Unit and Batch Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Unit and Batch Costing – CA Inter Costing Question Bank

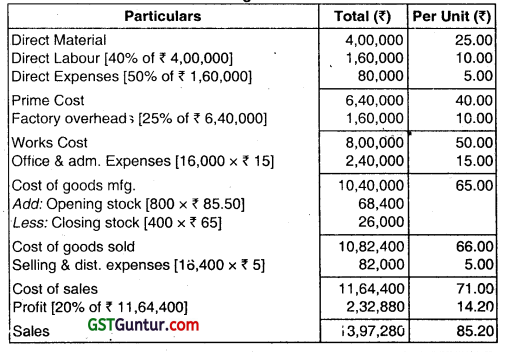

Question 1.

From the following information, prepare a statement showing the per unit cost and profit

Direct material consumed – ₹ 4,00,000

Direct labour – 40% of direct material cost

Direct expenses – 50% of direct labour cost

Factory overheads – 25% of prime cost

Office and adm, expenses have been absorbed @ ₹ 150 per 10 units produced.

Selling and distribution expenses have been applied @ ₹ 500 per 100 units sold.

Opening finished Stock – 800 units @ ₹ 85.50 per unit

Closing finished Stock – 400 units

Finished goods sold – 16,400

Profit – 1 /6th of sales

Answer:

Statement showing the Cost and Profit

![]()

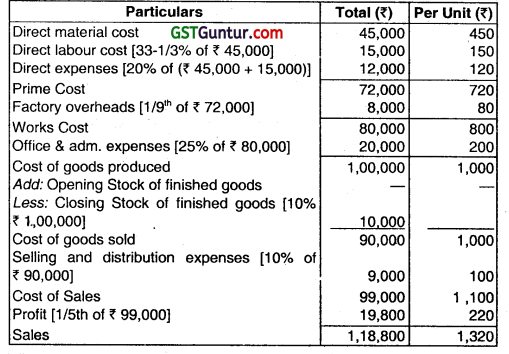

Question 2.

From the following information, prepare a statement showing cost and profit per unit:

Direct material – ₹ 45000

Direct labour – 33-1/3% of direct material cost.

Direct expenses – 20% of direct material cost and direct labour cost.

Factory overheads – 1/9th of prime cost.

Adm. Expenses – 25% of works cost.

Selling & Distribution Expenses – 10% of cost of goods sold.

Units produced – 100

Closing stock of finished goods – 10% of units produced.

Profit – 1/6th of sales.

Answer:

Statement showing the Cost and Profit

![]()

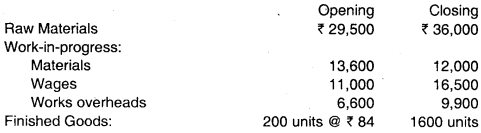

Question 3.

From the following information, prepare a Cost Sheet showing the cost and profit.

Purchases of raw material ₹ 1 ,90,000, Carriage on purchases ₹ 1,500,

Sales of scrap of raw materials ₹ 5,000

Wages ₹ 2,97,000

Works overheads are absorbed @ 60% of direct labour cost.

Administration overheads are absorbed @ ₹ 12 per unit produced.

Selling & distribution overheads are absorbed @ 20% of selling price.

Sales – 7600 units @ at a profit of 10% on saies price.

Answer:

Cost Sheet

Working Notes

(i) Units produced = Closing Stock + Sales – Opening Stock

= 1600 + 7600 – 200 = 9000

(ii) Let Sales be X, then, X = 6,38,400 + 20% of X + 10% of X

7X = 6.38,400

X 6,38,400/.7 = ₹ 9,12,000

![]()

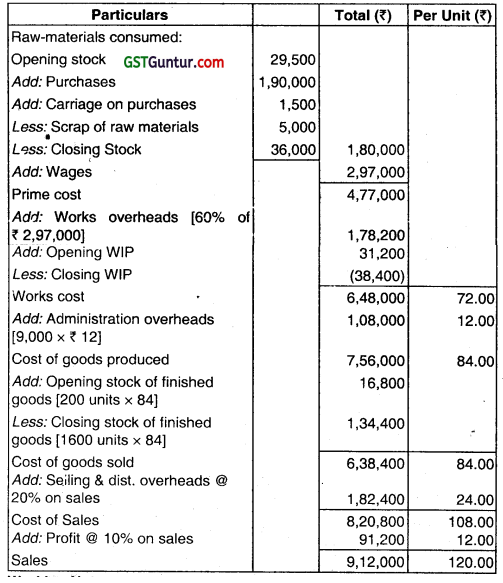

Question 4.

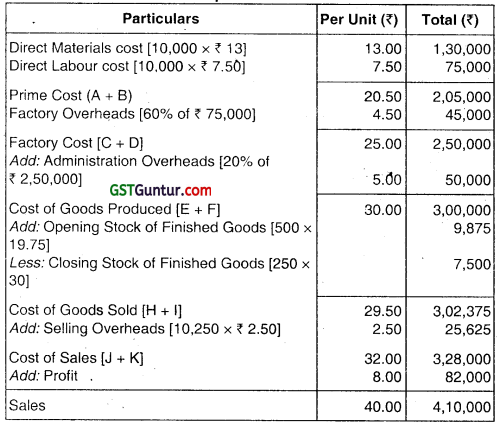

From the following information, prepare a statement of cost showing cost and the profit per unit:

Cost of materials @ ₹ 13 per unit.

Labour cost @ ₹ 7.50 per unit.

Factory overheads are absorbed @ 60% of labour cost.

Administration overheads are absorbed @ 20% of factory cost.

Selling overheads are charged @ ₹ 2.50 per unit sold.

Opening stoek of finished goods – 500 units @ 19.75

Closing stock of finished goods – 250 units

Sales – 10250 units at profit of 20% on sales.

Answer:

Statement of per unit Cost and Profit

Note: No. of units produced = Units Sold + Closing Stock – Opening Stock

= 10,250 + 250 – 500 = 10,000 units.

![]()

Question 5.

Describe Job Costing and Batch Costing giving examples of industries where these are used (May 2001, 3 marks)

OR

Answer the following:

Explain ‘Job Costing’ and ‘Batch Costing’. (May 2018, 5 marks)

Answer:

Job Costing:

Meaning:

It is a method of costing which is used when the work is undertaken as per the customer’s special requirement. When an inquiry is received from the customer costs expected to be incurred on the job are estimated and on the basis of this estimate a price is quoted to the customer. Actual cost of materials, labour and overhead are accumulated and on the completion of job, these actual costs are compared with the quoted price and thus the profit or loss on it is determined.

Job Costing is applicable in printing press, hardware foundry, ship building, heavy machinery, general engineering works, machine tools, interior decoration, repairs and other similar work.

Batch:

A batch s a group of similar and identical product which is produced in a factory and is treated as a single cost unit.

![]()

Batch Costing:

Batch costing is a specific type ot job costing and is used in industries whose production are of repetitive nature and where articles are produced in definite batches and held in stock. It is that form of job costing where in cost is ascertained collectively for a batch and then cost per unit is determined.

The Salient Features of Batch Costing are as follows:

- Batch costing is applied in industries where identical products are produced.

- The output of a batch Consists of a number of units and it is not economical to ascertain cost of every unit of output independently.

- Certain physical characteristics like size colour, taste, quality etc. are required uniformly over a collection of units e.g. garments of same size, pharmaceuticals etc.

Batch Costing is usually undertaken in the following industries:

Pharmaceuticals, garment manufacture, manufacture of spare parts, Radio, TV, Computer manufacture etc.

Computation:

Batch costing is but a specific type of job costing. Hence cost of each batch is ascertained in the same way as that of an individual job.

Under batch costing a unit cost is ascertained by dividing the batch cost by the no.of units in a batch as follows.

![]()

![]()

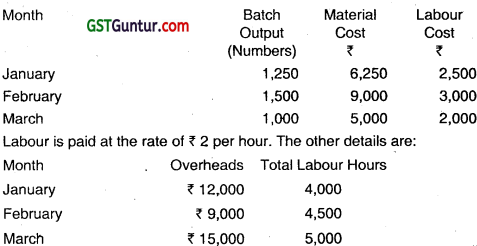

Question 6.

ABC Ltd. undertakes to supply 1,000 assemblies per month for the months of January, February and March. Every month, a batch order is opened against which Materials and Labour Cost is booked at actuals. Labourers are paid at ₹ 2 per hour. Overheads are levied at a rate per labour hour. The unit Selling Price is fixed at ₹ 15. From the following data, present the profit per unit each batch order and The overall position of the order for 3,000 units.

| Month | Batch Output | Material Cost | Labour Cost | Total OH tor the month | Total Labour Hours for the month |

| Jan | ₹ 1,250 units | ₹ 6,250 | ₹ 2,500 | ₹ 12,000 | 4,000 |

| Feb | ₹ 1,500 units | ₹ 9,000 | ₹ 3,000 | ₹ 9,000 | 4,500 |

| Mar | ₹ 1,000 units | ₹ 5,000 | ₹ 2,000 | ₹ 15,000 | 5,000 |

Answer:

1. Computation of OH for the Batch

| Month | Total OH | Total Direct Labour Hrs | So, OH Rate | Direct Lab. for the batch = Direct Wages ÷ Wage Rate | OH for the job |

| (1) | (2) (given) | (3) (given) | (4) = (2) ÷ (3) | (5) = Wages ÷ ₹ 2 | (6) = (5) × (4) |

| Jan | ₹ 12,000 | 4,000 | ₹ 3 per hour | = 1,250 hours | ₹ 3,750 |

| Feb | ₹ 9,000 | 4.500 | ₹ 2 per hour | = 1,500 hours | ₹ 3,000 |

| Mar | ₹ 15,000 | 5,000 | ₹ 3 per hour | = 1,000 hours | ₹ 3,000 |

![]()

2. Batch Cost Sheet

| Particulars | Jan | Feb | March | Total |

| Quantity | 1,250 units | 1,500 units | 1,000 units | 3,750 units |

| Direct Material (given) | 6,250 | 9,000 | 5,000 | 20,250 |

| Direct Labour (given) | 2,500 | 3,000 | 2,000 | 7,500 |

| Overhead (as per WN above) | 3,750 | 3,000 | 3,000 | 9,750 |

| Total Cost (Sub- total) | 12,500 | 15,000 | 10,000 | 37,500 |

| Add: Profit (balancing figure) | 6,250 | 7,500 | 5,000 | 18,750 |

| Sales at ₹ 15 p.u. (Qty. × ₹ 15) | 18,750 | 22,500 | 15,000 | 56,250 |

| Cost per unit (Total Cost ÷ Qty) | 10 | 10 | 10 | 10 |

| Profit per unit (bal. fig.) | 5 | 5 | 5 | 5 |

| Selling Price per unit (given) | 15 | 15 | 15 | 15 |

Over Protit position for 3,000 units = 3,000 × ₹ 5 (average Profit p.u.)

= ₹ 15,000.

![]()

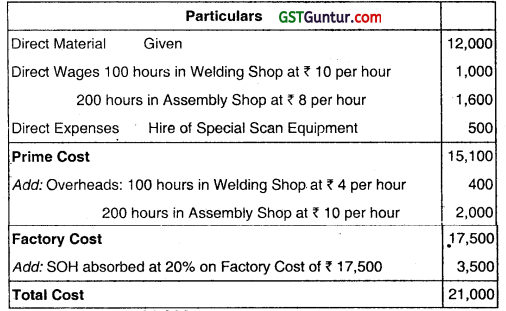

Question 7.

A Company produces product X to order and has the following budgeted OH:

| Department | Budgeted Overhead | Budgeted Activity Levels |

| Welding | ₹ 6,000 | 1,500 Labour Hours |

| Assembly | ₹ 10,000 | 1,000 Labour Hours |

Selling and Administration OH are 20% of Factory Cost. An order for 250 widgets type X – 128 and made as Batch S – 937, had the following costs – (1) Materials – 12,000, (2) Labour – 100 hours in Welding Shop at ₹ 10 per hour, 200 hours in Assembly Shop at ₹ 8 per hour, (3) ₹ 500 was paid for hire of special scan equipment for testing the widgets. From the given data calculate the cost per unit for Batch S – 937.

Answer:

1. Computation of OH Absorption Rates

Welding Department: = \(\frac{₹ 6,000}{1,500}\) = ₹ 4 per Labour Hour.

Assembly Department: = \(\frac{₹ 10,000}{1,000}\) = ₹ 10 per Labour Hour.

2. Batch Cost Sheet

Cost per unit = \(\frac{₹ 21,000}{250}\) = ₹ 84.00

![]()

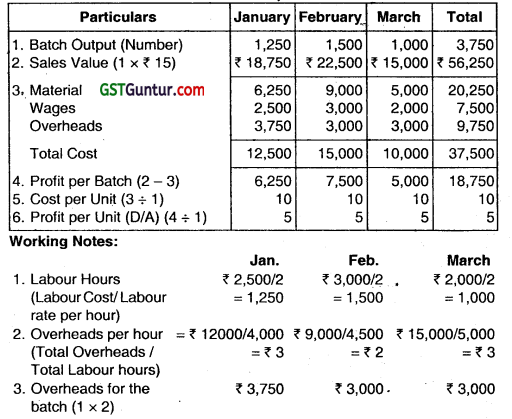

Question 8.

ABC Limited undertakes to supply 1,000 units of a component per month- for the months of January, February and March. Every month a batch order ¡s opened against which materials and labour cost are booked at actuals. Overheads are levied at a rate per labour hour. The selling price is ₹ 15 per unit.

From the following data, present the cost and profit per unit of each batch order and the overall position of the order for the 3,000 units.

Answer:

Statement of Cost and Profit per unit of each Batch

Overall Position for 3,000 Units

| Particulars | ₹? |

| 1. Sales Value (3,000 units × ₹ 15)

2. Less: Total cost (3,000 units × ₹ 10) 3. Profit (1 – 2) |

45,000

30,000 |

| 15,000 |

![]()

Question 9.

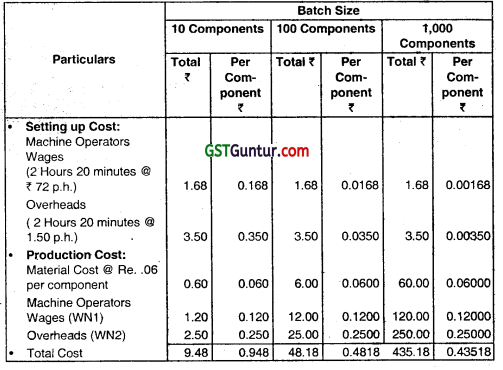

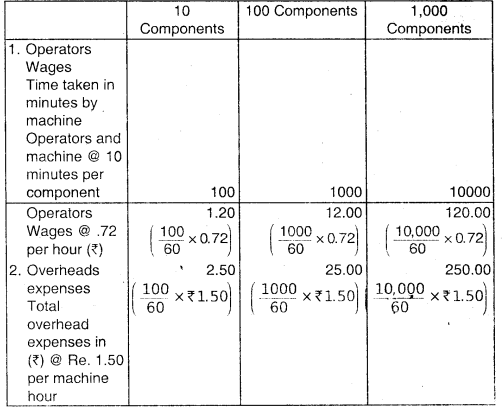

Component x is made entirely in cost centre 100. Material cost is 6 paise per component and each component takes 10 minutes to produce. The machine operator is paid 72 paise per hour, and machine hour rate is ₹ 1.50. The setting up of the machine to produce the component ‘Pee’ takes 2 hours 20 minutes.

On the basis of this information, prepare a cost sheet showing the production and setting up cost both in total and per component, assuming that a batch of:

(a) 10 components, (b) 100 components, and (c) 1,000 components is produced.

Answer:

Cost Sheet of Component ‘Pee’

Working Note:

![]()

Question 10.

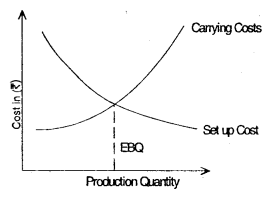

Discuss the concept of Economic Batch Quantity (EBQ). (May 2000, 2 marks)

Answer:

Economic batch quantity (EBO) is the optimum size of a batch to be produced. It represents that number of units to be produced in a batch which will keep the aggregate 01 set up cost and carrying cost to its minimum.

The determination of EBQ is important because if batch size is kept low the per unit set up cost increases, lithe batch size is increased it results in accumulation of inventory which increases the carrying cost. Thus to minimize the set up cost per unit the batch size is to be increased and to minimize the total carrying cost the batch size is to be lowered. Thus it is necessary to strike a balance between these two costs to minimize the aggregate of these two costs and this balance is brought about by EBO.

![]()

Question 11.

In Batch Costing, how is Economic Batch Quantity determined? (May 2001, 3 marks)

Answer:

The determination of EBO involves:

- Set up cost

- Carrying cost

1. Set up cost: Production of each batch of output necessitates the setting up of machine and tools at the commencement of production and again its cIsasscmbling on completion of production. The set up cost is the cost of setting up and disassembling of the machines and tools.

The cost remains fixed respective of the batch size. Thus if the batch size is low the set up cost per unit is high and vice-versa.

2. Carrying cost: The cost associated with the holding the inventory is called carrying cost. It includes rent of the space occupied by the inventory, interest on capital etc. It is a variable cost and is dependent on the batch size.

If the batch size is increased the carrying cost increases and vice-versa.

Thus to keep the aggregate of set up costs and carrying cost to a minimum EBQ is determined with the help of the following formula

EBO = \(\sqrt{\frac{2 A S}{C}}\)

Where A = Annual demand for the product

S = Set up cost per batch

C = Carrying cost per unit of production

If the rate of interest (I) and unit cost of production (C) are given,

then EBQ = \(\sqrt{\frac{2 A S}{1C}}\)

EBQ can also be determined graphically as under

![]()

Question 12.

XYZ Ltd. has obtained an order to supply 48000 bearings per year from a concern. On a steady basis, it is estimated that it costs ₹ 0.20 as inventory holding cost per bearing per month and the set-up cost per run of bearing manufacture is ₹ 384.

You are required to:

(i) compute the optimum run size and number of runs for bearing manufacture.

(ii) compute the interval between two consecutive runs.

(iii) find out the extra costs to be incurred, if company adopts a policy to manufacture 8000 bearings per run as compared to optimum run size.

(iv) give your opinion regarding run size of bearing manufacture. Assume 365 days in a year. (Nov 2018, 10 marks)

Answer:

(i) Economic Batch Cuantity (EBQ):

EBO = \(\sqrt{\frac{2 D S}{C}}-\sqrt{\frac{2 \times 48,000 \times 384}{0.2 \times 12}}-\sqrt{\frac{3,68,64,000}{2.4}}\) = 3919 units

Number of optimum runs for Bearing Manufacture = 48,000 ÷ 3919

= 12.25 runs or 12 run

(ii) Interval between two runs (in days) = 365 days ÷ 12.25 = 29.80 days

![]()

(iii) Total Cost (of maintaining the inventories) when production run size

(a) are 3919 units and 8000 units respectively.

Total Cost = Total Set – up Cost + Total Carrying Cost

| When run size is 3919 bearings | When run size is 8000 bearings | |

| Total Set-up Cost | = \(\frac{48,000}{3919}\) × ₹ 384 = ₹ 4,703.24 |

= \(\frac{48,000}{8000}\) × ₹ 384 = ₹ 2,304 |

| Total Carrying Cost | 1/2 × 3919 × 0.2 × 12 = ₹ 4,702.80 |

1/2 × 8000 × 0.2 × 12 = ₹ 9,600 |

| Total Cost | ₹ 9,406.04 | ₹ 11,904 |

(iv) At the optimum run size of 3919 units the setup cost and the carrying costs are the same. So, it is the most economical batch quantity and should be preferred.

![]()

Question 13.

Answer the following:

GHI Ltd. manufactures ‘Stent’ that is used by hospitals in heart surgery. As per the estimates provided by Pharmaceutical Industry Bureau, there will be a demand of 40 Million ‘Stents’ in the coming year. GHI Ltd. is expected to have a market share of 2.5% of the total market demand of the Stents in the coming year. It is estimated that it costs ₹ 1.50 as inventory holding cost per stent per month and that the set-up cost per run of stent manufacture is ₹ 225.

Required:

(i) What would be the optimum run size for Stent manufacture?

(ii) What is the minimum inventory holding cost?

(iii) Assuming that the company ha;a policy of manufacturing 4,000 stents per run, how much extra costs the company would be incurring as compared to the optimum run suggested in (i) above? (Jan 2021, 5 marks)

Question 14.

From the following information, calculate Economic Batch Quantity for a company using batch costing:

Annual Demand for the components – 2400 units

Setting up cost per batch – ₹ 100

Manufacturing cost per unit – ₹ 200

Carrying cost per unit – 6% p.a.

Answer:

EBQ = \(\sqrt{\frac{2 \mathrm{AS}}{\mathrm{C}}}=\sqrt{\frac{2 \times 2400 \times ₹ 100}{6 \% \text { of } ₹ 200}}\) = 200 units

Where A = Annual demand of Units

S = Setting up and order processing cost (per batch)

C = Carrying cost per unit per annum

![]()

Question 15.

Compute the economic batch quantity for a company using batch costing with the following information:

Annual demand for the component: – 4,000 units

Setting up and order processing cost: – ₹ 50

Cost of manufacturing one unit – ₹ 100

Rate of interest p.a. 10%

Answer:

Economic Batch Quantity (EBO) = \(\sqrt{\frac{2 A S}{C}}=\sqrt{\frac{2 \times 4000 ₹ 50}{6 \% \text { of } ₹ 10}}\) = 200 units

here: A = Annual demand = 4000 Units

S = Setting up and order processing cost (per batch) = ₹ 50

C = Carrying cost per unit per annum = 10% of ₹ 100 = ₹ 10

![]()

Question 16.

Distinguish between “Job costing and batch costing”. (Nov 2004, May 2006, 2,2 marks)

Answer:

Difference between Job Costing and Batch Costing

| Sl. No. | Basis | Job Costing | Batch Costing |

| 1. | Nature | Job costing is a specific order costing. | Batch costing is a special type of job costing. |

| 2. | Applicability | It is undertaken in such industries where work is done as per the customers requirement. | It is undertaken in such industries where production is of repetitive nature. |

| 3. | Similarity | No two jobs are alike. | The articles produced in a batch are alike. |

| 4. | Cost

determination |

The cost is determined on job basis. | The cost is determined on batch basis. |

| 5. | Output

quantity |

The output of a job may be 1 unit, 2 units of a batch. | The output of a batch is usually a large quantity. |

| 6. | Cost estimation | The cost is estimated before the production. | The cost is determined after completion of production. |

| 7. | Examples | Industries where job costing is undertaken are repair workshop, furniture, general engineering works. | Industries where batch costing is undertaken are pharmaceuticals, garment manufacturing, radio, T.V. manufacturing etc. * |