TDS on Transportation Charges: Confusion regarding the application of Section 194C has been observed amongst people. Section 194C focuses on TDS on the contract during payment to the transporter. This might result from various amendments through the years related to the specific points 194C(6) and 194C(7). The summarization of the details of Section 194C is discussed below.

Points Regarding TDS Under Section 194C

- This revised sub-section is applicable with effect from April 1st, 2015.

- The transporter for the sub-sections mentioned is the person handling plying, hiring, or leasing assets carriages.

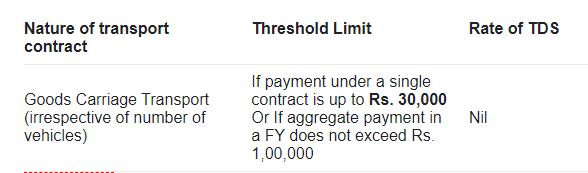

- The advantage of non-deduction of tax is available only for small transportation operators owning less than ten goods carriages.

Therefore, if the transporter having not more than ten goods carriages through the year, provides his PAN and the declaration, then, being a payer, they don’t have to deduct his TDS.

But suppose the transporter was owning more than ten goods carriages at any time during the year. Then, as payers, they must deduct TDS during payment of charges to goods transporter at the price of 1% or 2% depending on the case and status of the transport contractor.

Note: The TDS rate of 1% and 2% will decrease to 0.75% and 1.50%, respectively, through the period from the month of May 14th, 2020, to the month of March 31st, 2021.

- The person accountable for paying or charging any amount to such transporters shall furnish a declaration along with their PAN to the income tax authority.

Under Section 194C, the specified persons must deduct income tax:

- Central/State Government employee

- Co-operative society/Statutory corporation

- Housing/Town development authority

- Registered society

- Trust/Local authority

- University

- Foreign Government/Enterprise/Association

- Individual/Association of persons gross receipts Rs. 1 crore during the preceding financial year.

Is TDS applicable on transportation charges?

What is TDS on Transportation (Freight)? According to Section 194C, any payment made to a transporter is subject to TDS deduction on freight charges. The payer must reduce the income tax amount before transferring the fee.

What is the TDS on transportation?

Section 194C of Income Tax Act is amended to include TDS deduction of 1 % for individuals and Hindu Undivided Families owning more than 10 goods carriage, and at the rate of 2% in case of other payees.

What is the TDS limit for transporter?

TDS on transporter

Is transporter in TDS return?

As per Income tax act 194C, TDS is not required to be deducted on payments made to transporter If PAN number has been provided to the deductor. To incorporate nil rate transporter entries in E-TDS return by inserting a tag “T” in remarks in 26Q.

Is TDS applicable on vehicle insurance?

Most times people choose their insurance via agents, brokers, etc. In such cases, the insurance commission or any other remuneration/reward received by such agents, brokers etc., are subjected to Tax Deducted at Source (TDS) as dictated under Section 194D of the Income Tax Act.