Analysis of Financial Statements – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Analysis of Financial Statements – CA Final FR Study Material

Questions on IND AS

Question 1.

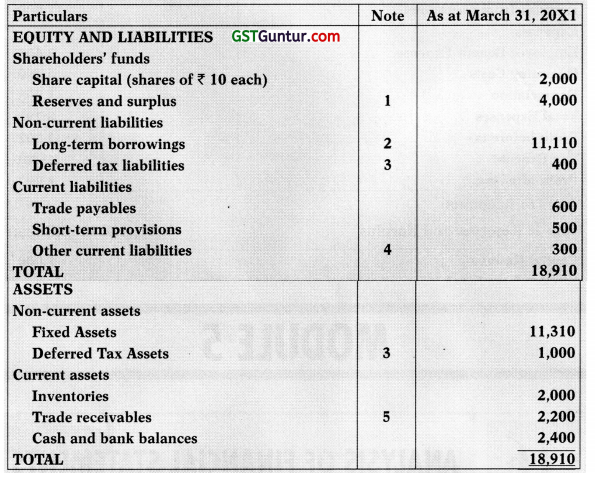

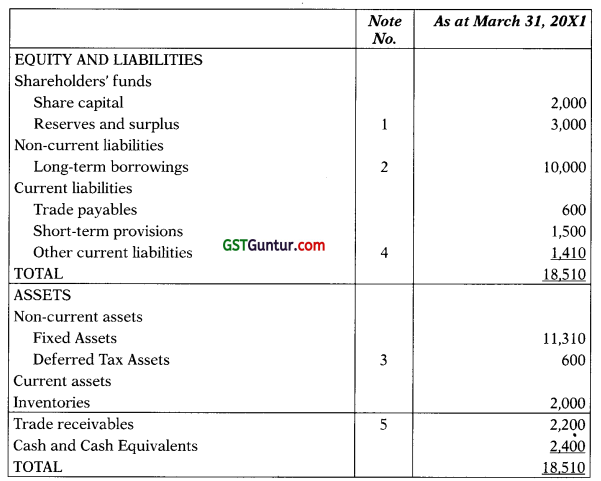

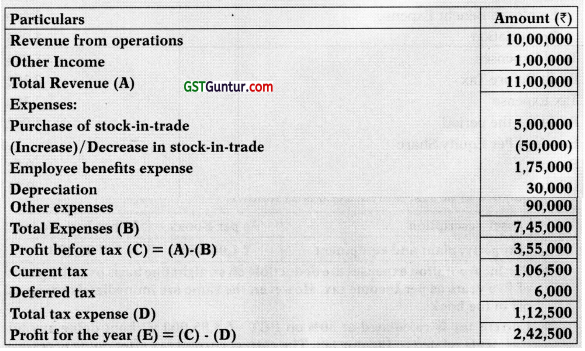

A Ltd. is an entity who prepares its financial statements based on Accounting Standards. Following is the draft financial statement for the year ended on 31st March, 20X1:

(Note all figures are ? in million)

Balance Sheet

Note 1: The Company has achieved a major breakthrough in its consultancy services in South Asia following which it has entered into a contract of rendering services with Floral Inc. for ₹ 12 Billion during the year. The termination clause of the contract is equivalent to ₹ 14 Million and is payable in case transition time schedule is missed from 15th December 20X5. The management however is of the view that the liability cannot be treated as onerous.

![]()

Note 2: The Company is not able to assess the final liability for a particular tax assessment pertaining to the assessment year 20X1-20X2 wherein it has received a demand notice of ₹ 12 Million. However, the company is contesting the same with CIT (Appeals) as on the reporting date.

Statement of Profit & Loss

Notes to Accounts:

Note 1: Reserves and Surplus (INR in millions)

Note 2: Long Term Borrowings

Additional Information:

(a) Share capital comprises of 200 million shares of ₹ 10 each

(b) Term Loan from bank for ₹ 11,110 million also includes interest accrued and due of ₹ 11,110 million as on the reporting date.

(c) Reserve for foreseeable loss is created against a service contract due within 6 months.

Required:

(i) Evaluate and report the errors and misstatements in the above extracts; and,

(ii) Prepare the corrected Balance Sheet & Statement of Profit and Loss.

Answer:

(a) On evaluation of the financial statements, following was observed:

1. For foreseeable loss provision is made and not reserves. Hence, reserve for foreseeable loss for INR 1000 million, (due within 6 months), should be a part of provision. Therefore, it needs to be regrouped. If it was also a part of previous year’s comparatives, then a note should be added in the notes to account for regrouping done this year.

2. Interest accrued and due of INR 1,110 million on term loan will be a part of current liabilities since it is supposed to be paid within 12 months from the reporting date. Hence, it should be shown under the heading “Other Current Liabilities”.

3. It can be inferred from Note 3, that the deferred tax liabilities and deferred tax assets relate to taxes on income levied by the same governing

taxation laws. Hence, these shall be set off, in accordance with AS 22. The net DTA of INR 600 million shall be shown in the balance sheet.

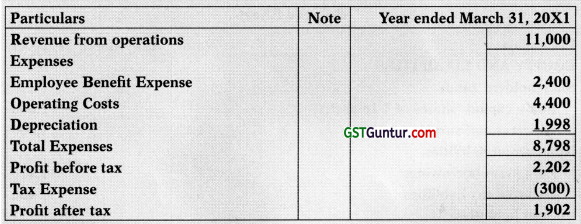

4. The note to trade receivables was incorrectly presented. The rectified note would be as follows:

5. It is common to have a termination clause in service contracts. Just by having a termination clause, a company cannot create a liability. Para 14 of AS 29 inter alia states that a provision will be recognized when an enterprise has a present obligation as a result of a past event.

![]()

Since there is nothing to show that there is a present obligation, no provision will be made.

As per para 27 of AS 29, a contingent liability is recognized only where the possibility of an outflow of resources embodying economic benefits is not remote. Since there is no onerous liability as on the reporting date, the possibility of an outflow becomes remote. Therefore, no contingent liability will arise. In fact, the management has wrongly worded it as ‘onerous liability’ in its notes to accounts. Onerous liability arises only when the unavoidable costs of meeting the obligation under the contract exceeds the economic benefits expected to be received from it. This note should be eliminated.

6. The demand notice from the tax department (that is under litigation) is a clear instance of a ‘contingent liability’. Accordingly, the note should be revised as –

Contingent Liability’:

There is a demand notice INR 12 Million, which is under CIT (Appeals) as on the reporting date.

7. The Statement to Profit and Loss needs to represent earnings per share, as per AS 20.

(b) Revised extracts of the financial statements

Balance Sheet (INR in Million)

Statement of Profit and Loss

Revised Notes (wherever applicable):

Note on Reserves and Surplus (INR in Million)

Note on Long Term Borrowings

Note on Other Current Liabilities

![]()

Question 2.

Deepak started a new company Softbharti Pvt. Ltd. with Iktara Ltd. wherein investment of 55% is done by Iktara Ltd. and rest by Deepak. Voting powers are to be given as per the proportionate share of capital contribution. The new company formed was the subsidiary of Iktara Ltd. with two directors, and Deepak eventually becomes one of the directors of company. A consultant was hired and he charged ₹ 30,000 for the incorporation of company and to do other necessary statutory registrations. ₹ 30,000 is to be charged as an expense in the books after incorporation of company. The company, Softbharti Pvt. Ltd. was incorporated on 1st April 2019.

The financials of Iktara Ltd. are prepared as per Ind AS.

An accountant who was hired at the time of company’s incorporation, has prepared the draft financials of Softbharti Pvt. Ltd. for the year ending 31st March, 2020 as follows:

Statement of Profit and Loss

Balance Sheet

Additional information of Softbharti Pvt Ltd.:

- Deferred tax liability of ₹ 6,000 is created due to following temporary difference:

Difference in depreciation amount as per Income tax and Accounting profit - There is only one property, plant and equipment in the company, whose closing balance as at 31st March, 2020 is as follows:

Asset description As per Books As per Income tax Property, plant and equipment ₹ 1,00,000 ₹ 80,000 - Pre-incorporation expenses are deductible on straight line basis over the period of five years as per Income tax. However, the same are immediately expensed off in the books.

- Current tax is calculated at 30% on PBT – ₹ 3,55,000 without doing any adjustments related to Income tax. The correct current tax after doing necessary adjustments of allowances/disallowances related to Income tax comes to ₹ 1,25,700.

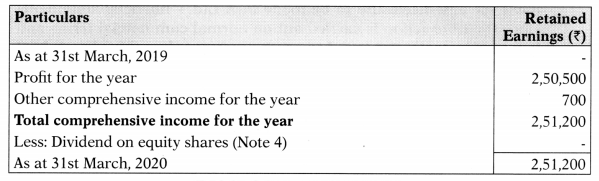

- After the reporting period, the directors have recommended dividend of ₹ 15,000 for the year ending 31st March, 2020 which has been deducted from reserves and surplus. Dividend payable of ₹ 15,000 has been grouped under ‘other current liabilities’ along-with other financial liabilities.

- There are ‘Government statutory dues’ amounting to ₹ 15,000 which are grouped under ‘other current liabilities’.

- The capital advances amounting to ₹ 50,000 are grouped under ‘Other non-current assets’.

- Other current assets of ₹ 51,000 comprise Interest receivable from trade receivables.

- Current investment of ₹ 30,000 is in shares of a company which was done with the purpose of trading; current investment has been carried at cost in the financial statements. The fair value of current investment in this case is ₹ 50,000 as at 31st March, 2020.

- Actuarial gain on employee benefit measurements of ₹ 1,000 has been omitted in the financials of Softbharti Private Limited for the year ending 31st March, 2020.

![]()

The financial statements for financial year 2019-20 have not been yet approved.

You are required to ascertain that whether the financial statements of Softbharti Pvt. Ltd. are correctly presented as per the applicable financial reporting framework. If not, prepare the revised financial statements of Softbharti Pvt. Ltd. after the careful analysis of mentioned facts and information. [RTP – November 2020]

Answer:

Note:

If IndAS is applicable to any company, then IndAS shall automatically be made applicable to all the subsidiaries, holding companies, associated companies, and joint ventures of that company, irrespective of individual qualification of set of standards on such companies.

Analysis:

In the given case it has been mentioned that the financials of Iktara Ltd. are prepared as per Ind AS. Accordingly the results of its subsidiary Softbharti Pvt. Ltd. should also have been prepared as per Ind AS. However, the financials of Softbharti Pvt. Ltd. have been presented as per accounting standards (AS).

Hence, it is necessary to revise the financial statements of Softbharti Pvt. Ltd. as per Ind AS after the incorporation of necessary adjustments mentioned in the question.

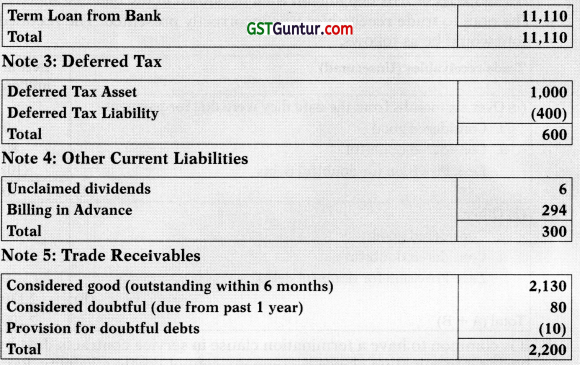

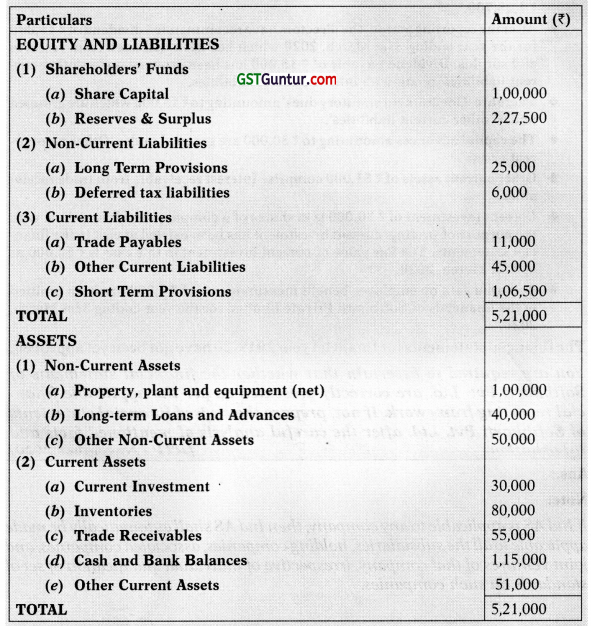

Revised financial statements of Softbharti Pvt. Ltd.

(as per Ind AS and Division II to Schedule III of the Companies Act, 2013)

STATEMENT OF PROFIT AND LOSS for the year ended 31st March, 2020

Working Note – I :

Computation of Deferred tax on temporary differences:

(as per Ind AS 12 for financial year 2019 – 2020)

| Particulars | Carrying amount (₹) | Tax base (₹) | Temporary Difference (₹) | DTA/DTL @ 30% (₹) |

| Property, Plant and Equipment Pre-incorporation expenses | 1,00,000 | 80,000 | 20,000 | 6,000 (DTL) |

| Nil | 24,000 | 24,000 | 7,200 (DTA) | |

| Net DTA | 1,200 (DTA) |

![]()

BALANCE SHEET as at 31st March, 2020

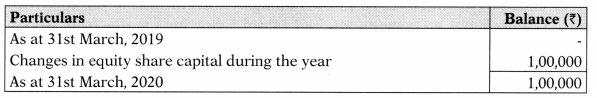

STATEMENT OF CHANGES IN EQUITY for the year ended 31st March, 2020

A. EQUITY SHARE CAPITAL

B. OTHER EQUITY (Extract)

![]()

DISCLOSURE FORMING PART OF FINANCIAL STATEMENTS:

Proposed dividend on equity shares is subject to the approval of the share-holders of the company at the annual general meeting and not recognized as liability as at the Balance Sheet date. (Note 4)

Notes:

1. Current investment are held for the purpose of trading. Hence, it is a financial asset classified as FVTPL. Any gain in its fair value will be recognized through profit or loss. Hence, ₹ 20,000 (50,000 – 30,000) increase in fair value of financial asset will be recognized in profit and loss.

2. Assets for which the future economic benefit is the receipt of goods or services, rather than the right to receive cash or another financial asset, are not financial assets.

3. Liabilities for which there is no contractual obligation to deliver cash or other financial asset to another entity, are not financial liabilities.

4. As per Ind AS 10, if dividends are declared after the reporting period but before the financial statements are approved for issue, the dividends are not recognized as a liability at the end of the reporting period because no obligation exists at that time. Such dividends are disclosed in the notes in accordance with Ind AS 1.

5. Other current financial liabilities:

![]()

Question 3.

Mr. X, is the financial controller of A Ltd., a listed entity which prepares consolidated financial statements in accordance with Ind AS. Mr. X has recently produced the final draft of the financial statements of A Ltd. for the year ended 31st March, 2018 to the managing director Mr. Y for approval. Mr. Y, who is not an accountant, had raised following queries from Mr. X after going through the draft financial statements:

(a) One of the notes to the financial statements gives details of purchases made by A Ltd. from P Ltd. during the period 2017-2018. Mr. Y owns 100% of the shares in P Ltd. However, he feels that there is no requirement for any disclosure to be made in A Ltd.’s financial statements since the transaction is carried out on normal commercial terms and is totally insignificant to A Ltd., as it represents less than 1% of ABC Ltd.’s purchases.

(b) The notes to the financial statements state that plant and equipment is held under the ‘cost model’. However, property which is owner occupied is revalued annually to fair value. Changes in fair value are sometimes reported in profit or loss but usually in ‘other comprehensive income’. Also, the amount of depreciation charged on plant and equipment as a percentage of its carrying amount is much higher than for owner occupied property. Another note states that property owned by A Ltd. but rent out to others is depreciated annually and not fair valued. Mr. Y is of the opinion that there is no consistent treatment of PPE items in the accounts.

(c) In the year to March, 2018, A Ltd. spent considerable amount on designing a new product. A Ltd. spent the six months from April, 2017 to September, 2017 researching into the feasibility of the product. Mr. X charged these research costs to profit or loss. From October, 2017, A Ltd. was confident that the product would be commercially successful and ABC Ltd. is fully committed to finance its future development. A Ltd. spent remaining part of the year in developing the product, which is expected to start from selling in the next few months. These development costs have been recognised as intangible asset in the Balance Sheet. State whether the treatment done by Mr. X is correct when all these research and development costs are design costs.

Provide answers to the queries raised by the Managing Director Mr. Y as per Ind AS.

Answer:

Ongoing through the queries raised by the Managing Director Mr. Y, the financial controller Mr. X explained the notes and reasons for their disclosures as follows:

(a) Related parties are generally characterised by the presence of control or influence between the two parties.

Ind AS 24 ‘Related Party Disclosures’ identifies related parties as, inter alia, key management personnel and companies controlled by key management personnel. On this basis, P Ltd. is a related party of A Ltd.

The transaction is required to be disclosed in the financial statements of A Ltd. since Mr. Y is Key Management personnel of A Ltd. Also at the same time, it owns 100% shares of P Ltd. Le. he controls P Ltd. This implies that P Ltd. is a related party of A Ltd.

Where transactions occur with related parties, Ind AS 24 requires that details of the transactions are disclosed in Notes to the financial statements. This is required even if the transactions are carried out on an arm’s length basis.

Transactions with related parties are material by their nature, so the fact that the transaction may be numerically insignificant to A Ltd. does not affect the need for disclosure.

![]()

(b) The accounting treatment of the majority of tangible non-current assets is governed by Ind AS 16 ‘Property, Plant and Equipment’. Ind AS 16 states that the accounting treatment of PPE is determined on a class by class basis. For this purpose, property and plant would be regarded as separate classes. Ind AS 16 requires that PPE is measured using either the cost model or the revaluation model. This model is applied on a class by class basis and must be applied consistently within a class.

Ind AS 16 states that when the revaluation model applies, surpluses are recorded in other comprehensive income, unless they are cancelling out a deficit which has previously been reported in profit or loss, in which case it is reported in profit or loss. Where the revaluation results in a deficit, then such deficits are reported in profit or loss, unless they are cancelling out a surplus which has previously been reported in other comprehensive income, in which case they are reported in other comprehensive income.

According to Ind AS 16, all assets having a finite useful life should be depreciated over that life. Where property is concerned, the only depreciable element of the property is the buildings element, since land normally has an indefinite life. The estimated useful life of a building tends to be much longer than for plant. These two reasons together explain why the depreciation charge of a property as a percentage of its carrying amount tends to be much lower than for plant.

Properties which are held for investment purposes are not accounted for under Ind AS 16, but under Ind AS 40 ‘Investment Property’. As per Ind AS 40, investment properties should be accounted for under a cost model. A Ltd. had applied the cost model and thus our investment properties are treated differently from the owner occupied property.

(c) As per Ind AS 38 ‘Intangible Assets’, the treatment of expenditure on intangible items depends on how it arose. Internal expenditure on intangible items incurred during research phase cannot be recognised as an asset. Once it can be demonstrated that a development project is likely to be technically feasible, commercially viable, overall profitable and can be adequately resourced, then future expenditure on the project can be recognised as an intangible asset. The difference in the treatment of expenditure upto 30th September, 2017 and expenditure after that date is due to the recognition phase Le. research or development phase.

![]()

Question 4.

On 1st April 2017 A Ltd. commenced joint construction of a property with G Ltd. For this purpose, an agreement has been entered into that provides for joint operation and ownership of the property. All the ongoing expenditure, comprising maintenance plus borrowing costs, is to be shared equally. The construction was completed on 30th September 2017 and utilisation of the property started on 1st January 2018 at which time the estimated useful life of the same was estimated to be 20 years.

Total cost of the construction of the property was ₹ 40 crores. Besides internal accruals, the cost was partly funded by way of loan of ₹ 10 crores taken on 1st January 2017. The loan carries interest at an annual rate of 10% with interest payable at the end of year on 31st December each year. The company has spent ₹ 4,00,000 on the maintenance of such property.

The company has recorded the entire amount paid as investment in Joint Venture in the books of account. Suggest the suitable accounting treatment of the above transaction as per applicable Ind AS.

Answer:

As provided in Ind- AS 111 – Joint Arrangements – this is a joint arrangement because two or more parties have joint control of the property under a contractual arrangement. The arrangement will be regarded as a joint operation because Alpha Ltd. and Gama Ltd. have rights to the assets and obligations for the liabilities of this joint arrangement. This means that the company and the other investor will each recognise 50% of the cost of constructing the asset in property, plant and equipment.

The borrowing cost incurred on constructing the property should under the principles of Ind AS 23 ‘Borrowing Costs’, be included as part of the cost of the asset for the period of construction.

In this case, the relevant borrowing cost to be included is ₹ 50,00,000 (₹ 10,00,00,000 × 10% × 6/12).

The total cost of the asset is ₹ 40,50,00,000 (₹ 40,00,00,000 + ₹ 50,00,000) ₹ 20,25,00,000 crores is included in the property, plant and equipment of A Ltd. and the same amount in the property, plant and equipment of G Ltd.

The depreciation charge for the year ended 31st March 2018 will therefore be ₹ 1,01,25,000 (₹ 40,50,00,000 × 1/20 × 6/12) ₹ 50,62,500 will be charged in the statement of profit or loss of the company and the same amount in the statement of profit or loss of G Ltd.

The other costs relating to the arrangement in the current year totalling ₹ 54,00,000 (finance cost for the second half year of ₹ 50,00,000 plus maintenance costs of ₹ 4,00,000) will be charged to the statement of profit or loss of A Ltd. and G Ltd. in equal proportions- ₹ 27,00,000 each.

![]()

Question 5.

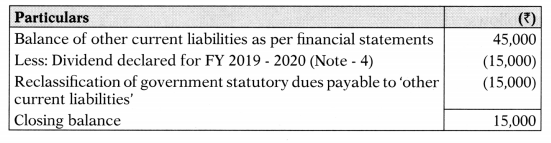

S Ltd. is a multinational entity that owns three properties. All the three properties were purchased on 1st April 2016. The details of purchase price and the market values of the properties are given as follows:

Property 1 and 2 are occupied by S Ltd., whilst property 3 is let out to a non-related party at a market rent. The management presents all three properties in balance sheet as ‘Property, plant and equipment’.

The company does not depreciate any of the properties on the basis that the fair values are exceeding their carrying amount and recognise the difference between purchase price and fair value in Statement of Profit and Loss.

Evaluate whether the accounting policies adopted by the S Ltd. in relation to these properties is in accordance of relevant Indian Accounting Standards (Ind AS). If not, advise the correct treatment along with workings.

Answer:

(i) For classification of assets

As per Ind AS 16 ‘Property, Plant and Equipment’ states that Property, plant and equipment are tangible items that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes.

As per Ind AS 40 ‘Investment property’, investment property is a property held to earn rentals or for capital appreciation or both, rather than for use in the production or supply of goods or services or for administrative purposes; or sale in the ordinary course of business.

According, to the facts given in the questions, since Property 1 and 2 are used as factory buildings, their classification as PPE is correct. However, Property 3 is held to earn rentals; hence, it should be classified as Investment Property. Thus, its classification as PPE is not correct. Property 3 shall be presented as separate line item as Investment Property as per Ind AS 1.

![]()

(ii) For valuation of assets

Ind AS 16 states that an entity shall choose either the cost model or the revaluation model as its accounting policy and shall apply that policy to an entire class of property, plant and equipment. Also, Ind AS 16 states that if an item of property, plant and equipment is revalued, the entire class of property, plant and equipment to which that asset belongs shall be revalued.

However, for investment property, Ind AS 40 states that an entity shall adopt as its accounting policy the cost model to all of its investment property. Ind AS 40 also requires that an entity shall disclose the fair value of investment property.

Since property 1 and 2 is used as factory building, they should be classified under same category or class Le. ‘factory building’. Therefore, both the properties should be valued either at cost model or revaluation model. Hence, the valuation model adopted by Stars Ltd. is not consistent and correct as per Ind AS 16.

In respect to property 3 being classified as Investment Property, there is no alternative of revaluation model i.e. only cost model is permitted for subsequent measurement. However, Stars Ltd. is required to disclose the fair value of the investment property in the Notes to Accounts.

(iii) For changes in value on account of revaluation and treatment thereof

Ind AS 16 states that if an asset’s carrying amount is increased as a result of a revaluation, the increase shall be recognised in other comprehensive income and accumulated in equity under the heading ‘revaluation surplus’. However, the increase shall be recognised in profit or loss to the extent that it reverses a revaluation decrease of the same asset pre-viously recognised in profit or loss. Accordingly, the revaluation gain shall be recognised in other comprehensive income and accumulated in equity under the heading of revaluation surplus.

![]()

(iv) For treatment of depreciation

Ind AS 16 states that depreciation is recognised even if the fair value of the asset exceeds its carrying amount, as long as the asset’s residual value does not exceed its carrying amount. Accordingly, Stars Ltd. is required to depreciate these properties irrespective of that their fair value exceeds the carrying amount.

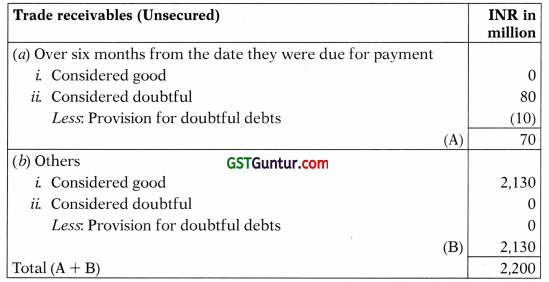

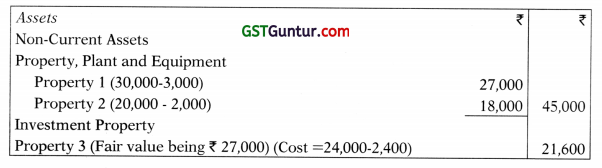

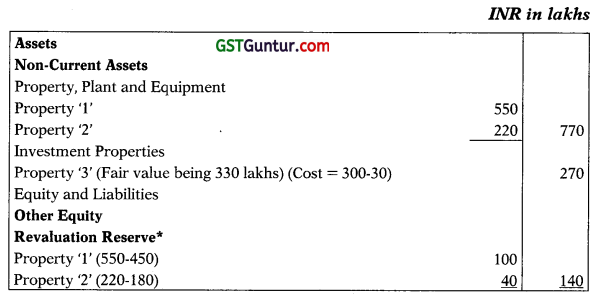

(v) Rectified presentation in the balance sheet

As per the provisions of Ind AS 1, Ind AS 16 and Ind AS 40, the presentation of these three properties in the balance sheet should be as follows:

Case 1.If S Ltd. has applied the Cost Model to an entire class of property, plant and equipment.

Balance Sheet extracts as at 31st March 2017

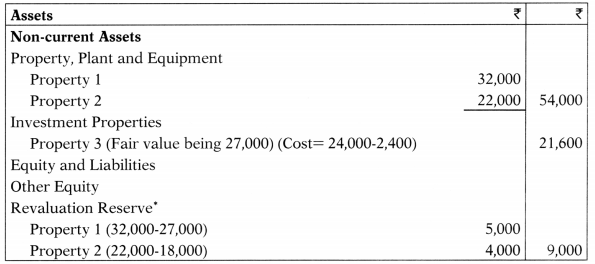

Case 2: If S Ltd. has applied the Revaluation Model to an entire class of property, plant and equipment.

Balance Sheet extracts as at 31st March 2017

* Revaluation reserve should be routed through Other Comprehensive Income (OCI) (subsequently not reclassified to Profit and Loss) in the Statement of Profit and Loss and shown as a separate column in the Statement of Changes in Equity.

![]()

Question 6.

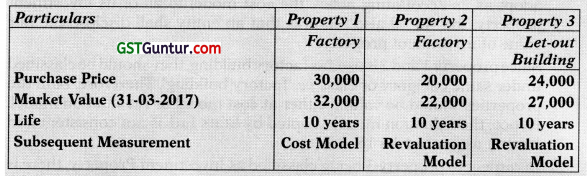

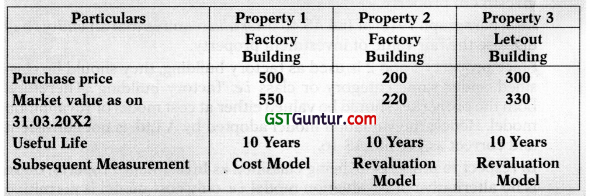

A Ltd. owns three properties which are shown in its financial statements as ‘Property, Plant and Equipment’. All three properties were purchased on April 1, 20X1. The details of purchase price and market values of the properties are given as follows: ₹ in lakhs

Property 1 and 2 are used by A Ltd. as factory building whilst property 3 is let-out to a non-related party at a market rent.

A Ltd. does not depreciate any of the properties on the basis that the fair values are exceeding their carrying amount and recognise the difference between purchase price and fair value in Statement of Profit and Loss.

Evaluate whether the accounting policies adopted by A Ltd. in relation to these properties, on various accounting aspects, are in accordance with Ind AS or not. If not, advise the correct treatment alongwith the workings for the same in all the cases.

Answer:

(i) For classification of assets

Para 6 of Ind AS 16 ‘Property, Plant and Equipment’ inter alia, states that Property, plant and equipment are tangible items are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes.

As per para 6 of Ind AS 40 ‘Investment property’, Investment property is property held to earn rentals or for capital appreciation or both, rather than for use in the production or supply of goods or services or for administrative purposes; or sale in the ordinary course of business.

According, to the facts given in the questions, since Property 1 and 2 are used as factory buildings, their classification as PPE is correct. However, Property 3 is held to earn rentals; hence, it should be classified as Investment Property. Thus, its classification as PPE is not correct. Property ‘3’ shall be presented as separate line item as Investment Property as per Ind AS 1.

![]()

(ii) For valuation of assets

Paragraph 29 of Ind AS 16 states that an entity shall choose either the cost model or the revaluation model as its accounting policy and shall apply that policy to an entire class of property, plant and equipment. Also, paragraph 36 of Ind AS 16 states that If an item of property, plant and equipment is revalued, the entire class of property, plant and equipment to which that asset belongs shall be revalued.

However, for investment property, paragraph 30 of Ind AS 40 states that an entity shall adopt as its accounting policy the cost model to all of its investment property.

Also, paragraph 79 (e) of Ind AS 40 inter alia requires that an entity shall disclose the fair value of investment property.

Since property 1 and 2 is used as factory building, they should be clas-sified under same category or class i.e. ‘factory building’. Therefore, both the properties should be valued either at cost model or revaluation model. Hence, the valuation model adopted by A Ltd. is not consistent and correct as per Ind AS 16.

In respect to property ‘3’.being classified as Investment Property, there is no alternative of revaluation model ie. only cost model is permitted for subsequent measurement. However, A Ltd. is required to disclose the fair value of the investment property in the Notes to Accounts.

(iii) For changes in value on account of revaluation and treatment thereof

Paragraph 39 of Ind AS 16 states that if an asset’s carrying amount is increased as a result of a revaluation, the increase shall be recognised in other comprehensive income and accumulated in equity under the heading ‘revaluation surplus’. However, the increase shall be recognised in profit or loss to the extent that it reverses a revaluation decrease of the same asset previously recognised in profit or loss. Accordingly, the revaluation gain shall be recognised in other comprehensive income and accumulated in equity under the heading of revaluation surplus.

(iv) For treatment of depreciation

Paragraph 52 of Ind AS 16 states that Depreciation is recognised even if the fair value of the asset exceeds its carrying amount, as long as the asset’s residual value does not exceed its carrying amount. Accordingly, A Ltd. is required to depreciate these properties irrespective of that their fair value exceeds the carrying amount.

![]()

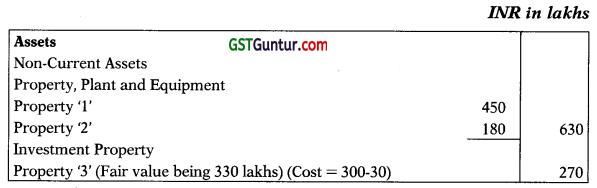

(v) Rectified presentation in the balance sheet

As per the provisions of Ind AS 1, Ind AS 16 and Ind AS 40, the presentation of these three properties in the balance sheet should be as follows:

Case 1.If A Ltd. has applied the Cost Model to an entire class of property, plant and equipment.

Balance Sheet extracts as at 31st March 20X2

Case 2: If A Ltd. has applied the Revaluation Model to an entire class of property, plant and equipment.

Balance Sheet extracts as at 31st March 20X2

* * The revaluation reserve should he routed through Other Comprehensive Income (OCI) (subsequently not reclassified to Profit and Loss) in the Statement of Profit and Loss and shown as a separate column in Statement of Changes in Equity.

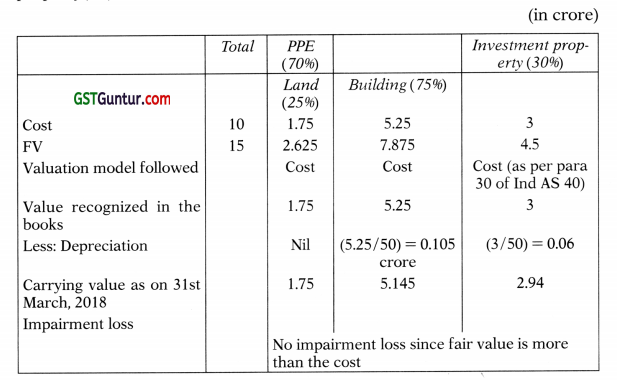

Question 7.

U Ltd. has purchased a new head office property for ₹ 10 crores. The new office building has 10 floors and the organisation structure of U Ltd. is as follows:

tableee

Since UK Ltd. did not need the floors 8, 9 and 10 for its business needs, it has leased out the same to a restaurant on a long-term lease basis. The terms of the lease agreement are as follows:

- Tenure of Lease Agreement – 5 Years

- Non-Cancellable Period – 3 years

- Lease Rental-annual lease rental receivable from these floors are ₹ 10,00,000 per floor with an escalation of 5% every year.

Based on the certificate from its architect, U Ltd. has estimated the cost of the 3 top floors as approximately ₹ 3 crores. The remaining cost of ₹ 7 crores can be allocated as 25% towards Land and 75% towards Building.

As on 31st March, 2018, U Ltd. obtained a valuation report from an independent valuer who has estimated the fair value of the property at ₹ 15 crores. U Ltd. wishes to use the cost model for measuring Property, Plant & Equipment and the fair value model for measuring the Investment Property. U Ltd. depreciates the building over an estimated useful life of 50 years, with no estimated residual value.

Advise U Ltd. on the accounting and disclosures for the above as per the applicable Ind AS.

Answer:

Ind AS 16 ‘Property, Plant and Equipment’ states that property, plant and equipment are tangible items that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes.

As per Ind AS 40 ‘Investment property’, investment property is a property held to earn rentals or for capital appreciation or both, rather than for use in the production or supply of goods or services or for administrative purposes or sale in the ordinary course of business.

Further, as per para 8 of Ind AS 40, the building owned by the entity and leased out under one or more operating leases will be classified as investment property.

![]()

Here top three floors have been leased out for 5 years with a non-cancellable period of 3 years. The useful life of the building is 50 years. The lease period is far less than the useful life of the building leased out. Further, the lease rentals of three years altogether do not recover the fair value of the floors leased i.e. 15 crore × 30% = 4.50 crore. Hence the lease is an operating lease. Therefore, the 3 floors leased out as operating lease will be classified as investment property in the books of lessor i.e. U Ltd.

However, for investment property, Ind AS 40 states that an entity shall adopt as its accounting policy the cost model to all of its investment property. Ind AS 40 also requires that an entity shall disclose the fair value of such investment property(ies).

Question 8.

On April 1, 20X1, P Ltd. has advance a loan for ₹ 10 lakhs to one of its employees for an interest rate at 4% per annum (market rate 10%) which is repayable in 5 equal annual instalments along with interest at each year end. Employee is not required to give any specific performance against this benefit.

The accountant of the company has recognised the staff loan in the balance sheet equivalent to the amount disbursed i.e. ₹ 10 lakhs. The interest income for the period is recognised at the contracted rate in the Statement of Profit and Loss by the company i.e. ₹ 40,000 (₹ 10 lakhs × 4%).

Analyse whether the above accounting treatment made by the accountant is in compliance with the Ind AS. If not, advise the correct treatment alongwith working for the same.

Answer:

The above treatment needs to be examined in the light of the provisions given in Ind AS 32 and Ind AS 109 on Financial Instruments’ and Ind AS 19 ‘Employee Benefits’.

The Accountant of P Ltd. has recognised the staff loan in the balance sheet at ₹ 10 lakhs being the amount disbursed and ₹ 40,000 as interest income for the period is recognised at the contracted rate in the statement of profit and loss which is not correct and not in accordance with Ind AS 19, Ind AS 32 and Ind AS 109.

Accordingly, the staff advance being a financial asset shall be initially measured at the fair value and subsequently at the amortised cost. The interest income is calculated by using the effective interest method. The difference between the amount lent and fair value is charged as Employee benefit expense in statement of profit and loss.

![]()

(a) Calculation of Fair Value of the Loan

| Year | Cash Inflow | Discounting Factor (10%) | Present Value |

| 1 | 2,40,000 | 0.909 | 2,18,160 |

| 2 | 2,32,000 | 0.826 | 1,91,632 |

| 3 | 2,24,000 | 0.751 | 1,68,224 |

| 4 | 2,16,000 | 0.683 | 1,47,528 |

| 5 | 2,08,000 | 0.621 | 1,29,168 |

| Total | 8,54,712 |

Staff loan should be initially recorded at ₹ 8,54,712.

![]()

(b) Employee Benefit Expense

Loan Amount – Fair Value of the loan = ₹ 10,00,000 – ₹ 8,54,712 = ₹ 1,45,288

₹ 1,45,288 shall be charged as Employee Benefit expense in Statement of Profit and Loss for the year ended 31.03.20X2.

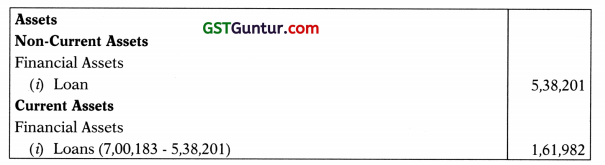

Amortisation table:

| Year | Opening balance of Staff Advance (a) | Interest (10%) (b) = (ax 10%) | Repayment (c) | Closing balance of Staff Advance (d) = a + b – c |

| 1 | 8,54,712 | 85,471 | 2,40,000 | 7,00,183 |

| 2 | 7,00,183 | 70,018 | 2,32,000 | 5,38,201 |

| 3 | 5,38,201 | 53,820 | 2,24,000 | 3,68,021 |

| 4 | 3,68,021 | 36,802 | 2,16,000 | 1,88,823 |

| 5 | 1,88,823 | 19,177 (b.f.) | 2,08,000 | Nil |

Balance Sheet extracts showing the presentation of staff loan as at 31st March 20X2

Ind AS compliant Division II of Schedule III needs to be referred for presentation requirement in Balance Sheet on Ind AS.

Though not in course but question has been asked in Nov. 2019 also.