Decision Making – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Decision Making – CA Final SCMPE Study Material

Question 1.

Mr. Rachit Arora is a canteen contractor in Hindu College. He manages college canteen of 1,200 students where tea and snacks are served between 9 am to 5 pm. He has employed four supervisors for managing cash.

Mr. Rachit pays ₹ 400 per working day to every supervisor. The college remains closed on Saturday and Sunday. A solution provider has ap-proached Mr. Rachit for managing Cash. He has advised Rachit to install an automated payment mechanism for accepting payments through machines. Every student of college will swipe smart card for making the payment. The complete system would cost ₹ 3,35,000 with working life of 4 years with annual maintenance of ₹ 60,000. Only one supervisor will be required after the installation of machines.

Required

ADVISE Mr. Rachit on his plan of installation of automated payment mechanism. (Ignore the time value of money.) [Nov. 2020] (5 Marks)

Answer:

Advise

Considering the financial aspects only, it is advised to Mr. Rachit that automated payment mechanism shall be installed; because it will expected to result in net saving of ₹ 6,73,000 during its entire working life span as shown in working note 1 below.

But in order to be sustainable, business decision shall also take non-financial factors into consideration. The automated payment mechanism may be more efficient and faster than human supervisor, but also more rigid. In situation like, wherein student forget to carry the smart card or willing to order customise serving of snacks then automated payment mechanism may be less effective (because it is hard to quantify human aspects mechanically).

Mr. Rachit shall also consider the nature and terms of employment in case of those three supervisors who will be retrenched (or laid-off) and legal implications of this.

Smart card which to be used under automated payment mechanism is expected to be prepaid card, because have swipe feature instead of making cash payment; hence student need to pay in advance. Mr. Rachit also need to consider how many student willing to pay upfront (prior to the point, they suppose in current system).

Working Note:

Statement of Comparison of Costs and Benefits

| Particulars | Amount in ₹ |

| Cost of installing automated payment mechanism | |

| Installation cost | 3,35,000 |

| Annual Maintenance Cost (₹ 60,000 × 4 Yrs.) | 2,40,000 |

| Total Cost to be incurred …(A) | 5,75,000 |

| Benefits (in form of savings) due to installation of automated payment mechanism | |

| (3 supervisors × ₹ 400 per working day × 4 years × 52 weeks in a year × 5 working days in a week) | 12,48,000 |

| Total benefit in form of savings …(B) | 12,48,000 |

| Net Saving during entire span of automated payment mechanism (B)-(A) | 6,73,000 |

Note – One supervisor will continue even in automated paym ent mechanism, hence saving is considered in respect to 3 supervisors only.

Author’s Note:

- This question can also be solved by assuming 365 days in a year.

- Therefore 261 working days in a year, after deducting 52 Saturdays and 52 Sundays. The calculation of supervisor’s salary will be changed as follows:

- (3 supervisors × ₹ 400 per working day × 4 years × 261 working days in a year) = ₹ 12,52,800; the net saving during entire span of automated payment mechanism will be ₹ 6,77,800 (₹ 12,52,800 – ₹ 5,75,000).

- Instead of making calculation for four years, this question can also be solved by calculating savings on yearly basis.

- Alternate non-financial factors are also possible.

![]()

Question 2.

Mr. Shiva manages the school canteen (approximately 1,600 students) at Nehru Place. The current cash payment system requires three clerks (paid 90 per hour), employed for about 4 hours a day. The canteen operates approximately 240 days a year. Mr. Shiva Is considering a Wireless Cash Management System (WCMS), where a student could just swipe an ID Card for payment. This system would cost 1,25,000 to setup and 36,000 per year to operate. Mr. Shiva believes that he could manage with one clerk If he were to implement the system.

Required

ADVISE Mr. Shiva on the choice of a plan, assuming working life of WCMS as 5 years. (Ignore the time value of money) (October 2020 MTPJ (5 Marks)

Answer:

For each day, Mr. Shiva spends 360 per clerk ( 90 per hr. × 4 hrs.).

Therefore, Mr. Shiva spends 1,080 per day to employ three clerks. Annually, this outlay amounts to 2,59,200 1,080 per day × 240 days).

Over five years, the outlay would be 12,96,000. If the WCMS is implemented, the initial cost is ₹ 1,25,000. If we add the annual cost of ₹ 36,000, the total cost over five years amounts to ₹ 3,05,000. Since one clerk will be needed as well, Mr. Shiva has to incur ₹ 4,32,000 over five years to pay clerk (₹ 4,32,000 = ₹ 90 × 4 hrs. × 1 clerk × 240 days × 5 years). Therefore, the total cost of this option is ₹ 7,37,000.

Accordingly, there is cost saving of ₹ 5,59,000 from WCMS implementation. Relevant Non-Financial Considerations

The WCMS may be a lot more efficient, but more rigid. For instance, what if, a student forgets to bring his/her card or transaction failure due to connectivity issue, and may not have enough cash to pay. Automated systems may be less able to handle these situations. Having clerks may add an aspect of flexibility and a human aspect that is hard to quantify.

Conclusion

Obviously, WCMS option is more cost effective for Mr. Shiva because there is a cost saving of ₹ 5,59,000. But, non-financial factors should also be taken into consideration.

Question 3.

(Activity Based CVP Analysis)

Core Ltd. makes a single product with the following details:

| Description | Current Situation | Proposed Change |

| Selling Price (₹/unit) | 10 | |

| Direct Costs (₹/unit) | 5 | |

| Present number of setups per production period (before each production run, setup is done) | 42 | |

| Cost per setup (₹) | 450 | Decrease by ₹ 90 |

| Production units per run | 960 | 1,008 |

| Engineering hours for production period | 500 | 422 |

| Cost per engineering hour (₹) | 10 |

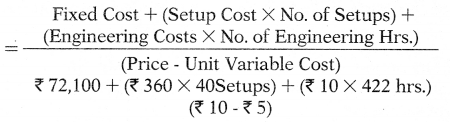

The company has begun Activity Based Costing of fixed costs and has presently identified two cost drivers, viz, production runs and engineering hours. Of the total fixed costs presently at ₹ 96,000, after the above, ₹ 72,100 remains to be analyzed. There are changes as proposed above for the next production period for the same volume of output.

Required

(i) COMPUTE units and » reduction rues Core lid. should produce in the changed scenario for break-even.

(ii) ADVISE whether Core Ltd. should continue to break up the remaining fixed costs into activity-based costs.

Answer:

(i) Break Even Point (Changed Scenario)

= 18,144 units

Break Even Point (No. of Production Runs)

= Break Even (units) ÷ Production (units per run)

= \(\frac{18,144 \text { units }}{1,008 \text { units }}\)

= 18 Runs

(ii) A company should adopt Activity Based Costing (ABC) system for accurate product costing, as traditional volume based costing system does not take into account the Non-unit Level Overhead Costs such as Setup Cost, Inspection Cost, and Material Handling Cost etc. Cost Analysis under ABC system showed that while these costs are largely fixed with respect to sales volume, but they are not fixed to other appropriate cost drivers. If break up the remaining ₹ 72,100 fixed costs consist of only a small portion of these costs, ABC need not be applied. However, it may also be noted that the primary study has resulted in cost savings. If the savings in cost are expected to exceed the cost of study and implementing ABC, it may be justified. Further it is pertinent to mention that ABC offers no increase in product-costing accuracy for single-product setting.

Working Notes:

Statement Showing ‘Non-unit Level Overhead Costs’

| Particulars | Current Situation | Proposed Situation |

| No. of Production Runs/ Setups | 42 | 40 |

| For proposed situation: | \( \frac{(960 \text { runs } \times 42 \text { setup })}{1,008 \text { Units }} \) | |

| Cost per Setup | ₹ 450 | ₹ 360 |

| Production Units per run | 960 units | 1,008 units |

| Production Units (960 units × 42) | 40,320 | 40,320 |

| Engineering Hrs. | 500 | 422 |

| Engineering Cost per hour | ₹ 10 | ₹ 10 |

Question 4.

(CVP Analysis in Service and Non-profit Organisations)

Toyada Services Pvt. Ltd. is planning to run a fleet of 15 buses in Seelampur City on a fixed route. Toyada has estimated a total of 2,31,85,000 passenger kilometers per annum. It is estimated buses to have 100% load factor. Buses are purchased at. a price of ₹ 44,00,000 per unit whose scrape value at the end of 5 years life is ₹ 5,50,000. Seating capacity of a bus excluding a Driver’s sea? is 42. Each bus can give a mileage of 5 kmpl. Average cost of fuel is ₹ 66 per liter. Cost of Lubricants & Sundries per 1,000 km would be 3,300. Company will pay ₹ 27,500 pe month to Driver and two attendants for each bus. Other annual charges per bus: Insurance ₹ 55,000, Garage Charges ₹ 33,000, RepaIrs & Maintenance ₹ 55,000. Route Permit Charges upto 20,000 km is ₹ 5,500 and ₹ 2,200 for every additional 5,000 km or part thereof.

Required

CALCULATE a suggested fare per passenger/km taking into account markup on cost @ 20% to cover general overheads and sufficient profit,

(ii) The Transport Sector of Seelampur is highly regulated. The Government has fixed the fare @ ₹ 1,35 for next 2 years. COMMENT on the two year’s proofitability taking into consideration the inflation rate of 8%.

Note: Route permit charges is not subject to Inflation

Answer:

(i) Statement Suggesting “Fare per passenger – km (Each Bus)”

| Fixed Expenses: | ₹ |

| Insurance | 55,000.00 |

| Garage Charges | 33,000.00 |

| Depreciation | 7,70,000.00 |

| Running Expenses: | |

| Repair and Maintenance | 55,000.00 |

| Cost of Lubricants and Sundries „ | 1,38,517.50 |

| Fuel Cost | 5,54,070.00 |

| Salary of Driver and Two Attendants | 3,30,000.00 |

| Route Permit Charges | 16,500.00 |

| Total Cost per annum | 19,52,087.50 |

| Add; Markup @ 20% of Total Cost or 16.67% of Total Revenue | 3,90,417.50 |

| Total Revenue | 23,42,505.00 |

Rate per passenger- km equals to ₹ 1.395

Workings

Total Passenger Kms = 2,51,85,000

Total Buses = 15

Passenger Kms per bus = 16,79,000 (2,51,85,000 Kms/15)

Total Passenger Capacity per bus = 42 – 2 = 40

Annual Distance Covered by a bust = 41,975 Kms. (16,79,000 Kms/’ 40)

Regulated Fare per passenger km is ₹ 1.35

(ii) Profitability Statement for Each Bus

| Particulars | Year 1 (₹) | Year 2 (₹) |

| Fixed Expenses: | ||

| Insurance | 59,400,00 | 64,152.00 |

| Garage Charges | 35,640.00 | 38,491.20 |

| Depreciation | 7,70,000.00 | 7,70,000.00 |

| Running Expenses: | ||

| Repair and Maintenance | 59,400.00 | 64,152.00 |

| Cost of Lubricants and Sundries | 1,49,598.90 | 1,61,566.81 |

| Fuel Cost | 5,98,395,60 | 6,46,267.25 |

| Salary of Driver and Two Attendants | 3,56,400.00 | 3,84,912.00 |

| Route Permit Charges | 16,500.00 | 16,500.00 |

| Total Cost …[A] | 20,45,334.50 | 21,46,041.26 |

| Total Revenue (Regulated) … [B] | 22,66,650.00 | 22,66,650.00 |

| Profit … [B] – [A] | 2,21,315.50 | 1,20,608.74 |

| Profit to Total Revenue | 9.7696 | 5.3296 |

The gross margin is showing a downward trend because the cost components have taken into the effect of inflation hence increasing year by year but the total revenue has remained stagnant due to Government regulations which resulted in reduction in gross margin per bus.

The Toyada company’s gross margin to total revenue ratio has come out to be 9.7696 and 5.3296 in first and second year respectively but initially the Toyada company’s desired gross margin to total revenue ratio is 16,6796 to cover general overheads and sufficient profit. Though the amount of general overheads is not given but we can safely assume that they may also subject to inflation i.e. increase year by year then in such case the company needs to maintain or increase its gross margin per bus to maintain its net profit after general overheads which is not possible in regulated environment. The information about regulated fare in the given case is regarding first two years only but if this regulated fare scenario persists for further years then the project may not be viable for the company.

Question 5.

After the Second wave of COVID pandemic, Ministry of Health and Family Welfare along with Drug Control Department have come hard on health care centres tor charging exorbitant fees from their patients. Vedanta Health Care Ltd. (VHCL), a leading integrated health- rase deliver? provider company is feeling pinch of measures taken authorities and facing margin pressures due lo this. VHCL is operating in a competitive environment so; it’s difficult to increase patient numbers also. Management Consultant of the company has come out with some plan for cost control and reduction.

VHCL provides treatment under package system where fees is charged irrespective of days a patient stays in the hospital. Consultant has estimated 2.50 patient days per patient. He wants to educe it to 2 days. By doing Ibis, consultant has targeted the general variable cost of ₹ 500 per : patient day. Annually 15,000 patients visit to die hospital for treatment.

Medical Superintendent has sorne concerns with that of Consultant’s plan. According to him, reducing the patient stay would be detrimental to the full recovery of patient. They would come again for admission thereby increasing current readmlsslon rate from 3% to 5%; it means readmitting 300 additional patients. Company has to spend ₹ 25,00,000 naore to accommodate this increase in readmission. But Consultant has found bless In disguise in tuis. He said every readinision is treated as new admission so it would result in additional cash flow of ₹ 4,500 per patient, in the form of’admission fees.

Required

(i) CALCULATE the impact of Management Consultant’s plan on profit of the company.

(ii) Also COMMENT on result and other factors that should be kept in mind before taking any uccision. ’

Answer:

(i) Impact of Management Consultant’s Plan on Profit of the VHCL

Vedanta Health Care Ltd.

Statement Showing Cost Benefit Analysis

| Particulars | ₹ |

| Cost: | |

| Incremental Cost due to Increased Readmission | 25,00,000 |

| Benefit: | |

| Saving in General Variable Cost due to Reduction in Patient Days [15,000 Patients × (2.5 Days – 2.0 Days) × ₹ 500] | 37,50,000 |

| Revenue from Increased Readmission (300 Patients × ₹ 4,500) | 13,50,000 |

| Incremental Benefit | 26,00,000 |

(ii) Comment

Primary goal of investor-owned firms is shareholder wealth maximization, which translates to stock price maximization. Management consultant’s plan is looking good for the VHCL as there is a positive impact on the profitability of the company (refer Cost Benefit Analysis).

Also VHCL operates in a competitive environment so for its survival, it has to work on plans like above.

But there is also the other side of a coin that should also be considered i.e. humanity values and business ethics. Discharging patients before their full recovery will add discomfort and disruption in their lives which cannot be quantified into money. There could be other severe consequences as well because of this practice. For gaining extra benefits, VHCL cannot play with the life of patients. It would put a question mark on the business ethics of the VHCL.

May be VHCL would able to earn incremental profit due to this practice in short run but it will tarnish the image of the VHCL which would hurt profitability in the long run.

So, before taking any decision, Vedanta Health Care Ltd. should analyze both quantitative as well as qualitative factors.

![]()

Question 6.

(Ethical and Mon-Financial Considerations)

RANBAX Limited specializes in the manufacture of chemical intermedi ares in a very competitive business environment. RANBAX is a public iisted company, with majority of its shareholders being institutional investors like mutual funds, banks and insurance companies.

It is located in a water scarce zone in Karnataka. There are restrictions on the tapping and usage of groundwater under the relevant laws. Penal provisions of the law will apply in case of violations. The production process requires water and the amount of water that the company can draw is limited to 19,000 kilolitres (1 Kilolitre is 1,000 litres). Purchase of water is not an option as availability is highly erratic and exorbitant on cost.

RANBAX Ltd. manufactures two types of chemicals “AX” and “EX” and these are sold in kilograms. The company is in the process of making the

business plan for the year 2021.

Based on the actual operating data for 2020 and taking into consideration the inflation and possible price increases that it can obtain from the market, the following product costing details have been arrived at:

| Product | AX | BX |

| Capacity Volume kg. (not inter-changeable) | 8,25,000 | 9,30,000 |

| Selling Price per kg. | ₹ 2,000 | ₹ 1,000 |

| Variable Cost per kg. | ₹ 1,500 | ₹ 650 |

| Water (litre/ kg.) | 12.5 | ₹ 10 |

Under the relevant income tax laws prevalent, companies with a turnover of ₹ 250 Cr. (Crores) or less are taxed at a lower rate of 25% as against .the normal 30%, The company intends to keep its sales for 2021 equal to ₹ 250 Cr, or slightly lesser to avail this concessional income tax benefit.

With capacity constraints, the company has calculated that it would be still beneficial for the company to stick to ₹ 250 Cr. as only a marginal Increase in turnover is possible over.

₹ 250 Cr.; after a higher tax @30’%, the PAT would be still lower than the PAT arrived at after doing just ₹ 250 Cr. and availing the lower income iax rate.

CFO asked management consultant to work out the volumes in kg. of products “AX” and “BX” which would give an optimal (maximum) contribution given the constraints on capacity, water usage and turnover to avail ihe concessional income tax benefit.

Consultant work out with the following product mix using Linear Programming. She also proposes another mix which does not meet the constraint on water usage where the company could end up drawing excess water than permitted by 113 kilo-litres but would result in an increase of ? 30 lacs in contribution. She says that it is easily possible to do this by managing reporting to the water authorities.

| Product | Optimal | Suggested | |

| AX (Volume in kg.) | 8,00,000 | 7,85,000 | |

| BX (Volume in kg.) | 9,00,000 | 9,30,000 | |

| Contribution in ₹ Cr. | 71.5 | 71.8 | |

| Constraints | |||

| Sales | <= 250 Cr. | 250 | 250 |

| Volume of “AX” in kg. | <= 8,25,000 | 8,00,000 | 7,85,000 |

| Volume of ‘’BX’’ in kg | <= 9,30,000 | 9,00,000 | 9,30,000 |

| Water uasage (in KL) | <= 19,000 | 19,000 | 19,113 |

Required

The CFO is not satisfied with the calculations. He wants you (Sr. Finance Manager) to come up with a proper DISCUSSION. [May 2020MTP]

Answer:

Primary goal of investor – owned firms is shareholder wealth max-imisation, which translates to stock price maximisation. Management Consultant’s plan is looking good for the RANBAX Ltd as there is a positive impact on the profitability (? 30 lacs) of the company. Also, RANBAX Ltd. operates in a competitive environment so for its survival, it has to work on plans like above.

There is second side of coin that cannot also he ignored i.e. business ethics, It is easily possible to manage drawing of excess water, but it is not an ethical practice as the company has responsibilities towards use of natural resources like water and protecting the environment.

Besides, a whistle-blower complaint to the water authorities can land the company into trouble in terms of penalties, a financial impact and also such penalties are disallowed for income tax purposes. It is possible that such a violation may be reported in the media causing disrepute to the name of the company. It can also make investors in the share market stay away from the company as it has ethical governance issues. The company will face challenges in obtaining other government approvals when it will plan expansion as this violation may have to be reported on the applications seeking approvals.

Overall

May be RANBAX would able to earn profit due to this plan in short run but it will tarnish the image of the RANBAX which would hurt profitability in long run. Therefore, before taking any decision on this plan, RANBAX should analyse both qualitative and qualitative factors.

Question 7.

(Make or Buy)

AJanta Air Ltd., manufactures and sells 25,000 table fans annually. One of the components required for fans is purchased from an outside supplier at a price of ₹ 190 per unit, it is purchasing 25,000 components annually for its usage. The Production Manager is of the opinion that if all the components are produced at own plant, U is possible to maintain better quality in the finished product. Further, he proposed that the inhouse production of the component with other items will provide more flexibility to increase the annual production by another 5,000 units. He estimates the cost of making the component as follows:

| ₹ Per unit | |

| Direct materials | 80 |

| Direct labour | 75 |

| Factory overhead (70% variable) | 40 |

| Total Cost | 195 |

The proposal of the Production Manager was referred to the Marketing Manager for his remarks. He pointed out that to market the additional units, the overall unit price should reduced by 5% and additionally ₹ 1,00,000 p.m. should be incurred fei advertising, Present selling price and

contribution per fan are ₹ 2, Of and ₹ 600 respectively.No other increase or decrease in all other expenses at a result of this proposal will arise.

Since the making cost of the component Is more than the buying cost, the Management asks you to:

(i) ANALYSE the make or buy decision on unit basis and total basis.

(ii) RECOMMEND the most profitable alternative [Nov. 2018] (10 Marks)

Answer:

(i) Ajanta Air Ltd. purchases 25,000 units of components to manufacture 25,000 fans annually. The external purchase price per component is ₹ 190 per unit. It has the option of manufacturing these components in house. The cost structure of manufacturing these components would be as below:

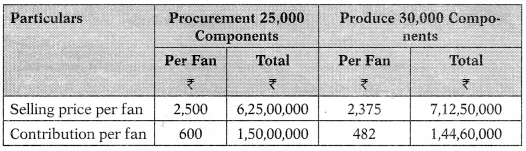

(a) Production Capacity will increase from 25,000 fans to 30,000 fans.

(b) Variable Cost of Production of fan would be ₹ 1,710 [(2,500 – 600) – 190] per unit.

(c) Fixed Factory Overhead off 12 per component would be incurred irrespective of whether component is produced or not. Therefore, this cost is not considered.

(d) Increase in advertising expense would be ₹ 1,00,000 per month or ₹ 12,00,000 annually.

(e) Overall selling price would reduce from the current rate of ₹ 2,500 per fan to ₹ 2,375 (95% of ₹ 2,500) per fan.

(f) Current contribution considering a procurement price of ₹ 190 per component unit, is ₹ 600 per fan. As calculated above, if produced in house, the variable cost would be ₹ 183 per component unit. This would result in an increase in contribution by ₹ 7 per fan (procurement price of f 190 per component unit less variable cost of ₹ 183 per component unit). In addition, there is an impact of f 125 on account of reduction in selling price. Therefore, the contribution if component produced in house would be ₹ 482 per fan (₹ 600 + ₹ 7 – ₹ 125).

To summarize the above figures:

Therefore, incremental loss by switching to in house production (on a total basis) would be ₹ 17,40,000 (incremental loss ₹ 5,40,000 – additional advertising expenses ₹ 12,00,000). On a per unit basis, it would result in a loss of ₹ 58 per fan.

(ii) Recommendation

As explained above, if production increases from 25,000 fans to 30,000 fans, it would not be profitable to make these components in house. Overall profit decreased by ₹ 17,40,000. However, Company may prefer to make component, even though it could be financially beneficial to buy from outside supplier. Sometimes qualitative factors become very important and can override some financial benefit. This can be coupled with uncertainty about the supplier’s ability or intention to maintain the price, quality, delivery dates of the components etc.

Alternatively, the company may continue with the sale of 25,000 units without any price reduction and advertising expenses. The component required for the 25,000 fans may be produced internally at a cost of ₹ 183 per unit. In this situation, the contribution shall be increased by ₹ 1,75,000 (₹ 7 × 25,000 units).

So, Ajanta Air Ltd. may recommend about the most profitable alternative after due and careful consideration of the facts illustrated above.

Question 8.

(Outsourcing Decision; Gain Sharing Arrangement)

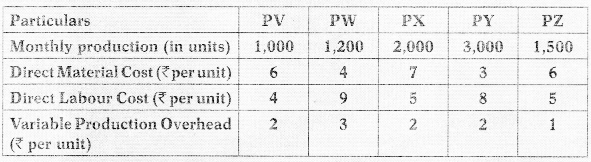

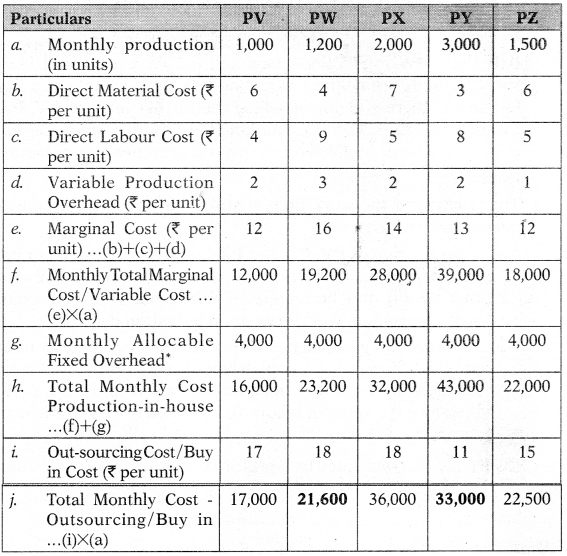

High Sports Inc deals in. manufacturing of sports articles. Although HSI Is major market player but can capture the market further. Currently HSI manufactures five types of badminton shuttle named as PV, PW, PX, PY ana PZ, Production facilities are limiting factor at HSI. Production and marginal cost data of these 5 Products are specified in table below:

On drive to cost leadership strategy, HSI is thinking to out-source some of the products. Shuttles can be sourced from a well-established company Protease’ at the following prices. There is no tie-in between products, all products can outsources individually. These costs are on GIF basis;

Company-wide fixed overheads are of 15 Lacs each year. Out of which 2,40,000 is directly attributable to the production of these 5 products on annual basis. This fixed overhead of 2,40,000 is evenly split across such 5 products and entirely avoidable. Till date company does not have experience to outsource any element of production.

Mr. Singla who is newly appointed management accountant, bring the huge experience to the organization on cost control and reduction techniques. While discussing the possibility of outsourcing with CFO, Mr. Singh explained the limitation of out-sourcing and also presents a white paper on gain sharing arrangement; which can be entered with supplier to whom out-sourcing is considered.

Required

CEO post presentation /discussion seeks report from Mr. Singh to RECOMMEND, the product/(s) which should be outsourced. Report should also EXPLAIN gain sharing arrangement along with aspects that HSI need to consider, ensuring success out of gain sharing arrangement as a part of out-sourcing contract with Protease. [May 2020 RTF]

Answer:

Report to;

Office of CEO,

High Sports Inc (HSI),

Dated – 03rd Jan. 2020

Report on Outsourcing of Products to Protease

(i) Decision on out-sourcing of the products – Product PW and PY can be out-sourced, (see computations below)

Total monthly cost of in house production is ₹ 1,36,200 and Total comparable monthly cost of out-sourcing/Buy-in is ₹ 1,30,100. There is overall saving of ₹ 5,100, but since there is no tie-in between products, hence decision on all products whether can be outsources or produced in-house can be taken individually.

The above calculation suggests that only PW and PY can be sourced through out-sourcing due to, whereas PV, PX and PZ can be produced more cheaply in-house.

Since avoidable in nature, hence relevant for decision making. ₹ 2,40,000 is annual cost, hence monthly fixed overhead expenditure will be ₹ 20,000.

However, following aspects needs to be kept in mind, prior to entering to out-sourcing arrangement of product PW and PY

Issue 1

If products PW and PY are outsourced, the company would then have spare capacity. Since the production function/capacity is a limiting factor and there is scope of selling the further units of PV, PX and PZ; in order to acquire the market share. Hence, spare capacity of great importance and will be a powerful argument for outsourcing.

Issue 2

The reaction of the workforce at HSI is also need to be considered because of two reasons;

a. If production of PV, PX and PZ cannot be expanded to take up the spare capacity on account of out-sourcing of PW and PY, then lay-off may be required – Which may cause problem like strike by remain workforce or an industrial dispute.

b. Facts also suggest that products PW and PY are labour intensive (due to high comparative high labour cost). Hence even the spare capacity on account of out-sourcing of PWr and PY is used, and then also the some of labour forces need to be retrenched.

Issue 3

Even if lay-off is accepted by workforce, then also cost associated with redundancies may be critical. Such cost is relevant for decision-making, hence should be considered.

Issue 4

Since the HSI has no experience operating the out-sourcing till now, hence while dealing with Protease, HSI need to ensure;

a. Timely delivery in right quantity

b. Quality of material supplied

c. Penalties in case of default by outsource supplier.

(ii) Gain Sharing Arrangement by HSI as part of outsourcing agreement with Protease

Gain Sharing Arrangement is a contractual arrangement where, entity (HSI) & outsourcing supplier (In this case protease) share the financial gain which result out of either productivity gains or increased efficiency at end of outsourcing supplier from continuous improvement, transformation, or innovation.

This arrangement in form of clause is usually included in Master Agreement of outsourcing. Outsource supplier find it unique selling point and entity is also on for continuous improvement apart this both will get share in cost saved.

Although gain sharing arrangement is largely useful in case of outsourcing services agreement, but HSI can also while entering out-sourcing contract with Protease for PW and PY; but following aspects need to be considered;

Reason of failure of Gain Sharing Arrangement – Gain Sharing Arrangement sounds great but in practice it is quite difficult to execute. Even after a considerable level of efforts due to following reasons it may fail;

a. Unstructured/Poorly structured terms of arrangement, in outsourcing contracts.

b. Error in implementation.

c. Relationship between outsource supplier and entity.

Precaution need to be taken – Action plan for executing gain share arrangement must contain;

a. Be specific in outsourcing agreement.

b. Pre-defined formula for sharing of benefits and period thereof.

c. Effort from entity, because innovation is not only responsibility of outsource supplier.

d. Constitute innovation team to create an innovation structure, generate the idea and execution of same.

Overall

In consideration of above analysis, company should consider the outsourcing of PW and PY by entering out-sourcing contract with Protease. At this point, it is important to note that cost analysis emphasizes purely quantitative, financial considerations. However, outsourcing decisions are often influenced by qualitative factors, which are not directly affected in calculations. The impact of the same should also be taken into consideration. The issues suggested above are not exhaustive. Further, before opting gain sharing arrangement, the same should also be reviewed carefully from a business, legal, and tax perspective. I hope this helps – if you need any further information, please let me know.

Closure of Report

Mr. Singh,

Management Accountant

(For Management Accounting Division)

High Sports Inc (HSI)

![]()

Question 9.

(Sell or Further Process)

A process industry unit manufactures three joint products: A, B and C. € has no realisable value unless it undergoes further processing after the point of separation. The cost details of C are as follows:

| Upto point of separation | |

| Marginal cost | 30 |

| Fixed Cost | 20 |

| After point of separation | |

| Marginal cost | 15 |

| Fixed cost | 5 |

| 70 |

C can be sold at ₹ 37 per unit and no more.

Cost incurred on Product ‘C’ upto point of separation is irrelevant for decision making as Product ‘C’ is a Joint Product. Joint Products are the result of same raw material & same process Operations.

Cost incurred after point of separation will be considered for decision making as specifically incurred for Product ‘C’.

Requirement

Calculate whether production of Product C is recommended?

Answer:

After further processing Product ‘C’ will contribute ₹ 17 per unit toward ‘Joint Production Cost’. Calculation is as follows

| Particulars | Amount (₹) |

| Selling Price per unit | 37.00 |

| Less: Cost after separation: | |

| Marginal Cost per unit | 15.00 |

| Fixed Cost per unit | 5.00 |

| Contribution toward ‘Joint Production Cost’ | 17.00 |

Hence, further processing of Product ‘C’ is recommended.

| Particulars | Amount (₹) |

| Selling Price per unit | 37.00 |

| Less: Marginal Cost (₹ 30 + ₹ 15) | 45.00 |

| Contribution | (8-00) |

Question 10.

(Minimum pricing decision)

MaLa Polymers, located in Sahibabad Industrial Area, manufactures high quality industrial products. AT Industries has asked Mala Polymers rot a special job that must be completed within one week.

Raw material R1 (highly toxic) will he needed to complete the AT Industries’ special job. MaLa Polymers purchased the Rt two weeks ago for ₹ 7,500 for a job ‘A’ that recently was completed. The R1 currently in stock Is the excess from that job and MaLa Polymers had been planning to dispose of it. MaLa Polymers estimates that it would cost them ₹ 1,250 to dispose of the R1. Current replacement cost of R1 is ₹ 6,000.

Special job will require 250 hours of labour G1 and 100 hours of labour G2. MaLa Polymers pays their G1 and G2 employees ₹ 630 and ₹ 336 respectively for 42 hours of work per week.

MaLa Polymers anticipates having excess capacity of 150 [G1] and 200 [G2] labour hours in the coming week. MaLa Polymers can also hire additional G1 and G2 labour on an hourly basis; these part-time employees are paid an hourly wage based on the wages paid to current employees.

Suppose that material and labour comprise MaLa Polymers’s only costs for completing the special job.

Required

CALCULATE the ‘Minimum Price’ that MaLa Polymers should bid on this job?

Answer:

Opportunity Cost of Labour – The G2 labour has zero opportunity cost as there is no other use for the time already paid for and is available. However, MaLa Polymers needs to pay an additional amount for G1 labour. This amount can be save if the special job were not there.

| G1 labour: | |

| Hours Required | 250 |

| Hours Available | 150 |

| Extra Flours Needed | 100 |

| Cost per hour (₹ 630/42 hrs) | ₹ 15 |

| Opportunity Cost | ₹ 1,500 |

Thus, the ‘Opportunity Cost of Labour’ for completing the special job is ₹ 1,500.

Opportunity Cost of Material – MaLa Polymers has no alternative use for the Rl, they must dispose of it at a cost of ₹ 1,250. Thus, MaLa Polymers actually saves ₹ 1,250 by using the materials for the AT Industries special job. Consequently, the ‘Opportunity Cost of Material’ is – ₹ 1,250 (ie., the opportunity cost of this resource is negative).

The minimum price is the price at which MaLa Polymers just recovers its ‘Opportunity Cost’. MaLa Polymers’s ‘Total Opportunity Cost’ is t 250 (₹ 1,500 – 11,250). Accordingly, minimum Price for the Special Job is ₹ 250.

Question 11.

(CVP Analysis)

Recently, Ministry of Health and Family Welfare along with Drug Control Department have come hard on health care centres for charging exorbitant fees from their patients. Human Health Care Ltd. (HHCL), a leading integrated healthcare delivery provider company is feeling pinch of measures taken by authorities and facing margin pressures due to this. HHCL is operating in a competitive environment so; it’s difficult to increase patient numbers also. Management Consultant of the company has come out with some plan for cost control and reduction.

HHCL provides treatment under package system where fees is charged irrespective of days a patient stays in the hospital. Consultant has estimated 2.50 patient days per patient. He wants to reduce it to 2 days. By doing this, consultant has targeted the general variable cost of ₹ 500 per patient day. Annually 15,000 patients visit to the hospital for treatment.

Medical Superintendent has some concerns with that of Consultant’s plan. According to him, reducing the patient stay would be detrimental to the full recovery of patient. The* would come again for admission thereby increasing current readmission rate from 3% to 5%; it means readmitting 300 additional patients. Company has to spend ₹ 25,00.000 more to accommodate this increase in readmission. But Consultant has found bless in disguise in this. He said every readmission is treated as new admission so it would result in additional cash flow of ₹ 4,500 per patient in the form of admission fees.

Reauired

(i) CALCULATE the impact of Management Consultant’s plan on profit of the company.

(ii) Also COMMENT on result and other factors that should be kept in mind before taking any decision. [Mock Test Paper April 2019]

Answer:

(i) Impact of Management Consultant’s Plan on Profit of the HHCL

Human Health Care Ltd.

Statement Showing Cost Benefit Analysis

| Particulars | ₹ |

| Cost: | |

| Incremental Cost due to Increased Readmission | 25,00,000 |

| Benefit: | |

| Saving in General Variable Cost due to Reduction in Patient Days | 37,50,000 |

| [15,000 Patients × (2.5 Days – 2.0 Days) × ₹ 500) | |

| Revenue from Increased Readmission (300 Patients × ₹ 4,500) | 13,50,000 |

| Incremental Benefit | 26,00,000 |

(ii) Comment

Primary goal of investor-owned firms is shareholder wealth maximization, which translates to stock price maximization. Management consultant’s plan is looking good for the HHCL as there is a positive impact on the profitability of the company (refer Cost Benefit Analysis).

Also HHCL operates in a competitive environment so for its survival, it has to work on plans like above.

But there is also the second side of a coin that cannot also be ignored i.e. humanity values and business ethics. Discharging patients before their full recovery wall add discomfort and disruption in their lives which cannot be quantified into money. There could be other severe consequences as well because of this practice. For gaining extra benefits, HHCL cannot play with the life of patients. It would put a question mark on the business ethics of the HHCL.

May be HHCL would able to earn incremental profit due to this practice in short run but It will tarnish the image of the HHCL which would hurt profitability in the long run.

So, before taking any decision on this plan, HHCL should analyze both quantitative as well as qualitative factors.

![]()

Question 12.

[Minimum Pricing]

Rayla runs the Planetarium Station in New Delhi, India. The strength of the station lies in its live interactions and programs for visitors, students and amateur astronomers. The station is always active with programs for school and college students and for amateur astronomers. One of the station’s key attractions is a big screen VMAX theatre. VMAX is a 70 mm motion picture film format which shows images of far greater size and resolution than traditional film systems. The VMAX cinema projection standards were developed in Canada in the late 1960s. Unlike traditional projectors, the film is run horizontally so that the image width is greater than the width of the film.

The Hobart School has approached Rayla about scheduling an extra show for its class VIII students. One hundred students and five teachers are expected to join the special show on the ‘Planets & Solar System’, a feature that is currently showing. The school has asked Rayla for a price i quote. The special show will take place at 08:30 AM when the VMAX is not usually open.

Required

RECOMMEND the minimum amount that Rayla should charge [May 2018 RTP]

Answer:

The incremental cost associated with the VMAX show appears to be ₹ 10,000 i.e. cost of running the show. The allocated fixed cost per show is not relevant because the total amount of fixed costs for the year will not change as a result of the special show. Further, the stated ticket prices are not relevant because the show will take place ai 08:30 AM when the VMAX is not usually open – thus, the students will not be displacing any regular visitors. Based on the financial data provided, the minimum price quote appears to be ₹ 10,000.

Rayla should consider the following factors:

- Does the station have a souvenir shop and/or cafeteria?

If so, many students are likely to buy food and/or souvenir items, thereby increasing the station’s contribution. In turn, this would reduce the minimum price quote. - What is the impact on future revenue?

After seeing the show, many students may return with their parents, thereby increasing future revenue. - Are there costs linked with the special showing that are not included in the ₹ 10,000 variable cost number?For example, will the station have to pay an overtime premium.

Rayla should also consider the educational mission of the Planetarium Station. Such shows directly contribute to this mission, the station, and, hopefully, the betterment of the students. The special shows may be an H excellent way to expose some students to earth science -these students x may have never gone through the Planetarium Station if it were not for the school excursion.

Overall, the “best” price to charge is unclear and requires some judgment as Rayla needs to balance an array of financial and non-financial factors.

Question 13.

(Minimum Pricing; Pricing Decision)

Diyana inc is engaged in manufacturing chemicals products of different category, some of which are fast moving, some are slow moving and few are in non-moving category. The firm has a stock of 10 units of one

acm-moving toxic chemical. Its book value is ₹ 2,400, realizable value is ₹ 3.300 and replacement cost is ₹ 4.200,

One of the customers of the firm asks to supply 10 units of a product which needs all the 10 units of thettOtt-moving chemical as an input. The other costs associated with the production of the product are:

Allocated overhead expenses: ₹ 16 per unit Out of pocket expenses ₹ 50 per unit Labour cost ₹ 40 per hour.

For each unit two hours are required. Ollier material cost 80 per unit.

The labour force required for the production of the product will be

deployed from among the permanent employees of the firm. This temporary deployment will not lead to any loss of contribution.

Required

(i) RECOMMEND the minimum unit price to be charged to the customer u if bout any loss to the firm.

(ii) ANALYSE with reasons for the inclusion or exclusion of each of the cost associated with the production of the product.

(iii) ADVICE a pricing policy to be followed by Diyana in perfect competition.

Ans.

(i) Diyana has the opportunity to utilize 10 units of non-moving chemical as input to produce 10 units of a product demanded by one of its customers. The minimum unit price to be charged to the customer would be-

| Cost Component | Cost per unit of product (₹) |

| Cost of Material

(Realizable value = ₹ 3,500/10 units of chemical) |

350 |

| Out of Pocket Expenses | 50 |

| Other Material Cost | 80 |

| Minimum Unit Price that can be charged | 480 |

Therefore, the minimum unit price that can be charged to the customer, without incurring any loss is ₹ 480 per unit of product. As explained below in point (ii), allocated overhead expenses and labour cost are sunk costs that have been ignored while calculating the minimum unit price to be charged.

(ii) Analysis

(a) Cost of Material: Relevant and hence included at realizable value. Diyana has 10 units of non-moving chemical input that has a book value of ₹ 2,400, realizable value of ₹ 3,500 and replacement cost of ₹ 4,200. Realizable value of ₹ 3,500 would be the salvage value of the chemical had it been sold by Diyana instead of using it to meet the current order. This represents an opportunity cost for the firm and hence included while pricing the product. Book value would represent the cost at which the inventory has been recorded in the books, a sunk cost that has been ignored. Replacement cost of ₹ 4,200 would be the current market price to procure 10 units of the input chemical. This would be relevant only when the inventory has to be replenished after use. This chemical is from the non-moving category, that means that it is not used regularly in production process and hence need – not be replenished after use. Therefore, replacement cost is also ignored for pricing.

(b) Labour Cost: Not relevant and hence excluded from pricing. It is given in the problem that this order would be met by permanent employees of the firm. Permanent employee cost is a fixed cost that Diyana would incur irrespective of whether this order is produced or not. No additional labour is being employed to meet this order. Therefore, this cost is a sunk cost, excluded from pricing.

(c) Allocated Overhead Expenses: These expenses have been incurred at another Cost Centre, typical example would be office and administration costs. Such costs are fixed in nature that would be J incurred irrespective of whether this order is produced or not. Therefore, this cost is a sunk cost, excluded from pricing.

(d) Out of Pocket Expenses: These are expenses that are incurred to § meet the production requirement of this order. These are addi- f tional variable expenses, that need to be included in pricing.

(e) Other Material Costs: These are expenses that are incurred to meet the production requirement of this order. These are additional variable expenses, that need to be included in pricing.

(iii) Advice on Pricing Policy

Under perfect competition conditions, Diyana can have no pricing policy of its own, here sellers are price takers. It cannot increase its price beyond the current market price. The firm can only decide on the quantity to sell and continue to produce as long as the marginal cost is recovered. When marginal cost exceeds the selling price, the firm starts incurring a loss.

Since Diyana cannot control the selling price individually in the market, it can adopt the going rate pricing method. Here it can keep its selling price at the average level charged by the industry. This would yield a fair return to the firm. An average selling price would help the firm attract a fair market share in competitive conditions.

Question 14.

[Keep or Drop Decision]

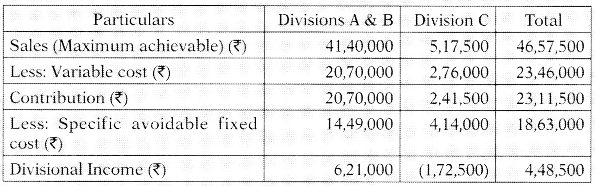

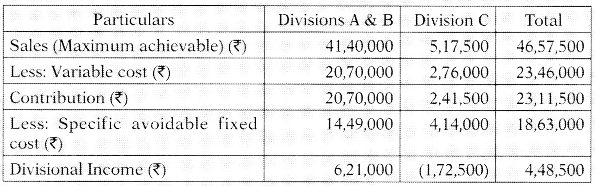

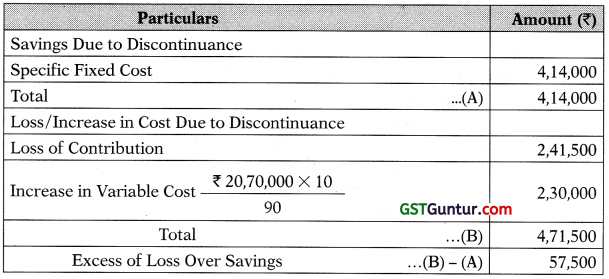

Riya Ltd. is considering the discontinuance of Division C. The following information is given:

The rules of variablc costs arc 90% ot the normal rales due to the eurrent volume of operation. There is adequate market demand.

For any lower volume of operation, the rates would go back to the normal rates. Facilities released by discontinuing Division C cannot be used for any other purpose.

Required

COMMENT on the decision to discontinue Division C using relevant cost approach.

Answer:

As given in the problem Riya Ltd. is considering to discontinue the Division C perhaps by seeing the Division C’s income as it is a loss of ₹ 1,72,500. Discontinuance of Division C might be saving ₹ 4,14,000 on specific fixed costs to the company but due to this decision company will not only be losing ₹ 2,41,500 contribution from the Division C but also an additional burden of variable cost of ₹ 2,30,000 to Divisions A & B and Riya Ltd. as a whole.

Let assess the decision of the Riya Ltd. with the help of the Relevant Cost approach.

In a nutshell considering the above analysis we can conclude that the decision of discontinuing Division C will not be beneficial for the Riya Ltd and it should review its decision on the basis of relevant cost approach to reach at right decision

Question 15.

(Special Order Decision)

ZAM Ltd. is engaged in the manufacture of plasiic bottles of a standard size and produced by a joint process of machines. The factory has 5 machines and capable of producing 40 bottles per hour. The variable cost per bottle is ₹ 0.32 and the selling price is ₹ 0.80 each. The company has received an offer from another company for manufacture of 40,000 units of a plastic moulded toy. The price per toy is ₹ 30 and the variable cost is ₹ 24 each. In case of the company takes up the job, it has to meet the expenses of making a special mould required for the manufacture of the toy. The cost of the mould is ₹ 1,00,000. The company’s time study analysis shows that the machines can produce only 16 toys per hour. The company has a total capacity of 10,000 hours during the period in which the toy is required to be manufactured. The fixed costs excluding the cost of construction of the mould during the period will be ₹ 10 Lakh. The jg company has an order for the supply of 3,00,000 bottles during the period

Required

(i) Do you ADVISE the company to take up the order for manufacturing plastic moulded toys during the time when it has an order in its book for the supply of 3,00,000 bottles. (3 Marks)

(ii) An associate company of ZAM Ltd. has idle capacity and is willing to take up the whole or part (3 Marks)

(iii) If the order for the supply of bottles increases to 4,00,000 bottles, will you ADVISE the company to accept the order for the supply of plastic moulded toys? State the reasons of the manufacturing of the plastic moulded toys on sub-contracting basis. The sub-contract price inclusive of the cost of construction of mould is ₹ 28 per toy. DETERMINE the minimum expected excess machine hour capacity needed to justify producing any portion of the toy order by the company itself rather than sub-contracting. (4 Marks) [May 2018] (3 + 3 + 4 Marks)

Answer:

Workings

Statement Showing “Contribution/Machine Hour”

| ‘Bottle’ | ‘Toy’ | |

| Demand (units) | 3,00,000 | 40,000 |

| Sales (₹/u) | 0.80 | 30.00 |

| Less: Variable Cost (₹/u) | 0.32 | 24.00 |

| Less: Specific Fixed Cost (₹/u) | — | 2.50 |

| Contribution (₹/u) | 0.48 | 3.50 |

| Machine Hours Required per unit | 0.025 | 0.0625 |

| Contribution/Machine Hour | 19.20 | 56.00 |

Advice on Supply of 3,00,000/4,00,000 Bottles

(i) ZAM Ltd. can accept plastic moulded toy’s order as sufficient number of hrs. ie. 2,500 hrs. (10,000 hrs.- 3,00,000 bottles × 0.025 hrs.) are available and would be able to generate additional benefit of ₹ 3.50 per unit on 40,000 units of toys i.e. ₹ 1,40,000.

(ii) If the order for the supply of bottles increases to 4,00,000 bottles, then 2,500 more hrs. will be required to produce the additional bottles. ZAM Ltd. has to decide whether to utilize 2,500 hrs. for existing bottle order or for toy Order.

Machine time is limiting factor. Therefore, contribution per machine hour from both the activities (ie. bottles and toys) should be calculated to decide whether the order should be accepted. Contribution per hour is more in case of toys (refer workings). Therefore, ZAM Ltd. should utilize the remaining 2,500 hours for manufacturing toys rather than to fulfil the order for supply of additional bottles.

Prioritizing production based on contribution per machine hour would maximize profits. However, existing order fulfilment is necessary for building long term and sustainable customer relationship. Developing and maintaining long term and intimate relationships with the profitable customers provides valuable benefits to the company as the relationships between company and customers grow, a customer who is satisfied with the company’s products and services, tends to commit the relationship, and buy more over time. Cost of keeping the existing customers is less expensive than the cost of acquiring new customers.

Hence, ZAM Ltd. should be taken into consideration long term supplier relation before accepting the toy order based on financial consideration as contribution per hour is more in case of toys. Further, company may also explore outsourcing opportunities for production of toys.

(iii) Minimum number of toys needed to be manufactured to justify the increase in fixed cost of ₹ 1,00,000 to make the mould is 25,000 toys {1,00,000/ (₹ 28 – ₹ 24). Thus, as long as company has excess capacity available to manufacture more than 25,000 toys it is cheaper to produce than to buy from sub-contractor.

Minimum Expected Excess Capacity hours to = 25,000 toys/16 toys justify

= 1,562.5 or 1,563 hours

This question has been solved by considering 7,500 hrs. (3,00,000 bottles/40 bottles per hr.) for bottles. This question can also be solved by taking alternative assumption as well.

Question 16.

Magic Automation Limited, a 150 persons engineering company, decided it was time to fire the company’s biggest client. Although the client provided close to 60% of the company’s annual revenue, Magic Automation Limited decided that dropping this client was necessary. The client was profitable.

Magic Automation Limited stated “We cannot be a great place to work -3 without employees, and this client was bullying my employees. Its demands g for turnaround were impossible to meet even with people working seven $ days a week. No client is worth losing my valued employees”.

The initial impact on revenues was significant. However, Magic Automation Limited was able to cut costs and obtain new customers to fill the void. Moreover, the dropped client later gave Magic Automation Limited two projects on more equitable terms.

Required

(i) DISCUSS the reasons behind dropping of a profitable client by j Magic Automation Limited.

(ii) STATE three qualitative factors that management should consider in outsourcing and make or buy decisions. [Nov. 2019 Exam] (2 + 3 Marks)

Answer:

(i) Decision Making – Magic Automation Ltd.

With increasing completion, dynamic market changes, changing needs of customers, non-financial and ethical considerations have gained relevance in the decision-making process. A company may face the dilemma of meeting customers’ needs while protecting employees’ rights. While there are no clear-cut parameters to measure the impact of such decisions, they have a long-term impact on the company’s op-erations that ensures profitability and sustainability of an organization.

In the given scenario, a customer who contributes close to 60% of Magic Automation Ltd.’s profits has been making turnaround demands that are unreasonable for the company employees to meet. Magic Automation Ltd. has to decide whether to continue doing business with the customer based on the current terms or protecting the work environment of its employees. In the current scenario, it is in Automation’s long term interests to protect its employees’ rights (a non-financial consideration). Keeping this approach in mind, Magic Automation Ltd. decided to terminate business with the profitable client. While this had a significant impact on revenues in the short term, in the long run Magic Automation Ltd. was able to get business from new clients. Also, realizing the value of service provided, the dropped client came back with projects on equitable terms. Therefore, even though it did not make financial sense in the short run, decisions based on non-financial metrics played an important role in ensuring Magic Automation Ltd.’s long term sustainability.

(ii) Qualitative factors to consider while making the outsourcing and make or buy decisions:

(a) Quality of goods produced outside vs. in-house production of the component. Outsourcing or buying a component from the external market, should not impact the overall quality of the product. Therefore, any component critical for a product would generally not be outsourced unless its supplier gives quality assurance.

(b) Reliability of suppliers in the outsourcing arrangement. Assurance must be given by the supplier in terms of both quality and timely delivery of components for the given price. Also, there must be a sufficient pool of suppliers from whom the company can buy the product. If one supplier closes shop, there must be alternate suppliers available.

(c) Availability of skilled labour and infrastructure to make the component in-house. If not available, then the component may have to be bought from the external market.

(d) Regularity of demand for the product-If made in-house, seasonal demand for a product may result in the risk of holding high inventories (including that of raw materials) or making high capital investments that will prove unproductive during off-season. Therefore, outsourcing or buying from external market may be more viable when the demand for the final product is seasonal

(e) Risk of technological obsolescence for the component -when the risk is higher company may favour outsourcing.

(f) Confidentiality of process or patent of process – Confidential processes or critical components may not be outsourced.

(g) The shutting down of company’s manufacturing facility might have a negative impact on the morale of remaining employees.

Question 17.

(Special order decision)

M2K Co. is the manufacturer and supplier of firefighting and safety equipment for industrial use and follows the international quality standards and uses the high grade raw material. It is a fast-growing brand that protects millions of people across the India, every single day. M2K has been offered a bid on a prospective export contract for 20,000 commercial fire extinguishers with following specification from 5USA buyer and the delivery terms is FOB.

“two-gallon cylinder holding 10 pounds of multi-purpose dry chemical at 380PSI”

M2K is exporting first time. The price computation per fire extinguisher is as follows:

| ₹ | ₹ | |

| Direct Material | ||

| Circle Part Cost | 620 | |

| Necking Part | 30 | |

| Bottom Part | 50 | |

| Fire Extinguisher Powder | 590 | |

| Heal Process | 50 | |

| Nozzle | 60 | |

| Meter | 20 | |

| Pipe | 50 | |

| Nitrogen | 30 | 1,500 |

| Direct Labour (2 lirs. × ₹ 40) | 80 | |

| Leakage Testing | 50 | |

| Variable Overheads (including packing) | 214 | |

| Export Clearance Charges on FOB term | 36 | |

| Fixed Overhead | 100 | |

| Total | 1,980 | |

| Add: Markup @ 10% | 198 | |

| Price | 2,178 | |

| USD to INR | 67 | |

| Price in USD | 32.51 | |

After quotation of USD 32.51, the buyer is negotiating the price and ready to pay only USD 28.50.

Required

ADVISE whether it is worth accepting at USD 28.50 considering other factors. [Nov. 2019, Nov. 2021 RTF] (10 Marks)

Answer:

1. Workings

Statement Showing Benefit from Prospective Export Contract

| ₹ | |

| Direct Material | 1,500 |

| Direct Labour (2 hrs. × ₹ 40) | 80 |

| Leakage Testing | 50 |

| Variable Overheads (including packing) | 214 |

| Export Clearance Charges on FOB term | 36 |

| Total Relevant Cost | 1,880 |

| USD to INR | ₹ 67 |

| Relevant Cost | $28.06 |

| Price Offered by Customer | $28.50 |

| Benefit per extinguisher | $0.44 |

| No. of Extinguishers | 20,000 |

| Total Benefit | $8,800 |

Advise

From financial perspective, it will be profitable for M2K to accept the contract because of gain of $8,800 (? 5,89,600) along with export incentives of drawback. Besides this, following consideration should also be taken into consideration while exporting fire extinguishers:

Statutory Compliances

Before exporting to a foreign country or even agreeing to sell to a new customer in a foreign country, M2K should be aware of foreign laws that might affect the sale. Export documentation is important as it plays a significant role in regulating the flow and movement of goods in international markets. Each country has its own prescribed statutory documents to be complied by exporters and importers. Thus, M2K should consider about the documentation and inspection compliances part of new buyer. It may include third party audit, commercial invoice and packaging list requirements, certificate requirements like- no child labour certificate, inspection certificate, reach compliance certificate etc. If any compliance requirement is not met, what will be the consequences? There may be stiff penalty has to be paid owing to non-compliance or failure to accurately comply with the export obligation.

Buyer Creditworthiness

It is necessary that before shipment the exporter to carry out its own credit check on the importer to determine creditworthiness. Thus, M2K should make a proper assessment of the creditworthiness of the foreign buyer and spend sufficient time in cross checking the credit worthiness of his counterpart to avoid any kind of unforeseen situation in future. Such information can be easily availed through contracts or through ECGC. Private agencies also provide information on paid service basis. However, this risk can be covered by asking for LC payment terms or 100% advance or opting for post shipment insurance for goods being exported.

Industry Analysis

Industry analysis involves such things as assessing the competition in the industry; the interplay of supply and demand in the industry; how the industry holds up against other industries that are emerging and providing competitions; the likely future of the industry, especially in light of technological developments; how credit works in the industry; and the exact extent of the impact that external factors have on the industry.

For M2K, it is worthwhile to know the current and future demand of fire extinguisher and factors influencing the growth of global fire extinguisher market. M2K can perform industry analysis through three main ways ie. the Competitive Forces Model (also known as Porter’s 5 Forces); the broad factors analysis, also known as PEST analysis; and SWOT Analysis. It may also arrange industry report from trusted sources.

Additional Terms

Ensure that the all terms are clear and suit the business purpose. For instance, delivery terms should provide date of shipment or means of determining the date. In some circumstances, a late delivery penalty may be incurred where goods are not supplied by a specific delivery date. Therefore, M2K should evaluate whether shipment date is attainable or not. If the target shipment date could not be met, what will be the charges? Further, M2Kmust also check whether the foreign bank charges are subject to beneficiary account. If yes, then the same must be considered in the quotation.

Overall, M2K should accept the proposed contract only after due and careful consideration of above factors.

![]()

Question 18.

(Product Mix Decision)

Rocky Ltd. is a manufacturing company. It manufactures two product, Product X and Product Y. Each product passes through two departments A and B before it becomes a finished product. The data for the year are as under:

| Product X | Product Y | |

| Maximum Sales Potential (in units) | 7,400 | 10,000 |

| Product unit data: | ||

| Selling Price p. u. | ₹ 90 | ₹ 80 |

| Machine hrs. p.u. | ||

| Department A hrs. @ ₹ 40/hr. | 0.50 | 0.30 |

| Department B hrs. @ ₹ 60/hr. | 0.40 | 0.45 |

Maximum Capacity of Department A is 3,400 hrs. and Department B is 3,640 hrs.

Maximum Quantity of Direct Materials available is 17,000 kgs. Each product requires 2 kg. of Direct Materials. The Purchase Price of direct materials is ₹ 5/kg.

Required

(i) FIND optimum product mix.

(ii) In view of the aforesaid production capacity constraints, the company has decided to produce only one of the two products during the year. Which of the two products should be produced and sold in the year to maximise profit? FIND the number of units of that product and relevant contribution.

Answer:

(i) Calculation of Optimum Production Mix Statement Showing Limiting Factor

| Particulars | Material | Hours in Department A | Hours in Department B |

| Required: X | 14,800 kg. | 3,700 hrs. | 2,960 hrs. |

| Required: Y | 20,000 kg. | 3,000 hrs. | 4,500 hrs. |

| Total Requirement | 34,800 kg. | 6,700 hrs. | 7,460 hrs. |

| Available Resources | 17,000 kg. | 3,400 hrs. | 3,640 hrs. |

| Shortage | 17,800 kg. | 3,300 hrs. | 3,820 hrs. |

Hence all the three resources are limiting factors.

Statement of Rank

| Particulars | Product X | Product Y |

| Sales | 90 | 80 |

| Less: Direct Material | 10 | 10 |

| Dept. A | 20 | 12 |

| Dept. B | 24 | 27 |

| Contribution p.u. | 36 | 31 |

| Contribution per kg. of Raw Material | 18 | 15.5 |

| Rank | I | n |

| Contribution/hr. of Dept. A | 72 | 103.33 |

| Rank | II | I |

| Contribution/hr. of Dept. B | 90 | 68.89 |

| Rank | I | II |

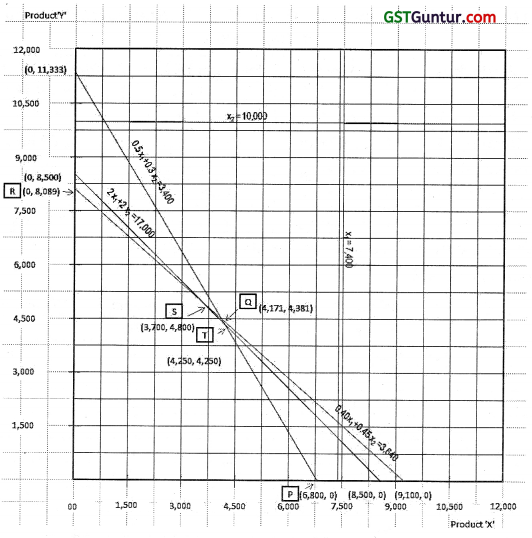

To find the optimum mix of products that shall lead to maximum profits while taking into consideration of shortage of resources (ie. constraints), we have to use Linear Programming.

Let x1 and x2 donate quantities of product ‘x’ and product ‘y’ respectively The linear programming model for the given problem is

So, different combinations of product mix include,

Combination Q (4,171, 4,381) is not possible as it is satisfying three conditions out of above four conditions. To produce combination Q (4,171, 4,381), requirement of the material will be 17,104 Kgs. (2 Kg × 4,171 units + 2 Kg × 4,381 units). However, material is available 17,000 Kgs. Accordingly, this combination is not possible.

Therefore, optimum product mix = X 4,250 units and Y 4,250 units.

(ii) Statement Showing Product with Higher Contribution

Therefore, Product Y should be produced at 8,089 units resulting in a contribution of ? 2,50,759.

Question 19.

(CVP Analysis)

Hotel Bahaar, Zeeland, an affordable leisure hotel resort is an ideal retreat to escape, unwind and enjoy peace of mind. Set amid expansive tropical greenery in the enclave of Zeeland, Hotel Bahaar is designed for pleasure, where services reign supreme and Italian- style architecture of its 25 classic rooms harmonize with nature. Hotel Bahaar, Zeeland is a beachfront resort that features a good choice of swim-up pool bar, p gym, and variety of restaurants. A wide array of water sport activities like surfing, sailing, jet skiing etc. are available from beach operators at walking distance. The hotel is synonymous with enjoyment and value for I money, with a large choice of very attractive “All Inclusive” packages.

Bahaar charges guests ZD 2,700 per room per night, irrespective of single or double occupancy. The variable cost is ZD 900 per occupied room per night. The Bahaar is available throughout 365 days a year and has a 75% budgeted occupancy rate. Fixed costs are budgeted at ZD 9 million and are incurred evenly during the year.

During the second quarter (Q2) of the year, usually the room occupancy rates remains substantially below the levels expected at other quarters of j the year. Bahaar is expecting to sell 900 occupied room nights during Q2. Management is considering strategy to improve profitability, including j closing the Bahaar for the duration of Q2 or adopting one possible option

as follows –

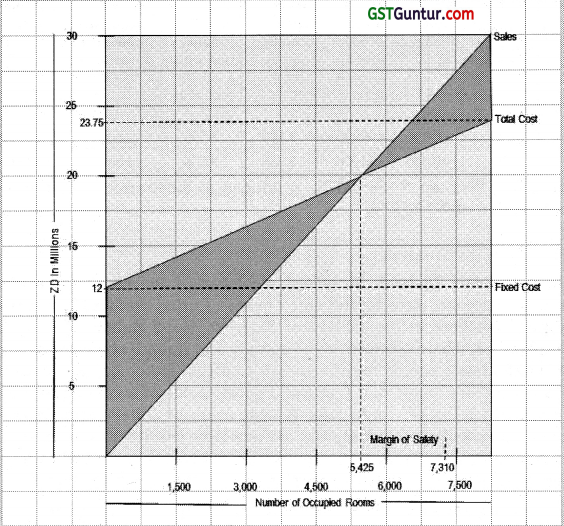

There is scape to extend the Bahaar by creating enough space to run a Rustic Chic, Italian Style restaurant to serve its guests. The annual j revenues, costs and sales volumes for the combined operations are given in the following graph

Note

Zeeland’s home currency is the ZD.

Required

ANALYZE the profit improvement plan [Nov. 2019] [Nov. 2021 RTP]

Answer:

The Present Profit of Hotel Bahaar

Total Room Days = 25 Rooms × 365 days × 75% = 6,844

Profit = Total Contribution – Fixed Cost

= 6, 844 room days × (ZD 2,700 – ZD 900) – ZD 90,00,000

= ZD 33,19,200

Proposal of Opening an Italian Restaurant (If Bahaar is closed during Q2)

Opening a restaurant will increase the fixed costs of the Hotel Bahaar from ZD 9 million p.a. to ZD 12 million p.a. Thus, annual increment of ZD 3 million. Average Revenue per occupied room will rise from ZD 2,700 to ZD 3,636.36… (ZD 30 Million/8,250 rooms) because increasing guest expenditure in Italian restaurant.

The total cost predicted at a level of 8,250 occupied rooms is ZD 23.75 million which means the variable costs must be ZD 11.75 million (ZD 23.75 million – ZD 12 million fixed costs). This is a variable cost per occupied room of ZD 1,424.24… which is an increase of ZD 524.24…

Consequently, the breakeven point has gone up from 5,000 to 5,425 (as shown in the diagram) occupied rooms so the Bahaar is required to sell more room nights to cover costs. However, budgeted occupancy is now 7,310 occupied room nights which is 80.11% occupancy (7,310/9,125). This provides a margin of safety of 1,885 occupied room nights or 25.79%. At 7,310 occupied room nights, Bahaar’s budgeted profit would be ZD41,70,597 {7,310 × (ZD 3,636.36 – ZD 1,424.24) -12 million} which is more than present budgeted profit by ZD 8,51,397. So, it is better for Bahaar to go for opening an Italian Restaurant

Question 20.

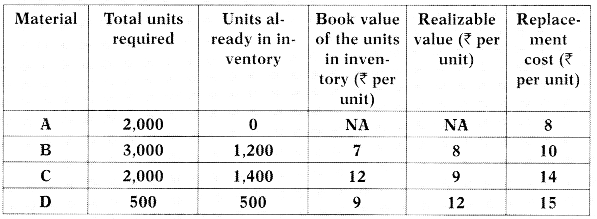

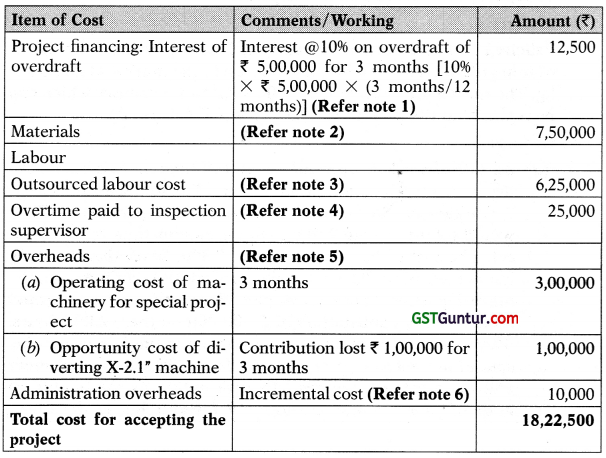

(Design Making) Asiyana Colour paints is a manufacturer of industrial dyes. It has received an order for 200 kgs of powder dye that needs to be customized to certain specifications. The job would require the following materials:

(I) Material B is used regularly in production of all types of dyes that Asiyana Colour plaints produces. Therefore, any stock used towards this job order would need to be replaced to meet other production demands.

(II) Inventory of material C and D are from stock that was purchased in excess previously. Material C has no other use other than for this special order. Material D can be used as a substitute for 700 units of material Z which currently costs ₹ 11 per unit. The company does not have any inventory of material Z currently.

Required

ANALYSE the relevant costs of material while deciding whether to accept the order or not?

Answer:

Material A

The requirement of 2,000 units of Material A has to be purchased in entirety since there are no units in stock. Therefore, the relevant cost will be the replacement cost at ₹ 8 per unit, which for 2,000 units is ₹ 16,000 (2,000 units × ₹ 8 per unit).

Material B

There is a requirement of 3,000 units of Material B, of which 1,200 units are in stock. Material B used regularly in the production of all types of dyes. If the 1,200 units in stock are used, they need to be replenished (replaced) in order to meet production demands of other dyes. In addition, for the special order, additional 1,800 units of Material B is required to be procured from the market. Therefore, 3,000 units of Material B has to be procured if the special order is undertaken. The relevant cost will be the 1 replacement cost at ₹ 10 per unit, which for 3,000 units is ₹ 30,000 (3,000 units × ₹ 10 per unit).

Material C

1 There is a requirement of 2,000 units of Material C, of which 1,400 units are in stock. The balance 600 units have to be procured at the replacement § (market) price of ₹ 14 per unit, which would be ₹ 8,400. Material C has no other use, so if the special order is not undertaken the stock of 1,400 units 21 can be sold at ₹ 9 per unit. So, the opportunity cost of undertaking this order is ₹ 12,600. Therefore, the relevant cost for Material C is procurement cost of 600 units plus the opportunity cost of not disposing the current stock of 1,400 units, which would be ₹ 8,400 + ₹ 12,600 = ₹ 21,000.

Material D

The entire requirement of 500 units of Material D is in stock. If the special order is not accepted, Asiyana Colour paints has two options (i) sell the excess material at ₹ 12 per unit or (ii) use it as a substitute for Material Z, which would otherwise need to be procured.

(i) The realizable value of Material D is ₹ 6,000 (500 units × ₹ 12 per unit).

(ii) Material D can be used as a substitute for 700 units of Material Z. Since there is no stock of Material Z currently, if the special order is accepted, the entire quantity would have to be procured at ₹ 11 per unit. This would cost the company ₹ 7,700 (700 units × ₹ 11 per unit).

Both options (i) and (ii) represent opportunity cost if the special order is accepted. The relevant cost for Material D, if the special order is accepted would be higher of either of these two opportunity costs. The higher opportunity cost of that of procuring Material Z from the market at ₹ 7,700.

Therefore, the relevant cost for Material D is ₹ 7,700.

Therefore, the relevant cost to accepting the special order would be the cumulative of the relevant cost for Materials A, B, C and D. This works out to ₹ 74,700.

![]()

Question 21.

(Relevant Cost Concept)

Royal King Airlines Ltd. operates its services under the brand ‘Royal King’. The ‘Royal King’ route network spans prominent business metropolis as well as key leisure destinations across the Indian subcontinent. ‘Royal King’, a low-fare carrier launched with the objective of commoditizing air travel, offers airline seats at marginal premium to train fares across India.

Profits of the ‘Royal King’ have been decreasing for several years. In an effort to improve the company’s performance, consideration is being given to dropping several flights that appear to be unprofitable.

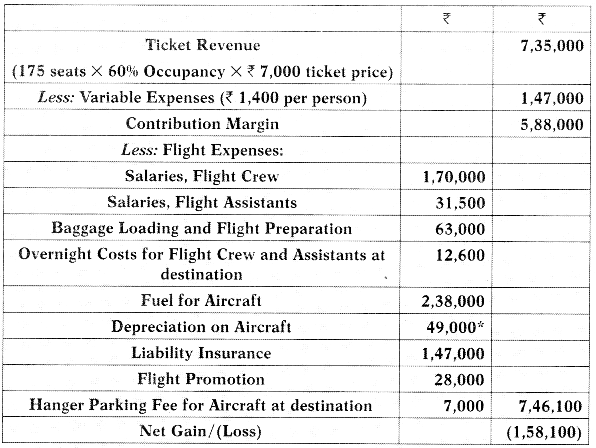

Income statement for one such flight from ‘Mew Delhi’ to ‘Leh’ (PP – 2) is given below (per flight):

* Based on obsolescence

The following additional information is available about flight PP-2.

1. Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid by the flight.

2. The baggage loading and flight preparation expense is an allocation of ground crew’s salaries and depreciation of ground equipment.

3. One third of the liability insurance is a special charge assessed against flight PP-2 because in the opinion of insurance company, the destination of the flight is in a “high – risk” area.

4. The hanger parking fee is a standard fee charged for aircraft at all airports.

5. If flight PP-2 is dropped, ‘Royal King’ Airlines has no authorization at present to replace it with another flight.

Required

Using the data available, prepare an ANALYSIS showing what impact dropping flight PP-2 would have on the airline’s profit. [Nov. 2018 RTP]

Answer:

As per the statement given in the problem, Flight PP-2 incurs a net (loss) of ₹ 158,100. This is the net result of revenue less costs. Revenue is entirely variable depending upon passenger occupancy. Costs are both variable and fixed nature. To analyze the impact of dropping flight PP-2, we need to re-compute net gain/(loss) that Royal King earns when it operates the flight based on relevant costing principles.

Net Gain/(Loss) = Revenue earned from flight operations less Variable costs of operation

Revenue earned is the ticket revenue earned from flight operations of PP-2, this is entirely variable. Variable costs of flight operations are those expenses that would be incurred only when the flight is operated. These include variable expenses per passenger, salaries flight assistants, overnight costs for flight crew and assistants, fuel for aircraft, a third portion of flight insurance that is specifically related to this flight sector and flight promotion expense. These are expenses that will not be incurred if the flight is not operated. Hence, relevant for decision making.

Other expenses like salaries of flight crew and hanger parking fees for aircraft are fixed expenses that will be incurred even if the flight does not operate. Loading and flight preparation expense is an allocated cost that will continue to be incurred even if flight PP-2 does not operate. Depreciation of aircraft and liability insurance expense (2/3rd portion not related to a specific flight sector) are sunk costs. These expenses have already been incurred and hence are irrelevant to decision making. Therefore, these fixed, allocated and sunk expenses are ignored while analyzing the decision whether to continue operating flight PP- 2.

Flight PP-2

Statement Showing Net Gain/(Loss)

| ₹ | ₹ | |

| Contribution Margin if the flight is continued | 5,88,000 | |

| Less: Flight Costs | ||

| Flight Promotion | 28,000 | |

| Fuel for Aircraft | 2,38,000 | |

| Liability Insurance (1/3 × ₹ 1,47,000) | 49,000 | |

| Salaries, Flight Assistants | 31,500 | |

| Overnight Costs for Flight Crew and Assistants | 12,600 | 3,59,100 |

| Net Gain/(Loss) | 2,28,900 | |

If Royal King Airlines Ltd. discontinues flight PP-2, profits will reduce by ₹ 2,28,900. The statement showing loss in operations of ₹ 158,100 is misleading for decision making purpose because it accounts for costs that are fixed and irrelevant. However, since flight PP-2 yields a net gain of ₹ 2,28,900, flight operations should continue.

Question 22.

‘Rose Laundry* Is one of the largest laundry service provider for g

Suits. The firm has set a price of ₹ 510 for cleaning the “suit set”. ‘Rose Laundry’ derived this price as follows: cleaning materials ₹ 35, labour (3 %

hrs. (@ ₹ 50 per hr.) ₹ 150, variable overheads ₹ 70, fixed overheads (3 hrs. @ ₹ 15 per hr.) ₹ 45 plus mark-up 70% on total cost. ‘Rose Laundry’ is known for its quality work and timely delivery; hence, customers are willing to pay this premium price. Firm’s employees receive a fixed salary.