Tax On Conversion of Unaccounted Money – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Tax On Conversion of Unaccounted Money – CA Final DT Question Bank

Question 1.

Kala purchased a residential flat from her friend Bala at ₹ 10 lakhs in the city of Jaipur on 3rd October, 2020. The value determined by the Stamp Duty Authority for stamp duty purpose amounted to ₹ 15 lakhs. Bala had purchased the flat on 1st August, 2019 at a cost of ₹ 3.50 lakhs. Kala sold the flat for ₹ 20 lakhs on 30th March, 2021.

Determine the effect of the above transactions on the assessments of Bala and Kala for assessment year 2021-22, assuming that value for stamp duty purpose in case of the second sale was not more than the sale consideration. [CA Final May 2010] [5 marks]

Answer:

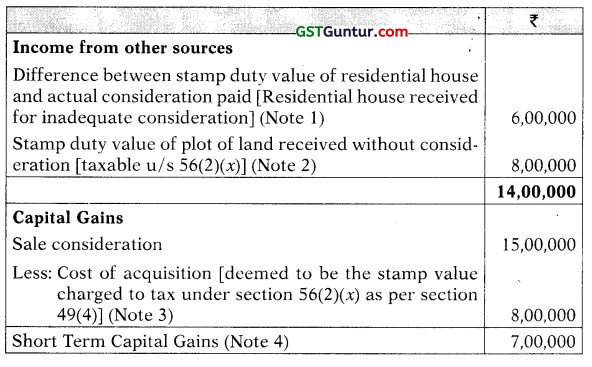

Tax treatment in the hands of the seller, Mr. Bala:

As per Sec. 50C, where the stamp duty value exceeds 110% of the actual sale consideration, the stamp duty value shall be deemed to be the full value of consideration received or accruing as a result of transfer of a capital asset, being land or building or both for computing capital gain.

![]()

In the instant case, Bala sold the residential flat at Jaipur to his friend Kala for ₹ 10 lakhs, whereas the stamp duty value was ₹ 15 lakhs which exceeds 11096 of actual sale consideration. Therefore, stamp duty value shall be deemed to be the full value of consideration for sale of the property. Therefore, short-term capital gains arising to Bala for A.Y. 2021-22 will be ₹ 11.50 lakhs (i.e. ₹ 15 lakhs – ₹ 3.50 lakhs).

Tax treatment in the hands of the buyer, Ms. Kala:

As per Sec. 56(2)(v), if an immovable property is received by an individual for inadequate consideration, and the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 1096 of the consideration, the difference of stamp duty value and the consideration shall be taxable as “Income from other sources”.

Income from other sources

In this case, since the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the consideration, the difference of ₹ 5 lakhs (i.e. ₹ 15 lakhs – ₹ 10 lakhs) shall be taxable in the hands of Ms. Kala as “Income from other sources”.

Capital Gains

Kala sold the flat for ₹ 20 lakhs on 30th March, 2021. Section 49(4) provides that where the capital gain arises from the transfer of such property which has been subject to tax u/s 56(2)(x), the cost of acquisition of the property shall be deemed to be the value taken into account for the purpose of section 56(2)(x).

Therefore, the cost of acquisition of the flat, in this case, would be ₹ 15 lakhs. The short-term capital gain of Kala from sale of the property is, therefore, ₹ 5 lakhs (i.e. ₹ 20 lakhs – ₹ 15 lakhs).

![]()

Question 2.

Compute the income of Mr. Y chargeable under the heads “Capital Gains” and “Income from other sources” for Assessment Year 2021-22. Mr. X transferred his’residential house to Y for ₹ 10 lakh on 1st April, 2020. The value of the said house as per Stamp Valuation Authority was ₹ 16 lakh. Mr. Y is a childhood friend of Mr. X.

Mr. X gifted a plot of land (purchased by him on 1st August, 2017) to Mr. Y on 1st July, 2020. The value as per Stamp Valuation Authority is ₹ 8 lakh. Mr. Y sold the land on 1st March, 2021 at ₹ 15 lakh.

Cost Inflation Index – 2017-18 : 272; 2020-21 : 301. [CA Final Nov. 2011] [5 Marks]

Answer:

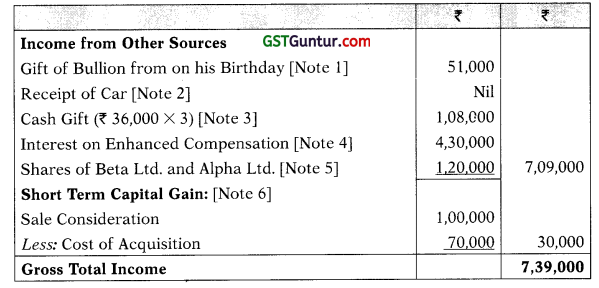

Computation of income for the A. Y. 2021-22

Notes:

(1) Transfer of immovable property for inadequate consideration attracts the provisions of section 56(2)(x), if the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the actual consideration. Since, in this case, the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the actual consideration, the difference of ₹ 6 lakhs between stamp duty value and actual consideration will be taxable u/s 56(2)(v).

(2) Section 56(2)(x) is also attracted in respect of transfer of immovable property without consideration, if the stamp duty value of such property exceeds ₹ 50,000. In this case, since Mr. Y has received a plot of land from Mr. X, a non-relative, without consideration and the stamp duty value of ₹ 8 lakhs exceeds ₹ 50,000, the entire stamp duty value of ₹ 8 lakh is chargeable to tax u/s 56(2)(v).

(3) Section 49(4) provides that where the capital gain arises from the transfer of such property which has been subject to tax u/s 56(2) (x), the cost of acquisition shall be deemed to be the value taken into account for the purpose of section 56(2)(.x). Therefore, ₹ 8 lakhs would be the cost of acquisition of land.

(4) The resultant capital gains will be short-term capital gains since for calculating the period of holding, in a case where cost is computed under section 49(4), the period of holding of the previous owner is not to be included. As per section 2(42A), the period of holding will include the period of holding of the previous owner only in the case 1 of a capital asset which becomes the property of the assessee in the circumstances mentioned in section 49(1) [i.e., where cost to previous owner would be deemed as the cost of acquisition].

![]()

Question 3.

Mr. X borrowed on Hundi, a sum of ₹ 30,000 by way of bearer cheque on 12.06.2020 and repaid the same with interest amounting to ₹ 35,000 by account payee cheque on 13.07.2020.

The Assessing Officer (AO) wants to treat the amount borrowed as income during the previous year. Is the action of AO valid? [CA Final May 2012] [3 Marks]

Answer:

As per section 69D, where any amount is borrowed on a hundi or any amount due thereon is repaid otherwise than by way of an account payee cheque drawn on a bank, the amount so borrowed or repaid shall be deemed to be the income of the person borrowing or repaying the amount for the previous year in which the amount was so borrowed or repaid, as the case may be.

In this case, Mis X has borrowed ₹ 30,000 on Hundi by way of bearer cheque and therefore, it shall be deemed to be his income for the P Y. 2020-21. So, the action of the Assessing Officer treating the amount borrowed as income dining the previous year is valid in law.

But, since the repayment of the same along with interest was made by way of account payee cheque, the provisions of section 69D shall not be attracted here on repayment.

![]()

Question 4.

Mr. Y received the following gifts/amounts during the previous year 2020-21:

(a) Gift of Bullion worth ₹ 51,000 on his Birthday from his friend.

(b) Received a car from his cousin on payment of ₹ 2 Lakhs, FMV of ; which was ₹ 4 Lakhs.

(c) Received cash gift of ₹ 36,000 each from three of his friends A, B & C on 24.09.2020.

(d) In respect of land of Mr. Y compulsorily acquired by Railways in the b year 2018, he received the following amount on 25.12.2020 as Interest on enhanced compensation on the order of the Court,

Relating to Previous Year

2018-19 : ₹ 2,90,000

2019-20 : ₹ 3,50,000

2020-21 : ₹ 2,20,000

(e) 50 shares of Beta Ltd., the FMV of which was ₹ 50,000, on his marriage anniversary from his cousin. He also received 100 shares of Alpha Ltd., the FMV of which was ₹ 70,000 on the date of transfer. This gift was received on the occasion of Diwali. Mr. Sundar had originally purchased the shares on 10.8.2020 at a cost of ₹ 50,000.

(f) On 15th February, 2021, he sold the 100 shares of Alpha Ltd. for ₹ 1,00,000.

You are required to compute the Income of Mr. Y under the head “Income from Other Sources” and Capital gains, if any, for the Assessment Year 2021-22 assuming that he has no other Income. [CA Final May 2012] [7Marks]

Answer:

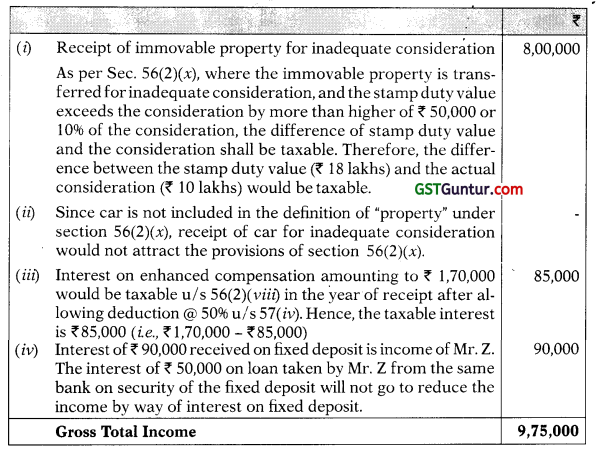

Notes:

1. Bullion is received without consideration and aggregate FMV exceeds ₹ 50,000 and hence full value of the bullion is taxable u/s 56(2)(x).

2. Car is not included in the definition of ‘property’ as specified in the Explanation to Section 56(2)(x) and therefore nothing shall be taxable.

3. Any sum of money received without consideration and aggregate value if exceeds ₹ 50,000 is taxable u/s 56(2)(x).

4. Interest on Enhanced Compensation is taxable in the year of receipt after a deduction of 50% as provided by section 57 (i.e. ₹ 8,60,000 – ₹ 4,30,000).

5. If shares of any company are received without consideration and aggregate FMV of shares exceeds ₹ 50,000, the whole of such aggregate FMV of shares is taxable u/s 56(2)(x). Although the FMV of shares of Beta Ltd. does not exceed ₹ 50,000, but the aggregate of the FMV of the shares of Alpha Ltd. and Beta Ltd. is ₹ 1,20,000 which exceeds ₹ 50,000. Hence, their aggregate value shall be taxable. Cousins are not included in the definition of relatives for the purpose of sec. 56(2) (.x) and so shares received without consideration from them shall be taken for the purpose of taxability under this section.

6. Section 49(4) provides that where the capital gain arises from the transfer of such property which has been subject to tax u/s 56(2)(v), the cost of acquisition shall be deemed to be the value taken for the purpose of section 56(2)(x). Therefore ₹ 70,000 would be the cost of acquisition in this case.

![]()

Question 5.

Discuss the taxability of the following transactions under section 56(2) of the Income-tax Act, 1961:

(i) Bharat is the Karta of Bharat HUF. Sujata, daughter of Bharat is a member of the HUF. She transferred a house property to the HUF without any consideration. The value of the house property for stamp duty purpose is ₹ 10 lakhs.

(ii) JD Private Limited issued 50,000 equity shares of face value of ₹ 10 per share at a premium of ₹ 70 per share. The FMV of the share as per prescribed rule is ₹ 50 per share. [CA Final May 2013] [4 Marks]

Answer:

(i) Where any assessee receives immovable property, being land or building or both, without consideration from its relative (i.e. for HUF – the members of the HUF), the same is not taxable under section 56(2)(x). Since, Sujata is a member of Bharat HUF, she is a “relative” of the HUF. Therefore, if Bharat HUF receives a house property from its member, Sujata, without consideration, the stamp duty value of such property will NOT be taxable in the hands of the HUF.

(ii) Section 56(2)(viib) is attracted in this case since the shares of a closely held company are issued at a premium (i.e., the issue price of ₹ 80 per share exceeds the face value of ₹ 10 per share) and the consideration received by the company exceeds the FMV of the shares.

The consideration received by the company in excess of the fair market value of the shares; i.e. ₹ 15,00,000 [i.e., (₹ 80 – ₹ 50) × 50,000 shares] would be taxable under section 56(2)(viib) as “Income from other sources” in the hands of JD Private Limited.

![]()

Question 6.

In the course of scrutiny assessment of Mr. A, the Assessing Officer, on the basis of information available with him, sought an explanation for the source of the expenditure of ₹ 25 lakhs incurred on the wedding of his son. The said expenditure was neither recorded in the books of account maintained nor was the explanation offered by Mr. A satisfactory. What are the consequences? [CA Final May 2013] [6 Marks]

As per section 69C, where an assessee has incurred any expenditure in any financial year and he offers no explanation about the source of such expenditure or part thereof, or the explanation, if any, offered by him is not satisfactory in the opinion of the Assessing Officer, then the amount of such expenditure or part thereof, as the case may be, may be deemed to be the income of the assessee for such financial year.

In this case, the expenditure was neither recorded in the books of account of Mr. A nor the explanation offered by Mr. A was satisfactory. Therefore, the expenditure of ₹ 25 lakhs incurred by Mr. A on the wedding of his son may be deemed by the Assessing Officer as the income of Mr. A as per section 69C.

Practical Question 7:

From the following particulars, compute the gross total income of Mr. Z for the assessment year 2021-22.

(i) Mr. Y transferred his residential house to Mr. Z for ₹ 10 lakh on 1.4.2020. The value of the said house as per stamp valuation authority was ₹ 18 lakhs. Mr. Z is a childhood friend of Mr. Y.

(ii) Mr. Z received a car from his cousin on payment of ₹ 2,50,000, fair market value of which was ₹ 4,00,000.

(iii) Land of Mr. Z was acquired by railways in 2018. On 15.12.2020, he received ₹ 1,70,000 as interest on enhanced compensation on the order of court.

(iv) On a fixed deposit of ₹ 10 lakhs, in a bank, Mr. Z received an interest of ₹ 90,000. He had also borrowed ₹ 50 lakhs from the same bank, on security of the fixed deposit and was liable,to pay ₹ 50,000 by way of interest to the bank. He, therefore, offered the difference between the two amounts i.e. ₹ 40,000 as “Income from Other Sources”. [CA Final Nov. 2014] [4 Marks]

Answer:

Computation of gross total Income of Mr. Z for the A.Y. 2021-22

![]()

Question 7.

Discuss the liability of the following receipts, during the year ended 31 st March, 2021, in the hands of Miss Jyoti under the Income-tax Act, 1961:

(i) Gift of ₹ 60,000 in cash from her father’s sister on her birthday.

(ii) Acquired the paintings from grandfather’s younger brother. The FMV of the paintings was ₹ 3 lakhs but the consideration paid was ₹ 2 lakhs.

(iii) Received a car from her friend on payment of ₹ 2,50,000, the market value of which Was ₹ 3,00,000.

(iv) Interest on enhanced compensation on the order of court, from NHAI in respect of her land which was compulsorily acquired, was received ₹ 3,50,000 on 12.11.2020 which includes interest of ₹ 2,00,000 pertaining to previous year 2018-19.

(v) Received cash gift of ₹ 15,000 each from three of her friends. [CA Final May 2016] [4 Marks]

Answer:

(i) As per sec. 56(2)(x), where any assessee receives any sum of money from a person or persons, without consideration in excess of ₹ 50,000, then he shall be taxable for whole of such amount received under “Income from Other Sources”. However, such amount is not taxable if it is received from any relative and here, Miss Jyoti has received gift of ₹ 60,000 in cash from her father’s sister and father’s sister is included in the definition of relative u/s 56(2)(x). Therefore, Miss Jyoti shall not be taxable in this case.

(ii) As per sec. 56(2)(x), any property other than the immovable property received from any person or persons for inadequate consideration shall be taxable, if the difference between the FMV of the property and consideration exceeds by more than ₹ 50,000. The definition of property given under the said section include paintings and therefore, the difference of ₹ 1,00,000 (₹ 3,00,000 – ₹ 2,00,000) shall be taxable.

(iii) As per sec. 56(2)(x), any property other than the immovable property received from any person or persons for inadequate consideration shall be taxable, if the difference between the FMV of the property and consideration exceeds by more than ₹ 50,000. But the definition of property given under the said section does not include car. Therefore the value of car received by Miss Jyoti from her friend shall no be taxable. This case shall also be applicable even if the difference between the FMV of the property and the consideration paid by Miss Jyoti exceeds ₹ 50,000 which is not so in this case.

(iv) Interest on enhanced compensation received on the order of the court shall be taxable in the year in which it is received after providing deduction of 5096 of such interest amount as per Sec. 57(i). Therefore, Miss Jyoti shall be taxable for 50% of the amount received as interest on enhanced compensation i.e. 50% of ₹ 3,50,000 = ₹ 1,75,000 shall be taxable in her hands under the head “Income from Other Sources”.

(v) As per Sec. 56(2)(v) where any assessee receives any sum of money without consideration from any person or persons in excess of ₹ 50,000, then he shall be taxable for whole of such amount received. This means the total amount receives from any person or persons during the whole year shall be aggregated. Miss Jyoti had received ₹ 15,000 each from her three friends which makes the total of ₹ 45,000 (₹ 15,000 × 3) which is less than ₹ 50,000. Therefore, such ₹ 45,000 shall not be taxable in the hands of Miss Jyoti.

![]()

Question 8.

Discuss the tax implications u/s 56(2) in respect of each of the following transactions:

(i) Mr. Anaimudi received a painting by Raja Ravi Verma worth 165,000 from his nephew by way of gift on his 25th wedding anniversary.

(ii) Dodabetta’s son transferred shares of Pir Panjal Ltd. to Dodabetta HUF without any consideration. The fair market value of the shares is ₹ 3 lakhs.

(iii) ABC Private Ltd. purchased 8,000 equity shares of Satarupas Private Ltd. at ₹ 72 per share from Ms. Yamuna. The fair market value per share on the date of transaction is ₹ 90. [CA Final Nov 2016] [6 Marks]

Answer:

(i) As per section 56(2)(x), where any assessee receives any property from any person or persons without consideration and the aggregate FMV of such property exceeds ₹ 50,000, then he shall be taxable for whole of the FMV amount of such property under the head ‘Income from Other Sources’.

In this case, Mr. Anaimudi has received paintings, which is included in the definition of property given u/s 56(2)(x), from his nephew worth ₹ 65,000 which exceeds ₹ 50,000 and therefore, he shall be taxable for whole of such amount of ₹ 65,000. However, if such property is received from any relative, then the FMV of the property received shall not be taxable. But, here, Mr. Anaimudi has received paintings from his nephew and definition of relative u/s 56(2)(x) does not include nephew. Therefore, Mr. Anaimudi shall be taxable for ₹ 65,000 worth paintings received from his nephew.

(ii) As per section 56(2)(x), where any assessee receives any property from any person or persons without consideration and the aggregate FMV of such property exceeds ₹ 50,000, then he shall be taxable for whole of the FMV amount of such property under the head ‘Income from Other Sources’.

In this case, Dodabetta HUF has received shares of Pir Panjal Ltd. having FMV of ₹ 3 lakhs from Dodabetta’s son and the shares are included in the definition of property given u/s 56(2) (x). However, such tax liability shall not arise when the property is received from any relative and for HUF, relative means any member of the HUF. Therefore, shares received from Dodabetta’s son shall not be taxable in the hands of Dodabetta HUF as the son is a member of HUF.

(iii) As per section 56(2)(x), where any assessee receives any property front any pet son or persons for inadequate consideration and the aggregate difference between the FMV and consideration of the shares exceeds ₹ 50,000, then such difference between the FMV and consideration of shares shall be taxable in the hands of such assessee under the head Income from Other Sources.

In this case, the FMV of the shares of Satarupas Pvt. Ltd. received by ABC Pvt. Ltd. is ₹ 7,20,000 (8,000 shares × ₹ 90 per share) and the consideration of the shares is ₹ 5,76,000 (8,000 shares × ₹ 72 per share). The difference between the FMV and consideration of the shares of ₹ 1,44,000 (₹ 7,20,000 – ₹ 5,76,000) exceeds ₹ 50,000 and therefore, such difference of ₹ 1,44,000 shall be taxable in the hands of ABC Pvt. Ltd.

![]()

Question 9.

The assessee M/s Career Network is a partnership firm comprising of four partners, who have contributed capital in the books of the firm, but failed to explain satisfactorily the source of receipt in their individual hands. The A.O. has proposed to tax the amounts credited in their accounts in the books of the firm as cash credit in the hands of the partnership firm. Is the action of the Assessing Officer valid? [CA Final May 2017] [4 Marks]

Answer:

The issue under consideration is whether capital contribution of the individual partners credited to their accounts in the books of the firm can be taxed as cash credit in the hands of the firm, where the partners have admitted their capital contribution but failed to explain satisfactorily the source of receipt in their individual hands.

As per section 68, if an assessee fails to explain the nature and source of credit entered in its books of account of any previous year, the sum so credited shall be charged tax in the hands of the assessee of that previous year.

The facts of the case are similar to the facts in CIT v. M. Venkateswara Rao (2015), where the Telangana & Andhra Pradesh High Court observed that the amount sought to be treated as income of the firm is the contribution made by the partners to the capital. Where the firm explains that the partners have contributed capital, section 68 cannot be pressed into service.

The Court further observed that when the amount so contributed constitutes the very substratum for the business of the firm, it is difficult to treat the pooling of such capital as cash credit. In the absence of any material to indicate that they are the profits of the firm, the cash credits cannot be assessed in the hands of the firm, though they may be assessed in the hands of individual partners.

Hence, applying the rationale of the Telangana and Andhra Pradesh High Court, the action of the A.O., in proposing to tax the amounts credited in the partners accounts in the books of the firm as cash credit in the hands of the firm is not valid.

![]()

Question 10.

Discuss the taxability or otherwise of the following transactions:

(i) Mr. A purchased 10 acres of agricultural lands from Mr. B at the rate of ₹ 2 lakh per acre on 10-05-2020. The guideline value of the land on the date of the transaction was ₹ 3 lakhs per acre. However he had entered into an agreement for purchase of the land on 10-03-2020 when the guideline value was ₹ 2.50 lakhs per acre. He had paid a token advance of ₹ 1 lakh by account payee cheque.

(ii) Mr. A received cash gift of ₹ 4.75 lakhs from B on the occasion of his 61st birthday which was celebrated like marriage as per tradition, and ₹ 25,000 from C. Both B and C are his distant relatives.

(iii) Mr. Dileep contributed ₹ 2 lakhs to a Trust created for the purpose of marriage of his friend’s daughter.

Note: (Guideline value means Assessable stamp duty value) [CA Final May 2018 (New Syllabus)] [6 Marks]

Answer:

(i) As per Sec. 56(2)(v), where any person receives any immovable property for inadequate consideration from a person (other than relative) and the stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the consideration, then such difference of stamp duty value and consideration is chargeable to tax as income under the head “Income from Other Sources”.

Here, Mr. A purchased 10 acres of agricultural lands from Mr. B at the rate of ₹ 2 lakhs per acre. The guideline value on the date of agreement i.e. ₹ 2.50 lakhs per acre, may be taken as the stamp duty value instead of guideline value on the date of transaction i.e. ₹ 3 lakhs per acre, since the advance in respect of agricultural lands has been paid by way of an account payee cheque on the date of agreement.

The total consideration paid by Mr. A to Mr. B is ₹ 20 lakhs (₹ 2 × 10 acres) but the stamp duty value of the agricultural lands is ₹ 25 lakhs (₹ 2.5 lakhs × 10 acres). The stamp duty value exceeds the consideration by more than higher of ₹ 50,000 or 10% of the consideration and therefore, such difference of ₹ 5 lakhs (₹ 25 lakhs – ₹ 20 lakhs) shall be taxable in the hands of Mr. A as ‘Income from Other Sources.’

![]()

(ii) As per Sec. 56(2)(v), where any assessee receives any sum of money from a person or persons, without consideration in excess of ₹ 50,000, then he shall be taxable for whole of such amount received under the head “Income from Other Sources”. However, he shall not be taxable if such sum of money is received on the occasion of the marriage of the Individual.

Here, Mr. A received cash gift of ₹ 4,75,000 and ₹ 25,000 from C on the occasion of his 61st birthday which was celebrated like marriage as per tradition. Since, the amount has.been received on the occasion of birthday of Mr. A, sum amount of ₹ 5,00,000 (₹ 4,75,000 + ₹ 25,000) shall be taxable in the hands of Mr. A under the head “Income from Other Sources”, even though the birthday was celebrated like marriage as per the tradition.

(iii) As per Sec. 56(2)(x), where any assessee receives any sum of money from a person or persons, without consideration in excess of ₹ 50,000, then he shall be taxable for whole of such amount received under the head “Income from Other Sources”.

However, he shall not be taxable if such sum of money is received from an individual by a trust created or established solely for the benefit of relative of the individual. Here, Mr. Dileep contributed ₹ 2,00,000 to a trust created for the purpose of marriage of his friend’s daughter. Since, the amount contributed to the trust is not for the benefit of relative of the individual creating trust, ₹ 2,00,000 shall be taxable in the hands of trust.