Tax Incidence in India – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Tax Incidence in India – CA Final DT Question Bank

Question 1.

Poulomi, a Chartered Accountant, is presently working in a firm in India. She has received an offer for the post of Chief Financial Officer from a company at Singapore. As per the offer letter, she should join the company at any time between 1st September, 2020 and 31st October, 2020. She approaches you for your advice on the following issues to mitigate her tax liability in India:

(i) Date by which she should leave India to join the company;

(ii) Direct credit of part of her salary to her bank account In Kolkata maintained jointly with her mother to meet requirement of her family.

(iii) Period for which she should stay in India when she comes on leave. [CA Final Nov. 2012] [4 Marks]

Answer:

(i) Indian citizens, leaving India for employment outside India will be treated as residents only if the period of their stay in India during the relevant previous year is 182 days or more Since, Poulomi is leaving India for the purpose of employment outside India, she will be treated as resident only if the period of her stay during the previous year is 182 days or more.

Therefore, Pouiomi should leave India on or before 28th September, 2020, in which case, her stay in India during the previous year would be less than 182 days and she would become non-resident for the purpose of taxability in India. in such a case only the income which accrues or arises in India or which is deemed to accrue or arise in India or received or deemed to be received in India shall be taxable. The income earned by her in Singapore would not be chargeable to tax in India for A.Y. 202 1-22, if she leaves India on or before 28th September 2020.

(ii) If any part of Poulomi’s salary will be credited directly to her bank account in Kolkata then, that part of her salary would be considered as income received in India during the previous year and would be chargeable to tax even if she is a non-resident. Therefore, Poulomi should receive her entire salary in Singapore and then remit the required amount to her bank account in Kolkata in which case, the salary earned by her in Singapore would not be subject to tax in India.

(iii) In case Poulomi visits India after taking up employment outside India, she would be covered in the exception provided in (b) above and she will be treated as resident only if the period of her stay during the relevant previous year amounts to 182 days or more. Therefore, when Poulomi comes India on leave, she should stay in India for less than 182 days during the relevant previous year so that her status remains as a non-resident for the relevant previous year. Moreover, she should not visit India again during the current previous year i.e. P.Y. 2020-21.

![]()

Question 2.

Watson, a Non-Resident Indian, returned to India on 12th June 2020, for permanently residing in India after a stay of 20 years in UK. He provides the sources of his various incomes and seeks your opinion to know about his liability to Income-Tax in India in A.Y. 2021-22:

1. Rental income of a flat in Loudon which was deposited there in a bank. The flat was given on rent by him since July 2020, i.e. after his return to India.

2. Dividends on shares of three German Companies which are being collected in a Bank Account in London. He proposes to keep the dividend on shares in London with the permission of the Reserve Bank of India.

3. He has two sons, one of whom is 12 years. Both the sons are staying in London and not returned India with him. Each of his sons is having income of ₹ 75,000 in U.K. (not received in India) and of ₹ 20,000 in India.

4. During the preceding year when he was a Non-Resident, he had sold 1,000 Shares which were acquired by him in British Pound and the sale proceeds were repatriated. The profit in terms of British Pound on sale of these shares was 175% of the cost at ₹ 37,500 while in terms of Indian Rupee it was ₹ 50,000. [CA Final Nov. 2013] [7 Marks]

Answer:

Since, Watson is in India for 182 days or more during the PY. 2020-21 he would be resident in India for A.Y. 2021-22. However, he is not satisfying both the conditions laid u/s 6(6), as he was not in India from since last 20 years and therefore, the residential status of Watson is Resident but Not Ordinarily Resident for A.Y. 2021-22.

![]()

As per section 5(1), only income which is received/deemed to be received or accrued or arisen/deemed to accrue or arise in India is taxable in case of a Resident but not Ordinarily Resident. Income which accrues or arises outside India shall not be included in his total income, unless it is derived from a business controlled in, or a profession set up in, India. Accordingly:

1. Rental income from a flat in London which was deposited in a bank there shall not be taxable in the case of a resident but not ordinarily resident, since both the accrual and receipt of income are outside India.

2. Dividends from shares of three German Companies, collected in a bank account in London, would also not be taxable in the case of a resident but not ordinarily resident since both the accrual and receipt of income are outside India.

3. As per section 64(1 A), all income accruing or arising to a minor child is includible in the hands of the parent, after providing for deduction of ₹ 1,500 per child under section 10(32).

Accordingly, income accruing to his minor son in India is includible in the income of Watson, after providing deduction of ₹ 1,500. Therefore, ₹ 18,500 [₹ 20,000 – ₹ 1,500] is includible in the income of Watson. Income accruing to the minor child outside India (which is also received outside India) is not includible in the income of Watson. It is assumed that his other son is a major son and hence, his income is not includible in the income of Watson.

4. Repatriation of sale proceeds of 1,000 shares sold in the preceding accounting year, when Watson was a non-resident, is not taxable in the A.Y. 2021-22 since it is not the income of the RY. 2020-21

Consequently, only the income includible under section 64(1 A) would form part of the total income of Mr. Watson for A.Y. 2021-22. Since his total income (i.e., ₹ 18,500) is less than the basic exemption limit, there would be no liability to income-tax for A.Y. 2021-22.

![]()

Question 3.

State with reasons whether the following transactions attract Income-tax in India, in the hands of recipients’ u/s 9 of Income-tax Act, 1961:

(i) A non-resident German company, which did not have a permanent establishment in India, entered into an agreement for execution of electrical work In India. Separate payments were made towards drawings & designs, which were described as “Engineering Fee”. The assessee contended that such business profits should be taxable in Germany as there is no business connection within the meaning of section 9(1)(i) of the Income-tax Act, 1961.

(ii) A firm of solicitors in Mumbai engaged a barrister in UK for arguing a case before Supreme Court of India. A payment of 5000 pounds was made as per terms of professional engagement.

(iii) Amount paid by Government of India for use of a patent developed by Mr. A, who is a non-resident.

(iv) Sai Engineering, a non-resident foreign company entered into a collaboration agreement on 25.6 2020, with an Indian Company and was in receipt of interest on 8% debentures for ₹ 20 lakhs, issued by Indian Company, in consideration of providing technical know-how during previous year 2020-21. [CA Final Nov. 2014] [4 Marks]

Answer:

(i) In the given case, separate payments have been made towards drawings and designs which is described as engineering fee but are actually in the nature of fee for technical services. Therefore, it is taxable in India by virtue of section 9(1)(vii) – AegAktiengeSellSChaftv. CIT(2004) (Kar.).

As per Explanation to section 9, where income is deemed to accrue or arise in india under section 9(l)(vii, such income shall be included in the total income of the non-resident, irrespective of whether it has a residence or place of business or business connection in India. Thus, it will be taxable in the hands of the German Company even though it does not have a permanent establishment in India.

![]()

(ii) As per section 9(l)(ì), all income accruing or arising, whether directly or indirectly, through or from any business connection in India is deemed to accrue or arise in india.

In the given case, there exists a professional connection between the firm of solicitors in Mumbai and the barrister in UK. Further, the expression “business includes not only trade and manufacture; but also “profession”. Thus, such professional connection would amount

to “business connection” under section 9(1)(i) as per Supreme Court judgment in Barendia Prasad Royv. ITO(1981).

Hence, the amount of 5,000 pounds paid to the barrister in UK would be deemed to accrue or arise in India under section 9(1)(i) and it will be liable to tax in india.

(iii) As per section 9(1)(vi), income by way of royalty is deemed to accrue or arise in India if it is paid by the Government. “Royalty” has been defined to include even consideration for use of patent. Thus, the amount paid by Government of India for use of patent developed by Mr. A, a non-resident, is deemed to accrue or arise in India and hence, will be taxable in India.

(iv) Debentures of ₹ 20 lakhs issued by the Indian Company as consideration for providing technical know-how is in the nature of fee for technical services and hence as per Sec. 9(1)(vii) it will be deemed to accrue or arise in India. Thus, it will be liable to tax in India.

As per section 9(1)(v), income by way of interest payable by a person who is a resident of India is deemed to accrue or arise in India. So, interest income from these debentures of an Indian company will also be deemed to accrue or arise in India in the hands of Sai Engineering. Therefore, interest income will also be taxable.

Note: The provisions of double taxation avoidance agreement, if any, applicable in the above cases, have not been taken into consideration since the question specifically requires to examine the taxability of the above transactions under section 9.

![]()

Question 4.

In the context of provisions contained in the Income-tax Act, 1961 examine the correctness of the following.

Liaison Office maintained in India to explore the opportunity of business in India does not constitute business connection. [CA Final May 2016] [3 Marks]

Answer:

The statement is correct: If a Liaison Office is maintained solely for the purpose of carrying out activities which are preparatory or auxiliary in character, and such activities are approved by the Reserve Bank of India, then, no business connection is established. In this case, the Liaison Office is maintained for the purpose of exploring the opportunity of business in India, which is in the nature of preparatory or auxiliary activity. It is assumed that such activities are approved by the Reserve Bank of India. Since it does not undertake any commercial, trading or industrial activity, directly or indirectly, the Liaison Office does not constitute a business connection in this case.

Question 5.

As per agreement between S Limited, a company incorporated in Korea and Bharti Motors Limited, an Indian company, S Limited rendered both off-shore and on-shore technical services to Bharti Motors Limited for setting up a car manufacturing plant in Gujarat. S Limited rendered off-shore services and on-shore services at fee of ₹ 2 crore and ₹ 3 crore respectively. S Limited claims that it is not liable to tax in India in respect of fee of ₹ 2 crore as it is for rendering services outside India. Is the view taken by S Limited correct? [CA Final Nov. 2016, Nov. 2011] [4 Marks]

Answer:

Explanation to section 9(2) provides that income by way of, inter alia, fees for technical services for services utilized in India would be deemed to accrue or arise in India under section 9(l)(vn) in case of a non-resident and be included in his total income, whether or not such services were rendered in India.

In this case, the technical services rendered by the foreign company, S Ltd., were for setting up a car manufacturing plant in Gujarat. Therefore, the off-shore and on-shore services were utilized in India.

Consequently, as per section 9(2), the fee for technical services rendered by S Ltd. to Bharti Motors Ltd., is deemed to accrue or arise in India and includible in the total income of S Ltd.

![]()

Question 6.

Altant Italy, a company incorporated in France, was engaged in manufacture, trade and supply equipment and services for GSM Cellular Radio Telephones Systems. It supplied hardware and software to various entities in India. Software licensed by assessee embodies the process which is required to control and manage the specific set of activities involved in the business use of its customers. Software was also made available to its customers, who used it to carry out their business activities. The A.O. contented that the consideration for supply of software embedded in hardware in ‘Royalty’ u/s 9(1)(vi). Examine the correctness of the action of the A.O. [CA Final May 2017] [4 Marks]

Answer:

As per section 9(1)(vi Royalty is deemed to accrue or arise in India if the Intellectual Property Rights (in this case software) is used in India.

The issue is whether software provided along with the hardware of GSM mobile telephone system can be regarded as having independent status? If yes then the consideration for its use can he regarded as royalty.

Similar question arose in case of CIT y. Alcatel Lucen t Canada (2015) (Del). Here Delhi High Court observed that –

- the software that was loaded on the hardware did not have any independent existence;

- the software supply is an integral part of GSM mobile telephone system and is used by the cellular operators for providing cellular services to its customers;

- the software is embedded in the system and there could not be any independent use of such software;

- this software merely facilitates the functioning of the equipment and is an integral part of the hardware.

Further, the High Court had also referred the decision of the Apex Court in Tata Consultancy Services y. State of Andhra Pradesh (2004), wherein it was held that software incorporated on a media would be goods liable to sales tax.

Based on above discussion we conclude that where payment is made for hardware in which the software is embedded and the software does not have independent functional existence, no amount could be attributed as ‘royalty’ for software in terms of section 9(1)(vi).

![]()

Question 7.

LLM Bank Ltd. carrying on banking business is incorporated in Melbourne, Australia. It has branches in different countries including India. During the F.Y. 2020-21 the Indian branch of the bank paid interest of ₹ 20 lakhs and ₹ 15 lakhs respectively to its head office in Melbourne and to the branch office in California. State with reasons whether interest so paid shall be liable to tax in India in the hands of head office and California branch. [CA Final Nov. 2017] [4 Marks]

Answer:

As per Explanation to Sec. 9(l)(v), in the case of a non-resident, being a person engaged in the business of banking, any interest payable by the permanent establishment (PE) in India of such non-resident to the head office or any PE or any other part of such non-resident outside India shall be deemed to accrue or arise in India and shall be chargeable to tax in addition to any income attributable to the PE in India and the PE in India shall be deemed to be a person separate and independent of the non-resident person of which it is a PE and the provisions of the Act relating to computation of total income, determination of tax and collection and recovery shall apply accordingly.

In the given case, PE in India of the LLM Bank Ltd. has paid interest to its Head office and to another PE of the bank. Applying the above provisions, interest paid by the Indian branch of LLM Bank Ltd to head office in Melbourne and California branch shall be deemed to accrue or arise in India and the PE in India and its Head office in Melbourne and branch in California, shall all be deemed to be separate and independent. Thus, interest so paid shall be liable to tax in India in the hands of head office and California branch.

![]()

Question 8.

State with reasons whether the following transactions are subject to tax as deemed income.

(i) XYZ Ltd. is a broadcaster of News Channel In India. It had made payments to a Malaysian company having no PE in India for down-linking Television Channels into India and international ‘footprint through a channel.

(ii) Mr. A, a foreign citizen and a diamond merchant from US has earned income of ₹ 10 croresfrom display of uncut and unassorted diamonds in the Bharat Diamond Bourse a notified special zone in Surat. [CA Final May 2018 (New Syllabus)] [6 Marks]

Answer:

(i) As per Explanation 2 to Sec. 9(1)(vi), royalty means the consideration for, inter alia, transfer of all or any rights in respect of any copyright, literacy, artistic, scientific work including films or video tapes for use in connection with television or tapes or in connection with radio broadcasting. In this case, XYZ Ltd., a broadcaster of News channel in India has made payments to a Malaysian company having no PE in India for downlinking Television Channels into India and international footprint through a channel.

However, the payment in respect of downlinking television channels and international footprint through a channel does not amount to royalty as defined under Explanation 2 to Sec. 9(1)(vi). Therefore, the payment received by the Malaysian company shall not be taxable in India.

(ii) As per Explanation 1(e) to Sec. 9(l)(z), in case of a foreign company engaged in the business of mining of diamonds, no income shall be deemed to accrue or arise in India to it through or from the activities which are confined to the display of uncut and unassorted diamond in any special zone notified by the C.G. in the official gazette.

In this case, Mr. A, who is a foreign citizen and diamond merchant from US has earned income of ₹ 10 crores from display of uncut and unassorted diamonds in the Bharat Diamond Bourse, a notified special zone in Surat. Since, Mr. A is a foreign citizen and not a foreign company, Explanation 1(e) to Sec. 9(1)(i) shall not be applicable and the income earned of ₹ 10 crores by him shall deemed to accrue or arise in India.

![]()

Question 9.

Examine in the context of provisions contained under the Income-tax Act, 1961, each of the following independent cases and state in brief whether there exists business connection in each of the cases in India so as to bring the income earned, if any, to tax net in India:

(i) ABC Ltd., a company resident in Dubai, had set-up a liaison office at Mumbai to receive trade inquiries from customers in India. The work of the liaison office is not only restricted to forwarding of the trade Inquiries to ABC Ltd. but the liaison office also negotiates and enters into the contracts on behalf of ABC Ltd. with the customers in India.

(ii) XYZ Inc. a resident of USA, has set up a branch at Hyderabad for the purpose of purchase of raw materials for manufacturing its products. The branch office is also engaged in selling the products manufactured by XYZ Inc. and in providing sales related services to customers in India on behalf of XYZ Inc.

(iii) Mr. Rajesh, a resident in India and based at Delhi, is appointed as an agent by PQR Inc. a company incorporated in UK for tracking the Indian markets. He was canvassing the orders and then communicating to PQR Inc. in UK. He had no authority to accept the orders. All the orders were directly received, accepted and after receipt of the price/ value, the delivery of goods was given by PQR Inc. outside India. No purchase of raw material or manufacturing of finished goods took place in India. The agent was entitled to receive the commission on the sales so concluded by PQR Inc. [CA Final Nov. 2018 (Old Syllabus)] [6 Marks]

Answer:

(i) If a Liaison Off& is maintained solely for the purpose of carrying out activities which are preparatory or auxiliary in character, and such activities are approved by the Reserve Bank of India, then, no business connection is established.

In this case, had the liaison office’s activities been restricted to for warding of trade inquiries to ABC Ltd., a Dubai based company, its activities would not have constituted business connection. However, the activities of the liaison office extends to also negotiating and entering into contracts on behalf of ABC Ltd. with the customers in India, on account of which business connection is established.

![]()

(ii) As per Explanation 2 to section 9(1)(i) “business connection” shall include any business activity carried out through a person in.India acting on behalf of the non-resident. Accordingly in this case, since the branch office is carrying out a business activity by purchasing raw materials in India for XYZ Inc. and selling finished product manufactured by XYZ Inc. to customers in India and providing sales related services to them on behalf of XYZ inc., business connection is established.

It may be noted that as per clause (a) of Explanation 2, in the case of a non-resident, no business connection would be established if the activitics of the person acting on behalf of the non-resident were limited to the purchase of goods or merchandise for the non-resident.

In the present case, however, business connection would be established, since the branch set up at Hyderabad by XYZ Inc. is not solely engaged in purchase of raw materials for XYZ Inc. for manufacturing its products hut is also engaged in selling such manufactured products to customers in India and providing sales related services to them on behalf of XYZ Inc.

(iii) ‘Business connection’ shall include any business activity carried out through a person acting on behalf of the non-resident. For a business connection to be established, the person acting on behalf of the non-resident –

(a) must have an authority which is habitually exercised in India to conclude contracts on behalf of the non-resident or;

(b) in a case where he has no such authority, but habitually maintains in India a stock of goods or merchandise from which he regularly delivers goods or merchandise on behalf of the non-resident, or

(c) habitually secures orders in India, mainly or wholly for the non-resident.

In the present case, business connection would not be established, since Mr. Rajesh does not have the authority to accept or conclude orders in India on behalf of PQR Inc. Moreover, all the orders were directly received, accepted and after receipt of the price/value, the delivery of goods was also given by PQR Inc. outside India. Hence, no business connection is established in this case.

![]()

Question 10.

Discuss the correctness or otherwise of the following with reference to the provisions of Income-tax Act, 1961: –

The contents of a business transaction done through e’-commerce are not different from that of a business transaction carried out through traditional means. Which are the distinct means/methods for doing e-business? [CA Final Nov. 2018 (Old Syllabus)] [2 Marks]

Answer:

The statement is not correct.

The content of business transaction done through e-commerce is not the same as the content of a business transaction carried out through traditional means. The taxation of e-commerce transactions poses a stiffer challenge as compared to taxation of traditional business transactions.

In e-commerce, there are three distinct means of doing business:

- electronic advertising,

- electronic sales; and

- electronic delivery.

The presence of anyone or more of these is sufficient to characterize the business as e-commerce.

Question 11.

Red Ltd., a non-resident foreign company had entered into a collaboration agreement, approved by the Central Government, with Blue Ltd., an Indian company on February 21, 2004 and is in receipt of following payments during the previous year ending on March 31, 2021:

- Interest on 8% debentures for ₹ 40 lakhs issued by Blue Ltd. on July 1, 2020 in consideration of providing of technical know-how, manufacturing process and designs (date of payment of interest being March 31 every year).

- Service charges @ 2.5% of the value of plant and machinery for ₹ 500 Lakhs leased out to Blue Ltd. payable each year before March 31.

- Apart from the above incomes, Red Ltd. received a long term capital gain amounting to ₹ 1.90 Lakhs on sale of debentures of Green Ltd., an Indian company, subscribed in US$.

Compute the Total Income of Red Ltd. and determine its tax liability for the assessment year 2021-22. [CA Final Nov. 2018 (New Syllabus)] [6 Marks]

Answer:

Computation of Total Income Red Ltd. for A.Y. 2021 -22

| ₹ | |

| Value of debentures issued by Blue Ltd. (Note 1) | 40,00,000 |

| Interest on debentures issued by Blue Ltd. (₹ 40,00,000 × 8% × 9/12) (Note 1) | 2,40,000 |

| Service charges on leased out plant and machinery (₹ 500 lakhs × 2.5%) | 12,50,000 |

| Long term capital gain on sale of debentures of Green Ltd. | 1,90,000 |

| Total Income | 56,80,000 |

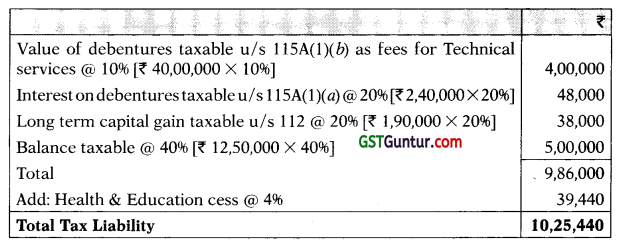

Computation of Tax Liability

Notes:

1. ₹ 40,00,000, being the value of debentures issued by Blue Ltd. in consideration of providing technical know-how for use in its business in India, is in the nature of fee for technical services, deemed to accrue or arise in India to Red Ltd., a non-resident foreign company, u/s 9(1) (vii) and taxable in India.

Further, as per section 9(1)(v), interest payable by a person resident of India is deemed to accrue or arise in India and therefore, interest income from debentures of Blue Ltd. is deemed to accrue or arise in India in the hands of Red Ltd. by virtue of section 9(1)(v) and taxable in India.

2. As per Sec. 9(1)(i), income from property in India or from any asset or source of income in India would be deemed to accrue or arise in India. Therefore, service charges of ₹ 12,50,000 from leased out plant and machinery t6 Blue Ltd. shall be taxable in India.

3. As per Sec. 9(1)(i), capital gains arising through transfer of capital asset situated in India would be deemed to accrue or arise in India. Therefore, long term capital gains of ₹ 1,90,000 on sale of debentures of Green Ltd., an Indian company, shall be taxable in India.

![]()

Question 12.

John Butler Tex. Inc., is a company incorporated in Colombo, Sri Lanka. 60% of its shares are held by Pvt. Ltd., a domestic company. John Butler Tex. Inc. has its presence in India also. The data relating to John Butler Tex. Inc., are as under:

| Particulars | India | Sri Lanka |

| Fixed assets at depreciated values for tax purposes (₹ in cores) | 90 – | 70 |

| Intangible assets (₹ in cores) | 40 | 180 |

| Other assets (₹ in crores) | 30 | 90 |

| Income from trading operations (₹ in cores) | 15 | 42 |

| Income from investments (₹ in cores) | 30 | 13 |

| Number of employees (Residents in respective countries) | 40 | 60 |

For POEM purposes, state whether,

(i) The company shall be said to be engaged in ‘active business outside India’.

(ii) Because of increased operations in India, more manpower is needed. 30 more employees may be required in this regard. The company can either take these employees directly in its roll or can outsource the increased operation to an external agency which will engage the 15 employees in its roll and finish the work for the company. Which choice will be better?

Note: If for any test, average figures are needed, the same may be ignored and the data as given above to the applicant may be used. [CA Final Nov. 2018 (New Syllabus)] [6 Marks]

Answer:

(i) The company shall be said to be engaged in ‘active business outside India’, only if the following conditions are simultaneously satisfied;

- Passive income is not more than 50% of its total income; and

- less than 50% of its total assets are situated in India; and

- less than 50% of total number of employees are situated in India or are resident in India; and

- the payroll expenses incurred on such employees is less than 50% of its total payroll expenditure.

![]()

Passive income means an income which is aggregate of:

- income from the transactions where both the purchase and sale of goods is from/to its associated enterprises; and

- income by way of royalty, dividend, capital gains, interest or rental income;

| Total | In India | % | |

| Passive income (Income from trading operation + Income from investment) | 100 | 45 | 45 |

| Assets (Fixed assets + Intangible assets + Other assets) | 500 | 160 | 32 |

| Employee | 100 | 40 | 40 |

John Butler Tex. Inc., shall be said to be engaged in ‘Active business outside India’, as all the conditions of “Active business outside India” (ABOI) test is satisfied.

(ii) Because of increased operations in India, if 30 employees are directly employed, then the conditions of ABOI test will not be fulfilled, as the percentage of employees situated in India shall be more than 50% of total number of employees in that case [i.e. 30 + 40/130 = 54%].

In case, if 15 employees are outsourced, then the percentage of employees situated in India will be within 50% and the conditions of ABOI test will be satisfied [i.e. 15 + 40/115 = 48%].

Therefore, outsourcing the work to external agency will be a better option for the company.

![]()

Question 13.

State with reasons whether the following income of the non-resident is deemed to accrue or arise in India:

(1) M/s XYZ Highway Ltd., a resident Indian company is engaged in the business of building highway projects in India. It has borrowed US $ 250 million from a financial institution resident in US to invest in one of its ongoing projects in India. The rate of interest charged is 8% p.a. Assume 1 US $ 69. Will your answer differ in case the money is invested in one of its ongoing projects in Sri Lanka?

(2) Mr. A, a non-resident, staying in England, holds 10% of the total share capital in M/s ABC Ltd. a company incorporated in England. M/s ABC Ltd. directly owns assets in India. Mr. A has transferred his entire share capital to Mr. B an Indian resident when he was in England. [CA Final Nov. 2019 (Old Syllabus)] [6 Marks]

Answer:

(1) As per section 9(1)(v), interest payable by a resident in respect of any debt incurred, or any moneys borrowed and used for the purpose of business or profession carried on by such person in India shall be deemed to accrue or arise in India. Therefore, interest of ₹ 1,3 80 million [($ 250 million × ₹ 69) × 8%] payable by M/s XYZ Ltd. for borrowings to be used in its ongoing project in India will be deemed to accrue or arise in India in hands of the financial institution being resident of US.

Yes, the answer will be different if the borrowed money is invested ‘ in one of its projects in Sri Lanka. In that case the income will not be deemed to accrue or arise in India since, Sec. 9(1)(v) provides that interest payable by a resident will not be deemed to accrue or arise in India where the interest is payable by a resident in respect of moneys borrowed and used for the purpose of business carried on by such person outside India or for the purpose of earning any income from any source outside India.

![]()

(2) As per section 9(1)(i), capital gains arising through the transfer of a capital asset situated in India would be deemed to accrue or arise in India irrespective of place of registration of the document or transfer or the place of payment of the consideration.

As per Explanation 5 to the section, shares in a company incorporated outside India shall be deemed to be situated in India, if the shares derive its value substantially from the assets located in India.

Further, as per Explanation 6 to the section, the shares will be deemed to derive its value substantially from the assets located in India. If on the specified date the value of such assets

- exceeds Rs. 10 crore and

- represents at least 50% of the value of all assets owned by the company of which shares are being transferred.

Thus, if shares of ABC Ltd. derive its value substantially from the assets located in India then the income will be deemed to accrue or arise in India. Otherwise, it will not be deemed to accrue or arise in India.

The said income will not be deemed to accrue or arise in India by virtue of Explanation 5 if conditions specified in Explanation 7 to the section are being satisfied.

![]()

Question 14.

ABC Ltd., a software giant in India, sets up a 100% subsidiary company by the name SHD Inc. in Switzerland on 1st April, 2020. The subsidiary company SHD Inc., is mainly engaged in the software services, hardware services and data backup services in three different countries viz., Switzerland, Sweden and India. The following information is furnished by SHD Inc. for the F.Y. 2020-21:

| In Switzerland | In Sweden | In India | |

| Value of Assets as per books of account (in crores) | 24 | 12 | 24 |

| Number of Employees working (in thousands) | 30 | 10 | 28 |

| Pay Roll expenditure (in crores) | 4 | 2.6 | 5.4 |

| Total aggregate income earned | ₹ 80 crores | ||

Other Information:

I. Break up of total income:

- 28 crores derived from the transactions where purchases are made from associated enterprises and sold to non-associated enterprises;

- 24 crores derived from the transactions where both purchases and sales are made from/to associated enterprises;

- 16 crores derived from the transactions where purchases are made from non-associated enterprises and sold to associated enterprises:

- 8 crores by way of income from capital gains on trading of shares;

- 4 crores by way of interest from non-associated enterprises;

II. During FY 2020-21, total 5 board meetings were held, 2 in India, in Sweden and 2 in Switzerland.

Based on the above information, determine the residential status of SHD Inc., applying the provisions of POEM for the A.Y. 2021-22. [CA Final Nov. 2019 (New Syllabus)] [6 Marks]

Answer:

As per Sec. 6(3), a company is said to be resident in India in any previous year, if

(a) It is an Indian Company, or

(b) Its place of effective management (POEM) in that year, is in India.

Explanation to Sec. 6(3), defines POEM as a place where key management and commercial decision that are necessary for the conduct of business of an entity as a whole, are in substance made.

POEM is determined based on the fact as to whether or not the company is engaged in “active business outside India”.

![]()

The company shall be said to be engaged in ‘active business outside India’, only if the following conditions are simultaneously satisfied;

- Passive income is not more than 50% of its total income; and

- less than 50% of its total assets are situated in India; and

- less than 50% of total number of employees are situated in India or are resident in India; and

- the payroll expenses incurred on such employees is less than 50% of its total payroll expenditure.

Passive income means an income which is aggregate of:

- income from the transactions where both the purchase and sale of goods is from/to its associated enterprises; and

- income by way of royalty, dividend, capital gains, interest or rental income;

Calculation of Passive Income of SHD Income

| ₹ in crores | |

| Income where both purchase & sale are made to/from associated enterprises | 24 |

| Capital gains on trading of shares | 8 |

| Interest Income from Non-Associated enterprises | 4 |

| Total Passive Income | 36 |

![]()

Determination of whether SHD Inc. is has engaged in “Active Business outside India”

| India | Total | % of India out of Total | |

| Value of Assets (Cr.) | 24 | 60 | 40.00 % |

| No. of employees (‘000) | 28 | 68 | 41.17 % |

| Payroll expenses (Cr.) | 5.4 | 12 | 45.00 % |

| Passive Income/Total Income (36/80) | 45.00 % |

Since, all the conditions are fulfilled, it can be said that SHD Inc. is engaged in Active Business outside India.

Now, POEM of a company, engaged in active business outside India shall be presumed to be outside India of the majority of board meetings are held outside India.

During EY. 2020-21, out of total 5 board meetings of SHD Inc., 3 arc held outside India and thus, POEM of SHD Inc. is said to be Outside India.

Thus, SHD Inc. is a Non-Resident Company in India as its POEM is outside India for A.Y. 2021-22.