Students should practice Income from Salary – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Income from Salary – CS Executive Tax Laws MCQ Questions

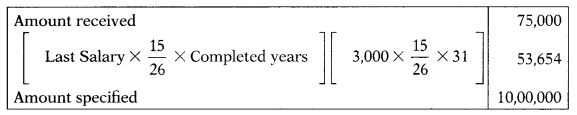

Question 1.

Bimal is employed in a factory at a salary of ₹ 2,400 per month. He also gets a dearness allowance @ ₹ 600 per month and a bonus of @ ₹ 200 per month. He retired on 31 st December 2020 and received ₹ 75,000 as gratuity under the Payment of Gratuity Act, 1972 after serving 31 years and 4 months in that factory. The amount of gratuity exempt under the Income-tax Act, 1961 will be

(A) ₹ 75,000

(B) ₹ 53,654

(C) ₹ 21,346

(D) ₹ 20,00,000 [Dec. 2014]

Hint:

Minimum of the following three is exempt as gratuity:

Salary = Basic + DA (All, as he is covered under Payment of Gratuity Act, 1972)

= 2,400 + 600 = 3,000

Answer:

(B) ₹ 53,654

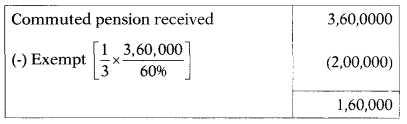

Question 2.

Akash is entitled to get a pension of ₹ 6,000 per month from a private company. He gets 60% of the pension commuted and receives ₹ 3,60,000. He also receives ₹ 2,00,000 as gratuity from the same employer.

Taxable portion of commuted value of pension will be:

(A) ₹ 1,60,000

(B) Nil

(C) ₹ 3,60,000

(D) ₹ 60,000 [Dec. 2014]

Hint:

Answer:

(A) ₹ 1,60,000

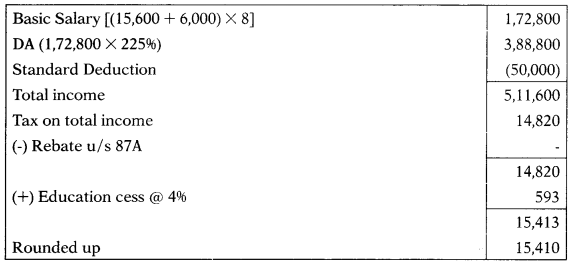

Question 3.

Anjan joins a service in the grade of ₹ 15,600 – 39,100 plus grade pay of ₹ 6,000 on 1.8.2020. He also gets

a dearness allowance @ 225% of his salary. His tax liability for AY 2021 -2022 will be:

(A) ₹ 15,410

(B) ₹ 5,940

(C) Nil

(D) ₹ 19,340 [Dec. 2014]

Hint:

Answer:

(A) ₹ 15,410

Question 4.

Chandan, a handicapped employee receives ₹ 3,000 p.m. as a transport allowance from his employer. His actual expenditure on transport is ₹ 2,000 p.m. The amount of transport allowance taxable under the head income from salaries will be—

(A) ₹ 18,000

(B) Nil

(C) ₹ 6,000

(D) ₹ 8,000 [Dec. 2014]

Hint:

In the case of handicapped employees, transport allowance is exempt up to ₹ 3,200. Hence, the entire allowance is exempt. The actual expenditure incurred does not have any significance.

Answer:

(B) Nil

Question 5.

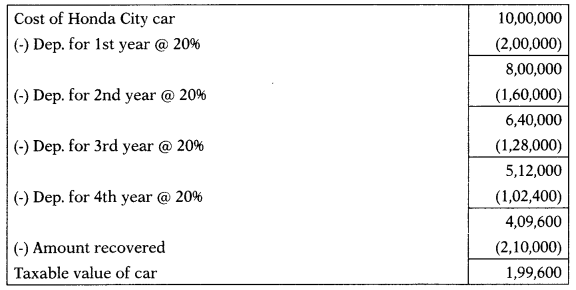

Joy Ltd. transfers a Honda City car to its employee Happy after using it for 4 years and 10 months, for ₹ 2,10,000. The cost of the car is Y10,00,000. The value of taxable perquisite in the hands of Happy is:

(A) ₹ 1,17,680

(B) ₹ 1,99,600

(C) Nil

(D) ₹ 7,90,000 [Dec. 2014]

Hint:

Answer:

(B) ₹ 1,99,600

Question 6.

Ramesh, an employee of Gauri & Co. of Delhi, received the following payments during the previous year ended 31st March 2021:

Basic salary: ₹ 2,40,000

Dearness allowance: 40% of basic salary (40% forming part of salary).

Rent-free unfurnished accommoda¬tion provided by the employer for which rent paid by employer being ₹ 50,000.

The value of taxable perquisite in the hands of Ramesh will be:

(A) ₹ 41,760

(B) ₹ 50,000

(C) ₹ 36,000

(D) ₹ 52,500 [Dec. 2014]

Hint:

15% of salary or actual hire charges, whichever is less.

– 15% of salary ₹ 41,760

– Actual hire charges ₹ 50,000.

Answer:

(A) ₹ 41,760

Question 7.

Children education allowance received by an employee from his employer is ₹ 80 per month per child for 3 children.

Taxable education allowance will be

(A) ₹ 960

(B) ₹ 480

(C) Nil

(D) ₹ 1,200 [Dec. 2014]

Hint:

Children’s education allowance is the amount received per month per child or ₹ 100 whichever is less than too only for two children. Thus, out of three children for one child it is taxable 80 × 12 = 960.

Answer:

(A) ₹ 960

Question 8.

Which of the following is not correct about the approved superannuation fund?

(A) Employees’contribution qualifies for deduction under section 80C

(B) Any amount contributed by the employer is exempt from tax

(C) Interest on accumulated balance is exempt from income-tax

(D) Under some circumstances, payments from the fund are chargeable to income-tax [June 2015]

Answer:

(B) Any amount contributed by the employer is exempt from tax

Question 9.

Ashraf is an employee of Moon Public School. His daughter, Zara, is studying in the said school at concessional fees of ₹ 600 p.m. (Actual fee: ₹ 4,000 p.m.)

Amount taxable in the hands of Ashraf will be

(A) ₹ 48,000

(B) ₹ 7,200

(C) Nil

(D) ₹ 40,800 [June 2015]

Hint:

(4,000 – 600) × 12 = 40,800.

Answer:

(D) ₹ 40,800

Question 10.

Ashok took an interest-free loan of ₹ 15,000 from B Ltd. (the employer). Assuming that the market rate of interest on the similar loan is 10%, the taxable value of the prerequisite in the hands of Ashok will be:

(A) ₹ 150

(B) ₹ 1,500

(C) Nil

(D) None of the above [June 2015]

Hint:

A loan of up to ₹ 20,000 is exempt. No interest on it is taxable.

Answer:

(C) Nil

Question 11.

During the previous year 2020-21, Barun received a watch worth ₹ 20,000 from his employer. The taxable value of the watch will be

(A) ₹ 20,000

(B) ₹ 15,000

(C) Nil

(D) None of the above [June 2015]

Hint:

A gift in excess of ₹ 5,000 is fully taxable.

Answer:

(B) ₹ 15,000

Question 12.

Kapil gets a salary of 712,000 p.m. and is provided with rent-free unfurnished accommodation at Pune (population 31 lakh). House is owned by the employer, the fair rental value of which is ₹ 1,400 p.m. House was provided with effect from 1st July 2020. Value of the prerequisite of rent-free accommodation will be:

(A) ₹ 21,600

(B) ₹ 10,800

(C) ₹ 16,200

(D) ₹ 12,600 [Dec. 2015]

Hint:

12,000 × 9 × 15% = 16,200

Answer:

(C) ₹ 16,200

Question 13.

Anil is employed in a company with an annual salary of ₹ 8,60,000 (computed). The company paid income-tax of ₹ 37,000 on his non-monetary perquisites. He paid ₹ 1,20,000 to recognized provident fund during the year 2020-21. His total income would be:

(A) ₹ 7,77,000

(B) ₹ 7,40,000

(C) ₹ 7,97,000

(D) ₹ 7,60,000 [Dec. 2015]

Hint:

Section 10 (10CC) provides exemption in respect of tax paid by employer on the non-monetary perquisite. Hence such tax paid shall not form part of salary. Hence, total income = 8,60,000 – 1,20,000 = 7,40,000

Answer:

(B) ₹ 7,40,000

Question 14.

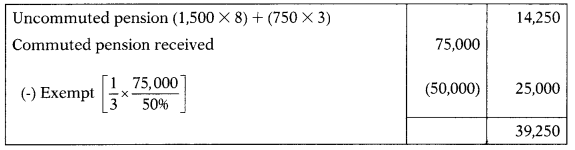

Rohan retires from private service on 30th April 2020 and his pension has been fixed at ₹ 1,500 p.m. He gets 1/2 of his pension commuted during January 2020 and receives ₹ 75,000. He also gets ₹ 60,000 as gratuity. The total pension taxable including commuted value will be

(A) ₹ 16,500

(B) ₹ 41,500

(C) ₹ 39,250

(D) ₹ 14,250 [Dec. 2015]

Hint:

Answer:

(C) ₹ 39,250

Question 15.

Govt, of India paid a salary of ₹ 5 lakh and allowances and perquisites valued at ₹ 2.20 lakh to a person who is a citizen of India for the services rendered by him outside India for 5 months during the previous year. His total income chargeable to tax would be:

(A) ₹ 6,80,000

(B) ₹ 4,50,000

(C) ₹ 5,70,000

(D) Nil [Dec. 2015]

Hint:

As per Section 10(17), in the case Indian citizen who is a Government employee and working outside India all allowance and perquisites are exempt. Hence, as per the data given in the problem, only basic salary is taxable.

₹ 5,00,000 – ₹ 50,000 (standard deduction u/s 16(ia)) = 4,50,000

Answer:

(B) ₹ 4,50,000

Question 16.

Pankaj joins service on 1st April, 2016 in the grade of ₹ 15,000-1,000-18,000-2,000-26,000. He shall be paying

tax for the year ended on 31st March, 2021 on the total salary of:

(A) ₹ 2,16,000

(B) ₹ 2,40,000

(C) ₹ 2,28,000

(D) ₹ 1,80,000 [Dec. 2015]

Hint:

1.4.2015 to 31.3.2016 15,000 p.m.

1.4.2016 to 31.3.2017 16,000 p.m.

1.4.2017 to 31.3.2018 17,000 p.m.

1.4.2018 to 31.3.2019 18,000 p.m.

1.4.2019 to 31.3.2020 20,000 p.m.

Answer:

(B) ₹ 2,40,000

Question 17.

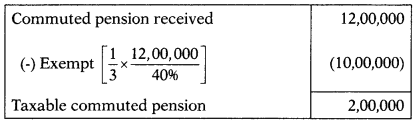

An employee of a company, who was entitled for a gratuity of ₹ 8,00,000, also received ₹ 12,00,000by commuting 40% of his pension. The taxable amount of commuted pension is:

(A) ₹ 2,00,000

(B) ₹ 4,00,000

(C) ₹ 12,00,000

(D) ₹ 22,00,000 [June 2016]

Hint:

Answer:

(A) ₹ 2,00,000

Question 18.

Ravi is receiving ₹ 10,000 as a medical allowance from his employer. Out of this, he spends ₹ 5,000 on his own medical treatment, ₹ 2,000 on the medical treatment of his dependent wife, and another ₹ 3,000 for the medical treatment of his major son who is not dependent on him. The amount of medical allowance taxable in his hand is:

(A) ₹ 10,000

(B) ₹ 5,000

(C) ₹ 3,000

(D) Nil [June 2016]

Hint:

Medical allowance is fully taxable.

Answer:

(A) ₹ 10,000

Question 19.

Ms. Janhvi is provided with an interest loan by her employer for the purchase of a house. The value of the perquisite shall be:

(A) Simple interest computed at the rate charged by the Central Government to its employees on 1st April of the previous year

(B) Simple interest computed at the rate charged by State Bank of India on 1st April of the previous year

(C) Simple interest computed at the rate charged by National Housing Bank on 1st April of the previous year

(D) Simple interest computed at the rate determined by the employer on 1 st April of the previous year [June 2016]

Answer:

(B) Simple interest computed at the rate charged by State Bank of India on 1st April of the previous year

Question 20.

Murali is employed in Megha Ltd., Delhi. He is paid a house rent allowance of ₹ 9,000 per month in the financial year 2020-21 his salary for the purpose of computation or house rent allowance relief may be taken as ₹ 20,000 per month. Murali pays actual rent of ₹ 10,000 per month. How much of the house rent allowance is tax-free?

(A) ₹ 1,08,000

(B) ₹ 1,20,000

(C) ₹ 96,000

(D) ₹ 60,000 [June 2016]

Hint:

Minimum of the following three is exempt as HRA:

| (1) HRA received | 2,40,000 |

| (2) Rent paid less 10% of salary (1,20,000 – 24,000) | 96,000 |

| (3) 50% of salary | 1,20,000 |

Answer:

(C) ₹ 96,000

Question 21.

Satish is employed as chief engineer in Gama Ltd., Chennai w.e.f. 1st April 2020 for a consolidated salary of ₹ 60,000 per month. He is provided with rent-free unfurnished accommodation owned by the employer from 1st July 2019 onwards. The value of taxable perquisite is

(A) ₹ 1,08,000

(B) ₹ 81,000

(C) ₹ 72,000

(D) ₹ 54,000 [June 2016]

Hint:

60,000 × 9 × 1596 = 81,000

Answer:

(B) ₹ 81,000

Question 22.

Mrs. Meena retired from service with Sky Ltd. on 31st January 2021. She received the following amounts from the unrecognized provident fund:

(i) Own contribution ₹ 1,50,000

(ii) Interest on own contri- ₹ 21,000 bution

(iii) Employer’s contribu- ₹ 1,10,000 tion

(iv) Interest on employer’s ₹ 15,000 contribution

How much of the receipt is chargeable to tax as income from salary?

(A) ₹ 21,000

(B) ₹ 15,000

(C) ₹ 1,25,000

(D) ₹ 1,71,000 [June 2016]

Answer:

(C) ₹ 1,25,000

Question 23.

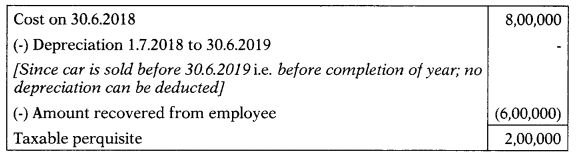

A company acquired a motor car for ₹ 8 lakh on 30th June 2019. It sold the said motor car to its employee, Jayant, for ₹ 6 lakh on 10th June 2020. The company claimed depreciation @ 15% for the year ended 31st March 2020. The perquisite value in the hands of Jayant on sale of motor car would be –

(A) ₹ 80,000

(B) Nil

(C) ₹ 2,00,000

(D) ₹ 1,40,000 [Dec 2016]

Hint:

Answer:

(C) ₹ 2,00,000

Question 24.

Pawan, employed in Magic Ltd., was eligible for a transport allowance of ₹ 2,000 per month to meet his travel expenses from residence to office. He actually incurred ₹ 1,200 per month towards travel. The amount of travel allowance chargeable to tax as perquisite would be:

(A) ₹ 24,000

(B) ₹ 14,000

(C) ₹ 4,800

(D) Nil [Dec. 2016]

Hint:

Exemption of s. 10(14) w.r.t. Transport Allowance is not available now.

Answer:

(A) ₹ 24,000

Question 25.

An employee of a public limited company received ₹ 3,00,000 as encashment of leave salary at the time of retirement. He has 18 months left to his credit at the time of retirement and his average salary for the last 10 months is ₹ 24,000. The taxable amount of leave encashment would be:

(A) ₹ 2,40,000

(B) ₹ 3,00,000

(C) ₹ 60,000

(D) Nil [Dec. 2016]

Hint:

| Leave encashment received | 3,00,000 |

| (-) Exempt u/s 10 (10AA) | (2,40,000) |

| Taxable leave encashment | 60,000 |

Minimum of the following four is exempt as leave encashment:

| Amount received | 3,00,000 |

| The average salary for the last 10 months | 2,40,000 |

| Cash equivalent on unveiled leaves on the basis of 30 days | No data given |

| Amount specified | 3,00,000 |

Answer:

(C) ₹ 60,000

Question 26.

Allowances and perquisites allowed to an employee for services rendered outside India are tax-free in case of –

(A) All types of employees

(B) Government employees only

(C) Non-government employees only

(D) None of the above [Dec. 2016]

Answer:

(B) Government employees only

Question 27.

The company has provided a laptop worth ₹ 50,000 to his employee for official as well as personal purposes. The taxable amount of perquisites will be:

(A) ₹ 5,000

(B) ₹ 25,000

(C) ₹ 10,000

(D) Nil [Dec. 2016]

Answer:

(D) Nil

Question 28.

Mr. Ashwin retired on 31.10.2020 after rendering 35 years of service in PLN & Co. Ltd. He received a gratuity of ₹ 18 lakhs. He is governed by the Payment of Gratuity Act, 1972. The monetary limit eligible for the exemption is:

(A) ₹ 20 lakhs

(B) ₹ 10 lakhs

(C) ₹ 3,50,000

(D) Nil [June 2017]

Answer:

(A) ₹ 20 lakhs

Question 29.

Mr. A is employed in ABS Transports as a cabin driver. He is paid ₹ 15,000 every month in the whole of the previous year 2020-21 as an allowance for meeting his personal expenditure in the course of running the goods vehicle. Mr. A does not receive any other amount by way of the daily allowance. The amount of allowance eligible for the exemption is:

(A) ₹ 1,80,000

(B) ₹ 1,20,000

(C) ₹ 1,26,000

(D) Nil [June 2017]

Hint:

For a person employed in transport organization minimum of following two is exempt:

(1) 70% of the allowance (15,000 × 12 × 70%) ₹ 1,26,000

(2) ₹ 10,000 p.m. (10,000 × 12) ₹ 1,20,000

Answer:

(B) ₹ 1,20,000

Question 30.

Mr. Arjun employed in KL (P) Ltd. at Mumbai was provided rent-free accommodation by the employer who owned such accommodation. The salary income of Mr. Arjun for the purpose of computing the perquisite value is ₹ 8 lakhs.

The perquisite value of rent-free accommodation in the hands of Mr. Arjun is:

(A) 10% of salary ie. ₹ 80,000

(B) 7.5% of salary ie. ₹ 60,000

(C) Nil

(D) 15% of salary ie. ₹ 1,20,000 [June 2017]

Answer:

(D) 15% of salary ie. ₹ 1,20,000

Question 31.

Mr. Gupta is given a motor car with chauffeur by the employer which is used for both official and personal purposes. The entire running expenses of the car amounting to ₹ 64,800 were met by the employer in the previous year 2020-21. The cubic capacity of the engine of the motor car exceeds 1.6 liters.

The perquisite value of motor car taxable in the hands of Mr. Gupta is:

(A) ₹ 19,200

(B) ₹ 39,600

(C) ₹ 28,800

(D) ₹ 64,800 [June 2017]

Hint:

(2,400 + 900) × 12 = 39,600

Answer:

(B) ₹ 39,600

Question 32.

Ashwin Co. Ltd. contributed 15% of the salary of the employee Virat towards the recognized provident fund. Amount liable to tax as perquisite in the hands of Virat would be of contribution.

(A) 5%

(B) 396

(C) Nil

(D) Any sum exceeding ₹ 1,50,000 [June 2017]

Answer:

(B) 396

Question 33.

During the previous year, the employee was reimbursed ₹ 24,000 as medical expenses incurred by him which includes ₹ 7,000 spent in a Government hospital. The taxable prerequisite, in this case, shall be:

(A) ₹ 2,000

(B) Nil

(C) ₹ 17,000

(D) ₹ 24,000 [June 2017]

Answer:

(C) ₹ 17,000

Question 34.

The employee is provided with furniture costing ₹ 1,50,000 along with house w.e./. 1.7.2020. The value of the furniture to be included in the valuation of the unfurnished house shall be:

(A) ₹ 11,250

(B) ₹ 15,000

(C) ₹ 22,500

(D) ₹ 16,875 [June 2017]

Hint:

1,50,000 × 10% × 9/12 = 11,250

Answer:

(A) ₹ 11,250

Question 35.

Interest credited to the statutory provident fund shall be:

(A) Fully exempt

(B) Exempt up to 8.596 p.a.

(C) Fully-taxable

(D) Exempt up to 9.596 [June 2017]

Answer:

(A) Fully exempt

Question 36.

Mr. Vijay employed in ABC Ltd opted for voluntary retirement and received ₹ 22 lakh by way of gratuity.

The Payment of Gratuity Act, 1972 is applicable in his case. The monetary limit for exemption under Section 10(10) is:

(A) ₹ 35,00,000

(B) ₹ 10,00,000

(C) ₹ 20,00,000

(D) ₹ 30,00,000 [Dec. 2017]

Answer:

(C) ₹ 20,00,000

Question 37.

The maximum amount eligible for exemption in respect of encashment of earned leave on retirement is:

(A) ₹ 3,00,000

(B) ₹ 10,00,000

(C) ₹ 50,000

(D) ₹ 5,00,000 [Dec. 2017]

Answer:

(A) ₹ 3,00,000

Question 38.

Mr. Murthy is employed in, ABC Management Institute, Pune. He is eligible for ₹ 24,000 as an allowance for the year towards academic and research work. The amount of academic and research allowance chargeable to tax is:

(A) ₹ 10,000

(B) ₹ 24,000

(C) Nil

(D) ₹ 9,000 [Dec. 2017]

Answer:

(B) ₹ 24,000

Question 39.

Mr. Amit employed in X Co. Ltd. received ₹ 10,000 per month as house rent allowance in the year 2020-21. His total salary is ₹ 4 lakhs consisting of Basic Pay + DA. He paid rent of ₹ 8,000 per month. How much of HRA is exempt from tax?

(A) ₹ 40,000

(B) ₹ 56,000

(C) ₹ 1,20,000

(D) ₹ 1,60,000 [Dec. 2017]

Hint:

| HRA Received (10,000 × 12) | 1,20,000 |

| (-) Exempt | (56,000) |

| Taxable HRA | 64,000 |

Calculation of exempted HRA:

| HRA Received | 1,20,000 |

| Rent paid – 10% of salary [96,000 – 40,000] | 56,000 |

| 40% of salary | 1,60,000 |

Answer:

(B) ₹ 56,000

Question 40.

Mr. Balan is employed in SS Ltd at Madurai. He is provided with rent-free accommodation owned by the employer. The percentage of salary to be adopted for the purpose of valuation of perquisite would be:

(A) 15%

(B) 10%

(C) 7.5%

(D) 20% [Dec. 2017]

Hint:

The population of Madurai in 2012 is as per the 2012 census is between 10 to 15 lakh; hence the percentage of salary to be adopted for the purpose of valuation of perquisite would be 10%.

Answer:

(B) 10%

Question 41.

Ravi employed in Cotton India Ltd. as an accounts manager. The employer paid ₹ 1,60,000 as a contribution to the approved superannuation fund to benefit the employee, Ravi. The amount of such contribution liable to tax as perquisite in the hands of Mr. Ravi is:

(A) Nil

(B) ₹ 10,000

(C) ₹ 1,60,000

(D) ₹ 60,000 [Dec. 2017]

Answer:

(B) ₹ 10,000

Question 42.

Mr. Bobby employed in QPR Ltd. was permitted to admit his only son to the school run by the employer. No fee was charged on such education provided to the son of Mr. Bobby. The cost of such education for other children is ₹ 1,800 per month. The perquisite value of free education in the hands of Mr. Bobby would be:

(A) ₹ 21,600

(B) ₹ 12,000

(C) ₹ 36,000

(D) ₹ 9,600 [Dec. 2017]

Hint:

The cost of education for other children is ₹ 1,800 per month ie. above the prescribed sum of ₹ 1,000; hence fully taxable. 1,800 × 12 = 21,600.

Answer:

(A) ₹ 21,600

Question 43.

When interest on employee’s own contribution from the unrecognized provident fund is received, it is:

(A) taxable as income from other sources

(B) taxable as income from salary

(C) exempt from tax

(D) taxable if the interest exceeds ₹ 10,000 [Dec. 2017]

Answer:

(A) taxable as income from other sources

Question 44.

The maximum amount of gratuity exempt and the maximum amount of leave encashment exempt under the Act respectively are:

(A) ₹ 2,50,000 in each case

(B) ₹ 20,00,000 and ₹ 3,00,000

(C) ₹ 5,00,000 and ₹ 2,50,000

(D) None of the above [June. 2018]

Answer:

(B) ₹ 20,00,000 and ₹ 3,00,000

Question 45.

An assessee is not eligible to claim any relief under section 89 of Income-tax Act, 1961, when he is in receipt of income as arrears or in advance during the previous year from his employer:

(A) in respect of gratuity

(B) in respect of commutation of pension

(C) in respect of arrears of family pension

(D) in respect of amount received on voluntary retirement or termination of services [Dec. 2018]

Answer:

(D) in respect of amount received on voluntary retirement or termination of services [Dec. 2018]

Question 46.

Mohan retired from Y & Company Ltd. on 31.8.2020 after rendering services for 31 years and 7 months. He was paid ₹ 11 lakh as gratuity under the Payment of Gratuity Act, 1972. His last drawn salary was ₹ 52,000. How much of the amount of gratuity would be exempt?

(A) ₹ 10,00,000

(B) ₹ 20,00,000

(C) ₹ 9,30,000

(D) ₹ 9,60,000 [June 2019]

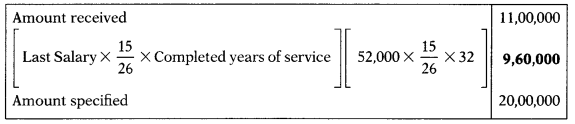

Hint:

Minimum of the following three is exempt as gratuity:

Answer:

(D) ₹ 9,60,000

Question 47.

Rohan, an employee of the State Government received ₹ 1,000 per month as an entertainment allowance during the financial year 2020-21. His salary excluding any allowance, benefit, or other perquisites for the year is ₹ 8,40,000. The amount of entertainment allowance eligible for deduction is:

(A) ₹ 12,000

(B) 1% of the salary of ₹ 8,400

(C) ₹ 5,000

(D) (12,000 – 8,400) = 3,600 [June 2019]

Answer:

(C) ₹ 5,000

Question 48.

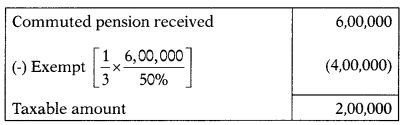

John, who recently retired from service of a company on 31st March 2021 is eligible for a monthly pension of ₹ 20,000. He has received gratuity on his retirement also. He wants to commute 50% of his pension for ₹ 6.00 lakh. How much amount of this commuted pension shall be subject to tax in AY 2021-2022?

(A) ₹ 6,00,000

(B) ₹ 2,00,000

(C) ₹ 3,00,000

(D) ₹ 3,50,000 [June 2019]

Hint:

Answer:

(B) ₹ 2,00,000

Question 49.

Employer’s contribution to Recognized Provident Fund (RPF) in excess of 12% of salary income of an employee shall be treated as:

(A) Taxable income from salaries

(B) Deemed income from salaries

(C) Exempted income

(D) Income of other sources [June 2019]

Answer:

(A) Taxable income from salaries

Question 50.

What will be the amount of gross salary which shall be required to be declared in the return of income to be filed for the previous year 2020-21 by Harun, who joined services as Manager Accounts on the salary of ₹ 17,000 p.m. in XYZ Ltd. on 1st April 2018 in the grade of 15,000 – 2000 – 19,000 – 3000 – 28,000?

(A) ₹ 3,00,000

(B) ₹ 2,28,000

(C) ₹ 2,64,000

(D) ₹ 2,52,000 [Dec. 2019]

Hint:

2018-19: Salary: ₹ 17,000 p.m.

2019- 20: ₹ 19,000 p.m.

2020- 21: ₹ 22,000 p.m. × 12 month = ₹ 2,64,000

Answer:

(C) ₹ 2,64,000

Question 51.

Total income of Nand Kishore under the head ‘Salary’ for the financial year 2020-21 of whose basic salary and DA per month was of ₹ 40,000 and ₹ 3,000 respectively and who was also paid leave salary of ₹ 6,000 and ₹ 1,000 of professional tax by the employer shall be

(A) ₹ 4,72,000

(B) ₹ 4,76,000

(C) ₹ 5,23,000

(D) ₹ 5,16,000 [Dec. 2019]

Hint:

Computation of Total Income:

| ₹ | |

| Basic Salary (₹ 40,000 × 12) | 4,80,000 |

| Dearness Allowance (₹ 3,000 × 12) | 36,000 |

| Leave Salary | 6,000 |

| Profession Tax | 1,000 |

| Gross Taxable Salary | 5,23,000 |

| Less: Deductions under section 16 | |

| (ii) Standard Deduction | (50,000) |

| (iii) Profession Tax | (1,000) |

| Net Taxable Salary/Gross Total Income/Total Income | 4,72,000 |

Answer:

(A) ₹ 4,72,000

Question 52.

A Central Government Officer received during the year 2020-21 salary excluding all allowances of ₹ 9,00,000 and amount of entertainment allowance of ₹ 12,000 @ ₹ 1,000 p.m. The maximum amount of entertainment allowance so received by him being exempt under section 16(h) of the Act is

(A) 1 / 5th of salary

(B) ₹ 1,000 p.m.

(C) ₹ 5,000

(D) ₹ 10,000 [Dec. 2019]

Hint:

Entertainment Allowance exempted shall be lower of following 3:

a. Actual Entertainment Allowance received = ₹ 12,000

b. 20% of Salary i.e. ₹ 9,00,000 × 2096 = ₹ 1,80,000

c. ₹ 5,000 p.a.

Hence, Entertainment Allowance exempted shall be ₹ 5,000.

Answer:

(C) ₹ 5,000