Students should practice TDS, Advance Tax, Interest Payable By/To Assessee – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

TDS, Advance Tax, Interest Payable By/To Assessee – CS Executive Tax Laws MCQ Questions

Question 1.

Interest payable by a non-corporate assessee for deferment of advance tax is

(A) 1.03% p.m.

(B) 15% p.a.

(C) 18% p.a.

(D) 1% p.m. [Dec. 2014]

Answer:

(D) 1% p.m.

Question 2.

The maximum amount of rent payment where deduction of tax at source is not required in a financial year is

(A) ₹ 1,20,000

(B) ₹ 1,80,000

(C) ₹ 2,40,000

(D) None of the above [Dec. 2014]

Answer:

(C) ₹ 2,40,000

Question 3.

At what rate, will the tax be deducted at source by a banking company, responsible for paying to a resident any income by way of interest other than interest on securities amounting to more than ₹ 10,000, when the payee does not furnish his PAN to the deductor

(A) 10%

(B) 20%

(C) 30%

(D) 40% [Dec. 2014]

Answer:

(A) 10%

Question 4.

In a contest, Amit wins ₹ 50,000 cash and a motorcycle worth ₹ 50,000.

The amount of tax deducted at the source will be

(A) ₹ 30,000

(B) ₹ 15,000

(C) ₹ 27,000

(D) ₹ 27,810 [Dec. 2014]

Answer:

(A) ₹ 30,000

Question 5.

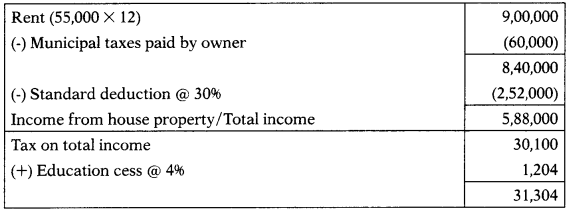

Calculate advance tax payable by Sumit on or before 15th September 2020 from the following:

Rent from house property ₹ 75,000 per month;

Municipal taxes paid by him ₹ 60,000.

(A) ₹ 48,311

(B) ₹ 7,245

(C) ₹ 14,087

(D) ₹ 36,227 [Dec. 2014]

Hint:

Advance tax payable by Sumit on 30th Sep. = 31,304 × 45% = 14,087

Answer:

(C) ₹ 14,087

Question 6.

An assessee liable to pay advance tax is not liable to pay interest u/s 234B if the advance tax paid by him is not less than

(A) 90% of advance tax payable by him

(B) 80% of advance tax payable by him

(C) 100% of advance tax payable by him

(D) 70% of advance tax payable by him [Dec. 2014]

Answer:

(A) 90% of advance tax payable by him

Question 7.

Which of the following assessee is not liable to pay advance tax u/s 207?

(A) A senior citizen having income chargeable under the head ‘profits and gains of business or profession’

(B) A senior citizen not having in-come chargeable under the head ‘profits and gains of business or profession’

(C) A super senior citizen having in-come chargeable under the head ‘profits and gains of business or profession’

(D) A resident individual not being senior citizen having income chargeable under the head ‘profits and gains of business or profession’. [June 2015]

Answer:

(B) A senior citizen not having in-come chargeable under the head ‘profits and gains of business or profession’

Question 8.

Zen Ltd. made a payment of ₹ 11,00,000 to Amar, a resident transport contractor who has intimated his PAN details.

The tax to be deducted at source u/s 194C will be

(A) ₹ 10,000

(B) ₹ 200

(C) Nil

(D) ₹ 11,000 [June 2015]

Answer:

(C) Nil

Question 9.

Interest payable u/s 234C is computed at

(A) Compound interest @ 1% p.m.

(B) Simple interest @1% p.a.

(C) Compound interest @ 1 % p.a.

(D) Simple interest @1% p.m. [June 2015]

Answer:

(D) Simple interest @1% p.m.

Question 10.

Interest for default in payment of installments of advance tax is levied u/s

(A) 234A

(B) 234B

(C) 234C

(D) 234D [June 2015]

Answer:

(C) 234C

Question 11.

U/s 208, it is obligatory for an assessee to pay advance tax where the tax payable is

(A) 10,000 or more

(B) 20,000 or more

(C) 5,000 or more

(D) 8,000 or more [June 2015]

Answer:

(A) 10,000 or more

Question 12.

A HUF, not subject to tax audit in the earlier year, paying fees of ₹ 35,000 to a Practising Company Secretary shall

(A) Not deduct TDS

(B) Deduct TDS @ 10%

(C) Deduct TDS @ 20%

(D) Deduct TDS @ 10.3% [June 2015]

Answer:

(A) Not deduct TDS

Question 13.

Laxmi & Co. paid ₹ 6,10,000 as contract payments to Monu Ltd. during the financial year 2020-21. It did not deduct tax at source u/s 194C.

The amount liable for disallowance is

(A) ₹ 6,10,000

(B) ₹ 3,05,000

(C) ₹ 12,200

(D) ₹ 1,83,000 [Dec. 2015]

Hint:

6,10,000 × 3096 = 1,83,000

Answer:

(D) ₹ 1,83,000

Question 14.

Steam (P) Ltd. reports a total income of ₹ 20 lakhs for the year ended 31st March 2021. Turnover of the company never exceeded ₹ 400 crores in past.

The total tax liability payable before 15th September, 2020 by way of advance tax is

(A) ₹ 92,700

(B) ₹ 1,85,400

(C) ₹ 2,34,000

(D) ₹ 3,09,600 [Dec. 2015]

Hint:

| Total income | 20,00,000 |

| Tax on total income @ 25% | 5,00,000 |

| (+) Education cess @ 4% | 20,000 |

| 5,20,000 |

Advance tax payable by Steam (P) Ltd. on 30th Sep.:

5,20,000 × 4596 = 2,34,000

Answer:

(C) ₹ 2,34,000

Question 15.

Interest for deferment in payment of advance tax u/s 234C is calculated on the tax liability computed on

(A) Assessed income

(B) Returned income

(C) Disputed income

(D) Appealed income [Dec. 2015]

Answer:

(A) Assessed income

Question 16.

The person responsible for paying any income by way of winnings from lottery an amount exceeding ₹ 10,000, shall deduct

(A) TDS @ 30.9%

(B) No TDS

(C) TDS @31.2%

(D) TDS @30% [Dec. 2015]

Answer:

(D) TDS @30%

Question 17.

An assessee is required to make payment of interest where he failed to make the payment of demand before the expiry of 30 days from the service of notice of demand @

(A) 1% for every month or part thereof till the date of payment

(B) 2% p.m. till the date of payment

(C) 1.5% p.m. till the date of payment

(D) 1.25% for every month or part thereof till the date of payment [Dec. 2015]

Answer:

(B) 2% p.m. till the date of payment

Question 18.

Raghu, aged 62 years, has a pension income of ₹ 2,40,000 and rental income (computed) of ₹ 3,60,000 for the financial year 2020-21.

How much amount be must have paid as advance tax in September 2020?

(A) ₹ 12,000

(B) ₹ 10,000

(C) ₹ 30,000

(D) Nil [June 2016]

Hint:

No advance tax is payable by the assessee if his age exceeds 60 years and he has no income under the head “PGBP”.

Answer:

(D) Nil

Question 19.

Interest is payable to the assessee on refund under the Income Tax Act, 1961 at the rate of

(A) 5% per annum

(B) 6% per annum

(C) 9% per annum

(D) 12% per annum [June 2016]

Answer:

(B) 6% per annum

Question 20.

Pradip acquired urban land from Chitra for ₹ 70 lakh on 10th October 2019.

At what rate, tax is deductible at source in respect of such transaction?

(A) 2%

(B) 5%

(C) 1%

(D) 3% [June 2016]

Answer:

(C) 1%

Question 21.

Deduction of tax from salary as per Section 192 shall be at

(A) 10% of salary

(B) The average rate of income tax computed, on the basis of rates in force for the financial year in which the payment is made

(C) The maximum marginal rate of 30%

(D) None of the above [June 2016]

Answer:

(B) The average rate of income tax computed, on the basis of rates in force for the financial year in which the payment is made

Question 22.

Rohan won a State Government lottery of ₹ 1,00,000 on 11th October 2020.

The government should deduct tax on such winning amounting to

(A) ₹ 30,000

(B) ₹ 33,000

(C) ₹ 33,990

(D) ₹ 30,900 [June 2016]

Answer:

(A) ₹ 30,000

Question 23.

If a payee eligible for commission exceeding ₹ 50,000 does not furnish his PAN to the payer, tax is deductible at source at

(A) Nil rate

(B) 20%

(C) 10%

(D) 30% [Dec. 2016]

Answer:

(B) 20%

Question 24.

When an assessee has paid advance tax more than the tax due on the returned income and the return is filed before the “due date” specified in Section 139(1), the refund amount is eligible for interest –

(A) @12% p.a.

(B) @ 6% p.a.

(C) @ 9% p.a.

(D) @ 8% p.a. [Dec. 2016]

Answer:

(B) @ 6% p.a.

Question 25.

The liability to deduct tax at source on insurance commission will arise when the commission paid or payable to an agent for the year exceeds

(A) ₹ 5,000

(B) ₹ 10,000

(C) ₹ 15,000

(D) ₹ 20,000 [Dec. 2016]

Answer:

(C) ₹ 15,000

Question 26.

If a person responsible for deduction of tax at source, after deduction, fails to deposit the same into the Government treasury, he will be liable to pay interest @…….

(A) 1% p.m. or part of the month

(B) 1.5% p.m. or part of the month

(C) 2% p.m. or part of the month

(D) 15% p.m. or part of the month [Dec. 2016]

Answer:

(B) 1.5% p.m. or part of the month

Question 27.

The liability to pay interest u/s 234B would arise when the advance tax plus TDS/TCS to the credit of the assessee is less than

(A) 75% of the assessed tax

(B) 90% of the assessed tax

(C) 60% of the assessed tax

(D) 100% of the assessed tax [Dec. 2016]

Answer:

(B) 90% of the assessed tax

Question 28.

A senior citizen is not liable to pay advance tax if he does not have income from

(A) Interest on securities

(B) Capital gains

(C) Profits and gains from business or profession

(D) All of the above [Dec. 2016]

Answer:

(C) Profits and gains from business or profession

Question 29.

When an employee makes a premature withdrawal from employees provident fund account, the requirement of the deduction is attracted when the quantum of withdrawal exceeds

(A) ₹ 10,000

(B) ₹ 30,000

(C) ₹ 50,000

(D) None of the above [Dec. 2016]

Answer:

(C) ₹ 50,000

Question 30.

Mr. Nitin after serving Lion Ltd. for 4 years resigned from his job to commence a business of his own. His provident fund account consisted of his own contribution of ₹ 50,000; the employer’s contribution of ₹ 50,000 and interest of ₹ 20,000 being attributable equally to the said contributions.

How much would be the amount deductible at source under section 192 A?

(A) ₹ 12,000 being 10% of total withdrawal

(B) ₹ 10,000 being 10% of total contributions

(C) ₹ 6,000 being 10% of employer’s contribution and interest thereon

(D) ₹ 2,000 is 10% of interest on the contributions [June 2017]

Answer:

(A) ₹ 12,000 being 10% of total withdrawal

Question 31.

A Co. Ltd. made payments to B Co. Ltd. towards contracts executed during the financial year 2020-21. They are

(i) Contract-1 ₹ 15,000 on 15.6.2020 (ii) Contract-2 ₹ 22,000 on 29.9.2020 (iii) Contract-3 ₹ 27,000 on 30.12.2020 (iv) Contract-4 ₹ 29,000 on 13.3.2021 The tax deductible at source would be:

(A) ₹ 1,560 @ 2% on ₹ 78,000

(B) ₹ 1,860 @ 2% on ₹ 93,000

(C) ₹ 780 @ 1% on ₹ 78,000

(D) Nil [Dec. 2017]

Answer:

(D) Nil

Question 32.

P & Co. a partnership firm whose turnover was ₹ 42,60,000in the previous year 2019-20 and ₹ 1,01,30,000 in the previous year 2020-21 paid brokerage of ₹ 21,000 to Mr. Ashwin during the financial year 2020-21. Mr. Ashwin furnished his PAN to the firm.

The amount of tax deductible at source on such brokerage payment would be:

(A) ₹ 2,100 @ 10%

(B) ₹ 1,050 @ 5%

(C) Nil

(D) ₹? 4,200 @20% [Dec. 2017]

Answer:

(B) ₹ 1,050 @ 5%

Question 33.

Mr. Rajan (a trader in furniture items) acquired a motor car for ₹ 11 lakhs by availing loan from a nationalized bank. The amount was paid by demand draft.

The amount of tax collectible at source by the car dealer who sold the car is:

(A) Nil

(B) ₹ 22,000 @2%

(C) ₹ 11,000 @ 1%

(D) ₹ 1,10,000 @ 10% [Dec. 2017]

Answer:

(C) ₹ 11,000 @ 1%

Question 34.

LM, a co-operative society, has paid an interest of ₹ 1,05,000 to PQ, another co-operative society.

The tax to be deducted at source u/s 194A is:

(A) ₹ 10,500

(B) ₹ 10,815

(C) ₹ 5,250

(D) Nil [June 2018]

Hint:

If interest is paid by one co-operative society to another co-operative society, no TDS is required to be deducted.

Answer:

(D) Nil

Question 35.

Mr. Rajesh had a turnover of ₹ 3 Crore during the year ended 31st March 2020. During the FY 2020-21, he paid a sum of ₹ 10 lakh to E, an Engineer for the construction of his self-occupied residence, and ₹ 25 lakh to E, for the construction of the office building.

The amount of tax to be deducted at source from payments made to E is:

(A) ₹ 3 lakh

(B) ₹ 150,000

(C) ₹ 2.5 lakh

(D) None of the above [June 2018]

Hint:

The rate of TDS is 196 where the payment is made to an individual or HUF for any contract [Section 194C],

Thus, TDS required to be deducted for payment to E = 25,00,000 × 1% = 25,000. Hence, Option (D) is correct.

Answer:

(D) None of the above

Question 36.

Where the advance tax paid on or before March 2021 is less than 100% of the tax due on the total income declared in the return of income, as reduced by tax deducted at source, the assessee shall be making payment of interest on the amount of shortfall on the returned income so declared at the rate of per month for the period of delay.

(A) 2%

(B) 1%

(C) Nil

(D) 1.5%

Answer:

(B) 1%

Question 37.

Payment of ₹ 2,00,000 was made to Krishna Roadways Pvt. Ltd. owning nine heavy goods carriages and having PAN which was furnished by them to the payer of freight GG Carriers.

The amount of tax to be deducted by the payer on such amount is as per section

(A) ₹ 2,000, 194C

(B) ₹ 10,000, 194C

(C) ₹ 4,000, 194C

(D) Nil because PAN furnished, 194C(6) [Dec. 2018]

Answer:

(D) Nil because PAN furnished, 194C(6)

Question 38.

Tax is required to be collected at source (TCS) under the provision of section 206C of Income-tax Act, 1961 by a person making

(A) Payment of dividend

(B) Winning from horse races

(C) Sale of a motor vehicle of the value exceeding ₹ 10 lakh by a dealer to the customer

(D) Payment to non-resident [Dec. 2018]

Answer:

(C) Sale of a motor vehicle of the value exceeding ₹ 10 lakh by a dealer to the customer

Question 39.

It is obligatory for an assessee to make payment of tax under section 208 of the Income Tax Act, 1961

(A) Where the advance tax payable is ₹ 10,000 or more

(B) Where the advance tax payable is ₹ 2,500 or more

(C) Where the advance tax payable is ₹ 5,000 or more

(D) Where the advance tax payable is ₹ 1,000 or more [Dec. 2018]

Answer:

(A) Where the advance tax payable is ₹ 10,000 or more

Question 40.

Interest is payable to an assessee on the amount of refund under the Income Tax Act, 1961 where the amount of refund is

(A) More than ten percent of the tax as determined on regular assessment

(B) More than five percent of the tax as determined on regular assessment

(C) More than fifteen percent of the tax as determined on regular assessment

(D) More than twenty percent of the tax as determined on regular assessment [Dec. 2018]

Answer:

(A) More than ten percent of the tax as determined on regular assessment

Question 41.

Ashish, director of QPR Ltd. is eligible for board sitting fees of ₹ 10,000 for every meeting attended by him. During the year 2020-21, he had attended six meetings.

The amount of tax required to be deducted from such sitting fees to be paid to Ashish by the company shall be:

(A) ₹ 12,000 @ 20%

(B) ₹ 1,200 @ 2%

(C) ₹ 3,000 @5%

(D) ₹ 6,000 @ 10% [June 2019]

Answer:

(D) ₹ 6,000 @ 10%

Question 42.

Prakash maintained a recurring deposit by paying ₹ 20,000 per month in a bank. The interest accrued and credited during 2020-21 on such deposit is ₹ 15,000.

The amount of TDS required to be deducted by the bank would be

(A) NIL

(B) ₹ 1,500 @ 10%

(C) ₹ 3,000 @ 20%

(D) ₹ 500 @ 10% over ₹ 10,000 [June 2019]

Answer:

(B) ₹ 1,500 @ 10%

Question 43.

Sagar engaged in a business, booked a marriage hall of Yash having PAN for conducting mega sale during festival season of FY 2020-21, and paid rent of ₹ 55,000 for 3 days period. His total turnover for financial year 202021 is ₹ 85 lakhs.

The amount of Tax Deduction at Source (TDS) to be made by Sagar on the amount of rent paid will be:

(A) NIL

(B) ₹ 5,500

(C) ₹ 2,750

(D) ₹ 11,000 [June 2019]

Hint:

Payment of rent by certain individuals or HUF [Section 194-IB]

Who is responsible to deduct tax at source: Any person, being an individual or HUF (other than those referred to in the second proviso to Section 194-1), responsible for paying to a resident any income by way of rent exceeding ₹ 50,000 for a month or part of a month during the previous year.

Rate of tax deduction:

When to deduct: Income Tax shall be deducted on such income at the time of credit of rent, for the last month of the previous year or the last month of tenancy, if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier.

In a case where the tax is required to be deducted as per the provisions of Section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Answer:

(C) ₹ 2,750

Question 44.

Rakesh entered into a Joint Development Agreement with Reality Builders Pvt. Ltd. for developing a project on the land owned by him during the previous year 2018-19 and the builder who agreed to make the payment of ₹ 50 lakh to Rakesh paid the same to him on the execution of the Joint Development Agreement. The amount of TDS u/s 194-IC required to be deducted on the amount of ₹ 50 lakh shall be

(A) ₹ 50,000

(B) ₹ 2,50,000

(C) ₹ 5,00,000

(D) ₹ 10,00,000 [Dec. 2019]

Answer:

(C) ₹ 5,00,000

Question 45.

Wealth Maximization Fund Limited had paid an amount of interest of ₹ 20 lakh in respect of money borrowed outside India on rupee-denominated bonds to a Foreign Institutional Investor. Wealth Maximization Fund Limited is required to deduct tax at source out of such payment of interest on these bonds at the rate of

(A) 10%

(B) 15%

(C) No TDS

(D) 5%

Answer:

(D) 5%

Question 46.

A house property owned by Nitin, a non-resident, at Delhi was agreed to be sold to Ramesh for consideration of ₹ 70,00,000. Ramesh has stated to Nitin that the payment of sale consideration shall be subject to TDS and the amount of TDS on the sale consideration will be @……as per section of the Income-tax Act, 1961.

(A) 34.32%, 195

(B) 10%, 194-IC

(C) 5.72%, 194LBA

(D) 15, 194-IA [Dec. 2019]

Answer:

(A) 34.32%, 195

Question 47.

The quarterly return of TDS relating to payments made to non-resident and the foreign company being a unitholder of mutual funds is to be filed in return form number :

(A) 24Q

(B) 27Q

(C) 26Q

(D) 22Q [Dec. 2019]

Answer:

(B) 27Q

Question 48.

Where the advance tax paid on or before March 2021 is less than 90% of the tax due on the total income declared in the return as reduced by the amount of tax deducted at source, the assessee shall be making payment of interest on the amount of shortfall for the tax due on the returned income so declared per month at the rate of

(A) 2%

(B) 1%

(C) Nil

(D) 1.5% [Dec. 2019]

Answer:

(B) 1%