Students should practice Budgetary Control – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Budgetary Control – Corporate and Management Accounting MCQ

Question 1.

Dec 2014: The budgeting system designed to change in relation to the level of activity actually attained is known as

(A) Fixed budgeting

(B) Flexible budgeting

(C) Performance budgeting

(D) Functional budgeting

Answer:

(B) Flexible budgeting

Question 2.

Dec 2014: From the following, which one is a functional budget

(A) Master budget

(B) Fixed budget

(C) Sales budget

(D) Current budget

Answer:

(C) Sales budget

Question 3.

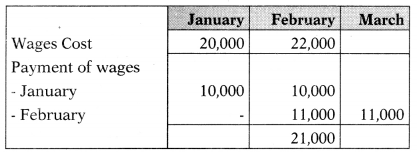

Dec 2014: The following information is available:

Wages for January: ₹ 20,000

Wages for February: ₹ 22,000

Delay in payment of wages: 1 /2 month

The amount of wages paid during the month of February is

(A) ₹ 11,000

(B) ₹ 22,000

(C) ₹ 20,000

(D) ₹ 21,000

Hint:

Answer:

(D) ₹ 21,000

Question 4.

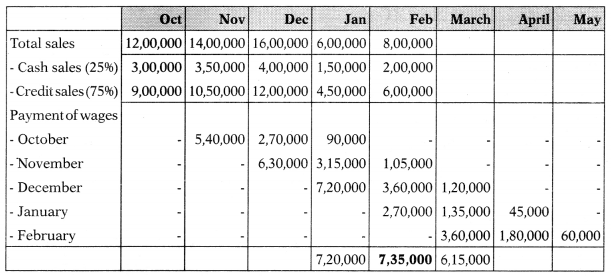

Dec 2014: In an organization, cash sales are 25% and credit sales are 75%. Sales for October, 2013 is ₹ 12,00,000, November, 2013 ₹ 14,00,000, December, 2013 ₹ 16,00,000, January, 2014 ₹ 6,00,000 and February, 2014 ₹ 8,00,000. 60% of credit sales are collected in the next month after-sales, 30% in the second month and 10% in the third month. No bad debts are anticipated. The cash collected in the month of February 2014 from debtors is

(A) ₹ 15,00,000

(B) ₹ 9,80,000

(C) ₹ 7,35,000

(D) ₹ 80,000

Hint:

Answer:

(C) ₹ 7,35,000

Question 5.

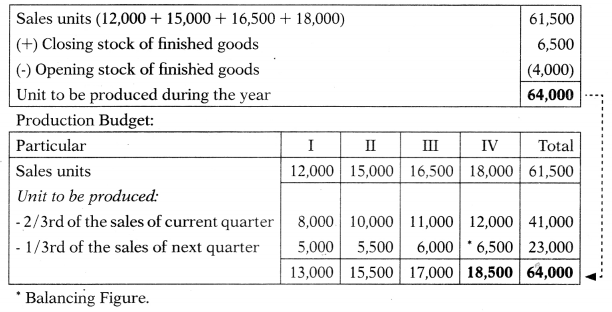

Dec 2014: ABC Ltd. produces and sells a single product. The sales budget to the calendar year 2015 for each quarter is as under:

No. of units to be sold:

Quarter-I: 12,000

Quarter-II: 15,000

Quarter-III: 16,500

Quarter-TV: 18,000

The year 2015 is expected to open with an inventory of 4,000 units of finished product and close with an inventory of 6,500 units. Production is customarily scheduled to provide for two-thirds of the current quarter’s demand plus

one-third of the following quarter’s demand. Production for Quarter-IV would be

(A) 13,500 units

(B) 15,500 units

(C) 17,000 units

(D) 18,500 units

Hint:

Answer:

(D) 18,500 units

Question 6.

Dec 2014: Under which of the following method of budgeting, all activities are re-evaluated each time a budget is set

(A) Materials budget

(B) Zero base budgeting

(C) Sales budget

(D) Overheads budget

Answer:

(B) Zero base budgeting

Question 7.

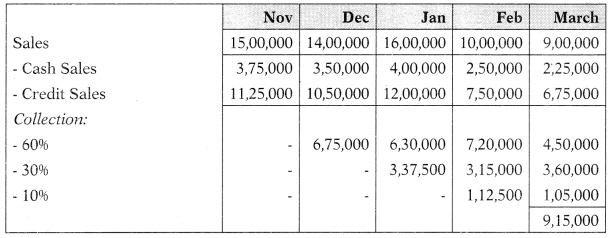

June 2015: In Rise Ltd., cash sales is 25% and credit sales 75%. Sales for November, 2014 is ₹ 15,00,000, December, 2014 ₹ 14,00,000, January, 2015 ₹ 16,00,000, February, 2015 ₹ 10,00,000 arid March, 2015 ₹ 9,00,000. 60% of the credit sales are collected in the next month after sales, 30% in the second month and 10% in the third month. No bad debts are anticipated. The cash collected – in the month of March, 2015 from debtors is

(A) ₹ 14,60,000

(B) ₹ 14,20,000

(C) ₹ 12,20,000

(D) ₹ 9,15,000

Hint:

Answer:

(D) ₹ 9,15,000

Question 8.

June 2015: A factor that limits the activities of an undertaking and which is taken into account while preparing a budget is known as

(A) Budget manual

(B) Budget controller

(C) a Budget key factor

(D) Budget centre

Answer:

(C) a Budget key factor

Question 9.

June 2015: A document that sets out the responsibility of the persons engaged in the routine of and the procedures, forms and records required for budgetary control is called

(A) Budget centre

(B) Budget report

(C) Budget controller

(D) Budget manual

Answer:

(D) Budget manual

Question 10.

June 2015: A budget that gives a summary of all the functional budgets and budgeted statement of profit and loss is called

(A) Flexible budget

(B) Master budget

(C) Performance budget

(D) Zero base budget

Answer:

(B) Master budget

Question 11.

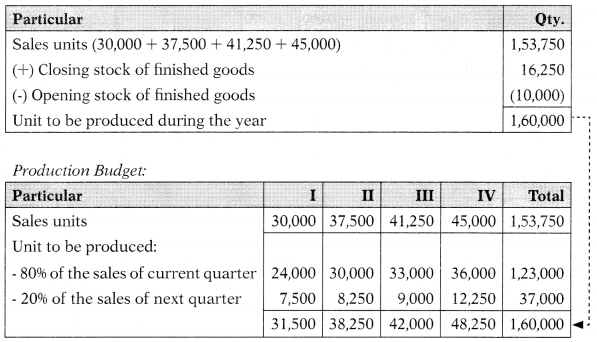

June 2015: A company estimates its quarter wise sales (in units) for the next year as under:

![]()

The opening stock of finished goods is

10,0 units and the company expects to maintain the closing stock of finished goods at 16,250 units at the end of the year. The production pattern in each quarter is based on 80% of the sales of the current quarter and 20% of the sales of the next quarter. The production for quarter IV will be

(A) 36,000 units

(B) 42,000 units

(C) 48,250 units

(D) 38,250 units

Hint:

Answer:

(C) 48,250 units

Question 12.

June 2015: Budget which remains unchanged regardless of the actual level of activity is known as –

(A) Fixed budget

(B) Functional budget

(C) Flexible budget

(D) Cash budget

Answer:

(A) Fixed budget

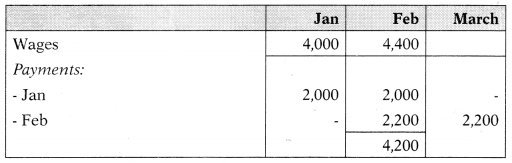

Question 13.

June 2015: Estimated wages for January is ₹ 4,000 and for February ₹ 4,400. If the delay in payment of wages is 1 /2 month, the number of wages to be considered in the cash budget for the month of February will be –

(A) ₹ 4,000

(B) ₹ 4,400

(C) ₹ 4,600

(D) ₹ 4,200

Hint:

Answer:

(D) ₹ 4,200

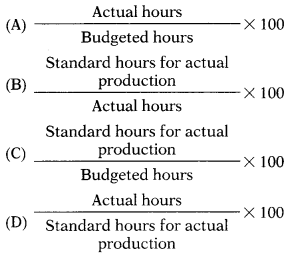

Question 14.

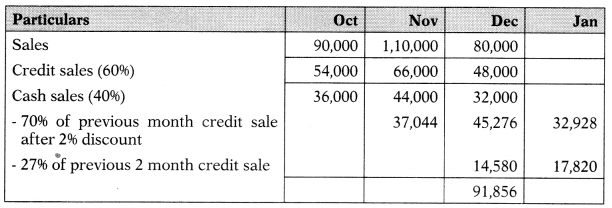

June 2015: Which of the following formulas is used to calculate efficiency ratio –

Answer:

(B)

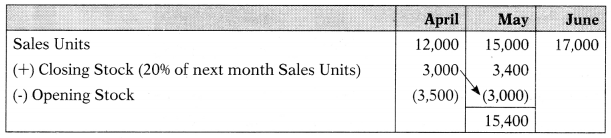

Question 15.

June 2015: Crown Ltd. has forecast its sales for the next three months as follows:

April: 12,000 units, May: 15,000 units, June: 17,000 units.

Opening stock as of 1st April is expected to be 3,500 units.

The closing stock should be equal to 20% of the coming month’s sales needs. The number of units required to be produced in May is-

(A) 14,600 units

(B) 11,500 units

(C) 15,400 units

(D) 13,600 units

Hint:

Answer:

(C) 15,400 units

Question 16.

Dec 2015: The basic difference between a static budget and a flexible budget is

(A) A static budget is based on one specific level of production and a flexible budget can be prepared for any production level within a relevant range

(B) A static budget is for an entire production, but a flexible budget is applicable only to a single department

(C) Flexible budget allows management latitude in meeting goals, whereas a static budget is based on a fixed standard

(D) A flexible budget considers only variable costs, but a static budget considers all costs

Answer:

(A) A static budget is based on one specific level of production and a flexible budget can be prepared for any production level within a relevant range

Question 17.

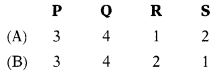

Dec 2015: Match the following:

| List-I | List-II |

| P. Performance budgeting | 1. Fixed budget |

| Q. Zero base budgeting | 2. Production oriented |

| R. Summary of all functional budgets | 3. Jimmy Carter |

| S. Remain unchanged irrespective of the level of activity actually attained | 4. Master budget |

Select the correct answer from the options given below

Answer:

(D)

Question 18.

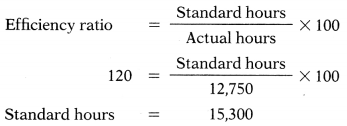

Dec 2015: X Ltd. has forecast its sales for the next three months as follows:

May: 12,000 units

June: 20,000 units

July: 25,000 units

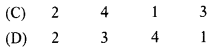

Opening stock as of 1st April is expected to be 5,000 units. The closing stock should equal 20% of the coming month’s sales needs. How many units should be produced in June

(A) 20,000 Units

(B) 11,000 Units

(C) 21,000 Units

(D) 25,000 Units

Hint:

Answer:

(C) 21,000 Units

Question 19.

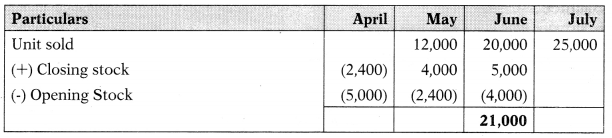

June 2016: QPR Ltd. has prepared the budget for the production of one lakh units of the only commodity manufactured by them for a costing period as follows:

| Cost elements | ₹ in lakh |

| Raw material | 252 |

| Direct labour | 75 |

| Direct expenses | 10 |

| Works overheads (60% fixed) | 225 |

| Administrative overheads (80% fixed) | 40 |

| Selling overheads (50% fixed) | 20 |

If the actual production during the period was 60,000 units, the revised budget cost per unit will be

(A) ₹ 740

(B) ₹ 800

(C) ₹ 700

(D) ₹ 840

Hint:

Answer:

(A) ₹ 740

Question 20.

June 2016: A budget in which a responsibility centre manager must justify each planned activity and its budgeted total cost is called

(A) Traditional budget

(B) Zero-based budget

(C) Master budget

(D) Functional budget

Answer:

(B) Zero-based budget

Question 21.

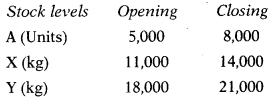

June 2016: To produce one unit of ‘A’, two ingredients, Le., 2 kg of X and 3 kg of Y are required:

What will be the quantity of consumption of ingredients X and Y, if 20,000 units of A are sold

(A) 46,000 kg & 69,000 kg respectively

(B) 49,000 kg & 72,000 kg respectively

(C) 40,000kg & 60,000 kg respectively

(D) 43,000 kg & 63,000 kg respectively

Hint:

Units produced for Product A:

Opening Stock + Units Produced – Closing Stock = Unit Sold

5,000 + x – 8,000 = 20,000 x = Units Produced = 23,000

Consumption of Input X = 23,000 × 2 = 46,000

Consumption of Input Y = 23,000 × 3 = 69,000

Answer:

(A) 46,000 kg & 69,000 kg respectively

Question 22.

June 2016: Which one of the following would not form part of the master budget

(A) Cash budget

(B) Statement of profit and loss

(C) Statement of financial position

(D) None of the above

Answer:

(D) None of the above

Question 23.

June 2016: Which one of the following is not an advantage of budgetary control?

(A) Maximization of profit through effective planning

(B) Planned approach for expenditure

(C) Create necessary conditions for setting-up of standard costs

(D) Based on quantitative data and represent only an impersonal appraisal of the conduct of the business activity

Answer:

(B) Planned approach for expenditure

Question 24.

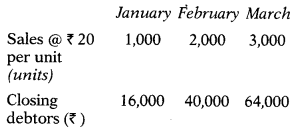

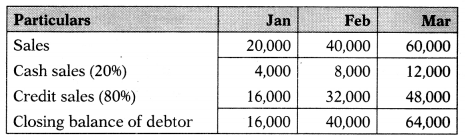

June 2016: Kriti Ltd. has provided the following information for the quarter of January to March:

20% of the sales are on a cash basis and balance on a credit basis. The amount to be collected from debtors in the month of February and March will be

(A) Zero and ₹ 8,000 respectively

(B) ₹ 8,000 & ₹ 16,000 respectively

(C) ₹ 8,000 & ₹ 24,000 respectively

(D) ₹ 16,000 & ₹ 36,000 respectively

Hint:

Amount collected from debtors = Opening Balance + Credit Sales – Closing Balance

Feb = 16,000 + 32,000 – 40,000 = 8,000

Mar = 40,000 + 48,000 – 64,000 = 24,000

Answer:

(C) ₹ 8,000 & ₹ 24,000 respectively

Question 25.

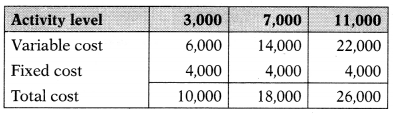

June 2016: For a department, the standard overheads rate is ₹ 2.50 per hour and the overheads allowances are as follows:

| Activity level (hours) | Budget overheads allowance (₹) |

| 3,000 | 10,000 |

| 7,000 | 18,000 |

| 11,000 | 26,000 |

Calculate the normal capacity level on the basis of which the standard overheads rate has been worked out

(A) 8,000 Hours

(B) 7,000. Hours

(C) 6,000 Hours

(D) 9,000 Hours

Hint:

Variable cost per hour = \(\frac{\text { Change in cost }}{\text { Change in hours }}=\frac{8,000}{4,000}\) = 2

Overhead rate = \(\frac{\text { Total cost }}{\text { Hours }}\)

2.5 = \(\frac{\text { Total cost }}{x}\)

2.5x = Total cost

2.5x = Fixed cost + Variable cost

2.5x = 4,000 + (x × 2)

2.5x = 4,000 + 2x

0.5x = 4,000

x = 8,000

Answer:

(A) 8,000 Hours

Question 26.

Dec 2016: The budget which usually takes the form of budgeted profit and loss account and balance sheet is known as

(A) Cash budget

(B) Master budget

(C) Flexible budget

(D) Sales budget

Answer:

(B) Master budget

Question 27.

Dec 2016: While preparing the cash budget, which of the following items would not be included

(A) Interest paid to debenture holders

(B) Salaries and wages

(C) Bonus shares issued

(D) Income-tax paid

Answer:

(C) Bonus shares issued

Question 28.

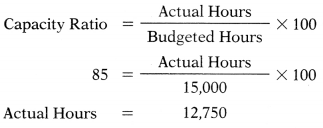

Dec 2016: Budgeted standard hours of a factory are 15,000. The capacity utilization ratio for May 2016 is 85% and the efficiency ratio for the month is 120%. The standard hours for actual production in the month will be

(A) 12,750

(B) 18,000

(C) 15,300

(D) 18,000

Hint:

Answer:

(C) 15,300

Question 29.

June 2017: A plant produces a product in the quantity of 10,000 units at a cost of ₹ 3 per unit. If 20,000 units are produced, the cost per unit will be ₹ 2.50. The selling price per unit is ₹ 4. The variable cost per unit will be:

(A) ₹ 2

(B) ₹ 3

(C) ₹ 4

(D) ₹ 1

Answer:

(A) ₹ 2

Question 30.

June 2017: When demand forecasting is difficult, the budget which is prepared:

(A) Sales Budget

(B) Production Budget

(C) Financial Budget

(D) Flexible Budget

Answer:

(D) Flexible Budget

Question 31.

June 2017: The budget which usually takes the form of profit and loss account and balance sheet is known as:

(A) Cash budget

(B) Master budget

(C) Flexible budget

(D) Labour budget

Answer:

(B) Master budget

Question 32.

June 2017: A fixed budget is one which:

(A) is a plan for capital expenditure in monetary terms

(B) is designed to remain unchanged irrespective of the volume of output or turnover attained

(C) deals with income and expenditure applicable to a particular function

(D) deals with none of these

Answer:

(B) is designed to remain unchanged irrespective of the volume of output or turnover attained

Question 33.

June 2017: One of the most significant tools in cost planning is:

(A) Direct material

(B) Budget

(C) Marginal costing

(D) Direct labour

Answer:

(B) Budget

Question 34.

June 2017: When the standard output is 10 units per hour and actual output is 14 units per hour, the efficiency level will be:

(A) 60%

(B) 120%

(C) 140%

(D) None of the above

Answer:

(C) 140%

Question 35.

Dec 2017: A short term budget, broken down into a quarterly or monthly period and reviewed and modified in the light of changing conditions is:

(A) Current Budget

(B) Flexible Budget

(C) Rolling Budget

(D) Zero Base Budget

Answer:

(B) Flexible Budget

Question 36.

Dec 2017: While preparing a flexible budget indirect wages was considered as semi-variable expenses. At 50% level of production, it was estimated as 1,50,000. If it has a tendency to increase by 10% between 60% to 75% capacity and further will increase by another 5% when production crosses 75%, the amount of indirect wages at 9096 levels of production is:

(A) ₹ 1,65,000

(B) ₹ 1,72,500

(C) ₹ 1,73,250

(D) None of the above

Hint:

1,50,000 × 110% = 1,65,000

1.65.0 × 105% = 1,73,250

Answer:

(C) ₹ 1,73,250

Question 37.

Dec 2017: The units to be sold for different months are as follows:

Jan Feb Mar April May June 1,200 1,300 1,600 2,000 2,400 3,000

There will be no WIP at the end of any month. Finished units equal to half the sales for the next month will be in stock at the end of each month. The required production in units for April will be:

(A) 2,800

(B) 2,200

(C) 2,400

(D) 3,200

Hint:

Unit sold + Closing stock – Opening stock = Unit produced

2.0 + 1,200 – 1,000 = 2,200.

Answer:

(B) 2,200

Question 38.

Dec 2017: In budgeting, there was a shift from financial classification to objective classification in respect of functions, activities etc.

(A) Programme

(B) Performance

(C) Zero base

(D) None of the above

Answer:

(B) Performance

Question 39.

June 2018 & June 2019: The budget which remains unchanged regardless of the actual level of the activity is known as:

(A) Fixed Budget

(B) Functional budget

(C) Flexible budget

(D) Cash budget

Answer:

(A) Fixed Budget

Question 40.

June 2018:____ is prepared for the estimation of plant capacity to meet the budgeted production during the budgeted period.

(A) Plant utilization budget

(B) Production budget

(C) Manufacturing overhead budget

(D) Labour budget

Answer:

(A) Plant utilization budget

Question 41.

June 2018: A flexible budget is:

(A) A budget that is designed to furnish budgeted costs at different activity levels

(B) A budget that will be changed at the end of the month in order to reflect the actual costs of a department

(C) A budget that comprises variable costs only

(D) A budget that is designed for a specific planned output level

Answer:

(A) A budget that is designed to furnish budgeted costs at different activity levels

Question 42.

June 2018: ABC Ltd. has forecast its sales for the next three months as follows:

May : 12,000 units June : 20,000 units July : 25,000 units

As per the company policy, the closing stock should be equal to 20% of the coming month’s sales forecast. How many units should be produced in June?

(A) 20,000 Units

(B) 11,000 Units

(C) 21,000 Units

(D) 25,000 Units

Hint:

Answer:

(C) 21,000 Units

Question 43.

Dec 2018:_____is a budget that, by recognizing different cost behaviour patterns, is designed to change in relation to the volume of output.

(A) Production Budget

(B) Performance Budget

(C) Zero Base Budget

(D) Flexible Budget

Answer:

(D) Flexible Budget

Question 44.

Dec 2018:_____is an operating and financial plan of a business enterprise.

(A) Forecast

(B) Budget

(C) Estimate

(D) Standard

Answer:

(B) Budget

Question 45.

Dec 2018: ____ is based on the premise that every rupee of expenditure requires justification.

(A) Zero Base Budgeting

(B) Programme Budgeting

(C) Performance Budgeting

(D) Appraisal Budgeting

Answer:

(A) Zero Base Budgeting

Question 46.

Dec 2018: Under the Balance Sheet Method of preparing a cash budget, budget is prepared on the basis of :

(A) Current year balance sheet

(B) Previous year balance sheet

(C) Forecasted balance sheet

(D) Consolidated balance sheet

Answer:

(C) Forecasted balance sheet

Question 47.

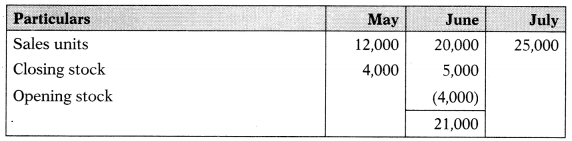

June 2019: The following information extracted from the records of P. Ltd. Sales for October, November and December 2018 is ₹ 90,000, ₹ 1,10,000 and ₹ 80,000 respectively. 40% of its sales are expected to be for cash. Of its credit sales, 70% are expected to pay in the month after-sales and take a 2% discount on it. Balance is expected to pay in second-month after-sales and 3% of it is expected to bad debts.

What are the sales receipts to be shown in the cash budget for the month of December?

(A) ₹ 92,990

(B) ₹ 1,23,174

(C) ₹ 95,609

(D) ₹ 1,25,793

Note: MCQ is wrongly drafted; for further clarification please see the hints.

Hint:

None of the options contains a figure of 91,856 and hence MCQ is wrong.

Answer:

Question 48.

June 2019: Which of the following is not a step for successful implementation of the budgetary control system?

(A) Budget manual

(B) Budget controller

(C) Budget period

(D) Budget standard

Answer:

(D) Budget standard

Question 49.

June 2019:

Assertion (A):

The purpose of performance budgeting is to focus on work to be done and services to be rendered.

Reason (R):

The main purpose of performance budgeting is not to inter-relate the physical and financial aspects of every program, project, or activity.

Select the correct answer from the options given below.

(A) Both A and R are true and R is the correct explanation of A.

(B) Both A and R are true but R is not the correct explanation of A.

(C) A is true but R is false

(D) A is false but R is true

Answer:

(C) A is true but R is false