Go through this Partnership Accounts-Fundamentals – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Partnership Accounts-Fundamentals – CS Foundation Fundamentals of Accounting Notes

Definition:

1. (As per Section – 4 of Indian Partnership Act 1932:

“Partnership is the relationship between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all.”)

2. In simple words, a partnership is an arrangement whereby two or more people agree to carry on a business together and to share the profits.

Features of partnership:

- There must be an agreement between partners.

- There should be two or more persons.

- The agreement must be entered into by the person concerned.

- It should be formed for the purpose of carrying on a business for earning profit.

- The Partnership Act does not lay down any maximum number of partners. But according to Section 464, Rule 10 of Companies Miscellaneous Rule 2014, maximum number of partners is 100.

- Partnership follows the principle of mutual agency. This means that every partner is an agent as well as principle of another partner.

- The business should be carried on by all or any one of them acting for all.

- In a partnership, the partners have unlimited liability.

Partnership Firm:

Collection of partners is known as the partnership firm and the name in which this collection is carried on is known as the “firm name.”

Note:

- The assets of the firm are the joint property of partners.

- The partners are personally liable for the liability of the firm.

Partnership Deed:

- It is an agreement determining the rights and liabilities of partners.

- It is a written contract between the partners.

Features of a partnership deed:

- It is an agreement between the partners.

- The Partnership Act does not lay down any maximum number of partners; But according to Section 464, Rule 10 of Companies Miscellaneous Rule 2014, maximum number of partners is 100.

- It should be in black and white (i.e. in writing).

- It is not compulsory to have a partnership deed. The terms and conditions may be in oral also.

- Partnership deed is a legal document.

- It helps in easy settlement of disputes among partners.

- Its purpose of earning profit which would be divided among partners.

Contents of partnership deed:

- Name and address of the firm.

- Name and address of partners.

- Type and nature of business firm.

- Amount of capital contributed by each partner.

- Details of interest on capital of the partners.

- Details of drawings and rates of interest on drawings.

- Profit sharing ratio.

- Other points like salary to partners, duration of partnership etc.

- The best course is to have a written partnership deed duly signed by all the partners and registered under the Act.

Rules applicable in absence of partnership deed:

1. It is not compulsory to have a partnership deed.

2. If there is a partnership deed, the terms and conditions as mentioned in the deed will be followed.

3. If there is no partnership deed, the following rules will be applicable:

- Profit sharing ratio – Equal

- Interest on capital – No interest on capital will be allowed.

- Interest on drawings – No interest on drawings is charged.

- Salary to partner – No salary/commission should be given to partners.

- Interest on loan – Even if there are losses, interest @ 6% per annum shall be paid.

- Participation in firm – Every partner has a right to take part in the business of the firm.

- Admission of a partner – A new partner can be admitted only with the consent of all other partners.

Note:

Even if a firm has a partnership deed but it is silent on any of the above matters, the above rules will be applicable.

Joint Venture:

1. A joint venture is a business venture in which two or more parties agree to join together for doing a specific business.

2. It is a temporary partnership.

3. Although joint venture form of business is much like partnership, still both are different in the following ways

| Basis of difference | Joint Venture | Partnership |

| 1. Name of the business | Joint Venture does not have a specific name. | A partnership firm has a name of its own. |

| 2. Name of the members | In Joint Venture, each member is called coventurer. | In partnership, each member is called partner. |

| 3. Number of members | In Joint Venture, minimum number of coventurer is two and there is no limit for maximum. | In partnership, minimum number is two and maximum number is 50. (As per Companies Act, 2013) |

| 4. Registration | There is no need of its registration. | Companies Act lays down the maximum no. of association of person as 100 whereas as per companies rules the presently applicable limit is 50. |

| 5. Duration | It is temporary and comes into existence for doing a specific job. Hence, it comes to an end when the job is completed. | In order to make claim of partnership enforceable against third parties, partnership must be registered. |

Partnership Accounts:

Partnership Accounts involves the preparation of:

- Partner’s capital accounts (fixed and fluctuating).

- Partner’s loan account.

- Profit and loss Appropriation A/c.

Partner’s Capital Account:

In a partnership, every partner has a separate capital account. Amount contributed as capital by the partner is shown in this account.

Types of Capital Account:

- Fixed Capital A/c.

- Fluctuating Capital A/c.

(i) Fixed Capital:

1. Under this system, the capital accounts of the partners are to be kept intact (fixed).

2. The regular earnings or drawings should not effect the fixed capital of the partners.

3. For this purpose, under this system two capital accounts are prepared:

- Partner’s Capital Account

- Partner’s Current Account

Partners Capital Account:

It shows the fixed capital of the partner. Any amount of capital further introduced or withdrawn by the partner are also shown in this account. Apart from this, no other entry is shown in this account.

Partner’s Current Account:

All entries relating to partner capital A/c other than capital contributed or withdrawn are shown in this account. It records the entries of drawings, interest on drawings, interest on capital, salary to partner, share of profit/loss etc. are made in separate account called current A/c.

Under this method fixed capital remains intact in the Capital A/c and changes are made in Current A/c.

Sometimes an additional drawings A/c is also prepared to record the frequent drawings made by the partner. At the end, the balance of drawings A/c is transferred to Capital A/c.

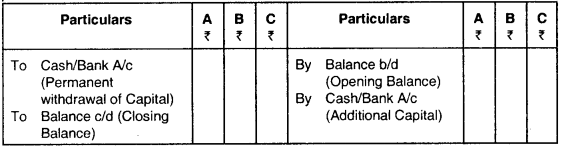

Capital Accounts (when the capitals are Fixed):

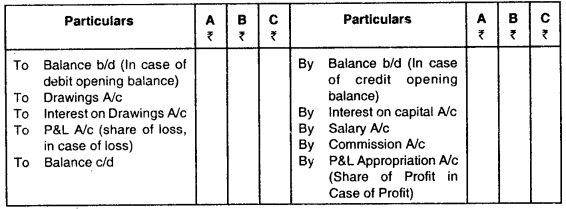

Current Accounts

(ii) Fluctuating Capital Account:

- Under this system, capital accounts need not be kept fixed.

- Here only one account (capital a/c) is maintained which contains all the entries of capital introduced, drawings, interest on drawings, interest on capitals, salary to partners etc.

- Due to these entries, the amount of capital keeps on fluctuating.

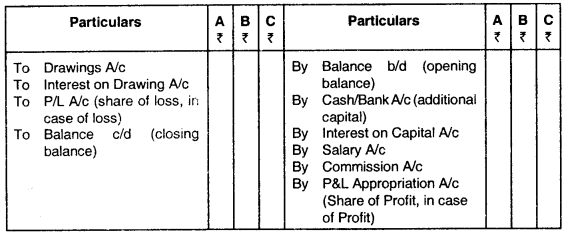

Capital Accounts (When the capitals are fluctuating):

Distinction Between Fixed Capital Account and Fluctuating Capital Accounts:

| Basis of Distinction | Fixed Capital Accounts | Fluctuating Capital Accounts |

| 1. Change in Capital | When the capitals are fixed, the balances in capital accounts usually remain unchanged during the life time of business, except in extraordinary circumstances. | When the capital are fluctuating, the balance in capital accounts keep on changing from time to time. |

| 2. Number of accounts | When the capitals are fixed, each partner has two accounts, namely Capital Account and a Current Account. | When the Capitals are fluctuating, each partner has only one account, namely capital account. |

| 3. Recording of Transactions | When the capitals are fixed, transactions relating to drawing, interest on capital, interest on drawings, salary, share of profit or loss etc. are not made in Capital Accounts but are entered in separate Current Accounts. | In this case, all the transactions relating to partners are made directly in the Capital Account itself. |

| 4. Account that can show a negative balance | Fixed Capital Account can never show a negative balance. | Fluctuating Capital Account can show a negative balance. |

Partner’s Loan A/c:

- It represents the amount given by the partners to the firm in the form of loans.

- These are treated as liability of the firm and are not shown in the Capital A/c of partners.

- Repayment of partner’s loan is a priority over repayment of partner’s capital.

- Firm pays interest to the partners for this loan at an agreed rate [If no rate is agreed it is paid @ 6% p.a.

- If capital is insufficient to meet losses on dissolution the amount of the loan can be used to meet losses.

Profit and Loss Appropriation A/c:

- Profit and Loss Appropriation A/c is an extension of Profit and Loss A/c which shows the appropriation of profit among various partners.

- Apart from entries relating to the adjustments made from the profit in the form of interest on capital, interest on drawing etc. are shown in this A/c.

Items of Profit and Loss Appropriation A/c:

(i) Interest on Capital –

- Firm pays interest on the amount of capital contributed by the partners at an agreed rate in the deed.

- Interest on capital will be paid only when there are profits in the firm.

- Interest on capital is calculated on time basis (i.e. it takes into account any tresh capital introduced or withdrawn).

Provisions relating to interest on capital:

| Case | Provision |

| When partnership deed is silent about interest on capital.

|

No interest will be allowed. |

| When the partnership agreement provides for interest on capital but it is silent whether to treat it as a charge or appropriation | 1. Interest on capital will be allowed only when there is profit. 2. When there is loss, no interest will be allowed on capital. 3. When profit before interest is more than or equal to the amount of interest – full interest will be allowed. 4. When profit before interest is less than interest – interest will be restricted to the amount of profit. Hence, profit will be distributed in the ratio of interest on capital of each partner. |

| When partnership agreement provides for treating interest as a charge. | Full interest will be allowed whether there ids profit or loss. |

Distinction between Charge Against Profit and Appropriation Out of Profit:

| Basis of Distinction | Charge Against Profit | Appropriation Out of Profit |

| 1. Nature | It indicates expenses to be deducted from profits while calculating net profit or loss. | It indicates distribution of net profit to various heads. |

| 2. Recording | It is debited to Profit and Loss Account. | It is debited to Profit and Loss Appropriation Account. |

| 3. Necessary or Not | It is necessary to make charges against profits even if there is loss. | Appropriations are made only when there is profit. |

| 4. Example | Interest on partner’s loan and rent paid to a partner etc. | Interest on capital, partner’s salary, etc. |

Calculation of Interest:

Amount of capital x Time period x \(\frac { Rate }{ 100 }\)

Entry of Interest on Capital:

(i) Interest on Capital A/c Dr.

To Partner’s Capital A/c (Being interest on Capital at – % p.a.)

(ii) Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

(Being interest on capital transferred)

Example:

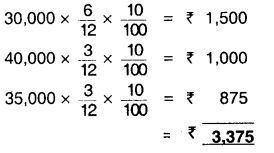

Ajay contributed ₹ 30,000 as an initial capital on 1st January, 2012. He introduced additional capital of ₹ 10,000 on 1st July, 2012 and withdraw ₹ 5,000 on 1st October, 2012. Interest was paid @ 10% p.a. Calculate the interest on capital at the year ending 31st December, 2012.

Solution:

| Amount of Capital | Duration | Months |

| 1. ₹ 30,000 | Jan. – June | 6 Months |

| 2. ₹ 30,000 + ₹ 10,000 | July – Sep. | 3 Months |

| 3. ₹ 30,000 + ₹ 10,000 – 5,000 | October – Dec. | 3 Months |

Amount of Interest:

(ii) Interest on Drawings:

- Drawings refers to the amount withdrawn by the partner for personal use.

- The firm charges interest on the amount of such withdrawals.

- Interest on drawings will be calculated from the date of withdrawal of the amount.

- Rate of interest on drawings shall be decided in the partnership agreement. If nothing is decided, no interest on drawings shall be provided for.

- Interest on drawings is an income for the firm and hence, recorded on the credit side of profit/loss appropriation account.

Calculation of interest on drawings:

(i) If date of withdrawal is not Months – It is assumed that drawings are known made evenly throughout the year and hence, will be charged for 6 months.

Amount of drawings x \(\frac { Rate }{ 100 }\) x \(\frac { 6 }{ 12 }\)

(ii) When drawings are made at the beginning of every month – Interest will be charged on whole amount for 6.5 months. (interest for 6.5 months will be equal to the interest calculated on monthly basis).

Amount of drawings x \(\frac { 6.5 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

(iii) When drawings are made at end of every month – Interest will be charged on whole amount for 5.5 months (interest for 5.5 months will be equal to the interest calculated on monthly basis).

Amount of drawings x \(\frac { 5.5 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

(iv) When drawings are made in the middle or at any time – Interest will be charged on whole amount for 6 months, during the month.

Amount of drawings x \(\frac { 6 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

(v) When drawings of equal amount are made in the beginning of each quarter – Interest will be charged on whole amount for 7.5 months.

Amount of drawings x \(\frac { 7.5 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

(vi) When drawings of equal amount are made at the end of each quarter – Interest will be charged on whole amount for 4.5 months.

Amount of drawings x \(\frac { 4.5 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

(vii) When drawings of equal amount are made during middle of each quarter – Interest will be calculated on whole amount for 6 months.

Amount of drawings x \(\frac { 6 }{ 12 }\) x \(\frac { Rate }{ 100 }\)

Note:

- The above method or formulas will be used only and when there are equal monthly or quarterly drawings.

- If the drawings are not equal or are drawn at unequal intervals, then rate of drawing will be calculated using the product method.

Product Method:

- Step 1: Calculate the product by multiplying drawings with its duration.

- Step 2: Calculate the sum of all products.

- Step 3: Calculate interest on drawing as follows:

Total of products x \(\frac { Rate }{ 100 }\) x \(\frac { 1 }{ 2 }\)

Entry for Interest on Drawings:

(i) Partner’s capital A/c Dr.

To Interest on drawings A/c

(ii) Interest on drawings A/c Dr.

To P/L appropriation A/c

(iii) Salary Payable to Partners

- The firm may provide salary to some active partners for their work.

- Salary may be determined as per the agreement between the partners.

Entry:

(a) Partners Salary A/c Dr.

To Capital A/c

(b) Profit/Loss Appropriation A/c Dr.

To Partner’s Salary A/c

(iv) Commission Payable to Partners:

1. The firm may provide commission to the partners based on net profits.

2. Calculation of Commission:

(a) If commission is based on net profits before charging such commission.

Profit before charging commission x \(\frac { Rate }{ 100 }\)

(b) If commission is based on net profits after charging such commission

Net profit before charging commission x \(\frac { Rate }{ 100+Rate }\)

Example: If the profit before charging commission is ₹ 30,000 and manager is entitled to a commission of 10%

(i) before charging commission

(ii) after charging commission.

Calculate manager’s commission.

Solution:

(i) Before Charging Commission:

Net profit before commission x \(\frac { Rate }{ 100 }\)

= ₹ 30,000 x \(\frac { 10 }{ 100 }\)

= ₹ 3,000

(ii) After Charging Commission:

Net profit before commission x \(\frac { Rate }{ 100+Rate }\)

₹ 30,000 x \(\frac { 10 }{ 100+10 }\) = ₹ 2,727.27

Entry for Partner’s Commission:

(i) Partner’s Commission A/c Dr.

To Partner’s Capital A/c

(ii) Profit/Loss Appropriation A/c Dr.

To Partners Commission A/c .

Past Adjustment of Profits:

1. If any error is disclosed, after the accounts have been closed, then in order to correct the errors, these accounts cannot be reopened.

2. For this purpose, the following steps should be followed to correct the errors –

- Step 1: Write the amounts (in rough) which have been actually debited or credited.

- Step 2: Write the amounts (in rough) which should be debited or credited.

- Step 3: Note the difference in the two amounts.

- Step 4: Pass the adjusting entry.

Guarantee of Profit to a Partner:

- Sometimes, in order to induce a person to join as partner in the firm, other partners guarantee him a certain share of profit.

- Guarantee of profit means that the partner will be getting the profit which is guaranteed to him even if the firm does not have sufficient profits.

- For this purpose, firstly the actual profits are divided among partners and then, the shortfall to the partner is borne-by the other partners.

Shortfall = Guaranteed profit – Actual profit - The shortfall shall be credited to the new partner and debited to old partners in their mutual profit sharing ratio.

- A guarantee to the other partners that the share of the new partner will not exceed a stipulated figure.

Partnership Accounts-Fundamentals MCQ Questions

1. The relationship between persons who have agreed to share the profits of a business carried on by all or any of them acting for all is known as:

(a) Partnership

(b) joint Venture

(c) Association of Persons

(d) Body of Individuals.

Answer:

(a) Partnership

2. Features of a partnership firm are:

(a) Two or more persons are carrying common business under an agreement.

(b) They are sharing profits and losses in the fixed ratio.

(c) Business is carried by all or any of them acting for all as an agent.

(d) All of the above.

Answer:

(d) All of the above.

3. In the absence of any agreement, partners are entitled to receive interest on their loans at the rate of:

(a) 12% Simple Interest

(b) 12% Compounded Annually

(c) 6% Simple Interest

(d) 6% p.a. Simple Interest.

Answer:

(d) 6% p.a. Simple Interest.

4. Following is the difference between partnership deed and partnership agreement.

(a) Partnership deed is’ in writing and partnership agreement may be oral.

(b) Partnership deed is signed by all the partners but partnership agreement is signed by majority of the partners.

(c) Partnership deed is registered in the court of law whereas partnership agreement is not.

(d) Partnership deed is not subject to changes unless all partners agree to it. Partnership agreement can be amended with the consent of more than 50% partners.

Answer:

(a) Partnership deed is’ in writing and partnership agreement may be oral.

5. In the absence of an agreement to the contrary, the partners are:

(a) entitled to 6% interest on their capitals, only when there are profits.

(b) entitled to 9% interest on their capitals, only when there are profits.

(c) entitled to interest on capital at the bank rate, only when there are profits.

(d) not entitled to any interest on their capitals.

Answer:

(d) not entitled to any interest on their capitals.

6. What time would be taken into consideration for calculation of interest on drawings if equal monthly amount is drawn as drawing at the beginning of each month?

(a) 7 months

(b) 6 months

(c) 5 months

(d) 6.5 months.

Answer:

(d) 6.5 months.

7. Is rent paid to a partner appropriation of profits?

(a) It is appropriation of profit

(b) It is not appropriation of profit

(c) If partner’s contribution as capital is maximum

(d) If partner is a working partner.

Answer:

(b) It is not appropriation of profit

8. A is drawing ₹ 500 regularly on the 16th of every month. He will have to pay interest in a year on ₹ 6,000 (at the given rate of interest) for a total period of:

(a) 5 months

(b) 6 months

(c) 7 months

(d) 61/2 months.

Answer:

(b) 6 months

9. A is drawing ₹ 1,000 p.m. on the last day of every month. If the rate of interest is 5% p.a., then the total interest chargeable from him in to accounting year will be:

(a) ₹ 325

(b) ₹ 275

(c) ₹ 300

(d) ₹ 350.

Answer:

(b) ₹ 275

10. Bill and Monica are partners sharing profits and losses in the ratio of 3:2 having the capital of ₹ 80,000 and ₹ 50,000 respectively. They are entitled to 9% p.a. interest on capital before distributing the profits. During the year firm earned ₹ 7,800 before allowing any interest on capital. Profits apportioned among Bill and Monica is:

(a) ₹ 4,680 and 3,120

(b) ₹ 4,800 and 3,000

(c) ₹ 5,000 and 2,800

(d) None of these.

Answer:

(a) ₹ 4,680 and 3,120

11. Seeta and Geeta are partners sharing profits and losses in the ratio 4:1. Meeta was manager who received the salary of ₹ 4,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profits for the year is ₹ 6,78,000 before charging salary. Find the total remuneration of Meeta.

(a) ₹ 78,000

(b) ₹ 88,000

(c) ₹ 87,000

(d) ₹ 76,000.

Answer:

(a) ₹ 78,000

12. Firm has earned exceptionally high profits from a contract which will not be renewed. In such a case, the profit from this contract will not be included in __________.

(a) Profit share of the partners

(b) Calculation of the Goodwill

(c) Both

(d) None.

Answer:

(b) Calculation of the Goodwill

13. Interest on capital will be paid to the partners if provided for in the agreement but only from __________.

(a) Profits

(b) Reserves

(c) Accumulated Profits

(d) Goodwill.

Answer:

(a) Profits

14. Partners are suppose to pay interest on drawing only when __________ by the __________.

(a) Provided, Agreement

(b) Permitted, Investors

(c) Agreed, Partners

(d) ‘a’ & ‘c’ above.

Answer:

(d) ‘a’ & ‘c’ above.

15. When a partner is given guarantee by other partners, loss on such guarantee will be borne by:

(a) Partnership firm

(b) All the other partners

(c) Partners who give the guarantee

(d) Partner with highest profit sharing ratio.

Answer:

(c) Partners who give the guarantee

16. What would be the profit sharing ratio, if the partnership act is complied with:

(a) As per Agreement

(b) Equally

(c) In Capital Ratio

(d) None of the above.

Answer:

(b) Equally

17. Where will you record interest on drawings:

(a) Debit Side of Profit & Loss Appropriation Account

(b) Credit Side of Profit & Loss Appropriation Account

(c) Credit Side of Profit & Loss Account

(d) Debit Side of Capital/Current Account Only.

Answer:

(b) Credit Side of Profit & Loss Appropriation Account

18. What balance does a Partner’s Current Account has:

(a) Debit Balance

(b) Credit Balance

(c) Either ‘a’ or ‘b’

(d) None of the above.

Answer:

(c) Either ‘a’ or ‘b’

19. How would you close the Partner’s Drawing Account:

(a) By transfer to Capital or Current Account Debit Side.

(b) By transfer to Capital Account Credit Side.

(c) By transfer to Current Account Credit Side.

(d) Either ‘b’ or ‘c’

Answer:

(a) By transfer to Capital or Current Account Debit Side.

20. A, B and C were Partner’s with capitals of ₹ 50,000; ₹ 40,000 and ₹ 30,000 respectively carrying on business in partnership. The firm’s reported profit for the year was ₹ 80,000. As per provision of the Indian Partnership Act, 1932, find out the share of each partner in the above amount after taking into account that no interest has been provided on an advance by A of ₹ 20,000 in addition to his capital contribution.

(a) ₹ 26,267 for Partner B and C & ₹ 27,466 for Partner A.

(b) ₹ 26,667 each partner.

(c) ₹ 33,333 for A, ₹ 26,667 and ₹ 20,000 for C.

(d) ₹ 30,000 each partner.

Answer:

(a) ₹ 26,267 for Partner B and C & ₹ 27,466 for Partner A.

21. X, Y and Z are partners in a firm. At the time of division of profit for the year, there was dispute between the partners. Profits before interest on partner’s capital was ₹ 6,000 and Y determined interest @ 24% p.a. on his loan of ₹ 80,000. There was no agreement on this point. Calculate the amount payable to X, Y and Z respectively.

(a) ₹ 2,000 to each partner.

(b) Loss of ₹ 4,400 for X and Z & Y will have ₹ 14,800.

(c) ₹ 400 for X, ₹ 5,200 for Y and ₹ 400 for Z.

(d) None of the above.

Answer:

(c) ₹ 400 for X, ₹ 5,200 for Y and ₹ 400 for Z.

22. X, Y and Z are partners in a firm. At the time of division of profit for the year there was dispute between the partners. Profits before interest on partner’s capital was ₹ 6,000 and Z demanded minimum profit of ₹ 5,000 as his financial position was not good. However, there was no written agreement on this point.

(a) Other partners will pay Z the minimum profit and will share the loss equally.

(b) Other partners will pay Z the minimum profit and will share the loss in capital ratio.

(c) X & Y will take ₹ 500 each and Z will take ₹ 5,000.

(d) ₹ 2,000 to each of the partners.

Answer:

(d) ₹ 2,000 to each of the partners.

23. Following are the differences between Partnership and Joint Venture Except.

(a) Joint Venture is essentially planned for short term mainly for one transaction. However, partnerships are normally undertaken as going concerns and are expected to last for a very long period.

(b) The persons involved in a Joint Venture are called co-ventures whereas persons involved in a partnership are called partners.

(c) Any specific statute of the Government does not govern Joint Ventures but the India Partnership Act, 1932, governs partnerships.

(d) Memorandum of Undertaking is mandatory to be drafted to spell the relationship between the Co-ventures whereas the basic relationship between the partners is defined by the partnership deed.

Answer:

(d) Memorandum of Undertaking is mandatory to be drafted to spell the relationship between the Co-ventures whereas the basic relationship between the partners is defined by the partnership deed.

24. Every partner is bound to attend diligently to his __________ in the conduct of the business.

(a) Rights

(b) Meetings

(c) Capital

(d) Duties.

Answer:

(d) Duties.

25. In the absence of agreement, partners are not entitled to:

(a) Salary

(b) Commission

(c) Equal share in profit

(d) Both (a) and (b).

Answer:

(d) Both (a) and (b).

26. Profit on Profit/Loss Appropriation Account should be transferred to:

(a) Partner Capital A/c. Credit Side

(b) Partner Capital A/c. Debit Side

(c) B/S Assets Side

(d) B/S Liability Side.

Answer:

(a) Partner Capital A/c. Credit Side

27. If any loan or advance is provided by partner then, balance of such Loan Account should be transferred to:

(a) B/S Assets side

(b) B/S Liability Side

(c) Partners Capital A/c.

(d) Partners Current A/c.

Answer:

(b) B/S Liability Side

28. Out of the following which item is not shown in Partners Capital A/c:

(a) Managerial Commission

(b) Partners Salary

(c) Partners Commission

(d) None.

Answer:

(a) Managerial Commission

29. Loss in P/L App. A/c will:

(a) Reduce capital of partners

(b) Increase capital of partners

(c) Both (a) and (b).

(d) None.

Answer:

(a) Reduce capital of partners

30. Partner’s Current A/c are opened in case there Capital A/c are:

(a) Fluctuating

(b) Fixed

(c) Both (a) and (b)

(d) None.

Answer:

(b) Fixed

31. Partnership is defined under which section of the Partnership Act, 1932?

(a) Section 4

(b) Section 2

(c) Section 3

(d) Section 5

Answer:

(a) Section 4

32. Which one of the following is NOT an essential feature of a partnership?

(a) There must be an agreement

(b) There must be a business

(c) The business must be carried on for profits

(d) The business must be carried on by all the partners

Answer:

(d) The business must be carried on by all the partners

33. In the absence of partnership deed.

(a) Every partner has the right to participate in the business

(b) Profit sharing ratio is equal

(c) Partners are not entitled to interest on capital

(d) All of the above

Answer:

(d) All of the above

34. In the absence of partnership deed, interest on loan is payable at the rate of:

(a) 5%

(b) 7%

(c) 6%

(d) 4%

Answer:

(c) 6%

35. In the absence of partnership deed, interest on drawing is payable at:

(a) 2%

(b) Not payable

(c) 5%

(d) 6%

Answer:

(b) Not payable

36. Which of the following is NOT a feature of Joint Venture?

(a) There is no common firm name

(b) There is no specific act for joint ventures

(c) The profit/loss is to be ascertained at the starting of the joint venture

(d) The doctrine of implied authority is not applicable

Answer:

(c) The profit/loss is to be ascertained at the starting of the joint venture

37. Which of the following is a type of capital A/c?

(a) Fixed Capital A/c

(b) Fluctuating Capital A/c

(c) Both (a) & (b)

(d) None of these

Answer:

(c) Both (a) & (b)

38. Partners Capital A/c and Partners Current A/c are prepared in the case of _____________.

(a) Fixed Capital A/c

(b) Fluctuating Capital A/c

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(a) Fixed Capital A/c

39. In the case of fixed capital method, adjustments in respect of profit, loss, drawings etc. are made in __________.

(a) Current Account

(b) Capital A/c

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Current Account

40. Which of the following statement is true?

(a) Fixed capital account will always have a credit balance

(b) Current account can have a positive or negative balance

(c) Fluctuating capital can have a positive or a negative balance

(d) All of the above

Answer:

(d) All of the above

41. Goodwill is valued when:

(a) When the profit sharing ratio amongst the partner is changed

(b) When a partner retires or dies

(c) In the case of amalgamation

(d) All of the above

Answer:

(d) All of the above

42. If a firm makes exceptional profits which are not routine in nature, then such profits will not be included in:

(a) Profit share of the partners

(b) Calculation of goodwill

(c) Both (a) and (b)

(d) None of the above

Answer:

(b) Calculation of goodwill

43. In the absence of a agreement, the partners are entitled to:

(a) Salary

(b) Interest on loan

(c) Commission

(d) All of the above

Answer:

(b) Interest on loan

44. If A, B & C are three partners in a firm and C pays ₹ 20,000 against the liability of the firm, then the entry passed will be:

(a) No entry

(b) Debit C’s capital A/c & credit liability A/c

(c) Debit liability A/c and credit C’s capital A/c

(d) None of the above

Answer:

(c) Debit liability A/c and credit C’s capital A/c

45. Interest on drawing is __________.

(a) Debited to P & L A/c

(b) Credited to P & L Appropriation A/c

(c) Debited to Capital A/c

(d) Both (b) & (c)

Answer:

(d) Both (b) & (c)

46. A draws ₹ 1,000 p.m. on the last day of every month. If the rate of interest is 5% p.a., then the total interest on drawings will be:

(a) ₹ 825

(b) ₹ 275

(c) ₹ 300

(d) None of these

Answer:

(b) ₹ 275

47. A and B are partners sharing profits and losses in the ratio of 4:1 N, the manager was entitled to a commission @ 5% of net profits after charging such commission. If the profit before commission is t 6,30,000 find out the commission:

(a) ₹ 78,000

(b) ₹ 30,000

(c) ₹ 28,000

(d) ₹ 32,000

Answer:

(b) ₹ 30,000

48. A and B are the two partners having a capital of ₹ 50,000 and ₹ 60,000. Interest on capital is @ 5% p.a. If the profit before appropriation is ₹ 4,600, then find out the interest allocated to the partners:

(a) ₹ 3,500 1,100

(b) ₹ 600 & ₹ 400

(c) ₹ 2,090 & ₹ 2,509

(d) ₹ 2,112 & ₹ 4,111

Answer:

(c) ₹ 2,090 & ₹ 2,509

49. In a partnership firm, a partner withdraws ₹ 5,000 per month in the beginning of month for personal use. The rate of interest on drawings is 6% p.a. What is the amount of interest on drawings for the year?

(a) ₹ 1,950

(b) ₹ 1,800

(c) ₹ 300

(d) ₹ 1,650

Answer:

(a) ₹ 1,950

When a fixed amount is drawn regularly at the beginning of every month, the amount of interest on total drawings for the year will be on an average for 6.5 months.

So, Interest = 5,000 x 12 x \(\frac { 6 }{ 100 }\) x \(\frac { 6.5 }{ 12 }\) = ₹ 1,950

Interest on drawings for the year is ₹ 1,950.

50. Interest on capital will be paid to the partners if provided for in the partnership deed but only out of __________.

(a) Profits

(b) Reserves

(c) Accumulated profits

(d) Goodwill

Answer:

(a) Profits

Provisions relating to interest on capital:

| Case | Provision |

| 1. When partnership deed is silent about interest on capital. | No interest will be allowed. |

| 2. When the deed provides for interest on capital but it is silent whether to treat it as a charge. | Interest on capital will be allowed only when there is profit. |

| 3. When partnership deed provides for treating interest as a charge. | Full amount of interest will be allowed whether there is profit or loss. |

51. In case of partnership the act of any partner is:

(a) Binding on all partners

(b) Binding on that partner only

(c) Binding on all partners except that particular partner

(d) None of the above

Answer:

(a) Binding on all partners

Partnership follows the principle of mutual agency. This means that every partner is an agent as well as principle of another partner. Therefore, the act of any partner is binding on all partners.

52. X, Y and Z are partners sharing profits and losses equally. Their capital balances on March, 31, 2012 are ₹ 80,000, ₹ 60,000 and ₹ 40,000 respectively. Their personal assets are worth as follows: X – ₹ 20,000, Y – ₹ 15,000 and Z – ₹ 10,000. The extent of their liability in the firm would be:

(a) X – ₹ 80,000 : Y – ₹ 60,000 : and Z – 140,000

(b) X – ₹ 20,000 : Y – ₹ 15,000 : and Z – ₹ 10,000

(c) X – ₹ 1,00,000 : Y – ₹ 75,000 : and Z – ₹ 50,000

(d) Equal.

Answer:

(b) X – ₹ 20,000 : Y – ₹ 15,000 : and Z – ₹ 10,000

In case of a partnership firm the liability of each partner is unlimited. Still this liability is limited to the value of personal assets of the partners as they cannot contribute anything more than that. Hence liability is X : 20,000; Y : 15,000; Z : 10,000.

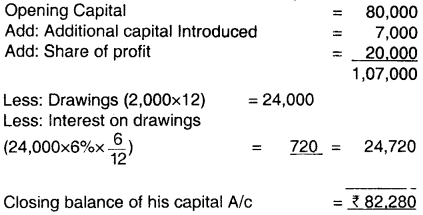

53. In a partnership firm, in the beginning of the year, capital of one partner is ₹ 80,000. During the year, he introduced ₹ 7,000 as additional capital. In addition to this, he withdraws ₹ 2,000 in the middle of every month. The firm does not pay any interest on capital but charges 6% interest on drawings. His share of profit after interest on drawings is ₹ 20,000. At the end of the year, his capital in the firm would be __________.

(a) ₹ 83,000

(b) ₹ 1,05,000

(c) ₹ 82,280

(d) ₹ 1,09,000.

Answer:

(c) ₹ 82,280

Calculation of closing balance of capital:

54. If partnership deed is not there, then profit is shared in:

(a) Old Ratio

(b) Capital Ratio

(c) Equally

(d) New Ratio

Answer:

(c) Equally

It is not compulsory to have a partnership deed. If there is no partnership deed, profit sharing ratio is equal.

55. What will be the interest on Partner’s loan when there is no partnership deed₹

(a) 6% p.a.

(b) 6%

(c) 6% simple interest p.a.

(d) 6% compound interest p.a.

Answer:

(c) 6% simple interest p.a.

If there is no partnership deed, interest on loan even if there are losses, to be paid at the rate of 6%.

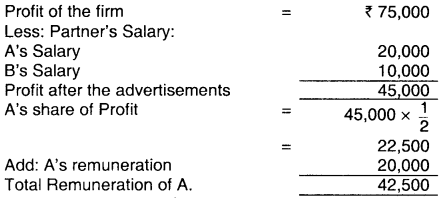

56. In a firm of A & B having equal profit sharing ratio. Salary of A is ₹ 20,000, B is ₹ 10,000. Profit of the firm is ₹ 75,000. What is the total remuneration of A.

(a) ₹ 20,000

(b) ₹ 30,000

(c) ₹ 42,500

(d) ₹ 22,500

Answer:

(c) ₹ 42,500

57. Calculate interest on drawings of A and B if accounts are closed on 31st March, 1973.

A – ₹ 10,000 – 1st April, 1972.

B – ₹ 20,000 – 17 August, 1972.

Interest – 8.5%

(a) ₹ 1,894.94

(b) ₹ 1,890

(c) ₹ 1,900

(d) ₹ 1,902.6

Answer:

(c) ₹ 1,900

58. Under Fixed capital method. __________ A/c remains fixed and changes are made in current A/c.

(a) Partner’s Capital A/c

(b) Partner’s Current A/c

(c) Both (a) and (b)

(d) None of these.

Answer:

(a) Partner’s Capital A/c

Under fixed capital method, Partner’s Capital A/c remain fixed until and unless addition or deletion to the capital is made.

While all the adjustments are made through the Partner’s current A/c.

Hence, capital remains fixed under fixed capital method.

59. A partner that doesn’t take part in the management of business, but he/she has made investment in business and liable to creditors of the business is known as:

(a) Dormant partner

(b) Active partner

(c) Minor partner

(d) Junior partner

Answer:

(a) Dormant partner

Dormant partner doesn’t take part in the management of business, but he/she has made investment in business and is liable to creditors of the business.

60. On 1st April, 2012 Raghu invested capital of ₹ 2,00,000. He withdrew ₹ 50,000 during the ₹ear. Interest on drawings is charged @ 10% per annum. The amount of interest on drawings deducted from capital at the end of financial year is:

(a) ₹ 15,000

(b) ₹ 2,500

(c) ₹ 7,500

(d) ₹ 5,000

Answer:

(b) ₹ 2,500

The amount of interest on drawings:

Int. on drawings:

→ Amt. x \(\frac { Rate of Drawings }{ 100 }\) x \(\frac { 6 }{ 12 }\)

→ 50,000 x \(\frac { 10 }{ 100 }\) x \(\frac { 6 }{ 12 }\) = ₹ 2,500

61. Which of the following is not recorded in the partners current accounts₹

(a) Interest on Drawings

(b) Administrative Expenses

(c) Drawings

(d) Partners Salaries.

Answer:

(b) Administrative Expenses

| Particulars | ₹ | Particulars | ₹ |

| Drawings A/c Int. on drawing A/c | Salaries | ||

| Administrative expenses are shown in Profit & Loss A/c. | |||

62. Total capital employed by a partnership firm is ₹ 1,00,000 and its average profit is ₹ 25,000. Normal rate of return is 20% in similar firms working under similar conditions. The firm earns super profit of:

(a) ₹ 5,000

(b) ₹ 2,000

(c) ₹ 4,000

(d) ₹ 3,000.

Answer:

(b) ₹ 2,000

Super profit = Average Prof it – Normal Profit

Normal profit = Capital x Rate

Normal profit = 1,00,000 x 20%

= ₹ 20,000

= ₹ 25,000 – 20,000

= ₹ 5,000

63. The investment of personal assets by the owner in the business will:

(a) Increase total assets and increase owners equity

(b) Increase assets and decrease liabilities

(c) Increase total assets only

(d) Has no effect on assets but increase owners equity.

Answer:

(a) Increase total assets and increase owners equity

Introduction of personal assets by the owner in the business will increase total assets of the business and will also have effect of increase in owner’s equity.

64. A, B and C started a business by investing ₹ 45,000, ₹ 55,000 and ₹ 60,000 respectively and sharing profit or losses in the ratio of capital. At the end of a year they got a total profit of ₹ 11,200. How much “B” get more than “A” in the profit?

(a) ₹ 780

(b) ₹ 700

(c) ₹710

(d) ₹ 750

Answer:

(b) ₹ 700

The ration of capital = 45 : 55 : 60

= 9 : 11 : 12

Share of A in Profit = 11200 x 9/32 = 3150

Share of B in Profit = 11200 x 11/32 = 3850

Therefore, the amount by which profit of B exceeds that of A is (3,850 – 3,150) = ₹ 700

65. In the general form of partnership, liability of partner are:

(a) Limited

(b) Limited to the capital invested by them

(c) Unlimited

(d) Limited to an amount guaranteed by them.

Answer:

(c) Unlimited

Generally speaking, every partner in a partnership has unlimited liability for all of the partnership’s debts. Each partner can be held responsible not only for liabilities resulting from a lawsuit but also for liabilities stemming from a contract signed by only one of the partners This is due to the fact that each partner is an “agent” of the partnership.

66. Which of the following is not recorded in the partners current accounts?

(a) Interest on drawings

(b) Partners salaries

(c) Administrative expenses

(d) Drawings

Answer:

(c) Administrative expenses

The Partner’s Current Account under the Fixed Capital A/c contains

- Interest on capital

- Interest on drawing

- Salary on commission to partner

- Adjustment of profit

- Drawings

67. In case if partnership deed is silent, profit is divided as follows?

(a) Gaining ratio

(b) Equally

(c) Sacrifice ratio

(d) Either of (a) & (b)

Answer:

(b) Equally

If there is no partnership deed or if there is no provision in it indicating a contrary intention, the following provisions of the Partnership Act, apply.

- Every partner has a right to take part in the conduct of the business of the firm and also the right of free access to all records, books and accounts of the firm.

- Partners share profits and losses equally. It is so, even when partners contribute capital unequally.

- Partners are not entitled to any interest on capital contributed by them nor can they claim any salary for the work done by them for the firm. In case a partnership deed provides for payment of interest on capital or salary, it is payable only if there is a profit.

- On amounts advanced by a partner to the firm in excess of his agreed share of capital, the partner is entitled to receive interest on such excess at the rate of 6% per annum. Such interest is payable even if there is a loss.

- No interest is to be charged on drawings.

68. If profit is divided equally so it is necessary that loss should also be divided?

(a) Partly yes

(b) Partly no

(c) Yes

(d) No

Answer:

(c) Yes

The business must be carried on for the purpose of earning profits which would be divided among the partners i.e. there must be an agreement among the partners to share the profits (including negative profits, i.e., losses) of a business. Hence, the above statement is correct.

69. As per the Partnership Act, 1932 if a partner with a capital deficiency is unable to pay the amount owed to the partnership, the deficiency is borne by other partners with credit balances:

(a) On the basis of their income ratio’s

(b) On the basis of their capital balances

(c) Equally

(d) On the basis of their original investments.

Answer:

(b) On the basis of their capital balances

As per the Decision in Garner, vs Murray Case. The loss should be divided among the other partners in the ratio of capitals then standing.

70. As per Partnership Act, 1932 the following are characteristics of partnership except:

(a) Earning of profit

(b) Co-ownership of property

(c) Unlimited liability

(d) Mutual agency

Answer:

(b) Co-ownership of property

The Partnership form of business organisation is characterised by the Co-ownership of property.

71. If capital at the end of the year is ₹ 70,000 capital introduced during the year is ₹ 50,000 is drawing would be equal to?

(a) ₹ 30,000

(b) ₹ 12,000

(c) ₹ 16,000

(d) ₹ 20,000

Answer:

(d) ₹ 20,000

Capital shown at the end is ₹ 70,000 and Capital introduced during year ₹ 50,000. So, ₹ 20,000 is drawing due to which capital shown at the end is ₹ 70,000.

72. In general partnership, liability of a partner is:

(a) Limited

(b) Unlimited

(c) Limited up to the capital contributed by partner

(d) None of the above.

Answer:

(b) Unlimited

In general partnership liability of partner is unlimited, hence, option

73. Registration of partnership is:

(a) Voluntary

(b) Mandatory

(c) Compulsory

(d) None of the above.

Answer:

(a) Voluntary

Registration of a firm is voluntary. Hence, option (a) is correct.

74. Which of the following is true about a partnership

(a) All partners invest an equal amount of capital in the partnership’s business

(b) All partners are personally liable for the debts of the partnership business

(c) Partnerships get favourable tax treatment compared to corporations

(d) A partnership requires at least three persons

Answer:

(b) All partners are personally liable for the debts of the partnership business

In a partnership due to existence of mutual agency, all partner are principal as well as agent of the other partners. Hence, all partners are personally liable for the debts of the partnership business.

75. In a partnership firm, in the beginning of the year, capital of one partner is ₹ 80,000. During the year, he introduced ₹ 7,000 as additional capital. In additional to this, he withdraws ₹ 2,000 in the middle of every month. The firm does not pay any interest on capital but charges 6% interest on drawings. His share of profit after interest on drawings is ₹ 20,000. At the end of the year, his capital in the firm would be:

(a) ₹ 83,000

(b) ₹ 1,05,000

(c) ₹ 82,280

(d) ₹ 1,09,000

Answer:

Interest on drawings = (2000 x 12) x \(\frac { 6 }{ 12 }\) x \(\frac { 6 }{ 100 }\) = ₹ 720

Note: Since, drawings are made at middle of every month, interest for 6 months is charged on an average.

| Beginning | 80,000 |

| Add: Additional Capital Introduced | 7,000 |

| Less: Interest on drawings | (720) |

| Less: Drawings | (24,000) |

| Add: Share of Profit | 20.000 |

| Closing Capital | 82.280 |

76. A & B share capital ratio in 2:3. A withdraws after 9 months from business. How long did B invest his capital __________?

(a) 8 Months

(b) 12 Months

(c) 11 Months

(d) 10 Months

Answer:

(b) 12 Months

A : B Share Capital Ratio in 2: 3. A withdraws his capital after a months hence A’s capital is invested in the bushiness for 9 months, but it does not mean that B also withdrawal his capital. Concluded, B’s capital is invested in the partnership till year end i.e for 12 months.

77. Find Goodwill of 3 years purchase if super profit of 5 years is 1st year – 30,000 2nd – 32,000; 3rd year = 30,000 (including gain 2,000) 4th year (26,000) 5th year (14,000) and capital employed 1,00,000 and normal rate of return 15% __________.

(a) 45,000

(b) 30,000

(c) 24,000

(d) 10,000

Answer:

(a) 45,000

Average profit for last 5 years

= 30,000 + 32,000 + 30,000 – 2,000 – 26,000 – 14,000 – \(\frac { 50,000 }{ 5 }\)

= 10,000

Normal profit = Capital employed x \(\frac { R% }{ 100 }\)

= 10,000 x \(\frac { 15 }{ 100 }\)

= 15.000.

Super Profit = 15,000 – 10,000

= 5,000 x 3

= 15.000

Goodwill = 15,000 x 3 = 45,000