Tax Invoice, Credit and Debit Notes – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Tax Invoice, Credit and Debit Notes – CA Inter Tax Question Bank

Question 1.

Determine with reason whether the following statements are true or false:

(i) A registered person shall issue a separate invoice for supplying both taxable as well as exempted goods to an unregistered person.

(ii) A Non-banking financial company can issue a consolidated tax invoice at the end of every month for the supply made during that month. (May 2018, 3 marks)

Answer:

(i) The statement is false. A single invoice-cum-bill of supply may be issued for all supplies whether taxable or exempted.

(ii) The statement is true. Insurer/Banking Company Financial Institution, including a NBFC are allowed to issue a consolidated tax invoice at the end of the month.

![]()

Question 2.

List out the situations in which a Credit note/Debit note may be issued under the CGST Act, 2017 (May 2019, 5 marks)

Answer:

Credit note ¡s required to be Issued by the Supplier:

- If taxable value charged in the tax invoice is found to exceed the taxable value in respect of supply of goods and/or services, or

- If tax charged in the tax invoice is found to exceed the tax payable in respect of supply of goods and/or services, or

- if goods supplied are returned by the recipient, or

- if goods and/or services supplied are found to be deficient.

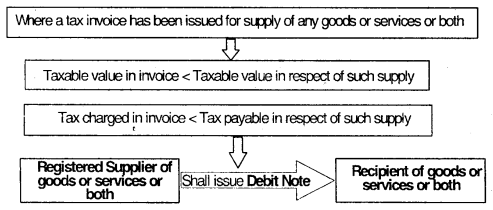

Debit note is required to be issued by the Supplier:-

- if taxable value charged in the tax invoice is found to be less than the taxable value in respect of supply of goods and/or services or

- if tax charged in the tax invoice is found to be less than the tax payable in respect of supply of goods and/or services.

![]()

Question 3.

Mr. Shah, a consignor is required to move goods from Ahmedabad (Gujarat) to Nadiad (Gujarat). He appoints Mehta Transporter for movement of goods. Mehta Transporter moves the goods from Ahmedabad (Gujarat) to Kheda (Gujarat). For completing the movement of goods from Kheda (Gujarat) to Nadiad (Gujarat) , Mehta Transporter now hands over the goods to Parikh Transporter.

Explain the procedure regarding e-way bill to be followed by consignor and transporter as per provisions of GST law and rules made thereunder. (Nov 2019, 5 marks)

Answer:

As per Rule 138(1) of CGST Rules 2017, Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees-

- in relation to a supply; or

- for reasons other than supply; or

- due to inward supply from an unregistered person,

shall, before commencement of such movement, furnish information relating to the said goods as specified in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required on the common portal and a unique number will be generated on the said portal:

![]()

Provided that the transporter, on an authorization received from the registered person, may furnish information in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required on the common portal and a unique number will be generated on the said portal:

As per Rule 138(5) Where the goods are transferred from one conveyance to another, the consignor or the recipient, who has provided information in Part A of the FORM GST EWB-01, or the transporter shall, before such transfer and further movement of goods, update the details of conveyance in the e-way bill on the common portal in Part B of FORM GST EWB-01:

Provided that where the goods are transported for a distance of upto fifty kilometers within the State or Union territory from the place of business of the transporter finally to the place of business of the consignee, the details of the conveyance may not be updated in the e-way bill.

In the given case, Mr. Shah, either he or transporter i.e. Mehta transporter can generate the E-way bill for transporting the goods from Ahmedabad (Gujarat) to Nadiad (Gujarat) i.e. intra state supply. Since the Mehta transporter moves the goods from Ahmedabad (Gujarat) to Kheda (Gujarat) and for completing the movement of goods from Kheda(Gujarat) to Nadiad (Gujarat) Mehta transporter hand over the goods to parikh transporter.

So as per the rule 138(5) stated as above the E-way bill needs to be updated either by the consignor i.e. (Mr. Shah) or the recipient, who has provided information in Part A of the FORM GST EWB-01, or the transporter i.e. Mehta Transporter.

![]()

Question 4.

“It is mandatory to furnish the details of conveyance in Part-B of E-way Bill.”

Comment on the validity of the above statement with reference to provisions of E-Way Bill under CGST Rules, 2017. (Nov 2020, 3 marks)

Question 5.

ABC Cinemas, a registered person engaged in making supply of services by way of admission to exhibition of cinematograph films in multiplex screens was issuing consolidated tax invoice for supplies at the close of each day in terms of section 31 (3)(b) of CGST Act, 2017 read with fourth proviso to rule 46 of CGST Rules, 2017.

During the month of October 2020, the Department raised objection for this practice and asked to issue separate tax invoices for each ticket.

Advise ABC Cinemas for the procedure to be followed in the light of recent notification. (Jan 2021, 4 marks)

Question 6.

Agni Ltd. a registered supplier wishes to transport cargo by road between two cities situated at a distance of 368 kilometres. Calculate the validity period of e-way bill under rule 138(10) of CGST Rules, 2017 for transport of the said cargo, if it is over dimensional cargo or otherwise. (Jan 2021, 3 marks)

![]()

Question 7.

Mr. Lakhan provides Continuous Supply of Services (CSS) to M/s. TNB Limited. He furnishes the following further information:

- Date of commencement of Providing CSS – 01 -10-2020

- Date of completion of Providing CSS – 31 -01 -2021

- Date of receipt of payment by Mr. Lakhan . 30-03-2021

Determine the time of issue of invoice as per provisions of CGST Act, 2017, in the following circumstances:

- If no due date for payment is agreed upon by both under the contract of CSS.

- If payment is linked to the completion of service.

- If MIs. TNB Limited has to make payment on 25-03-2021 as per the contract between them. (Nov 2018, 5 marks)

Answer:

(i) Where the due date of payment is not ascertainable from the contract, the invoice shall be issued before or at the time when the supplier of service receives the payment.

Thus, in the given case, the invoice should be issued on or before 30.03.2021 (date of receipt of payment by Mr. Lakhan).

(ii) It payment is linked to the completion of an event, the invoice should be issued on or before the date of completion of that event.

Since in the given case payment is linked to the completion of service, invoice should be issued on or before 31.01.2021 (date of completion of service).

![]()

Question 8.

Examine the following independent cases of supply of goods and services and determine the time of issue of invoice under each of the cases as per the provisions of CGST Act, 2017:

(i) Sakthi Enterprises, Kolkata entered into a contract with Suraj Enterprises, Surat for supply of goods on 3rd October, 2020. The goods were removed from the factory at Kolkata on 11th October, 2020. As per the agreement, the goods were to be delivered by 31st October, 2020. Suraj Enterprises has received the goods on 14th October, 2020.

(ii) Trust and Fun Ltd., an event management company, has provided its services for an event at Kapoor Film Agencies, Mumbai on 5th June, 2020. Payment for the event was made on 19th June, 2020. (May 2019, 4 marks)

Answer:

(i) A registered person supplying taxable goods shall issue a tax invoice, before or at the time of removal of goods for supply to the recipient, where the supply involves movement of goods. Therefore, in the given case, invoice has to be issued on or before, 11th October 2020 (the time of removal of goods).

(ii) A registered person [other than an insurer/banking company/financial institution, including an NBFC] supplying taxable services shall issue a tax invoice before or after the provision of service, but within a period of 30 days from the date of supply of service. Thus, in the given case, invoice has to be issued within 30 days of 5th June 2020 (date of supply of service), i.e. on or before, 5th July 2020.

![]()

Question 9.

When should a Tax Invoice be issued for supply of Goods?

Answer:

The answer depends upon the type of goods. As per Sec.31 (1), if the nature of the supply is such that:

- Movement of goods is involved, then the tax invoice has to be issued before or at the time of removal of the goods for supply to the recipient.

- Movement of goods is not involved, then the tax invoice has to be issued before or at the time of the goods are delivered to the recipient or when the goods are made available to the recipient.

Question 10.

How can I supply goods without movement?

Answer:

In cases where the ownership, or the risks and rewards are transferred without requiring the movement of goods, the goods would be treated as supplied although no movement is involved in effecting such supply.

E.g. when an Agent who is in possession of certain goods decides to buy the goods from the principal, on-side installation of machinery, sale and lease back transactions, etc.

![]()

Question 11.

Who can remove the goods?

Answer:

Goods can be removed by way of:

- Dispatch by the supplier himself

- Dispatch by any person acting on behalf of the supplier

- Collection by the recipient himself

- Collection by any person acting on behalf of the recipient

Question 12.

I am supplying A4-sized bundles of paper to an Advocate’s Office. I submit the account of total supplies made during the 2-month period on the 25th of alternate month. Do I have to issue an invoice each time I dispatch the bundles?

Answer:

As per Sec.31 (4) where, under a contract, there is a continuous/ recurrent supply of goods involving periodic invoices or payments, the invoice shall be issued before or at the time of issue of the statements of account or receipt of payments. Since the given instance is a case of continuous supply of goods, tax invoice has to be issued latest by the time of submitting the statement every time.

![]()

Question 13.

I have a contract to supply manpower to a factory for 12 months, whereby the recipient should make payment by the 15th of the succeeding month. When should I raise the invoice?

Answer:

Given that the contract is for a period exceeding 3 months, to provide services on a continuous/ recurrent basis, the supply will be treated as a continuous supply of services. As the due date of payment is ascertainable from the contract, the invoice has to be raised on or before the due date of payment – Sec 31 (5)(a).

Question 14.

I had a contract for supplying manpower for 28 days for ₹ 28,000. However, after 10 days, the service has stopped. Should I raise an invoice?

Answer:

Yes. Where a supply of service ceases before its completion, an invoice has to be issued at the time the supply ceases, i.e., on the 10th day. The invoice shall be to the extent of the service provided before its cessation – Sec. 31(6).

![]()

Question 15.

I became liable to pay tax on 1st April. I have applied for registration on 15th April, which is within the 30 days window given to me. My registration is granted on 29th April. What document can I issue to collect tax from 1st April to 28th April?

Answer:

Till the grant of registration on i.e., 29th April, tax cannot be collected on the supplies made.

However, even though the registration is granted on 29lh April, the effective date of registration will be 1st April, as registration is applied for within the permissible period.

Section 31 (3) provides for issue of ‘revised invoices’ against the bills raised on a regular basis (without collection of tax) from 1st April to 28th April, within a period of 1 month from the date of grant, i.e., within 29th May. Applicable taxes can be collected in the revised invoices issued.

![]()

Question 16.

What is meant by Continuous Supply of Goods or Services?

Answer:

U/s 2(32), Continuous supply of goods means a supply of goods which is provided or agreed to be provided continuously or on recurrent basis. There should be a contract for such a supply requiring the supplier to issue invoices to the recipient on a regular or periodic basis. Also, the supply may or may not be through a wire, cable, pipeline or other conduit.

U/s 2(33), Continuous supply of services means a supply of services which is provided or agreed to be provided continuously or on recurrent basis under a contract. Such contract should be for a period exceeding 3 months, with periodic payment obligations.

The Government is also empowered to treat the supply of a particular category of goods or services as ‘continuous supply’, irrespective of the criteria specified above.

![]()

Question 17.

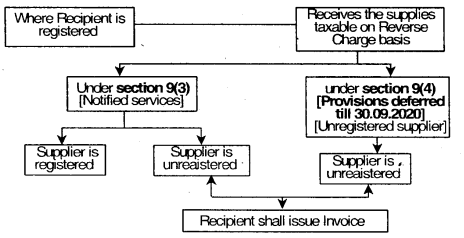

What are the circumstances in which a Credit Note is to be issued?

Answer:

As per Sec. 34(1), for issuing a Credit note, an invoice for a supply should have been issued earlier. A credit note may be issued in the following cases:

- The taxable value on which the tax is collected is more than the actual taxable value;

- The tax charged is more than what should have been charged;

- The recipient has returned the goods;

- The recipient has found that the goods or services supplied are deficient.

Question 18.

I had made a supply in April. The party returned the goods in May. How will I declare the credit note to the tax authorities?

Answer:

The Credit Note should be declared in return of outward supplies (GSTR-1) for the month of May.

![]()

Multiple Choice Question

Question 1.

Tax invoice must be issued by _________.

(a) Every supplier

(b) Every taxable person

(c) Registered persons not paying tax under composition scheme

(d) All the above

Answer:

(c) Registered persons not paying tax under composition scheme

Question 2.

Law permits collection of tax on supplies effected prior to registration, but after applying for registration;

(a) Yes, but only on intra-State supplies, if the revised invoice is raised within one month

(b) Yes, but only on intra-State supplies effected to unregistered persons, if the revised invoice is raised within one month

(c) Yes, on all supplies, if the revised invoice is raised within one month

(d) No, tax can be collected only on supplies effected after registration is granted.

Answer:

(c) Yes, on all supplies, if the revised invoice is raised within one month

![]()

Question 3.

A bill of supply can be issued in case of inter-State and intra-State:

(a) Exempted supplies

(b) Supplies to unregistered persons

(c) Both of above

(d) None of the above.

Answer:

(a) Exempted supplies

Question 4.

A credit note is issued by __________ and it is a document accepted for GST purposes:

(a) Supplier, for reducing the tax/ taxable value

(b) Recipient, for reducing the tax/ taxable value

(c) Supplier, for increasing the tax/ taxable value

(d) Recipient, for increasing the tax/ taxable value

Answer:

(a) Supplier, for reducing the tax/ taxable value

![]()

Question 5.

For an increase in the tax/ taxable value, a debit note for GST purposes:

(a) Should be issued by the supplier

(b) Should be issued by the recipient

(c) May be issued by the supplier

(d) May be issued by the recipient

Answer:

(a) Should be issued by the supplier

Question 6.

The last date for declaring the details of a Credit Note issued on 25-Jun-2020 for a supply made on 19-Sep-2019 is:

(a) 31 -Dec-2020 – Last date for filing annual return

(b) 20-Jul-2020 – Actual date for filing annual return

(c) 20-Jan-2020 – Due Date of Filing of December Return

(d) 20-0ct-2020 – Due Date of Filing of September Return

Answer:

(d) 20-0ct-2020 – Due Date of Filing of September Return

![]()

Question 7.

In case of inter-State movement of goods, every registered person who causes movement of goods of consignment value exceeding …………………. in relation to a supply or for reasons other than supply or due to inward supply from an unregistered person shall, before commencement of such movement, file FORM GST EWB-01.

(a) ₹ 50,000/-

(b) ₹ 1,00,000/-

(c) ₹ 70,000/-

(d) None of the above

Answer:

(a) ₹ 50,000/-

Question 8.

When the movement of goods is caused by an unregistered person the e-way bill shall be generated by:

(a) Unregistered person himself

(b) The Transporter

(c) Either of them

(d) Neither of them

Answer:

(c) Either of them

![]()

Question 9.

When an e-way bill is not required to be generated?

(a) Where the goods being transported are specified in Annexure to Rule 138 of the CGST Rules

(b) Where the goods are being transported by a non-motorised conveyance

(c) Where the goods are being transported from the customs port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by customs

(d) All of the above

Answer:

(d) All of the above

Question 10.

How should e-way bill be generated for multiple consignments intended to be transported in one conveyance?

(a) The transporter shall generate separate e-way bills for each consignment

(b) A consolidated e-way bill in FORM GST EWB-02 maybe generated

(c) No e-way bill shall be required

(d) None of the above

Answer:

(b) A consolidated e-way bill in FORM GST EWB-02 maybe generated

![]()

Tax Invoice, Credit and Debit Notes

1. Who can raise a tax invoice

Registered Person

- Supplying taxable goods or service

- Receiving taxable goods or services from unregistered supplier

2. Time limit for issuance of invoice

Taxable Supply

- Goods

- Involving movement of goods

- At the time of removal

- No movement of goods

- At the time of delivery

- Sae or return supplies

- Before or at the time of supply, or within 6 months from the removal — whichever is earlier

- Services

- Within 30 days from the supply of services

- insurance, Banking – 45 days

- Within 30 days from the supply of services

- Involving movement of goods

![]()

| In case of continuous supply of goods | before/at the time each successive statements of accounts is issued or each successive payment is received | |

| In case of continuous supply of services | due date of payment is ascertainable from the contract | on/before due date of payment |

| not so ascertainable | before/at the time of receipt of payment | |

| payment is linked to the completion of an event | on/before the date of completion of that event | |

3. Important contents of tax invoice

| GSTIN of supplier | Consecutive Serial Number & date of issue | GSTIN of recipient, if registered | Name & address of recipient, if not registered | HSN |

| Description of goods or services | Quantity in case of goods | Total Value of supply | Taxable Value of supply | Tax rate-Central tax &State tax or Integrated tax, cess |

| Amount of tax charged | Place of supply | Address of delivery where different than place of supply | Tax payable on reverse charge basis | Signature of authorised signatory |

![]()

4. Manner of issuing the invoice

| Supply of Goods | Supply of services |

| Triplicate | Duplicate |

| Original copy for recipient Duplicate copy for transporter; and Triplicate copy for supplier | Original copy for recipient; and Duplicate copy for supplier |

The serial number of invoices issued during a month/quarter shall be furnished electronically in FORM GSTR – 1

5. Revised Tax

Revised Tax Invoices to be issued in respect of taxable supplies effected during this period

Consolidated Revised Tax Invoice (CTRI) may be issued in respect of taxable supplies made to an unregistered recipient during this period

- In case of inter-State supplies, CTRI cannot be issued in respect of all unregistered recipients if the value of a supply exceeds ₹ 2,50,000 during this period.

- Particulars of the Debit and Credit Notes are also same as revised tax invoices.

![]()

6. Consolidated Tax Invoice

Tax invoice is not required to be issued

- Value of supply < ₹ 200

- Recipient is unregistered

- Recipient does not require such invoice

- Consolidated Tax Invoice shaH be issued for such supplies at the close of each day in respect of all such supplies.

7. Bill of Supply

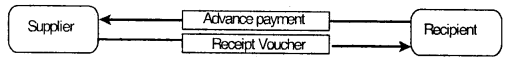

8. Receipt Voucher

Where at the time of receipt of advance, rate of tax/nature of supply is not determinable

| Where at the time of receipt of advance | |

| (i) rate of tax is not determinable | tax shall be paid at the rate of 18% |

| (ii) nature of supply is not determinable | same shall be treated as inter-State supply. |

![]()

9. Refund Voucher

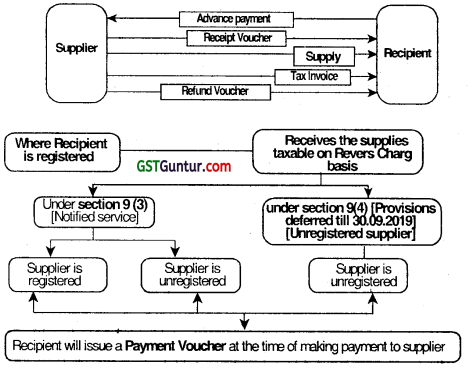

10. Invoice and Payment Vouchers to be Issued by recipient of supply liable to pay tax under reverse charge

Payment Voucher

![]()

11. Credit Notes

12. Debti Notes

![]()

13. E-Way Bill

Meaning of e-way bill and why is it required

E-way bill is an electronic document generated on the GST portal evidencing movement of goods.

Section 68 mandates that the Government may required the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed. Rule 138 of CGST Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods in certain prescribed cases.

When is required to be.generated?

E-way Bill s mandatory in case of movement of goods of consignment value exceeding ₹ 50,000.

Movement should be:

- in relation to a suppfy; or

- for reasons other than supply; or

- due to inward supply horn an unregistered person,

Registered person causing movement of goods shall furnish the information relating to the said goods in Part A of Form GST. EWB-01 before commencement of such movement.

![]()

Exceptions to minimum consignment value of ₹ 50,000

- Inter-State transfer of goods by principal to job-worker.

- Inter-State transfer of handicraft goods by a person exempted from obtaining registration. Who causes movement of goods?

Who causes movement of goods?

If supplier is registered and undertakes to transport the goods, movement of goods is caused by the supplier. If recipient arranges transport, movement would be caused by him.

If goods are supplied by an unregistered supplier to a registered known recipient, movement shall be caused by such recipient.

Information to be furnished in e-way bill

Part A: to be furnished by the registered persons** who is causing movement of goods.

Part B: to be furnished by the person who is transporting the goods.

However, information in Part- A may be furnished:

- by the transporter if so authorised or

- by the e-commerce operator/courier agency, where the goods are supplied through them.

![]()

Who can generate the e-way bill?

E-way bill Is to be generated by the registered consignor or consignee (if the transportation is being done in own/hired conveyance or by raHways by air or by vessel) or the transporter (if the goods are handed over to a transporter for transportation by road). Where neither the consignor nor consignee generates the e-way bill and the value of goods is more than ₹ 50.000/- it shall be the responsibility of the transporter to generate it.

Other point

- Goods transported by railways shall be delivered only on production of e-way bill.

- E-way bill can be generated even if consignment value is less than ₹ 50,000.

Details of conveyance may not be furnished in Part – B

In case of intra – State movement of goods upto 50 km distance:

- from place of business (PoB) of consignor to P08 of transporter for further transportation or

- from PoB of transporter finally to PoB of the consignee.

Transfer of goods to another conveyance

In such cases, the transporter or generator of the e-way bill shall update the new vehicle number in Part B of the EWB before such transfer and further movement of goods.

Transfer of goods to another conveyance

In such cases, the transporter or generator of the e-way bill shall update the new vehicle number in Part B of the EWB before such transfer and further movement of goods.

Consolidated E-way Bill in case of road transport

After e-way bill has been generated, where multiple consignments are intended to be transported in one conveyance, the transporter may indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and a consolidated e-way bill in Form GST EWB-02 may be generated by him on the said common portal prior to the movement of goods.

![]()

Where the consignor/consignee has not generated the e-way bill in Form GST EWB-O1 and the aggregate of the consignment value of goods carried in the conveyance is more than ₹ 50,000, the transporter shall generate individual Form GST EWB-O1 on the basis of invoice or bill of supply or delivery challan and may also generate a consolidated e-way bill in Form GST EWB-02 prior to the movement of goods [This provision is not yet effective].

Cancellation of e-way bill

E-way bill can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill. The e-way bill can be cancelled within 24 hours from the time of generation.

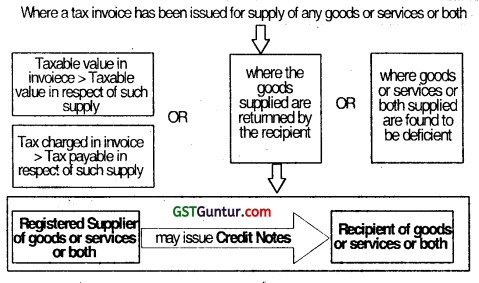

Validity period of e-way bill / consolidated e-way bill

| S. No. | Distance within country | Validity period from relevant date |

| 1. | Upto 100 km | One day in cases other than Over Dimensional Cargo** or multimodal shipment in which at least one leg involves transport by ship |

| 2. | For every 100 km or part thereof thereafter | One additional day in cases other than Over Dimensional Cargo or multimodal shipment in which at least one leg involves transport by ship |

| 3. | Upto 20 km | One day in case of Over Dimensional Cargo or multimodal shipment in which at least one leg involves transport by ship |

| 4. | For every 20 km or part thereof thereafter | One additional day in case of Over Dimensional cargo or multimodal shipment in which at least one leg involves transport by ship |

![]()

Acceptance/rejection of e-way bill

The person causing movement of goods shall generate the e-way bill specifying the details of other person as a recipient who can communicate the acceptance or rejection of such consignment specified in the e-way bill. If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-way Bill or the time of delivery of goods whichever is earlier, it will be deemed that he has accepted the details.

Is e-way bill required in all cases?

E-way bill is not required to be generated in certain specified cases. [Discussed in detail earlier in this chapter]

Documents/devices to be carried by a person -in – charge of a conveyance

- invoice or bill of supply or delivery challan

- copy of the e-way bill in physical form or the e-way bill number in electronic form or mapped to a RFID** embedded on to the conveyance

Verification of documents and conveyances

Commissioner or an officer empowered by him in this behalf may authorise the proper officer to intercept any conveyance to verify the e-way bill or the e-way bill number in physical form for all inter-State and intra-State movement of goods.

Physical verification of a specific conveyance can also be carried out by any officer, on receipt of specific information on evasion of tax, after obtaining necessary approval of the Commissioner or an officer authorised by him in this behalf.

![]()

Inspection and verification of goods

A summary report of every inspection of goods in transit shall be recorded online on the common portal by the proper officer within 24 hours of inspection and the final report shall be recorded within 3 days of such inspection.

Once physical verification of goods being transported on any conveyance has been done during transit at one place with the State or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless a specific information relating to evasion of tax is made available subsequently. Where a vehicle has been intercepted and detained for a period exceeding 30 minutes, the transporter may upload the said information in on the common portal.

Restriction on furnishing of information in Part A of Form GST EWB- 01:

No person (including a consignor, consignee, transporter,-an’e-commerce operator or a courier agency) shall not be allowed to furnish the information in Part A of Form GST EWB-01 in respect of following registered persons; whether as a supplier or a recipient:

- A composition supplier has not f urnished the statement for payment of self-assessed tax for 2 consecutive quarters, or

- A person paying tax under regular scheme has not furnished the returns for 2 consecutive months, or

- A person paying tax under regular scheme has not furnished GSTR-1 for any 2 months or quarters, as the case may be.

![]()

However, Commissioner (jurisdictional commissioner) may, on sufficient cause being shown and for reasons to be recorded in writing, allow furnishing of the said information in Part A of Form GST EWB-01, subject to prescribed conditions and restrictions.