How To File Income Tax Return Online: Step By Step Procedure To File ITR

Income Tax E-filing: Filing Income Tax is a mandatory thing for all the citizens of India whose annual earnings exceed more than a certain amount. The process of filing the Income Tax Return (ITR) electronically is known as Income Tax Return E-filing. With the help of ITR E-filing, any individual will be able to process the ITR Online gathering anywhere. On this page, we have provided the detailed step-by-step procedure on how to file Income Tax Return online for salaried employees, individuals. Also, check out the documents which are required to process the ITR E-filing. Read on to find out more.

Income Tax E-Filing Important Dates

It is to be noted that individual who is E-filing the ITR online will have to file the same within the time frame specified by the officials. The important dates of Income Tax Online Return and ITR date extensions notified by the officials are tabulated below:

| Taxpayer Categories | ITR Last Date Extended Till |

|---|---|

| For Individuals | 31st July 2021 |

| Body of Individuals – BOI | 31st July 2021 |

| Hindu Undivided Family – HUF | 31st July 2021 |

| Association of Persons – AOP | 31st July 2021 |

| For Businesses Requiring Audit | 31st September 2021 |

| For Businesses Requiring TP Report | 30th November 2021 |

Income Tax Due Date Extension

The individual taxpayer’s due date to file Income Tax Returns is on 31st July 2021 for the Financial Year of 2020-21 which nothing but for the Annual Year of 2021-22.

Who Can File Income Tax Return Online?

According to the Tax Law, individuals meeting the following criteria will have to file the Income Tax Returns Online.

- Any organization which is taxable

- Individuals wishing to claim a refund from the Income Tax Department

- Individuals earning income from house property

- If individuals are investing or earning from foreign assets

- If the individual’s gross annual income is exceeding more than:

| Individuals Age | Gross Annual Income In Rupees |

|---|---|

| Age Below 60 Years | 250,000 Lakhs |

| Age Above 60 Years But Below 80 Years | 300,000 Lakhs |

| Age Above 80 Years | 500,000 Lakhs |

However, if you find that your income is not taxable then you don’t have to file for the Income Tax Returns.

Documents Required For Income Tax E-filing

In order to file the Income Tax Returns (ITR) online, one will have to keep certain documents handy. The list of documents that one must have to file the ITR online are given below:

- PAN Number

- Aadhaar Number

- Bank Account Details

1. In case, if the individuals are filing ITR based on their salary income, then they will have to keep the following documents:

- Form 16

- House Rent Slips

- Salary or Pay Slips

2. In case, if individuals wish to claim deductions, they will have to keep the following documents:

- Proof of Income

- Investment details

- Home Loan details

- Insurance Details

- Deposit or Savings account details

If any of the above details are applicable, then individuals will have to submit them while E-Filing the ITR.

How To File Income Tax Return Online Step by Step Process?

The step by step procedure to file the Income Tax Return Online are given below:

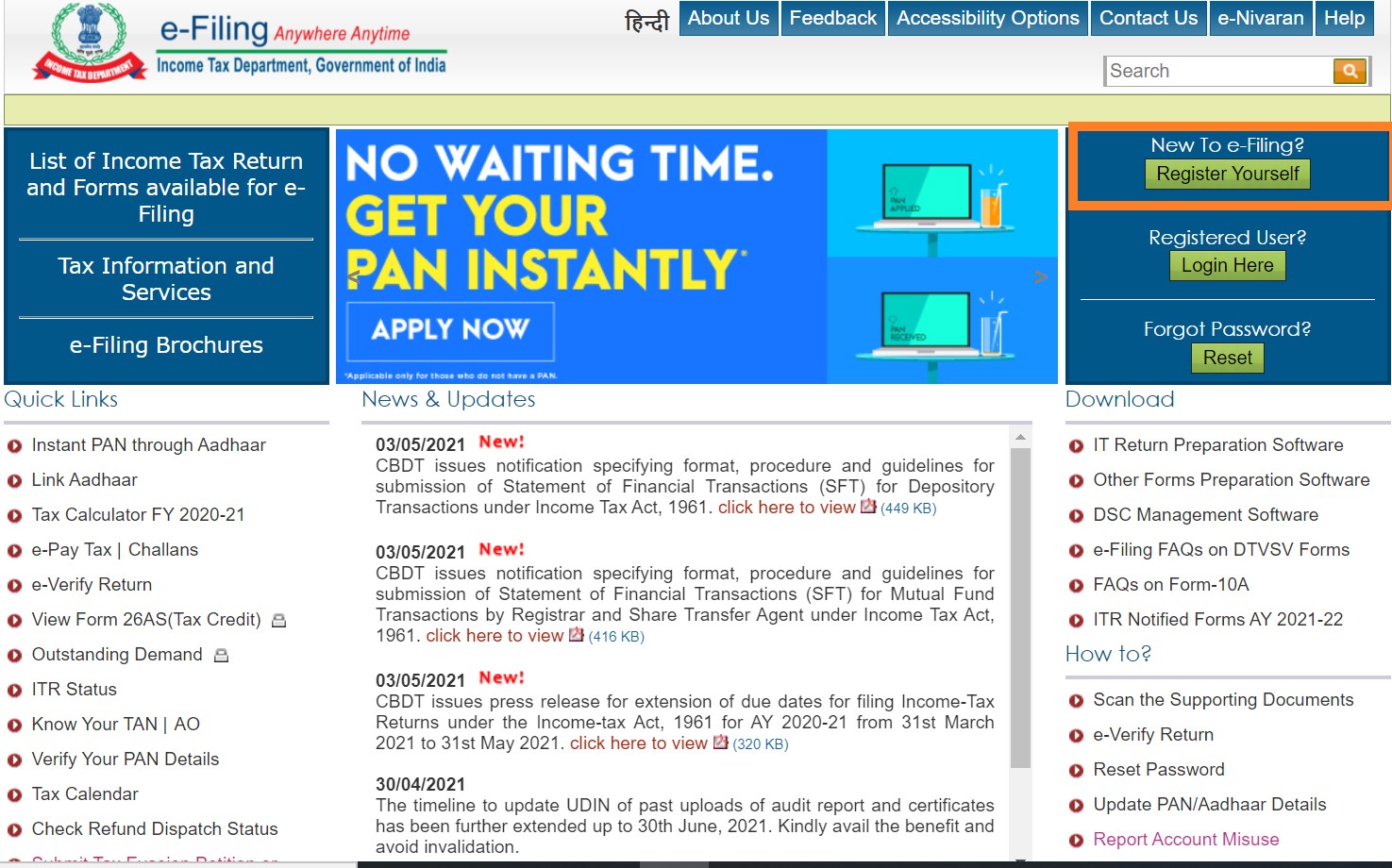

- Step 1: Visit the official website of E-Filing: Click Here

- Step 2: If you are a new user then click on “Register Yourself“.

- Step 3: If you are not a new user click on the “Registered User – Login Here” button. And move to the heading after step 9 on “how to e-file income tax returns on the portal“.

- Step 4: Once you click on “Register Yourself“, a new page will open. Here select “Individual” from the drop-down menu and click on the “Continue” button.

- Step 5: Enter the necessary details such as PAN No, Surname Verification, DOB, Residential Address, etc.,

- Step 6: Now click on “Continue“.

- Step 7: Now your PAN & transaction ID will be verified. And a new page “Registration Form” will be opened on the screen. Here enter all the necessary details.

- Step 8: Click on “Continue“. The officials will send a link to registered mobile and email id. Upon validating the link, your registration will be successful.

- Step 9: Now login with the help of your credentials and follow the steps listed below to file the Income Tax Return Online.

How To e-file Income Tax Returns On The Portal?

- 1st Step: Firstly fill the Form 26AS to summarize your TDS payment for all the 4 quarters of the assessment year your filing for.

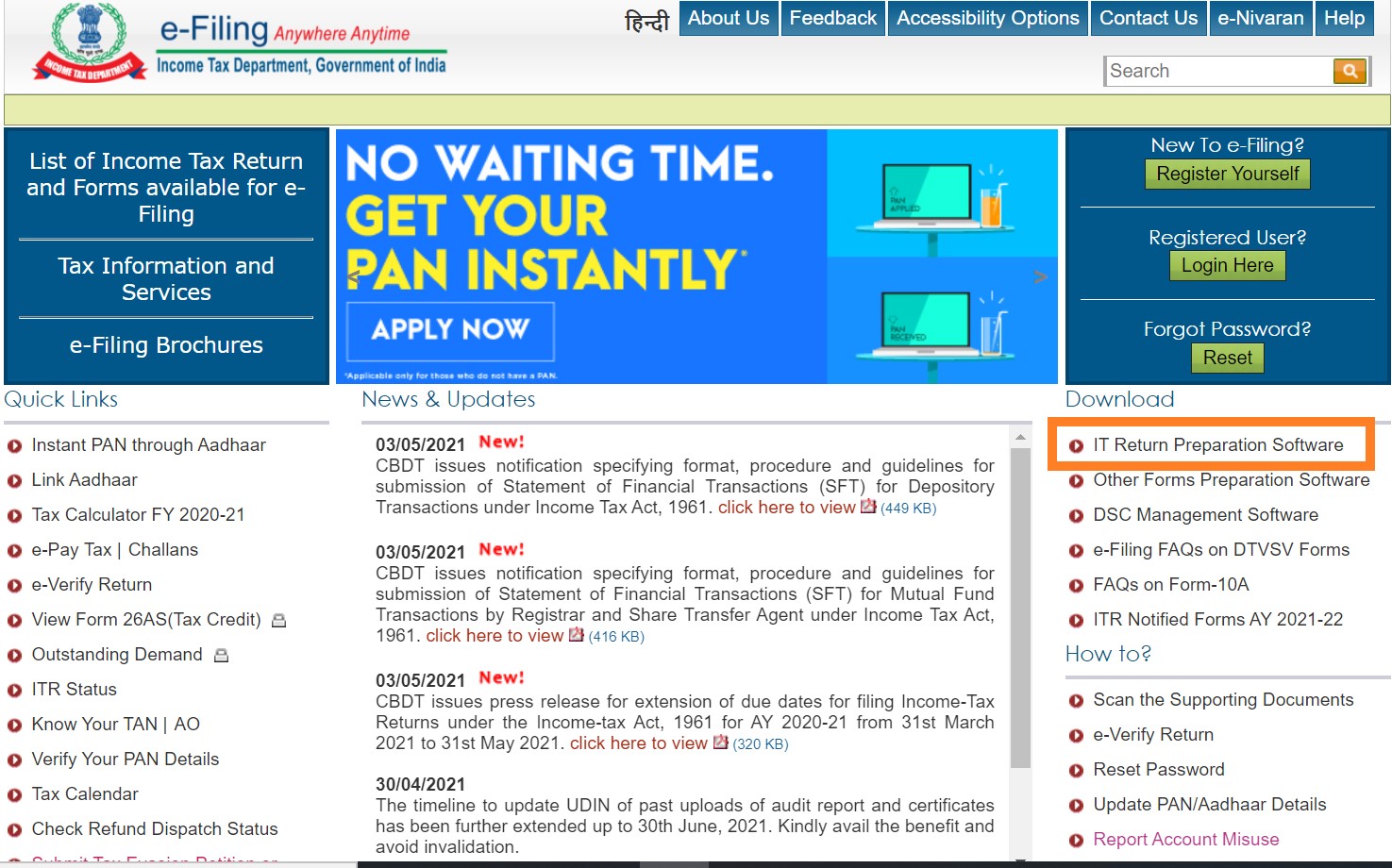

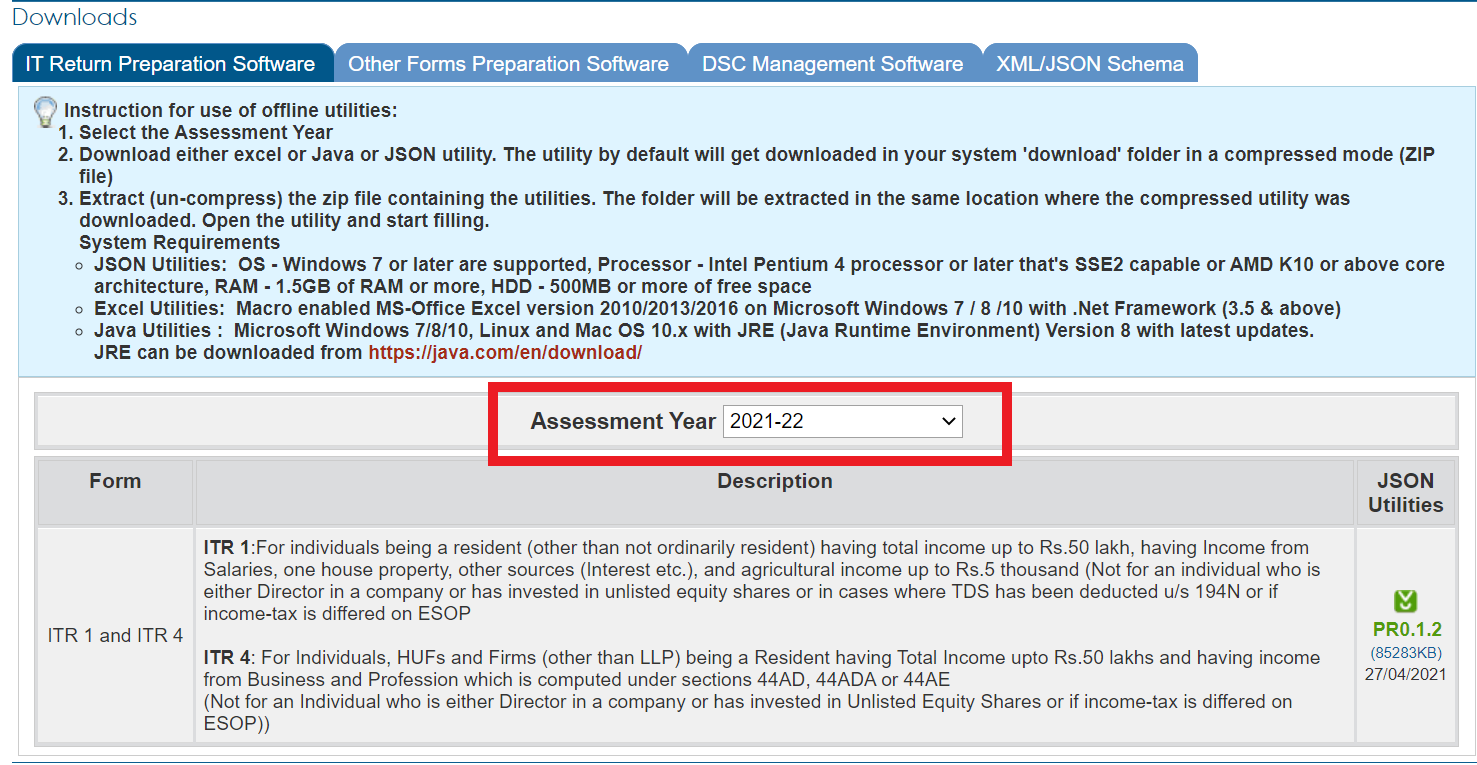

- 2nd Step: Now visit the official website of e-Filing and download the “IT Return Preparation Software“.

- 3rd Step: Choose your assessment year.

- 4th Step: Now you can download the software either in Java Utility or MS-Excel file.

- 5th Step: Once you have downloaded the file, enter all the details in the specified fields.

- 6th Step: After filling out the form, click on “Validate” in the form itself to check if the necessary fields are filled out.

- 7th Step: After the validation, click on the “Generate XML” button which converts you to the XML file. Keep this XML saved on your device.

- 8th Step: Now visit the official website and hit on the “Registered User – Login Here” button to get logged in to the portal.

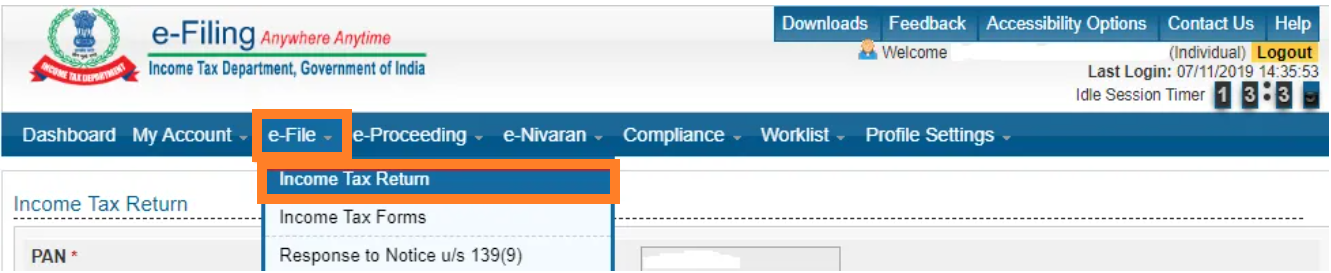

- 9th Step: Click on the “e-File” tab and select “Income Tax Return” from the drop-down menu.

- 10th Step: A new page will open. Choose your assessment year and enter other details such as PAN, ITR Form Number, and submission mode.

- 11th Step: Now move to the “Submission Mode” and select “Upload XML” to upload the XML.

- 12th Step: After uploading the XML file, click on the “Submit” button.

- 13th Step: A list verification mode list will be displayed on the screen. Select the verification mode at your convenience.

- 14th Step: Based on your verification mode, OTP will be sent to the registered device.

- 15th Step: Validate the OTP and click on “Submit“.

- 16th Step: Now your ITR-V will be displayed on the screen. Download the ITR-V and sign it and get it to upload to the website.

- 17th Step: Once you upload it, your ITR filing process is completed.

Penalty for Late Filing of ITR

Any individual who fails to pay the ITR on or before the deadline is liable to pay Rs.10,000 under Section 234F of the Income Tax Act.

FAQs on ITR E-Filing

The frequently asked questions on how to file Income Tax Return Online are given below:

Q. Can I file my ITR myself?

A. Yes, any individual can file their ITR themselves by registering in the Income Tax Department E-Filing portal.

Q. How to file income tax returns online for salaried employee 2020-21?

A. Any salaried employee will be able to file the Income Tax Returns online by logging into the Income Tax India, the E-Fling website. The steps to file the Income Tax have been discussed in detail in the above section of the article.

Q. Which ITR Form should I choose if I am a salaried employee?

A. If you are a salaried employee then you will have to choose the ITR-1 Form to file the Income Tax Returns online. The ITR-1 Form is otherwise called as SAHAJ Form.

Now that you are provided with all the necessary information on how to file the Income Tax Returns Online and we hope this detailed article is helpful to you. If you have any queries on ITR Online Filing, ping us through the comment box below and we will get back to you as soon as possible.