AS 11: The Effects of Changes in Foreign Exchange Rates – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

AS 11: The Effects of Changes in Foreign Exchange Rates – CA Inter Accounts Study Material

Monetary And Non Monetary Items (Based On Para No. 7)

Question 1.

Explain ‘monetary item’ as per Accounting Standard 11. How are foreign currency monetary items to be recognized at each Balance Sheet date? Classify the following as monetary or non-monetary item: (4 Marks) (May 2013)

- Share Capital

- Trade Receivables

- Investments

- Fixed Assets.

Answer:

As per AS 11 ‘The Effects of Changes in Foreign Exchange Rates’ Monetary items are money held and assets and liabilities to be received or paid in fixed or determinable amounts of money.

Foreign currency monetary items should be reported using the closing rate at each balance sheet date. However, in certain circumstances, the closing rate may not reflect with reasonable accuracy the amount in reporting currency that is likely to be realised from, or required to disburse, a foreign currency monetary item at the balance sheet date. In such circumstances, the relevant monetary item should be reported in the reporting currency at the amount which is likely to be realised from or required to disburse, such item at the balance sheet date.

Share capital – Non-monetary

Trade receivables – Monetary

Investments – Non-monetary

Fixed assets – Non-monetary

![]()

Foreign Currency Transactions (Based On Para Nos. 8 To 14)

Question 2.

A Ltd. purchased fixed assets costing ₹ 6,000 lakhs on 1.1.2010. This was financed by foreign currency loan (U.S. Dollars) payable in three annual equal instalments. Exchange rates were 1 Dollar = ₹ 40 and ₹ 45 as on 1.1.2010 and 31.12.2010 respectively. First instalment was paid on 31.12.2010.

You are required to state, how these transactions would be accounted for?

Answer:

As per para 13 of AS 11 (Revised) ‘The Effects of Changes in Foreign Exchange Rates’, exchange differences arising on the settlement of monetary items or on reporting an enterprise’s monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, should he recognised as income or as an expense in the period in which they arise. Tims, exchange differences arising on repayment of liabilities incurred for the purpose of acquiring fixed assets cue recognised as income or expenses.

Computation of exchange difference:

Foreign Exchange Loan = \(\frac{6000}{40}\) = US $ 150 lakhs

Exchange Difference = US $ 150 lakhs × (45 – 40) = ₹ 750 lakhs.

Loss due to exchange difference amounting ₹ 750 lakhs should be charged to profit and loss account for the year ended 31st December, 2010.

![]()

Question 3.

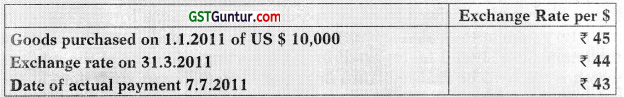

Ascertain the loss/gain for financial years 2010-11 and 2011-12, also give their treatment as per AS 11.

Answer:

Av per AS 11 on ‘The Effects of Changes in Foreign Exchange Rates’, all foreign currency transactions should be recorded by applying the exchange rate on the date of transactions.

Thus, goods purchased on 1.1.2011 and corresponding creditor would be recorded at ₹ 4,50,000 (i.e. $10,000 × ₹ 45)

Balance Sheet Date:

According to the standard, at the balance sheet date all monetary transactions should be reported using the closing rate.

Thus, creditor of US $10,000 on 31.3.2011 will be reported at ₹ 4,40,000 (i.e. $10,000 × ₹ 44) and exchange profit of ₹ 10,000 (i.e. 4,50,000 – 4,40,000) should be credited to Profit and Loss account in the year 2010-11.

Payment Date:

On 7.7.2011, creditor of $10,000 is paid at the rate of ₹ 43. As per AS 11, exchange difference on settlement of the account should also be transferred to Profit and Loss account.

Therefore, ₹ 10,000 (i.e. 4,40,000 – 4,30,000) will be credited to Profit and Loss account in the year 2011-12.

![]()

Question 4.

S Limited imported raw materials worth US Dollars 9,000 on 25th February, 2011, when the exchange rate was ₹ 44 per US Dollar. The transaction was recorded in the books at the above-mentioned rate. The payment for the transaction was made on 10th April, 2011, when the exchange rate was ₹ 48 per US Dollar. At the year end 31st March, 2011, the rate of exchange was ₹ 49 per US Dollar.

The Chief Accountant of the company passed an entry on 31st March, 2011 adjusting the cost of raw material consumed for the difference between ₹ 48 and ₹ 44 per US Dollar. Discuss whether this treatment is justified as per the provisions of AS-11 (Revised).

Answer:

As per para 9 of AS 11, ‘The Effects of Changes in Foreign Exchange Rates’, initial recognition of a foreign currency transaction is done in the reporting currency by applying the exchange rate at the date of the transaction.

Date of Transaction:

Accordingly, on 25th February 2011, the raw material purchased and its creditors will be recorded at US dollar 9,000 × ? 44 = ₹ 3,96,000.

Balance Sheet Date:

As per para 11 of the standard, on balance sheet date such transaction is reported at closing rate of exchange, hence it will be valued at the closing rate i.e. ? 49 per US dollar (USD 9,000 × ₹ 49 = ₹ 4,41,000) at 31st March, 2011, irrespective of the payment made for the same subsequently at lower rate in the next financial year.

The difference of ₹ 5 (49 – 44) per US dollar i.e. ₹ 45,000 (USD 9,000 × ₹ 5) will be shown as an exchange loss in the profit and loss account for the year ended 31st March, 2011 and will not be adjusted against the cost of raw materials.

Subsequent Measurement:

In the subsequent year on settlement date, the company would recognize or provide in the Profit and Loss account an exchange gain of ₹ 1 per US dollar, i.e. the difference from balance sheet date to the date of settlement between ₹ 49 and ₹ 48 per US dollar i.e. ₹ 9,000.

Hence, the accounting treatment adopted by the Chief Accountant of the company is incorrect i.e. it is not in accordance with the provisions of AS 11.

![]()

Question 5.

A Ltd. borrowed US $ 5,00,000 on 31-12-2012 which will be repaid (settled) as on 30-6-2013. A Ltd. prepares its financial statements ending on 31-3-2013. Rate of exchange between reporting currency (Rupee) and foreign currency (US $) on different dates are as under:

31-12-2012 – 1 US $ = ₹ 44.00

31-3-2013 – 1 US $ = ₹ 44.50

30-6-2013 – 1 US $ = ₹44.75

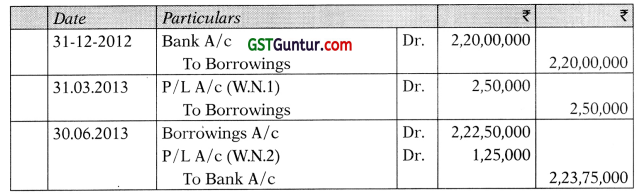

Calculate borrowings in reporting currency to be recognised in the books on above mentioned dates & also show journal entries for the same. (RTP)

Answer:

As per para 9 of AS 11 ‘The Effects of Changes in Foreign Exchange Rates ’ a foreign currency transaction should be recorded, on initial recognition in the reporting currency, by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of the transaction. Accordingly, on 31.12.2012, borrowings will be recorded at ₹ 2,20,00,000 (i.e. $ 5,00,000 × ₹ 44.00)

As per para 11(a) of the standard, at each balance sheet date, foreign currency monetary items should be reported using the closing rate.

Accordingly, on 31.03.2013, borrowings (monetary items) will be recorded at ₹ 2,22,50,000 (i.e. $ 5,00,000 × ₹ 44.50).

Journal Entries

Working Notes:

- The exchange difference of ₹ 2,50,000 is arising because the transaction has been reported at different rate 44.50 = 1 US $) from the rate initially recorded (i.e. ₹ 44 = 1 US $).

- The exchange difference of ₹ 1,25,000 is arising because the transaction has been settled at an exchange rate 44.75 = 1 US $) different from the rate at which reported in the last financial statement 44.50= 1 US $).

![]()

Question 6.

A company had imported raw materials worth US Dollars 6,00,000 on 5th January, 2017, when the exchange rate was ₹43 per US Dollar. The company had recorded the transaction in the books at the above mentioned rate. The payment for the import transaction was made on 5th April, 2017 when the exchange rate was ₹ 47 per US Dollar. However, on 31st March, 2017, the rate of exchange was ₹ 48 per US Dollar. The company passed an entry on 31st March, 2017 adjusting the cost of raw materials consumed for the difference between ₹ 47 and ₹ 43 per US Dollar.

In the background of the relevant accounting standard, is the company’s accounting treatment correct? Discuss. (RTP)

Answer:

As per AS 11 (revised 2003), ‘The Effects of Changes in Foreign Exchange Rates’, monetary items denominated in a foreign currency should be reported using the closing rate at each balance sheet date. The effect of exchange difference should be taken into profit and loss account.

Trade payables is a monetary item, hence should be valued at the closing rate i.e., ₹ 48 at 31st March, 2014 irrespective of the payment for the same subsequently at lower rate in the next financial year. The difference of ₹ 5 (₹ 48 less ₹ 43) per US dollar should be shown as an exchange loss in the profit and loss account for the year ended 31st March, 2014 and is not to be adjusted against the cost of raw materials.

In the subsequent year, the company would record an exchange gain of ₹ 1 per US dollar, i.e., the difference between ₹ 48 and ₹ 47 per US dollar. Hence, the accounting treatment adopted by the company is incorrect.

![]()

Question 7.

Sunshine Company Limited imported raw materials worth US Dollars 9,000 on 25th February, 2011, when the exchange rate was ₹ 44 per US Dollar. The transaction was recorded in the books at the above mentioned rate. The payment for the transaction was made on 10th April, 2011, when the exchange rate was ₹ 48 per US Dollar. At the year end 31st March, 2011, the rate of exchange was ₹ 49 per US Dollar.

The Chief Accountant of the company passed an entry on 31st March, 2011 adjusting the cost of raw material consumed for the difference between ₹ 48 and ₹ 44 per US Dollar. Discuss whether this treatment is justified as per the provisions of AS-11 (Revised). (4 Marks) (Nov. 2011)

Answer:

As per para 9 of AS 11, ‘The Effects of Changes in Foreign Exchange Rates’, initial recognition of a foreign currency transaction is done in the reporting currency by applying the exchange rate at the date of the transaction.

Date of Transaction:

Accordingly, on 25th February 2011, the raw material purchased and its creditors will be recorded at US dollar 9,000 × ₹ 44 = ₹ 3,96,000.

Balance Sheet Date:

As per para 11 of the standard, on balance sheet date such transaction is reported at closing rate of exchange, hence it will be valued at the closing rate i.e. ₹ 49 per US dollar (USD 9,000 × ₹ 49 = ₹ 4,41,000) at 31st March, 2011, irrespective of the payment made for the same subsequently at lower rate in the next financial year.

The difference of ₹ 5 (49 – 44) per US dollar i.e. ₹ 45,000 (USD 9,000 × ₹ 5) will be shown as an exchange loss in the profit and loss account for the year ended 31st March, 2011 and will not be adjusted against the cost of raw materials.

Subsequent Measurement:

In the subsequent year on settlement date, the company would recognize or provide in the Profit and Loss account an exchange gain of ₹ 1 per US dollar, i.e. the difference from balance sheet date to the date of settlement between ₹ 49 and ₹ 48 per US dollar i.e. ₹ 9,000.

Hence, the accounting treatment adopted by the Chief Accountant of the company is incorrect i.e. it is not in accordance with the provisions of AS 11.

![]()

Question 8.

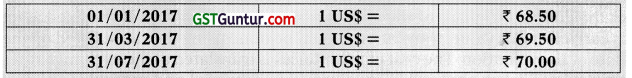

You are required to ascertain the loss/gain for financial years 2016-17 and 2017-18, also give their treatment as per AS 11. (RTP)

Answer:

As per AS 11 on ‘The Effects of Changes in Foreign Exchange Rates’, all foreign currency transactions should be recorded by applying the exchange rate on the date of transactions.

Date of Transaction:

Thus, goods purchased on 1.1.2017 and corresponding creditor would be recorded at ₹ 11,25,000 (i.e. $15,000 × ₹ 75)

Balance Sheet Date:

At the balance sheet date all monetary transactions should be reported using the closing rate. Thus, creditors of US $15,000 on 31.3.2017 will be reported at ? 11,10,000 (i.e. $15,000 × ₹ 74) and exchange profit of ₹ 15,000 (i.e. 11,25,000 – 11,10,000) should be credited to Profit and Loss account in the year 2016-17.

Date of Payment:

On 7.7.2017, creditors of $15,000 is paid at the rate of ₹ 73. As per AS 11, exchange difference on settlement of the account should also be transferred to Profit and Loss account. Therefore, ₹ 15,000 (i.e. 11,10,000 – 10,95,000) will be credited to Profit and Loss account in the year 2017-18.

![]()

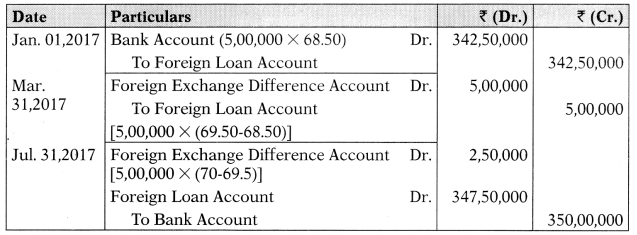

Question 9.

ABC Ltd. borrowed US $ 5,00,000 on 01/07/2017, which was repaid as on 31 /07/2017. ABC Ltd. prepares financial statement ending on 31 /03 /2017. Rate of Exchange between reporting currency (INR) and foreign currency (USD) on different dates are as under:

You are required to pass necessary journal entries in the books of ABC Ltd. as per AS11. (5 Marks) (May 2018)

Answer:

Journal Entries

![]()

Foreign Operations – Classification (Based On Para Nos. 17 To 20)

Question 10.

‘Assets and liabilities and income and expenditure items in respect of dependent foreign branches are translated into Indian rupees at the prevailing rate of exchange at the end of the year. The resultant exchange differences in the case of profit, is carried to other Liabilities Account and the Loss, if any, is charged to revenue.’ Comment. (RTP)

Answer:

The financial statements of an integral foreign operation (dependent foreign branches) should be translated using the principles and procedures described in paragraphs 8 to 16 of AS 11 The Effects of Changes in Foreign Exchange Rates’ (Revised 2003). The individual items in the financial statements of a foreign operation are translated as if all its transactions had been entered into by the reporting enterprise itself.

Individual items in the financial statements of the foreign operation are translated at the actual rate on the date of transaction. For practical reasons, a rate that approximates the actual rate at the date of transaction is often used, for example, an average rate for a week or a month may be used for all transactions in each foreign currency during the period.

The foreign currency monetary items (for example cash, receivables, payables) should be reported using the closing rate at each balance sheet date. Non-monetary items (for example, fixed assets, inventories, investments in equity shares) which are carried in terms of historical cost denominated in a foreign currency should be reported using the exchange date at the date of transaction.

Thus, the cost and depreciation of the tangible fixed assets is translated using the exchange rate at the date of purchase of the asset if asset is carried at cost. If the fixed asset is carried at fair value, translation should be done using the rate existed on the date of the valuation. The cost of inventories is translated at the exchange rates that existed when the cost of inventory was incurred and realizable value is translated applying exchange rate when realizable value is determined which is generally closing rate.

Exchange difference arising on the translation of the financial statements of integral foreign operation should be charged to profit and loss account. Thus, the treatment by the management of translating all assets and liabilities; income and expenditure items in respect of foreign branches at the prevailing rate at the year end and also the treatment of resultant exchange difference is not in consonance with AS 11 (Revised 2003).

![]()

Question 11.

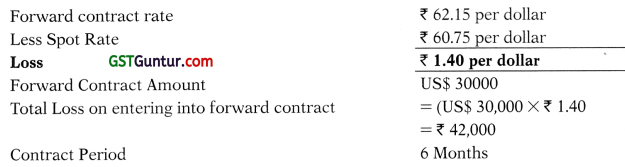

Stem Ltd. purchased a Plant for US$ 30,000 on 30th November, 2013 payable after 6 months. The company entered into a forward contract for 6 months @ ₹ 62.15 per dollar. On 30th November, 2013; the exchange rate was ₹ 60.75 per dollar.

How will you recognise the profit or loss on forward contract in the books of Stem Ltd. for the year ended 31st March, 2014? (5 Marks) (Nov 2014)

Answer:

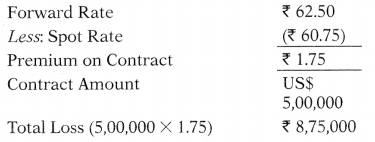

Computation of Profit or Loss:

Out of total contract period of 6 months, 4 months are falling in the financial year 2013-14. Loss for the period from 1st Dec. 2013 to 31st March, 2014= (₹ 42,000/6) × 4 = ₹ 28,000.

Thus, the loss amounting to ₹ 28,000 for the period is to be recognised in the year 2013-14.

Question 12.

With reference to AS 11, define the following:

(i) Integral Foreign Operation.

(ii) Non-Integral Foreign Operation. (4 Marks) (Nov. 2016)

Answer:

Integral Foreign Operation (IFO):

It is a foreign operation, the activities of which are an integral part of those of the reporting enterprise. The business of IFO is carried on as if it were an extension of the reporting enterprise’s operations. Generally, IFO carries on business in a single foreign currency, i.e. of the country where it is located. For example, sale of goods imported from the reporting enterprise and remittance of proceeds to the reporting enterprise.

Non-Integral Foreign Operation (NFO):

It is a foreign operation that is not an Integral Foreign Operation. The business of a NFO is carried on in a substantially independent way by accumulating cash and other monetary items, incurring expenses, generating income and arranging borrowing in its local currency.

An NFO may also enter transactions in foreign currencies, including transactions in the reporting currency. An example of NFO may be production in a foreign currency out of the resources available in such country independent of the reporting enterprise.

![]()

Question 13.

What are the indicators of Non-Integral Foreign Operation (NFO)? (4 Marks) (Nov. 2014)

Answer:

The following are the indicators of Non-Integral Foreign Operations (NFO):

- While the reporting enterprise may control the foreign operation, the activities of foreign operations are carried independently without much dependence on reporting enterprise.

- Transactions with the reporting enterprise are not a high proportion of the foreign operation’s activities.

- Activities of foreign operation are mainly financed by its operations or from local borrowings. In other words, it raises finance independently and is in no way dependent on reporting enterprises.

- Foreign operation’s sales are mainly in currencies other than reporting currency.

- Day-to-day cash flow of the reporting enterprises is independent of the foreign operation’s cash flow.

- Sales price of the foreign operations are not affected by the day-to-day changes in exchange rate of the reporting currency but determined more by local competition or local government regulations.

- There is an active local sales market for the foreign operation’s product, although there may be significant amount of exports.

- Costs of labour, material and other components of foreign operation’s products or services are primarily paid or settled in the local currency rather than in the reporting currency.

Forward Exchange Contracts (Based On Para Nos. 36 To 39)

Question 14.

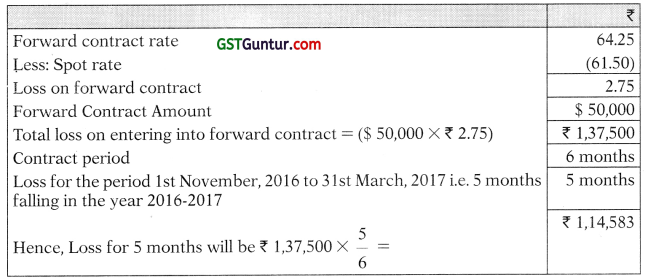

P Ltd. purchased a plant for US$ 50,000 on 31st October, 2016 payable after 6 months. The company entered into a forward contract for 6 months @ ₹ 64.25 per Dollar. On 31st October, 2016, the exchange rate was ₹ 61.50 per Dollar.

You are required to recognize the profit or loss on forward contract in the books of the company for the year ended 31st March, 2017. (RTP)

Answer:

Computation of profit or loss:

Thus, the loss amounting to ₹ 1,14,583 for the period is to be recognized in the year ended 31st March, 2017.

![]()

Question 15.

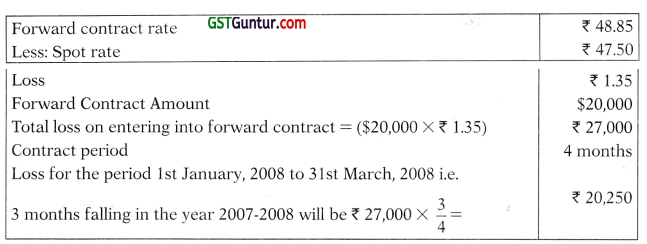

Sterling Ltd. purchased a plant for US $ 20,000 on 31st December, 2007 payable after 4 months. The company entered into a forward contract for 4 months @ ₹ 48.85 per dollar. On 31st December, 2007, the exchange rate was ₹ 47.50 per dollar.

How will you recognize the profit or loss on forward contract in the books of Sterling Limited for the year ended 31st March, 2008. (2 Marks) (Nov. 2009)

Answer:

Calculation of profit or loss to be recognised in the books of Sterling Limited

Balance loss of ₹ 6,750 (i.e. ₹ 27,000 – ₹ 20,250) for the month of April, 2008 will be recognised in the financial year 2008-2009.

Question 16.

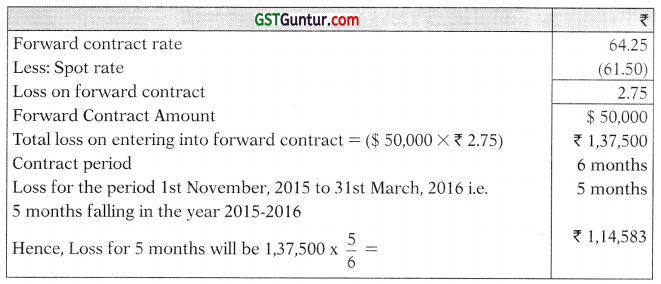

Power Track Ltd. purchased a plant for US$ 50,000 on 31st October, 2015 payable after 6 months. The company entered into a forward contract for 6 months @ ₹ 64.25 per Dollar. On 31st October, 2015, the exchange rate was ₹ 61.50 per Dollar.

You are required to recognise the profit or loss on forward contract in the books of the company for the year ended 31st March, 2016. (5 Marks) (May 2016)

Answer:

Computation of profit or loss:

Thus, the loss amounting to ₹ 1,14,583 for the period is to be recognized in the year ended 31st March, 2016.

![]()

Question 17.

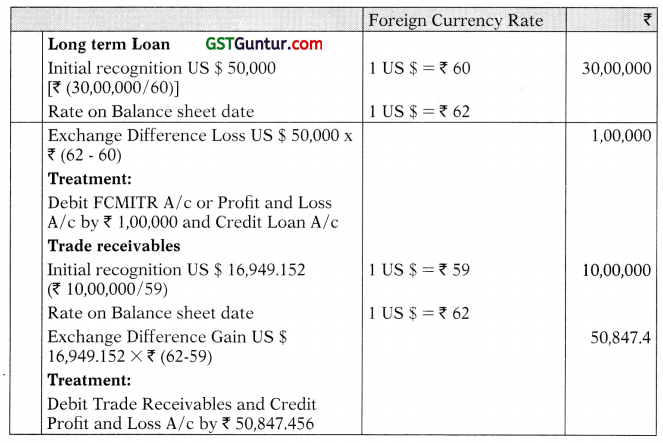

AXE Limited purchased fixed assets costing $ 5,00,000 on 1st Jan. 2018 from an American company M/s M&M Limited. The amount was payable after 6 months. The company entered into a forward contract on 1st January 2018 for five months @ ₹ 62.50 per dollar. The exchange rate per dollar was as follows:

On 1st January, 2018 ₹ 60.75 per dollar

On 31st March, 2018 ₹ 63.00 per dollar

You are required to state how the profit or loss on forward contract would be recognized in the books of AXE Limited for the year ending 2017-18, as per the provisions of AS 11.

Answer:

As per AS 11 ‘The Effects of Changes in Foreign Exchange Rates’, an enterprise may enter into a forward exchange contract to establish the amount of the reporting currency required, the premium or discount arising at the inception of such a forward exchange contract should be amortized as expenses or income over the life of the contract.

![]()

Contract period 5 months

3 months are falling in the year 2017-18;

Therefore, loss to be recognized in 2017-18 (8,75,000/5) × 3 = ₹ 5,25,000. Rest ₹ 3,50,000 will be recognized in the following year 2018-19.

Exchange Gain/Loss On Long Term Foreign Currency Mon-Etary Items (Based On Para Nos. 46 And 46a)

Question 18.

Explain briefly the accounting treatment needed in the following cases as per AS 11:

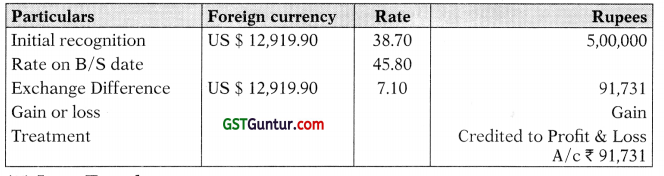

(i) Sundry Debtors include amount receivable from Ted of U.S., ₹ 5,00,000 recorded at the prevailing exchange rate on the date of sales, transaction recorded at $1 = ₹ 38,70.

(ii) Long term loan taken from a U.S. Company, amounting to ₹ 60,00,000. It was recorded at $1 = ₹ 35.60, taking exchange rate prevailing at the date of transactions.

Exchange rates at the end of the year were as under:

$1 Receivable = ₹ 45.80

$1 Payable = ₹ 45.90 (RTP)

Answer:

AS 11 ‘The Effects of Changes in Foreign Exchange Rates’ provides that exchange differences attributable to monetary items should be taken to Statement of Profit and Loss. In case the option under para 46A is exercised, the exchange differences arising on long-term foreign currency monetary items can be adjusted in the cost of the depreciable capital asset or in other cases transferred in Foreign Currency Monetary Item Translation Difference Account (.FCMITD) and amortised.

(i) Sundry Debtors:

(ii) Long Term loan

![]()

Question 19.

Beekay Ltd. purchased fixed assets costing ₹ 5,000 lakh on 01.04.2012 payable in foreign currency (US$) on 05.04.2013. Exchange rate of 1 US$ = ₹ 50.00 and ₹ 54.98 as on 01.04.2012 and 31.03.2013 respectively.

The company also obtained a soft loan of US$ 1 lakh on 01.04.2012 payable in three annual equal instalments. First instalment was due on 01.05.2013.

You are required to state, how these transactions would be accounted for in the books of account ending 31st March, 2013. (5 Marks) (Nov. 2013)

Answer:

Ministry of Corporate Affairs has amended AS 11 through a notification. As per the notification, exchange difference arising on reporting of long-term foreign currency monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, in so far as they relate to requisition of depreciable capital asset, can be added to or deducted from cost of asset.

The MCA has given an option for the enterprises to capitalize the exchange differences arising on reporting of long- term foreign currency monetary items till 31 st March, 2020. Thus, the company can capitalize the exchange differences arising due to long term loans-linked with the acquisition of fixed assets.

Transaction 1:

Calculation of exchange difference on fixed assets

Foreign Exchange Liability = \(\frac{5000}{50}\) = US $ 100 lakhs

Exchange Difference = US $ 100 lakhs × (₹ 54.98 – ₹ 50) = ₹ 498 lakhs.

Loss due to exchange difference amounting 498 lakhs will be capitalised and added in the carrying value of fixed assets. Depreciation on the unamortised amount will be provided in the remaining years.

Transaction 2:

Soft loan exchange difference (US $ 1 lakh i.e. ₹ 50 lakhs)

Value of loan 31.3.13 – US $ 1 lakh × 54.98 = ₹ 54,98,000

AS 11 also provides that in case of liability designated as long-term foreign currency monetary item, the exchange difference is to be accumulated in the Foreign Currency Monetary Item Translation Difference (FCMITD) and should be written off over the useful life of such long-term liability, by recognition as income or expenses in each of such periods.

Exchange difference between reporting currency (INR) and foreign currency (USD) as on 31.03.2013 = US$1.00 lakh × ₹ (54.98 – 50) = ₹ 4.98 lakh.

Loan account is to be increased to 54.98 lakh and FCMITD account is to be debited by 4.98 lakh. Since loan is repayable in 3 equal annual instalments, ₹ 4.98 lakh/3 = ₹ 1.66 lakh is to be charged in Profit and Loss Account for the year ended 31st March, 2013 and balance in FCMITD A/c ₹ (4.98 lakh – 1.66 lakh) = ₹ 3.32 lakh is to be shown on the ‘Equity & Liabilities’ side of the Balance Sheet as a negative figure under the head ‘Reserve and Surplus’ as a separate line item.

![]()

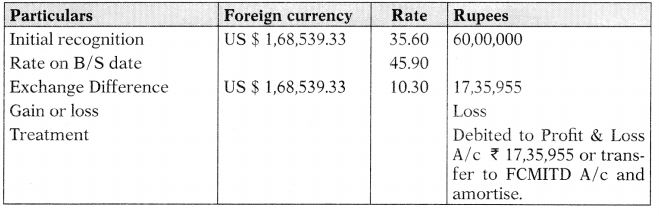

Question 20.

(i) ABC Ltd. an Indian Company obtained long term loan from WWW Private Ltd., a U.S. company amounting to ₹ 30,00,000. It was recorded at US $1 = ₹ 60.00, taking exchange rate prevailing at the date of transaction. The exchange rate on balance sheet date (31.03.2018) was US $1 = ₹ 62.00.

(ii) Trade receivable includes amount receivable from Preksha Ltd., ₹ 10,00,000 recorded at the prevailing exchange rate on the date of sales, transaction recorded at US $1 = ₹ 59.00. The exchange rate on balance sheet date (31.03.2018) was US $1 = ₹ 62.00.

You are required to calculate the amount of exchange difference and also explain the accounting treatment needed in the above two cases as per AS 11 in the books of ABC Ltd. (5 Marks) (Nov. 2018)

Answer:

Computation of Exchange difference and its Accounting Treatment

Note:

Exchange Difference on Long term loan amounting ₹ 1,00,000 may either be charged to Profit and Loss A/c or to Foreign Currency Monetary Item Translation Difference Account but exchange difference on trade receivables amounting ₹ 50,847.456 is required to be transferred to Profit and Loss A/c.