EPF Form 15G Download: Sample Filled Form 15G For PF Withdrawal

What is EPF Form 15G? In the financial year of 2016-17, the officials of EPFO had issued a notice stating that Tax Deducted at Source (TDS) is applicable on EPF withdrawal above Rs.50,000. Thus any employee who wishes to withdraw PF money above 50,000 will have to pay the TDS charges. So if any individual’s EPF withdrawal limit is more than 50,000 and PAN Card is not verified at the EPF portal, then he/she can simply submit Form 15G/15H to the EPF officials requesting them not to deduct TDS (if applicable) on the PF withdrawal amount.

On this page, we have provided all the details on how to withdraw the EPF amount by submitting Form 15G, along with instructions, documents required, and a detailed procedure on how to submit EPF withdrawal claim form 15G online. Read on to find out more.

Is Form 15G Mandatory For PF Withdrawl Less Than 50,000?

Individuals must note that Form 15G is not applicable if your withdrawal limit is less than 50,000. However, TDS is also not applicable for individuals who wish to withdraw the PF amount under the following scenarios:

- If an individual is transferring his PF money from one account to another account

- If the employee service is terminated due to health issues

- If business by the employer is discontinued

- If the employee service period is more than 5 years that is there is no TDS on PF withdrawal. Which also includes 5 years of employee service under one or multiple organizations.

When TDS Is Deduceted on PF Withdrawl?

If an employee withdraws 50,000 or more than that, the TDS will be deducted. The TDS charges applicable for the same are as follows:

- If an individual submits PAN Card and doesn’t submit Form 15G/15H, then 10% will be deducted.

- If the individual fails to submit the PAN Card, then TDS will be deducted at maximum marginal rate i.e, 34.608%.

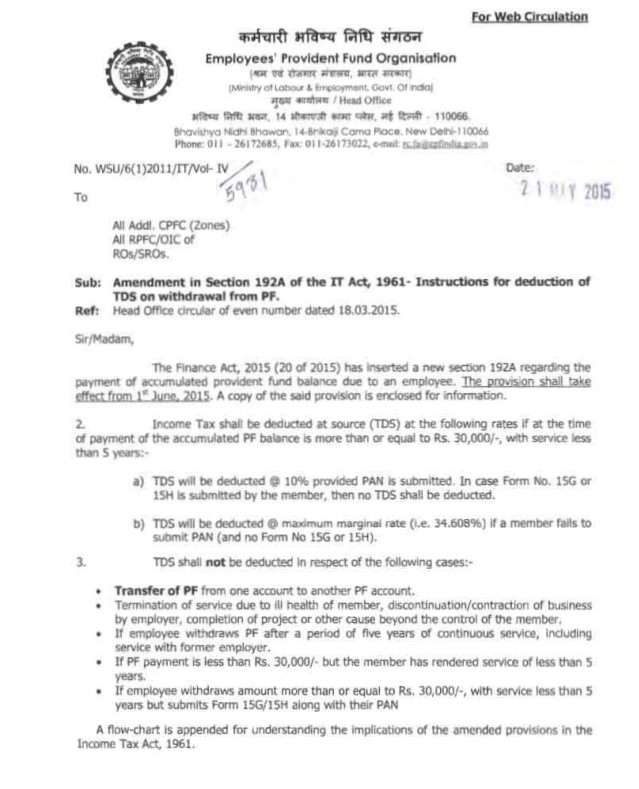

EPFO Notification On No TDS For EPF Withdrawal

The official EPFO notification on No TDS deduction for EPF Withdrawal are given below:

How To Submit Form 15G Online For EPF Withdrawal?

Many of the EPF members fail to get verify their PAN Numbers digitally in the EPFO portal because of personal details mismatch in UAN & PAN Card. And this is the main reason, the EPFO officials will impose TDS in EPF withdrawals. So one of the best ways to run off the TDS is by submitting Form 15G.

How To Get Form 15G Online For PF Withdrawl?

The direct link to download Form 15G is given below:

Click Here To Download Form 15G PDF For EPF Withdrawl

You can either download EPF Form 15G ODF from the above link or also can check the procedure to download the same from the official website.

The steps to download 15G Form Online for PF withdrawal are listed below:

- Visit the official website of UAN Member Website: Click Here

- Now login with the help of your UAN Number & UAN Password.

- In the UAN dashboard, move to the Online Services tab.

- Now select Claim (Form 31, 19, 10C) from the drop-down menu.

- Verify your last 4 digits of your bank account number.

- EPF withdrawal form will be displayed on the screen. Below the EPF withdrawal form, the user will be able to “Upload Form 15G”.

- Click on it and From 15G will be downloaded to your device.

- Two pages namely Part I & Part II will be there where you will have to fill out the details.

Form 15G Download In Word Format

Many individuals will search for Form 15G in Word format since it makes one’s work easier. However, there is no option for individuals to download Form 15G in word format since the officials will give them only in PDF format. So individuals looking for Form 15G download link in Word format for PF withdrawal can follow the steps as listed below to get the same:

- Download Form 15G in PDF format.

- Now search “PDF to Word Conversion” in Google or search engine.

- Upload the PDF to any of the third-party websites and click on Convert.

- As soon as you click on Convert, the Form 15G PDF will be converted to Word Format which can be downloaded for free.

How To Fill Form 15G For PF Withdrawal?

As discussed above, there are 2 pages Part I and Part II in Form 15G. Only Part I needs to be filled by the individuals. The steps to fill Form 15G filed wise are given below:

- Field 1 – Name: Enter your name as per your PAN Card

- Field 2 – PAN: Enter your PAN number

- Field 3 – Status: Mark your status such as Individual, HUF, or AOP as applicable for you.

- Field 4 – Previous Year: Refers to the current financial year you are filling the form. For example, if you are filling for 1st April 2020 to 31st March 2021, then enter 2020-21.

- Field 5 – Residential Status: Enter your nationality. Mostly Indian.

- Field 6 to 12 – Address Details: Enter your current address details.

- Field 13 – Emai ID: Enter your valid email ID.

- Field 14 – Telephone Number: Enter your mobile number, If the landline is available enter your landline number with the STD code.

- Field 15 (a) – Whether assessed to tax under the Income-tax Act,1961: Mention Yes or No.

- Field 15 (b): If Yes, the Latest Assessment Year Which Assessed: If you have marked yes in Field 15 a, then mention the last filed ITR financial year.

- Field 16 – Estimated Income for which this declaration is made: Calculate your total income which you have earned during the financial year excluding EPS or Pension.

- Field 17 –the Estimated total income of the P.Y. in which income mentioned in column 16 to be included: Mention the total income along with EPF withdrawal amount.

- Field 18 –Details of Form No. 15G other than this form filed during the previous year, if any: If you have filled Form 15G previously then mention those details.

- Field 19 – Field 19. Details of income for which the declaration is filed: Mention the nature and amount of income here.

Sample Filled Form 15G For PF Withdrawal

The sample filled Form 15G is given below:

How To Upload Form 15G for PF Withdrawl?

The steps to upload Form 15G in the portal are given below:

- After filling out Form 15G, convert it to PDF format.

- Make sure your Form 15G is less than 1 MB.

- Now login to the UAN website with the help of your credentials.

- Click on the “Online Services” tab and select Claim Form 31, 19, 10C.

- Now choose Form 19 from the dropdown menu.

- Click on Choose File and Upload the PDF.

Difference between Form 15G and 15H

The main difference between form 15G and 15H is that the 15H form is applicable for senior citizens only. Because the interest rates differ from individuals to senior citizens, Form 15H can be submitted by senior citizens whose is eligible for TDS but also 60 years old.

FAQs on Form 15G

The frequently asked questions on Form 15G are given below:

Q. Is 15G form required for PF withdrawal?

A. Yes, if you are an individual below 60 years and want to withdraw more than 50,000 then Form 15G can be submitted.

Q. How can I download Form 15G for PF?

A. You can either download From 15G from this page or also from the officials EPFO Portal under ONLINE SERVICES >> Claim (Form 31, 19, 10C).

Q. What happens if 15G not submitted?

A. If form 15G is not submitted then TDS charges will apply for your PF withdrawal amount.

Now that you are provided all the necessary information on Form 15G and we hope this article is helpful to you. If you have any questions ping us through the comment box below and we will get back to you as soon as possible.