Students should practice Capital Structure Decisions – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Capital Structure Decisions – Financial and Strategic Management MCQ

Question 1.

_____refers to the mix of a firm’s capitalization and includes long term sources of funds.

(A) Leverage

(B) Capital structure

(C) Debt mix

(D) Owner’s equity

Answer:

(B) Capital structure

Question 2.

The term “capital structure” refers to:

(A) Current assets & current liabilities

(B) Long-term debt, preferred stock, and common stock equity

(C) Total assets minus liabilities

(D) Shareholders’ equity

Answer:

(B) Long-term debt, preferred stock, and common stock equity

Question 3.

The decisions regarding the forms of financing, their requirements, and their relative proportions in total capitalization are known as –

(A) Equity decisions

(B) Equilibrium decisions ‘

(C) Outright decisions

(D) Capital structure decisions

Answer:

(D) Capital structure decisions

Question 4.

Which of the following statement is false?

I. In case the firm wants to grow at a faster pace, it would be required to incorporate debt in its capital structure to a greater extent.

II. If the firm has no long-term debt in its capital structure, it means that either it is risk-averse or it has a cost of equity capital or cost of retained earnings less than the cost of debt.

Select the correct answer from the options given below.

(A) Statement I is true while Statement II is false.

(B) Statement I is false while Statement II is true.

(C) Both Statement I and Statement II are false.

(D) Both Statement I and Statement II are true.

Answer:

(D) Both Statement I and Statement II are true.

Question 5.

While designing a capital structure a finance manager should choose a pattern of capital which –

(A) Minimizes cost of capital

(B) Maximizes the owner’s return.

(C) Maximizes the cost of capital and minimizes the owner’s return.

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 6.

Which of the following changes in capital structure would you recommend for growth at a faster rate?

(A) Incorporate more retained earnings out of profit and loss accounts.

(B) Incorporate debt in its capital structure to a greater extent.

(C) Merge with other companies.

(D) Pay more dividends to equity shareholders.

Answer:

(B) Incorporate debt in its capital structure to a greater extent.

Question 7.

The manner in which an organization’s assets are financed is referred to as its –

(A) Capital structure

(B) Financial structure

(C) Asset structure

(D) Owners structure

Answer:

(B) Financial structure

Question 8.

The optimal capital structure consists of –

(A) Appropriate mix of fixed assets and current assets.

(B) Appropriate mix of long-term debts and fixed assets.

(C) Appropriate mix of sales and profit.

(D) Appropriate mix of debt and equity.

Answer:

(D) Appropriate mix of debt and equity.

Question 9.

Which of the following is not included in the capital structure?

(A) Long term debt

(B) Preferred stock,

(C) Current assets

(D) Retained earnings

Answer:

(C) Current assets

Question 10.

Which of the following shows the significance of capital structure?

(A) Capital structure reflects the overall strategy of the firm.

(B) One can get a reasonably accurate broad idea about the risk profile of the firm from its capital structure.

(C) The capital structure acts as a tax management tool.

(D) All of the above

Answer:

(D) All of the above

Question 11.

The financial structure involves the creation of ___

(1) Long term assets

(2) Short term assets

Select the correct answer from the options given below.

(A) (2) only

(B) Neither (1) nor (2)

(C) (1) only

(D) Both (1) and (2)

Answer:

(D) Both (1) and (2)

Question 12.

Which of the following statement is incorrect?

(1) High debt funds in capital structure increase EPS.

(2) High debt funds increase the operating or business risk.

Select the correct answer from the options given below.

(A) Both Statement 1 and Statement 2 are correct.

(B) Statement 1 is correct while Statement 2 is incorrect.

(C) Statement 2 is correct while Statement 1 is incorrect.

(D) Both Statement 1 and Statement 2 are incorrect.

Answer:

(D) Both Statement 1 and Statement 2 are incorrect.

Question 13.

Financial structure is___ concept while the capital structure is__ concept.

(A) Inappropriate; appropriate

(B) Appropriate; inappropriate

(C) Narrow; border

(D) Border; narrow

Answer:

(D) Border; narrow

Question 14.

Assertion (A):

The capital structure should be determined within the debt capacity of the company and this capacity should not be exceeded.

Reason (R):

The debt capacity of a company depends on its ability to generate future cash flows. It should have enough cash to pay creditors’ fixed charges and principal sum.

Select the correct answer from the options given below

(A) A is true but R is false

(B) A is false but R is true.

(C) Both A and R are true but R is not the correct explanation of A.

(D) Both A and R are true and R is the correct explanation of A.

Answer:

(D) Both A and R are true and R is the correct explanation of A.

Question 15.

Which of the following capital structure consist of zero debt components in the structure mix?

(A) Pyramid Shaped Capital Structure

(B) Inverted Pyramid Shaped Capital Structure

(C) Horizontal Capital Structure

(D) Vertical Capital Structure

Answer:

(C) Horizontal Capital Structure

Question 16.

Which of the following statement is false?

(A) The use of excessive debt threatens the solvency of the company.

(B) A firm having operating loss would find it worthwhile to incorporate debt in the capital structure in a greater measure.

(C) The capital structure should be flexible.

(D) None of the above

Answer:

(B) A firm having operating loss would find it worthwhile to incorporate debt in the capital structure in a greater measure.

Question 17.

One can get a reasonably accurate broad idea about the risk profile of the firm from its –

(A) Dividend policy

(B) Capital structure

(C) Debt service ratio

(D) Earning yield

Answer:

(B) Capital structure

Question 18.

A critical assumption of the net operating income (NOI) approach to valuation is that:

(A) Debt and equity levels remain unchanged.

(B) Dividends increase at a constant rate.

(C) Ko remains constant regardless of changes in leverage.

(D) Interest expense and taxes are included in the calculation.

Answer:

(C) Ko remains constant regardless of changes in leverage.

Question 19.

If the debt component in the capital structure is predominant –

(A) The fixed interest cost of the firm will be minimum thereby decreasing its risk.

(B) Earnings per share (EPS) will be very low.

(C) Dividend expectations of equity shareholders are also and P/E Ratio may decrease.

(D) The fixed interest cost of the firm increases thereby increasing its risk.

Answer:

(D) The fixed interest cost of the firm increases thereby increasing its risk.

Question 20.

Capital structure relates to capital deployment for the creation of assets.

(A) Long term; long term

(B) Long term; short term

(C) Short term; long term

(D) Short term; short term

Answer:

(A) Long term; long term

Question 21.

Assertion (A):

The capital structure acts as a tax management tool also.

Reason (R):

A relatively lesser component of equity capital is vulnerable to hostile takeovers.

Select the correct answer from the options given below

(A) A is true but R is false

(B) A is false but R is true.

(C) Both A and R are true but R is not the correct explanation of A.

(D) Both A and R are true and R is the correct explanation of A.

Answer:

(C) Both A and R are true but R is not the correct explanation of A.

Question 22.

Which of the following statement is correct?

Horizontal capital structure

1. is quite stable.

2. is formed by a small amount of equity share capital.

3. there is the absence of debt.

4. have an increasing component of debt.

Select the correct answer from the options given below.

(A) 1, 2 & 4

(B) 2 & 3

(C) 1 only

(D) 1 & 4 only

Answer:

(C) 1 only

Question 23.

One can design a capital structure with proper proportions of equity, preference, and debt mix. The choice of the combination of these sources is called –

(A) Structural mix

(B) Policy mix

(C) Capital structure mix

(D) Finance mix

Answer:

(C) Capital structure mix

Question 24.

In horizontal capital structure –

(A) Expansion of the firm takes place by the issuance of debt securities.

(B) Expansion of the firm takes place by the issuance of debt securities and preferred stocks.

(C) Expansion of the firm takes in a lateral manner, Le. through equity or retained earning only.

(D) Expansion of the firm takes place by the issuance of short-term and marketable securities.

Answer:

(C) Expansion of the firm takes in a lateral manner, Le. through equity or retained earning only.

Question 25.

According to Cost Principle, an ideal pattern or capital structure is one that –

(A) Minimizes cost of capital structure

(B) Maximizes earnings per share (EPS).

(C) Both (A) and (B)

(D) None of the above

Answer:

(C) Both (A) and (B)

Question 26.

Which term would most likely be associated with the phrase “actions speak louder than words”?

(A) Incentive signaling

(B) Shareholder wealth maximization

(C) Financial signaling

(D) Optimal capital structure

Answer:

(C) Financial signaling

Question 27.

External sources of finance do not include:

(A) Overdrafts

(B) Leasing

(C) Retained earnings

(D) Debentures

Answer:

(C) Retained earnings

Question 28.

Internal sources of finance do not include:

(A) Retained earnings

(B) Ordinary shares

(C) Better management of working capital

(D) Trade credit

Answer:

(B) Ordinary shares

Question 29.

A firm’s optimal capital structure:

(A) Is the debt-equity ratio that exists at the point where the firm’s weighted after-tax cost of debt is minimized.

(B) Is generally a mix of 40% debt and 6096 equity

(C) Is the debt-equity ratio that results in the lowest possible weighted average cost of capital.

(D) Is found by locating the mix of debt and equity which causes the earnings per share to equal exactly ₹ 1.

Answer:

(C) Is the debt-equity ratio that results in the lowest possible weighted average cost of capital.

Question 30.

M & M Proposition I, without taxes, states that:

(A) Firms should borrow to the point where the tax benefit from debt is equal to the cost of the increased probability of financial distress.

(B) Financial risk is determined by the debt-equity ratio.

(C) The cost of equity rises when financial leverage rises.

(D) It is completely irrelevant how a firm arranges its finances.

Answer:

(D) It is completely irrelevant how a firm arranges its finances.

Question 31.

Which of the following step would you recommend to avoid the negative consequences of overcapitalization?

(A) Company should go for thorough reorganization.

(B) Buyback of shares.

(C) Reduction in claims of debenture-holders and creditors.

(D) All of the above

Answer:

(D) All of the above

Question 32.

Which one of the following statements concerning financial leverage is correct?

(A) If a firm employs financial leverage, the shareholders will be exposed to greater risk.

(B) A firm employing leverage will always have higher earnings per share than a firm that does not employ leverage.

(C) The benefits of leverage are unaffected by changes in a firm’s earnings before interest and taxes.

(D) The earnings per share remain constant even when an all-equity firm switches to a debt-equity ratio of 4.

Answer:

(A) If a firm employs financial leverage, the shareholders will be exposed to greater risk.

Question 33.

Market values are often used in computing the weighted average cost of capital because

(A) This is the simplest way to do the calculation.

(B) This is consistent with the goal of maximizing shareholder value.

(C) This is required in India by the Securities and Exchange Board of India.

(D) This is a very common mistake

Answer:

(B) This is consistent with the goal of maximizing shareholder value.

Question 34.

Two firms that are virtually identical except for their capital structure are selling in the market at different values. According to M & M:

(A) One will be at greater risk of bankruptcy.

(B) The firm with greater financial leverage will have the higher value.

(C) This proves that markets cannot be efficient.

(D) This will not continue because arbitrage will eventually cause the firms to sell at the same value.

Answer:

(D) This will not continue because arbitrage will eventually cause the firms to sell at the same value.

Question 35.

An EBIT-EPS indifference analysis chart is used for –

(A) Evaluating the effects of business risk on EPS.

(B) Examining EPS results for alter-native financing plans at varying EBIT levels.

(C) Determining the impact of a change in sales on EBIT.

(D) Showing the changes in EPS quality over time.

Answer:

(B) Examining EPS results for alter-native financing plans at varying EBIT levels.

Question 36.

EBIT of NS Ltd. is ₹ 4,50,000.

Debt in capital structure = ₹ 9,00,000

Cost of debt (Kd) = 12%

Cost of equity (Ke) = 15%

Ignore taxation.

The total market value of NS Ltd. =?

(A) ₹ 22,80,000

(B) ₹ 31,80,000

(C) ₹ 21,80,000

(D) ₹ 30,80,000

Answer:

(B) ₹ 31,80,000

Question 37.

EBIT of R Ltd. is ₹ 5,00,000. The company has 10%, ₹ 20,00,000 debentures. The equity capitalization rate i.e. Ke is 16%. Calculate the market value of the firm as per the Net Income (NI) Approach. Ignore taxation.

(A) ₹ 20,00,000

(B) ₹ 38,75,000

(C) ₹ 38,57,000

(D) ₹ 20,75,000

Answer:

(B) ₹ 38,75,000

Question 38.

Take the data of the above question and calculate the overall cost of capital.

(A) 12.90%

(B) 11.90%

(C) 10.90%

(D) 9.90%

Answer:

(A) 12.90%

Question 39.

EBIT of NS Ltd. is ₹ 4,50,000.

Debt in capital structure = ₹ 6,00,000

Cost of debt (Kd) = 10%

Cost of equity (Ke) = 12.5%

Ignore taxation.

The total market value of NS Ltd. =?

(A) ₹ 37,20,000

(B) ₹ 34,72,222

(C) ₹ 32,70,000

(D) ₹ 34,70,000

Answer:

(A) ₹ 37,20,000

Question 40.

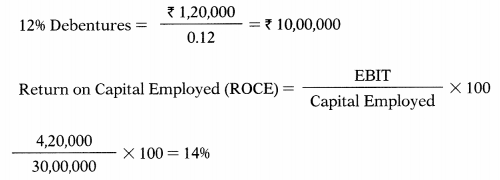

A new project under consideration requires a capital outlay of ₹ 300 lakhs. The required funds can be raised either fully by equity shares of ₹ 100 each or by equity shares of the value of ₹ 200 lakhs and by the loan of ₹ 100 lakh at 15 % interest. Assuming a tax rate of 50%, calculate the figure of profit, before tax that would keep the equity investors indifferent to the two options.

(A) ₹ 4.5 lakh

(B) ₹ 45 lakh

(C) ₹ 450 lakh

(D) ₹ 40.5 lakh

Hint:

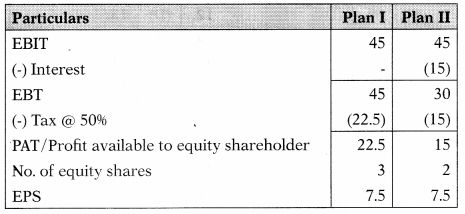

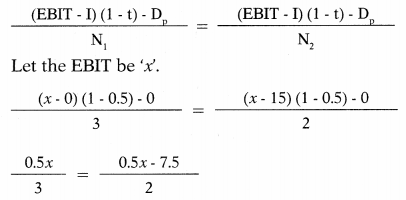

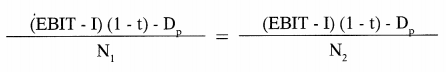

Calculation of indifferent point between Plan I & Plan II:

x = 1.5x – 22.5

– 0.5x = – 22.5

x = EBIT 45 Lakhs

At EBIT of 45 Lakhs, EPS under both options will be the same i.e. ₹ 7.5 per share.

Verification:

Answer:

(B) ₹ 45 lakh

Question 41.

Following details are presented by Y Ltd.:

| Particulars | ₹ |

| Equity Share Capital | 8,00,000 |

| Retained Earnings | 12,00,000 |

| Current Assets | 3,00,000 |

The company earns a profit of ₹ 3,00,000 per annum after meeting its interest liability of ₹ 1,20,000on 12% Debentures. Calculate return on capital employed.

(A) 10%

(B) 12%

(C) 14%

(D) 16%

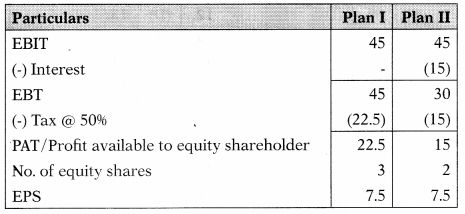

Hint:

EBIT = ₹ 3,00,000 + ₹ 1,20,000 = ₹ 4,20,000

Present Capital structure:

| Equity Share Capital | 8,00,000 |

| Retained Earnings | 12,00,000 |

| 12% Debentures | 10,00,000 |

| 30,00,000 |

Answer:

(C) 14%

Question 42.

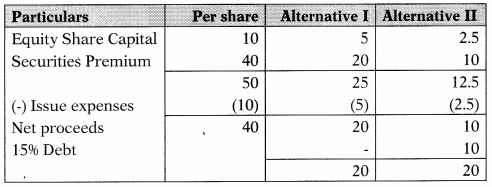

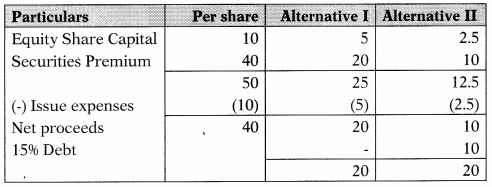

Financing alternatives for obtaining the requisite amount of ₹ 20 Crores are under consideration.

It was decided to issue equity shares of ₹ 10 par at a premium of ₹ 40 each. Share issue expenses as also underpricing of the issue in comparison to ruling market price result in net proceeds of ₹ 40 for every new share issued. How many equity shares are required to be issued for availing finance of ₹ 20 Crore?

(A) 0.5 Crore shares

(B) 0.05 Crore shares

(C) 5 Crore shares

(D) 5 Crore shares

Hint:

Calculation of net proceeds per share:

| The issue price per share | 50 |

| (-) Issue expenses | (10) |

| Net proceeds | 40 |

No. of equity shares to be issued under each Option:

Alternative I = \(\frac{20 \text { Crore }}{40}\) = 0.5 Crore shares

Alternative II = \(\frac{10 \text { Crore }}{40}\) = 0.25 Crore shares

Capital structure for new finance: (Figures in Crores)

Answer:

(A) 0.5 Crore shares

Question 43.

Financing alternatives for obtaining the requisite amount of ₹ 20 Crores are under consideration.

The alternative I: Equity shares can be issued at ₹ 10 par with a premium of ₹ 40 each. Share issue expenses as also underpricing of the issue in comparison to ruling market price result in net proceeds of ₹ 40 for every new share issued.

Alternative II: Company can borrow the requisite amount at a 15% rate of interest per year.

The company decided to borrow ₹ 10 Crore at a 15% rate of interest per year and the balance amount obtained by share issue at par terms indicated in the first alternative.

How many equity shares are required to be issued for availing finance of ₹ 20 Crore?

(A) 0.25 Crore shares

(B) 0.025 Crore shares

(C) 2.5 Crore shares

(D) 25 Crore shares

Hint:

Calculation of net proceeds per share:

| The issue price per share | 50 |

| (-) Issue expenses | (10) |

| Net proceeds | 40 |

No. of equity shares to be issued under each Option:

Alternative I = \(\frac{20 \text { Crore }}{40}\) = 0.5 Crore shares

Alternative II = \(\frac{10 \text { Crore }}{40}\) = 0.25 Crore shares

Capital structure for new finance: (Figures in Crores)

Answer:

(A) 0.25 Crore shares

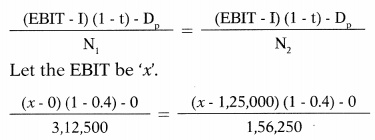

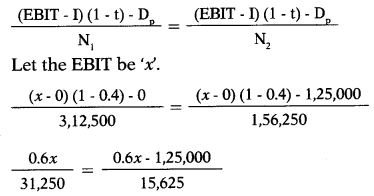

Question 44.

A company needs ₹ 31,25,000 for the construction of a new plant. The following two plans are feasible:

(i) Company may issue 3,12,500 equity shares at ₹ 10 per share.

(ii) The company may issue 1,56,250 ordinary equity shares at ₹ 10 per share and 15,625 debentures of ₹ 100 denomination bearing an 8% rate of interest.

The corporate income tax rate is 40%. Calculate indifference point.

(A) ₹ 2,50,000

(B) ₹ 2,75,000

(C) ₹ 2,25,000

(D) ₹ 3,00,000

Hint:

\(\frac{0.6 x}{31,250}=\frac{0.6 x-75,000}{15,625}\)

9,375x = 18,750x – 2,34,37,50,000

-9,375x = -2,34,37,50,000

x = EBIT = 2,50,000

At EBIT of ₹ 2,50,000, EPS under both options will be the same i.e. ₹ 0.48 per share.

Answer:

(A) ₹ 2,50,000

Question 45.

A company needs ₹ 31,25,000 for the construction of a new plant. The following two plans are feasible:

(i) Company may issue ₹ 3,12,500 equity shares at ₹ 10 per share.

(ii) The company may issue ₹ 1,56,250 equity shares at ₹ 10 per share and 15,625 preference shares at ₹ 100 per share bearing an 8% rate of dividend.

The corporate income-tax rate is 40%.

At indifferent point EPS under both plans will be –

(A) ₹ 0.75 per share

(B) ₹ 0.95 per share

(C) ₹ 0.60 per share

(D) ₹ 0.80 per share

Hint:

9,375x – = 18,750x – 3,90,62,50,000

-9,375x = -3,90,62,50,000

x = EBIT = 4,16,667

At EBIT of ₹ 4,16,667, EPS under both options will be the same i.e. ₹ 0.80 per share.

Answer:

(D) ₹ 0.80 per share

Question 46.

M Ltd. requires ₹ 25,00,000 for a new plant. This plant is expected to yield an EBIT of ₹ 5,00,000. The company considers the objectives of maximizing EPS. It has 3 options to finance the project – by raising debt of ₹ 2,50,000 or ₹ 10,00,000 or ₹ 15,00,000 and the balance, in each case, by issuing equity shares. The company’s shares are currently selling at ₹ 150, but it is expected to decline to ₹ 125 in case the funds are borrowed in excess of ₹ 10,00,000. The funds can be borrowed at the rate of 10% up to ₹ 2,50,000 and 15% up to ₹ 10,00,000 and at 20% over ₹ 10,00,000. The tax rate is 50%. Which form of financing should the company choose?

(A) Option m containing debt issue of ₹ 15,00,000

(B) Option II containing debt issue of ₹ 10,00,000

(C) Option II containing debt issue of ₹ 2,50,000

(D) None of the above

Answer:

(B) Option II containing debt issue of ₹ 10,00,000

Question 47.

Domino is an all-equity firm with a current cost of equity of 18%. The EBIT of the firm is ₹ 2,04,000 annually forever. Currently, the firm has no debt but is in the process of borrowing ₹ 5,00,000 at 9% interest. The tax rate is 34%. What is the value of the un-levered firm?

(A) ₹ 7,23,150

(B) ₹ 6,54,900

(C) ₹ 7,48,000

(D) ₹ 6,09,900

Hint:

| EBIT | 2,04,000 |

| (-) Tax @ 34% | (69,360) |

| PAT | 1,34,640 |

Value of equity = \(\frac{1,34,640}{0.18}\) = 7,48,000

Answer:

(C) ₹ 7,48,000

Question 48.

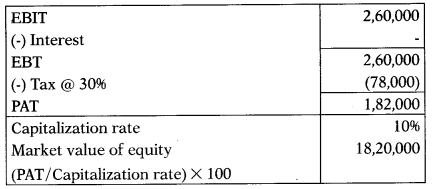

There are two firms P and Q which are identical except P does not use any debt in its capital structure while Q has ₹ 8,00,000, 9% debentures in its capital structure. Both the firms have EBIT of ₹ 2,60,000 p.a. and the capitalization rate is 10%. Corporate tax is 30%. Calculate the total market value of these firms according to MM Hypothesis.

(A) ₹ 20,60,000; ₹ 18,20,000

(B) ₹ 18,20,000; ₹ 20,60,000

(C) ₹ 18,20,000; ₹ 12,60,000

(D) ₹ 12,60,000; ₹ 20,60,000

Hint:

Value of un-levered firm (P Ltd.):

According to MM, the value of the levered firm would exceed that of the un-levered firm by an amount equal to the levered firm’s debt multiplied by the tax rate.

Value of unlevered firm + (Value of debt × Tax rate) = Total Value

Value of the company with ₹ 8,00,000 in debt (0 Ltd.):

18,20,000 + (8,00,000 × 30%) = 20,60,000

Answer:

(B) ₹ 18,20,000; ₹ 20,60,000

Question 49.

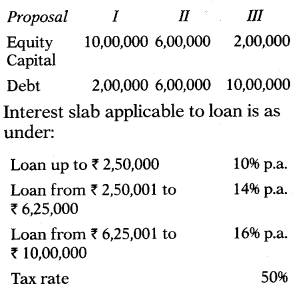

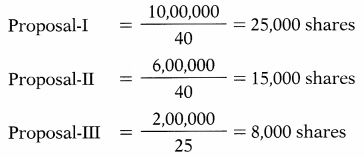

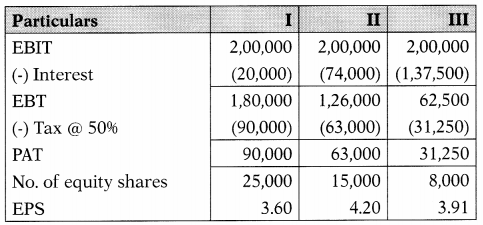

B Ltd. requires ₹ 12 lakh to finance its activities. Its earnings before interest and tax amount to ₹ 2 lakh. The Finance Manager has forwarded three proposals:

The market price of a share of the company is ₹ 40 which is expected to come down to ₹ 25 a share if the market borrowings exceed ₹ 7,50,000.

Which proposal is a most profitable proposal from the shareholders’ point of view?

(A) Proposal I

(B) Proposal II

(C) Proposal III

(D) None of the above

Hint:

No. of equity shares to be issued under each proposal:

Interest expenses for various proposals:

Proposal-I = 2,00,000 × 10% = 20,000

Proposal-II = (2,50,000 × 10%) + (3,50,000 × 14%) = 74,000

Proposal-Ill = (2,50,000 × 10%) + (3,75,000 × 14%) + (3,75,000 × 16%) = 1,37,500

Analysis: Since EPS is highest under Proposal-II, the company is advised to go with this proposal.

Answer:

(B) Proposal II

Question 50.

Skyline Software Ltd. wants to implement a project for which ₹ 30 lakhs is required. Following financing options are at hand:

| Option 1: Equity Shares |

30,000 |

| Option 2: Equity Shares |

10,000 |

| 12% Preference Shares | 10,000 |

| 10% Debentures | 10,000 |

Calculate the indifference point & EPS at that level of EBIT assuming corporate tax to be 35%.

(A) ₹ 4,26,923; ₹ 12.00

(B) ₹ 4,26,923; ₹ 9.25

(C) ₹ 5,53,846; ₹ 9.25

(D) ₹ 3,00,000; ₹ 6.25

Hint:

6.5x = 19.5A-55,50,000

– 13x = – 55,50,000

x = EBIT = 4,26,923

At EBIT of ₹ 4,26,923, EPS under both options will be the same i.e. ₹ 9.25 per share.

Answer:

(B) ₹ 4,26,923; ₹ 9.25

Question 51.

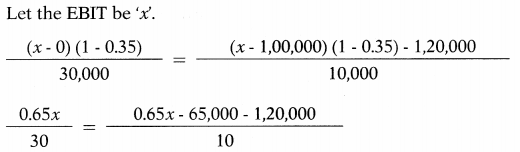

Alpha Ltd. is contemplating the conversion of .500 14% convertible bonds of ₹ 1,000 each. The market price of the bond is ₹ 1,080. Bond indenture provided that 1 bond will be exchanged for 10 shares. P/E ratio before redemption is 20:1 and anticipating price-earnings ratio after redemption is 25:1. The number of shares outstanding prior to redemption are 10,000. EBIT amounts to ₹ 2,00,000. The company is in the 35% tax bracket.

Calculate market price – (i) Pre-redemption and (ii) Post redemption.

(A) ₹ 169 & ₹ 216.67 per share

(B) ₹ 159 & ₹ 206.67 per share

(C) ₹ 179 & ₹ 226.67 per share

(D) ₹ 170 & ₹ 220 per share

Hint:

Answer:

(A) ₹ 169 & ₹ 216.67 per share

Question 52.

Following data is available for Company X:

Total Assets: ₹ 15,00,000

10%Debt: ₹ 9,00,000

EBIT: 20% of total assets

Tax rate : 50%

Capitalization rate =15%

Calculate the market value of equity using the Net Income (NI) approach.

(A) ₹ 16,00,000

(B) ₹ 7,00,000

(C) ₹ 10,00,000

(D) ₹ 5,00,000

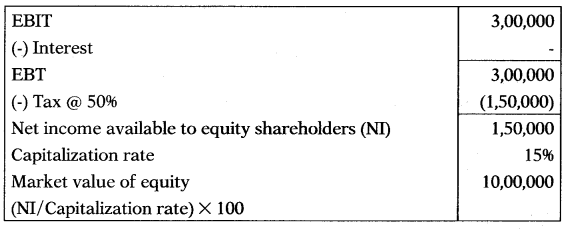

Hint:

| Equity Share Capital | 6,00,000 |

| 10% Debt | 9,00,000 |

| Total Assets | 15,00,000 |

Answer:

(B) ₹ 7,00,000

Question 53.

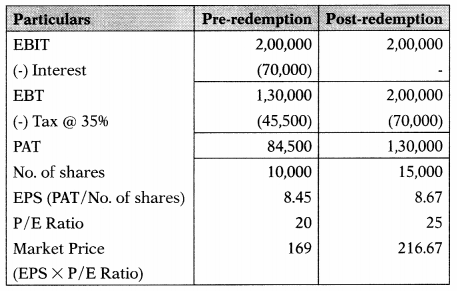

The following data is available for Company Y:

Total Assets : ₹ 15,00,000

Debt: Nil

EBIT: 20% of total assets

Tax rate: 50%

Capitalization rate = 15%

Calculate the market value of equity using the Net Income (NI) approach.

(A) ₹ 10,00,000

(B) ₹ 16,00,000

(C) ₹ 12,00,000

(D) ₹ 15,00,000

Hint:

Answer:

(A) ₹ 10,00,000

Question 54.

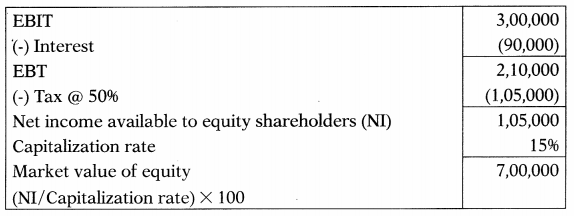

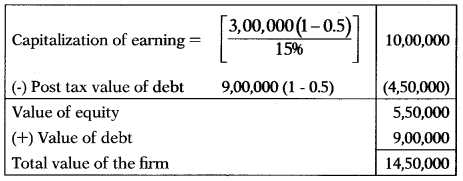

Following data is available for P Ltd.:

Total Assets: ₹ 15,00,000

10% Debt: ₹ 9,00,000

EBIT: 20% of total assets

Tax rate: 50%

Capitalization rate = 15%

Calculate the total value of the firm using the Net Operating Income (NOI) approach.

(A) ₹ 5,50,000

(B) ₹ 14,50,000

(C) ₹ 10,50,000

(D) ₹ 12,50,000

Hint:

Answer:

(B) ₹ 14,50,000

Question 55.

The following data is available for Q Ltd.:

Total Assets: ₹ 15,00,000

Debt: Nil

EBIT: 20% of total assets

Tax rate: 50%

Capitalization rate =15%

Calculate the total value of the firm using the Net Operating Income (NOI) approach.

(A) ₹ 8,00,000

(B) ₹ 9,00,000

(C) ₹ 12,00,000

(D) ₹ 10,00,000

Answer:

(D) ₹ 10,00,000

Question 56.

A student studying Financial Management subject is not able to understand when total market value will be the same for Company X and Company Y if both companies have the same total assets.

Company X calculates total value under Net Income (NI) approach and Company Y calculates total value under Net Operating Income (NOI) approach. Help him by selecting the correct option.

(A) When the tax rate is the same for both the companies.

(B) When one company is totally financed by debt and the other is totally financed by equity.

(C) When both companies are financed by equity only.

(D) When both companies adopt the same selling price.

Answer:

(C) When both companies are financed by equity only.

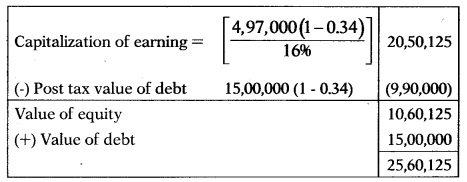

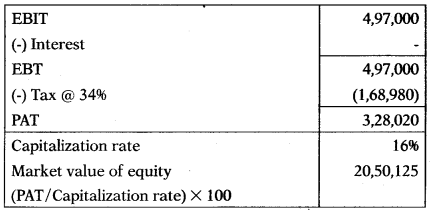

Question 57.

Trade International is an all-equity firm that has projected earnings before interest and taxes of ₹ 4,97,000 forever. The current cost of equity is 16% and the tax rate is 34%. The company is in the process of issuing ₹ 1.5 million of bonds at par that carries a 6% annual coupon. What is the levered value of the firm?

(A) ₹ 20,50,125

(B) ₹ 24,48,009

(C) ₹ 21,13,609

(D) ₹ 25,60,125

Hint:

Alternatively

Value of un-levered firm:

According to MM, the value of the levered firm would exceed that of the un-levered firm by an amount equal to the levered firm’s debt multiplied by the tax rate.

Value of unlevered firm + (Value of debt × Tax rate) = Total Value

Value of the company with ₹ 15,00,000 in debt:

20,50,125 + (15,00,000 × 34%) = 25,60,125

Answer:

(D) ₹ 25,60,125

Question 58.

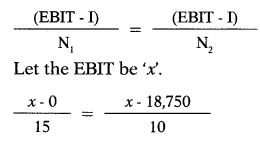

Bharat Cylinders has 15,000 shares of stock outstanding and no debt, as the original founder of the firm did not approve of debt financing. The new CEO is considering issuing ₹ 2,50,000 of debt and using the proceeds to retire 5.0___shares of stock. The interest rate on debt is 7.5%. What is the break-even level of EBIT between these two capital structure options?

(A) ₹ 59,250

(B) ₹ 38,500

(C) ₹ 56,250

(D) ₹ 47,750

Hint:

10x = 15x – 2,81,250

-5x = – 2,81,250

x = EBIT = 56,250

Answer:

(C) ₹ 56,250

Question 59.

What is the market value of common equity under the NOI approach? The firm has an expected net operating income of ₹ 5,000 with ₹ 4,000 of debt (market value). Assume that the overall capitalization rate is 20%.

(A) ₹ 5,000

(B) ₹ 20,000

(C) ₹ 21,000

(D) ₹ 24,000

Hint:

Value of equity = \(\frac{5,000}{0.20}\) – 4,000 = 21,000

Answer:

(C) ₹ 21,000

Question 60.

Ganesha Ltd. is setting up a project with a capital outlay of ₹ 60,00,000. It has two alternatives in financing the project cost.

Alternative (a): 100% equity finance

Alternative (b): Debt-equity ratio 2:1

The rate of interest payable on the debts is 18% p.a. Corporate tax rate is 40%. Calculate the indifference point between the two alternative methods of financing.

(A) ₹ 10,80,000

(B) ₹ 18,80,000

(C) ₹ 18,00,000

(D) ₹ 10,08,000

Answer:

(A) ₹ 10,80,000

Question 61.

One-third of the total market value of X Ltd. consists of loan stock, which has a cost of 10%. Another company, Y Ltd. is identical in every respect to X Ltd., except that its capital structure is all-equity, and its cost of equity is 16%. According to Modigliani and Miller, if we ignored taxation and tax relief on debt capital, what would be the cost of equity of X Ltd.?

(A) 14%

(B) 17%

(C) 19%

(D) 13%

Hint:

Miller and Modigliani’s first model argues that no optimal capital structure exists and supports this proposition with arbitrage theory. Therefore, the two companies should have similar WACCs. Because Y Ltd. is all-equity financed, its WACC is the same as its cost of equity finance, ie. 16%. It follows that X Ltd. should have WACC equal to 16% also.

Therefore, (1/3 × 1096) + (2/3 × K ) = 16%

3.3333 + 0.6667x = 16

0.6667x= 12.6667

Hence, x = Ke = 19%.

Answer:

(C) 19%

Question 62.

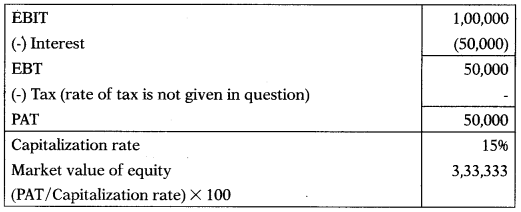

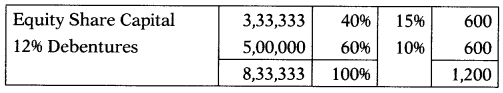

IPL Ltd. has an EBIT of ₹ 1,00,000. The company makes use of debt and equity capital. The firm has 10% debentures of ₹ 5,00,000 and the firm’s equity capitalization rate is 15%. You are required to compute: (i) the Current value of the firm; (ii) the Overall cost of capital.

(A) ₹ 3,33,333; 15%

(B) ₹ 8,33,333; 12%

(C) ₹ 5,33,333; 14%

(D) ₹ 6,33,333; 18%

Hint:

| Value of equity | 3,33,333 |

| (+) Value of debt | 5,33,333 |

| Total value of firm | 8,33,333 |

Calculation of overall cost of capital (market value basis):

WACC = \(\frac{1,200}{100}\) = 12%

Answer:

(B) ₹ 8,33,333; 12%