Students should practice Capital Budgeting – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Capital Budgeting – Financial and Strategic Management MCQ

Question 1.

Capital budgeting is the process___

(A) This helps to make the master bud-get of the organization.

(B) By which the firm decides how much capital to invest in business

(C) By which the firm decides which long-term investments to make.

(D) Undertaken to analyze how to make available various finance to the business.

Answer:

(C) By which the firm decides which long-term investments to make.

Question 2.

The values of the future net incomes discounted by the cost of capital are called –

(A) Average capital cost

(B) Discounted capital cost

(C) Net capital cost

(D) Net present values

Answer:

(D) Net present values

Question 3.

The decision to accept or reject a capital budgeting project depends on –

(A) An analysis of the cash flows generated by the project

(B) Cost of capital that is invested in business/project.

(C) Both (A) and (B)

(D) Neither (A) nor (B)

Answer:

(C) Both (A) and (B)

Question 4.

Internal Rate of Return (IRR) criterion for project acceptance, under theoretically infinite funds, is:

Accept all projects which have –

(A) IRR equal to the cost of capital

(B) IRR greater than the cost of capital

(C) IRR less than the cost of capital

(D) None of the above

Answer:

(B) IRR greater than the cost of capi¬tal

Question 5.

___ is a project whose cash flows are not affected by the accept/reject decision for other projects.

(A) Mutually exclusive project

(B) Independent project

(C) Low-cost project

(D) Risk-free project

Answer:

(B) Independent project

Question 6.

Where capital availability is unlimited and the projects are riot mutually exclusive, for the same cost of capital, following criterion is used?

(A) Net present value

(B) Internal Rate of Return

(C) Profitability Index

(D) Any of the above

Answer:

(D) Any of the above

Question 7.

___ is the discount rate that should be used in capital budgeting.

(A) Cost of capital (Ko)

(B) Risk-free rate (Rf)

(C) Risk premium (Rm)

(D) Beta rate (β)

Answer:

(A) Cost of capital (Ko)

Question 8.

Which of the following represents the amount of time that it takes for a capital budgeting project to recover its initial cost?

(A) Maturity period

(B) Payback period

(C) Redemption period

(D) Investment period

Answer:

(B) Payback period

Question 9.

Incorporating flotation costs into the analysis of a project will:

(A) Have no effect on the present value of the project.

(B) Increase the NPV of the project.

(C) Increase the project’s rate of return.

(D) Increase the initial cash outflow of the project.

Answer:

(D) Increase the initial cash outflow of the project.

Question 10.

A project is accepted when:

(A) Net present value is greater than zero

(B) Internal Rate of Return will be greater than the cost of capital

(C) Profitability index will be greater than unity

(D) Any of the above

Answer:

(D) Any of the above

Question 11.

When choosing among mutually exclusive projects, the project with –

(A) Longest payback is preferred

(B) Higher NPV get selected

(C) Quickest payback is preferred

(D) Lower cost of capital will be selected

Answer:

(C) Quickest payback is preferred

Question 12.

With limited finance and a number of project proposals at hand, select that package of projects which has:

(A) The maximum net present value

(B) Internal rate of return is greater than the cost of capital

(C) Profitability index is greater them unity

(D) Any of the above

Answer:

(A) The maximum net present value

Question 13.

Statement I:

In the case of capital rationing, a company is compelled to invest in projects having the shortest payback period.

Statement II:

The shorter the payback period, the less risky is the project. Therefore, it can be considered as an indicator of risk.

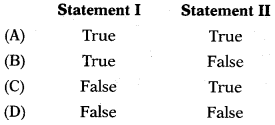

Select the correct answer from the options given below:

(A) Statement I is true but Statement II is false.

(B) Statement His true but Statement I is false.

(C) Both Statement I and Statement II are false.

(D) Both Statement I and Statement II are true.

Answer:

(D) Both Statement I and Statement II are true.

Question 14.

A Profitability Index (PI) of 0.92 for a project means that

(A) The project’s costs (cash outlay) are (is) less than the present value of the project’s benefits.

(B) The project’s NPV is greater than zero.

(C) The project’s NPV is greater than 1.

(D) The project returns 92 cents in present value for each rupee invested.

Answer:

(D) The project returns 92 cents in present value for each rupee invested.

Question 15.

The shorter the payback period –

(A) The riskier is the project.

(B) The less risky is the project.

(C) Less will the NPV of the project.

(D) More will the NPV of the project

Answer:

(B) The less risky is the project.

Question 16.

Which of the following statements is incorrect regarding a normal project?

(A) If the NPV of a project is greater than 0, then its PI will exceed 1.

(B) If the IRR of a project is 8%, its NPV, using a discount rate, K0, greater than 8%, will be less than 0.

(C) If the PI of a project equals 0, then the project’s initial cash outflow equals the PV of its cash flows.

(D) If the IRR of a project is greater than the discount rate, K0, then its PI will be greater than 1.

Answer:

(C) If the PI of a project equals 0, then the project’s initial cash outflow equals the PV of its cash flows.

Question 17.

Ranking projects according to their ability to repay quickly may be useful to firms:

(A) When experiencing liquidity constraints.

(B) When careful control over cash is required.

(C) To indicate the prospective investors specifying when their funds are likely to be repaid.

(D) All of the above

Answer:

(D) All of the above

Question 18.

Capital budgeting decisions are analyzed with help of a weighted average and for this purpose –

(A) Component cost is used

(B) Common stock value is used

(C) Cost of capital is used

(D) Asset valuation is used

Answer:

(C) Cost of capital is used

Question 19.

What is the difference between economic profit and accounting profit?

(A) Economic profit includes a charge for all providers of capital while accounting profit includes only a charge for debt.

(B) Economic profit covers the profit over the life of the firm, while accounting profit only covers the most recent accounting period.

(C) Accounting profit is based on currently accepted accounting rules while economic profit is based on cash flows.

(D) All of the above are correct.

Answer:

(A) Economic profit includes a charge for all providers of capital while accounting profit includes only a charge for debt.

Question 20.

Which of the following is a demerit of the payback period?

(A) It is difficult to calculate as well as understand it as compared to the accounting rate of return meth¬od.

(B) This method disregards the initial investment involved.

(C) It fails to take into account the timing of returns and the cost of capital.

(D) None of the above

Answer:

(C) It fails to take into account the timing of returns and the cost of capital.

Question 21.

A project whose acceptance does not prevent or require the acceptance of one or more alternative projects is referred to as

(A) Mutually exclusive project

(B) Independent project

(C) Dependent project

(D) Contingent project

Answer:

(B) Independent project

Question 22.

Which of the following is a demerit of the payback period?

(A) It does not indicate whether an investment should be accepted or rejected unless the payback period is compared with an arbitrary managerial target.

(B) The method ignores cash gene-ration beyond the payback period and this can be seen as more as a measure of liquidity than of profitability.

(C) This method makes no attempt to measure a percentage return on the capital invested and is often used in conjunction with other methods.

(D) All of the above

Answer:

(D) All of the above

Question 23.

When operating under a single-period capital-rationing constraint, you may first want to try selecting projects by descending order of their____in order to give yourself the best chance to select the mix of projects that adds most to the firm value.

(A) Profitability Index (PI)

(B) Net Present Value (NPV)

(C) Internal Rate of Return (IRR)

(D) Payback Period (PBP)

Answer:

(A) Profitability Index (PI)

Question 24.

What is the idea behind project-specific required rates of return for a firm or division?

(A) Different projects should have different required rates of return because they are not alike with respect to risk.

(B) Each firm should have a different required rate of return because firms are not alike with respect to risk and have been created historically by projects taken that differ with regards to risk.

(C) A division of the firm will always have a required rate of return different from the firm’s overall weighted average cost of capital because the risk of the division always differs from that of the firm.

(D) All of the above

Answer:

(A) Different projects should have different required rates of return because they are not alike with respect to risk.

Question 25.

Which of the following statements is correct regarding the internal rate of return (IRR) method?

(A) Each project has a unique internal rate of return.

(B) As long as you are not dealing with mutually exclusive projects, capi¬tal rationing, or unusual projects having multiple sign changes in the cash-flow stream, the interned rate of return method can be used with reasonable confidence.

(C) The internal rate of return does not consider the time value of money.

(D) The internal rate of return is rarely used by firms today because of the ease at which net present value is calculated.

Answer:

(B) As long as you are not dealing with mutually exclusive projects, capi¬tal rationing, or unusual projects having multiple sign changes in the cash-flow stream, the interned rate of return method can be used with reasonable confidence.

Question 26.

The concept of joint probability is used in the case of:

(A) Independent cash flows

(B) Uncertain cash flows

(C) Dependent cash flows

(D) Certain cash flows

Answer:

(C) Dependent cash flows

Question 27.

The decision-tree approach is used in:

(A) Proposals with longer life

(B) Sequential decisions

(C) Independent Cash flows

(D) Accept-Reject Proposal

Answer:

(B) Sequential decisions

Question 28.

The situation in which the company replaces existing assets with new assets is classified as

(A) Replacement projects

(B) New projects

(C) Existing projects

(D) Internal projects

Answer:

(A) Replacement projects

Question 29.

The investment proposal with the greatest relative risk would have:

(A) Highest standard deviation of net present value.

(B) Highest coefficient of variation of net present value.

(C) Highest expected value of net present value.

(D) Lowest opportunity loss.

Answer:

(B) Highest coefficient of variation of net present value.

Question 30.

The probability-tree analysis is best used when cash flows are expected to be:

(A) Independent over time.

(B) Risk-free.

(C) Related to the cash flows in previous periods.

(D) Known with certainty.

Answer:

(C) Related to the cash flows in previous periods.

Question 31.

You are considering two mutually exclusive investment proposals, project A and project B. B’s expected value of net present value is $1,000 less than that for A and A has less dispersion. On the basis of risk and return, you would say that:

(A) Project A dominates project B.

(B) Project B dominates project A.

(C) Project A is riskier and should offer greater expected value.

(D) Each project is high on one variable, so the two are basically equal.

Answer:

(A) Project A dominates project B.

Question 32.

If two projects are completely independent (or unrelated), the measure of the correlation between them is:

(A) 0

(B) 0.5,

(C) 1.0

(D) -1.0

Answer:

(A) 0

Question 33.

Consider the following two statements.

(I) Capital budgeting decisions are reversible in nature.

(II) An expansion decision is not a capital budgeting decision.

Select the correct answer from the options given below.

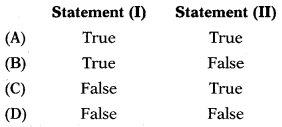

Answer:

(D)

Question 34.

Match List-I with List-II:

| List-I | List-II |

| A. Standard Deviation | 1. Government bond |

| B. Risk-free rate | 2. Capital budgeting |

| C. Linear Programming | 3. Risk |

| D. Capital Rationing | 4. Limited funds |

| 5. Coefficient of Variation |

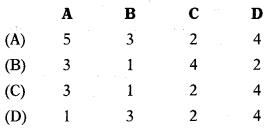

Select the correct answer from the options given below.

Answer:

(C)

Question 35.

Money Discount Rate is equal to:

(A) (1 + IR) × (1 + RDR) – 1

(B) (1 + IR) – (1 + RDR) – 1

(C) (1 + RDR) – (1 + IR) – 1

(D) (1 + RDR) + (1 + IR) – 1

Answer:

(A) (1 + IR) × (1 + RDR) – 1

Question 36.

Real Discount Rate is equal to:

(A) (1 + IR)(1 +MDR) – 1

(B) (1 +MDR) + (1 + IR) – 1

(C) (1 + MDR) ÷ (1 + IR) – 1

(D) (1 + MDR) – (1 + IR) – 1

Answer:

(C) (1 + MDR) ÷ (1 + IR) – 1

Question 37.

Consider the following statements:

(1) Expected value of cash flows is equal to the arithmetic average of the cash flows.

(2) In the case of capital budgeting, the higher the standard deviation better the project is.

(3) In the case of dependent cash flows, the risk is measured with reference to joint probabilities.

Select the correct statement.

(A) (1) False (2) False (3) False

(B) (1) False (2) True (3) True

(C) (1) True (2) True (3) False

(D) (1) False (2) False (3) True

Answer:

(D) (1) False (2) False (3) True

Question 38.

In the open-ended lease_____

(A) The seller of an asset leases back the same asset from the purchaser.

(B) The lease arrangement is made immediately after the sale of the asset with the amount of the payments and the time period specified.

(C) The lessee has the option of purchasing the assets at the end of the lease period.

(D) None of the above.

Answer:

(C) The lessee has the option of purchasing the assets at the end of the lease period.

Question 39.

Assume that a firm has accurately calculated the net cash flows relating to two mutually exclusive investment proposals. If the net present value of both proposals exceed zero and the firm is not under the constraint of capital rationing, then the firm should

(A) Calculate the IRRs of these investments to be certain that the IRRs are greater than the cost of capital.

(B) Compare the profitability index of these investments to those of other possible investments.

(C) Calculate the payback periods to make certain that the initial cash outlays can be recovered within an appropriate period of time.

(D) Accept the proposal that has the largest NPV since the goal of the firm is to maximize shareholder wealth and since the projects are mutually exclusive, we can only take one.

Answer:

(D) Accept the proposal that has the largest NPV since the goal of the firm is to maximize shareholder wealth and since the projects are mutually exclusive, we can only take one.

Question 40.

Which of the following statements is correct regarding the risk-adjusted discount rate (RADR) approach?

(A) Under the RADR approach, we should accept a project if its net present value (NPV) calculated using a risk-adjusted discount rate is positive.

(B) Adjusting the firm’s overall cost of capital upward is required if the project or group is of higher than average risk.

(C) Under the RADR approach, we would still compare a project’s interned rate of return (IRR) to the firm’s overall weighted-average cost of capital in order to decide acceptance/rejection.

(D) Adjusting the firm’s overall cost of capital downward is required if the project or group is of lower than average risk.

Answer:

(A) Under the RADR approach, we should accept a project if its net present value (NPV) calculated using a risk-adjusted discount rate is positive.

Question 41.

Which one of the following projects – A, B, C, or D – should be accepted? The expected return on the market is 16% and the risk-free rate is 6%.

(A) Project A, which has a beta of 0.50 and an expected return of 11.2%.

(B) Project B, which has a beta of 2.50 and expected to return 25.4%.

(C) Project C, which has a beta of 1.25 and expected to return 18.2%.

(D) Project D, which has abetaofl.00 and an expected return of 15.8%.

Answer:

(A) Project A, which has a beta of 0.50 and an expected return of 11.2%.

Question 42.

Damodhar is evaluating two conventional, independent capital budgeting projects (X & Y) by making use of the risk-adjusted discount rate (RADR) method of analysis. Projects X & Y have internal rates of return of 1696 & 1296, respectively. RADR appropriate to Project X is 1896, while Project Y’s RADR is only 1096. The company’s overall, weighted-average cost of capital is 1496. Damodhar should –

(A) Accept Project X and accept Project Y

(B) Accept Project X and reject Project Y

(C) Reject Project X and accept Project Y

(D) Reject Project X and reject Project Y

Answer:

(C) Reject Project X and accept Project Y

Question 43.

Two mutually exclusive projects are being considered. Neither project will be repeated again in the future after their current lives are complete. There exists a potential problem through – the expected life of the first project is one year and the expected life of the second project is three years. This has caused the NPV and IRR methods to suggest different project preferences. What technique can be used to help make a better decision in this scenario?

(A) Rely on the NPV method and make your choice as it will tell you which one is best.

(B) Use the common-life technique to replicate the one-year project three times and recalculate the NPV and IRR for the one-year project.

(C) Ignore the NPV technique and simply choose the highest IRR since managers are concerned about maximizing returns.

(D) In this situation, we need to rely on the profitability index (PI) method and choose the one with the highest PI.

Answer:

(A) Rely on the NPV method and make your choice as it will tell you which one is best.

Question 44.

In the Certainty Equivalent Approach, the first step is to Convert uncertain cash flows to certain cash flows by multiplying it with the CE Factor, and step two is –

(A) Discount the certain cash flows at the IRR to arrive at NP.

(B) Discount the certain cash flows at WACC rate to arrive at NP.

(C) Discount the certain cash flows at the risk-free rate to arrive at NP.

(D) Discount the certain cash flows at the market rate of return to arrive at NP

Answer:

(C) Discount the certain cash flows at the risk-free rate to arrive at NP.

Question 45.

Which of the following is the correct formula to calculate the risk-adjusted discount rate?

(A) Rt + β (Rm – Rf)

(B) Ke × β(Rm – Rf)

(C) (Rm – Rf) + (Ke – Rf)

(D) SD (σ) ÷ NPV

Answer:

(A) Rt + β (Rm – Rf)

Question 46.

You are considering two projects namely Project X and Project Y.

Project X has a low standard deviation but a high coefficient of variation as compared to Project Y.

Project Y has a high standard deviation but a low coefficient of variation as compared to Project X.

Which project will you select?

(A) Project X only

(B) Both Project X & Project Y

(C) Neither Project X nor & Project Y

(D) Project Y only

Answer:

(D) Project Y only

Question 47.

The coefficient of variation of net present value measures the

(A) Total risk of the project

(B) Relative risk of the project

(C) Highest expected value of net present value

(D) Market’risk of the project

Answer:

(B) Relative risk of the project

Question 48.

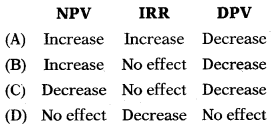

Vayu Ltd. uses the Net Present Value (NPV) method, the Internal Rate of Return (IRR) method, and Discounted Payback Period (DPP) to appraise its new investment. An investment opportunity was recently appraised using each of these methods and was estimated to provide a positive NPV of ₹ 1.5 million, an IRR of 15%, and a DPP of 3 years. Later, it was discovered that the cost of capital of the company was lower than had been previously estimated. What would be the effect on the figures provided by each investment appraisal method of taking account of the lower cost of capital?

Answer:

(C)

Question 49.

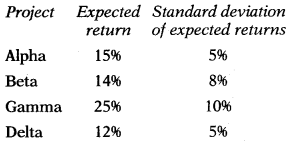

A risk-averse investor is considering four mutually exclusive investments, which have the following characteristics:

Which two of the above investments will the investor immediately reject?

(A) Alpha & Beta

(B) Alpha & Gamma

(C) Gamma & Delta

(D) Beta & Delta

Answer:

(C) Gamma & Delta

Question 50.

An approach to examining project risk occurs when the manager applies a probability distribution to factors such as market size, selling price, fixed and variable costs, and the useful life of the project. The manager then runs a computer program to determine the project worth by randomly selecting values for each variable, within the limits assigned. This is done numerous times to generate a complete risk-return analysis.

(A) Simulation

(B) Probability-tree

(C) Firm-portfolio

(D) Market risk

Answer:

(A) Simulation

Question 51.

A ____approach to examine project risk occurs when cash flows are arranged such that a cash flow in one period leads to several possible cash flow outcomes in the subsequent period. Each individual cash flow in the subsequent period then leads to several possible cash flow outcomes in its subsequent period. This process continues numerous times to generate a complete risk-return graphic.

(A) Simulation

(B) Probability-tree

(C) Firm-portfolio

(D) Market risk

Answer:

(B) Probability-tree

Question 52.

The probability in subsequent periods that is conditioned on what has occurred earlier is referred to as the –

(A) Initial probability

(B) Conditional probability

(C) Joint probability

(D) None of the above

Answer:

(B) Conditional probability

Question 53.

A firm that ignores risk differences (does not adjust for risk) when choosing new investment projects will generally –

(A) Reduce the overall risk of the firm over time

(B) Not change the overall risk of the firm over time

(C) Increase the overall risk of the firm over time

(D) None of the above

Answer:

(C) Increase the overall risk of the firm over time

Question 54.

If two projects are completely and positively linearly dependent (or positively related), the measure of the correlation between them is

(A) 0

(B) +0.5

(C) +1

(D) -T

Answer:

(C) +1

Question 55.

The probability associated with the first portion of a complete branch of the probability tree is referred to as the

(A) Initial probability

(B) Conditional probability

(C) Joint probability

(D) None of the above

Answer:

(A) Initial probability

Question 56.

The probability that a particular sequence of cash flows might occur is referred to as the

(A) Initial probability

(B) Conditional probability

(C) Joint probability

(D) None of the above

Answer:

(C) Joint probability

Question 57.

What technique is best used when cash flows are related to cash flows in previous periods?

(A) Cash flow analysis

(B) Risk aversion analysis

(C) Probability-tree analysis

(D) None of the above

Answer:

(C) Probability-tree analysis

Question 58.

When evaluating the risk and return of a project using the probability tree approach, what is the appropriate rate to discount each sequence of cash flows in the tree?

(A) Zero

(B) Risk-free rate

(C) Cost of capital

(D) Firm’s historical return on its stock

Answer:

(B) Risk-free rate

Question 59.

Consider the following two statements concerning finance leasing.

Statement I:

The lessor is responsible for the maintenance and servicing of the asset.

Statement II:

The period of the lease will cover all, or substantially all, of the useful economic life of the leased asset.

Select the correct answer from the options given below:

Answer:

(C)

Question 60.

Which of the following relate to finance leases as opposed to operating leases?

1. At the inception of the lease the present value of the minimum lease payments amounts to at least substantially all of the fan- the value of the leased asset.

2. Ownership of the asset remains with the lessor for the entire lease period.

3. Asset acquired under a finance lease is shown as an asset in the balance sheet of the lessee.

Select the correct answer from the options given below:

(A) 2 only

(B) 1 and 3 only

(C) 1 and 2 only

(D) 2 and 3 only

Answer:

(B) 1 and 3 only

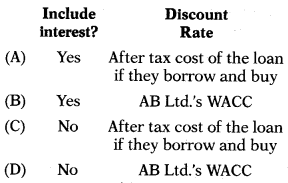

Question 61.

AB Ltd. is considering either leasing an asset or borrowing to buy it and is attempting to analyze the options by calculating the NPV of each. When comparing the two, AB Ltd. is uncertain whether they should include interest payments in their option to ‘borrow and buy’ as it is a future, incremental cash flow associated with that option. They are also uncertain which discount rate to use in the NPV calculation for the lease option. How should AB Ltd. treat the interest payments and what discount rate should they use?

Answer:

(C)

Question 62.

Consider the following two statements:

1. Risk analysis gives management better information about the possible outcomes that may occur so that management can use their judgment and experience to accept investment or reject it.

2. In relation to capital budgeting, sensitivity analysis deals with the consideration of the sensitivity of the NPV to different variables contributing to the NPV.

Select the correct answer from the options given below:

(A) Both Statements are false

(B) Statement 1 is true while Statement 2 is false.

(C) Statement 2 is true while Statement 1 is false.

(D) Both Statements are true

Answer:

(D) Both Statements are true

Question 63.

Which of the following is the advantage of sensitivity analysis?

(A) It compels the decision-maker to identify the variables which affect the cash flow forecasts. This helps him in understanding the investment project in totality.

(B) It indicates the critical variables for which additional information may be obtained. The decision-maker can consider actions that may help in strengthening the “weak spots” in the project.

(C) It helps to expose inappropriate forecasts and thus guides the decision-maker to concentrate on relevant variables.

(D) All of the above.

Answer:

(D) All of the above.

Question 64.

Which of the following is the correct formula to calculate the coefficient of variation?

(A) Standard deviation ÷ Expected NPV

(B) Standard deviation × Expected NPV

(C) Correlation × SD ÷ Expected NP

(D) None of the above

Answer:

(A) Standard deviation ÷ Expected NPV

Question 65.

Select the odd one.

(A) Certainty Equivalent Approach

(B) Expected Net Present Value

(C) Simulation

(D) ARR

Answer:

(D) ARR

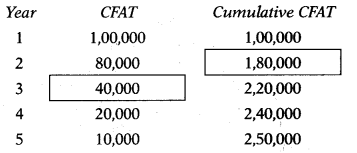

Question 66.

A project requires initial investment of ₹ 2,00,000 and estimated to generate cash flow after tax of ₹ 1,00,000, ₹ 80,000, ₹ 40,000, ₹ 20,000 & ₹ 10,000 in next 5 years. What is the payback period of the project?

(A) 3 years and 4 months

(B) 2 years and 6 months

(C) 4 years and 2 months

(D) 2 years and 8 months

Hint:

Payback period = 2 years + \(\frac{2,00,000-1,80,000}{40,000}\) × 12

Payback period = 2 years & 6 months

Answer:

(B) 2 years and 6 months

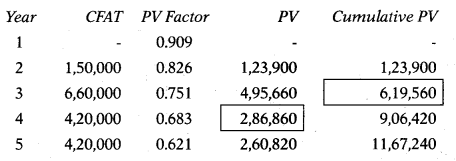

Question 67.

Y Ltd. is considering a project which requires an initial investment of ₹ 6,75,000. The cost of capital is 10%. Estimated cash flow after tax are as follows:

| Year 1 | – |

| Year 2 | 1,50,000 |

| Year 3 | 6,60,000 |

| Year 4 | 4,20,000 |

| Year 5 | 4,20,000 |

What is the project’s discounted payback period?

(A) 3 years & 7.58 months

(B) 4 years & 4.12 months

(C) 3 years & 2.32 months

(D) 4 years & 8.11 months

Hint:

Discounted payback period = 3 years + \(\frac{6,75,000-6,19,560}{2,86,860}\) × 12

= 3 years & 232 months

Answer:

(C) 3 years & 2.32 months

Question 68.

Rakesh Ltd. is considering investing in one of four projects for which an analyst has calculated payback period reciprocal’ as 25%, 40%, 50% & 75% respectively for Project P, Q, R & S. Which project will be selected on ‘payback period’ method of capital budgeting?

(A) Project R

(B) Project P

(C) Project S

(D) Project Q

Hint:

Payback period reciprocal = \(\frac{1}{\text { Payback Period }}\) × 100

The payback period of the Project P, Q, R & S project will be 4 years, 2.5 years, 2 years & 1.33 years. Since the payback period of Project, S is minimum; it will get selected.

Answer:

(C) Project S

Question 69.

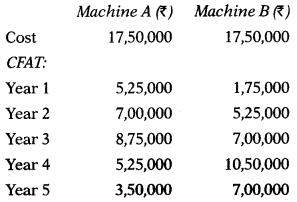

Ramsey Ltd. wants to select one machine out of two. Data for machines are given below:

The machine has to be written off over a period of 5 years by SLM.

The company will select –

(A) Machine A because its ARR is 15% while that of Machines B is 14%

(B) Machine B because it has higher average CFAT

(C) Machine A because it has higher average CFAT

(D) Machine B because its ARR is 16% while that of Machine A is 14%

Hint:

ARR of Machine A = \(\frac{2,45,000}{17,50,000}\) × 100 = 14%

ARR of Machine B = \(\frac{2,80,000}{17,50,000}\) × 100 = 16%

Answer:

(D) Machine B because its ARR is 16% while that of Machine A is 14%

Question 70.

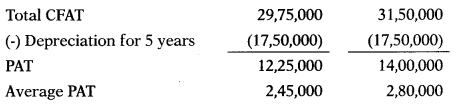

The following data is available for Project A whose initial investment is ₹ 50,000 and salvage value after 5 years is ₹ 3,750.

| Year | CFAT (₹) |

| 1 | 25,000 |

| 2 | 20,000 |

| 3 | 10,000 |

| 4 | 10,000 |

| 5 | 1,250 |

What is the NPV of Project A if the Ke of the company is 10%? Ignore taxation.

(A) ₹ 5,710

(B) ₹ 6,690

(C) ₹ 6,800

(D) ₹ 7,216

Hint:

CFAT for 5th year = 1 250 + 3,750 = 5,000

Answer:

(B) ₹ 6,690

Question 71.

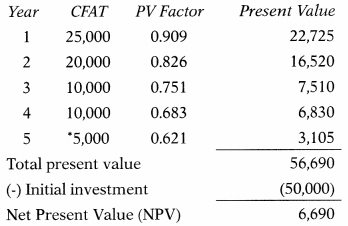

A Machine requires an initial investment of ₹ 40,000 and expected to generate a cash flow of ₹ 8,400, ₹ 14,300 & ₹ 32,800 in the next 3 years. The applicable tax rate is 30% and the WACC of the company is 12%. The company will select machine because –

(A) It has a positive NPV of ₹ 2,522

(B) Its profitability index is 1.653 which is more than 1.

(C) Its IRR is between 14% to 15% which is more than the WACC of the company.

(D) All of the above

Hint:

IRR = 12 + \(\frac{2,252}{2,252+1,898}\) × 5

= 12 + \(\frac{2,252}{4,150}\) × 5

= 12 + 2.71

= 14.71%

Answer:

(C) Its IRR is between 14% to 15% which is more than WACC of the company.

Question 72.

The profitability index of Project X is 1.20167 when its cash flow is discounted at 12%. The initial investment in the project was ₹ 1,50,000. This project generates equal cash flow over five years time. How much cash flow will be generated by the project each year?

(A) ₹ 50,000

(B) ₹ 40,000

(C) ₹ 60,500

(D) ₹ 40,897

Hint:

Profitability Index = \(\frac{\text { Total present value }}{\text { Initial investment }}\)

1.20167 = \(\frac{\text { Total present value }}{1,50,000}\)

Total present value 1,50,000 × 1.20167 = 1,80,250

Let the cash flow of each year be x.

x × 3.605 1,80,250

x= 1,80,250/3.605 50,000

Answer:

(A) ₹ 50,000

Question 73.

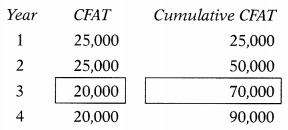

LMN Corporation is considering an investment that will cost ₹ 80,000 and have a useful life of 4 years. During the first 2 years, the net incremental after-tax cash flows are ₹ 25,000 per year and for the last 2 years, they are ₹ 20,000 per year. What is the payback period for this investment?

(A) 3.2 year

(B) 3.5 year

(C) 4.0 year

(D) Cannot be determined with this information.

Hint:

Payback period = 3 years + \(\frac{80,000-70,000}{20,000}\) × 12

= 3 years & 6 months

= 3.5 years

Answer:

(B) 3.5 year

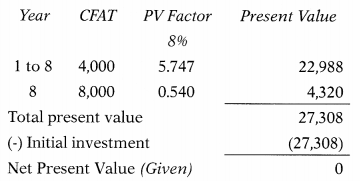

Question 74.

Bhaskar Ltd. estimated that a proposed project’s 8-year net cash benefit will be ₹ 4,000 per year for years 1 to 8, with an additional terminal benefit of ₹ 8,000 at the end of the eighth year. Assuming that these cash inflows satisfy exactly the required rate of return of 8 percent, the project’s initial cash outflow is closest to which of the following four possible answers?

(A) ₹ 27,308

(B) ₹ 25,149

(C) ₹ 14,851

(D) ₹ 40,000

Hint:

Answer:

(A) ₹ 27,308

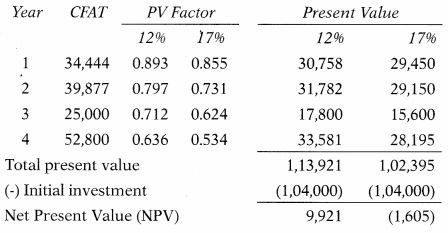

Question 75.

A project has the following cash inflows ₹ 34,444, ₹ 39,877, ₹ 25,000 & ₹ 52,800 for years 1 to 4, respectively. The initial cash outflow is ₹ 1,04,000. Which of the following four statements is correct concerning the project internal rate of return (IRR)?

(A) The IRR is less than 10%.

(B) The IRR is greater than 10%, but less than 14%.

(C) The IRR is greater than 14%, but less than 18%.

(D) The IRR is greater than or equal to 18%.

Hint:

IRR = 12 + \(\frac{9,921}{9,921+1,605}\) × 5

= 12 + \(\frac{9,921}{11,526}\) × 5

= 12 + 4.30

= 16.30%

Answer:

(C) The IRR is greater than 14%, but less than 18%.

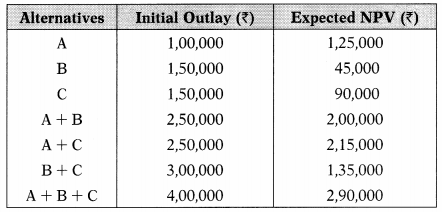

Question 76.

A company is considering three methods of attracting customers to expand its business by undertaking –

(A) advertising campaign; (B) display of neon signs; and (C) direct delivery service. The initial Outlay for each alternative is as under:

A ₹ 1,00,000

B ₹1,50,000

C ₹ 1,50,000

If A is carried out, but not B, it has an NPV of ₹ 1,25,000. If B is done, but not A, B has an NPV of ₹ 45,000. However, if both are done, then NPV is ₹ 2,00,000. The NPV of the delivery system C is ₹ 90,000. Its NPV is not dependent on whether A or B is adopted and the NPV of A or B does not depend on whether C is adopted. Which of the investments should be made by the company if the budgeted amount is only ₹ 2,50,000?

(A) The firm should adopt mode A + B only. The outlay would be ₹ 12,50,0 & the total NPV would be ₹ 2,00,000

(B) The firm should adopt mode B + C only. The outlay would be ₹ 3,00,000 & the total NPV would be ₹ 1,35,000

(C) The firm should adopt mode A + G only. The outlay would be ₹ 12,50,0 & the total NPV would be ₹ 2,15,000.

(D) None of the above

Hint:

No Budget Constraint: The Firm should adopt all three modes of attracting customers. Its outlay, in this case, would be 400,000 and the expected NPV would be 290,000.

Budget Constraint: If the budget constraints are limited to 2,50,000 then the firm should adopt mode A + C only. In this case, the outlay would be 2,50,000 and the total NPV would be 2,15,000.

Answer:

(C) The firm should adopt mode A + G only. The outlay would be 12,50,0 & the total NPV would be ₹ 2,15,000.

Question 77.

A company is faced with the decision to purchase or acquire on lease a machine. The cost of the machine is ₹ 2,53,930. The asset can be financed by taking a loan on which interest is payable @15% and the loan will be paid in 5 equal installments inclusive of interest. The tax rate is 40%. Assume loan installment is payable at the end of each year. What will be the loan installment amount for each year?

(A) ₹ 75,800

(B) ₹ 65,278

(C) ₹ 67,800

(D) ₹ 66,824

Hint:

Investment cost = \(\frac{\text { Investment cost }}{\text { Annuity factor of } 15 \% \text { for } 5 \text { years }}=\frac{2,53,930}{3.35}\) = 75,800

Answer:

(A) ₹ 75,800

Question 78.

X Ltd. faced with the decision to purchase or acquire on lease a machine. The cost of the machine is ₹ 5,07,860. The asset can be financed by taking a loan on which interest is payable @15% and the loan will be paid in 5 equal installments inclusive of interest. The tax rate is 40%. Assume loan installment is payable at the beginning of the year. What will be the loan installment amount for each year?

(A) ₹ 1,19,778

(B) ₹ 1,29,580

(C) ₹ 1,31,570

(D) ₹ 1,45,452

Hint:

Instalment Amount = \(\frac{\text { Investment cost }}{1+\text { Annuity factor of 15% for 4 years }}=\frac{5,07,860}{3.86}\) = 1,31,570

Answer:

(C) ₹ 1,31,570

Question 79.

A company can obtain an asset on lease by paying 5 equal lease rentals annually. Such lease rentals are payable at the end of the year. The leasing company desires a return of 10% on the gross value of the asset. The tax rate is 40%. The cost of capital is 9%. The cost of the asset is ₹ 7,61,790. Calculate the lease rental payable by the company each year.

(A) ₹ 2,01,000

(B) ₹ 1,95,833

(C) ₹ 1,98,563

(D) ₹ 2,10,000

Hint:

Lease Rental = \(\frac{\text { Cost of asset }}{\text { Annuity factor of } 10 \% \text { for } 5 \text { years }}=\frac{7,61,790}{3.79}\) = 2,01,000

Answer:

(A) ₹ 2,01,000

Question 80.

A company can obtain an asset on lease by paying 5 equal lease rentals annually. Such lease rentals are payable at the beginning of the year. The leasing company desires a return of 10% on the gross value of the asset. The tax rate is 40%. The cost of capital is 9%. The cost of the asset is ₹ 7,61,790. Calculate the lease rental payable by the company each year.

(A) ₹ 1,79,667

(B) ₹ 1,80,600

(C) ₹ 1,87,504

(D) ₹ 1,82,683

Hint:

Lease Rental = \(\frac{\text { Cost of asset }}{1+\text { Annuity factor of } 10 \% \text { for } 4 \text { years }}=\frac{7,61,790}{4.17}\) = 1,82,683

Answer:

(D) ₹ 1,82,683

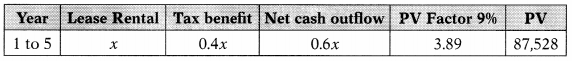

Question 81.

Z Ltd. can acquire a machine by taking a 15% loan or on a lease basis from a leasing company. The cost of the machine is ₹ 1,26,965. The tax rate is 40%. The leasing company desires a return of 10% on the gross value of the asset. The present value of cash flow under buying option is ₹ 87,528. What should be the annual lease rental to be charged by the leasing company to match the loan option?

(A) ₹ 37,900

(B) ₹ 37,805

(C) ₹ 37,424

(D) ₹ 37,501

Hint:

PV Factor = 15 (1 – 0.4) = 9%

Let the lease rental be ‘x’.

0.6x × 3.89 = 87,528

2.334x = 87,528

x = 37,501

Answer:

(D) ₹ 37,501

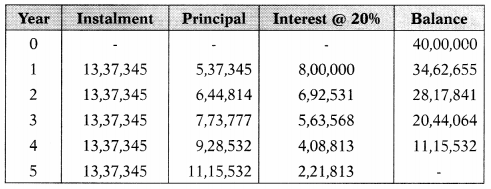

Question 82.

Agrani Ltd. is in the business of manufacturing bearings. Some more product lines are being planned to be added to the existing system. The cost of the machine is ₹ 40,00,000 having a useful life of 5 years with a salvage value of ₹ 8,00,000. The full purchase value of the machine can be financed by a 20% loan repayable in 5 equal installments falling due at the end of each year. Calculate the figure of interest payable at the end of the 5th year.

(A) ₹ 4,08,831

(B) ₹ 2,08,138

(C) ₹ 2,21,813

(D) ₹ 3,12,318

Hint:

Loan Amount = \(\frac{\text { Investment cost }}{\text { Annuity factor of } 20 \% \text { for } 5 \text { years }}=\frac{40,00,000}{2.991}\) = 13,37,345

Answer:

(C) ₹ 2,21,813

Question 83.

Following data are furnished by Lalita Leasing Ltd.:

| Investment cost | ₹ 1,250 lakhs |

| Primary lease term | 5 Years |

| Residual value | NIL |

| The pre-tax required rate of return | 24% |

The company wants to charge equated lease rentals ie. the equal amount of lease rental per year. Is lease rental payable at the end of each year =?

(A) ₹ 437.35 lakh

(B) ₹ 457.53 lakh

(C) ₹ 453.73 lakh

(D) ₹ 455.37 lakh

Hint:

Lease rentals = \(\frac{\text { Investment cost }}{\text { Annuity factor for } 5 \text { years of } 24 \%}=\frac{1,250}{2.745}\) = 455.37 lakh

Answer:

(D) ₹ 455.37 lakh

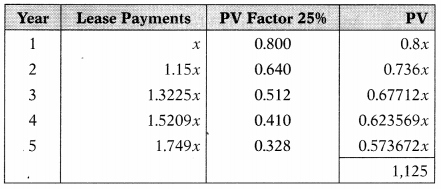

Question 84.

Following data are furnished by XY Leasing Ltd.:

| Investment cost | ₹ 1,125 lakhs |

| Primary lease term | 5 Years |

| Residual value | NIL |

| The pre-tax required rate of return | 25% |

The company wants to charge stepped lease rentals (an annual increase of 15%).

Lease rental for the 3rd year =?

(A) ₹ 436.26 lakh

(B) ₹ 501.68 lakh

(C) ₹ 379.36 lakh

(D) ₹ 225.25 lakh

Hint:

Let the lease rental for the first year be ‘x’.

0.8x + 0.736x + 0.67712x + 0.623569x + 0.573672x = 1,125

3.410361x = 1,125

x = 329.88 lakh

Thus, stepped lease rentals will be as follows:

| Year | Lease Payments |

| 1 | 329.88 |

| 2 | 379.36 |

| 3 | 436.26 |

| 4 | 501.68 |

| 5 | 576.93 |

Answer:

(A) ₹ 436.26 lakh

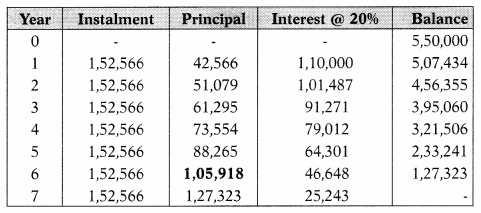

Question 85.

Apple Ltd. has decided to invest in earth-moving equipment which costs ₹ 5,50,000. The company can take it on lease for 7 years at ₹ 90,000 p.a. payable in advance. Alternatively, it can borrow at 20%. An asset can be written off over 6 years under the straight-line method of depreciation. Asset’s useful life is 7 years. In the terminal year, the asset will be sold for ₹ 40,000. The tax rate is 30%. In the 6th year, the principal amount contained in the loan installment amount will be___

(A) ₹ 88,265

(B) ₹ 1,05,918

(C) ₹ 1,27,323

(D) ₹ 1,08,426

Hint:

Loan Amount = \(\frac{\text { Investment cost }}{\text { Annuity factor of } 20 \% \text { for } 7 \text { years }}=\frac{5,50,000}{3.605}\) = 1,52,566

Answer:

(B) ₹ 1,05,918

Question 86.

A company buys a machine for ₹ 10,000 and sells it for ₹ 2,000 at the end of year 3. Running costs of the machine are:

Year 1 = ₹ 3,000

Year 2 = ₹ 5,000

Year 3 = ₹ 7,000

If a series of machines are brought, run, and sold on an infinite cycle of replacements, what is the equivalent annual cost of the machine if the discount rate is 10%?

(A) ₹ 22,114

(B) ₹ 8,288

(C) ₹ 246

(D) ₹ 7,371

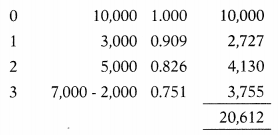

Hint:

20,612/2.487 = 8,288

Answer:

(B) ₹ 8,288

Question 87.

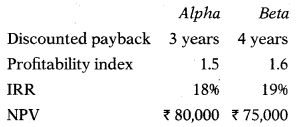

T Ltd. is considering an investment in one of two mutually exclusive projects. The company is committed to maximizing the wealth of its shareholders. Details of each project, which have the same level of risk, are as follows:

Which project should be selected and for what reason?

(A) Project Alpha because it has the shorter discounted payback period

(B) Project Alpha because it has the higher net present value

(C) Project Beta because it has the higher profitability index

(D) Project Beta because it has a higher internal rate of return.

Answer:

(B) Project Alpha because it has the higher net present value

Question 88.

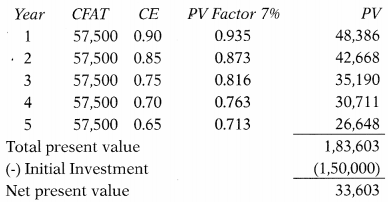

Taxmann is considering taking a new project. Management uses the Certainty Equivalent (CE) approach to evaluate the projects. The project is expected to generate a cash flow of ₹ 57,500 for the next 5 years. CE Factors are 0.90,0.85,0.75,0.70 & 0.65. Projects require an initial investment of ₹ 1,50,000. The company’s cost of capital is 12% and the risk-free borrowing rate is 7%. What is the NPV of this project?

(A) ₹ 24,486

(B) ₹ 38,103

(C) ₹ 33,603

(D) ₹ 27,542

Hint:

Answer:

(C) ₹ 33,603

Question 89.

The present value at year 3 is ₹ 35,190 by using CE Approach. CE Factor is 0.75. The risk-free rate is 7%. The cost of capital is 11%. What is the cash flow of year 3?

(A) ₹ 57,500

(B) ₹ 55,500

(C) ₹ 52,500

(D) ₹ 56,500

Answer:

(A) ₹ 57,500

Question 90.

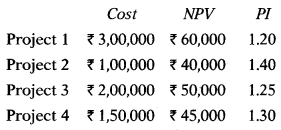

A company has 15,00,000 available for investment and is considering the following four divisible, but not repeatable, projects to invest in:

What is the maximum net present value the company can generate from its investment?

(A) ₹ 1,95,000

(B) ₹ 1,45,000

(C) ₹ 1,35,000

(D) ₹ 1,10,000

Answer:

(C) ₹ 1,35,000

Question 91.

X Ltd. is considering to start a new project for which it has gathered following datar

| Cash Flow | Probability |

| 1,08,000 | 0.1 |

| 2,16,000 | 0.4 |

| 4,32,000 | 0.4 |

| 5,40,000 | 0.1 |

Calculate the expected cash flow.

(A) ₹ 3,42,000

(B) ₹ 3,18,000

(C) ₹ 3,24,000

(D) ₹ 3,32,000

Answer:

(C) ₹ 3,24,000

Question 92.

X Ltd. is considering to start a new project for which it has gathered the following data:

| NPV (₹ in lakh) | Probability |

| 32 | 0.4 |

| 44 | 0.4 |

| 57 | 0.2 |

Compute the risk associated with the project.

(A) 89.88

(B) 9.30

(C) 11.62

(D) 8.97

Answer:

(B) 9.30

Question 93.

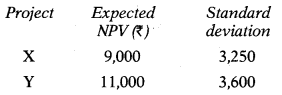

A company is considering Projects X and Y with the following information:

Which project will you recommend and why?

(A) Project Y as its higher expected NPV

(B) Project X as its coefficient of variation is high

(C) Project Y as its coefficient of variation is less

(D) Project X as its risk ie. standard deviation is less.

Answer:

(C) Project Y as its coefficient of variation is less

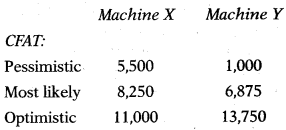

Question 94.

Laxmi Ltd. is considering a proposal to buy one of the two machines. Each machine requires an investment of 134,375 and has a useful life of 12 years. Estimates associated with these two machines are as follows:

The company’s cost of capital is 15% and the risk-free borrowing rate is 6%. Which of the following statement is correct?

(A) The company will select Machine X as its NPV is high in an optimistic scenario

(B) The company will select Machine Y as its NPV is high in an optimistic scenario

(C) Purchasing Machine Y will be riskier as NPV is negative as high as ₹ 7,523 while if Machine X is purchased, the NPV can be negative only ₹ 2,980.

(D) Purchasing Machine Y will be riskier as NPV is negative as high as ₹ 28,954 while if Machine X is purchased, the NPV can be negative only ₹ 4,560.

Answer:

(D) Purchasing Machine Y will be riskier as NPV is negative as high as ₹ 28,954 while if Machine X is purchased, the NPV can be negative only ₹ 4,560.

Question 95.

The following data is available for Project Q:

| NPV (₹ in Crore) | Probability |

| 15 | 0.2 |

| 30 | 0.3 |

| 60 | 0.3 |

| 75 | 0.2 |

The project requires an initial investment of ₹ 180 Crore. Calculate the profitability index of Project Q.

(A) 0.25

(B) 1.25

(C) 1.35

(D) 1.45

Answer:

(B) 1.25

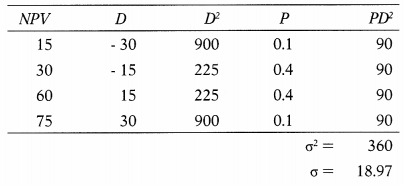

Question 96.

The following data is available for Project P:

| NPV (₹ in Crore) | Probability |

| 15 | 0.1 |

| 30 | 0.4 |

| 60 | 0.4 |

| 75 | 0.1 |

Calculate co-efficient of variation for Project P.

(A) 0.42

(B) 0.43

(C) 0.44

(D) 0.45

Hint:

Expected NPV = 45

Coefficient of variation = \(\frac{\sigma}{\overline{\mathrm{NPV}}}=\frac{18.97}{45}\) = 0.42

Answer:

(A) 0.42

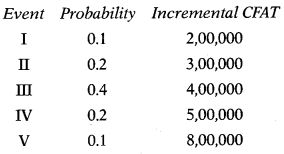

Question 97.

B Ltd. is considering the renovation of its one of the department. The renovation will cost 110 lakh. Its CFAT sensitive to various events as shown below:

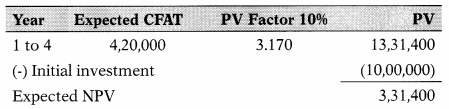

The company estimates that the probability distribution of incremental CFAT will exists for 4 years. The company’s cost of capital is 10%. What is the project expected NPV?

(A) ₹ 3,41,300

(B) ₹ 3,13,400

(C) ₹ 3,31,400

(D) ₹ 3,00,340

Hint:

Expected annual incremental CFAT = 4,20,000

Answer:

(C) ₹ 3,31,400

Question 98.

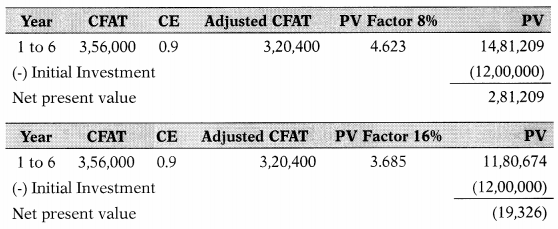

A project is expected to generate a CFAT of ₹ 3,56,000. Other data relating to the project are as follows:

Useful life = 6 years.

Risk free rate = 8%

Certainty factor = 0.9 Tax rate = 35%

Initial investment = ₹ 12,00,000.

Depreciation Method = SLM.

Calculate risk-adjusted IRR of the project using rates of 8% & 16%.

(A) 14.62%

(B) 18.51%

(C) 16.47%

(D) 15.49%

Hint:

IRR = 8 + \(\frac{2,81,209}{2,81,209+19,326}\) × 8

= 8 + \(\frac{2,81,209}{3,00,535}\) × 8

= 8 + 7.49

= 15.49% (Approximate)

Answer:

(D) 15.49%

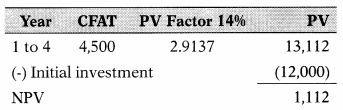

Question 99.

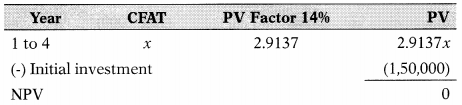

Raja & Co. desires to take a project whose cost is t 12,000 and useful life is 4 years. Expected annual cash flows are t 4,500 p.a. Cost of capital is 14%. Calculate the sensitivity of the project cost in percentage given that:

PVAF(14%4): 2.9137

(A) 10%

(B) 8.72%

(C) 12.56%

(D) 9.27%

Hint:

Margin for initial outlay = \(\frac{1,112}{12,000}\) × 100 = 9.27%

Answer:

(D) 9.27%

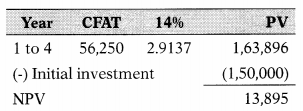

Question 100.

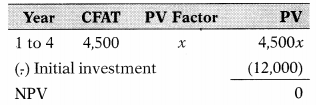

Following forecasts are made about a proposal which is being evaluated by a firm:

Initial outlay: ₹ 1,50,000

Life: 4 years

CFAT: ₹ 56,250

PVAF(14%, 3): 2.3216

PVAF(14%, 4): 2.9137

Calculate the sensitivity of the annual cash flows.

(A) 8.48%

(B) 9.32%

(C) 7.77%

(D) 8.84%

Hint:

Let the annual cash inflow be ‘x’.

2.9137x- 1,50,000 = 0

2.9137x = 1,50,000

x = 51,481

The CFAT can decrease from the present level of ₹ 56,250 to ₹ 51,481 before NPV becomes zero. So, the CFAT has a margin of ₹ 4,769.

Margin for CFAT = \(\frac{4,769}{56,250}\) × 100 = 8.48%

Answer:

(A) 8.48%

Question 101.

Rani & Co. desires to take a project whose cost is ₹ 12,000 and useful life is 4 years. Expected annual cash flows are t 4,500 p.a. Cost of capital is 14%. Calculate the sensitivity of the ‘cost of capital in percentage given that:

PVAF(14%, 4): 2.9137

PVAF(18%, 4): 2.6667

(A) 29%

(B) 22%

(C) 22.22%

(D) 24.64%

Hint:

Let the discount factor be ‘x’.

4,500x- 12,000 = 0

4,500x = 12,000

x = 2.6667

The PVAF 2.6667 is found for 4 years in the 18% column in the PVAF table. Thus, the discount rate can increase from the present level of 14% to 18% before the NPV becomes zero. Therefore, there is a margin of 4%(18% – 14%)

or 29% (i.e. 4/14 × 100).

Answer:

(A) 29%

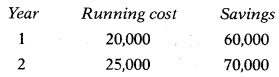

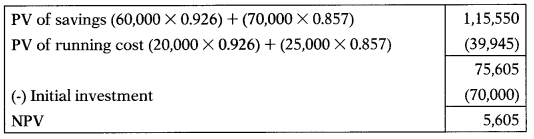

Question 102.

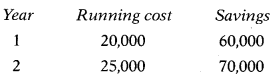

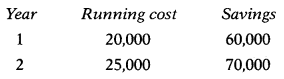

X Ltd. is considering a project with the following cash flow:

Cost of the plant: 70,000

The cost of capital is 8%. Measure the sensitivity of the project to the change in the level of plant cost.

PVAF(8%, 1): 0.926

PVAF (8%, 2): 0.857

(A) 8.92%

(B) 7.50%

(C) 9.16%

(D) 8.00%

Hint:

Margin for initial outlay = \(\frac{5,605}{70,000}\) × 100 = 8%

If the present value of running cost increases by 5,605 the NPV will become zero. Therefore sensitivity for running cost is –

\(\frac{5,605}{39,945}\) × 100 = 14.0396

If the present value of savings decreases by 5,605 the NPV will become zero. Therefore sensitivity for savings is –

\(\frac{5,605}{1,15,550}\) × 100 = 4.85%

Answer:

(D) 8.00%

Question 103.

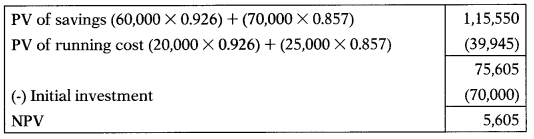

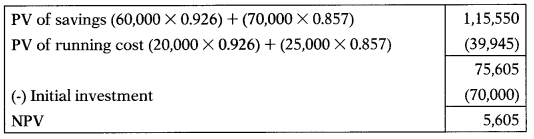

Y Ltd. is considering a project with the following cash flow:

Cost of the plant: 70,000

The cost of capital is 8%. Measure the sensitivity of the project to the change in the level of running cost.

PVAF (8%1): 0.926 PVAF(8% 2- 0.857

(A) 15.06%

(B) 13.07%

(C) 14.03%

(D) 12.08%

Hint:

Margin for initial outlay = \(\frac{5,605}{70,000}\) × 100 = 8%

If the present value of running cost increases by 5,605 the NPV will become zero. Therefore sensitivity for running cost is –

\(\frac{5,605}{39,945}\) × 100 = 14.0396

If the present value of savings decreases by 5,605 the NPV will become zero. Therefore sensitivity for savings is –

\(\frac{5,605}{1,15,550}\) × 100 = 4.85%

Answer:

(C) 14.03%

Question 104.

Z Ltd. is considering a project with the following cash flow:

Cost of the plant: 70,000

The cost of capital is 8%. Measure the sensitivity of the project to the change in the level of savings.

PVAF(8%, 1): 0.926

PVAF (8%, 2): 0.857

(A) 3.58%

(B) 4.85%

(C) 8.54%

(D) 6.78%

Hint:

Margin for initial outlay = \(\frac{5,605}{70,000}\) × 100 = 8%

If the present value of running cost increases by 5,605 the NPV will become zero. Therefore sensitivity for running cost is –

\(\frac{5,605}{39,945}\) × 100 = 14.0396

If the present value of savings decreases by 5,605 the NPV will become zero. Therefore sensitivity for savings is –

\(\frac{5,605}{1,15,550}\) × 100 = 4.85%

Answer:

(B) 4.85%

Question 105.

A project has an expected NPV of 1,22,000, Its coefficient of variation is 0.73 77. The risk-free rate is 8% and the cost of capital is 10%. What is the standard deviation of the project?

(A) 1,00,000

(B) 80,000

(C) 90,000

(D) 88,889

Hint:

1,22,000 × 0.7377 = 89,999 i.e. 90,000

Answer:

(C) 90,000