NACH: Full Form, Credit, Debit, Meaning, Mandate, NACH OTM Form

NACH Meaning: The full form of NACH is the National Automated Clearing House. NACH is a payment system that helps corporate sectors, banks, governments, and other financial organizations to process bulk payments. Payments such as salary processing, pension payments, subsidy approvals are done through NACH. The NACH system was launched by the NPCI (National Payment Corporation of India) to facilitate the bulk volume payments quickly. In this article, we will provide you with all the necessary information about NACH. Read on to find out more.

NACH: Payment Systems In India

The officials of the Reserve Bank of India are responsible to authorise and implement the pavement system in India. RBI has facilitated many forms of payment systems in India and one of the core facilitation is electronic payment transactions. According to RBI officials, 75% of payments in India have adapted online or electronic transactions. This shows the importance of Plastic money in India.

Plastic Money: Paperless money. Example: Debit Card, Credit Card, Online Payments.

NACH: Payment Systems In India Examples

There are many types of payment system in India which are given below:

- Paper Mode: Cheques are one of the important payment systems in India. The RBI officials have originated Magnetic Ink Character Recognition (MICR) technology to speed up the processing of cheques.

- ECS Credit System: RBI officials have introduced an ECS Credit scheme that processes bulk payments such as salary processing, interest, or dividend payments.

- ECS Debit System: ECS Debit scheme helps the account holder or user to make repetitive payments by mandating banks to debit their accounts.

- NEFT Payments: National Electronic Fund Transfer is majorly used by individuals or corporates for one-to-one fund transfer. NEFT transfers are mostly paid for services or products.

- RTGS Payment System: Real-Time Gross Settlement System comes under Gross Payment settlement in India. The RTGS payment is processed through the online system which has payment status then and there.

- Other Payment Systems in India: There are many other payment systems in India such as CCIL, Aadhar Enabled Payment System, ATMs, POS Terminals, and Mobile banking.

What is NACH?

NACH is part of the National Payments Corporation of India (NCPI) which was initiated in the year of 2007. NACH is otherwise called as National Automated Clearing House which is initiated by RBI officials. The main objective of NACH is to process the bulk transactions online. The NACH payments system method is adapted by small retailers, governments, corporate sectors, banks, and many other financial organizations. Many financial organizations which performs core banking or interbank transactions through online or mobile banking process the payments through NACH.

NACH Credit System

The Reserve Bank of India, RBI officials have initiated the NACH Credit which is an electronic payment service adapted by huge organizations and corporate sectors. With the help of NACH credit, any organization which is authorized under RBI can process the bulk payments directly to the receiver’s account. Corporate salaries, dividends, pension processing, interest payments, or subsidies are processed through the NACH credit system. Many corporations adapt the NACH system to make transactions since it is a single system to process the payments at one go.

NACH Credit System: Key Features

The Key Features of the NACH Credit System are given below:

- Through the NACH credit system, 10 million transactions can be processed in a single day.

- NACH system is safe and secure for online access.

- The online dispute management system is also available under NACH.

- Any corporate sectors that process the payments through NACH will have direct access to track their transactions or payments. Corporates or Organizations can access the same through Direct Corporate Access.

NACH Debit System

The NACH debit system is similar to that of the NACH Credit system. NACH debit system is mostly used by banks or other financial institutions to accept bulk payments without any interference or barriers from third parties. Through the NACH Debit system, any financial organization such as Banks, Government, or Corporate sectors can accept bulk payments such as EMIs, Loans, Water & Electricity bills, and much more.

NACH Debit System: Key Features

The key features of the NACH Debit system are given below:

- Online Dispute Management System is also available under NACH.

- NACH provides a Unique Mandate Reference Number that helps the user to track their payments.

- NACH provides safe and secure transactions. The transaction can be tracked only by the organization and the relevant parties. No third-party user can access the NACH Debit System.

What Is The Difference Between NACH and ECS?

The main difference between NACH and ECS are given below:

| NACH | ECS |

| NACH has a smoother workflow and doesn’t require much paperwork. | ECS requires more paperwork which delays the process. |

| NACH payments are processed in 24 hours. | ECS takes more than 3 to 4 days to process the payments. |

| NACH has a Unique Mandate Registration Reference Number which enables the user to track their payments easily. | There is no Unique Mandate Registration Reference Number in ECS. |

| NACH consists of an online dispute management system. | ECS doesn’t have an online dispute management system. |

Objective of NACH

The main objective of NACH is to process end-to-end bulk transactions online. Some of the objectives why NACH was initiated by RBI officials are given below:

- To initiate the national eco-framework that covers entire banks in India to accept and request electronic payments.

- To create a Mandate Management System (MMS) and related governance mechanism to the users. Also, NACH has multiple objectives to process the bulk transactions online safely.

NACH system is completely based on Core-Banking Solution (CBS) to provide internal debit/credit transactions for all the banks.

Does NACH Apply to ECS Transactions?

From 1st May 2016, NACH has taken over all the ECS transactions and NACH is applicable for all the ECS transactions. Any payments such as credit card bills, SIPs in mutual funds, interest payments, premiums, or any other bulk payments can be processed through NACH easily.

However, any organization which is working under ECS cannot automatically convert to NACH. They have to close their account under ECS and then register for NACH. Any organization that wishes to register under NACH can apply for the banks. Many commercial banks adopt paperwork to register for NACH whereas few banks choose an online process to provide NACH registration.

How Will NACH Modify Investing In Mutual Funds?

Investing in Mutual Funds is now easy with NACH. Through a one-time registration process, any individual can invest in Mutual Funds. This is because, once the user is registered under NACH, the account is automatically linked with the bank account with the help of which Mutual Fund’s investment is made easy.

Through NACH one-time mandate registration a user can invest offline without multiple cheque deposits or online money transfers. Any user or investor can make use of NACH for bulk investments apart from SIPs.

NACH For Lump Sum Purchase

- Any investor will have to simply submit the One Time Mandate NACH form to register the relevant bank details with the NACH for the payment process.

- On the successful registration, the investor will be able to avail of the additional purchase, SIP transactions, and other modes of purchase.

- The payments can be done only through RTGS/NEFT. Also, there is a provision where an investor can make Fax/Email about the transactions to purchase lump sum.

SIP Registration

- When it comes to SIP registration, NACH takes at least 15 days which is better than ECS since ECS takes more than 30 days.

- If the bank of investor is already registered under NACH, then the investor can register for SIP by filling out the NACH One time Mandate Registration Form.

- It is to be noted that the bank under which the investor is investing must be one of the listed banks under NACH.

Does NACH Affect Existing Mutual Fund SIPs?

No, NACH doesn’t affect the existing Mutual Fund SIPs. However, users who already have an ECS mandate for their SIPs will have to continue under ECS till the expiry of ECS. Once the ECS is expired then the investor who wishes to renew their SIP will have to go for the NACH Fresh registration process.

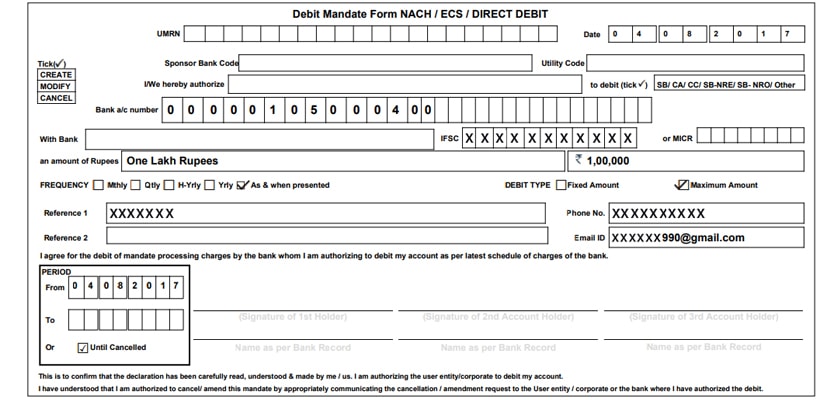

NACH OTM Form: NACH One Time Mandate Form

NACH OTM (NACH One Time Mandate) form is a form that needs to be filled out by the user for the registration process under NACH. While filling out the form, the users will have to enter the following details such as:

- Bank Details: Here users will have to enter details such as Bank Name, Branch address, account number, IFSC code, MICR number.

- Personal Details: Name, Contact details (Mobile & Email ID), Signature should be entered here.

- Folio Details: The folio number and application number need to be entered here. Folio is nothing but a unique number allotted to each mutual fund investor.

- Limit Details: Here the user will have to enter their daily maximum limit.

- Period: Enter the start date and end date

NACH Registration: How To Register For NACH?

The steps for NACH Registration is as follows:

- One must fill the OTM form in NACH.

- After filling out the form, one must submit the form online in the portal for verification purposes.

- On successful verification, NACH will send the form to banks for taking the registration process further.

- Once the registration process from the relevant bank is completed, the bank will confirm the confirmation through registered phone and email ID. The NACH registration process takes 10 to 15 days.

List of Banks Supporting NACH

1000+ banks are supported by NACH. To know the list of banks supported by NACH, follow the steps listed below:

- Visit the official website of NPCI – Click Here

- Click on the tab “What We Do” and select “NACH”.

- Now the page will be directed to NACH. Here click on the NACH Live Members.

- A new page will open. Now click on Live Banks.

- A list of Banks supported by NACH will be displayed on the screen.

How Does NACH Benefit Customers, Banks, and Organizations?

The main objective of NACH is to process bulk or high volume payments in one go. Any individual be it a customer, bank or organization is equally benefited from NACH.

NACH Benefits For Customer

- Reminds the due dates to process the bills such as electricity, phone, credit card, interest, premium payments, and much more.

- Enables fast and secure payments.

- No manual process involved here which means automated payments only.

NACH Benefits For Organization

- Organizations don’t have to depend upon the cheques and clearance.

- Takes less time to process payments such as scholarships, allowances, subsidies, etc.,

- Pension payments, salary processing makes it easier.

- Offers great customer service.

NACH Benefits For Bank

- No Paperwork. Easy registrations and payments.

- Less error and smoother workflow.

- Collection of EMIs, the Loan amount is easy through NACH.

- Better customer service can be provided through NACH.

FAQs on NACH

The frequently asked questions on NACH are given below:

Q. What is NACH payment?

A. NPCI – National Payments Corporation of India has invented NACH to help financial organizations such as Corporates, Banks, Government sectors, and other sectors to process bulk payments in one go.

Q. Is NACH safe?

A. NACH is recommended by NPCI which is regulated by RBI under the Indian Payment and Settlement System Act 2007. Thus NACH payment method is more reliable, secure, and affordable than other payment methods.

Q. How many days does it take for NACH mandate registration?

A. NACH mandate registration hardly takes 10 days to complete the registration process. However, in a few cases, it might exceed 15 days but not more than that.

Q. Does ECS work on Sunday?

A. NACH doesn’t work on Sundays and other holidays which RTGS follows.

We hope this detailed article on NACH is helpful to you. If you have any questions on NACH System, ping us through the comment box below and we will get back to you as soon as possible.