Chapter 3 Audit and Investigations – Forensic Audit ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Audit and Investigations – CS Professional Forensic Audit Study Material

Question 1.

Vishnu Polymers Ltd., has got complaints from three anonymous persons which were found placed inside the employee’s complaints box, that the internal financial controls for cash management in the company are weak and that the head cashier is defrauding the company by making defalcation of cash.

You are appointed to conduct the forensic audit to weigh the veracity of the complaints received, both regarding the weaknesses of the system, if any and about the charges on the head cashier being levied.

(a) What are the statutory and other aspects to be considered and look out for in this context, by the forensic auditor ?

(b) What will be the red flag indicators to look for by him ? (June 2019, 6 marks each)

Answer:

(a) Weakness in internal control system and suspected fraud by Cashier:

Internal financial controls in cash management: The main aspect of the complaint is that the internal financial controls for cash are weak.

Internal Financial Control: As per Section 134 of the Companies Act 2013. the term Internal Financial Controls means the policies and procedures adopted by the company for ensuring the following:

- Orderly and efficient conduct of its business, including adherence to the policies of the Company,

- Safeguarding of its assets,

- Prevention and detection of frauds and errors,

- Accuracy and completeness of the accounting records, and

- Timely preparation of reliable financial information.

Adherence to company’s policies has also been emphasized here. No company shall have a policy of permitting its employees to make unlawful gains. The FA should therefore thoroughly study the internal control systems for cash.

Internal Financial Control over Financial Reporting : As per Guidance Note issued by ICAI on Guidance Note on Audit of Internal Financial Controls over Financial Reporting,” Internal Financial Controls Over Financial Reporting (ICFR) shall mean:

“A Process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles”.

A Company’s internal financial control over financial reporting includes those policies and procedures:

- Pertaining to the maintenance of the records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company.

- It provides reasonable assurance that transactions are recorded as necessary to permit preparation of financial statement in accordance

with generally accepted accounting principles, and those receipts and expenditures of the company are being made only in accordance with authorizations of management and director of the company. - Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statement.

Investigation of internal controls by FA:

- The FA can conduct interviews with all mid-Level employees. Disgruntled employees are often the best source for this.

- Both the aspects relating to cash receipts, cash outflows as well as cash management (like deposits into bank account, whether they are correct) should be thoroughly analyzed by the FA.

- Monthly comparatives of cash expenses with previous period. Extraordinary increase or decrease in particular expense or payment to a particular party can be scrutinized.

- Possibility of fictitious refunds should be analyzed by FA.

(b) Cashier fraud: Red Flag Indicators

Following are the red flag indicators:

- Frequent receipt of gifts;

- Disproportionate increase in the assets of the cashier;

- Unjustified favoritism shown to certain parties.

- Multiple refunds or cancellations just under review limit.

- Excessive number of adjusting entries during specific period.

- Change in lifestyle of the cashier

- Collusion between cashier persons making payments

Investigation of the cashier on the basis of Red Flag Indicators:

- FA should take access of the cashier’s emails and all correspondences, company mobiles, as per the company’s policy.

- Lifestyle of the cashier should be investigated to ensure that it is commensurate with the salary drawn from the company.

- In case if cashier has history of debts there is likelihood of engaging in opportunistic fraud. Hence FA should initiate background check of the cashier.

- Bank statement of the cashier has to be examined

- Enquiry into the assets acquired bty the cashier or his close relatives during the last few years must be undertaken. Most companies ask for annual declarations in this regard and for filing of income-tax acknowledgments. These can also be looked into.

- Deploy a market intelligence executive to keep a track on movements of cashier and his family members. This has to be done discreetly.

- Enquiries can also be made with the HR Department of earlier employer to ascertain whether there have been any similar allegations levied against him.

![]()

Question 2.

PD Limited which is a public limited Company incorporated on 1st January, 2000 under the provisions of Companies Act, 1956. The main object of the company is to promote the formation and mobilisation of capital and to promote industrial finance by way of advance, deposits, lending money, to manage the capital, saving and investment, to act as a discount and acceptance.

Further, it is also stated that the company can carry on and undertake business of finance and trading, refinance, to act as or carry on the business of consultants, advisors, experts and technical collaborators in matters pertaining, without prejudice to the generality of the foregoing, portfolio management services, syndication of loans, counselling and tie-up of project and working capital, infrastructure of finance, corporate restructuring, corporate planning and strategic planning, foreign currency lending or borrowing, project planning and feasibility, investment counselling, setting up of joint ventures and further perform any other kind of role as an Intermediary or Advisor in the security market.

The PD Limited has a wholly owned subsidiary company and that subsidiary company has subsidiary company. These companies are formed for the same objects as of the main company. The company launched various public deposit schemes such as saving deposits, fixed deposits and recurring deposits. The total amount of public deposits collected by the Company amounts to ? 1400.00 crores. However only 19% of the above amount has been invested by the company in statutory liquidity ratio. In the year 2019, it is observed that various complaints came to be lodged by the depositors and creditors before statutory agencies like RBI on non-payment of interest and non-return of deposits. It appears that the company has failed to comply with almost all the norms prescribed for a non-banking financial company. The unpaid depositors and creditors filed a petition for the winding-up of the company. Further complaints have been lodged against the directors/promoters alleging fraudulent diversion of money and dishonest misappropriation of funds. The company apparently in financial troubles and is found struggling to pay interest and principal to the depositors. Based on the allegations, Government conducted a preliminary investigation which reveals a misappropriation of nearly ₹ 1000.00 crores.

The Government has approached your firm to conduct a Forensic Audit of the PD Limited and its subsidiaries. The scope of the audit has to be formulated on the following allegations made:

(1) Non-maintenance of books of accounts and proper records;

(2) Diversion and misappropriation of funds, including acquisition of immovable properties at Mumbai and Chennai;

(3) Failure on part of the company in non-payment of invest and in repaying the deposits accepted.

On the basis of the above, draw up a plan of action which you will adopt to fulfill your work to (suitable assumption may be made by you) indicate your approach in the following areas:

(a) Detailed Methodology.

(b) Findings of the case based on your methodology.

(c) Limitation to a forensic report.

(d) Legal steps that could be taken against company, its subsidiaries and their directors. (Dec 2019, 10 marks each)

Question 3.

PQR & company are the manufacturers of sophisticated consumer products. They have a system of getting certain work done by Job Workers. The costly raw material will be sent to the Job Worker through the company’s transport and delivery challan will be prepared by the Stock manager and acknowledgement obtained from the Job-workers on delivery. Job Worker will process the material as per the company’s instruction and specification and the same will be inspected by the Quality Controller of the company at the premises of the Job Worker; entire quantity of material sent earlier now in semi-finished form will be returned to the company for which the company itself provides their own transport. A reasonable percentage for shortage and wastage and rejections of a maximum of 2% was allowed by the company to the Job Worker. This engagement was established for some years and was found to be working well. Processing charges are paid to the Job Workers on receipt of the processed material along with his challan. However, some complaints have come recently from some sources that some processed materials was selling in the market.

Management is desirous of conducting a Forensic Audit. In the background of aforesaid facts, you are required to:

(a) Indicate your line of Investigation. (Dec 2019, 8 marks)

(b) Do the facts fall to be considered as fraud as per sec. 447 of the Companies Act, 2013? Discuss. (Dec 2019, 4 marks)

![]()

Question 4.

Agarwal & Company is one of the major infrastructure companies, deals with building of bridges, roads etc. They obtained road construction contract from the Government for execution of a project. They called for tender area wise and bids were received from subcontractors. It is the policy to entrust the job only to the person who has a class I status in contracting. Bids were finalised and the one who quoted lower price was awarded construction of road etc. in a particular area. In one of the contract the estimated value of contract was ₹ 20 lakh and the winner of the subcontract was LM. Past records show that LM had undertaken such type of contract earlier, say five years back, for this company and he was very familiar to Executive Engineer of the company. He used to visit the company frequently and finally succeeded in getting the contract now. LM has made the request for advance of 50% of the contract amount, but the company policy was to give advance only 20% subject to production of a bank guarantee from a nationalized bank in favour of the company. In the. instant case LM persuaded the company to accept his FD receipt i.e two receipts for each ₹ 2 lakh issued by the banker in lieu of bank guarantee. After prolonged discussion among the Executives, the company has agreed to accept FD receipt and paid advance money.

LM commenced work and finished only 10% of the road construction contract. Information reached the company that LM stopped the work abruptly and no further work was carried out. The company made efforts to contact him but to no avail. Company issued notice to LM and there was no response. The legal notice was also issued and returned with the remark that “’addressee not found”.

Recovery process: The company approached the bank for the purpose of encashing the two FD receipts of ₹ 4 lakh endorsed in favour of Company by LM. To the disappointment of the company, the bank said that they had not issued the said FD receipts to LM and that the said two receipts were fake. Denial by the bank does not seem to be correct and require further investigation.

The company decided to have the matter investigated. Your help is sought to conduct a Forensic Audit.

(i) What may be your assumption before proceeding to unde take this case? (Dec 2019, 3 marks)

(ii) What will be your mechanism of Forensic Audit to help the Company to recover the advance money? (Dec 2019, 5 marks)

(iii) What will be liability of bank in this case? (Dec 2019, 1 mark)

Question 5.

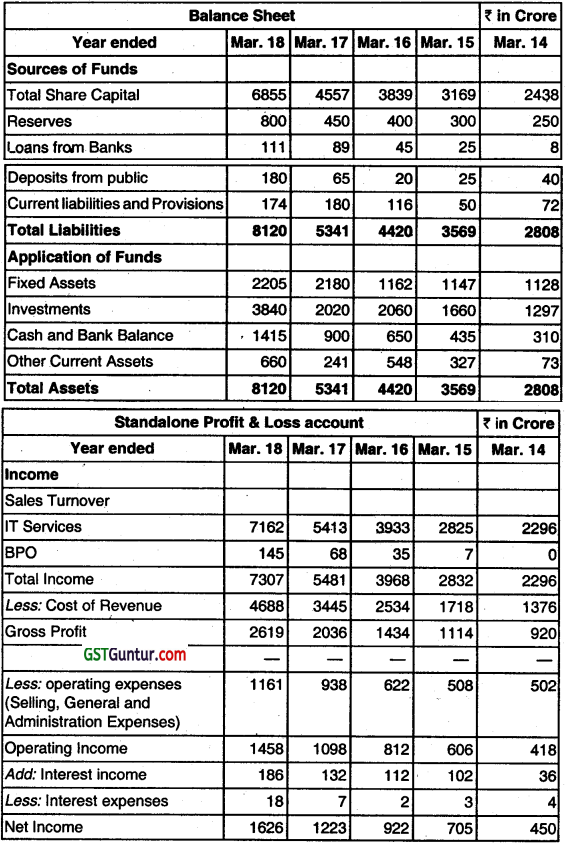

ABC Computers Services Ltd. has been a pioneering force in the global information technology (IT), outsourcing market-the company prefers the term right sourcing since late 2013 the company provides full range of IT services including software and systems management and development, engineering solutions, infrastructure management, and enterprise business solutions. They also serve the business processing outsourcing (BPO), market in particular through majority held subsidiary providing back office customer care, product and technical support, human resources, finance and accounting, and many other related services. The company also provides e-commerce and website development and management operations including web based financial, supply chain, customer relationship and other services. They operate on global level with offices in 40 countries and more than 50,000 employees serving nearly 600 clients and companies. The company offers outsourcing services through its network offices throughout India. The company also provides onsite services and offsite operations in other western countries and in India. The company has also been developing network of near shore offices, filling the gap between offshore and onsite segment. The company is listed on the New York stock exchange. The company has been recognised as part of the growing computer industry and the rapid incorporation of computer technology into the corporate market would create demand for new type of specialised services. Their operation started in the year 2013 and within a span of 5 years its turnover reached ₹ 7,162 crore. Each and every year turnover is rapidly increasing. The company was also accepting fixed deposits from the public. It pays interest in crore and also the company took loans from the reputed banks each year. The year wise details of the related igures are given below:

Assume that the company was involved in falsifying accounts and inflating the company revenue and the profit and profit margin. If you are appointed as the Forensic auditor, answer the following questions:

(a) Identify the Green flags and Red flags indicators. What may be the reasons for such unusual increase in Turnover? (Dec 2019, 6 marks)

(b) How would you proceed to unearth fraud in this case? (Dec 2019, 3 marks)

(c) Comment on unusual Turnover and payment of Interest to Depositors. (Dec 2019, 3 marks)

- Analyzing data which is available

- Creating a hypothesis based on such data

- Testing the hypothesis

- Refining and altering the hypothesis

![]()

Question 6.

Write short note on Fraud audit investigation methodology.

Answer:

Forensic Audit Investigation Methodology:

Forensic investigation is the utilization of specialized investigative skills in carrying out an inquiry conducted in such a manner that the outcome will have application to a court of law. Forensic Investigators are be grounded in accounting, medicine, engineering or some other discipline. Forensic investigation is the examination of evidence regarding an assertion to determine its correspondence to established criteria carried out in a manner suitable to the court. An example would be a Forensic Audit of sales records to determine the quantum of rent owing under a lease agreement, which is the subject of litigation.

Umeraziz (2014) while discussing the methodology to be followed by fraud/forensic auditors/investigators opines that the examination could be approached from both the angels of whether the fraud could have occurred and whether it could not have occurred. The methodology which he believes that is straight forward as follows:

Question 7.

Discuss the Role of Company Secretaries in Forensic Audit.

Answer:

Role of CS as a Forensic Auditor:

A Forensic Auditor is often retained to analyze, interpret, summarize and present complex financial and business-related issues in a manner that is both understandable and properly supported. Forensic Auditors can be engaged in Public Practice or employed by Insurance companies, banks, police forces, government agencies and other organizations. The Role of Company Secretary as a Forensic Auditor may be understood as follow:

1. Criminal Investigations:

A Company Secretary would use his/her investigative accounting skills to examine the documentary and other available evidence to give his/her expert opinion on the matter. Their services could also be required by Government departments, the Revenue Commissioners, the Fire Brigade, etc. for investigative purposes. Practicing forensic accountants could be called upon by the police to assist them in criminal investigations which could either relate to individuals or corporate bodies.

2. Personal Injury Claims:

Where losses arise as a result of personal injury, insurance companies sometimes seek expert opinion from a forensic auditors before deciding whether the claim is valid and how much to pay.

3. Fraud Investigations:

A Company Secretary might be called upon to assist in business investigations which could involve funds tracing, asset identification and recovery, forensic intelligence gathering and due diligence review. In cases involving fraud perpetrated by an employee, the forensic auditors will be required to give his/her expert opinion about the nature and extent of fraud and the likely individual or group of individuals who have committed the crime. The forensic expert undertakes a detailed review of the available documentary evidence and forms his/her opinion based on the information gleaned during the course of that review.

4. Investigation and Inspection:

Company Secretary may help the Police, ACB and other investigating authorities in collecting evidences and other investigation purposes. For example, section 157 Cr. P.C, 1973; sections 17 and, 18 of the Prevention of Corruption Act, 1988; Section 6 of The Bankers Books Evidence Act, 1891; Section 78 of Information Technology Act, 2000; Section 447 of the Companies Act, 2013 wherein the Court or Police may require the skills of Forensic auditors while inspecting any books in so far as related to the accounts of an accused.

5. Expert Opinion:

Company Secretaries see and carefully examine the accounts and balance sheets and use his skills to find out whether there is any fraud committed or any anomaly associated with it by giving his expert opinion. This finds place in for example section 45, section 118 of Indian Evidence Act, 1872; section293 of Cr. P.C, 1973.

6. Professional Negligence:

The forensic auditor might be approached in a professional negligence matter to investigate whether professional negligence has taken place and to quantify the loss which has resulted from the negligence. A matter such as this could arise between any professional and their client. The professional might be an accountant, a lawyer, company secretary etc. The forensic expert uses his/her investigative skills to provide the services required for this assignment.

7. Expert Witness Cases:

Company Secretary as Forensic Auditor often attend court to testify in civil and criminal court hearings, as expert witnesses. In such cases, they attend to present investigative evidence to the court so as to assist the presiding judge in deciding the outcome of the case.

8. Meditation and Arbitration:

Some forensic auditors because of their specialist training they would have received in legal mediation and arbitration, have extended their forensic auditing practices to include providing Alternative Dispute Resolution (ADR) services, in absence of which a matter could be expensive and time consuming for individuals or businesses involved in commercial disputes with a third party.

9. Computer Forensics:

A Company Secretary is trained in assist in electronic data recovery and enforcement of IP rights etc.

Power and Duties of Auditors and Accounting Standards: Role of Company Secretary in Mitigating the Corporate Frauds.

![]()

Question 8.

What are Red Flags and Green Flags? Discuss.

Answer:

RED FLAGS:

Red flags are nothing but symptoms or indicator of situation of fraud. A red flag is a set of circumstances that are unusual in nature or vary from the normal activity. It is a signal that something is out of the ordinary and may need to be investigated further.

Definition of Red Flag for Forensic Audit:

Red flags are nothing but symptoms or indicator of situation of fraud.

- A red flag is a set of circumstances that are unusual in nature or vary from the normal activity.

- It is a signal that something is out of the ordinary and may need to be investigated further.

Significance of Red Flags:

Red Flags aids the Auditor’s Responsibility to Consider Fraud & Error

- Effective for all audits relating to accounting periods commencing on or after 1st April 2009.

- When planning and performing audit procedures and evaluating and reporting the results thereof, the auditor should consider the risk of material misstatements in the financial statements resulting from fraud or error.

- Two types of misstatements are relevant to the auditor’s consideration of fraud:

- Misstatements arising from misappropriation of assets.

- Misstatements arising from fraudulent financial reporting.

- Studies of fraud cases consistently show that red flags were present, but were either not recognized or were recognized but not acted upon by anyone.

- Sometimes an error is just an error.

Common Types of Red flags:

The most common types of Red Flags and fraudulent activity can be categorized as:

1. Employee Red Flags

2. Management Red Flags

1. Employee Red Flags are like:

- Employee lifestyle changes: expensive cars, jewelry, homes, clothes

- Significant personal debt and credit problems

- Behavioral changes: these may be an indication of drugs, alcohol, gambling, or just fear of losing the job

- High employee turnover, especially in those areas which are more vulnerable to fraud

- Refusal to take vacation or sick leave

- Lack of segregation of duties ‘m the vulnerable area

2. Management Red Flags are like:

- Reluctance to provide information to auditors

- Managers engage in frequent disputes with auditors

- Management decisions are dominated by an individual or small group

- Managers display significant disrespect for regulatory bodies

- There is a weak internal control environment

- Accounting personnel are lax or inexperienced in their duties

- Decentralization without adequate monitoring

- Excessive number of checking accounts

- Significant downsizing in a healthy market

- Continuous rollover of loans

- Excessive number of year end transactions

- High employee turnover rate

- Unexpected overdrafts or declines in cash balances

- Refusal by company or division to use serial numbered documents (receipts)

- Compensation program that is out of proportion

- Any financial transaction that doesn’t make sense – either common or business

- Service Contracts result in no product

- Photocopied or missing documents

- Frequent changes in banking accounts

- Frequent changes in external auditors

- Company assets sold under market value

Green Flags:

Above discussion on Red Flags says that red flags are symptoms or indicators of fraud, white collar crime or something detrimental to the interest of the organization. To the contrary there are other signals which could also imply the existence of fraud but do not activate alarm bells. Rather they may even lead to a greater sense of assurance and comfort in a scenario which may be potentially infused with fraud. These signals are referred as ‘green flags’.

The instance of Green Flags could be15 helpful in identifying are unusual signs or inconsistencies, but apparently harmless or perhaps even helpful.

![]()

Question 9.

What are the different types of Investigation?

Answer:

Types of Investigations:

The forensic auditor could be asked to investigate many different types of fraud. It is useful to categorize these investigations into following groups to provide an overview of the wide range of investigations that could be carried out. The three categories of frauds are corruption, asset misappropriation and financial statement fraud.

1. Corruption:

There are three types of corruption fraud: conflicts of interest, bribery, and extortion. Research shows that corruption is involved in around one third of all frauds.

- In a conflict of interest fraud, the fraudster exerts their influence.to achieve a personal gain that detrimentally affects the company. The fraudster may not benefit financially, but rather receives an undisclosed personal benefit as a result of the situation. For example, a manager may approve the expenses of an employee who is also a personal friend in order to maintain that friendship, even if the expenses are inaccurate.

- Bribery is when money (or something else of value) is offered in order to influence a situation.

- Extortion is the opposite of bribery, and happens when money is demanded (rather than offered) in order to secure a particular outcome.

2. Asset misappropriation:

By far the most common frauds are those involving asset misappropriation, and there are many different types of fraud which fall into this category. The common feature is the theft of cash or other assets from the company, for example:

- Cash theft – the stealing of physical cash, for example petty cash, from the premises of a company.

- Fraudulent disbursements – company funds being used to make fraudulent payments. Common examples include billing schemes, where payments are made to a fictitious supplier, and payroll schemes, where payments are made to fictitious employees (often known as ‘ghost employees’).

- Inventory frauds – the theft of inventory from the company.

- Misuse of assets – employees using company assets for their own personal interest.

3. Financial statement fraud:

This is also known as fraudulent financial reporting, and is a type of fraud that causes a material misstatement in the financial statements. It can include deliberate falsification of accounting records; omission of transactions, balances or disclosures from the financial statements; or the misapplication of financial reporting standards. This is often carried out with the intention of presenting the financial statements with a particular bias, for example concealing liabilities in order to improve any analysis of liquidity and gearing.

![]()

Question 10.

Discuss the Power and Duties of auditors.

Answer:

Power and Duties of Auditors and Accounting Standards:

1. Section -143 of Companies Act, 2013 talks about the power and duties of auditors and auditing standards. It reads: “Every auditor of a company shall have a right of access at all times to the books of account and vouchers of the company, whether kept at the registered office of the company or at any other place and shall be entitled to require from the officers of the company such information and explanation as he may consider necessary for the performance of his duties as auditor and amongst other matters inquire into the following matters, namely:

a. whether loans and advances made by the company on the basis of security have been properly secured and whether the terms on which they have been made are prejudicial to the interests of the company or its members;

b. whether transactions of the company which are represented merely by book entries are prejudicial to the interests of the company;

c. where the company not being an investment company dr a banking company, whether so much of the assets of the company as consist of shares, debentures and Other securities have been sold at a price less than that at which they were purchased by the company;

d. whether loans and advances made by the company have been shown as deposits;

e. whether personal expenses have been charged to revenue account;

f. where it is stated in the books and documents of the company that any shares have been allotted for cash, whether cash has actually been received in respect of such allotment, and if no cash has actually been so received, whether the position as stated in the account books and the balance sheet is correct, regular and not misleading:

Provided that the auditor of a company which is a holding company shall also have the right of access to the records of all its subsidiaries in so far as it relates to the consolidation of its financial statements with that of its subsidiaries.

2. The auditor shall make a report to the members of the company on the accounts examined by him and on every financial statements which are required by or under this Act to be laid before the company in general meeting and the report shall after taking into account the provisions of this Act, the accounting and auditing standards and matters which are required to be included in the audit report under the provisions of this Act or any rules made there under or under any order made under sub-section (11) and to the best of his information and knowledge, the said accounts, financial statements give a true and fair view of the state of the company’s affairs as at the end of its financial year and profit or loss and cash flow for the year and such other matters as may be prescribed.

3. The auditor’s report shall also state :

a. whether he has sought and obtained ail the information and explanations which to the best of his knowledge and belief were necessary for the purpose of his audit and if not, the details thereof and the effect of such information on the financial statements;

b. whether, in his opinion, proper books of account as required by law have been kept by the company so far as appears from his examination of those books and proper returns adequate for the purposes of his audit have been received from branches not visited by him;

c. whether the report on the accounts of any branch office of the company audited under sub-section (8) by a person other than the company’s auditor has been sent to him under the proviso to that sub-section and the manner in which he has dealt with it in preparing his report;

d. whether the company’s balance sheet and profit and loss account dealt with in the report are in agreement with the books of account and returns;

e. whether, in his opinion, the financial statements comply with the accounting standards;

f. . the observations or comments of the auditors on financial

transactions or matters which have any adverse effect on the functioning of the company;

g. whether any director is disqualified from being appointed as a director under sub-section (2) of section 164;

h. any qualification, reservation or adverse remark relating to the maintenance of accounts and other matters connected therewith;

i. whether the company has adequate internal financial controls system in place and the operating effectiveness of such controls;

j. such other matters as may be prescribed.

4. Where any of the matters required to be included in the audit report under this section is answered in the negative or with a qualification, the report shall state the reasons therefor.

5. In the case of a Government company, the Comptroller and Auditor-General of India shall appoint the auditor under sub-section (5) or sub-section (7) of section 139 and direct such auditor the manner in which the accounts of the Government company are required to be audited and thereupon the auditor so appointed shall submit a copy of the audit report to the Comptroller and Auditor-General of India which, among other things, include the directions, if any, issued by the Comptroller and Auditor-General of India, the action taken thereon and its impact on the accounts and financial statement of the company.

6. The Comptroller and Auditor-General of India shall within sixty days from the date of receipt of the audit report under sub-section (5) have a right to,-

a. conduct a supplementary audit of the financial statement of the company by such person or persons as he may authorize in this behalf; and for the purposes of such audit, require information or additional information to be furnished to any person or persons, so authorized, on such matters, by such person or persons, and in such form, as the Comptroller and Auditor-General of India may direct; and

b. comment upon or supplement such audit report:

Provided that any comments given by the Comptroller and Auditor-General of India upon, or supplement to, the audit report shall be sent by the company to every person entitled to copies of audited financial statements under sub section (1) of section 136 and also be placed before the annual general meeting of the company at the same time and in the same manner as fee audit report.

7. Without prejudice to the provisions of this Chapter, fee Comptroller and Auditor- General of lndia may, in case of any company covered under sub-section (5) or sub-section (7) of section 139, if he considers necessary, by an order, cause test audit to be conducted of the accounts of such company and the provisions of section 19A of the Comptroller and Auditor-General’s (Duties, Powers and Conditions of Service) Act, 1971, shalt apply to the report of such test audit.

8. Where a company has a branch office, the accounts of that office shall be audited either by fee auditor appointed for the company (herein referred to as the company’s auditor) under this Act or by any other person qualified for appointment as an auditor of the company under this Act and appointed as such under section 139, or where the branch office is situated in a country outside India, fee accounts of the branch office shall be audited either by the company’s auditor or by an accountant or by any other person duly qualified to act as an auditor of the accounts of the branch office in accordance with the laws of that country and the duties and powers of the company’s auditor with reference to the audit of the branch and the branch auditor, if any, shall be such as may be prescribed:

Provided that fee branch auditor shall prepare a report on the accounts of the branch examined by him and send ittothe auditor of the company who shall deal with it in his report in such manner as he considers necessary.

9. Every auditor shall comply with the auditing standards.

10. The Central Government may prescribe thestandards of auditing or any addendum thereto, as recommended by’the Institute of Chartered Accountants of India, constituted under section 3 of the Chartered Accountants Act, 1949, in consultation wife and after examination of the recommendations made by the National Financial Reporting Authority: Provided that until any auditing standards are notified, any standard or standards of auditing specified by the Institute of Chartered Accountants of India shall be deemed to be the auditing standards.

11. The Central Government may, in consultation with the National Financial Reporting Authority, by general or special order, direct, in respect of such class or description of companies, as may be specified in fee. order, that fee auditor’s report shall; also include a statement on such matters as may be specified therein.

12. Notwithstanding anything contained in this section, if an auditor of a company, in the course of the performance of his duties as auditor, has reason to believe that an offence involving fraud is being or has been committed against the company by officers or employees of the company, he shall immediately report the matter to the Central Government within such time and in such manner as may be prescribed.

13. No duty to which an auditor of a company may be subject to shall be regarded as having been contravened by reason of his reporting the matter referred to in sub-section (12) if it is done in good faith.

14. The provisions of this section shall mutatis mutandis apply to –

a. The cost accountant in practice conducting cost audit under section 148; or

b. The company secretary in practice conducting secretarial audit under section 204.

15. If any auditor, cost accountant or company secretary in practice do not comply with the provisions of sub-section (12), he shall be punishable with fine which shall not be less than one lakh rupees but which may extend to twenty-five lakh rupees.”

Powers:

- Right to access: Every auditor of a company shall have right to access at all time to book of accounts and vouchers of the company. The Auditor shall be entitled to require from officers of the company such information and explanation as he may consider necessary for performance of his duties. Auditor to sign audit reports: The auditor of the company shall sign the auditor’s report or sign or certify any other document of the company and financial transactions or matters, which have any adverse effect on the functioning of the company mentioned in the auditor’s report shall be read before the company in general meeting and shall be open to inspection by any member of the company.

- Right to remuneration: The remuneration of the auditor of a company shall be fixed in its general meeting or in such manner as may be determined therein. It must include the expenses, if any, incurred by the auditor in connection with the audit of the company and any facility extended to him but does not include any remuneration paid to him for any other service rendered by him at the request of the company.

- Consent of auditor: As per Section 26, the company must mention in their prospectus the name, address and consent of the auditors of the company. Duties

- Fraud Reporting: Among others, fraud reporting is one of the major duties of a Company Secretary in the context of forensic audit. If an auditor of a company, in the course of the performance of his duties as auditor, has reason to believe that an offence involving fraud is being or has been committed against the company by officers or employees of the company, he shall immediately report the matter to the Central Government within such time and in such manner as may be prescribed.

Offence of Fraud Non – Compoundable

As the punishment for Fraud is both imprisonment and fine, it is considered a non-compoundable offence. It shows that, the commission of Fraud has become a serious offence in the eyes of law. The Act has provided punishment for fraud under Section 447 and around 20 sections of the Act talk about fraud committed by the directors, key managerial personnel, auditors and/or officers of company. Here, the contravention of the provisions of the Act with an intention to deceive are also considered as fraud, to name a few acts amounting to fraud-

- Furnishing of false information at the time of incorporation of company by promoters, first directors or any other person – Section 7(5)&(6)

- Managing the affairs of the non-profit company fraudulently – Section 8(11)

- Misrepresenting any material information in prospectus – Section 34

- Making of applications for acquisition of any securities in fictitious names – Section 38(1)

- Transfer of any shares by depository or depository participant with an intent to defraud, deceive any person – Section 56(7)

- Concealment of name or misrepresenting the amount of claim knowingly of any creditor – Section 66(10).

- Failure to repay deposit with intent to defraud depositor -Section 75(1)

Punishment for Fraud (section 447):

Section 447 reads that ‘Without prejudice to any liability including repayment of any debt under this Act or any other .law for the time being in force, any person who is found to be guilty of fraud, shall be punishable with imprisonment for a term which shall not be less than six months but which may extend to ten years and shall also be liable to fine which shall not be less than the amount involved in the fraud, but which may extend to three times the amount involved in the fraud.

Punishment for False Statement (Section 448):

If in any return, report, certificate, financial statement, prospectus, statement or other document required by, or for, the purposes of any of the provisions of this Act or the rules made thereunder, any person makes a statement,:

- which is false in any material particulars, knowing it to be false; or

- which omits any material fact, knowing it to be material He shall be liable under section 447.

Punishment for False Evidence (Section 449)

If any person intentionally gives false evidence:

- upon any examination on oath or solemn affirmation; or

- in any affidavit, deposition or solemn affirmation in or about winding up of any company under this Act, or otherwise in or about any matter arising under this Act,

He shall be punishable with imprisonment for a term which shall not be less than three (03) years but which may extend to seven years (07) and with fine which may extend to ten lakh rupees (₹ 10 Lacs).

Punishment Where No Specific Penalty or Punishment Is Provided (Section 450):

If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder and for which no penalty or punishment is provided elsewhere in the Act, they shall be punishable with fine which may extend to ten thousand rupees (₹ 10,000) and where the contravention is continuing one, with a further fine which may extend to one thousand rupees (? 1,000) for every day after the first during which the contravention continues.

Punishment in case of Repeated Default (section 451):

If a company or an officer of a company commits an offence punishable either with fine or with imprisonment and where the same offence is committed for the second or subsequent occasions within a period of three (03) years, then, that company and every officer thereof who is in default shall be punishable with twice the amount of fine for such offence in addition to any imprisonment provided for that offence. This section is not applicable to the offence repeated after a period of three (03) years from the commitment of first offence.

Other Duties of Company Secretary under Companies Act, 2013:

Make report: The auditor shall make a report to the members of the company on accounts examined by him on every financial statement and shall state: (a) Whether he has sought and obtained all the necessary information and explanations, (b) Whether proper books of account have been kept, (c) Whether company’s balance sheet and profit and loss account are in agreement with books of accounts and returns.

Audit report of Government Company: The auditor of the government company will be appointed by the Comptroller and Auditor-General of India and such auditor shall act according to the directions given by them. He must submit a report to them which should include the action taken by him and impact on accounts and financial statement of the company. The Comptroller and Audit – General of India shall within 60 days of receipt of the report have right to (a) conduct a supplementary audit and (b) comment upon or supplement such audit report. The Comptroller and Audit – General of India may cause test audit to be conducted of the accounts of such company.

Liable to pay damages: As per section 245, the depository and members of the company have right to file an application before the tribunal if they are of the opinion that the management or conduct of the affairs of the company are being conducted in a manner prejudicial to the interests of the company. They also have right to claim damages or compensation from the auditor for any improper or misleading statement made in his audit report or for any fraudulent or unlawful conduct.

Branch Audit: Where a company has a branch office, the accounts of that office shall be audited either by the auditor appointed for the company, or by any other person qualified for appointment as an auditor of the company. The branch auditor shall prepare a report on the accounts of the branch examined by him and send it to the auditor of the company who shall deal with it in his report in such manner as he considers necessary.

Auditing Standards: Every auditor shall comply with the auditing standards. The Central Government shall notify these standards in consultation with National Financial reporting Authority. The government may also notify that auditors’ report shall include a statement on such matters as notified. Winding up: As per section 305, at the time of voluntary winding up of a company it is a mandatory requirement that auditor should attach the copy of the audits of the company prepared by him.

Punishment for Default by the Professionals Including Company Secretaries Section 143 (15) says If any auditor, cost accountant or company secretary in practice do not comply with the provisions of sub-section (12) of Section 143 of the Act, he shall be punishable with fine which shall not be less than one (01) lakh rupees but which may extend to twenty-five lakh (₹ 25 lakh) rupees.

Fraud Reporting Procedure:

Rule 13 of Companies (Audit and Auditors) Rules, 2014 contains the operational procedure for reporting of Fraud prescribed in Section 143(12) of the Act. If the statutory auditor detects any Fraud, it is his duty to inform the same to the Audit Committee or the Board of Directors, seeking their reply within forty-five (45) days. After receiving the aforesaid reply, he has to toward his report to the Central Government within fifteen (15) days of receipt of such reply or observations. Even in the case of no reply from the Audit Committee or the Board of Directors he has to forward his report along with his comments to the Central Government within stipulated time frame. Similar provisions of Fraud Reporting are applicable to the cost auditor and the secretarial auditor.

Serious Fraud Investigation Office (SFIO):

The Central Government shall, by notification, establish an office to be called the Serious Fraud Investigation Office (SFIO) to investigate frauds relating to a company. This body shall consist of the experts from the field of law, corporate affairs, banking, taxation, etc. It shall share the information which it is having with police department, taxation authority or with the State Government or any other investigating authority as per the need of the time. SFIO will submit its report to the Central Government.

Secretarial Audit:

Realizing the need to ensure compliance of laws in its letter and spirit on continuous basis by an independent professional, the Act has mandated the carrying out of secretarial audit for bigger companies.

Companies (Auditors Report) Order, 2016 (CARO):

Every report made by the auditor under Section 143 of the Act, on the accounts of every company examined by him to which CARO applies for the financial year commencing on or after, 1st April, 2014, should include the matters specified under CARO. The main objective being to detect fraud and inform about the same to the regulators.

![]()

Question 11.

Explain Seven Investigation Tools.

Answer:

Seven Investigative Tools:

Further, on forensic audit procedures,- there are seven recognized investigative tools and techniques used by forensic specialist / fraud examiners. (Richard 2013)

- Public document reviews and background investigations

- Interviews of knowledgeable persons (the witness and the accused)

- Confidential sources and informants

- Laboratory analysis of physical and electronic evidence (Physical Forensic Analysis which includes Handwriting analysis, fingerprint analysis, document dating, ink sampling, simulated forgery of signatures analysis, Computer Forensics which includes hard disk imaging, E-mail analysis, search for erased files, analyze use & possible misuse of office computers for personal use, ensure chain of custody for electronic evidence.)

- Electronic and physical surveillance.

- Undercover operations

- Analytical procedures (Using of Ratio analysis, Trend or time series analysis, Horizontal and vertical analysis and use of work-back ratios techniques to analyze financial statement).

Reporting: A report is required so that it can be presented to a client about the fraud. The report should include the findings of the investigation, a summary of evidence, an explanation of how the fraud was perpetrated, and suggestions on how internal controls can be improved to prevent such frauds in future. The report needs to be presented to a client so that they can proceed to file a legal case if they so desire.

Question 12.

Discuss the ten Steps receives for finding facts in case of frauds and corruption.

Answer:

STEP ONE: Begin the case (respond to complaint, etc.):

If the case starts with a complaint or report, fully debrief the complainant, getting as much detail as possible. If the case starts with the discovery of a red flag, match the red flag to the potential scheme and then look for other red flags of the suspected schemes. An automated, “proactive” search for fraud indicators might be effective if the necessary data is available.

STEP TWO: Evaluate the allegations or suspicions:

Determine whether the allegations or suspicions – the “Red Flags” – are. specific and serious enough to justify an investigation, which can be time consuming, disruptive and costly.

If you determine that a complaint or report warrants further investigation, try to make a quick, preliminary assessment of the accuracy of the complaint. For example, if the complainant alleges that he or she was unfairly disqualified from a tender, examine the relevant project files to attempt to determine if this may have occurred. Use this information to prepare for the follow up interview of the complainant.

STEP THREE: Conduct due diligence background checks:

Check on-line and other records on the suspect firms and individuals to evaluate the allegations and to look for other evidence of fraud or corruption, such as the presence of shell companies as subcontractors, prior debarments of a contractor or evidence that a project official is living beyond his means.

STEP FOUR: Complete the internal stage of the investigation:

Complete the collection of documents, data and interviews within the investigating organization, For example:

- Look in the bidding documents for evidence of corrupt influence through the manipulation of the “SPQQD” factors – Selection, Pricing, Quantity, Quality and Delivery.

- Carefully examine bids and proposals, CVs and other documents submitted by a suspect firm for possible fraudulent representations;

- Access, with the proper authority, the relevant e-mail and computer hard drive information;

- Determine if an early interview of the subject is warranted.

STEP FIVE: Check for predication and get organized:

Review the results of the investigation to date to determine if there is adequate “predication” – a sufficient factual basis – to proceed. Decide or refine the initial “Case Theory” and organize the evidence according to the elements of proof of the potential claims. If law enforcement assistance is needed (e.g., to subpoena documents, exercise search warrants or to request legal assistance) take steps to ensure that there is sufficient “probable cause” to obtain such cooperation.

STEP SIX: Begin the external investigation:

Conduct interviews of witnesses outside the investigating organization, proceeding from the disinterested, cooperative witnesses to “facilitators” to co-conspirators to the subjects. Request or compel documents from third parties and the suspect contractors through negotiated agreements, the exercise of contract audit rights or, if available with law enforcement assistance, subpoenas or search warrants.

STEP SEVEN: Prove illicit Payments:

Determine the best strategy to prove illicit payments: out from the point of payment (by examining the contractor’s records), or back from the point of receipt (from the suspect employee’s records) and begin the tracing process. If it is not possible to prove the corrupt payments directly, try to prove them circumstantially by showing the subject displayed unexplained sudden wealth or expenditures.

STEP EIGHT: Obtain the cooperation of an inside witness

A Cooperative Witness could be an honest inside observer or a lesser participant in the offense, such as a middleman or the smaller of several bribe payers. Decide the best strategy to obtain his or her cooperation.

STEP NINE: interview the primary subject:

In a corruption case, conduct a thorough interview of the primary subject, usually the suspected bribe recipient. Ask about his role in the suspect contract award and relevant financial issues, such as his sources of income and expenditures. Decide if there is sufficient evidence to obtain a confession; if not, try to get helpful admissions and identify possible defenses (different objectives require different tactics.) Record the interview, if possible, and request all relevant financial and other records. In a fraud case, interview the person most knowledgeable and responsible for the suspected false statement or fraudulent document.

STEP TEN: Prepare the final report

Decide what action to recommend based on the results of the investigation – an administrative sanction or criminal referral, for example – and prepare a concise final report, organized according to the elements of proof for the relevant offenses.

![]()

Question 13.

Discuss the ten most important points in Interviewing.

Answer:

1. Be prepared:

Master the known facts of the case – review the case files and prior interviews – and decide what you need from the witness to prove the offense or fill gaps. Do not rush into an interview until you are fully prepared. Prepare an outline of the points you want to cover, but do not write out the questions. That will distract you from carefully listening to the witness’s answers and generating useful follow up questions. As the interview progresses, the answers will suggest the next questions.

2. Allow adequate time for the interview, to be conducted in an appropriate environment:

Be honest with the witness about how long the interview will take. Most interviews in complex cases take much longer than the witness anticipates. Conduct the interview in a professional environment; do not attempt to interview an important witness at lunch or in another social setting.

3. Bring the pertinent files with you and use them

If the relevant files are voluminous, do the interview where the files are located. As appropriate, show the witness the relevant documents and let him or her review them before answering. Otherwise very important points will be missed or forgotten.

4. Organize the interview questions:

Go through the transactions in chronological order – as they occurred – or according to the documents, or in some other logical order, rather than just firing questions at random as they occur to you. If you are not organized there will be gaps in the questioning and you will inevitably forget to ask something important.

5. Ask short, simple, concise questions:

Avoid the long, unfocused, repetitive stream of consciousness questions that are typical of an inexperienced or unprepared investigator. Train yourself to fully cover a particular topic by asking a series of short, simple questions. This is quite Important but not easy to do. Short, dear questions make it easier for the witness to understand the question and for you to understand and evaluate the answer. And if the answers are not truthful, it will be easier to impeach the witness and rebut his or her claim that he misunderstood the question.

6. Listen intently – watch the witness:

Good interviewers rely more on their eyes and ears than their mouth in interviews. If feasible, have a second investigator attend and take notes so you can concentrate on the witness. Look at the witness (not down at your notes) as he or she answers and think about the answer – is it

Audit and Investigations Notes

Tools for handling forensic audit:

Forensic Auditing is a new concept that comprises three key ingredients:

1. Forensic Audit Thinking (Thinking Forensicaliy):

Involves the critical assessment throughout the audit of all evidential matter and maintaining a higher degree of professional skepticism that for example fraud or financial irregularity may have occurred, is occurring, or will occur in the future. Furthermore, Forensic thinking is a mind shift where the auditor believes that the possibility of fraud or financial irregularity may exist and the controls may be overridden to accomplish that possibility. Forensic thinking is used throughout the audit work i.e. from start to finish.

2. Forensic Audit Procedures:

Forensic audit procedures are more specific and geared toward detecting the possible material misstatements in financial statements resulting from fraudulent activities or error.

Audit procedures should align with Fraud Risks and Fraud Risk Assessments.

There are three interrelated elements that enable someone to commit fraud:

(a) The Motive that drives a person to want to commit the fraud,

(b) The Opportunity that enables him to commit the fraud, and

(c) The ability to Rationalize the fraudulent behavior.

The vulnerability that an organization has to those capable of overcoming all three elements of the fraud triangle is fraud risk. Fraud risk can come from sources both internal and external to the organization.

Fraud Risk Assessment:

A fraud risk assessment is a powerful proactive tool in the fight against fraud for any organization. According to Association of Certified Fraud Examiners, Fraud Risk assessment is a process aimed at proactively identifying and addressing an organization’s vulnerabilities to internal and external fraud.

![]()

3. Appropriate Use of Technology:

Forensic Data Analysis can be used to Prevent, detect and control fraud along with other irregularities.

Forensic. Data Analysis:

Forensic data analysis is the process of gathering, summarizing, comparing, and aggregating existing different sets of data that organizations routinely collect in the normal course of business with the goal of detecting anomalies that are traditionally indicative of fraud or other misconduct.

Tools for handling Forensic Audit and the Role of Company Secretary:

It is reiterated time and again that Good Governance is paramount for the inclusive growth of the country while promoting the community confidence, their participation, transparency, accountability, lead for the better decisions embarking the welfare of the masses and supporting the ethical decision making, which all in consolidation call for the emergent and bright future of the nation at global platform. In the similar context, India has opted to Reform, Perform, Transform under vision New India, 2022, adhering to the best practices of good governance. In this direction, we are witnessing various legal reforms like GST, RERA, IBC, and initiation of amendments in Prevention of Money-laundering Act, 2002 through Finance Act, 2018 and alike.

The objects of all these reforms and initiatives is to support and ensure inclusive growth and development of the nation in the all the sphere while encountering the challenging hindering the growth of those spheres. When talking the all compassing growth, economic growth is one of the significant spheres to be adhered with the premium practices of good governance and henceforth the glitches bugging the emerging growth of economy are tackled by the government at priority.

In this context among other things, Corporate Frauds are considered as one of the major challenges which is obstructing the growth of corporates as well as of economy as a whole.

Right from initiating the amendments in the Prevention of Money-laundering Act, 2002 (PMLA) through Finance Act 2018 to enhancing the scope of preventing and punishing the frauds with the assistance of Serious Fraud Investigation Office, Government is working at length and breadth to enhance governance in the corporates and to ensure corporate compliances at par.

In the paraphrase of reforms, good governance, interpretation leading the world in the direction of transformation, the performance and role of Company Secretaries tends vital. In a system of reformed rules, practices, processed by which the new era of good governance is directed and subsumed, it is the Company Secretary who balances the interest of various stakeholders and ensure well complied mechanism of these reforms.

Role of CS as a Forensic Auditor:

A Forensic Auditor is often retained to analyze, interpret, summarize and present complex financial and business-related issues in a manner that is both understandable and properly supported. Forensic Auditors can be engaged in Public Practice or employed by Insurance companies, banks, police forces, government agencies and other organizations. The Role of Company Secretary as a Forensic Auditor may be understood as follow:

1. Criminal Investigations:

A Company Secretary would use his/her investigative accounting skills to examine the documentary and other available evidence to give his/her expert opinion on the matter. Their services could also be required by Government departments, the Revenue Commissioners, the Fire Brigade, etc. for investigative purposes. Practicing forensic accountants could be called upon by the police to assist them in criminal investigations which could either relate to individuals or corporate bodies.

2. Personal Injury Claims:

Where losses arise as a result of personal injury, insurance companies sometimes seek expert opinion from a forensic auditors before deciding whether the claim is valid and how much to pay.

3. Fraud Investigations:

A Company Secretary might be. called upon to assist in business investigations which could involve funds tracing, asset identification and recovery, forensic intelligence gathering and due diligence review. In cases involving fraud perpetrated by an employee, the forensic auditors will be required to give his/her expert opinion about the nature and extent of fraud and the likely individual or group of individuals who have committed the crime. The forensic expert undertakes a detailed review of the available documentary evidence and forms his/ her opinion based on the information gleaned during the course of that review.

![]()

4. Investigation and Inspection:

Company Secretary may help the Police, ACB and other investigating authorities in collecting evidences and other investigation purposes. For example, section 157 Cr.P.C, 1973; sections 17 and, 18 of the Prevention of Corruption Act, 1988; Section 6 of The Bankers Books Evidence Act, 1891; Section 78 of Information Technology Act, 2000; Section 447 of the Companies Act, 2013 wherein the Court or Police may require the skills of Forensic auditors while inspecting any books in so far as related to the accounts of an accused.

5. Expert Opinion:

Company Secretaries see and carefully examine the accounts and balance sheets and use his skills to find out whether there is any fraud committed or any anomaly associated with it by giving his expert opinion. This finds place in for example section 45, section 118 of Indian Evidence Act, 1872; section293 of Cr. P.C, 1973.

6. Professional Negligence

The forensic auditor might be approached in a professional negligence matter to investigate whether professional negligence has taken place and to quantify the loss which has resulted from the negligence. A matter such as this could arise between any professional and their client. The professional might be an accountant, a lawyer, company secretary etc. The forensic expert uses his/her investigative skills to provide the services required for this assignment.

7. Expert Witness Cases:

Company Secretary as Forensic Auditor often attend court to testify in civil and criminal court hearings, as expert witnesses. In such cases, they attend to present investigative evidence to the court so as. to assist the presiding judge in deciding the outcome of the case.

8. Meditation and Arbitration:

Some forensic auditors because of their specialist training they would have received in legal mediation and arbitration, have extended their forensic auditing practices to include providing Alternative Dispute Resolution (ADR) services, in absence of which a matter could be expensive and time consuming for individuals or businesses involved in commercial disputes with a third party.

9. Litigation Consultancy:

Company Secretaries are eligible to be engaged in litigation and assisting with evidence, strategy and case preparation. Computer Forensics: Assisting in electronic data recovery and enforcement of IP rights etc.

10. Computer Forensics:

A Company Secretary is trained in assist in electronic data recovery and enforcement of IP rights etc. Power and Duties of Auditors and Accounting Standards: Role of Company Secretary in Mitigating the Corporate Frauds.

Power and Duties of Auditors and Accounting Standards

Section – 143 of Companies Act, 2013 talks about the power and duties of auditors and auditing standards. It reads: “Every auditor of a company shall have a right of access at all times to the books of account and vouchers of the company, whether kept at the registered office of the company or at any other place and shall be entitled to require from the officers of the company such information and explanation as he may consider necessary for the performance of his duties as auditor and amongst other matters inquire into the following matters, namely:

a. whether loans and advances made by the company on the basis of security have been properly secured and whether the terms on which they have been made are prejudicial to the interests of the company or its members;

b. whether transactions of the company which are represented merely by book entries are prejudicial to the interests of the company;

c. where the company not being an investment company or a banking company, whether so much of the assets of the company as consist of shares, debentures and other securities have been sold at a price less than that at which they were purchased by the company;

d. whether loans and advances made by the company have been shown as deposits;

e. whether personal expenses have been’ charged to revenue account;

f. where it is stated in the books and documents of the company that any shares have been allotted for cash, whether cash has actually been received in respect of such allotment, and if no cash has actually been so received, whether the position as stated in the account books and the balance sheet is correct, regular and not misleading:

Provided that the auditor of a company which is a holding company Shall also have the right of access to the records of all its subsidiaries in so far as it relates to the consolidation of its financial statements with that of its subsidiaries.

![]()

Powers:

Right to access: Every auditor of a company shall have right to access at all time to book of accounts and vouchers of the company. The Auditor shall be entitled to require from officers of the company such information and explanation as he may consider necessary for performance of his duties.

Auditor to sign audit reports: The auditor of the company shall sign the auditor’s report or sign or certify any other document of the company and financial transactions or matters, which have any adverse effect on the functioning of the company mentioned in the auditor’s report shall be read before the company in general meeting and shall be open to inspection by any member of the company.

Auditor in general meeting: It is a prime requirement under section 146, that the company must send all notices and communication to the auditor, relating to any general meeting, and he shall attend the meeting either through himself or through his representative, who shall also be an auditor.

Right to remuneration: The remuneration of the auditor of a company shall be fixed in its general meeting or in such manner as may be determined therein. It must include the expenses, if any, incurred by the auditor in connection with the audit of the company and any facility extended to him but does not include any remuneration paid to him for any other service rendered by him at the request of the company.

Consent of auditor: As per Section 26, the company must mention in their prospectus the name, address and consent of the auditors of the company.

Duties: Fraud Reporting: Among others, fraud reporting is one of the major duties of a Company Secretary in the context of forensic audit. If an auditor of a company, in the course of the performance of his duties as auditor, has reason to believe that an offence involving fraud is being or has been committed against the company by officers or employees of the company, he shall immediately report the matter to the Central Government within such time and in such manner as may be prescribed.

Punishment for Default by the Professionals Including Company Secretaries:

Section 143 (15) says If any auditor, cost accountant or company secretary in practice do not comply with the provisions of sub-section (12) of Section 143 of the Act, he shall be punishable with fine which shall not be less than one (01) lakh rupees but which may extend to twenty-five lakh (₹ 25 lakh) rupees.

Serious Fraud Investigation Office (SFIO):

The Central Government shall, by notification, establish an office to be called the Serious Fraud Investigation Office (SFIO) to investigate frauds relating to a company. This body shall consist of the experts from the field of law, corporate affairs, banking, taxation, etc. It shall share the information which it is having with police department, taxation authority or with the State Government or any other investigating authority as per the need of the time. SFIO will submit its report to the Central Government.

Investigation Mechanism:

- Step 1 – Accepting the Investigation

- Step 2 – Planning the Investigation

- Step 3 – Gathering Evidence

- Step 4 – Reporting

- Step 5 – Court Proceeding

Types of Investigations:

The forensic auditor could be asked to investigate many different types of fraud. It is useful to categorize these investigations into following groups to provide an overview of the wide range of investigations that could be carried out. The three categories of frauds are corruption, asset misappropriation and financial statement fraud.

Methods of Investigations:

Common techniques used for collecting evidence in a forensic audit include the following:

- Substantive Techniques: For example, doing a reconciliation, review of documents, etc.

- Analytical Procedures: Used to compare trends over a certain time period or to get comparative data from different segments

- Computer-Assisted Audit Techniques: Computer software programs that can be used to identify fraud.

- Understanding Internal Controls and Testing them so as to understand the loopholes which allowed the fraud to be perpetrated.

- Interviewing and Interrogation: Interview and Interrogation are two major techniques in investigation. That are used to elicit responses from the suspect or accused. It should however be noted that the investigator (interviewer or interrogator) cannot usurp the power of the court of competent jurisdiction by pronouncing the suspect or accused guilty.

![]()

Seven Investigative Tools:

Further, on forensic audit procedures, there are seven recognized investigative tools and techniques used by forensic specialist / fraud examiners. (Richard 2013)

- Public document reviews and background investigations.

- Interviews of knowledgeable persons (the witness and the accused).

- Confidential sources and informants.

- Laboratory analysis of physical and electronic evidence (Physical Forensic Analysis which includes Handwriting analysis, fingerprint analysis, document dating, ink sampling , simulated forgery of signatures analysis, Computer Forensics which includes hard disk imaging, E-mail analysis, search-for erased files, analyze use & possible misuse of office computers for personal use, ensure chain of custody for electronic evidence).

- Electronic and physical surveillance.

- Undercover operations.

- Analytical procedures (Using of Ratio analysis, Trend or time series analysis, Horizontal and vertical analysis and use of work-back ratios techniques to analyze financial statement).

Finding Facts and Conducting Investigations: A Process Exemplified The Basic Steps of a Complex Fraud and Corruption Investigation

(A) Preliminary Matters

Use the “Case Theory” approach to investigations

Learn the elements of proof for the suspected offenses

Carefully organize and maintain the evidence

Prepare the case chronology

(B) The Basic Steps of a Complex Investigation

The TEN Steps that are generally required for finding facts in a case of frauds and corruption are listed as below:

- STEP ONE: Begin the case (respond to complaint, etc.)

- STEP TWO: Evaluate the allegations or suspicions

- STEP THREE: Conduct due diligence background checks

- STEP FOUR: Complete the internal stage of the investigation

- STEP FIVE: Check for predication and get organized

- STEP SIX: Begin the external investigation

- STEP SEVEN: Prove Illicit Payments

- STEP EIGHT: Obtain the cooperation of an inside witness

- STEP NINE: Interview the primary subject

- STEP TEN: Prepare the final report

Red Flags:

Red flags are nothing but symptoms or indicator of situation of fraud. A red flag is a set of circumstances that are unusual in nature or vary from the normal activity. It is a signal that something is out of the ordinary and may need to be investigated further.

Significance of Red Flags

Red Flags aids the Auditor’s Responsibility to Consider Fraud & Erro

- Effective for all audits relating to accounting periods commencing on or after 1st April 2009.

- When planning and performing audit procedures and evaluating and reporting the results thereof, the auditor should consider the risk of material misstatements in the financial statements resulting from fraud or error.

- Two types of misstatements are relevant to the auditor’s consideration of fraud:

- Misstatements arising from misappropriation of assets.

- Misstatements arising from fraudulent financial reporting.

- Studies of fraud cases consistently show that red flags were present, but were either not recognized or were recognized but not acted upon by anyone.

- Sometimes an error is just an error.

Common Types of Red flags

The most common types of Red Flags and fraudulent activity can be categorized as:

- Employee Red Flags

- Management Red Flags

![]()

Green Flage:

There are other signals which could also imply the existence of fraud but do not activate alarm bells. Rather they may even lead to a greater sense of assurance and comfort in a scenario which may be potentially infused with fraud. These signals are referred as ‘green flags’.

The instance of Green Flags could be15 helpful in identifying are unusual signs or inconsistencies, but apparently harmless or perhaps even helpful.