Chapter 10 Valuation during Mergers & Acquisitions – CS Professional Valuations and Business Modelling Study Material is designed strictly as per the latest syllabus and exam pattern.

Valuation during Mergers & Acquisitions – CS Professional Valuations and Business Modelling Study Material

Question 1.

Write a short note on the following:

Hostile Takeover Bids (June 2016, 4 marks) [CMA Final]

Answer:

Hostile Takeover Bids: The acquiring firm, without the knowledge and consent of the management of the target firm, may unilaterally pursue the efforts to gain a controlling interest in the target firm, by purchasing shares of the latter firm at the stock exchanges. Such case of merger/acquisition is popularity known as ‘raid’.

The Caparo group of the U.K. made a hostile takeover bids to takeover DCM Ltd. and Escorts Ltd. Similarly, some other NRI’s have also made hostile bids to takeover some other Indian companies. The new takeover code, as announced by SEBI deals with the hostile bids. Space to write important points for revision

![]()

Question 2.

Write short notes on the following:

(a) Shareholder Value Analysis

(b) Valuing Synergy (Dec 2016, 4 × 2 = 8 marks) [CMA Final]

Answer:

(a) Shareholder Value Analysis:

Shareholder Value Analysis (SVA) focuses on the creation of economic value for shareholders, as measured by share price performance and flow of funds.

Shareholders Value is used to link management strategy and decision to the creating of value for shareholders.

Value Drivers: Factors or Value Drivers which influence the Shareholder’s Value are identified.

Example: Growth in Sales, Profit Margin, Capital Investments Decisions, etc.

Management Responsibilities: Management should pay attention to value drivers, while taking investment and finance decisions.

Benefit

(a) SVA helps the management to concentrate on activities which create value to the shareholders rather than on short-term profitability.

(b) SVA and EVA together helps to strengthen the competitive position at the firm, by focusing on wealth creation.

(c) They provide an objective and consistent framework of evaluation and decision making across all functions, departments and units of the Company.

![]()

(b) Synergy:

- The most general definition of synergy is a whole that is greater than the sum of its parts. In the context of takeovers, the additional value from synergy can come from a variety of sources, either operational or financial.

- The key to the existence of synergy is that the target firm controls a specialized resource that becomes more valuable when combined with bidding firm’s resources.

- The specialized resource will vary depending on the type of merger. In case of horizontal merger (it occurs when two firms in the same line of business merge), the synergy must come from some form of economies of scale, which reduces costs, or from increased market power, which increases profit margin and sales.

- Valuing synergy requires assumptions about future cash flows and growth.

- The lack of precision in the process does not mean that an unbiased estimate of value cannot be made.

- Thus, we maintain that synergy can be valued by answering two fundamental questions:

- What form is the synergy expected to take? Will it reduce costs as a percentage of sales and increase profit margins? Will it increase future growth?

- When can the synergy be expected to start affecting cash flows instantaneously.

- Once these questions are answered, the value of synergy can be estimated using an extension of discounted cash-flow techniques.

- First, the firms involved in the merger are valued independently by discounting expected cash flows to each firm at the weighted average cost of capital for that firm.

- Second, the value of the combined firm, with no synergy, is obtained by adding the values obtained for each firm in the first step.

- Third, the effects of synergy are built into the expected growth rates and cash flows, and the combined firms revalued with synergy.

- The difference between the values of the combined firm with synergy and the value of the combined firm without synergy provides a value for synergy.

![]()

Question 3.

(a) Why do many mergers fail? (June 2009) (5 marks) [CMA Final]

(b) What factors are considered for selection of a target in a business acquisition strategy? (5 marks) [CMA Final]

Answer:

(a) Major reasons why mergers fail:

- Lack of fit due to difference in management styles or corporate structures.

- Lack of commercial fit.

- Paying too much.

- Cheap purchases turning out to be costly in terms of resources required to turn around the acquired company.

- Lack of community of goals.

- Failure to integrate effectively.

(b) Factors to be considered for selecting a target:

- The target fits well with the acquisition objective.

- The target has growth potential but faces some solvable managerial problems.

- The market value of the target is lower than the acquirer’s.

- The target does not have too many ongoing litigations with substantial financial impact.

- The target’s market-to-book value ratio is less than one.

![]()

Question 4.

Explain the relationship of synergy with Strategic realignment in the context of Merger. (June 2010, 5 marks) [CMA Final]

Answer:

Synergy is the term used to describe a situation where different entities co-operate and the value created is greater than the sum of its parts. The most fundamental of all reasons for mergers is the ‘Synergy’ argument, which serves as the basis of strategic realignment.

Separate Companies “pre-merger values”: Accordingly under Synergy, the combined value of a firm is much greater than the value of individual firms. The phenomenon of synergy arises due to economies of scale of operation. Besides, the combined mega features such as enhanced managerial capabilities, creativity innovativeness, R&D and market coverage capacity expand beyond simple arithmetic. Due to the complementary nature of the resources and skills, a widened horizon of opportunities is also responsible for “Synergy” on a merger situation.

For example, Madura Bank had a very big network compared to ICICI Bank. Bank of Madura had one of the lowest costs of deposit and capital Adequacy Ratio was very high. ICICI had latest technology to be implemented and subsidiaries overseas but had no significant network in India. So ICICI and Madura Bank came together and there was a dramatic improvement post merger due to synergy.

![]()

Question 5.

Discuss the causes of horizontal and vertical mergers. (June 2011, 5 marks) [CMA Final]

Answer:

The causes of mergers of two firms in the same industry Horizontal Mergers:

- Economies of scale

- Increased monopoly and bargaining power

- Complementary nature of product and services

- Management opportunity

- Acquisition of new products and brands

Vertical Mergers:

- Value chain management

- Technological and other economies

- Tax benefit

- Better control on the supply side

![]()

Question 6.

Explain the various methods of payment in case of mergers and amalgamations. (June 2011, 3 marks) [CMA Final]

Answer:

METHODS OF PAYMENT IN MERGERS & AMALGAMATIONS

The different methods of payment in mergers and acquisitions are given below:

Cash :

Where one company purchases the shares or assets of another for cash, the shareholders of the latter company cease to have any interest in the combined business. The shareholders of the selling company get the specified sum on the disposal of their shares. The disadvantage is that they may be liable to capital gains tax.

Loan Stock :

In this case, the shareholders of the selling company exchange their equity investment for a fixed interest investment in the other company. The advantage is that any liability to capital gains tax will be deferred until the disposal of the loan stock. The advantage to the shareholders increases with higher residual income accruing to them. In addition, interest on the loan stock is deductible for company tax purposes.

![]()

Ordinary Shares :

A share for share exchange is often the method used in combinations involving large companies. Here the shareholder merely exchanges his shares in one company for shares in another company, the advantage is that the shareholders of the selling company continue to have an interest in the combined businesses and will not be subject to capital gains tax on the exchange. However, the value of the security, which he receives, is not certain but will depend upon market reaction to the combination.

Convertible Loan Stock :

The issue of convertible loan Stock is sometimes used in connection with business combinations. In such a case, the shareholders in one company exchange their shares for convertible loan stock in another company. The selling shareholder exchanges an equity investment for a fixed interest security which is convertible into an equity investment at some time in the future if he so desires.

![]()

Question 7.

What is partial Sell off? (Dec 2011, 4 marks) [CMA Final]

Answer:

- A partial sell off means Slump sale is transfer of one or more business undertakings for a lump sum consideration, without assigning individual values to the each assets and liabilities to be transferred. It is not sale of assets which on its own cannot produce sustainable revenue.

- Under Indian Income tax Act, 1961, “slump sale” means the transfer of one or more undertakings as a result of the sale for a lump sum consideration without values being assigned to the individual assets and liabilities in such sales.

- Therefore transferor is not required to assign value to each “assets and liabilities” of “business undertaking” to be transferred.

- In other words, the sale of a business unit or plant of one firm to another. It involves the purchase of a business unit or plant of one firm by another.

- It is the mirror image of a purchase of a business unit or plant. From the seller’s perspective, it is form of contraction; from the buyer’s point of view, it is a form of expansion.

![]()

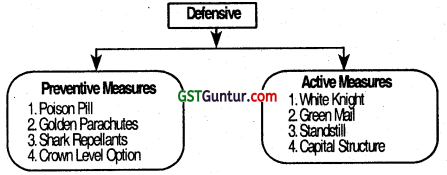

Question 8.

What are the defensive strategies available to a company in case of hostile takeover ? (Dec 2011, 5 marks)

Answer:

Question 9.

(a) Why do many mergers fail? (June 2012) (5 marks) [CMA Final]

(b) Discuss Synergy with reference to merger. (5 marks) [CMA Final]

Answer:

(b) Synergy:

- Synergy results from complementary activities.

- For example one firm may have a substantial amount of financial resources while the other has profitable investment opportunities.

- Likewise one firm may have a strong research and development team whereas the other may have a very efficiently organized production department.

- Similarly one firm may have well established brands of its products but lacks marketing organization and another firm may have a very strong marketing organization.

- The merged business unit in all these cases will be more efficient than the individual firms. And hence the combined value of the merged firms is likely to be greater than the sum of the individual entities (units).

- Symbolically; Combined value = Stand alone value of acquiring firm Va + Stand alone value of acquired target firm Vt +Value of synergy ∆Vat

- Normally the value of synergy is positive and this constitutes the rationale for the merger.

- In valuing synergy costs attached with acquisitions should also be taken into account.

- These costs primarily consist of costs of integration and payment made for the acquisition of the target firm in excess of its value Vt.

- Therefore the net gain from the merger is equal to the difference between the value of synergy and costs.

Net gain = Value of synergy ∆ Vat – costs.

![]()

Question 10.

What do you mean by reverse merger? (Dec 2012, 5 marks) [CMA Final]

Answer:

A Reverse Merger is a transaction whereby the private company shareholders may gain’control of a public company by merging it in with their private company. The private company shareholders receive a substantial majority of the shares qf the public company (normally 85% to 90% or more) and the control of the board of directors. When a healthy company merges with a sick or a small company it is called reverse merger.

Following are some of the reverse merger:

1. The Transferee Company is a sick company and has carried forward losses and Transferor Company is profit making company. If Transferor Company merges With sick transferee company, it gets advantages of setting off carry forward losses without any additions. If sick company merges with a healthy company, many restrictions are applicable for allowing set off of the accumulated losses.

2. If Transferee Company is a listed company and transferor, non-listed company merges With the listed company; it gets advantages of listed company without fQllowing strict norms of listing of stock exchanges. In such cases, it is provided that on the date of merger, name of Transferee Company will be changed to that of Transferor Company. Thus, outside people even may not know that the transferee company with which they are dealing after merger is not the same as the earlier one.

![]()

Question 11.

What is value chain analysis? (Dec 2012, 5 marks) [CMA Final]

Answer:

Value Chain Analysis is a useful tool for working out how you can create the greatest possible value for your customers. In business, we’re paid to take raw inputs, and to “add value” to them by turning them into something of worth to other people. This is easy to see in manufacturing, where the manufacturer “adds value” by taking a raw material of little use to the end-user (for example, wopd pulp) and converting it into something that people are prepared to pay money for (e.g. paper).

Value chain analysis is relevant for most business, but particularly useful: A vertically integrated business is engaged in all the activity required for converting raw material from sourcing to converting into and selling the finished goods to the ultimate consumers including after sales service. Value chain analysis helps in identifying company is doing well, where the company needs to improve and what the company can outsource profitably.

Activity susceptible to technological change. Technological changes can disintegrate value chains, permitting companies to specialize in to narrow set of activities.

![]()

Question 12.

(a) Discuss the amalgamation in the nature of merger as per Accounting Standard, AS-14. (Dec 2013) (6 marks) [CMA Final]

(b) What are the factors that favour external growth and diversification through mergers and acquisitions? (4 marks) [CMA Final]

Answer:

(a) Amalgamation in the nature of merger: As per AS -14, an amalgamation is called in the nature of merger if it satisfies all the following condition:

(i) All the assets and liabilities of the transferor company should become, after amalgamation the assets and liabilities of the other company.

(ii) Shareholders holding not less than 90% of the face value of the equity shares of the transferor company (other than the equity share already held therein, immediately before the amalgamation, by the transferee company or its subsidiaries or their nominees) become equity shareholders of the transferee company by virtue of the amalgamation.

(iii) The consideration for the amalgamation receivable by those equity shareholders of the transferor company who agree to become equity shareholders of the transferee company is discharged by the transferee company wholly by the issue of equity shares in the transferee company, except that cash may be paid in respect of any fractional shares.

(iv) The business of the transferor company is intended to be carried on, after the amalgamation by the transferee company.

(v) No adjustment is intended to be made in the book value of the assets and liabilities of the transferor company when they are incorporated in the financial statements of the transferee company except to ensure uniformity of accounting policies.

![]()

Amalgamation in the nature of merger is an organic unification of two or more entities or undertaking or fusion of one with another. It is defined as an amalgamation which satisfies the above conditions. As per Income Tax Act 1961, merger is defined as amalgamation with the following three conditions to be satisfied.

(i) All the properties of amalgamating company(s) should vest with the amalgamated company after amalgamation.

(ii) All the liabilities of the amalgamating company(s) should vest with the amalgamated company after amalgamation.

(iii) Shareholders holding not less than 75% in value or voting power in amalgamating company (s) should become shareholders of amalgamated companies after amalgamation. Amalgamation does not mean acquisition of a company by purchasing its property and resulting in its winding up. According to Income tax Act, exchange of shares with 90% of shareholders of amalgamating company is required.

(b) Factors that favour external growth and diversification through Mergers and Acquisitions

- Some goals and objectives may be achieved more speedily through an external acquisition.

- The cost of building an organization internally may exceed cost of an acquisition.

- There may be fewer risks, lower costs or shorter time requirements involved in achieving an economically feasible market share by the external route.

- The firm may not be utilizing their assets or arrangement as effectively as they could be utilized by the acquiring firm.

- The firm may be able to use securities in obtaining other companies, where as it might not be able to finance the acquisition of equivalent assets and capabilities internally.

- There may be tax advantages.

- There may be opportunities to complement capabilities of other firms.

![]()

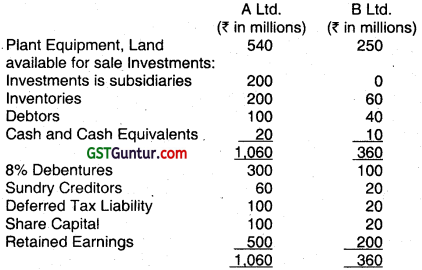

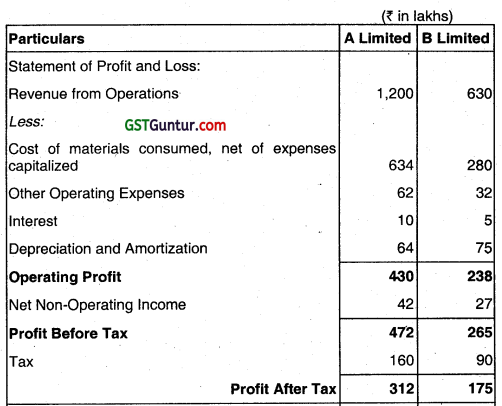

Question 13.

The Balance Sheets of A Ltd. and B Ltd., separately are given to you. B Ltd. ¡s a legal subsidiary of A Ltd.

A Ltd. holds 90% of 20 million shares of B Ltd. (face value Re.1), A Ltd. has 100 million shares. Market price of A Ltd. shares as on December 31,2007 is ₹ 70 and that of B Ltd. ₹ 18.

It was decided that B Ltd. will acquire A Ltd., by issuing its equity shares. For this purpose the plant equipment of A Ltd. were valued at ₹ 644 million and investments in B Ltd., which are 18 million shares, valued at market price. How many shares of B Ltd. should be issued to acquire A Ltd. without any acquisition of goodwill? (Dec 2008, 15 marks) [CMA Final]

Answer:

B Ltd. may issue shares to the extent fair value of the net assets of A Ltd. including its own shares held by A Ltd.

By this it will effectively buy-back its 18 million shares from A Ltd. through Business Acquisition.

| Fair Value of Assets acquired | ₹ in million |

| Plant, Equipment etc., | 644 |

| Investment in subsidiaries | 324 |

| Inventories | 200 |

| Debtors | 100 |

| Cash | 20 |

| Total | 1,288 |

| Less: Liabilities acquired | |

| 8% Debentures | 300 |

| Sundry Creditors | 60 |

| Deferred Tax Liability | 100 |

| Total | 460 |

| Net Assets acquired | 828 |

| Consideration paid | 828 |

| No. of shares issued = 828/18 | 46 million shares. |

![]()

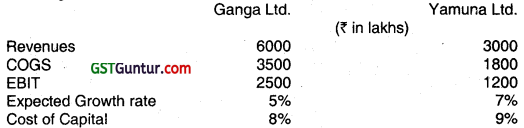

Question 14.

Consider two firms that operate independently and have following characteristics:

Both firms are in steady state with capital spending offset by depreciation. Both firms have an effective tax rate of 40% and are financed only by equity. Consider the following two scenarios:

Scenario-1: Assume that combining the two firms will create economies of scale that will reduce the COGS to 50% of Revenue.

Scenario-ll: Assume that as a consequence of the merger, the combined firm is expected to increase its future growth to 7% while GOGS will be 60%.

It is given that Scenario I & II are mutually exclusive.

You are required to:

(a) Compute the values of both the firms as separate entities.

(b) Compute the value of both the firms together if there were absolutely no synergy at all from the merger.

(c) Compute the value of cost of capital and the expected growth rate.

(d) Compute the value of synergy in (i) Scenario I & (ii) Scenario II. (June 2009, 3 + 2 + 2 + 4 + 4 = 15 marks) [CMA Final]

Answer:

(a) Value of Ganga Ltd. = FCFF(1 + g)/(Ke – g) = EBIT(1 – t)(1 + 0.05) /(0.08 – 0.05)

= 2500(1 – 0.4)(1 + 0.05)/0.03

= ₹ 52,500L.

Value of Yamuna Ltd. = 1200(1 – 0.4)(1 + 0.07)/(0.09 – 0.07) = ₹ 38,520L.

(b) Value of both firms without synergy = ₹ 52.500L + ₹ 38,520L = ₹ 91020L

(c) Cost of capital 8% × 52,500/91,020 + 9% × 38,520/91,020 = 8.42%

Expected growth = .05 × 52,500/91,020 +.07 × 38,520/91,020 = 5.84%

(d) Claculation of Value of Synergy:

![]()

Question 15.

Perfect Precision Limited has adopted a strategy of inorganic growth and as a consequence, it is always on the look out for a soft vjj target to be acquired. Recently, the company has identified Exact Precision Limited as a target company and the concerned team is working on this acquisition. Some of the financial data collected by the team is given below:

| Perfect Precision Limited | Exact Precision Limited | |

| Earnings per Share (EPS) | ₹ 7.50 | ₹ 5.00 |

| Market Price per Share (MPS) | ₹ 80.00 | ₹ 35.00 |

| Number of Shares (in Crores) | 100 | 25 |

It is expected that there may be a synergy gain of 5%. Assume that you are one of the members of the concerned team and are requested to determine the exchange ratio it Perfect Precision Limited wants to have post-merger earnings per share of ₹ 6 (June 2010, 8 marks) [CMA Final)

Answer:

| Perfect Precision Limited | Exact Precision Limited | |

| Earnings Per Share (EPS) | ₹ 7.50 | ₹ 5.00 |

| Market Price Per Share (MPS) | ₹ 80.00 | ₹ 35.00 |

| Number of Shares (in crores) | 100 | 25 |

| Total Earnings of Perfect Precision Limited | ₹ 750.00 | |

| Total Earnings of Exact Precision Limited | ₹ 125.00 | |

| Total | ₹ 875.00 | |

| Synergy Gain @ 5% | ₹ 43.75 | |

| Total Earnings of the Combined Entity | ₹ 918.75 | |

| Desired. Post-Merger EPS | ₹? 6.00 | |

| No. of Shares of Perfect Precision Limited postmerger | 153.125 | |

| Therefore, new shares are to be issued | 53.125 | |

| Hence, exchange ratio will be | 2.125 | |

![]()

Question 16.

Two firms ANKIT LTD., and SMITH LTD., operate independently and had the following financial statements:

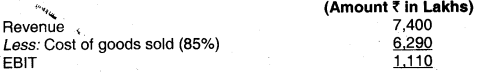

(Amount in ₹ Lakhs)

| Particulars | ANKIT LTD. | SMITH LTD. |

| Revenues | 4400 | 3000 |

| Cost of Goods Sold | 3850 | 2670 |

| EBIT | 550 | 330 |

| Expected Growth Rate | 5% | 6% |

| Cost of Equity | 10% | 12% |

| Cost of Debt (pre-tax) | 9% | 9% |

| Debt Equity Ratio | 1 : 2 | 2 : 3 |

Both firms are in a steady state and working capital requirements for both firms are Nil. Both firms have tax rate of 35%. Combining the two firms will create economies of scale in the form of shared distribution and advertising costs which will increase its future growth to 7% and reduce the cost of goods sold to 85% of revenues.

Requirements:

(i) Estimate the value of both firms as separate entities

(ii) Estimate the value of combined firm with no synergy effect

(iii) Estimate the value of combined firm with synergy effect

(iv) Compute the value of synergy (June 2010, 3 + 2 + 3 + 2 = 10 marks) [CMA Final]

Answer:

(i) Value of Ankit Ltd.:

FCFF (1 + g)/Kc – g)

= [EBIT(1 – t) × 1.05]/(0.0862 – 0.05)

= (550 × 0.65 × 1.05)/0.0362

= ₹ 10,369.48 lakh

![]()

Cost of Capital:

[2 × 0.10 + 1 × (1 – 0.35) × 0.09] / 3 = 8.62%

Value of Smith Ltd.:

FCFF(1 + g)/(Kc – g)

= [EBIT(1 – t) × (1 + g)]/(Kc – g)

= (330 × 0.65 × 1.06)/(0.0954 – 0.06)

= ₹ 6,422.88 lakh

Cost of Capital :

[3 × 0.12 + 2 × (1 – 0.35) × 0.09] / 5 = 9.54%

(ii) Value of combined firm with no synergy:

(10369.48 + 6422.88) = ₹ 16,792.36 lakh

(iii) Value of combined firm with synergy effect:

Cost of Capital for combined firm:

(0.0862 × 10369.48 × 0.0954 × 6422.88)/16792.36

= 0.08972 i.e. 8.97% (WACC)

Expected Growth = 7%

4″Value of combined firm with synergy:

[1110 × (1 – t) × 1.07]/(Kc – g)

= (1110 × 0.65 × 1.07)/(0.0897 – 0.07)

= ₹ 39188.07 lakh

(iv) Value of Synergy:

[Value of combined firm with Synergy – Value of combined firm without Synergy

(39,188.07 – 16,792.36) = ₹ 22,395.71 lakh]

![]()

Question 17.

As the General Manager (Finance) of ZENITH LTD. you are investigating the acquisition of STARLIGHT LTD. The following tacts are given:

| ZENITH LTD. | STARLIGHT LTD. | |

| Earning per Share | ₹ 6.75 | ₹ 2.50 |

| Dividend per Share | ₹ 3.25 | ₹ 1.00 |

| Price per Share | ₹ 48 | ₹ 15 |

| Number of Shares | 60,00,000 | 20,00,000 |

Investor currently expected the dividends and earnings of Starlight Ltd. to grow at a steady rate of 7%. After acquisition, this growth rate would increase to 8% without any additional investment.

Required:

(i) What is the benefit of the acquisition?

(ii) What is the cost of the acquisition to ZENITH LTD. if it pays.

(a) 7 17 per share compensation(cash) to Starlight Ltd., and (b) Offer one share for every 3 shares of Starlight Ltd.? (June 2010, 4 + 3 + 4 =11 marks) [CMA Final]

Answer:

(i) Rate of Return (Ke) required by the investors of Starlight Ltd:

Ke = D1/P1 + g = 1/15 + 0.07 = 0.1367 i.e. 13.67%

If g – 8% then Pst = (1.00 × 1.08) / (0.1367 – 0.08) = ₹ 19.0476

Benefit of Acquisition = (Price of Starlight with Merger – Price of Starlight without Merger) × Ns

= (19.0476 -15) × 20,00,000]

= ₹ 80,95,200

![]()

(ii) Cost of Acquisition to Zenith Ltd.

(a) If it pays ₹ 17 cash compensation

= Cash Compensation – PVs

= (17 × 20,00,000) – (15 × 20,00,000)

= ₹ 40 lakh

(b) if Zenith Ltd. offers one share for every three shares of Starlight, then the share of Starlight (a) in the combined entity will be:

(∝) = [(1/3) × 20,00,000]/[60,00,000 + (1/3) × 20,00,000]

= 6,66,667/66,66,667

= 0.10

Pvzs = PVz + PVs + Synergy (Benefit Merger)

= 2880 + 300 + 80.95

= ₹ 3260.95 lakh

Cost of Acquisition to Zenith Ltd. given the exchange ratio:

= (∝) × PVzs – PVs

= 0.10 × 3260.95 – 300

= ₹ 26.95 lakh

![]()

Question 18.

AKASH LTD. wants to take over VASTAN LTD. and the financial details are as follows:

(Amount in ₹ lakhs)

| AKASH LTD. | VASTAN LTD. | |

| Preference Share Capital | 20 | — |

| Equity Share Capital (₹10 at par) | 100 | 50 |

| Share Premium | — | 2 |

| Profit & Loss Account 10% Debentures | 38 | 4 |

| 15 | 5 | |

| Total | 173 | 61 |

| Property, Plant and Equipment | 122 | 35 |

| Current Assets | 51 | 26 |

| Total | 173 | 61 |

| Profit after Tax & Preference Dividend | 24 | 15 |

| Market Price | ₹ 24 | ₹ 27 |

![]()

Requirements:

(a) What should be the share exchange ratio to be offered to the shareholders of VASTAN LTD. based on:

(i) Net Asset Value;

(ii) EPS, and

(iii) Market Price;

(b) Which should be preferred from the point Of AKASH LTD.? (June 2010, 5 + 4 + 4 + 2 = 15 marks) [CMA Final]

Answer:

(a) (i) Share exchange ratio based on Net Asset Value:

| (Amount in ₹ Lakh) | Akash Ltd. | Vastan Ltd. |

| Total Assets | 173 | 61 |

| Liabilities | (15) | (5) |

| Preference Share Capital | (20) | — |

| Net Assets for equity Shareholders | 138 | 56 |

| No. of Equity Shares (lakhs) | 10 | 5 |

| Worth per share | ₹ 13.80 | ₹ 11.20 |

| Ratio of Net Asset Value per share | 1.00 | 0.812 |

For 5 Iakh shares of Vastan Ltd., Akash Ltd. will have to issue (5 × 0.812)

= 4.060 lakh shares

![]()

(ii) Share exchange ratio based on EPS:

| (Amount in ₹ Lakh) | Akash Ltd. | Vastan Ltd. |

| Earnings | 24 | 15 |

| Shares outstanding (nos. Lakhs) | 10 | 5 |

| EPS | ₹ 2.40 | ₹ 3.00 |

| Ratio of EPS | 1.00 | 1.25 |

For 5 lakh shares of Vastan Ltd.. Akash Ltd. will have to issue (5 × 1.25)

= 6.250 lakh shares

(iii) Share exchanqe ratio based on Market Price:

| Akash Ltd. | Vastan Ltd. | |

| Market Price | ₹ 24 | ₹ 27 |

| Ratio | 1.000 | 1.125 |

For 5 lakh shares of Vastan Ltd., Akash Ltd. will have to issue (5 × 1.125) = 5.625 lakh shares

(b) From the point of view of Akash Ltd., the shares exchange ratio based on Net Asset Value may be preferred as in this case number of shares to be issued is the least 4.060 lakh shares.

![]()

Question 19.

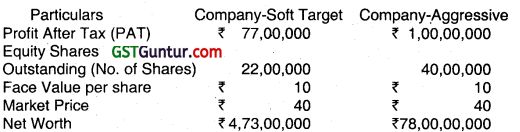

Company-Aggressive has decided to takeover Company-Soft Target and merge it with itself. In this respect, you have been provided the following information:

It is decided that the exchange ratio would be based on the market prices of these two companies and there would not be any cash payment, all settlement would be by issuing equity shares of Company-Aggressive to the shareholders of Company-Soft Target.

You are required to determine the following:

(i) What will be the EPS of both the companies after the merger?

(ii) What will be the change in the EPS of each company due to the merger?

(iii) Assuming that Relative Valuation Method based on P/E Multiple is an appropriate method for determining the price of the equity share of Company-Aggressive and its P/E should be 15 after the merger, what will be the market price of the equity share of Company-Aggressive after the merger?

(iv) What will be the market capitalization of Company-Aggressive after the merger?

(v) What will be the gains accruing to the shareholders of both the companies after the merger?

(vi) Will the decision of Company-Aggressive to acquire Company-Soft Target and merge it in itself be a value creating decision? (Dec 2010, 4+2+4+2+2+1=15 marks) [CMA Final]

Answer:

- Since the market price of both companies are same, the Exchange Ratio will be 1:1

- New Shares to be issued to the shareholders of Company – Soft Target: 22,00,000

- Total Shares of Company-Aggressive (22,00,000 + 40,00,000) : 62,00,000

- Assuming no synergy gains, the Total Profit of the Company – Aggressive after merger will be (₹ 77,00,000 + 1,00,00,000) : ₹ 17,700,000

![]()

Therefore, New EPS of Company – Aggressive after the merger is: ₹ 2.85

(i) Old EPS (before merger):

Company – Soft Target (77,00,000/22,00,000) : ₹ 3.50

Company – Aggressive (1,00,00,000/40,00,000): ₹ 2.50

(ii) Decrease in the EPS – Company -Soft Target (₹ 3.50 – 2.85): ₹ 0.65

Increase in the EPS – Company – Aggressive (₹ 2.85 – 2.50) ₹ 0.35

(iii) Market Price of the Equity Share of Company – Aggressive after merger based on the P/E of 15 is (15 × 2.85): ₹ 42.82 [(1,77,00,000 ÷ 62,00,000) × 15 = ₹ 42.82]

(iv) Market Capitalization of Company – Aggressive after merger (₹ 42.82 × 62,00,000): ₹ 26,55,00,000 or, [1,77,00,000 × 15] = ₹ 26,55,00,000

(v) Market Capitalization of both companies (before merger):

Company – Soft Target (₹ 40 × 22,00,000): ₹ 88,000,000

Company – Aggressive (₹ 40 × 40,00,000): ₹ 160,000,000

Total Market Capitalization: ₹ 248,000,000

Total Gains to shareholders of both the companies (₹ 26,55,00,000 – 24,80,00,000): ₹ 17,500,000

(vi) Since the market capitalization of the companies after the merger has gone up, it shows that the decision to merger has created value for shareholders.

![]()

Question 20.

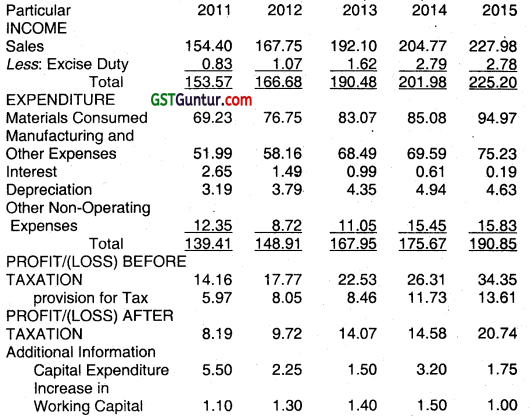

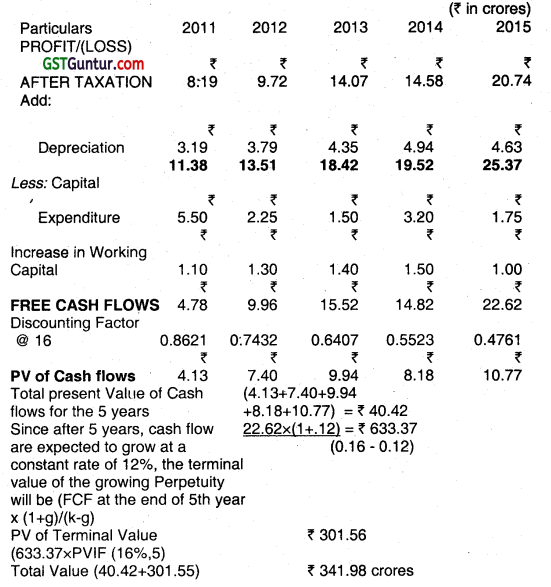

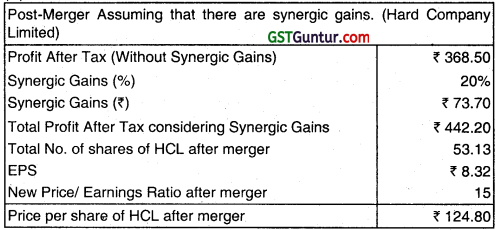

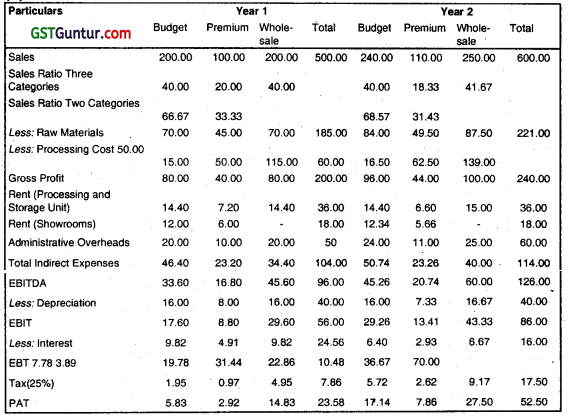

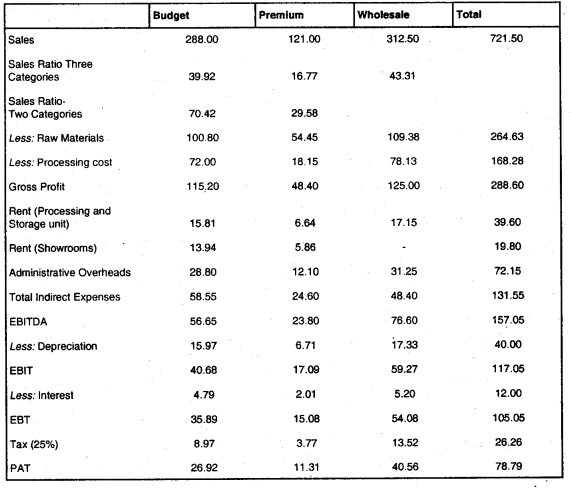

Soft-Tech International Limited has identified a target company, Sunshine India Ltd. and asked Value Search Consultant Pvt. Limited to provide necessary valuation of the business of the target company. The target company identified is from Karnataka and is located in Mysore. On the basis of the past financial records, Value Search Consultant Pvt. Limited has projected necessary financials for the company for the next five years which are given below:

PROFIT AND LOSS ACCOUNT OF SUNSHINE INDIA LIMITED FOR THE YEAR ENDING ON 31ST MARCH (₹ crores)

The Cost of capital for the company is estimated to be 16%. Assuming that the free cash flows of the target company will grow at a constant rate of 12% forever after 2015, you are required to determine the value of the business based on the free cash flows. (Dec 2010, 15 marks) [CMA Final]

Answer:

![]()

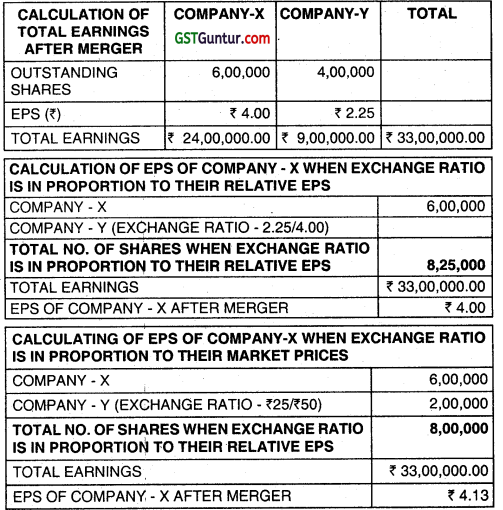

Question 21.

A Company-X is contemplating the purchase of another Company-Y. Company-X is having 6 lakhs shares outstanding having a current market price of ₹ 50 per share, while Company-Y has 4 lakhs shares outstanding having a current market price of ₹ 25 per share. The Earning Per Share (EPS) of Company-X is ₹ 4 while that of the Company-Y is ₹ 2.25 per share. Company-X in consultation with Company-Y is considering the following two alternative ways to determining the exchange ratio:

(i) In proportion of their relative EPS.

(ii) In proportion of their current market prices.

Suggest which alternative way Company-X should use to determine the exchange ratio so that after the merger increase in the EPS of Company-X is higher. (Dec 2010, 8 marks) (CMA Final)

Answer:

Since EPS s higher ¡p case the exchange ratio is determined on the basis of market prices, Coripany-X should go for the same.

![]()

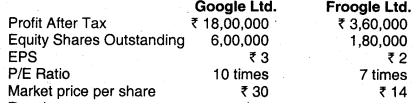

Question 22.

Google Ltd. wants to acquire Froogle Ltd. and has offered a swap ratio of 1 : 2 (0.5) shares of Google Ltd. for every oneshare of Froogle Ltd. Following Information is provided :

Require:

(i) The number of equity shares to be issued by Google Ltd. for acquisition of Froogle Ltd.

(ii) What is the EPS of Google Ltd. after acquisition ?

(iii) What is the expected market price per share of Google Ltd. after the acquisition, assuming Its P/E multiple remains unchanged ?

(iv) Determine the market value of the merged firm. (June 2011, 12 marks) [CMA Final]

Answer:

(i) The number of shares to be issued by Google Ltd. 1,80,000*0.5

= 90,000 shares

(ii) EPS of Google Ltd. after acquisition

Total earning (1 8,00.000 + 3,60.000) = ₹ 21,60,000

No. of shares (6,00,000 + 90,000) = 6,90,000

EPS = 21 ,60,000 / 6,90,000 = ₹ 3.13

(iii) New Market price of Google Ltd. (PIE remaining unchanged)

Present PIE Ratio of Google Ltd. 10 times

Expected EPS after merger ₹ 3.13

Expected market price (3.13*10) = ₹ 31.30

(iv) Market value of merged firm

Total No. of shares 6,90,000

Expected market price ₹ 31.30

Total Value (6,90.000*31.30) ₹ 2,15,97,000

![]()

Question 23.

Dominating Limited is planning to acquire Weak Limited and it is expected that the deal would be finalized after one year. The management of Dominating Limited is trying to get an estimate of share prices of Weak Limited after one year.

Assume that the company contacts you and provides the following necessary information:

- Beta of Weak Limited = 1.25

- Expected Return on the Market Index = 16.50%

- Risk Free Rate = 8%

- Expected Dividend Payment by the end of the year by Weak Limited = ₹ 5 per share on a face value of ₹ 10 each.

- Share price of Weak Limited at present = ₹ 70

You are required to determine the expected price of Weak Limited after one year. (Dec 2011, 6 marks) [CMA Final]

Answer:

Cost of Equity as per CAPM = 8% + (16.50 – 8)*1.25

= 18.625%

Price after One Year = Price at Present × (1 + cost of equity) – Divided Payment

= 70 × (1 +18.625%) – 5 = 78.04

![]()

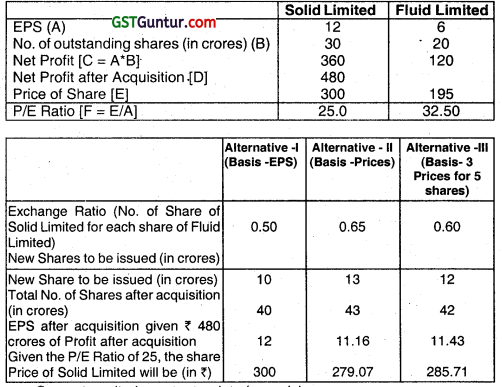

Question 24.

Solid Limited is in the Pharmaceutical Industry and has a business strategy of growing inorganically. For this purpose, it is contemplating to acquire Fluid Limited which has a strong hold in cardiac segment. Solid Limited has 30 crores shares outstanding which are trading on an average price of ₹ 300 while Fluid Limited has outstanding shares 20 crores and are selling at an average price of ₹ 195 per share. The EPS are ₹ 12 and ₹ 6 for Solid Limited and Fluid Limited respectively. Recently, the management of both the companies had a meeting wherein number of alternative proposals were considered for exchange of shares. They are –

(i) Exchange Ratio should be in proportion to the relative EPS of two companies.

(ii) Exchange Ratio should be in proportion to the relative Prices of two companies.

(iii) Exchange Ratio should be 3 shares of Solid Limited for every 5 shares of Fluid Limited.

You are required to estimate EPS and Market Price assuming the P/E of Solid Limited after merger will remain unchanged, under each of the three options. (Dec 2011, 6 marks) [CMA Final]

Answer:

![]()

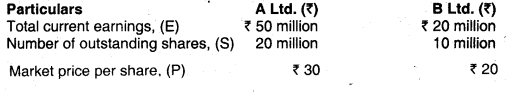

Question 25.

A Ltd. Plans to acquire B Ltd. The following information is available:

(i) What is the maximum exchange ratio acceptable to the shareholders of A Ltd. if the PE ratio of the combined entity is 12 and there is no synergy gain.

(ii) What is the exchange ratio acceptable to the shareholders of B Ltd. if the PE ratio is 1]1 and there is synergy benefit of 5%?

(iii) Assuming that there is no synergy gain, at what level of PE multiple will the lines indicating earnings ratio 1 and earnings ratio 2 intersect? (Dec 2011, 4 + 4 + 3 = 11 marks) [CMA Final]

Answer:

(i) Maximum exchange ratio from the point of the shareholder of A Ltd.

ER1 = -S1/S + PE12(E12)/P1S2

= -20 million/1 Omillion + 12*70million/30*10 million

= 0.80

(ii) Exchange ratio from the point of the shareholder of B Ltd.

ER2 = P2S1/(P12)(E12) – P2S2

= 20*20 million/11 *(70million*1,05)-20*10 million

= 400million/ 808.5-200

= 0.657

(iii) Assuming that there is no synergy gain, the lines ER and ER will intersect at the weighted average of the two price-earnings multiples, wherein the weights correspond to the respective earnings of the two firms:

PE12 = 50/70PE1 + 20/70PE2

= 50/70*12 + 20/70*10

= 11.43

![]()

Question 26.

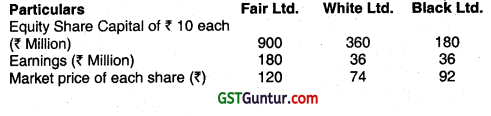

Fair Ltd. is considering takeover of White Ltd. and Black Ltd. The financial data for the three company are as follows:

You are required to calculate:

(i) Price Earning Ratios

(ii) Earning per share of Fair Ltd. after acquisition of White Ltd. and Black Ltd. separately.

(iii) Will you recommend the merger of either/both of the companies? Justify your answer. (Dec 2011, 10 marks) (CMA Final)

Answer:

(i) Calculation of PIE Ratio

(iii) EPS of Fair Ltd. after acquisition with Black Ltd. is higher than EPS of Fair Ltd. itself as well as EPS if Fair Ltd. acquires White Ltd. Hence, merger with only Black Ltd. suggested increasing the value to shareholder of Fair Ltd.

![]()

Question 27.

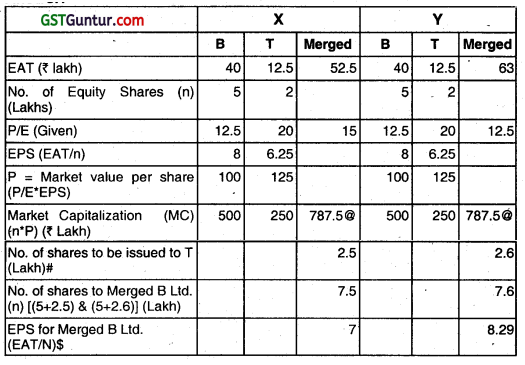

X Ltd. is investigating the acquisition of Y Ltd. Y Ltd.’s balance sheet is given below: –

Y Ltd: Balance Sheet (₹ in crore)

| 10% Cumulative preference shares | 100 | |

| Ordinary share capital (30 crore shares @ ₹ 10 per share) | 300 | |

| Reserves & Surplus | 150 | |

| 14% Debentures | 80 | |

| Current Liabilities | 100 | |

| Total | 730 | |

| Property, Plant and Equipment | 275 | |

| Investments | 50 | |

| Current Assets | ||

| Stock | 190 | |

| Book debts | 150 | |

| Cash & Bank | 65 | 405 |

| Total | 730 |

![]()

X Ltd. proposed to offer the following to Y Ltd.

(a) 10% cumulative preference shares of ₹ 100 crore In X Ltd. for paying 10% cumulative preference capital of Y Ltd.

(b) 12% convertible debentures of ₹ 84 crore in X Ltd. to redeem 14% debentures of Y Ltd.

(c) One ordinary share of X Ltd. for every three shares held by Y Ltd.’s shareholders, the market price being ₹ 42 for X Ltd’s shares and ₹ 20 for Y Ltd.’s shares.

After acquisition, X Ltd. is expected to dispose of Y Ltd.’s stock for ₹ 150 crore, book debts for ₹ 102 crore and investments for ₹ 55 crore. It would pay entire current liabilities. What ¡s the cost of acquisition to X Ltd.? If X Ltd.’s required rate of return is 20% how much should be the annual after-tax cash flows from Y Ltd.’s acquisition assuming a time horizon of 8 years and a zero salvage value? Would your answer change if there is a salvage value of ₹ 30 crore alter 8 years?

Given, Present Value of ₹ 1 discounted © 20% cumulative for 1 to 8 years = 3.837 and Present Value of ₹ 1 in 8th year discounted @ 20% = 0.233. (June 2012, 15 marks) (CMA Final)

Answer:

Cost of Acquisition

| Crore | ||

| 10% Cumulative Preference share | 100 | |

| 12% Convertible debentures | 84 | |

| Ordinary share capital ₹ (30/3 × 42) | 420 | |

| Payment of current liabilities | 100 | |

| Gross payment (A) | 704 | |

| Less: realization from Investment | 55 | |

| Stock | 150 | |

| Book debts | 102 | |

| Cash & Bank | (B) 65 | 372 |

| Net Cost (A-B) | 332 |

![]()

Computation of annual after – tax cash flows.

332 = A × PVAF (0.208)

332 = A × 3.837 or A = ₹ 86.53 crore (Annual Cash Flows)

Computation of annual after – tax cash flows with salvage value.

332 = A × PVAF (0.208) + 30 × PVF (0.208)

332 = 3.837 A + 0.233 × 30

332 = 3.837 A + 6.99

A = ₹ 84.70 crores (Annual cash flows with salvage value of ₹ 30 crore after 8 years.)

![]()

Question 28.

The following is provided in relation to VASUDA LTD. and MASH IT LTD. (June 2012)

| VASUDA LTD. | MASHIT LTD. | |

| Market Price per Share | ₹ 60 | ₹ 20 |

| No. of Shares | 6,00,000 | 2,00,000 |

| Market Value of the Firm | ₹ 360 lakhs | ₹ 40 lakhs |

Firm Vasuda Ltd. iintends to acquire firm Mashit Ltd. The market price per share of Mashit Litd. has increased by ₹ 4 because of rumours that Mashit Ltd. might get a favourable merger offer. Vasuda Ltd. assumes that by combining the two firms it will save in costs by ₹ 20 lakh. Vasuda Ltd. has two options:

(i) Pay ₹ 70 lakhs cash for Mashit Ltd.

(ii) Offer 125000 Shares of Vasuda Ltd. instead of ₹ 70 lakh to the shareholders of Mashit Ltd.

You are required to calculate:

(a) The cost of the cash offer if Mashit Ltd.’s market price reflects, only its value as a separate entity. (2 marks) [CMA Final]

(b) Cost of cash offer if Mashit Ltd.’s market price reflects, the value of the merger announcement. (2 marks) [CMA Final]

(c) Apparent cost of the stock offer. (3 marks) [CMA Final]

(d) True cost of the stock offer. (3 marks) [CMA Final]

Answer:

(a) Cost of the Cash offer if Mashit Ltd’s Market price reflects only its value as a Separate entity:

Cost: = Cash Paid – PVM

= 70,00,000 – 40,00,000 = ₹ 30,00,000.

![]()

(b) Mashit Ltd’s Share price risen by ₹ 4 because of rumours that Mashit might get a favorable merger offer, means that the market price is over stated by 4 × 2,00,000 = ₹ 8,00,000.

Hence the true value of Mashit Ltd. in PVM is only:

(40,00,000 – 8,00,000) = ₹ 32,00,000

In this Case, Cost = Cash Paid – PVM = (70,00,000 – 32,00,000)

= ₹ 38,00,000

(c) Cost of Stock Offer: N × PVM – PVM

Vasuda offers 1,25,000 Shares instead of ₹ 70 Lakh in Cash. Vasuda Ltd’s Share price before the deal is announced was ₹ 60. If Mashit Ltd is worth ₹ 40 Lakh stand alone (disregarding rumours) the Cost of the Merger will be:

Apparent Cost = (1,25,000 × 60 – 40,00,000)

= 75,00,000 – 40,00,000 = ₹ 35,00,000.

(d) The new firm will have 6,00,000 + 1,25,000 = 7,25,000 Shares.

PVM = Gain + (PVv + PVM)

= 20,00,000 + (3,60,00,000 + 40,00,000)

= ₹ 4,20,00,000.

New Share Price = (4,20,00,000) ÷ 7,25,000 = ₹ 57.93

True Cost = (1,25,000 × 57.93 – 40,00,000)

= (72,41,250 – 40,00,000) = ₹ 32,41,250

![]()

Question 29.

The following information is provided in relation to the acquiring Company MARKET LTD. and the Target Company TRITON LTD. (June 2012)

| MARKET LTD. | TRITON LTD. | |

| Earning after Tax (?) | 2,000 lakh | 400 lakh |

| Number of shares outstanding | 200 lakh | 100 lakh |

| P/E Ratio | 10 | 5 |

Required:

(a) What is the Swap Ratio in terms of current market prices? (4 marks) [CMA Final]

(b) What is the EPS of Market Ltd. after acquisition? (3 marks) [CMA Final]

(c) What is the expected Market Price per Share of Market Ltd. after acquisition assuming that P/E ratio of Market Ltd. remain unchanged? (2 marks) [CMA Final]

(d) Determine the Market value of the Merged Company. (2 marks) [CMA Final]

(e) Calculate Gain/Loss for shareholders of the two erstwhile independent companies after acquisition. (4 marks) [CMA Final]

Answer:

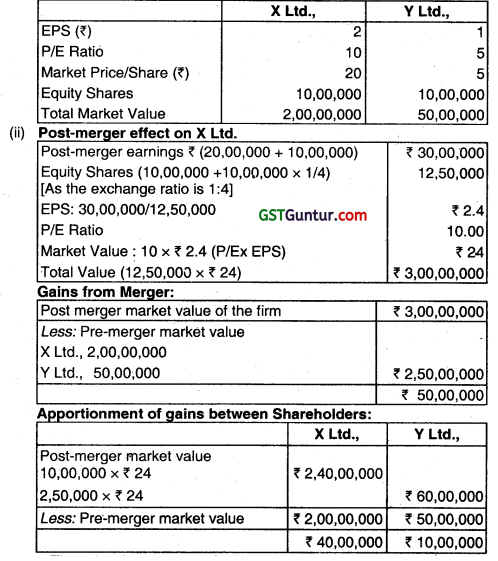

(a)

| MARKET LTD. | TRITON LTD. | |

| Earning After Tax | 2,000 Lakh | 400 Lakh |

| Number of Shares (Outstanding) | 200 Lakh | 100 Lakh |

| P / E Ratio | 10 | 5 |

| EPS | 10 (2,000/200) | 4(400/100) |

| Market Price = P/E × EPS | ₹ 100 | ₹ 20 |

![]()

Therefore, swap ratio in terms of Market prices

MPS of target Company / MPS of acquiring company. (20 ÷ 100) = 0.20

i.e. 1 Share of Market Ltd for every 5 shares of Triton Ltd.

(b) We have a general formula given by:

EPSMT = \(\frac{\left(E_M+E_T\right)}{\left(S_M+S_T\left(E R_{M W}\right)\right.}\)

Therefore, EPS of MARKET LTD after acquisition

= \(\frac{2400}{220}\) = ₹ 10.91

(c) Expected Market Price per Share of Market Ltd with the same P/E of 10 will be

= EPS × P/E

= ₹ 10.91 × 10

= ₹ 109.10

(d) Market value of the Merged company:

= Total number of outstanding shares × market price

= (200 + 20) Lakh × ₹ 109.10

= ₹ 24,002 Lakh

![]()

(e) Calculation of Gain / Loss Accuring to the Share holders of both Companies

| Total | Market Ltd. | Triton Ltd | |

| Number of shares after acquisition | 220 Lakh | 200 Lakh | 20 Lakh |

| Market Price after acquisition | ₹ 109.10 | ₹ 109.10 | ₹ 109.10 |

| Total Market Value after acquisition Existing Market Value | ₹ 24,002 Lakh ₹ 22,000 Lakh |

₹ 21,820 Lakh ₹ 20,000 Lakh |

₹ 2,182 Lakh ₹ 2,000 Lakh |

| Gain to Shareholders: | ₹ 2,002 Lakh | ₹ 1,820 Lakh | ₹ 182 Lakh |

![]()

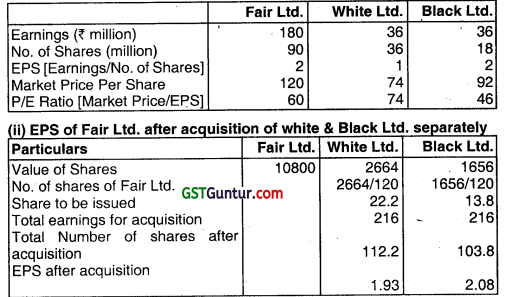

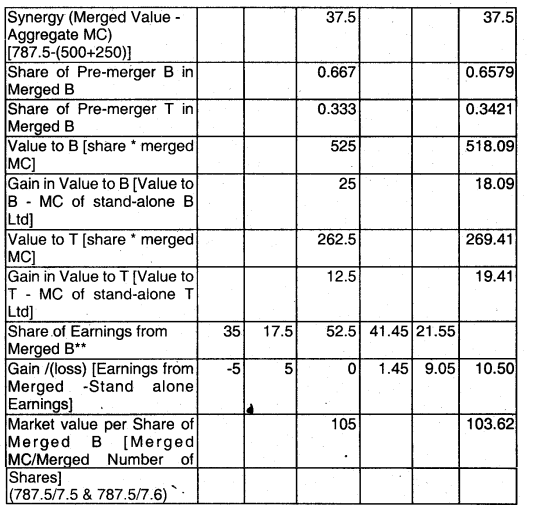

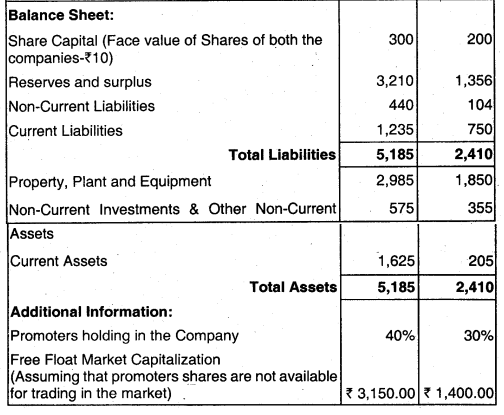

Question 30.

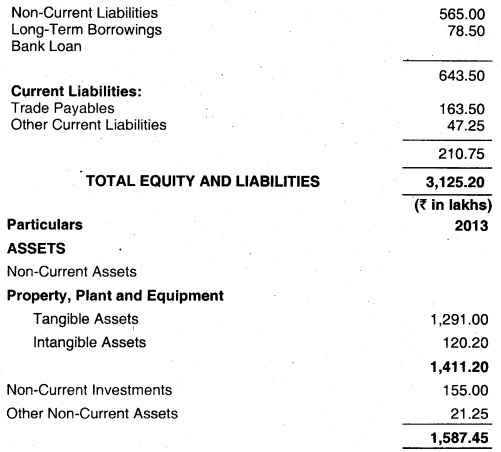

The following information has been extracted from the Annual Report 201 1-12 of ABC Limited:

Balance Sheet of ABC Limited as at 31st March, 2012

Current Assets :

Note: Profit on Sale on Non-current Assets (included in other Income above) being exceptional items. : 313.58

Tax expense is 30% of the profit.

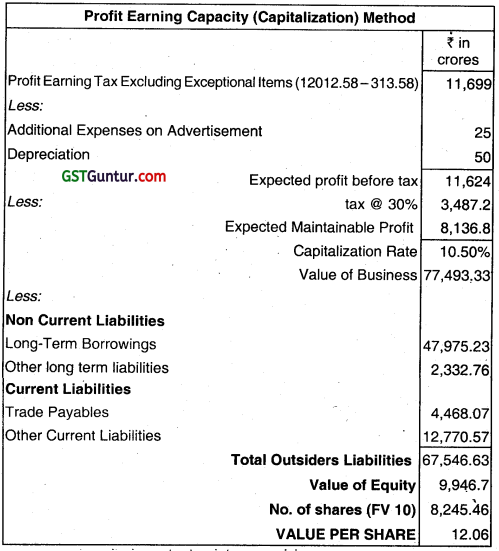

The directors of XYZ Ltd. are considering a take over of ABC Ltd. As the consultant of XYZ Ltd., you are required to determine the value of a share of ABC Limited on the basis of the Profit-Earning Capacity (Capitalization) Method by considering the following additional information:

(i) The face value of the share is ₹ 10.

(ii) Profit on Sale on Non-current Assets is an exceptional item of the profit and it is expected that in future no such profits are likely to occur.

(iii) In subsequent years, additional expenses on advertisements of ₹ 25 crores and on depreciation of ₹ 50 crores each year are expected to be incurred.

(iv) The Capitalization rate on the similar business is 10.50%.

(v) All other items of the above financial statements are expected to remain same in the future. (Dec 2012, 10 marks) [CMA Final]

Answer:

![]()

Question 31.

Frontier Company Limited (FCL) is in negotiation for taking over Back Moving Company Limited (BMCL). The management of FCL is seeing strong strategic fit in taking over BMCL provided it is a profitable proposition. Mr. Guha, GM (Finance) has been asked to look into the viability of the probable takeover of BMCL. He has collected the following necessary information.

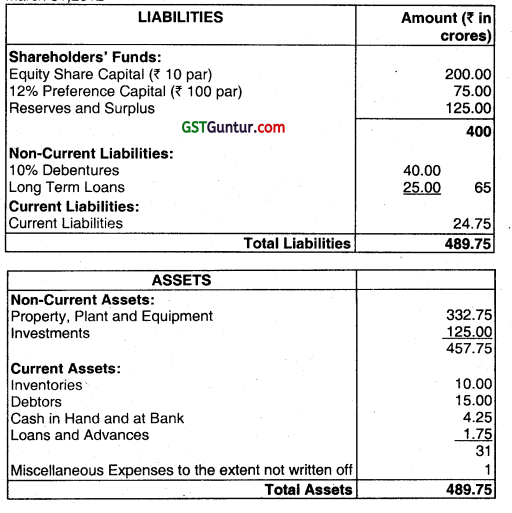

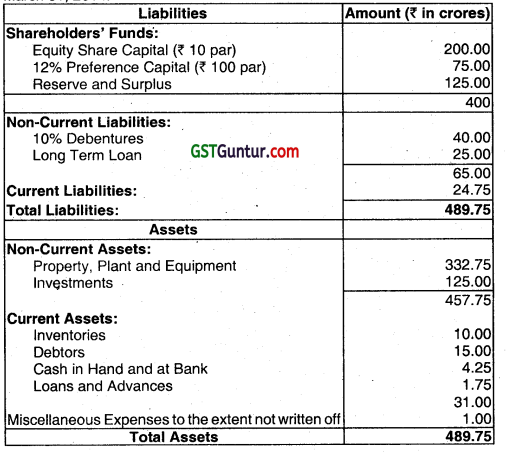

Summarized Balance Sheet of Back Moving Company Limited (BMCL) as on March 31,2012

Proposed Purchase Consideration:

- 10.50% Debentures of FCL for redeeming 10% Debentures of BMCL- ₹ 44 crores.

- 11% Convertible Preference Shares of FCL for the payment of Preference Shareholders of BMCL – ₹ 100 crores.

- 12.50 crores of Equity Shares of FCL would be issued to the shareholders of BMCL at the prevailing market price of ₹ 20 each.

- FCL would meet all dissolution expenses of ₹ 0.50 crores.

The management of FCL would dispose any asset and liability which may not be required after takeover:

- Investments : ₹ 150 crores

- Debtors : ₹ 15 crores

- Inventories : ₹ 9.75 crores

- Payment of Current Liabilities : ₹ 25 crores

- All intangible assets will be written off

![]()

The management of FCL would like to run the taken over company, BMCL, for next 7 years and after that, it would discontinue with it. It is expected that for the next 7 years, the taken over company would generate the following yearly operating cash flows after tax:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| Operating Cash Flows After Tax (₹ In crores) | 70 | 75 | 85 | 90 | 100 | 125 | 140 |

It is estimated that the terminal cash flows of BMCL would be ₹ 5 the end of 7th year.

If the cost of capital of FCL is 16%, then you are required to find out whether the decision to takeover BMCL at the terms and conditions mentioned above will be a profitable decision : (June 2013, 15 marks) [CMA Final]

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Discounting Factor @ 16% | 0.8621 | 0.7432 | 0.6407 | 0.5523 | 0.4761 | 0.4104 | 0.3538 |

Answer:

| Year | Cash Flow (in ₹ crores) | Discounting factor | Present Value |

| 1. | 70 | 0.8621 | 60.34 |

| 2. | 75 | 0.7432 | 55.74 |

| 3. | 85 | 0.6407 | 54.46 |

| 4. | 90 | 0.5523 | 49.71 |

| 5. | 100 | 0.4761 | 47.61 |

| 6. | 125 | 0.4104 | 51.31 |

| 7. | 140 | 0.3538 | 49.54 |

| 7. | 50 | 0.3538 | 17.69 |

| Total = | 386.39 | ||

Since the present value of the future cash flows is more than the cost of acquisition. it will be a profitable proposition to take over the said company, BMCL.

![]()

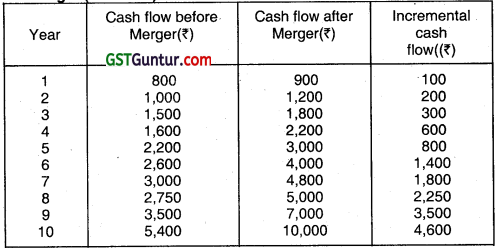

Question 32.

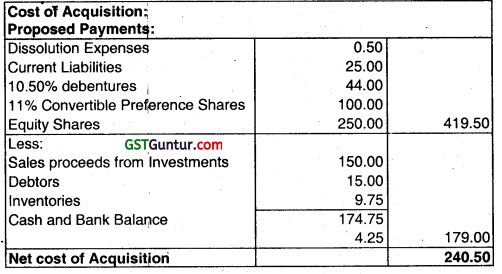

Acquiring Ltd. is in the business of making bicycles. The Company operates from North India. To diversify its operations Acquiring Ltd. has identified Target Tyres Ltd., a South India based company, as a potential takeover candidate. After due diligence, the following information is available: (Dec 2013, 15 marks) [CMA Final]

(i) Cash Flow Forecasts (₹ in Lakhs)

(iii) Talks for the takeover have crystallized on the following:

(a) Acquiring Ltd. will not be able to use Machinery worth ₹ 175 lakhs which will be disposed off by them subsequent to take over. The expected realization will be ₹ 150 lakhs.

(b) The inventories and receivables are agreed for take over at value of ₹ 400 and ₹ 700 lakhs respectively, which is the price they will realize on disposal.

(c) The liabilities of Target Tyres Ltd. will be discharged in full on take over along with an employee settlement of ₹ 120 lakhs for the employees who are not interested in continuing under the new management.

(d) Acquiring Ltd. will invest a sum of ₹ 250 lakhs for upgrading the Plant of Target Tyres Ltd. on take over. A further sum of ₹ 250 lakhs will also be incurred in the second year to revamp the machine shop floor of Target Tyres Ltd.

(e) The anticipated cash flows of the combined business post take over are as follows: (₹ in lakhs)

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Cash Flows | 900 | 1,200 | 1,800 | 2,200 | 3,000 | 4,000 | 4,800 | 5,000 | 7,000 | 10,000 |

The management of Target Ltd. is not ready to accept its present standalone value as consideration for the takeover. Acquiring Ltd. wishes to know upto what extent they can quote higher price, without suffering any loss in value post merger.

![]()

You are required to advice the management the upper limit price which they can pay per share of Target Tyres Ltd., if a discount factor of 15% is considered appropriate.

Use the following Discount Factor Table:

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Discount Factor at 15% | 0.8696 | 0.7561 | 0.6575 | 0.5718 | 0.4972 | 0.4323 | 0.3759 | 0.3269 | 0.2843 | 0.2472 |

Answer:

(a) Computation of Operational Synergy expected to arise out of merger (₹ in lakhs):

(b) Valuation of Target Tyres Ltd. (₹ in Iakhs)

Total Valuation with Merger ₹ 5,325.81

![]()

(c)

| Total valuation with merger | ₹ 5,325.81 | |

| Add: Cash to be collected on the disposal of assets | 150 | |

| Machinery | 400 | |

| Inventories | 700 | 1,250 |

| Less: Liabilities to be discharged on the takeover | ||

| Long term Borrowings | 565 | |

| Bank Loan | 78.50 | |

| Trade Payables | 163.5 | |

| Other Current Liabilities | 47.25 | |

| Employee Settlement | 120 | |

| Investment to made on takeover | 250 | |

| Present value of the investment to be made at the end of year 2[250*0.7561 ] | 189.03 | 1,413.28 |

| Maximum amount to be quoted | 5,162.53 |

Total shares of Target Ltd.= 10 lakhs. Upper limit price per share to be quoted is ₹ 516.25 .

![]()

Question 33.

Consider two firms that operate independently and have the following financial characteristics: (June 2014)

(₹ in millions)

| Firm A | Firm B | |

| Revenues | 8000 | 4000 |

| Cost of goods sold | 6000 | 2400 |

| EBIT | 2000 | 1600 |

| Expected growth rate | 4% | 6% |

| Cost of capital | 9% | 10% |

Both firms are in steady state wiih capital spending offset by depreciation. Both firms have an effective tax rate of 50% and are financed only by equity.

![]()

Scenario I

Assume that the combining of the two firms will create economies of scale that will reduce the cost of goods sold to 65%.

Scenario II

Assume that as a consequence of the merger the combined firm is expected to increase its future growth to 6% while cost of goods sold remains at 70% and does not come down to 65%.

Scenario I and Scenario II are mutually exclusive.

You are required to:

(i) Compute the value of both the firms as separate entities. (3 marks) [CMA Final]

(ii) Compute the value of both the firms together if there were absolutely no synergy at all from the merger (Scenario III). (1 mark) [CMA Final]

(iii) Compute the cost of capital and the expected growth rate for the combined entity. (2 marks) [CMA Final]

(iv) Compute the value of synergy in Scenario I and Scenario II. (3 marks) [CMA Final]

Answer:

(i) Value of the firms before the merger:

Calculation of free cash flow to each of the firm

Free cash flow to Firm A = EBIT (1 – tax rate)

= 2,000(1 – 0.50)

= 1,000

Free cash flow to Firm B = EBIT (1 – tax rate)

= 1,600 (1 – 0.50)

= 800

Value of the two firms independently:

Value of Firm A = [1,000 (1.04)] / (0.09 – 0.04)

= 20,800

Value of Firm B = [800 (1.06)] / (0.10 – 0.06)

= 21,200

![]()

(ii) In the absence of synergy the combined firm value is:

Combined Firm Value with no synergy

= 20,800 + 21,200 = 42,000

(iii) On Combining the two firm the cost of goods sold is reduced from 70% to 65% of revenues. The revenue of the combined firms

= 8,000 + 4,000 = 12,000

= 0.65 × 12,000 = 7,800

Weighted average cost of capital for the combined firm

= 9% [20,800/42,000] + 10% [21,200/42,000]

= 0.0446 + 0.0505 = 0.0951

= 9.50% approximately

Weighted average expected growth rate for the combined firm

= 4% [20,800/42,000] + 6% [21,200/42,000]

= 0.0198 + 0.0303 = 0.0501

= 5% approximately

(iv) Value of Synergy

Scenario I

Revenues – ₹ 12,000 million

COGS (65%) – ₹ 7,800 million

EBIT – ₹ 4,200 million

PAT – ₹ 2,100 million

Cost of Capital – 9.504%

g (growth rate) – 5.01 %

Value = \(\frac{2,100(1.0501)}{0.09504-0.0501}\) = ₹ 49,070.09 million

Value of synergy = ₹ (49,070.09 – 42,000)million = ₹ 7,070.09 million

![]()

Scenario II

Revenues – ₹ 12,000 million

COGS (70%) – ₹ 8,400 million

EBIT – ₹ 3,600 million

PAT – ₹ 1,800 million

Cost of Capital – 9.504%

g (growth rate) – 6% (5% for combination without synergy)

Value = \(\frac{1,800(1.06)}{(0.09504-0.06)}\) = ₹ 54, 452.06 million

Synergy Value = ₹ (54,452.06 – 42,000) million = ₹ 12,452.06 million

![]()

Question 34.

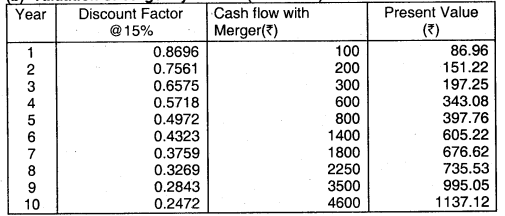

Healthy Ltd. is planning to takeover Dull Ltd. and merged it with itself. The following information has been taken from the books of both the companies: (Dec 2014)

Balance Sheet as on March 31, 2014 (₹ in crores)

| Equity and Liabilities: | Healthy Ltd. | Dull Ltd. |

| Equity Share Capital | 4,000.00 | 2,200.00 |

| Reserves and Surpius | 5,250.00 | 3,250.00 |

| Shareholders’ Funds | 9,250.00 | 5,450.00 |

| Non-Current Liabilities: | ||

| Long Term Debt | 3,000.00 | 1,375.00 |

| Deferred Tax Liabilities (Net) | 670.00 | 450.00 |

| Current Liabilities | 2,060.00 | 13,640.00 |

| Total Liabilities | 14,980.00 | 8,615.00 |

| Assets | ||

| Non-Current Assets: | ||

| Property, Plant and Equipment | 9,745.00 | 4,310.00 |

| Investments | 1,650.00 | 900.00 |

| Current Assets | 3,585.00 | 3,405.00 |

| Total Assets | 14,980.00 | 8,615.00 |

![]()

Profit and Loss Account for the year ending on March 31, 2014 (₹ in crores)

| Particulars | Healthy Ltd. | Dull Ltd. |

| Income:

Net Revenue Other Income Total Income |

30,150.00

460.00 |

12,529.00

900.00 |

| 30,610.00 | 13,429.00 | |

| Less: Expenses

Total Operating Expenses Operating Profit |

20,135.00 | 6,214.00 |

| 10,475.00 | 7,215.00 | |

| Less: Interest | 375.00 | 171.88 |

| Profit Before Tax | 10,100.00 | 7,043.12 |

| Less: (Tax @ 30%) | 3,030.00 | 2,112.93 |

| Profit After Tax | 7,070.00 | 4,930.19 |

| Price/Earning Ratio | 21.80 | 15.25 |

| Notes: | ||

![]()

Notes:

- Face value of both companies shares is lo.

- There will not be any synergy gain after merger of the companies.

- The management of Healthy Ltd. believes that the PIE Ratio of the merged entity will be 22.50.

The management wants to determine the exchange ratio or swap ratio for the said merger in such a manner that the market price per share of the merged entity is maximum. Therefore, you are required to determine a suitable exchange ratio or swap ratio based on Book Value per share or EPS or Markt Price per share so that the market price per share of the merged entity is maximum. (10 marks) (CMA Final)

Answer:

![]()

Question 35.

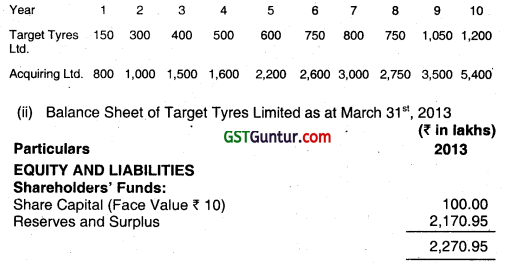

Frontier Company Limited (FCL) is in negotiation for taking over Back Moving Company Limited (BMCL). The management of FCL is seeing strong strategic fit in taking over BMCL provided it is a profitable proposition. Mr. Guha, GM (Finance) has been asked to look into the viability of the probable takeover of BMCL. He has collected the following necessary information. (Dec 2014, 15 marks) [CMA Final]

Summarized Balance Sheet of Back Moving Company Limited (BMCL) as on March 31, 2014.

Proposed Purchase Consideration:

- 10.50% Debentures of FCL for redeeming 10% Debentures of BMCL – ₹ 44 crore.

- 11% Convertible Preference Shares of FCL for the payment of Preference Shareholders of BMCL – ₹100 crore.

- 12.50 crores of Equity Shares of FCL would be issued to the shareholders of BMCL at the prevailing market price of ₹ 20 each. . FCL would meet all dissolution expenses of ₹ 0.50 crores.

The management of FCL would dispose any asset and liability which may not be required after takeover:

- Investments – ₹ 150 crores

- Debtors – ₹ 15 crores

- Inventories – ₹ 9.75 crores

- Payment of Current Liabilities – ₹ 25 crores

- All intangible assets will be written off

![]()

The management of FCL would like to run the taken over company, BMCL, for next 7 years and after that, it would discontinue with it. It is expected that for the next 7 years, the taken over company would generate the following yearly operating cash flows after tax.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| Operating Cash Flows After Tax (₹ in crores) | 70 | 75 | 85 | 90 | 100 | 125 | 140 |

It is estimated that the terminal cash flows of BMCL would be ₹ 50 crores at the end of 7th year.

If the cost of capital of FCL is 16%, then you are required to find out whether the decision to takeover BMCL at the terms and conditions mentioned above will be a profitable decision ?

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Discounting Factor @ 16% | 0.862 | 0.7432 | 0.641 | 0.552 | 0.476 | 0.41 | 0.3538 |

Answer:

Since the present Value of the future cash flows is more than the cost of acquisition, it will be a profitable proposition to take over the said company, BMCL

![]()

Question 36.

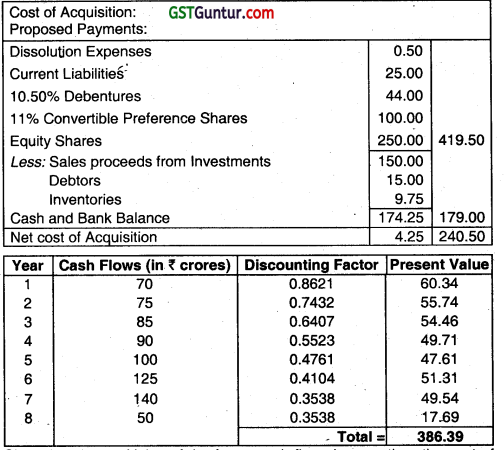

The bidding company B Ltd. is contemplating a merger with the target company, T Ltd. so as to form the merged B Ltd. under two distinct situations X and Y. You are provided with the following information about the proposed merger: (June 2015)

| Company | B Ltd. | T Ltd. |

| EAT'(₹ lakh) | 40 | 12.5 |

| No. of Equity Shares (in lakh) | 5 | 2 |

| P/E ratio | 12.5 | 20 |

Situation X:

There is no synergy in earnings, but PIE of merged B Ltd. will stand at 15. Merger is based on market value of shares.

Situation Y:

Post merger PIE stands at that of stand-alone S Ltd., but earnings of the merged entity rises by 20% over the aggregate earnings of B Ltd. and T Ltd. Swap ratios 1.3 for every share of T Ltd.

![]()

Find for both the situations X and Y:

(i) Post merger EPS. (3 marks) (CMA Final)

(ii) Post merger market value per share. (2 marks) (CMA Final)

(iii) Synergy due to merger. (2 marks) (CMA Final)

(iv) Gain/’oss for merger to shareholders of B Ltd. and T Ltd. (a) in value of share holdings and (b) in earnings available to them. (4+4= 8 marks) (CMA Final)

Answer:

@ MC = EAT × PIE = 52.5 × 15 = 787.50 & 63 × 12.5 = 787.50

# (125/1 00) × 2 = 2.5 for × and 1.3 × 2 =2.6 torY

$ (52.5/7.5) = 7 for X and (63/7.6) = 8.29 for Y

**(0667 × 52.5) = 35 (rounded off) for B and (0.333 × 52.5) = 17.5 (rounded off) for T under X;

(0.6579 × 63) = 41.45 (rounded off) for B and (0.3421 × 63) = 21.55 (rounded off) for T under Y.

![]()

Question 37.

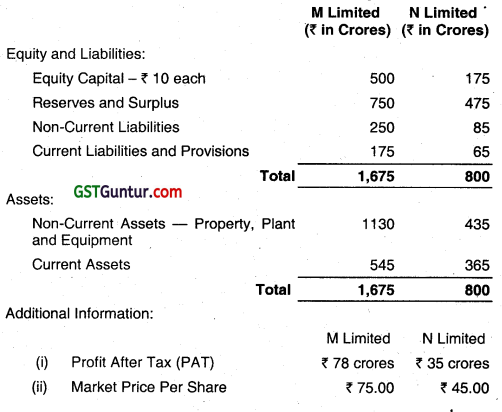

M Limited wants to takeover N Limited and their Summarized Balance Sheet as on March 31. 2015 are give below: (Dec 2015)

I. Using the above information, what should be the share exchange ratio

to be offered to the shareholders of N Limited by M Limited based on:

(i) Net Worth .

(ii) Earnings Per Share (EPS)

(iii) Market Price

II. Suggest which one out of the above basis should be preferred by N Limited?

III. Assuming that there are no synergy gains, then determine the EPS after merger if the exchange ratio is one as suggested in (II) above. (9+2+4= 15 marks) (CMA Final)

Answer:

(i)

Exchange Ratio is 2.00:1.56; or 2.00/1.56 = 1.282

It means is (17.50 × 1.282 = 22.435) crores shares of M Limited will be issued to the shareholders of N Limited.

| M Limited | N Limited | |

| Market Price Per Share | ₹ 75.00 | ₹ 45.00 |

Exchange Ratio is 45:75; or 45/75 = 0.60.

It means is (17.50 × 0.60 = 10.50) crores shares of M Limited will be issued to the shareholders of N Limited.

![]()

(ii) Since the shareholders of N Limited are getting maximum number of shares -26 crores when the Exchange Ratio is fixed as per the Book Value or Net Worth, Shareholders of N Limited will prefer fixing of the Exchange Ratio as per Net Worth.

(iii)

| Total PAT after Merger (78 + 35)

Total No. of Shares assuming that Exchange Ratio is determined as per Book Value (50 + 26) |

₹ 113.00

76

|

| EPS after Merger will be | ₹ 1.49 |

![]()

Question 38.

Answer the following:

If value of B Ltd. is ₹ 50 lakhs, T Ltd. is ₹ 20 lakhs, and on merger their combined value is ₹ 94 lakhs and B Ltd. receives premium on merger ₹ 13 lakhs, then what is the synergy gain? (June 2016, 2 marks) [CMA Final]

Answer:

Synergy gain = Combined Value – Value of merging companies

= ₹ [94 – (50 + 20)] lakhs = ₹ 24 lakhs.

Question 39.

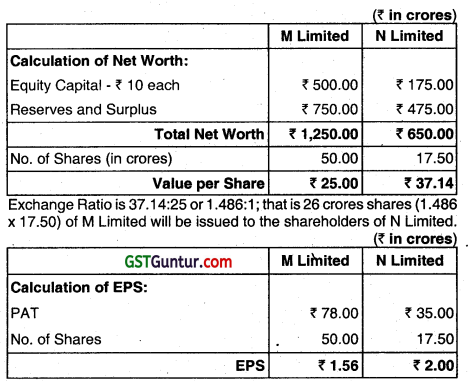

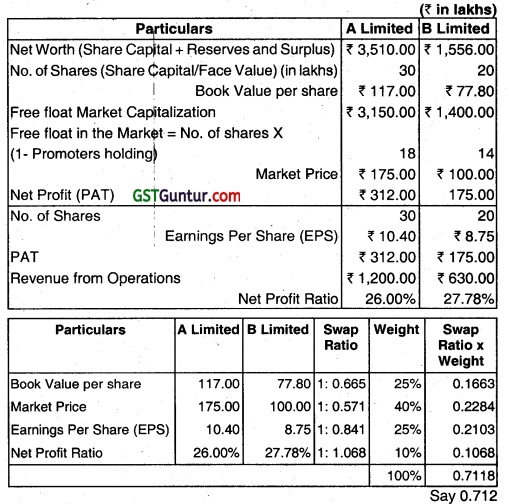

A Limited and B Limited are in negotiations in which A Limited has expressed the desire to acquire B Limited and it is decided that A Limited will acquire B Limited. For this, purpose, the following information has been extracted from the books of both the companies for F.Y. 2015-16. (June 2016)

In a joint meeting of the directors of both companies, the following decisions are taken:

(i) The swap ratio will bedecided by considering the following parameters

with the weights as given below:

(a) Book Value – 25%

(b) Market Price – 40%

(c) EPS – 25%

(d) Net Profit Ratio – 10%

![]()

(ii) All assets and liabilities will be taken over by A Limited at book values.

(iii) The combined profit will increase by 10% due to synergy gains arising because of higher scale of operations.

(iv) It is expected that the market will look this decision of A Limited as ‘a value creator’ decision and consequently, it is expected that A Limited’s PIE Ratio will increase by 10% from Its existing level after the acquisition of B Limited.

Given the above information, you are required to compute assuming that the acquisition will be completed as per the terms given.

(a) The Swap Ratio

(b) Book Value per share of A Limited after acquisition

(c) Earnings per share of A Limited after acquisition

(d) Market Price of A Limited’s share after acquisition (7+3+3+3 = 16 marks) (CMA Final)

Answer:

(i) It means that the Swap Ratio is – 0.712 shares of A Limited for every share of B Limited.

Therefore, total no. of shares to be issues by A Limited (20 × 0.712) – 14.24

Net Worth of A Limited after acquisition:

Share Capital (30 +14.24) × 10 – ₹ 442.40

Reserves and Surplus (3210 +1 356) – ₹ 4,566.00

Net Worth of A Limited after acquisition – ₹ 5,008.40

Book Value per Share – ₹ 113.21

(ii) Net Profit of A Limited after acquisition

Considering 10% synergy gain

=(312 + 175) × 1.1 = ₹ 535.70

(iii) EPS – 12.11

PIE ratio of A Limited before acquisition (175 ÷1 0.40) = 16.83

New PiE Ratio of A Limited after acquisition (10% synergy impact) – 18.51

(iv) Therefore, Market Price (18.51 × 12.11) – 224.16

* Note: Capital Reserve of ₹ 57.60 lakhs arising on takeover of all assets and liabilities by A Ltd. at book value is not considered as it is not a part of distributable surplus. If the same is included Net worth is ₹ 5,066 lakhs & book value is ₹ 114.51.

![]()

Question 40.

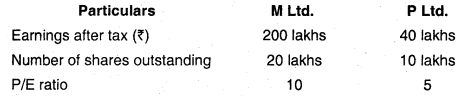

(a) The following information is provided in relation to the acquiring firm M Ltd. and the target firm P Ltd.:

Required:

(i) What is the swap ratio in terms of current market price?

(ii) What is the EPS of M Ltd. after acquisition?

(iii) What is the expected market price per share of M Ltd. after acquisition assuming that P/E ratio of M Ltd. remains unchanged?

(iv) Determine the market value of the merged firm. (Dec 2016, 12 marks) [CMA Final]

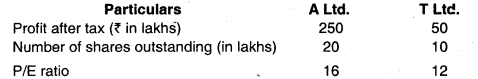

(b) A Ltd. is planning to acquire T Ltd. and the following information is provided in relation to the acquisition about both the companies:

Required:

(i) What will be the swap ratio if it is to be determined on the basis of market prices? (2 marks) [CMA Final]

(ii) Assuming that the swap ratio is on the basis of market price, what will be the market value of A Ltd. after acquisition if the merged entity is expected to have a P/E ratio of 20? (2 marks) [CMA Final]

Answer:

(a)

| Particulars | M Ltd. | P Ltd. |

| Earnings after tax (₹) | 200 lakhs | 40 lakhs |

| Number of shares outstanding | 20 lakhs | 10 lakhs |

| P/E Ratio | 10 | 5 |

| ESP | 10 | 4 |

| Market price (?) | 100 | 20 |

(i) Swap ratio in terms of market prices: 20/100 = 0.20

(ii) EPS of M Ltd. after acquisition: (200 + 40)/(20 +.2 × 10) = 240/22 or say ₹ 10.91

(iii) Expected market price per share of M Ltd. with the same P/E ratio of 10 will be: 10.91 × 10 = ₹ 109.10

(iv) Market value of merged firm:

Total number of outstanding shares × market price

= ₹ 2,400.2 lakhs.

![]()

(b)

Question 41.

(a) The following information is provided related to the acquiring firm, Sun Ltd. and the target firm Moon Ltd.

| Particulars | Sun Ltd. | Moon Ltd. |

| Profits after Tax | ₹ 2,000 Lakh | ₹ 4,000 Lakh |

| Number of Shares outstanding | 200 Lakh | 1,000 Lakh |

| P/E Ratio (times) | 10 | 5 |

Required:

(i) What is the swap ratio based on the current market prices?

(ii) What is the EPS of Sun Ltd., after the acquisition? (June 2017 10 marks) (CMA Final)

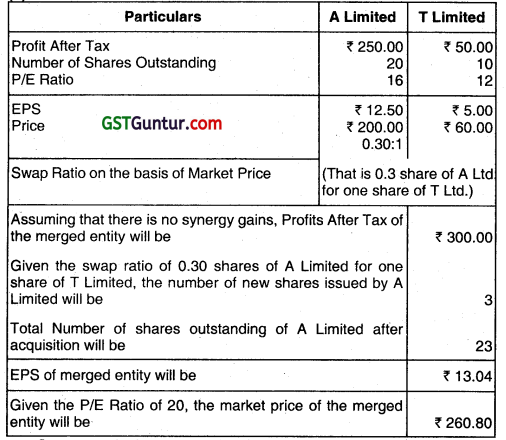

(b) X Ltd. is considering a takeover of Y Ltd. The particulars of the two companies are given below:

| Particulars | X Ltd. | Y Ltd. |

| Earnings after Tax (EAT) in ₹ | 20,00,000 | 10,00,000 |

| Equity Shares (Nos.) | 10,00,000 | 10,00,000 |

| EPS | 2 | 1 |

| P/E Ratio (times) | 10 | 5 |

![]()

Required:

(i) What is the market value of each company before merger?

(ii) Assuming that the management of X Ltd. estimates that the shareholders of Y Ltd. will accept an offer of one share of X Ltd. for four shares of Y Ltd. If there are no synergic effects, what is the market value of the Post-merger X Ltd.? Are the shareholders of X Ltd. better off than they were before the merger?

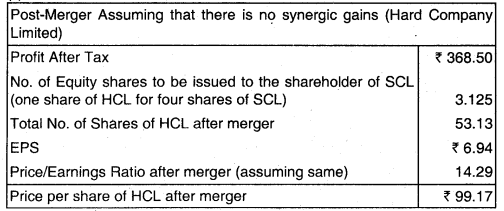

(iii) Due to synergic effects, the management of X Ltd. estimates that the earnings will increase by 20%. What is the new Post-merger EPS and the Price per Share? Will the shareholders be better-ott or worse-off? (10 marks) (CMA Final)

Answer:

(a) EPS before acquisition

Sun Ltd., = ₹ 2,000 / Lakhs = ₹ 10.

Moon Ltd., = ₹ 4,000 Lakhs / 1,000 Lakhs = ₹ 4.

Market Price of shares before acquisition

Sun Ltd.,= ₹ 10 × 10 = ₹ 100.

Moon Ltd., = ₹ 4 × 5 = 20.

(i) Swap ratio based on current market price:

= ₹ 20/₹ 100 = 0.2 i.e. 1 share of Sun Ltd., for 5 shares of Moon Ltd.,

No. of shares to be issued = 1,000 Lakhs × 0.20 Lakh = 200 Lakhs.

(ii) EPS after acqulsetions:

(₹ 2,000 Lakhs + ₹ 4,000 Lakhs) / (₹ 200 Lakhs + ₹ 200 Lakhs)

= ₹ 6,000Lakhs/ ₹ 400Lakhs = ₹ 15.

![]()

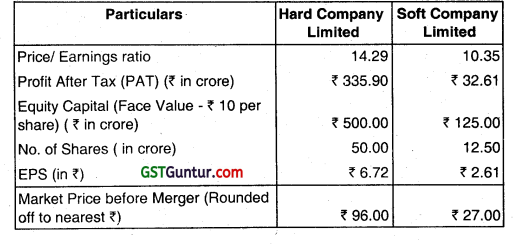

(b)

(i) Market Value of Companies before merger:

Thus, the shareholders of both the companies have gained from the merger.

(iii) Post-merger Earnings:

Increase in earnings by 20%

New earnings: ₹ 30,00,000 × 120% = ₹ 36,00,000

No. of Equity Shares = ₹ 12,50,000

EPS = ₹ 36,00,000/12,50,000 = ₹ 2.88

PIE Ratio = 10

Market Price/Share = ₹ 2.88 × 10

= 28.80

Therefore, shareholders will be better-off.

![]()

Question 42.

R. Ltd. is intending to acquire S Ltd. (by merger) and the following information are available in respect of both the companies:

| Particulars | R Ltd. | S Ltd. |

| Total Current Earnings (₹) | 2,50,000 | 90,000 |

| No. of Outstanding Shares | 50,000 | 30,000 |

| Market Price per Share (₹) | 21 | 14 |

(i) What is the present EPS of both the companies?

(ii) If the proposed merger takes place, what would be the new earnings per share for R Ltd. (assuming the merger takes place by exchange of Equity Shares and the Exchange Ratio ¡s based on the Current Market Price)? Assume no synergy impact. (June 2017, 10 marks)

Answer:

(I) EPS = Total earnings /No. of Equity shares

EPSR Ltd. = ₹ 2,50,000150,000 = ₹ 5.

EPSS Ltd. = ₹ 90,000/30,000 = ₹ 3.

(ii) No. of shares S Ltd., shareholders will get in R Ltd., based on market prices of shares ¡s as follows:

Exchange Ratio= 14121 = 2/3 i.e., for every 3 shares of S Ltd.,

2 Shares of R Ltd., Total No. of shares of R Ltd., issued = (14/21) × 30,000 = 20.000 shares.

Total number of shares of R Ltd., after merger 50,000 + 20000 = 70,000.

Total earning of R Ltd., after merger = ₹ 2,50,000 + ₹ 90,000 = ₹ 3,40,000 (No synergy given)

The new EPS of R Ltd., after merger = ₹ 3,40,000/70,000 = ₹ 4.86.

![]()

Question 43.

A Ltd., is considering the acquisition of B Ltd., with stock. Relevant financial information is given below:

| Particulars | A Ltd. | B Ltd. |

| Present earnings (₹) | 7.5 Lakhs | 2.5 Lakhs |

| Equity (no. of shares) | 4.0 Lakhs | 2.0 Lakhs |

| EPS (₹) | 1.875 | 1.25 |

| P/E ratio | 10 | 5 |

Answer the following questions:

(i) What is the market price of each company?

(ii) What is the market Capitalization of each company?

(iii) If the P/E of A Ltd., changes to 7.5, what is the market price of A Ltd.?

(iv) Does market value of A Ltd., change?

(v) What would be the exchange ratio based on Market Price? (Take the revised price of A Ltd.) (Dec 2017, 2 × 5 = 10 marks)

Answer:

(i) P/E = Market Price/EPS.

Therefore, we have, Market Price = P/E × EPS A Ltd.’s

Market Price = 10 × 1.875 = ₹ 18.75

B Ltd.’s Market Price = 5 × 1.25 = ₹ 6.25.

(ii) Market Capitalization (Same as market value or in short referred to as market cap) = Number of outstanding shares × market price

A Ltd.’s Market cap = 4.0 lakhs × ₹ 18.75 = ₹ 75 Lakhs

B Ltd.’s Market cap = 2.0 Lakhs × ₹ 6.25 = ₹ 12.5 Lakhs

(iii) If the P/E of A Ltd., changes to 7.5, then the market price is given by

= 7.5 × ₹ 1.875 = ₹ 14.0625

(iv) Yes. The market value decreases, i.e., = A Ltd.’s market value = 4.0 Lakhs × ₹ 14.0625 = ₹ 56.25 Lakhs

(v) General Formula for exchange ratio = MPS of Target Firm / MPS of acquiring Firm = 6.25/14.0625 = 0.44.

![]()

Question 44.

The shareholders of A Co. Ltd., have voted in favour of a buyout offer from B Co. Ltd. Information about each firm is given here below. Moreover, A Co. Ltd.’s shareholders will receive one share of B Co. Ltd. Stock for every three shares they hold in A Co. Ltd.

| Particulars | A Co. Ltd. | B Co. Ltd. |

| Present earnings (₹) | 6.75 | 3.00 |

| EPS (₹) | 3.97 | 5.00 |

| Number of share (Lakhs) | 1.70 | 0.60 |

| P/E ratio | 20 | 5 |

(i) What will the EPS of Co. Ltd., will be after the merger? What will the PE ratio if the NPV of the acquisition is zero?

(ii) What must B Co. Ltd. feel would be the value of the synergy between these firms? (Dec 2017, 10 marks) [CMA Final]

Answer:

(i) The EPS of the combined company will be the sum of the earnings of both companies divided by the shares in the combined company. Since the stock offer is one share of the acquiring firm for three shares of the target firm, new shares in the acquiring firm will increase by one-third (Exchange ratio = 1/3)

So, the new EPS will be = (₹ 3,00,000 + 6,75,000) / [1,70,000 + (1/3)(60,000)]

= (9,75,000/1,90,000)

= ₹ 5.132.

The market price of B Co. will remain unchanged if it is a zero NPV acquisition. Using the P/E ratio, we find the current market price of B Co. stock, which is = P/E × EPS = 20 × (6.75 lakhs /1.70 lakhs) = 20 × (3.97) = ₹ 79.40

![]()

(ii) If the acquisition has a zero NPV, the stock price should remain unchanged. Therefore, the new P/E will be = P/E = ₹ 79.40 / ₹ 5.132 = 15.47.

(iii) If the NPV of the acquisition is zero, it would mean that B Co. would pay just the market value of A Co. i.e., Number of shares x market price of A Co. i.e.,

= 60,000 × 25 (MPS = P/E × EPS = 5×5 =25)

The market value received by B Co. = ₹ 15,00,000.

The cost of the acquisition is the number of shares offered times the share price, so the cost is = (1/3) (60,000) (₹ 79.40) = ₹ 15,88,000.

The difference is synergy i.e., ₹ 88,000.

![]()

Question 45.

Q Ltd. wants to acquire R Ltd. and has offered a swap ratio of 1: 2 (0.5 shares for every one share of R Ltd.).

Following information is provided:

| Particulars | Q Ltd. | R Ltd. |

| Profit after tax (₹) | 18,00,000 | 3,60,000 |

| Equity shares outstanding (Nos.) | 6,00,000 | 1,80,000 |

| EPS (₹) | 3 | 2 |

| P/E Ratio | 10 times | 7 times |

| Market price per share (₹) | 30 | 14 |

Required:

(i) The number of equity shares to be issued by Q Ltd., for acquisition of R Ltd.

(ii) What is the EPS of Q Ltd., after the acquisition?

(iii) Determine the equivalent earnings per share of R Ltd.

(iv) What is the expected market price per share of Q Ltd., after the acquisition, assuming its P/E multiple remains unchanged?

(v) Determine the market value of the merged firm. (Dec 2017, 2 × 5 = 10 marks) [CMA Final]

Answer:

(i) The Number of Shares to be issued by Q Ltd.:

The Exchange ratio is 0.5

So, the new shares = 1,80,000 × 0.5 = 90,000 shares.

(ii) EPS of Q Ltd., after acquisition:

| Total Earnings = ₹ (18,00,000 + 3,60,000) | ₹ 21,60,000 |

| No. of Shares (6,00,000 + 90,000) | 6,90,000 |

| EPS (₹ 21,60,000) / 6,90,000 | ₹ 3.13 |

![]()

(iii) Equivalent EPS of R Ltd.,

| No. of Shares | 0.5 |

| EPS (₹) | 3.13 |

| Equivalent (3.13 × 0.5) (₹) | 1.57 |