Export Import Bank of India Personal Loan | Features, Benefits, How To Apply?, Eligibility and Purpose

Export Import Bank of India Personal Loan: The Government of India formed Exim Bank under the Export-Import Bank of India Act, 1981, as a provider of export financing, replicating worldwide Export Credit Agencies. The EXIM Bank’s full form is Export-Import Bank. Through a diverse range of goods and services, Exim Bank acts as a development engine for sectors and SMEs.

This comprises the import of technology and the creation of export products, as well as export production, export marketing, pre-and post-shipment services, and international investment. It’s important to know this subject topic because several questions may come in the EXIM Bank UPSC exam.

Curious to check other banks’ offered Personal loan features, eligibility, interest rates, tax benefits, and a repayment plan. Go with our one-stop Personal Loan Page & swipe out your doubts within no time.

Bank of India Export finance extends Lines of Credit (LOCs) to foreign financial institutions, sovereign governments, regional development banks, and other foreign entities to enable purchasers in those countries to import developmental and infrastructure projects, equipment, goods, and services from India on deferred credit terms.

The EXIM Bank has placed a high premium on expanding project exports, which has been facilitated by the launch of the Buyer’s Credit-National Export Insurance Account (BC-NEIA) program. EXIM Bank sanctioned loans of Rs 40255 crore during the fiscal year ending March 31, 2020, while disbursing Rs 33735 crore. As of March 31, 2020, loan assets totalled Rs 99447 crore.

Export Import Bank of India

- About Export-Import Bank Of India

- Features and Benefits of Export-Import Bank Of India Personal Loan

- How to Apply for Export-Import Bank Of India Personal Loan?

- Purpose of Export-Import Bank Of India Personal Loan

- Export-Import Bank Of India Personal Loan Eligibility

- India’s Export-Import Bank: Equated Monthly Installments (EMI)

About Export-Import Bank Of India

India’s Export-Import Bank is a public sector bank. Its headquarters are located in Mumbai. India’s Export-Import Bank was established in 1982. It operates one branch and

It offers various types of financial services to its customers, including saving deposits, fixed deposits, recurring deposits, house loans, personal loans, vehicle loans, school loans, gold loans, PPF accounts, lockers, net banking, mobile banking, RTGS, NEFT, IMPS, and E-Wallets. Among these are the Bima Yojana, the Pradhan Mantri Jeevan Jyoti Bima Yojana, and several more.

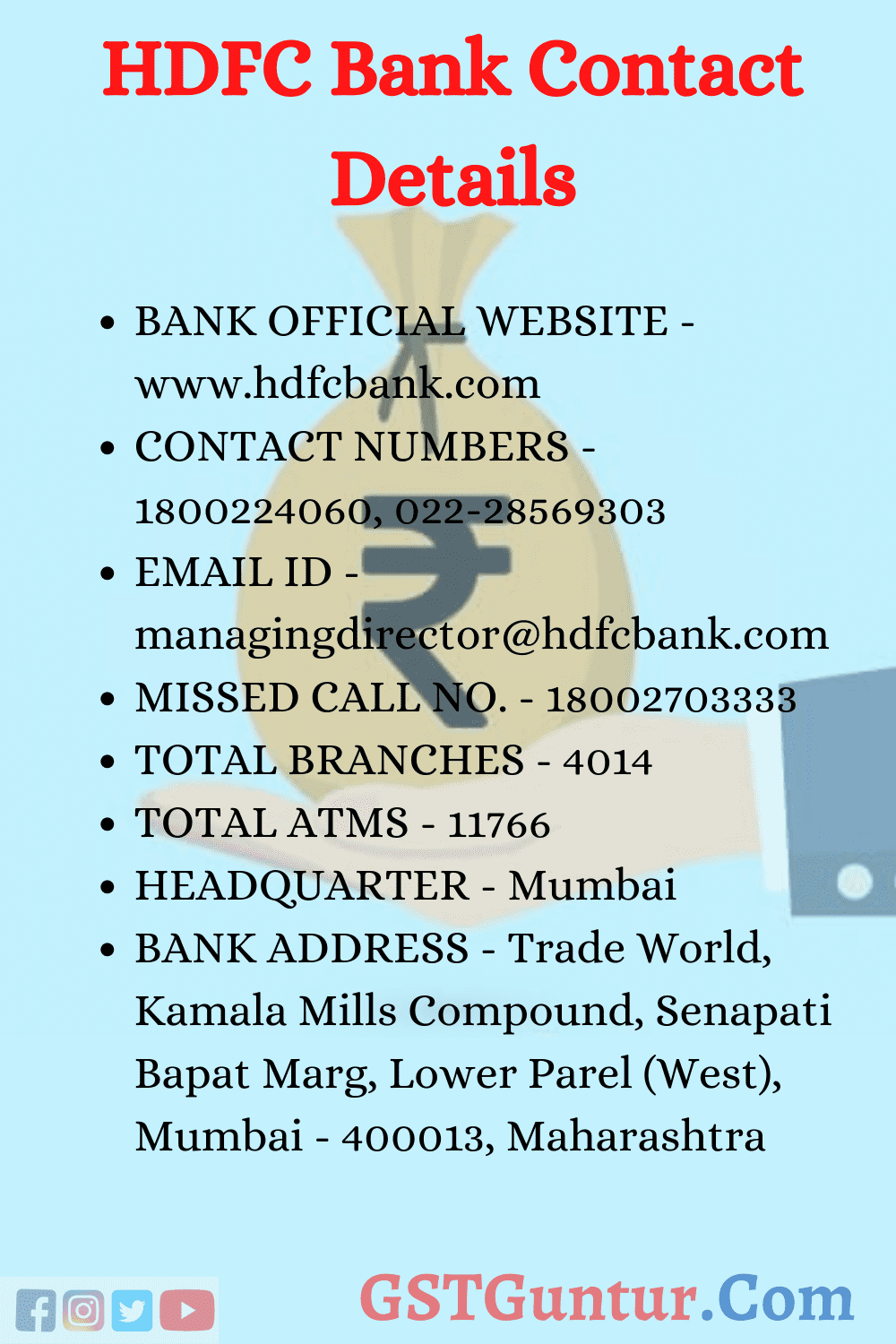

Discover information about Export-Import Bank Of India, including the Export-Import Bank Of India official website, Export-Import Bank Of India ATM locations throughout India, Export-Import Bank Of India branch locations throughout India, Export-Import Bank Of India contact numbers, Export-Import Bank Of India official email address, Export-Import Bank Of India headquarters, and Export-Import Bank Of India headquarters address. Export-Import Bank Of India two-wheeler loan purposes, eligibility, margin, loan repayment, security, and documentation required for a personal loan are listed below.

Features and Benefits of Export-Import Bank Of India Personal Loan

- Loan amount not to exceed

- Numerous repayment alternatives for loans

- Personal loan applications are processed efficiently and quickly.

- The rapid acceptance of loans

- The bank does not require a guarantor.

- Interest rates that are both attractive and competitive

- Special programmes and discounts are available to workers of major firms.

- Generally, no collateral is necessary to obtain a personal loan.

How to Apply for Export-Import Bank Of India Personal Loan?

- Apply Online: You may apply online by visiting the Bank website and entering your personal and job details, as well as uploading any required papers. You may apply once your loan eligibility has been determined.

- Apply Offline: You may visit any Bank office in person with all relevant papers, complete the application form, and initiate the loan approval procedure.

Purpose of Export-Import Bank Of India Personal Loan

To cover a variety of financial demands, such as a vacation abroad, home relocation, family marriage, credit card bill payment, loan repayment, and medical crises, without having to retain any collateral or property.

A Bank Loan for Exporting

Along with payment processing and current accounts, banks can also provide loans to export businesses. Bank loans in the form of term loans and working capital are available to export enterprises. Along with cash credit and letters of credit, banks can issue the following forms of bank loans to exporters:

Credit for Packing or Credit for Pre-Shipment

To assist the exporter in completing the export order, the bank may provide a packaging credit loan. Packaging credit is a sort of bank loan for an export company that is given to an exporter to finance the acquisition, processing, manufacturing, and packing of commodities necessary for export from India. Packing credit is a type of working capital loan that is granted in response to an export order from an international customer. The bank may issue a packing credit loan based on the time necessary to execute the export order. If a packaging credit loan is not changed within 360 days of the loan’s release date through the filing of export documentation, a higher interest rate may be charged.

Loans Upon Shipment

Post shipment loans are available to exporters from the date of shipping of goods or services until the date of exporter payment realisation. As a result, the exporter does not need to await payment from the customer and can collect cash from the bank prior to shipping the products or services. Three forms of post-shipment loans are available:

- Purchasing, discounting or negotiating export bills

- For collection purposes, a loan against export bills is made.

- Loan secured by a duty drawback claim against the government.

Export Credit Refinancing Program

Additionally, the Reserve Bank of India (RBI) offers export credit refinancing to banks based on the bank’s qualified outstanding rupee export credit, both pre-and post-shipment. Banks may provide loans equal to up to 15% of the outstanding export credit available for refinancing at the conclusion of the prior two-week period. Export credit refinancing schemes must be repaid within 180 days and do not require collateral.

Export-Import Bank Of India Personal Loan Eligibility

- Age ranges from 21 to 58 years.

- Permanent workers of the State/Central Government, Public Sector Undertakings, Corporations, Private Sector Businesses, and other reputable enterprises.

- Salaried/self-employed having a stable source of income.

- Years in current job/business/profession: up to three years

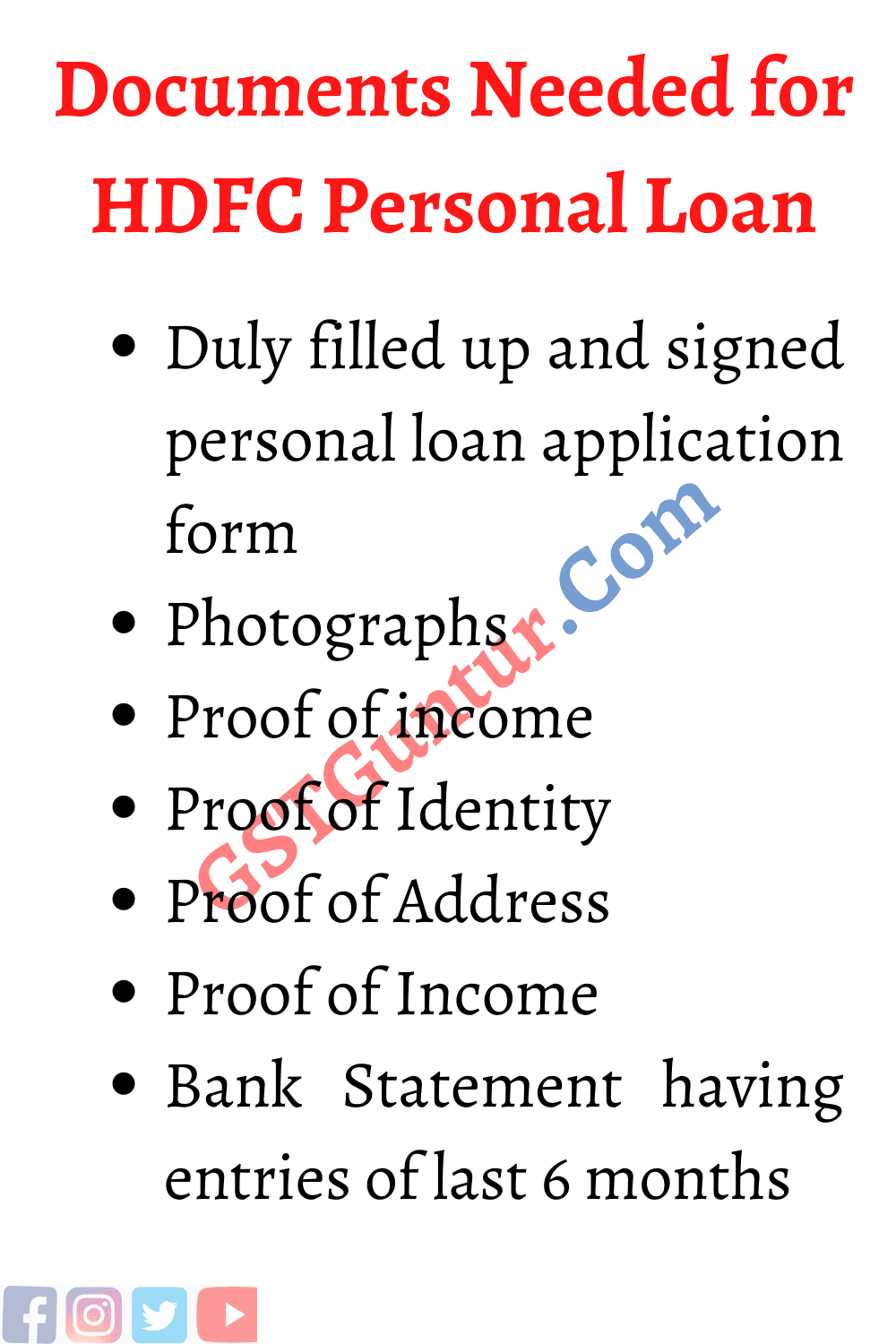

- India’s Export-Import Bank Loan for Individuals Documentation Is Required

- Completed and signed application for a personal loan

- Photographs

- Identification documents include a passport, a voter identification card, a driver’s licence, a PAN card, an Aadhar card, and a government agency ID card.

- Income documentation – Most recent salary slip showing all deductions or Form 16 in conjunction with a recent salary certificate (for salaried individuals)

- Income documentation—Two preceding fiscal years’ income tax returns (for other than salaried individuals)

- Proof of Address – Bank account statement, most recent power bill, most recent mobile/telephone bill, most recent credit card statement

- Statement of Accounts or Bank Pass Book containing entries from the previous six months.

India’s Export-Import Bank – Equated Monthly Installments (EMI)

India’s Export-Import Bank Repayment of Personal Loans

A maximum of 60 EMIs is permitted for personal loan repayment. It begins with 12 EMIs. Additionally, the repayment time is determined by your credit score.

One of the following techniques can be used to repay the loan:

- Registration of standing instructions with your bank

- By use of Internet Banking

- Automated Payments through ECS (Electronic Clearing Service) or using a bank-provided mobile banking application

- Security

- NIL

If big banks do not provide house loans to those with weak credit scores, you may be able to get a loan from one of the many cooperative banks or non-bank financial companies (NBFCs).

Visit the organization’s website at www.eximbankindia.in for more information on what they do.