Computation of Total Income and Tax Payable – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Computation of Total Income and Tax Payable – CA Inter Tax Question Bank

Question 1.

(a) Answer the question.

(ii) State under which heads the following incomes are taxable :

(i) Rental income in case of dealer in property

(ii) Dividend on shares in case of a dealer in shares

(iii) Salary by a partner from his partnership firm

(iv) Rental income of machinery

(v) Winnings from lotteries by a person having the same as business activity

(vi) Salaries payable to a Member of Parliament

(vii) Receipts without consideration

(viii) In case of retirement, interest on provident fund is unrecognized. (Nov 2010, 4 marks)

Answer:

| Particulars | Head of Income |

| (i) Rental income in case of dealer in property | Income from house property |

| (ii) Dividend on shares in case of a dealer in shares | Income-from other sources |

| (iii) Salary by partner from his partnership firm | Profit and gains of business or profession |

| (iv) Rental income of machinery | Income from other sources; profits and gains of business or profession |

| (v) Winnings from lotteries by a person having the same as business activity | Income from other sources |

| (vi) Salaries payable to a Member of Parliament | Income from other sources |

| (vii) Receipts without consideration | Income from other sources |

| (viii) In case of retirement, interest on employee’s contribution if provident fund is unrecognized | Income from other sources |

Note – According to Section 56(2)(ii), rental income of machinery would be chargeable to tax under the head “Income from Other sources”, if the same is not chargeable to income-tax under the head “Profits and gains of business or profession”.

![]()

Question 2.

Mr. Ashok kumar, an employee of a PSU furnishes the following particulars for the previous year ending 31.3.2021:

(i) Salary Income for the year (computed) : ₹ 525,000

(ii) Salary (computed) for Financial Year 2010-11 received during the year. : ₹ 40,000

(iii) Assessed Income for the Financial Year 2010 -11 : ₹ 1,80,000

You are requested by the assessee to compute relief under section 89 of the Income-tax Act, 1961, ¡n terms of tax payable for assessment year 2021-22.

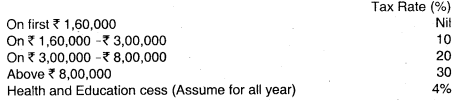

The rates of Income-tax for the assessment year 2011-12 are:

(May 2009, 7 marks)

Answer:

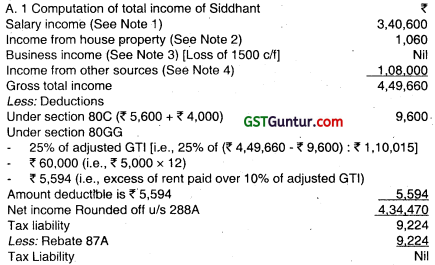

1. Computation of relief under Section 89

Question 3.

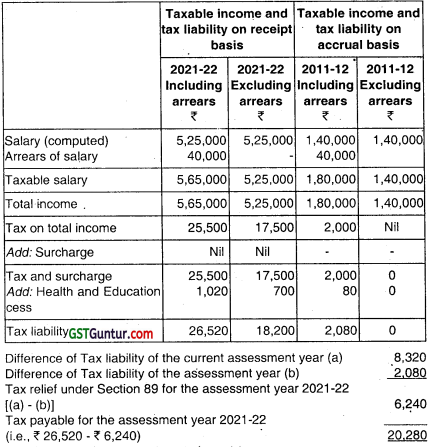

From the following details compute the total income of Siddharth of Delhi and Tax payable for the Assessment year 2021-22 :

Salary including dearness allowance : ₹ 3,35,000

Bonus : ₹ 11,000

Slary of Servant provided by the employer : ₹ 12,000

Rent Paid by Siddhant for his accommodation : ₹ 49,600

Bills paid by the Employer for Gas, Electricity and Water Provided free of Cost at the above flat : ₹ 11,000

Siddhant was provided with Company’s Car (Self driven) also for personal use and it is not possible to determine expenditure on personal use and all expenses were borne by the employer.

Siddhant purchased a Flat in a Co-operative Housing Society for ₹ 4,75,000 in April, 1990, which was financed by a loan from Life Insurance Corporation of India of ₹ 1,60,000 @ 15% interest, his own savings of ₹ 85,000 and a deposit from a nationalised bank for ₹ 2,50,000 to whom this flat was given on lease for ten years. The rent payable was ₹ 3,500 per month. The following Particulars are relevant:

(a) Municipal Taxes Paid : ₹ 4,300 (per annum)

(b) Society charges for passage Lights, watchman’s salary ₹ 1,900 (per annum)

(c) Insurance : ₹ 860

(d) He earned : ₹ 2,700 in share speculation business and lost ₹ 4,200 in Cotton Speculation business.

(e) In the year 2005-06 he had gifted ₹ 30,000 to his wife and ₹ 20,000 to his son who was aged 11. The gifted amounts were advanced to Mr. Rajesh, who was paying interest @19% per annum.

(f) Siddhant received a gift of ₹ 25,000 each from four friends.

(g) He contributed ₹ 5,600 to Public Provident Fund and ₹ 4,000 to Unit Linked Insurance Plan.

(h) He received national award for humanitarian work from the Central Government in the form of a Land whose fair market value is ₹ 5,00,000 as on 31st March, 2021. (Nov 2009, 16 marks)

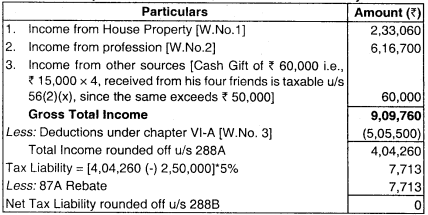

Answer:

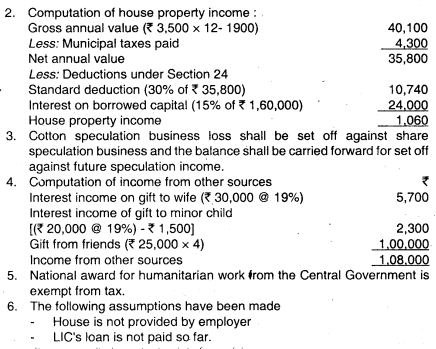

Notes :

![]()

Question 4.

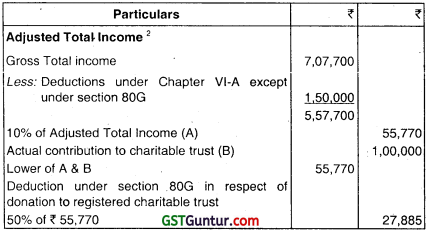

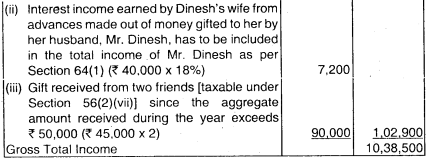

Mr. Dinesh Karthik, a resident individual aged 45, furnishes the following information pertaining to the year ended 31.3.2021:

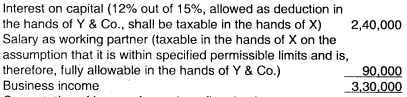

(i) He is a partner in Badririath & Co. He has received the following amounts from the firm :

Interest on capital at 15% : ₹ 3,00,000

Salary as working partner (at 1 % of firm’s sales) : ₹ 90,000

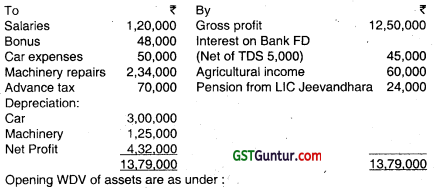

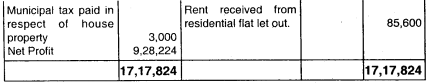

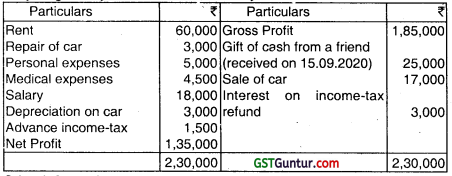

(ii) He is engaged in a business in which he manufactures wheat flour from wheat. The Profit and Loss account pertaining to this business (summarised form) is as under:

Opening WDV of assets are as under:

Car : ₹ 3,00,000

Machinery : ₹ 6,50,000

(Used during the year for 170 days)

Additions to machinery

New purchased on 23.9.2020 : ₹ 2,00,000

New purchased on 12.11.2020 : ₹ 3,00,000

Old purchased on 12.4.2020 : ₹ 1,25,000

(All assets added during the year were put to use immediately after purchase)

Of the total bonus amount, ₹ 15,000 was paid on 11.10.2020. One-fifth of the car expenses are towards estimated personal use of the assessee.

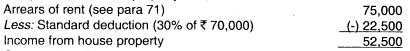

(iii) In March, 2014, he had sold a house at Chennai. Arrears of rent relating to this house amounting to ₹ 75,000 was received in February, 2021.

(iv) Details of his Savings and Investments are as under:

Life Insurance premium for policy in the name of his major son employed in LMN Ltd. at a salary of ₹ 6 lacs p.a.

Sum assured ₹ 1,50,000 [Policy taken in year 2000] : ₹ 50,000

Contribution to Pension Fund of National Housing Bank : ₹ 70,000

(This was met partially from out of premature withdrawal of deposit in Post Office Time Deposit made on 12.3.2012 Principal component ₹ 55,000 and Interest ₹ 5,000)

Medical Insurance premium for his father aged 70, who is hot dependent on him : ₹ 22,000

You are required to compute the total income of Mr. Dinesh Karthik for the assessment year 2021 -22 and the tax payable by him. Computation of interest, if any, is NOT required. (May 2010, 16 marks)

Answer:

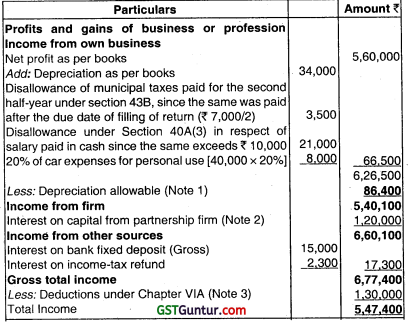

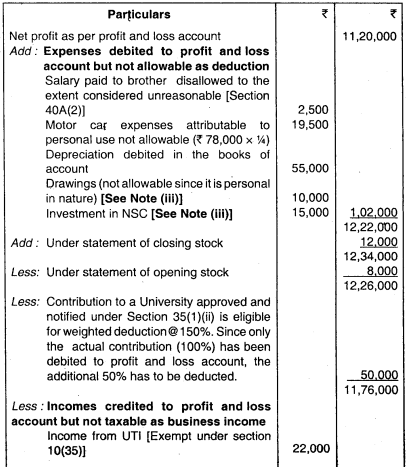

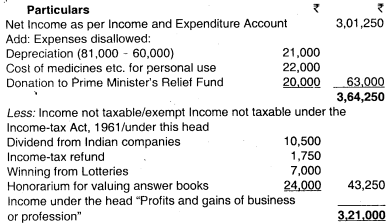

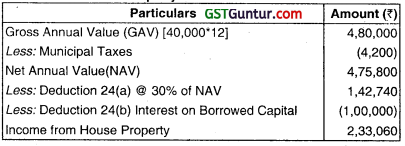

Computation of total income of Dinesh Karthik.

Income-tax will be computed as under:

Notes:

1. Computation of house property income –

2. Computation of taxable business income in the hands of X from Y & Co., a partnership firm :

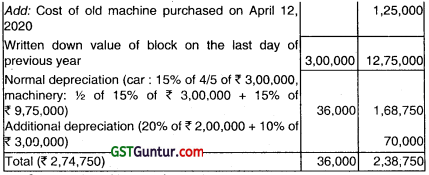

3. Computation of income from wheat flour business –

4. Computation of depreciation:

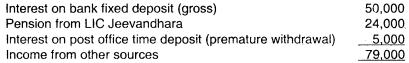

5. Computation of income from other sources :

6. Computation of deduction.under Section 80C :

![]()

Question 5.

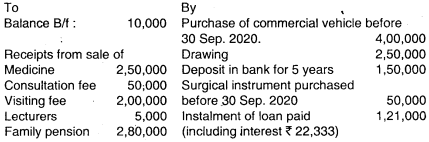

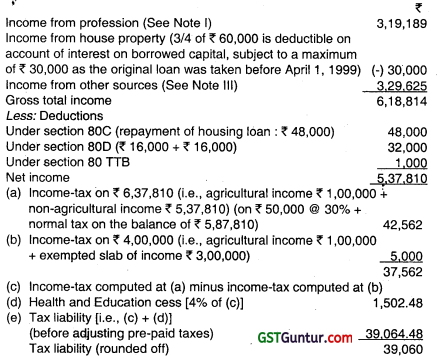

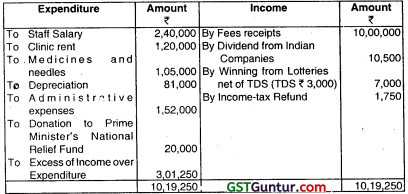

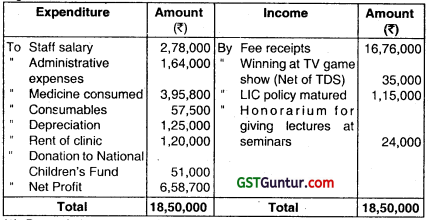

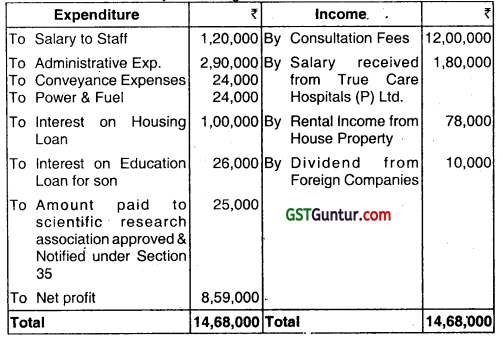

Dr. Shuba is medical practitioner. Her age is 64 as on 1 Jan 2021. The receipts and payments account of 2020-21 of her is as under:

Other relevant information is as under:

(i) She resides in her own house which was constructed in 2007 – 08 with a loan from LIC Housing of ₹ 10,00,000 out of which 6,00,000 was still due. She got it refinanced from SBI on 01.04.20 at the rate of 10%. One fourth portion of the house is used for clinic purposes.

(ii) She invested in term deposit ₹ 1,50,000 in Bank of Baroda on 01.07.20 for a period of 5 years in the name of her minor daughter at 9% interest p.a.

(iii) She purchased a commercial vehicle on 1 July 2020 at ₹ 4,00,000. A loan of ₹ 3,00,000 was taken to buy the van at 8% interest. One fourth use of vehicle is estimated to be personal.

(iv) She paid medical insurance premium for herself of ₹ 16,000 and for mother ₹ 16,000. Her mother is dependent on her.

(v) She got her share from HUF’s income of ₹ 50,000. (Nov 2010, 8 marks)

Answer :

Point wise answer –

1. Computation of income of Dr. Shuba for the assessment year 2021 -22. To solve the problem the following assumptions have been made as the given information is not complete –

(a) Opening stock of medicine on April 1, 2020 and closing stock on March 31, 2021 is zero;

(b) Agricultural income is from a source situated in India;

(c) Dr. Shuba is resident in India;

(d) Construction of the residential house was completed in the previous year 2007 – 08;

(e) Cost of the aforesaid house is ₹ 10,00,000;

(f) In the absence of a clear cut guideline as to what exactly needs to be done to solve the problem, it is further assumed that one has to calculate not only taxable income of Dr. Shubha but also her tax liability which is calculated as follows:

Notes:

Question 6.

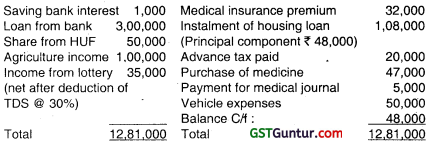

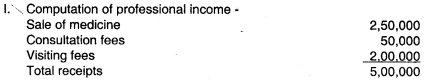

(a) Mr. Vidyasagar, resident individual aged 64, is a partner in Oscar Musicals & Co., a partnership firm. He also runs a wholesale business in medical products.

The following details are made available for the year ended 31 -3-2021:

Compute the total income of the assessee for the assessment year 2021 -22. The computation should show the proper heads of income. Also compute the WDV of the different blocks of assets as on 31-3-2021. (May 2011, 8 marks)

Answer:

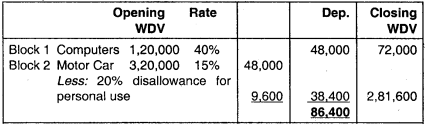

Calculation of total Income of Mr. Vidyasagar for the A.Y. 2021-22

Notes:

1. Depreciation allowable under the Income-Tax Rules. 1962

2. Deduction under chapter VI-A

3. Only to the extent the interest is allowed as deduction in the hands of the firm, the same is includible as business income in the hands of the partner. Maximum interest allowable as deduction in the hands of the firm is 12% p.a. It is assumed that the partnership deed provides for the same and hence is allowable to this extent in the hands of the firm. Therefore, interest @ 12% p.a. amounting to ₹ 1,20,000 would be treated as the business income of Mr. Vidyasagar.

![]()

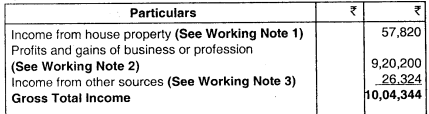

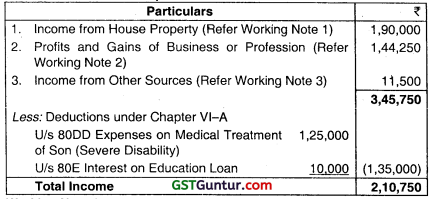

Question 7.

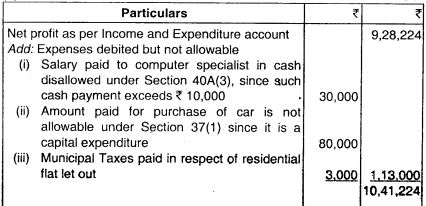

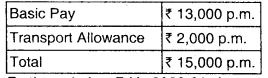

Ms. Purvi is a Chartered Accountant in practice. She maintains her accounts on cash basis. Her Income and Expenditure account for the year ended March 31, 2021 reads as follows:

Other Information:

(i) Allowable rate of depreciation on motor car is 15%.

(ii) Value of benefits received from clients during the course of profession is ₹ 10,500.,

(iii) Incentives to articled assistants represent amount paid to two articled assistants for passing IPCC Examination at first attempt.

(iv) Repairs and maintenances of car include ₹ 2,000 for the period from 1-10-2020 to 30-09-2021.

(v) Salary include ₹ 30,000 to a computer specialist in cash for assisting Ms. Purvi in one professional assignment.

(vi) The total travelling expenses incurred on foreign tour was ₹ 32,000 which was within the RBI norms.

(vii) Medical Insurance Premium on the health of dependent brother and major son dependent on her amounts to ₹ 5,000 and ₹ 10,000 respectively paid in cash.

(viii) She invested an amount of ₹ 10,000 in National Saving Certificate. Compute the total income and tax payable of Ms. Purvi for the assessment year 2021-22. (May 2012, 10 marks)

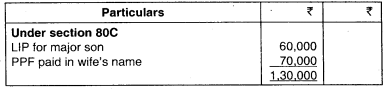

Answer:

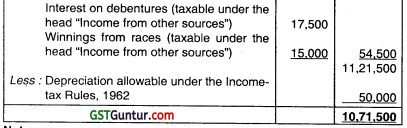

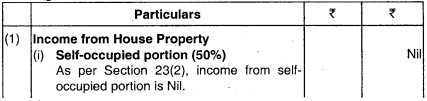

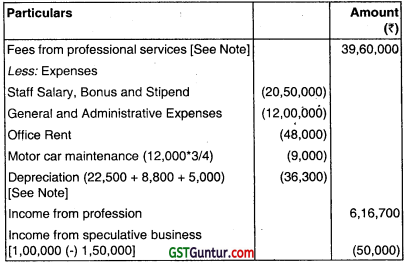

Computation of total income and tax liability of Ms. Purvi for the A.Y.

Working

(1) Income from House Property

Note: Rent received has been taken as the Gross Annual Value in the absence of other information relating to Municipal Value, Fair Rent and Standard Rent.

(2) Income under the head “Profits & Gains of Business or Profession”

Notes:

(i) It has been assumed that the motor car was put to use for more than 180 days during the previous year and hence, full depreciation @ 15% has been provided for under Section 32(1)(ii).

Note:

Alternatively, the question can be solved by assuming that motor car has been put to use for less than 180 days and accordingly, only 50% of depreciation would be allowable as per the second proviso below Section 32(1)(ii).

(ii) Incentive to articled assistants for passing IPCC examination in their first attempt is deductible under Section 37(1).

(iii) Repairs and maintenance paid in advance for the period 1.4.2021 to 30 9.2021 i.e. for 6 months amounting to ₹ 1000 is allowable since Ms. Purvi is following the cash system of accounting.

(iv) ₹ 32,000 expended on foreign tour is allowable as deduction assuming that it was incurred in connection with her professional work, Since it has already been debited to income and expenditure account, no further adjustment is required.

(3) Income from other sources:

(4) Deduction under Chapter VI-A

Notes:

- Premium paid to insure the health of brother is not eligible for deduction under Section 80D, even though he is a dependent, since brother is not included in the definition of “family” under Section 80D.

- Premium paid to insure the health of major son is not eligible for deduction, even though he is a dependent, since payment is made in cash.

Question 8.

Mr. Y carries on his own business. An analysis of his trading and profit & loss for the year ended 31 -3-2021 revealed the following information:

1. The net profit was ₹ 11,20,000.

2. The following incomes were credited in the profit and loss account;

(a) Dividend from UTI ₹ 22,000.

(b) Interest on debentures ₹ 17,500.

(c) Winnings from races ₹ 15,000.

3. It was found that some stocks were omitted to be included in both the opening and closing stocks, the value of Which were :

Opening stock ₹ 8,000.

Closing stock ₹ 12,000.”

4. ₹ 1,00,000 was debited in the profit and loss account being contribution to a University approved and notified under Section 35(1) (ii).

5. Salary includes ₹ 20,000 paid to his brother which is unreasonable to the extent of ₹ 2,500.

6. Advertisement expenses include 15 gift packets of dry fruits costing ₹ 1,000 per packet presented to important customers.

7. Total expenses on car was ₹ 78,000. The car was used both for business and personal purposes. 3/4th is for business purposes.

8. Miscellaneous expenses included ₹ 30,000 paid to A & Co., a goods transport operator in cash on 31 -1 -2021 for distribution of the company’s product to the warehouses.

9. Depreciation debited in the books was ₹ 55,000. Depreciation allowed as per IT rules was ₹ 50,000.

10. Drawing ₹ 10,000.

11. Investment in NSC ₹ 15,000.

Compute the total income of Mr. Y for the assessment year 2021-22. (May 2012, 8 marks)

Answer:

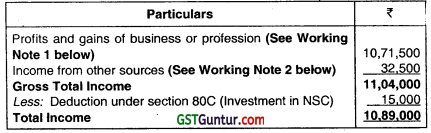

Computation of total income of Mr. Y for the A.Y. 2021-22.

Working Notes:

1. Computation of profits and gains of business or profession

Notes:

(i) Advertisement expenses of revenue nature, namely, gift of dry fruits to important customers, are incurred wholly and exclusively for business purposes. Hence, the same is allowable as deduction under section 37.

(ii) Disallowance under Section 40A(3) is not attracted in respect of cash payment of ₹ 30000 to A & Co., a goods transport operator, since, in case of payment made for plying, hiring or leasing goods carriages, an increased limit of ₹ 35,000 is applicable (i.e. payment of upto ₹ 35,000 can be made in cash without attracting disallowance under Section 40 A (3))

(iii) Since drawings and investment in NSC have been given effect to in the profit and loss account, the same have to be added back to arrive at the business Income.

2. Computation of “Income from other sources”

Note:

The following assumptions have been made in the above solution:

1. The ligures of interest on debentures and winnings from races represent the gross income (i.e., amount received plus tax deducted at source).

2. In point no. 9 of the question, it has been given that depreciation as per Income-tax Rules, 1962 is ₹ 50,000. It has been assumed that, in the said figure of ₹ 50,000, only the proportional depreciation(i.e.,75% for business purposes) has been included in respect of motor car.

![]()

Question 9.

Mr. Hari provides the following information for the year ending 31-03-2021.

(i) Rent from vacant sîte let on lease : ₹ 1,12,000

(ii) Rent from house property at Delhi : ₹ 20,000 per month

(iii) Turnover from retail trade in grains (No books of account maintained) : ₹ 24,37,500

(iv) Arrears of salary received from ex-employer : ₹ 8,40,000

(v) Purchase of 10,000 shares of X Co. Ltd. on 01-01-2013 : ₹ 1,00,000

He received a 1:1 bonus on 01.01.2014. Sale of 5,000 bonus shares in September, 2020 : ₹ 2,20,000

(vi) Received ₹ 1,50,000 on 12-02-2021 being amount due from Mr. A relating to goods supplied by Hari’s father, which was written off as bad debt by his father in Assessment Year 2018-19 and allowed as deduction. Hari’s father died in July 2017.

(vii) Brought forward business loss relating to discontinued textile business of Hari relating to the Assessment Year 2018-19. : ₹ 1,97,500

(viii) Brought forward depreciation relating to discontinued textile business of Hari. : ₹ 1,50,000

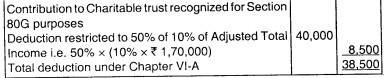

(ix) Hari contributed ₹ 30,000 to Prime Minister’s National Relief Fund and ₹ 40,000 to Charitable Trust enjoying exemption u/s 80G.

Compute the total income and the tax thereon of Mr. Hari for the Assessment Year 2021-22. (Nov 2012, 10 marks)

Answer:

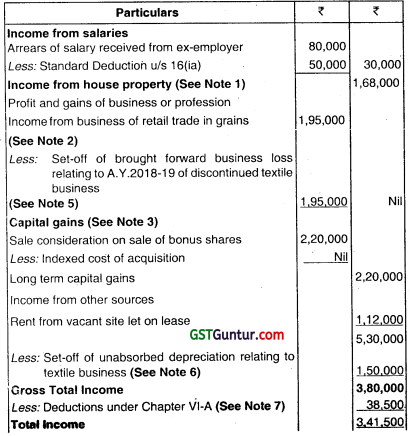

Computation of total income and tax liability of Mr. Hari for the A.Y. 2021-22

Notes:

(1) Income from House Property at Delhi

Note: Rent received has been taken as the Gross Annual Value in the absence of other information relating to Municipal Value, Fair Rent and Standard Rent.

(2) Since Mr. Han has not maintained books of accounts in respect of the business of retail trade in grains and the turnover from such business is less than ₹ 2 crores, the income from such business would be computed

on a presumptive basis under Section 44AD @ 8% of turnover. The income under Section 44AD is, therefore, ₹ 195,000. being 8% × ₹ 24,37,500.

(3) Cost of acquisition of bonus shares is Nil as per section 55. Since the bonus shares were allotted on 1.1.2014. the period of holding of bonus shares exceeds 1 year, therefore, it is a long-term capital asset and the gain arising from sale of such shares shall be long-term capital gains.

Note: The problem has been solved by assuming that the shares are not listed and securities transaction tax ¡s not paid on sale of such shares, and hence such long-term capital gains is taxable.

(4) ₹ 1,50,000 represents the amount due from Mr. A relating to goods supplied by Mr. Hari’s father, which was written off as a bad debt by his father in the A. Y.2018-19 and allowed as deduction to him. The said sum recovered by Mr. Hari, in the A.Y.2021-22, would not be treated as his income since there is no such provision under Section 41 (4) to treat the sum recovered by the successor in business as his income.

(5) Business loss of a discontinued business can be carried forward and set-off against the profits of an existing business in the subsequent years. Brought forward business loss of ₹ 1,97,500 from discontinued textile business can be set-off against the current year income of ₹ 1,95,000 from the business of retail trade. The balance loss of ₹ 2,500 can be carried forward to the next year to be set-off against the business income of that year. It can be carried forward upto a maximum of 6 more assessment years to be set-off against the business income of those years.

(6) Unabsorbed depreciation under Section 32 can be carried forward indefinitely and set-off against income under any head.

Section 44AD specifically provides that while computing income of an eligible business on presumptive basis, any deduction allowable under sections 30 to 38 shall be deemed to have been given full effect to and no further deduction under those sections shall be allowed. However, in the given problem, the unabsorbed depreciation relates to discontinued textile business and not to the retail trade business (eligible business) in respect of which income is computed on a presumptive basis under Section 44AD.

Therefore, it is possible to take a view that such unabsorbed depreciation not relating to the eligible business under section 44AD, can be set-off against income of the current year.

(7) Deduction under Chapter VI-A:

Adjusted total income (for the purpose of computation of deduction under Section 80G):

(8) The basic exemption limit of ₹ 2,50,000 is first adjusted against the normal income of ₹ 1,21,500 of Mr. Hari, a resident assessee. As per Section 112, the unexhausted basic exemption limit of ₹ 1,28,500 (i.e., ₹ 2,50,000 – ₹ 1,21,500) can be exhausted against the long-term capital gains of ₹ 2,20,000 and the balance long term capital gains of ₹ 9,500 shall be taxable@20%.

(9) It is assumed that Mr. Hari is a resident below the age of 60 years. Note – In the above solution, the deduction under Chapter Vl-A and computation of tax liability has been worked out by setting-off the unabsorbed depreciation against income, other than long-term capital gains. The unabsorbed depreciation may also be set-off against long-term capital gains, which would be most beneficial for Mr. Hari, since the long-term capital gain is taxable @ 20%, whereas the normal income of Mr. Hari (i.e., ₹ 2,74,000) after such set-off would be taxable at 5%, which is the rate applicable to the income slab which Mr. Hari falls in. In such a case, the deduction under Chapter VI-A and the total tax liability would be as follows –

Deduction under Chapter VI-A:

Adjusted total income (for the purpose of computation of deduction under Section 80G):

Question 10.

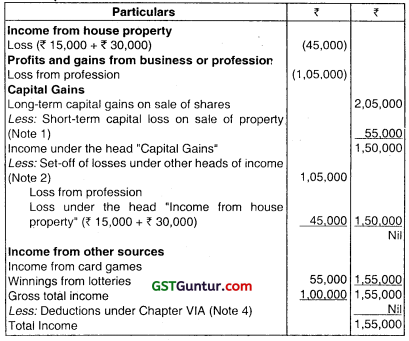

Mr. Rahul an assessee aged 61 years gives the following information for the previous year 31 -03-2021:

Sr. Particulars : ₹

a. Loss from profession : ₹ 1,05,000

b. Capital loss on the sale of property-short term : ₹ 55,000

c. Capital gains on sale of shares-long term : ₹ 2,05,000

d. Loss in respect of self occupied property : ₹ 15,000

e. Loss in respect of let out property : ₹ 30,000

f. Share of loss from firm : ₹ 1,60,000

g- Income from card games : ₹ 55,000

i. Loss from horse races in Mumbai : ₹ 40,000

j. Investment in infrastructure bonds : ₹ 21,000

k. Medical Insurance premium paid by cheque : ₹ 18,000

Answer:

Computation of total income of Mr. Rahul for the A.Y. 2021-22

Notes:

(1) As per Section 74, short-term capital loss can be set-off against both short-term capital gains and long-term capital gains. Hence, short term capital loss of ₹ 55,000 can be set- off against long-term capital gains of ₹ 2,05,000 on sale of shares. The net income under the head ‘Capital gains would be ₹ 1,50,000.

(2) Section 71 provides for set-oil of loss from one head against income from another As per Section 71(2), loss under any head of income, other than capital gains, can be set-off against income under any head, including capital gains. Therefore, loss of ₹ 1,05,000 from profession and loss of ₹ 45,000 from house properly (both let Out and self-occupied) can be set-off against the net income of ₹ 1,50,000 under the head Capital Gains”.

(3) Loss from an exempt source cannot be set-off against profit from a taxable source. Therefore, share of loss from a firm cannot be set-off against any other income, since share of profit from firm is exempt under Section 10(2A).

(4) As per Section 58(4), no deduction n respect of any expenditure or allowance in connection with income by way of winnings from lotteries and income from card games is allowable under any provišion of the Income-tax Act, 1961. Therefore, since the total income comprises only of income from card games and winnings from lotteries, deduction under Chapter VI-A is not allowable from such income. Therefore, Mr. Rahul will not be entitled to claim deduction under Section 80D in respect of medical insurance premium paid by cheque.

(5) Further. loss from horse races can neither be set-off against winnings from lotteries and income from card games nor can it be carried forward.

![]()

Question 11.

Mrs. Rani a resident aged 50 years is running an acupuncture clinic. Her Income and Expenditure Account and other relevant information for the year ending 31st March, 2021 are given below:

(i) Depreciation in respect of all assets has been ascertained at ₹ 60,000 as per Income-tax rules.

(ii) Medicines & needles of ₹ 22,000 have been used for her family.

(iii) Fees Receipts include ₹ 24,000 being honorarium for valuing acupuncture examination answer books. ‘

(iv) She has also received ₹ 57,860 on maturity of one LIC Policy, not included in the above Income and Expenditure Account.

(v) She has paid an LIC premium of ₹ 12,000 for self (Sum Assured ₹ 50,000).

(vi) She has paid ₹ 2,500 for purchase of lottery tickets.

From the above compute the total Income and tax payable thereon of Mrs. Rani for the Assessment year 2021-22. (May 2013, 10 marks)

Answer:

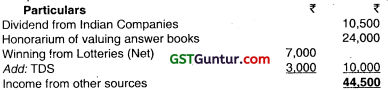

Computation of total income and tax liability of Mrs. Rani for the A.Y. 2021-22

Working Notes:

1. Computation of income under the head Profits and gains of business or profession

2. Computation of income under the head “Income from other sources”

Note – No deduction in respect of any expenditure or allowance is allowable in respect of winnings from lotteries as per Section 58(4). Hence, ₹ 2,500 paid for purchase of lottery tickets is not allowable as deduction.

3. Computation of deduction under Chapter VI – A

4. Computation of tax on total income

5. Maturity proceeds of life insurance policy

Under section 10(10D), any sum received under a life insurance policy is wholly exempt from tax.

Note: The following assumptions have been taken into consideration:

(1) The life insurance policy, in respect of which premium of ₹ 12,000 is paid, is issued on or after 1st April, 2012, So, deduction under section 80C has been restricted to 10% of actual capital sum

assured.

(2) The maturity proceeds of LIC have been taken as exempt under section 10(10D) taking into consideration that the premium paid during any of the years of the policy does not exceed the specified percentage of the actual capital sum assured.

![]()

Question 12.

The following is the Profit and Loss Account of Mr. Aditya, aged 58 years, a resident, for the year ended 31.03.2021:

Other information:

1. Aditya bought a car during the year for ₹ 20,000. He charged depreciation @ 15% on the value of the car. The above car was sold during the year for ₹ 17,000. The use of the car was 3/4th for business and 1/4th for personal use.

2. Medical expenses were incurred for the treatment of Nikita, his wife.

3. Salary had been paid on account of car driver.

4. Rent Includes arréars of rent from April, 19 to October, 20 @ ₹ 5,000 p.m., paid in cash on 1.11.2020.

5. Mr. Aditya had also let out a house property at a monthly rent of ₹ 25,000. The annual letting value is considered to be ₹ 2,50,000. The municipal taxes are ₹ 6,000, out of which ₹ 3,000 are paid by the tenant and ₹ 3,000 are yet to be paid by Mr. Aditya. Interest on loan taken for the house property is ₹ 20,000.

6. Mr. Aditya’s minor daughter received ₹ 75,000 from stage acting. Interest on company deposits of Mr. Aditya’s daughter (deposit was made out of income from stage acting) was ₹ 10,000.

7. Aditya incurred an expense of ₹ 50,000 on the medical treatment of his dependant son, who has disability of more than 80%.

8. Aditya had taken a loan during the year 2020-21 for the education of his son, who is pursuing B.Com in Delhi University. Interest paid on the same during the year was ₹ 10,000.

Compute the total income of Mr. Adityalor the assessment year 2021-22. (Nov 2013, 10 marks)

Answer:

Computation of Total Income

Working Note 1:

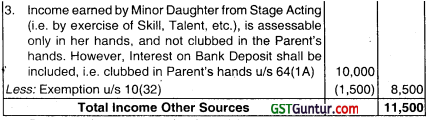

Computation of Income from House Property (Let out Property)

Working Note 2:

Computation of Profits and Gains of Business or Profession

Working Note 3:

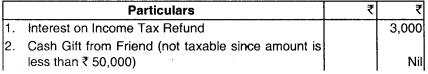

Computation of Income from Other Sources

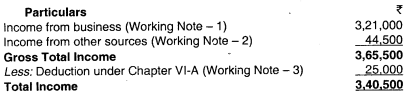

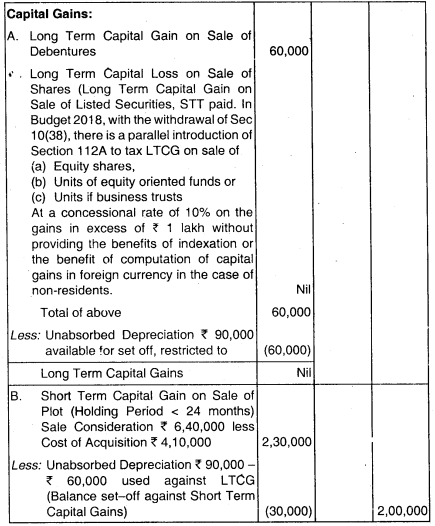

Question 13.

Compute the total income of Mr. Krishna for the assessment year 2021.22 from the following particulars:

Particulars : Amount (₹)

Income from business before adjusting the following items: ₹ 1,75,000

(a) Business loss brought forward from assessment year 2019-20 : ₹ 70,000

(b) Current depreciation : ₹ 40,000

(c) Unabsorbed depreciation of earlier year : ₹ 1,55,000

Income from house property (Grass annual value) : ₹ 4,32,000

Municipal taxes paid : ₹ 32,000

Mr. Krishna sold a plot at Noida on 12th Sep., 2020 for a consideration of ₹ 6,40,000, which had been purchased by him on 20th Dec., 2018 at a cost of ₹ 4,10,000.

Long-term capital loss on sale of shares sold through recognized stock exchange (STT paid) : ₹ 75,000

Long-term capital gain on sale of debentures : ₹ 60,000

Dividend on shares held as stock in trade : ₹ 22,000

Dividend from a company carrying on agri business : ₹ 10,000

During the previous year 2020-21, Mr. Krishna has repaid : ₹ 1,67,000

towards housing loan from a scheduled bank. Out of ₹ 1,67,000 ₹ 97,000 was towards payment of interest and rest towards principal payments. Cost inflation indices are as under:

Financial Year : Index

2018-19 : 280

2020-21 : 301 (Nov 2013, 8 marks)

Answer:

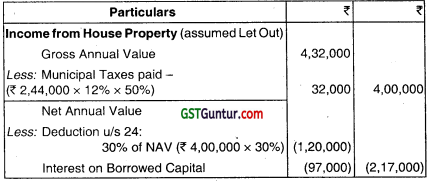

Computation of Total Income

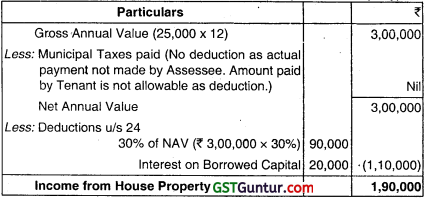

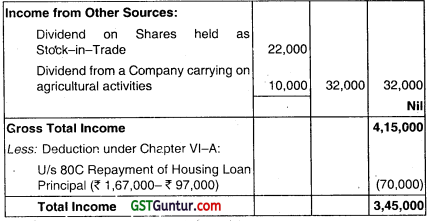

Question 14.

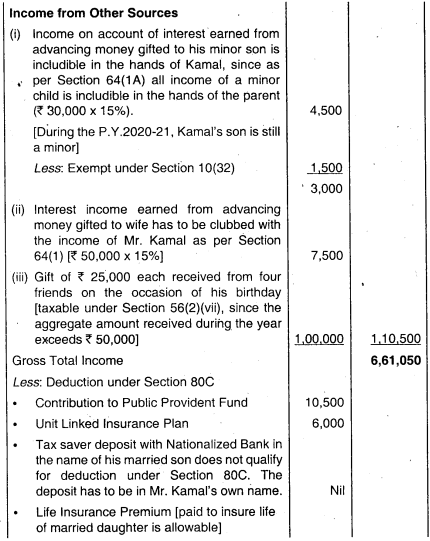

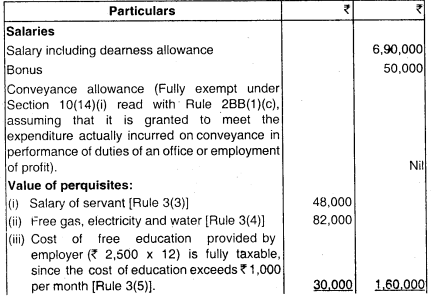

From the following details compute the total income of Kamal, A resident individual aged 54 years for the year ended 31-3-202. Tax payable need not be calculated.

1. Salary including Dearness Allowance : ₹ 5,40,000

2. Bonus : ₹ 15,000

3. Salary to servant provided by Employer : ₹ 12,000

4. Bill paid by Employer for Gas, Electricity and water provided free of cost at his flat : ₹ 14,500

5. Cost of Laptop provided by the employer (Used both for official and personal purposes) : ₹ 40,000

Following additional information is provided:

1. Kamal purchased a flat in a Cooperative Housing Society in Delhi for ₹ 10,75000 in April, 2015 by taking loan from State Bank of India amounting to ₹ 5,00,000 @ 15% per annum interest, ₹ 65,000 from his own savings and a deposit rom a Nationalized Bank to whom this flat was given on lease for 10 years at a monthly lease rental of ₹ 5,500. The outstanding amount of loan is ₹ 1,60,000.

2. Municipal Taxes paid by Karnal ₹ 4,500 P.A.

3. Insurance in respect of the said flat ₹ 1,275.

4. Kamal earned a profit of ₹ 15,000 in shares speculation business and ‘Incurred a loss of ₹ 20,200 in speculation business of cotton.

5. In the year 2013-14, he had gifted ₹ 50,000 to his wife and ₹ 30,000 to his son who was aged 11 years then. These amounts were advanced to Mr. M.ohan @ 15% per annum interest.

6. Kamal received a gift of ₹ 25,000 each from his tour friends on the occasion of his birthday.

7. He contributed ₹ 10,500 to Public Provident Fund and ₹ 6,000 to Unit Linked Insurance plan.

8. He deposited ₹ 60,000 in tax saver deposit with a Nationalised Bank in the name of his married son.

9. He has taken a policy on life for his married daughter on 1-4-2020 and paid a premium of ₹ 25,000. The sum assured for policy is ₹ 2,00,000. (May 2014, 10 marks)

Answer:

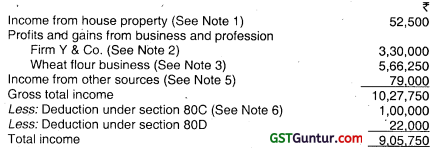

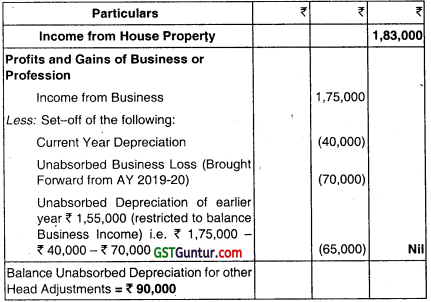

Computation of total income of Kamal for AY 2021-22

Notes:

(1) No separate deduction is available for insurance of ₹ 1,275, while computing income under the head income from house property.

(2) It is assumed that ₹ 1,60,000 is the (pan outstanding at the beginning of the year and there is no principal repayment of housing loan during the year qualifying for deduction under Section 80C. Interest under Section 24 has, accordingly, been calculated at the rate 15% of ₹ 1,60,000.

(3) It is assumed that Mr. Kamal’s total income, before including minor’s income, is higher than that of his spouse.

![]()

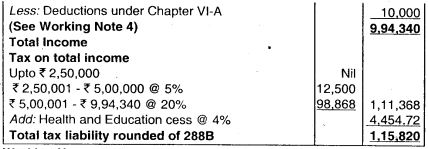

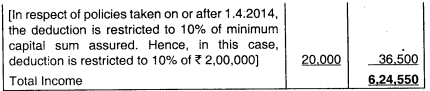

Question 15.

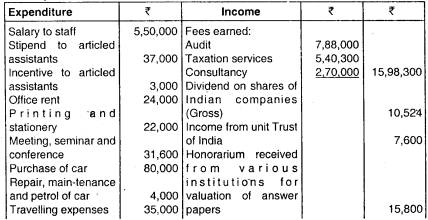

Mr. Devansh an Indian Resident aged 38 years carries on his own business. He has prepared following Profit & Loss A/c for the year ending 31-03-2021:

Other information:

(i) Mr. Devansh owns a House Property which is being used by him for the following purposes:

- 25% of the property for own business

- 25% of the property for self-residence

- 50% let out for Residential purpose

(ii) Rent received from 50% let out portion during the year was ₹ 1,65,000.

(iii) On 1-12-2019 he acquired a vacant site from his friend for ₹ 1,05,000.

The State Stamp Valuation Authority fixed the value of the site at ₹ 2,80,000 for stamp duty purpose.

(iv) He received interest on Post office Savings bank Account amounting to ₹ 500.

(v) Cash gift on the occasion of marriage includes gift of ₹ 20,000 from Non-relatives.

(vi) LIC premium paid (Policy value ₹ 3,00,000 taken on 01-06-2018) ₹ 60,000 for his handicapped son. (Section 80U disability)

(vii) He purchased 10000 shares of X Company Ltd on 01-01-2016 for ₹ 1,00,000 and received a 1:1 bonus on 01-01-2018. He sold 5000 bonus shares in September 2020 for ₹ 2,20,000. (Shares are not listed and STT not paid).

Compute Total Income and Net Tax payable by Mr. Devansh for the Assessment Year 2021-22. (Nov 2014, 10 marks)

Answer:

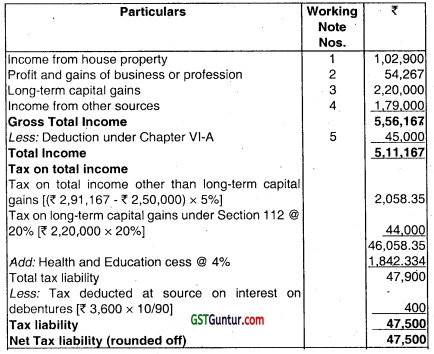

Computation of total income and net tax liability of Mr. Devansh for A.Y. 2021-22

Working Notes:

Note: TDS provisions under Section 194A would be attracted only if the amount of interest on debentures exceeds ₹ 5,000. In this case, interest is only ₹ 4,000. Hence, TDS provisions under Section 194A would not be attracted. However, since the question specifically mentions that interest of ₹ 3,600 on debentures has been credited to the profit and loss account “net of taxes”, the interest has been grossed up for inclusion under the head “Income from other sources”.

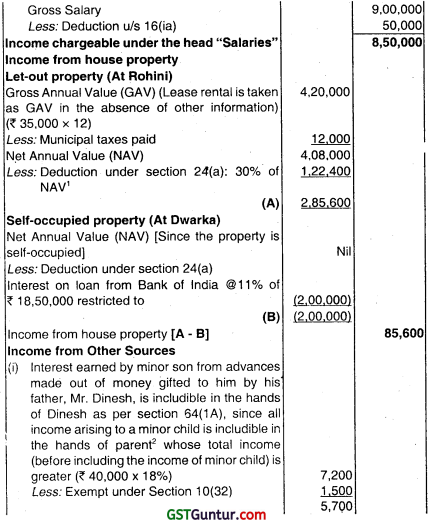

Question 16.

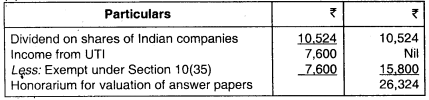

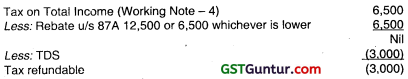

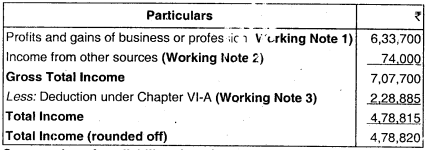

Dr. Shashank is a noted child specialist of Mumbai. His Income and Expenditure account for the financial year ended 31 -03-2021 is given below:

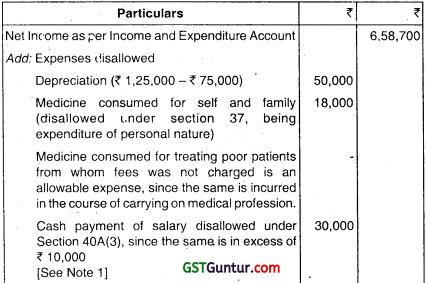

(1) Depreciation computed as per income Tax Rules, 1962 has been

(2) Medicines consumed include cost of medicine for self and family of ₹ 18,000 and for treating poor patients of ₹ 24,000 from whom he did not charged any fee either.

(3) Salary includes ₹ 30,000 paid in casti to a computer specialist who computerized his patient’s data on 30th September, 2020 at 3 p.m.

(4) Donation to National Children’s Fund has been made by way of an account payee cheque.

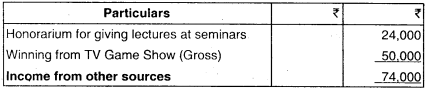

(5) He has paid a sum of ₹ 25,000 for a Life Insurance Policy (Sum assured ₹ 2,00,000) of himself, which was taken on 1 -07-2015.

(6) He also contributed ₹ 1,20,000 towards Public Provident Fund.

(7) Dr. Shashank also paid interest of ₹ 10,000 on loan taken for higher education of his daughter.

(8) Dr. Shashank made investments in equity shares listed in a recognized stock exchange of ₹ 30,000 and units of equity oriented fund of Rajiv Gandhi Equity Savings Scheme of ₹ 40,000.

(9) Dr. Shashank also made donation of ₹ 1,00,000 to a charitable trust registered & eligible for deduction under Income Tax Act, 1961.

You are required to compute the total income and tax payable by Dr. Shashank for the Assessment Year 2021 -22. (May 2015, 10 marks)

Answer:

Computation of Total income of Dr. Shashank for the Assessment Year 2021-22

Computation of Tax liability of Dr. Shashank for the Assessment Year 2021-22

Working Note:

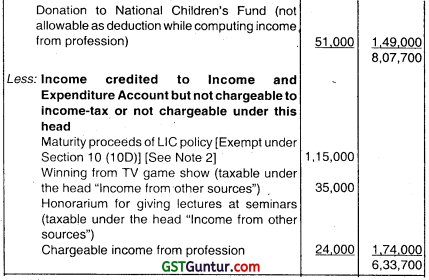

1. Computation of income under the head “Profits and gains of business or profession”

2. Computation of income under the head “Income from other sources”

![]()

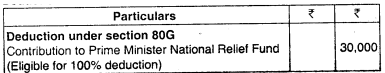

3. Computation of deduction under Chapter VI-A

4. Deduction under section 80G in respect of donation to charitable trust

2 It is also possible to lake a view that winnings from TV game show should be deducted from gross total income for computing adusted total income for the purpose of Section 80G, on the reasoning that since no decision is allowable under any provision of the Act, including Chapter VIA in respect of such income which istaxable@30% under Section 115BB, the same should not be considered for computing adjusted total income also.

Notes:

(1) The exception under Rule 6DD(j) would not be attracted in this case, since 30th September, 2018 is not a bank holiday but a day on which some banks may be closed for public dealing. Further, the question does not specifically mention that the payment was necessarily required to be made on that date, which is necessary for the exception under Rule 6DD(j) to get attracted. Hence, disallowance under Section 40A(3) would be attracted in this case.

(2) The maturity proceeds received under a life insurance policy are wholly exempt from tax under Section 10(10D), assuming that the conditions given thereunder are satisfied (i.e., the annual premium does not exceed the specified percentage of actual capital sum assured)

(3) It is assumed that the donation of ₹ 100,000 to the charitable trust is made by any mode other than cash.

Question 17.

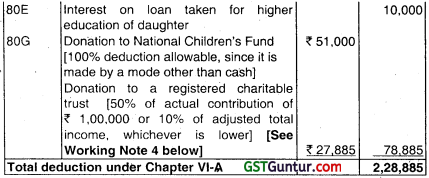

From the following details furnished by Mr. Dinesh, a marketing manager of XL Corporation Ltd., Delhi. Compute the gross total income for the Assessment Year 2021.22.

Particulars : Amount (₹)

Salary including Dearness Allowance : ₹ 6,90,000

Conveyance allowance of ₹ 900 p.m. : ₹ 10,800

Bonus : ₹ 50,000

Salary of servant provided by the employer : ₹ 48,000

Bills paid by the employer for gas, electricity and water provided free of cost at the residence of Mr. Dinesh. : ₹ 82,000

Dinesh purchased a flat in a co-operative housing society in Dwarka, Delhi for self occupation for ₹ 35,00,000 in April 2014, which was finance by a loan from Bank of India of ₹ 20,00,000 @ 11% interest and his own savings of ₹ 5,00,000 and a deposit of ₹ 10,00,000 from Bank of Baroda, to whom he let out his another house in Rohini, Delhi on lease for tori years. The rent payable by Bank of Baroda is ₹ 35,000 per month. Other relevant particulars

are given below:

(i) Municipal taxes paid by Dinesh for his flat in Dwarka are ₹ 18,000 per annum and for his house in Rohini are ₹ 12,000 per annum.

(ii) Principal loan amount outstanding as on 01-04-2020 was ₹ 18,50,000.

(iii) He also paid ₹ 8,000 towards insurance of both the houses.

(iv) In the financial year 2020-21, he had gifted ₹ 40,000 each to his wife and minor son. The gifted amounts were advanced to Mr. Sandeep, who is paying interest @ 18% per annum.

(v) Mr Dinesh’s son is studying in a school run by the employer company throughout the financial year 2020-21. The education facility was provided free of cost. The cost of such education in similar school is ₹ 2,500 per month.

(vi) Dinesh also received gifts of ₹ 45,000 each from his two friends during the financial year 2020-21. (May 2015, 8 marks)

Answer:

Computation of gross total Income of Mr. Dinesh for the A.Y. 2021-22

Notes:

- No separate deduction is allowable in respect of insurance.

- It is assumed that Mr Dinesh’s total income before including the income of minor child is higher than wife’s total income.

Question 18.

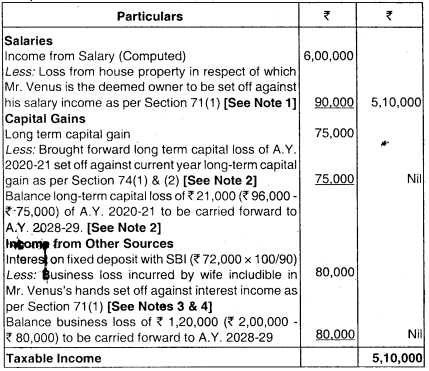

Mr. Venus provides the following details for the previous year énding 31-3-2021

(i) Salary from HNL Ltd. (Computed) : ₹ 6,00,000

(ii) Interest on FD with SBI for the Financial Year 2020-21 : ₹ 72,000 (Net of TDS)

(iii) Determined long term capital loss of AY 2020-2 1 (to be carried forward) : ₹ 96,000

(iv) Long term Capital gain : ₹ 75,000

(v) Loss of minor son ₹ 90,000 computed in accordance with the provisions of Income tax Act. Mr. Venus transferred his own house to his minor son without adequate consideration few years back and minor son let it out and suffered loss.

(vi) Loss of his wife’s business : ₹ (2,00,000)

She carried business with funds which Mr. Venus gifted to her. You are required to compute taxable income of Mr. Venus for the AY 2021-22. (Nov 2015, 8 marks)

Answer:

Computation of Taxable Income of Mr. Venus for the A.V. 2021-22

Notes:

(1) As per Section 27(i), Mr. Venus is the deemed owner of the house transferred to his minor son without adequate consideration. Hence, the income from house property would be assessable in Mr. Venus’s hands.

Since, there is a loss from house property transferred to minor son without adequate consideration, Mr. Venus can set off the same against salary income, since he is the deemed owner of such property.

(2) As per Section 74(1) and 74(2). brought forward long-term capital loss can be set-off only against long-term capital gains. Unabsorbed long-term capital loss can be carried forward for a maximum of eight assessment years (upto A.Y. 2028-29 in this case) for set-off against long-term capital gains.

(3) As per Section 64(1)(iv), income from funds gifted to spouse-by an individual and invested in business by the spouse is includible in the hands of the individual. As per Explanation 2 to Section 64, income includes loss. Hence, in the given case, loss arising out of the business carried on by Mr. Venus’s wife is to be included in the income of Mr. Venus,’ as she has carried on business with the funds gifted to her by Mr, Venus.

(4) As per Section 71 (2A), business loss cannot be set-off against salary income. However, the same can be set-off against income from other sources (consisting of interest on fixed deposit).

![]()

Question 19.

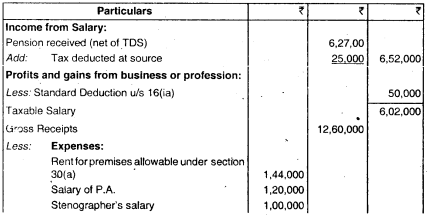

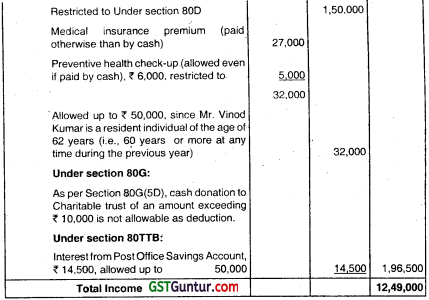

Mr. Vinod Kumar, resident, aged 62, furnishes the following information pertaining to the year ended 31-3-2021:

(i) Pension receives (Net of TDS) : ₹ 6,27,000

Short-term capital gains (from sale of listed shares) : ₹ 65,000

Long-term capital gains (from sale of listed shares) : ₹ 1,24,000

Interest on fixed deposit from bank : ₹ 1,60,000

Pertaining to consultancy services provided by him:

Gross receipts : ₹ 12,60,000

Expenses:

Rent for premises : ₹ 1,44,000

Salary of PA. : ₹ 1,20,000

Stenographer’s salary : ₹ 1,00,000

Business Development expenditure : ₹ 91,000

Conveyance : ₹ 3,00,000

(vi) Contribution to PPF : ₹ 1,10,000

(vii) Premium on life insurance policy taken on 10-1-2021 (Sum assured ₹ 5,00,000) : ₹ 60,000

(viii) Mediclaim insurance Premium for self (paid otherwise than by cash) : ₹ 27,000

Preventive health checkup expenses (in cash) : ₹ 6,000

(ix) Donation given in cash to a charitable trust registered under Section 1 2AA (eligible for deduction u/s 80G) of the income-Tax Act. 1961 : ₹ 14,000

(x) interest received from Post Office Savings A/c. : ₹ 18,000

Additional Information:

- TDS from pension : ₹ 25,000

- 1/4th of conveyance expenses is estimated for personal use.

Compute the total income of the assessee for the assessment year 2021-22, under proper heads of income. Listed share were sold in recognized stock exchange. (May 2016, 10 marks)

Answer:

Computation of total income of Mr. Vinod Kumar for the Assessment Year 2021-22:

Question 20.

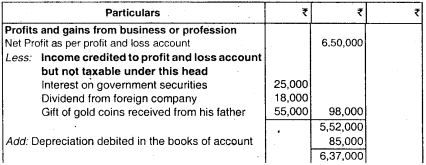

Mr. Raghuveer, a resident individual aged 35 years, furnished the following information from his Profit and Loss Account for the year ended 31st March 2021:

(i) Tha net profit was ₹ 6,50,000.

(ii) The following incomes were credited in the Profit & Loss Account:

(a) Interest on government securities ₹ 25,000

(b) Dividend from a foreign company ₹ 18,000

(c) Gold coins worth ₹ 55,000 received as gift from his father.

(iii) Depreciation debited in the books of account was ₹ 85,000. Depreciation allowed as per Income-tax Act, 1961 was ₹ 96,000.

(iv) Interest on loan amounting to ₹ 68,000 was paid in respect of capital borrowed for the purchase of the new asset which has not been put to use till 31st March 2021.

(v) General expenses included:

(a) An expenditure of ₹ 20,500 which was paid by a bearer cheque.

(b) Compensation of ₹ 4,500 paid to an employee while terminating his services in business unit.

(vi) He contributed the following amounts by cheque:

(a) ₹ 45,000 in Sukanya Samridhi Scheme in the name of his minor daughter Alpa.

(b) ₹ 20,000 to the Swachh Bharat Kosh set up by the Central Government.

(c) ₹ 28,000 towards premium for health insurance and ₹ 2,500 on account of preventive health check up for self and his wife.

(d) ₹ 35,000 on account of medical expenses of his fauher aged 82 years (no insurance scheme had been availed on the health of his father).

You are required to compute the total income of Mr. Raghuveer for the Assessment Year 2021-22. (Nov 2016, 10 marks)

Answer:

Computation of total income of Mr. Raghuveer for the Assessment Year 2021-22

Notes:

1. Interest on government securities is taxable under the head “Income from Other Sources”. However, if the securities are notified for the purpose of exemption under Section 10(15), then interest income would be exempt. The question does not specify whether the government securities are notified securities. In the above solution, it is assumed that the Government securities are not notified for the purpose of Section 10(15), and accordingly, the interest income of ₹ 25,000 is brought to tax under the head “Income from Other Sources”.

Alternatively, it can be assumed that the government securities are notified for the purpose of exemption under Section 10(15). In that case, the interest on government securities would be exempt under Section 10(15) and hence, the Gross Total Income would be ₹ 6,47,500 and the total income would be ₹ 5,27,500.

2. The first sentence of the question states that Mr. Raghuveer has furnished the following information from his profit and loss account for the year ended 31st March, 2021. Thereafter, items (i) to (vi) containing information relating to net profit, income, expenditure, depreciation, interest, payment of premium and deposit have been given. Item (vi) particularly relates to deposit in Sukanya Samriddhi Scheme, payment of medical insurance premium for self and spouse and payment of medical expenses for father, each of which wholly or partly qualifies for deduction under Chapter VI-A from gross total income.

Generally, this item is given separately under “Additional Information”, and accordingly, the above solution has been worked out on this basis. However, from the manner in which information is presented in the question, it appears that the same have been given effect to in the profit and loss account, in which case the contributions have to be added back at the first instance while computing business income and thereafter, the eligibility for deduction under Chapter VI-A from gross total income has to be considered. In that case, ₹ 1,30,500 (₹ 45,000 + ₹ 20,000 + ₹ 28,000 + ₹ 2,500 + ₹ 35,000), being the aggregate of contributions mentioned in item (vi), has to be added while computing business income. The business income would be ₹ 7,60,000. The gross total income would be ₹ 8,03,000 and total income ₹ 6,78,000.

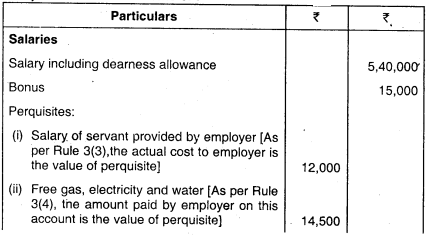

![]()

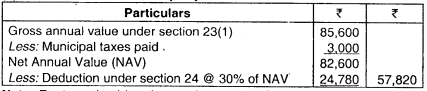

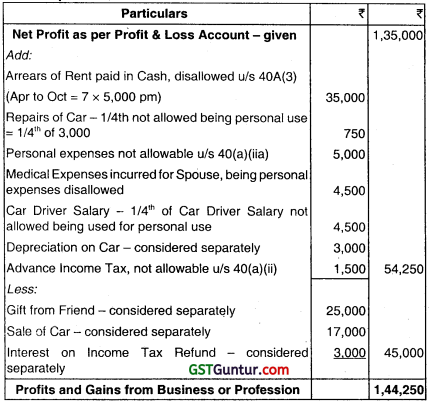

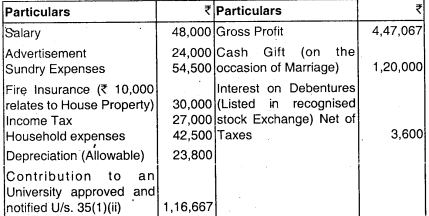

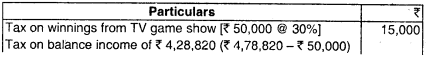

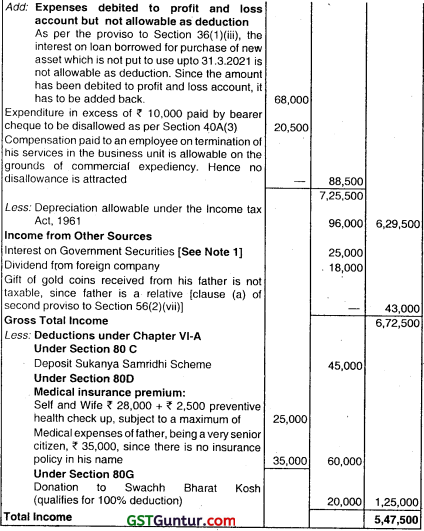

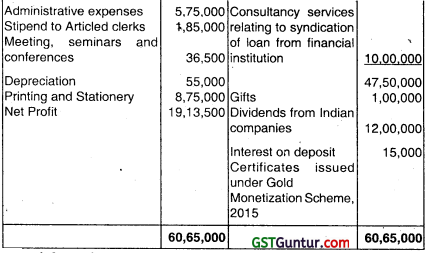

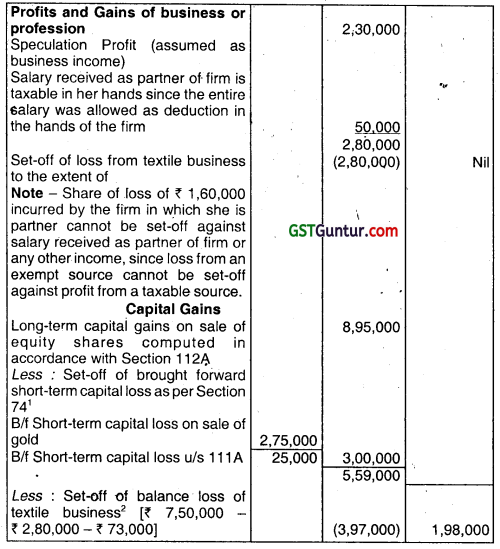

Question 21.

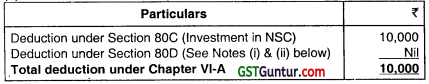

Ms. Rekha, a resident individual aged 50, provides the following information for the financial year 2020-21:

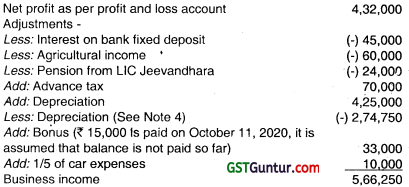

(i) She is a partner in AK & Co. and received the following amounts from the firm:

Share of profit from the firm ₹ 35,000

Interest on capital @ 15% p.a. ₹ 3,00,000

Salary as working partner ₹ 1,00,000

(fully allowed in the hands of the firm)

(ii) She is running a rice mill as proprietor. The Net profit as per Profit & Loss Account is ₹ 4,50,000. The following items are debited to Profit and Loss account:

- Advance Income-tax paid ₹ 1,00,000

- Personal drawings ₹ 50,000

The following items are credited to Profit and Loss Account:

- Interest on savings bank account with SBI ₹ 12,000

- Interest on savings account with post office ₹ 5,000

(iii) She owned a house property in Mumbai which was sold in January, 2019. She received ₹ 90,000 by way of arrear rent in respect of the said property in October, 2020.

(iv) She made the following investments:

Life insurance premium on a policy in the name of her married daughter ₹ 60,000. (The policy was taken on 1 -10-2016 and the sum assured being ₹ 5,00,000).

Health insurance premium on a policy covering her mother aged 75. She is not dependant on Ms. Rekha. Premium paid by cheque ₹ 35,000.

Compute the Total Income and the tax liability of Ms. Rekha for the Assessment Year 2021-22. (May 2017, 10 marks)

Answer:

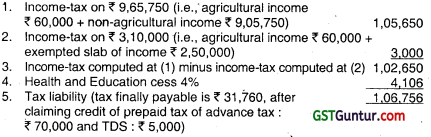

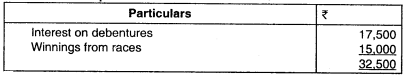

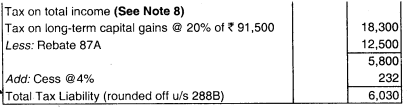

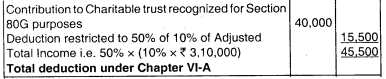

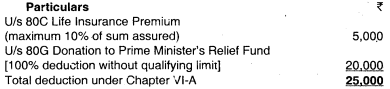

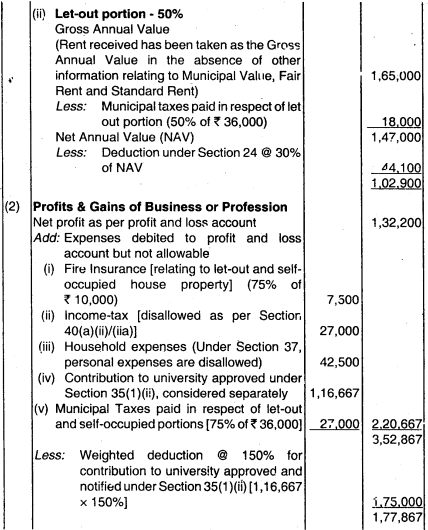

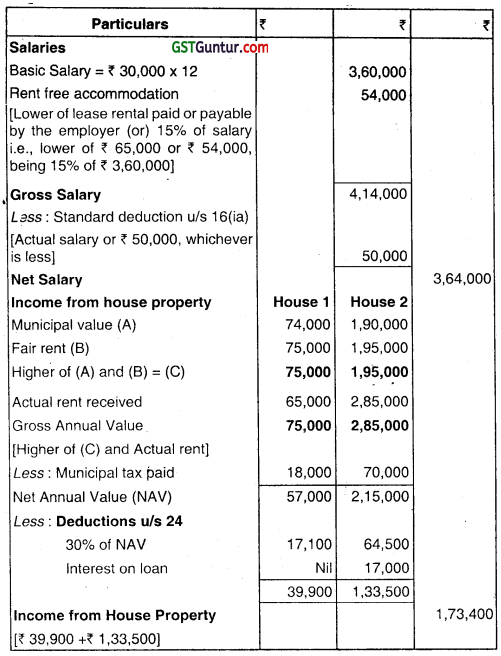

Computation of Total Income

![]()

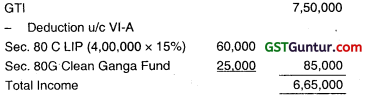

Question 22.

Mr. Rohan, a resident individual has Gross Total Income of ₹ 7,50,000 comprising of Income from salary and income from house property for the assessment year 2021 -22. He provides the following information:

Paid ₹ 70,000 towards premium on life insurance policy of his Handicapped Son (Section 80 U disability). Sum assured ₹ 4,00,000; and date of issue of policy 1-8-2019.

Deposited ₹ 90,000 in tax saver deposit in the name of his major son in State Bank of India.

Contributed ₹ 25,000 to The Clean Ganga Fund, set up by the Central Government.

Compute the Total Income and deduction under Chapter VI-A for the Assessment year 2021-22. (May 2017, 4 marks)

Answer:

Computation of Total Income

Question 23.

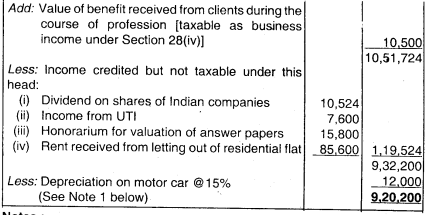

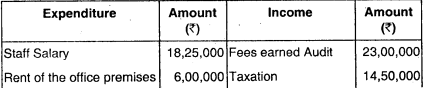

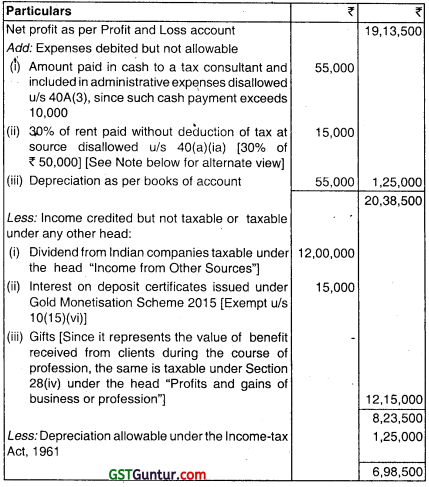

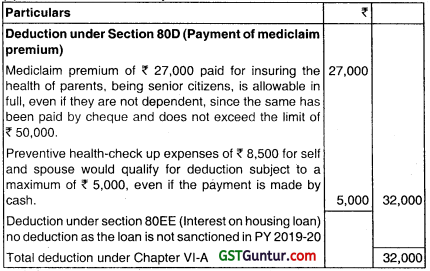

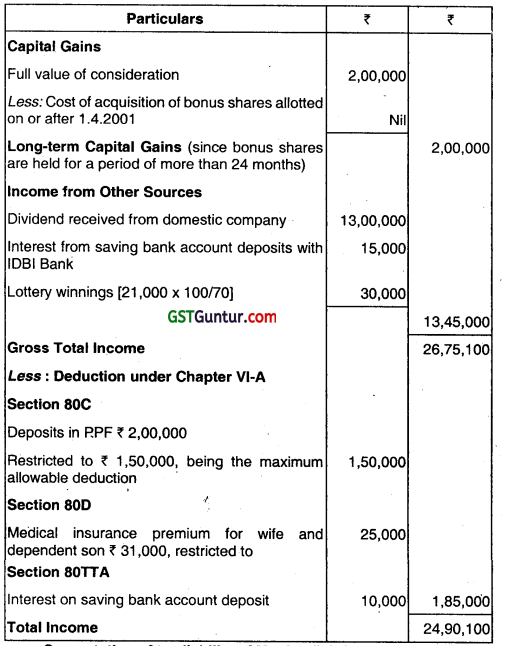

Mr. Pandey, a resident individual, aged 45 years, is a Chartered Accountant in practice. He maintains his accounts on cash basis. His Profit & Loss Account for the year ended 31st March, 2021 is as follows:

Other Information:

(1) Depreciation allowable under Income-Tax Act ₹ 1,25,000.

(2) Administrative expenses include ₹ 55,000 paid to a tax consultant in cash for assisting Mr. Pandey in one of the professional assignments.

(3) Gifts represent fair market value of a LED TV which was given by one of the clients for successful presentation of case in the Income Tax Appellate Tribunal.

(4) Last months rent of ₹ 50,000 was paid without deduction of tax at source.

(5) Mr. Pandey had taken a loan of ₹ 32,00,000 for the purchase of a house property valuing ₹ 45,00,000 from a recognized financial institution on 1st May, 2020. He repaid ₹ 1,50,000 on 31st March, 2021 out of which ₹ 1,00,000 is towards principal payment and the balance is for interest on loan. The possession of the property will be handed over to him in October 2021.

(6) Mr. Pandey paid medical insurance premium of his parents (senior citizens and not dependent on him) by cheque amounting to ₹ 27,000.

He also paid ₹ 8,500 by cash towards preventive health checkup for himself and his spouse.

Compute the total income of Mr. Pandey and tax payable by him for Assessment Year 2021-22. assuming that Mr. Pandey does not want to opt for presumptive taxation scheme under Section 44ADA (Nov 2017, 10 marks)

Answer:

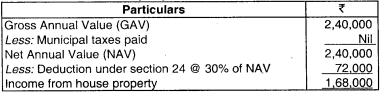

Computation of total Income and tax liability of Mr. Pandey for the A.Y. 2021-22

Working Notes:

(1) Income under the head “Profits & Gains of Business or Profession”

(2) Deductions under Chapter VI-A

![]()

Question 24.

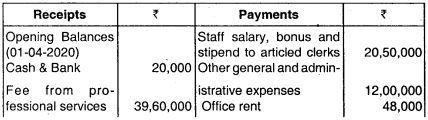

Mr. Hari, aged 55 years. a resident individual and practicing Chartered Accountant, furnishes you the receipts and payments account for the financial year 2020-21.

Other Information:

(i) Motor car was put to use for both official and personal purposes. 1/4th of the motor car is for personal purpose. No interest on car loan was paid during the year.

(ii) Mr. Han purchased a flat in Jaipur for ₹ 15,00,000 in July 2014 cost of which was partly financed by a loan from State Bank of India of ₹ 1000000 @ 10% interest, his own savings ₹ 1,00,000 and a deposit from Bank of Baroda for ₹ 4,00,000. The flat was given to Bank of Baroda on lease for 10 years @ ₹ 40,000 per month. The following particulars are relevant:

(a) Municipal taxes paid by Mr. Hari ₹ 4,200 per annum

(b) House insurance ₹ 1,000

(iii) He earned ₹ 1,00,000 in share speculation business and lost ₹ 1,50,000 in commodity speculation business.

(iv) Mr. Hari received a gift of ₹ 15,000 each from four of his family friends.

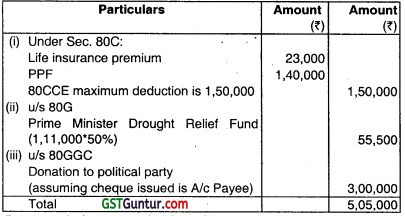

(v) He contributed ₹ 1,11,000 to Prime Minister’s Drought Relief Fund by way of bank draft.

(vi) He donated to a registered political party ₹ 3,00,000 by way of cheque.

Compute the total income of Mr. Hari and the tax payable for the Assessment year 2021 -22. (May 2018, 10 marks)

Answer:

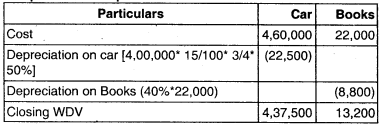

Computation of Taxable Income and Tax Liability

Working Notes:

1. Income from House Property

Points of consideration:

- In the absence of Information, actual rent received is considered as GAV.

- It is assumed loan is outstanding throughout the year. Interest is calculated on 10,00,000@10% = 1,00,000

- Only deduction u/s 24(a) and 24(b) is allowed. Since 24(a) is a standard deduction hence no deduction is allowed for house insurance.

2. Income from Profession

(This loss cannot be set off from professional income. Hence it shall be c/f for 4 years)

Note:

For the P.Y. 2020-21, the gross receipts of Mr, Han is ₹ 39,60,000. Since, it does not exceed ₹ 50,00,000, he is eligible to opt for presumptive tax scheme under section 44ADA. In such case, his professional income would be ₹ 19,80,000, being 50% of ₹ 39,60,000. It is more beneficial for Mr. Hari to declare profit of ₹ 6,16,700 as per books of accounts whid is lower than the profits computed on presumptive basis under Section 44ADA. However, for declaring lower profits, he has to maintain books of account under section 44AA and get the same audited under Section 44AB.

Computation of Depreciation

Computer @40% of ₹ 25,000 × 50% = 5,000, since the same is put to use for less than 180 days, assuming that payment was made through A/c payee cheque/bank draft or ECS through bank account

It is assumed that interest on motor car loan is not paid upto limit u/s 139(1). Hence not considered for computing professional income.

3. Deduction under chapter VI-A:

Question 25.

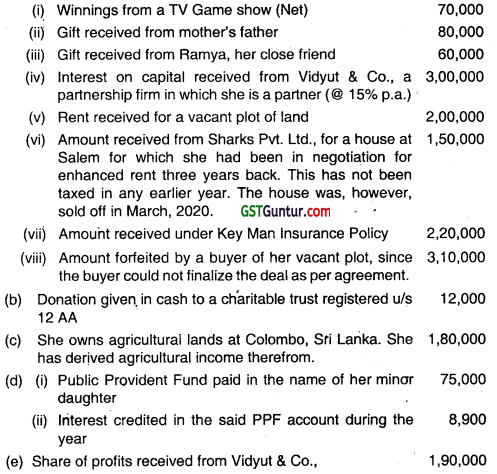

Miss Sakshitha, a resident individual, aged 32 years, furnishes the following particulars relating to the year ended 31-3-2021:

(a) Analysis of her bank account in her ledger reveals the under-mentioned data:

You are required to compute the total income of the assessee and the tax payable for the assessment year 2021 -22.

Computation should be made under proper needs of income. (Nov 2018, 10 marks)

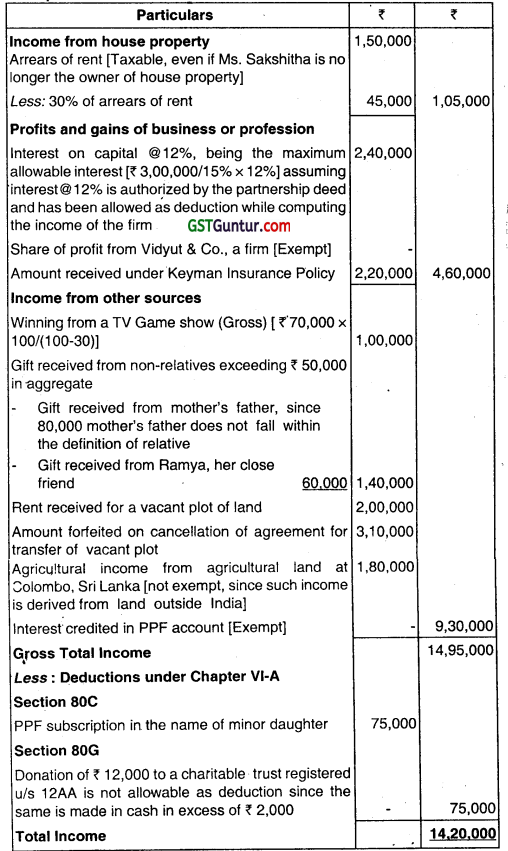

Answer:

Computation of total income of Miss Sakshitha for the A.Y. 2021-22

Computation of tax liability of Miss Sakshitha for A.Y. 2021-22

Note : Gift of ₹ 80.000 received from mother’s father has been brought to tax under section 56(2)(x) on the basis of the view that maternal grandparents are not “lineal ascendants” and hence, do not fall within the definition of ‘relative’ given there under, However, there is an alternate view that maternal grandparents are lineal ascendants and hence, fall under the definition of relative under section 56(2). If this view is considered, gift of ₹ 80,000 from mother’s father would not be taxable. In such case, the total income would be ₹ 13,40,000 and tax payable would be ₹ 1,93,080.

![]()

Question 26.

Answer of the following:

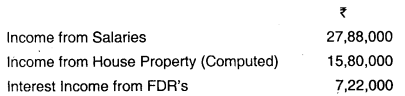

Mr. Rajat Saini, aged 32 years, furnishes the following details of his total income for the A.Y. 2021-22:

He has not claimed any deduction under chapter VIA. You are required to compute tax liability of Mr. Rajat Saini as per the provisions of Income Tax Act, 1961 (Nov 2018, 5 marks)

Answer:

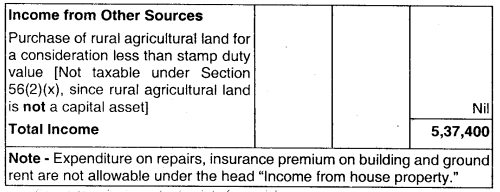

Computation of tax liability of Mr. Rajat Saini for the A.Y: 2021 -22

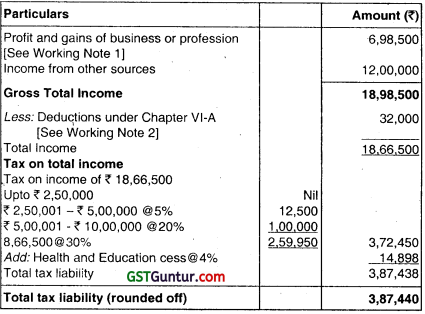

Question 27.

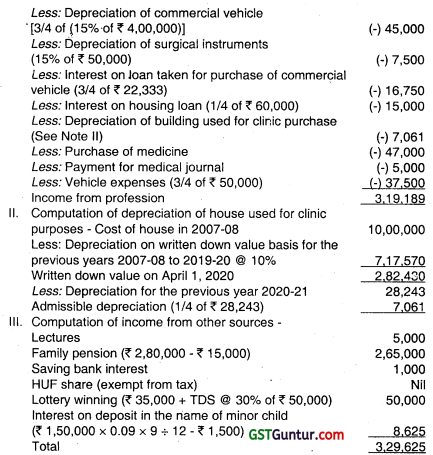

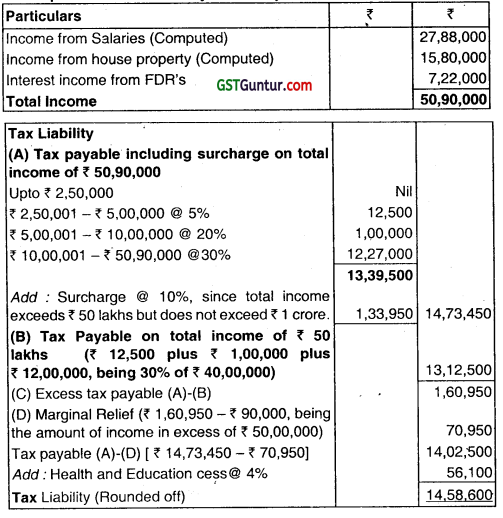

From the following particulars of Shri Jagdish (Aged 59 years) for the Assessment Year 2021 -22, you are required to find out his taxable income and net tax liability:

(i) Basic Salary @ ₹ 51,000 per month, Dearness allowance @ ₹ 10,000 per month (Part of salary for retirement benefits), House rent allowance ₹ 4,000 per month and rent paid for house in Mumbai is ₹ 7,000 per month.

(ii) He owns a commercial building at New Delhi, which is let out on 1/7/2020 at a monthly rent of ₹ 46,000. He paid for municipal taxes of ₹ 27,000 and ₹ 25,000 for the financial year 2019-20 and 2020.21 on 31-3-2021 and 20-4-2021 respectively.

(iii) He deals in shares. During financial year 2020-21 be earned ₹ 1,70,000 from his share business and paid ₹ 30,000 as security transaction tax.

(iv) He purchased 4000 unlisted shares of Shyam Limited on 16-1-2010 for ₹ 80,000. Company declared bonus in the ratio of 1:1 on 1st February, 2010. Shri Jagdish sold 3000 Bonus Shares on 28/12/2019 for ₹ 2,00,000 to his friend Mr. Mehul through unrecognized stock exchange. (Cost Inflation Index : 2009-10: 148. 2020-21 : 301)

(v) He received dividend of ₹ 13,00,000 as dividend income from listed domestic company, Interest from saving bank account deposits with IDBI Bank ₹ 15,000 and lottery winnings (Net of TDS @ 30%) is ₹ 21,000.

He paid the following amount out of his taxable income:

(a) Deposits in Public Provident Fund ₹ 2,00,000.

(b) Medical insurance premium paid for health of his wife ₹ 19,000 and for health of dependent son ₹ 12,000 through cheque. (May 2019, 14 marks)

Answer:

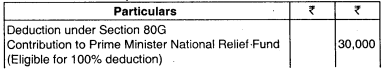

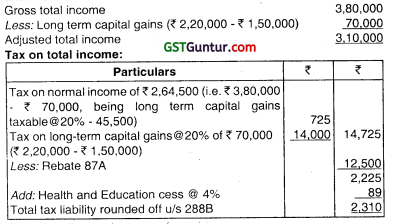

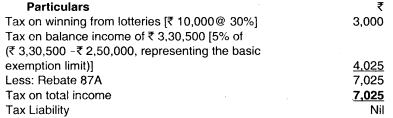

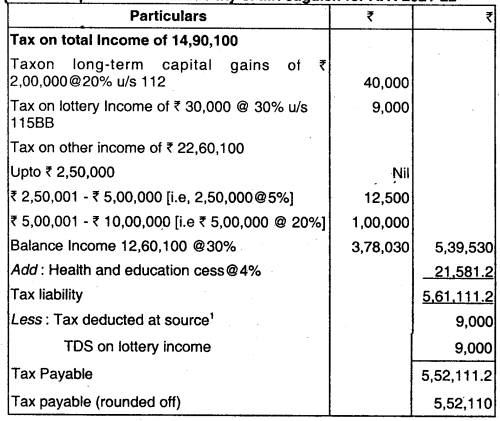

Computation of Taxable Income of Mr. Jagdish for the A.Y.2021-22:

Computation of tax liability of Mr. Jagdish for A.Y. 2021-22

It is presumed that commercial building is let out to an individual /HUF whose turnover does not exceed limit specified in section 44MB during the immediately proceeding F.Y. Hence, TDS u/s 1 94-IB is not attracted Also, TDS u/s 194-IB is not attracted since monthly rent does not attracted since monthly rent does not exceeds ₹ 50,000.

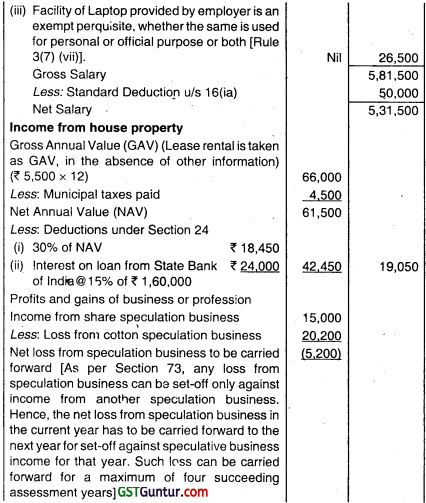

![]()

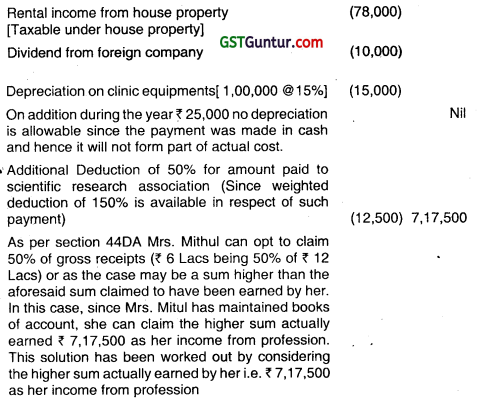

Question 28.

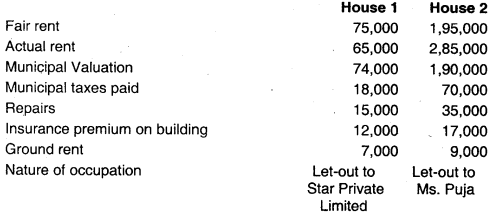

Mr. Madhvan is a finance manager bi Star Private Umited. He gets a salary of t 30000 per month. He owns two houses, one of which has been let out to his employer and which is in-turn provided to him as rent free accommodation. Following details (annual) are furnished in respect of two house properties for the Financial Year 2020-21.

₹ 17,000 were paid as Interest on loan taken by mortgaging House 1 for construction of House 2.

During the previous year 2020-21, Mr. Madhvan purchased a rural agricultural land for ₹ 2,50,000. Stamp valuation of such property is ₹ 3,00,000.

Determine the taxable income of Mr. Madhvan for the assessment year 2021-22. All workings should form part of your answer. (May 2019, 8 marks)

Answer:

Computation of taxable Income of Mr. Madhvan for AY. 2021-22

Question 29.

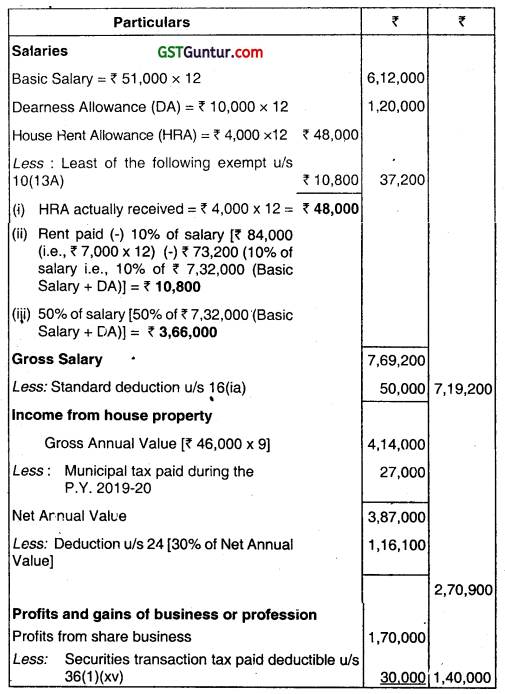

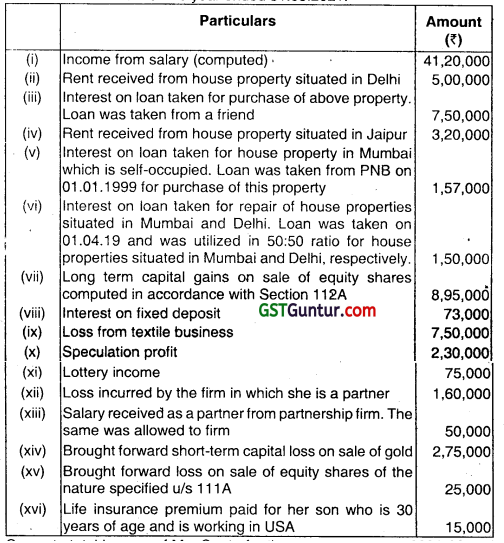

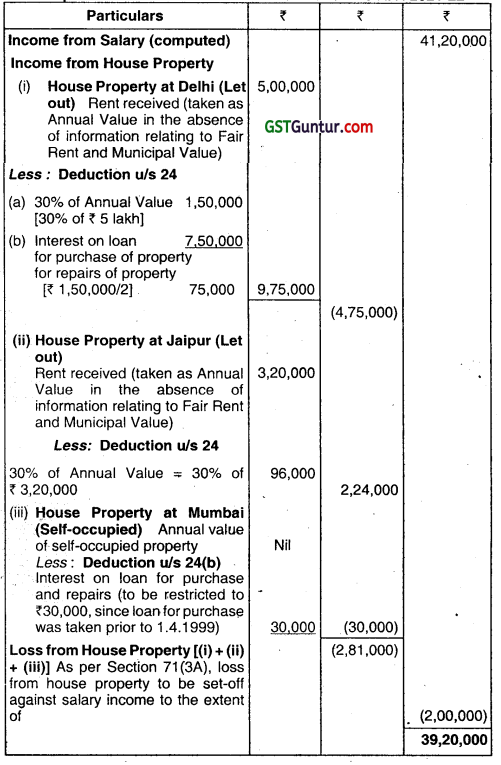

Ms. Geeta, a resident individual, provides following details of her income/losses for the year ended 31.03.2021:

Compute total income of Ms. Geeta for the assessment year 2021-22 and the amount of loss that can be carried forward.

For the above solution, you may assume principal repayment of loan as under:

(1) Loan taken for purchase of house property in Delhi – ₹ 250,000

(2) Loan taken for purchase of house property in Mumbai – ₹ 50,000

(3) Loan taken for repair of house properties in Delhi and Mumbai – ₹ 75,000

Working notes should form part of your answer. Wherever necessary, suitable assumptions may be made by the candidates and disclosed by way of note. (May 2019, 10 marks)

Answer:

Computation of total income of Ms. Geeta for the A.Y.2021-22

1. As per section 74, 8/f short-term capital loss can be set-off against long-term capital gain taxable u/s 11 2A. It is assumed that the eight year period for set-off of losses has not expired.

2. Permitted as per section 71(2)

Loss to be carried forward to A.Y. 2022-23

Question 30.

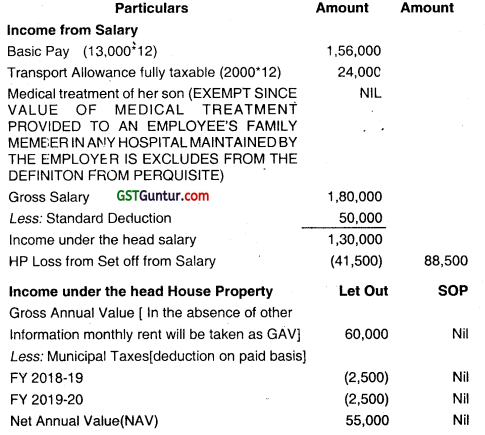

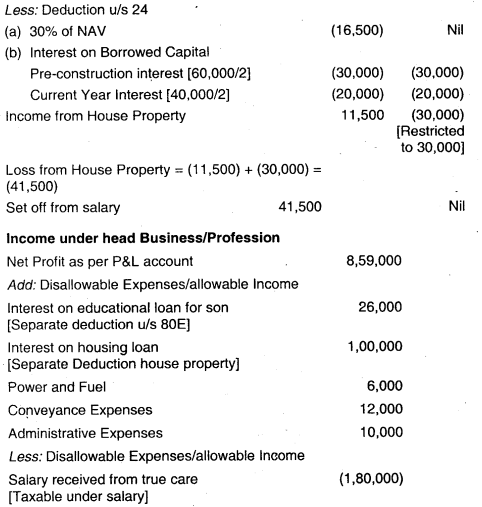

Mrs. Mitul, a resident individual, aged 63 years, is a qualified medical practitioner. She runs her own clinic. Income & Expenditure A/c of Mrs. Mitul for the year ending March 31st 2021 is asunder.

Explanatory Informations:

She is working part-time details are as under:

Further during PV. 2020-21, her son had undergone a medical treatment in True Care Hospitals (P) Ltd. free of cost. The hospital would have charged a sum of ₹ 60,000 for a similar treatment to unrelated patients.

(ii) She owns a residential house. Ground floor of the house is self-occupied by her while first floor has been rented out since 01/10/2020. The reconstruction of the house was started on 01-04-2020 and was completed on 30-09-2020. The monthly rent is 10,000. The tenant also pays ₹ 3,000 p.m. as power back-up charges. She took a housing loan of ₹ 12 lakhs on 01 -04-2020. Interest on housing loan for the period 01-04-2020 to 30-09-2020 was 60,000 and for the period 01-10-2020 to 31-03-2021 was ₹ 40.000. During the year, she also paid municipal taxes for the F.Y. 201 9-20 ₹ 5,000 and for F.Y. 2020-21 ₹ 5,000.

(iii) Other Informations:

(a) Conveyance expenses include a sum of ₹ 12,000 incurred for conveyance from house to True Care Hospitals (P) Ltd. arid vice versa in relation to her employment.

(b) Power & fuel expenses include a sum of ₹ 6,000 incurred for generator fuel for providing power back-up to the tenant.

(c) Administrative expenses include a sum of ₹10,000 paid as Municipal Taxes for her house:

(d) Clinic equipments’ details are:

Opening .W.D.V. of clinic equipments as on 01-04-2020 was ₹ 1,00,000 and fresh purchase made on 28-08-2020 is ₹ 25,000 which was paid in cash.

(e) She also paid tuition fee of ₹ 40,000 for her grand-daughter, which has been debited to her Capital A/c.

(f) She availed a loan of ₹ 8,00,000 from bank for higher education of her son. She repaid principal of ₹ 50,000 and interest of ₹ 26,000 during P.Y. 2020-21.

You are required to compute her net taxable income and net tax liability for the Assessment Year 2021 -22. (Nov 2019, 14 marks)

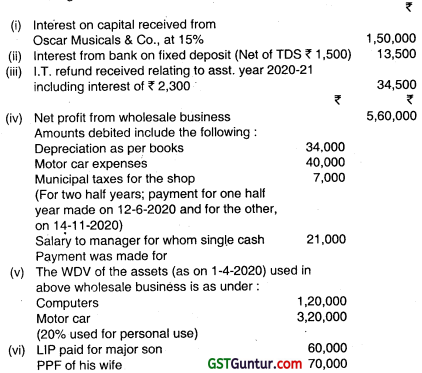

Answer:

Computation of Net taxable Income and Tax Liability of Mrs. Mitul a resident aged 63 years for the Assessment year 2021.22

Income from other Sources:

Note: Loss from house property can also be set-oft against business income. In such a case, salary income would be ₹ 1,30,000 and business income would be ₹ 6,76,000 (i.e. ₹ 7,17,500 – ₹ 41,500). Gross total income, total income and tax liability would remain the same.

If professional income is computed based on presumptive provisions under section 44ADA, her business income would be ₹ 5,58,5000 (i.e., ₹ 6,00,000 – ₹ 41,500) and salary income would be ₹ 1,30,000. Gross total income, total income and tax liability would remain the same.

![]()

Question 31.

Mr. Jagdish, aged 61 years, has set-up his business in Thailand and is residing in Thailand since last 20 years. He owns a house property in Bangkok, half of which is used as his residence and half is given on rent (such rent received, converted in INR is ₹ 6,00,000). The annual value of the house in Thailand is ₹ 50,00.000 i.e. converted value in INR. He purchased a flat in Pune during F.Y. 2016-17, which has been given on monthly rent of ₹ 27,500 since 01.07.2019. The annual property tax of Pune flat is ₹ 40,000 which is paid by Mr. Jagdish whenever he comes to India. Mr. Jagdish last visited India in July 2019. He has taken a loan from Union Bank of India for purchase of the Pune flat amounting to ₹ 15,00,000. The interest on such loan for the F.Y. 2020-2 1 was ₹ 84,000. However, interest (or March 2021 quarter has not yet been paid by Mr. Jagdish.

He had a house in Jaipur which was sold ¡n May 2015. In respect of this house he received arrear of rent of ₹ 96,000 in Feb. 2021 (not taxed earlier), He also derived some other incomes during F.Y. 2020-21 which are as follows:

Profit from business in Thailand ₹ 2,75,000

Interest on bonds of a Japanese Co ₹ 45,000 out of which 50% was received in India.

Income from Apple Orchid in Nepal given on contract and the yearly contract fee of ₹ 5,00,000, for F.Y. 2020-21 was deposited directly by the contractor in Kathmandu branch of Union Bank of India in Mr. Jagdish’s bank account maintained with Union Bank of India’s Pune Branch.

Compute the total income of Mr Jagdish for Assessment Year 2021-22 chargeable to income tax in India. (Nov 2019, 7 marks)

Answer:

Computation of Total Income of Mr. Jagdish (age 61 years) for the AY 2021-22 chargeable to tax in India

Since Mr. Jagdish is residing in Thailand for last 20 years hence he will be non-resident for AY 2020-2 1 For non-resident Indian income is chargeable to tax. As Mr. Jagdish is non-resident the house property which is situated in Bangkok, half of which is used as residence and half of which is let out the income of which is received outside India hence the house property income is not taxable in india.

The house which is situated in pune the computation is as follows:

Gross Annual Value [Lease rental is taken GAV in the absence of other information (27500*12)] = 3,30,000/-

Less: Municipal Taxes [Since payment is being made only in year in which he visited India.

He visited India on July 2018 after that no visit hence no payment is made in PV 201 9-201 = —

Net Annual Value = 330000/-

Less: Standard Deduction @30% of NAV = 99,000/-

Less: Interest on Borrowed Capital = 84000/-

Income from House Property at Pune = 1,47,000/-

Add: Arrear of rent of Jaipur property received in Feb., 2019 taxable in year of receipt

after standard deduction [96000 (-) 30% of 96000] = 67,200/-

Total Income from House Property = 2,14,200/-

Prof it from business in Thailand (Not taxable as it is foreign income) = —

Income from Other Sources:

Interest on bonds of Japanese company (50% received in india) = 22,500/-

Contract Income from apple orchid received in India taxable = 5,00,000/-

Gross Total Income = 7,36,700/-

Less: Deduction u/s 80G to 80U = Nil

Total income = 7,36,700/-

Question 32.

From the following particulars furnished by Mr. Ganesh, aged 58 years, a resident Indian for the previous year ended 31.03.2021, you are requested to compute his total income and tax liability under normal as well as special provisions (AMT), if any, applicable to him for the Assessment Year 2021-22.

(i) He occupies ground floor of his residential building and has let out first floor for residential use at an annual rent of ₹ 228,000. He has paid municipal taxes of ₹ 60,000 for the current financial year.

(ii) He owns an industrial undertaking established in a SEZ and which had commenced operation during the financial year 2018-19. Total turnover of the undertaking was ₹ 200 lakhs, which includes ₹ 140 lakhs from export turnover. This industrial undertaking fulfills all the conditions of section 10AA of the Income-Tax Act, 1961. Profit from this industry is ₹ 25 lakhs.

(iii) He receive royally of ₹ 2,88,000 from abroad for a book authored by him on the nature of artistic. The rate of royalty as 18% of value of books and expenditure made for earning this royalty was ₹ 40,000. The amount remitted to India till 30th September, 2021 is ₹ 2,30,000.

(iv) Received ₹ 40,000 as interest on saving bank deposits.

(v) Received ₹ 47,000 as share of profit from an AOP where all the members are individual and which had paid the tax by normal rates of income tax.

(vi) He also sold his vacant land on 10.11.2020 for ₹ 10 lakhs. The stamp duty value of land at the time of transfer was ₹ 14 lakhs. The FMV of the land as on 1 April, 2001 was ₹ 4 lakhs. This land was acquired by him on 5.08.1995 for ₹ 1.80 lakhs. He had incurred registration expenses of ₹ 10,000 at that time. The cost of inflation index for the year 2020-21 and 2001-02 are 301 and 100 respectively.

(vii) He paid the following amounts, out of his taxable income:

(a) Insurance premium of ₹ 39,000 paid on life insurance policy of son. who is not dependent on him.

(b) Insurance premium of ₹ 48,000 on policy of his dependent father.

(c) Tuition fees of ₹ 42,000 for his three children to a school. The fees being ₹ 14,000 p.a. per child (Nov 2020, 14 marks)

Question 33.

Mr. Krishna (aged 65 years), a furniture manufacturer, reported a profit of ₹ 5,64,44,700 for the previous year 2020-21 after debiting/crediting the following items:

Debits:

1. ₹ 20,000 paid to a Gurudwara registered u/s 80G of the income-tax Act, in cash where no cheques are accepted.

2. ₹ 48,000 contributed to a university approved and notified u/s 35(1 )(ii) to be used for scientific research.

3. Interest paid ₹ 1,67,000 on loan taken for purchase of E-vehicle on 15-05-2020 from a bank. The E-vehicle was purchased for the personal use of his wife.

4. His firm has purchased timber under a forest lease of ₹ 20,00,000 for the purpose of business.

Credits:

1. Income of ₹ 4,00,000 from royalty on patent registered under the Patent Act received from different resident clients. No TOS was needed to be deducted by any of the clients.

2. He received ₹ 3,00,000 from a debtor which was written off as bad in the year 2016-17. Amount due from the debtor (which was written off as bad) was 5,00,000, out of which tax officer had only allowed ₹ 3,00000 as deduction in computing the total income for assessment year 2017-18.

3. He sold some furniture to his brother for ₹ 7,00,000. The fair market value of such furniture was ₹ 9,00,000.

Other information:

1. Depreciation in books of accounts is computed by applying the rates prescribed under the Income tax laws.

2. Mr. Krishna purchased a new car of ₹ 12,00,000 on 1st September. 2020 and the same was put to use in the business on the same day. No depreciation for the same has been taken on car in the books of account.

3. Mr. Krishna had sold a house on 30th March, 2018 and deposited the long term capital gains of ₹ 25,00,000 in capital gain account scheme by the due date of filing return of income for that year. On 1st March, 2021, he sold another house property in which he resided for ₹ 1 crore. He earned a long term capital gain of ₹ 50,00,000 on sale of this property. On 25th March, 2021, he withdrew money out of his capital gain account and invested ₹ 1 crore on construction of one house.

4. Mr. Krishna also made the following payments during the previous year 2020-21

— Lump-sum premium of ₹ 30,000 paid on 30th March, 2021 for the

medical policy taken for self and spouse. The policy shall be effective for five years i.e. from 30th March, 2021 to 29th March, 2026.

— ₹ 8,000 paid in cash for preventive health check-up of self and spouse.

Compute the total income and tax payable by Mr. Krishna for the assessment year 2021-22. (Jan 2021, 14 marks)

Question 34.

During the previous year 2020-21. following transactions took place in respect of Mr. Raghav who is 56 years old.

(i) Mr. Aaghav owns two house properties in Mumbai. The details in respect of these properties are as under –

(ii) Mr. Raghav had a house in Delhi. During financial year 201 1-12, he had transferred the house to Ms. Vamika, daughter of his sister without any consideration. House would go back to Mr. Raghav after the life time of Ms. Vamika. The transfer was made with a condition that 10% of rental income from such house shall be paid to Mrs. Raghav. Rent received by Ms, Varriika during the previous year 2020-21 from such house property is ₹ 5,50,000.

(iii) Mr. Raghav receives following income from M/s M Pvt. Ltd. during P.Y. 2020-21 :

- Interest on Debentures of ₹ 7,50,000; and

- Salary of ₹ 3,75,000. He does not possess the adequate professional qualification commensurate with the salary received by him.

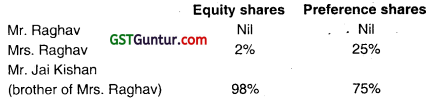

Shareholding of M/s M Pvt. Ltd. as on 31.3.2021 is as under –

(iv) Mr. and Mrs. Raghav forms a partnership firm with equal share in profits. Mr. Raghav transferred a fixed deposit of ₹ 1 crore to such firm. Firm had no income or expense other than the interest of ₹ 9,00,000 received from sud fixed deposit. Firm distributed the entire surplus to Mr. and Mrs. Raghav at the end of the year.

(v) Mr. Raghav holds preference shares in MIs K Pvt. Ltd. He instructed the company to pay dividends to Ms. Geetanshi, daughter of his servant, The transfer is irrevocable for the life time of Geetanshi. Dividend received by Ms. Geetanshi during the previous year 2020-21 is ₹ 13,00,000.

(vi) Other income of Mr. Raghav includes

- Interest from saving bank account of ₹ 2,00,000

- Cash gift of ₹ 75,000 received from daughter of his sister on his birthday.

Compute the total income of Mr. Raghav for the Assessment Year 2021-22. (Jan 2021, 8 marks)

Multiple Choice Question

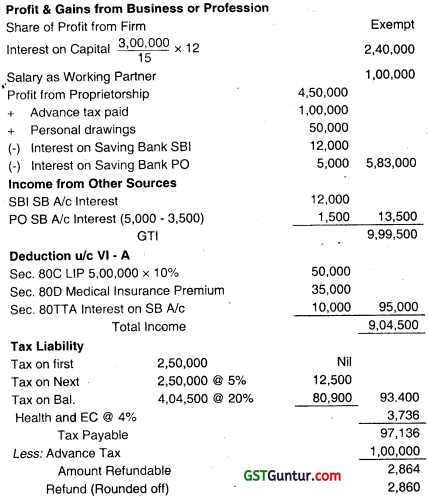

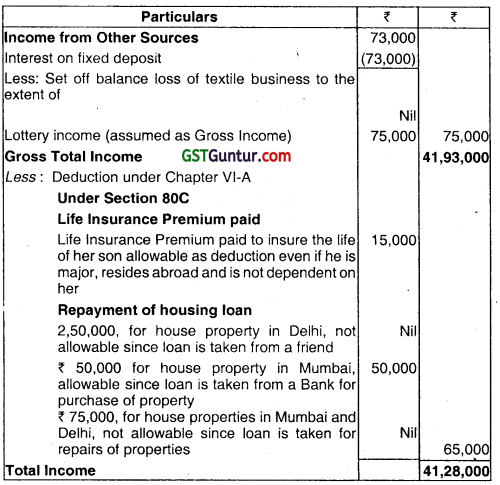

Question 1.

Correct serial of heads of income is-

(a) Salary, House, Capital gain

(b) House, Salary, Business

(c) Salary, House, Business

(d) Capital gain, Other Business.

Answer:

(c) Salary, House, Business

![]()

Question 2.

Ms. Shelvi, employed in a private sector company, furnishes following

information for the year ended 31-03-2021:

Income from Salary (computed) – 3,45,000

Saving Bank Interest – 15,000

Tax on Non-monetary perquisite paid by employer – 20,000

Amount contributed by her during the year are given below:

Contribution to recognized Provident fund – 60,000

Health Insurance Premium – on self (paid by crossed cheque) – 7,000

Medical expenditure for dependent sister with disability – 20,000

Compute the Total Income of Ms. Shelvi for the assessment year 2021-22.

(a) ₹ 2,08,000

(b) ₹ 2,63,000

(c) ₹ 2,73,000

(d) ₹ 2,33,000

Answer:

(a) ₹ 2,08,000

Question 3.

Ms. Shubhi, employed in a private sector company, furnishes following information for the year ended 31 -03-2021:

Income from Salary (computed) – 3,45,000

Saving Bank Interest – 8,000

Interest on public provident fund 20,000 Amount contributed by her during the year are given below:

Life Insurance Premium paid on her own life on policy taken on 01 -04-2020 (capital sum assured ₹ 6,00,000) – 70,000

Health Insurance Premium – on self (paid by crossed cheque) – 15,000

Repayment of housing loan along with interest in respect of self occupied house (Principal – ₹ 15,000 and interest ₹ 30,000) – 45,000

Compute the Total Income of Ms. Shubhi for the assessment year 2021-22

(a) ₹ 2,25,000

(b) ₹ 2,55,000

(c) ₹ 2,75,000

(d) ₹ 2,68,000

Answer:

(a) ₹ 2,25,000

Question 4.

If a firm is not evidenced by an instrument or if the partners shares are not determinate or if the partnership deed is not submitted along with the return of income then such firm shall be

(a) Assessed as firm but firm shall not be entitled to deduction on account of any interest or remuneration to partners.

(b) Assessed as individual.

(c) Assessed in the hands of its partners by including the share of profits in their income.

(d) Assessed as AOP.

Answer:

(a) Assessed as firm but firm shall not be entitled to deduction on account of any interest or remuneration to partners.

Question 5.

A Co-operative Society is although a body of individual but taxable at:

(a) The same rate as are applicable to individual/HUF

(b) The rates given in Schedule I of the Income-tax Act

(c) The maximum marginal rate of 30%

(d) None of the above

Answer:

(b) The rates given in Schedule I of the Income-tax Act

Question 6.

Co-operative Society means a Co-operative Society registered under:

(a) Co-operative Societies Act, 1913

(b) Co-operative Societies Act, 1921

(c) Co-operative Societies Act, 1912

(d) Co-operative Societies Act, 1914

Answer:

(c) Co-operative Societies Act, 1912

Question 7.

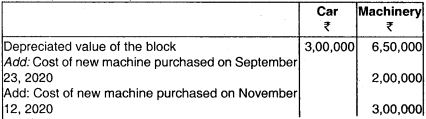

In case of AOP whose members include a foreign company, and their shares are determinate, the tax shall be charged:

(a) At the rate applicable to individuals

(b) At the maximum marginal rate

(c) At the rate applicable to the foreign company i.e. 40% + surcharge + health and education cess @ 4%

(d) On that portion or portions of income of AOP which is relatable to the share of the member which is a foreign company, the tax shall be charged @ 40% + surcharge if applicable + health and education cess @ 4% and on the balance income at the maximum marginal rate

Answer:

(d) On that portion or portions of income of AOP which is relatable to the share of the member which is a foreign company, the tax shall be charged @ 40% + surcharge if applicable + health and education cess @ 4% and on the balance income at the maximum marginal rate

![]()

Question 8.

A Society registered under the Societies Registration Act, 1860 is taxable:

(a) As AOP/BOI as per Section 167B

(b) As BOI but the tax rate shall be same as is applicable in case of an individual/HUF

(c) At special rate of tax

(d) None of the above

Answer:

(b) As BOI but the tax rate shall be same as is applicable in case of an individual/HUF

Question 9.

In computing the income under the head Profits and Gains of Business or Profession of a firm which is assessed as such, any interest paid to

any partner in excess of __________ simple interest p.a. shall be disallowed in accordance with the provisions of Section 40(b),—

(a) 6.00%

(b) 12.00%

(c) 15%

(d) 18%

Answer:

(b) 12.00%

Question 10.

If for a particular year relevant to an assessment year, the firm has incurred loss, such loss:

(a) is shared by partners and set off with their respective other income

(b) shall be carried forward by the firm only

(c) shall be either carried forward by firm or its partners

(d) None of the above

Answer:

(b) shall be carried forward by the firm only