer:

Effective and efficient management of advances portfolio is the key to successful banking. Some aspects of this matter relate to pre-sanction appraisal, timely sanction, sanction of adequate amount in order to avoid under financing or over financing, release of loan in stages as per the progress of work, supervision on end use of funds, effective monitoring in order to check deviation from planned path and to take timely corrective steps, proper documentation and charging of securities, proper follow up for timely recovery of loans and timely renewal of documents, etc. Apart from the general principles of lending all the above factors mentioned are to be taken due care of by the banks.

![]()

Question 7.

Why margins are maintained by the bank? (June 2015, 4 marks)

Answer:

A banker always keeps adequate margin because of the following reasons:

- The market value of the securities is liable to fluctuations in future with the result that the banker’s secured loans may turn into partly secured ones.

- The liability of the borrower towards the banker increases gradually as interest accrues and other charges become payable by him.

Therefore, margins acts as a safety net which banker keeps cover the present debt and the future additions to them.

![]()

Question 8.

Answer the following question in brief:

Illustrate the concept of ‘window dressing’ with a suitable example. (June 2015, 1 mark)

Answer:

‘Window Dressing’ is a situation of presenting a rosy picture instead of the real one. Such a situation is created, intentionally by manipulating the financial statements at the end of the year.

For example, some firms try to present a higher current ratio than the actual to create better liquidity impression of the organization.

![]()

Question 9.

Describe briefly whether garnishee order can attach undrawn or unutilized balance in an overdraft and/or cash credit account. (June 2017, 5 marks)

Answer:

Third party (e.g., bank, customer, employer etc.) who, while not involved in the Court Case between a debtor or creditor is required by a Court Order (Garnishee Order) to retain the money (account balance, amount due, wages etc.,) belonging to debtors. The issue whether garnishee order applies to undrawn balance is discussed below.

If the account is overdrawn, the banker owes no money to the customer and hence the Court Order (Garnishee Order) ceases to be effective. A bank is not a garnishee with respect to the unutilized portion of the overdraft or cash credit facility sanctioned to its customer and such utilized portion of cash credit or overdraft facility cannot be said to be an amount due from the bank to its customer.

The above decision was given by the Karnataka High Court in Canara Bank Vs. Regional Provident Fund Commissioner. In this case, the Regional Provident Fund Commissioner wanted to recover the arrears of provident fund contribution from the defaulters’ bankers out of the unutilized portion of the cash credit facility. Rejecting this claim, the High Court held that the bank cannot be termed as a Garnishee of such unutilized portion of cash credit, as the banker’s position is that of creditor.

The banker, of course, has the right to set off any debt owed by the customer before the amount to which the Garnishee Order applies is determined. But it is essential that debt due from the customer is actual and not merely contingent.

Hence, it can be said that garnishee order is not applicable to undrawn/unutilized balance in an overdraft/loan account and the order ceases to be effective.

![]()

Question 10.

Explain the reasons in brief for the following statements in the context of practices prevailing under the banking: (June 2018, 3 marks each)

(i) Additional credit facilities are not extended by the bank to wilful defaulters or group defaulters.

(ii) A board resolution is obtained by the bank from a company ratifying the excess drawings permitted to the company, in case drawings in excess of the limit are permitted.

(iii) While creating equitable mortgage, nothing in writing should be obtained from the person creating the mortgage.

(iv) A very high current ratio is not a welcome sign.

(v) DSCR of less than 1 is not considered good for sanction of Term Loans (generally the norm is 2 : 1).

Answer:

(i) Wilful defaulters are those who have not effected repayment of the loans despite generating profits by diverting funds. They do not follow the terms and conditions of the advance and are not desirable / dependable customers. RBI has also advised that the borrower whose name appears in the list of wilful defaulters released by them should not be financed for at least 5 years from the date of the release. In this case of group borrowers, non payment by one /two borrowers affect the group image and pose problems for the bank in renewal / recovery of the loan.

(ii) As per Section 179(3) and 180(1) (c) of the Companies Act, 2013 the power to borrow is vested with the Board of Directors, they should exercise this power by means of resolutions passed at meeting of the Board. Any excess drawings have to be authorised by a board resolution. Otherwise, it will not be binding on the company; Further also it may also not bind the company even if the excess drawings have been liquidated subsequently.

![]()

(iii) If any instrument is signed by the mortgagor while he creates an equitable mortgage, it may be contended that the, mortgage is a registered mortgage. It is inadmissible as evidence, as no stamp duty has been paid on it. The documents has not been registered with Registrar of Assurances. Therefore nothing in writing be obtained from the person who is creating an equitable mortgage.

(iv) Current Ratio is the index of the borrower’s liquidity. If the ratio is very high it will put the bank on the alert as it may be due to inefficient working capital management, manipulation in the quality / valuation of stocks, large concentration of unsold goods / unrealised book debts, etc. have taken place.

(v) DSCR is the ratio of annual cash accruals to the amount of term loan instalments and DPG instalments payable in the year. Cash accruals should be adequate to provide for fluctuations in business, increased margin for working capital, etc. If it is less than 1, the cash accruals are not sufficient to meet term loan instalments and DSCR is not adequate, thereby the repayment will be affected.

![]()

Question 11.

Apart from the credit evaluation procedures and the lending rates, the loan policy of a bank also has various other components. Discuss these components. (Dec 2018, 5 marks)

Answer:

The Components of credit evaluation procedures and lending rates in banks are as under:

Loan Objectives: Due to the presence of multifarious objectives like profitability, liquidity, volume of business, risk levels, etc. there will be prioritization of objectives while drafting the policy. But due to certain conflicting situations, reconciliation/trade-off between different objectives may become necessary.

Volume and Mix of Loans: The policy should specify the targeted composition of the loan portfolio, such composition being in terms of industry/location/size/interest rate/security.

Geographical Spread: There will be various locations from where a bank conducts its operations. Of these locations, some may be weak credit demand areas with a considerably high deposit potential and vice versa.

![]()

Loan Administration: Efficient administration is the key to the success of the lending policy and for improving its efficiency, the authority of the loan executives should be clearly stated as also their responsibilities. The loan policy should state the sanctioning powers of the loan officers regarding the credit limits.

Credit Files: The contents of the credit file should include all details of the borrower including detailed financial statements and analysis, collateral provided and the value of the same, details of compensating balances, nonrate clauses, etc. Other issues/parameters that the loan policy may contain:

- Type and extent of collaterals.

- Compensating balances.

- Statutory limits for different types of loans.

- Monitoring mechanism.

- Loan-Deposit ratio.

- Incentive schemes for the loan officers.

- Loan repayment pattern.

- Communication practices.

- Extension of renewals of past-due installment ioans (rescheduling the loans).

- Loan-loss reserves.

- Consumer laws and regulations.

- Role of credit and recovery department.

![]()

Question 12.

(a) ‘Although a depositor is a creditor of the bank, but he is not a secured creditor’. Elucidate with reference to banker-customer relationship.

(b) Explain the type of relationship between banks and their borrowing customers who borrow against securities from the bank. (June 2019, 3 marks each )

Answer:

(a) Banker – Customer Relationship

When a customer deposits money with his bank, the ownership of that money is transferred to bank who can use it as per its requirement without the permission of the customer, however it is obligatory on the part of a bank to honour the cheque issued by the customer if the cheque is in order and applicable funds are available in his account, the customer becomes tender(lender) and the bank becomes borrower.

As such, the relationship is that of a Debtor and Creditor. Although a depositor is a creditor of the Bank, he is not a secured creditor. In case of liquidation or winding up of the Banks, depositors do not get preferential treatment in repayment of their deposits. It is for this reason that deposits Insurance Corporation was set up and scheme of deposit insurance was started (which is at present ₹ One lakh per customer per bank).

(b) When a customer borrows against tangible securities, the following relationships are created depending on the transaction and security offered. A few examples in this regard are as under:

| Security | Charge | Borrower | Bank |

| Insurance policy / book debts | Assignment | Assignor | Assignee |

| Property | Mortgage | Mortgagor | Mortgagee |

| Gold ornaments / shares | Pledge | Pledgor | Pledgee |

| Stocks / debtors/ Car / Machinery | Hypothecation | Hypothecator | Hypothecatee |

![]()

Question 13.

Answer briefly the following question:

What is non-fund based financing of banks? (June 2022, 2 marks)

Question 14.

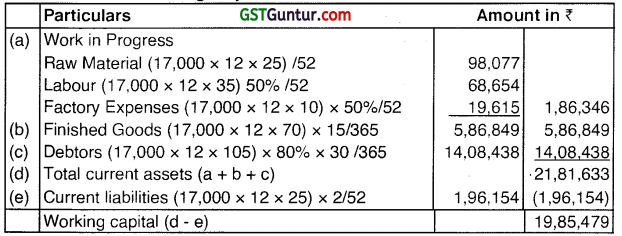

The summary of per unit cost of production of a product of A & Co. is as under: (Dec 2014)

(i) Raw material cost : ₹ 25

(ii) Labour and other manufacturing cost : ₹ 35

(iii) Factory expenses : ₹ 10

(iv) Office expenses : ₹ 20

(v) Depreciation on machinery is ₹ 5 for a production capacity of 25,000 units per month.

(vi) The optimum batch quantity is 5,000 units with a work cycle of 1 week.

(vii) The credit available for raw materials is 2 weeks.

(viii) Sales are 20% in cash and the remaining on credit with an average period of 30 days’ credit.

(ix) Holding period of stock of finished goods is 15 days.

(x) The article is sold for t 105 and average sales for the next year is estimated at 17,000 units per month.

The proprietor wants to avail of working capital limits from the bank. Guide him as to what limits he should apply? (5 marks)

Answer:

Calculation of Working Capital

As per Tondon Committee limits would be either of the following:

1. 75% of Working Capital = ₹ 14,89,109

2. 75% of Current Assets less 1000/o of current liabilities = ₹ 14,40,071

Notes:

- It has been assumed that depreciation is not considered in factory expenses and so it has been ignored as it is not a part of working capital.

- For raw material 1 week holding is considered as production cycle is of 1 week.

- For labour and factory expenses 50% are considered as part of WIP.

![]()

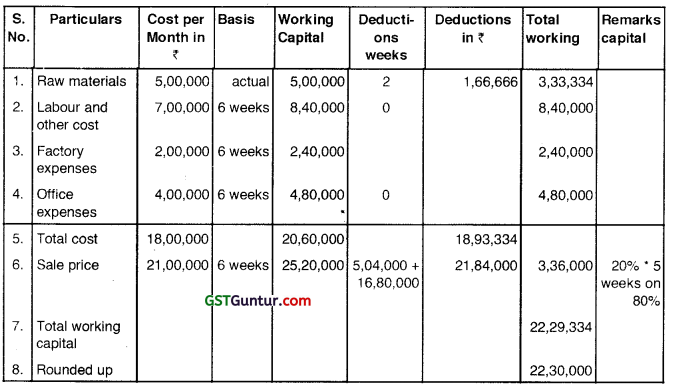

Alternative Answer 4

(Amount in ₹)

| S. No. | Particulars | Per unit | For 5,000 units | For 17,000 units | For 20,000 units |

| 1. | Raw materials | 25 | 1,25,000 | 4,25,000 | 5,00,000 |

| 2. | Labour and other cost | 35 | 1,75,000 | 5,95,000 | 7,00,000 |

| 3. | Factory expenses | 10 | 50,000 | 1,70,000 | 2,00,000 |

| 4. | Office expenses | 20 | 1,00,000 | 3,40,000 | 4,00,000 |

| 5. | Total cost | 90 | 4,50,000 | 15,30,000 | 18,00,000 |

| 6. | Sale price | 105 | 5,25,000 | 17,85,000 | 21,00,000 |

| Less: Total cost | 90 | 4,50,000 | 15,30,000 | 18,00,000 | |

| 7. | Profit | 15 | 75,000 | 2,55,000 | 3,00,000 |

![]()

The working capital requirement would have to be calculated for 20,000 units as the min batch size is 5000 units. The working capital requirements will be as under:

While calculating the working capital the cost for 6 weeks is considered and the credit period for purchase of raw materials is reduced. Since the total cost of manufacture is considered the working capital requirement for credit sale of only 1 week is considered to avoid duplication.

The limits to be applied would be as under.

Cash credit against stock ₹ 19.00 Lakhs

Cash credit against Book debts ₹ 3.26 Lakhs

Bills discount ₹ 3.36 Lakhs

Maximum ₹ 22.30 Lakhs

![]()

Question 15.

Sunshine Ltd. is sanctioned ₹ 10 crore cash credit limit but utilises only ₹ 8 crore on an average at contracted rate of 20%. The borrower will have to pay a commitment fee @ 0.50% on the unused portion of the credit limit. Additionally, the bank insists for margin (cash deposit) of 20% of the utilised limit and 5% of the unutilised portion. Reserve requirement imposed by Central Bank is 10% of the deposits. In light of the above –

(i) What is the revenue from this loan to the bank?

(ii) Work out estimated funds outlay for the borrower. (Dec 2016, 5 marks)

Answer:

(i) Calculation of revenue from this loan to the bank

= Revenue from credit limit utilized + Revenues from credit limit unutilized

= ₹ 8 crores × 0.20 + ₹ 2 crores × 0.005

= ₹ 1.61 crores

(ii) Calculation of funds outlay for the borrower

= Utilized Credit limit less (Margin requirement + Reserve requirement)

= ₹ 8 crore – {₹ 8 crore × 0.20 + ₹ 2 crore × 0.05) – (₹ 1.6 crore + ₹ 0.10 crore) × 0.10

= 8 – (1.60 + 0.10) – (1.7 × 0.10)

= 8 – 1.70 – 0.17

= ₹ 6.13 crore

![]()

Question 16.

“Akshay” wants to take a loan of ₹ 10,000 from “Bharat”, but “Bharat” does not know “Akshay” very well and fears that “Akshay” may not return the money. “Chandar” is a good friend of “Akshay”. “Chandar” tells “Bharat” that if “Akshay” does not return the money to “Bharat”, “Chandar” will personally, pay it to “Bharat”. Under this assurance by “Chandar” to “Bharat”, “Bharat” lends the money to “Akshay”. On the date on which the money was to be returned, “Akshay” fails to pay back ₹ 10,000. Can “Bharat” now, demand this money from “Chandar”? Respond in detail in the context of the relevant provisions of the law. Support your answer with a decided case law, if any. (June 2018, 5 marks)

Answer:

Yes, he can. The contract, described above is called a Contract of Guarantee. This contract involves three persons. Under the above illustration, “Akshay” is the Principal Debtor, “Bharat ”is the Creditor. “Chandar” is the Surety. Therefore, in the above scenario, “Chandar” shall pay to “Bharat” ₹ 10,000/-.

However, it is important to note that the contract does not end here. “Bharat” can, after he has paid the amount to “Chandar”, claim the same amount from “Akshay”. This is the unique feature of a Contract of Guarantee. There are actually two separate agreements each between two of the parties. The first is an express contract between the person standing guarantee (surety) and the person to whom the guarantee is made (creditor). The second agreement is between the person who is being guaranteed (principal debtor) and the surety and this is an implied contract.

The essence of guarantee is that a guarantor agrees to discharge his liability in the happening of one event, i.e., when the principal debtors fails in his duty. The surety should undertake to perform the promise or discharge the liability of a third person in case of his default.

A contract of guarantee must be supported by consideration and consideration between the creditor and principal debtor is a valid and good consideration for the guarantee given by the surety. Injunction against encashment of bank guarantee without establishing fraud or irretrievable injustice not granted (Dodsal Ltd. Vs. Krishak Bharati Co – operative Ltd.). An unconditional irrevocable bank guarantee provides, inter alia, for encashment on demand without demur.

![]()

Question 17.

Calculate the working capital finance (Bank Finance) for the year 2019-20 of M/s Ganga Enterprises Pvt. Ltd. as per Simplified Turnover Method of lending based on the following information :

Balance Sheet As on 31st March 2019

| Liabilities | ₹ | Assets | ₹ |

| Equity Share Capital | 10,00,000 | Fixed Assets | 12,50,000 |

| Long term Debt | 10,00,000 | Debtors | 5,00,000 |

| Creditors | 5,00,000 | Stock | 16,00,000 |

| Cash Credit | 10,00,000 | Cash | 1,50,000 |

| 35,00,000 | 35,00,000 |

Sales of the company for the year 2018-19 were ₹ 80,00,000. (Dec 2019, 6 marks)

Answer:

Turnover method of lending is suggested by Nayak committee. Under this method minimum 25% of the projected turnover (or 3 months sales) is the working capital requirement. The working capital limit given is 20% of projected sales and the borrower’s contribution (margin) is 5% of projected turnover.

| Particulars | Amount |

| Sales turnover (assuming they are projected by the borrower and accepted by the banker) | 80,00,000 |

| Minimum WC required (25% of projected sales) | 20,00,000 |

| Minimum Borrower’s contribution 5% of projected sales | 4,00,000 |

| Available margin (NWC) | |

| Excess of LTS over LTU 7,50,000 + Creditors 5,00,000 | 12,50,000 |

| Bank finance as per Turnover method | 7,50,000 |

![]()

Question 18.

Write short notes on:

(a) Financing joint liability groups (JLGS)

(b) Financing self help groups (SHGS)

Answer:

(a) A JLG is group formed basically consisting of tenant farmers and small farmers cultivating land, without having proper title of such land and rural entrepreneurs practicing non-farm activities.

JLG – some important features

Members residing in the same village/ area, agree to function as a join liability group. One of the important requirement is that each member should have trust among the members to accept the joint liability for individual and group loans. One person from a family can become a member of a JLG.

The members should be practicing agricultural activity at least for a continuous period of not less than one year, within the area of operations of the bank branch. Such members should not be a defaulter to any other formal financial institution Joint Liability Group – Banks give two types of loans to JLGs (i) individual loans (ii) group finance.

![]()

Model I: Banks can give individual loans, and all members would jointly execute one inter-se document (i.e., every member is jointly and severally liable for repayment of all loans taken by all individuals in the group. In this case, banks need to assess the proposal based on the individual member’s activities and credit absorption capacity. Banks should also ensure that there is a mutual agreement and consensus among all members in respect of the amount of individual loan amount that would be created.

Model II: Banks can finance the JLG on group basis, in this case 4 to 10 individuals would form a group and function as one borrowing unit. The group would be sanctioned one loan, which could be a combined loan requirement of all its members, in case of crop loan, the bank would assess the loan amount based on crop/s to be cultivated and the available area to each member of the JLG.

All members would jointly execute the document and takes the responsibility of the debt liability jointly and severally. In both models the group would give a mutual guarantee offered by the JLG members for the group and/or individual loan.

![]()

(b) SHG is “a voluntary association of poor formed with the common goal of social and economic empowerment”. In micro financing, a SHG is mainly used as a medium(channel) of credit delivery. It is an voluntary association formed by the members as a group with the objective of eradication of poverty of the members. The members of SHG agree to save regularly to create a common savings called as group corpus. The SHGs encourages the savings habit among group members.

The SHG mobilizes the resources of the individual members with a common goal for the overall economic development. The SHG assist banks, financial institutions, in the recovery of loans. SHGs empower women in the developmental activities SHGs – important aspects Generally the number of members in a SHG is 10 to 20. In certain exceptional areas like, hills, deserts and areas with less population, and in case of economically weaker and/or physically disabled persons, the number of members may be 5 to 20. Only one member from a family can be the member of a SHG.

The desirable requirement is that all the members of a SHG should belong to the families below the poverty line. The main objective of a SHG is to promote the common savings, hence all members need to contribute regularly to the common savings (corpus) of the group. No interest is payable to the members for the savings. The members should not be encouraged to adjust their savings amount against their loan due to the SHG.

![]()

Every SHG needs to have a SB account (preferably with a bank in their service area). To open an account the SHG needs to pass a resolution in the group meeting and signed by all the members. A copy of the resolution should be submitted to the bank, while opening the bank account.

Operations in Bank account: The SHG should authorize at least three members, any two of them, to jointly operate the bank account. The bank account should be in the name of the group and not in the names of individual members. The SHG should clearly decide the terms and conditions of the functioning of the SHG regarding lending to the members (viz., the interest, the loan amount, repayment period etc.)