Students should practice Aggregation of Income and Set-off or Carry Forward of Losses – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Aggregation of Income and Set-off or Carry Forward of Losses – CS Executive Tax Laws MCQ Questions

Question 1.

If an individual, having a sales turnover of ₹ 60 lakhs files his return of income for the AY 2021 -22 after the due date, showing unabsorbed business loss of ₹ 23,000 and unabsorbed depreciation of ₹ 45,000, he can carry forward to the subsequent assessment years

(A) Both unabsorbed business loss of ₹ 23,000 and unabsorbed depreciation of ₹ 45,000

(B) Only unabsorbed business loss of ₹ 23,000

(C) Only unabsorbed depreciation of ₹ 45,000

(D) Neither unabsorbed business loss of ₹ 23,000 nor unabsorbed depreciation of ₹ 45,000. [June 2015]

Answer:

(C) Only unabsorbed depreciation of ₹ 45,000

Question 2.

Loss from the activity of owning and maintaining race horses could be set-off

(A) Against income under any of the five heads of income

(B) Only against income under the head “Income from other sources

(C) Only against income under the head ‘Profits and gains of business or profession’

(D) Only against income from the same activity. [June 2015]

Answer:

(D) Only against income from the same activity.

Question 3.

If a person is eligible to claim:

(1) Unabsorbed depreciation

(2) Current scientific research expenditure

(3) Current depreciation

(4) Brought forward business loss

The order of priority to set-off would be

(A) (4), (3), (2) & (1)

(B) (2), (3), (4) & (1)

(C) (3), (4), (1) & (2)

(D) (1), (2), (3) & (4) [Dec. 2015]

Answer:

(B) (2), (3), (4) & (1)

Question 4.

A partnership firm with 4 equal partners brought forward depreciation of ₹ 3 lakhs and business loss of ₹ 3 lakhs relating to AY 2019-2020. On 1st April 2020, two partners retired.

The amount that assessee-firm can set off against its income for the AY 2021-22 would be

(A) Unabsorbed depreciation of ₹ 3 lakhs plus brought forward business loss of ₹ 3 lakhs

(B) Unabsorbed depreciation ‘nil’ plus brought forward business loss of ₹ 3 lakhs

(C) Unabsorbed depreciation ₹ 3 lakhs plus brought forward business loss ‘nil’.

(D) Unabsorbed depreciation ₹ 3 lakhs plus brought forward business loss of ₹ 1.50 lakhs. [Dec. 2015]

Answer:

(D) Unabsorbed depreciation ₹ 3 lakhs plus brought forward business loss of ₹ 1.50 lakhs.

Question 5.

Which of the following losses available after inter source set-off, cannot be set-off from incomes in other heads in the same assessment year

(A) Speculation losses

(B) Loss from specified business

(C) Loss under the head ‘Capital gains’

(D) All of the above [June 2016]

Answer:

(D) All of the above

Question 6.

To carry forward and set off losses, a loss return must be filed by the assessee within the stipulated time and gets the loss determined by the Assessing Officer. However, this condition is not applicable to

(A) Loss from house property

(B) Loss from speculation

(C) Loss from discontinued business

(D) Loss from capital assets [June 2016]

Answer:

(A) Loss from house property

Question 7.

Biren discontinued wholesale trade in medicines from 1st July 2017. He recovered ₹ 1,50,000 in October 2020 being a bad debt that was written-off and allowed in the assessment year 20182019. He has eligibly brought forward business loss of wholesale trade in medicines of ₹ 1,70,000.

The consequence of bad debt recovery is that

(A) It is chargeable to tax

(B) It is eligible for set-off against brought forward business loss

(C) The brought forward business loss is taxable now

(D) 50% of the amount recovered now is taxable [June 2016]

Answer:

(B) It is eligible for set-off against brought forward business loss

Question 8.

Unabsorbed loss from house property can be carried forward for

(A) 4 years

(B) 8 years

(C) Indefinite period

(D) Cannot be carried forward [Dec. 2016]

Answer:

(B) 8 years

Question 9.

Loss from speculation business is eligible for carrying forward for a period of

(A) 4 Years

(B) 6 Years

(C) 8 Years

(D) 12 Years [Dec. 2016]

Answer:

(A) 4 Years

Question 10.

No loss can be set off against

(A) Income from salaries

(B) Income from house property

(C) Income from capital gains

(D) Winnings from lotteries [Dec. 2016]

Answer:

(D) Winnings from lotteries

Question 11.

The amount of depreciation not absorbed in the same year can be carried forward

(A) For a period of 4 years

(B) For a period of 8 years

(C) For a period of 6 years

(D) Indefinitely [Dec. 2016]

Answer:

(D) Indefinitely

Question 12.

Loss from speculation business can be set off against

(A) Income from salaries

(B) Income from house property

(C) Income from speculation business only

(D) Any head of income [Dec. 2016]

Answer:

(C) Income from speculation business only

13.

Mr. Shahu has lost from house property of ₹ 1,10,000 (computed) for the assessment year 2021-22. He can carry forward such loss for subsequent assessment years.

(A) 4

(B) Nil

(C) 8

(D) Indefinite [June 2017]

Answer:

(C) 8

Question 14.

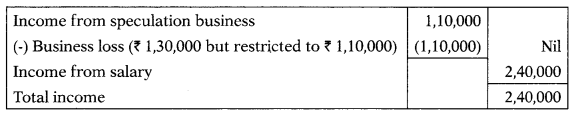

Mr. Hussey for the previous year has:

(i) Business loss of ₹ 1,30,000;

(ii) Income from salary ₹ 2,40,000; and

(iii) Speculation gain of ₹ 1,10,000.

His total income for income tax assessment is:

(A) ₹ 3,50,000

(B) ₹ 2,20,000

(C) ₹ 2,40,000

(D) ₹ 1,10,000 [June 2017]

Hint:

Loss under the head PGBP cannot be set off against income under the head salary.

Answer:

(C) ₹ 2,40,000

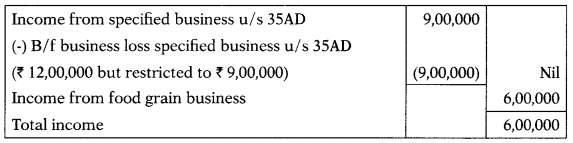

Question 15.

Mathur Storage (P) Ltd. engaged in chain cold storage has brought forward business loss of ₹ 12 lakhs relating to the assessment year 2020-2021. During the previous year2020-2021, its income from the said business is ₹ 9 lakhs. It also has profited from trade in food grains of ₹ 6 lakhs.

The total income of the company for the assessment year 2020-2021 is:

(A) ₹ 15 lakhs

(B) ₹ 6 lakhs

(C) ₹ 9 lakhs

(D) ₹ 3 lakhs [June 2017]

Hint:

“Cold chain facilities” is specified business u/s 35AD. Any loss computed in respect of any specified business referred u/s 3 5AD can be set-off only against profits of any specified business carried on by the assessee.

Answer:

(B) ₹ 6 lakhs

Question 16.

A Co. Ltd. has business loss and unabsorbed depreciation of ₹ 10 Crore. B Co. Ltd is a profit-making company. B Co. Ltd. wanted to acquire A Co.

Ltd. with the benefit of set-off of brought forward loss and unabsorbed depreciation.

The legally permissible method is:

(A) Reverse merger

(B) Outright purchase

(C) Slump sale of A Co. Ltd.

(D) Converting A Co. Ltd. into a subsidiary of B. Co. Ltd. [June 2017]

Answer:

(B) Outright purchase

Question 17.

When an assessee has lost from house property, it is eligible for carrying forward for the subsequent assessment years.

(A) 2

(B) 4

(C) 6

(D) 8 [Dec. 2017]

Answer:

(D) 8

Question 18.

Mr. Siddharth is employed in a company. His income under various heads are

(i) Salary ₹ 5,60,000;

(ii) Loss from letting out properly ₹ 65,000;

(iii) Loss from business ₹ 1,10,000 and

(iv) Loss under the head other sourc-es ₹ 30,000.

His total income after set off of losses would be:

(A) ₹ 3,55,000

(B) ₹ 4,65,000

(C) ₹ 4,20,000

(D) ₹ 5,30,000 [Dec. 2017]

Hint:

Loss from business cannot be set off against income from salary.

Answer:

(B) ₹ 4,65,000

Question 19.

A company has the following:

(i) Current scientific research ex-penditure;

(ii) Current depreciation;

(iii) Unabsorbed depreciation;

(iv) Brought forward business loss.

The order sequence of set off is:

(A) (i), (it), (Hi), (iv)

(B) (iv), (iii), (i), (ii)

(C) (i), (ii), (iv), (iii)

(D) (iv), (ii), (i), (iii) [Dec. 2017]

Answer:

(C) (i), (ii), (iv), (iii)

Question 20.

Rohan engaged in multifarious activities reports the following:

(i) Loss from business ₹ 80,000;

(ii) Loss from house property ₹ 1,20,000;

(iii) Long-term capital loss ₹ 70,000;

He filed his return beyond the ‘due date’ specified in Section 139(1). Which of the above losses cannot be carried forward to the subsequent assessment year?

(A) Loss from business

(B) Loss from house property

(C) Long term capital loss

(D) None of the above [Dec. 2017]

[Note: Above MCQ is not correctly drafted. For further clarification please see the hints.)

Hint:

The question is not correctly drafted.

If a return is not filed in time then losses cannot be carried forward to next year except loss from house property. Thus, loss from house property can be carried forward to next year even if the return is not filed in time.

The question requires “which of the losses cannot be carried forward to subsequent assessment year?” Question need to be correct as follows:

“Which of the loss can be carried forward to subsequent assessment year?”

If the question is corrected as above then Option (B) will be correct.

Answer:

Question 21.

Speculation loss can be carried forward for subsequent assessment years.

(A) 8

(B) Nil

(C) 4

(D) 6 [Dec. 2017]

Answer:

(C) 4

Question 22.

In which case a partnership firm is not entitled to carry forward and set off so much of the losses proportionate to the share of a retired or deceased person exceeding his/her share of profits, if any, in the firm in respect of the previous year:

(A) When the public are not substantially interested infirm

(B) When the business or profession is succeeding by another person

(C) When a change occurred in the constitution of the firm

(D) None of the above [June 2018]

Answer:

(C) When a change occurred in the constitution of the firm

Question 23.

The loss derived from house property can be set off during the year against:

(A) the income of any other house property

(B) the capital gain

(C) the income under other sources

(D) (A) and (C) above [June 2018]

[Note: Above MCQ is not correctly drafted. For further clarification please see the hints.)

Hint:

Loss from house property can be set off against – (A) income from any other house property (B) capital gain (C) income under other sources.

Option (D) needs to be corrected – “(D) All of the above”.

Answer:

Question 24.

Anand, a resident individual having computed for the previous year 1st April 2020 to 31st March 2021 his business loss at ₹ 60,000, short term capital gain on sale of gold of ₹ 40,000 long term capital gain on sale of house property of ₹ 3,60,000.

The amount of total income to be declared in the return for the assessment year 2021-22 by Anand shall be

(A) ₹ 4,00,000

(B) ₹ 3,40,000

(C) ₹ 4,00,000 and carry forward loss of ₹ 60,000

(D) None of the above [Dec. 2018]

Answer:

(B) ₹ 3,40,000

Question 25.

The loss computed under the head “Income from house property” can be set off by Intra head adjustment during the same year from:

(A) Any other head of income up to a maximum of ₹ 2,50,000

(B) Any other head of income up to a maximum of ₹ 3,00,000

(C) Any other head of income up to a maximum of ₹ 5,00,000

(D) Any other head of income up to a maximum of ₹ 2,00,000 [Dec. 2018]

Answer:

(D) Any other head of income up to a maximum of ₹ 2,00,000

Question 26.

The benefit of carrying forward and set-off of losses under section 79 of Income-tax Act, 1961, by a closely held Indian company which is a subsidiary of a foreign company as a result of amalgamation or demerger, is subject to the condition that specified percentage of the shareholders of the amalgamating or demerged foreign company continues to be the shareholders of the amalgamated or the resulting foreign company which is:

(A) 51%

(B) 1096

(C) 2696

(D) 10096 [Dec. 2018]

Answer:

(A) 51%

Question 27.

Business loss can be set off from income of any other business but cannot be set off from:

(A) Salary Income

(B) House Property Income

(C) Long Term Capital Gains

(D) Income from derivatives specified in section 43(5) [June 2019]

Answer:

(A) Salary Income

Question 28.

Short term capital loss can be setoff as per provisions of section 72 of the Income-tax Act, 1961 from:

(A) Short term capital gain

(B) Short term capital gain and Long term capital gain

(C) Long term capital gain

(D) Short term capital gain and profit & gain from business [June 2019]

Answer:

(B) Short term capital gain and Long term capital gain

Question 29.

The loss from the activity of owning and maintaining race horses is eligible for carrying forward and set off for a maximum period of:

(A) 8 Assessment years

(B) 6 Assessment years

(C) 4 Assessment years

(D) 2 Assessment years [June 2019]

Answer:

(C) 4 Assessment years