TDS Payment And Interest On Late Payment: An employer’s TDS compliance requirements do not end with the deduction of taxes from salary. It is important for an employer will have to file quarterly TDS returns for tax deducted from pay. TDS Returns are quarterly statements provided by deductors to the Income Tax (IT) department. It keeps track of all TDS-related transactions over the course of a quarter.

The filing of TDS returns is not as simple as it appears. The IRS may issue a notice if there is any omission or misstatement of information. In this article, let’s understand how TDS payment is made and what is the interest attracted for late paying of TDS.

- TDS Return Filing Due Date for FY 2020-21

- How To Pay TDS Online?

- Late Fees for TDS Return

- What Is Interest On The Late Deduction Of TDS?

- TDS Payment Penalty

- Prosecution of Section 276B

- Penalty for Late Filing of TDS Return

- No Penalty Under Section 271H For TDS

- FAQs On TDS Interest And Penalty

TDS Return Filing Due Date for FY 2020-21

The TDS payment due date for March 2021 has been extended due to the spread of the COVID-19 situation in the country. The extended TDS return due dates are tabulated below:

| Month of Deduction | Quarter Ending | The due date for all deductors to pay TDS via challan(including govt. deductors) | Due Date for filing of Return for the financial year 2020-21 for all the deductors |

|---|---|---|---|

| April | 30th June | 7th May | 31st March 2021 |

| May | 7th June | ||

| June | 7th July | ||

| July | 30th September | 7th August | 31st March 2021 |

| August | 7th September | ||

| September | 7th October | ||

| October | 31st December | 7th November | 31st Jan 2021 |

| November | 7th December | ||

| December | 7th Jan | ||

| January | 31st March | 7th Feb | 31st May 2021 |

| February | 7th March | ||

| March | 7th April (for govt. deductors) | ||

| 30th April (for other deductors) |

How To Pay TDS Online?

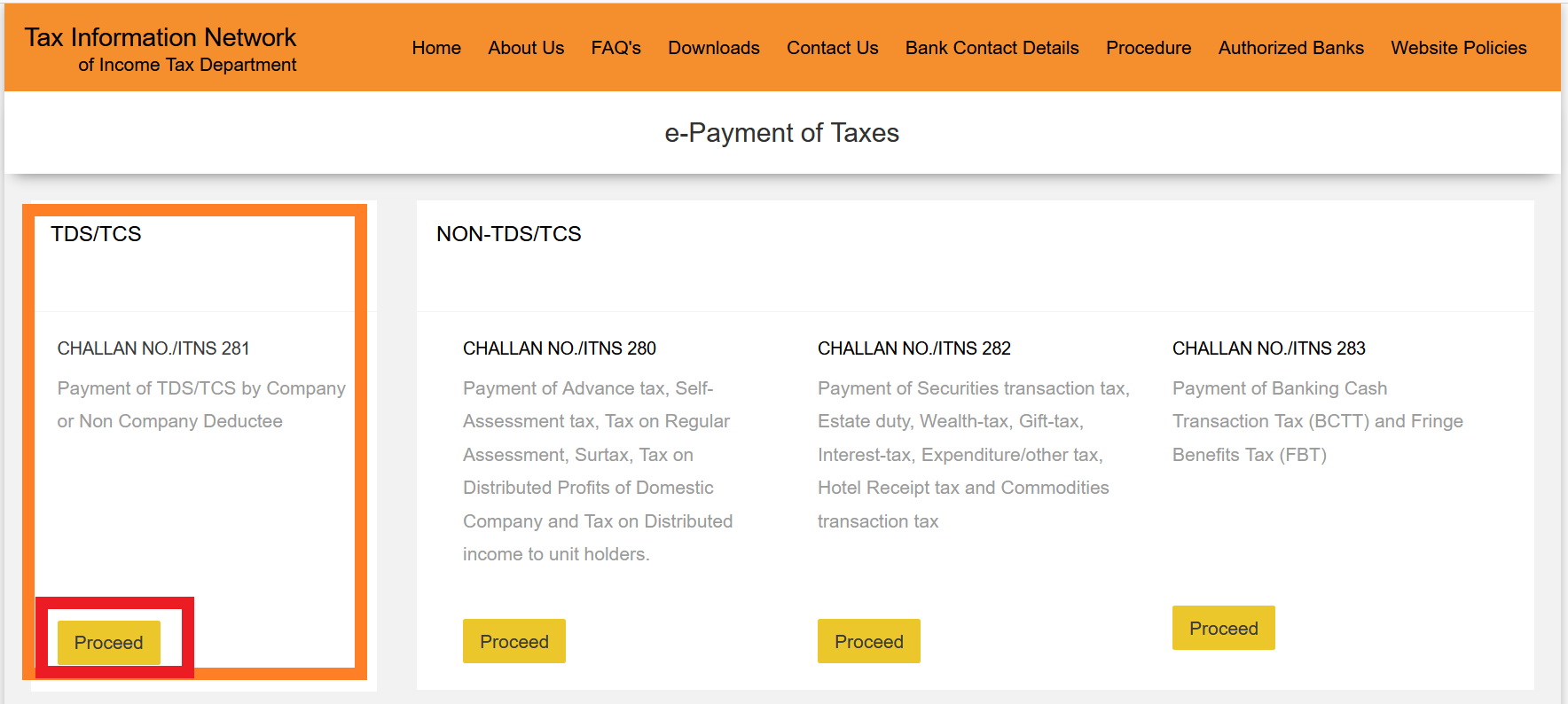

Follow the steps as listed below to pay TDS through the e-tax payment system:

- Step 1: Visit the official website of ePayment for TIN – Click Here

- Step 2: Move to the section “TDS/TCS” and click on “Proceed“.

- Step 3: A new page will open. Now enter all the details such as Tax Applicable (Tax Deducted/Collected At Source From), Payment Type, Mode of Payment, Tax Deduction Account No, Address and other details.

- Step 4: A confirmation page would appear when the data is submitted. Now the taxpayer should validate the information given in the challan.

- Step 5: Once the information is validated by the taxpayer, the page will be redirected to the bank’s net-banking page, where the payment will be made, as specified in the challan.

- Step 6: Now the taxpayer will have to visit his/her bank’s net-banking page using the user-id and password provided by the bank to make the TDS payment.

- Step 7: A challan counterfoil including the Challan Identification Number (CIN), payment details, and the bank name via which the e-payment was made would be provided after a successful TDS Payment. The counterfoil will act as evidence for the TDS payment made.

- Step 8: After a week of making the TDS payment using the CIN produced, you can check the status of the challan via the NSDL-TIN website’s “Challan Status Inquiry.”

Late Fees for TDS Return

One will be fined Rs 200 each day (two hundred) till your TDS return is filed under Section 234E as TDS late payment fee. That is one will have to pay this fine for each day you are late until the fine equals the amount you are required to pay as TDS.

TDS Late Fee Payment Online Example:

If your payable TDS amount is Rs 5000 on May 13th, and you file your Q1 return on November 17th instead of July 31st. Counting to the 17th of November, the delay is 105 days.

So Rs 200 x 105 days = Rs 21,000;

But while this is larger than Rs 5000, you will only have to pay Rs 5000 as a late filing fee. In addition, you must pay interest for late TDS deposits.

What Is Interest On The Late Deduction Of TDS?

You must pay interest under Section 201(1A) if you fail to deposit TDS after deduction on time. From the date TDS was deducted to the actual date of deposit, interest is calculated at a rate of 1.5% per month. It’s important to note that this is should be determined on a monthly basis rather than by the number of days, thus a partial month counts as a full month.

| Section | Default Nature | Due to COVID-19, interest subject to TDS/TCS amount has been reduced | Period for which interest is to be paid |

|---|---|---|---|

| 201(1A)(i) | Tax is not deducted at source, in full or in part. | 1% per month | From the time when taxes are deductible until the time when they are really deducted |

| 201(1A)(ii) | Non-payment of tax, in whole or in part, after deduction of tax | 1.5% per month Only for due dates between March 20 and June 29, 2020, 0.75% per month or part of a month will be charged for remittance delays beyond the due date. If the balance is not paid before the 30th of June, a standard interest of 1.5% will be charged. |

From the date of deduction to the date of payment |

TDS Payment Penalty

As a consequence of the lockdown, the government has waived all penalty provisions for the period between March 20th and June 30th, 2020, in accordance with Ordinance 2020.

However, a penalty equal to the amount that was deducted/collected or remitted may be levied within the normal course of business.

Prosecution of Section 276B

If a person fails to pay to the Central Government’s credit: he shall be punished with rigorous imprisonment for a term not less than three months but not more than seven years and a fine for the tax deducted at source as required by or under the requirements of Chapter XVII-B.

Penalty for Late Filing of TDS Return

- Fee for late filing (Section 234E): Until the TDS Return is filed, the deductor must pay INR 200. The penalty, however, should not exceed the amount of TDS for which a statement filing was necessary.

- Penalties (Section 271H): An individual who fails to file the TDS statement by the due date shall be subject to a minimum penalty of INR 10,000, which may be increased to INR 1,000,000 under this section. This penalty is in addition to the late filing charge imposed by Section 234E.

Note: Section 271H will also cover the cases of incorrect TDS Return Filing.

No Penalty Under Section 271H For TDS

If an individual meets the following conditions, no penalty under Section 271H will be imposed in the case of a late TDS/TCS return filing:

- Late TDS return filing fees and interest (if any) to be paid to the credit of the Government

- TDS/TCS return to be filed before the expiry of a one-year period from the stated due date

- TDS/TCS return to be filed before the expiration of a one-year period from the specified due date

FAQs On TDS Interest And Penalty

Question 1.

What is the interest for late payment of TDS?

Answer:

The interest rate will be calculated at 1.5% per month from the date of the deduction of TDS on the current deposit date.

Question 2.

Is there any penalty for the revised TDS return?

Answer:

Yes, a minimum of Rs.10,000 and a maximum of Rs.1.00,000 penalty may be levied if the deductor/collector files the wrong TDS/TCS return.

Question 3.

What is the late filing fee for payment of TDS?

Answer:

Until the TDS Return is filed, the deductor must pay INR 200. However, the TDS late filing fee should not exceed the actual TDS amount to be filed.