Students should practice Residential Status – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Residential Status – CS Executive Tax Laws MCQ Questions

Question 1.

Following additional conditions are to be satisfied by a person to be resident and ordinarily resident in India:

(A) He is a resident in India at least any two out of the ten previous years immediately preceding the relevant previous year

(B) He has been in India for 730 days or more during the seven previous years immediately preceding the relevant previous year

(C) Both (A) and (B) or above

(D) None of the above. [Dec. 2014]

Answer:

(C) Both (A) and (B) or above

Question 2.

Abhay earns the following income during the previous year ended 31st March 2021:

Interest on UK Development Bonds: ₹ 2,00,000

(1 /4th being received in India)

Profits on sale of a building in India: ₹ 2,00,000

(Received in Holland)

Income liable to tax for the AY 2021-22 if Abhay is resident and not ordinarily resident in India, is:

(A) ₹ 2,50,000

(B) ₹ 4,00,000

(C) ₹ 2,00,000

(D) ₹ 50,000 [Dec. 2014]

Hint:

1 /4th of 2,00,000 + 2,00,000 = 2,50,000.

Answer:

(A) ₹ 2,50,000

Question 3.

If Karta is resident and ordinarily resident in India but control and management of HUF are situated partly outside India in the previous year, the HUF is:

(A) Resident and ordinarily resident

(B) Not ordinarily resident

(C) Non-resident

(D) Resident [Dec. 2014]

Answer:

(A) Resident and ordinarily resident

Question 4.

Paresh, a software engineer at ABC Ltd. left India on 10th August 2020 for the treatment of his wife. For income- tax purpose, his residential status for the AY 2021-22 will be:

(A) Resident

(B) Non-resident

(C) Not ordinarily resident

(D) Cannot be determined from the given information [June 2015]

Answer:

(A) Resident

Question 5.

The residential status of an Indian company is resident for the year [Dec. 2015]

(A) If the entire control and management is wholly in India

(B) If part of the control and management is in India

(C) Regardless of the place of control and management

(D) If it is listed on the recognised stock exchange.

Hint:

Now “control & management” for the company is not checked for determining residential status, but “Place of Effective Management” (POEM) is relevant.

Answer:

(C) Regardless of the place of control and management

Question 6.

HUF of Ashwin consisting of himself, his wife and 2 sons are assessed to income-tax. The residential status of HUF would be non-resident, when:

(A) The management and control of its affairs is wholly in India

(B) The management and control of its affairs is wholly outside India

(C) The status of Karta is non-resident for that year

(D) When the majority of the members are non-residents. [Dec. 2015]

Answer:

(B) The management and control of its affairs is wholly outside India

Question 7.

Income of non-resident, when attributed from operations in India relating to the following, is taxable in India:

(1) Profits of business

(2) Fee for technical services

(3) Royalty

(4) Income from house property in India

Select the correct answer from the options given below:

(A) (1) and (4)

(B) (1), (3) and (4)

(C) (1) and (3)

(D) (1), (2), (3) and (4) [Dec. 2015]

Answer:

(D) (1), (2), (3) and (4)

Question 8.

Arun, a non-resident of India celebrated his 80th birthday on 10th October 2020. If his total income for the previous year is ₹ 6,00,000 his income-tax liability for the previous year 2020-21 is:

(A) ₹ 33,800

(B) ₹ 41,200

(C) ₹ 33,475

(D) Nil [June 2016]

Hint:

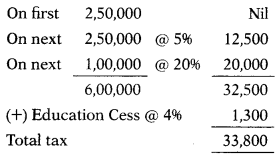

Calculation of tax liability of Arun (non-resident, age 80):

Note: Irrespective of the age of the non-resident, the tax will be calculated as per the first slab. The benefit of age is available to the resident assessee only and not to non-residents.

Answer:

(A) ₹ 33,800

Question 9.

Alpha Ltd. is an Indian company. It carries its business in Delhi and London. Total control and management of the company is situated in London. More than 85% of its business income is from the business in England. If so, its residential status will be:

(A) Resident

(B) Non-resident

(C) Not ordinarily resident

(D) Foreign company [June 2016]

Hint:

An Indian company is always resident in India even though most of its control & management is situated outside India.

Answer:

(A) Resident

Question 10.

A company incorporated outside India having its place of effective management situated in India in the previous year will be treated as:

(A) Resident

(B) Not ordinarily resident

(C) Non-resident

(D) None of the above [Dec. 2016]

Answer:

(A) Resident

Question 11.

Satish brought into India, in the previous year, past untaxed income which was earned in the UK The income will be taxable if Satish is:

(A) An ordinarily resident

(B) A not ordinarily resident

(C) A non-resident

(D) None of the above [Dec. 2016]

Answer:

(D) None of the above

Question 12.

Mr Rajiv, born and brought up in India left for employment in Belgium on 15.10.2020 He has never gone out of India, previously. What is his residential status for the Assessment Year 2021-22?

(A) Non-resident

(B) Not ordinarily resident

(C) Resident

(D) Indian citizen [June 2018]

Hint:

Stay in current previous year = 198 days

| He is in India for 182 days or more | ✓ |

| He is in India for 182 days or more AND 365 days in the last 4 previous years | ✓ |

Since Rajiv fulfil both basic conditions; hence he is a resident.

He also fulfils both additional conditions; hence is an Ordinary Resident.

Answer:

(C) Resident

Question 13.

Mr Ramji (age 55) is Karta of HUF doing the textile business at Nagpur. Mr Ramji is residing in Dubai for the past 10 years and visited India for 20 days every year for filing the income tax return of HUF. His two major sons take care of the day to day affairs of the business in India. The residential status of HUF for the Assessment Year 2021-22 is:

(A) Non-resident

(B) Resident

(C) Not ordinarily resident

(D) None of the above [June 2017]

Hint:

HUF is treated as a resident in India if the control and management of its affairs are situated wholly or partly in India.

To determine whether HUF is an ordinary resident or a not-ordinary resident additional condition has to be checked for Karta of HUF.

Since Mr Rajiv does not fulfil both additional conditions, HUF is Not an Ordinary Resident.

Answer:

(A) Non-resident

Question 14.

When a capital asset located in India is sold by a non-resident to another non-resident at a place outside India, the capital gain is taxable:

(A) at the place of the transferor

(B) at the place of the transferee

(C) at the place of location of asset

(D) at the place of both transferor and transferee [June 2017]

Answer:

(C) at the place of location of asset

Question 15.

Thomas Inc. of Australia borrowed money from various companies in Australia for doing business in India by the name ANS Co. Ltd., Mumbai. Thomas Inc. paid interest of ₹ 500 lakhs (converted) to various lenders. The amount of interest paid:

(A) has accrued in India

(B) is exempt from tax

(C) does not accrue in India

(D) is taxable in Australia [June 2017]

Answer:

(A) has accrued in India

Question 16.

Mr Alok Chatterjee born and brought up in India since 1972, left for Singapore on 10.10.2019 for the purpose of employment. His residential status would be:

(A) Resident

(B) Not ordinarily resident

(C) Non-resident

(D) None of the above [Dec 2017]

Hint:

Stay in India for the current previous year =184 days.

Since Mr Alok fulfils both the basic conditions as well as both additional conditions, he is ordinarily resident in India.

Answer:

(A) Resident

Question 17.

In the case of an individual who is not ordinarily resident the following income is chargeable to tax:

(A) Business income accruing outside India

(B) Property income accruing outside India

(C) Income accruing outside India if it is derived from a business controlled in India

(D) Interest income accruing outside India [Dec. 2017]

Answer:

(C) Income accruing outside India if it is derived from a business controlled in India

Question 18.

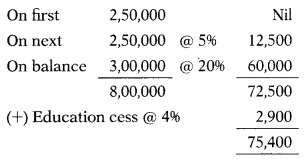

Mr Ajay (age 40) resident of India earned an agricultural income of ₹ 1 lakh from land situated in Sri Lanka. His total income in India amounts to ₹ 7 lakhs. The tax liability would be:

(A) ₹ 77,250

(B) ₹ 75,400

(C) ₹ 74,675

(D) ₹ 56,650 [Dec. 2017]

Hint:

Agricultural income outside India is not treated as ‘Agricultural Income’ as per Section 2(1 A). Thus, such income will come under a regular slab.

Answer:

(B) ₹ 75,400

Question 19.

John is a foreign citizen born in the USA. His father was born in Delhi in 1961 and his grandfather was born in Lahore in 1936 but his mother was born in the UK in 1964. John came to India for the first time on 1st June 2019 and stayed in India for 183 days and then left for the USA. His residential status for the AY 2020-2021 shall be:

(A) Resident

(B) Resident but not ordinary resident

(C) Non-resident

(D) Foreign national [June 2018]

Answer:

(B) Resident but not ordinary resident

Question 20.

The following income of Ms Nargis who is a non-resident shall be included in her total income:

(i) Salary for 2 months received in Delhi ₹ 40,000.

(ii) Interest in Savings Bank Account in Mumbai ₹ 2,100.

(iii) Agricultural income in Bangladesh and Invested in shares in Bangladesh.

(iv) Amount brought into India out of past non-taxed profits earned in the USA.

Select the correct answer from the options given below:

(A) (i), (iii) and (iv)

(B) (i) and (ii)

(C) (i), (ii) and (iv)

(D) All the four above [June 2018]

Answer:

(B) (i) and (ii)

Question 21.

The income earned during the previous year is subject to tax under the Act on the basis of the residential status of an assessee. However, the residential status of an assessee every year.

(A) Will not change

(B) Will certainly change

(C) May change

(D) None of the above [June 2018]

Answer:

(C) May change

Question 22.

Which out of the following criteria determines the Place of Effective Management (POEM) in order to treat a foreign company as a resident in India (resident company) during the previous year as per guidelines issued by CBDT and the provisions contained under the Income-tax Act, 1961

(A) General Meeting held in India

(B) Research and Development work is done in India

(C) Board Meetings are held in India

(D) None of the above [Dec. 2018]

Answer:

(C) Board Meetings are held in India

Question 23.

In the case of an individual who is not an ordinarily resident in India, the income chargeable to tax in India out of the following shall be:

(A) Rental income in a foreign country

(B) Interest income in a foreign country

(C) Income from outside India from a business controlled in India

(D) All the three above in (A), (B) & (C) [June 2019]

Answer:

(C) Income from outside India from a business controlled in India

Question 24.

Agriculture income from agricultural land located in a foreign country is taxable in the case of:

(A) Non-resident

(B) Not ordinarily resident

(C) Resident

(D) In all cases stated in A, B & C [June 2019]

Answer:

(C) Resident

Question 25.

In the case of a non-resident, which of the following income is not taxable in his hand:

(A) Interest received from Government of India

(B) Capital gain on transfer of capital assets situated in India

(C) Interest received from a person resident in India on money borrowed and used outside India for carrying a business

(D) Royalty received from a person resident in India for the patent rights used in India [June 2019]

Answer:

(C) Interest received from a person resident in India on money borrowed and used outside India for carrying a business

Question 26.

A person is deemed to be of Indian origin if he, or either of his parents or any of his grandparents, was born in

(A) India

(B) India other than J & K

(C) Undivided India

(D) Greater India [Dec. 2019]

Answer:

(C) Undivided India

Question 27.

Central Board of Direct Taxes (CBDT) vide Circular No. 8 of 2017, dated 23rd February 2017 has clarified that the Place of Effective Management (POEM) provisions shall not apply to a company having turnover or gross receipts in a financial year of

(A) ₹ 30 crores or less

(B) ₹ 10 crores or less

(C) ₹ 50 crores or less

(D) ₹ 5 crores or less [Dec. 2019]

Answer:

(C) ₹ 50 crores or less

Question 28.

Rajendra a non-resident Indian in the previous year 2020-21 was in receipt of rent of house property located in Dubai of ₹ 27,50,000. The amount of rent was transferred and credited in the bank account of Rajendra maintained with SBI, Vadodara by the tenant quarterly. The Annual Letting Value (ALV) of the house located in Dubai subject to tax under the head Income from house property in A.Y. 2021 -22 shall be

(A) ₹ 16,50,000

(B) ₹ 19,25,000

(C) ₹ 27,50,000

(D) Not taxable as property is in Dubai and he is non-resident [Dec. 2019]

Hint:

Since the amount was credited ie. received in the Bank Account of Non-resident in India, it will be taxable in India even though the assessee is non-resident and even the property is outside India.

| ₹ | |

| Gross Annual Value/Net Annual Value (NAV) | 27,50.000 |

| Less: Standard deduction @ 30% of NAV | (8,25,000) |

| Income from House Property | 19,25,000 |

Answer:

(B) ₹ 19,25,000 / (C) ₹ 27,50,000