Go through this Tools of Auditing – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Tools of Auditing – CS Foundation Fundamentals of Auditing Notes

Audit Plan:

- Audit planning is one of the basic principles governing an audit.

- Auditor should plan his work to enable him to conduct an effective audit in an efficient manner.

- For this purpose, audit plan is prepared.

- An audit plan lays down the strategies to be followed to conduct an audit.

An audit plan should cover the following :

- acquiring knowledge of clients accounting systems, policies and internal control procedures.

- establishing expected degree of reliance to be placed on internal control.

- determining the nature, timing and extent of the procedures to be performed.

- coordinating the work to be performed.

Before making an Audit Plan, the auditor should consider the following points:

- terms of engagement and statutory responsibilities.

- accounting policies followed by enterprise and changes in it.

- identifying significant audit areas.

- setting materiality levels.

- degree of reliance to be placed on internal control.

- nature and extent of audit evidence, etc.

- affects of new accounting or auditing requirements.

- work of internal auditor.

- establishing and co-ordinating staffing requirements

- nature and timing of report or other communication.

- Audit plans are flexible and should be changed by the auditor depending upon the changing conditions.

- Audit planning is covered under SA 300.

Audit Programme:

- An audit programme is a detailed plan of work, prepared by the auditor for carrying out an audit.

- It is a set of instructions which are to be followed for proper execution of audit.

- It consist of a set of techniques and procedures which the auditor plans to apply in the given audit.

- There is no standard audit programme applicable for all situations.

- Audit programme is documented in the audit working papers.

Benefits of Audit Programme:

- ensures that all areas have been covered during audit.

- acts as an evidence against charge of negligence.

- helps in fixing responsibilities.

- helps in providing clear instructions and setting guidelines for the audit staff.

- helps in distributing work among assistants.

- helps in assessing the progress of work.

- provides records for future reference.

Limitations of an Audit Programme:

- An audit programme is rigid i.e. not flexible. One audit programme may not suit all organisations.

- Independent judgement and initiative of the audit staff may be restricted. It may frustrate the talented and efficient audit staff.

- With an audit programme, the audit work becomes mechanical. Special circumstances, unusual features of the client may not be referred.

- New areas will be overlooked as the audit will be carried out based on traditional audit programme only.

Remedy of Disadvantage of Audit Programme:

- Programme should be flexible

- Audit staff should be encouraged to draw attention of the auditor to any defect in the programme

- The staff should be encouraged to explore fully unusual transaction and do not get restricted with the audit programme.

In order to attain the benefits of audit programme, an auditor should:

- Make a flexible audit programme.

- Encourage the staff to keep an open mind while auditing and consider all unusual transactions.

- Modify the audit programme depending upon the type of business.

Difference between audit plan and audit programme:

| Audit Plans | Audit Programmes |

| (i) Lays down the audit strategies for conducting an audit | (i) It refers to those outlines needed for auditing |

| (ii) Plan should cover the things: (1) Extract information of accounting systems, policies and control procedures. (2) Putting the reliance on internal control. (3) To determine the nature, timing and limit of auditing procedures. (4) Coordinating the work to be done. |

(ii) Lays down the following procedure to follow: (1) Internal control evaluation (2) Arithmetical accuracy (3) Vouching of transactions (4) Verification and valuation of assets and liabilities (5) Ledger scrutiny and checking of overall disclosures. (6) Preparation and sub-mission of audit report. (7) Checking of overall disclosures and presentation of all items in final accounts. |

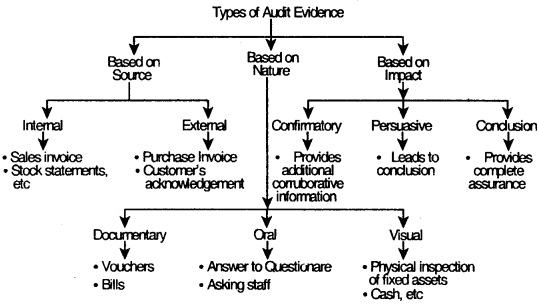

Audit Evidence:

1. Audit evidence refers to any information, verbal or written, obtained by the auditor during the course of audit to arrive at the conclusion on which he bases his opinion on financial statements.

2. Audit evidence provides grounds for believing that a particular thing is true or not

Essentials of a good audit evidence:

- Should be sufficient i.e. in adequate quantity.

- Should be reliable, (reliability depends upon source and nature)

- Should be relevant to the matter being checked.

Judging appropriateness of evidence:

- Documentary evidence is better than testimonial evidence.

- Obtaining same evidence from different sources makes it more reliable.

- Original documents are more reliable than its copies.

- Evidence obtained from third parties is more reliable.

- The auditor’s direct observation inspection and computation is more reliable.

- Quality of information generated by the audited organisation is directly related to the strength of the organisation internal audit

Testimonial evidence:

It is the evidence that is obtained from a witness who makes a solemn statement or declaration of fact. It may be oral/written and usually made by an oath.

Factors to be considered while obtaining audit evidence:

- The quality of evidence (i.e. its relevancy, reliability and validity)

- The materiality of the evidence (i.e. its level of significance). The higher the materiality, higher will be the standard that evidence will have to meet.

- What level of assurance is required (audit (high) level or review (low) level).

- Risk involved in making incorrect observation.

- Cost of obtaining evidence relative to likely benefit in items of supporting observations and conclusion.

Techniques of obtaining audit evidence:

- Inspection (documentary evidences like papers etc).

- Observation (physical verification, counting etc).

- Enquiry (from staff, client etc).

- Confirmation (from the third parties)

- Computation (checking arithmetical accuracy of accounting records)

- Analytical review procedures (analysis of ratios)

- Independent execution.

Audit Working Papers:

1. These are documents prepared or obtained by the auditor during the course of audit.

2. Audit working papers are maintained to ensure that

- Audit was properly planned

- Audit was carried out

- Audit was adequately supervised

- Review was undertaken

- Evidence is sufficient to obtain audit evidence

3. Working papers act as a link between client’s record and audit report.

4. Working papers are the property of the auditor.

5. Auditor should maintain confidentiality of the clients information

Benefits of maintaining audit working papers:

- Helps in proper planning and performance of audit.

- Helps the auditor to supervise the work of juniors

- Acts as an evidence for audit work performed.

Types of working papers:

Working papers are categorized and maintained under two heads :

(a) Permanent Audit File

(b) Current Audit File

| Permanent Audit File | Current Audit file |

| It consist of data which is of continuous use in current as well as subsequent audits. | It consist of data which is relevant only for the current period audit. |

| This file has: (a) Articles of incorporation (b) Loan agreements (c) Leases (d) Audit observations of previous years (e) Others |

This file has: (a) Working trial balance and work sheets (b) Audit programmes (c) Financial statements (d) Others |

Tools of Auditing MCQ Questions

1. lays down the strategies to be followed to conduct an audit.

(a) Audit plan

(b) Audit Programme

(c) Working Papers

(d) All of these

Answer:

(a) Audit plan

2. Audit plan and programme means the same thing. State true or false:

(a) True

(b) False

(c) Partly true

(d) None

Answer:

(b) False

3. Audit planning is covered under:

(a) SA 200

(b) SA 300

(c) SA 400

(d) SA 450

Answer:

(b) SA 300

4. Audit Programme is not prepared by :

(a) the auditor

(b) the client

(c) the audit assistants

(d) the auditor and his audit assistants

Answer:

(b) the client

5. The working papers which auditor prepares for financial statement audit are:

(a) For property of government.

(b) owned by the client.

(c) owned by the auditor.

(d) retained in auditors office until a change in auditors.

Answer:

(c) owned by the auditor.

6. Which of the following are not considered by an auditor before making an audit plan :

(a) level of internal control effectiveness

(b) significant audit areas

(c) accounting policies of the enterprise

(d) None of these.

Answer:

(d) None of these.

7. An auditor made an audit programme for conducting an audit in a textile firm. He used the same audit programme with no changes for conducting the audit of an automobile firm. Here the auditor:

(a) was right in doing so as he can use the same audit programme for all types of audit.

(b) was wrong, as the audit programme should be changed depending upon the nature of organisation.

(c) was right as it was his standard audit programme.

(d) None of these.

Answer:

(b) was wrong, as the audit programme should be changed depending upon the nature of organisation.

8. Obtaining same evidence from different sources make it ________ reliable.

(a) More

(b) Less

(c) Both

(d) None

Answer:

(a) More

9. Stock statement is a ________ evidence.

(a) Internal

(b) External

(c) Cant say

(d) None of these

Answer:

(a) Internal

10. Which of these is not a technique of obtaining audit evidence?

(a) Observation

(b) Enquiry

(c) Analytical Review

(d) Investigation

Answer:

(d) Investigation

11. Audit working papers are the property of:

(a) Auditor

(b) Owner

(c) Government

(d) Income Tax Department.

Answer:

(a) Auditor

12. Audit working papers act as a link between.

(a) Client records and audit report

(b) Audit report and financial statements

(c) Auditor and his staff

(d) None.

Answer:

(a) Client records and audit report

13. Working papers are classified into:

(a) Permanent audit file

(b) Temporary audit file

(c) Special audit file

(d) Both (a) and (b)

Answer:

(d) Both (a) and (b)

14. The file which is used only for current period audit is ________.

(a) Temporary audit file

(b) Special audit file

(c) Running audit file

(d) current audit file

Answer:

(d) current audit file

15. Financial statements of an entity are kept in :

(a) Permanent file

(b) Temporary file

(c) Current file

(d) None of these

Answer:

(c) Current file

16. Analytical review involves:

(a) test checking

(b) ratio analysis

(c) physical verification

(d) All of these

Answer:

(b) ratio analysis

17. An audit evidence can be of the following types :

(a) Based on source

(b) Based on nature

(c) Based on impact

(d) All of these

Answer:

(d) All of these

18. Audit programme is documented in the ________.

(a) Permanent audit file

(b) Audit working paper

(c) Current Audit file

(d) Audit paper

Answer:

(c) Current Audit file

19. Whether a client has a right to ask for the custody of working papers from the auditor?

(a) Yes

(b) No

(c) Not fully

(d) None of these

Answer:

(b) No

20. The extent and ________ of audit depends upon effectiveness of internal control.

(a) Nature

(b) Periodicity

(c) Relevance

(d) Format

Answer:

(a) Nature

21. The auditor’s permanent working paper file should not normally, include:

(a) Extracts from client’s bank statement

(b) Past year’s financial statement

(c) Attorney’s letters

(d) Debt agreements

Answer:

(a) Extracts from client’s bank statement

22. Which of the following factors is most important in determining the appropriations of audit evidence:

(a) The reliability of audit evidence and its relevance in meeting the audit objective

(b) The objectivity and integrity of the auditor

(c) The quantity of audit evidence

(d) The independence of the source of evidence.

Answer:

(a) The reliability of audit evidence and its relevance in meeting the audit objective

23. Which of the following statement is true regarding an auditor’s working papers :

(a) They document the level of independence maintained by the auditor

(b) They should be considered as the principle support for the auditor’s report

(c) They should not contain details regarding weakness in the internal control system.

(d) They help the auditor to monitor the effectiveness of the audit firm’s quality control procedures.

Answer:

(b) They should be considered as the principle support for the auditor’s report

24. The current file of the auditor’s working paper’s generally, should include:

(a) A flowchart of the internal controls

(b) Organisation charts

(c) A copy of financial statement

(d) Copies of bond & debentures

Answer:

(c) A copy of financial statement

25. Appropriateness of evidence depends on the following:

(a) Information must be true

(b) Information must be affordable

(c) Information must be relevant

(d) Information must be valid

Answer:

(c) Information must be relevant

26. Auditor has to obtain ________ audit evidence.

(a) Adequate

(b) Correct

(c) Relevant

(d) Sufficient & appropriate

Answer:

(d) Sufficient & appropriate

27. Due to lock of audit evidence, auditor issues a:

(a) Qualified opinion

(b) Unqualified opinion

(c) Adverse opinion

(d) Disclaimer of opinion

Answer:

(d) Disclaimer of opinion

28. Current Audit file contains information relating to the audit of the ________.

(a) Current Period

(b) Permanent Period

(c) None of these

(d) Both (a) & (b)

Answer:

(a) Current Period

29. Current audit file can include the following data:

(a) Financial statement & audit report

(b) Working trail balance & work-sheets

(c) Audit Programmes

(d) All of these

Answer:

(d) All of these

30. Data in Permanent Audit file can include:

(a) Articles of incorporation

(b) Loan agreement

(c) Leases

(d) All of these

Answer:

(d) All of these

31. Auditor working paper are dividend into:

(a) Three parts

(b) Four parts

(c) Two parts

(d) None

Answer:

(c) Two parts

32. Techniques of obtaining audit evidence:

(a) Inspection

(b) Enquiry

(c) Observation

(d) All of these

Answer:

(d) All of these

33. Benefit of maintaining audit working papers:

(a) Helps in Proper Planning & Performance of audit

(b) Helps the auditor to supervise the work of juniors

(c) Acts as an evidence for audit work performed

(d) All of these

Answer:

(d) All of these

34. Audit working papers are maintained to ensure that:

(a) Audit was Properly Planned

(b) Audit was carried out

(c) Both (a) & (b)

(d) None of these

Answer:

(c) Both (a) & (b)

35. Benefits of Audit Programme are:

(a) Helps in fixing responsibilities

(b) Helps in providing clear instructions

(c) Ensures that all areas have been covered during audit

(d) All of these

Answer:

(d) All of these

36. Before making an audit plan, the auditor should consider:

(a) Setting materiality levels

(b) Identifying materiality levels

(c) Both (a) & (b)

(d) None of these

Answer:

(c) Both (a) & (b)

37. Audit evidence based on source:

(a) Internal

(b) External

(c) Both (a) & (b)

(d) None

Answer:

(c) Both (a) & (b)

38. Types of Audit evidence:

(a) Based on Source

(b) Based on Nature

(c) Based on Impact

(d) All of these

Answer:

(d) All of these

39. Working papers are the property of the auditor:

(a) True

(b) False

(c) Not fully true

(d) None of these

Answer:

(a) True

40. Disadvantages of audit programme are:

(a) Flexibility

(b) Praises the efficient audit

(c) New areas are looked at

(d) None

Answer:

(d) None

41. Sufficient evidence can be obtained by test checking instead of ________ checking.

(a) 95%

(b) 100%

(c) 50%

(d) None of these

Answer:

(b) 100%

42. An audit programme is a set of instructions:

(a) False

(b) Partly true

(c) True

(d) None of these

Answer:

(c) True

43. Which of the following are not considered by an auditor before making an audit plan:

(a) Level of internal control

(b) Significant audit areas

(c) Accounting policies of enterprise

(d) None of the above

Answer:

(d) None of the above

44. Stock statement is a/an ________ statement:

(a) Internal

(b) External

(c) Both

(d) None of the above

Answer:

(a) Internal

45. Audit Program is not prepared by:

(a) Auditor

(b) Client

(c) Auditor assistants

(d) Auditor and his audit assistant

Answer:

(b) Client

46. The nature, timing and extent of the audit procedures are contained in ________.

(a) Audit plan

(b) Audit status

(c) Audit evidence

(d) Audit programme.

Answer:

(a) Audit plan

47. The materiality level should be ascertained at the ________.

(a) Execution stage

(b) Reporting stage

(c) Planning stage

(d) None of the above

Answer:

(c) Planning stage

48. ________ is a set of instructions that are required to be followed for proper execution of audit.

(a) Audit file

(b) Working papers

(c) Audit status

(d) Audit programme

Answer:

(d) Audit programme

49. The official records containing the planning and execution of the audit agreement is called as ________.

(a) Audit status

(b) Audit working papers

(c) Audit plan

(d) None of the above

Answer:

(d) None of the above

50. Which of the following is NOT an advantage of audit programme?

(a) It serves as an evidence against charge of negligence

(b) It serves as an audit record

(c) It ensures that all the important areas are covered

(d) It is flexible in nature and a same audit programme can be used in different organisation.

Answer:

(d) It is flexible in nature and a same audit programme can be used in different organisation.

51. The internal audit is ________.

(a) Mandatory

(b) Beneficiary

(c) Both (a) & (b)

(d) None of the above

Answer:

(b) Beneficiary

52. Which of the following statement is True?

(a) There exists direct relationship between the effectiveness of internal control and the extent of checking to be done

(b) There exists an inverse relation between the effectiveness of internal control and the extent of checking to be done by the auditor

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(b) There exists an inverse relation between the effectiveness of internal control and the extent of checking to be done by the auditor

53. The analysis of significant trends for investigating unusual fluctuations and items is called.

(a) Analytical review procedures

(b) Independent execution

(c) Observation

(d) Computation

Answer:

(a) Analytical review procedures

54. The audit working papers are the property of ________.

(a) Auditor

(b) Management

(c) Shareholders

(d) Registrar

Answer:

(a) Auditor

55. Audit observations of the previous year’s leases, loan agreements etc. are the elements of ________.

(a) Permanent audit file

(b) Temporary audit file

(c) Routine audit file

(d) None of the above.

Answer:

(a) Permanent audit file

56. Working trial balance, audit programme, MRL, records of test of control etc. are the elements of ________.

(a) Permanent audit file

(b) Routine audit file

(c) Temporary audit file

(d) All of the above

Answer:

(c) Temporary audit file

57. Primary responsibility for the adequacy of financial statements disclosures rests with _________.

(a) Auditor

(b) Management

(c) Auditor’s Staff

(d) Central Government

Answer:

(b) Management

The Control of the company is in the hands of Management. Moreover the financial statements are also prepared by Management. Management has to ensure that all the disclosures relating to accounting standards and principles that are followed in the preparation of financial statements have been made properly and they are followed consistently.

Thus, the primary responsibility for the adequacy of financial statements disclosures rests with management.

58. Which one shall be kept in mind while carrying out audit?

(a) High risk areas should be checked as others

(b) High risk areas should be checked in detail

(c) High risk areas should not be checked

(d) High risk areas should be checked briefly

Answer:

(b) High risk areas should be checked in detail

Before planning for an audit is important for the auditor to identify the areas which involves greater audit risk, so that audit can be planned in such a way that overall audit risk will be less. .More high risky areas should be checked in detail and vice-versa.

59. Which of the following is not a method of obtaining evidence ________.

(a) Observation

(b) Confirmation

(c) Declaration

(d) Analytical review

Answer:

(c) Declaration

Following are the techniques of obtaining evidences:

- Inspection

- Observation

- Enquiry

- Confirmation

- Computation

- Analytical Review Production

- Independent Execution.

Thus, declaration is not a method of obtaining audit evidence.

60. Articles of Association of a company should be stored in a ________

(a) Permanent audit file

(b) Current audit file

(c) System audit file

(d) None of the above

Answer:

(a) Permanent audit file

Permanent file includes the data which is of continuous interest and relevant to succeeding audits. It includes the following.

- Articles of Incorporation /Articles of Association/ Memorandum of Association.

- Loan agreements.

- Documents related to understanding internal control.

- Leases

- Significant audit observations of earlier years.

- Notes regarding significant accounting policies.

Thus, Articles of Association should be stored in a Permanent Audit File.

61. In audit assignment, who among the following set the level of materiality?

(a) Shareholders

(b) Board of Directors

(c) Auditor

(d) Manager of the entity/department concerned.

Answer:

(c) Auditor

At the planning stage, the auditor sets the materiality levels. For example, the auditor may decide that in the case of audit of sales he will examine all sales transactions above ₹ 5,000.

62. Audit working papers are the property of:

(a) Owner

(b) Government

(c) Auditor

(d) Income Tax Department.

Answer:

(c) Auditor

Audit working papers are the documents prepared or obtained by the auditors and retained by him in connection with the audit. They are the connecting link between the client’s record and the audited accounts. They are the property of the auditor and the client cannot ask the auditor for their custody.

63. Primary responsibility for the adequacy of financial statement disclosures rest with the:

(a) Auditor

(b) Management

(c) Auditor’s staff

(d) Central Government

Answer:

(b) Management

The control of the company is in the hands of management.

Moreover, the financial statements are also prepared by management. Management has to ensure that all the disclosures . relating to accounting standards and principles that are followed in the preparation of financial statements have been made properly and they are followed consistently.

Thus, the primary responsibility for the adequacy of financial statements disclosures rests with the management.

64. Which of the following is not an advantage of the preparation of audit working paper?

(a) To provide a basis for review of audit work

(b) To provide a basis for subsequent audits

(c) To ensure audit work is being carried out as per program

(d) To provide a guide for advising another client on similar issues.

Answer:

(d) To provide a guide for advising another client on similar issues.

Following are the advantages of the audit working papers:

- It helps in proper planning and performance of audit.

- Seniors can supervise the audit work performed by the juniors by examining their working papers.

- It provide an evidence of the audit work performed to support the auditor’s opinion.

- It ensures that the appropriate review was undertaken.

- These also serves as a guide to the staff to whom the work of audit has been assigned after the previous year audit.

- It provides an assurance that the audit was performed in accordance with the relevant auditing standards.

Thus, audit working papers cannot in any way provide a guide for advising another client on similar issues since, it is the duty of the auditors to maintain confidentiality of the client information and if they are disclosed then it will amount to professional misconduct.

65. Which of the following is not true about audit plan?

(a) Audit plan lays out the strategies to be followed to conduct an audit

(b) Audit plan is made to ensure that audit assignment is done smoothly

(c) Audit plan is not made from audit programme

(d) Audit plan is prepared considering the terms of engagement and statutory responsibilities.

Answer:

(c) Audit plan is not made from audit programme

Following are the features of audit plan:

- It lays out the strategies to be followed to conduct an audit.

- It includes the nature, timing and extent of audit procedures to be performed by the engagement team members.

- It is made to ensure that audit assignment is done smoothly. However the audit plan is not made from audit programme. In fact after the development of audit plan, a detailed audit programme is prepared.

66. The nature, time and extent of audit procedure are covered under:

(a) Audit Programme

(b) Audit Execution

(c) Audit Plan

(d) None of the above

Answer:

(c) Audit Plan

Audit Plan covers the nature, timing and extent of audit procedure for conducting audit by engagement of team members. Auditor shall develop audit plan by considering :

- The nature, timing and extent of planned risk assessment procedures.

- Nature and timing of audit procedures at the assertion level.

- Other planned audit procedure that are required to be carried out, so that engagement complies with SAS.

67. Which of the following technique is used to ascertain the correctness of debtors balance in books?

(a) Observation

(b) Enquiry

(c) Computation

(d) Confirmation.

Answer:

(d) Confirmation.

Confirmation is a technique to obtain audit evidences which involves seeking information from third party having knowledge about a particular transaction e.g. debtors.

68. For auditors, which of the following document generally contains the scope of work:

(a) Appointment letter

(b) Terms of engagement

(c) Offer letter

(d) None of the above.

Answer:

(b) Terms of engagement

Before planning for an audit, the auditor form the terms of engagement which contains the scope of audit work to be performed by the auditor.

69. Which of the following are techniques of gathering audit evidence?

X. Inspection

Y. Enquiry

Z. Observation Correct option is:

(a) X and Y

(b) Y and Z

(c) X and Z

(d) X, Y and Z

Answer:

(d) X, Y and Z

Following are the techniques of obtaining audit evidences –

- Inspection

- Observation

- Enquiry

- Confirmation

- Computation

- Analytical Review Procedures

- Independent Execution

Thus, all the given evidences in the question are the audit evidences and so the answer is X, Y and Z.

70. Who is the custodian authority for audit working papers?

(a) Shareholders

(b) Managing Director

(c) Company Secretary

(d) Auditor

Answer:

(d) Auditor

Audit working papers are the documents prepared or obtained by the auditors and retained by him in connection with the audit. They are property of auditor and the client cannot ask the auditor for their custody.

71. Audit working papers acts as a link between ________.

(a) Client records and audit reports

(b) Audit report and financial statements

(c) Auditor and his staff

(d) None of these

Answer:

(a) Client records and audit reports

Audit working papers are documents prepared or obtained by the auditor during the course of audit, Audit working papers act as a link between client records and audit report.

72. Which of the following is not recorded in current Audit working file?

(a) Financial statement in audit report

(b) Audit programme

(c) Confirmation responses

(d) Articles of Association

Answer:

(d) Articles of Association

Current Audit file contains information relating to the audit of the current period. Data in this file includes

- Financial Statements and Audit Report

- Working Trial Balance and Worksheets

- Adjusting journal entries and reclassification entries

- Audit Programs

- Documentation of the consideration of internal control and the consideration of fraud risk factors

- Record of test of controls and substantive tests

- Record of audit exceptions and their resolutions

- Letter of attorneys, representation letter

- Confirmation responses.

Thus, Articles of Association is not recorded in current audit working file but in permanent file.

73. Which of the following is dis-advantage of Audit programme?

(a) Reduces scope of misunderstanding

(b) Serve as evidence

(c) Against charge of negligence

(d) New area may be overlooked.

Answer:

(d) New area may be overlooked.

Following are the disadvantages of audit programme:

- Rigidity

- Reduces the initiative of efficient staff

- Audit work becomes mechanical

- New areas may be overlooked.

Thus, Option (d) is correct.

74. Terms of engagement between auditor and client are given in ________.

(a) Audit Engagement Letter

(b) Audit Plan

(c) Audit Programme

(d) None of these

Answer:

(a) Audit Engagement Letter.

While framing an audit plan auditor should ascertain his terms of appointment and responsibilities cast by various legislations on him. The auditor should then prepare his audit plan based on what he is required to do.

This shows that there is an official relationship between the auditor and the client which is written in the audit engagement letter.

75. Which of the following is an example of external:

(a) Carbon Copies of cheques

(b) Bank statements

(c) Employees time reports

(d) Purchase order of company purchases

Answer:

(a) Carbon Copies of cheques

Audit working papers are documents prepared or obtained by the auditor during the course of audit, Audit working papers act as a link between client records and audit report.

76. Which of the following factors would least likely affect the quantity and content of an auditors working papers.

(a) The nature of auditors report

(b) The assessed level of control risk

(c) The possibility of peer review

(d) The content of management representation letter

Answer:

(a) The nature of auditors report

Working papers are the connecting link between the client’s records and audited accounts. Working papers helps in proper planning, performance, supervision of audit. Audit working paper can be divided in permanent and current audit file.

It includes :

- Record of test of controls and substantive test

- Peer review [external confirmation]

- Letter of attorneys, representation letters.

Hence, working papers are least affected by the nature of auditor’s report.

77. An audit plan is an integral part of which of the:

(a) Closing

(b) Initiation

(c) Reporting

(d) Preparation

Answer:

(b) Initiation

Bank statements are the statement which are given by the bank of a customer of his/her banking transactions. So, it is an example of external. Inspite of above, other things i.e. carbon copies of cheques, employees time reports, purchase order of company purchases are the internal sources.

78. The format of Audit programme is:

(a) Prescribed in Companies Act

(b) Prescribed in Chartered Accountants Act

(c) Prescribed by appointing authority

(d) Not prescribed in any law

Answer:

(d) Not prescribed in any law

An audit programme is a set of instructions which are to be followed for proper execution of audit. It contains the measures that are generally employed to determine what, and how much evidence must be collected and evaluated. There is no standard audit programme applicable for all situations.

So, the format of audit programme is not prescribed in any law.

79. The evidence gathered during investigation exercise are:

(a) Corroborative

(b) Corroborative and conclusive

(c) Persuasive

(d) Corroborative and Persuasive

Answer:

(b) Corroborative and conclusive

Evidences obtained from investigation are corroborative and conclusive rather than corroborative and persuasive.

80. The methodology of audit planning is:

(a) Not prescribed in any law

(b) Prescribed in Companies Act, 2013

(c) Prescribed in Chartered Accountants Act, 1949

(d) Prescribed by the appointing authority.

Answer:

(a) Not prescribed in any law

Auditor develops an audit plan considering:

- Nature, timing and extent of planned risk assessment procedures

- Nature, timing and extent of audit procedures at assertion level. But there is no prescribed method by law.

81. Which of the following are techniques of gathering audit evidence?

(x) Inspection

(y) Enquiry

(z) Observation.

Correct option is:

(a) x and z only

(b) y and z only

(c) x and y only

(d) x, y and z

Answer:

(d) x, y and z

Inspection, observation enquiry confirmation, computation, analytical review procedures and independent execution are all techniques of obtaining evidences.

82. Audit program does not consist of:

(a) Technique

(b) Procedure

(c) Working paper

(d) Evidence

Answer:

(c) Working paper

Audit programme consist of technique, procedure set of instructions but it does not consist of working paper. Working paper are the documents prepared or obtained by auditor and retained by him in connection with audit. These are prepared in the course of execution of audit programme. Thus, audit program does not consist working papers.

83. ________ is a detailed plan of work prepared by auditor for carrying out an audit:

(a) Audit programme

(b) Audit plans

(c) Working papers

(d) Evidence

Answer:

(a) Audit programme

Audit programme is a set of instructions which are to be followed for proper execution of audit. It is a detailed plan of work prepared by an auditor for carrying out an audit.

84. Which of the following factor is most important in determining the appropriation of audit evidence?

(a) The reliability of audit evidence and in relevance in meeting the audit objective

(b) The objectivity and integrity of the auditor

(c) The quality of audit evidence

(d) The independence of the source of evidence.

Answer:

(a) The reliability of audit evidence and in relevance in meeting the audit objective

The auditor has to obtain sufficient and appropriate evidence to substantiate his opinion making reliable and in relevant in meeting the audit objective. It provides the grounds for believing that a particular thing is true or not by providing support for a fact or a point in question.

85. In which of the following phase of audit, knowledge of accounting system, policies and internal control procedure are accepted?

(a) Audit charter

(b) Audit follow-up

(c) Audit planning

(d) Audit reporting.

Answer:

(b) Audit follow-up

Audit follow up is the phase where accounting system, policies and internal control procedures are accepted. Thereby review and corrective measures if needed are taken to perform properly.

86. Audit working papers are useful for:

(I) Auditor

(II) Management

(III) Government.

(a) (III) only

(b) (I) only

(c) (II) only

(d) (I), (II) and (III)

Answer:

(b) (I) only

Audit working papers are useful for auditors as it is required to comment whether the company is having sound internal audit system or not, to review the working of business, locate the weak points etc.

87. Which of the following statement is true about audit planning?

(I) Audit planning depends on nature, timing and scope of audit

(II) Effectiveness of system and procedure does not affect the audit planning

(III) In audit planning the significant audit areas are identified.

The options are:

(a) (I) and (II) only

(b) (I) and (III) only

(c) (I), (II) and (111)

(d) (I) and (III)

Answer:

(b) (I) and (III) only

Audit plans lays out the strategies to be followed to conduct an audit and includes the nature, timing and extent of audit procedures to be performed by the team members. The objective of the auditor is to plan the audit so that it will be performed in an effective manner.

88. Which of the following expression identifies the significant audit areas?

(a) Audit programme

(b) Audit plan

(c) Audit engagement letter

(d) Audit charter

Answer:

(b) Audit plan

Audit plan lays down strategies to be followed to conduct an audit and it include nature timing and extent of audit procedure to be performed by team members. So, it is audit plan which identifies significant audit areas.

89. Which of the following is an example of external evidence?

(a) Employee’s time reports

(b) Bank statements

(c) Purchase order for company purchases,

(d) Carbon copies of cheques.

Answer:

(b) Bank statements

Bank Statement is an example of External Evidence because it is prepared by Bank which is external to company.

90. For what minimum period should audit working paper be retained by audit firm?

(a) For a period auditor opines them to be useful in servicing the client

(b) For the period the audit firm is in existence

(c) Seven year

(d) For a period of 10 year.

Answer:

(c) Seven year

Auditor should retain audit working paper for a minimum period of seven years.

91. Unpaid salary for 340 is to be provided for in the accounts. The entry will be entered in:

(a) Bills receivable Book

(b) Journal Proper (General Journal)

(c) Purchases Book

(d) Purchase Return Book

Answer:

(b) Journal Proper (General Journal)

Journal proper or General Journal is used for making the original record of such transaction for which no special book is allotted.

For Example:

Unpaid Salary/Expense, Prepaid Expense, Accrued Income, etc.

92. The format of audit programme is:

(a) Not prescribed in any law

(b) Prescribed in Chartered Accountants Act, 1949.

(c) Prescribed in Companies Act, 2013.

(d) Prescribed by appointing authority.

Answer:

(a) Not prescribed in any law

Audit programme is a set of instructions which are to be followed for proper execution of audit. There is no standard audit programme applicable for all situation and the format of audit programme is not prescribed in any law.

93. Who prepares audit programme?

(a) CS

(b) Auditor

(c) CA

(d) Government

Answer:

(b) Auditor

Auditor uses various types of tools such as audit plan, audit programme etc. for carrying out an audit. An audit plan lays down the strategies to be followed for carrying out an audit. It is the first step of audit. After preparing an audit plan, the auditor will make an audit programme which contains the instructions to be followed by the audit staff. This helps auditor in proper supervision of the audit,

94. Which of the following is not a limitation of internal audit?

(a) Time lag

(b) Responsibility

(c) Error

(d) Investigation

Answer:

(d) Investigation

Internal audit is of help to investigate in to the business matters, in case of doubt internal auditor can be asked to examine the facts and figures to confirm or clear any doubt. The internal auditor can investigate the matter in any manner. Such investigation can be made at the request of management or owners. Thus investigation is not a limitation but counted under the benefits of the internal audit.

95. Which of the following lays out the strategies to be followed to conduct an audit?

(a) Audit programme

(b) Audit plan

(c) Audit evidence

(d) Audit report

Answer:

(b) Audit plan

An audit plan lays out the strategies to be followed to conduct an audit. It includes the nature, timing and extent of audit procedures to be performed by the engagement team members. The auditor shall develop an audit plan while considering the following:

- The nature, timing and extent of planned risk assessment procedures.

- The nature, timing and extent of audit procedures at the assertion level.

- Other planned audit procedures that are required to be carried out so that the engagement complies with Standard on Auditing (SA).

96. Essential of good audit report does not includes ________.

(a) Sufficient

(b) Reliable

(c) Relevant

(d) Inspection

Answer:

(d) Inspection

The auditor’s report is a formal opinion, issued by either an internal auditor or an independent external auditor as a result of an internal or external audit or evaluation performed on an organisation. The auditor should review and assess whether the financial statements have been prepared in accordance with an acceptable financial reporting framework applicable to the entity under audit. Therefore, the auditor’s report should contain a clear written expression of opinion on the financial statements taken as a whole. Hence, option

97. It is always voluntary?

(a) Auditing

(b) Investigation

(c) Both (a) & (b)

(d) None of above.

Answer:

(b) Investigation

The investigation is related to critical checking of particular records. Investigation is done when a lapse already exists to pin point the reason and person involved in it so that responsibility for such lapse could be fixed. It is thus, voluntary in nature.

98. Which of the following are techniques of gathering audit evidence?

(x) Inspection

(y) Enquiry

(z) observation correct option is:

(a) y and z only

(b) x and y only

(c) x and z only

(d) x, y and z

Answer:

(d) x, y and z

Technique of Audit Evidence:

- Inspection

- Enquiry

- Observation

99. The objective of the audit plan is: (I) To conduct the audit in accordance with Generally Accepted Auditing Standard (II) Reduce the risk of material misstatements to an acceptably low level (III) Prepare an unqualified report the options are:

(a) I and III

(b) I and II

(c) II and III

(d) I, II and III

Answer:

(b) I and II

The objectives of Audit Plan are:

- To conduct audit according to GAAP

- Reduce the Risk of Material Misstatement

100. Consider the following statements:

Statement A: It is the responsibility of the auditor to obtain sufficient appropriate audit evidence to be able to draw reasonable conclusions on which to base an audit opinion.

Statement B: Different types of audit have different objectives. Which of the following combinations is correct?

(a) Statement A and Statement B both are false

(b) Statement A is true but Statement B is false

(c) Statement A and Statement B both are true

(d) Statement A is false but Statement B is true

Answer:

(c) Statement A and Statement B both are true

Both the Statement are true.

101. Who is the custodian authority for audit working papers?

(a) Shareholders

(b) Auditors

(c) Company Secretary

(d) Managing Directors

Answer:

(b) Auditors

Audit Working Papers are property of Auditors.

102. Which of the following process is carried out offer the preparation and finalization of audit programme?

(a) Audit Charter

(b) Audit Planning

(c) Audit Execution

(d) Audit Engagement Letter

Answer:

(c) Audit Execution

Audit execution is done after the Audit programme has been finalised.

103. Audit working papers are the property of ________.

(a) Owner

(b) Government

(c) Auditor

(c) Income Tax Department

Answer:

(c) Auditor

Audit working papers prepared or obtained by auditors and retained by them in connection with the audit.

Audit working papers are connecting link between client’s records and audited accounts. These provide permanent historic record. These are property of auditor work as evidence in future.

104. Which of the following is not an advantage of the preparation of audit working paper?

(a) To provide a basis for review of audit work

(b) To provide a basis for subsequent audits

(c) To ensure audit work is being carried out as per program

(d) To provide a guide for advising another client on similar issues.

Answer:

(d) To provide a guide for advising another client on similar issues.

Preparation of Audit working paper is done for taking some advantages by both client and auditor. There are so many advantages which are:

- Audit working paper is to be prepared to provide a basis for review of audit work.

- To ensure audit work is being carried out as per program

- To provide basis for subsequent audit

- To provide as evidence in case of dispute between client and auditor.

Audit working paper is not prepare to provide a guide for advising another client on similar issues.

105. Which of the following is not true about Audit Plan?

(a) Audit plan lays out the strategies to be followed to conduct an audit

(b) Audit plan is made to ensure that audit assignment is done smoothly

(c) Audit plan is made from audit programme

(d) Audit plan is prepared considering the term of engagement and statutory responsibilities

Answer:

(c) Audit plan is made from audit programme

Audit Plan is not made from audit programme.

106. Which of the following statement is correct

(a) Audit programme dosn’t help in distributing the work.

(b) In audit programme new area may not be over looked.

(c) Audit programme is set of instructions which execution.

(d) All of the above.

Answer:

(d) All of the above.

Audit Programme: It is a set of instruction which are to be followed for proper execution of audit. It’s concern with distribution of work of audit team, (not of organisational activities). With the passage of time new problem arising during audit may not be over looked in Audit programme. Hence, option (d) is correct.

107. Audit working papers are:

(a) Documents prepared by auditors

(b) Documents prepared by management

(c) Normal working papers

(d) All of the above

Answer:

(a) Documents prepared by auditors

Audit working papers are the official record that contains the planning and execution of the audit programme prepared by an auditor. Hence, option (a) is correct.

108. An auditor cannot ask for:

(a) Vouchers

(b) Accounting documents

(c) MOA

(d) None of the above.

Answer:

(c) MOA

An auditor cannot ask for MOA because his only responsibility is audit the financial statements of a company not to legal or privacy matters (which are disclosed in MOA). Hence, option (c) is correct.

109. Audit plan is not include:

(a) Accounting Policies & Practices

(b) Statutory Planning

(c) Audit Programme

(d) None of the above.

Answer:

(d) None of the above.

Audit plan include the following:

- Accounting Policies and Procedures

- Statutory Planning and Responsibilities

- Nature, Time, extent of Audit procedures etc., hence, option (d) is correct.

110. Which of the following are techniques of gathering audit evidence?

X. Inspection

Y. Enquiry

Z. Observation Correct option is:

(a) X and Y

(b) Y and Z

(c) X and Z

(d) X, Y and Z

Answer:

(d) X, Y and Z

Techniques of Obtaining Audit Evidence are Inspection, observation, Enquiry, Confirmation, Computation, Analytical Review Procedures, Independent Execution.

111. Who is the custodian authority for audit working papers?

(a) Shareholders

(b) Managing Director

(c) Company Secretary

(d) Auditor

Answer:

(d) Auditor

Audit working papers are the documents prepared or obtained by the auditor and retained by him in connection with the audit. The working papers are the property of the auditor and the client cannot ask the auditor for their custody.

112. The nature, time and extant of audit procedure are covered under:

(a) Audit Programme

(b) Audit Execution

(c) Audit Plan

(d) None of the above

Answer:

(c) Audit Plan

An audit plan lays out the strategies to be followed to conduct an audit. It includes the nature, timing and extent of audit procedures to be preformed by team members. Audit plan is developed by the auditor.

113. Which of the following technique is used to ascertain the correctness of debtors balance in books ________.

(a) Observation

(b) Enquiry

(c) Computation

(d) Confirmation

Answer:

(d) Confirmation

Technique used to ascertain the correctness of debtors balance is known as confirmation.

114. The checking of arithmetical accuracy of source documents ________.

(a) Confirmation

(b) Computation

(c) Investigation

(d) Enquiry

Answer:

(b) Computation

lt involves checking of the arithmetical accuracy of a source document and accounting rewards.

Hence, option ‘b’ is correct.

115. Audit working papers are used to support and provide assurance that audit was performed in relevance with ________.

(a) Accounting Standard

(b) Standards on Auditing

(c) Auditing Standards

(d) Both (a) and (c)

Answer:

(c) Auditing Standards

Audit working papers are used to support the audit work done in orders to provide assurance that the audit was performed in accordance with the relevant auditing standards.

Hence, option ‘c’ is correct.

116. Sufficient evidence can be obtained by instead of ________.

(a) 100% test checking, checking

(b) checking, test checking

(c) test checking, 100% checking

(d) audit, investigation

Answer:

(c) test checking, 100% checking

The audit evidence are said to be sufficient when they are in adequate quantity. Sufficient evidence can be obtained by test checking instead of 100% checking.

Hence, option ‘c’ is correct.

117. Evidence generated through ________ is usually better evidence obtained indirectly.

(i) Auditor’s direct observation

(ii) Inspection

(iii) Computation

(iv) Investigation

(a) I & II

(b) II & III

(c) I, II, III, IV

(d) I, II, III

Answer:

(d) I, II, III

The rules of thumb have proven helpful in judging the appropriateness of evidence that the evidence generated through the auditor’s direct observation, inspection and computation is usually better than evidence obtained indirectly.