Chapter 19 Final Accounts of Banking Companies – CS Professional Banking Law and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Final Accounts of Banking Companies – CS Professional Banking Law and Practice Study Material

Question 1.

Attempt the following:

Give a brief account of asset-liability management process in banking. (Dec 2009, 5 marks)

Answer:

Asset-liability management process in banking

Asset-Liability Management (ALM) is a dynamic process of Planning, Organizing and controlling of Assets & Liabilities – their volumes, mixes, maturities, yields and costs in order to maintain liquidity and Net Interest Income. An effective Asset Liability Management Technique aims to manage the volume, mix, maturity, rate sensitivity, quality and liquidity of assets and liabilities as a whole so as to attain a predetermined acceptable risk/reward ratio.

It is aimed to stabilize short-term profits, long-term earnings and long-term substance of the bank. The parameters for stabilizing ALM are- Net Interest Income, Net Interest Margin and Economic Equity Ratio. Bank’s liquidity management is the process of generating funds to meet contractual or relationship obligations at reasonable prices at all times. New load demands, existing commitments, and deposit withdrawals are the basic contractual or relationship obligations that a bank must meet.

![]()

Analysis of following factors throw light on a bank’s adequacy of liquidity position:

(a) Historical Funding requirement.

(b) Current liquidity position .

(c) Anticipated future funding needs

(d) Sources of funds

(e) Options for reducing funding needs

(f) Present and anticipated asset quality

(g) Present and future earning capacity

(h) Present and planned capital position

To satisfy funding needs, a bank must perform one or a combination of the following:

(a) Dispose off liquid assets

(b) Increase short term borrowings

(c) Decrease holding of less liquid assets

(d) Increase liability of a term nature

(e) Increase Capital funds

![]()

Liquidity risks may stem both internally and externally. External liquidity risks can be geographic, systemic or instrument specific. Internal liquidity risk relates largely to perceptions of an institution in its various markets: local, regional national or international.

All assets & liabilities are to be reported as per their maturity profile into 8 maturity buckets:

- 1 to 14 days

- 15 to 28 days

- 29 days and upto 3 months

- Over 3 months and upto 6 months

- Over 6 months and upto 1 year

- Over 1 year and upto 3 years

- Over 3 years and upto 5 years

- Over 5 years

Mismatches can be positive or negative.

Positive Mismatch : MA > ML

Negative Mismatch : ML < MA

In case of a positive mismatch, excess liquidity can be deployed in money market instruments, creating new assets & Investment swaps, etc.

For negative mismatch, it can be financed from market borrowings (Call/Term), Bills rediscounting, Repos & deployment of foreign currency converted into rupee.

To meet the mismatch in any maturity bucket, the bank has to look into taking deposit and invest it suitably so as to mature in time bucket with negative mismatch.

![]()

Question 2.

Return on capital employed (ROCE) is one of the important financial analysis tools which provides information about the earning power of a firm. In this context, discuss the ‘DU PONT MODEL’ of financial analysis. Support your answer with two examples one with poor ROCE and other with positive ROCE. (June 2014, 15 marks)

Answer:

Return on Capital Employed (ROCE) is a measure of how well a company’s management creates value for its shareholders. The computation of ROE requires only net income and shareholders’ equity. ROE = net income / shareholder’s equity.

If this number goes up, it is generally a great sign for the company as it is showing that the rate of return on the shareholders’ equity is rising. The problem is that this number can also rise simply when the company takes on more debt, thereby decreasing shareholder equity. This would increase the company’s leverage, which will make the stock more risky. Therefore for more detailed analysis DU PONT Model is used.

Du Pont Model: The Du Pont Company of the United States introduced a system of financial analysis considered as one of the important tool for financial analysis. Du Pont Model is an extended analysis of a company’s return on equity. It concludes that a company can earn a high return on equity if:

- It earns a high net profit margin;

- It uses its assets effectively to generate more sales; and/or

- It has a high financial leverage.

![]()

According to Du Pont analysis:

Return on Equity = Net Profit Margin × Asset Turnover × Financial Leverage

Example: Company A and B operate in the same market and are of the same size. The following table shows their respective net profit margin, asset turnover and financial leverage.

Return on Equity = \(\frac{\text { Net Income }}{\text { Sales }}\) × \(\frac{\text { Sales }}{\text { Total Assets }}\) × \(\frac{\text { Total Assets }}{\text { Total Equity }}\)

Du Pont equation provides a broader picture of the return the company is earning on its equity. It tells where a company’s strength lies and where there is a room for improvement.

Example: Company A and B operate in the same market and are of the same size. The following table shows their respective net profit margin, asset turnover and financial leverage.

| Company A | Company B | |

| Profit Margin | 30% | 30% |

| Total Asset Turnover | 0.50 | 6.0 |

| Financial Leverage | 3 | .50 |

| ROE | 45% | 90% |

In the above example, both companies have the same overall profit margin, but the companies’ ROE are completely different.

![]()

Question 3.

Answer the following questions in brief: (June 2015)

(a) What is ‘net worth’ and explain its significance? (1 mark)

(b) Name any four ratios that the management of every firm is interested in along with their significance? (1 mark)

Answer:

(a) ‘Net Worth’ represents the amount that belongs to the owners of the firm. In true sense, equity shareholders are the real owners of the firm. Paid up share capital, general reserves, capital reserves, share premium and balance lying in Profit and Loss Account, totally, constitute net worth. Preference share capital amount is also included in net worth. It also states a cushion available to the outside creditors of the firm.

(b) Every management is interested to maintain sufficient liquidity and utmost profitability of the firm, they manage. The ratios in which management is more interested are:

(a) Current ratio shows the liquidity strength of the firm.

(b) Net Profit Ratio gives the net profit margin of the firm that can be compared with the industry about its competitors.

(c) Return on Equity ratio shows the earning capacity of proprietors’ fund.

(d) Debt to Equity ratio is the key financial ratio and is used to assess the long-term financial solvency of a firm.

![]()

Question 4.

Explain briefly the significance of any four types of ratio that the management of every firm is interested in. (June 2016, 10 marks)

Answer:

1. Profitability Ratios :

Operating Profit Margin (OPM) and Net Profit Margin (NPM) are calculated by dividing the figures of operating profit (EBIT) which means earnings before interest and tax and net profit respectively by the net sales. OPM is an indicator of the operating efficiency of the enterprise while NPM is an indication of ability to withstand the adverse business conditions.

2. Liquidity Ratios :

These are Current Ratio (CR) and Quick Ratio or Acid Test Ratio. While the CR is a ratio of total current assets to total current liabilities, quick ratio is calculated by dividing current assets (excluding inventory) by total current liabilities. These ratios indicate the capacity of an enterprise to meet its short term obligations.

3. Capital Structure Ratios :

Debt Equity Ratio (DER) is a ratio of total outside long term liability to the Net Worth of an enterprise. High debt equity ratio are an indication of high borrowings in relation to the owned funds. It also affects the viability of the operation of the enterprise, as higher borrowings means higher costs and lower operating margins. In case of those enterprises, which are not capital intensive (i.e. the requirement of fixed assets is low), which are not indicated by DER, may be disproportionate to the capital. To get a better result, OL/TNW ratio i.e. the ratio of total out side liabilities to tangible Net Worth can be used.

4. Inventory Turnover Ratio :

This ¡s one of the important ratios to measure the skills of the management of the firm. This is an indicator of how fast or slow is the movement of inventory. It is calculated by dividing cost of goods sold by average inventory. A higher ratio indicates faster movement of inventory. This is also used for calculating average inventory holding period.

![]()

Question 5.

Basel Committee on Banking Supervision (BCBS) has identified Compliance Risk as one of the major risk faced by banks. In this context, explain the Basel Committee’s principles for managing ‘Compliance Risk’in banks. (Dec 2018, 10 marks)

Answer:

Basel committee has defined “Compliance risk” as the risk of legal or regulatory sanctions, material financial loss, or loss of reputation a bank may suffer as a result of its failure to comply with laws, regulations, rules, related self-regulatory organization standards, and codes of conduct applicable to its banking activities (together, compliance laws, rules and standards).

Basel Committee’s Principles

1. The bank’s board of directors is responsible for overseeing the management of the bank’s compliance risk. The board should approve the bank’s compliance policy, including a formal document establishing a permanent and effective compliance function, the board should oversee the implementation of the policy, including ensuring that compliance issues are resolved effectively and expeditiously by senior management with the assistance of the compliance function.

2. The bank’s senior management is responsible for the effective management of the bank’s compliance risk.

3. Senior management should, with the assistance of the compliance function at least once a year, identify and assess the main compliance risk issues facing the bank and the plans to manage them, report to the board of directors or a committee of the board on the bank’s management of its compliance risk and report promptly to the board of directors or a committee of the board on any material compliance failures.

![]()

4. The bank’s senior management is responsible for establishing a permanent and effective compliance function within the bank as part of the bank’s compliance policy and take the necessary measures to ensure that the bank can rely on a permanent and effective compliance function.

5. The bank’s compliance function should be independent. Head of Compliance should not be placed in a position where there is a possible conflict of interest between his compliance responsibilities and any other responsibilities he may have and Banking supervisors must be satisfied that effective compliance policies and procedures are followed and that management takes appropriate corrective action when compliance failures are identified. Compliance starts at the top.

It will be most effective in a corporate culture that emphasizes standards of honesty and integrity and in which the board of directors and senior management lead by example and compliance function staff should have access to the information and personnel necessary to carry out their responsibilities.

6. The bank’s compliance function should have the resources to carry out its responsibilities effectively. Compliance function staff should have a sound understanding of compliance laws, rules and standards and their practical impact on the bank’s operations.

7. The compliance function should advise senior management on compliance laws, rules and standards, including keeping them informed on developments in the area. The compliance function may have specific statutory responsibilities (e.g. fulfilling the role of anti-money laundering officer).

It may also contact relevant external bodies, including regulators, standard setters and external experts. after the technical and manufacturing activities of the company. He is an engineer. Z is also a whole-time director and looks after marketing, business development and finance areas of the company. He is son of X.

![]()

Products

The company is one of the leading equipment manufacturers for electrical industry of the country and engaged in manufacturing LOW AND MEDIUM VOLTAGE equipments for distribution of electricity.

Marketing network

The company has a robust marketing and distribution network in the low and medium voltage electrical distribution industry. It comprises 20 branches and 30 representative offices covering length and breadth of the country with its headquarters in New Delhi. The branches are spread over in all major State capitals and big cities.

Distribution and Service network

The company has more than 3,000 authorised dealers and 2,500 retail outlets across the country. The service set-ups are having well trained service engineers located at headquarters and all branches to provide efficient after-sales service.

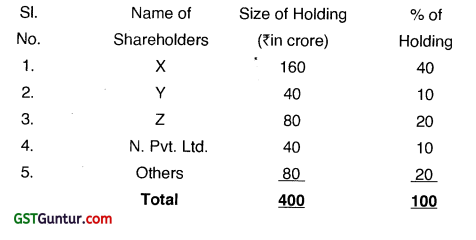

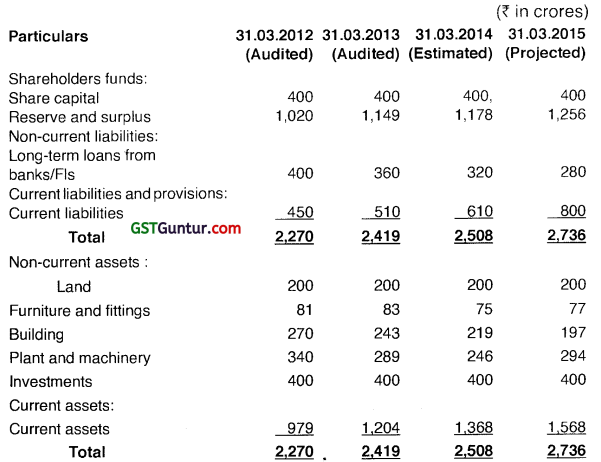

Capital Structure (as on 31.3.2014)

The total paid-up capital of the company is ₹ 400 crore. The reserves and surplus of the company are ₹ 1,178 crore. The shareholding pattern of the company is as under:

N. Pvt. Ltd. belongs to the promoters of ABC Ltd. whose shareholding pattern is as follows :

X and Z are featuring as defaulters in the RBI list of defaulters. The company has clarified that X and Z are not related to the defaulting companies and it is only similarity in names. They did not put any affidavit from the directors at the time of documentation. The company has also confirmed that they do not have any court cases relating to financing initiated by any bank or other financial institution.

![]()

Corporate Governance

The company holds its Board meetings generally in Delhi. In the last year (2013), the Board met 4 times i.e. on 1st January, 2013, 30th June 2013, 30th August, 2013 and 29th December, 2013. The proposal for further loan was approved by the Board in its meeting held on 4th April, 2014 where 7 directors out of 10 were present. All the whole-time directors were present at the meeting.

D has been appointed as the Chairman of the Audit Committee of the Board. The Chairman of the Audit Committee was not present at the last Annual General Meeting of the company held on 30th September, 2013.

The company assigned a major contract to N. Pvt. Ltd. on 30th August, 2013 where 6 members of the Board were present, including all three whole-time directors. Minutes of the meeting reveal that none of the directors abstained from the deliberation while assigning contract to N. Pvt. Ltd.

The company is facing stress in its business operation due to slow down of the economy and particularly in electrical industry.

The Board decided to boost up its operations and it requires infusing more working capital to gear up the operations. In order to finance enhanced operation, the Board proposed to have its cash credit limit increased from ₹ 200 crore to ₹ 300 crore with a sub-limit of ₹ 50 crore for packing credit/packing credit in foreign currency/foreign demand bill of exchange/bill re-discounting. Sub-limit is required due to expected foreign orders from EU countries. The existing sanctioned limit is ₹ 200 crore. It was reported that the bank offers margin of 25% on cash credit/overdraft against book debts/packing credit/packing credit in foreign currency.

![]()

Bank interest for domestic credit is Base Rate + 2.50 (floating) totaling 13% rate of interest. For packing credit/foreign demand bill/foreign bill of exchange, the bank charges 11.25% as interest. Packing credit in foreign currency/bill re-discounting rate is 6-months LIBOR + 350 bps. In addition, there are 0.50% commitment and usance charges on letter of credit. The bank also charges normal commission on bank guarantee.

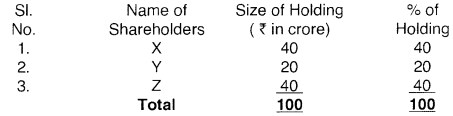

Details of Securities Proposed

The company is not willing to give any personal guarantee by its whole-time promoter directors. The select financial indicators of the company for last 2 years, estimates for current year and projection for next year are as under:

Financial Indicators

Note : The company has a policy of charging depreciation on WDV basis. Any purchase after the middle of year is charged with depreciation at half rate.

![]()

Keeping the above details in view, prepare a Proposal Assessment Report covering the following for Credit Approval Committee of the bank :

- Major factors deciding the credit enhancement. (10 marks)

- Shareholding structure of the company and perceived risk from bank’s point of view. (10 marks)

- Governance practices of the company vis-a-vis requirement of the Companies Act, 1956. (10 marks)

- Financial position of the company indicating the company capacity to pay the enhanced working capital loan, if approved. (10 marks)

- A report consolidating the (i) to (iv) above and final recommendation to approve or disapprove the credit limit enhancement proposal. (10 marks)

Answer:

(i) Major factors deciding credit enhancement

There are many factors affecting the credit decision. The few factors are mentioned below:

- The promoters track record/back ground & experience in line of activity.

- Outlook of the industry.

- Financial position of the company & resourcefulness of the promoters.

- Company’s arrangement for networking/marketing.

- Availability of the infrastructure.

![]()

In instant case, the company is the leading equipment manufactures for electrical industry of the country and the promoters have long association with the line of activity and chairman of the company is also chairman of the leading chamber of Original Equipment Manufacturers (OEM) in electrical industry. The affairs of the company are being managed by the promoters themselves with multiple responsibilities which may result in losing the focus on the core area of the business. Hence Management risk is considered to be Moderate.

The company has well established marketing and distribution network and spread over the country. Apart from this the company has service set ups which having well trained service engineers. However it is reported at present there is stress on account of slow down in the economy. Considering the experience of the promoter in the line of the activity, outlook of industry can be considered as normal.

In present case, the company has net worth of ₹ 1,549.00 crores as on 31.03.2013 with low gearing ratio. Though the profitability of the company is low, the overall financials can be considered as satisfactory.

Keeping in view of the size of the investment in fixed assets of ₹ 815.00 crores and level of sales of ₹ 1,700.00 crores, we presume that company has adequate infrastructure to increase the level of operation.

(ii) Share holding structure of the company and perceived risk from bank’s point of view.

Ideally the shareholding structure of the company should be broad based with different entities in order to have better say in the management & control. In the instant case, the majority stakes are held by the 3 promoters along with the company which is also owned by the promoters.

![]()

Though the shares are offered to the public, the stake of the promoter in the company is more than 2/3 of the total voting rights. Hence they may pass major resolutions with their present voting rights without considering minority stakeholders views. In view of the above there is possibility that promoters may borrow in excess of the company’s genuine requirement, declare higher dividends, remunerations to the directors etc.

(iii) Governance practices of the company vis-a-vis requirement of the Companies Act, 2013.

The company being a listed company has to comply with the Corporate Governance as required under the Listing Agreement with stock exchanges. However it is observed that the company’s corporate governance is far from satisfactory in view of the following:

The Chairman of the Audit Committee was not present in the last Annual General Meeting where stakeholders interacts with the promoters regarding financials, future plans etc.

It is stated that Mr. X and Mr. Z are appearing in RBI Defaulter list and it is clarified that is only similarity of names. However the promoters have not provided suitable affidavit in this regard at the time of documentation which lead to suspect the intention of the promoters.

Company assigning major contracts with the group company which is against the normal practice of keeping the group company’s at arm’s length. There is scope for accommodation of contracts to boost parent company sales & present rosy pictures to lenders.

![]()

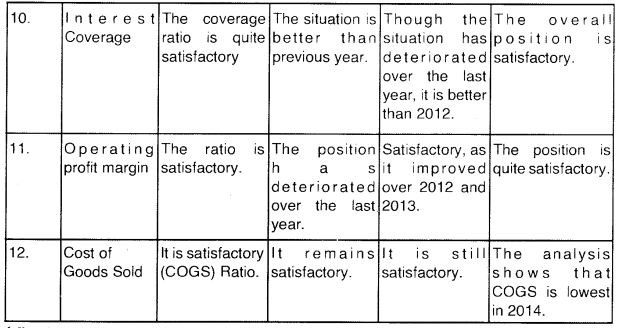

(iv) Financial position of the company indicating the company capacity to avail enhance working capital loan, if approved.

- The company has incurred operating loss during the year 2013 while marginal estimated operating profit have been shown for the year 2014 and 2015.

- Profit after Tax of ₹ 11.00 crores as on 31.03.2013 is positive only on account of other income of ₹ 190.00 crores the details of which are not known.

- In projected figures 2015, the interest cost has been estimated at present level inspite of increase in bank borrowing to the extent of ₹ 100.00 crores.

- For increase in sales of ₹ 60.00 crores for the year 2014-15, additional bank borrowing envisaged of ₹ 100.00 crores which is not convincing one.

- Net profit ratio have been estimated at very high level (i.e. 5.27%) compared to the last year i.e. 2013 (i.e. 0.65%) which appears very optimistic particularly in stressed economy wherein there always be strain in margins.

- Major contracts are given to the group company which may affect the diversion of the funds by way of intergroup transactions.

- The net-worth of the company as on 31.03.2013 is ₹ 1,549.00 crores. The company has investment portfolio of ₹ 400.00 crores. It is not clear that whether this investment are yielding or not.

- It is observed from the working capital cycle that realization of debtors takes place within period of 30 days whereas creditors are being paid at 45 days which indicates that there is no need for additional working capital borrowing to the extent credit limits requested.

- Though the current assets is estimated to increase substantially whereas there is no corresponding increase in the working capital cycle, which indicates that the additional borrowing sought is likely to go for non business purpose leading to diversion of funds.

- For the proposed additional cash credit limit of ₹ 100.00 crores there is no sufficient DP available against stock and book debts & no additional collateral security offered including personal guarantee of promoters. In terms of RBI guidelines, personal guarantee of promoter Directors are required.

- In proportion to additional working capital of ₹ 100.00 crores requested, promoter’s stake is not increasing. The company is raising additional working capital funds with the existing stake only.

![]()

(v) A report consolidating the (1) to (4) above and final recommendations to approve or disapprove the credit limit enhancement proposal.

We may not recommend the proposal in view of the following:

- Though the promoters are highly experience, the corporate governance practiced by the company is to be strengthened.

- Though apparently financials looks good, on analyzing the financials in depth it observed that the company has built up the current assets in excess of the requirement resulting in blockage of funds. Instead of resorting to additional borrowings, company should liquidate the excess current assets built up including investments which is staggering around ? 400.00 crores to improve the liquidity.

- There is a need to reduce working capital cycle to improve the profitability which is surviving only on the strength of other income.

- From long term viability perspective, company should survive from its own operational profits rather than on other income.

- Sale contracts among group companies to be avoided & to go beyond group companies.

- The long term source for funding to be examined by way of fresh capital in proportion to Working Capital sought.

- Broad based product development & connected activity where profit margin is higher may be thought off/examined.

- Cost control exercise is to be carried out to improve the profitability.

![]()

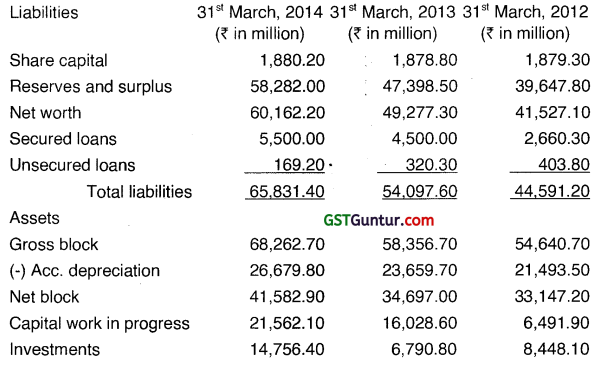

Question 6.

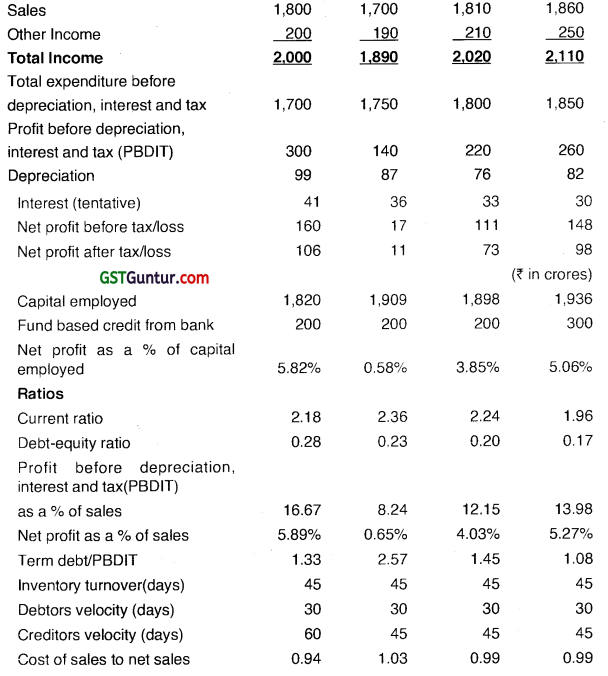

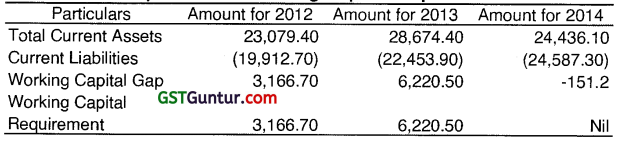

Following are the balance sheets and statements of profit and loss of XYZ Ltd. for the years ended 31st March, 2012 to 31st March, 2014: (June 2015)

Balance sheets of XYZ Ltd. as at ………………….

You are required to —

(a) Prepare summary of the balance sheet and profit and loss account for the years ended 31st March, 2012 to 31st March, 2014. (15 marks)

(b) Compute the balance sheet and profit and loss ratios for the years 2012 to 2014 which the bank would ask XYZ Ltd. to submit for financial appraisal of the company. (15 marks)

(c) Comment on the ratios as computed above. (10 marks)

(d) Compute working capital requirement for the years 2012 to 2014. (10 marks)

Answer:

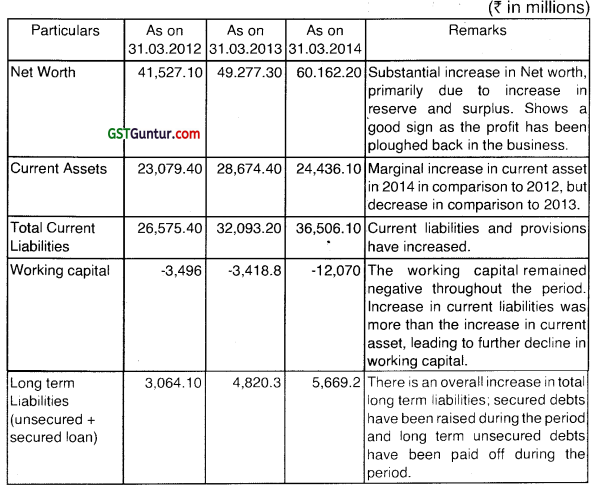

(a) Summary of Balance Sheet of XYZ Ltd.

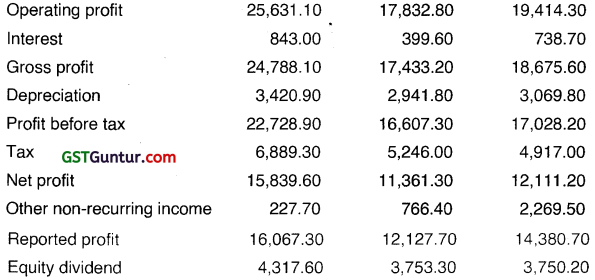

Summary of Profit & Loss statement of XYZ Ltd.

‘Sales Revenue has been taken as (Sales-Excise), this is as per revised Schedule VI

![]()

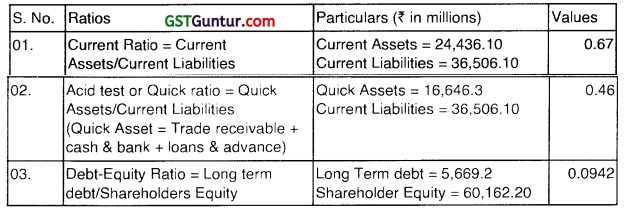

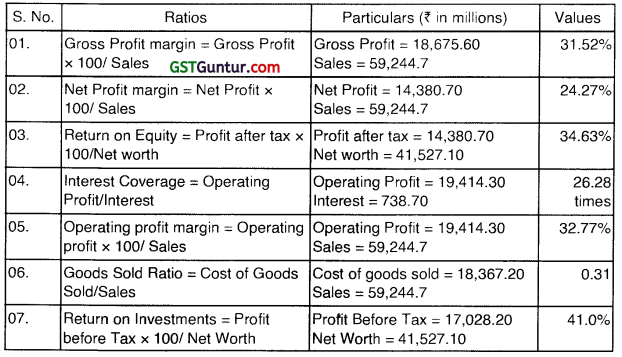

(b) The Computation of the Balance Sheet and Profit and Loss related Ratios along with comments on the same (mentioned in Remarks column) is as under:

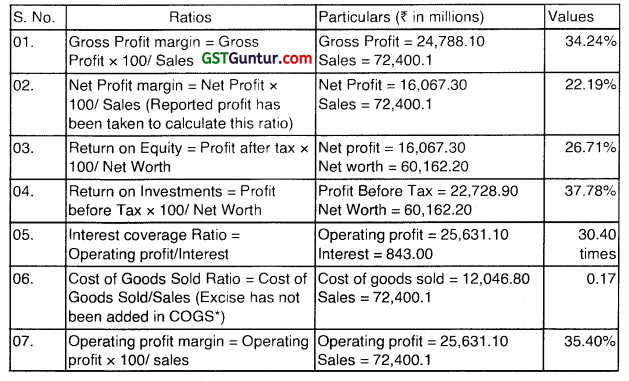

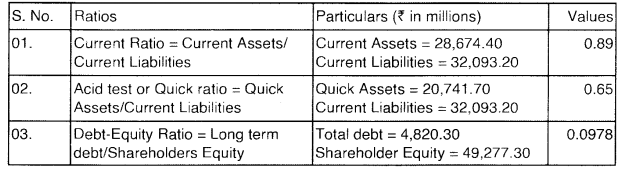

Ratio analysis for 2014

Balance Sheet Ratios

Profit & Loss Statement Ratios

Note: –

- Other non-recurring income is taken into account to arrive at actual Net Profit.

- Only raw material cost has been included in the COGS.

- Sales Revenue has been taken as (Sales-Excise), this is as per revised Schedule VI.

![]()

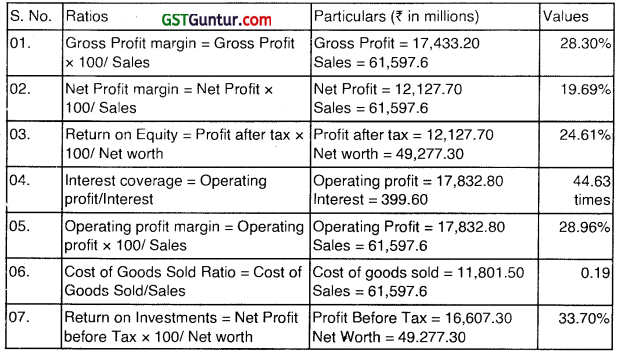

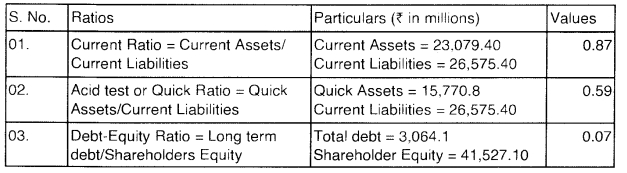

Ratio analysis for 2013

Balance Sheet Ratios

Profit and Loss Ratios

Note :

- Other non-recurring income is taken into account to arrive at actual Net Profit.

- Only raw material cost has been included in the COGS.

- Sales Revenue has been taken as (Sales-Excise), this is as per revised Schedule VI.

![]()

Ratio analysis for 2012

Balance Sheet Ratios

Profit and Loss Ratios

Note:

- Other non-recurring income is taken into account to arrive at actual Net Profit.

- Only raw material cost has been included in the COGS.

- Sales Revenue has been taken as (Sales-Excise) this is as per revised Schedule VI.

![]()

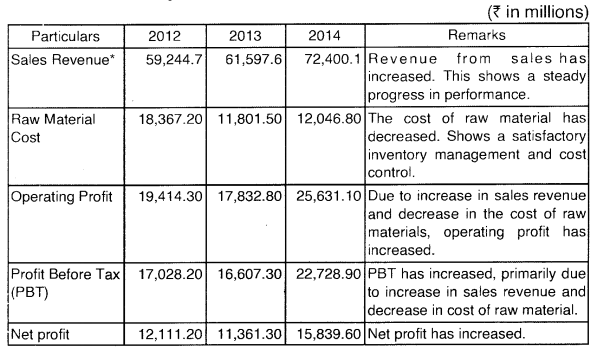

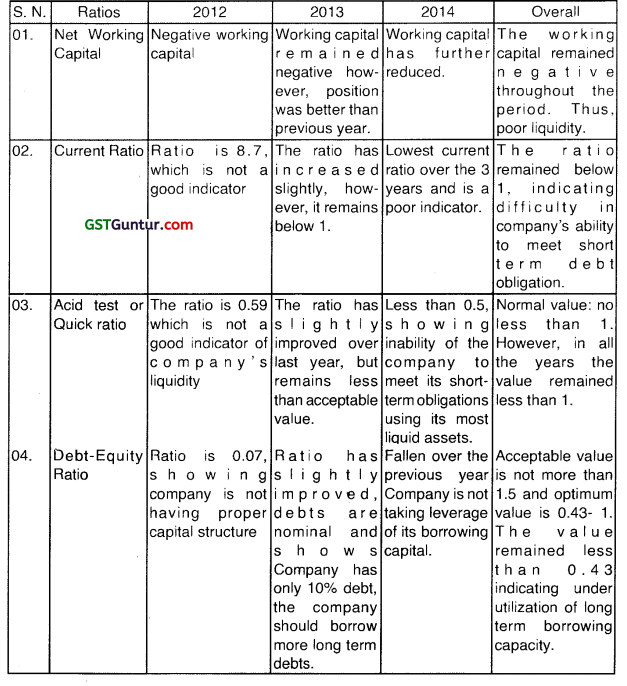

(c) The Analysis of the Balance Sheet and Profit and Loss Ratios along with comments on the same (mentioned in Remarks column) is as under:

Balance Sheet Ratios

Profit and Loss Ratios

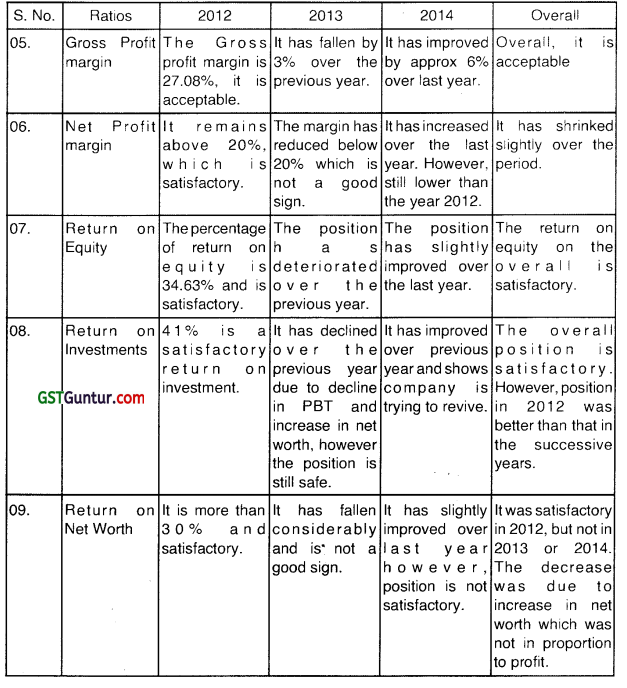

(d) (₹ in millions)

Computation of Working Capital Requirements

Note: For the purpose of calculation pf working capital requirements, provisions have not been included in the current liabilities.

![]()

Question 7.

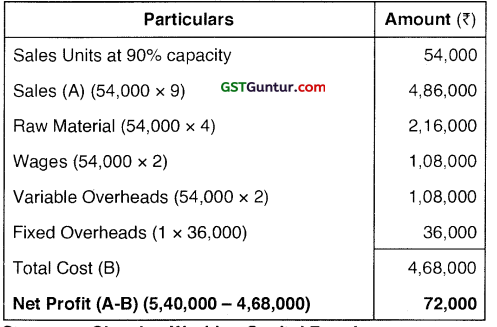

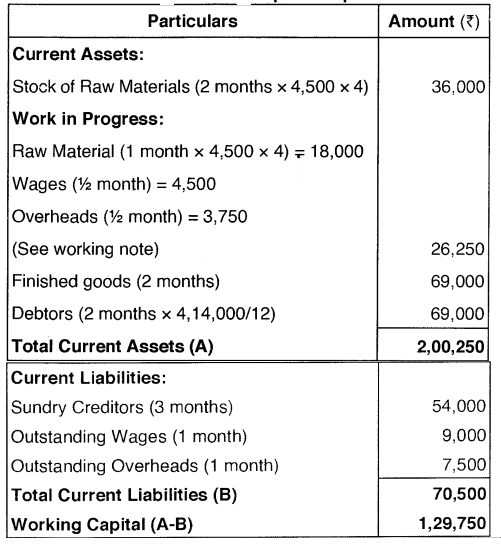

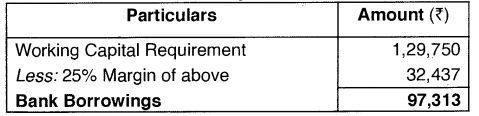

Grow More Ltd. is presently operating at 60% capacity level, producing 36,000 units of a product per annum. In view of favourable market conditions, it has been decided that from 1st January, 2016, the company would operate at 90% capacity. (June 2016)

Following information is available:

- Existing cost – price structure per unit is :

Raw material : ₹ 4

Wages : ₹ 2

Variable overheads : ₹ 1

Fixed overheads : ₹ 1

Profits : ₹ 1 - It is expected that the cost of raw material, wages, overheads and sales per unit will remain unchanged in the year 2016.

- Raw material remain in stores for 2 months before being issued to production. These units remain in production process for one month.

- Finished goods remain in godown for 2 months.

- Credit allowed to debtors is 2 months while credit allowed by creditors is 3 months.• Lag in wages and overheads payments is 1 month; it may be assumed that wages and overheads accrue evenly throughout the production cycle.

Assume that the opening balance of raw material, work-in-progress and finished goods have already been brought to desired level. Consequently, goods purchased during the period will only be for the production requirement and not for increasing the level of stock.

![]()

You are required to :

(a) Prepare a statement of profit and loss at 90% capacity level. (15 marks)

(b) Calculate the working capital requirements on an estimated basis to sustain the increased production level. (15 marks)

(c) Compute the permissible bank finance under the 1st and 2nd method of lending. (10 marks)

(d) What is the direction to banks regarding determination of working capital credit? (5 marks)

(e) What precautions should have been taken by the bank, if the bank has granted working capital finance to the company against inventory/goods? (5 marks)

Answer:

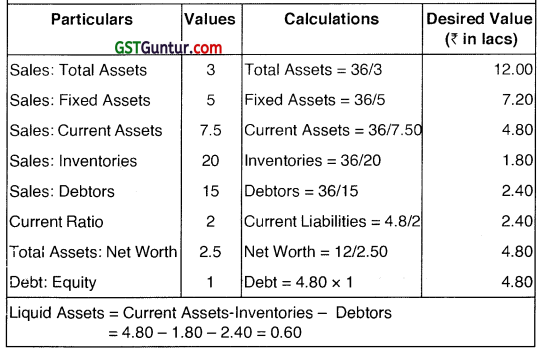

(a) Statement of Profitability at 90% capacity:

(b) Statement Showing Working Capital Requirement:

![]()

Working Note:

Overheads and Wages:

The work in progress period is one month, so the wages and overheads included in work in progress are on an average, for half month or 1/24 of a year.

Wages = 1,08,000/24 = ₹ 4,500.

Overheads = (54,000 + 36,000)/24 = 90,000/24 = ₹ 3,750.

(c) (i) Permissible Bank Finance by First Method of Lending:

(ii) Permissible Bank Finance by Second Method of Lending:

(d) Working Capital credit may be determined by banks according to their perception of the borrower and the credit needs. Accordingly, an appropriate system may be evolved by the Banks for assessing the working capital needs of the borrowers, within the prudential guidelines, and exposure norms, prescribed by the Reserve Bank of India.

![]()

(e) Precautions to betaken:

- Advances against goods should be restricted to genuine traders and not to speculators.

- Loans must be given for short periods, since the quality and the value of the security is likely to diminish.

- The Banker must have a working knowledge and gather information of the different types of goods regarding their character, price movements, storage value etc.

- The Banker should confirm the state of goods.

- The goods should be insured against loss by theft or fire.

- The Banker should verify and confirm the title of the borrower to the goods by inspecting the invoice or cash memos.

- The Banker as a Pawnee is liable, if reasonable care is not taken of the goods pledged. He should therefore, take proper care for their storage and also take reasonable steps to protect them from damage and pilferage.

- The price of the goods must be accurately ascertained.

- Necessary margin should be kept.

- The banker must obtain absolute or constructive possession of the goods.

- In the case of hypothecated goods, the Bank should obtain from the borrower a written undertaking that the goods are not charged to any bank or creditor and will not be so charged as long as the borrower regarding the quantity and valuation of the goods, which should be physically verified by the banker.

![]()

Question 8.

Using the information on ratios and the format given below, compute and provide the value of balance sheet items for Wisdom Ltd. which has sales of ₹ 36 lakh for the year 2015-16 : (June 2016, 20 marks)

Sales : Total assets 3

Sales : Fixed assets 5

Sales : Current assets 7.5

Sales : Inventories 20

Sales : Debtors 15

Current ratio ; 2

Total assets : Net worth : 2.5

Debt : Equity : 1

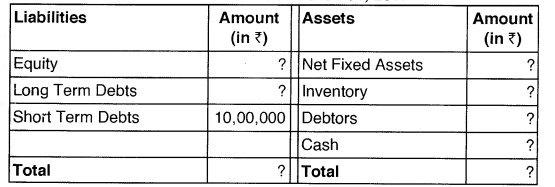

Balance Sheet of Wisdom Ltd. as on ……….

Answer:

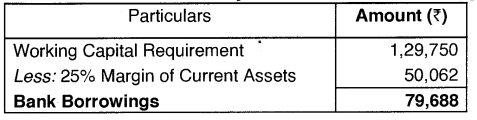

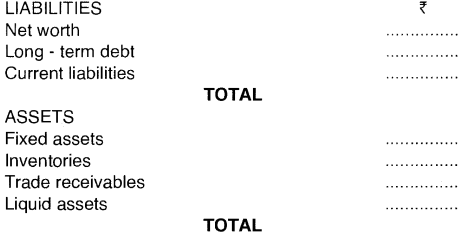

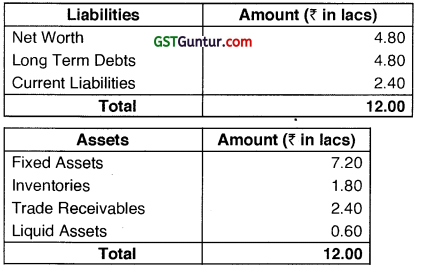

Balance Sheet of Wisdom Ltd. as on 31 .03.2016

Working Note:

The sales of Wisdom Ltd. is ₹ 36.00 lacs.

Liquid Assets = Current Assets-Inventories – Debtors

= 4.80 – 1.80 – 2.40 = 0.60

![]()

Question 9.

Analysis of financial statements is an important exercise for the purpose of studying the trends and behaviour of different financial parameters from a leader’s point of view. Before an analysis is undertaken, the various parameters and items of financial statements are restructured and rearranged in the order of priority set by a credit analyst. This is necessary because enterprises prepare financial statements mainly in order to cater to the needs of the shareholders and the government. Analysis of these statements without any rearrangement may not serve a meaningful purpose for a lending banker. (June 2017)

The process of restructuring of financial statements starts with classification of various items as current, non-current and fixed assets or liabilities. Restructuring also includes the process of filtering out items or entries resulting from those transactions which, though permitted by statues, may present picture other than reality. Apart from this, the analyst also undertakes various other analysis, like, comparative balance sheet, ratio analysis, cash flow and funds flow, etc., to name a few to arrive at a considered view.

The following example is a live situation requiring your logical conclusion as an analyst. Analyse the situation and respond to the questions indicated there against.

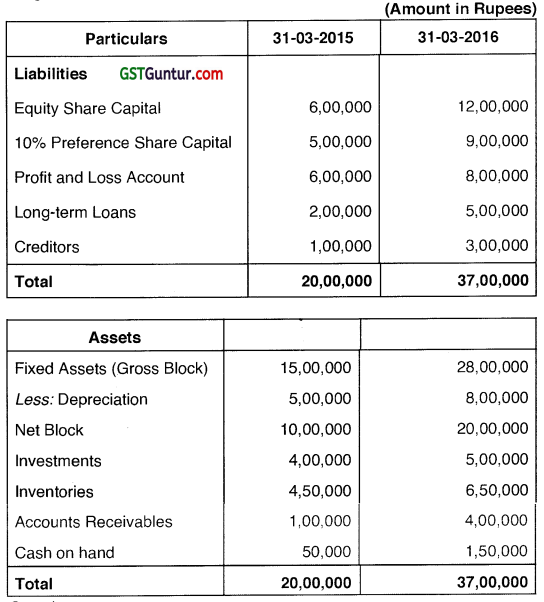

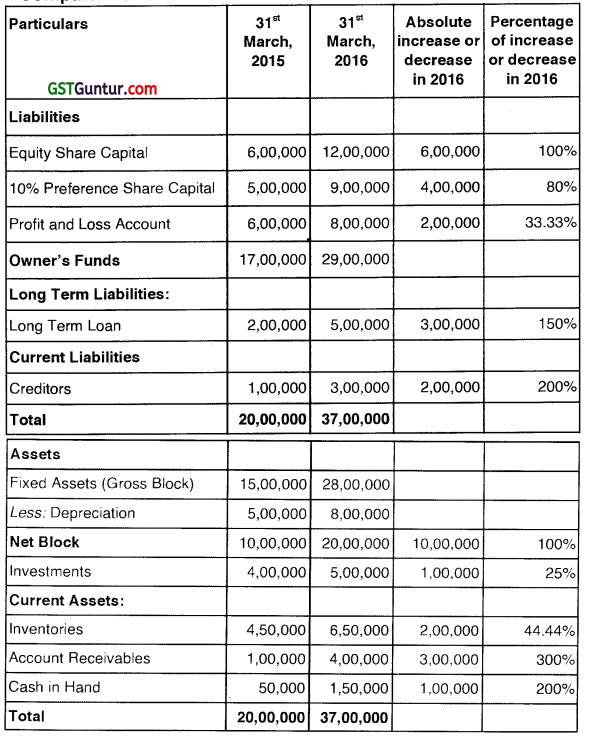

The Balance Sheet of Sri Ganesh & Co. Ltd., for the years 2015 and 2016 are given below:

Questions:

(a) Prepare a Comparative Balance Sheet showing increase or decrease in individual assets and liabilities together with percentage of such increase or decrease between the two years. (20 marks)

![]()

(b) Based on the above comparative analysis, offer your comments on the following items:

(i) Fixed Assets;

(ii) Long-term Loans;

(iii) Investments and Inventories;

(iv) Accounts receivables and Cash on hand;

(v) Current Assets, Current Liabilities and Profit & Loss Account. (2 marks each)

(c) Assuming that the current ratio is 1.5, state with reasons in each of the following cases, whether the current ratio will improve or decline or will have no change:

(i) Payment of a current liability

(ii) Purchase of fixed assets;

(iii) Cash collected from customers;

(iv) Bill receivable dishonoured;

(v) Issue of new shares. (2 marks each)

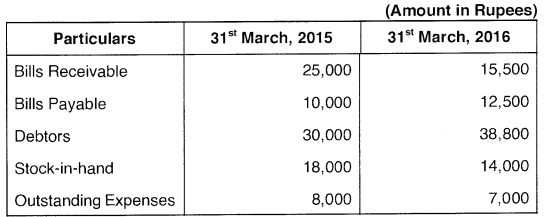

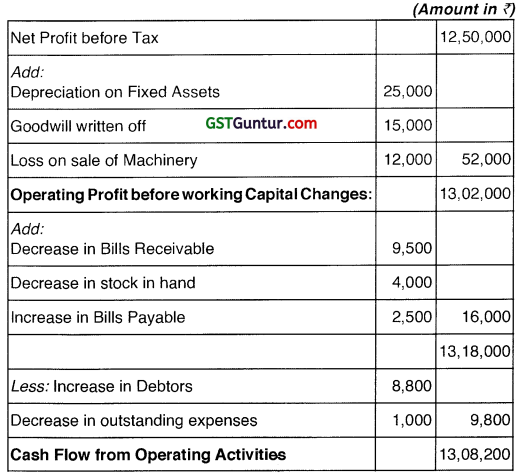

(d) Assuming that the Net Profit before’tax as on 31st March, 2016, after considering the following stood at ₹ 12,50,000:

(i) Depreciation on Fixed Assets : ₹ 25,000

(ii) Goodwill Written Off : ₹ 15,000

(iii) Loss on Sale of Machinery : ₹ 12,000

The Current Assets and Current Liabilities of the Company in the beginning and at the end of the year being as follows:

![]()

Calculate the Cash Flow from Operating activities under the indirect method of cash flow from operations. (10 marks)

Answer:

(a) Comparative Balance Sheet as on 31.03.2015 and 31.03.2016

![]()

(b) The following comments/ conclusions can be drawn from the comparative Balance Sheet analysis based on the financial position of the company between the two years:

(i) Fixed Assets: There has been an increase of ₹ 10,00,000 in fixed assets. The increase in fixed assets has been financed through additional equity share capital of ₹ 6,00,000 an additional preference share capital of ₹ 4,00,000. Assuming that long-term own capital (equity and preference shares) is used to finance fixed assets. Financing the increase in fixed assets through additional equity share capital and preference share capital; is a sound financial policy.

(ii) Long Term Loans: There has been a substantial increase of ₹ 3,00,000 in long term loans, ft has to be seen whether the long¬term loans have been used productively or not. It appears that such funds are used partly for buying investments. Such a policy may be counter-productive as yield from investments is likely to be lower than interest payable on loan. Moreover some portion of loan is used for financing working capital needs (stock and accounts receivables). Unless working capital requirement is changed permanently, use of long-term fund to finance working capital may not be prudent.

(iii) Investments and Inventories: Investments are treated as long term investments. There has been an increase of ₹ 1,00,000 in investments. The increase in investments is appreciable provided yield from investment is good.

There is an increase of 44.44% in inventories. This increase is not very high. That means, much working capital is not locked up in inventories.

![]()

(iv) Accounts Receivables and Cash on Hand: There is very high increase of 300% in accounts receivables. That means, steps taken for the collection of debts by the company require closer scrutiny. There has been an increase of 200% in cash. Cash is an idle asset. That means, a huge cash balance is kept idle which is not a healthy trend.

(v) Current Assets, Current Liabilities and Profit & Loss Account:

There is an overall increase of ₹ 6,00,000 in current assets. There is also an overall increase of ₹ 2,00,000 in current liabilities. Whether such a delay in settling dues is affecting reputation or purchase terms require close scrutiny. Generally, suppliers’ credit is a costly source of finance. The percentage of increase in current liabilities is at 200%. That means there is a slight decrease in current ratio. But the current ratio of the concern is quite good.

There is an increase of ₹ 2,00,000 in Profit & Loss account balance. This suggests that the profitability of the concern is good. (In the absence of Profit & Loss Account, it is assumed that profit margin is good and return on assets is satisfactory)

To conclude, the financial position of the concern seems to be satisfactory.

(c) The current ratio is 1.5:1, the effect of the transactions given in the problem on current ratio will be as follows:

(i) Payment of a current liability: On payment of a current liability out of current assets, working capital will remain unchanged. However, current ratio will improve and will be more than the current level of 1.5 as there will be decrease in the figure in the denominator and numerator by equal amount.

(ii) Purchase of fixed assets: On purchase of fixed assets in cash, current assets will decrease without any change in current liabilities. This is because when fixed assets are purchased for cash, the current assets will decrease, but the current liabilities will remain the same as before. Thus, the transaction will result in decline of current ratio from the earlier level of 1.5:1.

![]()

(iii) Cash collected from customers: Collection of debtors results in the conversion of one current assets, viz., debtors into another current assets, viz., cash. Hence, amount of current assets and current liabilities remain unchanged, the current ratio will, therefore, remain at 1.5:1.

(iv) Bills receivable dishonoured: When a bill receivable is dishonoured, it cannot always be presumed that the customer has become insolvent. Hence, if the customer is solvent, the amount of bills receivable will get reduced and the amount due from debtors will increase. There will be no change in the amount of current liabilities. In short, when bills receivable are dishonoured, there is change only in the composition of current assets and hence when there is a change only in the composition of current assets, the current ratio will not change. Hence, on this assumption current ratio will continue to be 1.5:1.

However, if it is anticipated that the debt become bad and it is recorded as such, it will result in the reduction of current assets resulting in fall in the current ratio from 1.5:1.

(v) Issue of new shares: If issue of new shares is for cash, it will result in an increase in the current assets. Hence, there will be change in current assets and current ratio will improve due to increase in current assets.

![]()

(d) Cash Flow from Operating Activities

![]()

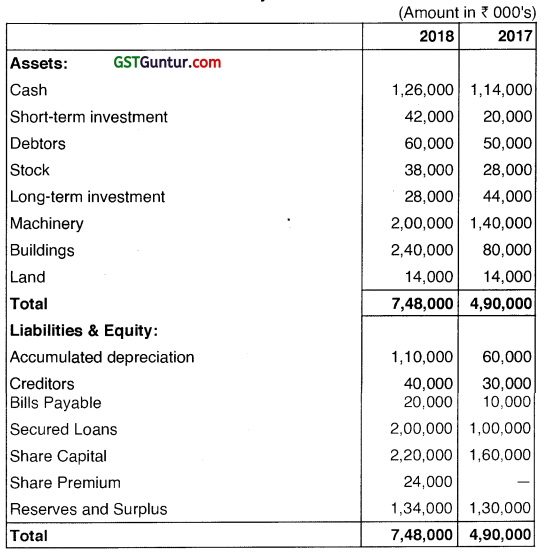

Question 10.

Following information is given on Ratios and the figures for Balance Sheet items of M/s Way to Wisdom Company as on March 31, 2017. Net Sales of the company for the Financial Year 2016-17 was ₹ 20 lakh. (Dec 2017)

- Debt Assets Ratio : 0.6

- Debtors Turnover Ratio based on Net Sales : 2.0

- Inventory turnover ratio : 1.25

- Fixed Assets turnover ratio : 0.80

- Net Profit Margin : 5%

- Gross Profit Margin : 25%

- Return on investment : 2%

Balance Sheet as at March 31, 2017

![]()

On the basis of given details:

(a) Compute the Balance Sheet items and prepare Balance Sheet of the Company as on March 31,2017. (20 marks)

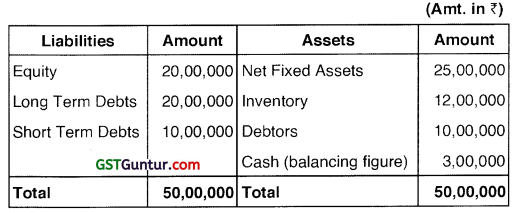

(b) Calculate working capital requirement with a provision for contingencies 10% of net working capital. (10 marks)

(c) Out of the 7 ratios mentioned, which are more important for working capital lending and why? As a banker give your comments on these ratios of the company. (15 marks)

(d) Do you agree that working capital is the long term investment in Operating Current Assets? (5 marks)

Answer:

(a) Balance Sheet of M/s Way to Wisdom Company

As at March 31, 2017

Working Notes:

Computation of Balance Sheet items:

(a) Fixed Assets:

Fixed Assets Turnover Ratio = Net Sales/Fixed Assets

0.80 = ₹ 20,00,000/Fixed Assets

Fixed Assets × 0.80 = ₹ 20,00,000

Fixed Assets = ₹ 20,00,000/0.80

Fixed Assets = ₹ 25,00,000

![]()

(b) Gross Profit:

Gross Profit Margin = Gross Profit/Net Sales × 100

25% = Gross Profit / ₹ 20,00,000 × 100

Gross Profit = ₹ 20,00,000 × 0.25

Gross Profit = ₹ 5,00,000

(c) Inventory:

Inventory Turnover Ratio = Cost of Sales/Inventory

Cost of Sales = (₹ 20,00,000 – ₹ 5,00,000) / Inventory

Hence, 1.25 = ₹ 15,00,000 / Inventory

Inventory = ₹ 15,00,000 / 1.25

Inventory = ₹ 12,00,000

(d) Debtors:

Debtors Turnover Ratio = Net Credit Sales / Average Trade Debtors

2.0 = ₹ 20,00,000 / Debtors

2.0 × Debtors = ₹ 20,00,000

Debtors = ₹ 20,00,000 / 2.0

Debtors = ₹ 10,00,000

![]()

(e) Net Profit:

Net Profit Margin = Net Profit / Net Sales × 100

5% = Net Profit / ₹ 20,00,000 × 100

Net Profit = ₹ 20,00,000 × 0.05

Net Profit = ₹ 1,00,000

(f) Investment:

Return on Investment = Net Profit / Investment × 100

2% = 1 1,00,000 / Investment × 100

Investment = ₹ 1,00,000 / 0.02

Investments = ₹ 50,00,000

(g) Total Debt:

Debt Asset Ratio = Total Debt / Total Assets (Investment)

0.60 = Total Debt / ₹ 50,00,000

Total Debt = ₹ 50,00,000 × 0.60 = ₹ 30,00,000

(h) Capital (Equity):

Capital = Total Assets – Total Debt

Capital = ₹ 50,00,000 – ₹ 30,00,000

Capital = ₹ 20,00,000

![]()

(i) Short Term Debts:

Given in the question ₹ 10,00,000

(j) Long Term Debts:

Long Term Debts = Total Debts – Short Term Debts

Long Term Debts = ₹ 30,00,000 – ₹ 10,00,000

Long Term Debts = ₹ 20,00,000

(b) Calculation of Working Capital Requirement

In the absence of information on Components of Raw Material Consumption, Work-in Progress, Finished Goods etc. The working capital has been estimated on the basis of information compiled in Balance Sheet.

![]()

Statement Showing Estimates of the Working Capital

(c) Following Ratios are more important for Working Capital lending:

1. Debtors Turnover Ratio: This ratio measures the efficiency of the receivables management of the firm. It is an indicator of how fast or slow the debtors are realised. It is calculated by dividing the net credit sales of a company by average debtors outstanding during the year. A higher ratio indicates faster collection of debts. This is also used for calculating average collection period.

Comments: Debtors Turnover Ratio is 2.0. It shows 6 months holding period of debtors. It also shows that collection from debtors is very slow and may include bad debts. In working capital lending bank creates charge on debtors. Normally, bank does not allow lending against the debtors outstanding more than 6 months. Hence, this ratio is not satisfactory.

2. Inventory Turnover Ratio: This is an indicator of how fast or slow is the movement of inventory. It is calculated by dividing cost of goods sold by average inventory. A higher ratio indicates faster movement of inventory. This is also used for calculating average inventory holding period. Also indicates a faster working capital borrowed and helps in lower interest liabilities.

![]()

Comments: Ratio is 1.25. It shows that inventory holding period is about 9 months. It implies that stock is not moving smoothly. Stock may contain unsalable stock or quality of stock is poor or not acceptable in the market. Bank creates charge on inventory at the time of lending of working capital loan. Bank will not accept this old or poor quality or non-movable stock. Hence, it is not satisfactory.

3. Fixed Assets Turnover Ratio: This ratio is calculated by dividing Net Credit Sales by Fixed Assets. A higher fixed assets turnover ratio indicates that a company has more effectively utilize investments in fixed assets to generate revenues.

Comments: Ratio is 0.80. It shows that turnover is 80% of Fixed Assets. Sale is lower with compare to installed capacity (Fixed Assets). Stock and Debtors holdings of the company are also higher. Company has some issues in product or in its market. Lower ratio shows lower capacity utilisation, which is not good for the short term solvency of the company. It is not satisfactory.

4. Net Profit Margin: Net Profit Margin = Net Profit / Net Sales × 100 Company should have sufficient net profit margin as bank evaluate the profitability of firm at the time of working capital lending. Comments: Ratio is 5%, which may be treated as satisfactory.

5. Gross Profit Margin: Gross Profit Margin = Gross Profit/Net Sales × 100. Reflects earning margins of company. It is important to assess the short term viability of business.

![]()

Comments: Ratio is 25%, which may be treated as satisfactory.

(d) The Working Capital represents the investment of current assets, which have been financed by long term funds (either equity or long term debt). The rationale for financing a part of the current assets with long term finance is that a part of the current assets remains in stock throughout the life of the business.

The core working capital, though made up of items which are rotated constantly, is maintained by the business on a long term basis. So, working capital is the long term investment in operating current assets. Even though the working capital reflects a margin of safety, an excessive amount of working capital would imply an inefficient use of the resources; say by means of accumulation of inventory and / or overdue receivables and / or idle cash etc, it is in this context that turnover of working capital gains significance.

![]()

Question 11.

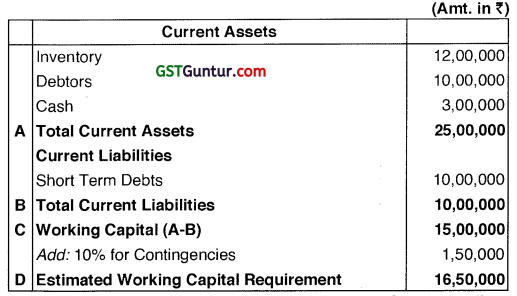

The following are the data of Shri Vigneshwar and Company Ltd. for the two years ended on 31 -3-2017 and 31 -3-2018: (June 2018)

Shri Vigneshwar and Company Ltd.

Balance Sheet for the year ended on 31st March

Shri Vigneshwar and Company Ltd.

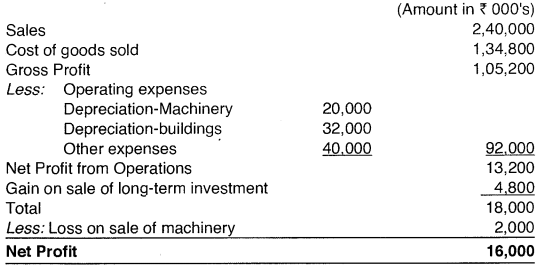

Income Statement for the year ended on 31st March, 2018

![]()

Note: The proceeds from the sale of machinery were 16,000 From the data and details given above you are required to prepare:

(a) Statement of sources and uses of Working Capital Funds. (25 marks)

(b) Schedule of changes in working capital. (5 marks)

(c) Statement of sources and uses of cash. (10 marks)

(d) In the context of Vigneshwar and Company Ltd., please explain in brief

the points Of differences when it is taken to be not a company but a partnership firm. (10 marks)

Answer:

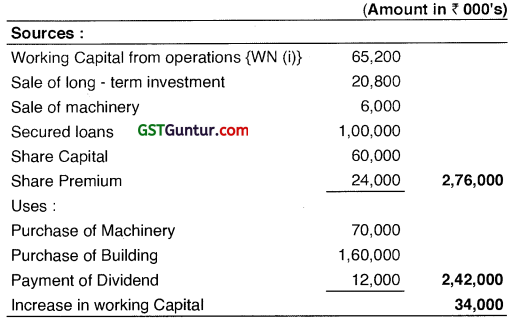

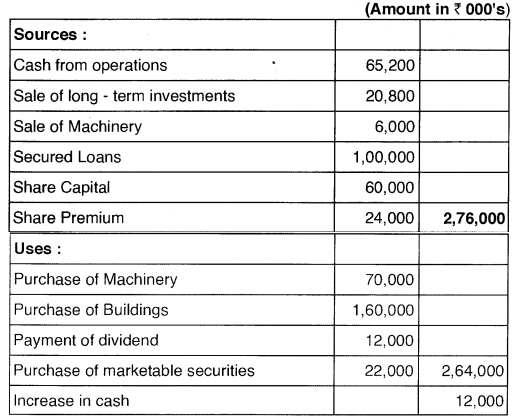

(a) Statement of Sources and Uses of Working Capital for the year ended on 31st March, 2018

Shri Vigneshwar and Company Ltd.

Statement of Sources and Uses of Working Capital for the year ended on 31st March, 2018

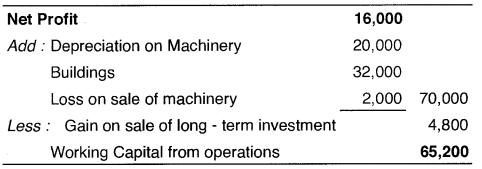

Working Notes (all the figures given in working notes are amount in thousand)

(i) Working Capital from operations in found as follows :

![]()

(ii) The Comparative Balance Sheet indicates that long – term investments have decreased by ₹ 16,000, which is due to the sale of investments. On sale, a gain of ₹ 4,800 is made. This means that the long – term investment must have been sold for cash of ₹ 20,800 (₹ 16,000 + ₹ 4,800).

(iii) The proceeds from the sale of machine, ₹ 6,000, have been reported as source of working capital.

(iv) Secured loan increased by ₹ 1,00,000; thus providing working capital.

(v) Share Capital together with share premium has contributed a working capital of ₹ 84,000 (₹ 60,000 + ₹ 24,000).

(vi) During the year working capital was utilized to acquire machinery of ₹ 70,000. The opening balance of machinery account is ₹ 1,40,000. After the sale of machinery costing ₹ 10,000, this balance at the close of the year should have been ₹ 1,30,000. But the closing balance is ₹ 2,00,000, which implies that machinery worth ₹ 70,000 was acquired and funds were used.

(vii) The cost of machinery sold has been worked out:

The accumulated depreciation has increased by ₹ 50,000 (₹ 1,10,000 – ₹ 60,00 . If we subtract depreciation on buildings, ₹ 32,000, we are left with the closing balance of accumulated depreciation of X18,000 for machinery. During the year depreciation provided on machinery is ₹ 20,000.

This means that the accumulated depreciation on machinery sold was ₹ 2,000 (₹ 20,000 – ₹ 18,000) which must have been written off at the time of the sale of machinery. The cost of machinery sold is : Sale proceeds, ₹ 6,000 plus accumulated depreciation, ₹ 2,000, plus loss, ₹ 2,000, i.e. ₹ 10,000.

![]()

(viii) The increase in building by ₹ 1,60,000 is a purchase, using working capital funds.

(ix) The net profits are ₹ 16,000, but the reserve has increased by ₹ 4,000 only. This means that the difference, ₹ 12,000 (₹ 16,000 – ₹ 4,000) must have been paid as cash dividends to the shareholder.

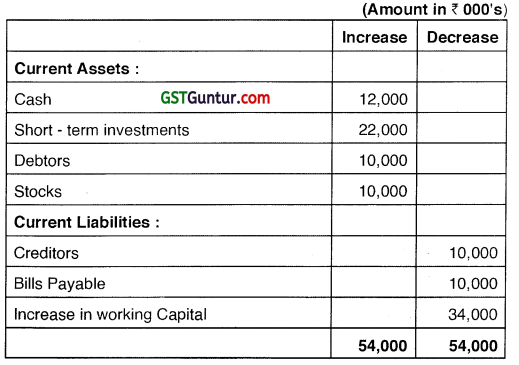

(b) Schedule of Working Capital Changes

(c) Statement of Sources and Uses of Cash

For the year ended on 31st March, 2018

![]()

Working Note

Cash from operations is found as follows :

(d) The major distinction between a Company and a Partnership Firm can be summarized as under:

(a) Registration

Registration of a Company is compulsory under the Companies Act, 2013. Registration of a Partnership is not compulsory under the Indian Partnership Act, 1932.

(b) Number of Members / Partners

Minimum of two in case of a One Company, and of two hundred in case of a private company, one person can be a Director and a minimum of seven and no limit on maximum number of members in case of a public company.

Minimum number of two persons required to form a partnership. The maximum number is ten for banking business and twenty for any other business.

![]()

(c) Legal Status

A company has a legal existence separate from its own members and is viewed as a separate legal person from its members. A firm does not have a separate legal existence different from its own partners.

(d) Ownership of Property

The property of the company is owned by the company itself and not its members as the company has a separate legal existence. The property of the firm is owned by the partners themselves and not by the firm as a firm does not have a separate legal existence different from its own partners.

(e) Management

The company is managed by a Board of Directors elected by the shareholders. A partnership is managed by the partners except the dormant and sleeping partners.

(f) (i) Perpetual Existence

A company has a perpetual existence, whereas a partnership does not have a perpetual existence.

(ii) Contracts

A member of the company can contract with the company. A Partner cannot contract with the partnership firm.

(g) Liability

Except in case of a company with unlimited liability, the liability of the members of the company is limited. The liability of partners in a partnership is unlimited.

(h) Transfer

A transferee of shares in a company becomes a member of the company and the consent of all members is not required to become a member. A person can become a partner in a partnership firm with the consent of all the parties.

(i) Death

The death of any or all members of the company does not determine (end) the existence of the company. Death of a partner dissolves the partnership deed, unless the partnership deed provides otherwise.

(j) The members of a company are not the agents of each other or of the company. Every partner of a firm is an agent of the other.

![]()

Question 12.

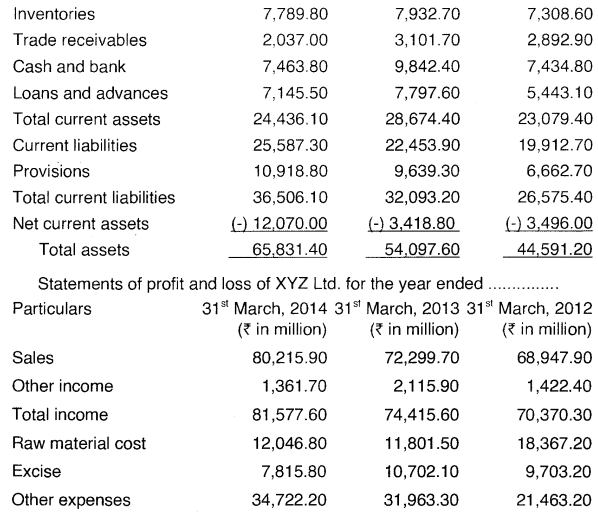

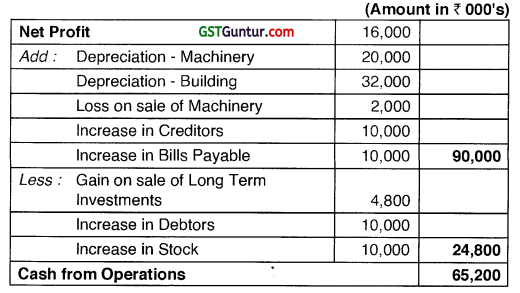

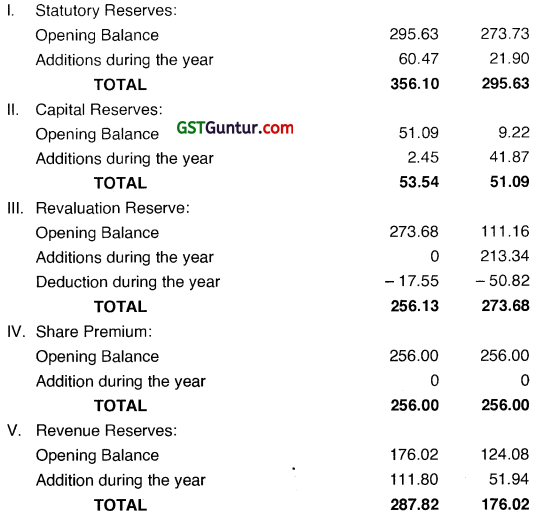

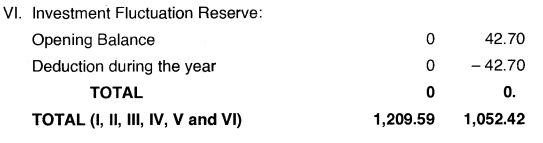

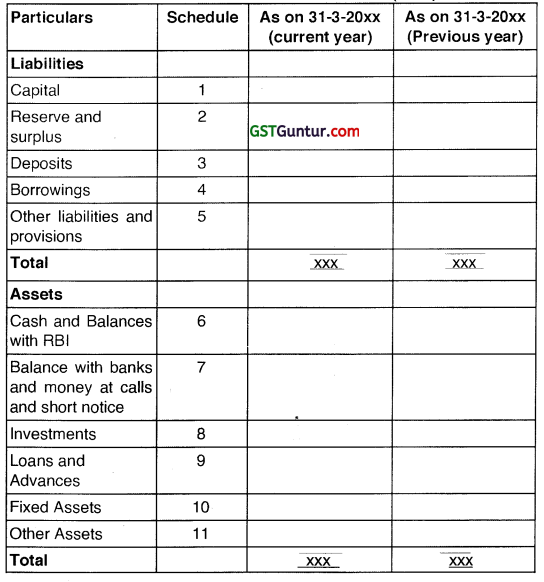

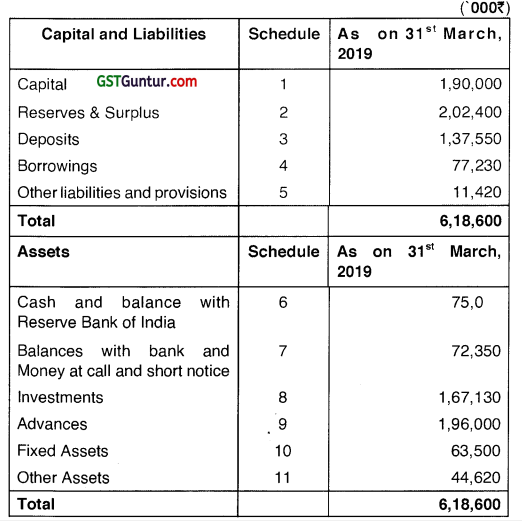

Read the financial data of The Kuber Bank Ltd. as below: (Dec 2018)

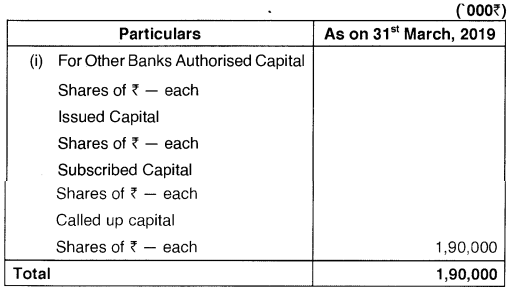

Balance Sheet of The Kuber Bank Ltd. as on 31st March, 2017

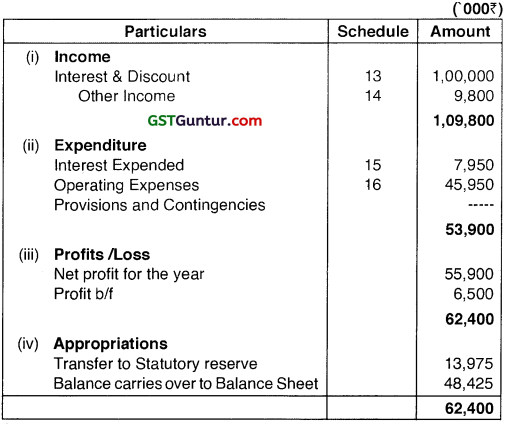

Profit and Loss Account for the year ended 31.03.2017

![]()

Significant Account Policies and Notes on Accounts

SCHEDULES TO THE BALANCE SHEET

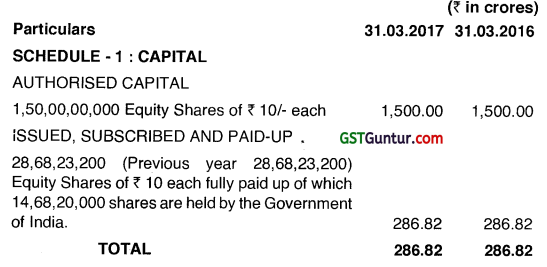

SCHEDULE – 2 : RESERVES AND SURPLUS

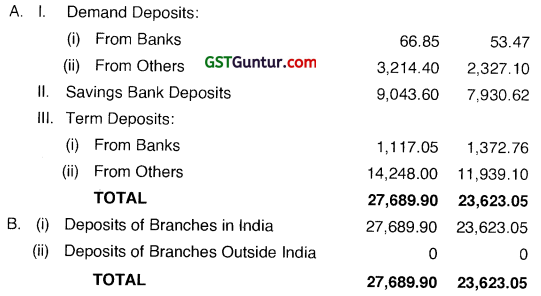

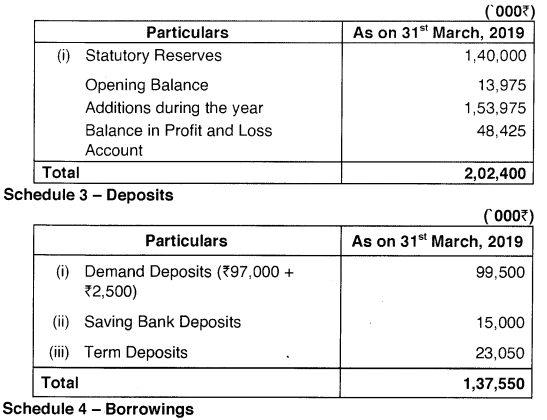

SCHEDULE – 3 : DEPOSITS

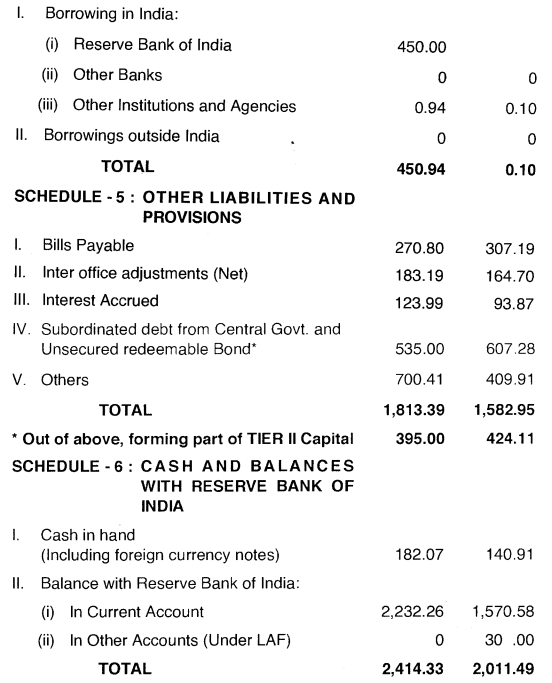

SCHEDULE – 4 : BORROWINGS

![]()

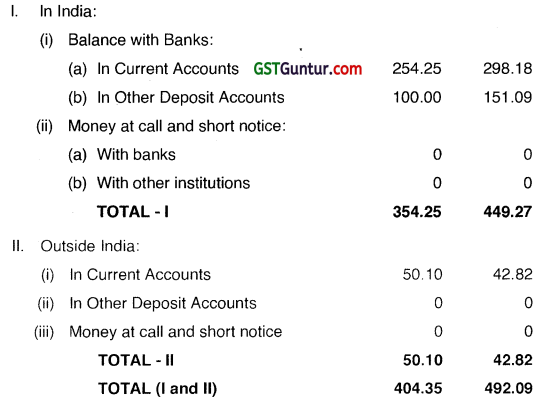

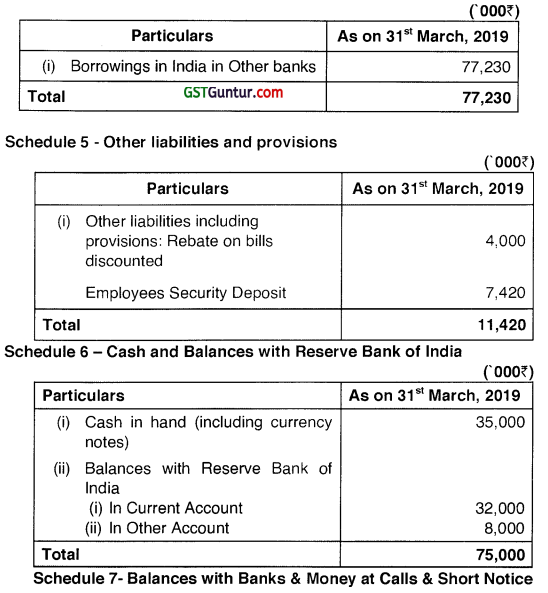

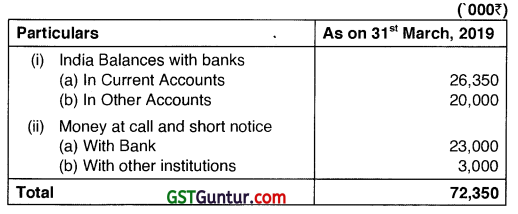

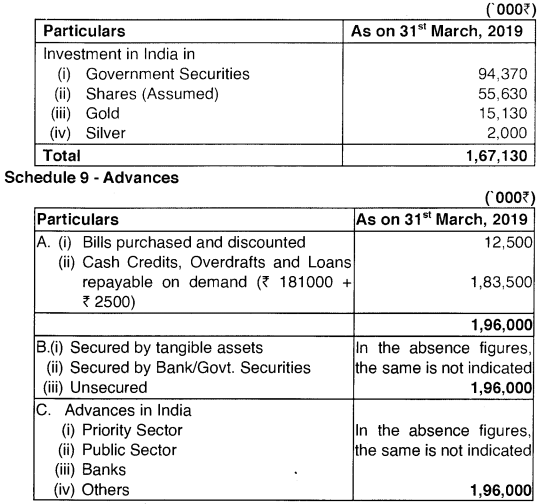

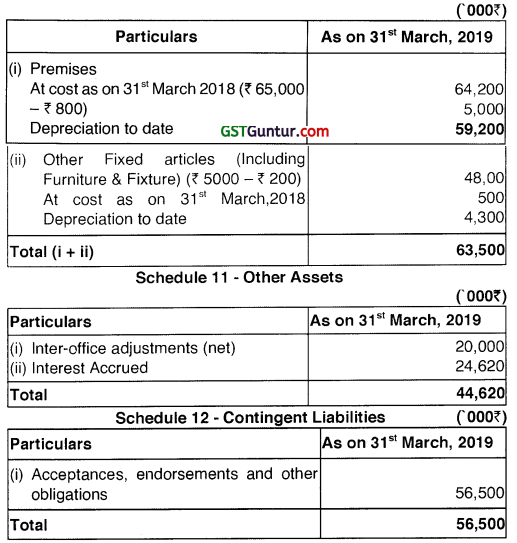

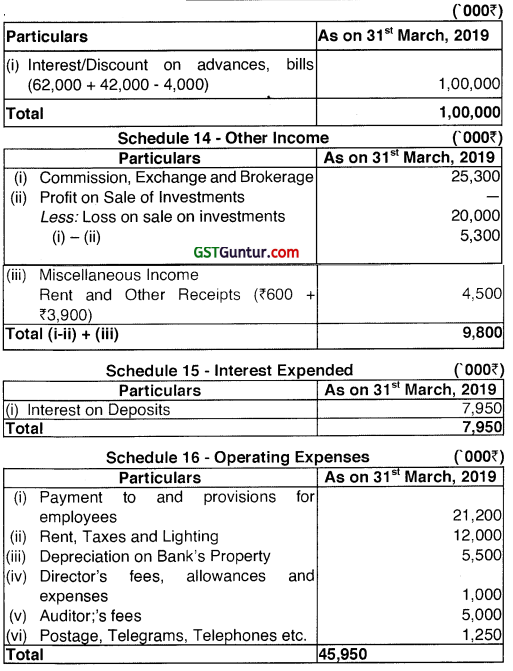

SCHEDULE – 7 : BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

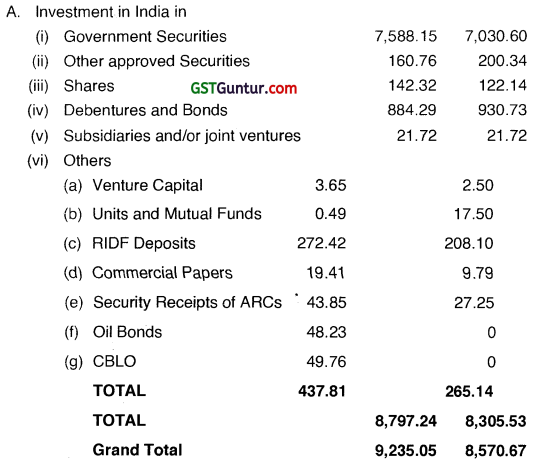

SCHEDULE – 8 : INVESTMENTS

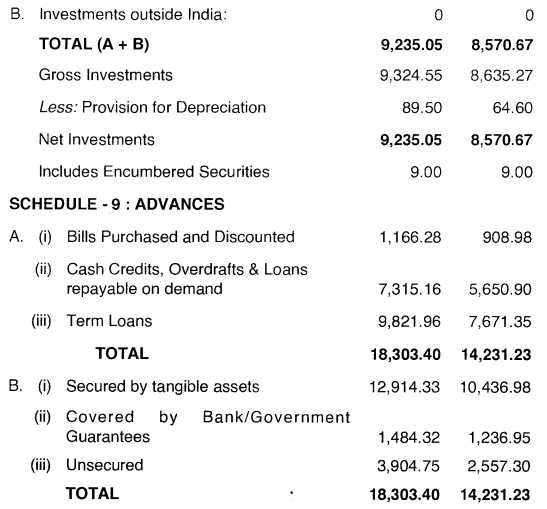

Based on the financial data of The Kuber Bank Ltd., answer the following questions (a to e):

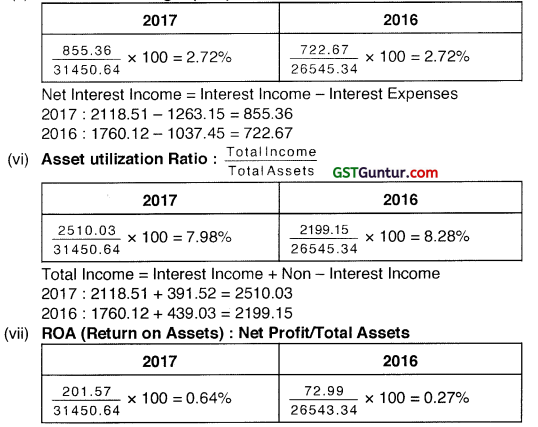

(a) Compute the following ratios:

- Interest Expense Ratio.

- Burden Ratio : Non-Interest Income to Non-Interest Expenses Ratio.

- Efficiency Ratio : Non- Interest Expenses to Net Total Income Ratio.

- Equity Multiplier.

- Net Interest Margin (NIM).

- Asset Utilization : Total Income to Total assets Ratio.

- Return of Assets (ROA).

- Return On Equity (ROE).

- Liability Mix Ratio : Total deposits to Total Liability Ratio.

- CD Ratio : Credit to Deposits Ratio. (20 marks)

![]()

(b) Based on the above ratios, comment on the performance of The Kuber Bank Ltd. in terms of profitability specifically indicating the reasons for the variation. (10 marks)

(c) Compute the Net Demand and Time Liabilities (NDTL) of The Kuber Bank Ltd. as on 31.03.2017. Calculate and comment on the levels of CRR and SLR maintained by the bank. (Assuming that the current level stipulated by RBI is CRR-7.5% and SLR-25%). (10 marks)

(d) How you interpret the increase in Contingent liabilities V/s increase in advances of The Kuber Bank Ltd.? (5 marks)

(e) Asset Liability Management (ALM) is concerned with strategic balance sheet management. The significance of ALM to the financial sector is highlighted due to the dramatic changes that have occurred in recent years in the assets and liabilities of banks. Discuss the various reasons for the growing significance of ALM. (5 marks)

Answer:

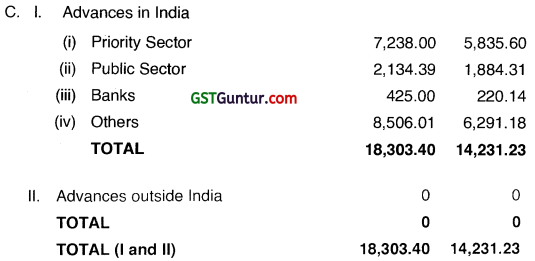

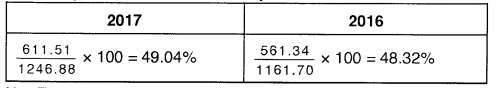

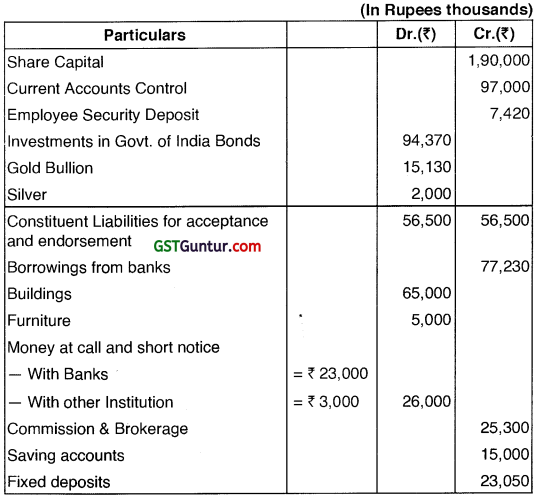

(a) (i) interest Expenses Ratio = \(\frac{\text { Interest Expenses }}{\text { TotalIncome }}\) × 100

Total Income = Interest Income + Non-Interest Income

2017 : 2118.51 + 391.52 = 2510.03

2016 : 1760.12 + 439.03 = 2199.15

![]()

(ii) Burden Ratio : Non – Interest Income/Non-interest Expenses

(iii) Efficiency Ratio : Non-Interest Expenses/Net Total Income

Net Total Income = Net Interest Income (Interest Income-Interest Expenses) + Other Income

2017 : 2118.51 – 1263.15 + 391.52 = 1246.88

2016 : 1760.12 – 1037.45 + 439.03 = 1161.70

(iv) Equity Multiplier: Total Assets/Total Equity

2017 : Total Equity = 286.82 + 1209 = 1496.41

2016 : Total Equity = 286.62 + 1052.42 = 1339.24

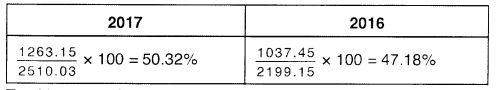

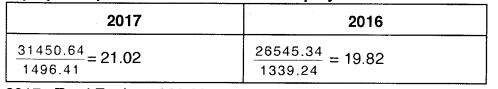

(v) Net Interest Margin (NIM): Net Interest Income/Total Assets

![]()

(viii) Return on Equity – Net Profit / Capital + Reserves & Surplus

(b) (i) Interest Expenses Ratio. The net profit in turn is influenced by the interest and non-interest income and expenses. Interest expenses ratio shows interest expenses to total income. In 2016-17 interest expenses ratio has marginally increased from 47.18% to 50.32% from the year 2015-16.

(ii) Burden Ratio it is the ratio of non-interest income to non-interest expenses, in the year 2016-17 burden ratio reduced from the 78.21% to 64.02% from the previous year. This reduced is because of fall in other income.

(iii) Efficiency Ratio on the other hand compares the non-interest expense to net total income. This ratio marginally increased from 48.32% to 49.04 in 2016-17 from the year 2015-16.

![]()

(iv) Equity multiplier is an indicator of total assets to total equity. There is marginal increase in equity multiplier from 19.82 times to 21.02 times in the year 2016-17 from the previous year.

(v) Net Interest Margin (NIM): The difference between the revenue generated by interest bearing assets and cost of borrowed fund gives the Net Interest Income (Nil) of the bank. The Nil when expressed as a percentage of the assets gives the NIM of the bank. NIM of the bank remained same in both the year.

(vi) Assets utilization is an indicator of the efficiency usage of bank’s assets. In 2016-17 asset utilization ratio has decrease from 8.28% to 7.98% this is mainly due to fall in other income of the bank.

(vii) Return on Assets (ROA) assesses the profitability of the bank based on the assets. ROA of the bank has increased to 0.64% in 2016-17 from the 0.27% in 2015-16, but still this is considered as very low and indicates that banks deployment of the fund is not up to the mark.

(viii) Return on Equity (ROE) shows the return earned by the shareholder of the bank. In the year 2016-17 ROE of the bank has increased to 13.47%, from 5.45% in 2015-16. This is due to significant rise in the net profit of the bank.

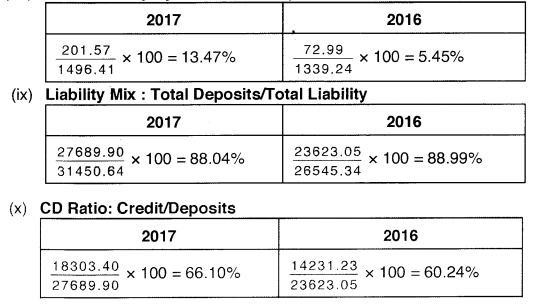

(ix) Liability Mix Ratio decreased from 88.99% in F.Y’. 16 to 88.04% in F.Y’. 17 shows that share of deposits in total liabilities have marginally decreased.

(x) CD Ratio: (Cost to Deposit Ratio). This ratio improved have from 60.24% in F.Y’. 16 to 66.10% in F.Y’. 17 which is good for the bank. Bank has tapped the lending opportunity available in the market which gives more margins to the bank in future.

![]()

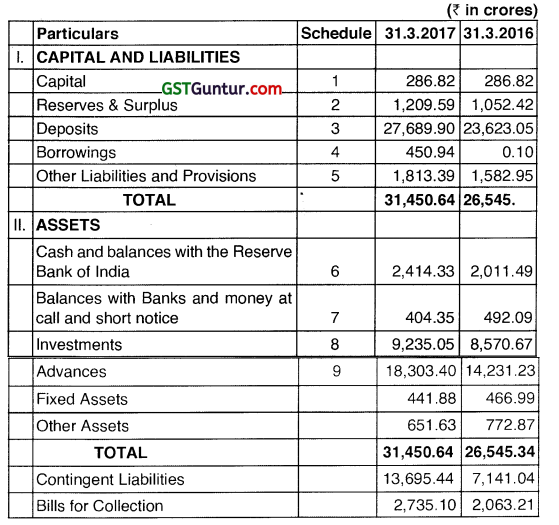

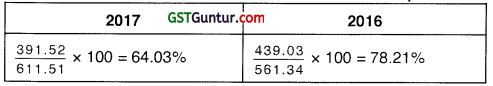

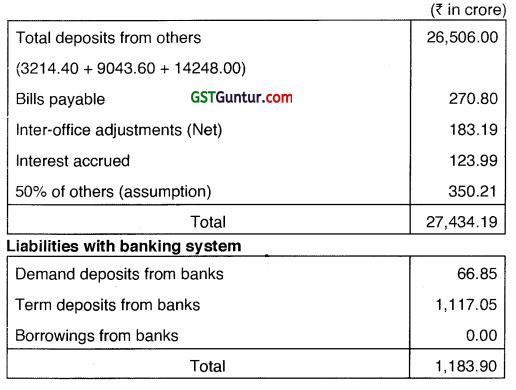

(c) Calculation of NDTL: Net Demand and time liabilities

Assets with banking system

NDTL = Liabilities to others + Net Inter-Bank Liabilities (NIBL)

Where NIBL = Liabilities to banking system – Assets with banking system

Net Inter-Banking Liabilities (NIBIL) = 1183.90 – 354.25 = 829.65

NDTL = 27,434.19 + 829.65 = 28,263.84

CRR maintained = \(\frac{\text { Balance with RBI }}{\text { NDTL }}\)

= \(\frac{2.232 .26}{28.263 .81}\) = 7.90%

CRR is maintained at 7.90%

![]()

Assuming CRR of 7.5%, the additional amount of cash with RBI in current account is considered for SLR purpose.

SLR maintained =Cash + Government securities + Approved securities + Net balances with banks in current accounts + Excess cash reserve = 182.07 + 7,588.15 + 160.76 + (254.25 – 66.85) + [2,232.26 – (0.075*28,263.84)]

= 8,230.85

SLR as % of NDTL = \(\frac{8,230.85}{28,263.84}\) = 29.12%

Bank is maintaining SLR at 29.12%

(d) Contingent liabilities of the bank increased to 91.78% in F.Y’. 2017 whereas advances increased by 28.61% during the same period. In Contingent liabilities bank undertake to pay the amounts on happening of a contingency. Contingent liabilities mainly contain Bank Guarantees, Letter of Credit, underwritings and credit guarantees.

Exceptional growth in contingent liabilities may be the strategy of the bank or bank may not aware on this item.

If growth in contingent liabilities is the strategy of bank, it will improve the non interest income of the bank, it generates other business for the bank like deposits in the shape of margins. It does not require funds for income generation.

But sudden spurt in contingent liabilities should alarm our control systems and polices. It should attract the attention of management and all stake holders of the bank.

Many questions should come in the mind of management:

(a) Whether it is a conscious decision?

(b) Whether it is according to the prescribed policy?

(c) Which type of contingent liabilities are increasing?

(d) Who are the beneficiaries?

(e) Whether beneficiaries are financially sound?

(f) Whether proper assessments were made into consideration?

(g) Whether proper margins were taken into consideration?

![]()

Contingent liabilities attract credit risk which requires capital as per Risk rating of the party.

Keeping in view of recent fraud in one of Indian Bank, accounting and monitoring of contingent liabilities require more attention as risk is equivalent to fund based limits.

(e) The main reasons for the growing significance of Assets Liability Management (ALM) are:

(a) Volatility: In the recent times, we have witnessed increasing number of free economics, with more and more nations globalizing their operations. Closely regulated markets are paving the way for market-driven economics. The vagaries of such free economic environment are reflected in the interest rate structures, money supply and the overall credit position of the market, the exchange rates and the price levels.

For a business which involves trading in money, rate fluctuations invariably affect the market value, yields/costs of the assets/liabilities which further affect the market value of the bank. Tackling this situation would have been a very difficult task in a setup where interest rates are volatile and exchange rate volatility is high, but for ALM.

(b) Product Innovation: The second reason for the growing significance of ALM is the rapid innovations taking place in the financial products of the bank. In several cases, the same product has been repackaged with certain differences and offered by various banks. Whatever may be the features of the products, most of them have an impact on the risk profile of the bank thereby enhancing the need for ALM.

(c) Regulatory Environment: In order to enable the banks to cope with the changing environment that has resulted due to the integration of the domestic markets with international markets, the regulatory authorities of various financial markets have initiated a number of measures with an objective to prevent market vagaries.

One step towards this direction was the increased focus in the management of the bank’s assets and liabilities. The RBI also asserted for a framework for banks to develop ALM policies.

(d) Management Recognition: All the above mentioned aspects forced the managements of the banks to have a serious thought about the management of the assets and liabilities. The managements have realized that it is just not sufficient to have very goods franchise for credit disbursement nor is it enough to have just a very good retail deposits base. In addition to these, the banks should be in a position to relate and link the assets side with the liability side and this calls for efficient ALM.

![]()

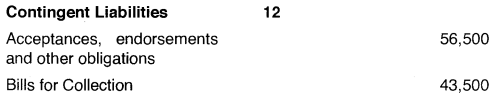

Question 13.

Case Study : (June 2019)

The accounting system followed by the banks in India, differs from the general accounting system followed by companies and other business entities. Nevertheless, all banks are required to prepare and present their Annual Financial Statements as per specified formats in compliance with the provisions of Banking Regulation Act (B.R. Act), the Companies Act, RBI directions and the ICAI Accounting Standards.

Banking Companies are required to provide a statement of all the accounting policies followed in preparing these financial statements and also required to comply with disclosure/additional disclosure requirements as advised by Reserve Bank of India (RBI) from time to time relating to capital, lendings and others. Like any other business entity banks also follow the mercantile system of accounting. However there is a slight difference in the methodology followed by banks when compared to other commercial entities.

The reason of difference is that the banks are entering the transactions of customers first, in ledgers (which are subsidiary books under conventional accounting) rather than in Journals. This is so because, accounts of customers which are maintained in ledgers should be accurate and must be free from errors so that accuracy is being maintained as to the transactions.

Financial Statements of banking companies are an important source of information for a variety of stakeholders. These financial statements are prepared after an extensive compliance with the directions and guidelines issued by RBI and other regulatory authorities, and therefore, contain a treasure of useful information. One should necessarily focus on :

- Requirements regarding accounts and audit of banking companies.

- Features of accounting system of banks.

- Books of account of banks.

- Presentation and formats used for financial statements.

- Accounting treatment of various items.

- Disclosure requirements.

![]()

Sections 29 to 34A of the B.R. Act deal with the accounts and audit of banking companies. Section 29 of the B.R. Act casts a responsibility on every banking company incorporated/operating in India which are involved in transacting the business of banking through its branches, prepare and submit Balance Sheet and Profit & Loss Account for the financial year in the specified formats set out in Ill-schedule of the Act as on the last working day of that financial year. Such Balance Sheet and P&L Account should be signed by the manager or the principal officer and at least by three directors, if there are more than three directors and if only three directors then all of them should sign the same.

However, for a foreign bank operating in India, the manager or principal officer of the concerned bank should sign these statements. The Central Government has the powers to amend the formats of Balance Sheet and P&L Account as given in Section 29 of B.R. Act and thereafter the banks are required to prepare the financial statements in these formats only.

According to Section 30 of the B.R. Act, the Balance Sheet and P&L Account prepared are to be audited by a duly qualified person as per applicable law for the time being in force without prejudice to anything contained in the Companies Act or any other law for the time being in force.

Where the Reserve Bank of India is of opinion that it is necessary in the public interest or in the interest of the banking company or its depositors so to do,it may at any time by order direct that a special audit of the banking company’s accounts, for any such transaction or class of transactions or for such period or periods as may be specified in the order, shall be conducted by the same or by a different auditor.

The RBI may either appoint a person duly qualified under any law for the time being in force to be an auditor of such banking company or direct the auditor of the banking company to conduct such special audit and the auditor shall comply with such directions and make a report of such audit to the Reserve Bank of India and forward a copy thereof to the banking company too.

As per Section 31 of the B.R. Act, every banking company has to submit three copies of annual accounts consisting of Balance Sheet along with P&L Account prepared in accordance with Section 29 of B.R. Act together with Auditor’s Report to RBI within three months from the end of the period to which they relate. In the case of Regional Rural Banks (RRBs), they shall furnish the Balance Sheet and P&L Accounts to NABARD instead of RBI.

![]()

Linder Section 32 of the B.R. Act, a banking company (not other types of banking entities) has to submit three copies of Balance Sheet and P&L Account to the Registrar of Companies when it submits the same to RBI. Such banking company, also within a period of six months from the date of accounts and Auditors’ Report, publish the same in a newspaper which is widely circulated where the banking company has its principal place of business.

This compliance has to be done according to Banking Companies Regulation (Rules), 1949. As per Section 33 of the B.R. Act, in the case of foreign banks operating in India required to display a copy of audited accounts and Balance Sheet at a clear place in their notice board for public display. This has to be done before 1st Monday in the month of August every year. Banks have to maintain a ‘Regulatory Disclosure Section’ on their website, where all the information relating to disclosures will be made available to the market participants.

Bank which have been listed on stock exchanges in India and abroad have to comply with terms of SEBI (LODR) Regulations, 2015 including reporting and other compliances regulations in a timely manner failing which they would be facing penal action including fines. Disclosures related to individual banks within the groups would not generally be required to be made by the parent bank. In order to encourage market discipline, Reserve Bank of India has over the years developed a set of disclosure requirements, which allow the market participants to assess the key points of information on capital adequacy, risk exposure, risk assessment provisions and key business parameters to provide a consistent and understandable disclosure framework that enhances comparability.

Banks are also required to comply with the Accounting Standard-1 (AS-1) on ‘Disclosure of Accounting Policies’ issued by the Institute of Chartered Accountants of India (ICAI). The enhanced disclosures have been achieved through the version of Balance Sheet and Profit & Loss Account of banks and enlarging the scope of disclosures to be made in ‘Notes to Accounts’.

As a standard practice to bring in uniform reporting ‘Summary of Significant Accounting Policies’ and ‘Notes to Accounts’ are to be shown in Schedule 17 and 18 by banks. RBI through its Master Circular No. : RBI/2015-16/99 DBR.BP.BC.No. 23/21.04.018/2015-16 dated July 1st, 2015 has provided detailed guidelines in this regard. In the backdrop of the above you are required to give answer to the following :

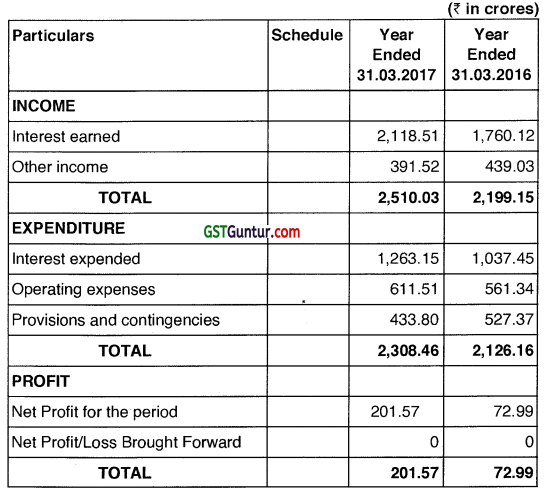

(a) Banks in India prepare their Annual Financial Statements as per specified formats. Explain where such formats have been prescribed for the banks to prepare their annual statement of accounts. Also explain the ‘Act’ which have a bearing on financial statements of banks ? (6 marks)

![]()

(b) State the principal books of accounts which are being maintained by banks in India. In what respects the balance sheet of a bank is different from Balance Sheet of a company. (8 marks)

(c) What are the particulars of Liabilities and Assets to be provided in the Balance Sheet of a Bank as being prescribed under the Banking Regulation Act ? (6 marks)

(d) As a standard practice to bring in uniform reporting ‘Summary of Significant Accounting Policies’ and ‘Notes to Accounts’ are to be shown in Schedule 17 and 18 by banks. What are being required under major disclosure ? Also state the mandatory requirements of SEBI (LODR) Regulations 2015 which the banks have to comply relating to listing of securities on stock exchange. (8 marks)

(e) (i) What are the items to be adjusted before disclosing Net Profit in the Profit and Loss Account of a bank ? (4 marks)

(ii) Financial Statements of Banking Companies are an important source of information for a variety of stakeholders. Who are such stakeholders and why they need such statements ? (4 marks)

(iii) Explain how the bank manages the economic risk due to fluctuations in the forex market. (4 marks)

Answer:

(a) A banking company being a body corporate has statutory obligation to present annual financial statements in terms of formats prescribed under the Companies Act, 2013 / Banking Regulation Act, 1949 (BR Act, 1949). The Banks, under the Banking Regulation Act, 1949 have to prepare and submit Balance Sheet and Profit and Loss account for the financial year, in the specified formats – Form A and Form B. RBI has also notified detailed guidelines in this regard including disclosure norms.

![]()

Section 29 of the BR Act, 1949 casts a responsibility on every Banking company incorporated/operating in India which are involved in transacting the business of banking through its branches, prepare and submit Balance Sheet and Profit and Loss account for the financial year, in the specified formats set out in the III Schedule of the Act, as on the last working day of that financial year. The Central Government has the powers to amend the formats of Balance Sheet and Profit and Loss as in Section 29 of the BR Act, 1949.

The BR Act, 1949, the Companies Act, 2013, RBI directions, ICAI Accounting Standards and other applicable provisions have a bearing on the Financial Statements of the Banks. The Central Government has also the power to appoint the management, the Board of the Directors and also have power to issue directions. Besides these regulatory provisions having bearing on the financial statements of banks the norms of disclosure of accounting policies and the Notes on accounts indicating how the figures have been arrived at in the balance sheet also plays a vital role.

Such balance sheet and Profit and Loss account should be signed by the Manager or the Principal Officer and at least three directors if there are more than three directors and if only three directors are then all of them should sign the same. For a foreign bank operating in India, the Manager or Principal Officer of the concerned bank should sign.

![]()

(b) (i) The following books of accounts are mainly maintain by Banks in India:

(a) Ledgers of Savings Bank, Current Account, Cash credit, Loans, FD Accounts, Recurring Deposit Accounts, Investment Ledgers, Bill discounted/purchase (Inland and Foreign) etc.

(b) Registers for collection (inland and foreign), cash, clearing, Safe deposit lockers, DD/Pay order issued, DD’s paid, Bank Guarantee issued, Bills Margin, LC issued, Clearing cheques returned, NEFT/RTGS issued etc. Pension payment, PPF Accounts, Demat Accounts, etc.

(c) Registers for Profit and Loss heads, Suspense account etc. ;

(d) General Ledger S

(e) Cash book/Day Book

(f) Profit and Loss registers.

Note : There are differing practices among banks in maintaining registers for various heads of accounts. However under Core Banking Principal books of account are maintained in different software modules.

(ii) Under the Companies Act, 2013, a company has to prepare and submit financial statements as per Schedule III of the Act. However banks under the Banking Regulation Act, 1949 have to prepare and submit their Balance Sheet, Profit and Loss Account in specified formats – Form A and Form B. RBI has also notified detailed guidelines in this regard in respect of these including disclosure norms.

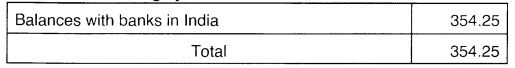

(c)

FORM A – Form of Balance Sheet Under BR Act

Balance Sheet of Bank xxx

Balance Sheet as on 31st March 20 ……………… (Year)

![]()

Schedule 12. Contingent liabilities

(d) As per RBI’s directions banks should disclose the accounting policies regarding key areas of operations at one place (under Schedule 17) along with ‘Notes to Accounts in their financial statements. A suggestive list includes:

Basis of Accounting, Transactions involving Foreign Exchange, Investments-Classification, Valuation, etc, Advances and Provisions thereon, Fixed Assets and Depreciation, Revenue Recognition, Employee Benefits, Provision for Taxation, Net Profit, etc. Mandatory Requirements of listing of banks on Stock Exchange as to the composition of the Board of Directors, Composition and quorum of the Audit Committee, Non-Executive Directors compensation, the appointment, re-appointment of the Statutory Auditors and fixation of their fees and also to have the following committees under various regulations of SEBI(LODR) Regulations 2015:

- Stake holder Relationship Committee

- Risk Management Committee

- Nomination and Remuneration Committee

All listed banks for the purpose of disclosures as per SEBI(LODR) Regulations comply with the Regulations 30,31 A,33,34,35,51,52 and 62 relating to website.

The banks are also required to have vigil mechanism as per Regulations 22 and sound system of corporate governance as per Regulations 24 and 27 as well as a grievance redressal mechanism required under Regulation 13 of SEBI(LODR) Regulations 2015.

![]()

(e)

- The net profit disclosed in the Profit and Loss Account after:

- Provisions for taxes on income, in accordance with the statutory requirements

- Provisions for doubtful advances

- Adjustments to the value of “current investments” in Government and other approved securities in India, valued at lower of cost or market value

- Transfers to contingency funds and other usual or necessary provisions.

(ii) Employees, Management, Depositors, Borrowers, Investors, Academics, Research bodies, Economists, Analysts, Regulatory Authorities/Bodies, Students are the stake holders in general of the financial statement of Banking Company.

The Financial statements are being used by the stakeholders and the regulatory authorities to find out the performance and operations of the bank as well as quality of assets and for assessing the financial health of the banks.

(iii) Economic Risk refers to unfavorable economic conditions in buyer or seller’s country which may affect both parties in fulfilling their obligation on the buyer side, economic risk may result in Buyer’s insolvency or inability to accept the goods and services. On the other hand the seller may experience difficulty in providing or supplying the goods.