Students should practice Deductions from Total Income – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Deductions from Total Income – CS Executive Tax Laws MCQ Questions

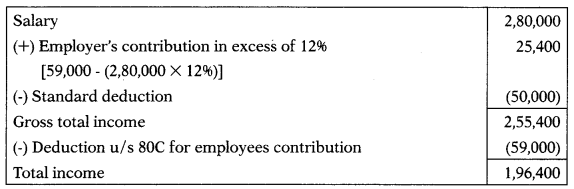

Question 1.

For the year ended 31 st March 2021, Paresh receives a salary of ₹ 2,80,000. Paresh’s contribution to employees’ recognized provident fund account is ₹ 59,000 and a matching contribution has been made by the employer.

Taxable income of Paresh will be

(A) ₹ 1,96,400

(B) ₹ 2,06,400

(C) ₹ 3,39,000

(D) ₹ 2,80,000 [Dec. 2014]

Hint:

Answer:

(A) ₹ 1,96,400

Question 2.

The maximum possible amount of deduction u/s 80DDB for senior citizen is

(A) ₹ 75,000

(B) ₹ 1,25,000

(C) ₹ 1,00,000

(D) ₹ 60,000 [Dec. 2014]

Answer:

(C) ₹ 1,00,000

Question 3.

Following is not allowed as deduction u/s 80TTA

(A) Interest on deposits in savings account with a bank up to ₹ 10,000

(B) Interest on time deposits with the bank up to ₹ 10,000

(C) Interest on deposits in savings account with post office up to ₹ 10,000 [Dec. 2014]

(D) Interest on deposits with co-operative society engaged in carrying on the business of banking up to ₹ 10,000

Answer:

(B) Interest on time deposits with the bank up to ₹ 10,000

Question 4.

The maximum amount of deduction u/s 80U allowed to a person with 80% or more of one or more disabilities is

(A) ₹ 40,000

(B) ₹ 60,000

(C) ₹ 50,000

(D) ₹ 1,25,000 [Dec. 2014]

Answer:

(D) ₹ 1,25,000

Question 5.

An Indian resident patentee is entitled to a deduction u/s 80RRB to the extent of

(A) 100% of such income

(B) 50% of such income

(C) 100% of such income or ₹ 3,00,000 whichever is less

(D) 50% of such income or ₹ 3,00,000 whichever is more [Dec. 2014]

Answer:

(C) 100% of such income or ₹ 3,00,000 whichever is less

Question 6.

Deduction under section 80CCG is available to an eligible resident individual whose gross total income does not exceed

(A) ₹ 10,00,000

(B) ₹ 12,00,000

(C) ₹ 5,00,000

(D) No such limit [June 2015]

Answer:

(B) ₹ 12,00,000

Question 7.

Sahil works in a technology company. On 1st January 2019, he took a loan of ₹ 2,40,000 from his company for the education of his daughter. During the year 2020-21, he paid an interest of ₹ 46,000 towards the said loan and repaid the principal component of ₹ 10,000.

The deduction that he can claim u/s 80E would be

(A) Nil

(B) ₹ 24,000

(C) ₹ 46,000

(D) ₹ 10,000 [June 2015]

Hint:

Deduction in respect of interest on loan taken for Higher Education is allowed if the loan is from Approved Charitable Institutions or Financial Institution. (S. 80E)

Here, the loan is taken from the employer & hence, no deduction is allowed u/s 80E.

Answer:

(A) Nil

Question 8.

Under the Income-tax Act, 1961, which of the following can claim a deduction for any sum contributed during the previous year to a political party or electoral trust

(A) Local authority

(B) Individual

(C) Artificial juridical person

(D) None of the above [June 2015]

Answer:

(B) Individual

Question 9.

Deduction in respect of donations to National Defence Fund is allowed u/s

(A) 80G

(B) 80CCG

(C) 80C

(D) None of the above [June 2015]

Answer:

(A) 80G

Question 10.

Raman purchased a residential house property in Ahmedabad on loan for which he paid an interest of ₹ 50,000 during the previous year. He is working in Delhi and getting an HRA of ₹ 4,000 per month.

He can claim exemption/deduction for

(A) Only HRA

(B) Only interest paid

(C) Either interest paid or HRA but not both

(D) Both HRA and interest paid. [June 2015]

Answer:

(D) Both HRA and interest paid.

Question 11.

Which of the following cannot claim a deduction for the loan taken to purchase a house property?

(A) Karta, in respect of property purchased by HUF

(B) An individual, in respect of property purchased by him

(C) Partner, in respect of property purchased by the firm

(D) Spouse of an individual, in respect of property, purchased jointly by the individual and his/her spouse. [June 2015]

Answer:

(C) Partner, in respect of property purchased by the firm

Question 12.

The monetary limit for deduction in respect of royalty on patents received by a resident individual is

(A) ₹ 1,00,000

(B) ₹ 3,00,000

(C) ₹ 5,00,000

(D) Nil [Dec. 2015]

Answer:

(B) ₹ 3,00,000

Question 13.

An individual has made investments in the schemes approved u/s 80C, and 80CCD of ₹ 2,50,000 and ₹ 1,00,000 respectively during the year ended 31st March 2021.

Amount that can be claimed by him as deduction out of income in AY 2021-22 is

(A) 50% of ₹ 3,50,000

(B) ₹1,50,000 u/s 80C and ₹ 1,00,000 u/s 80CCD

(C) ₹ 1,50,000

(D) None of the above [Dec. 2015]

Answer:

(B) ₹1,50,000 u/s 80C and ₹ 1,00,000 u/s 80CCD

Question 14.

Raghu’s father is dependent on him and suffering from 90% disability. Raghu has incurred an amount of ₹ 72,500 in maintaining and medical treatment of his father.

The deduction he can claim in his income-tax return for AY 2021-22 is

(A) ₹ 72,500

(B) ₹ 50,000

(C) ₹ 1,25,000

(D) None of the above [Dec. 2015]

Answer:

(C) ₹ 1,25,000

Question 15.

Bharat, engaged in business, claimed that he paid ₹ 10,000per a month by cheque as rent for his residence. He does not own any residential buildings. His total income computed before deduction under section 80GG is ₹ 3,40,000.

The amount he can claim as deduction under section 80GG is

(A) ₹ 60,000

(B) ₹ 86,000

(C) ₹ 1,20,000

(D) ₹ 85,000 [June 2016]

Hint:

Minimum of the following three is exempt u/s 80GG:

| Rent paid less 10% of adjusted total income (1,20,000 – 34,000) | 86,000 |

| 25% of Adjusted total income (3,40,000 × 25%) | 85,000 |

| ₹ 5,000 p.m. | 60,000 |

Answer:

(A) ₹ 60,000

Question 16.

Rajan paid ₹ 25,000 to LIC of India for the maintenance of his disabled son and incurred ₹ 15,000 for the treatment of his handicapped wife who is working in the State Bank of India.

The deduction allowable to him under Section 80DD is

(A) ₹ 15,000

(B) ₹ 25,000

(C) ₹ 50,000

(D) ₹ 75,000 [June 2016]

Answer:

(D) ₹ 75,000

Question 17.

Deduction in respect of interest on savings accounts under Section 80TTA shall be allowed with respect to a savings account with

(A) Bank

(B) Co-operative society

(C) Post office

(D) All of the above [June 2016]

Answer:

(D) All of the above

Question 18.

Deduction under section 80C can be claimed for a fixed deposit made in any scheduled bank if the minimum period of deposit is

(A) 5 Years

(B) 8 Years

(C) 10 Years

(D) 12 Years [June 2016]

Answer:

(A) 5 Years

Question 19.

In the case of which of the following co-operative society, the deduction under Section 80P is restricted to ₹ 1,00,000

(A) Consumers’ co-operative society

(B) Society engaged in collection and disposal of labor

(C) Society engaged in fishing

(D) Society engaged in processing of agricultural produce without the aid of power [June 2016]

Answer:

(A) Consumers’ co-operative society

Question 20.

When a person suffers from severe disability, the quantum of deduction allowable under Section 80U is

(A) ₹ 50,000

(B) ₹ 75,000

(C) ₹ 1,25,000

(D) ₹ 1,00,000 [June 2016]

Answer:

(C) ₹ 1,25,000

Question 21.

Under section 80QQB, the maximum deduction in respect of royalty is allowed up to

(A) ₹ 1,00,000

(B) ₹ 1,50,000

(C) ₹ 2,50,000

(D) ₹ 3,00,000 [Dec. 2016]

Answer:

(D) ₹ 3,00,000

Question 22.

An amount up to a maximum of ₹ 10,000 is deductible under Section 80TTA from the gross total income of

(A) Individual only

(B) HUF and Individual only

(C) Company only

(D) All assessee [Dec. 2016]

Answer:

(B) HUF and Individual only

Question 23.

Deduction available u/s 80GG in respect of rent paid cannot be more than –

(A) ₹ 6,000 p.m.

(B) ₹ 5,000 p.m.

(C) ₹ 2,000 p.m.

(D) ₹ 110,000 p.m. [Dec. 2016]

Answer:

(B) ₹ 5,000 p.m.

Question 24.

Raghunath repaid during the previous year 2020-2021 education loan of ₹ 60,000 and interest on an education loan of ₹ 18,000 taken from Punjab National Bank for his son to pursue MS in India. The loan was taken in the financial year 2013-2014 and the payment commenced from the financial year 2014-2015.

The amount eligible for deduction under section 80E for the assessment year 2021-22 is:

(A) ₹ 60,000

(B) ₹ 78,000

(C) ₹ 18,000

(D) Nil [June 2017]

Hint:

Deduction u/s 80E is allowed for 8 years from the year in which the first interest is paid. The deduction is allowed only for interest and not for principle. Thus, the total deduction allowed is ₹ 18,000.

Answer:

(C) ₹ 18,000

Question 25.

Shravan engaged in the business paid monthly rent of 15,000 by cheque for his residence during the previous year 2020-21. His adjusted total income is ₹ 3,40,000.

The amount eligible for deduction under section 80GG is:

(A) ₹ 86,000

(B) ₹ 60,000

(C) ₹ 26,000

(D) ₹ 85,000 [June 2017]

Hint:

Minimum of following three is deductible u/s 80GG:

| Rent paid (-) 10% of adjusted total income (60,000 – 34,000) | 26,000 |

| 25% of Adjusted Total Income (3,40,000 × 25%) | 85,000 |

| ₹ 5,000 per month | 60,000 |

Answer:

(C) ₹ 26,000

Question 26.

Deduction under Section 80G on account of donation is allowed to:

(A) A business assessee only

(B) Any assessee

(C) Individual or HUF only

(D) Any resident assessee [June 2017]

Answer:

(B) Any assessee

Question 27.

Donation to university for research in Social Science is eligible for deduction at:

(A) 100%

(B) 25%

(C) 150%

(D) 175% [Dec. 2017]

Answer:

(A) 100%

Question 28.

Mr. Mithun acquired a house property for ₹ 8 lakhs and paid stamp duty and registration fee of ₹ 80,000. He borrowed a housing loan and repaid a principal of ₹ 60,000 and interest of ₹ 20,000.

The amount eligible for deduction under Section 80C would be:

(A) ₹ 80,000

(B) ₹ 60,000

(C) ₹ 1,00,000

(D) ₹ 1,40,000 [Dec. 2017]

Hint:

Stamp duty, registration fee, and repayment of principal are eligible for deduction u/s 80C.

80,000 + 60,000 = 1,40,000.

Answer:

(D) ₹ 1,40,000

Question 29.

Mr. Uday is a resident individual having a patent registered on 1.7.2016 under the Patents Act, 1970. He received ₹ 5 lakh by way of royalty from ABC Ltd. during the financial year 2020-21.

The quantum of royalty eligible for deduction would be:

(A) ₹ 5 lakhs

(B) ₹ 3 lakhs

(C) ₹ 1 lakh

(D) ₹ 2 lakhs [Dec. 2017]

Hint:

As per Section 80RRB, 100% of royalty income or ₹ 3,00,000 whichever is less is exempt.

Answer:

(B) ₹ 3 lakhs

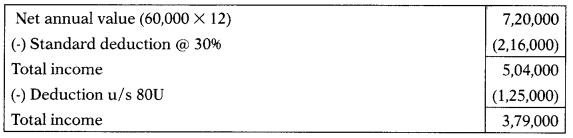

Question 30.

Mr. Veer earns a monthly rental income of ₹ 60,000 from house property. He suffers from a severe disability and has obtained a certificate from the prescribed medical authority. He has not incurred any expenditure towards the treatment of severe disability.

His total income chargeable to tax after deduction under Section 80U would be:

(A) ₹ 3,79,000

(B) ₹ 4,29,000

(C) ₹ 5,04,000

(D) ₹ 7,20,000 [Dec. 2017]

Hint:

Answer:

(A) ₹ 3,79,000

Question 31.

Mr. Baskar a person with a disability referred to in Section 80U is employed in a bank. He paid ₹ 50,000 as a premium on the life insurance policy taken on himself and whose sum assured is ₹ 4 lakh.

The amount of premium eligible for deduction under Section 80C would be:

(A) ₹ 40,000 (10% of sum assured)

(B) ₹ 50,000

(C) Nil (since it exceeded 10%)

(D) None of the above [Dec. 2017]

Hint:

Premium on an insurance policy in excess of 15% of the actual sum assured shall not qualify for a deduction in respect of policies issued on or after 1-4-2013, where the policy, is for insurance on the life of any person, who is

(i) a person with a disability or a person with severe disability as referred to in Section 80U, or

(ii) suffering from disease or ailment as specified in the rules made u/s 80DDB.

Answer:

(B) ₹ 50,000

Question 32.

Mr. Anand engaged in business wants to deposit in the pension fund of the Life Insurance Corporation of India.

The maximum amount of contribution eligible for deduction from total income is:

(A) ₹ 10,000

(B) ₹ 50,000

(C) ₹ 1,00,000

(D) ₹ 1,50,000 [Dec. 2017]

Answer:

(D) ₹ 1,50,000

Question 33.

Sudhan Ltd. incorporated in April 2020 commenced commercial production from 1.6.2020. It deployed 100 employees who were employed for 260 days during the year and recruited 50 casual workmen who were employed for 100 days during the financial year 2020-21. The salary paid to 100 employees was ₹ 25 lakh and the salary paid to casual workmen was ₹ 6 lakh.

The quantum of deduction under section 80JJAA is:

(A) ₹ 7.50 lakh

(B) ₹ 9.30 lakh

(C) ₹ 25 lakh

(D) ₹ 6 lakh [Dec. 2017]

Hint:

25,00,000 × 30% = 7,50,000.

Answer:

(A) ₹ 7.50 lakh

Question 34.

Mr. Rath borrowed a loan of ₹ 10 lakh for higher education in India in the year 2009-10. He completed the course study in 2012-13. He started repayment of the loan in April 2014. He paid interest of ₹ 41,000 and principal of ₹ 1,20,000 during the financial year 2020-21.

The amount eligible for deduction under section 80E would be:

(A) ₹ 1,20,000

(B) ₹ 1,61,000

(C) ₹ 41,000

(D) ₹ 1,00,000 (monetary limit) [Dec. 2017]

Answer:

(C) ₹ 41,000

Question 35.

Mr. Ganesh gave a donation by way of a cheque of ₹ 40,000 and by cash ₹ 5,000 to an approved charitable trust having recognition under section 80G. His gross total income for the assessment year 2021-22 is ₹ 5 lakh.

The quantum of deduction under section 80G would be:

(A) ₹ 45,000

(B) ₹ 5,000

(C) ₹ 40,000

(D) ₹ 20,000 [Dec. 2017]

Hint:

No deduction shall be allowed under section 80G in respect of donation of any sum exceeding ₹ 2,000 unless such sum is paid by any mode other than cash.

Thus, the eligible amount of donation is ₹ 40,000. (50% deduction with qualifying limit)

Gross total income (Assumed adjusted total income) = 5,00,000. Qualifying limit = 5,00,000 × 10% = 50,000.

The qualifying limit is covering the full amount of eligible donations. Thus, deduction will be 40,000 × 50% = 20,000.

Answer:

(D) ₹ 20,000

Question 36.

Deduction u/s 80C from the gross total income of an amount equal to the eligible investment made subject to a maximum amount of ₹ 1,50,000 is allowed to the assessee who is:

(A) A Hindu Undivided Family

(B) Any person

(C) An individual

(D) Both (A) and (C) [June 2018]

Answer:

(D) Both (A) and (C)

Question 37.

50% deduction of the eligible amount is allowed u/s 80CCG, provided some of the conditions out of the following are to be fulfilled:

(i) The assessee is a Resident Individual.

(ii) The gross total income does not exceed ₹ 12 lakh.

(iii) He has acquired listed shares or listed units of equity-oriented funds in accordance with a notified scheme.

(iv) The investment is locked in for a period of 3 years from the date of acquisition in accordance with the equity-oriented scheme.

(A) (i), (ii) and (iv)

(B) All the four above

(C) (i) and (iii)

(D) (i), (ii) and (iii) [June 2018]

Answer:

(B) All the four above

Question 38.

An assessee can avail of the deduction in respect of rent paid u/s 80GG of the Act subject to a maximum amount of:

(A) ₹ 5,000 p.m.

(B) 25% of the adjusted total income

(C) ₹ 3,000 p.m.

(D) None of the above [June 2018]

Answer:

(A) ₹ 5,000 p.m.

Question 39.

The profits of a co-operative society engaged in (i) Carrying out the business of banking, (ii) A cottage industry, and (iii) Collective disposal of labors of its member are eligible for deduction u/s 80P up-to

(A) 75% of the profits

(B) 100% of the profits

(C) 50% of the profits

(D) None of the above [June 2018]

Answer:

(B) 100% of the profits

Question 40.

The maximum amount of deduction (in terms of ₹) in the case of an individual who is resident in India, a patentee, and in receipt of income by way of royalty in respect of a patent registered on or after the first day of April 2003 under the Patents Act, 1970 is allowed:

(A) 100% of such income

(B) 50% of such income

(C) ₹ 3 lakh

(D) No such deduction under the Act [June 2018]

Answer:

(C) ₹ 3 lakh

Question 41.

The contribution made or given other than by way of cash by an Indian company in the previous year to any political party or to an electoral trust shall be allowed as deduction while computing its total income under section 80GGB of Income-tax Act, 1961 of an amount maximum or up to:

(A) ₹ 50,000

(B) ₹ 1,50,000

(C) No monetary ceiling limit

(D) None of the above [Dec. 2018]

Answer:

(C) No monetary ceiling limit

Question 42.

S JG Ltd., a manufacturer of leather goods in a factory located at Noida having an annual turnover of ₹ 50 Crore. The company, during the year, employed 200 new regular workers in the factory, which was 2096 of the existing workforce employed on the last day of the preceding year. It paid ₹ 30 lakh to the new workers during the year as additional wages. All workmen were employed from 1st May 2019.

The eligible amount of deduction which the company can claim under section 80JJAA of Income-tax Act, 1961 is:

(A) ₹ 30 lakh

(B) ₹ 15 lakh

(C) ₹ 9 lakh

(D) ₹ 18 lakh [Dec. 2018]

Hint:

30,00,000 × 30% = 9,00,000.

Answer:

(C) ₹ 9 lakh

Question 43.

The quantum of deduction available to offshore Banking Units under section 80LA of Income-tax Act, 1961 located in Special Economic Zone (SEZ) and satisfying all conditions from the Gross Total Income is:

(A) 10096 of such income for five consecutive assessment years, relating to the previous year in which the permission was obtained

(B) 5096 of such income for the next five consecutive years

(C) 2596 of such income for the next ten years

(D) Both (A) and (B) [Dec. 2018]

Answer:

(D) Both (A) and (B)

Question 44.

Which of the under-mentioned incomes of a Co-operative Society is not eligible for deduction under Section 80P of the Income Tax Act, 1961 when the gross total income of the society exceeds ₹ 20,000?

(A) Agency business

(B) Income from letting of godown

(C) Income from house property

(D) Dividend from other Co-operative Societies [Dec. 2018]

Answer:

(C) Income from house property

Question 45.

Nargis during the previous year 1 st April 2020 to 31 st March 2021 had donated the amount of ₹ 50,000 each in Africa Fund, National Children Fund, National Illness Assistance Fund, and a further amount of ₹ 30,000 in Rajiv Gandhi Foundation.

The amount of deduction eligible to be claimed by her as per section………in AY 2021-22 shall be of……

(A) 8OG ₹ 1,80,000

(B) 80G ₹ 1,65,000

(C) 8OGGB ₹ 1,50,000

(D) 80G ₹ 90,000 [Dec. 2018]

Hint:

50,000 + 50,000 + 50,000 + 15,000 = 1,65,000.

Answer:

(B) 80G ₹ 1,65,000

Question 46.

The Patna High Court following the decision laid down by the Bombay High Court in the case of Mahindra Sintered Products Ltd. Held that to claim special deduction u/s 80J, the assessee has to establish the fact/facts relating to

(A) Investment of substantial fresh capital in the new industrial undertaking so set up

(B) Earning of profits clearly attributable to the said undertaking

(C) Manufacture or production of articles on the said undertaking

(D) All of the above [Dec. 2018]

Answer:

(D) All of the above

Question 47.

10096 deduction in respect of donations as per section 80G without any qualifying amount or limit is available in the case of:

(A) Prime Minister Drought Relief Fund

(B) Jawaharlal Nehru Memorial Fund

(C) Payment to the local authority for promotion of family planning

(D) Africa Fund [June 2019]

Answer:

(D) Africa Fund

Question 48.

Rao, carrying business, contributed ₹ 40,000 in the National Pension Trust account. He also made a tax-saving deposit of ₹ 1,20,000 in his PPF account and ₹ 40,000 in LIC Premium.

The total amount eligible for deduction under various sections enumerated in Chapter VI-A shall be:

(A) ₹ 1,90,000

(B) ₹ 1,50,000

(C) ₹ 1,20,000

(D) ₹ 2,00,000 [June 2019]

Hint:

The maximum amount of deduction under sections 80C, 80CCC, and u/s 80CCD(1) (i.e. employee’s contribution or an individual assessee’s contribution to pension scheme of Central Government) is restricted to ₹ 1,50,000.

Answer:

(B) ₹ 1,50,000

Question 49.

Timer, (aged 51 years) subscribed to health insurance for himself, his wife, and his son and paid a premium of ₹ 28,000. He also incurred medical expenditure for his parents during the year amounting to ₹ 32,000.

He can claim deduction for these expenses as per section 80D of the Income-tax Act, 1961, of:

(A) ₹ 57,000

(B) ₹ 30,000

(C) ₹ 28,000

(D) ₹ 55,000 [June 2019]

Hint:

| For Time and his family | 25,000 |

| For parent (senior citizen) | 32.000 |

| 57,000 |

Answer:

(A) ₹ 57,000

Question 50.

ABC Limited fulfilling all the conditions of operating different infrastructure facilities for claiming deduction u/s 80-IA. Find which are being not covered under infrastructure facility out of the following :

(A) Developing of Toll-Road

(B) Operating and maintaining of Highway Project

(C) Operating and maintaining of an Airport

(D) Developing of industrial park [Dec. 2019]

Answer:

(D) Developing of the industrial park

Question 51.

The profits of a Co-operative Society engaged in (i) Carrying out the business of banking, (ii) A cottage industry, and (m) Collective disposal of labor of its members are exempt from tax as per section 80P up to :

(A) 75% of the profits

(B) 100% of the profits

(C) 50% of the profits

(D) 40% of the profits [Dec. 2019]

Answer:

(B) 100% of the profits