LIC Tech Term Plan: LIC E Term Plan Premium Details, Benefits, Brochure

LIC Tech Term Plan: LIC Tech Term Plan is complete online insurance over. The main objective of the LIC Tech Term Policy is to provide financial security to the family members if the life assured or the proposer dies during the policy period. Any individual will be able to avail of the LIC Tech Term Policy only in online mode by processing the online application. On this page, we have provided all the details about LIC Tech Term Plan Premium details, benefits, documents required, and more. Read on to find out more.

Highlights of LIC Tech Term Plan

The highlights of the LIC Tech Term Plan are given below:

- There are two types of benefit options available. One can either choose Level Sum Assured or Increased Sum Assured.

- Three types of Premium payment methods are available and they are Single-Premium, Regular Premium, and Limited Premium Payment. One can choose any Premium payment method at their convenience.

- The life assured has the choice to choose their Policy Term or Premium paying Term.

- LIC Tech Term officials offer special rates for Women.

- The life assured has the option to receive the death benefits in installments.

- There is an option for Life assured to increase their premium cover by opting for accident benefit rider on payment of additional premium.

Eligibility Criteria of LIC Tech Term Plan

The eligibility criteria of LIC Tech Term Plan are tabulated below:

| Criteria | Details |

| Minimum Age Required | 18 years |

| Maximum Age Required | 65 years |

| Age of Maturity | 80 years (Last Birthday) |

| Minimum Sum Assured | Rs. 50,00,000 |

| Maximum Sum Assured | There is no limit for maximum sum assured |

| Policy Term | 10 to 40 Years |

| Policy Application | Only Online |

| Death Cover Options | Level Sum Assured and Increasing Sum Assured |

| Grace Period | 30 Years |

| Premium Paying Term | Single-Premium, Yearly Premium, or Half Yearly Premium |

LIC Tech Term Plan – Benefits

As discussed above, the LIC Tech Term Plan is a pure risk insurance cover and only death benefits are payable to the family members of the life assured. The list of benefits

1. LIC Tech Term Plan – Increase in Sum Insured

As discussed above there are two sum insured plans – Level Sum Assured and Increased Sum Assured. In Level Sum Assured, the sum amount to be paid on death remains the same until the policy term ends.

Whereas in Increased Sum Assured, after 5 back-to-back renewals, the sum insured will keep on propelling at 10% for ten years without any barrier. For example, if you have enrolled for a LIC Tech Term Plan where the sum insured is 50 Lakhs and have renewed the same for 5 consecutive years, then your sum insured will continually increase at 10% for 10 years.

Refer to the table below to understand the level sum assured and increased sum assured plans.

| Sum Assured Type | Age | Policy Term | Premium Payment Term |

Premium Payment Rs for Sum Assured of 50 Lakhs

|

| Level Sum Assured | 30 | 30 | 30 | 8400 |

| Increased Sum Assured | 30 | 30 | 30 | 13900 |

2. LIC Tech Term Plan – Death Benefit

Every Tech Term policy initiated by LIC India will have the death benefit. If the life assured dies when the policy is in the period, then the nominee will get the sum proposed amount.

3. Death Benefit Options In Instalments

If the life insured dies, then there is an option where the nominee can receive the death benefits in installments. The installment period can be chosen as 5 years, 10 years, or 15 years. The death benefit installments will be paid either annually, half-yearly or quarterly.

4. LIC Tech Term Plan – Health Benefits

While enrolling in the Tech Term policy, the online application asks if the person is a smoker or a non-smoker. Based on the information provided by the life to be assured, the health benefits will be provided to the person. However, if the life assured states that, if he/she consumes toxic substances such as cigarettes, drugs, tobacco, or any other hallucinogenic materials, then the health benefits will not be provided.

5. LIC Tech Term Plan – Offers For Women or Female Proposer

Women enrolling for Tech Term Policy will get a discount on premium under “special privilege for female life insured“. Any women enrolling for Tech Term Policy can avail of a 10% to 20% discount on the premium.

6. LIC Tech Term Plan – Huge Number of Sum Insured Benefits

LIC Tech Term Insurance also provides a discount on premium if the life insured chooses high sum insured under annual or single premium payment. Persons choosing the high sum insured can avail of at least 20% discount on the premium. For example, if a life assured has chosen the sum insured at 1 Crore under annual or single premium payment at the age of 30, then he/she can avail 12% discount on the premium.

7. LIC Tech Term Plan – Rider Benefit

The life to be assured has the option to choose the LIC Accident Benefit Rider. By choosing this option, the life assured will have to pay some extra premium. The purpose of this Rider Benefit is that if the life assured dies in the event of accidental death, then rider sum assured lump-sum amount along with death benefit will be paid to the nominee.

LIC Tech Term Premium Details

The LIC Tech Term premium comes in 3 forms – Regular Premium, Limited Premium, or Single Premium. If he/she chooses Single-Premium, then they will have to pay the premium at one go. Whereas if the Life assured chooses, Regular or Limited Premium, then the proposer can pay the premium on a regular basis annually or half-yearly mode.

The LIC Tech Term Plan Premium depends on the age, policy term, smoking status, gender, premium paying term, and sum assured by the proposer. If the life assured chooses a single premium, then the minimum single premium amount is Rs.30,000. If the life assured chooses regular premium or limited premium, then the minimum premium is Rs.3,000.

How To Buy LIC Tech Term Policy?

Any life assured will be able to purchase the LIC Policy only in online mode. The steps to purchase the LIC policy in Online mode are given below:

- 1st Step: Visit the official website of LIC – Click Here

- 2nd Step: On the homepage, under the “Buy Policy Online“, click on the link “Click Here To Buy“.

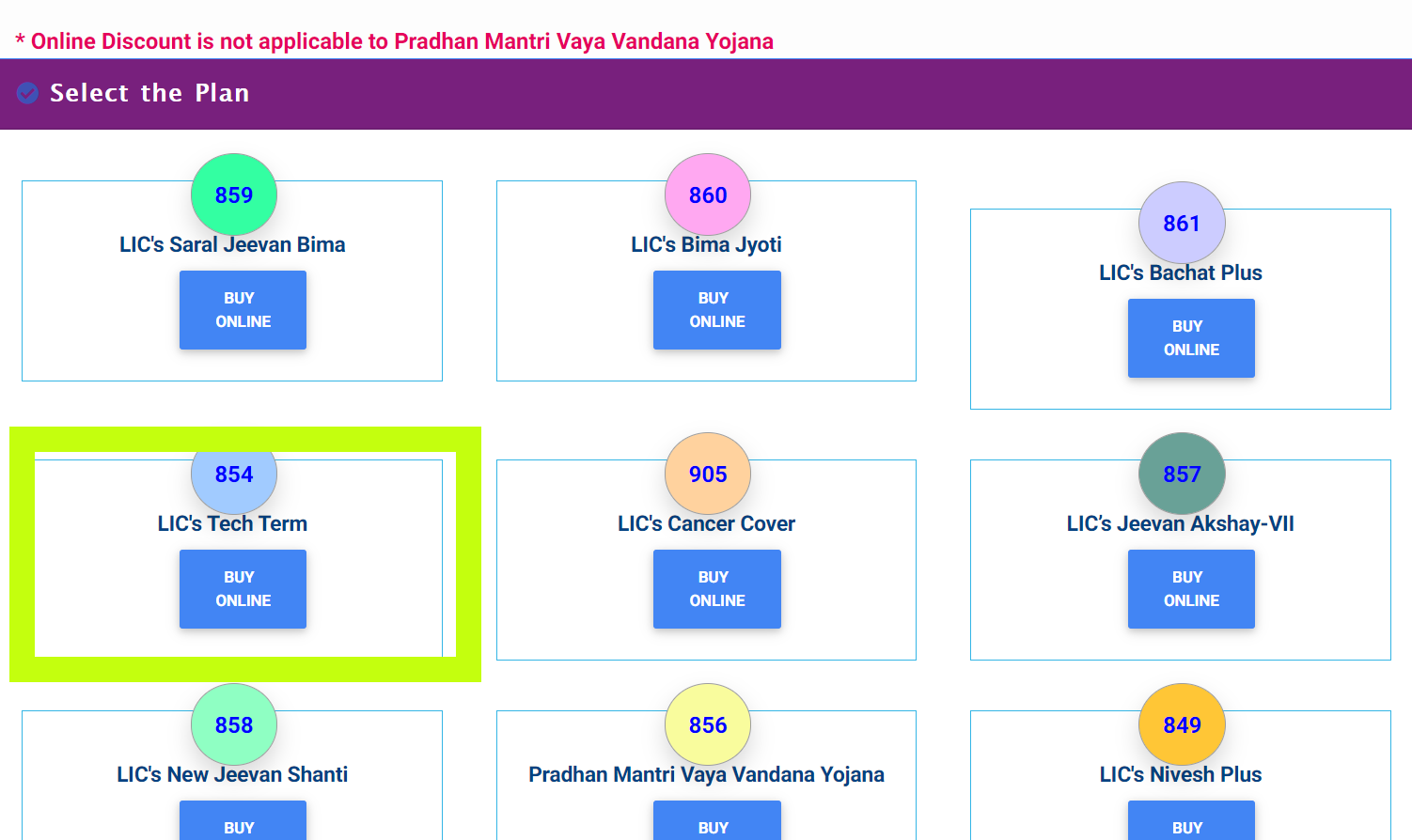

- 3rd Step: A new page will open. Now click on LIC Tech Term Plan 854. Refer to the image below:

- 4th Step: A new page with instructions will appear on the screen. Hit the button “Click to Buy Online” button.

- 5th Step: The page will be directed to the “Contact Details” page. Enter all the necessary contact details and solve the “Captcha“.

- 6th Step: Tick the checkboxes and click on the “Calculate Premium” button.

- 7th Step: The premium details will be displayed on the screen. Now upload all the necessary documents.

- 8th Step: Click on “Proceed“.

- 9th Step: Now a new page will open. Here you can review the proposal, edit the proposal.

- 10th Step: If all the details are reviewed, click on the button “Pay“.

- 11th Step: You will be redirected to the Payment Window. Process the premium amount online.

- 12th Step: After successful payment, you will receive the policy registered details to your registered mobile number and Email ID.

Once the LIC Tech Term Policy 854 is purchased, the proposer or life insured must keep track of premium due dates and pay the premium from time to time to enjoy the benefits from LIC Tech Term Policy.

FAQs on LIC Tech Term Policy

The frequently asked questions on LIC Tech Term Policy 854 are given below:

Q. How is the LIC Tech term plan premium calculated?

A. The LIC Tech Term Insurance Premium is calculated on the basis of the life assured age, sum proposed, gender, policy term, smoking status, premium paying term.

Q. Is a medical test required for the LIC Tech term plan?

A. If you meet the following conditions, then you don’t have to undergo Medical Test.

1. Life Insured must be a non-smoker

2. Life Insured must not have a past medical history

3. Life Insured must belong to the age group 18 to 35 years whose annual income should be greater than 3 Lakhs.

Q. What documents are required for LIC Tech term plan?

A. The list of documents required for LIC Tech Term Plan are given below:

a. Proof of Identity

b. Age Proof

c. Address Proof

d. Income Proof

e. Medical Reports (Applicable only for a few people)

d. Passport Size Photographs

Now that you are provided with all the necessary information on how to buy LIC Tech Term Policy along with benefits. If you have any queries about this article or in general about LIC Tech Term Insurance Policy details, ping us through the comment box below and we will get back to you as soon as possible.