Profits and Gains from Business or Profession – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Profits and Gains from Business or Profession – CA Inter Taxation Study Material

Introduction

Question 1.

State with reason, whether the following statements are true, or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment year 2021-22: [Nov. 2008, 2 Marks]

(a) Rural branches of the Cooperative banks are not allowed to claim provision for bad and doubtful debts.

(b) Depreciation is allowed only when it is claimed.

Answer:

(a) The Statement is false.

Section : 36(1) (viiia)

Explanation :

The Cooperative Bank can claim deduction for bad and doubtful debts in respect of advances made by rural branches of such bank subject to max. 10% of aggregate average advances made and computed in prescribed manner.

(b) The Statement is false

Section : 32

Explanation :

- Of depreciation shall be made compulsorily

- Whether or not the assessee

- Has claimed the deduction in computing his total income

- But it is compulsorily deducted to compute next year opening WDV

![]()

Question 2.

Answer the following with regard to the provisions of the Income-tax Act, 1961:

Can an Assessing Officer make a request for withdrawal of approval which was granted to an institution by National committee for carrying out eligible project or scheme, eligible u/s 35AC of the Income-tax Act, 1961? [Nov. 2008, 4 Marks]

Answer:

Section : 35AC-Expenditure on eligible projects or scheme

Explanation :

If a few conditions are satisfied then approval can be withdrawn

Contribution to institution is qualified for deduction

- Even if after the date of making contribution, the approval granted to the institution is withdrawn.

- The benefit of deduction under section 35AC of the IT Act is available only up to previous year ending 31-3-2017 (assessment year 2017-18) in respect of payments made to association or institution already approved by the national committee for carrying out any eligible project or scheme.

- In view of the above, it may be noted that requests received after 31-12-2016 for the grant/modification/ extension of approval beyond 31-3-2017 under section 35AC of the Income-tax Act shall not be considered/ entertained by the national committee.

![]()

Question 3.

Answer the following questions with regard to the Provisions of the Income-tax Act, 1961:

State the concessions granted to transport operators from 1st October 2010 onwards in the context of cash payments under section 40A(3) and deduction of tax at source under section 194C. [May 2010, 4 Marks]

Answer:

Section : 40A(3)

Explanation :

- Where the assessee incurs any expenditure in respect of which a payment or aggregate of payments made to a person in a day otherwise than by an account payee cheque drawn on a bank or account payee bank draft or use of electronic clearing system through a bank account exceeds ₹ 20,000 (₹ 10,000 on or after 01.04.2017) no deduction shall be allowed in respect of such expenditure.

- With effect from 01.10.2009, in case of payment made for plying, hiring or leasing goods carriage, section 40A(3) and 40A(3A) shall be applicable if such amount paid exceeds ₹ 35,000 instead of 20,000 (10,000 on or after 01.04.2017).

Section : 194C

Explanation :

No deduction is required to be made.

- From any sum credited or paid or likely to be credited or paid during the previous year.

- To the account of a contractor.

- During the course of the business of plying, hiring or leasing goods carriages.

- If the contractor furnishes his permanent account number (PAN) to the person paying or crediting such sum.

![]()

Question 4.

State any four of the specified businesses eligible for deduction under section 35AD of the Income-tax Act, 1961. [Nov. 2011, 4 Marks]

Answer:

Four of the specified businesses eligible for deduction under section 35AD of the Income-tax Act, 1961.

| S.No. | Particulars | |

| 1 | Setting up and operating a warehousing facility for storage of agricultural produce. | |

| 2 | Laying and operating a cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being an integral part of such network. | |

| 3 | Setting up and operating a cold chain facility. | |

| 4 | The business of building and operating anywhere in India, a hotel of two- star or above category, as classified by the Central Government. | |

![]()

Question 5.

Name any four specified businesses covered under section 35AD and state the fiscal incentives available to such businesses. [Nov. 2014, 4 Marks]

Answer:

Four of the specified businesses eligible for deduction under section 35AD of the Income-tax Act, 1961.

| S.No. | Particulars |

| 1 | Setting up and operating a warehousing facility for storage of agricultural produce. |

| 2 | Laying and operating a cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being an integral part of such network. |

| 3 | Setting up and operating a cold chain facility. |

| 4 . | The business of building and operating anywhere in India, a hotel of two- star or above category, as classified by the Central Government. |

Fiscal Incentives Available To Such Businesses.

| S.No. | Particulars |

| 1 | Capital expenditure incurred in the previous year, wholly and exclusively for specified business (including capital expenditure incurred before commencement of operations and capitalized in the books of account on the date of commencement of operations) will be allowed as deduction from the business income, but expenditure incurred on acquisition of any land, goodwill or financial instrument would not be eligible for deduction. |

| 2 | 100% of capital expenditure is allowed as deduction. |

| 3 | As per Section 73 A, the loss from specified business can be carried forward indefinitely to set-off against profits of the same or any other specified business. It is not essential that the return of income should be filed within the time specified under section 139(1) for carrying forward such losses. |

![]()

Question 6.

Sai Ltd. has a block of assets carrying 15% rate of depreciation, whose written down value on 01.04.2020 was ₹ 40 lacs. It purchased another asset of the same block on 01.11.2020 for ₹ 14.40 lacs and put to use on the same day. Sai Ltd. was amalgamated with Shirdi Ltd. with effect from 01.01.2021. You are required to compute the depreciation allowable to Sai Ltd. & Shirdi Ltd. for the previous year ended on 31.03.2021 assuming the assets transferred to Shirdi Ltd. at ₹ 60 lacs. [Nov. 2010, 8 Marks]

Answer:

Computation of Depreciation to be apportioned between amalgamating company Sai Limited and Amalgamated Company Shirdi Limited for previous year ending on 31.03.2021 (Assessment Year 2021-22)

| Calculation of Total Depreciation for Previous Year | |

| Particulars | Amount (₹) |

| Depreciation on ₹ 40,00,000 for full year @15% p.a. | 6,00,000 |

| Depreciation on ₹ 14,40,000 for half year @15% p.a. | 1,08,000 |

| Total amount of Depreciation | 7,08,000 |

Apportionment of Total Depreciation between Both Companies

| Particulars | Amount (₹) | Amount (₹) |

| Amalgamation Company Sai Limited (01.04.2020 to 31.12.2020) = 275 days | ||

| 7,08,000 × 275/365 | 5,33,425 | |

| Amalgamated Company Shirdi Limited (01.01.2021 to 31.03.2021) 90 days | ||

| 7,08,000 × 90/365 | 1,74,575 | |

| Total Depreciation | 7,08,000 |

![]()

Question 7.

Mr. Praveen Kumar has furnished the following particulars relating to payments made towards scientific research for the year ended 31-3-2021

| s.No. | Particulars | Amount (₹ in Lakhs) |

| 1 | Payments made to K Research Ltd. | 20 |

| 2 | Payment made to LMN College | 15 |

| 3 | Payment made to OPQ College | 10 |

| 4 | Payment made to National Laboratory | 8 |

| 5 | Machinery purchased for in-house scientific research | 25 |

| 6 | Salaries to research staff engaged in in-house scientific research | 12 |

Note: K Research Ltd. and LMN College are approved institutions and these payments’ are to be used for the purposes of scientific research. Compute the amount of deduction available under section 35 of the Income- tax Act, 1961 while arriving at the business income of the assessee. [May 2011, 4 Marks]

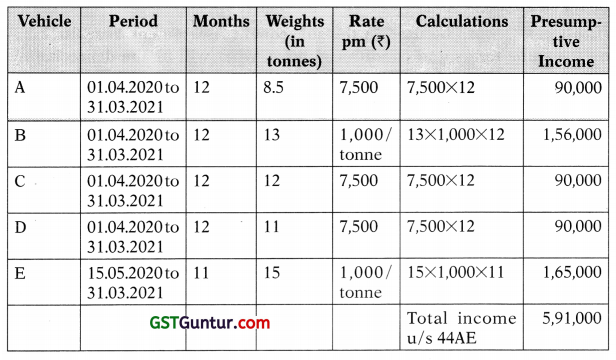

Answer:

Computation of deductions from business income under section 35 of the Income-tax Act 1961

![]()

Question 8.

Harish Jayaraj Pvt. Ltd. is converted into Harish Jayaraj LLP on 1-1-2021.

The following particulars are available to you:

| S. No. | Particulars | Amount (₹) |

| 1 | WDV of land as on 1-4-2020 | 5,00,000 |

| 2 | WDV of machinery as on 1-4-2020 | 3,3,30,000 |

| 3 | Patents acquired on 1-6-2020 | 3,00,000 |

| 4 | Building acquired on 12-3-2019 for which deduction was allowed under Section 35AD. | 7,00,000 |

| 5 | Above building was revalued as on the date of conversion into LLP as | 12,00,000 |

| 6 | Unabsorbed business loss as on 1-4-2020 AY. 2017-18 | 9,00,000 |

Though the conversion into LLP took place on 1-1-2021, there was disruption of business and the assets were put into use by the LLP only from 1st March, 2021 onwards. The company earned profits of ₹ 8 lacs, prior to computation of depreciation. Assuming that the necessary conditions laid down in Section 47(xiiib) of the Income-tax Act, 1961 have been complied with. Explain the tax treatment of the above in the hands of the LLP. [May 2011, 8 Marks]

Answer:

Computation of Apportionable Depreciation

| Asset | Particulars about Computation | Amount of Apportionable Depreciation (₹) |

| Land | Land is not a depreciable asset | NIL |

| Machinery | 330000 × 15/100 | 49,500 |

| Patents | 330000 × 25/100 | 75,000 |

| Building | Eligible for 100% deduction in the year of purchase | NIL |

| Total Apportionable Depreciation | 1,24,500 |

![]()

Question 9.

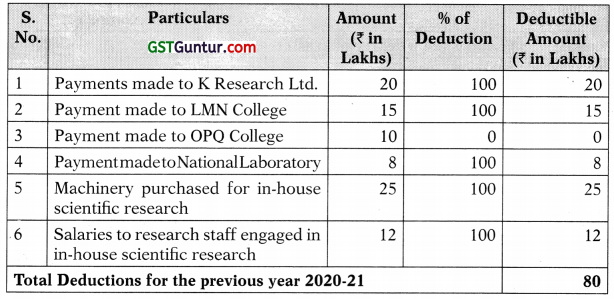

Rao and Jain, a partnership firm consisting of two partners, reports a net profit of 7,00,000 before deduction of the following items:

- Salary of ₹ 20,000 each per month payable to two working partners of the firm (as authorized by the deed of partnership),

- Depreciation on plant and machinery under section 32 (computed) ₹ 1,50,000,

- Interest on capital at 15% per annum (as per the deed of partnership), the amount of capital eligible for interest ₹ 5,00,000.

Compute:

(i) Book-profit of the firm under Section 40(b) of the Income-tax Act, 1961.

(ii) Allowable working partner salary for the assessment year 2021-22 as per Section 40(b) of the Income-tax Act, 1961. [Nov. 2011, 5 Marks]

Answer:

Computation of Profit and Gains from Business and Profession for the Assessment Year 2021-22

![]()

Question 10.

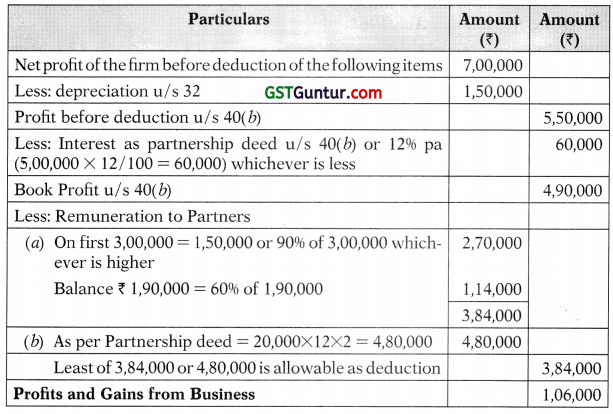

Ramji Ltd., engaged in manufacture of medicines (pharmaceuticals) furnishes the following information for the year ended 31.03.2021:

| S. No | Particulars |

| i | Municipal tax relating to office building ₹ 51,000 not paid till 30.09.2021. |

| 2 | Patent acquired for ₹ 20,00,000 on 01.09.2020 and used from the same month |

| 3 | Capital expenditure on scientific research ₹ 10,00,000 which includes cost of land ₹ 2,00,000 |

| 4 | Amount due from customer X outstanding for more than 3 years written off as bad debt in the books ₹ 5,00,000. |

| 5 | Income tax paid ₹ 90,000 by the company in respect of non-monetary perquisites provided to its employees. |

| 6 | Provident fund contribution of employees ₹ 5,50,000 remitted in July 2021. |

| 7 | Expenditure towards advertisement in souvenir of a political party ₹ 1,50,000. |

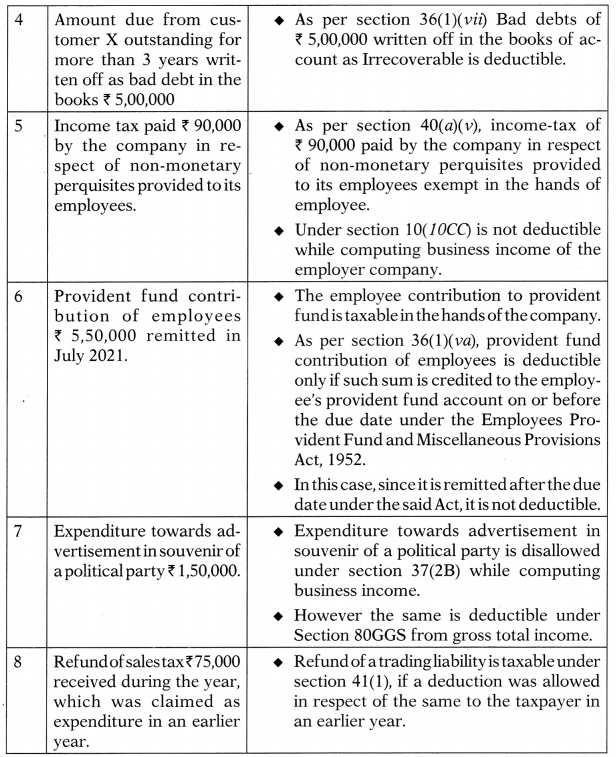

| 8 | Refund of sales tax ₹ 75,000 received during the year, which was claimed as expenditure in an earlier year. |

State with reasons the taxability or deductibility of the items given above under the Income-tax Act, 1961.

Note: Computation of total income is not required. [Nov. 2011, 8 Marks]

Answer:

![]()

Question 11.

MNP Ltd. commenced operations of the business of a new four-star hotel in Chennai on 1-4-2020. The company incurred capital expenditure of ₹ 40 lakh during the period January, 2020 to March, 2020 exclusively for the above business, and capitalized the same in its books of account as on 1st April, 2020.

Further, during the Previous Year 2020-21, it incurred capital expenditure of ₹ 2.5 crore (out of which 1 crore was for acquisition of land) exclusively for the above business.

Compute the income under the heading “profits and gains of business or profession” for the assessment year 2021-22, assuming that MNP Ltd. has fulfilled all the conditions specified for claim of deduction under Section 35AD and has not claimed any deduction under Chapter VI-A under the heading “C:-Deductions in respect of certain incomes”.

The profits from the business of running this hotel (before claiming deduction under Section 35AD) for the Assessment Year 2021-22 is ₹ 80 lakhs.

Assume that the company also has another existing business of running a four-star hotel in Kanpur, which commenced operations 6 years back, the profits from which was ₹ 130 lakhs for assessment year 2021-22. [May 2012, 8 Marks]

Answer:

Computation of Income from Business or profession for the Assessment Year 2021-22

| Particulars | Amount (₹ in Lakhs) | Amount (₹ in Lakhs) |

| Income from Four Star Hotel in Chennai | 80 | |

| Less: Eligible deductions under section 35AD | ||

| (a) Prior Period expenditure is | 40 | |

| (b) Capital Expenditure (₹ 250 Lakhs – 100 Lakhs) | 150 | 190 |

| Total Loss from Four Star Hotel in Chennai | (110) | |

| Income from four star hotel in Kanpur (It is specified business) | 130 | |

| Income from Business or profession | 20 |

Note:

- As Per Section 73A, Loss can be set of only against the income from any Specified Business. Chennai business loss is eligible.

- Expenditure relating to acquisition of Land is not allowable as deduction u/s 35AD.

![]()

Question 12.

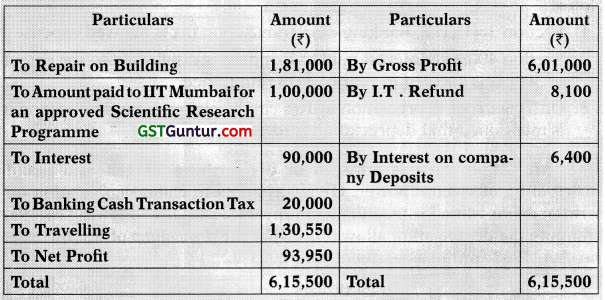

Following is the profit and loss account of Mr. Q for the year ended 31-03-2021

Following additional informations are furnished:

(1) Repairs on building includes ₹ 1,00,000 being cost of laying a toilet roof.

(2) Interest payments include ₹ 50,000 paid to a Resident on which TDS has not been deducted and penalty for contravention of Central Sales Tax Act of ₹ 24,000.

Compute the income chargeable under the head “Profits and gains of Business or Profession” of Mr. Q for the year ended 31-03-2021 ignoring depreciation. [Nov. 2012, 8 Marks]

Answer:

Computation of Income from Business or profession for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Net Profit as per Profit and Loss Account | 93,950 | |

| Add. | ||

| 1. Current Repair of Capital nature of the Building | 1,00,000 | |

| 2. Interest paid to Resident without deduction of tax at source (Note f) | 15,000 | |

| 3. Penalty in contravention of Central Sales Tax Act | 24,000 | 1,39,000 |

| Less: | ||

| 1. Amount paid to IIT for Scientific Programme | 50,000 | |

| 2. Income tax refund – not an Income | 8,100 | |

| 3. Interest on Company Deposit – Other sources income | 6,400 | (64,500) |

| Profits and Gains of Business or Profession | 1,68,450 |

Notes:

- Section 36(1)(xiii), Banking cash transaction tax is allowed expense.

- Section 40(a)(ia) Interest paid to Resident is disallowed to the extent of 30%. It is allowed in year of TDS remittance.

- On Toilet roof depreciation at 10% can be claimed. But in question it is mentioned that depreciation is to be ignored.

![]()

Question 13.

Mr. Abhimanyu is engaged in the business of generation and distribution of electric power. He always opts to claim depreciation on written down value for income-tax purposes. From the following details, compute the depreciation allowable as per the provisions of the Income- tax Act, 1961 for the assessment year 2021-22: [Nov. 2013, 4 Marks]

| S. No. | Particulars | Amount (₹ in Lacs) |

| 1 | Opening WDV of block (15% rate) | 42 |

| 2 | New machinery purchased on 12-10-2020 | 10 |

| 3 | Machinery imported from Colombo on 12-4-2020. This machine had been used only in Colombo earlier and the assessee is the first user in India. | 9 |

| 4 | New computer installed in generation wing of the unit on 15-7-2020 | 2 |

Answer:

Computation of Depreciation allowable under section 32

| Block 1 (15%) | Block 2 (40%) | |

| Particulars | Amount (₹) | Amount (₹) |

| Opening written down value on 01.04.2020 | 42,00,000 | 0 |

| Add: Additions made during the year | ||

| Second hand Machinery imported from Colombo (02.04.2020) | 9,00,000 | |

| New Machinery (12.10.2020) | 10,00,000 | |

| New Computer Installation (15.07.2020) | 2,00,000 | |

| Value of block before depreciation (A) | 61,00,000 | 2,00,000 |

| Less: Depreciation for the year | ||

| Normal Depreciation for the whole year | ||

| Block 1: [(42,00,000 + 9,00,000) × 15%] = 7,65,000 | (7,65,000) | |

| Block 2: [(2,00,000) × 40%] = 80,000 | (80,000) | |

| Depreciation on new machinery put use for less than 180 days on Plant 1: [(10,00,000 × 15%X50%)] = 75,000″ | (75,000) | |

| Additional Depreciation on New Machinery (Note 1) [(10,00,000 × 20% × 50%)] = 1,00,000 | (1,00,000) | |

| Total Depreciation u/s 32(B) | (9,40,000) | (80,000) |

| Closing written down value on 31.03.2021 | 51,60,000 | 1,20,000 |

Notes:

- Balance 50% of additional depreciation can be carried forward to next assessment year 2022-23.

- Additional Depreciation is allowed only for Plant and Machinery. It is not applicable for computer and second hand machinery.

![]()

Question 14.

JK Ltd., a manufacturing company purchased the following New Plant and Machinery:

| Date of Acquisition and Installation | Actual Cost (in ₹ Crores) |

| 25.05.2020 | 10 |

| 31.10.2020 | 22 |

From the above information compute the amount of depreciation available u/s 32, additional depreciation, if any and deduction u/s 32AC for the Assessment Year 2021-22. [Modified May 2014, 8 Marks]

Answer:

Computation of Depreciation allowable under section 32

| Particulars | Amount (₹ in Crore) | Amount (₹ in Crore) |

| New Plant and Machinery acquired | 32.00 | |

| Depreciation for previous year 2020-21 @15% of 10 crore | 1.50 | |

| Depreciation for previous year 2020-21 @7.5% of 22 crore | 1.65 | |

| Additional Depreciation @20% of 10 Crore | 2.00 | |

| Additional Depreciation @10% of 22 Crore | 2.20 | 7.35 |

| Closing written down value on 31.03.2021 | 24.65 |

![]()

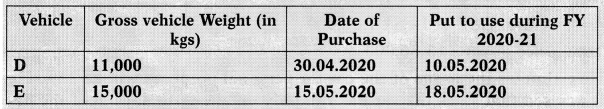

Question 15.

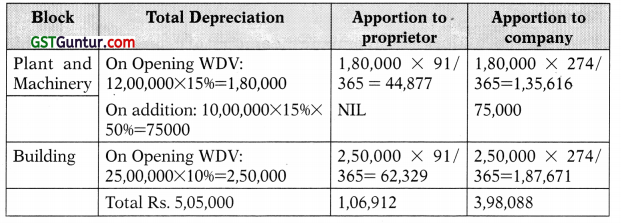

Mr. Gopi carrying on business as proprietor converted the same into a limited company by name Gopi Pipes (P) Ltd. from 01-07-2020. The details of the assets are given below:

Block-IWDV of plant & machinery (rate of depreciation @ 15%) ₹ 12,00,000 Block- II WDV of building (rate of depreciation @ 10%) ₹ 25,00,000

The company Gopi Pipes (P) Ltd. acquired plant and machinery in December 2020 for ₹ 10,00,000. It has been doing the business from 01.07.2020.

Compute the quantum of depreciation to be claimed by Mr. Gopi and Successor Gopi Pipes (Pvt) Limited for the assessment year 2021-22. Note: Ignore additional depreciation. [Nov. 2014, 4 Marks]

Answer:

Computation of days for apportionment of Depreciation

| For | days | Total days |

| Proprietor (01.04.2020 to 30.06.2020) | 30 + 31 + 30 = 91 | 91 |

| Company (01.07.2020 to 31.03.2021) | 365 – 91 = 274 | 274 |

Depreciation for the year on Assets Transferred

| For | Depreciation Calculation | Dep. Amt. |

| Plant and Machinery on opening WDV | 12,00,000 × 15% | 1,80,000 |

| Building on Opening WDV | 25,00,000 × 10% | 2,50,000 |

Apportionment of Depreciation and Allowable Depreciation

![]()

Question 16.

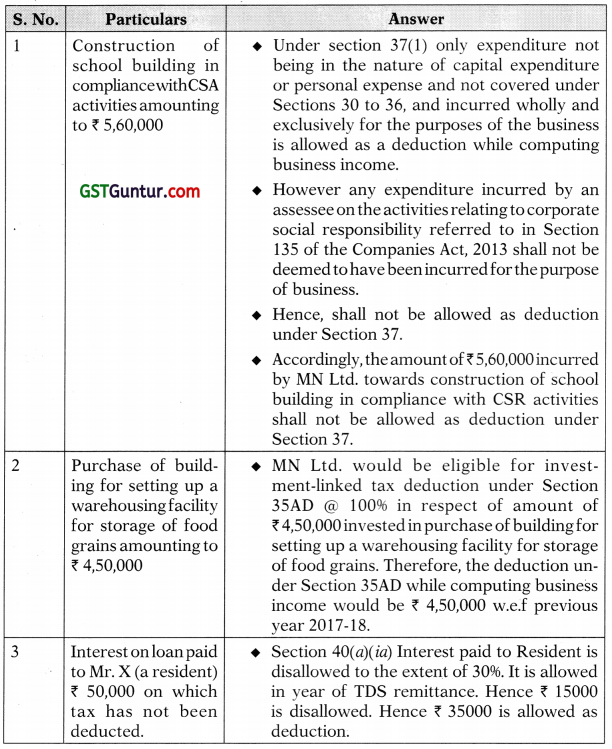

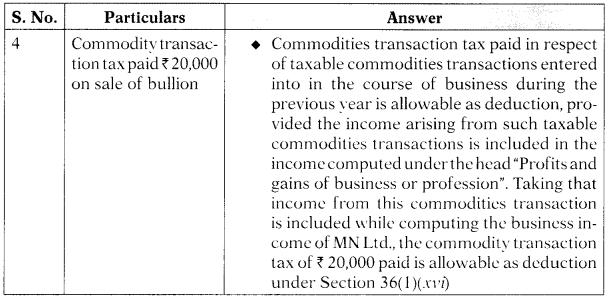

State with reasons, the allowability of the following expenses incurred by MN Limited, a wholesale dealer of commodities under the Income-tax Act, 1961 while computing Profits & Gains from business or profession for the Assessment Year 2020-21 . [Nov. 2015, 8 Marks]

| S. No. | Particulars |

| 1 | Construction of school building in compliance with CSA activities amounting to ₹ 5,60,000 |

| 2 | Purchase of building for setting up a warehousing facility for storage of food grains amounting to ₹ 4,50,000 |

| 3 | Interest on loan paid to Mr. X (a resident) ₹ 50,000 on which tax has not been deducted |

| 4 | Commodity transaction tax paid ₹ 20,000 on sale of bullion |

Answer:

![]()

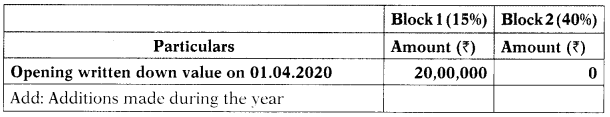

Question 17.

Venus Ltd., engaged in manufacture of pesticides, furnishes the following particulars relating- to its manufacturing unit at Chennai (for the year ending 31-3-2021):

| S.No. | Particulars | Amount (₹ in Lacs) |

| 1 | Opening WDV of Plant and Machinery | 20 |

| 2 | New Machinery purchased on 01.09.2020 | 10 |

| 3 | New Car Purchased on 01.12.2020 | 8 |

| 4 | Computer Purchased on 03.01.2021 | 40 |

Additional information:

- All assets were put to use immediately.

- Computer has been installed in the office.

- During the year ended 31-3-2020, a new machinery had been purchased on 31-10-2019 for ₹ 10 Lacs. Additional depreciation, besides normal depreciation, had been claimed thereon.

- Depreciation rate for machinery may be taken as 15%.

Compute the depreciation available to the assessee as per the provisions of the Income-tax Act, 1961 and the WDV of different blocks of assets as on 31.03.2021._ [May 2016, 8 Marks]

Answer:

Computation of Depreciation allowable under section 32

Question 18.

Mr. Rangamannar resides in Delhi. As per new rule in the city, private cars can be plied in the city only on alternate days. He has purchased a car on 21-09-2019, for the purpose of his business as per following details:

Cost of car (excluding GST) ₹ 12,00,000

Add: Delhi GST at 14% ₹ 1,68,000

Add: Central GST at 14% ₹ 1,68,000

Total price of car ₹ 15,36,000

He estimates the usage of the car for personal purposes will be 25%. He is advised that since the car has run only on alternate days, half the depreciation, which is otherwise allowable, will be actually allowed. He has started using the car immediately after purchase.

Determine the depreciation allowable on car for the Assessment Year 2021-22, if this is the only asset in the block. Rate of depreciation may be taken at 15%.

If this car were to be used in the subsequent Assessment Year 2022-23 on the same terms and conditions above, what will be the depreciation allowable? Assume that there is no change in the legal position under the Income-tax Act, 1961. [Nov. 2018, 4 Marks]

Answer:

Computation of Depreciation allowable

| Particulars | Amount (₹) |

| Depreciation for previous year 2020-21 = 12,00,000 × 1596 × 75% = 1,35,000 | 1,35,000 |

| Written Down Value on 01.04.2021 = 12,00,000 – 135000= 10,65,000 | |

| Depreciation for previous year 2021-22 = 10,65,000 × 15% × 75% = 1,19,813 | 1,19,813 |

Notes:

- In the previous year 2020-21 the car was put into use for more than 180 days in the previous year 2020-21 hence full year depreciation @15% is allowed on the actual cost of ₹ 12,00,000 exclusive of GST of 336000. It is presumed that input tax credit is available in respect of GST.

- Depreciation is allowed for 75% for business use only.

![]()

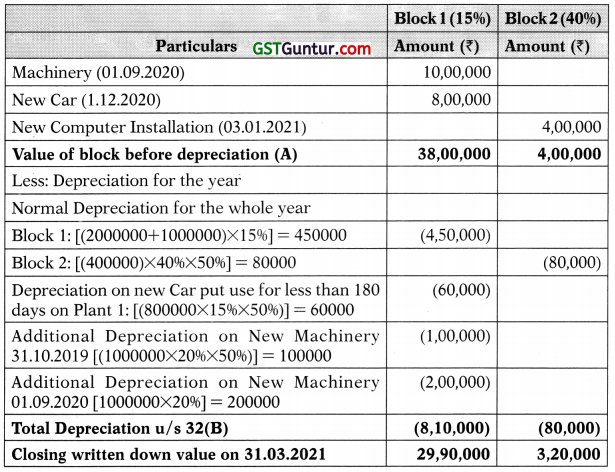

Question 19.

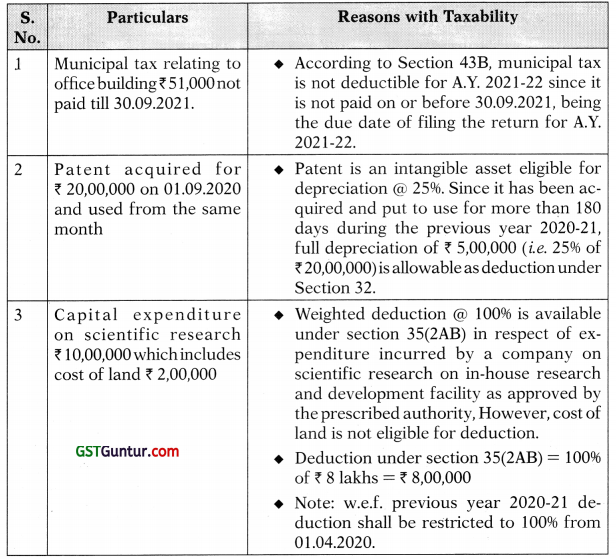

Mr. prakash is in the business of operating goods vehicles. As on 01.04.2020, he had the following vehicles:

During previous year 2020-21 he purchased the following vehicles.

Compute his income under section 44AE of the income-tax Act 1961 for Assessment Year 2021-22.

Answer:

Computation of Presumptive income of Mr. Prakash under section 44AE