Go through this Partnership Accounts-Admission of a Partner – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Partnership Accounts-Admission of a Partner – CS Foundation Fundamentals of Accounting Notes

1. Any change in partnership agreement is known as the reconstitution of partnership.

2. As a result of reconstitution, the existing agreement comes to an end and a new agreement is formed.

Reconstitution may take place because of the following reasons:

- Admission of a new partner

- Retirement of a partner

- Death of a partner

- Change in profit sharing ratio

Admission of a Partner:

Admission means when a new partner enters into the business.

A new partner is needed in the business because of any of the following reasons

- When firm needs‘more capital.

- When an experienced and knowledgeable person is needed in the business.

- For increasing goodwill of the firm by taking any reputed person as partner.

- Any other reason.

Admission of a new partner requires the following adjustments:

- Calculation of new profit sharing ratio

- Transfer of profits and reserves to existing partners

- Revaluation of assets and liabilities

- Treatment of goodwill

Calculation of New Profit Sharing Ratio:

- When a new partner is admitted into the partnership, he acquires his share of profit from the existing partners.

- Due to this, the old partner’s share is reduced, hence a new profit sharing ratio should be calculated.

- After admission, the future Profits/Losses shall be distributed in this new ratio.

- Revaluation of assets and liabilities.

- Treatment of goodwill.

Note: Sacrificing Ratio:

For giving a share of profit to new partner, the old partners have to sacrifice a portion of their share. Therefore, the ratio in which the old partners sacrifice their part is known as the sacrificing ratio.

Sacrificing Ratio = Old Ratio – New Ratio

Example: A, B, C are partners sharing profits in the ratio of 5 : 3 : 2. They admit D into partnership. The new profit sharing ratio of partners is 3 : 2 : 2 : 3. Calculate sacrificing ratio.

Solution:

Sacrificing Ratio = Old Ratio – New Ratio

Sacrifice made by A = \(\frac { 5 }{ 10 }\) – \(\frac { 3 }{ 10 }\) = \(\frac { 2 }{ 10 }\)

Sacrifice made by B = \(\frac { 3 }{ 10 }\) – \(\frac { 2 }{ 10 }\) = \(\frac { 1 }{ 10 }\)

Sacrifice made by C = \(\frac { 2 }{ 10 }\) – \(\frac { 2 }{ 10 }\) = 0.

So sacrificing ratio of A and B is 2 : 1 since C has not sacrificed.

Need for Calculation of Sacrificing Ratio:

→ For distribution of goodwill to old partners.

→ For calculation of new ratio if sacrificing ratio is given.

Calculation of New Profit Sharing Ratio:

Case – 1

When ratio of new partner is given, then in absence of any other agreement, it is presumed that all partners will continue to share remaining profit in the old profit sharing ratio.

Case – 2

When the new partner purchases his share of profit from the old partners in equal ratio.

Case – 3

When the new partner purchases his share from the old partners in a particular ratio.

Case – 4

When the old partners surrender a particular fraction of their share in favour of new partner.

Transfer of accumulated profits and reserves to existing partners:

- At the time of admission of a partner, if there are any accumulated profits or reserves, then they must be transferred to the existing partners’ capital A/c.

- A new partner is not entitled to any such benefit or bear any such liability which occurred before his admission.

- Transfer of reserves is done even when no new partner is admitted but the partner change their profit sharing ratio.

Note: Reason for this is that the reserves and profits were created because of the efforts of the old partners. So, they should be fully utilized by the old partners only. Hence, before a new partner gets admitted, such reserves are distributed among old partners.

(iv) Journal entries effecting such transfer:

(a) For distributing reserves and accumulated profits:

General Reserve A/c Dr.

Reserve Fund A/c Dr.

Profit / Loss (Cr. balance) A/c Dr.

To Old partners’ capital A/c

(b) For transferring accumulated losses:

Old partners’ capital A/c Dr.

To Profit / Loss (Dr. bal.)

(c) For distributing surplus of specific funds:

Workmen compensation fund A/c Dr.

Investment fluctuation fund A/c Dr.

To Old partners’ capital A/c

Revaluation of assets and liabilities:

(i) On admission of a new partner, the assets and liabilities of the firm are revalued to their true and fair figures.

(ii) The value of assets and liabilities may have changed over a period of time.

(iii) The new partner is not to bear any part of profit/loss due to change in value of asset and liability.

(iv) For this purpose, the assets and liabilities are revalued on the admission of the partner and the difference or change in value in form of profit/loss shall be distributed among old partners in the old ratio.

Note:

For this, Revaluation Account is Prepared.

(v) Accounting entries:

(i) For decrease in value of asset:

Revaluation A/c Dr.

To Asset A/c

(ii) For increase in value of asset:

Asset A/c Dr.

To Revaluation A/c

(iii) For increase in value of liability:

Revaluation A/c Dr.

To Liabilities A/c

(iv) For decrease in value of liability:

Liabilities A/c Dr.

To Revaluation A/c

(v) When revaluation A/c shows profit:

Revaluation A/c Dr.

To Old Partners’ Capital A/c [In the old ratio]

(vi) When revaluation A/c shows loss:

Old Partners’ Capital A/c Dr.

To Revaluation A/c

[In the old ratio]

Proforma Revaluation Account

| Particulars | ₹ | Particulars | ₹ |

| To Decrease in value of assets.

To Increase in value of liabilities. To Unrecorded Liabilities. To Profit on Revaluation transferred to old partners’ capital accounts (in old ratio)

|

By Increase in value of assets.

By Decrease in value of liabilities. By Unrecorded assets. By Loss on Revaluation transferred to old partners’ capital accounts (in old ratio) |

Difference between Revaluation A/c and Memorandum Revaluation:

| Revaluation A/c | Memorandum Revaluation A/c |

| Revaluation A/c is prepared to find out the profit and loss on revaluation of assets and liabilities which appear in the new balance sheet at the revalued figures. | It is prepared to record the effect of revaluation of assets and liabilities but they are recorded at their old figures in the new balance sheet. |

| Revaluation A/c is not divided in parts. The profit or loss of goes to old partners only. | It has two parts. The profit or loss of first part goes to old partners while profit or loss of the second part goes to all the partners including the new partner. |

Treatment of Goodwill:

In case of admission of partner-there can be following situations relating to the treatment of goodwill:

(a) When goodwill does not appear in books –

- When the amount of goodwill is paid privately.

- When the new partner brings his share of goodwill in cash.

- When the new partner does not bring his goodwill in cash.

(b) When goodwill already appears in book –

(a) When goodwill does not appears in books

1. When amount of goodwill is paid privately:

- Payment of goodwill privately means that the new partner pays goodwill in cash to the old partners outside the business.

- Since the amount is paid privately outside the business, hence there will be no entry for this in the books of business.

2. When the new partner brings his share of goodwill in cash:

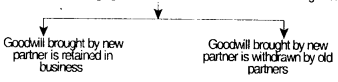

When new partner brings goodwill in cash there can be the following situations

(a) Retained in business –

(i) When new partner brings goodwill in cash

Cash/Bank A/c Dr.

To Goodwill A/c

(ii) Transfer of goodwill to partners’capital A/c

Goodwill A/c Dr.

To Old partners’ A/c

(In sacrificing ratio)

Effect of above two entries:

1. Old partners will be getting goodwill for the share of profit sacrificed by them, from the new partner.

2. Goodwill is transferred to old partners’ account; hence it will be retained in the business.

(b) Withdrawn by old partners:

(i) When goodwill is brought in cash

Cash/Bank A/c Dr.

To Goodwill A/c

(ii) Transfer of goodwill to old partners’ capital A/c

Goodwill A/c Dr.

To Old partners’ capital A/c (In sacrificing ratio)

(iii) When goodwill is withdrawn by old partners

Old partners’ capital A/c Dr.

To Cash/bank A/c

Effect of above entries:

- Old partners will be getting goodwill for the share of profit sacrificed by them for the new partner.

- Since the partners have withdrawn goodwill, hence goodwill is no longer retained in business.

Note :

If some amount is withdrawn, the remaining amount will be retained in business.

Hidden Goodwill:

- Sometimes the value of goodwill is not clearly given in question but is to be inferred from the question.

- In such cases, goodwill is calculated on the basis of total capital of the firm and profit.

Example: A and B are partners with capitals of ₹ 50,000 and ₹ 30,000 respectively. They admit C as partner with share and bring 40,000 as his capital. Calculate goodwill.

Solution :

If C brings ₹ 40,000 for \(\frac { 1 }{ 4 }\)th share,

So, based on this total capital of firm

= \(\frac { 1 }{ 4 }\) – 40,000

= 1 – 40,000 x 4

= ₹ 1,60,000.

Whereas, total capital of firm after C’s admission = 50,000 + 30,000 + 40,000 = ₹ 1,20,000

Goodwill = ₹ 1,60,000 – ₹ 1,20,000

= ₹ 40,000

Adjustment of old partners’ capital A/c on the basis of new partner:

1. This adjustment is done when it is decided that on admission of new partner, the capital of old partners’ be adjusted on the basis of new partner’s capital to make them proportionate to their share of profit.

2. For this adjustment, there are following steps:

- Step – 1 : Determine the entire capital of the new firm based on new partner’s capital.

- Step – 2 : Determine the capital of each partner by dividing the total capital according to his profit sharing ratio.

- Step – 3 : Ascertain the difference between the old and new capital of old partners.

(i) If old capital is more than the new, the excess amount will be paid off to the partner or credited to his current account.

Old partner’s Capital A/c Dr.

To Bank or partner’s current A/c

(ii) If the old capital is less than the new capital, the capital account of the partner will be increased (either by bringing cash or through current A/c)

Bank A/c or partner’s current A/c Dr.

To Partner’s capital A/c

Partnership Accounts-Admission of a Partner MCQ Questions

1. A new partner may be admitted to partnership:

(a) with the consent of all the old partners

(b) with the consent of any one partner

(c) with the consent of two thirds of the old partners

(d) with the consent of three fourth of the old partners.

Answer:

(a) with the consent of all the old partners

2. The balance of general reserve is to be transferred to the capital accounts of the partners in:

(a) Old profit sharing ratio

(b) New profit sharing ratio

(c) Capital ratio

(d) Sacrificing ratio.

Answer:

(a) Old profit sharing ratio

3. General reserve at the time of admission of a partner is transferred to:

(a) Revaluation account

(b) Partner’s capital accounts

(c) Neither of the two

(d) Profit and Loss Account.

Answer:

(b) Partner’s capital accounts

4. C is admitted in firm for a 1/4 share in the profits for which he brings ₹ 3,000 for goodwill. It will be taken by the old partners in:

(a) Old profit sharing ratio

(b) New profit sharing ratio

(c) Sacrificing ratio

(d) Capital ratio.

Answer:

(c) Sacrificing ratio

5. Goodwill raised by the partners at the time of admission of a partner will be written off in:

(a) Old profit sharing ratio

(b) New profit sharing ratio

(c) Sacrificing ratio

(d) Capital ratio

Answer:

(b) New profit sharing ratio

6. The balance of Memorandum Revaluation Account (second part), is transferred to the capital accounts of the partners in:

(a) Capital ratio

(b) Old profit sharing ratio

(c) New profit sharing ratio

(d) Equal ratio.

Answer:

(c) New profit sharing ratio

7. If the incoming partner is to bring his share of goodwill in cash, and there exists any balance in goodwill account, then this goodwill account is to be written off among old partners in:

(a) New profit sharing ratio

(b) Old profit sharing ratio

(c) Sacrificing ratio

(d) Equal ratio.

Answer:

(b) Old profit sharing ratio

8. A and B share profit and losses equally. They admit C as an equal partner and goodwill was valued as ₹ 30,000. C is to bring in ₹ 30,000 as his capital and necessary cash towards his share of goodwill. What will be the final effect of goodwill in the partner’s capital account?

(a) A and B’s accounts credited with ₹ 5,000 each

(b) All partner’s account credited with ₹ 10,000 each

(c) Only C’s account credited with ₹ 10,000 as cash bought in for goodwill

(d) None of the above.

Answer:

(a) A and B’s accounts credited with ₹ 5,000 each

9. C was admitted in a firm with 1 /4th share of the profit of the firm. C contributes ₹ 30,000 as his capital. A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s capital as base capital:

(a) ₹ 54,000 and ₹ 32,000 for A and B respectively

(b) ₹ 54,000 and ₹ 36,000 for A and B respectively

(c) ₹ 64,000 and ₹ 42,000 for A and B respectively

(d) ₹ 62,000 and ₹ 52,000 for A and B respectively.

Answer:

(b) ₹ 54,000 and ₹ 36,000 for A and B respectively

10. X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who paid ₹ 40,000 as goodwill, the new profit sharing ratio being 2:1:1 among X, Y and Z respectively. The amount of goodwill will be credited to :

(a) X and Y as ₹ 30,000 and ₹ 10,000 respectively

(b) X only

(c) Y only

(d) None of the above.

Answer:

(b) X only

11. X and Y are partners sharing profit in the ratio of 1 : 1. They admit Z for 1/5th share who contributed ₹ 25,000 for his share of goodwill. The total value of the goodwill of the firm will be:

(a) ₹ 25,000

(b) ₹ 50,000

(c) ₹ 1,00,000

(d) ₹ 1,25,000.

Answer:

(d) ₹ 1,25,000.

12. ‘A’ and ‘B’ are partners in a business sharing profits in the ratio of 5 : 3. They admit ‘C’ as a partner with 1/4 share in the profits which he acquires 3/4 from ‘A’ and 1/4 from ‘B’. He pays ₹ 4,000 as his share of goodwill. ‘A’ and ‘B’ will be credited by

(a) ₹ 2,500 and ₹ 1,500 respectively:

(b) ₹ 2,000 each

(c) ₹ 1,000 and ₹ 3,000 respectively

(d) ₹ 3,000 and ₹ 1,000 respectively.

Answer:

(a) ₹ 2,500 and ₹ 1,500 respectively:

13. A, B and C are equal partners in a firm with capital of ₹ 16,800, ₹ 12,600 and ₹ 6,000 respectively with bills payable ₹ 3,300; creditors ₹ 6,000; cash ₹ 600; debtors ₹ 10,800; stock ₹ 11,400; furniture ₹ 2,400 and building ₹ 19,500. E is admitted to the firm and brings ₹ 9,000 as goodwill and ₹ 15,000 as capital. Half the goodwill is withdrawn by old partners, and stock and furniture is depreciated by 10%. A provision of 5% on debtors is created and value of building is taken at ₹ 27,000. The profit on revaluation will be ________.

(a) ₹ 5,500

(b) ₹ 5,580

(c) ₹ 5,400

(d) ₹ 5,680.

Answer:

(b) ₹ 5,580

14. X and Y are sharing profits in the ratio of 2 : 1. They admit Z into the firm for 1/4 share in profits for which he brings ₹ 12,000 as his share of capital. Hence, the adjusted capital of Y will be –

(a) ₹ 12,000

(b) ₹ 16,000

(c) ₹ 24,000

(d) ₹ 20,000.

Answer:

(a) ₹ 12,000

15. A and B are partners sharing the profits in the ratio 2 : 3. They take C as the new partner who is supposed to bring ₹ 50,000 against capital and 20,000 against goodwill. New profit sharing ratio is 1 : 1 : 1. C is able to bring ₹ 60,000 only. How will this be treated in the books of the firm.

(a) A and B will share goodwill brought by c in the ratio 1 : 4

(b) Goodwill will be raised to ₹ 30,000 in old profit sharing ratio

(c) Both (a) and (b)

(d) None.

Answer:

(c) Both (a) and (b)

16. A and B are partners sharing the profit in the ratio of 3 : 2. They take C as the new partner who is supposed to bring ₹ 25,000 as capital and ₹ 20,000 against goodwill. New profit sharing ratio is 1 : 1 :1. C is able to bring only his share of capital. How will this be treated in the books of the firm.

(a) A and B will be credited by 8,000 and 2,000 for goodwill

(b) Goodwill will be raised to ₹ 30,000 by crediting A and B in old profit sharing ratio

(c) Both (a) and (b)

(d) None.

Answer:

(b) Goodwill will be raised to ₹ 30,000 by crediting A and B in old profit sharing ratio

17. A and B are partners in the ratio of 2 : 1. They admitted C for 1/4 share who contributes ₹ 3,000 for his share of goodwill. The total value of goodwill of the firm is :

(a) ₹ 3,000

(b) ₹ 9,000

(c) ₹ 12,000

(d) ₹ 15,000

Answer:

(c) ₹ 12,000

18. P and Q are partners sharing profits in the ratio of 2 : 1. R is admitted to the partnership with effect from 1st April on the term that he will bring ₹ 30,000 as his capital for 1/5 share and pays ₹ 18,000 for goodwill half of which is to be withdrawn by P and Q. Profit on revaluation is ₹ 6,000 and opening capital of P is ₹ 40,000 and Q 30,000, find the closing balance of each partner’s capital.

(a) ₹ 50,000 : 35,000 : 30,000

(b) ₹ 50,000 : 35,000 : 20,000

(c) ₹ 40,000 : 30,000 : 30,000

(d) ₹ 41,000 : 30,500 : 29,000.

Answer:

(b) 2 : 2 : 3

19. X and Y share profits and losses in the ratio of 4 : 3. They admit Z in the firm with 3/7 share which he gets 2/7 from X and 1/7 from Y. The new profit sharing ratio will be –

(a) 7 : 3 : 3

(b) 2 : 2 : 3

(c) 5 : 2 : 3

(d) 2 : 3 : 3

Answer:

(b) 2 : 2 : 3

20. X and Y are sharing profits and losses in the ratio of 3 : 2. Z is admitted with 1/5th share in profits of the firm which he gets from X. Now, the new profits sharing ratio between X, Y and Z will be ________.

(a) 12 : 8 : 5

(b) 8 : 12 : 5

(c) 2 : 2 : 1

(d) 2 : 2 : 2

Answer:

(c) 2 : 2 : 1

21. A and B are partners in a firm sharing profits in the ratio of 3 : 1. They have agreed to admit C into the partnership firm. C is given 1/4th share of future profits which he acquires in the ratio of 2 : 1 from A and B. The new profit sharing ratio would be:

(a) 4 : 3 : 1

(b) 7 : 2 : 3

(c) 3 : 1 : 7

(d) 7 : 3 : 2

Answer:

(c) 3 : 1 : 7

22. X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1 /5th profits, for which he paid ₹ 60,000 against capital and ₹ 30,000 against goodwill. Find the capital balance for each partner taking Z’s capital as base capital.

(a) ₹ 1,50,000; 60,000 and 60,000

(b) ₹ 1,50,000; 60,000 and 90,000

(c) ₹ 1,50,000; 90,000 and 60,000

(d) ₹ 1,50,000; 90,000 and 90,000.

Answer:

(c) ₹ 1,50,000; 90,000 and 60,000

23. A and B are partners sharing the profits in the ratio of 3 : 2. They take C as the new partner who brings in ₹ 50,000 against capital and ₹ 20,000 against goodwill. New profit sharing ratio is 1 : 1 : 1. In what ratio will this amount of goodwill be shared among the old partners.

(a) ₹ 16,000, 4,000

(b) ₹ 10,000, 10,000

(c) Old partners will not get any share in the goodwill bought in by C

(d) ₹ 12,000, 8,000.

Answer:

(a) ₹ 16,000, 4,000

24. A and B are partners of a partnership firm sharing profit in the ratio 3 : 2 respectively. C was admitted for 1/5,h share of profit. Machinery would be appreciated by 10% (book value ₹ 80,000) and building would be depreciated by 20% (₹ 2,00,000). Unrecorded debtors of ₹ 1,250 would be bought into books. Profits/Loss on revaluation is :

(a) Loss – ₹ 30,750

(b) loss 40,000

(c) Profits – ₹ 28,000

(d) profits – ₹ 40,000.

Answer:

(a) Loss – ₹ 30,750

25. A and B are equal partners in a firm. They admitted C as one – sixth partner who bought in ₹ 60,000 as goodwill. The new profit sharing ratio is 3 : 2 :1. If goodwill of ₹ 60,000 is to be paid to the old partners as per sacrificing ratio, B will receive:

(a) ₹ 30,000

(b) ₹ 60,000

(c) ₹ 45,000

(d) Nil.

Answer:

(b) ₹ 60,000

26. Goodwill of a firm of A and B is valued at ₹ 30,000. It is appearing in the books at ₹ 12,000, C is admitted for 1/4 share. What amount he is supposed to bring for goodwill?

(a) ₹ 3,000

(b) ₹ 4,500

(c) ₹ 7,500

(d) ₹ 10,500.

Answer:

(b) ₹ 4,500

27. P and Q are partners sharing profits in the ratio of 2 :1. R is admitted to the partnership with effect from 1st April on the terms that he will bring ₹ 30,000 as his capital for 114 share and pays ₹ 18,000 for goodwill, half of which is to be withdrawn by P and Q. How much cash can P & Q withdraw from the firm, if any,?

(a) ₹ 6,000, 3,000

(b) ₹ 12,000, 6,000

(c) Nil

(d) None of the above.

Answer:

(a) ₹ 6,000, 3,000

28. A and B share profits and losses equally. They have ₹ 20,000 each as capital. They admit C as equal partner and goodwill was valued as ₹ 30,000. C is to bring in ₹ 30,000 as his capital and necessary cash towards his share of goodwill. Goodwill Account will not remain open in books. If profit on revaluation is ₹ 13,000, find the closing balance of the capital accounts.

(a) ₹ 31,500; 31,500; 30,000

(b) ₹ 31,500; 31,500; 20,000

(c) ₹ 26,500; 26,500; 30,000

(d) ₹ 20,000; 20,000; 30,000.

Answer:

(a) ₹ 31,500; 31,500; 30,000

29. If A and B who are sharing profits in the ratio of 3 : 1 and they admit C to one – fourth share in the future profits, the new profit sharing ratio shall be .

(a) A : 9/16; B : 3/16; C : 4/16

(b) A : 10/16; B : 2/16; C : 4/16

(c) A : 8/16; B : 4/16; C : 4/16

(d) A : 7/16; B : 5/16; C : 4/16.

Answer:

(a) A : 9/16; B : 3/16; C : 4/16

30. ‘A’ and ‘B’ who are partners, share profits in the ratio of 7 : 3. ‘C’ is admitted as a new partner, ‘A’ Surrenders 1/7 of his share and ‘B’ Surrenders 1/3 of his share in favour of ‘C’, the new profit sharing ratio will be :

(a) 6 : 2 : 2

(b) 4 : 1 : 1

(c) 3 : 2 : 2

(d) None of the above.

Answer:

(a) 6 : 2 : 2

31. Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5 : 3 with capital of ₹ 2,50,000 and ₹ 2,00,000 respectively. Atul was admitted on the following terms. Atul would pay ₹ 50,000 as capital and ₹ 16,000 as goodwill for 1 /5th profit. Find the balance of capital accounts after admission of Atul.

(a) ₹ 2,60,000; 2,06,000; 50,000

(b) ₹ 2,20,000; 1,82,000; 66,000

(c) ₹ 2,92,500; 2,25,500; 50,000

(d) ₹ 2,82,000; 2,10,500; 66,000.

Answer:

(a) ₹ 2,60,000; 2,06,000; 50,000

32. A and B are partners of a partnership firm sharing profits in the ratio of 3 : 2 respectively. C was admitted for 1/5th share of profit. Machinery would be appreciated by 10% (book value ₹ 8,000) and building would be depreciated by 20% (₹ 2,00,000). Unrecorded debtors of ₹ 1,250 would be bought into books now and creditors amounting to ₹ 2,750 died and need not pay anything to its estate. What will be profit/ loss on revaluation?

(a) Loss – ₹ 28,000

(b) Loss – ₹ 40,000

(c) Profits – ₹ 28,000

(d) Profits – 40,000

Answer:

(a) Loss – ₹ 28,000

33. The opening balance of partner’s capital account is credited with:

(a) Interest on capital

(b) Interest on drawings

(c) Profit

(d) All of the above

Answer:

(a) Interest on capital

34. Reserves appearing in the balance sheet will be divided among the partners during admission in:

(a) Gaining ratio

(b) New ratio

(c) Sacrificing ratio

(d) Old ratio

Answer:

(d) Old ratio

35. The balance of memorandum revaluation account is transferred to the capital accounts of the partners in ________.

(a) New profit sharing ratio

(b) Old profit sharing ratio

(c) Capital ratio

(d) Sacrificing ratio

Answer:

(a) New profit sharing ratio

36. The entry for unrecorded investments will be:

(a) Debit partners capital A/c and credit investments A/c

(b) Debit revaluation A/c and credit investment A/c

(c) Debit unrecorded investment A/c and credit revaluation A/c

(d) None of the above

Answer:

(c) Debit unrecorded investment A/c and credit revaluation A/c

37. A, B, C share profit & losses in the ratio of 3:2:1. Z is admitted for 1 /6th share which he gets entirely from A. Find out the new profit sharing ratio.

(a) 2 : 2 : 1 : 1

(b) 3 : 1 : 1 : 1

(c) 2 : 2 : 2 : 1

(d) 2 : 1 : 2 : 1

Answer:

(a) 2 : 2 : 1 : 1

38. A and B are partners sharing profits and losses in the ratio of 3:2. A’s capital is ₹ 1,60,000 and B’s capital is ₹ 1,30,000. They admit C for 1 /5th share. How much capital should C bring?

(a) ₹ 40,000

(b) ₹ 62,500

(c) ₹ 22,500

(d) ₹ 72,500

Answer:

(d) ₹ 72,500

39. A and B are partners having profit sharing ratio of 1:2. The new profit sharing ratio is 1 : 2 : 3.

Calculate the sacrificing ratio

(a) 1 : 3

(b) 1 : 4

(c) 1 : 2

(d) 2 : 3

Answer:

(c) 1 : 2

40. When the balance sheet is prepared after the new partnership agreement, the assets and liabilities are recorded at:

(a) Historical cost

(b) Current cost

(c) Realisable value

(d) Revalued figures

Answer:

(d) Revalued figures

41. A and B are partners and they admit C with 1 /5th share and C brings ₹ 1,00,000 as his share towards capital. The total net worth of the firm is:

(a) ₹ 5,00,000

(b) ₹ 4,00,000

(c) ₹ 25,000

(d) ₹ 10,00,000

Answer:

(a) ₹ 5,00,000

42. P and Q share profit/loss in the ratio of 5:3. Z, is admitted as a partner for 1/5th share, which he takes from the old partners equally. New profit sharing ratio will be:

(a) 21 : 11 : 8

(b) 21 : 8 : 7

(c) 15 : 10 : 5

(d) None of the above

Answer:

(a) 21 : 11 : 8

43. A and B are partners. C is admitted with a guaranteed profits of ₹ 10,000 from A and the new profit sharing ratio is 3 : 2 : 1. The net profit for the year is ₹ 1,80,000. How much profit will A & C get respectively:

(a) 40,000 & 30,000

(b) 70,000 & 60,000

(c) 90,000 & 30,000

(d) None of the above

Answer:

(c) 90,000 & 30,000

44. A and B share profits & losses in the ratio of 5:3. P is admitted as the new partner equally. Calculate the new profit sharing ratio:

(a) 20 : 8 : 7

(b) 21 : 11 : 8

(c) 20 : 12 : 18

(d) None of these

Answer:

(b) 21 : 11 : 8

45. P and Q share profits and losses in the ratio of 3 : 2 and their respective capitals are ₹ 1,20,000 and ₹ 54,000. C is admitted for 1 /5th share and brings ₹ 1,20,000 as his share of capital. Calculate the amount to be refunded to A

(a) ₹ 45,000

(b) ₹ 1,68,000

(c) ₹ 1,00,000

(d) ₹ 1,20,000

Answer:

(b) ₹ 1,68,000

46. A and B share profits/losses equally. They admit C with 1 /5th share. The new profit sharing ratio will be:

(a) 2:2:1

(b) 2:2:2

(c) 1:2:1

(d) 2:3:1

Answer:

(a) 2:2:1

47. A, B and C are partners sharing profits in the ratio of 3:2:1. They agree to take C in the firm. A, B and C agree to take 1/3rd, 1 /6th and 1/9th share respectively. Calculate the share of D in profits.

(a) 1/10

(b) 11/54

(c) 13/54

(d) 26/54

Answer:

(c) 13/54

48. A and B are partners sharing profits in the ratio of 3 : 2 respectively. C is admitted in the firm for 1 /3rd share in profits. The new profit sharing ratio amongst A, B and C will be:

(a) 12 : 08 : 05

(b) 08 : 12 : 05

(c) 05 : 05 : 12

(d) None of the above.

Answer:

(d) None of the above.

Old profit sharing ratio of A = \(\frac { 3 }{ 5 }\)

Old profit sharing ratio of B = \(\frac { 2 }{ 5 }\)

New partner C’s profit = \(\frac { 1 }{ 3 }\)

Hence, remaining profit = 1 – \(\frac { 1 }{ 3 }\) = \(\frac { 2 }{ 3 }\)

New Profit sharing ratio of A = \(\frac { 2 }{ 3 }\) x \(\frac { 3 }{ 5 }\) = \(\frac { 6 }{ 15 }\)

New Profit sharing ratio of B = \(\frac { 1 }{ 3 }\) x \(\frac { 5 }{ 5 }\) = \(\frac { 5 }{ 15 }\)

New Profit sharing ratio of C = \(\frac { 1 }{ 3 }\) x \(\frac { 5 }{ 5 }\) = \(\frac { 5 }{ 15 }\)

So, A : B : C = \(\frac { 6 }{ 15 }\) x \(\frac { 4 }{ 15 }\) = \(\frac { 5 }{ 15 }\) = 6 : 4 : 5

49. A’s capital in a business is ₹ 20,000 and B’s capital is ₹ 25,000. Their profit sharing ratio is 4 : 5. They admit C in the firm as a new partner and ask him to contribute ₹ 40,000 for 1/3rd share of profit. Find the premium paid by C on account of goodwill:

(a) ₹ 17,500

(b) ₹ 20,000

(c) ₹ 15,000

(d) None of the above

Answer:

(a) ₹ 17,500

Remaining share of A and B = 1 – \(\frac { 1 }{ 3 }\)

Total capital (after admission of C) = (20,000 + 25,000) x \(\frac { 2 }{ 3 }\)

= 67,500

Capital of C = 67,500 – (20,000 + 25,000) = 22,500

Total contribution of cash by C = 40,000

So, Premium paid by C = 40,000 – 22,500 = ₹ 17,500

50. A and B are partners in a firm having capital balances of ₹ 54,000 and ₹ 36,000 respectively. They admit C in partnership for 1 /3rd share and C is to bring proportionate amount of capital. The capital amount of C would be:

(a) ₹ 90,000

(b) ₹ 45,000

(c) ₹ 5,400

(d) ₹ 36,000

Answer:

(b) ₹ 45,000

Total capital (before the admission of C)

= 54,000 + 36,000

= ₹ 90,000

Remaining share of A and B = 1 – \(\frac { 1 }{ 3 }\)

= \(\frac { 2 }{ 3 }\) shares

Total capital of the firm (after admission of C) will be = 90,000 x \(\frac { 3 }{ 2 }\)

= ₹ 1,35,000

So, Capital amount of C would be = ₹ 1,35,000 – ₹ 90,000

= ₹ 45,000

51. A and B are partners in a business sharing profits and losses in the ratio of 7 : 3 respectively. They admit C as a new partner A sacrificed Ml’h share of his profit and B sacrificed 1 /3rd of his share in favour of C. The new profit sharing ratio of A, B, and C will be:

(a) 3 : 1 : 1

(b) 2 : 1 : 1

(c) 2 : 2 : 1

(d) None of the above

Answer:

(a) A : B = 7 : 3

A Sacrificing 1/7th of his share

\(\frac { 7 }{ 10 }\) x \(\frac { 1 }{ 7 }\) = \(\frac { 1 }{ 10 }\)

B Sacrificing 1/3th of his share

\(\frac { 3 }{ 10 }\) x \(\frac { 1 }{ 3 }\) = \(\frac { 1 }{ 10 }\)

Total Share of C = \(\frac { 1 }{ 10 }\) + \(\frac { 1 }{ 10 }\) = \(\frac { 2 }{ 10 }\)

New share of A = \(\frac { 7 }{ 10 }\) – \(\frac { 1 }{ 10 }\)

= \(\frac { 6 }{ 10 }\)

New share of B = \(\frac { 3 }{ 10 }\) – \(\frac { 1 }{ 10 }\) = \(\frac { 2 }{ 10 }\)

New profit sharing ratio of

A : B : C = \(\frac { 6 }{ 10 }\) : \(\frac { 2 }{ 10 }\) : \(\frac { 2 }{ 10 }\)

= 3 : 1 : 1

52. Ramesh and Suresh are partners sharing profits in the ratio of 2 : 1 respectively. (Ramesh Capital is ₹ 1,02,000 and Suresh Capital is ₹ 73,000). They admit Mahesh and agree to give him 1/5th share in future profit. Mahesh brings ₹ 14,000 as his share of goodwill. He agrees to contribute capital in the new profit share ratio. How much capital will be brought by Mahesh?

(a) ₹ 43,750

(b) ₹ 45,000

(c) ₹ 47,250

(d) ₹ 48,000.

Answer:

(c) ₹ 47,250

| Capital of A | ₹ 1,02,000 |

| Capital of B | ₹ 73,000 |

| Goodwill | ₹ 14,000 |

| Total capital for 4/5<sup>th</sup> Share | ₹ 1,89,000 |

∴ Overall capital of firm will be 1,89,000 x \(\frac { 5 }{ 4 }\) = 2,36,250

Mahesh brings in 1/5th of ₹ 2,36,250 = ₹ 47,250

53. M and N are partners sharing profit and loss in equal ratio. Their capital balances stood at ₹ 23,000 and ₹ 27,000 respectively. They wanted to grow their business and admitted P as a working partner for 1/3rd share. P is to bring capital in the proportion of his share of profit and besides capital, he is to bring ₹ 9,000 as goodwill. What will be the amount of capital to be brought in by P _______.

(a) ₹ 27,000

(b) ₹ 23,000

(c) ₹ 36,000

(d) ₹ 29,500

Answer:

(d) Sacrifice Ratio of M and N = 1 : 1

M’s capital A/c and N’s capital A/c will be credited by the amount of goodwill in sacrifice ratio.

After distribution of goodwill capital balance will be:

M’s Capital = 23,000 + 4,500 = ₹ 27,500

N’s Capital = 27,000 + 4,500 = ₹ 31,500

Remaining share of old partner’s = 1 – \(\frac { 1 }{ 3 }\) = \(\frac { 2 }{ 3 }\)

Total capital of the firm would be = (27,500 + 31,500) x \(\frac { 3 }{ 2 }\) = ₹ 88,500

Capital will be bought by P = 88,500 x \(\frac { 1 }{ 3 }\) = ₹ 29,500

54. A & B are sharing profits and loss in ratio of 3 : 2. C was admitted for 1 /5th share, which he takes equally from A & B, i.e. 1/10th from A and 1/10lh from B. New profit sharing ratio will be ________.

(a) 5 : 3 : 2

(b) 29 : 19 : 10

(c) 9 : 6 : 5

(d) None of these

Answer:

(a) 5 : 3 : 2

Old profit sharing ratio of A and B = 3 : 2

∴ C is admitted for 1/5th share which he takes equally from A & B i.e. \(\frac { 1 }{ 10 }\) from A and \(\frac { 1 }{ 10 }\) from B.

Net profit sharing ratio A : B : C

A = \(\frac { 3 }{ 5 }\) – \(\frac { 1 }{ 10 }\) = \(\frac { 6 – 1 }{ 10 }\) = \(\frac { 5 }{ 10 }\)

B = \(\frac { 2 }{ 5 }\) – \(\frac { 1 }{ 10 }\) = \(\frac { 4 – 1 }{ 10 }\) = \(\frac { 3 }{ 10 }\)

C = \(\frac { 1 }{ 10 }\) + \(\frac { 1 }{ 10 }\) = \(\frac { 2 }{ 10 }\)

Hence, new profit sharing ratio is 5 : 3 : 2.

52. A & B are partners sharing profits in the ratio of 2:1 respectively (A’s capital is ₹ 1,02,000 & B’s capital is ₹ 73,000). They admit C & agreed to give him 1 /5th share in future profit. C brings ₹ 14,000 and share of goodwill. He agreed to contribute capital in the new profit sharing ratio. How much capital will be brought by C.

(a) ₹ 43,750

(b) ₹ 45,000

(c) ₹ 47,250

(d) ₹ 48,000

Answer:

(a) ₹ 43,750

| Capital of Ramesh | 1,02,000 |

| Capital of Suresh | 73,000 |

| Goodwill | 14,000 |

| Total capital for | 1,89,000 |

Overall capital of firm will be = 1,89,000 x \(\frac { 5 }{ 4 }\) = \(\frac { 5 }{ 4 }\) = ₹ 2,36,250/

C brings in 1/5,h of ₹ 2,36,250 – ₹ 47,250/-

53. At the time of admission of partner, amount of general reserve, revaluation a/c will be transferred to _______.

(a) Old Partners Capital A/c

(b) New Partners Capital A/c

(c) All Partners Capital A/c

(d) None of the above.

Answer:

(a) Old Partners Capital A/c

At the time of admission of partners, all the reserves and profits of existing partners are transferred to existing partners i.e. to old partners capital a/c.

54. If A and B are sharing profits in the ratio of 5 : 3 and on admission of C, the new profit sharing ratio becomes 7 : 5 : 4. Calculate the sacrificing ratio.

(a) 3 : 1

(b) 1 : 3

(c) 5 : 4

(d) 7 : 5

Answer:

(a) 3 : 1

Old Ratio of A & B = 5 : 3

New Profit Sharing Ratio for A, B and C = 7 : 5 : 4

→ Sacrificing Ratio = Old share – New share

→ A’s new share = \(\frac { 7 }{ 16 }\)

→ A’s old share = \(\frac { 5 }{ 8 }\)

→ A’s sacrifice = \(\frac { 5 }{ 8 }\) – \(\frac { 7 }{ 16 }\) = \(\frac { 10 – 7 }{ 16 }\) = \(\frac { 3 }{ 16 }\)

→ B’s new share = \(\frac { 5 }{ 16 }\)

→ B’s old share = \(\frac { 3 }{ 8 }\)

→ B’s sacrifice = \(\frac { 3 }{ 8 }\) – \(\frac { 5 }{ 16 }\) = \(\frac { 6-5 }{ 16 }\) = \(\frac { 1 }{ 16 }\)

→ Sacrificing ratio = 3 : 1

→ Hence, option (a) is correct.

55. A started a business with ₹ 18,000 after 4 months B joins with ₹ 24,000. After 2 more months C joins with ₹ 30,000. At the end of 10 months from A started the business. C received ₹ 1,850 as his share. They decided to share profit or losses in the ratio of capital. The total profit of the firm would be:

(a) ₹ 7,955

(b) ₹ 8,510

(c) ₹ 7,030

(d) ₹ 6,845

Answer:

(d) ₹ 6,845

Total profit for 10 months = 1850

A’s capital = 18000, duration = 10 months

B’s capital = 24000, duration = 6 months

C’s capital = 3000C, duration = 4 months

Total weighted capital ratio = (18000 x 10) : (24000 x 6) : (30000 x 4)

= 180000 : 144000 : 120000 = 180 : 144 : 120 (or)

(1 1 1) = 45 : 36 : 30.

Total profit of the firm = C’s share in profits x \(\frac { Total Capital }{ Cs Capital }\)

= 1,850 x \(\frac{4,44,000}{1,20,000}\) = 6,845

Alternatively, = 1,850 x \(\frac{111}{30}\) = 6,845

56. The balance of Revaluation account created at the time of admission of a new partner is:

(a) Transferred to old partners capital account

(b) Transferred to all partners capital account

(c) Transferred to profit and loss account

(d) Transferred to new partners capital account

Answer:

The balance of Revaluation account created at the time of admission of a new partner is transferred to old partners capital account because before a new partner is admitted, the assets and liabilities of the firm are revalued and any profit or loss resulting from such a revaluation is transferred to old partner’ capital accounts in the old profit sharing ratio.

57. A and B are partners sharing profit losses in ratio 2 : 3. C is admitted for 1/4 share in profit find new profit share ratio :

(a) 2 : 4 : 5

(b) 3 : 2 : 6

(c) 6 : 9 : 5

(d) 1 : 2 : 3

Answer:

(c) 6 : 9 : 5

Old Ratio = 2 : 3

C, admitted for = \(\frac{1}{4}\) share

Remaining share = 1 – \(\frac{1}{4}\)

= \(\frac{3}{4}\)

New Profit sharing ratio of A = \(\frac{2}{5}\) x \(\frac{3}{4}\) = \(\frac{6}{20}\)

New Profit sharing ratio of B = \(\frac{3}{5}\) x \(\frac{3}{4}\) = \(\frac{9}{20}\)

New Profit sharing ratio of C = \(\frac{1}{4}\) x \(\frac{5}{5}\) = \(\frac{5}{20}\)

New Profit Ratio = \(\frac{6}{20}\) : \(\frac{9}{20}\) = \(\frac{5}{20}\)

= 6 : 9 : 5

58. A and B are partner in a business sharing profit and losses in the ratio of 7 : 3 respectively. They admit “C” as a partner. “A” sacrifices 1/7th share of his profit and “B” sacrifices 1 /3rd share of his profit in favour “C”. The new profit sharing ratio of A, B, C will be :

(a) {3 : 2 : 1}

(b) {3 : 1 : 1}

(c) {2 : 2 : 1}

(d) {3 : 2 : 2}

Answer:

(b) {3 : 1 : 1}

Share sacrificed by A → \(\frac{7}{10}\) x \(\frac{1}{7}\) = \(\frac{1}{10}\)

Share sacrificed by B → \(\frac{3}{10}\) x \(\frac{1}{3}\) = \(\frac{1}{10}\)

Share of C → \(\frac{1}{10}\) + \(\frac{1}{10}\) = \(\frac{2}{10}\) = \(\frac{1}{5}\)

A = \(\frac{7}{10}\) – \(\frac{1}{10}\) = \(\frac{6}{10}\)

B = \(\frac{3}{10}\) – \(\frac{1}{10}\) = \(\frac{2}{10}\)

New ratio = \(\frac{6}{10}\),\(\frac{2}{10}\),\(\frac{2}{10}\) i.e 3 : 1 : 1

59. At the time of admission of a new partner, if the value of goodwill recorded is overstated in the books, it is written back by ________.

(a) Old partners in old profit/loss sharing ratio

(b) All the partners including the new partner in new profit/loss sharing ratio

(c) Old partners in sacrificing ratio

(d) New partners in gaining ratio

Answer:

(a) Old partners in old profit/loss sharing ratio

The Goodwill overstated will be written back in the old partners account in the old Profit Sharing Ratio.

60. A & B are partners sharing profits and losses in the Ratio of 5 : 3. C was admitted as a new partner and bring capital ₹ 70,000 and goodwill ₹ 48,000. The new profit ratio between A : B : C is 7 : 5 : 4. The sacrificing ratio A & B is ________.

(a) 3 : 1

(b) 5 : 4

(c) 2 : 1

(d) 3 : 5

Answer:

(a) 3 : 1

Old profit Sharing Ratio = 5 : 3

New profit Sharing Ratio = 7 : 5 : 4

Sacrificing Ratio = Old Ratio – New Ratio

A = \(\frac{5}{8}\) – \(\frac{7}{16}\) = \(\frac{10-7}{16}\) = \(\frac{3}{16}\)

B = \(\frac{3}{8}\) – \(\frac{5}{16}\) = \(\frac{6-5}{16}\) = \(\frac{1}{16}\)

Sacrificing Ratio = 3 : 1

61. A and B are Partners is a business sharing profit and losses in the ratio of 7 : 3 respectively. They admit C as a new partners. A sacrificed 1/7th share of his profit and B sacrificed 1/3th of his share in favour of C. The new profit sharing ratio of A, B, and C will be :

(a) 3 : 1 : 1

(b) 2 : 1 : 1

(c) 2 : 2 : 1

(d) None of the above

Answer:

(a) 3 : 1 : 1

A’s sacrifice = \(\frac{1}{7}\) x \(\frac{7}{10}\) = \(\frac{1}{10}\)

B’s sacrifice = \(\frac{1}{3}\) x \(\frac{3}{10}\) = \(\frac{1}{10}\)

A’s new share = \(\frac{7}{10}\) – \(\frac{1}{10}\) = \(\frac{6}{10}\)

B’s new share = \(\frac{3}{10}\) – \(\frac{1}{10}\) = \(\frac{2}{10}\)

C’s new share = \(\frac{1}{10}\) + \(\frac{1}{10}\) = \(\frac{2}{10}\)

A : B : C = 6 : 2 : 2 = 3 : 1 : 1

62. Ramesh and Suresh are partners sharing profits in the ratio of 2 : 1 respectively. (Ramesh capital is ₹ 1,02,000 and Suresh capital is ₹ 73,000). They admit Mahesh and Agree to give him 1/5th share in future profit. Mahesh brings ₹ 14,000 as his share of goodwill the agrees to contribute capital in the new profit share ratio. How much capital will be brought by Mahesh?

(a) ₹ 43,750

(b) ₹ 45,000

(c) ₹ 47,250

(d) ₹ 48,000

Answer:

(a) ₹ 43,750

Combined capital of Suresh and Ramesh is ₹ 1,75,000 (73,000 + 1,02,000).

When \(\frac{4}{5}\)th share of profit then Mukesh’s capital is ₹ 1,75,000

When 1 ___________________ is ₹ \(\frac{1,75,000 \times 5}{4}\)

When \(\frac{1}{5}\)th share of profit then Mukesh’s capital is

= \(\frac{1,75,000}{4}\) x 5 x \(\frac{1}{5}\)

= ₹ 43, 750

63. A, B sharing profits and losses in the ratio of 3 : 5. C is admitted in the partnership and new ratio below them is 3 : 5 : 2. Sacrificing ratio below A and B is

(a) 3 : 1

(b) 3 : 5

(c) 5 : 3

(d) None

Answer:

(b) 3 : 5

Sacrifice Ratio: A and B sharing profit ratio 3 : 5, new partner entered and new ratio of profit sharing is 3 : 5 : 2

Sacrifice by A = A’s old share – A’s new share

= \(\frac{3}{8}\) – \(\frac{3}{10}\) = \(\frac{30-24}{80}\) = \(\frac{6}{10}\)

Sacrifice by B = B’s old share – Bs new share

= \(\frac{5}{8}\) – \(\frac{5}{10}\) = \(\frac{50-40}{80}\) = \(\frac{10}{80}\)

Hence. Ratio of sacrifice between A & B = \(\frac{6}{80}\) : \(\frac{10}{80}\)

= 6 : 10 or 3 : 5

Hence, option (b) is correct.

64. M and N are partners sharing profit and loss in equal ratio. Their capital balances stood at ₹ 23,000 and ₹ 27,000 respectively. They wanted to grow their business and admitted P as a working partner for 1/3 share. P is to bring capital in the proportion of his share of profit and besides capital, he is to bring ₹ 9,000 as goodwill. What will be the amount of capital to be brought in by P:

(a) ₹ 27,000

(b) ₹ 23,000

(c) ₹ 36,000

(d) ₹ 29,500

Answer:

(d) ₹ 29,500

Total Capital of M&N = 23,000 + 27,000 + 9,000

= 59,000

This represents 2/3rd Share of firm

full Value of Capital = 59,000 x \(\frac{3}{2}\)

= 88,500

P share of capital in above = 88,500 x \(\frac{1}{3}\)

= ₹ 29,500

65. A, B & C started a business by investing ₹ 45,000, ₹ 55,000 and ₹ 60,000 respectively and sharing profit or losses in the ratio of capital. At the end of a year they got a total of ₹ 11,200. How much ‘B’ get more than ‘A’ in the profit.

(a) 780

(b) 700

(c) 710

(d) 750

Answer:

(b) 700

To A : B : C share profit and losses in

Ratio 45 : 55 : 60

Profit of the years = 11,200

A’s share = 11,200 x \(\frac{45}{160}\)

= 3,150

B’s share = 11,200 x \(\frac{55}{160}\)

= 3,850

B get more than A = 3,850 – 3,150 = 700