Mutual Funds – Securities Laws and Capital Markets Important Questions

Question 1.

Distinguish between: Front End Load & Back End Load“ [Dec. 2005 (2 Marks)]

Answer:

Following are the main points of difference between Front End Load & Back End Load:

| Points | Front End Load | Back End Load |

| Meaning | Front End Load means ‘entry load’ which is paid by investors while investing in mutual funds. | Back End Load means ‘exit load’ which is afforded by the investors while selling units of mutual funds. |

| Time of payment | Entry load is paid when an investor buys units of mutual funds. | Exit load is paid when the investor sells units of mutual funds. |

| Formula | NAV = Public Offer Price (1 – Front End Load) | NAV = Redemption Price (1 + Back End Load) |

There shall be no entry load for all mutual fund schemes. [SEBI/IMD/MC No.2/836/2011, January 07, 2011]

Question 2.

Write a short note on Asset Management Company (AMC) [June 2006 (5 Marks)]

Answer:

Asset Management Company is an entity registered under the Companies Act, to manage the money invested in the mutual fund and to operate the schemes of the mutual fund in accordance with the governing regulations.

Important points relating to Asset Management Company:

- AMC is a company incorporated under the Companies Act, 2013.

- Every mutual fund is required to have an AMC.

- AMC should be approved by the SEBI.

- AMC operates the schemes of the mutual fund.

- AMC is charged with the responsibility of investing and managing the investor’s resources.

- The application for the approval of the AMC shall be made in Form D.

- The appointment of an AMC can be terminated by the majority of the trustees or by 75% of the unitholders of the scheme.

- The AMC should have prescribed net worth.

Question 3.

Explain the various factors for judging the efficiency of mutual funds. [June 2011 (4 Marks)]

Answer:

Judging efficiency of mutual funds is done with reference to various factors such as:

- Whether the fund is stable

- Whether it is liquid (listed on exchanges)

- Whether it offers an increase in NAV, consistent growth in dividend and capital appreciation

- Whether the investment objectives are clearly laid and implemented

- Whether the issuer has a proven track record and offers assured returns or returns not less than a percentage

- Whether it observes investment norms to balance risks and profits

Question 4.

Discuss the accounting policies and standards that are to be mandatorily followed by the asset management companies. [June 2012 (5 Marks)]

Answer:

The AMC shall follow the accounting policies and standards as specified in mutual fund regulation to provide appropriate details of the scheme-wise disposition of the assets of the fund at the relevant accounting date and the performance during that period together with information regarding distribution or accumulation of income accruing to the unitholder in a fair and true manner.

The relevant Accounting Standards are:

- AS-9: Revenue Recognition

- AS-10: Accounting for Fixed Assets

- AS-19: Lease

- AS-29: Provisions, Contingent Liabilities Assets.

Question 5.

“Mutual funds have emerged as one of the important class of financial intermediaries which cater to the needs of retail investors.” Discuss. [Dec. 2014 (6 Marks)]

Answer:

The small investors who generally lack the expertise to invest on their own in the securities market have reinforced the saying “put not your trust in money, put your money in trust”. They prefer some kind of collective investment vehicle like, mutual funds, which pool their marginal resources, invest in securities, and distribute the returns therefrom among them on cooperative principles. The investors benefit in terms of reduced risk and higher returns arising from the professional expertise of fund managers employed by the mutual funds.

Question 6.

Explain briefly: Mutual Fund Costs [June 2017 (2 Marks)]

Answer:

There are two broad categories of mutual fund costs:

(а) Operating Expenses: Costs incurred in operating mutual funds are known operating expenses. It includes advisory fees paid to investment managers, custodial fees, audit fees, transfer agent fees, trustee fees, agents’ com-mission, etc. The break-up of these expenses is required to be reported in the schemes offer document.

When the operating expenses are divided by the average net asset, the expense ratio is arrived at. Based on the type of scheme and the net assets, operating expenses are determined within the limits indicated by SEBI (Mutual Funds) Regulations, 1996. Expenditure that is in excess of the specified limits shall be borne by the Asset Management Company, the Trustees, or the Sponsors. Operating expenses are calculated on an annualized basis but are accrued on a daily basis. Therefore, an investor face expenses prorated for the time he has invested in the fund.

(b) Sales Charges: These are called sales loads and are charged directly to the investors. Mutual funds use the sales loads for payment of the agent’s commission and expenses for distribution and marketing.

Question 7.

Write a short note on Advantages of Mutual Funds

Answer:

Following are the advantages of investing in mutual funds:

1. Professional Management: The small investor does not have the time or expertise to manage his own money. Mutual funds are run by professionals who are experts in the field of investment management. Thus, the money of small investors is in safe hands.

2. Diversification: The key to stock market investment is diversification. Diversification has the advantage of risk reduction. A well-diversified portfolio normally contains it about 10 to 15 stocks. If an individual investor has to buy, say 100 shares of each of the selected stocks, it could cost him about ₹ 2 to 3 lakhs. However, when he invests in a mutual fund a small sum say ₹ 5,000, he gets instant diversification at a fraction of the cost. This is because, as a unit holder he becomes a part-owner of the stock that the mutual fund holds. In short, mutual funds help him buy diversification off the shelf.

3. Economies of scale: Unlike small investor mutual funds makes large scale purchase and sale of shares. For example, if an investor invests in 500 shares of Reliance, a mutual fund would be investing 50,000 shares. Since they deal in large volumes, the funds are able to bargain for finer rates from the stockbrokers. Thus, if an individual investor is charged 1%, the mutual fund could be charged as low as 0.05%. As both purchase and sales take place on the stock, that means there is a net saving of 1.9%.

A low brokerage means a higher return and if we assume a return of 1.9% for a month, it means 23% p.a. (1.9% × 12)

4. Liquidity: Mutual funds are easy to buy and sell and hence provide great liquidity. Any person holding an open-ended scheme can sell the units of his mutual fund and get his money back.

5. Transparency: Mutual funds are regulated by the SEBI and hence as per SEBI regulations mutual funds have to provide various types of information periodically to the investors. Thus, there is much more transparency and the chance of investor being cheated are negligible.

6. Low Costs: Mutual funds are a relatively less expensive way to invest compared to directly investing in the capital markets because the benefits of scale in brokerage, custodial, and other fees translate into lower costs for investors.

7. Return Potential: Over the medium to long term, Mutual funds have the potential to provide a higher return as they invest in a diversified basket of selected securities.

Question 8.

Discuss briefly the risk involved in Mutual Funds. [Dec. 2009 (4 Marks)]

Answer:

The level of risk in a mutual fund depends on what it invests in. Usually, the higher the potential returns, the higher the risk will be. For example, stocks are generally riskier than bonds, so an equity fund tends to be riskier than a fixed income fund.

Some specialty mutual funds focus on certain kinds of investments, such as emerging markets, to try to earn a higher return. These kinds of funds also tend to have a greater risk of a larger drop in value.

Mutual funds may face the following risks, leading to non-satisfactory performance:

- Excessive diversification of portfolio, losing focus on the securities of the key segments.

- Too much concentration on blue-chip securities which are high priced and which do not offer more than average return.

- The necessity to effect high turnover through liquidation of portfolio resulting in large payments of brokerage and commission.

- Poor planning of investment with minimum returns.

- Un-researched forecast on income, profits, and Government policies.

- Fund managers being unaccountable for poor results.

- Failure to identify clearly the risk of the scheme as distinct from the risk of the market.

Question 9.

Write a short note on Disadvantages of Fund of Funds scheme [June 2017 (3 Marks)]

Answer:

Just like any other investment, the fund of funds is not free from shortcomings. A few of the disadvantages are specified below.

1. Additional Fees: The more diversified the fund is, the greater the likelihood that the investor will incur an incentive fee on one or more of the constituent managers, regardless of overall performance.

2. Associated Risks: Risks associated with all the underlying funds get added at this level. Following are the type of risks associated with a fund of funds scheme.

3. Management Risks: Every fund manager has a particular style of diversification. This diversification style will be in perfect correlation with the number of managers involved. The views of a manager may be altogether different from the market.

4. Operational Risks: Due diligence of a scheme in itself gives rise to operational risks. Continuous monitoring is required for knowing about the performance of the funds, any possibility of fraud and to know about the investment style of the funds and any desirable or undesirable changes in it.

5. Qualitative Risks: These include risks associated with the management environment of the fund such as organizational structure, infrastructure, investment process, operational issues, etc.

Question 10.

Distinguish between: Income Oriented Schemes & Growth Oriented Schemes [June 2007 (4 Marks)]

Answer:

Following are the main points of difference between income-oriented schemes & growth-oriented schemes:

| Points | Front End Load | Back End Load |

| Meaning | Front End Load means ‘entry load’ which is paid by investors while investing in mutual funds. | Back End Load means ‘exit load’ which is afforded by the investors while selling units of mutual funds. |

| Time of payment | Entry load is paid when an investor buys units of mutual funds. | Exit load is paid when the investor sells units of mutual funds. |

| Formula | NAV = Public Offer Price (1 – Front End Load) | NAV = Redemption Price (1 + Back End Load) |

Question 11.

Distinguish between: Open-ended mutual funds & Close-ended mutual funds [Dec. 2008 (2 Marks)]

Answer:

Following are the main points of difference between open & close-ended mutual funds:

| Points | Income Oriented Schemes | Growth Oriented Schemes |

| Meaning | Income Oriented Schemes are the scheme of mutual funds which provides a regular and steady income to the investors. | Growth Oriented Schemes are the scheme of mutual funds which provides capital appreciation to the investors. |

| Mode of investment | Under Income Oriented Schemes funds are invested in fixed income securities such as bonds, corporate debentures, Government securities, and money market instruments. | Under Growth-Oriented Schemes funds are invested in equity shares and related instruments. |

| Form of return | Income Oriented Schemes offers fixed income to investors. | Growth Oriented Schemes offers capital appreciation to the investors. When sells his units in mutual funds difference between the purchase price and sale price is capital gain. |

| Suitability | Income Oriented Schemes are suitable for investors seeking capital stability and regular income. | Growth Oriented Schemes are suitable for investors, having a long-term outlook seeking growth over a period of time. |

Question 12.

Write a short note on Money Market Mutual Funds (MMMF) [Dec. 2010 (4 Marks)]

Answer:

A money market fund is a mutual fund that invests in money market instruments. Since the operations in the money market are dominated by H institutional players, the retail investor involvement in the money market is limited. For such retail investors who want to invest in the money market, money market mutual funds provide a possibility for retail investors to invest their money into the money market.

Money market instruments are forms of debt that mature in less than one year and are very liquid. The monies are invested in safer short-term securities like treasury bills, certificate deposits, commercial papers, interbank call money, etc. the returns from these schemes fluctuate according to the interest rate that is prevalent at the market at that point in time. These funds must have high liquidity and should be of the highest quality.

A money-market mutual fund is akin to a high-yield bank account but is not entirely risk-free. When investing in a money-market fund, attention should be paid to the interest rate that is being offered.

Question 13.

Distinguish between ‘open-ended mutual fund’ and ‘close-ended mutual fund’. [Dec. 2016 (4 Marks)]

Answer:

Following are the main points of difference between open & close-ended mutual funds:

| Points | Open-Ended Mutual Funds | Close Ended Mutual Funds |

| Meaning | Open-ended mutual funds buy and sell units on a continuous basis and allow investors to enter and exit as per their convenience. | A closed-end fund is a collective investment model based on issuing a fixed number of shares that are not redeemable from the fund. |

| Corpus | Variable corpus due to ongoing purchase and redemption. | Fixed corpus: no new units can be offered beyond the limit. |

| Listing | No listing on an exchange; transactions done directly with the fund. | Listed on the stock exchange for buying and selling. |

| Values | Only one price available namely NAV. | Two values available namely NAV and the Market Trading Price. |

| Liquidity | Highly Liquid | Mostly liquid |

Question 14.

Write a short note on Real Estate Mutual Fund Scheme [June 2017 (3 Marks)]

Answer:

Some of the salient features of REMFs are as under:

1. Existing mutual funds are eligible to launch real estate mutual funds if they have an adequate number of experienced key personnel/directors.

2. Sponsors seeking to set up new mutual funds, for launching only real estate mutual fund schemes, shall be carrying on business in real estate for a period not less than 5 years. They shall also fulfill all other eligibility criteria applicable for sponsoring a mutual fund.

3. Every real estate mutual fund scheme shall be close-ended and its units shall be listed on a recognized stock exchange.

4. NAV of the scheme shall be declared daily.

5. At least 35% of the net assets of the scheme shall be invested directly in real estate assets. Balance may be invested in mortgage-backed securities, securities of companies engaged in dealing in real estate assets, or in undertaking real estate development projects and other securities. Taken together, investments in real estate assets, real estate-related securities (including mortgage-backed securities) shall not be less than 75% of the net assets of the scheme.

6. Each asset shall be valued by two valuers, who are accredited by a credit rating agency, every 90 days from the date of purchase. The lower of the two values shall be taken for the computation of NAV.

7. Caps will be imposed on investments in a single city, single project, securities issued by sponsor/associate companies, etc.

8. Unless otherwise stated, the investment restrictions specified in the Seventh Scheme shall apply.

9. No mutual fund shall transfer real estate assets amongst its schemes.

10. No mutual fund shall invest in any real estate asset which was owned by the sponsor or the AMC or any of its associates during the period of last 5 years or in which the sponsor or the AMC or any of its associates hold tenancy or lease rights.

11. A real estate mutual fund scheme shall not undertake lending or housing finance activities.

12. Accounting and valuation norms pertaining to Real Estate Mutual Fund schemes have also been specified.

Question 15.

Describe various schemes of mutual funds according to investment objectives. [Dec. 2017 (5 Marks)]

Answer:

There are different investors having different expectations from their investments. Some investors may desire regular and study income on their investment, while some investors may desire, have a capital appreciation, some investors may like to get the benefit of trading in real estate, and thus, various mutual funds offer various schemes keeping view the requirements of these investors.

Various investment schemes of mutual funds are as follows:

(a) Income Oriented Schemes: The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities, and money market instruments. Such funds are less risky compared to equity schemes. These funds are not affected because of fluctuations in equity markets. However, opportunities for capital appreciation are also limited in such funds.

(b) Growth Oriented Schemes: The aim of growth funds is to provide capital appreciation over the medium to long term. Such schemes normally invest a major part of their corpus inequities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, capital appreciation, etc., and the investors may choose an option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

(c) Hybrid Schemes: Such schemes covers both needs of an investor te. provide regular income as well as provide capital appreciation. Therefore, investment targets of these mutual funds are a judicious mix of both the fixed income securities like bonds and debentures and also sound equity scrips. In fact, these funds utilize the concept of balanced investment management. These funds are, thus, also known as “balanced funds”.

(d) High Growth Schemes: In the stock market, high risk gives high returns. So these funds primarily invest in high risk and high return volatile securities in the market and induce the investors with a high degree of capital appreciation. Aggressive investors willing to take excessive risks are the normal target group of such funds.

(e) Capital Protection Oriented Scheme: The investment objective of such scheme is to seek capital protection by investing a portion of the portfolio in highest rated debt securities and money market instruments and also to provide capital appreciation by investing the balance in equity and equity-related securities.

(f) Tax Saving Schemes: These schemes offer tax rebates to the investors under specific provisions of the Income Tax Act, 1961 as the Government offers tax incentives for investment in specified avenues. For example, Equity Linked Savings Schemes (ELSS). Pension schemes launched by the mutual funds also offer tax benefits. These schemes are growth-oriented and invest in pre-dominantly inequities. Their growth opportunities and risks associated are like any equity-oriented scheme.

(g) Sector-specific Schemes: These are the funds that invest in the securities of only those sectors or industries as specified in the offer documents. For example, Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns in these funds are dependent on the performance of the respective sectors. While these funds may give higher returns, they are riskier compared to diversified funds.

Investors need to keep a watch on the performance of those sectors and must exit at an appropriate time. They may also seek the advice of an expert.

(h) Real Estate Funds: A real estate fund is a type of mutual fund that primarily focuses on investing in securities offered by public real estate companies. Factors affecting the return of real estate mutual funds include the real estate market in general, housing starts, residential and commercial vacancy rates, and interest rates.

(i) Off-shore Funds: Such funds invest in securities of foreign companies with RBI permission.

(j) Leverage Funds: Leveraged funds are mutual funds using aggressive investment techniques of financial leverage, such as buying on margin, short selling, and options trading, to obtain maximum capital appreciation for investors in the fund. Leveraged funds use a variety of financial instruments from equity swaps to derivatives, such as futures contracts, to achieve their returns. Leveraged funds try to achieve returns that are more sensitive, by a specific magnitude, to market movements than non-leveraged funds. The returns for leveraged funds usually vary between two times and three times the movement in a given index or market sector.

(k) Index Funds: Index funds replicate the portfolio of a particular index such as the BSE Sensex, Nifty, etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors are known as “tracking error” in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme. There are also exchange-traded index funds launched by the mutual funds which are traded on the stock exchanges.

(l) New Direction Funds: They invest in companies engaged in scientific and technological research such as birth control, anti-pollution, oceanography, etc.

(m) Infrastructure Debt Fund: They invest primarily in the debt securities or securitized debt investment of infrastructure companies.

Question 16.

SEBI in its guidelines related to restrictions on investments by mutual funds prescribes that the investment in equity shares or equity-related securities of a single company must not exceed 10% of the net assets of the scheme. A particular mutual fund had repeatedly exceeded this permissible limit through its associate broker. The Adjudicating Officer (AO) concerned imposed a penalty. The mutual fund approached the Court and pleaded that the limit was not exceeded intentionally and hence, it should not be penalized for such unintentional deed. As per the provisions of the Securities and

Exchange Board of India Act, 1992 and decided case laws, suggest whether the Court should set aside AO’s order inter alia on the ground that the limit was not exceeded intentionally. [Dec. 2013 (6 Marks)]

Answer:

The facts of the given case are similar to SEBIv. Shriram Mutual Fund & Others – Appeal Nos. 9523-24 of2003, wherein a penalty of ₹ 2 lakhs was imposed by Adjudicating Officer on Shriram Mutual Fund (SMF) as it had repeatedly exceeded the permissible limits of transactions through its associate broker.

On an appeal by SMF, SAT set aside Adjudicating Officer’s order inter alia on the ground that the limit was not exceeded intentionally.

SEBI filed an appeal to Supreme Court. The Supreme Court set aside the judgment of SAT and settled the issues, as under:

- Men’s rea is not an essential ingredient for contravention of the provisions of a Civil Act.

- The penalty is attracted as soon as a contravention of the statutory obligation as contemplated by the Act is established, and therefore the intention of the parties committing such violation becomes immaterial.

- Unless the language of the statute indicated the need to establish the element of men’s rea, it is generally sufficient to prove that a default in complying with the statute has occurred.

- Once the contravention is established, the penalty has to follow and only the quantum of penalty is discretionary.

Thus, SEBI will succeed in its appeal to Supreme Court.

Question 17.

What do you understand by Infrastructure Debt Fund Schemes (IDFS)? Discuss the eligibility criteria required to be fulfilled by a mutual fund for launching such a scheme. [Dec. 2013 (5 Marks)]

Answer:

“Infrastructure debt fund scheme” means a mutual fund scheme that invests primarily (minimum 90% of scheme assets) in the debt securities or securitized debt instrument of:

- infrastructure companies or

- infrastructure capital companies or

- infrastructure projects or

- special purpose vehicles created for the purpose of facilitating or promoting investment in infrastructure

- other permissible assets or

- revenue-generating projects of infrastructure companies or projects or special purpose vehicles.

Eligibility criteria for launching infrastructure debt fund scheme [Regulation 49N]:

1. An existing mutual fund may launch an infrastructure debt fund scheme if it has an adequate number of key personnel having adequate experience in the infrastructure sector.

2. A certificate of registration may be granted to an applicant proposing to launch only infrastructure debt fund schemes if the sponsor or the parent company of the sponsor:

(a) has been carrying on activities or business in the infrastructure financing sector for a period of not less than 5 years;

(b) fulfills the eligibility criteria as provided in Mutual Fund Regulation.

Question 18.

An inquiry officer appointed by SEBI found evidence that a particular mutual fund was indulging in short-selling and buying-selling of derivative products for speculative purposes.

You are required to answer:

(i) Can the mutual fund be held liable for the violation of any provision/rule laid down by the SEBI in this regard?

(ii) If yes, then what kind of penalties can be imposed by the inquiry officer on the mutual fund? [Dec. 2014 (5 Marks)]

Answer:

As per Regulation 45 of the SEBI (Mutual Funds) Regulations, 1996, a mutual fund may enter into short-selling transactions on a recognized stock exchange, subject to the framework relating to short selling and securities lending and borrowing specified by the SEBI.

In the given case, the mutual fund was indulging in short-selling and buying-selling of derivative products for speculative purposes, which is a clear violation of Regulation 45 of the SEBI (Mutual Funds) Regulations, 1996.

Liability for action in case of default [Regulation 68]: A mutual fund who contravenes any of the provisions of the Act, Rules, or Regulations framed thereunder shall be liable for one or more action specified therein including the action under Chapter V of the SEBI (Intermediaries) Regulations, 2008.

Question 19.

Explain briefly: Infrastructure debt fund [June 2015 (3 Marks)]

Answer:

“Infrastructure debt fund scheme” means a mutual fund scheme that invests primarily (minimum 90% of scheme assets) in the debt securities or securitized debt instrument of:

- infrastructure companies or

- infrastructure capital companies or

- infrastructure projects or

- special purpose vehicles created for the purpose of facilitating or promoting investment in infrastructure

- other permissible assets or

- revenue-generating projects of infrastructure companies or projects or special purpose vehicles.

Eligibility criteria for launching infrastructure debt fund scheme [Regulation 49N]:

1. An existing mutual fund may launch an infrastructure debt fund scheme if it has an adequate number of key personnel having adequate experience in the infrastructure sector.

2. A certificate of registration may be granted to an applicant proposing to launch only infrastructure debt fund schemes if the sponsor or the parent company of the sponsor

(a) has been carrying on activities or business in the infrastructure financing sector for a period of not less than 5 years;

(b) fulfills the eligibility criteria as provided in Mutual Fund Regulation.

Question 20.

Is there any advertisement code for mutual funds?[Dec. 2015 (6 Marks)]

Answer:

Advertisement Material [Regulation 30]: Advertisements shall be in conformity with the Advertisement Code as specified in the Sixth Schedule and shall be submitted to the SEBI within 7 days from the date of issue.

1. Advertisements shall be accurate, true, fair, clear, complete, unambiguous, and concise.

2. Advertisements shall not contain statements that are false, misleading, biased, or deceptive, based on assumption/projections, and shall not contain any testimonials or any ranking based on any criteria.

3. Advertisements shall not be so designed as likely to be misunderstood or likely to disguise the significance of any statement. Advertisements shall not contain statements that directly or by implication or by omission may mislead the investor.

4. Advertisements shall not carry any slogan that is exaggerated or unwarranted or slogan that is inconsistent with or unrelated to nature and risk and return profile of the product.

5. No celebrities shall form part of the advertisement.

6. Advertisements shall not be so framed as to exploit the lack of experience or knowledge of the investors. Extensive use of technical or legal terminology or complex language and the inclusion of excessive details which may detract the investors should be avoided.

7. Advertisements shall contain information that is timely and consistent with the disclosures made in the Scheme Information Document (SID), Statement of Additional Information, and the Key Information Memorandum (KIM).

8. No advertisement shall directly or indirectly discredit other advertisements or make unfair comparisons.

9. Advertisements shall be accompanied by a standard warning in legible fonts which states ‘Mutual Fund investments are subject to market risks, read all scheme related documents carefully.’ No addition or deletion of words shall be made to the standard warning.

10. In audio-visual media-based advertisements, the standard warning in visual and accompanying voice-over reiteration shall be audible in a clear and understandable manner. For example, in standard warning, both the visual and the voice-over reiteration containing 14 words running for at least 5 seconds may be considered as clear and understandable.

Misleading Statements [Regulation 31]: The offer document and advertisement materials shall not be misleading or contain any statement or opinion, which is incorrect or false.

Question 21.

Briefly explain the advertisement code prescribed for mutual funds under the SEBI (Mutual Funds) Regulations, 1996. [June 2016 (9 Marks)]

Answer:

Advertisement Material [Regulation 30]: Advertisements shall be in conformity with the Advertisement Code as specified in the Sixth Schedule and shall be submitted to the SEBI within 7 days from the date of issue.

1. Advertisements shall be accurate, true, fair, clear, complete, unambiguous, and concise.

2. Advertisements shall not contain statements that are false, misleading, biased, or deceptive, based on assumption/projections, and shall not contain any testimonials or any ranking based on any criteria.

3. Advertisements shall not be so designed as likely to be misunderstood or likely to disguise the significance of any statement. Advertisements shall not contain statements that directly or by implication or by omission may mislead the investor.

4. Advertisements shall not carry any slogan that is exaggerated or unwarranted or slogan that is inconsistent with or unrelated to nature and risk and return profile of the product.

5. No celebrities shall form part of the advertisement.

6. Advertisements shall not be so framed as to exploit the lack of experience or knowledge of the investors. Extensive use of technical or legal terminology or complex language and the inclusion of excessive details which may detract the investors should be avoided.

7. Advertisements shall contain information that is timely and consistent with the disclosures made in the Scheme Information Document (SID), Statement of Additional Information, and the Key Information Memorandum (KIM).

8. No advertisement shall directly or indirectly discredit other advertisements or make unfair comparisons.

9. Advertisements shall be accompanied by a standard warning in legible fonts which states ‘Mutual Fund investments are subject to market risks, read all scheme related documents carefully.’ No addition or deletion of words shall be made to the standard warning.

10. In audio-visual media-based advertisements, the standard warning in visual and accompanying voice-over reiteration shall be audible in a clear and understandable manner. For example, in standard warning, both the visual and the voice-over reiteration containing 14 words running for at least 5 seconds may be considered as clear and understandable.

Misleading Statements [Regulation 31]: The offer document and advertisement materials shall not be misleading or contain any statement or opinion, which is incorrect or false.

Question 22.

“Expense Ratio for a mutual fund should be as low as possible.” Explain how an increase or decrease in Total Expense Ratio (TER) shall be disclosed by Asset Management Company under SEBI (Mutual Funds) Regulations, 1996? [Pec. 2018 (5 Marks)]

Answer:

Costs incurred in operating mutual funds are known operating expenses. It includes advisory fees paid to investment managers, custodial fees, audit fees, transfer agent fees, trustee fees, agents commission, etc. The break-up of these expenses is required to be reported in the schemes offer document.

When the operating expenses are divided by the average net asset, the expense ratio is arrived at. Based on the type of scheme and the net assets, operating expenses are determined within the limits indicated by SEBI (Mutual Funds) Regulations, 1996. Expenditure that is in excess of the specified limits shall be borne by the Asset Management Company, the Trustees, or the Sponsors. Operating expenses are calculated on an annualized basis but are accrued on a daily basis. Therefore, an investor face expenses prorated for the time he has invested in the fund.

Under SEBI (Mutual Funds) Regulations, 1996, Mutual Funds are permitted to incur/charge certain operating expenses for managing a mutual fund scheme – such as sales & marketing/advertising expenses, administrative expenses, transaction costs, investment management fees, registrar fees, custodian fees, audit fees – as a percentage of the fund’s daily net assets.

This is commonly referred to as ‘Expense Ratio’. In short, the Expense ratio is the cost of running and managing a mutual fund that is charged to the scheme. All expenses incurred by a Mutual Fund, AMC will have to be managed within the limits specified under Regulation 52 of SEBI (Mutual Funds) Regulations.

For actively managed equity schemes, the total expense ratio (TER) allowed under the regulations is –

- 2.5 % for the first ₹ 100 Crores of average weekly net assets;

- 2.25 % for the next ₹ 300 Crores,

- 2% for the subsequent ₹ 300 Crores and

- 1.75 % for the balance AUM.

For debt schemes, the expense ratio permitted is 0.25% lower than that allowed for equity funds. Information on the expense ratio applicable to an MF scheme is mentioned in the Scheme Information Document. For example, an expense ratio of 1% p.a. means that each year 1% of a scheme’s total assets will be used to cover the expenses managing and operating a scheme.

In addition, mutual funds have been allowed to charge up to 30 bps more, if 30% or more of new inflows come from locations “Beyond the Top-15 (B15) cities, to widen the penetration of the mutual funds in tier – 2 and tier – 3 cities.

The expense ratio is calculated as a percentage of the Scheme’s average Net Asset Value (NAV). The daily NAV of a mutual fund is disclosed after deducting the expenses. Thus, the TER has a direct bearing on a scheme’s NAV – the lower the expense ratio of a scheme, the higher the NAV.

Question 23.

Life-Changing Assets Management Ltd., a mutual funds company desires to engage a bully wood celebrity to popularize its schemes. Explain the SEBI provisions with regard to celebrity endorsements of Mutual Funds at the industry level. [June 2019 (4 Marks)]

Answer:

SEBI vide it Circular No. CIR/IMD/DF/23/2017 dated 15.3.2017 reviewed advertising guidelines for the mutual funds.

In this respect, it has been decided to permit celebrity endorsements at the industry level, for the purpose of increasing awareness of Mutual Funds as a financial product category.

However, such celebrity endorsements of Mutual Funds at the industry level, shall be subject to the following conditions:

1. Celebrity endorsement shall be allowed only at the industry level, for the purpose of increasing awareness of Mutual Funds as a financial product category. Such celebrity endorsements should not promote a scheme of a particular Mutual Fund or be used as a branding exercise of a Mutual Fund house/AMC.

2. Expenses towards such celebrity endorsements for increasing awareness of Mutual Funds shall be limited to the amounts that are aggregated by Mutual Funds at the industry level for the purpose of conducting investor education and awareness initiatives, in terms of clause F of SEBI circular dated September 13, 2012.

3. Prior approval of SEBI shall be required for issuance of any endorsement of Mutual Funds as a financial product, which features a celebrity for the purpose of increasing awareness of Mutual Funds.

Question 24.

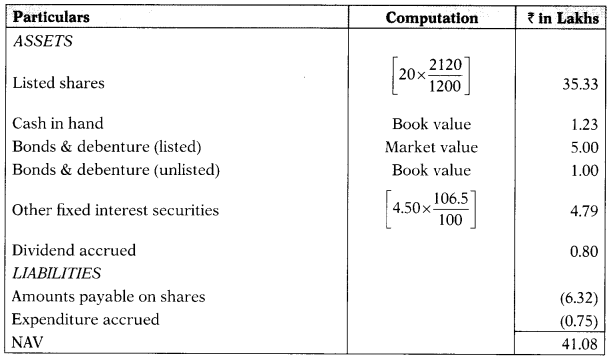

Based on the following data, determine the NAV of a regular income scheme.

| Particulars | ₹ in Lakh |

| Listed shares at cost (ex-dividend) | 20.00 |

| Cash in hand | 1.23 |

| Bonds & debenture at cost (of theses, bonds not listed and quoted ₹ 1 Lakh) | 4.30 |

| Other fixed interest securities at cost | 4.50 |

| Dividend accrued | 0.80 |

| Amounts payable on shares | 6.32 |

| Expenditure accrued | 0.75 |

Number of units (₹ 10 face value) = 2,40,000 units

Current realizable value of fixed income securities of face value of ₹100 = ₹ 106.50.

All listed shares are purchased at a time when the index was 1200. On NAV date, the index is ruling at 2120. Listed bonds and debentures carry a market value of ₹ 5 lakhs on NAV date. [Dec. 2007 (8 Marks)]

Answer:

NAV per unit = \(\frac{41.08}{2.40}\) = ₹ 17.12 per unit

Question 25.

Define ‘NAV’ and ‘offer price’. If Rahul invests ₹ 10,000 in a scheme that charges 2% front-end load at a NAV of ₹ 10 per unit, what shall be the public offer price? [Dec. 2008 (5 Marks)]

Answer:

NAV: The NAV of a mutual fund is the amount that a unitholder would receive if the mutual fund were wound up today. An investor in an MF is a part-owner of all its assets and liabilities.

NAV is calculated as follows:

The market value of assets of the fund minus Liabilities attributable to those assets

Example: If the total assets of a scheme are ₹ 500 Lakhs and its outside liabilities are ₹ 50 Lakh, the NAV ₹ 450 Lakh.

Offer price: It means public offer price ie. money payable by an investor for buying an unit of mutual fund.

NAV = Public Offer Price (1 – Front End Load)

Let the Public Offer Price be ‘x’

10 = x (1 – 0.02)

10 = x – 0.02x

10 = 0.98

x = \(\frac{10}{0.98}\)

x = Public Offer Price = 10.20

Question 26.

The redemption price of a mutual fund unit is ₹ 48 while the front end loader and back end load charges are 2% and 3% respectively. You are required to calculate:

(i) Net asset value per unit and

(ii) Public offer price of the unit [June 2010 (7 Marks)]

Answer:

NAV = Redemption Price (1 + Back End Load)

Let the NAV be x

x = 48 (1 + 0.03)

x = 48 + 1.44

x = NAV = 49.44

Let the Public Offer Price be ‘x’

NAV = Public Offer Price (1 – Front End Load)

49.44 = x (1 -0.02)

49.44 = x – 0.02x

49.44 = 0.98x

x = \(\frac{49.44}{0.98}\)

x = Public Offer Price = 50.45

Question 27.

The redemption price of a mutual fund unit is ₹ 48 while the front end loader and back end load charges are 2% and 3% respectively. You are required to calculate:

(i) Net asset value per unit and

(ii) Public offer price of the unit [June 2014 (7 Marks)]

Answer:

NAV = Redemption Price (1 + Back End Load)

Let the NAV be x

x = 48 (1 + 0.03)

x = 48 + 1.44

x = NAV = 49.44

Let the Public Offer Price be ‘x’

NAV = Public Offer Price (1 – Front End Load)

49.44 = x (1 -0.02)

49.44 = x – 0.02x

49.44 = 0.98x

x = \(\frac{49.44}{0.98}\)

x = Public Offer Price = 50.45

Question 28.

Calculate the value of the right, if [Dec. 2014 (3 Marks)]

| Number of right shares offered | 6,000 |

| Number of shares held | 3,000 |

| Ex-right price | ₹ 32 |

| Right offer price | ₹ 25 |

| Face value of shares | ₹ 10 |

Answer:

Value of right = \(\frac{\text { Right shares offered }}{\text { Number of shares held }}\) × (Ex-right price – Right offer price)

= \(\frac{6,000}{3,000}\) × (32 – 25)

Value of right = 14

Question 29.

Super mutual fund has launched a scheme named ‘Super Bonanza’. The net asset value (NAV) of the scheme is ₹ 12.00 per unit. The redemption price is ₹ 11.65 per unit and the offer price is ₹ 12.50 per unit.

You are required to calculate:

(i) Front-end load

(ii) Back-end load [June 2015 (6 Marks)]

Answer:

NAV = Redemption Price (1 + Back End Load)

Let the Back End Load be x

12 = 11.65(1 + x)

12 = 11.65 + 11.65x

0.35 = 11.65x

x = \(\frac{0.35}{11.65}\)

x = Back End Load = 0.03 i.e. 3%

Let the Front End Load be ‘x ’

NAV = Public Offer Price (1 – Front End Load)

12 = 12.50(1 – x)

12 = 12.50- 12.50x

0.50 = 12.50x

x = \(\frac{0.50}{12.50}\)

x = Front End Load = 0.04 ie. 4%

Question 30.

Calculate the value of the right, if [June 2015 (3 marks)]

| Number of right shares offered | 2,500 |

| Number of shares held | 1,000 |

| Ex-right price | ₹ 18 |

| Right offer price | ₹ 15 |

| Face value of shares | ₹ 10 |

Answer:

Value of right = \(\frac{\text { Right shares offered }}{\text { Number of shares held }}\) × (Ex-right price – Right offer price)

= \(\frac{2,500}{1,000}\) × (15 – 10)

Value of right = 12.5

Question 31.

Somnath Ltd. has a share capital of 50,000 equity shares of ₹ 100 each. Market value is ₹ 250 per share. Does the company decide to make a rights issue to the existing shareholders in proportion to one new rights share of ₹ 100 at a premium of ₹ 30 per share for every 5 shares held? Calculate the value of rights. [Dec. 2015 (6 Marks)]

Answer:

Value of right = \(\frac{\text { Right shares offered }}{\text { Number of shares held }}\) × (Ex-right price – Right offer price)

= \(\frac{1}{5}\) × (250 – 130)

Value of right = 24

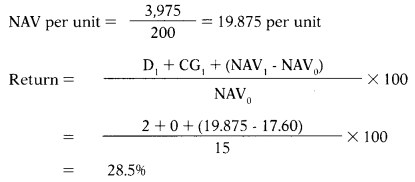

Question 32.

Compute NAV and rate of return for a unitholder who bought a unit at ₹ 17.60 and received a dividend of ₹ 2 per unit during the period. The face value of the unit is ₹ 10. Other details are as under: [Dec. 2016 (4 Marks)]

| ₹ in Crore | |

| The market value of funds portfolio | 4,200 |

| Size of the scheme | 2,000 |

| Accrued income | 100 |

| Receivables | 100 |

| Accrued expenses | 275 |

| Liabilities | 150 |

A number of outstanding units: 200 Crore.

Answer:

| Particulars | ₹ in Crore |

| Assets | |

| The market value of funds portfolio | 4,200 |

| Size of the scheme | 2,000 |

| Accrued income | 100 |

| Receivables | 100 |

| Accrued expenses | (275) |

| Liabilities | (150) |

| NAV | 3,975 |

Where,

D1 = Dividend

CG1 = Capital Gain

NAV1 = Net Asset Value at the end

NAV0 = Net Asset Value at the beginning

Question 33.

The redemption price of a mutual fund unit is ₹ 48 while the front-end load and back-end load charges are 2% and 3% respectively.

Compute:

(i) NAV per unit and

(ii) Public offer price of the unit. [June 2017 (4 Marks)]

Answer:

NAV = Redemption Price (1 + Back End Load)

Let the NAV be x ’

x = 48(1 + 0.03)

x = 48 + 1.44

x – NAV = 49.44

Let the Public Offer Price be x’

NAV = Public Offer Price (1 – Front End Load)

49.44 = x(1 – 0.02)

49.44 = x – 0.02x

49.44 = 0.98x

x = \(\frac{49.44}{0.98}\)

x = Public Offer Price = 50.45

Question 34.

Calculate the value of right If [June 2017 (4 Marks)]

| A number of shares offered (n): | 3,000 |

| A number of shares held (m): | 1,800 |

| Ex-right price (Pex): | ₹ 24 |

| Right offer price (P): | ₹ 21 |

| Face value of shares: | ₹ 10 |

Answer:

In case of mutual fund value of right shares is calculated by the following formula:

Value of right = \(\frac{\text { Right shares offered }}{\text { Number of shares held }}\) × (Ex-right price – Right offer price)

= \(\frac{3,000}{1,800}\) × (24 – 21)

Value of right = 5

Question 35.

A mutual fund had repeatedly exceeded the permissible limits of transactions through its associate brokers in terms of Regulation 25(7)(a) of SEBI (Mutual Funds) Regulations. Consequently, a penalty of Rupees Two lakh was imposed by an Adjudicating officer of SEBI on this mutual fund. Mutual Fund pleaded for waiver of penalty stating that the limit was not exceeded intentionally. Is this penalty justified? Discuss in reference to the relevant case. [June 2017 (5 Marks)]

Answer:

The facts of the given case are similar to SEBIv. Shriram Mutual Fund & Others – Appeal Nos. 9523-24 of2003, wherein a penalty of ₹ 2 lakhs was imposed by Adjudicating Officer on Shriram Mutual Fund (SMF) as it had repeatedly exceeded the permissible limits of transactions through its associate broker.

On an appeal by SMF, SAT set aside Adjudicating Officer’s order inter alia on the ground that the limit was not exceeded intentionally.

SEBI filed an appeal to Supreme Court. The Supreme Court set aside the judgment of SAT and settled the issues, as under:

- Men’s rea is not an essential ingredient for contravention of the provisions of a Civil Act.

- The penalty is attracted as soon as a contravention of the statutory obligation as contemplated by the Act is established, and therefore the intention of the parties committing such violation becomes immaterial.

- Unless the language of the statute indicated the need to establish the element of men’s rea, it is generally sufficient to prove that a default in complying with the statute has occurred.

- Once the contravention is established, the penalty has to follow and only the quantum of penalty is discretionary.

Thus, SEBI will succeed in its appeal to Supreme Court.

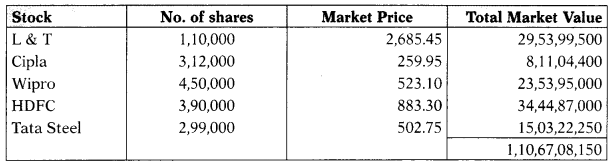

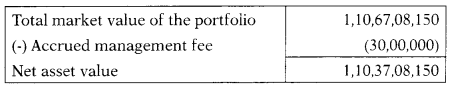

Question 36.

Following is the information pertaining to the portfolio of Dolex Mutual

Fund:

| Stock | No. of shares | Current Market Price |

| L&T | 1,10,000 | 2,685.45 |

| Cipla | 3,12,000 | 259.95 |

| Wipro | 4,50,000 | 523.10 |

| HDFC | 3,90,000 | 883.30 |

| Tata Steel | 2,99,000 | 502.75 |

The fund has not borrowed any money, but its accrued management fee with the portfolio manager currently total ₹ 30,00,000. The number of units outstanding is 10,75,73,000. Compute the value of the portfolio and NAV. [June 2018 (4 Marks)]

Answer:

NAV = \(\frac{1,10,37,08,150}{10,75,73,000}\) = 10.26 per unit

Question 37.

A mutual fund has a NAV of ₹ 11.50 at the beginning of the year. At the end of the year, NAV increases to ₹ 12.10. Meanwhile, the fund distributes ₹ 0.80 as dividend and ₹ 0.70 as capital gains.

(i) What is the fund’s return during the year?

(ii) Had these distributions been re-invested at an average NAV of ₹ 11.80, what is the return for 200 units? [Dec 2018 (5 Marks)]

Answer:

Return = \(\frac{\mathrm{D}_{1}+\mathrm{CG}_{1}+\left(\mathrm{NAV}_{1}-\mathrm{NAV}_{0}\right)}{\mathrm{NAV}_{0}}\) × 100

= \(\frac{0.80+0.70+(12.10-11.50)}{11.50}\) × 100

= 18.26%

Dividend & capital gain amount to be reinvested = (0.80 + 0.70) × 200 = 300

Fresh units = \(\frac{300}{11.80}\) = 25.42

Total units = 200 + 25.42 = 225.42

Total value at the year end = 225.42 × 12.10 = 2,728

Purchase cost = 200 × 11.50 = 2,300

Return = \(\frac{2,728-2,300}{2,300}\) × 100

= 18.61%

Question 38.

A Mutual Fund having 300 units has shown Net Asset Value (NAV) of ₹ 8.75 and ₹ 9.45 at the beginning and at the end of the year respectively. The Mutual Fund has given two options:

(i) Pay ₹ 0.75 per unit as dividend and ₹ 0.60 per unit as capital appreciation; or

(ii) These distributions are to be reinvested at an average NAV of ₹ 8.65 per unit.

What difference it would make in terms of return available and which option is preferable? [June 2019 (5 Marks)]

Answer:

Return = \(\frac{\mathrm{D}_{1}+\mathrm{CG}_{1}+\left(\mathrm{NAV}_{1}-\mathrm{NAV}_{n}\right)}{\mathrm{NAV}_{0}}\) × 100

= \(\frac{0.75+0.60+(9.45-8.75)}{8.75}\) × 100

= 23.43%

Dividend and capital gain amount to be reinvested = (0.75 + 0.60) × 300 = 405

Fresh units = \(\frac{405}{8.65}\) = 46.82

Total units = 300 + 46.82 = 346.82

Total value at the year end = 346.82 × 9.45 = 3278

Purchase cost = 300 × 8.75 = 2,625

Return= \(\frac{3,278-2,625}{2,625}\) × 100

= 24.88%

Option to reinvest is preferable.

Securities Laws and Capital Markets Questions and Answers