Winding Up – CA Final Law Study Material is designed strictly as per the latest syllabus and exam pattern.

Winding Up – CA Final Law Study Material

Question 1.

Under what circumstances shall it be deemed that the substratum of a company has gone? A company has ceased to carry on two of the ten business stated as the main objects of the company. Examine whether the company can be wound up on the ground that substratum of the company is gone. [Nov. 08 (5 Marks)]

Answer:

Circumstances in which loss of substratum is deemed:

Substratum is the purpose or the main object, for which the company was formed. If the company has abandoned all of its main objects and not merely some of them, or if it cannot achieve any of its main objects, its substratum has gone and will be wound up by the Tribunal.

The substratum of a company is deemed to have disappeared or gone, if the main objects for which the company was formed has become impracticable, i.e. permanently impracticable. Usual tests for determining whether the substratum of the company has disappeared are whether:

(a) the subject matter of the company is gone, or

(b) the object for which it was formed has substantially failed, or

(c) it is impossible to carry on the business of the company except at a loss, which means there is no reasonable hope that the object of trading at a profit can be attained, or

(d) the existing and probable assets are insufficient to meet the existing liabilities.

Determination of loss of substratum of a company which ceased to carry on two of the ten business stated as the main objects of the company:

The substratum of the company cannot be said to have gone, since there are other businesses authorized by the Memorandum which can be carried out successfully. Therefore, company cannot be wound up on the ground that it has ceased to carry on two of the 10 business authorized by the Memorandum of Association.

Question 2.

LED Bulb Ltd., has made default in filing financial statements and annual returns for a continuous period of 4 financial years ending on 31st March, 2020. The Registrar of Companies having jurisdiction approached the Central Government to accord sanction to present a petition to Tribunal (NCLT) for the winding up of the company on the above ground u/s 272 of the Companies Act, 2013. Examine the validity of the ROC move, explaining the relevant provisions of the Companies Act, 2013. State the time limit for passing an order by the Tribunal u/s 273 of the Companies Act, 2013? [May 18 – New Syllabus (6 Marks), MTP-Oct.18]

Or

Clarks Limited, has made default in filing financial statements and annual returns for a continuous period of 4 financial years ending on 31st March, 2020. The Registrar of Companies having jurisdiction approached the Central Government to accord sanction to present a petition to Tribunal (NCLT) for the winding up of the company as per the above ground under Section 272 of the Companies Act, 2013.

Examine the validity of the RoC move, explaining the relevant provisions of the Companies Act, 2013. State the time limit for passing an order by the Tribunal under Section 273 of the Companies Act, 2013? [RTP-Nov. 19]

Answer:

Examination of Validity of ROC move to present a petition for winding up:

Sec. 271(1)(d) of Companies Act, 2013 provides that a company may, on a petition u/s 272, be wound up by the Tribunal, if the company has made a default in filing with the Registrar its financial statements or annual returns for immediately preceding five consecutive financial years.

In the present case, the Registrar of Companies having jurisdiction over the company approached the Central Government to accord sanction to present a petition to Tribunal (NCLT) for the winding up of the company on the ground that company has made default in filing financial statements and annual returns for a continuous period of 4 financial years ending on 31st March, 2019.

Conclusion: ROC move is not valid as at present default in filing the financial statements and annual returns subsists for four years as of now.

Time Limit for passing order by Tribunal u/s 273:

As per proviso to Sec. 273(1) of Companies Act, 2013, an order by the Tribunal is to be passed within 90 days from the date of presentation of the petition.

![]()

Question 3.

Mr. X is appointed as a liquidator for PQR Ltd. Referring the provisions of the Companies Act, 2013 advise him about the period within which he is required to apply to the Tribunal for setting up a winding up committee and discuss the constitution and functions of the winding up committee. [Nov. 19 – Old Syllabus (4 Marks)]

Answer:

Constitution and Functions of Winding up committee:

Sec. 277 of Companies Act, 2013 deals with composition and functions of Winding up committee. Accordingly,

(a) Constitution of Winding up committee:

Within 3 weeks from the date of passing of winding up order, the Company Liquidator shall make an application to the Tribunal for constitution of a winding up committee to assist and monitor the progress of liquidation proceedings by the Company Liquidator and such winding up committee shall comprise of the following persons, namely:

- official Liquidator attached to the Tribunal;

- nominee of secured creditors; and

- a professional nominated by the Tribunal.

(b) Functions of winding up committee:

The Company Liquidator shall be the convener of the meetings of the winding up committee which shall assist and monitor the liquidation proceedings in following areas of liquidation functions, namely:

- taking over assets S

- examination of the statement of affairs;

- recovery of property, cash or any other assets of the company including benefits derived therefrom;

- review of audit reports and accounts of the company;

- sale of assets;

- finalisation of list of creditors and contributories;

- compromise, abandonment and settlement of claims;

- payment of dividends, if any; and

- any other function, as the Tribunal may direct from time to time.

![]()

Question 4.

Define “contributory” in a winding up. Explain the liabilities of contributories as present and past member. [May 11 (8 Marks)]

Answer:

Meaning of Contributory:

Clause 26 of Section 2 of Companies Act, 2013 defines Contributory as a person liable to contribute towards the assets of the company in the event of its being wound up.

A person holding fully paid-up shares in a company shall be considered as a contributory but shall have no liabilities of a contributory under the Act whilst retaining rights of such a contributory.

Liabilities of contributories as present and past member:

As per Sec. 285 of Companies Act, 2013, while settling the list of contributories, the Tribunal shall include every person, who is or has been a member, who shall be liable to contribute to the assets of the company an amount sufficient for payment of the debts and liabilities and the costs, charges and expenses of winding up, and for the adjustment of the rights of the contributories among themselves.

This is, however, subject to following conditions:

(a) a person who has been a member shall not be liable to contribute if he has ceased to be a member for the preceding 1 year or more before the commencement of the winding up;

(b) a person who has been a member shall not be liable to contribute in respect of any debt or liability of the company contracted after he ceased to be a member;

(c) no person who has been a member shall be liable to contribute unless it appears to the Tribunal that the present members are unable to satisfy the contributions required to be made by them in pursuance of this Act;

(d) in the case of a company limited by shares, no contribution shall be required from any person, who is or has been a member exceeding the amount, if any, unpaid on the shares in respect of which he is liable as such member;

(e) in the case of a company limited by guarantee, no contribution shall be required from any person, who is or has been a member exceeding the amount undertaken to be contributed by him to the assets of the company in the event if it’s being wound up. But if the company has a share capital, such member shall be liable to contribute to the extent of any sum unpaid on any shares held by him as if the company were a company limited by shares.

Question 5.

M/s. IJK Limited was wound up with effect from 15th March 2021 by an order of the Court. Mr. A, who ceased to be a member of the company from 1st June 2020, has received a notice from the liquidator that he should deposit a sum of ₹ 5,000 as his contribution towards the liability on the shares previously held by him. In this context explain whether Mr. A can be called as a contributory, whether he can be made liable and whether there is any limitation on his liability. [Nov. 18 – Old Syllabus (4 Marks), RTP – May 19]

Answer:

Meaning of Contributory:

Clause 26 of Section 2 of Companies Act, 2013 defines Contributory as a person liable to contribute towards the assets of the company in the event of its being wound up.

A person holding fully paid-up shares in a company shall be considered as a contributory but shall have no liabilities of a contributory under the Act whilst retaining rights of such a contributory.

Liabilities of contributories as present and past member:

As per Sec. 285 of Companies Act, 2013, while settling the list of contributories, the Tribunal shall include every person, who is or has been a member, who shall be liable to contribute to the assets of the company an amount sufficient for payment of the debts and liabilities and the costs, charges and expenses of winding up, and for the adjustment of the rights of the contributories among themselves.

However, a person who has ceased to be a member for the preceding 1 year or more before the commencement of the winding up shall not be liable to contribute.

In the instant case, M/s, IJK Limited was wound up with effect from 15th March 2021 by an order of the Court. Mr. A, who ceased to be a member of the company from 1st June 2020, has received a notice from the liquidator that he should deposit a sum of ₹ 5,000 as his contribution towards the liability on the shares previously held by him.

Conclusion: Mr. A will be past member contributory and liability is limited to the extent of unpaid amount on the shares and in respect of debt or liability of the company contracted before he ceased to be the member of the company.

Question 6.

Info-tech Overtrading Ltd. was ordered to be compulsory wound up by an order dated 10th March, 2021 by the Tribunal. The official liquidator who has taken control of the assets and other records of the company has noticed that:

(i) One of the contributory whose calls are pending to be paid is about to leave India for evading payment of calls and;

(ii) A person having books of account of the company in his possession may abscond to avoid examination of books of account in respect of the affairs of the company.

Apprehending such possibilities, Tribunal detained such contributory for next 6 month disallowing him to leave India as well as arrest & seized books of account from the person which may possibly abscond to avoid examination of the affairs of the company.

Referring to the provisions of Companies Act, 2013, answer the following in current scenario;

(i) What is the validity of Tribunal’s order for detention of contributory disallowing him to leave India?

(ii) Is it correct from Tribunal’s part to arrest and seize books of account from the person planning to abscond to avoid examination of books of accounts in respect of the affairs of the company? [May 19 – New Syllabus (8 Marks)]

Answer:

Arrest of person trying to leave India or abscond:

As per Sec. 301 of the Companies Act. 2013, if at any time either before or after passing a winding up order, if the Tribunal is satisfied that a contributory or a person having property, account or papers of the company in his possession is about to leave India or otherwise to abscond, or is about to remove or conceal any of his property, for the purpose of evading payment of calls or of avoiding examination respecting the affairs of the company, the Tribunal may cause—

(a) the contributory to be detained until such time as the Tribunal may order; and

(b) his books and papers and movable property to be seized and safely kept until such time as the Tribunal may order.

Conclusion: Considering the provisions of Sec. 301 as stated above, following conclusions may be drawn:

- Tribunal order for detention of contributory is valid.

- Tribunal order as to arrest and seize books of account is proper.

![]()

Question 7.

M/s Raman Ltd. was wound up by the Tribunal. The company liquidator invited claims from its creditors which stood as under:

| ₹ | |

| Income tax dues | 11 lakhs |

| Sales tax dues | 5 lakhs |

| Dues of workers | 25 lakhs |

| Unsecured loans payable to directors | 25 lakhs |

| Trade creditors who supplied raw material | 15 lakhs |

| Secured creditor being the bankers of the company | 75 lakhs |

| 156 lakhs |

Company Liquidator could realize only ₹ 80 lakhs by sale of assets and realizations made from the company’s debtors, which is not sufficient to pay to all the creditors. Please decide the order of priority for payment to creditors explaining the relevant provisions of the Companies Act, 2013. [Nov. 09 (4 Marks)]

Answer:

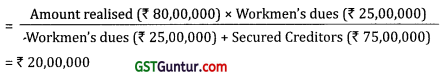

Computation of amount likely to get by the creditors:

- As the amount available for distribution falls short of dues of workmen and secured creditors, the amount will be distribution proportionately among the secured creditors and workmen.

- Proviso to Sec. 325 provides that the security of every secured creditor shall be deemed to be subject to a pari passu charge in favour of the workmen to the extent of the workmen’s portion therein.

- Workmen’s portion, in relation to the security of any secured creditor of a company, means the amount which bears to the value of the security the same proportion as the amount of the workmen’s dues bears to the aggregate of the amount of workmen’s dues and the amount of the debts due to the secured creditors.

- Accordingly, workmen share in secured assets may be computed as:

- Amount available to secured creditor is ₹ 80 Lakhs – ₹ 20 Lakhs = ₹ 60 Lakhs

- Amount available for payment of government dues and unsecured creditors is nil.

Question 8.

XYZ Limited is being would up by the tribunal. All the assets of the company have been charged to the company’s bankers to whom the company owes ₹ 5 crores. The company owes following amounts to others:

- Dues to workers – ₹ 1,25,00,000

- Taxes Payable to Government – ₹ 30,00,000

- Unsecured Creditors – ₹ 60,00,000

You are required to compute with the reference to the provision of the Companies Act, 2013 the amount each kind of creditors is likely to get if the amount realized by the official liquidator from the secured assets and available for distribution among creditors is only ₹ 4,00,00,000/-.

Answer:

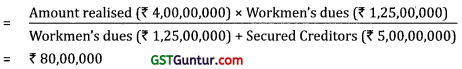

Computation of amount likely to get by the creditors:

Proviso to Sec. 325 provides that the security of every secured creditor shall be deemed to be subject to a pari passu charge in favour of the workmen to the extent of the workmen’s portion therein.

Workmen’s portion, in relation to the security of any secured creditor of a company, means

the amount which bears to the value of the security the same proportion as the amount of the workmen’s dues bears to the aggregate of the amount of workmen’s dues and the amount of the debts due to the secured creditors. –

Accordingly, workmen share in secured assets may be computed as:

- Amount available to secured creditor is ₹ 400 Lakhs – ₹ 80 Lakhs = ₹ 320 Lakhs

- Amount available for payment of government dues and unsecured creditors is nil.

Question 9.

In relation to winding up of a company,.explain dearly the meaning of the term ‘overriding preferential payments’. Examine the provisions of the Companies Act and decide whether the following debts of a company under the winding up shall be ‘Preferential payments’ and shall be paid in priority to the claim of unsecured creditors:

(a) Wages amounting to ₹ 30,000(Rupees Thirty thousand) only of an employee for services rendered for a period of 8 months within the preceding 12 months next before the relevant date.

(b) ₹ 1 lac due to an employee from Provident Fund and ₹ 50,000 towards gratuity.

(c) ₹ 20,000/- payable by the company on account of expenses incurred in respect of investigation held u/s 213 of the Companies Act, 2013. [Nov. 10 (8 Marks)]

Answer:

Meaning of Overriding preferential Payments:

Section 326 of Companies Act, 2013 deals with the overriding preferential payments. Accordingly, not withstanding anything contained in this Act or any other law for the time being in force, in the winding up of a company,

(a) workmen’s dues; and

(b) debts due to secured creditors to the extent such debts rank pari passu with such dues, shall be paid in priority to all other debts.

As per Sec. 327 of Companies Act, 2013, in a winding up, subject to the provisions of section 326, there shall be paid in priority to all other debts:

(a) all revenues, taxes, cesses and rates due from the company to the C.G. or a S.G. or to a local authority at the relevant date, and having become due and payable within the 12 months immediately before that date;

(b) all wages or salary due for a period not exceeding 4 months within the 12 twelve months immediately before the relevant date, subject to the condition that the amount payable under this clause to any workman shall not exceed such amount as may be notified;

(c) all accrued holiday remuneration becoming payable to any employee;

(d) unless the company is being wound up voluntarily merely for the purposes of reconstruction or amalgamation with another company, all amount due in respect, of contributions payable during the period of 12 months immediately before the relevant date by the company as the employer of persons under the ESI Act, 1948 or any other law for the time being in force;

(e) all amount due in respect of any compensation or liability for compensation under the Workmen Compensation Act, 1923 in respect of the death or disablement of any employee of the company;

(f) all sums due to any employee from the provident fund, the pension fund, the gratuity fund or any other fund for the welfare of the employees, maintained by the company; and

(g) the expenses of any investigation held in pursuance of sections 213 and 216, in so far as they are payable by the company.

Based on the provisions of Secs. 326 and 327 as stated above, following conclusions may be drawn:

(a) Wages for a period not exceeding 4 months within the preceding 12 months next before the relevant date will be the preferential payment.

(b) PF and gratuity in entirety are preferential payments.

(c) Expenses of investigation u/s 213 is preferential payment.

![]()

Question 10.

Modern Textiles Limited incurred huge losses during the last three financial years and its financial position was bad. The Company created a legal mortgage on some of its immovable properties in favour of a bank on 1st Sep., 2020 in the hope that by keeping good faith with the bank it could get further advances from the bank and the same could be utilized to revive the Company. Some creditors filed winding up petition on 15th January, 2021. Answer the following with reference to the provisions of the Companies Act, 2013:

(a) What is meant by ‘Fraudulent Preference’? State the effect of ‘Fraudulent Preference.

(b) Whether the creation of legal mortgage by the Company in favour of the bank would amount to fraudulent preference? [Nov. 13 (8 Marks)]

A company was in financial distress. They pledged certain movable properties with a nationalised bank in the belief that their loan limits would be increased. However, within 3 months, some creditors filed a petition for winding up. The management was accused of fraudulent preference:

(a) In the above context discuss fraudulent preference.

(b) Would your answer be different if the charge was created in favour of an NBFC? [May 16 (4 Marks)]

Answer:

(a) Fraudulent Preference:

Section 328 of Companies Act, 2013 deals with the fraudulent preference. Accordingly,

Where a company has given preference to a person who is one of the creditors of the company, or a surety or guarantor for any of the debts or other liabilities of the company, and the company does anything or suffers anything done which has the effect of putting that person into a position which, in the event of the company going into liquidation, will be better than the position he would have been in if that thing had not been done prior to 6 months of making winding up application, the Tribunal, if satisfied that such transaction is a fraudulent preference may order as it may think fit for restoring disposition to what it would have been if the company had not given that preference.

If the Tribunal is satisfied that there is a preference transfer of property, movable or immovable, or any delivery of goods, payment, execution made, taken or done By or against a company within 6 months before making winding up application, the Tribunal may order as it may think fit and may declare such transaction invalid and restore the position.

(b) Pledge of movable properties with a nationalised bank, whether amount to fraudulent preference: For the purpose of proving a fraudulent preference, two things need be shown, viz.:

(a) that in the case of a winding-up, the transaction took place within 6 months before the presentation of the petition; and

(b) that the main motive in the mind of the company, acting through its directors, was to prefer one creditor to the other.

Thus, pledging certain movable properties or mortgaging immovable properties with a bank is not a fraudulent preference because it has been done in the good faith so that their loan limits would be increased. It is a transaction in good faith. Answer would remain same if the charge was created in favour of an NBFC.

Question 11.

Info-tech Overtrading Ltd. was ordered to be wound up compulsory on a petition filed on 10th March, 2021 before the Tribunal. The official liquidator who has taken control for the assets and other records of the company has noticed the following:

The Managing Director of the company has sold certain properties belonging to the company to a private company in which his son was interested causing loss to the company to the extent of INR 50 lakhs. The sale took place on 15th October, 2020.

Examine what action the official liquidator can take in this matter, having regard to the provisions of the Companies Act, 2013. [MTP-March 18, March 19]

Answer:

Transactions to be treated as Fraudulent preference:

Sec. 328 of the Companies Act, 2013 provides that if the Tribunal is satisfied that there is a preference transfer of property, movable or immovable, or any delivery of goods, payment, execution made, taken or done by or against a company within 6 months before making winding up application, the Tribunal may order as it may think fit and may declare such transaction invalid and restore the position.

In the present case, Managing Director of the company has sold certain properties belonging to the company to a private company in which his son was interested causing loss to the company to the extent of ₹ 50 lakhs. The sale took place on 15th October, 2020. Petition for winding up filed on 10th March, 2021 before the Tribunal. Transaction of sale of properties has taken within 6 months before making winding up application.

Conclusion: Official Liquidator may apply to Tribunal to treat the sale of properties as a transaction for fraudulent preference and restoring the position.

Question 12.

By an order dated 25th June, 2020, NCLT had ordered for winding up of Kamath Trading Limited. Consequently, Official Liquidator took control for the assets and other records of the Company. During the winding up proceedings, the Official Liquidator came across a transaction where some of the properties of the Company was sold to a small Private Company. Mr. Nag, who was interested in that small Private Company happened to be the brother of Director of Kamath Trading Limited.

The sale of the said properties took place on 20th March, 2020 at a price which was ₹ 58 Lacs less than the market price. In the light of the facts given above, examine, with reference to relevant provisions of the Companies Act, 2013, what action the Tribunal can take in this regard? [Nov. 20 – New Syllabus (4 Marks)]

Answer:

Transactions to be treated as Fraudulent preference:

Sec. 328 of the Companies Act, 2013 provides that if the Tribunal is satisfied that there is a preference transfer of property, movable or immovable, or any delivery of goods, payment, execution made, taken or done by or against a company within 6 months before making winding up application, the Tribunal may order as it may think fit and may declare such transaction invalid and restore the position.

In the present case, during the winding up proceedings, the Official Liquidator came across a transaction where some of the properties of the Company was sold to a small Private Company. Mr. Nag, who was interested in that small Private Company happened to be the brother of Director of Kamath Trading Limited. The sale of the said properties took place on 20th March, 2020 at a price which was ₹ 58 Lacs less than the market price.

Conclusion: Official Liquidator may apply to Tribunal to treat the sale of properties as a transaction for fraudulent preference and restoring the position.

If the Tribunal is satisfied that there is a preference transfer of property, movable or immovable, within 6 months before making winding up application, the Tribunal may order as it may think fit and may declare such transaction invalid and restore the position.

Question 13.

Skyline Ltd. was ordered to be wound up compulsory on a petition filed on 10th February, 2021 before Tribunal. The official liquidator who has taken control for the assets and other records of the company has noticed that the Managing Director of the company has transferred certain properties belonging to the company to one of its creditor “Vansh (Pvt.) Ltd”, in which his son was interested. This was causing huge monetary loss to the company. The sale took place on 15th September, 2020.

Determine the rights and liabilities of fraudulently preferred persons by mortgage of charge of property to him to secure the company’s debt. [MTP-March 18, April 19]

Answer:

Determination of rights and liabilities of fraudulently preferred persons:

As per Sec. 331 of the Companies Act, 2013, where a company is being wound up and anything made, taken or done after the commencement of this Act is invalid under section 328 as a fraudulent preference of a person interested in property mortgaged or charged to secure the company’s debt, then, without prejudice to any rights or liabilities arising, apart from this provision, the person preferred shall be subject to the same liabilities, and shall have the same rights, as if he had undertaken to be personally liable as a surety for the debt,-

- to the extent of the mortgage or charge on the property, or

- the value of his interest, whichever is less.

![]()

Question 14.

Due to an unprecedented flood, all the fixed assets of a company were damaged extensively beyond renovation or repair. The cost of replacement of assets were huge and the sum insured on the fixed assets did not cover all the assets. Therefore, the operations of the company were permanently discontinued. Meanwhile, based on a winding-up petition filed by the secured creditors, the High Court passed a Winding-up order.

The workers of the company opposed to the winding-up petition and also filed an appeal against the winding-up order. The workers are not sure whether their appeal would be heard in the winding-up proceedings. Examine, under the provisions of the Companies Act, 2013, whether the appeal filed by the workers would succeed and their dues/interest will be protected in priority? [Nov. 19 – New Syllabus (4 Marks)]

Answer:

Rights of workers w.r.t. Winding up of the company:

There is no specific provision in Companies Act, 2013, as to workers’.rights at the time of filing of winding up petition. However, in may legal cases, it has been held that the workers of a company are entitled to appear at the hearing of the winding-up petition whether to support or to oppose it. They have a locus standi to appear and be heard both before the petition is admitted and an order for advertisement is made as also after the admission and advertisement of the petition until an order is made for winding up the company.

The workers also have a right of appeal against a winding up order. But when a winding-up order has become final, the workers ordinarily would not have any right to participate in any proceeding in the course of winding up.

As per Sec. 279 of the Companies Act, 2013, when a winding up order has been passed, no suit or other legal proceeding shall be commenced, or if pending at the date of the winding up order, shall be proceeded with, by or against the company, except with the leave of the Tribunal and subject to such terms as the Tribunal may impose.

As per Secs. 326 and 327 of the Companies Act, 2013, in the winding up of a company under this Act, the workmen’s dues shall be paid in priority to all other debts ranking pari passu with secured creditors.

Conclusion: Based on the discussion as stated above, it may be concluded that workers concerns will be duly considered and their dues will be given priorities as per provisions of sections 326 and 327.