Go through this Accounting Process-III – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Capital and Revenue Items:

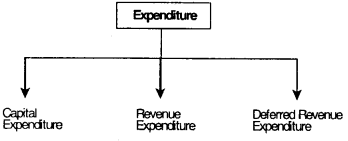

Expenditure – In accounting terms, expenditure means the amount spent or liability incurred for the value received.

Nature of Expenditure:

1. It is important to ascertain the nature of expenditure because the nature determines its treatment in accounts.

2. So based on nature, expenditures can be classified as –

Capital Expenditure – An expenditure which provides long term benefit to the business is known as a capital expenditure.

Features of Capital Expenditure:

- Such expenditure results in an increase in earning capacity of business.

- It normally yields benefit over a period extending beyond the accounting period.

- It is of a non recurring nature.

- It involves a fairly large amount.

Generally the following expenditures are considered as capital expenditures –

- Acquisition of an asset not for the purpose of resale.

- All sums spent to the point an asset is ready for use (e.g.- erection of fixed asset etc).

- Expenditure for extension or improvement of fixed asset.

- Expenditure incurred to acquire the right to carry on the business [e.g- license etc).

- Any other expenditure which procures benefit over several years.

Treatment of Capital Expenditure:

Capital Expenditures lead to a creation of an asset and hence, are shown in the Balance Sheet.

Examples:

The following expenditures are capital expenditure:

- Purchase of furniture worth ₹ 1,00,000 by Mr. A for his office.

- Mr. B purchased a new machine worth ₹ 50,000. ₹ 500 were paid for its erection. Here, both 50,000 and ₹ 500 are capital expenditures.

- ₹ 5,000 were spent by Mr. C on purchase of a second hand machinery.

Revenue Expenditure:

Amount spent for running a business is called revenue expenditure.

Features of Revenue Expenditure:

- Revenue expenditure gives the benefit only for that accounting year in which it is incurred.

- It generally involves a small amount.

- This expenditure is done to maintain the earning capacity of the business.

- It is of a recurring nature (i.e. occurring again and again).

- It is the expenditure incurred to meet the day to day expenses of the business.

Generally the following expenditures constitute revenue expenditure:

- Expenses incurred for running the business (like salaries, wages, power etc).

- Expenditure for maintaining the fixed assets.

- Expenditure incurred for purchase of material and stock.

- Charging depreciation on fixed asset.

Treatment of Revenue Expenditure:

These are treated as an expense of regular nature and hence, debited to the Profit/Loss A/c of the year in which it is incurred.

Examples:

1. ₹ 2,000 was spent for white washing of the building. White washing is a regular feature and hence, is a revenue expenditure.

2. Payment of salary, wages, rent, electricity bill etc. are all recurring in nature and hence, revenue expenses.

Distinction between Capital Expenditure and Revenue Expenditure:

| Basis | Capital Expenditure | Revenue Expenditure |

| 1. Purpose | It is incurred for acquisition of fixed assets for use in business which is not meant for sale. | It is incurred for conduct of business. |

| 2. Capacity | It increases the earning capacity of the business. | It is incurred for earning profits. |

| 3. Period | Its benefit extends to more than one year. | Its benefit extends to only one year. |

| 4. Nature of account | It is a real account. | It is a nominal account. |

| 5. Depiction | It is shown in the Balance Sheet. | It is a part of the Trading or Profit and Loss Account. |

| 6. Recurring | It is normally non-recurring in nature. | It is of recurring nature. |

| 7. Examples | (a) Cost of Plant and Machinery (b) Cost of Land and Building.(c) Cost of Furniture and Fixtures. |

(a) Depreciation on Plant and Machinery. (b) Rent (c) Repairs and Insurance. |

Deferred Revenue Expenditure:

There are certain revenue expenditures whose benefit extents to more than one accounting year. Such expenditures are known as deferred revenue expenditures.

Features of Deferred Revenue Expenditures:

- It is a type of or a part of revenue expenditure.

- It is of a non-recurring nature.

- Deferred Revenue Expenditure is to be written off during the years in which its benefits is to be received.

- The unwritten portion of deferred revenue expenditure is shown on the asset side of Balance Sheet.

The following expenditures are considered as deferred revenue expenditure:

- Large expenses on advertising on introducing a new product.

- Cost incurred on experiments, researches.

- Amount representing loss of an exceptional nature.

- Example – property confiscated in a foreign country, loss on uninsured assets etc

Comparison between Capital and Deferred Revenue Expenditure:

| Basis | Capital Expenditure | Deferred Revenue Expenditure |

| 1. Benefit | It result in a benefit which will accure to business for a long time. (i.e. 10-15 years). | It result in a result which will accure to business for mid term (i.e. 3-5 years). |

| 2. Losses | In case of loss, capital expenditure is usually capable of being reconverted into cash. (i.e. short term or small loss). | At times, heavy loss (such as loss of fire etc.) are treated as deferred revenue expenditure. They are written off over a period of 3-5 years. |

Receipts:

- Amount received in a business is termed as the receipt of the business.

- Same as in case of expenditure, the treatment of receipt depends upon its nature.

- Based on nature, receipts can be classified as – Revenue Receipts and Capital Receipts.

Capital Receipts:

- Receipts of a capital nature are termed as capital receipts.

- Capital receipts do not affect the Profit/Loss of that accounting period.

- Amount realised from the sale of a capital asset or investment.

- Instead of lump-sum payment, the payment is received in instalments.

The following receipts are considered as capital receipts:

- Payments or contributions into the business by the proprietors, partners or shareholders towards the capital of the firm.

- Amount received in the form of loans.

- Proceeds of sale of fixed assets.

2. Revenue Receipts:

If an income received in lump-sum, it is a revenue receipt.

- Receipts which have occurred due to normal business activity are known as Revenue Receipts.

- These are the outcomes of firm’s activity in the accounting period.

- Revenue receipts are shown in the Profit/Loss A/c and hence, affects the Profit/Loss of that accounting year.

- Following are considered as revenue receipts:

- Amount received from sale of goods

- Commission received, fees received, interest received.

Distinction between revenue receipt and capital receipt:

| Capital Receipt | Revenue Receipt |

| 1. It is the amount realised by sale of fixed assets or by issue of shares or debentures by secured or unsecured loans taken. | It is the amount realised by sale of goods or rendering of services. |

| 2. It is an item of Balance Sheet. | It is an item of Trading and Profit and Loss Accounts. |

| 3. Capital receipts are normally of non-recurring nature. | Revenue receipts are normally of recurring nature. |

| 4. Capital receipts are the receipts which are not obtained in course or normal business activities. | Revenue receipts are obtained in the course of normal trading operations. |

| 5. Capital receipts are normally not available for payment as profit to the owner of the business. | Revenue receipts net of revenue expenses and expired portion of capital expenditure/differed revenue expenditure are available for distribution to the owner of the business. |

Profits:

- The difference between income and expenditure is termed as profit.

- Profits can also be classified as – capital profits and revenue profits.

Capital Profits:

- Profits of capital nature are termed as capital profits.

- Capital profits are not earned during the ordinary course of business from normal business activities.

Capital profit arises from the following transactions –

- Sale of fixed assets

- Premium on issue of shares or debentures

- Redemption of long term liabilities (like debentures etc.)

Treatment of Capital Profits:

- These are not shown in the Profit/Loss Account as they are not concerned for any particular accounting year.

- These are transferred to the Capital Reserve Account which is shown on the liability side of Balance Sheet.

- Capital Reserve Account is utilized for meeting capital losses.

Revenue Profits:

Profits earned due to normal business activities are termed are revenue profits and are revenue in nature.

Revenue profits can be earned by:

- Profits on sale of goods.

- Discount received, commission earned, rent received etc.

Treatment of Revenue Profits:

Since they pertain to a particular accounting year and hence, are transferred to the Profit and Loss account.

Losses:

The difference between expenditure and income is termed as loss. Losses can be classified as capital losses and revenue losses.

Capital Losses:

Capital nature losses are termed as capital losses.

Capital Losses arises due to:

- Selling of fixed assets (if assets are selling at a loss).

- Loss on raising capital (issuing of shares etc.)

- Loss on redemption of long term liabilities (like debentures etc.)

Treatment of Capital Losses

(i) If the amount of loss is large:

- The loss is spread over a number of years and a part of it is charged in each year.

- The balance is shown on the asset side of Balance Sheet.

(ii) If the amount of Loss is Small:

They are debited to the Profit/Loss Account of the year in which they occur.

Revenue Losses:

1. Losses of a revenue nature are termed as revenue losses.

2. They arise on account of:

- Trading Loss (i.e. Loss on sale of goods)

- Any other loss arising in the normal course of business.

Treatment of Revenue Loss:

Revenue Losses are charged to Profit and Loss Account in the year in which they occur.

Contingent Assets and Contingent Liabilities:

1. A contingent asset may be defined as a possible asset that arises from past events and whose existence will be confirmed only after occurrence or non-occurrence of one or more uncertain future events not within the control of the enterprise.

2. In simple words, when the occurrence of some economic benefit from an asset depends upon some future event, such asset is known as a contingent asset, (i.e. if the event will occur, economic benefit will arise otherwise not)

Example:

A company has a claim of ₹ 5,00,000. But suit is still pending in the legal process.

This is a contingent asset because the economic benefit of ₹ 5,00,000 depends upon an uncertain event i.e. winning of the legal suit. If the company looses the suit, this economic benefit will not arise.

- Contingent asset will materialize or not depends upon the uncertain future event and hence, they are not shown in the company’s balance sheet.

- These are shown in financial statements by way of notes only if it is virtually certain.

- Usually, contingent assets are shown on the reports of approving authority.

- When realisation of asset becomes certain, it should be recognized in financial statements.

- Contingent asset are not recognized in financial statement.

Contingent Liability:

1. A contingent liability is a possible obligation arising from past events and may arise in future, depending on the occurrence or non occurrence of one or more uncertain future events.

2. A contingent liability may also be a present obligation that arises from past events.

3. In simple words, contingent liability refers to outflow of resources in future due to happening or non happening of an uncertain future event.

Example:

Income Tax Department imposes a penalty of ₹ 1,00,000 on AB Enterprises. The company files an appeal. Till the matter ¡s resolved in the appeal, it will be treated as a contingent liability because if the decision will not be in favor of the company then, it will lead to outflow of resources. Here, the uncertain event is the decision of the tribunal.

Some other examples of contingent liability can be:

- Claims against the company not acknowledged as debts.

- Guarantees given in respect of third party or bank guarantee.

- Outstanding law suit.

- Liability in respect of bill discounted.

- Statutory liabilities under dispute.

- A contingent liability is not recognized in financial statements, it is shown by way of footnotes.

- However if the loss becomes probable then, the contingent liability should be recognized.

- Contingent liabilities are recorded in a company’s account & shown in the balance sheet only when the both are probable and reasonably estimable.

Accounting Process-III MCQ Questions

1. An expenditure is capital in nature when:

(a) The receiver of the amount is going to treat it for the purchase of fixed assets

(b) If increases the quantity of fixed assets

(c) It is paid as interest on loans for the business.

(d) None of the above.

Answer:

(b) If increases the quantity of fixed assets

2. An expenditure is revenue in nature, when:

(a) It benefits the current period

(b) It benefits the future period

(c) It belongs to the previous period

(d) None of these.

Answer:

(a) It benefits the current period

3. The installation expenses for a new machinery will be debited to:

(a) Installation Expenses Account

(b) Cash Account

(c) Machinery Account

(d) Profit and Loss Account.

Answer:

(c) Machinery Account

4. The expenditure incurred for enhancing the capacity of an existing equipment is:

(a) A revenue expenditure

(b) A deferred revenue expenditure

(c) A Capital expenditure

(d) A charge on the profit to the business.

Answer:

(c) A Capital expenditure

5. Which of the following transaction is of capital nature?

(a) Purchase of a truck

(b) Replacement of old tyres

(c) Cost of repairing of truck

(d) All the above.

Answer:

(a) Purchase of a truck

6. Immediately after purchasing a new truck, ₹ 1,000 was paid to have the name of the company and other advertisement painted on the truck. This ₹ 1,000 is a:

(a) Capital Expenditure

(b) Deferred Revenue Expenditure

(c) Revenue Expenditure

(d) Loss.

Answer:

(a) Capital Expenditure

7. Expenditure incurred by a publisher for acquiring copy rights is a:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) None of the above.

Answer:

(a) Capital Expenditure

8. Cost of goods purchased for resale is an example of:

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred revenue expenditure

(d) None of these.

Answer:

(b) Revenue expenditure

9. A second hand car is purchased for ₹ 80,000. The amount of ₹ 1,000 is spent on its repairs, ₹ 500 is incurred to get the car registered in owner’s name and ₹ 1,500 is paid as dealer’s commission. The amount debited to car account will be:

(a) ₹ 81,000

(b) ₹ 81,500

(c) ₹ 80,000

(d) ₹ 83,000.

Answer:

(d) ₹ 83,000.

10. If repair cost is ₹ 20,000, white wash expenses are ₹ 10,000, cost of extension of building is ₹ 2,50,000 and cost of improvement in electrical wiring system is ₹ 20,000, the amount of revenue expenses will be:

(a) ₹ 2,70,000

(b) ₹ 3,00,000

(c) ₹ 30,000

(d) ₹.80,000.

Answer:

(c) ₹ 30,000

11. Amount of ₹ 10,000 spent as lawyer’s fee to defend a suit claiming the firm’s factory side is:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditures

(d) None of the above.

Answer:

(b) Revenue Expenditure

12. Entrance fee of ₹ 20,000 received by a club is a:

(a) Capital Receipt

(b) Revenue Receipt

(c) Capital Expenditure

(d) Revenue Expenditure.

Answer:

(a) Capital Receipt

13. The cash price of a machine is ₹ 1,20,000 and its hire purchase price is ₹ 1,50,000 to be paid in five equal yearly installments. If a company purchases the machine on hire purchase basis, the amount of capital expenditure will be:

(a) ₹ 1,20,000

(b) ₹ 1,35,000

(c) ₹ 1,50,000

(d) ₹ 1,60,000.

Answer:

(a) ₹ 1,20,000

14. A sum of ₹ 50,000 was spent by a factory in overhauling its existing plant and machinery. It has enhanced its working life by five years. The aforesaid expenditure is:

(a) Revenue Expenditure

(b) Deferred Revenue Expenditure

(c) Capital Expenditure

(d) Partly Capital and Partly Revenue Expenditure.

Answer:

(c) Capital Expenditure

15. Amount spent on an advertisement campaign, the benefit of which is likely to last for three years is a:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) Contingent Expenditure.

Answer:

(c) Deferred Revenue Expenditure

16. Building white washing expenses is:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) None of the above.

Answer:

(b) Revenue Expenditure

17. Paper purchased for use as stationery is:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) None of the above.

Answer:

(b) Revenue Expenditure

18. When obligation is not probable or the amount expected to be paid to settle the liability cannot be measured with sufficient reliability it is called _________.

(a) Liability

(b) Provision

(c) Contingent Liabilities

(d) Contingent Assets.

Answer:

(c) Contingent Liabilities

19. In the balance sheet, contingent liability should be:

(a) Recognized

(b) Not Recognized

(c) Adjusted

(d) None of the above.

Answer:

(b) Not Recognized

20. Money spent ₹ 10,000 as travelling expenses of the directors on trips abroad for purchase of capital assets is:

(a) Capital Expenditures

(b) Revenue Expenditures

(c) Deferred Revenue Expenditures

(d) None of the above.

Answer:

(a) Capital Expenditures

21. Amount of ₹ 5,000 spent as Lawyer’s fee to defend a suit claiming that the firm’s factory side belonged to the plaintiff’s land _________.

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) None of the above.

Answer:

(b) Revenue Expenditure

22. Subsidy of ₹ 40,000 received from the government by a manufacturing concern:

(a) Capital Receipt

(b) Revenue Receipt

(c) Capital Expenditures

(d) Revenue Expenditures.

Answer:

(b) Revenue Receipt

23. Insurance claim received on account of machinery damaged completely by fire:

(a) Capital Receipt

(b) Revenue Receipt

(c) Capital Expenditures

(d) Revenue Expenditures.

Answer:

(a) Capital Receipt

24. Interest on investments received from UTI.

(a) Capital Receipt

(b) Revenue Receipt

(c) Capital Expenditures

(d) Revenue Expenditures.

Answer:

(b) Revenue Receipt

25. A bad debt recovered during the year.

(a) Capital Expenditures

(b) Revenue Expenditures

(c) Capital Receipt

(d) Revenue Receipt.

Answer:

(d) Revenue Receipt.

26. Contingent asset usually arises from unplanned or unexpected events that give rise to:

(a) The possibility of an inflow of economic, benefits to the business entity.

(b) The possibility of an outflow of economic benefits to the business entity.

(c) Both (a) and (b)

(d) None of the above.

Answer:

(a) The possibility of an inflow of economic, benefits to the business entity.

27. If an inflow of economic benefits is probable, then a contingent asset is disclosed:

(a) In the financial statements

(b) In the report of the approving authority (Board of directors in the case of a company, and the corresponding approving authority in the case of any other enterprise).

(c) In the cash flow statement

(d) None of the above.

Answer:

(b) In the report of the approving authority (Board of directors in the case of a company, and the corresponding approving authority in the case of any other enterprise).

28. A revenue receipt is a receipt in substitution of:

(a) Source of Income

(b) Income

(c) Either (a) or (b)

(d) None of the these

Answer:

(b) Income

29. A capital receipt is a receipt in substitution of:

(a) Source of Income

(b) Income

(c) Both (a) or (b)

(d) Neither (a) nor (b)

Answer:

(a) Source of Income

30. Which of the following is NOT a source of capital receipt?

(a) Issue of Shares

(b) Loan from Bank

(c) Sale of Fixed Assets

(d) Sale of Goods

Answer:

(d) Sale of Goods

31. Amount received as a compensation under an agreement for the loss of future profits is:

(a) Revenue Receipt

(b) Capital Receipt

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Revenue Receipt

32. Capital profits are generally transferred to:

(a) Capital Reserve

(b) P&LA/c

(c) Miscellaneous Receipts

(d) General Reserve

Answer:

(a) Capital Reserve

33. Capital losses are shown in:

(a) Debit side of P & L

(b) Liability side of B/S

(c) Asset side of balance sheet

(d) None of these

Answer:

(c) Asset side of balance sheet

34. Deferred Revenue Expenditure are considered on the basis of which accounting concept?

(a) Business entity concept

(b) Accrual concept

(c) Cost concept

(d) Revenue matching concept

Answer:

(d) Revenue matching concept

35. Which of the following statement is true?

(a) Capital expenditures are usually capable of being converted into cash

(b) Deferred Revenue expenditure can be converted into cash

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Capital expenditures are usually capable of being converted into cash

36. If a suit is filed against the company and it is very much certain that the company shall have to pay ₹ 1,00,000 as damage charges, then ₹ 1,00,000 is:

(a) Contingent liability

(b) Provision

(c) Contingent asset

(d) All of the above

Answer:

(b) Provision

37. Cement purchased by a construction company for constructing its own factory is:

(a) Capital expenditure

(b) Revenue expenditure

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(a) Capital expenditure

38. If a company pays ₹ 20,000 for retaining the title of land purchased by it is:

(a) Capital expenditure

(b) Revenue expenditures

(c) Both (a) and (b)

(d) None of the above

Answer:

(b) Revenue expenditures

39. The profits which are normally available for distribution of dividend are called:

(a) Revenue profits

(b) Capital profits

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Revenue profits

40. Expenses incurred for trial runs of newly installed machinery is:

(a) Capital expenditure

(b) Revenue expenditure

(c) Both (a) and (b)

(d) None of the above

Answer:

(a) Capital expenditure

41. Interest on loan paid to bank which was taken for construction of a factory is:

(a) Revenue expenditure

(b) Capital expenditure

(c) Both (a) and (b)

(d) None of these

Answer:

(b) Capital expenditure

42. Which of the following is a deferred revenue expenditure?

(a) Expenditure paid in advance where a proportion service is taken and balance to be taken in future

(b) Expenditure which are hot allocable to one accounting year

(c) Loss of exceptional nature

(d) All of the above

Answer:

(d) All of the above

43. Advertisement expenses, discount on issue of debentures, cost of research and development etc. are examples of:

(a) Deferred Revenue expenditure

(b) Capital expenditure

(c) Revenue expenditure

(d) None of the above

Answer:

(a) Deferred Revenue expenditure

44. Which of the following expenditures is of capital nature?

(a) Purchase of goods

(b) Cost of repairs

(c) Wages paid for installation of machinery

(d) Rent of a factory.

Answer:

(c) Wages paid for installation of machinery

Capital expenditure is that expenditure which results in acquisition of an asset or which results in an increase in the earning capacity of a business. Thus, the expenditures which are not revenue nature are called capital expenditure e.g. purchase of machinery, wages paid for installation of machinery, etc. Moreover, purchase of goods, cost of repairs. Rent of a factory are revenue expenditures.

45. A liability which arises only on the happening of some event is called:

(a) Current liability

(b) Contingent liability

(c) Outstanding liability

(d) Fixed liability

Answer:

(b) Contingent liability

The possibility of an obligation to pay certain sums dependent on future events is known as contingent liabilities. Contingent liabilities are liabilities that may or may not be incurred by an entity depending on the outcome of a future event.

In other words, we can say that liability which arises only on the happening of some event is called contingent liability.

46. Heavy amounts were spent by Saroj for addition to machinery in order to increase the production capacity. The amount is _________.

(a) Revenue Expenditure

(b) Deferred Revenue Expenditure

(c) Capital Expenditure

(d) Liability

Answer:

(c) Capital Expenditure

That expenditure which results in an increase in production capacity or earning capacity or profitability of a business is known as Capital Expenditure. Thus, in the given case heavy amounts were spent by Saroj for addition to machinery is a Capital Expenditure.

47. What is the nature of expenses incurred on the issue of shares?

(a) Revenue

(b) Capital

(c) Neither (a) nor (b)

(d) Both (a) and (b)

Answer:

(b) Capital

Those expenditures whose benefit lasts for a long period of time is called Capital Expenditure. Thus, nature of expenses incurred on the issue of shares is of capital nature.

48. Which of the following is not a capital expenditure?

(a) Cost of issuing shares and debentures

(b) Wages paid for construction of a new office

(c) Purchase of a new spark plug for ₹ 10

(d) Repair of a second hand vehicle purchased.

Answer:

(c) Purchase of a new spark plug for ₹ 10

Capital Expenditure is that expenditure which results in acquisition of an asset or which results in an increase in the earning capacity of a business. Such expenditure provides benefit fora long time period. All sums spent up to the point an asset is ready to use should also be treated as capital expenditure Revenue Expenditure are the expenses whose benefit expires within a year of expenditure and is incurred to maintain the existing earning capacity of business.

Keeping above in mind:

- Cost of issuing shares & debentures is Capital Expenditure

- Wages paid for construction of new office is Capital Expenditure

- Purchase of a new spark plug for ₹ 10 is a Revenue Expenditure

- Repair of a second hand vehicle purchased is Capital Expenditure.

49. The cost of supplying uniform to employees is a:

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred revenue expenditure

(d) None of the above.

Answer:

(b) Revenue expenditure

The cost of supplying uniform to employees is a revenue expenditure as it is an employee welfare measure and there is no long term benefit of this expenditure.

50. Expenses incurred for obtaining a license for starting a factory are _________.

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) Prepaid Expenses

Answer:

(a) Capital Expenditure

Capital expenditure is that expenditure which results in acquisition of an asset or which results in an increase in the earning capacity of a business. The benefit of such expenditure lasts for a long period of time. Since benefit of expenses incurred for obtaining a license for starting a factory lasts for a long period of time, so it is a Capital Expenditure.

51. Which of the following is not a capital expenditure?

(a) Purchase of land & building

(b) Amount paid for wages.

(c) Improving permanent assets.

(d) None of the above.

Answer:

(b) Amount paid for wages.

An expenditure which provides long term benefit to the business is known as a capital expenditure. In the given question amount paid for wages is the amount spent for running a business and hence is a revenue expenditure instead of capital expenditure.

52. When we get the property registered, then what type of expenditure it is?

(a) Capital

(b) Revenue

(c) Deferred Revenue

(d) None.

Answer:

(a) Capital

Capital expenditure is that expenditure the benefit of which lasts for a long period of time. Since, benefits of registration of property lasts for a long period, so it is capital expenditure.

53. Insurance received by the company is what for the company?

(a) Capital expenditure

(b) Revenue expenditure

(c) Capital receipt

(d) Revenue receipt.

Answer:

(c) Capital receipt

Amount of insurance received by the company is a capital receipt because it is non-recurring in nature & it is not received during the normal course of business.

54. Interest on drawings to be treated as:

(a) Revenue Expenditure

(b) Capital Expenditure

(c) Revenue Income

(d) Capital Income

Answer:

(c) Revenue Income

Interest on drawings is the interest charged on day-to- day routine drawings made by the partners of the partnership firm. Since, it is the income of the firm of recurring nature it will be treated as revenue income.

55. At the time of commencement of business, preliminary expenses incurred are treated as:

(a) Revenue Expenditure

(b) Capital Expenditure

(c) Deferred Revenue Expenditure

(d) None of the above.

Answer:

(c) Deferred Revenue Expenditure

Features of a deferred revenue expenditure:

- It is a form of revenue expenditure.

- It is of non-recurring nature.

- It is written off during the years in which its benefits is to be received.

- The unwritten off amount is shown at the assets side of Balance Sheet.

Since, preliminary expenses fulfill all the above conditions option (c) is correct.

56. The expired portion of capital expenditure is shown in the:

(a) An expense

(b) An income

(c) An asset

(d) A liability

Answer:

(a) An expense

The cost is distinguished as expired and unexpired. Expired costs are the ones which have to produce revenues. Thus, expired costs are recognised as an expense.

57. A business entity distributed goods worth ₹ 15,000 as free sample. The adjustment to be made is:

(a) Subtracted from purchases A/c and credited to Profit and Loss A/c

(b) Added to Purchase A/c and credited to Profit and Loss A/c

(c) Added to Purchase A/c and debited to Profit and Loss A/c

(d) Subtracted from Purchases A/c and debited to Profit and Loss A/c.

Answer:

(d) Subtracted from Purchases A/c and debited to Profit and Loss A/c.

Adjustment of goods distributed as free sample Free sample/charity A/c. Dr.

To Purchases/Trading A/c.

P/L A/c Dr.

To Free sample/advertisement A/c.

It is deducted from purchase or appear in trading on credit side and on Debit Side of Profit and Loss.

58. Sriram purchased a furniture for ₹ 6,000, the accounts affected from this transaction will be:

(a) Capital account and cash account

(b) Furniture account and cash account

(c) Furniture account and capital account

(d) Capital account and bank account.

Answer:

(b) Furniture account and cash account

Journal entry for purchase of furniture in cash will be:

Furniture A/c ……… Dr.

To Cash A/c

(Hence, the account affected are furniture and cash accounts.)

59. ₹ 25,000 spent on the overhaul of second hand purchased machines would be (x) Revenue expenditure (y) Capital expenditure (z) Deferred revenue expenditure. The options are:

(a) (x) and (y)

(b) (x) only

(c) (y) only

(d) (z) only.

Answer:

(c) (y) only

All the expenses that are incurred in order to bring the asset to its present locations, conditions and use are to be capitalised with the cost of the asset and should not be treated as revenue expenses. Hence, the overhauling expenses incurred on second hand machine purchased in order to bring it to use are to be capitalised with the cost of the asset.

60. Fee paid to the lawyer for the suit against property is a _________.

(a) Capital expenditure

(b) Revenue expenditure

(c) Both (a) & (b)

(d) None of the above

Answer:

(a) Capital expenditure

Capital expenditure is that expenditure which results in acquisition of an asset or which results in an increase in earning capacity of business. The benefit of such expenditure lasts for a long period of time. Fee paid to lawyer is a capital expenditure because suit is against property, property is fixed assets and this expenditure is non-recurring in nature.

61. Purchase of building is:

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred Revenue expenditure

(d) None of the above

Answer:

(a) Capital expenditure

Capital expenditure is that expenditure which results in acquisition of an asset or which results in an increase in earning capacity of business. Purchase of building will result in increase in the earning capacity of business.

62. Amount paid annually for renewal of patents:

(a) Capital

(b) Revenue

(c) Deferred expenditure

(d) None of the above

Answer:

(b) Revenue

Revenue expenses are those expense whose benefit expires within one year and which are incurred to maintain the earning capacity of existing assets. Amount paid annually for renewal of patents is revenue expenditure because this is incurred to maintain the value of patents.

63. What among the following is capital expenditure?

(i) Fee paid to lawyer for acquiring new property

(ii) Expenses on maintaining machine

(iii) Repairing expenses of acquiring

(a) (i) & (ii)

(b) Only (i)

(c) Only (iii)

(d) (i) & (iii)

Answer:

(d) (i) & (iii)

Capital expenditure is that expenditure which results in acquisition of an asset or which results in an increase in earning capacity of business. Thus, here option (i) i.e. fee paid to lawyer for acquiring new property, option (iii) Repairing expenses of acquiring are capital expenditure.

64. Deferred revenue expenses are?

(a) Shown as contingent liability

(b) Shown in balance sheet

(c) Completely charged to profit and loss account

(d) Completely charged to trading account.

Answer:

(c) Completely charged to profit and loss account

Deferred Revenue Expenses are completely charged to profit and loss account. Charges of these expenses are deferred because expenses benefits more than one accounting period. The basis of charge is usually proportionate to the benefit consumed/reaped.

65. The amount of sales tax collected by a retailer is recorded as:

(a) Asset

(b) Current Liability

(c) Expense

(d) Sales Revenue.

Answer:

(b) Current Liability

The amount of sales tax collected by a retailer Is recorded as Current Liability because it is to be paid within 1 year or in near future.

66. The expired portion of capital expenditure is shown in the financial statement as:

(a) An Income

(b) An asset

(c) An expense

(d) A liability

Answer:

(c) An expense

The expired portion of capital expenditure is shown in the financial statement as an expense and is shown on the debit side of Profit and Loss A/c.

67. Monthly and quarterly time periods are called _________.

(a) Fiscal period

(b) Calendar period

(c) Quarterly period

(d) Interim period.

Answer:

(d) Interim period.

Interim period is a financial reporting period shorter than a full financial year. Thus the monthly and quarterly time periods are called interim period.

68. Which of the following is not a capital expenditure?

(a) Installation charges for second hand machinery

(b) Issuing shares and debentures

(c) Wages paid for construction of a new office

(d) Purchase of a new spark plug for ₹ 10.

Answer:

(d) Purchase of a new spark plug for ₹ 10.

Capital Expenditure is an Expenditure which result in acquisition of an asset or increase in earning capacity of Business. Point d is not a Capital Expenditure.

69. Which of the following is not a capital expenditure?

(a) Cost of issuing shares and debenture

(b) Wages paid for construction of a new office

(c) Purchase of a new spark plug for ₹ 10

(d) Repair of a second hand vehicle purchased.

Answer:

(c) Purchase of a new spark plug for ₹ 10

Purchase of a new spark plug for ₹ 10 is revenue nature not of capital nature. So, it is a revenue expenditure. Purchase of new spark plug does not increase earning capacity of business. So, it is not capital expenditure.

70. The cost of supplying uniform to employee is a:

(a) Capital expenditure

(b) Revenue expenditure

(c) Referred revenue expenditure

(d) None of the above

Answer:

(b) Revenue expenditure

Cost of supplying uniform to employee is not increase in revenue earning capacity so, it is revenue expenditure. Supplying uniform is not a one time supply. It is of recurring nature and considered as revenue expenditure.

71. Commission is _________.

(a) Revenue

(b) Expense

(c) Both (a) and (b)

(d) None of the above.

Answer:

(a) Revenue

Commission received is an income or revenue, shown in credit side of Profit & Loss Account. Option (a) is correct.

72. While finalising the current year’’s profits, the company realised that there was an error in the valuation of closing stock of the previous year, closing stock was valued more by ₹ 50,000. As a result:

(a) Previous year’s profit was overstated and current year’s profit is also overstated

(b) Previous year’s profit was understated and current years profit is overstated

(c) Previous year’s profit was understated and current years profit is also understated

(d) Previous year’s profit was overstated and current year’s profit is understated.

Answer:

(d) Previous year’s profit was overstated and current year’s profit is understated.

Closing stock and profits are directly related i.e. if closing stock is over-stated, the profits will also be over-stated and vice-versa.

Opening stock on the other hand is inversely related to profits i.e. if opening stock is over-stated the profits-will be under-stated. Also closing stock of a year is opening stock of another year. Thus, overstatement of closing stock of previous year will overstate the profits of previous year but understate the profits of current year.

73. Expenses incurred for obtaining a license for Starting a factory are _________.

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred Revenue Expenditure

(d) Prepaid Expenses

Answer:

(a) Capital expenditure

Expenses incurred on obtaining a licence for starting of a factory are capital expenditure.

74. The expired cost of a deferred revenue expense is known as:

(a) Assets

(b) Expense

(c) Liability

(d) Provision

Answer:

(b) Expense

Expired cost of a deferred revenue expense is known as an expense, and becomes cost of the current year.