Students should practice Underwriting of Shares & Debentures – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Underwriting of Shares & Debentures – Corporate and Management Accounting MCQ

Question 1.

In case of issue of shares, the under-writing commission shall not exceed

(A) 5% of the issue price

(B) 5% of the nominal value

(C) 10% of the market price

(D) 10% of the nominal value

Answer:

(A) 5% of the issue price

Question 2.

In case of issue of debentures, underwriting commission shall not exceed

(A) 2.5% of the nominal value

(B) 2.5% of the issue price

(C) 2.5% of the market price

(D) 3 .5% of the face value

Answer:

(B) 2.5% of the issue price

Question 3.

In case of issue of shares, the rate of underwriting commission paid or agreed to be paid shall not exceed:

(A) 5% of the issue price

(B) A rate authorized by the articles

(C) 5% of the issue price or a rate authorized by the articles, whichever is more.

(D) 5% of the issue price or a rate authorized by the articles, whichever is less.

Answer:

(D) 5% of the issue price or a rate authorized by the articles, whichever is less.

Question 4.

In case of issue of debentures, the rate of underwriting commission paid or agreed to be paid shall not exceed:

(A) 2.5% of the issue price

(B) A rate authorized by the articles

(C) 2.5% of the issue price or a rate authorized by the articles, whichever is more.

(D) 2.5% of the issue price or a rate authorized by the articles, whichever is less.

Answer:

(D) 2.5% of the issue price or a rate authorized by the articles, whichever is less.

Question 5.

A definite commitment by the underwriter to take up a specified number of shares or debentures of a company irrespective of the number of shares or debentures subscribed for by the public is known as

(A) Definite underwriting

(B) Pakka underwriting

(C) Marked underwriting

(D) Firm underwriting

Answer:

(D) Firm underwriting

Question 6.

Unmarked application has to be distributed to underwriters in the ratio of

(A) Gross Liability Ratio

(B) Last Agreed Ratio

(C) Net Liability Ratio

(D) Equal ratio

Answer:

(A) Gross Liability Ratio

Question 7.

Applications bearing the stamp of the respective underwriter are called as:

(A) Firm applications

(B) Stamped applications

(C) Underwritten application

(D) Marked applications

Answer:

(D) Marked applications

Question 8.

A broker

(A) Undertakes to find buyers who are willing to buy shares and debentures

(B) Does not guarantees the sale of shares and debentures

(C) Both (A) and (B)

(D) (B) only not (A)

Answer:

(C) Both (A) and (B)

Question 9.

An underwriter

(A) Guarantees that if the public does not take up all shares the underwriters will purchase the remaining shares.

(B) Agrees to receive an underwriting commission at the prescribed percentage allowed as per law.

(C) Both (A) and (B)

(D) (A) only not (B)

Answer:

(C) Both (A) and (B)

Question 10.

Who of the following generally acts as an underwriter?

(A) Financial institutions

(B) Banks

(C) Merchant bankers

(D) All of the above

Answer:

(D) All of the above

Question 11.

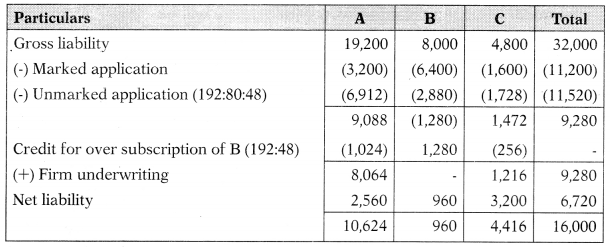

LPG Ltd. issued 32,000 shares which were underwritten as follows:

A: 19,200 shares, B: 8,000 shares & C: 4,800 shares.

The underwriters made applications for firm underwriting as

A: 2,560 shares, B: 960 shares & C: 3,200 shares.

Details of the marked application are

A: 3,200 shares, B: 6,400 shares and C: 1,600 shares.

Unmarked applications are for 11,520 shares. Find out the net liability of individual underwriters.

(A) 10,624; 960; 4,416 respectively

(B) 10,642; 906; 4,461 respectively

(C) 10,264; 940; 4,146 respectively

(D) 10,462; 940; 4,641 respectively

Hint:

Answer:

(A) 10,624; 960; 4,416 respectively

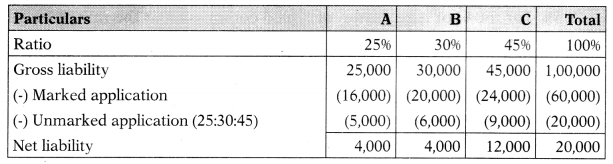

Question 12.

Cybertech Ltd. issued 1,00,000 shares for public subscription and these were underwritten by A, B, and C in the ratio of 25%, 30%, and 45% respectively. Applications were received for 80,000 shares and of these applications for 16,000 shares had the stamp of A, those for 20,000 shares had the stamp of B and those of 24,000 shares had the stamp of C. The remaining applications did not bear any stamp. Net liability of underwriters in shares is: A B C

(A) 4,000 12,000 4,000

(B) 6,000 6,000 18,000

(C) 4,000 4,000 12,000

(D) 12,000 4,000 4,000

Hint:

Answer:

(C) 4,000 4,000 12,000

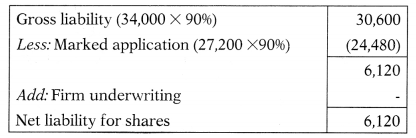

Question 13.

NZ Ltd. issued 34,000 shares of ₹ 100 at a premium of ₹ 15 each. 90% of the issue was underwritten by M/s. Broker & Co. Applications were received for 27,200 shares and allotment was fully made. Net liability of underwriter for shares =?

(A) 30,600 shares

(B) 24,480 shares

(C) 8,840 shares

(D) 6,120 shares

Hint:

Answer:

(D) 6,120 shares

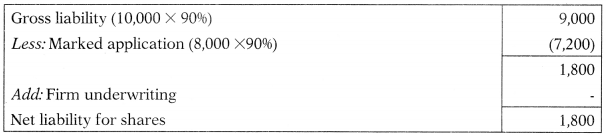

Question 14.

XM Ltd. issued 25,000 shares of ₹ 100 at a premium of ₹ 15 each. 9096 of the issue was underwritten by M/s. U WB & Co. at a maximum commission allowed under the Companies Act, 2013. Applications were received for 8,000 shares. Commission =?

(A) ₹ 1,92,725

(B) ₹ 1,29,375

(C) ₹ 97,750

(D) ₹ 62,450

Hint:

The maximum commission allowed under the Companies Act, 2013 is 5% of the issue price.

The commission is payable on ‘gross liability’ and not on ‘net liability’. Hence, net liability need not be calculated.

Commission = 25,000 × 90% × 115 × 5% = 1,29,375

Answer:

(B) ₹ 1,29,375

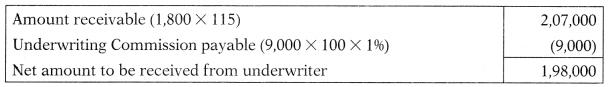

Question 15.

LG Ltd. issued 10,000 shares of ₹ 100 at a premium of ₹ 15 each. 90% of the issue was underwritten by M/s. X & Co. at a commission of 196 on the nominal value. Applications were received for 8,000 shares and allotment was fully made. All money was received in one installment. The net amount to be received from the underwriter at the time of allotment of shares is

(A) ₹ 2,07,000

(B) ₹ 1,98,000

(C) ₹ 2,16,000

(D) ₹ 1,42,000

Hint:

Answer:

(B) ₹ 1,98,000

Question 16.

Z Ltd. entered into an underwriting agreement with B Ltd. for the commission of 2.5% for 60% of the issue of ₹ 35,00,000,15% Debentures with a firm underwriting of ₹ 3,50,000. Marked applications were for ₹ 24,50,000 debentures. Calculate the commission payable to the underwriter.

(A) ₹ 75,000

(B) ₹ 87,500

(C) ₹ 64,750

(D) ₹ 52,500

Hint:

Gross liability = 35,00,000 × 60% = 21,00,000

Commission = 21,00,000 × 2.5% = 52,500.

Answer:

(D) ₹ 52,500

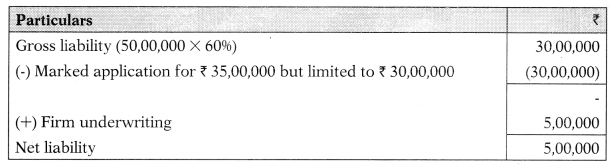

Question 17.

X Ltd. entered into an underwriting agreement with Y Ltd. for the commission of 2.5% for 60% of the issue of ₹ 50,00,000,15% Debenture with a firm underwriting of ₹ 5,00,000. Marked applications were for ₹ 35,00,000 debenture. Net liability of underwriter =?

(A) Nil

(B) ₹ 6,00,000

(C) ₹ 5,00,000

(D) ₹ 8,00,000

Hint:

Answer:

(C) ₹ 5,00,000

Question 18.

MMW Ltd. made an issue of 47.0, 10% mortgage debentures of ₹ 100 each at par. The whole of the issue was underwritten by Y & Co. 39,950 debentures were applied for and allotted to the public. Net liability of underwriter to take a number of debentures will be

(A) 39,950 debentures

(B) 47,000 debentures

(C) 7,050 debentures

(D) 8,370 debentures

Hint:

47,000 – 39,950 = 7,050

Answer:

(C) 7,050 debentures

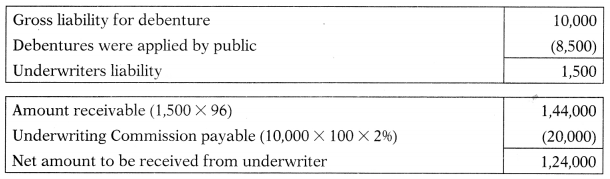

Question 19.

Biggie Ltd. made an issue of 10,000, 10% mortgage debentures of ₹ 100 each at ₹ 96. The whole of the issue was underwritten by Smart Bulls. 8,500 debentures were applied for and allotted to the public. The underwriters discharged their liability and were paid commission at the rate of 2% on the nominal value of the debentures. Which of the following statement is correct?

(A) Net amount to receivable from underwriter is ₹ 1,22,000

(B) The net amount payable to the underwriter is ₹ 12,000

(C) Net amount to receivable from underwriter is ₹ 1,24,000

(D) The net amount payable to the underwriter is ₹ 14,000

Hint:

Answer:

(C) Net amount to receivable from underwriter is ₹ 1,24,000

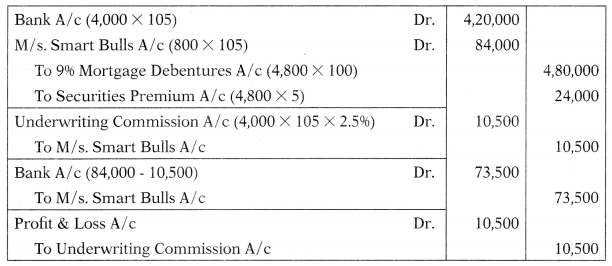

Question 20.

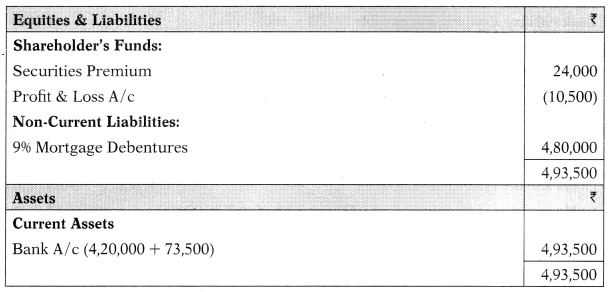

Abrol Ltd. offered to the public 5.0, 9% mortgage debentures of ₹ 100 each at ₹ 105, and 80% of the issue was underwritten by Smart Bulls for commission @ 2.5%. Applications were received from the public for 4,000 debentures which were allotted. The balance Sheet will tally at

(A) ₹ 5,03,500

(B) ₹ 4,93,500

(C) ₹ 4,63,500

(D) ₹ 5,23,500

Hint:

Balance Sheet of Abrol Ltd.

Answer:

(B) ₹ 4,93,500